-

CENTRES

Progammes & Centres

Location

Through the six decades of SBI’s presence, the initial objective of extending “banking facilities on a large scale, more particularly in the rural and semi-urban areas” has remained a policy fig leaf, and it is only now, through payments banks and Jan Dhan Yojana, that it is being fulfilled.

The following is a chapter from the book 70 Policies that Shaped India: 1947 to 2017, Independence to $2.5 Trillion.

Find the book here.

Following the launch of the first Five Year Plan with development as a priority, Parliament passed a law on 8 May 1955 that enabled the government to take over the Imperial Bank of India through the State Bank of India Act. <1> The bank was constituted on 1 July 1955 but amendments followed, the most interesting of which is based on a story that has been widely reported <2> and which bankers informally call the “Talwar amendment.” Then SBI chairman R.K. Talwar refused to give a loan to a sick cement company unless the company’s promoter, chairman and CEO made way for a professional. The promoter was a friend of Sanjay Gandhi, whose message to step back was given to Talwar. Talwar refused to relent. Sanjay Gandhi wanted to sack him, but there was no legal provision to do so. The ‘solution’ was the 1976 amendment to the SBI Act, under which appointments of chairmen, vice chairmen and managing directors as well as their removal were handed over to the central government. The chairman, henceforth, was to be appointed by the central government in consultation with the Reserve Bank <3> for a term “not exceeding five years,” <4> and the central government was given the right to terminate the terms of office of the chairman at any time before the expiry of the term. <5> For every Talwar who didn’t bow before powers, there could be dozens who did, leading to hundreds of bad loans given out of political considerations rather than commercial ones, a practice that created a fiscal monster and has contributed to the ongoing nonperforming assets crisis, particularly amongst public sector banks. The Lok Sabha on 10 August 2017 passed a bill <6> to amend the SBI (Subsidiary Banks) Act, 1959, <7> State Bank of Hyderabad Act, 1956 and further amend the State Bank of India Act, 1955, allowing for the merger of five associates with SBI. Through the six decades of its presence, the initial objective of extending “banking facilities on a large scale, more particularly in the rural and semi-urban areas” has remained a policy fig leaf, and it is only now, through payments banks and Jan Dhan Yojana, <8> that it is being fulfilled.

<1> The State Bank of India Act, 1955, Ministry of Law and Justice, Government of India, 8 May 1955.

<2> T.N. Ninan, “The ‘Talwar amendment’,” Business Standard, 24 January 2013, accessed 3 January 2018.

<3> Ibid., Amendment Act 73 of 1976, Chapter V, Section 19 (a).

<4> Ibid., Section 20 (1A).

<5> Ibid., Section 20 (1A).<6> The State Banks (Repeal and Amendment) Act, 2017, PRS Legislative Research, 10 August 2017, accessed 3 January 2018.

<7> The State Bank of India (Subsidiary Banks) Act, 1959, Ministry of Law and Justice, Government of India, 10 September 1959.

<8> Chapter 62: Pradhan Mantri Jan Dhan Yojana.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

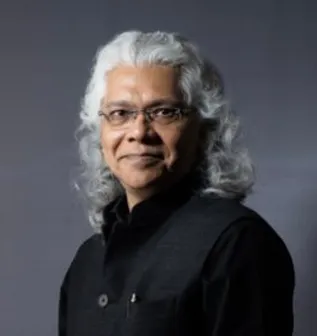

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +