On 1 December 2018, Huawei’s Chief Financial Officer (CFO) Meng Wanzhou was arrested in Vancouver, Canada at the request of the United States of America authorities. She has been accused of helping the company cover up violations of the US sanctions on Iran by telling financial institutions that a Huawei subsidiary was a separate company, according to the Canadian prosecutors. Subsequently, she was granted a $10 million bail but faces a probable extradition to the USA.

The US President Donald Trump effectively banned Huawei by issuing a national security order on 15 May 2019. If the situation remains similar, then US tech companies like Google and Facebook are likely to sever their ties with Huawei, and apps like Google Play Store or Facebook will no more be available in Huawei phones worldwide.

Meng Wanzhou is also the daughter of the Chief Executive Officer (CEO) and founder of Huawei, Ren Zhengfei. The US move to implicate Meng Wanzhou is widely perceived to be a part of its ongoing trade war with China, but the US lawmakers see Huawei as a security threat. There have been serious allegations, and aspersions were cast on Chinese companies including Huawei that hardware hacks were undertaken — which might or might not have resulted into compromising cybersecurity.

If the situation remains similar, then US tech companies like Google and Facebook are likely to sever their ties with Huawei, and apps like Google Play Store or Facebook will no more be available in Huawei phones worldwide.

As happened with some of the recent trade-related decisions taken by the USA (quite a few of them against China), the “national security exception” clause under Article XXI of the General Agreement on Tariffs and Trade (GATT) comes into play here. In a recent World Trade Organization (WTO) dispute settlement panel ruling, submitting its views as a third party the USA government emphatically affirmed that the national security exception is entirely “self-judging” (by an individual country) and the WTO lacks jurisdiction in determining that exception. This sums up the combative mood of Washington at current juncture.

Here it will be prudent to remember what one of the original drafters of the charter of Article XXI (of GATT) had said: “We have got to have some exceptions (to free trade). We cannot make it too tight, because we cannot prohibit measures which are needed purely for security reasons. On the other hand, we cannot make it so broad that, under the guise of security, countries will put on measures which really have a commercial purpose.”

Meanwhile, Ren Zhengfei vehemently denied the allegation that his company spies for Chinese Government and said: “Huawei is not that big. How can a small sesame seed affect a conflict between the two great powers of US and China? Huawei is just a sesame seed; it does not play a role.” As the conflict over Huawei persists, currently allegations and counter-allegations from all the sides involved are flying in all directions.

Why Huawei?

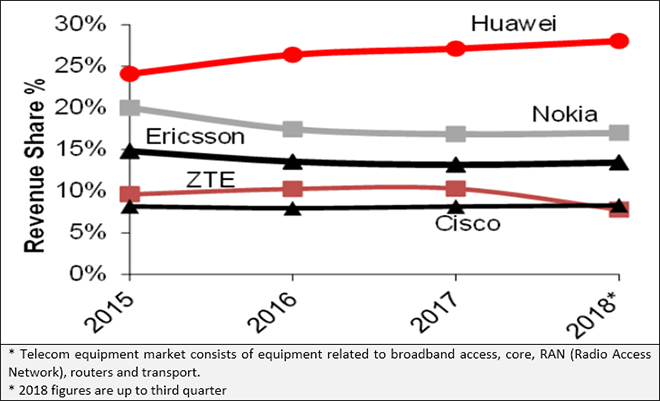

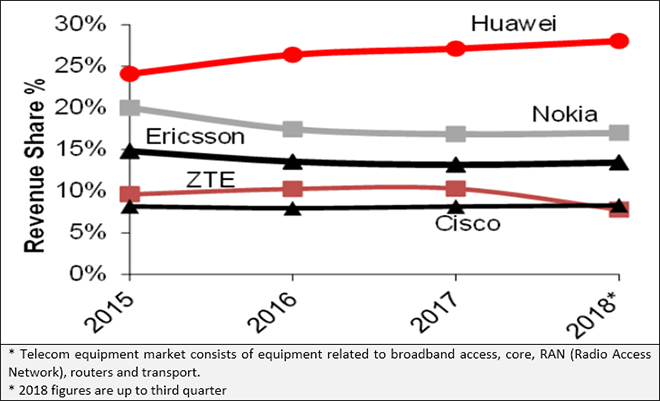

The spectacular rise of Chinese telecom equipment companies, including Huawei and ZTE, in the last ten years or so has been a point of discussion everywhere. Huawei’s rise stands out as it overtook Nokia and Ericsson to be the undisputed topper in telecom service provider equipment revenue share — as can be seen in Figure 1.

Huawei has a larger role to play in China’s ambition to become a global tech superpower — irrespective of its CEO trying to project a “sesame seed” image.

Moreover, it has also overtaken Sweden’s Ericsson to be the world’s largest telecom equipment supplier — in spite of moves by the USA and Australia to restrict official use of Huawei products. Restrictions on Huawei products is not a new phenomenon, as the USA banned all domestic carriers from buying equipment from Huawei and ZTE in 2012 — followed by similar ban by Australia in 2013 when the country banned Huawei as a supplier in its $38 billion high-speed national broadband network.

FIGURE 1: Global revenue shares of top five telecom service provider equipment companies

Source: Telecomlead, Huawei grabs 28% share in global telecom equipment market, 7December 2018

Source: Telecomlead, Huawei grabs 28% share in global telecom equipment market, 7December 2018

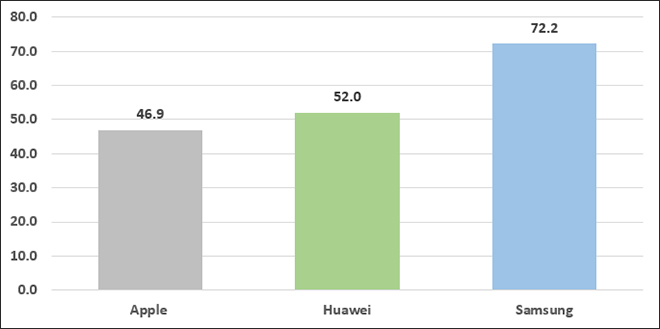

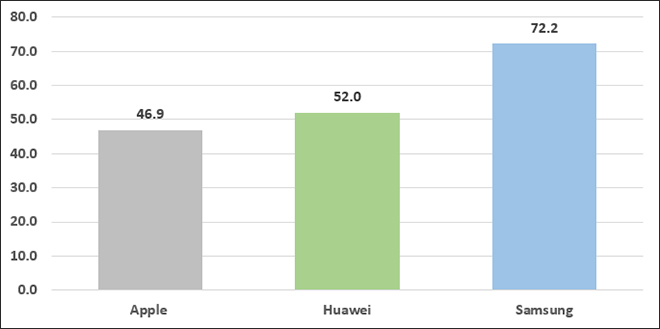

However, Huawei’s success story does not end here. By the third quarter of 2018, Huawei became the world’s second-largest smartphone maker behind Samsung, after overtaking Apple. So, Huawei has a larger role to play in China’s ambition to become a global tech superpower — irrespective of its CEO trying to project a “sesame seed” image.

FIGURE 2: Number of smartphones shipped in third quarter of 2018 (in million)

Source: Julia Horowitz, CNN Business, What is Huawei, and why the arrest of its CFO matters, 9th December 2018

Source: Julia Horowitz, CNN Business, What is Huawei, and why the arrest of its CFO matters, 9th December 2018

5G rollout: A collateral damage?

The new 5G technology will come with greater bandwidth, decreased latency times (the time taken to transfer data between two points), better energy efficiency (by reducing power consumption of various devices) and greater network capacity. Apart from expected improvement in mobile phone technology, 5G will also transform and catalyse technological advancements like self-driving cars, virtual/augmented reality, tactile internet (where machines would be able to touch and feel), smart cities, and internet of things (IoT).

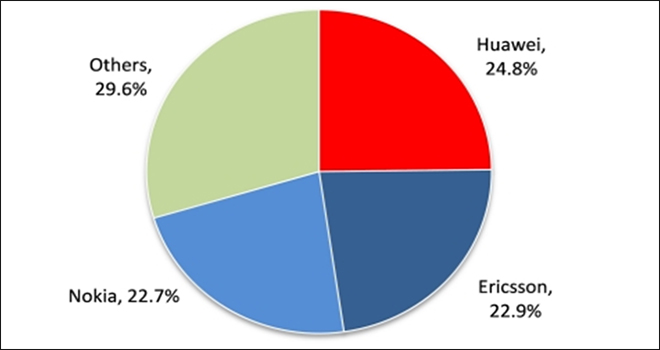

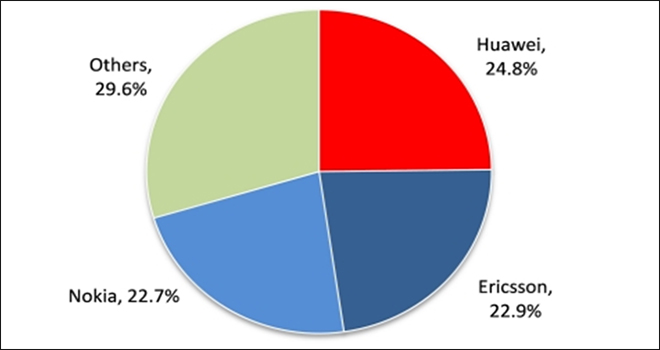

Huawei is a frontrunner in developing 5G technology and it is supposed to play a central role in China’s ambition to dominate the rollout of superfast wireless networks worldwide. Unveiling of the new 5G technology will radically change the technological demography of the world in the coming years. And whichever nation captures the larger market share will have the upper hand in futuristic tech domains such as artificial intelligence (AI). Therefore, China’s ambition to dominate the tech field is crucially dependent on Huawei. Future projections on 5G subscribers share (as depicted in Figure 3) also corroborates that fact.

FIGURE 3: 5G subscribers share projection by RAN (Radio Access Network) vendor by 2023

Source: Strategy Analytics: Huawei has two-point lead in 2023 5G Global Market RAN Forecast, 16 April 2019

Source: Strategy Analytics: Huawei has two-point lead in 2023 5G Global Market RAN Forecast, 16 April 2019

However, Huawei’s and China’s plan for such tech dominance can be seriously jolted by the effective export ban imposed on the company by the USA. Huawei’s phone production and subsequently world market share will be adversely affected by withdrawal of tech support for services of Google and Android. Apart from the potential temporary loss in its smartphone market, more serious implication will be in 5G rollout elsewhere in the world. Huawei is heavily dependent on semi-conductor microchips produced by some of the advanced countries, including the USA and the UK. Therefore, effective export ban will affect the company’s production of various devices and equipment, which will delay 5G rollout in several countries across the world.

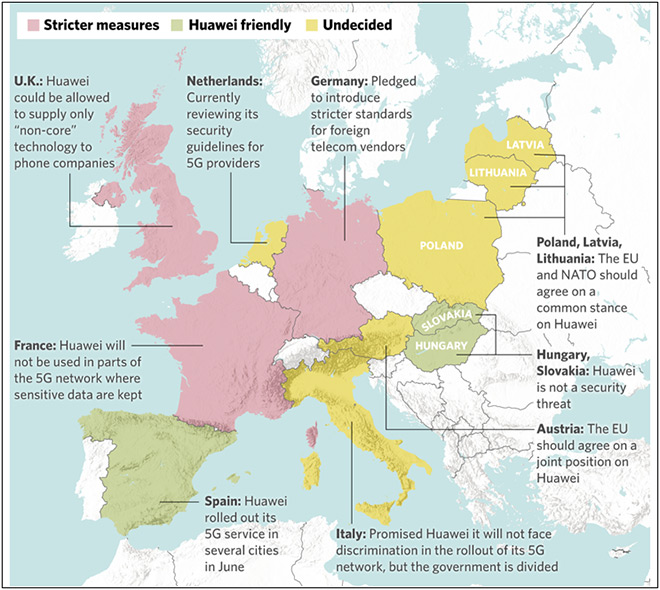

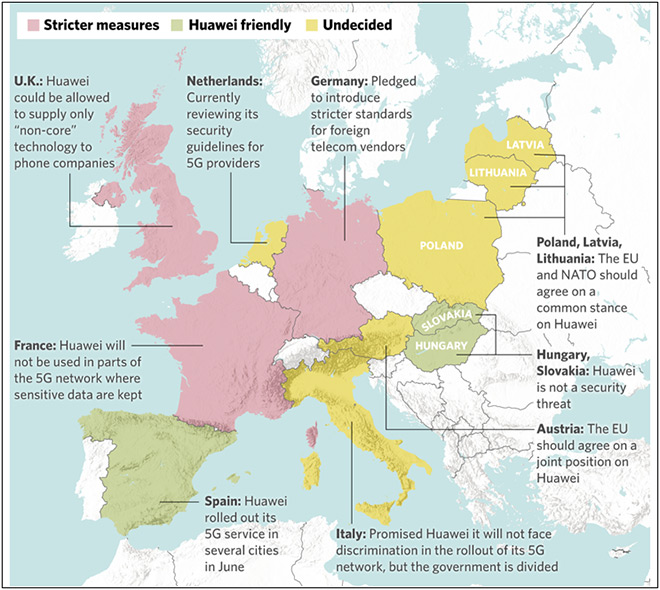

Opinions about Huawei are divided and the governments are undecided about future of the company in countries like the Netherlands, Italy, Austria, Poland, Latvia and Lithuania. Final tilt of these countries will largely decide the fate of Huawei in the European continent.

Figure 4 demonstrates the current situation in Europe regarding various governments’ position on Huawei. Spain, Slovakia and Hungary are currently seeing no threat in dealing with Huawei, but three largest European economies of Germany, UK and France are in the mood to block Huawei operations to a large extent. Opinions about Huawei are divided and the governments are undecided about the future of the company in countries like the Netherlands, Italy, Austria, Poland, Latvia and Lithuania. Final tilt of these countries will largely decide the fate of Huawei in the European continent. Needless to say, possible adverse final positions taken by these governments will hit the beleaguered company’s balance sheet further. Timeline of 5G rollout in these countries will also, no doubt, get jeopardised in the process.

FIGURE 4: Europe’s position on Huawei

Source: Stratfor/Worldview, Why Europe Won’t Shut the Door on Huawei

Source: Stratfor/Worldview, Why Europe Won’t Shut the Door on Huawei

More than Europe, the disruption in global supply chain induced by the US ban on Huawei will be felt in the continents of Africa and Latin America. China is Africa’s biggest lender and trade partner, and Huawei is the dominant company in the continent’s telecom market. It has constructed most of Africa’s telecom infrastructure, and is poised to play a crucial role in 5G rollout in the continent. Most of the continent’s manufacturing industries are expected to be curated by AI-driven technologies in the future. Production disruption at Huawei and subsequent delay in 5G rollout can potentially diminish the prospects of this industrialisation across the African continent. So, African countries may get adversely affected by a potential widespread Huawei ban.

Though Latin America’s biggest economies — Brazil, Mexico and Argentina — appear to be moving towards a pro-Huawei stance, serious disruptions in global supply chain of Huawei will hinder 5G rollout in these countries as well.

Similar situations prevail in different countries in Latin America, where Huawei enjoys substantial market shares in countries along the western belt of the continent including Venezuela, Columbia, Peru and Chile. Though the continent’s biggest economies — Brazil, Mexico and Argentina — appear to be moving towards a pro-Huawei stance, serious disruptions in global supply chain of Huawei will hinder 5G rollout in these countries as well.

In a recent media interaction, Ren Zhengfei said: “We didn’t expect US would so resolutely attack Huawei. We didn’t expect US would hit our supply chain in such a wide way — not only blocking the component supplies, but also our participation in international organisations.” The CEO for the first time admitted that US sanctions may curtail its revenue by around $30 billion in the next two years, thereby wiping out the network giant’s growth and making its revenue stagnant at around $100 billion in these two years. Though the company reportedly has built an emergency component buffer stock in last few months by frantically buying from international market, its dominance in global telecom market is going to be seriously challenged if major economies of the world stop doing business with it. In the long run, it may even threaten its survival.

During recent G20 Summit, President Trump softened his stance on Huawei and allowed US companies to sell again to the Chinese firms, which were put on the entity list of his administration’s earlier national security order. Clearly, he used Huawei as a bargaining chip in the trade negotiation with China. However, hardliners in Washington are miffed with his latest move and may push to use other measures to block Huawei. Meanwhile, China has maintained a cautious silence on the issue and played down prospects of progress in trade talks.

In the coming days, the Huawei saga will be an interesting and important subplot to watch out for while the main plot, ongoing trade war between the USA and China, is likely to deepen.

Nishant Jha is a research intern at ORF New Delhi.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Telecomlead,

Source: Telecomlead,  Source: Julia Horowitz, CNN Business,

Source: Julia Horowitz, CNN Business,  Source: Strategy Analytics:

Source: Strategy Analytics:  Source: Stratfor/Worldview,

Source: Stratfor/Worldview,  PREV

PREV