There’s something of a debate happening right now about inflation. In fact, this debate has three legs. First, are the inflationary signs being seen in various parts of the world “transitory”, or structural? Second, is inflation being juiced by actual fiscal policy actions? And, third, are central banks taking inflation as seriously as they used to?

In India, consumer price inflation soared in May out of the Reserve Bank of India’s (RBI’s) comfort zone. That extends for two percentage points above and below 4 per cent; but the CPI in May increased 6.3 per cent year on year, well above estimates. Some of this was due to food inflation — generally expected — and some due to imported fuel inflation, as global crude oil markets face the possibility of severe under-supply later this year. But the real problem was elevated and broad-based core inflation — driven perhaps by higher commodity prices, but also perhaps reflecting less anchored expectations.

Inflation elsewhere, including in the United States and the People’s Republic of China (PRC), has also been higher than expected. US inflation is running at 5 per cent, with core consumer inflation rising faster than it has for almost four decades, since the painful battle fought by Paul Volcker’s anti-inflation Fed. Wholesale inflation in China — which can be exported to the world, given the PRC’s export dominance — is at 9 per cent, the highest since the financial crisis hit in September 2008.

Those who argue this is transitory point out that supply chains are complex, and the resurgence of demand globally and nationally lives alongside temporary closures and disruptions caused by the ebb and flow of virus cases. Bottlenecks of one sort or another can cause inflation. The White House’s council of economic advisors strongly favours this notion, arguing in a recent blog post that “indices of current delivery times are at record highs in surveys of manufacturers by three regional Federal Reserve Banks, but Fed indices for future delivery times are in their typical ranges”. Some commodities that looked to be surging, such as lumber in the US, have dipped. Many financial managers, on the other hand, are betting on more structural forms of inflation, arguing that the Western labour market among other components of the economy has been permanently altered by the pandemic, by relief packages, and by the proposed expansion of the US welfare state by President Joe Biden.

On the one hand, the second wave of the pandemic has meant that local lockdown has exacerbated the disruptive effects of fuel price increases. On the other, it is clear that a supply-choked economy is unlikely to be able to deal with the restoration of demand as cases ebb

India, facing wholesale inflation at almost 13 per cent — more than at any point since June 1992 — has to deal with a similar set of issues. On the one hand, the second wave of the pandemic has meant that local lockdown has exacerbated the disruptive effects of fuel price increases. On the other, it is clear that a supply-choked economy is unlikely to be able to deal with the restoration of demand as cases ebb. According to economists at HSBC, “the May print is a reminder of how things can suddenly rise back up again in 2HFY22 when (1) high vaccination rates give a fillip to consumer demand and (2) rural Indians resurface from the second wave with higher demand for consumer durables”.

The second question, about the relationship between policy actions and inflationary pressures, is related — but more politically fraught. Is it the case that the vast fiscal and monetary expansion in several developed countries is entrenching higher inflation in their economies, and thus globally through asset prices? The evidence is mixed. Theoretically, however, there are multiple ways in which a policy-induced expansion in the US in particular could export inflation to the emerging world. Then there are questions about all the surging liquidity eventually parking itself in asset prices, as it did in the sharp expansion following the post-2008 stimulus packages. On that occasion, the PRC’s extraordinary stimulus pushed commodities in particular into a two-year high that left economies like India ragged and unable to weather external stimuli like the taper tantrum. While Beijing’s actions have been more restrained on this occasion, Washington’s have been less so. The RBI, judging from its annual report last month, is aware of the possibility that asset prices may come unanchored from the real economy, pointing out “liquidity injected to support economic recovery can lead to unintended consequences in the form of inflationary asset prices and … liquidity support cannot be expected to be unrestrained and indefinite”. In the post-2008 era, the fisc overstretched itself, adding to the macro-economic vulnerabilities that buffeted the economy in 2012-13. The government so far has not repeated that mistake, but it is to be hoped it will continue to resist appeals to ignore the deficit.

Inflation is only a problem if central banks supposedly directed to control inflation forget their duties. There remains a very real concern that the re-politicisation of central banking globally over the past few years will lead to a failure to recognise the threats of inflation until it is too late

In the end, inflation is only a problem if central banks supposedly directed to control inflation forget their duties. There remains a very real concern that the re-politicisation of central banking globally over the past few years will lead to a failure to recognise the threats of inflation until it is too late. In the West, in particular — which has not dealt with an inflationary environment in decades — the risk was the dangers would simply be forgotten. The last Fed meeting seems to have tempered those fears, and communication has turned slightly hawkish. Fed Chair Jerome Powell said the meeting was “the talking about talking about tapering meeting”. This seems to have calmed some inflation worriers, including Larry Summers, who said the meeting showed that “the Fed … recognised that we were in a different place than it expected”, and that the meeting should be seen as “the beginning of the Fed’s recognition that overheating is the issue that it has to deal with going forward”. Across the board, other central banks — including in emerging economies — are now cautiously adjusting their approach. Brazil’s central bank, facing inflation of over 8 per cent, has raised interest rates three times, as has Russia’s. European central banks — including those in Scandinavia and Eastern Europe — have signalled tighter policy in response to incipient asset price inflation, as has Korea’s.

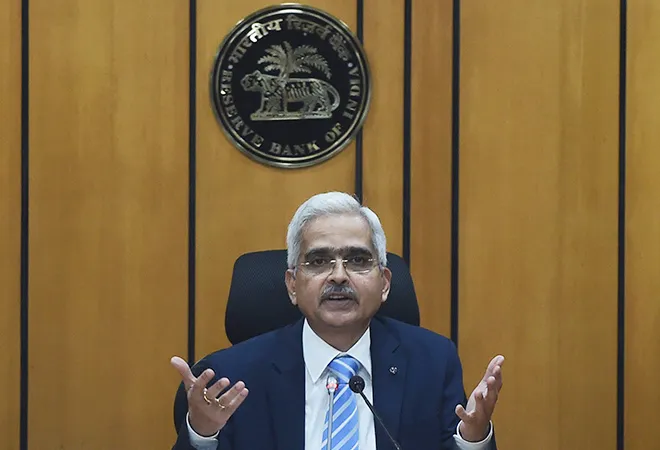

If the RBI intends to keep policy loose until the recovery is “durable” — as Governor Shaktikanta Das seems to have said in the minutes — then it may well be too late. India is not the West, and consumers and companies have clear memories of inflation — fertile ground for expectations of higher prices to become common

The worrying conclusion, therefore, is that the RBI looks like an outlier among its peers in dismissing inflation concerns, at least judging by the minutes from its June meeting that were made public last Friday. The RBI apparently believes that recent inflation is supply side-driven, and it will only need to worry about entrenched inflation when demand returns. It is far from clear whether there is any actual economic analysis behind this claim. If the RBI intends to keep policy loose until the recovery is “durable” — as Governor Shaktikanta Das seems to have said in the minutes — then it may well be too late. India is not the West, and consumers and companies have clear memories of inflation — fertile ground for expectations of higher prices to become common. The Fed might be able to operate on “outcome-based” targeting, in which policy will only respond after the event. The RBI cannot.

This commentary originally appeared in Business Standard.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV