On 8 June 2023, the Reserve Bank of India’s (RBI’s) six-member Monetary Policy Committee (MPC) opted to keep the repo rate unchanged for the second consecutive review meeting, based on cooling inflation and improved growth prospects. The RBI concurrently decided to revert to its main goal of inflation targeting, to lower headline inflation to 4 percent from the level of 4.7 percent recorded in April 2023.

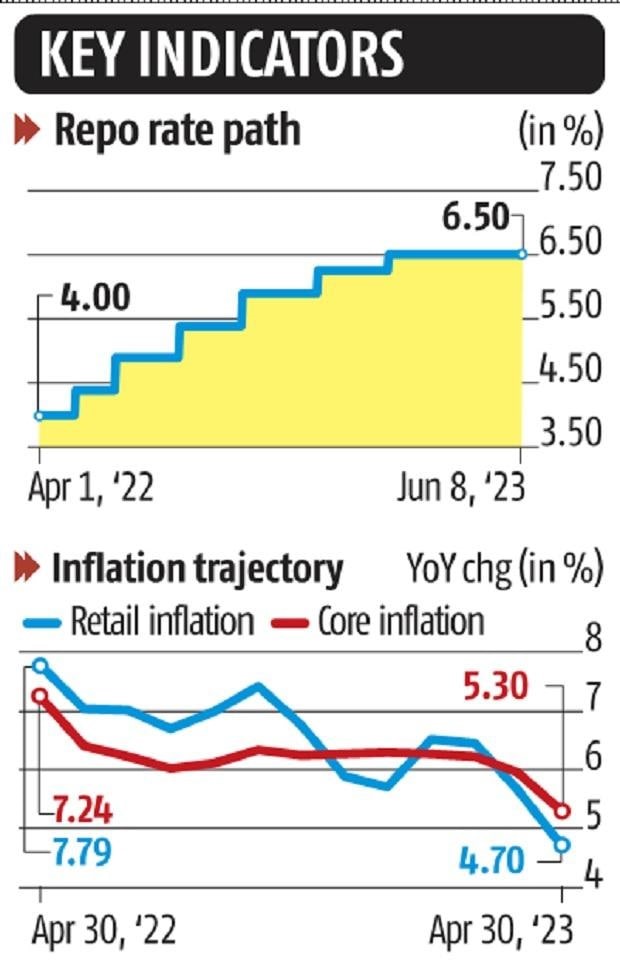

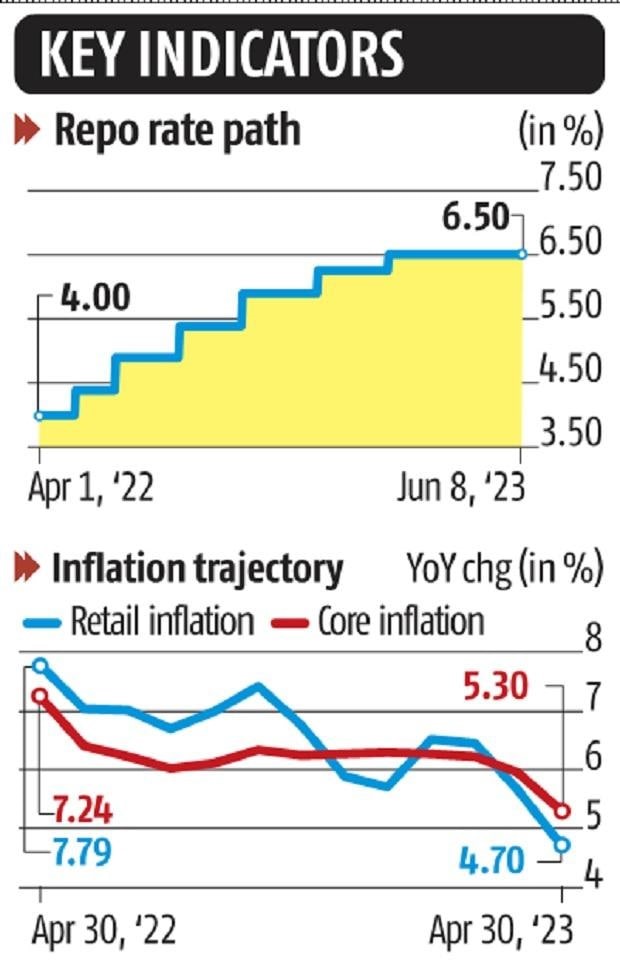

The continued repo rate pause follows unexpected policy rate hikes by the Reserve Bank of Australia (RBA) and Bank of Canada (BoC), after their preceding pause. The RBI held the rate in April post a 2.5-percent repo rate hike during the period from May 2022 to February 2023, to 6.5 percent, highlighting that its pause must not be viewed as a pivot (see Figure 1).

Figure 1: The RBI’s repo rate path and India’s inflation trajectory

Source: Business Standard

What appears somewhat dogmatic is the central bank’s decision to continue with its hawkish focus on withdrawing accommodation to align inflation with its 4-percent target, while purportedly encouraging growth.

WPI Deflation and its Impact

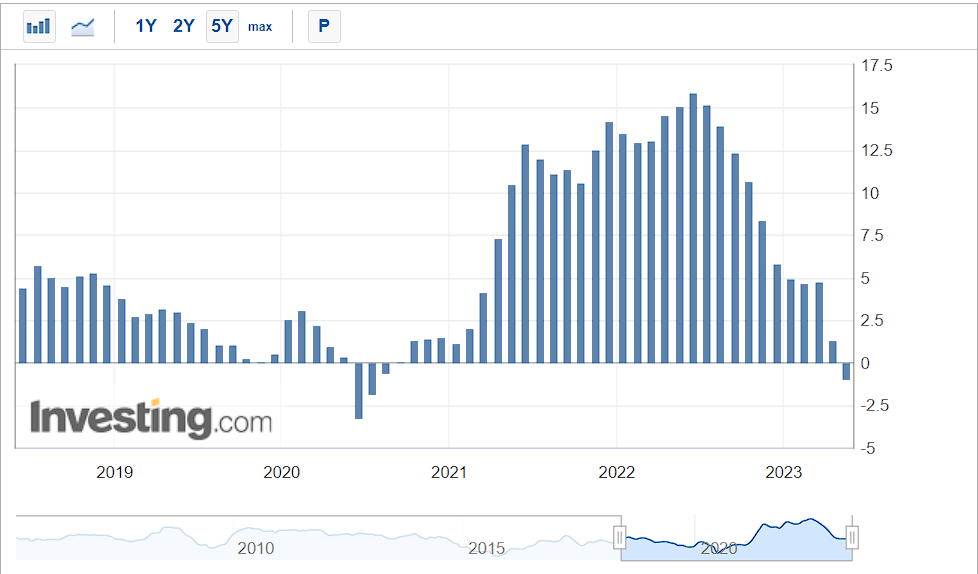

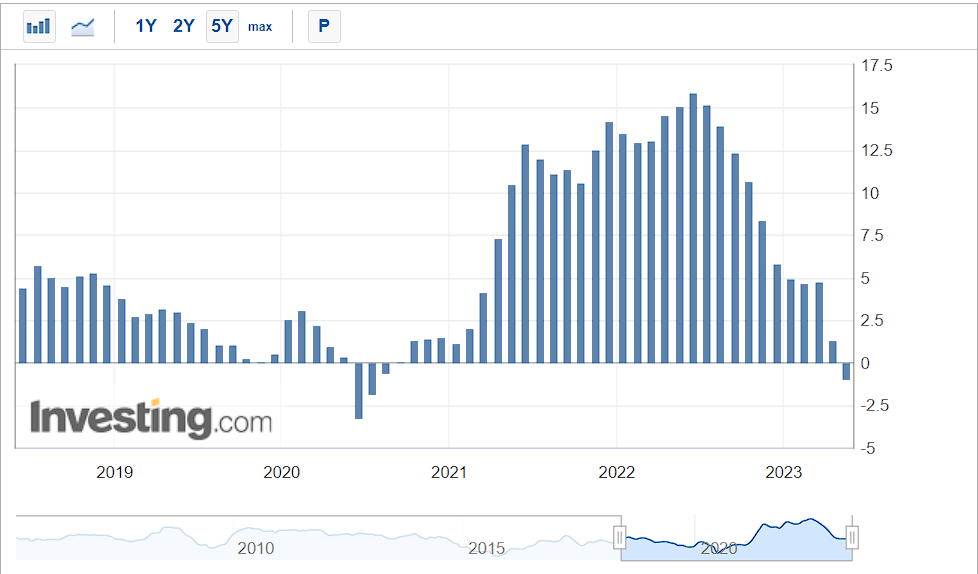

India has recorded a negative Wholesale Price Index (WPI) based inflation rate (-0.92 percent) for the first time in 33 months, as per data disclosed by the Ministry of Commerce and Industry in May 2023. WPI deflation was last recorded in the months of June 2020 and July 2020 (see Figure 2). Notably, WPI inflation is expected to stay soft over the coming months because of a high base effect and benign global commodity prices. The more closely followed Consumer Price Index (CPI) based retail inflation is also at an 18-month low.

Figure 2: India’s WPI-based inflation over time

Source: investing.com

The WPI deflation was driven by a decline in “prices of basic metal, food products, mineral oils, textiles, non-food articles, chemicals and chemical products, rubber and plastic products, and paper and paper products.” This deflation in wholesale or producer prices is expected to exert a lagged impact on retail prices; with lower WPI helping arrest retail inflation through the former’s lagged effect on core CPI-based inflation.

Though the prompt inference might be that declining prices are advantageous, a prolonged period of deflation can be harmful. It may induce purchasers and firms to postpone acquisitions and investments, to capitalise on further expected price reductions. This “game of deference” can cause reduced demand, incentivising production cuts and layoffs and thereby potentially leading to a recession. Banks may face a squeeze in their net interest margins due to reduced lending rates, retailers could witness declining profits due to consumers postponing purchases in the hope of lower future prices, and the real estate sector could stagnate with lower inflation eroding the investment-driven allure of the sector.

Questionable growth assumption

Interestingly, the RBI appears quite optimistic on the economic growth front, having repeated its prediction of 6.5 percent GDP growth for FY2023-24 even as the World Bank slashed its projection by 30 basis points (bps) to 6.3 percent. The RBI’s bullishness seems to be based on the better-than-anticipated real GDP growth of 7.2 percent in FY2022-23, and the ostensible robustness of consumer and investment sentiments prevailing over the ongoing year. Both must be scrutinised.

Although the extra 20 bps of growth in FY23 has been rationalised in terms of a delayed growth bump in the last quarter, the actual reason perhaps rests in the significant downward revision in the trade deficit by 28 percent between the second advance estimate in February 2023 and the provisional estimate released in May 2023, given the inverse relationship between the trade deficit and GDP. The reduction to the trade deficit print in May augmented GDP growth by roughly 90 bps, greater than consumption or investment. Quarterly data and revised figures have always proved troublesome with the World Bank observing that the final figures differed from initial forecasts by up to 50 bps at times.

The evidence on investment activity is also not very encouraging, with growth in steel consumption and cement production driven more by increased investment in housing and services sectors, rather than manufacturing.

The Chief Economic Advisor has suggested that the final growth rate for FY23 could be yet higher when the figures are confirmed in 2026. However, the issue is actually regarding the salient part played by crude oil prices and trade deficits. The cheaper oil from Russia during the latter part of FY23, which helped curtail India’s import bill and trade deficit, may soon become a thing of the past and thereby hinder the latter country’s economic growth.

On the consumption front, enhanced passenger vehicle sales, domestic air passenger traffic and credit card outsourcing may indicate a pick-up in urban demand, but aggregate private final consumption expenditure continues to be mostly non-discretionary, characteristic of an economy with low income per capita and elevated income inequality. The evidence on investment activity is also not very encouraging, with growth in steel consumption and cement production driven more by increased investment in housing and services sectors, rather than manufacturing.

A neutral stance?

While the status quo in the repo rate is justified, the RBI should have changed its stance to neutral. This was called for in light of the quick softening in retail inflation to 5.3 percent in FY24, within the central bank’s target range of 4–6 percent.

Even the Confederation of Indian Industries expects GDP growth to be in the range of 6.5 to 6.7 percent in FY24, with CPI inflation falling within the RBI’s target range. As such, a shift to a neutral stance would have signalled that the RBI could hike, pause, or cut at a future date, as required by the data and lags in transmission. Such a dovish pivot would have, therefore, been an appropriate reaction to the surprisingly abrupt disinflation in March and April.

The RBI’s growth forecast rests on assumptions pertaining to the sustainability of the robust growth witnessed toward the culmination of the previous fiscal, as well as the ostensible uptick in economy-wide consumption and investment activity.

Outlook

If India’s recent tryst with wholesale deflation—caused by softer global commodity prices—is transient, it might actually benefit the Indian economy through enhanced profitability for firms arising from lower input costs. Conversely, if the deflation is sticky and results in the harmful consequences alluded to above, it would harm the economy. Further, the RBI’s growth forecast rests on assumptions pertaining to the sustainability of the robust growth witnessed toward the culmination of the previous fiscal, as well as the ostensible uptick in economy-wide consumption and investment activity.

On the other hand, foretelling when the RBI would be amenable to changing its policy stance is turning hard with the varying views of the MPC members. In April, five of them voted in favour of staying focused on the withdrawal of accommodation while one articulated reservations on this. This remained unchanged in the latest meeting, with the same five members once again voting to continue the withdrawal of accommodation, and the same lone member once again expressing reservations on this part of the resolution. A normal monsoon and the consequently softer inflation in food prices, however, could force RBI’s hand on both its policy stance as well as on the policy rate front.

Aditya Bhan is a Fellow at the Observer Research Foundation

Views expressed are personal.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV