-

CENTRES

Progammes & Centres

Location

While Bangladesh is trying to address the domestic demand for energy, if the supply-side problems remain unchecked, it will impact the living standards of ordinary Bangladeshis

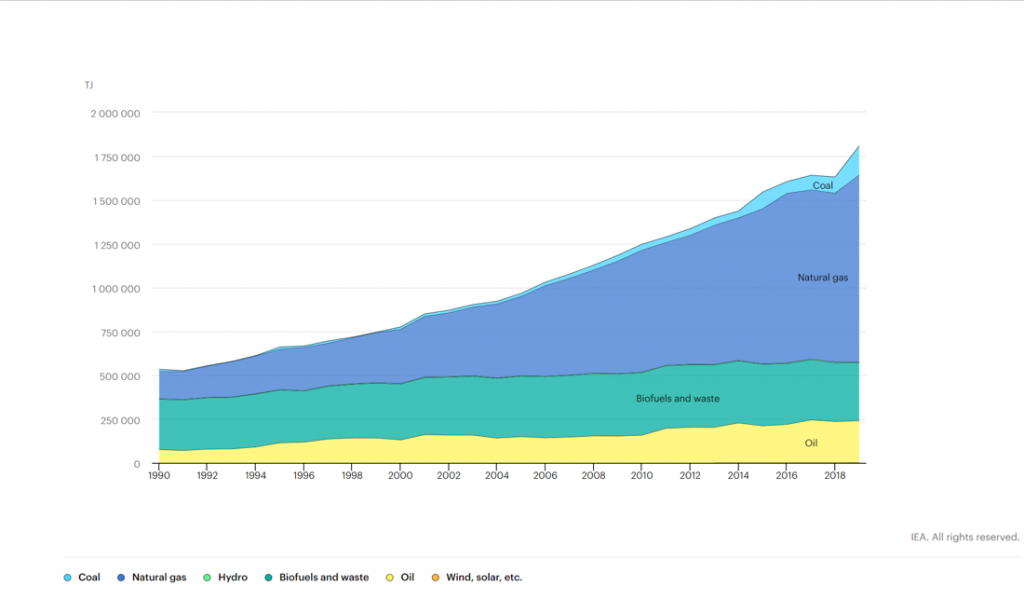

In the last two decades, Bangladesh has made significant strides in the domain of electricity access through its expansion in rural areas. Although, gas is still the dominant fuel for electricity generation; the uptake of solar power, wind, and hydel energy has been promising, though still limited to only 2.08 percent of the total installed capacity of 22,066 MW. In 2000, only 20 percent of the households were electrified, which has now been expanded to an estimated 85 percent of the country's population in 2020. In the previous decade itself, clean and renewable energy was provided to 7.3 million people. Women make up 60 percent of the rural electrification project beneficiaries—helping Bangladesh inch closer towards the UN Sustainable Development Goals, especially the targets for SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation and Infrastructure) and SDG 5 (Gender Equality).

Figure 1: Total Energy Supply (TES) by source in Bangladesh (1990-2019)

In the last two decades, Bangladesh has made significant strides in the domain of electricity access through its expansion in rural areas. Although, gas is still the dominant fuel for electricity generation; the uptake of solar power, wind, and hydel energy has been promising, though still limited to only 2.08 percent of the total installed capacity of 22,066 MW. In 2000, only 20 percent of the households were electrified, which has now been expanded to an estimated 85 percent of the country's population in 2020. In the previous decade itself, clean and renewable energy was provided to 7.3 million people. Women make up 60 percent of the rural electrification project beneficiaries—helping Bangladesh inch closer towards the UN Sustainable Development Goals, especially the targets for SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation and Infrastructure) and SDG 5 (Gender Equality).

Figure 1: Total Energy Supply (TES) by source in Bangladesh (1990-2019)

Source: International Energy Agency

Despite the electricity generation increasing from 5 Gigawatts (GW) in 2009 to 25.5 GW in 2022 —an 80-percent increase — the Plant Load Factor (PLF) (percent of the energy created by the power plant compared to its installed capacity) dropped to an extreme low as a result of the fuel and gas supply constraints. It fell to an abysmal 0.8 percent in some cases during the first two quarters of FY 2022. In the last decade, the Quick Rental Power Plants (QRPP), which were started in 2009 as temporary facilities for power generation, have produced most of the electricity for the country. However, these QRPPs have now been sitting idle as the government lacks sufficient FOREX reserves to obtain the fuel required to run them.

Source: International Energy Agency

Despite the electricity generation increasing from 5 Gigawatts (GW) in 2009 to 25.5 GW in 2022 —an 80-percent increase — the Plant Load Factor (PLF) (percent of the energy created by the power plant compared to its installed capacity) dropped to an extreme low as a result of the fuel and gas supply constraints. It fell to an abysmal 0.8 percent in some cases during the first two quarters of FY 2022. In the last decade, the Quick Rental Power Plants (QRPP), which were started in 2009 as temporary facilities for power generation, have produced most of the electricity for the country. However, these QRPPs have now been sitting idle as the government lacks sufficient FOREX reserves to obtain the fuel required to run them.

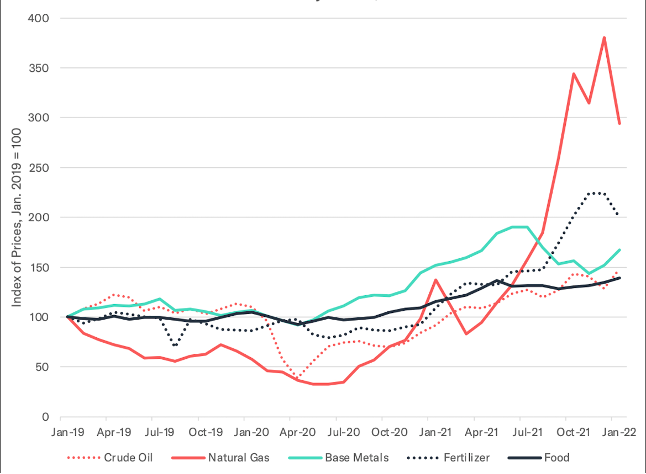

Source: IMF Primary Commodity Prices

The agreements with the QRPPs and Independent Power Producers (IPPs) in Bangladesh mandate payment for the capacity charges even if no electricity production occurs. The Russia-Ukraine conflict and the resulting supply-side disruptions had shot up global fuel prices to a approximately US$ 100/barrel in April 2022. This, combined with a shortage of other inputs, caused the Bangladesh Petroleum Corporation to bleed Tk 190 million daily as the power plants became idle. The power plants were also disincentivised in terms of the transition towards green energy, leading to the Bangladesh Power Developmental Board (BPDB) facing more losses. To manage this situation, the government had to increase subsidies to BPDB by a staggering 58.3 percent during 2020-2021.

Despite Petrobangla (the Oil, Mineral and Gas corporation of Bangladesh) warnings that there is an insufficiency in gas supply in Bangladesh for the operation of gas-based power plants, the private power plants in the country still choose to rely on gas. A lack of planning in the gas exploration operations meant that the availability of gas reserves in Bangladesh was limited. This becomes more pronounced because of the limited funding available for the Bangladesh Petroleum Exploration and Production Company Limited (BAPEX). Additionally, Bangladesh has not done much in terms of offshore gas exploration despite obtaining deep offshore regions from Myanmar and India. The government had floated a plan to transition to coal-based power plants in collaboration with Japan some years ago, but this was abandoned after Japan stopped its funding in 2021 and 2022 in the middle of criticisms directed towards increasing global carbon emissions. Bangladesh has been forced to import Liquified Natural Gas (LNG) to meet its energy demand, with 55 percent of the gas production coming from US firms. Bangladesh has also entered into two purchase agreements with Qatar (in 2017 for 15 years) and Oman (in 2018 for 10 years) for procuring LNG.

Source: IMF Primary Commodity Prices

The agreements with the QRPPs and Independent Power Producers (IPPs) in Bangladesh mandate payment for the capacity charges even if no electricity production occurs. The Russia-Ukraine conflict and the resulting supply-side disruptions had shot up global fuel prices to a approximately US$ 100/barrel in April 2022. This, combined with a shortage of other inputs, caused the Bangladesh Petroleum Corporation to bleed Tk 190 million daily as the power plants became idle. The power plants were also disincentivised in terms of the transition towards green energy, leading to the Bangladesh Power Developmental Board (BPDB) facing more losses. To manage this situation, the government had to increase subsidies to BPDB by a staggering 58.3 percent during 2020-2021.

Despite Petrobangla (the Oil, Mineral and Gas corporation of Bangladesh) warnings that there is an insufficiency in gas supply in Bangladesh for the operation of gas-based power plants, the private power plants in the country still choose to rely on gas. A lack of planning in the gas exploration operations meant that the availability of gas reserves in Bangladesh was limited. This becomes more pronounced because of the limited funding available for the Bangladesh Petroleum Exploration and Production Company Limited (BAPEX). Additionally, Bangladesh has not done much in terms of offshore gas exploration despite obtaining deep offshore regions from Myanmar and India. The government had floated a plan to transition to coal-based power plants in collaboration with Japan some years ago, but this was abandoned after Japan stopped its funding in 2021 and 2022 in the middle of criticisms directed towards increasing global carbon emissions. Bangladesh has been forced to import Liquified Natural Gas (LNG) to meet its energy demand, with 55 percent of the gas production coming from US firms. Bangladesh has also entered into two purchase agreements with Qatar (in 2017 for 15 years) and Oman (in 2018 for 10 years) for procuring LNG.

Unable to set in motion the transition to renewable energy, alongside heavy dependence on fuel imports, Bangladesh has been placed in a tough spot concerning energy security. The Russia-Ukraine war added more fuel to this fire. With the energy prices climbing upward and subsidy bills increasing, the fiscal balances and current account deficits have been worrisome for the economy. The government had to finally put in place some austerity measures. The domestic prices of diesel, kerosene, octane and petrol were increased by 42.5, 42.5, 51.6 and 51.1 percent, respectively, to Tk 114, Tk 114, Tk 135 and Tk 130 in August 2022—the highest jump in almost 20 years, achieving price parity with its neighbours such as India, China, and Nepal. The reasons for this steep increase in prices are three-fold:With the energy prices climbing upward and subsidy bills increasing, the fiscal balances and current account deficits have been worrisome for the economy.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +