-

CENTRES

Progammes & Centres

Location

The attempt to woo FIIs and FPIs may look like an innovative step to mobilise investment from abroad, yet this is a gamble which may or may not pay off. If this fails, it may make the economy vulnerable to international financial turmoil.

Finance Minister Nirmala Sitharaman presented the Union Budget on 5 July 2019 with a grand vision of making India a $5 trillion economy in the next few years. The budget speech largely dwelt on building physical and social infrastructure, increasing the outreach of Digital India, making India pollution-free, boosting MSMEs, start-ups and manufacturing, self-sufficiency and export of foodgrains among others — as parts of this grand vision.

However, Rathin Roy — a member of the Prime Minister’s Economic Advisory Council — later pointed out that revenue estimate (as percentage to GDP) quoted in budget documents, at 9.2%, is one percentage point lower than the estimate quoted in Economic Survey (see highlighted cells in Table 2), which used more recent provisional actuals (PA) vetted by the Controller General of Accounts (CGA). The difference of that one percentage point amounts to a whopping Rs 1.7 lakh crore, and suddenly the revenue performance — as described in the budget speech — undergoes a drastic change. Since then, a controversy erupted over the matter, and the Finance Minister reacted in Parliament by saying, “Both the projections are consistent with each other.”

The arguments made in this essay are not directly linked to this statistical controversy, but still mentioned because the data used for this analysis of budget are taken from the Economic Survey (ES) of this year for relatively better accuracy. The transparent disclosure of this information is intended to steer away from the controversy and to concentrate on the main arguments which are as follows.

National income/output (Y) or GDP consists of private consumption (C), government consumption (G), investment (I) and net export — given by the difference between exports (X) and import (M). The national income identity is, thus, expressed as —

Y = C + I + G + (X-M)

| TABLE 1: Growth rates of components of GDP at current prices (in percentage) | ||||||

| PFCE | GFCE | GFCF | Export | Import | GDP | |

| 2012-13 | 5.5 | 0.6 | 4.9 | 6.8 | 6.0 | 5.5 |

| 2013-14 | 7.3 | 0.6 | 1.6 | 7.8 | -8.1 | 6.4 |

| 2014-15 | 6.4 | 7.6 | 2.6 | 1.8 | 0.9 | 7.4 |

| 2015-16 | 7.9 | 7.5 | 6.5 | -5.6 | -5.9 | 8.0 |

| 2016-17 (2nd RE) | 8.2 | 5.8 | 8.3 | 5.1 | 4.4 | 8.2 |

| 2017-18 (1st RE) | 7.4 | 15.0 | 9.3 | 4.7 | 17.6 | 7.2 |

| 2018-19 (PE) | 8.1 | 9.2 | 10.0 | 12.5 | 15.4 | 6.8 |

| * RE = Revised Estimate, PE = Provisional Estimate * PFCE = Private Final Consumption Expenditure, GFCE = Government Final Consumption Expenditure, GFCF = Gross Fixed Capital Formation, GDP = Gross Domestic Product | ||||||

| Source: Economic Survey, 2018-19 |

Table 1 captures the growth rates in all these components of GDP in the period between 2012-13 and 2018-19. Consumption (PFCE) in the economy evidently has grown compared to the initial few years in this period, but did not pick up much in the last four years and consumption growth remained somewhere around 8% (in 2017-18, even went below at 7.4%). Imports have grown way more than exports in the last two years, signifying the global slowdown and mounting trade tensions.

For the last two years, government consumption expenditure (GFCE) growth stands out and a decent GDP growth rate in this period is heavily sustained by government spending. This finds little mention in most of the commentaries on budget.

Investment (captured by GFCF), both private and government, has grown considerably in the last four years or so. But the important point to note here is that a 10% growth in investment could only bring in 6.8% GDP growth. Clearly, the ambition of achieving a $ 5 trillion economy warrants a higher GDP growth and higher GFCF/investment growth — definitely much higher than 10%.

So, the stage was set for more investment in this year’s budget. In the absence of sizeable private initiative at boosting investment, the government was expected to take up the cudgels — may be through some fiscal stimulus policies. Instead, the onus fell on private investment once again, mainly through PPP (public-private partnership) model.

For example, railway infrastructure would be needing investment worth Rs.50 lakh crore between 2018 and 2030, but the capital expenditure outlays of Railways are around Rs.1.5 lakh crore to Rs.1.6 lakh crore per annum. So, the budget proposed to use PPP to “unleash faster development and completion of tracks, rolling stock manufacturing and delivery of passenger freight services.”

Similarly, infra projects like RRTS (Rapid Regional Transport System) and Bharat-Net (universal rural internet network) are also expected to be undertaken in the PPP model. General thrust of the vision charted out in the budget, therefore, veers towards the PPP model. The fact that private investment has been unable to grow substantially in recent years, could not pursue the Finance Ministry to take the fiscal stimulus route in this year’s budget.

The Government not going in the direct intervention mode to boost investment has a direct relationship with the fiscal consolidation path, as charted out in Fiscal Responsibility and Budget Management (FRBM) Act. Table 2 demonstrates that with greater detail.

| TABLE 2: Receipts and expenditures of the central government (as percentage of GDP) | |||||||||||

| 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 (BE) | 2018-19^ (RE) | 2018-19 (PA) | |

| Revenue Receipts (a+b) | 10.1 | 8.6 | 8.8 | 9.0 | 8.9 | 8.7 | 9.0 | 8.4 | 9.2 | 9.2 | 8.2 |

| (a) Tax Revenue (net of States' share) | 7.3 | 7.2 | 7.5 | 7.3 | 7.3 | 6.9 | 7.2 | 7.3 | 7.9 | 7.9 | 6.9 |

| (b) Non-tax Revenue | 2.8 | 1.4 | 1.4 | 1.8 | 1.6 | 1.8 | 1.8 | 1.1 | 1.3 | 1.3 | 1.3 |

| Revenue Expenditure | 13.4 | 13.1 | 12.5 | 12.2 | 11.8 | 11.2 | 11.1 | 11 | 11.4 | 11.4 | 10.6 |

| of which: | |||||||||||

| (a) Interest Payments | 3.0 | 3.1 | 3.1 | 3.3 | 3.2 | 3.2 | 3.2 | 3.1 | 3.1 | 3.1 | 3.1 |

| (b) Major subsidies | 2.1 | 2.4 | 2.5 | 2.2 | 2.0 | 1.8 | 1.3 | 1.1 | 1.4 | 1.4 | 1.0 |

| (c) Defence Expenditure | 1.2 | 1.2 | 1.1 | 1.1 | 2.1 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | 1.0 |

| Revenue Deficit | 3.2 | 4.5 | 3.7 | 3.2 | 2.9 | 2.5 | 2.1 | 2.6 | 2.2 | 2.2 | 2.3 |

| Capital Expenditure | 2.0 | 1.8 | 1.7 | 1.7 | 1.6 | 1.8 | 1.9 | 1.5 | 1.6 | 1.7 | 1.6 |

| Fiscal Deficit | 4.8 | 5.9 | 4.9 | 4.5 | 4.1 | 3.9 | 3.5 | 3.5 | 3.3 | 3.4 | 3.4 |

| Primary Deficit | 1.8 | 2.8 | 1.8 | 1.1 | 0.9 | 0.7 | 0.4 | 0.4 | 0.3 | 0.2 | 0.3 |

| ^ As per Interim Budget 2019-20 * BE = Budget Estimate, RE = Revised Estimate, PA = Provisional Actuals | |||||||||||

| Source: Economic Survey, 2018-19 |

While tax revenue as percentage of GDP has fallen in 2018-19 — bringing down revenue receipts, revenue expenditures are reduced by means of decreasing subsidies and defence expenditure as percentages of GDP. Capital expenditure as percentage of GDP, similarly, took a hit over the years and currently stands at 1.6% of GDP — down from 2% of GDP in 2010-11. This does not bode well for an economy searching for more investment.

And all these are done to keep the fiscal deficit and primary deficit at lower levels, as prescribed under the FRBM Act. Therefore, fiscal consolidation is chosen over a probable option of fiscal stimulus — even when there is a broad consensus that Indian economy has slowed down considerably in the last two years (Table 1).

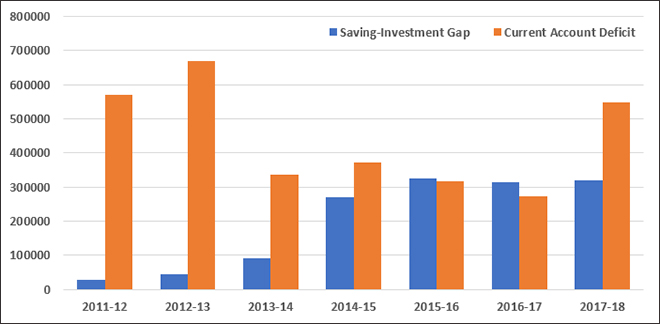

More nuances of the current situation get revealed when we look at the trends in savings-investment gap and current account deficit in recent years (Figure 1). Saving-investment gap has increased rapidly and for the last three years stayed at around Rs 3.2 lakh crore. In simple words, it means that a huge part of the savings is not getting converted into investment in the economy. This budget proposal does not make any effort to mobilise these savings.

This is consistent with the findings of Table 1 as well. It also implies that there is adequate amount of money saved in the economy but possibly there is a lack of investment demand. In that case, one has reasons to be sceptical about the efficacy of the PPP model in boosting investment.

| FIGURE 1: Recent trends in savings-investment gap and current account deficit (in Rs. Crore) |

|

| * All figures are in current prices * Exports and imports figures for 2016-17 are 2nd revised estimates, and for 2017-18 are 1st revised estimates |

| Source: Economic Survey, 2018-19 |

Secondly and more importantly, current account deficit is once again on the rise in 2017-18 after a distinct downward trend since 2014-15. For a major oil importing economy like India, this is a cause for headache and it may have future repercussions on the foreign exchange reserve.

To counter this, Finance Minister for the first time has made an attempt to attract foreign portfolio investment (FPI) in this budget. Usual measures to get more foreign direct investments (FDI) are there — including proposals for further opening up of FDI in aviation, media & animation, and insurance sectors; easing local sourcing norms for FDI in single brand retail; and 100% FDI in insurance intermediaries.

The budget has proposed to increase the statutory limit for FPI investment in a company from 24% to sectoral foreign investment limit, with an option given to the concerned corporates to limit it to a lower threshold. FPIs will also be permitted to subscribe to listed debt securities issued by the ReITs (Real Estate Investment Trusts) and InvITs (Infrastructure Investment Trusts). Budget also includes proposal to permit investments made by FIIs (foreign institutional investors) and FPIs in debt securities issued by Infrastructure Debt Funds-Non-Bank Finance Companies (IDB-NBFCs) to be transferred/sold to any domestic investor within the specified lock-in period.

Here it may be prudent to recall that real estate and infrastructure are currently among the most stressed sectors of the economy — in terms of bad loans, stalled projects and rapidly diminishing financial valuations.

Given rising current account deficit and fiscal constraints under FRBM, the attempt to woo FIIs and FPIs may look like an innovative step to mobilise investment from abroad. But nevertheless, this is a gamble which may or may not pay off. If this fails, there does not seem to be an alternative plan to mobilise investment. More importantly, given the volatile nature of FIIs/FPIs (textbook “hot money” that would go out of the country at the slightest turbulence in financial market), this may make the economy vulnerable to international financial turmoil.

If passed in Parliament, these measures to facilitate FIIs/FPIs will be akin to opening up the capital account of the economy further. The economy will be prone to financial crisis in future — not like the 2008 American crisis but similar to 1997 Asian crisis which was triggered by the collapse of Thai Baht due to lack of foreign currency induced by massive capital flight out of the country and subsequently was spread like wildfire in most of East Asia and South-East Asia through contagion effect.

Only time can tell whether this attempt made in Union Budget 2019-20 bears better fruits at mobilising investment than a fiscal stimulus route by relaxing fiscal responsibility norms.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Abhijit was Senior Fellow with ORFs Economy and Growth Programme. His main areas of research include macroeconomics and public policy with core research areas in ...

Read More +