Quick Notes

Carbon capture, utilisation, and storage: A means for coal dependent India to decarbonise?

Basics

Carbon capture, utilisation and storage (CCUS) may be defined as the capture, use, and secure storage of carbon that would otherwise be emitted into or remain in the atmosphere. The rationale for carbon capture and storage is to enable the use of fossil fuels while reducing the emissions of carbon dioxide (CO2) into the atmosphere, and thereby, mitigating global climate change. The storage period for CO2 exceeds the estimated peak periods of fossil fuel exploitation, so that if CO2 re-emerges into the atmosphere, it will occur after the predicted peak in atmospheric CO2 concentrations. Removing CO2 from the atmosphere by increasing its uptake in soils and vegetation (e.g., afforestation) or in the ocean (e.g., iron fertilization), is also a form of carbon sequestration through natural sinks.

Opinion on the use of CCUS in India is divided. At one end, the view is that CCUS is merely a means to extend fossil fuel use, particularly coal use in India that will delay or even prevent India leapfrogging into the future with low carbon renewable technologies such as solar and wind. CCUS technology is seen unproven, dangerous (especially in the context of storage), and expensive. At the other end, hyper-scale gasification of domestic coal along with CCUS is seen as a means for large-scale carbon-neutral industrialisation with domestic production of methanol, ammonia (fertiliser), olefins, steel, and power that will also enhance India’s oil production from its depleting oilfields. Methanol-based chemicals and olefins can be used for plastics and as a substitute for petrol, diesel, and liquefied petroleum gas (LPG). With domestic coal as feedstock for production of these chemicals, the Indian economy can potentially save billions of dollars and generate domestic activity and jobs through reduced import of crude oil according to this camp.

Globally even the most climate sensitive institutions favour CCUS as a critical means for decarbonisation. CCUS is one of the four pillars of a net-zero carbon world along with renewable energy-based electrification, bioenergy, and hydrogen by the International Energy Agency (IEA). In September 2019, the UN climate change Executive Secretary observed that “CCUS is not a destination, but a transition from current fossil fuel dependent reality to a climate-neutral future by 2050”.

Carbon Sources

Indian power plants account for most of the CO2 emissions. Natural gas ensuing from production wells often contains a significant fraction of CO2 that could be captured and stored. Other industrial processes that lend themselves to carbon capture are steel, ammonia and cement manufacturing, fermentation and hydrogen production (e.g., in oil refining). Future opportunities for CO2 capture may arise from producing hydrogen fuels from carbon-rich feedstocks, such as natural gas, coal, and biomass. The CO2 by-product would be relatively pure and the hydrogen could be used in fuel cells and other hydrogen fuel-based technologies, but there are major costs involved in developing a mass market and infrastructure for these new fuels.

Capture, Transport and Storage

There are many pre-combustion and post combustion methods for CO2 capture. In the chemical absorption process, CO2 is absorbed in a liquid solvent by formation of a chemically bonded compound. When used in a power plant to capture CO2, the flue gas (post-combustion) is bubbled through the solvent in a packed absorber column, where the solvent preferentially removes the CO2 from the flue gas. Afterward, the solvent passes through a regenerator unit where the absorbed CO2 is stripped from the solvent. The most commonly used absorbent for CO2 absorption is mono-ethanolamine (MEA). This is the most advanced and widely used CO2 separation technique currently applied in a number of small and large-scale projects worldwide in power generation, fuel transformation and industrial production.

Physical separation is based on either adsorption (adhesion of atoms, ions or molecules from a gas, liquid or dissolved solid to a surface), absorption, cryogenic separation, or dehydration and compression. Physical adsorption makes use of a solid surface, while physical absorption makes use of a liquid solvent. After capture by means of an adsorbent, CO2 is released by increasing temperature or pressure. This method of CO2 removal is used mainly in natural gas processing and ethanol, methanol, and hydrogen production.

Oxy-fuel separation method involves the combustion of a fuel using nearly pure oxygen and the subsequent capture of the CO2 emitted. Because the flue gas is composed almost exclusively of CO2 and water vapour, the latter is removed by means of dehydration to obtain a high-purity CO2 stream. Globally a number of prototype/ pre‑demonstration projects using this method have been completed in coal-based power generation and in cement production.

Membrane separation method is based on polymeric or inorganic membranes with high CO2 selectivity, which let CO2 pass through but act as barriers to retain the other gases in the gas stream. Membranes for CO2 removal from syngas and biogas are already commercially available, while membranes for flue gas treatment are currently under development.

Calcium and chemical looping technologies involve CO2 capture at a high temperature using two main reactors. In calcium looping, the first reactor uses lime (calcium oxide, CaO) as a sorbent (material used to absorb or adsorb liquids or gases) to capture CO2 from a gas stream to form calcium carbonate (CaCO3). The CaCO3 is subsequently transported to the second reactor where it is regenerated, resulting in lime and a pure stream of CO2. The lime is then looped back to the first reactor. In chemical looping, the first reactor uses small particles of metal (iron or manganese) to bind oxygen from the air to form a metal oxide, which is then transported to the second reactor where it reacts with fuel, producing energy and a concentrated stream of CO2, regenerating the reduced form of the metal. The metal is then looped back to the first reactor. This technology is at a pilot / pre-commercial stage.

Direct separation involves the capture of CO2 process emissions from cement production by indirectly heating the limestone using a special calciner. This technology strips CO2 directly from the limestone, without mixing it with other combustion gases, thus, considerably reducing energy costs related to gas separation. This technology is currently being tested in pilot projects.

In super-critical CO2 power cycles, supercritical CO2 (CO2 above its critical temperature and pressure) is used instead of flue gas or steam to drive one or multiple turbines. Supercritical CO2 turbines typically use nearly pure oxygen to combust the fuel, in order to obtain a flue gas composed of CO2 and water vapour only. Prototype and demonstration projects using this technology are currently in operation.

For transport of CO₂, the two main options are via pipeline and ship, although for short distances and small volumes CO2 can also be transported by truck or rail but at a higher cost. Pipelines are the cheapest way of transporting CO2 in large quantities onshore and, depending on the distance and volumes, offshore. Transport of CO2 by pipeline is already deployed at large scale globally.

For storage of CO2 coalfields and oil and gas fields are being studied in India. The potential for storage in coal fields at depths greater than 1,200 meters is thought to be quite high. Onshore and offshore CO2 storage potential in India estimated to be between a low of 99 giga tonnes (Gt) and a high of 697 Gt located mainly in geological formations such as coal fields, oil and gas fields, sedimentary basins, and saline aquifers. The CO2 storage potential in India is just over one percent of total global CO2 storage potential but this is not necessarily a problem as even low case storage potential far exceeds the India’s potential CO2 emissions in the future. India’s total carbon emissions was 2.48 Gt in 2019 and by 2040 India’s CO2 emissions are expected to increase to 3.359 Gt under the stated policy scenario of the IEA.

Energy and Economic Penalty

Each of these technologies carries both an energy and economic penalty. The economic penalty of CCUS can be considered in terms of four components: Separation, compression, transport, and injection. These costs depend on many factors, including the source of the CO2, transportation distance, and the type and characteristics of the storage reservoir. The energy and economic cost vary depending on capturing CO2 for commercial use or for storage.

The primary difference in capturing CO2 for commercial markets versus capturing CO2 for storage is the role of energy. In the former case, energy is a commodity, and all we care about is its price. In the latter case, using energy generates more CO2 emissions, which is precisely what we want to avoid.

We can account for the energy penalty by calculating costs on a CO2 avoided basis. Due to the extra energy required to capture CO2, the amount of CO2 emissions avoided is always less than the amount of CO2 captured. Therefore, capturing CO2 for purposes of storage requires more emphasis on reducing energy inputs than in traditional commercial processes.

In the case of CO2 capture for commercial use, captured CO2 is used for various industrial and commercial processes such as in the production of urea, foam blowing, carbonated beverages, and dry ice production. Because the captured CO2 is used as a commercial commodity, the absorption process, while expensive, is profitable because of the price realized for the commercial CO2.

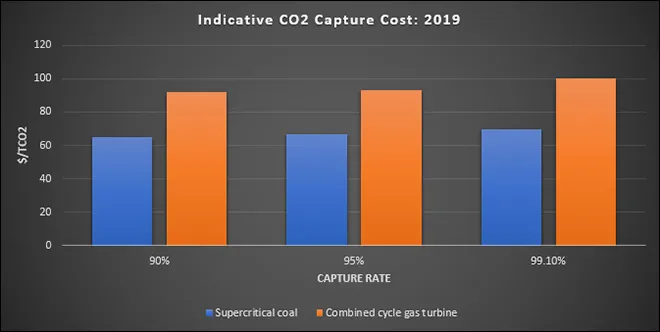

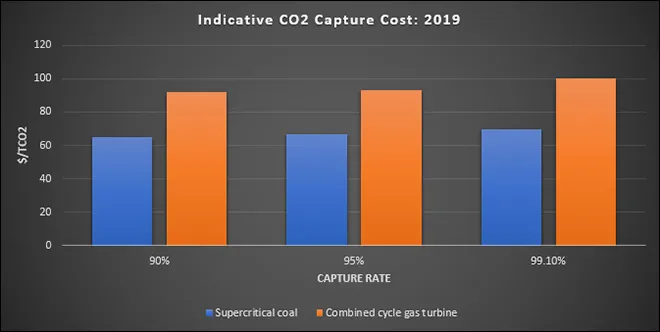

According to the IEA, the cost of CCUS can vary greatly by CO2 source, from a range of US $15-25/tonne of CO2 (tCO2) for industrial processes producing “pure” or highly concentrated CO2 streams (such as ethanol production or natural gas processing) to US $40-120/t CO2 for processes with “dilute” gas streams, such as cement production and power generation. Capturing CO2 directly from the air is currently the most expensive approach.

Transport of CO2 and storage costs can also vary greatly on a case-by-case basis, depending mainly on CO2 volumes, transport distances, and storage conditions. The cost of onshore pipeline transport is estimated at US $2-14/tCO2. Currently more than half of onshore storage capacity is estimated to be available below US $10/tCO2. The cost of storage can even be negative if the CO2 is injected into (and permanently stored in) oilfields to enhance production and, thus, generate more revenue from oil sales.

Indian Initiatives

In India, heavy industries such as cement, steel, chemicals, and aluminium manufacturing and heavy-duty transport such as shipping, trucking, and aviation are responsible for more than a third of the CO2 emissions. These CO2 emissions are considered ‘hard to abate’ because it is difficult to replicate fossil fuel-based high temperature high pressure production processes with low carbon electricity. Efficiency improvement and fuel shifts in existing production processes across industries could potentially reduce about 22 percent (600 million tonnes of CO2) emissions in 2050 compared to a scenario without efficiency measures. But this is not adequate for achieving a substantial reduction in emissions.

Given the difficulty in finding alternatives to fossil fuels in heavy industries and in some sectors of transport, the government of India has launched ‘mission innovation challenge’ on CCUS through the Department of Science and Technology (DST), to develop technologies that address high capital costs, safety, logistics, and high auxiliary power consumption in CCUS so that emission from thermal power plants and carbon-intensive industries can be reduced to near-zero levels at reasonable cost. The DST along with the department of biotechnology (DBT) jointly launched an initiative in 2018 to undertake joint research & development (R&D) with member countries France, Germany, Greece, Norway, Romania, Switzerland, The Netherlands, Turkey, the United Kingdom, and the United States to identify and prioritize breakthrough technologies in the field of CO2 capture, separation, storage, and CO2 value addition. The accelerating CCS technologies (ACT) initiative of the DST aims to facilitate R&D and innovation that can lead to development of safe and cost-effective CCUS technologies. In July 2020, India agreed to accept US assistance to introduce CCUS technology in coal-based power generation units in India. The Oil and Natural Gas Corporation Limited (ONGC) and Indian Oil Corporation (IOC) have joined hands for launching a CCUS project in IOCL’s Koyali refinery in Gujarat, where the captured CO2 will be used for enhanced oil recovery (EOR).

There are some private initiatives as well. Since October 2016, Tuticorin Alkali Chemicals and Fertilizers Limited (TACFL), in partnership with Carbon Clean, a UK-based private company has been operating the world’s first industrial-scale carbon capture and utilisation (CCU) plant near Chennai. Installed on a coal-fed boiler, the plant is designed to capture 60,000 tonnes of CO2 per year and convert it soda ash. The project is privately financed and the cost is estimated to be just US $30/tCO2, much lower than the US $60-90/t CO2 typically observed in the global power sector.

According to advocates of CCUS technology, coal gasification combined with CCUS in India could reduce CO2 emissions by over 90 percent, reduce India’s oil imports, and also offer a range of economic goods and revenue streams in the energy and core sectors. They highlight the CCUS investments by China and the USA.

China initiated industrial scale coal gasification few decades ago. Today, China is the world’s largest methanol producer, and almost all of it is produced through the coal gasification route. Methanol accounts for close to 10 percent of Chinese fuel consumption and 30 percent of feedstock for plastics today. Section 45Q of the U.S. tax code provides a performance-based tax credit to power plants and industrial facilities that capture and store CO2 that would otherwise be emitted into the atmosphere. The credit is linked to the installation and use of carbon capture equipment on industrial sources, gas or coal power plants, or facilities that would directly remove CO2 from the atmosphere. In all cases, to receive the credit, the CO2 must be stored geologically or be utilized as a feedstock or component of products.

For India, coal is not only the primary source of energy but also a source of revenue and means of social support. Coal India Limited (CIL) provides employment for millions for whom there is no alternative eschewing efficient technology which will improve productivity and profitability of the company; all coal mining companies contribute to local area development through royalty and development levies; expensive transport of coal subsidises passenger rail travel connecting the poor with distant employment opportunities; coal cess is a major part of GST (goods and services tax) compensation fund and coal mining companies pay taxes; dividend and other revenue streams to the government. Ironically, coal-based power generation also supports its nemesis (intermittent renewable energy) with ramping capacity whenever needed absorbing additional economic and technical costs. This complex and elaborate coal network that underpins energy provision and social support in India could be complemented with CCUS for decarbonisation without major economic and social disruption.

Source: Energy Technology Perspectives 2020: Special Report on Carbon Capture, Utilisation and Storage: CCUS in Clean Energy Transitions, IEA

Source: Energy Technology Perspectives 2020: Special Report on Carbon Capture, Utilisation and Storage: CCUS in Clean Energy Transitions, IEA

MONTHLY NEWS COMMENTARY: NATURAL GAS

Domestic production constrained by low prices

India

Production

Natural gas production remains a loss-making proposition for most fields for the Indian upstream producers as government-dictated gas price remains at its lowest level, according to Investment Information and Credit Rating Agency (ICRA). The domestic gas price notified at US $1.79/mmBtu (million metric British thermal units) for the six months beginning 1 April remains the lowest since the institution of the modified Rangarajan formula. Additionally, the ceiling on price for gas produced from deep water, ultra-deepwater, high temperature and high-pressure fields has also been announced at US $3.62/mmBtu for April-September 2021-22 which is 10.8 percent lower than the price ceiling of US $4.06/mmBtu for October-March 2020-21 which would dampen the development of such projects. As per an ICRA note, at such low gas prices, gas production remains a loss-making proposition for most fields for the Indian upstream producers notwithstanding some decline in oil field services/equipment costs. However, the depreciation of Indian Rupee against US (United States) dollar, would aid the realisations of the gas producers but only to an extent. The absence of a floor and sustained low prices as has been seen in the past few years post implementation of the modified Rangarajan formula make exploration and production unviable even for benign geologies. Spot LNG (liquefied natural gas) prices had breached US $30/mmBtu in February 2021 due to increase in oil prices, unplanned outages at export facilities in several countries, multiple cold waves, high shipping rates, and delays in the Panama canal. Nevertheless, the supply overhang remains with about 37.6 million tonnes per annum (MTPA) liquefaction capacity added in 2019 and 27.8 MTPA in 2020, besides which capacity additions till 2025 would be in excess of incremental demand which will weigh on gas prices. From the consumers' perspective, the low domestic gas price is a positive. During the first 11 months of 2020-21, the gas supply from domestic sources remained low at 22 percent of the allocated quantity for gas-based power generation units as per the data from Central Electricity Authority.

Reliance Industries Ltd (RIL) and its partner BP Plc ofUnited Kingdom (UK) have sought bids for sale of 5.5 million metric standard cubic meter per day (mmscmd) of additional natural gas that will be available for sale from their eastern offshore KG-D6 block. The gas supply will start from late April or early May, according to the tender document. Bidders will have to quote a price linked to Platts Japan Korea marker (JKM), the LNG benchmark price assessment for spot physical cargoes. At current price, the lowest price for the 5.5 mmscmd of gas that RIL-BP are auctioning comes to near US $6.5/mmBtu. But they will be entitled to a maximum of US $3.62/mmBtu ceiling fixed by the government for a six-month period to 30 September. The gas to be produced from the fields has been granted marketing and pricing freedom but this is subject to a ceiling price that the government fixes every six months. The ceiling price for 1 April to 30 September 2021 is US $3.62/mmBtu. Bidders can seek a supply tenure of three to five years. The minimum volume one could ask for is 0.01 mmscmd and the maximum could be the full volume on offer. RIL has so far made 19 gas discoveries in the KG-D6 block. Of these, D-1 and D-3—the largest among the lot—were brought into production from April 2009 and MA, the only oilfield in the block was put to production in September 2008. While the MA field stopped producing last year, output from D-1 and D-3 ceased in February. Other discoveries have either been surrendered or taken away by the government for not meeting timelines for beginning production. RIL is the operator of the block with 66.6 percent interest while BP holds the remaining stake.

The government-dictated price for natural gas produced by companies such as ONGC (Oil and Natural Gas Corp) is likely to inch up marginally to US $1.82/mmBtu while the same for difficult fields like one operated by RIL-BP may fall below US US $4/mmBtu. The price of gas, which is used to generate electricity, make fertiliser, and convert into compressed natural gas (CNG) for automobiles and cooking gas for households, is due to bi-annual revision. The rates paid for gas produced from fields given to ONGC and Oil India Ltd are most likely to go up to US $1.82/mmBtu for six-month period beginning 1 April from a decade low of US $1.79/mmBtu currently. Simultaneously, the price for gas produced from difficult fields such as deep sea, which is based on a different formula, is likely to fall below US $4/mmBtu from the current price of US $4.06/mmBtu. This is the maximum price that RIL and its partner BP plc are entitled to for gas they produced from deep sea blocks they won under New Exploration Licensing Policy (NELP). While the government sets the price of gas produced by ONGC from fields given to it on a nomination basis, it bi-annually announces a cap or maximum price that operators who won exploration acreage under NELP can get. RIL-BP had in recent price discovery for new gas from their Krishna Godavari basin block, got rates of over US $6/mmBtu but they would get less than US $4/mmBtu as per the pricing formula. The natural gas price is set every six months—on 1 April and 1 October—each year based on rates prevalent in surplus nations such as the US, Canada, and Russia.

ONGC invited bids for the sale of initial 2 mmscmd of gas from its KG basin fields at a minimum price of US $6.6/mmBtu. According to the tender document, ONGC intends to start natural gas sale from its KG-DWN-98/2 block, which sits next to RIL-BP Plc operated KG-D6 fields, from June-end. Initially, 2 mmscmd of gas has been offered for sale through an e-auction. ONGC has sought bids indexed to Brent crude oil. Bids have been sought at a minimum of 10.5 percent of the three-month average Brent crude oil price. At the current Brent crude oil price of US $63/barrel, the minimum price comes to US $6.6/mmBtu. This price, however, will be subject to the ceiling or cap fixed by the government for deep-sea fields every six months. The cap for six months beginning 1 April is US $3.62/mmBtu.

City Gas Distribution (CGD)

GAIL Gas and Confidence Petroleum India Ltd (CPIL) signed an agreement for setting up 100 CNG (compressed natural gas) stations in Bengaluru as they looked to strengthen the network supplying clean CNG to automobiles in the IT capital of the country. The new CNG stations will be located in core areas of the city or at CPIL's auto LPG retail outlet sites. To optimise uptake of CNG and improve the accessibility of CNG fuel for Bengalureans, GAIL Gas has been adopting various models of CNG dispensing in the city. GAIL Gas has extended its network through company-owned company-operated CNG station model and CNG stations at petrol pumps of oil firms. With this agreement, GAIL Gas will increase CNG stations in the city on dealership model. In the current scenario, CNG presents an affordable and environment-friendly alternative. CNG at present is priced at INR 51.50/Kg in Bengaluru. Currently, GAIL Gas has installed 55 CNG stations in the city.

Indraprastha Gas Ltd (IGL), India’s largest CNG retailer, signed a 10-year long-term agreement to supply CNG to Delhi Transport Corp (DTC) buses. The gas supply agreement is valid till December 2030. DTC is the largest CNG-powered bus service operator in the world with a fleet size of 3,762 buses and is also in the process of procuring 1,000 new CNG buses which would shortly be plying on the roads of the national capital. IGL retails CNG to automobiles and piped natural gas to households for cooking purposes and industries as fuel in 10 cities including Delhi, Noida, Greater Noida, and Ghaziabad (in Uttar Pradesh). It sells fuel to over 1.2 million vehicles in the national capital region (NCR) through a network of 560 CNG stations. Besides, it supplies piped natural gas to nearly 1.6 million households in these cities.

Continuing its thrust on the usage of clean fuel, Gujarat added the highest number of CNG stations in India during the April-January period in 2020-21. In fact, the state accounted for 20 percent of the new CNG stations developed in the country during the period. The number of CNG stations in Gujarat increased by 102 to 738 by the end of January 2021 as compared to 636 CNG stations on 1 April, 2020. The information was released by the rating agency Care Ratings, which cited the data from Petroleum and Planning Analysis Cell, the Union Ministry of Petroleum and Natural Gas. Gujarat figures include CNG stations in Dadra and Nagar Haveli, and Daman and Diu. The total number of CNG stations across the country increased by 506 to 2,713 as on January. The number was 2,207 at the beginning of the fiscal 2021. Gujarat was followed by Uttar Pradesh (89 new refuelling stations), Maharashtra (70), Odisha (47), Haryana (40), and Rajasthan (34). Gujarat is covered 100 percent under the CGDnetwork with the PNGRB awarding natural gas retailing licences to all the geographical areas in the state. As a result, more and more CNG stations are being set up in the state. The government’s push for cleaner fuel along with a deeper penetration of natural gas have led to the establishment of more CNG stations in the state, added industry players. City gas distribution players estimate that the number of new CNG stations in Gujarat could be about 150 by the end of the 2020-21 fiscal.

Torrent Gas announced it has signed a Share Purchase Agreement (SPA) with the promoters of Sanwaria Gas for the takeover of the company to provide CNG and PNG (piped natural gas) service in the geographical area of Mathura. With this acquisition, it has now authorization to set up CGD network across 17 geographical areas spread over 33 Districts in seven states and one union territory. The transaction is subject to approval from the PNGRB and fulfilment of other conditions. The company plans to invest over INR 80 billion for development of CGD network in these districts over five years, of which INR 15 billion has already been invested. Torrent Gas has been authorized to set up CGD infrastructure and sell CNG to vehicle users and PNG to industries and households in 33 districts across Uttar Pradesh, Gujarat, Maharashtra, Rajasthan, Punjab, Tamil Nadu, Telangana, and Puducherry.

Kolkata joined the league of cities having clean automotive fuel with the commercial launch of two CNG pumps. While IOC (Indian Oil Corp) set up a pump in New Town, the other was launched by BPCL in Garia. The CNG is being supplied by the Bengal Gas Company, a joint venture between GAIL (India) Ltd and the West Bengal government. The Bengal Gas Company has installed the dispensers, while the oil marketing companies have provided space and other infrastructure. Another five-six CNG pumps are expected to be unveiled very soon. IOC will set up another 20 pumps in FY22, while BPCL (Bharat Petroleum Corp Ltd) and HPCL (Hindustan Petroleum Corp Ltd) are also expected to add a similar number of pumps together.

LNG

India’s first Floating Storage and Regasification Unit (FSRU) arrived at H-Energy’s Jaigarh Terminal in Maharashtra. The FSRU 'Hoegh Giant', which sailed from Keppel Shipyard, Singapore, was berthed at Jaigarh terminal in Maharashtra. The LNG regasification terminal will be ready to start testing and commissioning activities soon.

Small-scale LNG could be delivered at prices competitive with diesel and LPG used in the industry, according to Council on Energy, Environment and Water (CEEW) study. Small-scale LNG systems transport the gas from LNG import terminals in containers and re-gasify the fuel at consumer sites, instead of relying on transmission pipelines. In locations currently served by city gas distributors, who get infrastructure exclusivity and charge high prices, LNG can offer a cheaper alternative.

Distributors can enable new CGD networks in locations without existing gas transmission pipelines, thereby, accelerating the government’s mission to connect 100 new cities to natural gas. The study recommends measures for the promotion of small scale LNG use and the expansion of natural gas access in India including standards for intermodal containerised transport of LNG, special railway tariffs for LNG transport, provisions in the Sagarmala initiative for the use of small scale LNG as a fuel in waterway transport, and reduced VAT on natural gas consumption for small consumers.

HPCL has acquired the balance 50 percent equity stake in HPCL Shapoorji Energy Private Ltd (HSEPL) from SP Ports Private limited company. Post-acquisition, HPCL's stake in HSEPL gets enhanced to 100 percent, making HSEPL a wholly-owned subsidiary of HPCL. HSEPL is constructing a 5 MTPA LNG terminal (with provision for expansion to 10 MTPA) at Chhara in Gujarat’s Gir-Somnath district, at an estimated cost of about INR 43 billion which is likely to be completed by end of 2022. The terminal will have all facilities for receipt of LNG through ocean-going tankers, marine unloading, storage, LNG road tanker loading, regasification, and supply of regasified LNG to the gas grid. The acquisition is in line with the overall future strategy of HPCL to diversify its product portfolio and is an important step in the direction of having a strong presence in the total natural gas value chain. The percentage of natural gas in the overall energy basket of India is expected to grow from 6 percent at present to 15 percent by 2030 which makes it one of the important growth drivers in the future. HPCL, along with its joint venture companies, has a presence in CGD business in 20 Geographical Areas (GA) in 34 districts covering nine states in the country.

Rest of the World

South America

The Brazilian government has authorized the local unit of energy company Royal Dutch Shell to import LNG from several countries into the Brazilian market, according to a notice in the official gazette. The authorization was granted by the mines and energy ministry for a total volume of up to 36.5 million cubic metres. The permit is valid till 31 March 2024 and limited to liquefied gas. Royal Dutch Shell is expected to import LNG by sea and sell the product to operators of thermal power plants, gas distributors, and consumers in the unregulated natural gas market. Other companies also received authorization to import LNG, including a unit of Brazilian steelmaker Gerdau SA.

Europe

The Dutch oil storage company, Vopak, wants to build an LNG import terminal in Australia’s Victoria state, vying with five other proposed projects to fill a looming gas supply gap in the country’s southeast. Vopak wants to dock a FSRU in Port Phillip Bay near Melbourne. It hopes to submit a proposal to the Victoria state government in the third quarter of 2021. It aims to have first imports after 2024, when the market is expected to face a gas shortfall as the ageing fields that have long supplied the state’s needs are rapidly drying up. Vopak expects the terminal to be able to import up to 50 LNG cargoes annually, with an open access model providing services to LNG suppliers and gas market customers.

The French oil and gas group, Total, will not stop producing gas on its Yadana fields in Myanmar as long as operations remained safe, in part to protect employees there who might otherwise risk repercussions from the military junta. Located off Myanmar’s southwest coast in the Gulf of Martaban, the Yadana fields produce gas for delivery to power plants in Thailand. They also supply Myanmar’s domestic market, via an offshore pipeline built and operated by the state energy firm, Myanmar Oil and Gas Enterprise (MOGE).

Russia and the Far East

Uzbekistan is set to launch its first gas-to-liquids (GTL) plant in the second half of this year according to project contractor Enter Engineering. The US $3.6 billion plant, originally expected to be launched in 2020, will allow the Central Asian nation to use its large natural gas reserve to produce more fuels such as diesel which it currently imports due to declining crude oil output and insufficient refinery capacity. The plant will refine 3.6 billion cubic metres (BCM) of gas a year and produce 1.5 million tonnes (MT) of fuel.

China

The China Oil and Gas Pipeline Network, or PipeChina began laying a natural gas trunkline in North China that links an import terminal in Tianjin and a new economic area Xiongan near the capital Beijing. The 413.5 kilometre (km) line with maximum diameter of 1.106 metres costs 8.6 billion yuan (US $1.31 billion) to build. The project, one of the new investments by PipeChina since its launch last October, has a designed transport capacity of 6.6 BCM, roughly 2 percent of China's total gas consumption. It will also be connected to several key projects including Shaanjing pipelines that transport gas from fields in China’s northwest to Beijing, as well as with the Power of Siberia project that sends Russian gas to China.

Japan

Chevron Corp’s unit will supply LNG to Japan’s Northern Hokkaido prefecture, via a deal with Hokkaido Gas Co Ltd. Chevron USA will supply about a half million tonnes of LNG over a period of five years starting April 2022 to Japan-based Hokkaido Gas. The second-largest US oil producer’s partnership with Hokkaido Gas will broaden its customer base in Japan, a market that is foundational to Chevron’s LNG business.

News Highlights: 14 – 20 April 2021

National: Oil

OMCs keep petrol, diesel prices unchanged across metros

18 April: Oil Marketing Companies (OMCs) kept petrol and diesel prices unchanged for the third straight day across four metro cities. In the national capital, petrol was sold for INR 90.40 per litre. Similarly, price of the fuel in Mumbai, Chennai, and Kolkata also was unchanged at INR 96.83, INR 92.43 and INR 90.62 per litre, respectively. In line with petrol, prices of diesel also were same for the third straight day. Price of the fuel in Delhi, Mumbai, Chennai, and Kolkata was INR 80.73, INR 87.81, INR 85.75, and INR 83.61 per litre, respectively. Fuel prices have been unchanged after declining on 15 April. Fuel prices in the country have been unchanged as OMCs decided to go on a pause mode and analyse the global developments on oil prices before effecting a revision.

Source: The Economic Times

COVID curbs and manufacturing slack take toll on fuel consumption

17 April: India’s fuel consumption dropped sharply in the first half of April as a resurgence in COVID-19 infections and local restrictions hit the movement of people and slowed down economic activities. Market data for the first fortnight of the month shows petrol sales dropping more than 5 percent and diesel consumption, a bellwether for economic activities, sliding almost 3 percent from a month ago. Consumption of jet fuel and LPG (liquefied petroleum gas), or household cooking gas, too shrank more than 7 percent and sales 6 percent, respectively. LPG consumption is certainly taking a knock as sales were down more than 3 percent from the last year’s level, while petrol and diesel sales posted growth of 196 percent and 150 percent, respectively, from the lockdown-hit rock bottom base of 2020. The fall in LPG consumption can be explained by the sharp increase in price since December totalling INR 175 per cylinder. The state-run retailers cut the price only by INR 10 per cylinder on 1 April, the first reduction in four months.

Source: The Economic Times

Despite high prices, India’s petrol consumption grew 10 percent in the fourth quarter

14 April: India consumed 7.8 million tonne (mt) of petrol in the fourth quarter ended on March 2021, a 9.7 percent jump as compared to 7.12 mt of the fuel consumed in the same quarter previous fiscal year (2019-20), despite record high prices. Consumption of diesel, the other key automobile fuel, also increased 4.1 percent to 20.60 mt during the Jan-March 2021 quarter, research firm ICICI Securities said in a report. Overall, consumption of all petroleum products was up 2.5 percent during the quarter. The three-month period was marked by record high retail rates of the fuels. Non-branded petrol was priced in range between INR 81 per litre and INR 90 per litrw while diesel was priced between INR 73 per litre and INR 80 per litre in Delhi during the quarter.

Source: The Economic Times

National: Coal

India may build new coal plants due to low cost despite climate change

19 April: India may build new coal-fired power plants as they generate the cheapest power, according to a draft electricity policy document, despite growing calls from environmentalists to deter use of coal. Coal’s contribution to electricity generation in India fell for the second straight year in 2020, marking a departure from decades of growth in coal-fired power. Still, the fuel accounts for nearly three-fourths of India’s annual power output. NTPC Ltd, India’s top electricity producer, said in September that it will not acquire land for new coal-fired projects. Private firms and many run by states across the country have not invested in new coal-fired plants for years saying thar they were not economically viable.

Source: The Economic Times

NALCO gets mining lease of Utkal-E coal block

18 April: The Department of Steel and Mines of Odisha government granted the mining lease of Utkal-E coal block to National Aluminium Company Ltd (NALCO) through a notification issued on 12 April. NALCO is a leading producer of alumina and aluminium in the country. As per the notification, the mining lease of the Utkal-E coal block is over an area of 523.73 hectares in villages Nandichhod, Gopinathpur Jungle, Kundajhari Jungle, Kosala, and Korada under Chendipada Tahasil of Angul District.

Source: The Economic Times

Dhanbad’s coking coal industry upbeat after Australia import

17 April: The scarcity of coal and a dwindling market affected more than 120 coking coal factories of Dhanbad, Giridih and Ramgarh in the last few years. Recently, with the revival of the steel industry and import of cheaper coal from Australia, the industry has made an upturn including generating over 50 thousand jobs for local labourers. Australian coal besides being good quality is also available at comparatively cheaper rates compared with the locally available coal provided by different Coal India Ltd (CIL) subsidiaries like Bharat Coking Coal Ltd (BCCL); Eastern Coalfields Ltd (ECL) and Central Coalfields Ltd (CCL). Around 50 of the 120 factories have completely shifted to Australian coal being provided to them by the pig iron industry and blast furnace industry. The remaining are using a combination of both. The trade war between China and Australia led to increased import of coal to India at cheaper rates. The coal is imported by ships through Haldia and Paradip ports.

Source: The Telegraph

CIL fuel allocation under spot e-auction rises 36 percent in April–February 2020–21

15 April: Coal India Ltd (CIL) allocated 37.21 million tonnes (mt) of coal during the April–February period of FY20–21 under the spot e-auction scheme, registering a year-on-year increase of 36.3 percent. CIL had allocated 27.30 mt of coal in the April–February period of FY 2019–20, according to the government data. Fuel allocation by CIL under the scheme also increased to 4.41 mt in February, from over 3.31 mt in the corresponding month of 2019–20, it said. Coal distribution through e-auction was introduced with a view to provide access to coal for such buyers who are not able to source the dry fuel through the available institutional mechanism, according to CIL. The purpose of e-auction is to provide equal opportunity to all intending buyers for purchasing coal through a single window service. CIL accounts for over 80 percent of domestic coal output. The company is eyeing one billion tonnes of coal output by 2023–24.

Source: The Economic Times

National: Power

MSEDCL starts issuing disconnection notices

19 April: The Maharashtra State Electricity Distribution Company Ltd (MSEDCL) has started sending SMSes carrying disconnection notices to consumers who owe dues of more than two months. The stern measure, which asks for payment of dues within 15 days, has evoked sharp criticism with a section of consumers citing weak financial condition due to the pandemic situation and curbs associated with it. As per section 56 (1) of the Indian Electricity Act 2003, it is mandatory for MSEDCL to serve notices to consumer 15 days prior to the disconnection. To comply with the laid down norm, the state power utility establishes necessary communication through registered mobile number of consumers. The MSEDCL Aurangabad zone, which covers Aurangabad and Jalna districts, has over 6.83 lakh residential consumers besides over 70,000 commercial and industrial consumers, among other categories. Notably, the recovery of power bills and possible waiver had stoked major controversy last year during the first-wave of COVID-19 with different ruling party leaders taking different stands. Eventually, consumers were made to pay dues in instalments among other easy options without any waiver.

Source: The Economic Times

India’s power consumption grows nearly 45 percent in the first half of April

18 April: Power consumption in the country grew by nearly 45 percent in the first half of April to 60.62 billion units over the corresponding period a year ago, showing robust recovery in industrial and commercial demand of electricity, according to the power ministry data. Power consumption in the first half of April last year (from 1 to 15 April 2020) was recorded at 41.91 billion units. On the other hand, the peak power demand met, which is the highest supply in a day, during the first half of this month remained well above the highest record of 132.20 Giga Watts (GW) in the same period in April 2020. During the first half of this month, peak power demand touched the highest level of 182.55 GW on 8 April 2021, and recorded a growth of 38 percent over 132.20 GW recorded in the entire month of April last year. Power consumption in April last year had dropped to 84.55 billion units from 110.11 billlion units in the same month in 2019. This happened mainly because of fewer economic activities following imposition of lockdown by the government in the last week of March 2020 to contain the spread of deadly COVID-19. However, they cautioned that local lockdowns across the country to curb the surge of COVID-19 positive cases may impact commercial and industrial power consumption adversely in coming days.

Source: The Economic Times

India should address water management challenge in adding power capacity: IEA

17 April: With India’s power sector development over the next two decades set to take place against a backdrop of increasing water stress, the International Energy Agency (IEA) has advised that water management challenges be addressed while boosting power capacity. The agency has come out with two key priorities to ensure a more resilient power sector.

Source: The Hindu Business Line

Punjab power distribution company surrendered power worth INR 40 billion: PSEB Engineers Association

17 April: PSPCL (Punjab State Power Corp Ltd) surrendered unutilised power worth more than INR 40 billion, the PSEB Engineers Association has claimed. The association has made 42 suggestions on reducing the cost of power, structural reforms, strengthening of the distribution system, and human resource management to the PSPCL management.

Source: The Economic Times

EDF completes installation of 1 lakh smart meters in India

15 April: EDF India announced it has completed the installation of 1 lakh (100,000) smart meters in India under a contract with Energy Efficiency Services Ltd (EESL) a joint venture of PSUs under the power ministry. The company marked this as the completion of the first stage of the contract and the beginning of the commercial rollout of 5 million smart meters installation across India, nearly half of which will be installed in Bihar.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Renewable energy is a key part of India’s growth programmes: Environment Minister

18 April: Environment Minister, Prakash Javadekar, said India is increasingly leveraging renewable energy to fuel its growing power consumption as it scales programmes like Aatmanirbhar Bharat. India has only 3 percent contribution in the historical emissions and that the US (United States), Europe, and other regions have contributed more to harmful emissions over the last 150 years, the Minister said. He said that India has taken the lead in not only discussions about climate change but also to show the world how these changes can be implemented. He said the country has taken a number of steps towards embracing sustainable energy, and solar energy production has grown 14-fold over the last six years. India has set up a larger target of having 450 GW of renewable energy by 2030. Also, under Fame I and II programmes, subsidy to the tune of INR 100 billion has been given for deploying 6,500 electrical buses in 65 cities. India has started building simultaneously a sustainable way of life through renewable energy programme, he added.

Source: The Economic Times

SPDA seeks more time from government for commissioning solar projects amid the pandemic

18 April: The Solar Power Developers Association (SPDA) has urged the Ministry of New and Renewable Energy (MNRE) to give three more months for commissioning solar projects amid the raging pandemic. The association has highlighted the continued challenges that the solar power industry is facing since the last year. It has requested MNRE for a blanket extension of an additional three months in SCoD (scheduled date of commissioning) of solar power projects in addition to five months granted by MNRE earlier, SPDA said.

Source: The Economic Times

CSC and Tata Power to set up 10,000 solar micro grids in rural areas

16 April: The government's e-governance services arm CSC announced a collaboration with Tata Power to set up solar-powered micro grids and water pumps in rural areas across the country. To begin with, Tata Power has proposed to set up 10,000 micro grids to support rural consumers through Common Service Centres (CSCs). The CSC e-Governance Services India’s Managing Director, Dinesh Tyagi, said the collaboration will amplify the government's ongoing campaign to provide clean and sustainable energy to households and businesses in rural areas. Under the partnership, over 3.75 lakh CSCs will be involved in supplying solar water pumps to farmers and help in setting up micro grids in residential and commercial establishments in rural areas.

Source: The Economic Times

NHPC to form a joint venture with JKSPDCL to set up 850 MW Ratle hydropower project in J&K

15 April: NHPC Ltd will form a joint venture with JKSPDCL, 'Ratle Hydroelectric Power Corp Ltd', to implement an 850 Megawatt-hydroelectric project in Chenab river basin. Under the pact, the parties have decided and agreed to jointly establish a company under the name of 'Ratle Hydroelectric Power Corp Ltd' for the implementation of Ratle hydroelectric project. It will have an installed capacity of 850 Megawatts (MW) in the Chenab river basin and any other project that may be entrusted to the company in the Union Territory of Jammu & Kashmir (J&K).

Source: The Economic Times

Facebook signs first deal to buy renewable energy in India

15 April: Facebook has signed a deal to buy renewable energy in India from a local firm’s wind power project, the social media giant's first such deal in the South Asian nation, the companies said. The 32 MW wind power project, located in southern Karnataka state, is part of a larger portfolio of wind and solar projects that Facebook and Mumbai-based CleanMax are working together on for supplying renewable power into India’s electrical grid, they said.

Source: The Economic Times

Adani SECOL commissions 50 MW solar power plant in Uttar Pradesh

14 April: Adani Solar Energy Chitrakoot One Ltd, a subsidiary of Adani Green Energy Ltd (AGEL), has commissioned a 50 MW-solar power plant at Chitrakoot in Uttar Pradesh. The plant has a 25-year power purchase agreement with the Uttar Pradesh Power Corp Ltd (UPPCL) at INR 3.07 per kilowatt hour. The commissioning takes AGEL’s total operational renewable capacity to 3,520 MW, a step closer to its vision of 25 GW capacity by 2025. With the commissioning of this plant, AGEL has an operational solar generation capacity of over 3 GW. AGEL has total renewable capacity of 15,240 MW, including 11,720 MW that has been awarded and is at different stages of implementation.

Source: The Economic Times

CIL plans Special Purpose Vehicle (SPV) for solar power generation

14 April: Coal India Ltd (CIL), which is betting big on solar power generation with a view to diversifying its portfolio, is looking to set up a SPV for the same. The country’s largest coal miner plans to generate close to 3,000 MW of solar power by 2024 at an estimated investment of around INR 135 billion, the company said. While part of it would be funded through the company’s internal accruals, the remaining would be met through the SPV and bank loans. CIL is developing necessary in-house expertise and has created a team of competent officers for its solar power initiatives. CIL, which recently won a 100 MW solar power bid in the auction held by Gujarat Urja Vikas Nigam Ltd, would look forward to participating in more such auctions to ramp up its solar power initiatives moving forward.

Source: The Hindu Business Line

International: Oil

China’s 2021 fuel exports to surge 32 percent as refining capacity swells

16 April: China’s fuel exports are likely to expand by nearly a third this year as the world’s second-largest oil consumer adds new refineries that will exacerbate a supply overhang, said a unit of top oil and gas group China National Petroleum Company (CNPC). An estimated 14.74 million tonnes (mt) per year, or 295,000 barrels per day (bpd) of crude run capacity, will be added this year, bringing the country’s total to 18 million bpd, CNPC’s Economics and Technology Research Institute (ETRI) said. That could result in fuel exports surging 31.7 percent to a record 54.7 mt. The group also forecast China's net crude oil imports to grow 3.4 percent this year to a record of about 559 mt, or 11.2 million bpd. Domestic fuel demand is expected to continue its recovery from the coronavirus pandemic, said the group, which pegs gasoline use to grow by 0.8 percent this year and aviation fuel to rise by 13 percent, though diesel will ease 0.8 percent.

Source: The Economic Times

Argentina calls for fresh talks between oil workers and companies, strike averted

15 April: Argentina’s labor ministry called for a mandatory 15-day period of fresh talks between oil sector workers and the country’s largest oil producing companies, requiring a workers’ union to call off a strike announced hours earlier over a wage hike. Workers and the companies, including those that operate in Argentina’s sprawling Vaca Muerta region, one of the world's largest shale-oil reserves, said earlier in the day they would walk off the job for 24 hours after failing to reach agreement in negotiations.

Source: Reuters

Mexico's lower house approves contentious oil legislation

15 April: Mexico's lower house of Congress approved changes to existing legislation that could allow the government to revoke private oil companies' permits to import gasoline and other fuels. One of the much-debated parts of the legislation would change Mexico’s hydrocarbons law to allow the suspension of permits to import and sell gasoline and other fuels under certain circumstances, including threats to the economy and national security.

Source: The Economic Times

Exxon slashes Guyana crude output due to gas compressor problem

14 April: Exxon Mobil’s Guyana unit said it had reduced crude output at its offshore Liza-1 project to 30,000 barrels per day (bpd), down from 120,000 bpd, due to a mechanical problem with the offshore platform's gas compressor. Exxon said the problem with the compressor's discharge silencer prompted it to reduce output to maintain gas injection and power supply and minimize gas flaring. It said a team from Exxon, equipment manufacturer MAN Energy Solutions and vessel operator SBM were assessing repairs. The incident marks the third time Exxon has reduced crude output on the Liza Destiny floating production, storage and offloading (FPSO) vessel due to gas compressor problems since output began in December 2019. Exxon, which operates the Stabroek block where Liza is located as part of a consortium with Hess Corp and China's CNOOC Ltd, has discovered more than 8 billion barrels of recoverable oil and gas off Guyana's shores, making the South American country the world's newest energy hotspot.

Source: The Economic Times

International: Gas

Asian spot LNG prices rise as China replenishes inventories

17 April: Asian spot prices for liquefied natural gas (LNG) rose as China, Japan and South Korea sought supply in an early move to stock up for winter. The average LNG price for June delivery into Northeast Asia was estimated at about US $7.60 per million metric British thermal units (mmBtu), the traders said. Cargoes for May delivery were about US $7.30 per mmBtu. Japan Petroleum Exploration Co. Ltd was seeking a cargo for delivery between 22 May and 13 June to the Soma terminal. Distributor ENN Energy Holdings Ltd. bought at least 12 cargoes for delivery between July and February in China, the traders said. Pavilion Energy said it had imported Singapore’s first carbon-neutral LNG cargo. The traders added that Europe is also storing up gas as a cold spell sustained heating demand and slowed stock replenishment, which are below historical levels for this time of the year.

Source: The Economic Times

International: Coal

Coal clearly has to end as power source: Poland’s PGE CEO

15 April: Coal has obviously to be scrapped as a power source, the CEO (Chief Executive Officer) Wojciech Dabrowski of the Polish group which owns the EU (European Union)’s biggest carbon-emitting power plant said, underscoring a policy shift in a country until recently wedded to coal to generate electricity. Poland produces most of its electricity from coal but has made a series of policy shifts in recent months and now plans investment in offshore wind, nuclear power and solar energy to help decarbonise its economy. Poland’s biggest coal producer Polska Grupa Górnicza (PGG) plans to close its last coal mine in 2049 but this is still being discussed with labour unions. Polska Grupa Energetyczna (PGE) has not yet set a date for the closure of its coal-fired power plants but Dabrowski said Poland will give up on coal in 30 years, which environmentalists say is too long.

Source: Reuters

German utility Uniper may turn Wilhelmshaven coal plant site into hydrogen hub

14 April: German utility Uniper is studying the conversion of its coal-fired power plant site at Wilhelmshaven on Germany’s North Sea coast into an import and electrolysis hub to tap into emerging demand for “green” hydrogen. Policymakers in Europe aim to produce green hydrogen from renewable power through electrolysis, to replace coal and gas-based hydrogen and open up new areas of usage to substitute oil products across manufacturing industries, heating and transport. Wilhelmshaven was retired last December under an agreed exit from carbon-emitting coal, while Germany will accelerate the build-up of renewable electricity and low-carbon hydrogen to reach climate goals. Uniper, which under the steer of majority-owner Fortum has committed itself to a more eco-friendly course, said Wilhelmshaven’s transformation could provide 10 percent of German hydrogen demand by 2030.

Source: Reuters

International: Power

J-Power scraps plan for new coal-fired power plant in western Japan

17 April: Japan’s Electric Power Development (J-Power) said it had scraped a plan to build a 1.2 GW coal-fired power plant in Yamaguchi, western Japan, after a comprehensive assessment of the changing business environment. The move comes amid a growing global trend towards decarbonisation and after Chugoku Electric Power and JFE Steel cancelled a plan to build a thermal power station last month. J-Power will use technology developed at its Osaki CoolGen’s project in Hiroshima, western Japan, which generates electricity with both gas turbines and steam turbines through a coal gasification combined cycle, turning coal into a combustible gas with a high proportion of hydrogen.

Source: The Economic Times

International: Non-Fossil Fuels/ Climate Change Trends

Thailand floats hydro-solar projects for its dams as fossil fuel supplement

20 April: Thailand is close to completing one the world's biggest floating hydro-solar hybrid projects on the surface of a dam, a step toward boosting renewable energy production after years of criticism for reliance on fossil fuels. About 144,417 solar panels are being installed on a reservoir in the northeast province of Ubon Ratchathani, where workers are completing the last of seven solar farms covering 300 acres (121 hectares) of water. The Electricity Generation Authority of Thailand (EGAT) is touting the pilot project as one of the world's largest hybrid hydro-solar power ventures and aims to replicate it at eight more dams over the next 16 years. Thailand has long relied on coal for power, but plans for new coal-fired projects have been met with opposition over health and environmental risks, and two proposed southern coal plants were shelved in 2018. It is aiming to draw 35 percent of its energy from non-fossil fuels by 2037, according to its latest Power Development Plan. Since November, EGAT has been putting together floating solar platforms at the Sirindhorn dam, one of the country’s largest hydropower sites, which it says should be able to generate 45 MW of power.

Source: The Economic Times

UK to cut emissions by more than three-quarters by 2035

20 April: Britain will ramp up its commitment to cut carbon emissions ahead of hosting a Unitednations) (UN) climate summit this year, vowing a 78 percent reduction by 2035, reports said. Prime Minister Boris Johnson is set to unveil the legally-binding target, which is 15 years earlier than once planned. It said that for the first time the commitment will also cover emissions from international aviation and shipping, a long-standing demand of environmental activists. Johnson will address a climate summit hosted by US (United States) President Joe Biden, as he attempts to make Britain a world leader on the issue in the run-up to November. The country has set a target of becoming carbon neutral by mid-century and has already ramped up its targets. In December, Britain said it will cut its greenhouse gas emissions by more than two-thirds, compared to 1990 levels, by 2030—one of the most ambitious aims of any major economy.

Source: The Economic Times

Power companies urge US President to implement policies to cut emissions 80 percent by 2030

18 April: A group of US (United States) electricity companies wrote to President Joe Biden this week saying it will work with his administration and Congress to design a broad set of policies to reach a near-term goal of slashing the sector’s carbon emissions by 2030. Washington should implement policies, including a clean energy standard, or CES, to ensure the electricity industry cuts carbon emissions 80 percent below 2005 levels by 2030, the group of 13 power interests, including generators Exelon Corp, PSEG, and Talen Energy Corp, said in a letter to Biden.

Source: The Economic Times

China, US agree on need for stronger climate action commitments

18 April: China and the United States (US) agree that stronger pledges to fight climate change should be introduced before a new round of international talks at the end of the year, the two countries said. China and the US also agreed to discuss specific emission reduction actions including energy storage, carbon capture, and hydrogen. They also agreed to take action to maximise financing for developing countries to switch to low-carbon energy sources.

Source: The Economic Times

Philippines raises carbon emission reduction target to 75 percent by 2030

16 April: The Philippines said it was revising its target to cut greenhouse gas emissions to a 75 percent reduction by 2030 under its commitment to the Paris Agreement on Climate Change, up from a target of 70 percent set four years ago. Breaking down the target, 72.29 percent is conditional on the support of climate finance, technologies, and capacity development provided by developed countries, as prescribed by the Paris Agreement. The Paris Agreement, which came into force in 2016, aims to transform the world's fossil-fuel-driven economy within decades and slow the pace of a global temperature increase to well below 2 degrees Celsius. The Philippines ratified the agreement in 2017, allowing Manila access to the Green Climate Fund, which aims to channel billions of dollars to help poor nations tackle global warming. The remaining 2.71 percent of the target should be implemented mainly through domestic resources, the Department of Finance said.

Source: The Economic Times

Land-starved Singapore gets creative with solar in clean energy push

16 April: Singapore is betting on floating solar farms and vertical panels to increase its clean-energy supplies and cut carbon emissions, a model that could work in other densely populated cities, urban experts said. With renewable energy options such as wind, hydro, nuclear and biomass ruled out, solar photovoltaic (PV) is the most viable option for Singapore, despite limited land for large-scale farms, and challenges such as frequent cloud cover. Singapore inaugurated a 5 MW offshore floating PV system on the Johor Strait, part of its goal to install at least 2 GW of solar power by 2030—five times current capacity—and halving its carbon emissions by 2050.

Source: The Economic Times

Canada’s Northland Power buys Spanish wind farms and solar parks

15 April: Northland Power has made its first foray into Spain’s fast-growing renewable energy generation market with a deal to buy a portfolio of wind farms and solar parks, the Canadian company said. A wave of global targets to cut carbon emissions are stoking investor interest in renewable energy businesses, and Spain’s sunny plains, windy hillsides, and political enthusiasm for the sector have made it a focus for the market in Europe. The solar and wind parks in question were built under a previous regulatory regime, which fixes the returns the owners receive for their output for an average of 13 years across the portfolio.

Source: Reuters

Eesti Energia, European Energy sign 10-year Baltic wind PPA

14 April: Estonian utility Eesti Energia and Danish project developer European Energy have signed a 10-year power purchase agreement (PPA) for deliveries from wind farms in Lithuania, they said. Starting in 2023, the agreement covers total deliveries of 3.8 terawatt-hours (TWh) over the ten-year period, the firms said. The agreement secured renewable energy equivalent to half of Estonia's annual electricity consumption and was the largest PPA signed in the Baltics to date, Eesti Energia said. The electricity will be used in the Baltic states and come from three wind farms with an expected installed capacity of 190 MW being developed by European Energy in Lithuania.

Source: The Economic Times

Genex Power secures funding for Australia’s first pumped hydro project in 40 years

15 April: Genex Power said it had secured all funding needed for what will be Australia’s first new pumped hydro project on the grid in about 40 years, and expects construction to start towards the end of the month. The power generation company will receive an Australian $610 million (US $471.16 million) loan from the Northern Australia Infrastructure Facility for the 250 MW Kidston project, which is being built at an abandoned gold mine in Queensland. Australia’s renewable energy agency will give Australian $47 million in grant, while government-owned green bank the Clean Energy Finance Corp will provide a further Australian $3 million of subordinated debt funding.

Source: Reuters

IKEA makes first solar park investment in Russia

14 April: Ingka Group, the owner of most IKEA stores world-wide, has agreed to buy a 49-percent stake in eight solar parks in Russia from Solar Systems LLC, marking its first investment in renewable energy in the country. The total book value for the eight parks is more than 21 billion roubles (US $272.16 million), Ingka Investments, the investment arm of the world's biggest furniture retailer, said. IKEA aims to be climate positive by 2030 by reducing greenhouse gas emissions by more than the entire IKEA value chain emits, from raw material production to customers' disposal of their furniture. To help reach the target, Ingka Group is looking to accelerate investments in renewable energy, eyeing Russia and China in particular. Ingka Group has invested €2.5 bn (US $2.97 bn) in renewable energy since 2009 and recently surpassed a target to produce as much renewable energy as the energy it consumes in its own operations. IKEA operates through a franchise system, with Ingka Group the biggest franchisee to brand owner Inter IKEA.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV