-

CENTRES

Progammes & Centres

Location

Investment and demand are interlinked, thus a lack of investment creates a lack of demand as it impacts income and employment levels, which in turn impact the level of investment in the economy.

The Finance Minister, Nirmala Sitharaman, recently announced the biggest reduction in corporate tax from 30% to 22% in 28 years. This will lead to a fall in tax, effectively, from 34.9% to 25.2% inclusive of all surcharges. In terms of corporate taxation, this will bring India at par with the other Asian countries. This long overdue reform was undertaken in the hope of reviving growth. It is expected to lead to an increase in private sector investment, even though it raises questions about how the government will maintain its fiscal deficit target of 3.4%.

Will a corporate tax cut be enough to revive investment and boost employment? Can private investment be a substitute for public investment? Will private investment lead to economy wide impact? While a lowering of corporate tax rate will help increase the profit margin, there are a number of other factors that have led to the current state of low growth in the economy, chief among them a lack of demand. In the absence of other measures to revive demand, will private investment alone lead to a revival?

While a lowering of corporate tax rate will help increase the profit margin, there are a number of other factors that have led to the current state of low growth in the economy, chief among them a lack of demand.

Agriculture employs about 50% of our working population. Thus, agriculture plays an important role in the overall demand condition of the economy. As also emphasised by our prime minister in his speech in parliament said, “Agriculture is the backbone of our economy.” As per a study by Nielsen, the dip in rural demand will slow down FMCG growth in 2019. This is significant given the fact that rural demand now contributes to 37% of the FMCG growth and is growing at a rate that is faster than the urban demand.

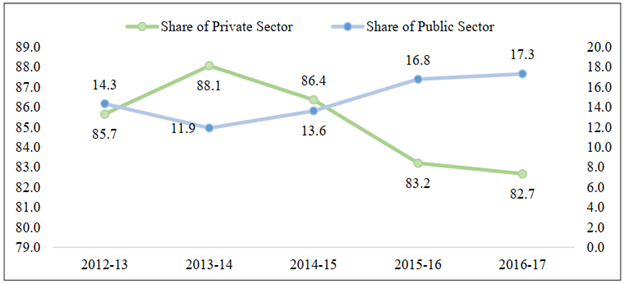

In the agriculture sector, private sector investment in agriculture has been falling as per the economic survey 2019. This is even as the private sector expenditure is around 85% and that of public expenditure is only 25%. This figure was the reverse in 1990 where the share of public expenditure was 80% and that of private expenditure was 20%. In this context, it is important to note the importance of public expenditure in agriculture. While private investment is associated with enhanced productive capacity at an individual level, public investment usually strengthens the basic infrastructure (such as roads, canal waters, watersheds, check dams) that has positive forward linkages which further helps raise private investment. Further, there are areas where the private sector has not shown much investment such as rain-fed areas, tribal areas, natural resource management, pulses, and the public research system. Here, the role of public investment has no substitute. Therefore, increased public investment would help raise rural output and thus rural demand. But agriculture has been sustaining on private investments so far. It is a question of how agricultural and rural growth will pick up without increased public investments.

Source: Economic Survey 2018-19

Source: Economic Survey 2018-19

As a result of the lower corporate tax receipts, the fiscal maneuvering for the government would reduce. The government does acknowledge the impact on fiscal deficit target. It is likely that this will be breached further given the fact that the tax earnings from Goods and Services Tax (GST) has also fallen short of expectations. Further, deviation from the target for the second consecutive year in a row may affect India’s sovereign rating.

This is a concern considering the fact that the burden of rationalisation of expenditure has historically fallen on capital expenditure of the government. Thus, an attempt to stick to the fiscal deficit figure would further impact the quality of government expenditure. The following table shows the share of revenue and capital expenditure as a percentage of total GDP.

| Year | Revenue expenditure | Capital expenditure | GDP at constant prices | Revenue expenditure as a % of GDP | Capital expenditure as a % of GDP |

| 2012-13 | 1,243,514 | 166,858 | 9,104,662 | 14% | 2% |

| 2013-14 | 1,371,772 | 187,675 | 9,679,027 | 14% | 2% |

| 2014-15 | 1,466,992 | 196,681 | 10,402,987 | 14% | 2% |

| 2015-16 | 1,537,761 | 253,022 | 11,234,571 | 14% | 2% |

| 2016-17 | 1,690,584 | 284,610 | 12,153,754 | 14% | 2% |

| 2017-18 | 1,878,833 | 263,140 | 13,034,121 | 14% | 2% |

| 2018-19 | 2,140,612 | 316,623 | 13,932,287 | 15% | 2% |

Source: RBI database

The share of capital expenditure has remained at a low of about 2% over the years and revenue receipt has a much higher share of 15%. This shows that the quality of fiscal expenditure has deteriorated. The share of capital expenditure declined over the past few decades, even as revenue expenditure has increased its share. Thus capital expenditure has taken an uneven burden of the rationalisation of expenditure by the government, in order to keep within the fiscal deficit target.

Investment and demand are interlinked, thus a lack of investment creates a lack of demand as it impacts income and employment levels, which in turn impact the level of investment in the economy. The way out of this vicious cycle as theorised by Paul Rosenstein-Rodan may be the “big push.” Big push refers the big initial momentum in terms of investment that needs to be imparted to a stagnant economy that would lead to self-generating and cumulative growth. But it is likely that the policy continuity with respect to public investment will remain the same and the big push will not come from the government; the private sector will be expected to step in. However, corporates would have an incentive to expand investment only if there is demand for their goods in the economy, otherwise it would be a risk to invest more.

Then Indian economy has grown at its slowest at 5% in the June quarter of 2019. Private final consumption expenditure (PFCE) accounts for 57% of GDP. PFCE, which reflects demand in the economy grew at 3.14 % in the first quarter, which is a seventeen quarter low. It collapsed from 10.6% in the fourth quarter of 2018. Automobile sales that act as a barometer for the health of the economy have declined sharply in the past few months.

Thus, more savings on account of lower taxes may only lead to a distribution of income rather than an increase in output and employment. The tax cut will surely help corporates to improve their balance sheets but it is a moot question whether the savings would be redirected to investment given the prevailing demand situation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Nandini Sarma was a Junior Fellow with the Green Transitions Initiative at ORF. Her research focuses on growth trade and climate.

Read More +