After a long period of stagnation, many African countries experienced strong growth from mid-1990s. Countries like Ghana, Angola, Democratic Republic of Congo, and Ethiopia emerged as some of the fastest growing countries in the world. Much of the growth in these countries can be attributed to a period of high commodity prices. This period was also marked by a rapid acceleration of economic ties with China. Within a short of a decade, China became the principal economic partner for most of the African economies. India, which had longstanding relations with Africa, did not lag very far behind. The scale of India’s trade, investment, and development cooperation linkages with Africa also expanded rapidly.

Liberalisation of the Indian economy in 1991 put India on a higher growth trajectory. As a result, India’s energy requirements increased manifold and energy security concerns moved to the centre stage of India’s foreign policy. Diversification of energy sources and investment in overseas oil and gas ventures became explicit objectives of India’s foreign policy. Public sector companies like ONGC Videsh, Gujarat State Petroleum Corporation, and Oil India Limited rapidly expanded their footprint in Africa with ONGC Videsh occupying the top spot with investments worth US$ 3.01 billion or about 59.8 per cent of total Indian investment flows to Africa. High growth and growing middles class in Africa also increased the attractiveness of the continent for India’s private sector. Many Indian private sector companies like the TATA Group, Bharati Airtel, Essar Group, Reliance, and Varun Beverages also invested heavily in African countries. According to the World Investment Report 2017, India was the seventh largest investor in Africa in 2015.

Although India has been engaged in development and technical cooperation since its independence, the scale of its development initiatives, particularly in Africa, expanded greatly in the 2000s. In 2004, the Indian Development and Economic Assistance Scheme (IDEAS) was launched with the objective of sharing India’s development experience by extending concessional lines of credit. Since the inception of the scheme, concessional lines of credit have played an instrumental role in shaping India’s development partnership with Africa. African countries have been the main beneficiaries of Indian credit lines. Urvashi Aneja and Tanoubi Ngangom have argued that India’s early partnerships were largely an attempt to establish solidarity and partnership with other post-colonial states. However, development cooperation strategy in the 2000s increasingly stressed on the principle of development partnership for mutual benefit. Securing natural resources, food, and energy, promoting exports, and opening new markets for Indian companies became stated objectives of India’s development and economic assistance scheme. Through its concessional credit lines, India offers alternative project financing options for African countries on the one hand and on the other hand it aims to create opportunities for Indian public and private sector companies to enter new markets. Experts like Samuel and George assert that India is increasingly promoting its private sector in its development cooperation agenda.

This was also the time when the role of the private sector in development cooperation was established globally. The Fourth High-Level Forum on Aid Effectiveness in Busan in 2011 stressed the need to build stronger relationships between development cooperation and the private sector. The role of the private sector in development cooperation was also emphasised in the Rio+20 Conference, the Global Partnership for Effective Development Cooperation, and the G20 Summits. Most donor countries, particularly Sweden, realigned their development cooperation to strengthen the private sector in their own countries.

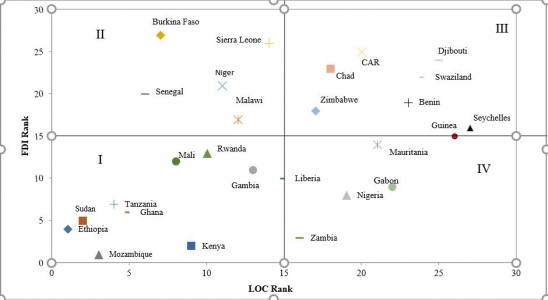

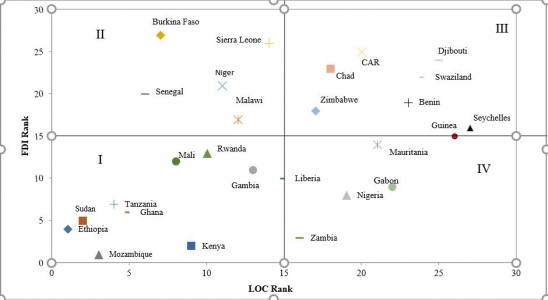

Despite the fact that in the post-liberalisation era, economic diplomacy became a key feature of foreign policy and India’s development cooperation now explicitly aims to promote India’s economic interests, the correlation between Indian investments and lines of credit is currently weak in Africa. In the Figure below, African countries have been ranked on the basis of the total value of lines of credit received and investment outflows from India between 2008 and 2016. The spearman rank correlation is just 0.44 which suggests a weak positive association between the total concessional credit received by a country and India’s foreign direct investment outflows in that country.

Ranking of African countries based on total concessional credit and FDI received. Source: Author’s own based on data from EXIM Bank and RBI database

Ranking of African countries based on total concessional credit and FDI received. Source: Author’s own based on data from EXIM Bank and RBI database

Countries in the first quadrant like Mozambique, Kenya, Rwanda, Ethiopia, Tanzania, which have been favoured destinations for both investments and lines of credit, are mostly in East Africa, a region with which India has traditionally enjoyed close relations due to the presence of a large diaspora, fewer regulatory hurdles, and the widespread use of English. This region is also very important for India because of its strategic location in the Indian ocean. Countries in the third quadrant, Djibouti, Swaziland, and Benin have not been major beneficiaries of either investments or credit lines from India. But the countries in the second and fourth quadrant present a disassociation between FDI flows and lines of credit.

Countries like Burkina Faso, Sierra Leone, Niger, Senegal, and Malawi have been major beneficiaries of concessional credit but have received scant FDI flows from India. Indian credit lines are failing to promote private sector investments in these countries. On the other hand, countries in the fourth quadrant: Zambia, Mauritania, Liberia, Nigeria, and Gabon, have not been major beneficiaries of concessional credit but have received high volumes of FDI. Thus, we find that India’s lines of credit are not very well aligned with India’s private sector in Africa. In fact, the role of the private sector is limited to that of a contractor in the whole process of the delivery of development cooperation.

India must adopt a more systematic approach to involve the private sector in its development cooperation programme. Its development cooperation initiatives must try to create positive externalities for Indian companies in Africa. Moreover, development projects should be targeted to sectors and countries which are of interest to Indian businesses. This will foster trade and investment relations between India and Africa. It is critical that India assess why its credit lines are failing to serve as stepping stones for Indian businesses in Africa. This is particularly relevant for countries in the fourth quadrant. India should try to create an institutional mechanism to promote Indian overseas investments in other developing countries. However, the Indian government must not support Indian businesses that fail to respect local laws and have adverse socio-economic impacts. The institutional vehicle which supports Indian businesses in Africa or other developing countries must bear in mind the development priorities of those countries and promote development friendly investments.

This commentary originally appeared in LSE Blogs

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Ranking of African countries based on total concessional credit and FDI received. Source: Author’s own based on data from EXIM Bank and RBI database

Ranking of African countries based on total concessional credit and FDI received. Source: Author’s own based on data from EXIM Bank and RBI database PREV

PREV