-

CENTRES

Progammes & Centres

Location

Image Source: Abdolreza Mohseni

A cruide oil rig operation in Tehran

The restoration of sanctions on Iran, following the United States’ withdrawal from the Joint Comprehensive Plan of Action (JCPOA) earlier this year, is set to drastically affect the Islamic republic’s economy. With the aim of ‘punishing’ the West Asian nation for supposedly violating the terms of the agreement, this move has far-reaching, and multifaceted implications for countries across the globe. However, for the purposes of this study, specific focus will be directed towards one sector – oil.

Home to the world’s fourth largest proved reserves of crude oil, Iran is a nation highly dependent on its fossil fuel exports, which accounted for close to 15 per cent of its GDP of US$440 billion<1>, the two largest importers of Iranian oil being China and India – emerging superpowers that both require massive quantities of oil to fuel their rapid industrial development.

However, the United States’ sanctions have targeted the purchase of Iranian crude oil. Through Executive Order 13622, and Section 1245 of the National Defense Authorisation Act, the US will impose sanctions on banks found enabling the import of Iranian oil by third countries. This will be done by restricting their accounts, and preventing the opening of new accounts.<2> Among the nations that will be majorly affected by these steps, is India.

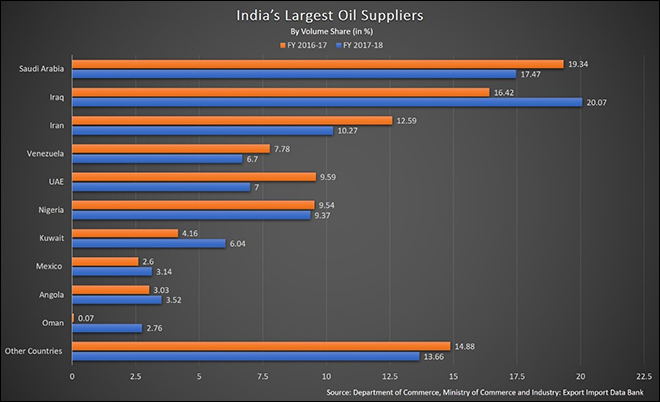

Heavily dependent on imports to meet its burgeoning energy requirements, about 80 per cent of India’s oil is shipped in from foreign countries<3>. Iran is India’s third biggest oil supplier, and in 2016-17, was the source of close to 13 per cent of India’s oil exports. Saudi Arabia and Iraq head the list, with the latter overtaking the former in the 2017-18 financial year.<4>

With the United States pushing India to nullify its trade with Iran, by 5 November, – the day the sanctions come into effect – the search for alternative sources of oil is on.

It is, of course, prudent to assume that rerouting oil imports lies exclusively in the domain of governmental decision making. India’s oil purchases are determined not by government policy, but largely by private oil companies. These private actors function in accordance with prices determined by the global spot market, and while their transactions must take place within the larger framework of India’s economic and energy policy, one must recognize the fact that they make decisions based on potential risks and profits.

There are three possible approaches to ensure oil inflows from abroad are not seriously affected by the sanctions. India could choose to act, using a combination of these, or to focus on a singular approach.

The first approach is to attempt to secure a waiver from the United States, thereby allowing India to continue its trade with Iran. Achieving this will involve leveraging the fact that India has noticeably reduced Iranian oil imports over the past two years. However, the likelihood of a waiver is fairly low, given that it would require a mandate from the United States Congress, which, under a Republican Party majority, seems unwilling to provide relaxations and concessions from the sanctions, to third countries.

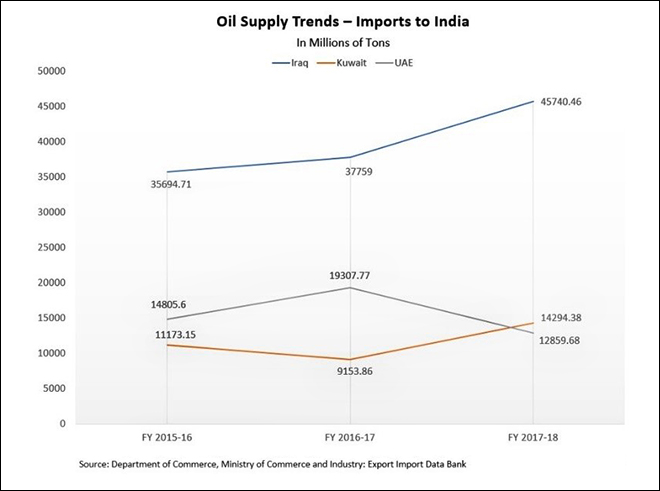

The second approach involves ramping up imports from nations that already supply India with substantial quantities of oil. Suitable examples would be Iraq, the United Arab Emirates (UAE), and Kuwait. These three nations have proven themselves to be reliable trading partners, and India has witnessed significant growth in their oil exports in the recent past. While India’s imports from the UAE did dip in the previous financial year, the optimism expressed by the strategic and financial communities of both nations, of the possibility of a closer, more-cooperative relationship in the near future provides ample reasons to avoid distress.<5> This was effectively summed up by Sanjiv Singh, Chairman of Indian Oil Corp (IOC), the nation’s biggest oil company, who in an interview with Bloomberg in early July, directly referred to the UAE as a likely alternative for the rerouting of IOC’s purchases.<6> Meanwhile, the surge in imports of oil from Iraq looks extremely encouraging, as the nation overtook Saudi Arabia as India’s largest supplier in 2017-18. Iraq chalked up a growth of 21.14% in actual quantity (as displayed in the graph below), while growth in terms of value (in US$) looks even more impressive, at 51.03%<7>. Kuwait, on the other hand, has been a steady and consistent source of oil for over two decades.

India must work to capitalise off these positive trends, and work towards ensuring the continuation of increases in inflows from such nations. It must also work towards steadying the supply from Saudi Arabia, traditionally India’s largest supplier, from where imports have dipped by almost 9 per cent over the past two years – an undue cause for worry, but noticeable nonetheless<8>. Given the gulf kingdom’s large reserves capacity, watching its contribution towards making up for India’s abrupt shortfall will be important.

The third possible approach could be to scour for new and willing partners, and work dedicatedly towards building a relationship of trust and understanding, albeit in a short period of time. Two nations come to mind, for the initiation of such an approach – Oman, and the United States.

With regards to Oman, India has witnessed an exponential rise in oil imports in the last year– with growth pegged at 1071 per cent increase in actual quantity from 2016-17 to 2017-18.<9> This is coupled with the acquisition of Shell’s 17 per cent stake in Oman’s Makhaizna Oil Field by Indian Oil Corp (IOC) in April.<10> India must continue to work on expanding and enhancing growth in the upstream sector, using this acquisition as a starting point. It must also work towards ensuring that the boom in Omani imports does not level off unexpectedly.

However, it is American oil companies that are turning their heads towards India – the world’s third largest oil consumer, to ensure stability of shale trade. In the face of a hike in Chinese tariffs on US Oil imports as part of the ongoing trade war, India can prosper from the fact it provides the next market for American oil. Refiners have been testing American crudes since last year, and Indian companies are confident about an approach where they balance American shale with crudes from other nations. Olivier Jakob, Managing Director of energy consultancy PetroMatrix, claims that India is already comfortable with a regular flow from the United States.<11> Jakob’s assertion is not without merit – The United States exported a record 228,000 barrels per day to India in June this year.<12>

For any of the aforementioned approaches to work, however, there also exist significant challenges that must be overcome. First and foremost, is the fact that imports hikes required by India are by no means meagre, and therefore, a strengthening of relationships between the Asian giant, and any supplier looking to significantly ramp up its exports are necessary. One may argue that the Indo-Iranian relationship was as symbiotic as it was, due to factors such as India’s substantial investments in connectivity and infrastructure within the Islamic republic – the most prominent example being the Chahabar Port development project. A further hurdle could be negotiating transportation concessions and extended credit periods - both guarantees that Iran gave India – with new partners.<13> Given that such terms are difficult to secure for an importing nation, a relative rise in costs, from the source that will replace Iranian oil, is on the cards.

Another contingency arises out of the proposed hike in purchases from the United States. Given that American Shale is much lighter than the crudes India imported from Iran, India will have to consider shipping in larger quantities. The other option – distributing purchases between American shale, and heavier crudes from elsewhere, involves further complications in the form of negotiation of deals with multiple parties.

However, an extremely significant challenge that has so far, gone largely unnoticed, is the technological restrictions of public oil refineries in India. While the Nelson Complexity Index rates refineries such as Reliance Industries Limited (RIL) extremely highly, public refineries often have far lesser adaptability. That is to say, that their capability to refine different kind of crudes is limited by the fact that they still use outdated technology. In fact, certain refineries are based specifically upon Iranian crudes, and therefore, nullifying imports from the Islamic Republic will involve significant investment in the upgradation of these refineries, not to mention the imminent possibility of permanent closure, on account of shortage of funds to do so.

Integrating the differing approaches of individual oil companies, within the shifts and realignments in foreign policy that the nation will have to make, is crucial. How the government will balance the risk-oriented strategy of private actors, and the broader considerations of foreign policy and public welfare is a question that must be answered. Arguably, the toughest challenges lie in this aspect of the rerouting initiative.

Aside from these specific challenges, there also remains the question of how India will balance these negotiations and renegotiations, while simultaneously dealing with the recent volatility in global oil prices. Indian refiners bought crude from April to July 5, this fiscal year, at $72.83 a barrel, as compared the $56.43 a barrel average for the entire 2017-18 fiscal year.<14> Rising oil prices could prove to clamp down on growth, and lead to rise in current account deficit. Combined with a rupee that is arguably at its weakest in history, this is likely to fuel inflation.

The mood in the Indian oil industry, where the ground level decision making lies, has remained overwhelmingly optimistic. Confidence regarding the ability to tackle the situation, and the aforementioned challenges effectively, is visibly high. This sentiment is perhaps best summed up in the words of Dharmendra Pradhan, Minister for Petroleum and Natural Gas, in an interview said that “India’s energy basket has multiple sources now. Our focus will be to see that our requirement is not affected, and to ensure this, we will do what we have to do.”<15> How effectively India will be able to negotiate these murky waters, and ready itself to deal with its energy demands come November 5th, remains to be seen.

The writer is a Research Intern at Observer Research Foundation, Delhi

<1> Islamic Republic of Iran: Overview, The World Bank, 1 April 2018, Accessed on 23 August 2018.

<2> Katman, Kenneth, Iran Sanctions, Congressional Research Service Report RS20871, Pgs. 29-30, 7 August 2018, Accessed on 22 August 2018.

<3> Energy Indicators (2015-16) at a Glance, Energy Statistics 2017, Central Statistics Office, Ministry of Statistics and Program Implementation, Government of India, pg. 89, Accessed on 22 August 2018.

<4> Export Import Data Bank, Import: Commodity-wise all countries, Department of Commerce, Ministry of Commerce and Industry, Government of India, Accessed on 23 August 2018.

<5> Quamar, Md. Muddassir, India and the UAE: Progress towards ‘Comprehensive Strategic Partnership’, Institute for Defence Studies and Analyses, 5 July 2018, Accessed 17 August 2018.

<6> Chakraborty, Debjit and Krishnan, Unni, India Has ‘Plan D’ for Iran Oil as Trump Adds Sanction Pressure, Bloomberg, 2 July 2018, Accessed 22 July 2018.

<7> Ibid, 4

<8> Ibid

<9> Ibid

<10> Press Trust of India, IOC acquires Shell’s 17 pc Oman oilfield, The Times of India Business, 5 April 2018, Accessed on 24 August 2018.

<11> Eaton, Collin and Verma, Nidhi, U.S. oil exports to India soar ahead of sanctions on Iran, Reuters Business News, 12 July 2018, Accessed on 21 August 2018.

<12> Ibid

<13> India to revive rupee trade mechanism for its payments to Iran: Source, Business Standard, 22 June 2018, Accessed on 22 August 2018.

<14> Mishra, Richa, Iran Oil: Demand will be the deciding factor, says Pradhan, The Hindu Business Line, 8 July 2018, Accessed 23 August 2018.

<15> Ibid

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.