This is the 92nd article in the series

This is the 92nd article in the series The China Chronicles.

Read the articles here.

The Covid-19 global pandemic has brought to the fore the intricate interdependencies that exist within the international pharmaceutical market. China, the epicentre of the global outbreak, is also the world’s largest supplier of active pharmaceutical ingredients (APIs) also known as bulk drugs. India, which is a leading exporter of generic drugs across the world depends on China for more than two-thirds of its bulk drug needs. Estimates indicate that India supplies upto 50% of the United States’ generic drug needs, and vulnerabilities caused by Covid-19 have caused disruptions across global pharmaceutical supply chains. Perhaps this is also a good opportunity for India to re-assess dependencies and plan for the future.

According to the Government of India’s own estimates, India ranks 3rd worldwide for pharmaceutical production by volume and 13th by value, accounting for around 10% of world’s production by volume and 1.5% by value. This apparent discrepancy points towards the relatively lower price of Indian pharmaceutical products, and the high demand they enjoy at the global market. A major supplier of affordable low-price drugs across the world, India’s role as the 'pharmacy of the world' is well acknowledged by experts.

Joint analysis recently conducted by the African Export-Import (EXIM) Bank and the Export-Import (EXIM) Bank of India shows that commercial trade between Africa and India has expanded more than eight-fold from $7.2 billion in 2001 to $ 59.9 billion in 2017. India is currently Africa’s fourth largest national trading partner, and accounts for more than 6.4 % of total African trade in 2017, considerably higher than the 2.7 percent it was in 2001. However, trade with Africa still accounts for around 8 % of India’s total trade, similar to the percentage in 2001.

Pharmaceuticals are a major component of India’s trade expansion strategy, particularly with the country’s stated objective of a wider diversification of the export profile in terms of both products as well as destinations. Along with other sunrise industrial products like electronics, India’s export push focuses on pharmaceuticals as global demand expands. Indian pharmaceutical industry aspires to become the world’s largest supplier of drugs by 2030, targeting $120-130 billion in revenue at a Compound Annual Growth Rate (CAGR) of 11-12%, from the current $38 billion.

Pharmaceuticals are a major component of India’s trade expansion strategy, particularly with the country’s stated objective of diversification of exports in terms of both products as well as destinations. India’s historical role in supporting a large number of relatively poorer nations – particularly in Africa- dealing with their HIV, tuberculosis, and malaria disease burden through low-cost, generic medicines is widely acknowledged. Pharmaceutical products dominate India’s exports to Africa and along with petroleum products, account for about 40 % of total Indian exports into African markets.

Given an increasing buy-in for domestic production within African political leadership and an expanding pharmaceutical market driven by improved purchasing power of governments and population, an analysis of long-term trends of pharmaceutical exports from India to African countries has been lacking. The import-substitution resulting from a focus on domestic production may shift composition of exports to Africa in favour of bulk drugs away from formulations or finished drugs, a category where India has traditionally dominated China.

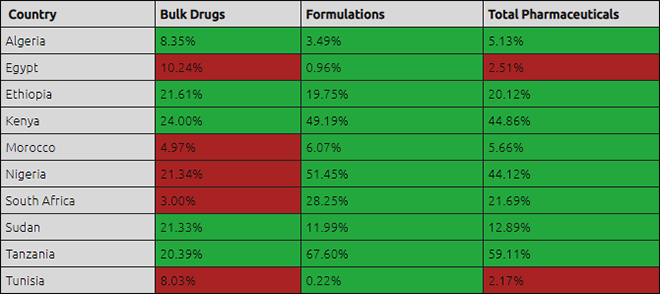

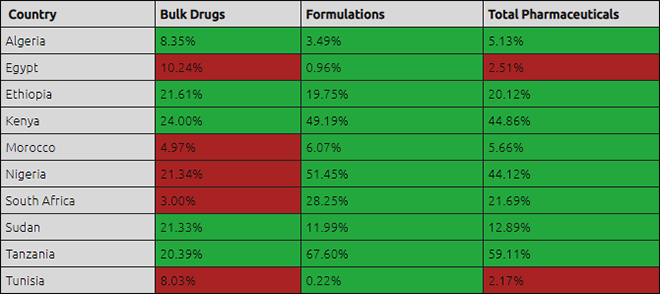

Table 1: Percentage of Indian Exports into Major African Pharmaceutical Markets (2017)

Source: Authors’ calculation using data from the Comtrade Database. Red colour indicates Chinese dominance over India. Green indicates Indian Dominance over china.

Source: Authors’ calculation using data from the Comtrade Database. Red colour indicates Chinese dominance over India. Green indicates Indian Dominance over china.

In 2017, India fared better than China in terms of formulations, across the ten largest export markets of pharmaceuticals in Africa namely South Africa, Egypt, Morocco, Kenya, Algeria, Ethiopia, Tunisia, Sudan, Tanzania and Nigeria. However, in regards to bulk drugs, China exported more to five of these ten markets (Table 1). With Covid-19 bringing to the forefront India’s blind spots as a global pharma giant when it comes to generics, India might want to reduce its own dependency on Chinese bulk drugs for strategic reasons.

In addition, with the ongoing trade war with the US, China has offered a major push to its pharmaceutical sector to diversify and produce generics and bio-similars. This move to aggressively replace innovation drugs with homemade follow-on drugs may have an implication in export markets like Africa as well.

India’s need to produce its own bulk drugs can perfectly align with its ambition to become a bulk drug exporter to markets like Africa. Given this context, India should consider embracing economies of scale and increasing the production of bulk drugs to aggressively compete with the Chinese in the Africa market. Our country specific analysis tracking exports of bulk drugs and formulations to the ten biggest pharmaceutical markets in Africa over the last three years can inform country-specific policy measures for the government as well as the private sector.

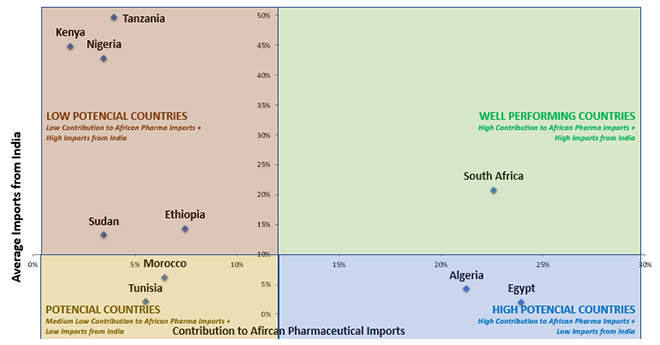

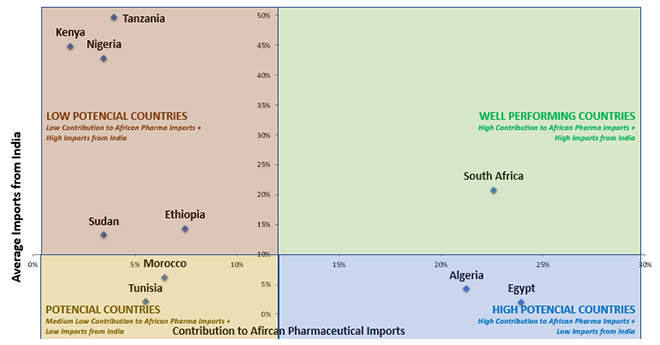

Figure 1: India’s Future in Major Pharmaceutical Markets in Africa

Source: Authors’ calculation using data from the Comtrade Database

Source: Authors’ calculation using data from the Comtrade Database

Our analysis shows that in the three biggest pharmaceutical markets – South Africa, Algeria and Egypt, India has room for tremendous improvement. South Africa, a country with a thriving domestic pharmaceutical industry, where India is source of 28.3% of imports of finished drugs, the contribution to bulk drug imports is a meagre 3%. Even as India strives to expand its finished drugs exports to Africa, the fact remains that in none of these markets is India’s share of bulk drugs more than 24%. Given India’s dependency on Chinese bulk drugs, perhaps it is time for India to help wean itself and its African trade partners off Chinese bulk drugs as well, going beyond the more short-term economic benefits.

Note: This article borrows analysis from an ORF study: Kriti Kapur, Vasundhara Singh and Oommen C Kurian (forthcoming). A Country Level Analysis of Pharmaceutical Exports from India to Africa (1992-2017): How big is the China Factor?, Observer Research Foundation, New Delhi.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This is the 92nd article in the series The China Chronicles.

Read the articles

This is the 92nd article in the series The China Chronicles.

Read the articles  Source: Authors’ calculation using data from the

Source: Authors’ calculation using data from the  Source: Authors’ calculation using data from the

Source: Authors’ calculation using data from the  PREV

PREV