This is the 155th in the series–The China Chronicles.

On 8 January 2024, newly-elected Maldives President Mohamed Muizzu broke tradition held by past presidents of the island republic and chose to embark on a five-day state visit to China instead of India, giving Beijing a diplomatic victory over its regional rival—New Delhi. During his visit to Beijing, Muizzu signed 20 bilateral economic cooperation agreements, worth US$4 billion, with Chinese President Xi Jinping ranging from agriculture, tourism, and transport infrastructure development to blue economy sectors such as fishing, deep-sea mining, etc. The head of states (HoS) also upgraded their countries’ bilateral relationship from a ‘Comprehensive Strategic Partnership’ to a ‘Comprehensive Strategic Cooperative Partnership,’ signalling deeper all-round cooperation between the two nations in the geostrategically important Indian Ocean region (IOR).

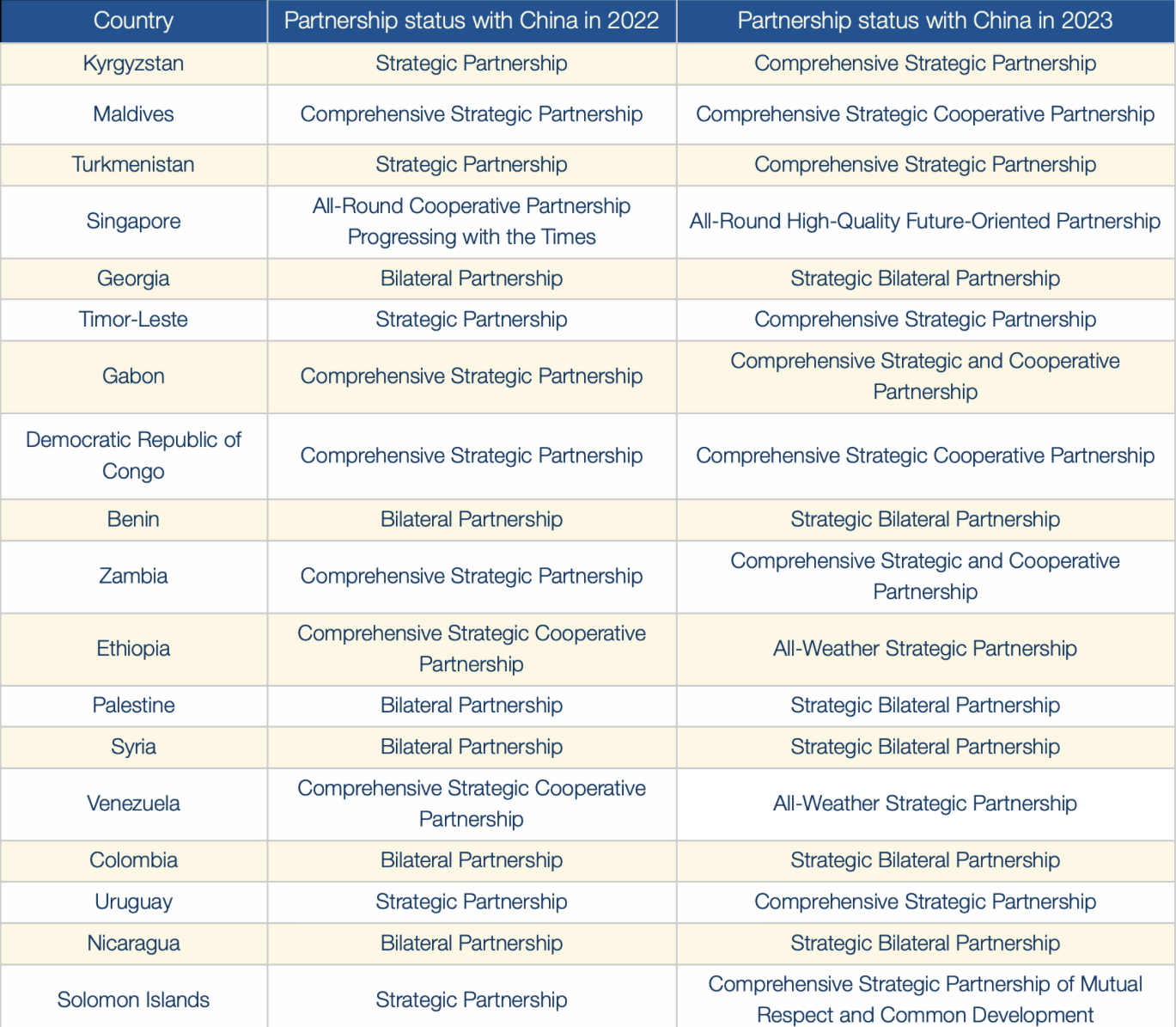

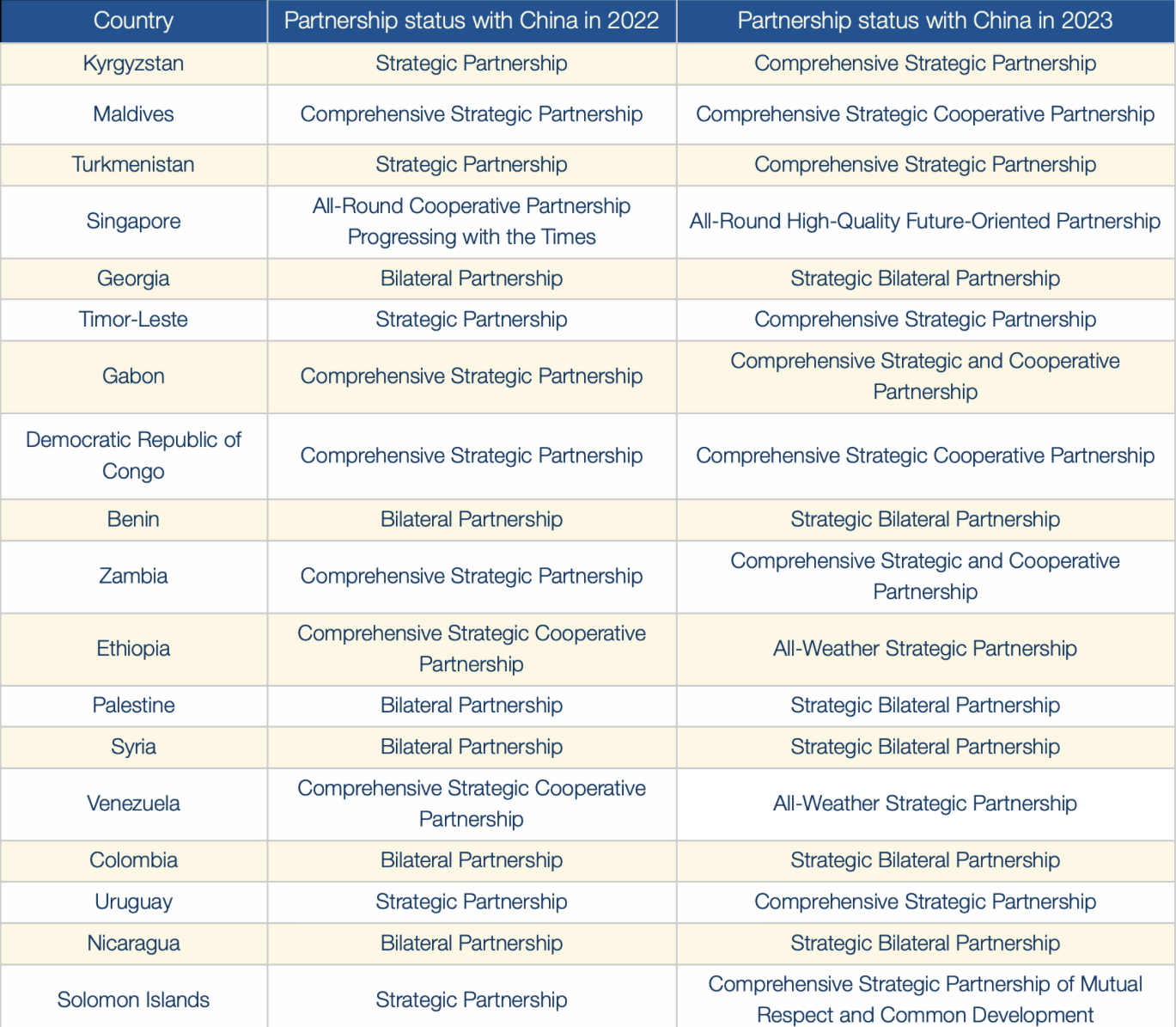

Table 1: China’s 2023 Partnership Upgradations

Sources: Chinese Foreign Ministry and The Third Belt and Road Forum Archives

This progression in the Sino-Maldives bilateral partnership was the latest in a string of strengthening Chinese bilateral partnerships in the developing world, last year. In 2023, China upgraded a record 18 bilateral partnerships (see Table 1), spanning four continents. Beijing’s bilateral partnership progression varies from country to country depending on the economic and strategic rationale behind pursuing stronger relations. For instance, with Ethiopia and Venezuela—resource-rich countries—Beijing upgraded its partnership to an ‘All Weather Strategic Partnership’ indicating that in times of adversity and prosperity alike, their bilateral ties will remain resilient and strong. Similarly, with Singapore, the bilateral ties have gone up from ‘All-Round Cooperative Partnership Progressing with the Times’ to ‘All-Round High-Quality Future-Oriented Partnership’ given their synergies in deepening economic cooperation. This article aims to analyse China’s 2023 whirlwind of bilateral partnership progressions and delineate the geostrategic and geoeconomic implications of the same.

China’s 2023 diplomatic overtures, resource-based diplomacy and the BRI

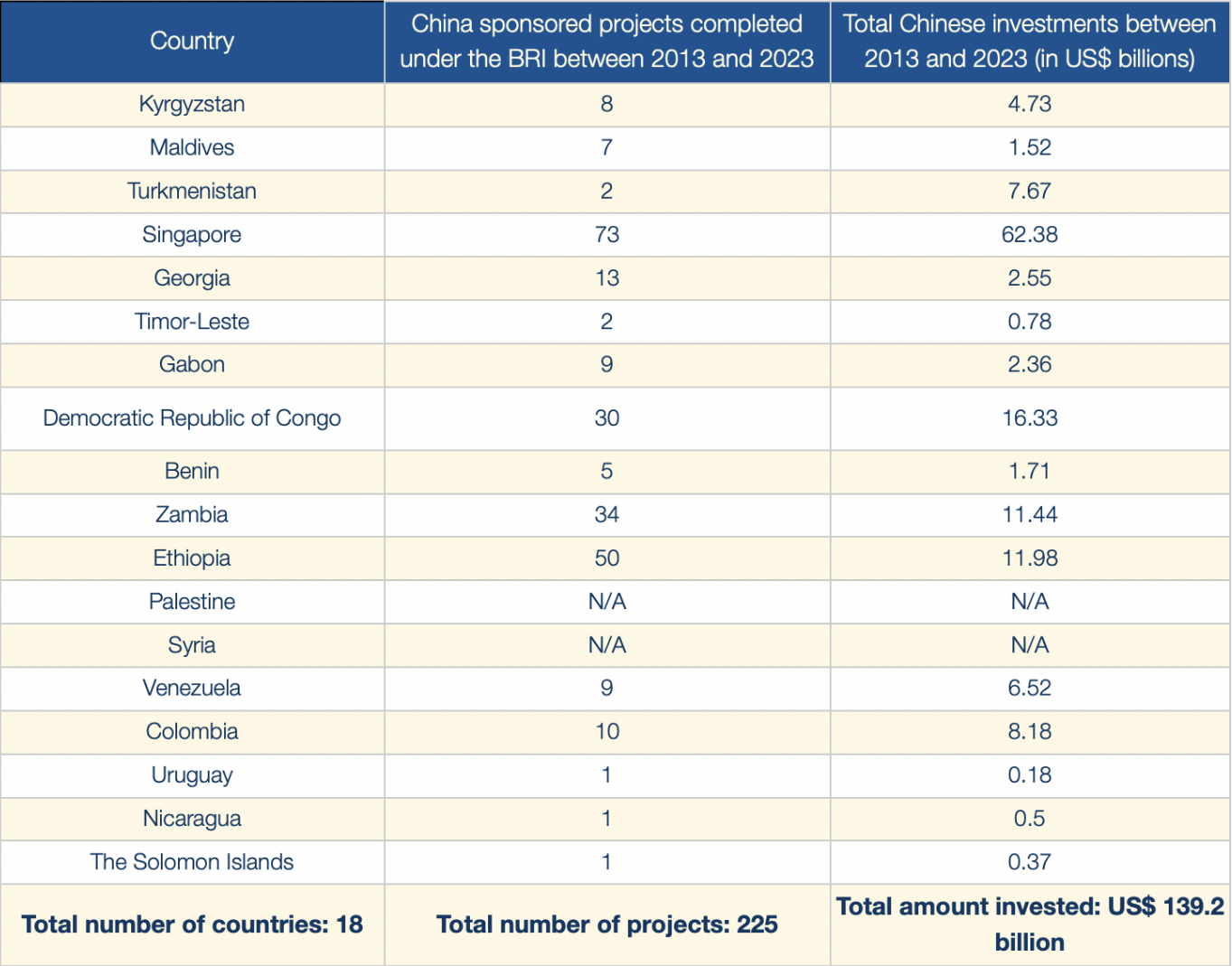

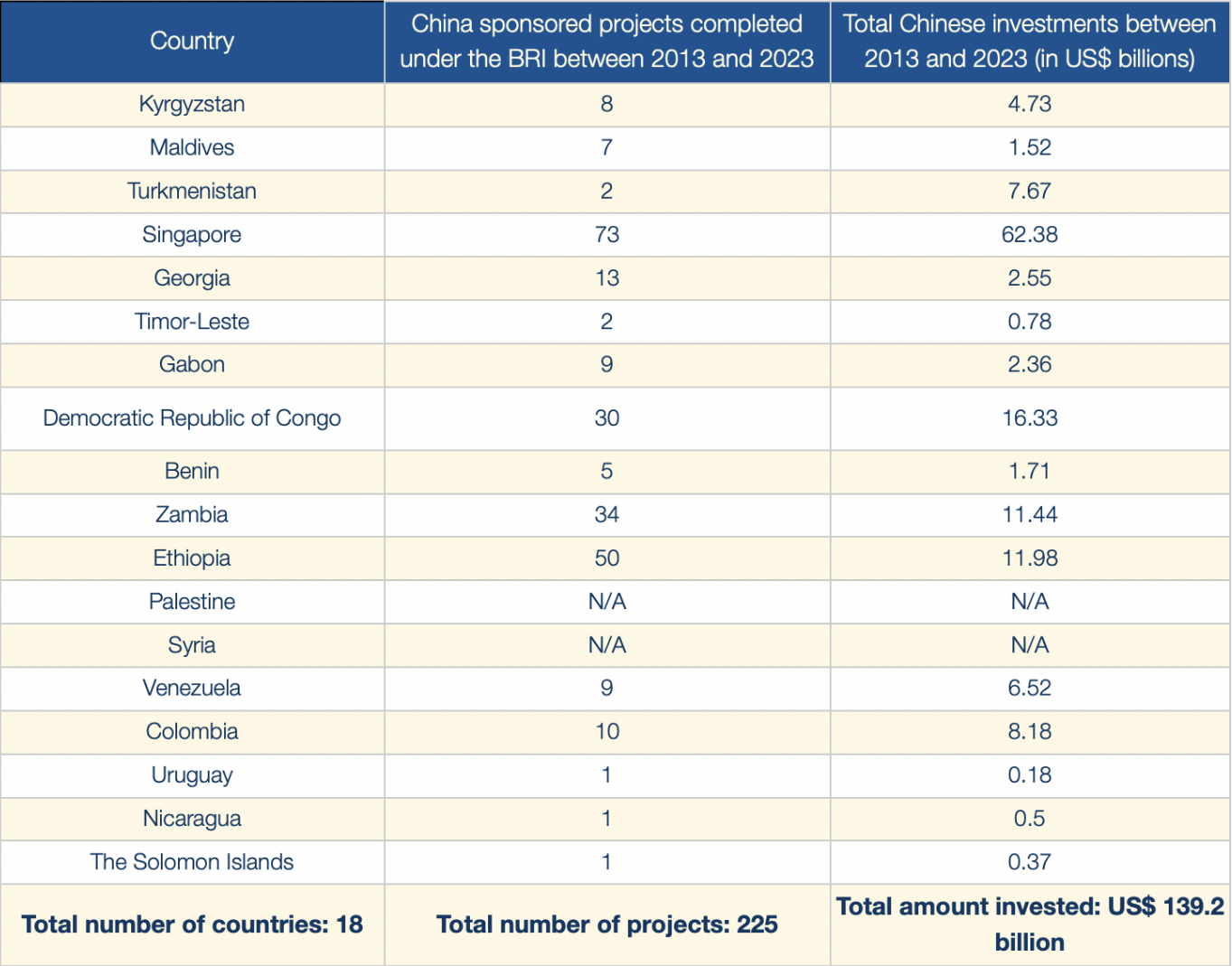

Beijing’s partnership upgrades come in the backdrop of its colossal BRI investments, totalling US$ 140 billion, in these 19 countries. A closer analysis reveals that China’s partnership upgrades can be loosely termed as being geostrategic or for securing (new and old) energy supply chains.

Table 2: Pre-existing BRI infrastructure investments in these countries

Source: The Belt and Road Portal, The Third Belt and Road Forum Archives, Chinese Foreign Ministry, China’s State Council

China’s partnership upgrades with Kyrgyzstan, Turkmenistan, Gabon, the DRC, Ethiopia, Zambia, Benin, Timor-Leste, and Venezuela centre around securing energy resources such as oil, crude, natural gas and critical minerals such as the ‘electric eighteen’ (critical minerals essential for electronic vehicles manufacturing) as well as for establishing resilient and diversified energy supply chains, needed for fuelling its domestic consumption and manufacturing and to aid its emergent green energy and electronic vehicles sector. These hypotheses are evidenced by analysing China’s bilateral cooperation agreement documents with these nations.

MoUs signed with Turkmenistan and Kyrgyzstan emphasised boosting natural gas exports to China and buckling down on the Kyrgyzstan-Uzbekistan-China (KUC) Railway construction. It is noteworthy that the increase in Turkmenistani natural gas exports has averaged 18.4 percent on a YoY basis this decade, and constitutes 98 percent of exports to China. Similarly, the KUC railway is aimed at enhancing and diversifying China’s land-based connectivity with Eurasia and it also offers the two landlocked nations access to Central Asian and European markets on one side and through connectivity with China—the Southeast Asian markets on the other. Beijing aims for this rail line to become another BRI Eurasian corridor in its Silk Road Economic Belt.

The Chinese have expanded their military exports and industrial presence to subdue Congolese rebels in eastern DRC while securing mining rights and purchasing stakes in Congolese copper mines.

Similarly in Africa, China’s bilateral relations upgrades with Gabon and DRC centre around securing natural resource supplies. Oil supplies constitute 61 percent of Gabon’s exports to China. China also secures 22 percent of its Manganese imports from Gabon. In DRC, the Chinese have expanded their military exports and industrial presence to subdue Congolese rebels in eastern DRC while securing mining rights and purchasing stakes in Congolese copper mines.

In Benin, Zambia, and Ethiopia, China’s aims are twofold—securing energy sources and building connectivity for their resource-rich landlocked neighbours. These nations’ geostrategically sound location has piqued Chinese interest. For instance, Beijing signed BRI MoUs with Benin, whose landlocked neighbour Niger is a major Chinese energy FDI recipient. Chinese National Petroleum Company, a Chinese state-owned company has 66 percent stakes in its largest oilfield. All three have signed BRI cooperation agreements.

China also instrumentalises its economic heft to create geopolitical leverage in its rivals’ neighbourhoods. With Nicaragua, Uruguay, and Colombia, part of the Chinese plan is to cultivate relationships with countries in the US’s vicinity as it has done in Maldives to India’s dismay, which sees the IOR as critical to its maritime security. The case is similar in the Solomon Islands which is part of the South Pacific. This region houses critical shipping lanes and is increasingly turning into a geopolitical hotbed between regional powers (US, Australia and New Zealand) and China.

Beijing’s strategic and geoeconomic considerations

China’s whirlwind of partnership upgrades comes at a time when its relations with the West are at an all-time low and the BRI is facing headwinds in the Global South. Unlike the West, a camp of mostly developed countries, Beijing is deepening its partnerships within the developing world. Beijing has also used ‘strategic’ in its partnership upgrades, which is indicative of increased regional, international, and multilateral cooperation with its reinvigorated partners. As China’s economy faces headwinds, 2023 was a year wherein Beijing seems to have solidified its diplomatic base as its leadership looks inwards in 2024 to manage issues such as the tumbling stock exchange, property market, reduced domestic consumption, etc. This is evidenced by Chinese President Xi’s bilateral meetings with other HoS. As opposed to having met 70 HoS in 2023, President Xi has met with only five in the year 2024 until now (Netherlands, Antigua and Barbuda, Maldives, Angola, and Uzbekistan).

China’s whirlwind of partnership upgrades comes at a time when its relations with the West are at an all-time low and the BRI is facing headwinds in the Global South.

Another geoeconomic consideration is the BRI’s energy sector, which has largely functioned under the ‘energy-for-development’ model in Africa, Asia, and South America. This model where China ties investment and loan repayments to the production of the energy source it develops has majorly failed to generate developmental results in the BRI EMDEs. The partnership upgrades in resource-rich countries are also, therefore, aimed at securing their continued energy exports and bolstering resilience in their energy supply chains.

Conclusion

China's rapid escalation of bilateral partnerships in 2023 reflects a strategic pivot towards the developing world. This comes amidst strained relations with the West and challenges to the Belt and Road Initiative (BRI). Upgrading partnerships with resource-rich nations like Turkmenistan, DRC, and Zambia strengthens China's grip on energy supplies and critical minerals. Additionally, partnerships with Maldives, Nicaragua, and the Solomon Islands establish a foothold in geopolitically significant regions, potentially countering US influence. By solidifying its diplomatic base, China seeks to address internal economic woes and navigate a complex global landscape. The success of this strategy, however, hinges on overcoming past missteps in BRI's “energy-for-development” model and ensuring sustainable development for partner nations.

Prithvi Gupta is a Junior Fellow in the Strategic Studies Programme at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV