-

CENTRES

Progammes & Centres

Location

Bangladesh would need to adopt long-term policy measures to achieve a robust growth rate.

Bangladesh’s export sector is often lauded due to the extraordinary growth in export revenues, dominated by the Ready-Made Garments (RMG) sector. In fact, the export earnings reached an all-time high of US$ 52 billion in FY 2021-22. While the export of knitwear garments grew by 36.88 percent year-on-year to US$ 23.21 billion, woven garment exports grew by 33.82 percent to US$ 19.40 billion, during the same fiscal year. However, in the first quarter of FY 2022-23, export revenues for chemical products, agricultural products and frozen & live fish saw a downturn of 30 percent, 14 percent, and 7.2 percent, respectively. While the country was doing well in terms of the various developmental parameters, the exogenous shocks arising from the pandemic and the Russia-Ukraine war have heightened the country’s financial vulnerabilities.

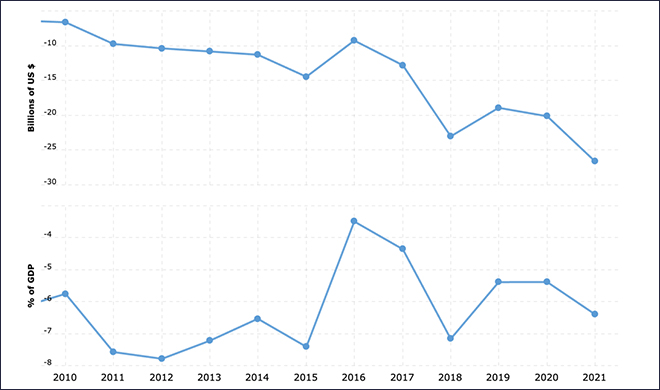

The import-export mismatch poses additional problems for its current account, and hence the Balance of Payments (BOP). The country majorly imports intermediate goods like petroleum products, and chemicals and capital goods like machinery. Only between the last quarter of 2021 and the first quarter of 2022, the import bill has risen by approximately US$ 327.2 million denoting an increase of 1.6 percent. Between 2016 and 2021, Bangladesh’s trade balance deteriorated from US$ (-) 9.26 billion (3.49 percent of GDP) to US$ (-) 26.63 billion (6.40 percent of GDP).

Figure 1. Bangladesh’s Balance of Trade (in US$ billion and percentage of GDP) in Bangladesh (2010 – 2021)

Source: Macrotrends, data from the World Bank

Source: Macrotrends, data from the World Bank

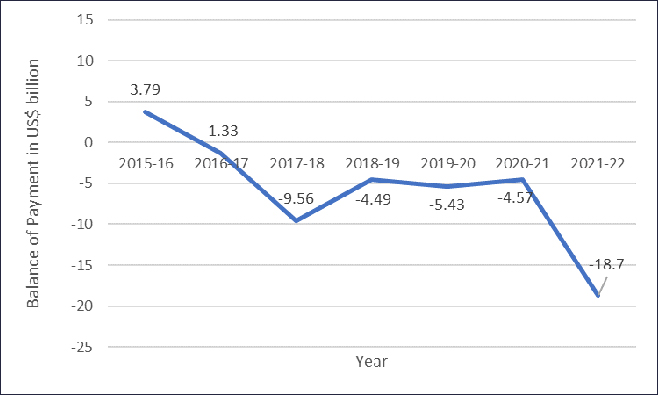

Unlike South Korea, China and some of its other Southeast Asian counterparts which managed to shift from garments and footwear exports to more complex products, Bangladesh still exports low-value added manufactured products and the export basket has not undergone any significant change since 2000. Knitwear, woven garments, cotton T-shirts and jute products which dominate its export basket are now exposed to Vietnamese competition owing to parameters such as better logistics and power supply. The current account deficit of Bangladesh rose by 308 percent in the fiscal year 2022 from US$ (-) 4.57 billion to US$ (-) 18.69 billion. While this is being considered a short-term shock owing to fluctuations in the global market, the inherent problem in the composition of the trade basket— the lack of diversification in exports and import of essential commodities—and the impending risks will disturb the macroeconomic stability of the country in the context of its overall BOP situation.

Figure 2. Balance of Payment in Bangladesh (in US$ billion) (2015 – 2022)

Source: Author’s own, data from Bangladesh Bank

Source: Author’s own, data from Bangladesh Bank

Against this background, it is important to note that like Sri Lanka, Bangladesh is another classic example of the ‘twin deficits hypothesis’–depicting a strong causal link between the economy’s fiscal balance and current account balance. An empirical investigation in 2021 finds unidirectional causation starting from the fiscal deficit to the trade deficit, and hence the current account deficit in the long-term. Therefore, maintaining a sustainable budget deficit is crucial in maintaining a stable current account deficit in Bangladesh’s economy. This phenomenon is quite prevalent in consumption-driven developing economies like Bangladesh, characterised by high levels of domestic and international debts. As the country holds excess demand levels, which necessitate increased imports to match the consumer’s needs, and further drive inflation—which has happened in the case of Bangladesh—the commodities thus being produced domestically have often been seen as less competitive in global export markets.

Now coming to the capital account of the BOP, Foreign Direct Investments (FDI) are an extremely important component of the capital account which helps in reducing the overall BOP deficits for Bangladesh. While FDI is essential in increasing the country’s ability to absorb short-term shocks, it also aims at overcoming the deficiencies of technology and helps in innovation via investment in R&D, thus, reducing the savings and investment gap in the economy. However, in Bangladesh, net inflows of FDI as a percentage of GDP have continuously fallen from the peak rate of 1.7 percent in 2013 to less than 0.4 percent in 2020, in tandem with the fall in the capital account balance from US$ 725 million to US$ 213 million from 2013 to 2020.

The FDI policy in Bangladesh has provided many concessions to foreign investors, and various export-promoting zones and economic zones have been created to attract FDI. In the past 4 years, Bangladesh has adopted several measures to increase FDI in areas of starting a business, easing credit availability, and access to electricity. Many infrastructural projects have been initiated but nothing could really materialise FDI inflows, while no mega multinational corporations have been observed in the RMG or other sectors. In 2019, Bangladesh received net FDI inflows that amounted to US$ 1.6 billion accounting for 0.53 percent of GDP, which was one of the lowest in Asia. Despite the above-mentioned measures, Bangladesh slipped 8 ranks down to 168 out of 190 countries in the World Bank Ease of Doing Business report, 2020. Starting a business is still considered a tedious task in the country with a complex dispute redressal and transferring property rights mechanism, in addition to getting access to electricity.

Table 1. Bangladesh’s Top Five Sources and Destination of FDI (As of December 2019) (in US$ million)

| Total Inward | 16,872 | 100% | Total Outward | 321 | 100% |

| The United States | 3,488 | 20.70% | The United Kingdom | 84 | 26.20% |

| The United Kingdom | 1,960 | 11.60% | Hong Kong | 72 | 22.40% |

| The Netherlands | 1,372 | 8.10% | India | 49 | 15.30% |

| Singapore | 1,254 | 7.40% | Nepal | 45 | 14.00% |

| Hong Kong | 869 | 5.20% | United Arab Emirates | 35 | 10.90% |

Source: 2021 Investment Climate Statements, Bangladesh, data from US Department of State

The Monetary Policy Review in December 2021 forecasted a real GDP growth rate of 7.2 percent in FY 2022-23. However, with the current circumstances of rising inflation, depleting reserves and value of the domestic currency, shortfall in government’s tax as well as non-tax revenue collection, widening trade balance and the fall in FDI, it seems less likely that the country will be able to achieve the target. A deviation from fiscal consolidation has additional risks of a downgraded sovereign rating which could also induce capital outflows from the economy, thereby, worsening the BOP situation. To address this, the government has adopted certain austerity measures—for instance, the Ministry of Finance has postponed the release of funds for ‘C’ category projects. Although the public policy discourse in Bangladesh is currently concentrating on short-term measures, it needs to also focus on the important determinants to induce structural changes in the fiscal balances, as well as the BOP to achieve a robust growth rate in the long term.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +