Lately, the decline in net financial assets of Indian households is making news. While the veracity of this claim is questionable, considering it as an indication of financial distress is even more baseless and misplaced. The misinterpretation flared up when it was widely reported in the media that household debt had hit an all-time high of 40 percent of Gross Domestic Product (GDP), using the latest RBI Household Financial Savings data. The logical fallouts of this phenomenon should have been an erosion of household purchasing power due to lower disposable incomes, and precariously overstretched credit markets—none of these are prevalent. This raises serious doubts about such claims of households’ financial distress due to enhanced debt.

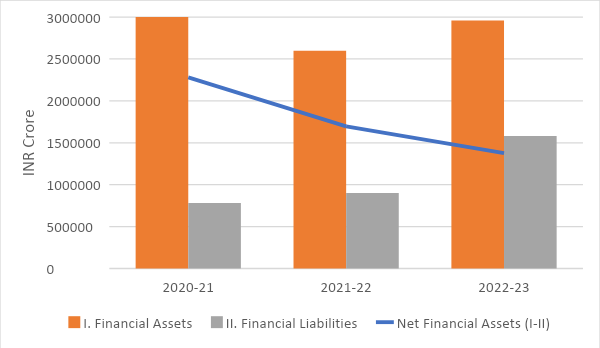

Sticking to the basics is sufficient to dismiss such claims. Household financial savings are classified as stocks (the cumulative value till a point in time) and flows (the value during a period). According to the Reserve Bank of India (RBI) data, the flow of net financial assets in 2022-23 was 5.1 percent of GDP (5.25 percent of the revised GDP estimates), down from 11.5 percent in 2020-21 and 7.2 percent in 2021-22. The decline to 5.1 percent was driven by both a 0.2 percentage point reduction in net financial assets and a strong 2.0 percentage point rise in net financial liabilities of households. Despite the steep rise in liabilities, they stood at only 5.8 percent of GDP during the year. However, a conceptual error emerges here while juxtaposing the cumulated stock of household debt of 37.6 percent as of March 2023 with the additional net flow of financial assets in the financial year. A stock figure cumulated over years cannot be compared to one-year flow data. Rather, the cumulated net (outstanding) debt numbers are dwarfed in front of the cumulated financial asset numbers that stand at a staggering 103.1 percent of the GDP. Here, one needs to remember that debt servicing or retirement can always be done by the assets, which are too overwhelming when compared to the outstanding debt figures.

A stock figure cumulated over years cannot be compared to one-year flow data. Rather, the cumulated net (outstanding) debt numbers are dwarfed in front of the cumulated financial asset numbers that stand at a staggering 103.1 percent of the GDP.

Let the numbers speak

In absolute terms, a year-on-year comparison shows an increase in both financial assets and liabilities, but a steeper rise in liabilities. This would have been concerning if it implied that aggregate household savings had slowed down, posing a threat to economic growth. However, this is not the case for two major reasons.

Fig. 1: Flow of Financial Assets and Liabilities

Source: RBI

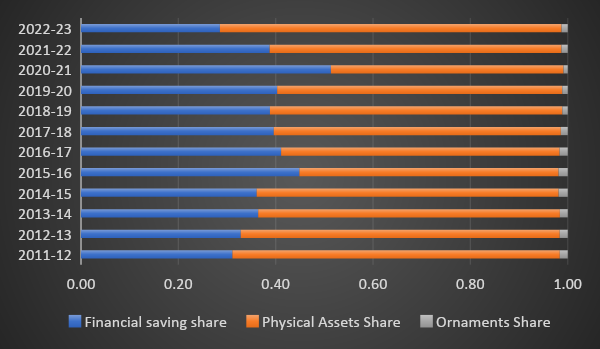

First, households still remain the largest driver of fixed capital formation accounting for over 60 percent of gross national savings as per recent NSO estimates. It needs to be understood that financial savings are only a component of gross savings that are classified into three avenues—financial savings, savings in physical assets, and savings in the form of gold and silver ornaments. Therefore, a dip in financial savings does not necessarily imply a slowdown in gross savings, but may be a result of savings shifting from one head to another. This can emerge from a shift in household preferences, risk appetite and confidence in national prospects. Second, the year-on-year growth rate of Private Final Consumption Expenditure (PFCE), has slowed down to 6.7 percent, lower than the GDP growth rate. Thus, the lower consumption must be reflected through higher savings, especially when national income is increasing. The macroeconomic identity of national income accounting guarantees that gross savings have not slumped—while on the contrary, the domestic savings propensity might stabilise at a higher level, allowing a shift towards an investment-led growth trajectory.

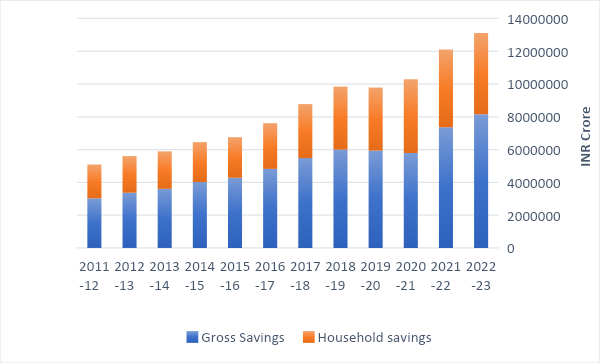

While households are still the largest source of domestic savings, exhibiting positive growth in absolute terms, their share in gross savings has seen a slow decline. This is due to stronger balance sheets of non-financial corporations and improved public finances in the aftermath of the pandemic. But the question remains, where are the household finances going?

Where have the households parked their money?

Consumption is bound to slow down when investment-friendly conditions have allowed the accumulation of wealth in the economy, skewing the wealth distribution. As incomes increase, the propensity to consume declines—this is partly true for the Indian economy as well. On the other hand, the aspirational Indian household is putting money into real estate, which is being reflected through the rise in physical assets share in household savings in 2022-23 (Fig. 2). Further, the gross household savings increase in 2022-23 as compared to 2021-22 is to the tune of 4.65 percent. This implies that the money is still in the households’ domain, but flowing from its left to right pocket!

Fig. 2: Household savings by category

Source: RBI

This is confirmed by the share of households in gross capital formation, i.e., investment. Households finance over 40 percent of the domestic investment, with most of it directed towards dwellings, buildings and structures, i.e. real estate. The aspirational Indian wants to own their roof, leading to a massive influx of savings in the market. This has also led to swelling of household debt for supporting the real estate buying spree.

The definition of financial savings is outdated. The assets include deposits, life insurance and pensions funds, currency and investments in equity or mutual funds. This is insufficient as greater financial penetration of the Indian market has provided households with multiple investment alternatives. Innovations such as the RBI Retail Direct have provided households access to government securities. Further, reduction in the face value of privately placed bonds by SEBI is expected to deepen the corporate bond market through increased non-institutional participation. Thus, there is an underestimation of the net household savings—calling for an urgent definitional revision of household assets and liabilities.

The definition of financial savings is outdated. The assets include deposits, life insurance and pensions funds, currency and investments in equity or mutual funds.

Is India saving more?

Gross savings in the economy has been secularly rising. This includes savings of financial and non-financial corporations, the government, and the household sector. Thus, on the aggregate, there is an inflow of funds that can be mobilised towards productive activities. From a neoclassical standpoint, this also translates into a higher savings rate which is essential for a higher steady-state level of income growth. In other words, if gross savings are consistently higher, India can continue to maintain a robust growth rate with lesser external dependence.

Fig. 3: Gross savings and household savings

Source: Reserve Bank of India

The decline in financial savings would have been a cause for concern if it implied a reduction in the availability of banking assets and credit in the market. However, as long as the economy as a whole is saving more, there are no economic repercussions. Instead, the shift of household savings towards the real estate sector is directly productive and reduces intermediation. The concomitant rise in borrowing to finance real estate demand is an intertemporal balancing process which is unlikely to introduce any permanent shocks to the economy. However, there needs to be continuous monitoring and regulatory intervention to ensure that this household debt is secured and does not breach permissible risk levels—to avoid any credit market crises.

The decline in financial savings would have been a cause for concern if it implied a reduction in the availability of banking assets and credit in the market. However, as long as the economy as a whole is saving more, there are no economic repercussions.

Confusion with nomenclature and definition

Household savings allocated to real estate, whether in the form of residences or other dwellings, are considered investments rather than consumption. This reflects a deliberate choice by households to defer current consumption in favour of building savings for future consumption or financial stability. The sustained upward trend in bullion markets, coupled with the rise in savings invested in ornaments, suggests that Indian households have a preference for tangible assets over financial ones, which typically carry higher risk. This is a reflection of the dynamism of the households’ preferences that are non-static and respond to changing economic environments and market forces. Without a nuanced understanding of households’ saving behaviours in the face of a host of choices, there will only be unfounded floating myths flouting the realities.

Nilanjan Ghosh is the Director at the Observer Research Foundation.

Arya Roy Bardhan is a Research Assistant at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV