Exploring the gas sector revival by using LNG, growth in the demand for jet fuel and gasoline — and other news.

COMPETITIVE LNG REVIVES GAS SECTOR

Monthly Gas News Commentary: May - June 2019

India

In a bid to promote a gas-based economy, the new Government may cut customs duty on LNG to 0% from 2.5%, to cut cost of power further and aid CGD projects besides boosting fertiliser production. LNG is a clean fuel and its imports currently attract 2.5% basic customs duty. In addition, a social welfare surcharge of 10% is levied that takes the effective customs duty on LNG to 2.75%. This adds up to the cost of imported gas as LNG requires additional cost for reconversion into gas and transportation. The Union Budget 2017-18 halved duty on LNG from 5%. The industry and the petroleum ministry have been pitching for exempting LNG from import duty for some time now as there is a shortage in domestic production. The Centre has exempted domestic power generators using gas as fuel to import LNG without payment of any duty. Cheaper access to LNG is expected to keep power tariff low while also allowing the government to save on fertiliser subsidy as cost of production will reduce. Spot rates of LNG are down at this juncture due to subdued global demand. The rates have fallen sharply since the beginning of this year with LNG prices coming down to $6 per mmBtu. With customs exemption, the situation would provide a bonanza to user industries and accelerate adoption of cleaner fuel. With stagnant domestic production, the demand for imported LNG is on the rise. In 2018-19, availability of domestic gas for sale rose merely 0.4% while import of LNG went up 2.6%. The share of LNG in total gas consumption in the year was 51%. India, the world’s fourth-biggest importer of LNG, does not have a free market regime for gas. Natural gas is sold on the basis of a government-mandated formula that links the local price to international rates, while most long-term import contracts are linked to crude oil. The country has, however, liberalised gas production regulations for new fields as well as deep sea and difficult blocks.

Petronet LNG Ltd, India’s largest natural gas importer, said it has expanded its Dahej import terminal capacity to 17.5 mtpa from current 15 mt. Petronet had more than one-and-a-half decade ago started operations of India’s maiden LNG import facility at Dahej in Gujarat with a nameplate capacity of 5 mt per annum. Petronet has a 5 mt facility at Kochi in Kerala.

IOC has issued a tender for short-term commercial lease of its LNG storage tank at Ennore terminal near Chennai, according to a notice posted on the company website. The company is seeking bids for the short-term lease for LNG unloading, storage and reloading services at the 5 mtpa import facility which was commissioned earlier this year. The contract period is for two years from the date of the agreement execution. Tenders are invited in a single-stage two-bid system, with the first part being the commercial bid and the second stage for the price bid, according to the notice. Bids are due by 15 July, the notice said.

GAIL (India) Ltd sold 100% US LNG till 2020, and about 80-90% beyond 2020. GAIL aims to import 75 LNG cargoes in FY20 Vs 62 in FY19. GAIL aims to borrow ₹50 bn in FY20. GAIL has signed MoU with ExxonMobil to explore use of LNG for transportation and bunkering.

H-Energy, the energy arm of realty major Hiranandani Group, is looking to source around 1 mtpa of additional LNG cargo for its Jaigarh terminal as the company plans to start operations in the October-December quarter of 2019. The terminal will start with a capacity of 1.5 mt and will be ramped up to 2.5 mtpa in a year. The company that plans to take its capacity to 8 mtpa after the second phase expansion at Jaigarh, believes, gas demand has been very stable in the last six months, and going ahead expects the demand to grow from the industrial and commercial sectors. Of late industries have become quality conscious and are relying more on cleaner fuels like natural gas. India is planning to raise the share of natural gas in its energy mix to 15% in three years from the present 6.5%. The country currently imports majority of its natural gas requirement in the form of LNG from Qatar, Nigeria, and the United Arab Emirates, among other nations. Qatar accounts for around 62% of overall LNG imports by India, followed by Nigeria (12%). H-Energy imports regassified LNG and supplies to its clients utilising the terminal.

Torrent Power and GSPC are seeking LNG cargoes for delivery in July. Torrent Power is seeking a cargo for late July in a tender that closed while GSPC is seeking a cargo for mid-July in a tender closing. Both cargoes are to be purchased on a delivered ex-ship basis.

India’s natural gas production decreased marginally to 2,656 mmscm in April 2019, as compared to the corresponding month a year ago. The country had produced 2,663 mmscm of natural gas in April 2018. ONGC the country’s largest upstream player’s, standalone natural gas production in April 2019 increased 3.34% to 2,038 mmscm, as compared to 1,972 mmscm produced in the corresponding month a year ago. The company’s natural gas production increased in April, primarily due to increased production from Eastern and Western offshore fields. Oil India Ltd, the country’s second largest oil and gas explorer’s natural gas production in April 2019 increased 1.39% to 224 mmscm, as compared to 221 mmscm produced in the corresponding month a year ago. The company’s natural gas production increased primarily due to better performance of fields in Assam, Arunachal Pradesh and Rajasthan. Natural gas production from PSC fields in April 2019 declined 16% to 394 mmscm, as compared to 470 mmscm produced in the corresponding month a year ago. Production from PSC fields declined primarily due to nil production from MA field in the eastern coast of India, closure of two wells in D1 and D3 field.

India’s top oil and gas producer ONGC will not see natural gas contributing heavily to its profitability in the near term despite the company aiming to raise output over the next few years, Moody’s Investors Service said. National oil companies worldwide are currently retailoring their business strategies in response to climate-change imperatives and developing energy transition changes, Moody’s said in a report that studies how state-sponsored oil companies are preparing against energy transition risk. As India’s largest national oil company, ONGC is aligned with the government’s aim to reduce India’s dependence on energy imports, which make up more than 80% of its oil consumption and more than 40% of its natural gas consumption, it said. Moody’s said although natural gas made up 44% of ONGC’s sales, it only accounted for about 17% of total sales revenue. The government has mandated a maximum price of $3.69 per mmBtu for most of the gas that ONGC produces during April to September 2019 period. This rate is below the cost of production for most fields. Moody’s said the recent acquisition of a stake in Russia’s Vankorneft fields increases ONGC’s crude reserves in that country. Also, ONGC has acquired a majority stake in refining and marketing company HPCL.

A ministerial group has given its nod to BPCL’s plan to invest $2.2-2.4 bn in the Rovuma Offshore Area-1 gas field in Mozambique. Two more Indian firms —OVL and OIL — have stakes in the gas field where 75 tcf of natural gas has been discovered. In 2013, OVL bought Videocon’s 10% stake in the project for $2.475 bn and a similar stake from Anadarko for $2.64 bn. Later, OVL gave 4% of its stake to Oil India Ltd. OVL already has approval to invest up to $7 bn in the gas field. BPCL paid $703 mn to buy the 10% stake in the project. The three Indian companies will be investing around $6 bn in all for their 30% stake in the project. For BPCL’s $2.2-2.4 bn investment, $800 mn would be equity and the rest would be raised as debt. The oil ministry had in the past been critical of the nearly $6 bn spent by the Indian public sector firms to take 30% stake in the Rovuma Offshore Area-1 in Mozambique as falling oil and gas prices did not justify such huge investment. In the first phase, $22-24 bn is to be spent by partners in Mozambique project to develop the field and build two LNG trains of 12.88 mt.

RIL and BP plc announced sanction for development of their deepest gas discovery in the eastern offshore KG-D6 block. MJ, or D55, development is the third project that the partners have taken up to revive flagging natural gas production from KG-D6 block. These projects together, when fully developed, will bring about 1 bn cubic feet a day of new domestic gas onstream, phased over 2020-2022.

PNGRB has fixed transportation tariff of GAIL’s main trunk natural gas pipeline at half of what the state-owned firm wanted, sending its stock nosediving. PNGRB in its transportation charge order for the 3,452 km long pipeline originating from Hazira in Gujarat and going up to Jagdishpur in Uttar Pradesh via Vijaipur in Madhya Pradesh (called HVJ pipeline) fixed levelised tariff for the integrated pipeline at ₹41.11 per mmBtu. This was lower than ₹97.04 per mmBtu tariff that GAIL had sought, citing a capex spending of ₹247.08 bn over the economic life of the pipeline lasting till 2035.

The government has stopped issuing penalties on RIL and its partner BP plc for natural gas production from eastern offshore KG-D6 fields not matching the targets after the matter went into arbitration. The government had between 2012 and 2016 disallowed RIL from recovering the cost of $3.02 bn for KG-D6 output lagging targets, but no notice was issued after that even though production has plummeted to a fraction of the projections. The DGH said that in all, four notices were issued that disallowed recovery of a part of the cost incurred by RIL-BP in producing gas from D1 and D3 fields; the last one being on 3 June 2016. The cost recovery disallowance notices to RIL-BP were issued as gas output lagged targets, a phenomenon that oil ministry and DGH have insisted was because of the company not drilling the committed number of wells on the fields. The total penalty slapped till 2016, which was in the form of disallowing recovery of cost incurred for missing the target during six years beginning 1 April 2010, was $3.02 bn. The PSC allows RIL and its partners BP PLC and Canada’s Niko Resources to deduct all capital and operating expenses from the sale of gas before sharing profit with the government. Gas production from D1 and D3 gas field in the KG-D6 block in the Bay of Bengal was supposed to be 80 mmscmd but actual production was only 35.33 mmscmd in 2011-12, 20.88 mmscmd in 2012-13 and 9.77 mmscmd in 2013-14. The output has continued to drop in the subsequent years and is now below 4 mmscmd. RIL-BP challenged the cost disallowance of the past years and have initiated international arbitration seeking dropping of the same on grounds that the PSC does not provide for any such punishment. It had blamed unanticipated sand and water ingress for shutting down of one well after the after, leading to drop in production. RIL holds 60% interest in block KG-DWN-98/3 or KG-D6 in the Bay of Bengal. BP has 30% and Niko the remaining 10%.

Rest of the World

Global gas demand is expected to grow at a rate of 1.6% a year until 2024, fueled by Chinese consumption which will account for over a third of the demand growth during the period, IEA said. China’s push to switch from coal to gas in power generation and natural gas for residential use to improve air quality under its “blue skies” initiative will play a major role in driving demand, IEA said. China’s gas demand growth is seen at an average rate of 8%, down from the two-digit growth rate in recent years as its economic growth slows, but would still account for around 40% of the global demand increase in the coming years, IEA said. The Asia-Pacific region will remain the largest source of gas consumption growth in the medium term with an average rate of 4% per year, and will account for around 60% of the total consumption increase until 2024. In 2018, global gas demand saw its strongest growth since 2010 at an estimated rate of 4.6%, driven by the US and China, both accounting for 70% of total demand growth. In the LNG market trade is expected to reach 546 bcm by 2024 from 432 bcm in 2018. China will become the largest LNG importer by 2024 at 109 bcm, ahead of Japan. The IEA report said the US was expected to surpass Qatar and Australia to become the world’s largest LNG exporter by the end of the forecast period, at 113 bcm in 2024, and the US, Australia and Russia would account for around 90% of the increase in LNG exports during the period. In Europe, the supply gap will widen to reach 336 bcm by 2024, increasing by almost 50 bcm per year as domestic production continues its slide with the phasing out of the Groningen field in the Netherlands, and North Sea depletion. IEA said the use of LNG for maritime transport was still a niche market concentrated in Europe with around 155 LNG-fuelled vessels in operation as of early 2019, but the fleet of LNG-powered vessels was growing fast, and would double by 2024.

Europe saved $8 bn on its natural gas bill last year because surging US shale production and a shake-up in EU energy markets forced Russia to change its gas pricing mechanism the IEA said. IEA said 2018 was a “golden year” for natural gas which accounted for 45% of total global energy growth, which in turn was the fastest in two decades. The shift in global gas markets stemming from the US shale gas revolution, a rapid expansion of the LNG industry and EU liberalisation of energy markets, had forced Russia to change its oil-indexed pricing of gas. The change began when rising US gas output led Qatar, the world’s largest LNG exporter, to divert LNG supplies to Europe, shaking up pricing on the continent and widening the influence of the Dutch TTF benchmark price. The IEA in its annual report forecast the LNG market to grow 26% between now and 2024 to 546 bcm with China becoming the largest buyer and the US the biggest seller. A trade war between Beijing and Washington could hamper the development of new US export terminals, which depend on long-term buyers. Chinese companies by and large have stayed away from US LNG projects especially after Beijing slapped on retaliatory tariffs. US prices of LNG being shipped to Europe will remain competitive with Russian piped gas prices over the long term. The US has strongly criticised Nord Stream 2, a €11 bn ($12.4 bn) project to build a gas pipeline from Russia to Germany, which opponents fear will undermine Ukraine’s gas transit revenues and increase the EU’s reliance on Russian gas.

Natural gas flaring and venting in the top US oil field reached an all-time high in the first quarter of the year due to the lack of pipelines, at a time of increased focus on environmental concerns about methane emissions. Producers burned or vented 661 mmcfd in the Permian Basin of West Texas and eastern New Mexico, the field that has driven the US to record oil production, according to a new report from Rystad Energy. The Permian’s first-quarter flaring and venting level more than doubles the production of the US Gulf of Mexico’s most productive gas facility, Royal Dutch Shell’s Mars-Ursa complex, which produces about 260 to 270 mmcfd of gas. The Permian is expected to flare more than 650 mmcfd until the second half of the year when the Gulf Coast Express pipeline comes online. The Gulf Coast Express is designed to transport up to 2 billion cubic feet of natural gas and is scheduled begin operations in October.

Cheniere Energy Inc said it would buy natural gas from Apache Corp’s Permian assets using a price mechanism linked to the LNG it ends up selling and not the typical US gas benchmark. The deal is the first sign Cheniere, by far the largest US LNG seller, may move away from its signature LNG pricing mechanism in future offtake agreements with LNG buyers by decoupling from the Henry Hub price used for US gas. To service its LNG sale agreements, Cheniere buys US gas to use as feedstock for its two LNG plants in Texas and Louisiana. It then sells LNG to long-term buyers who pay about 115% of the Henry Hub price plus a liquefaction fee of around $3 per mmBtu. This formula protects Cheniere from fluctuating US gas prices and covers its cost to transform gas into LNG through the liquefaction fee. By striking the agreement with Apache to buy gas at an LNG-indexed price, however, Cheniere is giving itself flexibility to sell LNG using a different pricing structure. It is another sign that US LNG producers are expanding the ways they attract buyers in a global market that is growing fast but is far from being as liquid and transparent as the crude market.

LNG producers ConocoPhillips and Woodside Petroleum expect prices for the commodity to pick up in the short term, pulling away from three-year lows that were hit after a mild northern hemisphere winter. But Australia’s Woodside is worried about companies approving new LNG projects without lining up long-term contracts, potentially weighing on prices when they start producing in the mid-2020s. ConocoPhillips operates the 3.7 mtpa Darwin LNG plant in northern Australia and the 9 mt a year east coast Australia Pacific LNG plant. Woodside does not expect the current weak prices to affect the timing of the company’s Browse gas project off northwest Australia, for which the company aims to make a final investment decision in late 2020. The timetable for a final investment decision was “safe” as Woodside’s partners include LNG buyers Mitsui & Co, Mitsubishi Corp and PetroChina. But what could weigh on the market in the mid-2020s is that a number of new LNG projects elsewhere could go ahead without having pre-sold all their volumes, as Shell has done with a project in Canada. ConocoPhillips expects to make a final investment decision later this year or in early 2020 on whether to develop the Barossa gas field to fill the Darwin LNG plant when supply runs out around 2022 from the Bayu Undan field in the Timor Sea. LNG buyers are taking advantage of weak spot LNG prices, now at three-year lows below $5 per mmBtu to demand shorter term contracts and more pricing latitude from suppliers.

Saudi Aramco has entered into a 20-year agreement with US-based Sempra Energy to purchase LNG from its subsidiary Sempra LNG, the two companies said. The Saudi state oil giant plans to become a major global gas player while the US market is undergoing a shale boom. Aramco has been developing its own gas resources and eying gas assets in the US, Russia, Australia and Africa. The two companies are also finalising a 25% equity investment in the phase 1 of Port Arthur LNG, they said. The sale-and-purchase agreement is for 5 mtpa of LNG from phase 1 of the Port Arthur LNG export project under development, the firms said. The proposed Port Arthur LNG Phase 1 project is expected to include two liquefaction trains, up to three LNG storage tanks and associated facilities which should enable the export of about 11 mtpa on a long-term basis. Aramco’s trading arm sold its first LNG cargo on the spot market in late March to an Indian buyer. Aramco plans to boost its gas production to 23 bn scf a day from about 14 bn scf now.

Bulgaria has agreed to buy US natural gas for the first time, signing a deal for a delivery in the second quarter and another in the third. Dutch-registered trader Kolmar NL will deliver a 90 mcm cargo of LNG and a second of 50 mcm. The first LNG shipment is from US producer Cheniere and the second one is from the US unit of BP. Bulgaria signed a contract in April with Greek DEPA for another small gas shipment, part of efforts to reduce an almost complete dependence on supplies from Russia’s Gazprom. Bulgaria said it would diversify after a 2009 row with Moscow disrupted winter supplies. The new contracts covered about 10% of Bulgaria’s gas needs and priced at a level to gas prices in Bulgaria to be cut in the third quarter, state gas wholesaler Bulgargaz said. Bulgaria plans to launch its own natural gas trading bourse in October and said Kolmar NL had expressed interest to offer about 500 mcm of LNG a year for the bourse over five years.

PetroChina is bucking normal practice and raising its wholesale natural gas prices during the weak-demand spring season, preparing for the coming consolidation of China’s pipeline assets and trying to recoup huge fuel import losses. The increases from PetroChina - which supplies more than 70% of China’s gas - come as spring brings warmer temperatures, when demand and prices typically fall. PetroChina is also under pressure to recoup continuing losses from its gas import business due to high input costs versus government-capped domestic prices. PetroChina lost 3.3 bn yuan ($480 mn) on its gas imports in the first quarter of this year due to high fuel costs. Over 2018, the Chinese major incurred a net loss on its gas imports of nearly 25 bn yuan. Beijing plans to launch this year a national oil and gas pipeline company that will combine assets from PetroChina, CNOOC and Sinopec, a move aimed at spurring private and foreign exploration investment. The price increases sought would apply to wholesale rates that PetroChina charges provincial piped-gas distributors, power plants and big industrial users such as fertiliser producers. PetroChina expects to agree with buyers to prices about 6.4% above government-set city-gate prices for gas from conventional domestic fields and imports by pipeline from Central Asia, which together make up more than 60% of PetroChina’s total gas supplies. PetroChina normally prices gas at a discount or flat to city-gate levels in the spring as demand ebbs in warmer weather. For supplies of higher-cost LNG imports and domestic shale gas output, PetroChina still aims to raise prices by up to 30% above city-gate levels, said the three sources. With a goal to sign up annual supply deals with buyers by end of June, PetroChina, the listed arm of CNPC, started raising prices with some customers of LNG or shale gas in April. Shaanxi Gas Group, a provincial utility, said it had reduced its gas intake because of a PetroChina price hike.

A total 12.9 bcm of natural gas worth 26 bn yuan ($3.8 bn) have been traded on China’s Chongqing Petroleum and Gas Exchange since it started operations in April 2018, according to the exchange. In a major auction held on 31 May, PetroChina Natural Gas Sales, Chuanyu Branch, sold 41.39 mcm of gas to 129 end-users at a premium of 2.08 yuan per cubic meter over city-gate benchmark prices, the exchange said. Two other PetroChina subsidiaries that handle gas sales in western and southern China also held auctions on the exchange at end-May and in early June, it said

Guangdong Energy Group emerged as a first-time spot buyer of LNG as the Chinese utility secured access to a receiving terminal in southern China. The state-run utility bought two cargoes of the super-chilled fuel totalling 120,000 tonnes, both from Malaysian state oil and gas producer Petronas. The utility for the first time exercised a right to use the Guangdong Dapeng LNG terminal in Shenzhen operated by CNOOC.

Ukrainian energy company Naftogaz has proposed a contract for gas swaps to Russian gas giant Gazprom instead of direct transit. Under the proposed deal Gazprom could sell its gas to Naftogaz at the Russia - Ukraine border, while Kiev would sell the same amount to Europe at the Ukraine – EU border crossing.

Cyprus and Greece heaped pressure on the EU to take action against Turkey over gas drilling in disputed waters, as Ankara said it would step up exploration in a move that could further strain ties with Western allies. Ankara, which does not have diplomatic relations with Cyprus, claims that certain areas in Cyprus’s offshore maritime zone, known as an EEZ, fall under the jurisdiction of Turkey or of Turkish Cypriots, who have their own breakaway state in the north of the island recognised only by Turkey.

Argentina’s rising natural gas output, along with competitive global LNG shipping costs, should make the South American country an emerging source of gas supply to Asia during peak demand periods, recent research from Wood Mackenzie concludes. Moreover, the consultancy envisions potential implications for US LNG exporters. Wood Mackenzie found that shipping LNG to Asia from Argentina would be cheaper than doing so from the US Gulf Coast because there would be no need to transit the Panama Canal. Argentina will ramp up production from the Vaca Muerta shale formation in the Neuquen basin over the next few years, and major-scale LNG production should start in 2024. Argentina’s LNG production volumes could reach 6 mtpa in 2024, increasing to 10 mtpa by 2030, Wood Mackenzie also noted. Moreover, the firm projects that associated gas from Vaca Muerta will account for 15% of Argentina’s gas production by 2024. Argentine oil company YPF SA said that it began loading the first shipment of LNG for export from Argentina. The shipment includes 30,000 cubic meters of LNG from the Vaca Muerta shale play, YPF said. The export of LNG will generate revenues of more than $200 mn a year, which represents 10% of its total fuel and energy exports, according to YPF data. Argentina seeks to become one of the few exporting countries of LNG through international sales of leftover gas in summer periods when local demand is lower, boosting the flow of dollars into the country.

Brazilian oil firm Petrobras has made natural gas discoveries in six deep-water fields in the Sergipe Basin, it said. The find was the largest since the sub-salt discoveries in 2006, and that Petrobras could extract up to 20 mn cubic meters of natural gas per day, equivalent to one third of total Brazilian production. The find could help deliver the “cheap energy shock” to Brazil as it will reduce the cost of natural gas by up to 50% and “reindustrialise” the country.

Japan’s biggest oil and gas explorer Inpex Corp and the Indonesian government signed a basic agreement on the development of Indonesia’s Abadi LNG project, moving forward the $15 bn project. Inpex President Takayuki Ueda said the Japanese company, which owns a 65% stake in the project, said they plan to submit a development plan for the project within several weeks to the Indonesian government and aim to make a final investment decision within 2-3 years. The remaining stake in the Abadi project, situated in the Masela block, is owned by Royal Dutch Shell, the world’s largest buyer and seller of LNG. Construction for this project was due to start in 2018, but in 2016 was delayed until at least 2020 after Indonesian authorities instructed a switch from an offshore to an onshore facility.

Royal Dutch Shell shipped the long-awaited first cargo of liquefied natural gas from its massive Prelude floating LNG plant off northwest Australia, sealing the nation’s position as the world’s top exporter of the fuel. Prelude’s start-up marks the end of a $200 bn LNG construction boom in Australia over the past decade, during which eight LNG plants were built on the country’s eastern and northwestern coasts. Prelude’s first cargo had been targeted for 2018, but was delayed as the company tackled a string of teething problems at the world’s biggest floating vessel. The 490-meter long ship is longer than four soccer fields and as big as six large aircraft carriers. The shipment on the Valencia Knutsen LNG tanker is going to customers in Asia, Shell said. Prelude will produce 3.6 mt a year of LNG, 1.3 mt a year of condensate and 400,000 tonnes a year of LPG. The start-up comes just as spot LNG prices have sunk to more than three-year lows, with new projects in Australia and the US boosting global supply while demand in Asia was dented by a mild winter. Shell had expected Prelude to be the world’s first floating LNG project, but was beaten by Malaysia’s Petronas, which shipped the first cargo from its PFLNG Satu project two years ago. Prelude is the world’s biggest floating LNG plant, however. It took two years from the time the vessel was first parked on top of the fields that feed it to ship the first LNG cargo.

Pakistan LNG, a subsidiary of state-owned Government Holdings Ltd, is seeking to buy 240 LNG cargoes for delivery over a 10-year period, a document on the company’s website showed. It is seeking two cargoes a month of 140,000 cubic metres each of the super-chilled fuel on a delivered ex-ship basis at Port Qasim in Karachi, Pakistan, according to the document.

Tanzania expects a consortium of international oil companies to start building a long-delayed LNG project in 2022. Construction of an LNG export terminal near huge offshore natural gas discoveries in deep water south of the East African country has been held up for years by regulatory delays. The government said in March it planned to conclude talks in September with a group of foreign oil and gas companies led by Norway’s Equinor on developing the LNG terminal. Equinor, alongside Royal Dutch Shell, Exxon Mobil and Ophir Energy and Pavilion Energy, plan to build the onshore LNG plant in Lindi region. The international oil companies will develop the project in partnership with the Tanzania Petroleum Development Corp. The government launched a new round of talks in April with each company in order to speed up the process. Tanzania has estimated recoverable reserves of over 57.54 tcf of natural gas. Tanzania already uses some of the gas for power generation and running of manufacturing plants.

Algeria has made an important gas discovery in the southwest province of Tindouf which could help the country boost exports and maintain its market share abroad. Algeria is a major gas supplier to Europe but rising domestic consumption and a failure to increase production in recent years have threatened its export volumes. State energy firm Sonatrach would make further evaluations of the field’s capacity. Algeria, which produces about 135 bcm of gas a year, has started to renew supply contracts with European clients as current contracts are due to expire by the end of this year or in early 2020. Algeria’s economy relies heavily on gas and crude oil, and the government has drafted a new energy law offering incentives to investors in a bid to attract foreign firms.

Bangladesh’s second LNG floating facility is set to receive its first ship-to-ship transfer of gas from an Algerian cargo, Summit LNG Terminal said. ‘Summit LNG’, the FSRU, will receive 159,000 cubic metres of LNG from Oman Trading International, with the transfer expected to be completed. The LNG tanker, Creole Spirit, loaded gas from Bethioua, Algeria. A second LNG tanker is expected to arrive on 3 June. The FSRU started to feed gas to Bangladesh’s national grid in late April after picking up its commissioning cargo from Qatar. Summit Power International, which owns power generation assets in Bangladesh and is owned by Bangladeshi conglomerate Summit Group, has chartered the vessel, which is able to regasify 500 million cubic feet of LNG a day from US based Excelerate Energy for 15 years.

| LNG: liquefied natural gas, CGD: city gas distribution, mmBtu: million metric British thermal units, mtpa: million tonnes per annum, mt: million tonnes, IOC: Indian Oil Corp, US: United States, FY: Financial Year, mn: million, bn: billion, MoU: Memorandum of Understanding, km: kilometre, GSPC: Gujarat State Petroleum Corp, mmscmd: million metric standard cubic meter per day, DGH: Directorate General of Hydrocarbons, ONGC: Oil and Natural Gas Corp, PSC: Production Sharing Contract, HPCL: Hindustan Petroleum Corp Ltd, BPCL: Bharat Petroleum Corp Ltd, OVL: ONGC Videsh Ltd, RIL: Reliance Industries Ltd, KG: Krishna-Godavari, PNGRB: Petroleum and Natural Gas Regulatory Board, IEA: International Energy Agency, tcf: trillion cubic feet, bcm: billion cubic meters, EU: European Union, mmcfd: million cubic feet per day, scf: standard cubic feet, mcm: million cubic meters, CNOOC: China National Offshore Oil Corp, CNPC: China National Petroleum Corp, Petrobras: Petroleo Brasileiro SA, FSRU: floating storage and regasification unit |

NATIONAL: OIL

India’s IOC sees growth in demand for jet fuel and gasoline easing this year

25 June. Growth in India’s demand for gasoline and jet fuel is expected to slow slightly this year, Indian Oil Corp (IOC) Chairman Sanjiv Singh refiner said, as prospects for world trade deteriorate. Singh said overall demand will remain at 4% to 4.5% . Still, the growth rate could be lowest for the country since fiscal year 2013-2014, according to government data, a sign that demand in India, one of the two pillars driving global oil consumption growth other than China, is slowing. The International Energy Agency has revised down its 2019 oil demand growth estimate by 100,000 barrels to 1.2 mn barrels per day due to the worsening prospects for world trade, although stimulus packages and developing countries should boost growth going into 2020. Demand for gasoline and jet fuel demand is expected to rise by 7-8%. this year, Singh said, down from rates of 9-10% in the previous year. Diesel consumption could increase by 3% this year, which is “still a decent growth,” Singh said. The country’s plans to add smaller airports to improve domestic transport systems will drive appetite for jet fuel, Singh said. India could increase fuel imports slightly during the refinery shutdowns, Singh said. IOC, along with other refiners in India, have halted Iranian oil imports because of US (United States) sanctions. IOC, which has term contracts with US oil sellers, is also open to buying more spot cargoes but this will depend on economics, Singh said.

Source: Reuters

India may discuss oil issues with Pompeo

25 June. India may discuss with US (United States) secretary of state Mike Pompeo a host of issues crucial for its energy security, including oil price volatility due to rising tensions between Tehran and Washington, disadvantages in purchasing American crude and technical issues arising due to sanctions that threaten India’s strategic projects. During Pompeo’s visit, New Delhi will seek Washington’s cooperation in getting reliable and affordable energy supply, especially after US sanctions that prohibited the import of Iranian crude from May. India, which is a net importer of energy, is a victim of volatility in crude prices that is often caused because of geo-political reasons. The recent tussle between the US and Iran has further aggravated the situation that could adversely impact major oil consumers such as India. Oil Minister Dharmendra Pradhan recently spoke to US energy secretary Rick Perry and raised these issues. Pradhan emphasised the impact of price volatility on Indian consumers and stressed the important role that the US could play in bringing global price stability. Traditionally, Iran has beena major crude oil supplier for India to meet almost 10% of its annual requirements. India, which has already stopped purchasing Iranian crude due to the sanction, is facing problems in meeting the shortfall.

Source: Hindustan Times

Petrol pumps stop giving fuel to two-wheeler riders without helmet in Aligarh

25 June. Petrol pumps in Aligarh have stopped giving fuel to two-wheeler riders who come in without wearing helmets. The directions for not giving petrol to two-wheeler riders who come without helmets was issued by District Magistrate (DM) Chandra Bhushan Singh. Petrol pump owners and workers have started instructing people who come to pumps to always carry a helmet. They have also been turning back numerous customers for coming without a helmet. Amanullah Khan, a social worker, welcomed the move by the DM and said he was pleased that the rule was being strictly followed. Petrol pump owners and managers too welcomed the move and said although they might be facing a little bit of difficulty still, it would save the lives of many people.

Source: The Economic Times

India intensifies talks to check oil prices as US-Iran tensions rise

24 June. India has stepped up diplomatic initiatives with top oil producers as rising US (United States)-Iran tension has pushed up crude prices and may raise freight and insurance costs. While tension has been rising for a year since the US decided to re-impose sanctions on Iran, recent attacks on oil cargoes in the Gulf region and downing of a US drone by the Islamic Republic has magnified the anxiety. Oil Minister Dharmendra Pradhan has spoken to US Energy Secretary Rick Perry, Russia’s Deputy Prime Minister Yury P Trutnev, UAE (United Arab Emirates) Minister Sultan Ahmed Al Jaber, and Saudi energy minister Khalid Al-Falih to discuss the geopolitical situation and its effect on oil prices. He sought their help in keeping prices at a reasonable level. For India, which imports 84% of its oil needs, any supply disruption or a price flare can be damaging. Oil gained 5% in a week on US-Iran conflict. Indian Navy has deployed warship and aircraft to secure tankers headed to India from the Persian Gulf region. It would be hard for one or two warships to fully secure all oil cargoes meant for India but it can be a strong deterrent for anybody wanting to harm ships.

Source: The Economic Times

Government plan of opening over 78k petrol pumps is uneconomical: CRISIL

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">More petrol pumps may mean low service standards driven by low profits!

< style="color: #ffffff">Bad! |

20 June. The government plan to double the number of petrol pumps in the country does not make economic sense as more number of outlets would only cut into each other's sale, leading to some becoming unprofitable, CRISIL Research said in a report. The three public sector oil marketing firms - Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) - in November last year advertised to open 78,493 more petrol pumps in the country. This on top of 64,624 fuel retail outlets currently operating in the country. As the addition of pumps will also be followed by closures where throughputs are not at sustainable levels, private players are expected to effectively add 7,500-8,000 petrol pumps till fiscal 2030, based on their plans and the pump licenses they hold. Of the 78,493 petrol pumps planned, about 68% belong to the regular category (highway and urban areas), and the remaining 32% is in rural areas.

Source: Business Standard

NATIONAL: GAS

Centre to provide CNG, PNG infrastructure in 406 districts: Pradhan

25 June. Oil Minister Dharmendra Pradhan said that the Centre has chalked out a plan to provide compressed natural gas (CNG) and piped natural gas (PNG) infrastructure in 406 districts of the country. He said that the government was expanding the CNG and PNG infrastructure in other cities. He said that ₹12 mn will be invested in the next eight years in the energy sector.

Source: The Economic Times

GAIL hires LNG carrier from Mitsui

20 June. GAIL (India) Ltd has hired a liquefied natural gas (LNG) carrier on short-term charter from Japan’s Mitsui OS K Lines Ltd, Junichiro Ikeda, President of the Japanese fleet owner, disclosed after signing the deal. Tokyo Stock Exchange-listed MOL, the world’s largest operator of LNG carriers, did not disclose further details of the charter deal, including the duration of the contract, the name of the ship and the day rate.

Source: The Hindu Business Line

NATIONAL: COAL

India’s annual coal demand rises 9.1% to nearly 1 bn tonnes: Coal Minister

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Coal demand growth should increase domestic production and not increase imports!

< style="color: #ffffff">Ugly! |

24 June. India’s annual coal demand rose 9.1% to 991.35 million tonnes (mt) during the year ended March 2019, India’s Coal Minister Pralhad Joshi said. Coal is among the top five commodities imported by India, one of biggest importers of the fuel despite having the world’s fifth largest reserves. Consumption by India’s utilities, which accounted for three-fourths of the total demand, rose 6.6% to 760.66 mt, Joshi said. Imports rose to 235.24 mt in 2018-19 from 208.27 mt in 2017-18, Joshi said. Domestic supplies rose to 734.23 mt during the year ended March 2019. India’s supply shortfall more than doubled to 23.35 mt, mainly because of Coal India Ltd (CIL)’s inability to cater to demand from the cement and sponge iron industries. Demand from the cement sector rose 70% to 37.22 mt while coal demand from the sponge iron industry rose by over two-thirds to 41.33 mt, Joshi said. A ban on the use of petroleum coke, a dirtier alternative to coal, in some parts of the country, and CIL’s focus on power sector ahead of the elections amid a promise to electrify all rural households in the country led to a rise in imports. CIL is prioritising starting production at mines with a capacity of more than 10 mt per year and improving mechanisation to increase output, Joshi said. CIL’s output rose 7% to 606.89 mt in 2018-19, and is targeting a production of 660 mt in 2019-20.

Source: Reuters

CIL targets stakes in overseas coke mines

24 June. Coal India Ltd (CIL) is looking for minority stakes in operational coking coal mines in Russia, Canada and Australia. Based on its experience it may gradually increase stakes, following which it may buy them out, and then look for new blocks in these countries, CIL said. The company has renewed its effort to acquire foreign coking coal assets as the fuel is getting unpopular in many countries, which can help the Indian company get a good price. Large banks in these countries have backed out from financing coal mines and thermal power plants. Many bankers have stayed away from such deals. CIL wants to grab this opportunity by using internal accruals to finance such acquisitions. For Australia, CIL has already floated a tender for appointing merchant bankers to scout for assets and advice the company in acquiring stakes. After merchant bankers are appointed the company will finalise the assets, in which CIL may buy a minority stake to begin with. Many bankers such as Goldman Sachs and Merill Lynch stayed away from the tender as the asset is considered dirty but ANZ, BNP Paribas, JP Morgan and some others have shown interest. CIL’s past experience in acquiring foreign assets is not a happy one. It had acquired a exploratory block in Mozambique in August 2009. It gave away the block as preliminary exploration showed that the block did not have good quality reserves

Source: The Economic Times

Reliance Power starts process to sell coal mines in Indonesia

23 June. Reliance Power (RPower) has started the process to sell its coal mines in Indonesia and is expected to close the deal in few months, according to people in the know. The deal, if completed, is expected to fetch the financially troubled group $150-200 mn. RPower holds three coal concessions that are fully explored and are ready to produce coal. The total capacity for these mines includes 1.4 bn metric tonnes coal and 450 mn metric tonnes of coal reserves. RPower was among those Indian power companies who aimed to secure coal supply from Indonesia as coal prices soared in 2010. However, with the crash in commodity prices in the following years, most of these acquisitions turned unviable for Indian power companies.

Source: Business Standard

NATIONAL: POWER

KSEB plans power generation curbs

25 June. The Kerala State Electricity Board (KSEB) has decided to regulate and impose restrictions on power generation in the wake of the dip in water level in reservoirs. Till the reservoirs have water to generate 390 mn units, a decision has been made to regulate the daily consumption from hydel sources to 12 mn units. The decision was made following a joint review meeting of the board of directors and heads of generation, transmission, system operation and planning wings. The total storage in dams in the State as per the estimates last was adequate only to generate 476 mn units. This was similar to the water level in 2017, when the State had to suffice with a weak monsoon. The board could cart only 63 mn units from other sources through its transmission infrastructure and there was no reason for any concern at present. But going by the current intensity of the monsoon, to touch the generation level of 390 mn units, it may take 18 to 20 days.

Source: The Hindu

Power demand jumps by 10% in Punjab

24 June. The power demand in the state has jumped by another 10% this year with the Punjab State Power Corp Ltd (PSPCL) supplying 2,638 lakh units of electricity to all the power consumers within Punjab. Last year, the PSPCL had supplied 11,994 MW which is about 1,000 MW higher as compared to 10,988 MW last year on the same day. PSPCL was providing 8-hour power supply to its agriculture consumers from 13 June, along with 24-hour power supply to all other categories of consumers. PSPCL has arranged for a buffer of six transformers of various capacities at all divisions in Punjab for replacement against damage so as to reduce the time for replacement and restoration of supply.

Source: The Economic Times

L&T wins more than ₹70 bn order for building power plant in Bihar

24 June. Larsen & Toubro (L&T) said it has won a project for constructing a power plant in Bihar. The project is estimated to be worth more than ₹70 bn. L&T’S power segment has been struggling for the lack of orders in the last few years. The new project will help improve L&T’s capacity utilisation, but the company’s orders from the private sector continue to remain muted.

Source: Business Standard

Power ministry working on new norms for discoms to secure payment to gencos

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Secure payment to gencos is necessary to address the circular debt problem!

< style="color: #ffffff">Good! |

23 June. Distribution companies (discoms) will no longer be able to get away without paying for the power they procure for supplying to consumers. The power ministry is ushering in a payment security mechanism on the principles of the pre-paid system to ensure prompt payment to generation companies (gencos). This is part of structural changes being implemented by Union Power Minister R K Singh to address issues facing the sector and attract investments needed for improving quality of life with reliable and sustainable electricity supply. A mounting pile of gencos’ unpaid bills has caused financial stress to many power projects, forcing some even to the brink of bankruptcy. The ministry’s PRAAPTI portal pegs generators’ total outstanding amount at ₹358.45 bn at the end of April. Under the new mechanism, discoms will have to furnish LCs (letters of credit) to ‘load despatch centres’ before power from generation companies is allowed to flow to states. The despatch centres will limit the flow of power to the quantum covered by the LCs provided. Load despatch centres are nodal control points – akin to large railway junctions – that function at the national, regional and state levels to facilitate smooth and safe flow of power within and across states. The ministry is expected to issue an order for the new mechanism within a week. The order is building upon the provision of LCs that exist in power purchase agreements but are followed erratically or not at all. The ministry order will empower the despatch centres to follow the PPA (power purchase agreement) provision and cut supply.

Source: The Economic Times

Singh assures support for electricity sector development in Rajasthan

22 June. Union Power Minister R K Singh met Rajasthan’s Energy Minister B D Kalla and assured him of all possible support for the development of power and renewable energy sector in the state. During the meeting, both leaders held discussions on various aspects of the power sector in the state. Singh asked Kalla to further improve power sector in Rajasthan. Singh also reviewed the progress of work sanctioned under the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and asked the state government to expedite the works, which are underway.

Source: The Economic Times

Residents write to UP CM against power tariff hike

22 June. The Noida RWA federation wrote to Uttar Pradesh (UP) Chief Minister (CM) Yogi Adityanath regarding 20% proposed power tariff hike and termed it as an ‘unjustified’ move. Federation of Noida Residents Welfare Association (FONRWA) submitted various points against the proposed hike in their letter which includes reduction in line losses, reduction in average purchase costs, abolition of fixed charges and justification for separate, special tariff for Noida being a profit centre. Noida is well controlled so tariff should be further reduced if distribution system is upgraded. Further, the RWA federation maintained that there should be reduction in average purchase costs. On fixed charges, the RWA federation maintained that while UPPCL (Uttar Pradesh Power Corp Ltd) has been levying fixed charges in addition to the electricity charges on the basis of the actual consumption of electricity, the total sanctioned load of UP is far more than the available power supply.

Source: The Economic Times

Average power usage spikes by 25% in Delhi this summer

20 June. A study by the Centre for Science and Environment (CSE) said the average power consumption in the national capital during peak heatwave days in June increased by 25% compared with the season’s average. Environment experts suggested that buildings must be designed for thermal comfort to minimise the use of mechanical cooling systems. The CSE has also noted that there was an increase of 1% in the peak energy demand per degree rise in temperature between 2018 and 2019 summers.

Source: Business Standard

No power tariff hike in Chandigarh: JERC

19 June. Providing major relief to the residents, the Joint Electricity Regulatory Commission (JERC) approved the electricity department’s petition, wherein they had not proposed any hike in power tariff for financial year 2019-20. As per the latest orders of the JERC, the new tariff will be applicable from 1 June and will remain valid till further orders from the commission. Last time, the JERC had marginally increased rates in domestic and commercial categories and had reduced rates in the industrial category for the financial year 2018-19. In the domestic category, rate were increased from ₹2.55 to ₹2.75 in the slab of 0-150 units, while there was no change in the rate of ₹4.80 in the slab of 151-400 unit. In the slab of above 400 units, the rate was increased from ₹5 to ₹5.20 per unit. Along the similar lines, a small increase in the commercial consumer category was also made. In the commercial category, there was no change in the rate of ₹5 in the slab between 0-150 units, while in slab of 151-400, rate was increased from ₹5.20 to ₹5.30 per unit. In above 400 slab, rate was increased from ₹5.45 to ₹5.60 per unit.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

India plans to add 500 GW renewable energy by 2030: Government

25 June. India plans to add 500 GW of renewable energy to its electricity grid by 2030 in a bid to clean up air in its cities and lessen the rapidly growing economy’s dependence on coal, the government said. India, the world’s third-largest emitter of greenhouse gases, has pledged to cut emissions and have clean energy account for at least 40% of its installed capacity by 2030, up from 21.4% now, while looking to manage its energy appetite as its population becomes more prosperous.

Source: Reuters

Inox Wind commissions common power evacuation facilities in Gujarat

24 June. Wind turbine maker Inox Wind said it has commissioned the common power evacuation facilities at Dayapar site in Bhuj in Gujarat. Inox Wind said this will enable commissioning of projects won under various Solar Energy Corp of India (SECI) auctions. SECI is a nodal agency of the central government for auctioning renewable energy projects in the country. The company said, at present, it has more than 1,400 MW of developed and under development projects in Gujarat and more than 2.6 GW installations all over India.

Source: Business Standard

Maharashtra to get solar power generation plants in four dams

24 June. Maharashtra is all set to get floating solar power generation plants in four dams, state Water Resources Minister Girish Mahajan said. He said the estimated investment per megawatt is ₹44.5 mn, with a total installed capacity of 500 MW. The work to set up the plants is under progress as permitted under the Maharashtra Infrastructure Development Enabling Authority Act, he said.

Source: Business Standard

Indians shifting to hybrids on green policies, carmakers’ push

21 June. Indian consumers are increasingly looking to buy a hybrid or an electric vehicle over conventional powertrain-driven ones on the back of supportive environmental policies, big-brand bets and shift in buyers’ mindset, shows a report by global consultancy firm Deloitte. As many as 39% of the respondents in the country said they would prefer a hybrid, a battery or an alternate powertrain-powered vehicle when buying their next vehicle (up from 31% in 2018) as per the 2019 Deloitte Global Automotive Consumer Survey. Around 21% of the buyers though said that they would prefer a hybrid electric vehicle to resolve issues related to range anxiety. About 6% said they would opt for full-electric vehicles while 12% would go for some other technology.

Source: The Economic Times

NHPC to finalise supply of 2.5 GW for short term through stressed thermal projects

20 June. NHPC Ltd is set to finalise in a couple of months the supply 2,500 MW through various coal-based thermal power plants for short term at a tariff of ₹4.41 per unit discovered in a reverse auction. NHPC has been appointed as an aggregator by PFC Consultancy through e-tendering for Pilot Scheme-II of the power ministry.

Source: Business Standard

MNRE to set up dispute resolution panel for solar, wind projects implemented by SECI, NTPC

19 June. The Ministry of New and Renewable Energy (MNRE) has decided to set up a three-member dispute resolution committee to look into disputes beyond contractual agreements between solar or wind power developers and Solar Energy Corp of India (SECI) or NTPC Ltd. This mechanism will cover all those projects that would be implemented through or by SECI and NTPC.

Source: Business Standard

INTERNATIONAL: OIL

Russia leads as top crude supplier to China, overtakes Saudi

25 June. Russia became the largest crude oil supplier to China in May, supported by robust demand from private refiners and alongside a fall in supplies from Iran. Imports from Russia came in at 6.36 million tonnes (mt) in May, or 1.50 mn barrels per day (bpd), data from the General Administration of Customs showed. On a bpd basis, imports were up 4% from a year ago, but were flat versus April when China’s total crude oil imports hit a monthly record. For the first five months of the year, shipments from Russia were 30.54 mt or 1.48 mn bpd, up 9.8% from a year ago, data showed.

Source: Reuters

Azerbaijan supports oil output deal rollover: Energy Minister

24 June. Azerbaijan’s Energy Minister, Parviz Shakhbazov, said he supported the rollover of the current global agreement on oil production cuts which expires at the end of June. The Organisation of the Petroleum Exporting Countries (OPEC) and other leading oil producers had agreed to cut their combined oil output by 1.2 mn barrels per day between 1 January 2019 and the end of June in order to evenly balance the oil market.

Source: Reuters

Global oil pact helped stabilise markets: Russian Energy Minister

24 June. A deal among the world’s crude producers to rein in output has stabilised oil markets and made oil industry investments attractive, Russian Energy Minister Alexander Novak said. Novak said that rivalry on world energy markets was heating up.

Source: Reuters

Iran, Venezuela to complicate global oil deal talks: Kazakh Energy Minister

24 June. Talks between OPEC (Organisation of the Petroleum Exporting Countries) and its allies next month over whether to extend their global oil output cut deal will be complicated by uncertainties over Iran and Venezuela’s stance, Kazakh Energy Minister Kanat Bozumbayev said. The OPEC and other large oil producers, including Russia and Kazakhstan, will meet in Vienna on 1-2 July to discuss whether the oil output deal, which expires after 30 June, should be continued.

Source: Reuters

Lundin makes 2 oil discoveries off Norway

21 June. Lundin Petroleum AB revealed that its wholly owned subsidiary, Lundin Norway AS, has made two oil discoveries on the eastern edge of the Edvard Grieg field, offshore Norway, in PL338. The discoveries have combined gross resources of between four and 37 mn barrels of oil equivalent, according to Lundin, which highlighted that both finds can be developed with wells from the Edvard Grieg platform. Goddo will test the extension of the Rolvsnes weathered basement oil discovery into the adjacent license, where the combined area is estimated to contain gross potential resources of more than 250 mn barrels of oil equivalent.

Source: Rigzone

Japanese refiners consider steps to handle oil supply disruptions amid Mideast tensions

21 June. Japanese oil refiners are studying measures to handle potential disruption to crude supply from the Middle East amid mounting tensions in the region, Japan Petroleum Association (PAJ) president Takashi Tsukioka said. The measures include purchasing spot oil from other areas such as West Africa or the United States (US), as well as the use of national reserves, he said. Two tankers, one operated by a Japanese shipping company, were attacked last week in the Gulf.

Source: Reuters

New oil contamination found in Druzhba pipeline: Russia’s Transneft

20 June. Russian pipeline monopoly Transneft said that more contaminated oil had been found at a section of the Druzhba pipeline from Belarus to Poland. Russia suspended west-bound flows through the pipeline in April due to excessive levels of organic chloride in the crude, affecting refiners in Germany, Poland, the Czech Republic, Slovakia, Hungary, Ukraine and Belarus.

Source: Reuters

Gulf oil producers to maintain output within OPEC target in July

20 June. Gulf OPEC (Organisation of the Petroleum Exporting Countries) producers will keep their July oil production within their OPEC target despite the current global supply cut pact expiring at end of June, a signal that the Gulf exporters are reluctant to boost supply. Saudi Arabia, the top global oil exporter’s crude output in June will be around the same level of its May production, and its July output will remain within its obligation under the OPEC-led supply cut deal. Saudi oil output in May was 9.67 mn bpd, according to OPEC figures. Riyadh has been pumping below its 10.3 mn barrels per day (bpd) target under the OPEC pact for the past months. In May, Kuwait pumped 2.709 mn bpd, and the UAE’s oil production was 3.055 mn bpd - both below their OPEC’s supply target. The moves indicate that the powerful Gulf oil producers block wants to keep the existing output cut by OPEC unchanged for the second half of the year. OPEC meets next in Vienna on 1 July to decide on its output policy, and will meet with its non-OPEC allies, led by Russia, on 2 July.

Source: Reuters

INTERNATIONAL: GAS

Brazil approves natural gas market overhaul to bring down energy prices

25 June. Brazil’s energy policy council approved a plan to overhaul the domestic natural gas market, with the country’s Mines and Energy Minister Bento Albuquerque said that the move would bring down gas prices within two to three years. Economy Minister Paulo Guedes offered a more bullish prediction, said the plan would “shock” the country’s energy market and cut energy prices by 40% within two years.

Source: Reuters

Bangladesh receives interest from 12 companies to build LNG terminal

21 June. Bangladesh has received interest from twelve companies to build the country’s first onshore liquefied natural gas (LNG) import terminal. The South Asian country, which has a population of more than 160 mn, is turning to land-based LNG terminals as its first imports of the super-chilled fuel via a floating platform were delayed due to weather and technical issues. Rupantarita Prakritik Gas Co, part of state-owned oil and gas company Petrobangla, had requested expressions of interest from potential terminal developers for a land-based LNG regasification terminal at Matarbari in the Cox’s Bazar district of southern Bangladesh. Twelve companies have submitted their interest to build the terminal, Rupantarita Prakritik Gas Co said. The companies include Japan’s Mitsui, South Korean utility KOGAS, and a consortium led by Summit Corp, a unit of Bangladesh’s Summit Group. Japan’s Mitsubishi and JERA Co, the world’s largest LNG buyer, are minority stakeholders in the Summit consortium. India’s Petronet LNG and a French company have also submitted their interest. The expression of interest is for the design, engineering, procurement, construction and commissioning of an onshore terminal that can handle 7.5 million tonnes (mt) a year of LNG, including receiving, unloading, storage and regasification. The project is on a build-own-operate basis for 20 years, with ownership to then be transferred at no cost to the Bangladeshi government or a company nominated by the government.

Source: Reuters

Global LNG producers see cost risks looming over next wave of projects

20 June. Construction delays and cost blowouts could hit the next wave of liquefied natural gas (LNG) projects as there are a limited number of contractors able to handle the huge projects, developers said. Around $200 bn in projects across the globe from Australia to the United States (US) are racing to be approved over the next two years, vying to provide around 65 million tonnes (mt) of new annual supplies that are needed by 2025, according to estimates by consultants Wood Mackenzie. To win project approvals, developers are pushing to line up long-term buyers, but with spot prices stuck at three-year lows and a flood of cheap US LNG, buyers are holding out for lower prices from new projects worldwide.

Source: Reuters

INTERNATIONAL: COAL

Asia’s coal developers feeling left out by cold shoulder from banks

25 June. Developers of coal mines and coal-fired power plants in Asia are facing difficulties growing their businesses as global financial institutions refuse to back their projects to avoid criticism over climate change, industry participants said. More than 100 major financial institutions have divested from thermal coal projects by February, along with more than 20 significant insurers, according to the Institute of Energy Economics and Financial Analysis. Indonesia is planning to add 35 GW of power capacity by 2024 of which 54% will come from coal-fired plants. The lack of funding may delay plants in other markets where thermal coal demand is expected to grow, including India and Vietnam, which are depending on low-cost coal-fired power to support their developing manufacturing sectors. Japan’s Mizuho Financial Group Inc and Mitsubishi UFJ Financial Group both said they would tighten their financing policies for coal-fired power projects to tackle global climate change. For miners, the withdrawal of financing is also threatening new thermal coal supply, particularly for smaller companies.

Source: Reuters

Noble Group sees lower coal prices for next few years

24 June. Commodity trader Noble Group sees thermal coal prices coming under pressure over the next few years given an oversupply and waning demand from Europe where natural gas and renewables are gaining a greater market share, analyst Rodrigo Echeverri said. Futures prices for coal and natural gas also point to gas remaining as a more economical source of power generation, further depressing the outlook for coal. In South Korea, coal and gas generation have both lost ground to nuclear generation.

Source: The Economic Times

South Korean firm wins mining leases for long-delayed Australian coal project

21 June. An Australian state granted mining leases for a coal mine controlled by Korea Resources Corp (KORES), clearing the way for a project that green groups and some local communities have battled for more than a decade. The final approval from the New South Wales (NSW) state government follows a surprise victory for the pro-coal conservative government in an Australian election in which climate change had been a key issue. The election outcome has put pressure on state governments that had been opposed to new coal mines to clear the way for projects that have long been held up, to create new jobs. KORES, leading the Wyong Areas Coal Joint Venture, plans to dig an underground mine to produce up to 5 million tonnes (mt) a year of thermal coal for power stations over 28 years, aiming to start production in late 2022 or early 2023, project manager Kenny Barry said.

Source: Reuters

China’s Shanxi orders 82 coal mines to halt production or construction

19 June. Northern China’s Shanxi province ordered 82 coal mines in the first five months of the year to either stop production or construction after uncovering hidden safety dangers at their sites. The authorities carried out 2,167 inspections in Shanxi over the January-May period, with 32,612 hidden dangers and 99 major hidden dangers found, the Shanxi Coal Mine Safety Administration and the provincial emergency management department said. Shanxi is China’s second-biggest coal-producing region after Inner Mongolia, with an output of over 893 million tonnes (mt) in 2018, according to the National Bureau of Statistics. At the end of May, Shanxi had 988 coal mines in operation, according to the Shanxi Coal Mine Safety Administration. China has been stepping up inspections on its coal mines after a spate of recent accidents, including a mine collapse in neighbouring Shaanxi province that killed 21 miners in January. In May, China’s state planner, the National Development and Reform Commission, said it would ramp up closures of small coal mines to boost safety and reduce pollution, and that it plans to cut the number of small coal mines nationally to less than 800 by 2021.

Source: Reuters

Eight EU countries to phase out coal by 2030

19 June. Eight of the EU (European Union)'s 28 countries have pledged to phase out coal for electricity production by 2030 to reduce greenhouse gas emissions. The European Commission, the EU's executive arm, received the pledges as contributions to the bloc's efforts to deliver on the 2015 Paris climate agreement. EU climate and energy commissioner Miguel Arias Canete said that among the European Union countries introducing or confirming such timelines, France intends to phase out coal by 2022 -- before Italy and Ireland by 2025. Under the 2015 Paris treaty, the EU pledged to reduce its carbon emissions by 40% below 1990 levels by 2030.

Source: The Economic Times

PPC seeks capacity mechanism from EU for Greek coal unit

19 June. Greece’s Public Power Corp (PPC) said that a €1.4 bn ($1.6 bn) coal-fired plant project is at risk without a capacity remuneration mechanism, following a jump in carbon emissions costs. Capacity mechanisms are measures introduced by some EU (European Union) member states to compensate power producers for making available electricity. Greece has been in talks with the European Commission for a capacity mechanism for PPC, which is 51% owned by the Greek state. The mechanisms must conform with EU guidelines on state aid.

Source: Reuters

INTERNATIONAL: POWER

Thailand to develop power transmission lines to become electricity hub of ASEAN

25 June. Thailand has announced it will develop its power transmission lines to become the electricity hub of the region, sourcing hydropower from Laos and selling it to Malaysia, Cambodia and Myanmar. The energy ministry said that the idea was part of the ASEAN (Association of Southeast Asian Nations) energy plans that ASEAN energy ministers would discuss in their meeting on 2-3 September to guarantee cheap electricity for ASEAN people. Modern transmission lines would serve the idea, the ministry said.

Source: Chiang Rai Times

Chinese-funded power plant in Bangladesh delayed after workers clash

23 June. The construction of a $2.5 bn power plant in Bangladesh, a joint venture with China, will be delayed after critical equipment was stolen or destroyed during clashes between workers at the site. A Chinese worker was killed and at least six injured when violence erupted between Bangladeshi and Chinese construction workers at the plant, with the former angered by the death of a colleague in a fall. Abdul Mowla, general manager of the Bangladesh-China Power Co Ltd (BCPCL), which is 50:50 funded by China and Bangladesh, said as a result of the damage the coal-based 1,320 MW power plant would not come on line early next year as planned. Construction of the coal-fired plant employs about 8,000 workers, of whom 2,700 are Chinese. Mowla said that the full cost of the destruction and delays has yet to be ascertained. All the Chinese workers are living in the dormitories inside the plant premises and their safety has been ensured, Mowla said.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Nevada utility announces three major solar projects with battery storage

25 June. Nevada’s largest utility NV Energy will procure 1,200 MW of solar electricity paired with batteries, or enough to power about 228,000 homes, as it seeks to double its renewable energy resources and move away from fossil fuels. The addition of energy storage to all three projects underscores how important - and cheap - batteries have become as utilities seek to extend the working hours of their solar facilities. The three solar projects will more than double the utility’s renewable energy by 2023, NV Energy said.

Source: Reuters

France wants EDF to sell more nuclear power to rivals, price could increase

24 June. The French government plans to increase the amount of nuclear energy utility EDF is forced to sell to its competitors by 50% to 150 terawatt hours and is in talks with the European Commission to potentially raise the fixed price. The government aims to have both measures ready before the November auction window of the so-called ARENH market mechanism, under which EDF’s rivals bid for wholesale nuclear electricity for the year ahead, the energy ministry said.

Source: Reuters

Nepal, Bangladesh agree for joint investment in hydropower projects

23 June. Nepal and Bangladesh have agreed to make joint investments in hydropower projects. The decision was taken at the Energy Secretary level meeting between the two nations which included the projects covered by the whitepaper issued by the previous meeting a year back. The whitepaper issued by Nepal’s finance ministry a year back had included 962 MW capacity holding Tamor reservoir, 800 MW Dudhkoshi project which has a reservoir, 725 MW Upper Arun, 450 MW Kimathanka Arun, 679 MW Lower Arun. Likewise, Sunkoshi-II 1,110 MW, Sunkoshi-III 536 MW, Tamakoshi-V 101 MW, Khimti Shiwalaya 500 MW and Kokhajor Reservoir 111 MW also are included in the then issued whitepaper.

Source: The Economic Times

US President orders review of controversial biofuel waiver program

20 June. US (United States) President Donald Trump has directed members of his Cabinet to review the administration’s expanded use of waivers exempting small refineries from the nation’s biofuel policy, after hearing from farmers angry about the issue during his recent Midwest tour. Trump’s move underscores the rising political importance of the US Renewable Fuel Standard, a more than decade-old law which requires refineries to blend corn-based ethanol into their gasoline to help farmers, but which also provides waivers to small refining facilities that can prove compliance would cause them financial harm.

Source: Reuters

New York lawmakers pass aggressive law to fight climate change

19 June. New York state lawmakers passed early one of the nation’s most ambitious plans to slow climate change by reducing greenhouse gas emissions to zero by 2050. If signed into law, it would make New York the second US (United States) state to aim for a carbon-neutral economy, following an executive order signed by then California Governor Jerry Brown last year to make that state carbon neutral by 2045. Democratic-led US states and cities have been developing environmental policies that advance action on climate change after President Donald Trump vowed to pull the US out of a 2015 global accord to fight climate change and has backed continuing planet-warming extraction and use of fossil fuels. New York’s “Climate and Community Protection Act” calls for reducing emissions by 40% by 2030 and using only carbon-free sources such as solar and wind to generate electricity by 2040.

Source: Reuters

DATA INSIGHT

Electricity Generation through Renewables

Million Units

| Renewable Sources |

Electricity Generation |

| 2016-17 |

2017-18 |

2018-19 |

| Wind |

46004.34 |

52666.09 |

62036.38 |

| Solar |

13499.41 |

25871.07 |

39268.2 |

| Biomass |

4198.3 |

3404.95 |

2763.82 |

| Bagasse |

9960.34 |

11847.35 |

13562.67 |

| Small Hydro |

7672.66 |

7691.58 |

8702.75 |

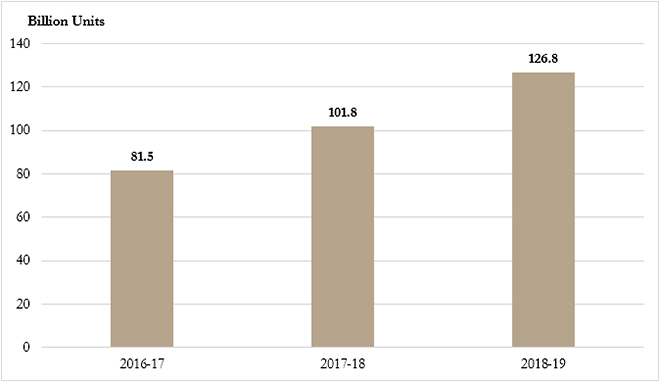

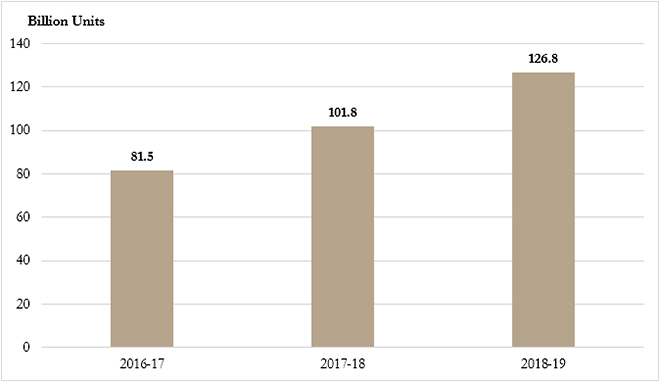

Trends in All India Renewable Generation

Source: Compiled from Lok Sabha Questions for Ministry of New & Renewable Energy

Source: Compiled from Lok Sabha Questions for Ministry of New & Renewable Energy

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

Source: Compiled from Lok Sabha Questions for Ministry of New & Renewable Energy

Source: Compiled from Lok Sabha Questions for Ministry of New & Renewable Energy PREV

PREV