-

CENTRES

Progammes & Centres

Location

This fact sheet explains the defence spending and the defence exports of the G20 countries

As the world’s most influential economic multilateral forum, the G20 also brings together major militaries. With robust domestic defence industrial capabilities, the group’s members include 12 of the world’s top 20 arms exporters. This fact sheet explains the defence and military strength of the G20 countries. It excludes the European Union (EU), which collectively includes the EU member-states, except for the United Kingdom, France, Germany, and Italy, which are G20 members.

The statistics used here are generated from the Stockholm International Peace Research Institute’s (SIPRI) Military Expenditure Database and Arms Transfers Database.

Defence Spending

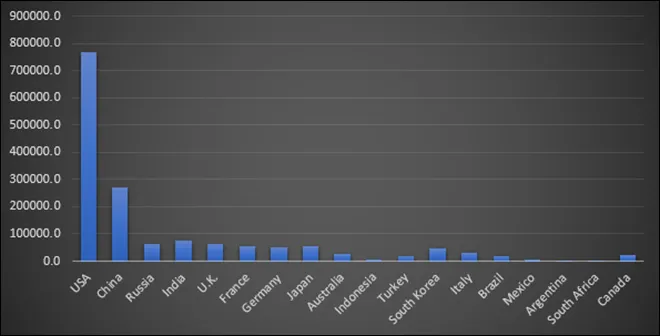

Figure 1: Country-wise and Overall Defence Spending Among G20 Members (2021-22)

Source: SIPRI database, figures in constant 2020 USD millions

Source: SIPRI database, figures in constant 2020 USD millions

Figure 1 explains the country-wise defence spending among G20 members in 2021-22. With defence spending of US$ 767 billion, the United States (US) races past the rest of the G20 member states. China is a distant second with a defence budget of US$ 270 billion. While Beijing annually releases its national defence budget figures, in recent decades, many military analysts have argued that these figures do not include major components of Chinese military activities. This prevents a comprehensive and transparent accounting of its defence spending.

Interestingly, while Japan and Germany are very large economies, their defence expenditure is not proportional to their economies’ size. Tokyo’s defence expenditure stands at US$ 55.77 billion, while Berlin’s is US$52.48 billion. However, this is going to change soon. With a dramatic transformation in their threat landscape, both countries have decided to hike their defence spending significantly. In December 2022, Japanese Prime Minister Fumio Kishida released a new National Security Strategy, which aims to increase the country’s defence spending to 2 percent of the national GDP. Likewise, following the Russian invasion of Ukraine, German Chancellor Olaf Scholz has pledged US$ 112.7 billion for military spending.

Russia’s defence spending stands at US$ 63 billion (as of March 2022), though the invasion of Ukraine would have significantly upped Moscow’s defence expenditure. Although, when one looks at the defence spending as a percentage of the Gross Domestic Product (GDP) (see figure 2), Russia’s defence spending lends more clarity.

Figure 2: G20 Members’ Defence Spending as Percentage of GDP (2021)

By allocating 4.1 percent of GDP to defence expenditure, Russia is the highest defence spender among the G20 members. Following closely on the heels of Russia is the US, with as much as 3.5 percent of its GDP spent on defence. It is followed by South Korea and India, with their respective defence expenditures at 2.8 and 2.7 percent of their GDP. Seoul’s higher spending is one of the largest among the treaty allies of the US and contrasts sharply with Japan. As a matter of fact, security alliance with the US has primarily shielded Tokyo from spending more than 1 percent of GDP on defence for most of the post-World War II period.

This is also partly true for Germany, which spends 1.3 percent of its GDP on defence, despite its membership in the North Atlantic Treaty Organization (NATO), which mandates that every NATO member annually dedicate 2 percent of the GDP to defence. However, this minimum ceiling is not met, as is evident with France and Italy spending 1.9 and 1.5 percent of their GDP on defence, respectively. The UK stands as the sole exception among the European members of the G20 and a NATO member to spend as much as US$ 62.48 billion or 2.2 percent of its GDP on defence.

Low defence spending by these countries is a by-product of their benign strategic circumstances, with little or no consequential military threats and rivalries facing each of them.

China’s defence expenditure stands at 1.7. percent of its GDP, though, as mentioned earlier, this figure can be much higher.

Overall, across all the G20 members, only four countries’ defence expenditure exceeds 2 percent of GDP. In contrast, 20 percent of G20 members, such as Indonesia, Argentina, South Africa, and Mexico, spend under 1 percent of their GDP on defence (see figure 2). Low defence spending by these countries is a by-product of their benign strategic circumstances, with little or no consequential military threats and rivalries facing each of them. Albeit, Indonesia must be treated as an anomaly here despite the growth of Chinese military power, its aggressiveness in the South China Sea and Jakarta’s competing maritime territorial claims with Beijing.

Defence Exports

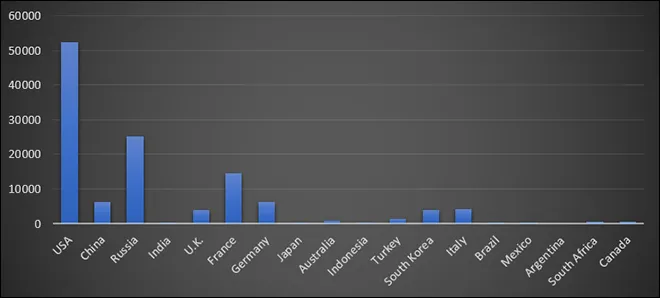

Figure 3: Top Defence Exporters Among G20 Members (2017-2021)

Figure 4: Defence Exports from G20 Members (2017-21)

Source: SIPRI database, figures in millions

Source: SIPRI database, figures in millions

The above two figures show exports between 2017 and 2021 in percentage and absolute value in defence exports. Among the G20 members, the US, in percentage terms, is by far the largest defence exporter, with 39 percent of all exports or US$ 52.5 billion, as shown in figure 4. Russia follows the US at 19 percent, with exports touching US$ 25.29 billion. However, after its invasion of Ukraine, Moscow’s export has likely dipped as the domestic defence industry scrambles to support the national war effort.

France is the third-largest defence exporter, with 11 percent or US$ 14.49 billion, followed by China with 4.6 percent or US$ 6.2 billion. Germany follows in fifth place with exports at 4.6 percent or US$ 6.15 billion. Italy and South Korea follow in sixth and seventh places as defence exporters among G20 members, with Italy exporting 3.1 percent or US$ 4.18 billion and South Korea 2.8 or US$ 3.83 billion. Turkey, Australia, Canada, South Africa and Brazil occupy eighth, ninth, tenth, eleventh and twelfth places, respectively, as the top G-20 defence exporters.

Interestingly, some of the world’s biggest defence exporters—Israel, Spain, and Sweden, are not part of the G20 grouping, at least the latter two are not individually.

India, which has been engaged in building its defence industrial capabilities, has not made its mark as far as defence exports are concerned. Despite being the fifth largest economy in the world, its defence exports have recently touched 0.2 percent or US$ 302 million. Thus, the relative size of the economy is not an adequate indicator of the strength of a country’s defence export capabilities. However, it is to be noted that Indian defence export performance has seen an increase, according to the SIPRI data released in December 2022.

To conclude, the G20 members’ overall defence spending accounted for US$ 1,585,910 million dollars or US$ 1.58 trillion in 2021. On the other hand, their share of world defence exports was almost 90 percent or US$ 120733 million during 2017-2021.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Kartik Bommakanti is a Senior Fellow with the Strategic Studies Programme. Kartik specialises in space military issues and his research is primarily centred on the ...

Read More +

Dr Sameer Patil is Director, Centre for Security, Strategy and Technology at the Observer Research Foundation. His work focuses on the intersection of technology and national ...

Read More +