Quick Notes

Windfall Taxes on Oil Companies: Sin Tax or Sin to Tax?

Background

On 1 July 2022, the government announced a windfall tax of INR23,250/tonne (t) on domestic crude oil production, INR6/litre(l) on the export of petrol and aviation turbine fuel (ATF), and INR13/l on the export of diesel. Three weeks later, the government reduced the export tax on diesel and ATF by INR2/l and removed the tax on petrol. The tax on domestically produced crude was reduced to INR17,000/t. Another two weeks later, the government removed the export tax on ATF and reduced the tax on diesel by half to INR5/l and increased the tax on domestically produced crude oil to INR17,750/t. The economic rationale for imposing windfall taxes was that India’s trade deficit had increased to record high levels and a weak rupee had increased the value of India’s imports.

In 2008, when oil prices increased to about US$100/barrel (b) some sections of the Indian government demanded the imposition of a windfall tax on oil companies. But the government refused to say that there was no economic rationale for such a tax. This week, UN Secretary General Antonio Guterres commented that it was "immoral" for oil & gas firms to profit from the ongoing geopolitical crisis and called for oil & gas companies to face special (windfall) taxes. Is profit, especially unexpected profit, a sin that must be taxed away or is it a sin to tax oil company profit?

The Economic Logic

Production of scarce, depletable energy resources such as oil and natural gas command an ‘economic rent’ which is central to natural resource valuation. Economic rent is defined as the return to any factor of production over the minimum amount required to retain it in its present use. It is broadly equivalent to the profit that can be earned from a factor of production (for example, a natural resource stock such as oil) beyond its normal supply cost. Discovered reserves of mineral resources such as oil and gas gain value over time as depletion increases their replacement cost. In theory, it is natural for oil and natural gas prices to reflect their current marginal cost.

A price exceeding long-run marginal cost is ‘monopoly profit’ which can only be achieved through collusion between producers or by government decree. The distinction between ‘economic rent’ and ‘monopoly profit’ is not merely semantic. Economic rent provides the incentive and cash flow necessary to simulate new supplies at ever rising replacement costs. The consequence of disallowing economic rents associated with depleting resources is future shortages of the resource. Economic rent is by no means limited to energy fuels. Still, energy’s social and economic significance instigates public antipathy towards economic rents that accrue to the energy industry in general and the oil industry in particular. The oil industry is singled out for attack as it is seen to be the beneficiary of both economic rent and monopoly profit, with collusion with OPEC (organization of the petroleum exporting countries) contributing to the monopoly component.

According to some interpretations, ‘windfall profit’ is distinct from that of both ‘economic rent’ and ‘monopoly profit’ and is defined as the ‘profit earned unexpectedly, through circumstances beyond the control of the company concerned’. As the profits are neither expected nor the result of efforts of the firm, it is assumed that taxing the firm would not harm the . A finer distinction could also be made in terms of whether the windfall profits arise out of the cyclical nature of the market or structural features of the industry. Studies have found that a tax on windfall profits arising out of the structural nature of the industry does not affect company behaviour whilst a tax on profits arising out of short term or cyclical factors affects company behaviour resulting in resource misallocation and distortion and is best avoided.

The empirical relevance to the case of oil depends on whether the supply of oil is given and limited for all times as is that of land. If the supply curve for oil is responsive to prices and therefore indicates that more oil is supplied at higher than lower prices, then the taxation of the windfall profits induces the misallocation of resources in the economy and leads to a reduction in public welfare.

American Experience

The American example of imposing windfall taxes in 1980 is widely quoted. When the Carter Government came to power, price decontrol was the only available instrument to curb growing demand for oil amidst the supply crisis set off initially by the OPEC embargo against America and its allies in 1973 and later in 1979 by the Iranian Revolution. Removing controls on domestic oil prices was expected to produce additional revenue of US$1 trillion, translating into more than US$300 billion of additional profit for oil companies. ‘Windfall profit tax’ was designed to capture this additional profit.

Unlike the ‘excess profits tax’ collected during the World Wars which was a supplementary tax on corporate income, the crude oil windfall profit tax collected in the United States had nothing to do with profits. It was a tax on oil price and was paid before profits made by an oil company were calculated. The price of oil in 1979 was assumed to be reasonable, and any price above that was taxed at rates between 15 and 70 percent. When the windfall tax bill was being debated in 1979 the Washington Post observed that the proposed tax was merely ‘an excise on every barrel of oil produced’. When the bill was passed, the Wall Street Journal described it as the ‘the Death of Reason’ which had ‘sacrificed the nation’s security to its thirst for revenues’.

Most analysts who studied the US crude oil windfall profit tax have concluded that it was not a great success. Against a revenue projection of over US$300 billion over ten years only US$80 billion was generated. Oil prices did not increase as anticipated through the 1980s, but the base price indexed to inflation continued to rise. In addition, administering the tax proved to be more complicated and expensive than originally thought. During the period of the tax’s existence, America’s reliance on foreign oil increased from 32 percent to 38 percent. This increase was partly attributed to windfall profit tax inhibiting domestic production.

The Indian Case

In the upstream sector production sharing contracts (PSC) allow the government to get a higher share of profits when oil prices increase. If a windfall tax is levied, oil companies will pass the cost to the government by way of reduced profit. Royalties levied by central and state governments under PSC are on an ad-valorem basis, which means that government revenue increases with an increase in oil prices. The downstream sector (refining) is a ‘margin’ business and gross refining margins do not necessarily follow crude price fluctuations. Given the competitive nature of the refining business and the fact that there is a global shortage of refining capacity, improvement of margins is attributable to enhanced productivity and not to high oil prices. Based on these fundamentals, it is possible to stay at the granular level and illustrate, balance sheet by balance sheet, that Indian oil companies do not make ‘windfall profits’ on account of high oil prices. But a more useful exercise would be to look at broader questions: What purpose would an additional tax on oil companies serve? Would it contribute to India’s energy security? Would it improve redistribution of wealth and quality of life for the poor?

The Chaturvedi Committee Report treated windfall profit as resource rent and recommended that revenue from windfall taxes could be used for supporting the subsidy mechanism as a ‘short term measure’. The report treated the government as the rightful owner of ‘resource rent’ and argued in favour of using the revenue to bridge budgetary gaps and support redistributive policies. Whilst this may sound reasonable, introducing subsidies with new revenue streams would only increase inefficient consumption. It is known that subsidies drive up energy consumption by middle class & rich households rather than facilitate consumption by the poor.

If windfall profit taxes are used to sustain price distortions or make up for budgetary shortfalls, even in the short term, it will comfort policymakers that they can always tap on this new revenue source to sustain their policies. In addition, windfall profit tax will reduce the incentive for domestic exploration and production of crude oil increasing import dependence. By skimming off the profit streams of oil companies, the government will not only compromise India’s energy security but also sustain its own inefficiency.

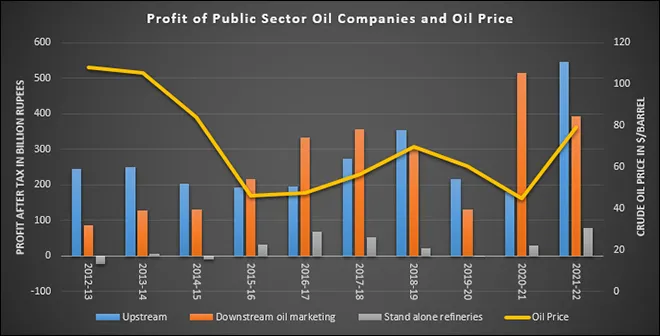

Source: Petroleum Planning & Analysis Cell

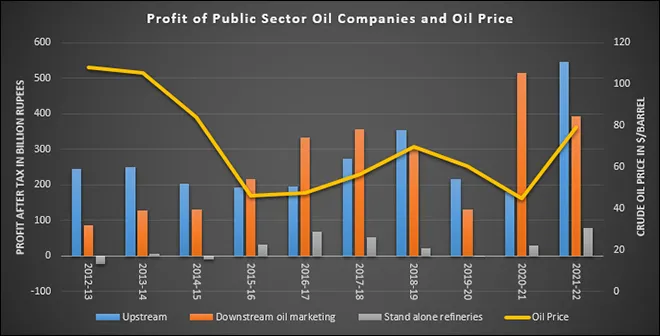

Source: Petroleum Planning & Analysis Cell

Monthly News Commentary: NON-FOSSIL FUELS

Renewables ease Electricity Shortages

India

RE Policy and Market Trends

India’s electricity shortages have eased over the last six weeks as renewables generation has increased seasonally and relieved some pressure on coal-fired units short of fuel. In a sign of reduced stress on the network, frequency averaged 50.00 cycles per second (hertz) in May, exactly in line with the operational target, up from just 49.93 Hz in April. Frequency fell below the minimum threshold of 49.90 Hz just 9.8 percent of the time in May compared with 32.0 percent of the time in April, data from the Power System Operation Corporation of India (POSOCO) showed. Below-target and falling frequency signals that consumption is exceeding generation, causing rotating generators to lose momentum, whilst above-target and rising frequency signals the opposite. Grid stability improved even though it supplied a record 136 billion kilowatt-hours (kWh) in May up from 133 billion kWh in April and 110 billion kWh in the same month a year earlier. Seasonal increases in hydropower and wind played a critical role in improving generation availability and easing the severe power shortages and blackouts evident in March and April. Wind farms added an extra 6 billion kWh in May compared with March and April whilst hydro generators added an extra 1-2 billion kWh.

The government will invite bids from states to sell electricity generated from 8,000 megawatt (MW) thermal capacities without PPAs (power purchase agreements), Power Minister R K Singh has said. He said that a total of 8,000 MW of thermal capacities in India are without any power purchase agreements. Some thermal capacities are also undergoing the National Company Law Tribunal (NCLT) proceedings, and the government has already taken several steps, including meeting with the bankers, to resolve the issue at the earliest so such plants can start operations.

Reliance Industries Ltd (RIL) is assessing new technologies for making electrolyzers in its efforts to produce low-cost green hydrogen in the country. As part of the push, the company also plans to bid for any production-linked incentives the government may offer to encourage the technology, Kapil Maheshwari, president for new energy at RIL, said. Prime Minister Narendra Modi’s government unveiled the first phase of its green hydrogen policy in February, offering a range of incentives for companies to set up projects. India is considering offering more “sweeteners” for producers, Power and Renewable Energy Minister R K Singh said. Maheshwari said India needs to provide certainty about policies and help build a market for green hydrogen by requiring some industries to purchase the fuel, a step the government is already discussing. RIL will pursue an aggressive target to produce green hydrogen at US$1 per kilogram (kg) by the end of this decade. At the time, the cost of producing the fuel was between US$2.22 and US$4.62 a kg in India.

India will need US$223 billion (bn) (US$2.8 bn) of investment to meet its goal of wind and solar capacity installations by 2030, according to a new report by research company BloombergNEF (BNEF). The government has targeted increasing non-fossil power capacity to 500 GW by 2030. It wants non-fossil fuel power sources to provide half of its electricity supply by 2030. At COP26 in November 2021, Prime Minister Narendra Modi announced that India plans to reduce emission intensity by more than 45 percent by 2030 to below 2005 levels. He also announced a net-zero by 2070 target. By 2021, 165 gigawatt (GW) of zero-carbon generation had already been installed in the country. Central Electricity Authority forecasts the country’s reliance on coal to drop from 53 percent of installed capacity in 2021 to 33 percent in 2030, whereas solar and wind together make up 51 percent by then, up from 23 percent in 2021.

Delhi’s Indira Gandhi International (IGI) airport has switched to hydro and solar power for its consumption needs from 1 June, making it India’s first airport to run entirely on a combination of these forms of green energy, operator Delhi International Airport Limited (DIAL) said. In 2015, the Cochin International Airport in Kerala became the first airport in the world to run solely using solar energy. Since 1 June, around 6 percent of the airport’s electricity requirement is being met from on-site solar power plants, whilst the remaining 94 percent of energy is coming from a hydropower plant, it said. The Delhi airport has a 7.84 MW solar power plant on the airside, whilst it recently added another 5.3 MW rooftop solar power plant at the cargo terminal as part of a stakeholder collaboration. In November, the airport announced of its aim to become a Net Zero Carbon Emission airport by the year 2030.

With no new thermal generation units coming up across Maharashtra, there is a huge push for multiple solar and wind projects. One of the objectives is to fuel e-vehicles, whose strength is growing gradually, especially e-buses, to make them run on “100 percent clean fuel”. At present, the state has over one lakh e-vehicles. The energy department announced that at 136 locations across the state, there are Photovoltaic (solar) systems for generating 1,247 MW energy, whilst at six locations, the government has sanctioned setting up solar projects totalling 136 MW, and at three other locations 12.5 MW projects for wind power generation are being carried out. In association with Energy Efficiency Services Limited, state power utility firm MSEDCL (Maharashtra State Electricity Distribution Company Ltd) is also involved in a 200 MW solar project. MSEDCL signed contracts at Davos for generating 12,000 MW of solar-wind energy in Maharashtra. According to an estimate, the state plans to generate 17,360 MW of solar energy with a few more projects in the pipeline for the next five years. MSEDCL said the state presently generates up to 9,000 MW from its various thermal units and hydro and solar plants.

Large developers in the renewable energy sector have enough options to boost returns even as challenges mount and will fight aggressively in the various auctions scheduled in 2022, the IEEFA (Institute for Energy Economics and Financial Analysis) report said. Falling costs of solar modules, which in turn brought down tariffs, fuelled the growth of India’s renewable energy growth story.

India will need an investment of INR4k bn for the implementation of 113 GW of renewable energy (RE) projects in the pipeline. India’s energy transition is gaining momentum post-COVID with strong backing from policy enablers focused on improving ease of doing business, competitiveness, and self-reliant supply chains, the joint report of EY-FICCI said. According to the report, about 103 GW of utility-scale renewable power generation projects and 11 GW of distributed renewable power generation projects are in the pipeline in India. The report said that implementing of these projects will create a total of 8,96,500 fresh jobs. EY India said India’s energy transition might leave fossil fuel industries, communities, and workers exposed to muted or declining demand for fossil fuel commodities in the long term.

The Mumbai airport has become India’s first airport to launch a renewable hybrid power generation project involving wind and solar energy. Called ‘Vertical Axis Wind Turbine’, the unit and a photovoltaic solar hybrid (solar mill) were installed under a pilot programme launched to explore wind energy. The airport said it plans to meet its ‘Net Zero’ carbon emission target by 2029. Mumbai International Airport Ltd (MIAL) said the 10 kilowatts peak (kWp) hybrid solar mill consisting of 2 kWp turbo mill and 8 kWp Solar PV modules has an estimated minimum energy generation of 36 kWh/day.

The weak financial health of distribution companies (discoms) will remain a challenge for India's renewable energy sector, where investments worth US$225-250 bn are estimated to reach a generation capacity of 500 GW by 2030, according to Moody’s. The payment delays to these companies are common, leading to a build-up of receivables from off-takers and an increase in working capital debt for renewable energy companies. The rating agency said that the weak financials of discoms have led to delays in signing PPAs. This in turn occasionally results in project delays or cancellations. Whilst renewable energy enjoys preferential dispatch in India, payments for electricity sold to state-owned discoms are usually delayed beyond the 60-day period as specified in the PPAs. There is no history of distribution companies not making payments to distribution companies according to PPA tariff (if undisputed), Moody’s said. India aims to triple its renewable energy capacity to 500 GW by 2030 from 157 GW as of March 2022, and to have 50 percent of the electricity generation from non-fossil fuel sources.

Ayana Renewable Power Pvt Ltd (Ayana) is scaling up its presence in Karnataka by setting up renewable energy projects totalling 2 GW with an investment of INR120 bn (US$1.51 bn). At present, it has an operational portfolio of 340 megawatt-alternate current (MWAC) in the state, Ayana said. With the addition of 2 GW of green capacities, the company aims to provide clean energy for nearly 2 million households. Karnataka, under its Renewable Energy Policy 2022-27, aims to develop 10 GW of additional renewable energy projects and Ayana is keen to help achieve the target, Ayana said. The company is amongst India’s fastest-growing renewable energy producers.

The Assam government is willing to set up a joint venture (JV) with SJVN for the development of renewable energy projects in the state. SJVN said the Assam government has also offered it an opportunity to explore 5,000 MW power project development within the state in a phased manner.

Record green energy output reduced Indian dependence on coal in May, despite a 23.5 percent growth in power demand, contributing to a rise in utilities' coal inventories, government data analysis showed. Surging supply from renewables will go mitigate India's coal shortage amid extraordinarily rapid growth in demand, which has forced the country to reopen mines and return to importing the fuel. The share of renewable energy sources in power output rose to 14.1 percent in May from 10.2 percent in April. Coal made room for it, dropping to 72.4 percent of Indian generation from 76.8 percent. However, coal’s share was still higher than 70.9 percent in May 2021.

Utility Scale Solar Projects

NTPC Ltd said its installed renewable energy capacity has crossed the 2 GW mark, with 92 MW floating solar capacity in Kerala. The company began commercial operations of the last part capacity commissioning of 35 MW out of 92 MW Kayamkulam Floating Solar PV Project at Kayamkulam, Kerala. Spread over a 480-acres reservoir, this floating solar project would generate electricity from more than 3 lakh solar PV modules, NTPC said. This would be sufficient to light around 26,000 households. Around 1,73,000 tons of CO2e would be avoided every year during the life of this project. More than 4 GW RE capacity in 22 projects is under implementation, whilst over 5 GW RE capacity is under tendering.

The Gujarat-based integrated power utility said it had completed the acquisition of a 50 MW solar power plant in Telangana from SkyPower Group for INR4.16 bn (US$52.3 mn). Torrent Power currently has an aggregate installed generation capacity of ~4.1 GW, which consists largely of clean generation sources such as gas (2.7 GW) and renewables (1.0 GW). It also has a capacity of 0.5 GW of renewable energy plants under development. With the latest acquisition, Torrent Power’s total generation capacity, including under development portfolio, will reach ~4.7 GW with a renewable portfolio of more than ~1.6 GW. Torrent Power, the integrated power utility of the diversified Torrent Group, is one of the largest companies in the country's power sector, with presence across the entire power value chain of generation, transmission, and distribution.

Tata Power Solar Systems Ltd has commissioned a 450 MW solar plant for Brookfield Renewable India in Rajasthan, the company said. The installation entailed a set-up of over 800,000 modules and was completed within "record seven months timeframe", it said. The project would produce over 800 gigawatt hours (GWh) of clean energy annually and help avoid up to 600,000 tons of annual carbon dioxide emissions, the company said. With the commissioning of the 450 MW project, the company's total utility-scale solar project portfolio touches 9.7 gigawatts peak (GWp).

The Northeast’s biggest solar power plant was inaugurated in Assam by Chief Minister (CM) Himanta Biswa Sarma. The 70 MW Amguri Solar Park in the upper Sivasagar district is expected to be constructed with an investment of around INR3.4 bn (US$42.7 mn). The CM has planned to install 1,000 MW of solar power plants on free government lands. However, the inauguration of the project was as much a source of joy as it was of relief to the people of Amguri and the state government.

Cipla Limited announced the commercial operation of additional capacity of a captive renewable energy power plant in Maharashtra and Karnataka. In January last year, Cipla commissioned a 30 MWp (megawatt peak) solar project at Tuljapur, it further added 16 MWp of solar capacity to supply renewable energy for its manufacturing units or facilities in Maharashtra. According to the company, these projects have been commissioned in partnership with AMP Energy India and are one of the state’s largest solar open access projects set up by a corporate. The project will support the Company’s green energy requirements for its manufacturing units at Kurkumbh & Patalganga and R&D center at Vikhroli in Maharashtra, replacing around 70 percent of total consumption for these units with green energy, the company claims. By 2025, Cipla plans to achieve carbon and water neutrality, zero-waste to landfill, anti-microbial resistance stewardship, and green chemistry.

Power producer SJVN will invest over INR10 bn (US$126 mn) in setting up three renewable energy projects in Uttar Pradesh. The company said two solar projects with a capacity of 75 MW each will be set up at villages Parasan and Gurha in district Jalaun. The third one of 50 MW solar power project will be set up at village Gujarai in Kanpur Dehat. With these three solar power projects, SJVN is investing around INR10.57 bn (US$133 mn) in Uttar Pradesh, the company said.

Hydro Power

Tamil Nadu Generation and Distribution Corp Ltd (TANGEDCO) is conducting a feasibility study on three hydropower projects that will generate 2500 MW of power. The TANGEDCO has asked a private consultant to conduct a study and prepare an initial report to establish 1000 MW capacity Pumped Storage Hydropower Stations each in Upper Bhavani and Sandy Nalla. The consultant has also provided a project report for a 500 MW hydropower project in Sigur in the Nilgiris. In addition to the three hydropower projects totaling 2500 MW, TANGEDCO is planning 7500 MW power projects in Nilgiris, Tirunelvelli, Kanniyakumari, Coimbatore, Dindigul, Theni, and Salem districts. In the first phase, the TANGEDCO will commence work in the Nilgiris whilst the other districts will be taken up during the second and third phases. TANGEDCO has also come to the assessment that the existing thermal power stations are old and will be replaced by renewable and clean energy sources.

The Indian Wind Power Association (IWPA), Northern Region Council, has filed a writ petition in the Delhi High Court challenging the validity of the new terms and conditions for Renewable Energy Certificates (RECs) for renewable energy generation regulations, 2022 published by the Central Electricity Regulatory Commission (CERC) on 28 May. The IWPA also sought ad interim reliefs regarding the said regulations. IWPA contended that the provision for a floor price of the RECs has been arbitrarily removed from the REC percent framework in the new regulations whilst highlighting the plight of its member renewable energy power generators, who had set up their wind power plants under the prior REC framework. As per the High Court directions, the petition was taken up considering the ad interim reliefs sought by IWPA. The order, IWPA said, comes as much-needed relief to the members of the petitioner association, who would have suffered huge losses had the new regulations were to be brought into force.

Biomass

Tirumala Tirupati Devasthanams is all set to tie up with the Indian oil company restricted to determine a compressed biogas plant at Tirumala at a price of INR120 mn (US$1.51 mn). As a part of its Swach Tirumala programme, the world’s richest Hindu temple physique has been tapping varied non-conventional power sources to off-load its dependence on standard power sources. TTD gives free meals to just about one lakh visiting devotees each day at Tirumala. The temple physique consumes 3.5-4 million tonnes (MT) of LPG (liquefied petroleum gas) on daily basis to prepare dinner free meals for the pilgrims. TTD which has also been exploring sustainable methodologies for applicable processing and disposal of Bio-degradable strong waste (moist waste) generated at Tirumala, proposed to faucet the Biomethanation course to generate Biofuel, which can be utilized for cooking or the manufacturing of electrical energy and warmth. Accordingly, TTD officers approached the Indian oil company restricted and the proposal to determine a compressed biofuel plant at Tirumala, is now taking form following a decision handed by the TTD belief board in April this year. Based on the decision handed by the TTD belief board, the temple physique will enter an MoU with the IOCL to generate 1.625 MT of compressed bio-fuel on a daily basis at Tirumala. IOCL representatives have assured the TTD that the web financial savings for the temple physique by establishing the biofuel plant shall be roughly INR20 mn yearly.

Rest of the World

China

China will aim to ensure that its grids source about 33 percent of power from renewable sources by 2025, up from 28.8 percent in 2020, the National Development and Reform Commission (NDRC) said in a new "five-year plan" for the renewable sector. China’s total renewable energy consumption is set to reach about 1 billion tonnes of standard coal equivalent (TCE) by 2025, as the country bids to raise the share of non-fossil fuels in total energy use to 20 percent, the NDRC said. Non-fossil fuels accounted for 15.4 percent of total primary energy consumption in 2020. China, the biggest source of climate-warming greenhouse gases, has pledged to raise total wind and solar capacity to 1,200 GW by 2030, almost double the current rate, with plans to build large-scale renewable energy bases in north-western desert regions. Climate groups hoped that China would set a strict energy consumption target for 2025 as it prepares to bring total greenhouse gas emissions to a peak before 2030. Though China has yet to announce a formal energy cap, the new non-fossil fuel energy consumption figure implies that total primary energy use could reach 5 billion tonnes of standard coal by 2025. The NDRC said renewables would account for more than half of new energy consumption growth from the 2021-2025. However, China still has leeway to build more fossil fuel-fired power plants over the period as it focuses on improving energy security. China is aiming to start cutting coal consumption in 2026, but in the meantime could put as much as 150 GW of new coal capacity into operation by then, according to research from the State Grid.

Other Asia Pacific

Japan’s government plans to resume public auctions for offshore wind power projects by the end of this year after revising rules to draw a wider range of bidders and encourage faster development of new infrastructure. The resumption follows the abrupt suspension of an auction in March for an offshore wind farm in Happo-Noshiro in northern Japan. Criticism has grown following the government’s selection in late December of three consortia all led by Mitsubishi Corp to operate three offshore wind power projects in Akita, northern Japan, and Chiba, near Tokyo. The proposed changes, presented by the industry and land ministries to a panel of experts, would give a higher evaluation score to operators who submit earlier start-up dates and set a limit on bids that one consortium can win when multiple ocean areas are auctioned. The government said the changes would be required as Japan needs to expand renewable energy faster considering Russia's invasion of Ukraine, which has sent energy prices soaring. Offshore wind power is a key part of Japan's decarbonisation strategy and the government plans to install up to 10 GW of offshore wind capacity by 2030 and up to 45 GW by 2040 to curb emissions.

Australia’s A$5 bn (US$3.6 bn) expansion of the country's biggest hydro scheme faces a delay of up to 19 months, pushing the start-up of the massive energy storage project out to 2028. The delay was due to a string contractors and construction issues, which surprised took the new Labor government. The market will need power from the massive, pumped hydro project at the Snowy Hydro scheme to help replace capacity from three coal-fired power stations due to close by 2028. The aim is to shore up the grid when solar and wind power supplies are low as Australia’s power supply becomes more dependent on intermittent renewable energy.

Mining giant Rio Tinto Ltd said it had asked for proposals to develop wind and solar energy plants in Australia’s Queensland state to power three of its aluminium projects by 2030. The plants are intended to power Rio's assets - the Boyne smelter, Yanwun alumina refinery and Queensland alumina refinery - in the Gladstone region of Queensland. The three projects need a combined 1,140 MW of reliable power, the Anglo-Australian miner said. In October, Rio committed to increasing renewable power usage and said its decarbonising efforts would focus on aluminium operations. The division accounts for about 70 percent of Rio’s direct and indirect emissions.

Philippine billionaire Enrique Razon’s infrastructure investment arm said it plans to construct what will be the world’s largest solar power facility, joining a growing number of local companies embracing the development of renewables. Unlisted Prime Infrastructure Holdings Inc said the facility would have a capacity of 2,500-3,500 MW combined with a 4,000 MWh to 4,500 MWh battery energy storage system. The project will be undertaken by Terra Solar Philippines, a unit of Prime Infrastructure’s subsidiary Terra Renewables Holdings Inc, in partnership with Solar Philippines Power Project Holdings Inc. Terra Solar will sell 850 MW of the facility’s output to Manila Electric Company, the country’s largest power utility. The Southeast Asian country has made a big push for renewable energy projects as it seeks to lessen its dependence on coal in power generation, in line with its goal to reduce greenhouse gas emissions. The government aims to increase the share of renewables in the power mix to 35 percent by 2030, from 21 percent in 2020, and to 50 percent by 2040. Coal accounted for nearly 60 percent of the 2020 mix.

Americas

United States (US) President Joe Biden rarely mentions electric car maker Tesla Inc in public. But privately, his administration has leaned on the company to help craft a new policy to allow electric vehicles (EVs) to benefit from the nation’s lucrative renewable fuel subsidies. The Biden administration contacted Tesla on its first day in office, marking the start of a series of meetings on the topic between federal officials and companies linked to the EV industry over the months that followed. The administration’s early and extensive outreach reflects that expanding the scope of the US Renewable Fuel Standard (RFS) to make it a tool for electrifying the nation’s automobile fleet is one of Biden’s priorities in the fight against climate change. The RFS, which dates to 2005, is a federal program that requires transportation fuel sold in the US to contain a minimum volume of renewable fuels. Until now, it has been primarily a subsidy for corn-based ethanol. The US Environmental Protection Agency (EPA), which administers the RFS, is expected to unveil proposed changes to the policy sometime this year, defining new winners and losers in a multibillion-dollar market for credits, known as RINs, that has supported corn growers and biofuels producers for more than a decade.

A group of US solar energy project developers said they would jointly spend about US$6 bn to support the domestic solar panel supply chain expansion. The US Solar Buyer Consortium, which includes developers AES Corporation, Clearway Energy Group, Cypress Creek Renewables and DE Shaw Renewable Investments, said that the funds would address current supply chain issues. Since the start of the pandemic, companies that buy solar panels for large power plants have struggled with global supply chain disruptions that have driven up costs, as well as potential US tariffs on imported panels from Asia. Duties on those products, which supply most US projects, would make solar energy more expensive and less competitive with power produced by fossil fuels. The consortium will invest US$6 bn as it recruits solar panel manufacturers in a long-term strategic plan to supply up to 7 GW of solar modules per year from 2024 - which could power nearly 1.3 million homes. The US installed 23.6 GW of solar capacity in 2021, according to the industry trade group the Solar Energy Industries Association. Asian imports account for most US panel demand from solar facility developers. US President Joe Biden waived tariffs on solar panels from four Southeast Asian nations for two years and invoked the Defense Production Act to spur solar panel manufacturing at home.

President Joe Biden ordered emergency measures to boost crucial supplies to US solar manufacturers and declared a two-year tariff exemption on solar panels from Southeast Asia as he attempted to jumpstart progress toward his climate change-fighting goals. The Commerce Department announced in March that it was scrutinizing imports of solar panels from Thailand, Vietnam, Malaysia and Cambodia, concerned that products from those countries are skirting US anti-dumping rules that limit imports from China.

Norsk Hydro’s Rein and Macquarie Asset Management's Green Investment Group plan to build and operate a 586 MW wind and solar power plant in northeast of Brazil, the companies said. A final investment decision for the US$700 mn wind farm portion of the project is expected in the fourth quarter of 2022, whilst a decision on the solar plant will be taken at a later stage. The project will supply 100 percent of the electricity required for Hydro’s Paragominas bauxite mine and reduce carbon emissions from Hydro’s Alunorte alumina refinery, replacing coal. In the first phase, 80 wind turbines with a combined capacity of 456 MW will be constructed, with the option to develop up to 130 MW of solar power production in phase two.

Middle East & Africa

Arab states could come close to achieving renewable energy targets for 2030 if they complete planned utility-scale solar and wind projects according to projected timelines. The planned projects would raise solar and wind capacity in Middle Eastern and North African Arab states to about 73 GW from 12.1 GW over the next eight years, according to the Global Energy Monitor, a US-based, non-profit research group. Projects already under construction would add 7.6 GW, whilst projects that are either in development or have been announced would contribute a further 65.5 GW, according to the group. In 2013, the Arab League committed to increasing the region’s installed renewable power generation capacity to 80 GW by 2030.

A consortium of Abu Dhabi’s Masdar and Egypt’s Infinity Energy is set to buy a majority stake in Lekela Power from private equity house Actis, in a deal that could be worth close to US$1 bn. The sale, which would be one of southern Africa’s biggest renewable energy deals, has attracted interest from across the world, including from Chinese state fund CNIC; Africa-focused power firm Globeleq, which is 70 percent-owned by UK development finance institution CDC Group; Chinese petroleum giant Sinopec; and South African coal firm Exxaro, amongst others. The deal would give Masdar, owned by United Arab Emirates' sovereign investment company Mubadala, its first foothold in southern Africa, expected by analysts and bankers to be the next major hub of renewables development after Asia considering the many hours of sunlight, even during winter. Meanwhile, Actis, which is the largest private capital investment firm in Africa, has put another Africa-focused renewable company - BioTherm Energy (BTE) Renewables - up for sale. BTE Renewables has over 400 MW of solar and wind plants in South Africa and Kenya, but its development pipeline is bigger than Lekela.

EU & UK

Finnish biofuel producer Neste said it would invest €1.9 bn (US$2.01 bn) in the Dutch port of Rotterdam for its next renewable products refinery, citing growing demand as climate change concerns intensify. Neste has bet heavily on renewable fuels as fossil fuel majors increasingly enter the market, pushing up costs for used cooking oil and discarded animal fat. The Rotterdam refinery would expand Neste’s renewable product capacity by 1.3 million tonnes per annum, the company said. It aims to start the new unit in the first half of 2026. The investment will increase Rotterdam’s total renewable product capacity to 2.7 MT annually, including 1.2 MT for sustainable aviation fuel.

European Union (EU) energy ministers agreed to increase the share of renewables in the bloc's energy production to 40 percent by 2030, the German economy ministry said. The goal had previously been set at 32 percent. The ministers agreed to make an existing energy savings target binding, meaning that EU member states that fall behind will have to commit to additional measures, according to the ministry.

Germany’s government will not agree to EU plans to effectively ban the sale of new cars with combustion engines from 2035, Finance Minister Christian Lindner said. In its bid to cut planet-warming emissions by 55 percent by 2030 from 1990 levels, the European Commission has proposed a 100 percent reduction in CO2 (carbon dioxide) emissions from new cars by 2035. That means it would be impossible to sell combustion engine cars from then.

Germany’s economy and climate ministry presented a package of measures to speed up the expansion of onshore wind power generation as the country seeks to reduce its reliance on Russian fossil fuels. Germany aims to fulfil 80 percent of its electricity needs from renewable sources by 2030, with a goal of increasing the capacity of onshore wind power to 115 GW - equivalent to the capacity of 38 nuclear plants. But only around 0.8 percent of land in Germany is currently designated for onshore wind power, with 0.5 percent actually being used. The draft legislation presented aims for that percentage to rise to 2 percent by setting out a minimum percentage of land each of the 16 federal states must make available for wind farms.

Norway’s largest power producer Statkraft is seeking to expand the capacity of its Mauranger hydropower plant in western Norway by 630 MW in a bid to increase flexible power generation, it said. The licence application request sent to the Norwegian Water Resources and Energy Directorate (NVE) seeks to increase the installed capacity of the Mauranger power plant from 250 MW to 880 MW. It said that this would provide 70-80 GWh of new clean energy, corresponding to the electricity consumption of 5,000 households. The project mainly seeks to add capacity to the plant balancing an expected rise in the intermittent generation, especially offshore wind.

News Highlights: 29 June – 5 July 2022

National: Oil

Government set to generate US$12 bn from windfall tax on oil businesses: Moody's

5 July: The windfall taxes on domestic crude oil production and fuel exports will generate close to US$12 billion (INR948 bn) for the government in the remainder of the current fiscal whilst trimming profits of firms such as Reliance Industries Ltd (RIL) and ONGC (Oil and Natural Gas Corporation), Moody’s Investors Service said. On 1 July, the government-imposed windfall gain taxes on the export of petrol, diesel and aviation turbine fuel (ATF), and on the domestic production of crude oil. It has also mandated exporters to meet the requirements of the domestic market first. Following the government’s announcement, Indian oil companies will have to pay INR6 per litre (US$12.2 per barrel) on petrol exports and ATF, and INR13 per litre (US$26.3 per barrel) on exports of diesel. At the same time, upstream producers will have to pay taxes of INR23,250 per tonne (US$38.2 per barrel) of crude oil produced in India. The additional revenue will help to offset the negative impact of a reduction in excise duties for petrol and diesel announced in late May to tame soaring inflation.

Government to review new taxes levied on crude, diesel, ATF every fortnight: FM

1 July: Finance Minister (FM) Nirmala Sitharaman said “phenomenal profits” made by some oil refiners on exporting fuel at the expense of domestic supplies had prompted the government to introduce an export tax on petrol, diesel and ATF. The export levy as also the windfall tax imposed on record profits of domestic oil producers will be reviewed every fortnight to calibrate them if the need arises, she said. She said the new taxes aim to improve the supply of petroleum products in the domestic market, as private producers mainly focus on exports. The government slapped an export tax on petrol, diesel and jet fuel (ATF) and imposed a windfall tax on crude oil produced locally. The government framed new rules requiring oil companies exporting petrol to sell in the domestic market, the equivalent of 50 percent of the amount sold to overseas customers, for the fiscal year ending 31 March 2023. This requirement has been put at 30 percent of the volume exported for diesel. These restrictions on export are aimed at shoring up domestic supplies at petrol pumps, some of which had dried up in states like Madhya Pradesh, Rajasthan and Gujarat as private refiners preferred exporting fuel to selling locally.

Indian Oil delivering cooking gas via boats in flood-hit Assam

29 June: Indian Oil Corporation (IOC) is using boats to deliver cooking gas or LPG (liquefied petroleum gas) cylinders to households in flood-ravaged southern Assam, especially in Silchar, the region’s main commercial hub. The company rose to the occasion and ensured an uninterrupted supply of cooking gas, petrol, and diesel in the flood-affected areas. Retail outlets were instructed to prioritise the supply of diesel to mobile tower operators to keep the communication channels alive in the face of continuous power cuts. LPG door delivery continued through boats, which replaced delivery vans. This resulted in achieving an enviable LPG cylinder backlog in Assam of only 1.03 days and just over 1.7 days in the three more severely affected districts - Cachar, Karimganj and Hailakhandhi.

Shell launches service to organise India’s waste oil disposal system

29 June: Shell, a UK-based oil and gas firm, said it had launched a used oil management service to organise India’s waste oil disposal system and to increase the rate of re-refining, as it aims to achieve circular economy goals whilst reducing waste. For this, the company has partnered with used oil re-refiners to initiate the collection and re-refining of used oil on a pan-India basis. The firm plans to strengthen its network of partners to further scale-up the initiative in the coming years. The service aims to create an ecosystem for transitioning used oil disposal, which is acknowledged as being the biggest challenge in promoting circularity in the industry, to a formal setup. India witnesses the generation of about 1.3 million tonnes (MT) of used oil annually, of which less than 15 percent is re-refined.

National: Coal

PSPCL misses June target to get Pachwara coal mines operational

5 July: Punjab State Power Corporation Limited (PSPCL) hopes of getting the Pachwara coal mines operational by June have been dashed by delay. The state power utility will have to wait at least two more weeks to operate these mines in Jharkhand. The coal mines were overburdened with stones, mud, and other hurdles and the cleaning process were underway. Earlier, this year, the dewatering process was done, and the officials were expecting to make the coal mine operational by the middle of June. The mines were allocated to PSPCL, but there were legal hurdles that were cleared by the Supreme Court last year. However, after that, the PSPCL faced the coal mining mafia, causing further hurdles in the mine operations. Once operational, the Pachwara coal mines would help PSPCL save around INR7 bn to 8 bn annually, besides helping in tariff reduction. It is spread over 1,000 hectares and will produce 7 million tonnes (MT) of high calorific value coal a year annually. The extra burden is being removed from the mines.

Adani Enterprises is the lowest bidder in Coal India’s import tender

4 July: Coal India Ltd (CIL) floated its first import tender on behalf of power companies, where Adani Enterprises Ltd came out to be the lowest bidder. The company quoted INR40.33 bn for the supply of 2.416 million tonnes (MT) of coal on a freight-on-road (FOR) basis. Between January and June, Gautam Adani-led Adani Enterprises bagged multiple contracts for coal import. Last year in December, the group shipped its first coal consignment from its Carmichael mines in Australia’s Queensland. A total of 11 importers and some overseas traders had shown interest in the tender during the pre-bid meeting, CIL had said. After the closing of bids, CIL will execute a contract with the top bidder, entering into a back-to-back agreement with state gencos (generating companies) and independent power producers (IPPs), who will get the imported coal. CIL is importing coal as the central government is looking to build enough stock at power plants before monsoon season affects coal mining, leading to a decrease in supply. The thermal power plants have 26.8 MT of coal stock, the Central Electricity Authority’s latest data showed. The plants will also blend this stock with domestic coal. The power plants have been asked to import 10 percent of their coal requirements CIL will on their behalf.

Power ministry team visits Coal India arm to monitor coal availability

3 July: A three-member team of the power ministry visited Coal India Ltd-arm MCL (Mahanadi Coalfields Ltd) to monitor the availability of the dry fuel at various railway sidings, and mines and prepare a plan for logistics to maximise the despatch of fuel to thermal power plants. The development assumes significance in the wake of efforts being made to avoid the reoccurrence of power outages faced by the country at the beginning of the summer season this year due to the shortage of coal supplies. The team led by Member Secretary, Eastern Regional Power Committee (ERPC), Ministry of Power, N S Mondal, concluded its three-day visit to Ib Valley and Talcher coalfields after their visit to different sidings and pit heads, Mahanadi Coalfields Ltd (MCL) has said. The team expressed its satisfaction with the availability and quality of coal at MCL and also gathered information on evacuation-related matters. Encouraged by the coal stock availability at MCL, the team has assured to initiate steps for improving rake supply as well as despatch via road and road-cum-rail (RCR) mode.

Coal India registers record 160 MT output in April-June this fiscal

2 July: Coal India Ltd (CIL) said its coal production increased 29 percent year-on-year to 159.8 million tonne (MT) in April-June this fiscal. It had produced 124 MT coal in the year-ago period, CIL said. With the coal demand from power plants reaching a higher pitch, CIL’s supplies to the power sector reached a new high of 153.2 MT during the quarter, registering a strong growth of 19.8 percent. The expansion in absolute terms was 25.3 MT over 127.9 MT of last fiscal’s Q1. CIL on average, supplied 1.684 MT of coal per day to the power sector in June 2022 quarter compared to a daily requirement of 1.650 MT. In June, supplies to coal-fired plants have gone up to 1.713 MT per day against the projected requirement of 1.6 MT. CIL’s off-take to the power sector witnessed a 27 percent growth to 51.4 MT compared to 40.4 MT in June 2021. Higher supplies during the month resulted in coal stock accretion to 77,000 tonnes per day at the end of power plants. The total coal off-take during the quarter rose nearly 11 percent to 177.6 MT against 160.3 MT a year ago. CIL’s total off-take in June grew 15.4 percent to 59 MT compared to 51.2 MT in the year-ago period.

National: Power

NTPC clocks 21.7 percent growth in power generation at 104.4 bn units in June quarter

4 July: NTPC Ltd said it has registered a 21.7 percent growth in electricity generation at 104.4 billion units (BU) in the April-June quarter of this financial year. NTPC group of companies recorded a generation of 104.4 BU in the April to June quarter of 2022, registering an increase of 21.7 percent from 85.8 BU generated in the corresponding quarter last year, the company said. In June, 2022, power generation was 34.8 BU, higher by 29.3 percent compared to 26.9 BU in June 2021, indicating an improved performance and an increase in demand for power in the current year, it said.

National: Non-Fossil Fuels/ Climate Change Trends

NGSL to build balance of systems for 325-MW solar projects in MP's Shajapur

3 July: NTPCGE Power Services Pvt Ltd has bagged contracts to build a balance of systems for two power projects with a total capacity of 325 MW at Shajapur Solar Park in Madhya Pradesh (MP). NTPCGE Power Services Pvt Ltd (NGSL) has received two awards from NTPC Renewable Energy Limited (NTPC-REL) for engineering, procurement and construction of balance of system at two sites with 105 MW and 220 MW capacity, respectively, along with operation and maintenance for three years, the company said. The projects are located at Shajapur Solar Park in Madhya Pradesh, which is being developed by Rewa Ultra Mega Solar Ltd (RUMSL). The solar power generated from these plants will be supplied to the Indian Railways system and the national grid. The project also supports the government of India’s overall strategy to reduce greenhouse gases and pave the way for achieving India's net zero emission target by 2070.

NTPC arm to develop 10 GW renewable energy power park in Rajasthan

2 July: NTPC’s arm, NTPC Renewable Energy Ltd (NREL), has signed a Memorandum of Understanding (MoU) with the Rajasthan government to develop 10 GW ultra mega renewable energy power parks (UMREPP) in the state. NTPC Group has set a target of 60 GW renewable energy capacity by 2032. The company said that in less than 2 years since its inception, NTPC REL has won 4 GW renewable energy capacity by bidding in various tenders under different stages of implementation. Additionally, NTPC REL is developing one UMREPP of 4.75 GW capacity in Rann of Kutch, Gujarat. NTPC REL has also entered into a joint venture agreement with DVC to develop RE parks and projects.

Chandigarh to have 10 solar plants likely by Aug 2023

2 July: From floating ones at the waterworks to panels at the parking of the new lake, Chandigarh Renewable Energy and Science and Technology Promotion Society (CREST) has proposed 10 solar power projects that it hopes to build by 23 August for producing the targeted 75 megawatt (MW) of electricity. CREST has achieved 48 MW solar power generation, whilst its 75 MW target is 15 August, 2023. Under ‘Azadi Ka Amrit Mahotsav’ campaign, Crest will also build two floating solar power plants in the city, a 2 MW one at Sector 39 waterworks and a 500 KW one at the Dhanas lake. The ministry of new and renewable energy (MNRE) has enhanced the city’s solar power generation target from 50 MW to 69 MW, to be achieved by 2022. So far, the UT has reached the point of 48 MW.

India bans single-use plastic to combat pollution

1 July: India imposed a ban on single-use plastics on items ranging from straws to cigarette packets to combat worsening pollution in the country whose streets are strewn with waste. Announcing the ban, the government dismissed the demands of food, beverage, and consumer goods companies to hold off the restriction to avoid disruptions. Plastic waste has become a significant source of pollution in India, the world’s second most populous country. India’s ban on single-use plastic items includes straws, cutlery, ear buds, packaging films, plastic sticks for balloons, candy and ice-cream, and cigarette packets, amongst other products, Prime Minister Narendra Modi’s government said. According to the United Nations, plastic waste is at epidemic proportions in the world’s oceans, with an estimated 100 million tonnes (MT) dumped there. Scientists have found large amounts of microplastic in the intestines of deep-dwelling ocean mammals like whales.

India’s largest 100 MW floating solar power project at Telangana becomes fully operational

1 July: India’s largest floating solar power project is now fully operational. NTPC Ltd declared commercial operation of the final part capacity of 20 MW out of 100 MW Ramagundam Floating Solar PV Project at Ramagundam, Telangana with effect from 1 July. With the operationalisation of solar PV project at Ramagundam, the total commercial operation of floating solar capacity in the southern region rose to 217 MW. Earlier, NTPC operationalised 92 MW Floating Solar at Kayamkulam (Kerala) and 25 MW floating solar project at Simhadri (Andhra Pradesh). The 100 MW floating solar project at Ramagundam is equipped with advanced technology as well as environment-friendly features.

International: Oil

Venezuelan, Iranian oil could ease energy crisis: OPEC Secretary General

5 July: The oil and gas industry is "under siege" due to years of under-investment, the OPEC (Organization of the Petroleum Exporting Countries) Secretary General Mohammad Barkindo said. The resulting supply shortage could be eased if extra supplies from Iran and Venezuela were allowed to flow. Years of sanctions have limited supplies from Iran and Venezuela. In addition, the West has imposed sanctions on Russia, a member of OPEC+ that groups the OPEC and allies, following Moscow's invasion of Ukraine on 24 February, tightening oil markets further.

OPEC oil output again misses target in June as outages weigh

1 July: OPEC (Organization of the Petroleum Exporting Countries) in June did not deliver on an oil output increase pledged under a deal with allies, a survey showed, as involuntary declines in Libya and Nigeria offset supply increases by Saudi Arabia and other large producers. The OPEC pumped 28.52 million barrels per day (bpd) in June, the survey found, down 100,000 bpd from May’s revised total. OPEC had planned to boost June output by about 275,000 bpd. OPEC plus Russia and other allies, known as OPEC+, are unwinding 2020 output cuts made due to the pandemic, although many are struggling to do so. OPEC+ at a meeting stuck to its planned output hike for August. The deal called for a 432,000 bpd increase in June from all OPEC+ members, of which the agreement covers about 275,000 bpd is shared by the 10 OPEC producers. Supply from the 10 rose by just 20,000 bpd, the survey found.

Ecuador’s Petroecuador lost 1.99 mn barrels of oil output during the protest

1 July: More than two weeks of protests in Ecuador caused oil company Petroecuador to lose 1.99 million barrels of oil production, the company said. it expects to reach 90 percent of pre-crisis output. Protests erupted in Ecuador in June to demand lower fuel prices and limits to the expansion of the mining and oil industries, leading to at least eight deaths and devastating oil production. The company said it recovered 19,000 barrels per day (bpd) of output since the protests ended, whilst its Esmeraldas refinery was working at 70 percent capacity.

Lanka IOC provides fuel as government pumps go dry in Sri Lanka

29 June: Lanka IOC, the subsidiary of Indian Oil Corporation (IOC) in Sri Lanka, kept its petrol pumps running throughout, 28 June, amid Sri Lanka’s worsening fuel crisis. This is happening whilst government-owned petrol pumps have run dry. The Sri Lankan government had announced that it was suspending the sale of fuel for non-essential services for two weeks till 10 July. Stating that it has run out of fuel, the island nation requested both private and public sector employees to work from home. Meanwhile, the government issued tokens to vehicles that had waited in queues for over three days. The military, which distributed the tokens, said that those vehicles would be prioritised when the Ceylon Petroleum Corporation (CPC) resumed their deliveries.

International: Gas

Australia proposes to extend gas security policy until 2030

5 July: The Australian government proposed to extend its gas security policy until 2030 to ensure the mechanism is available to help reserve domestic gas to prevent a supply crunch that would cause wholesale power and gas prices to rise. The extension would ensure the availability of the so-called Australian Domestic Gas Security Mechanism (ADGSM) whilst checks are made to improve the existing process, Resources Minister Madeleine King said. The current domestic gas security mechanism requires east coast suppliers of liquefied natural gas (LNG) to hold back some exports for the domestic market but the trigger would not help solve immediate shortages as it involves an annual review.

Gas consumption set to contract due to Russia: IEA

5 July: Gas consumption will contract slightly this year due to high prices and Russian cuts to Europe, with only slow growth over coming years as consumers switch to alternatives, the International Energy Agency (IEA) said. The IEA chopped its forecast for global gas demand by more than half in its latest quarterly report on gas markets. It now expects growth of just 3.4 percent by 2025, an increase of 140 billion cubic meters (bcm) from 2021 levels, which is less than the 175 bcm jump in demand registered in 2021 alone. The IEA chopped its forecast for global gas demand by more than half in its latest quarterly report on gas markets. It now expects growth of just 3.4 percent by 2025, an increase of 140 bcm from 2021 levels, which is less than the 175 bcm jump in demand registered in 2021 alone. Whilst Russia has cut supplies to Europe and European nations have pledged to wean themselves off Russian gas, the impact quickly rippled throughout the world. European nations are trying to make up the shortfall by importing more liquefied natural gas shipped by tanker, which the IEA said is creating supply tensions and leading to demand destruction in other markets. It warned that the scramble for LNG risked not only causing economic harm to other more price sensitive importers, but pushing up prices and thus contributing to additional revenues for Russia.

No guarantees Swiss will always have enough gas: Energy Minister

3 July: Swiss businesses would be first to have energy rationed in the event of supply shortages, Energy Minister Simonetta Sommaruga said. Landlocked Switzerland gets its gas via trading hubs in neighbouring countries in the European Union, so disruptions there would also affect Switzerland. Switzerland has relatively low demand for gas, which covers around 15 percent of total energy consumption. Around 42 percent of gas is used to heat households, and the rest in industry and in the service and transport sectors, according to government data.

Germany’s plans to spread gas price risk

1 July: Germany has prepared a facility to impose a levy on all gas consumers to help suppliers grappling with soaring gas import prices, according to a draft law amendment. In late May Germany passed a law to enable the state to ensure energy supply in the event of market failure because of Russia’s invasion of Ukraine and reductions to the Russian gas exports on which it relies heavily.

Spain begins natural gas exports to Morocco following diplomatic row

29 June: Natural gas has started flowing from Spain towards Morocco through a pipeline that stopped flowing in November amid a diplomatic row between Morocco and Algeria, data from Spanish gas grid operator Enagas showed. Algeria decided last year not to extend a deal to export gas through a pipeline running through neighbouring Morocco to Spain, halting nearly all of Morocco’s gas supply as relations between Rabat and Algiers worsened. In April, Algeria warned Madrid not to re-export Algerian gas supplies to its Southern neighbour after energy minister Teresa Ribera confirmed plans to reverse the flow of the Maghreb Europe pipeline and begin exportation of natural gas to Morocco. In March, Spain angered its main gas supplier Algeria by supporting a Moroccan plan to offer autonomy to Western Sahara, prompting Algiers to suspend its 20-year-old friendship treaty with Madrid and causing a diplomatic crisis.

International: Coal

Pakistan underlines affordable Afghan coal prices

4 July: Pakistan said it will continue to import coal from Afghanistan as long as prices of the commodity remain affordable. Prime Minister Shehbaz Sharif gave the go-ahead to coal imports from Afghanistan in Pakistani rupees, rather than dollars. Amid imports from the neighbouring country, the interim Afghan government recently hiked coal prices from US$90 to US$200 a tonne.

New Mexico customers to save monthly with coal plant closure

1 July: The largest electric provider in New Mexico outlined the savings that customers will see from the closure of a coal-fired power plant as part of a filing mandated by state utility regulators. The document was required to be submitted by 1 July as part of a financing order related to the San Juan Generating Station. The plant was set to shut down at the end of June, but regulators are allowing Public Service Co. of New Mexico to keep open one unit through September to meet peak summer demands.

China continues to snap up Russian coal at steep discounts

29 June: Russia’s coal shipments to China have been rising even though overall shipments to China have declined, new data from S&P Global Market Intelligence showed. Russian seaborne coal deliveries to China surged 55 percent to 6.2 million tonnes (MT) in the first 28 days of June compared to the same period last year, S&P’s Commodities at Sea database showed. In May, Russian seaborne supply to China also rose by 20 percent year-on-year to 5.5 MT. Domestic production in China has also been increasing. The latest data from the National Bureau of Statistics of China showed that between January and May, raw coal production rose 10.4 percent year-on-year to 1.81 billion tonnes, whilst imports dropped to around 96 MT down 13.6 percent compared to a year ago. Russia is a major global coal producer and exporter. But since its invasion of Ukraine, Moscow has been forced to sell coal at a discount after countries like Japan banned Russian imports of the commodity. Chinese customs data show Indonesia, Russia and Mongolia are now top coal exporters to China, with once major supplier Australia edged out after China imposed restrictions on Australian coal in 2020.

International: Power

Texas power use to break records next week as heatwave returns

1 July: Power demand in Texas will likely hit new all-time highs as economic growth boosts overall use and homes and businesses crank up their air conditioners to escape another heat wave. The Electric Reliability Council of Texas (ERCOT), which operates the grid for more than 26 million customers representing about 90 percent of the state’s power load, has said it has enough energy resources available to meet demand. Extreme weather is a reminder of the February freeze in 2021 that left millions of Texans without power, water and heat for days during a deadly storm as ERCOT scrambled to prevent a grid collapse after an unusually large amount of generation shut. ERCOT forecast power use would soar to 77,861 megawatt (MW) on 6 July and 78,532 MW on 7 July, which would top the current all-time high of 76,592 MW on 23 June.

International: Non-Fossil Fuels/ Climate Change Trends

Renewables provide 49 percent of the power used in Germany in the first half of 2022

5 July: Renewable energy accounted for 49 percent of German power consumption in the first half of 2022, up 6 percent percentage points from a year earlier, thanks to favourable weather conditions. Both higher sunshine intensity and wind speeds were behind the trend, utility industry association BDEW and the Centre for Solar Energy and Hydrogen Research (ZSW) said. The share of renewables in German power consumption hit 50.2 percent in the first half of 2020. Renewable generation, which along with wind includes solar, hydro, biomass, waste and geothermal energy, contributed 139 billion kWh to the total, up 13.5 percent from a year earlier. Germany last year reduced carbon dioxide (CO2) emissions by 39 percent compared with 1990 but aims to reach a 65 percent reduction by 2030, for which it needs to roll out more zero-carbon renewables.

Poland looks to ease rules blocking the development of onshore wind power

5 July: The Polish cabinet adopted legislation easing rules on the development of wind farms as the country aims to boost its installed capacity and diversify energy supplies. In practice blocking new projects, wind development in Poland has been stalled since 2016 by rules requiring a minimum distance of 10 times the height of an onshore wind power plant between the farm and residential buildings. Under the revised rules, a minimum distance between a wind farm and a residential building would be set at 500 metres. Onshore wind investments would have to be included in municipal zoning plans, Climate Minister Anna Moskwa said.

Shell, Philippine partner to build 1 GW renewable energy capacity

1 July: Shell Overseas Investments B.V., a unit of Shell plc has signed an agreement with the Philippines' Emerging Power Inc for an initial 1 gigawatt (GW) renewable energy project tapping solar, the companies said. Shell and Emerging Power, the energy unit of top Philippine nickel ore miner Nickel Asia Corp, said their venture is targeting 2028 completion and is scalable up to 3 GW. The focus is on solar but they said opportunities in onshore wind and energy storage systems were also being evaluated. A 1 GW capacity can supply the annual daytime consumption of more than 1.2 million Philippine homes, they said. London-based Shell, which aims to become a net zero greenhouse gas emissions company by 2050, currently has 4.7 GW of renewable energy generation capacity globally in operation, under construction or committed to the sale.

US Supreme Court limits federal power to curb carbon emissions

30 June: The US (United States) Supreme Court imposed limits on the federal government’s authority to issue sweeping regulations to reduce carbon emissions from power plants in a ruling that undermines President Joe Biden's plans to tackle climate change and could constrain various agencies on other issues. The court’s 6-3 ruling constrained the Environmental Protection Agency (EPA)’s authority to regulate greenhouse gas emissions from existing coal- and gas-fired power plants under the landmark Clean Air Act anti-pollution law. Biden’s administration is currently working on new regulations.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

For more energy insights follow the links below:

- Hydrogen: Versatile Zero Carbon Energy Carrier: https://www.orfonline.org/research/energy-news-monitor-27/

- Tax revenue from petroleum products in India: Golden eggs that may kill the goose?: https://www.orfonline.org/expert-speak/indias-tax-revenue-from-petroleum-products/

- Challenges in Optimising Power Demand & Supply: https://www.orfonline.org/expert-speak/challenges-in-optimising-power-demand-and-supply-68178/

- India’s Natural Gas Exchange: One Small Step or a Giant Leap?: https://www.orfonline.org/research/india-natural-gas-exchange-one-small-step-or-a-giant-leap/Natuhttps://www.orfonline.org/expert-speak/natural-gas-india-cinderella-goldilocks-66385/

- Natural gas in India: From Cinderella to Goldilocks (May 2020): https://www.orfonline.org/expert-speak/natural-gas-india-cinderella-goldilocks-66385/

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV