India’s economic slowdown has intensified, with GDP growth plummeting to 4.5% in the second quarter of FY19-20. Recent reports (which have been rejected by the government) suggest that household consumption spending, including food, reduced in FY17-181 for the first time in four decades; and the unemployment rate rose to a 45 year high at 6.1% in FY17-18. These clearly present a story of an economic slowdown in the country.

Similarly, on comparing the income growth for the top 1% with the bottom 50% of the Indian population, while the former has risen enormously by a whopping 750% from 1980 to 2014, the latter has only risen by 89% in the same time period. An inevitable fall in consumption resulting out of the slowing growth rate would then require a fiscal stimulus favouring the poorest.

The situation with regards to the rural economy, where most of the country resides, is much worse. The rural consumption spending declined by 8.8%1 the average monthly spending on food declined by a whopping 10% and rural unemployment increased by 8%2 between FY11-12 and FY17-18.

In this story of high joblessness, plunging growth, decreasing household consumption and falling demand, people hoped that the budget 2020 will help relieve the rural distress. However, the government while refusing to acknowledge the economic slowdown in all its gravity, announced relief in the budget through schemes like slashing corporate taxes and income tax cuts to counter the problem, hoping things would work. But schemes like these are mainly skewed towards the richest and don’t work in favour of the people who need money in their pockets to sustain their demand.

Then, in the present economic condition, an increased government spending on a scheme like MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) that aims to provide “at least 100 days of wage employment in a financial year to every household whose adult members volunteer to do unskilled manual work” and hence allot funds to the most vulnerable, would have made more sense.

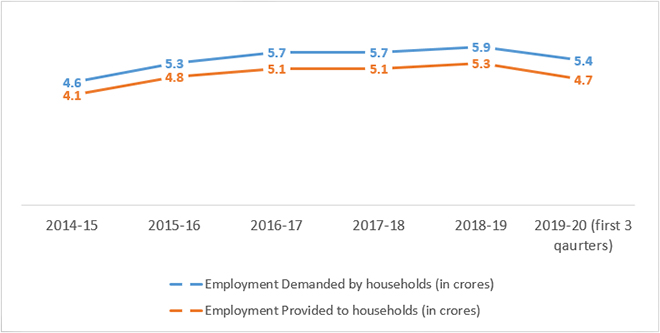

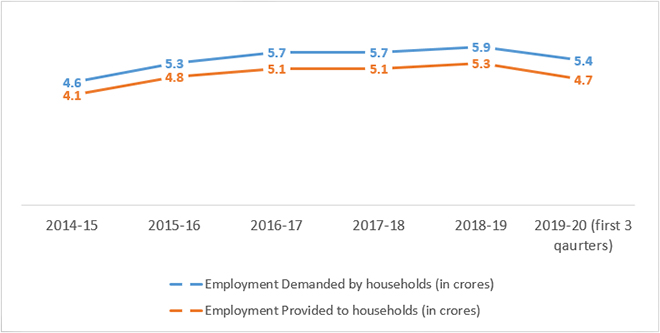

This was especially important since, with growing unemployment, while the job demand under MGNREGA has been rising in the past few years, the employment provided under the scheme has been falling short year after year2 (see chart below). The scheme witnessed a higher demand for jobs despite the various problems that people face while availing this scheme, related to wage payments and compensation payment delays, lower than notified wage, amongst others.

Figure 1: Gap between Employment Demanded and Generated under MGNREGA

Source: MGNREGS Portal, MIS Report, R 5.1.1, Employment Generated

Source: MGNREGS Portal, MIS Report, R 5.1.1, Employment Generated

Therefore, in the current slowdown, given the sharp fall in consumption growth, government spending on income and employment support schemes which puts money in the hands of people could have led to a boost in demand via a multiplier effect.

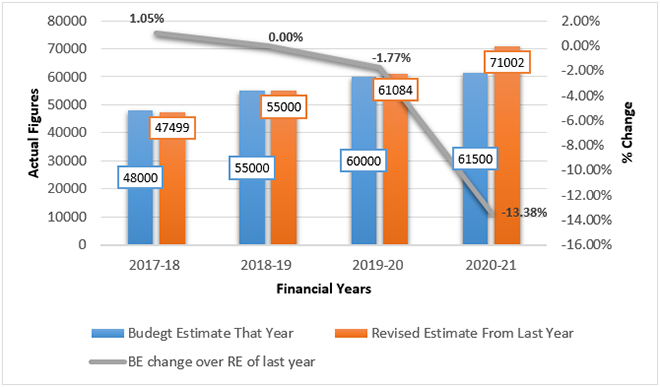

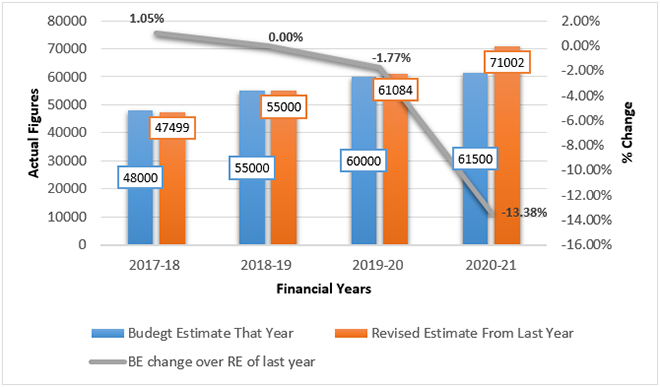

While that was expected, the budget allocation to the centrally sponsored scheme saw a meagre increase of Rs. 1,500 crores from FY19-20 to FY20-21. However, on comparison with the Revised Estimates of FY19-20, the budgetary allocation in FY20-21 was actually 13.38% less.

The fund crunch in MGNREGA leads to increasing pending liabilities as states do tend to overspend to meet the demand for jobs. This was evident by the financial statement released by the scheme earlier this year, pointing to 15 states already having overspent with two months remaining for the fiscal year to end. However, due to the lower funds, the states also tend to suppress demand and turn workers away.

Thus, a smaller budgetary allocation in MGNREGA in the present economic condition implies lesser money in the hands of the public. What ensues is a further fall in demand and hence, GDP and a greater rural distress in the economy which the government has decided to not deal with.

Furthermore, the MGNREGA has seen a continuously smaller budgetary allocation (BE) 4 as compared to the Revised Estimates (RE) 5 and the shortfall over Revised Estimates has actually seen a rise every year as is indicated in figure 2.

Figure 2: Actual Figures and Percentage Differences of BE over RE of last year - MGNREGA

Source: Union Budget website - BE – Budgetary Estimates, RE – Revised Estimates

Source: Union Budget website - BE – Budgetary Estimates, RE – Revised Estimates

The increased demand under MGNREGA points to a dire need of job creation in rural India. The lack of alternate job opportunities, falling farmer incomes, rising unemployment have all led to increasing agricultural distress. Yet, the resistance to increase budgetary allocation to scheme like MGNREGA points to the government’s inability to address the problem.

Another scheme that might have induced a fiscal stimulus in the rural economy was the Prime Minister’s flagship scheme – Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) that was announced during the 2019 Lok Sabha elections. The scheme provides direct cash transfer to every farmer forming a sort of universal basic income for them. However, the budgetary allocation for this scheme was also cut by 27.5% in the current budget.

Given the economic slowdown, and lack of quality jobs in India, increased budget allocations to schemes like MGNREGA and PM-KISAN was the need of the hour. The lower allocation has led to lost opportunities on two counts. The first is the lost opportunity to boost rural consumption, and the second is the lack of a social safety net for the economically vulnerable sections of society. This safety net is highly essential given high levels of rural distress, particularly in agriculture, which has grown at only 2.9% last year.

Until the government is ready to implement solutions to deal with low consumption spending and low demand in a slowing economy facing rural distress and absence of jobs, India will be prone to being knee deep in crisis.

Endnotes:

1. The figure is cited from the leaked results for all-India Household Consumer Expenditure Survey conducted by the National Statistical Office (NSO) during 2017-2018. Ministry of Statistics and Programme Implementation (MOSPI) stated that the results weren’t valid owing to data quality issues in the survey. However, reports that leaked the result state that the figures were withheld owing to ‘adverse findings in the survey’. Although, very recently the NSO decided not to release the results at all.

2. Another case of data leak occurred with regards to the NSSO employment-unemployment data, which was also withheld till after the 2019 Lok Sabha elections.

3. For 2019-20, only the data for the first three quarters was available.

4. Budget Estimates refers to the amount of money allocated in the Budget to any ministry or scheme for the coming financial year.

5. Revised Estimates are mid-year review of possible expenditure, taking into account the rest of expenditure, New Services and New instrument of Services etc. In a budget document, the revised estimates of last year are presented.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: MGNREGS Portal, MIS Report, R 5.1.1, Employment Generated

Source: MGNREGS Portal, MIS Report, R 5.1.1, Employment Generated Source:

Source:  PREV

PREV