-

CENTRES

Progammes & Centres

Location

Crude oil prices are likely to head under US$ 90 per barrel, rather than exceed US$ 100 per barrel, notwithstanding daily fluctuations

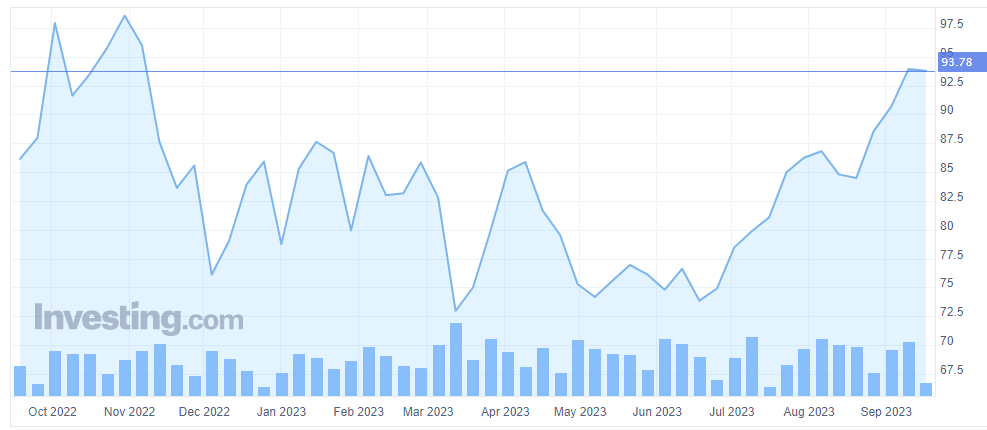

At the time of writing, international crude oil prices have been rising for three consecutive weeks, with Brent attaining its highest level since the last calendar year (Figure 1). The gains have been supported by underwhelming the United States (US) shale production and supply worries due to sustained output restrictions by Saudi Arabia and Russia. As part of the Organization of Petroleum Exporting Countries Plus (OPEC+) grouping, these two countries have decided to extend aggregate production cuts of 1.3 million barrels per day (bpd) to the culmination of CY2023. With US shale production headed toward its lowest levels since May 2023, many analysts believe that there is no stopping the ongoing crude price rally. On the other hand, there are tangible geopolitical and geoeconomic reasons that point towards current oil prices being close to their peak, including slowing demand in China, and Iran’s re-entry into the international crude oil market.

Figure 1: Price of Brent crude in US$

Source: Investing.com

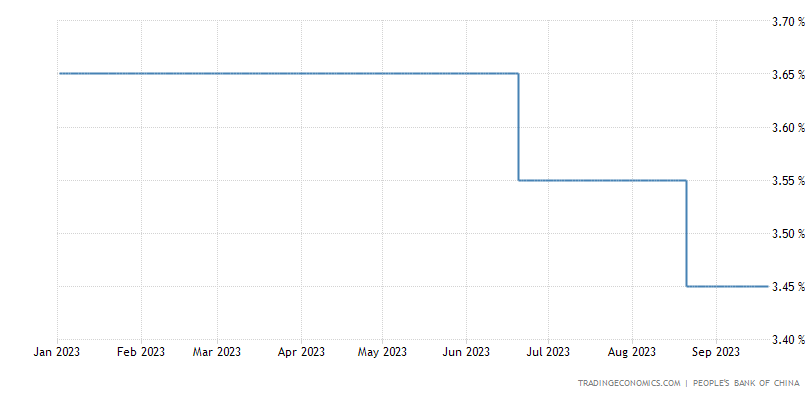

Providing a major boost to oil price bears, Beijing’s crude oil import volume declined to its lowest level in six months in July, with China’s onshore inventories near record highs. With its critical real estate sector in trouble, the Chinese economy finds itself in a challenging situation, potentially capping its demand for crude oil through the rest of CY2023. The reduction in interest rates by the People’s Bank of China (PBOC) is also insufficient to alter China’s near-term economic outlook (see Figure 2).

Figure 2: China’s one-year loan prime rate (LPR)—the medium-term lending facility used for corporate and household loans—was maintained at a record low of 3.45 percent.

Source: Trading Economics

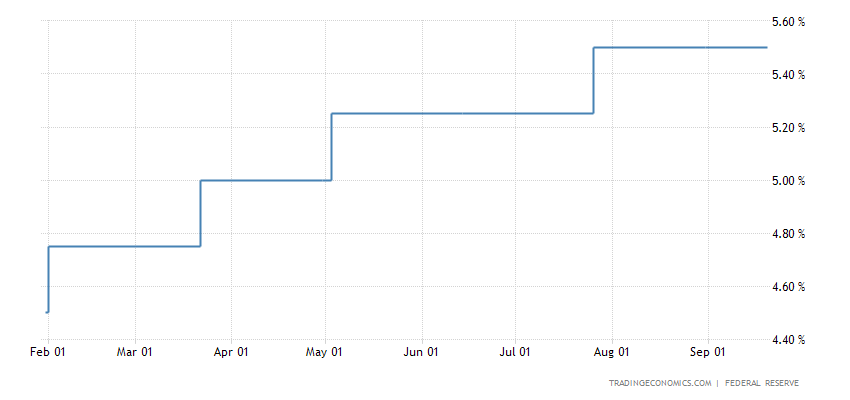

Oil markets have been especially roiled by recent hawkish noises from the Federal Reserve. While the US Central Bank maintained rates, it warned of the possibility of higher borrowing costs through the remainder of this year, with a smaller-than-anticipated decline in 2024 (see Figure 3). Along with similar hints from the Bank of England and the European Central Bank, the warning raised fears of increasing interest rates impeding economic activity and oil demand in the near-term and triggered a bout of profit-taking in oil markets, after prices zoomed to 10-month highs earlier in September.

Figure 3: The US federal funds rate

Source: Trading Economics

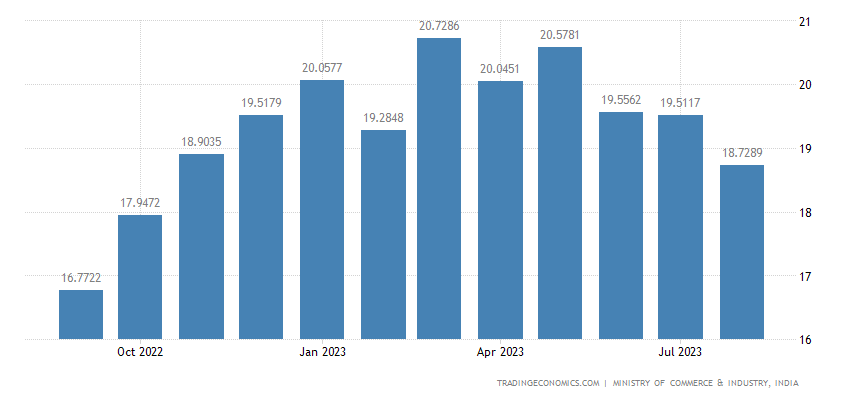

It stands to reason that crude oil’s spike into an overbought zone has left the market susceptible to a correction, with speeches by Saudi Aramco CEO Amin Nasser and Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman on 18 September 2023 hinting at this vulnerability. The Aramco CEO reduced the firm’s long-term view of worldwide crude oil demand to 110 million bpd by 2030—lower than a previous estimate of 125 million bpd, while Prince Abdulaziz bin Salman cited the necessity for strict regulation to curb volatility in global energy markets, the uncertain Chinese demand outlook, faltering economic growth in Europe, and anti-inflationary policies of central banks worldwide. For its part, India’s crude oil imports declined for the third straight month in August due to refinery maintenance activities in India and decreased shipments from Russia (see Figure 4). The former, in fact, has driven the reduction of India’s oil imports from Saudi Arabia—India’s third largest crude oil supplier after Russia and Iraq, respectively—to a multi-year low of roughly 5 lakh bpd in September 2023. For context, import volumes between January 2022 and August 2023 averaged over 7.5 lakh bpd.

Figure 4: India’s crude oil imports in million tonnes

Source: Trading Economics

On the supply side, Exxon Mobil Corp has committed to an incremental oil supply of almost 40,000 bpd in Nigeria amidst a new investment push in the African nation (see Figure 5). A rise in Iranian crude oil exports is also bolstering aggregate supply, constituting a bearish development for oil prices. As per TankerTrackers.com, which releases data on crude oil shipments to governments, Iranian crude oil exports increased to a 5-year high of 2.2 million bpd during the first 20 days of August 2023, with most shipments heading to China.

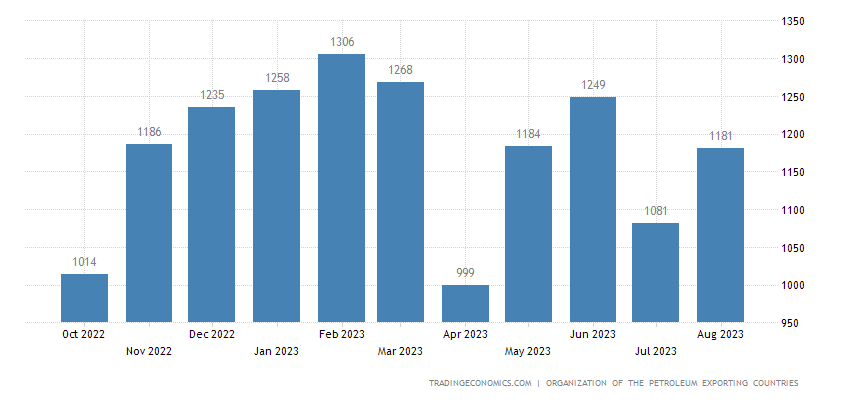

Figure 5: Nigeria’s crude oil output rose to 1,181 BBL/D/1K (bpd in thousands) in August 2023, from 1,081 BBL/D/1K in July 2023

Source: Trading Economics

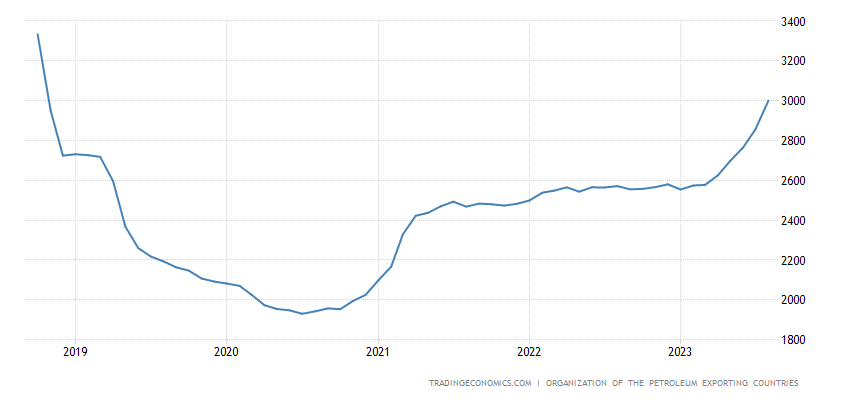

A bearish development for oil prices is the progress achieved in Iran-US relations, which could elevate oil exports from Iran. Tehran claims that the recent agreement with the US, on the freeing of prisoners and de-freezing of Iranian financial assets, could be seen as a precursor to negotiations in other areas including its nuclear programme—a deal which could persuade the US and its allies to abolish sanctions on Iran’s crude oil exports, enhancing worldwide supply. In fact, Iran has already boosted its crude oil production to its highest level since 2018 (see Figure 6).

Figure 6: Iran’s crude oil production rose to 3,000 BBL/D/1K in August 2023, from 2,857 BBL/D/1K in July 2023

Source: Trading Economics While Nigeria and Iran are certainly not the largest crude oil producers, Specifically, the OPEC produced 27.73 million bpd in September compared to 1,20,000 bpd in August, with production in the latter month having increased for the first time since February.

While many have predicted crude oil trading at US$ 100 plus per barrel levels by the end of CY2023 and into CY2024, it must be appreciated that the currently elevated oil prices have resulted from many months of seasonally high demand. In this restricted market, however, demand seems close to its summit. Looking ahead, however, demand may contract by about 3 million bpd, causing a loosening of the market toward the culmination of CY2023 and into early CY2024. To be sure, OPEC production cuts have been effective in their own rights thus far but non-OPEC producers shall eventually mitigate their impact by producing at peak capacity, except for some heavyweights with alternative priorities. Therefore, crude oil prices are likely to head under US$ 90 per barrel, rather than exceed US$ 100 per barrel, notwithstanding daily fluctuations.

Aditya Bhan is a Fellow at the Observer Research Foundation. Views expressed are personal.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.