This is a Budget with a human face! This is what is deserved after the trying times to which our lives were propelled by COVID-19 and the consequent lockdown. The world is at a defining moment of human civilisation, and so is India! As life revives from the shackles of the pandemic that posed a huge threat to humanity, the bigger challenge emerges on the economic front to combat the after-effects of the pandemic-induced lockdown. The lockdown should not be interpreted as the mere locking down of shops and households; it was tantamount to the locking down of market forces. Much in contrary to the thinking that “markets are ruthless,” the lockdown brought to the fore the importance of market forces in promoting equity. The locking of the market forces showed us the ugly face of the economy in the form of job losses, mental depression, and the difficult plight of the migrant labour force. The governmental safety nets simply proved inadequate while dealing with these socio-economic problems. Therefore, the plummetting growth (or negative growth rates as witnessed during the first two quarters of the ongoing FY) and the declining statures of the various developmental indicators exposed the nadir of the Indian economy!

The locking of the market forces showed us the ugly face of the economy in the form of job losses, mental depression, and the difficult plight of the migrant labour force.

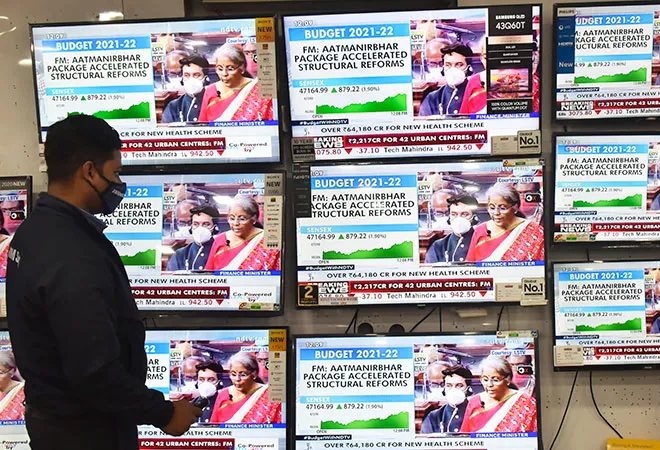

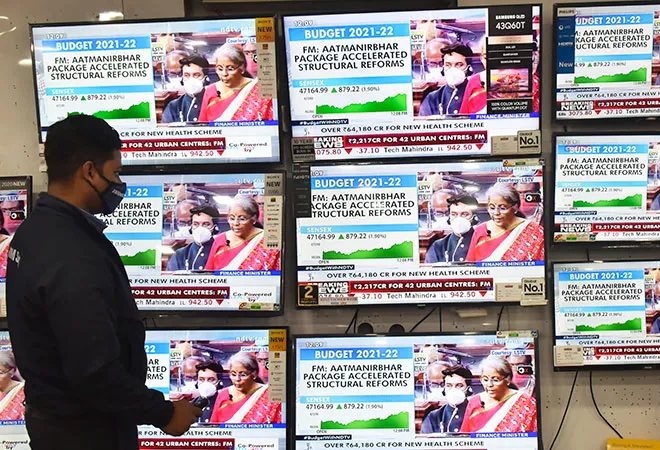

Generally, under such circumstances, the responses need to be inherently Keynesian — the government has to come in a big way to revive the markets so that it can then move in its own organic ways and generate forces for growth. There was already an expectation that under such exceptional circumstances, all tenets of fiscal discipline will be breached in the Union Budget 2021. Evidently, the budgetary estimates of fiscal deficit in 2021-22 are pegged at 6.8% of GDP, with a proposed gross borrowing of INR 12 Lakh crore. There was essentially no other way out of this! While the Finance Minister (FM) has shown the intention of moving in the right direction, the question is: In what way will this spending help achieve the broader developmental goals?

The Budget proposals for 2021-2022 rest on 6 pillars: i) Health and Wellbeing; ii) Physical & Financial Capital, and Infrastructure; iii) Inclusive Development for Aspirational India; iv) Reinvigorating Human Capital; v) Innovation and R&D; and vi) Minimum Government and Maximum Governance. It is interesting to note that all the first five pillars are embedded in the various UN Sustainable Development Goals (SDGs). Therefore, a holistic approach to health (by strengthening Preventive and Curative care, and Wellbeing) and increasing its allocation by 137 percent is undoubtedly a great move in the right direction. What is interesting is that the Budget acknowledges clean air and water availability as integral components of health infrastructure. On a different note, though the FM talks about education under human capital, both health and education are critical elements of creating and refurbishing human capital. While neoclassical economics has often taken human capital (or labour) as a given factor of production, the broader lens of development studies have acknowledged the need for refurbishing the same to sustain development. Given that, it seems that the Indian economic vision is progressing from a reductionist “growth-centric” approach to a broader and integrated “development-centric” approach. That is precisely why environmental resources like air and water have been being part of the budgetary discourse.

It seems that the Indian economic vision is progressing from a reductionist “growth-centric” approach to a broader and integrated “development-centric” approach.

It is from this perspective that one needs to look at the proposals for physical and financial capital and infrastructure. Under various heads, the Budget proposes a sharp increase in capital expenditure having provided INR 5.54 lakh crores — 34.5% more than the BE of 2020-21. CAPEX is not only a critical variable that creates the basis of profitability of firms at a micro-level and that of growth at a macro-level, it is also prone to create short and medium-run employment. This will help in generating the much needed yet dried out consumption demand in the economy. There is no harm reiterating here that the Indian growth story has so far been an organic consumption-led growth narrative spurred by the growth of the service sector; it was the pandemic and the lockdown that dried out consumption demand from the system.

Interestingly, the FM emphasises the need for a professionally managed Development Financial Institution to act as a provider, enabler and catalyst for infrastructure financing, and plans to introduce a Bill to set up a DFI with a provision of INR 20,000 crores to capitalise this institution. This may even turn out to be an excellent geostrategic move if this financing agency funds infrastructure projects outside India (like the Asian Infrastructure Investment Bank or AIIB). However, like other global DFIs, it is important that such infrastructure lending agencies keep in its ambit the concern of sustainability, as often funded infrastructure projects infringe into the working of the natural ecosystem (e.g., linear infrastructure like roads running through protected areas); thereby, making society pay in the long run through losses in ecosystem services.

This is the time when bold steps like boosting farm derivatives trading and development of electronic spot markets should have been proposed.

The most critical developmental statement has emerged under aspirational India where various elements of the welfare state in the Indian context, namely, agriculture and allied sectors, farmers’ welfare and rural India, migrant workers and labour, and financial inclusion, have emerged. The FM’s proposal of creating rural infrastructure is indeed praiseworthy. Yet, most of these proposals are hardly adequate to enhance agricultural productivity — neither will this reduce the two age-old problems of Indian agriculture, namely, the concern of surplus labour (the marginal product of labour in Indian agriculture is still negative), or the critical concern of inefficient agricultural marketing. Further, this is the time when bold steps like boosting farm derivatives trading and development of electronic spot markets should have been proposed.

On the Budget outlays with skilling, education and other human capital elements, the intentions are commendable. Similar is the case with innovation and research. What is appreciable in here is that the Budget acknowledges one very critical element of the Blue Economy: The marine ecosystem and its massive flow of services. Therefore, the FM proposes to “… launch a Deep Ocean Mission with a budget outlay of more than INR 4,000 crores, over five years. This Mission will cover deep ocean survey exploration and projects for the conservation of deep sea bio-diversity”. From an accounting perspective, there is a critical need to evaluate these “unvalued” ecosystem services and place them in the framework of “green accounting.”

Incremental income in the hands of middle and lower income groups would have gone into the consumption chain, thereby, helping the cause of growth.

Yet, there are three issues that remain to be addressed, two of them being from the consumption-led growth perspectives. The first is with increasing the consumer’s purchasing power by providing more money in his pocket. This could have been done with lowering of personal income taxes that have remained untouched in the Budget. Second is the convoluted issue of inequality. Given that over the last three decades, consumption has been the prime driver of growth, it may be noted that the “marginal propensity to consume” of the middle-income and lower income groups are way higher than the higher income groups. Therefore, incremental income in the hands of middle and lower income groups would have gone into the consumption chain, thereby, helping the cause of growth. Given the facts that as per Oxfam, the richest 1% held 73% of the wealth generated in 2017, while 67 million Indians who comprise the poorest half of the population witnessed only a 1% increase in their wealth, and the lockdown possibly witnessed a greater deterioration of this income and wealth distribution scenarios, consumption demand should have been boosted through some form of direct transfers or tax rebates for the cause of growth. The third issue that has not found any mention in the Budget is the cause of global warming and climate change, despite the same being one of the looming challenges of humanity. If this is an oversight in the midst of other developmental challenges facing the Indian economy, it must be stated that this is a very costly oversight!

Conclusion

In an essay in the Financial Times on 15 April 2020, Amartya Sen contended, “A better society can emerge from the lockdowns.” He reiterated the need for equity and the distribution aspects of development by quoting the example of how life expectancy at birth in England and Wales increased during the war decades. “… The positive lessons from pursuing equity and paying greater attention to the disadvantaged helped in the emergence of what came to be known as the welfare state.” While the lockdown has brought skeletons out of the closet, it creates opportunities for democratically elected governments to build the best distribution practices and institutions and continue with them in the post-pandemic world. The Budget of 2021 has a broad vision towards that direction despite, some of the misses mentioned in this essay.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV