Quick Notes

Carbon inequality in India: The need to look within

Economic Inequality

According to the World Inequality Report 2022 (WIR 2022), India and Brazil are countries with ‘extreme’ inequality amongst low- and middle-income group countries. China is slightly better as it is characterised by only ‘high levels’ of inequality. India is also amongst countries that experienced ‘spectacular’ increase in inequality along with USA and Russia. Amongst countries in South and Southeast Asia, the ratio of the income of the top 10 percent to the bottom 50 percent is 22 for India which is much higher than 17 for Thailand, a military dictatorship. Globally, the entire drop in growth in the share of income going to the bottom 50 percent of the population due to COVID-19 in 2020 was because of South and Southeast Asia, particularly India. When India was removed from the data set, the share of income going to the bottom 50 percent was found to increase slightly in 2020.

Carbon Inequality

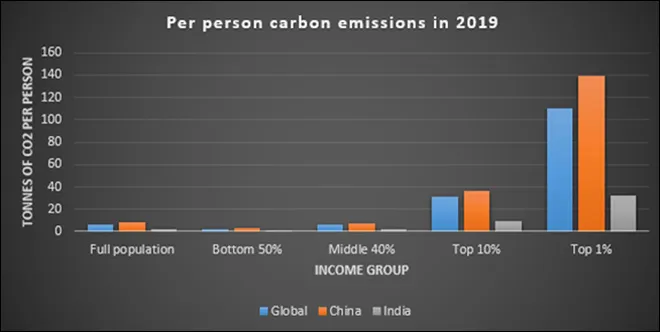

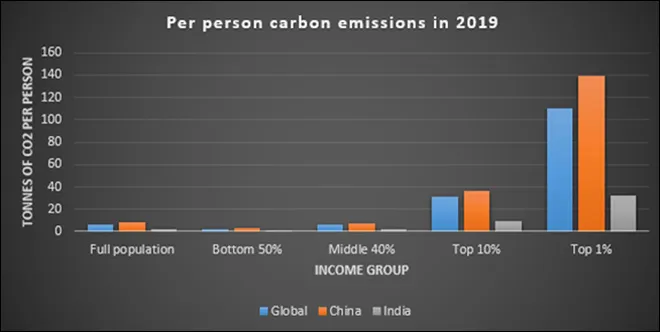

The inequality in income and wealth naturally translates into carbon inequality that arises from differences in consumption. Within India, the national average per person emission was about 2.2 tonnes of carbon dioxide (tCO2). The middle 40 percent emitted about 2 tCO2 per person, the bottom 50 percent about 1 tCO2 and the top 10 percent about 8.8 tCO2 per person in 2019. This pattern is not unique to India.

Globally, on average each individual emitted just over 6.5 tCO2 in 2021. In 2019, the bottom 50 percent of the world population emitted only 1.6 tCO2 per person accounting for 12 percent of emissions while the middle 40 percent emitted 6.6 tCO2 per person accounting for about 40 percent of total emissions. The top 10 percent emitting 31 tCO2 per person accounted for 47.6 of total emissions and the top 1 percent or about 77.1 million people emitting 110 tCO2 accounted for 16.8 percent of emissions. The top 0.1 percent or just 7.7 million people emitted 467 tCO2 per person and the top 0.01 percent or just 770,000 people emitted a staggering 2531 tCO2 per person in 2019.

Carbon inequality: Within and between countries

In multilateral climate negotiating platforms, India has consistently upheld the principle of equity between countries. Just before COP 26, the Government of India welcomed the launch of climate equity monitor (CEM), an online dashboard for assessing, at the international level, equity in climate action, inequalities in emissions, energy and resource consumption across the world. According to the CEM, its objective is to counter messages from western sources that rely on or promote methodologies that pay no more than scarce attention to equity, differentiation, and historical responsibility, all guiding principles of the UNFCCC (United Nations framework convention on climate change). The CEM observes that even where the discourse claims to focus on equity, it privileges views from the Global North that seek to establish themselves as acting on behalf of the rest of the world. The CEM aims to address this disparity and promote a new narrative where the South looks out for the North and the rest of the world. As nations rather than individuals are the units of negotiation in multilateral climate negotiations, contesting ‘between country’ inequality is a perfectly legitimate position for India. However, this does not mean ‘within country’ inequalities can be ignored.

According to WIR 2022, in 1990, 63 percent of the global carbon inequality was due to ‘between country’ inequality but in 2019, 63 percent of global carbon inequality was due to ‘within country’ inequality. Looking within to address carbon inequalities will strengthen India’s case for addressing between country carbon inequality in multilateral platforms.

Most of the emission reduction in India to meet the targets of the Paris Agreement must come from the top 10 percent of India’s population whose emissions are higher than world average emissions. Compared to 2019 levels, Indian emissions can increase by 70 percent or by 1.5 tCO2 per person until 2030. Emissions of the bottom 50 percent can increase by 281 percent to 2.7 tCO2 per person by 2030 while emissions of the middle 40 percent can increase by 83 percent to 1.7 tCO2 per person. However, emissions of the top 10 percent must fall by 58 percent to 5.1 tCO2 per person to meet the targets of the Paris Agreement.

Climate policies recommended by WIR 2022 that target the bottom 50 and the middle 40 percent of the population include public investment in renewable energy supply, protection for those affected by the transition to cleaner energy sources, construction of zero carbon social housing, cash transfer for increase in fossil fuel energy prices. Policies that target the top 10 percent include wealth or corporate taxes with pollution top-up.

The suggestion of a global carbon incentive (GCI) to address carbon inequality from Raghuram Rajan, former Governor of the Reserve Bank of India to address global carbon inequality is also a credible option. Under GCI, every country that emits more than the global average of around 5 tCO2 per person would pay annually an amount calculated by multiplying the excess emissions per person by the population and the GCI into a global GCI fund. Countries below the global per person average would receive a commensurate pay-out. With a per person emission way below the cut-off of 5 tCO2, India would not pay anything but instead receive a pay-out from richer countries. If the initial GCI is set at US$ 10/tCO2 emissions above the global average, substantial sums can be raised to address carbon inequality.

If the idea of a GCI is applied to address ‘within country’ carbon inequality in India, the top 10 percent or 138 million people will have to pay-out a total of over US$5.2 billion annually. This is about a third what the government spends on climate change each year. Compared to the current carbon price of close to €80/tCO2 at the EU ETS (European union emission trading system) in December 2021, the GCI of US$10/tCO2 is very low but it is a good starting point. The key bureaucratic challenge would be to identify the top 10 percent of carbon emitters, but it is not impossible.

Is Inequality Fair?

India’s current climate policies overwhelmingly promote production of cleaner sources of energy or technologies through large financial and other incentives to the private sector that includes protection from external competition (through import duties and tax breaks for example) at one end and a guaranteed market (through various mandates to increase the share of clean energy) at the other. The beneficiaries, primarily the promoters and shareholders of private entities constitute a large part of the top 10 percent of emitters. Empirical studies show that near-term climate action such as policies that incentivise production of clean energy comes at some cost to the poor. Using the nested inequalities climate economy (NICE) model, the study shows that an equal per person refund of carbon tax (or equivalent such as the GCI) revenues can pay large and immediate dividends for improving well-being, reducing inequality, and alleviating poverty.

It is unlikely that policies that favour the bottom of the carbon pyramid will find favour in India where power is characterised by the bond between capital and state. As noted by Nobel laureates Esther Duflo and Abhijit Banerjee in the foreword of the WIR 2022, inequality is not seen as a problem under private sector-led growth that celebrates the unabashed accumulation of individual wealth. The fact that the top marginal income tax rate in India has declined from a peak in the 1970s to a level that is lower than the top marginal income tax rate in much richer countries including Japan, United Kingdom, Germany, France, and even the USA illustrates state preference for capital.

The conclusions of an academic study on this subject that found that humans, even as young children and babies, actually prefer living in a world in which inequality exists is relevant in this context. It sounds counter-intuitive, but the study showed that when people find themselves in a situation where everyone is equal, many become bitter as those who work hard are not rewarded, and slackers are over-rewarded. This makes inequality ‘fair’ when those in the top 10 percent are framed as hard workers and those below as slackers. But climate change, like the pandemic, is a problem that does not respect borders or man-made barriers and labels. Policies that favour the top 10 percent may be ineffective in saving them when the bottom 90 percent crumbles under the weight of climate change.

Source: World Inequality Report 2022

Source: World Inequality Report 2022

Monthly News Commentary: Power

Power Demand Deficit Wiped Out

India

Demand Growth

According to Union power ministry peak power demand deficit in the country was almost wiped out in 2020-21 period. As per the ministry, the deficit stood at 0.4 percent in 2020-21 compared to 16.6 percent in 2007-08 and 10.6 percent in 2011-12. In the current year (2021-22) till October, the peak power demand has been (-)1.2 percent and the marginal spike was attributable to the annual post monsoon pressure on power output. According to the ministry, India had a massive power deficit of 16.6 percent in 2007-08 and in 2011-12, it was 10.6 percent. In the last nearly seven years, the augmentation of the installed power capacity in the country has been 1,55,377 MW (Megawatt).

India’s power consumption grew 4.8 percent in October to 114.37 bn units, indicating a good recovery amidst coal shortages at electricity generation plants, according to power ministry data. Last year in October, power consumption stood at 109.17 bn units and in the same period in 2019, it was at 97.84 bn units. During October, the peak power demand met or the highest supply in a day stood at 174.60 GW (Gigawatt), higher than 169.89 GW in the same month last year. The data clearly shows that there is recovery in power consumption as well as demand in the country. Experts said the recovery in power demand as well as consumption would increase further due to the government's efforts to ramp up coal supplies at plants and improvement in economic activities following the lifting of lockdown restrictions by states. Experts said the recovery in power demand and consumption in September 2021 remained subdued mainly because of delayed monsoon.

India is suffering its worst power shortage in October since March 2016 due to a crippling coal shortage, federal grid regulator POSOCO data showed. Power supply fell about 750 million kilowatt hours (0.75 million units) short of demand during the first 12 days of October, a deficit of 1.6 percent that was the worst in five and a half years, the data showed. The October shortfall was already the biggest in absolute terms for a single month since November 2018, even with 19 days of October still left. The shortfall this month already accounts for 21.6 percent of the total deficit this year. Northern states such as Rajasthan, Punjab, Haryana, and Uttar Pradesh, and the eastern states of Jharkhand and Bihar, were the worst affected, registering supply deficits of 2.3-14.7 percent. Increased economic activity after the second wave of the coronavirus pandemic has driven up demand for coal leading to a supply shortage, forcing northern states such as Bihar, Rajasthan and Jharkhand to cut power for up to 14 hours a day. According to India’s power ministry, the capacity of power plants under outage because of a coal shortage had fallen nearly to 6 GW, from 11 GW.

Discom Reform

Punjab Chief Minister (CM) approved a proposal of power utility Punjab State Power Corporation Limited (PSPCL) for terminating the power purchase agreement (PPA) with private sector electricity generator GVK due to high cost. The PSPCL has issued a termination notice to the company. According to the Chief Minister, this step has been taken to safeguard the interests of consumers by way of “reducing the burden of costly power”. As per the PPA, the company was required to arrange a captive coal mine but it failed to do so even after the lapse of more than five years of synchronisation with the grid. The capacity charges are being decided by the Punjab State Electricity Regulatory Commission (PSERC) based on capital cost of around INR30.58 bn (US$0.41 bn), which is equivalent to about INR1.61 per unit of fixed cost. GVK went against this decision and moved Appellate Tribunal for Electricity (APTEL) for claiming higher fixed cost to the tune of INR2.50/kWh based on claims of capital cost of about INR44 bn (US$0.58 bn), which is pending adjudication.

The AP (Andhra Pradesh) government will apprise Union Home Ministry of the outstanding dues to the tune of INR60.15 billion (bn) from Telangana power utilities during the 29th southern zonal council meeting in Tirupati. It will also request the Union government to prevail on Telangana and facilitate payment of arrears to APGenco at the earliest. As power generation in Telangana was not enough to meet the demand at the time of bifurcation, APGenco had supplied the deficit power to Telangana discoms. APGenco distributed 8,890 million units (MU) from 2 June 2014 to 10 June 2017 to Telangana as per AP Reorganisation Act, 2014. For the same, an undisputed due of INR34.41 bn (US$456 million) and INR28.41 bn (US$377 million) towards late payment surcharge, which is the cost of power supplied during that period, have remained unpaid. The two states agreed on payment of these dues on different occasions, including at a joint meeting between the power utilities of both states on 19 August 2019.

Regulation and Governance

The power ministry announced new rules to sustain economic viability of the sector, ease financial stress of various stakeholders and ensure timely recovery of costs involved in electricity generation. The ministry notified rules for the sustainability of the electricity sector and promotion of clean energy to meet the India’s commitment towards climate change. Investors and other stakeholders in the power sector had been concerned about the timely recovery of the costs due to change in law, curtailment of renewable power and other related matters. As per the ministry, rules notified by the Ministry of Power under Electricity Act, 2003 are in the interest of the electricity consumers and the stakeholders.

According to state power ministry Goa would achieve 100 percent household electrification by the end of this year. The proposal will be put before the cabinet shortly, and after the cabinet approval, a contractor will start the work. Initially, 250 households in Goa did not have electricity. So far, we have given connections to 150, and 100 will be given soon. The problem arose due to the houses’ inaccessibility from the grid. In such cases, the process of giving electricity connections is a lengthy process. Those houses are in the remotest parts of the state, mostly in forested areas. The electricity department has provided such houses with basic plug points through renewable energy sources.

Uttar Pradesh Power Ministry pressed for industrial consumers getting exemption from electricity duty. The Ministry asked the officials to ensure that the online consumer services are simplified and the consumers get benefits. It directed all the MDs of distribution companies to ensure that facilities should be increased according to the increasing investment and demand in the industrial areas of the state. UPPCL should continuously monitor and review it regularly, the Ministry elaborated. The Directorate of Electrical Safety should clear the pendency of about 250 pending cases in the next one month. The process will be monitored by the state government. The Ministry pitched for regular patrolling officers of industrial and commercial areas themselves to do it. In line with the ever-increasing demand, the process of necessary capacity addition should be done continuously. It reiterated that the industrial and commercial consumers be given prior information about shutdown.

Electricity Trade

Uttar Pradesh (UP) Chief Minister (CM) said that his government was buying electricity from energy exchange and other sources at a cost up to INR22 per unit (kwh) as it was unwilling to let the ongoing festivities get affected by shortage of power in the aftermath of a nationwide coal crisis. Private power producers and some state transmission utilities appear to be making a killing by selling electricity on the exchanges where rates have tripled owing to lower generation as a result of coal shortage, even as Union Power Ministry asked states to watch out for generators gaming the State transcos, pvt gencos make a killing on power exchanges. Earlier, the CM had asked the power officials to coordinate swiftly with the Centre and the Coal India Limited (CIL) to mitigate the crisis which was threatening to worsen the situation of the financially ailing UP Power Corporation Limited (UPPCL), it was already running at an accumulated loss of INR900 bn (US$11.93 bn).

Transmission

Sterlite Power has bagged Nangalbibra -Bongaigaon inter-state power transmission project worth INR3.24 bn. The project elements consist of a new 220/132 kV substation at Nangalbibra and laying of 130 km of 400kV D/c transmission line connecting Bongaigaon in Assam to Nangalbibra in Meghalaya across the river Brahmaputra. The project will also have 20 km of 132kV D/c line connecting Hatsinghmari in Assam to Ampati in Meghalaya. Sterlite Power has a track record of executing complex projects successfully with the use of technology and innovative solutions. The company has completed the NER-II project, an inter-state transmission scheme ning across the north-eastern states of Assam, Arunachal Pradesh and Tripura.

Rest of the World

China

China will encourage power consumers to trade directly with renewable power generators in cross-province spot electricity trading and will gradually add bulk power users and power sellers into the trade. The announcement is part of a reply from the National Development and Reform Commission (NDRC) to the State Grid Corp which proposed a draft trading rule on cross-region spot power trading. China, the world’s biggest greenhouse gases emitter, has been striving to boost renewable power consumption as it has vowed to bring its carbon emissions to a peak by 2030. Currently, more than 60 percent of electricity comes from coal-fired power plants. As renewable power sources are mainly in the far-west part of the country, thousands of kilometres away from the major power consumers, the government is keen to encourage cross-region power trade. In 2020, cross-province power trading reached 558.75 billion kilowatt-hours, about 17.6 percent of China’s total power trading, according to data from China Electricity Council.

China flagged it is targeting a 1.8 percent reduction in average coal use for electricity generation at power plants over the next five years, in a bid to lower greenhouse gas emissions. The target, announced by China’s economic planner, NDRC, comes as the world’s top climate negotiators have gathered in Scotland for the COP26 climate talks. Average coal use for electricity generation in China fell by about 17.4 percent in the 15 years till 2020. By 2025, coal-fired power plants in China must adjust their consumption rate to an average of 300 grams of standard coal per kilowatt-hour (kWh).

Other Asia Pacific

The global energy crunch which has sent natural gas prices to record highs and caused power shortages in many parts of the world is now spilling over to the island state of Singapore which is dependent on gas for power generation. Three energy providers in Singapore are exiting the market, and according to company sources at least two others have stopped accepting new clients amidst rocketing wholesale energy prices that retailers are unable to pass on to customers. Singapore’s energy regulator Energy Market Authority (EMA) said it was working closely with retailers facing challenges from volatile electricity prices—which rose to record high levels—and said there will be no disruption to their customers’ electricity supply. Singapore is one of few countries in Asia with a fully liberalised electricity retail market. Power generation firms in Singapore sell electricity in the Singapore Wholesale Electricity Market (SWEM) every half hour, with the price determined by supply and demand at that time. Electricity retailers buy electricity in bulk from the wholesale market and compete to sell electricity to consumers.

Electricity prices in Japan rose to their highest in nearly 10 months, amidst elevated global prices for liquefied natural gas (LNG) and coal — the main fuels to supply country’s US $150 bn power market. Prices for delivery of electricity early on Tuesday morning reached 55 yen (US$0.48) per kWh the highest since late-January. Traders said higher LNG prices were starting to filter through to the local power market. Elevated electricity prices in recent weeks are reviving memories of last winter when prices hit record highs and Japan’s grid nearly failed in the worst energy crisis for the country since the Fukushima disaster.

Africa and the Middle East

Cyprus and Egypt signed an accord to pursue links between the electricity transmission networks of the two countries. A Memorandum of Understanding (MoU) was signed by the energy ministers of Cyprus and Egypt, setting out a framework of cooperation from planning to implementation. Greece and Egypt signed a similar agreement, which sets the stage for an undersea cable that will transmit power produced by renewables from North Africa to Europe, the first such infrastructure in the Mediterranean.

News Highlights: 24 – 30 November 2021

National: Oil

India taps strategic oil reserves to cool prices

24 November: India, the world’s third-largest oil importer, has agreed to release 5 million barrels of crude oil from its strategic oil reserves in coordination with other major consumers, including the US (United States), China, Japan and South Korea. India has repeatedly expressed concern at the supply of oil being artificially adjusted below demand levels by oil-producing countries, leading to rising prices and negative attendant consequences, the oil ministry said. However, oil prices rose, erasing an earlier loss, as the plan from consumer nations to tap their strategic oil reserves was less severe than markets expected. India has an existing crude storage capacity of 5.3 million tonnes (mt), including 1.33 mt in Visakhapatnam, 1.5 mt in Mangaluru and 2.5 mt in Padur. Built at a cost of US$600 million, these reserves are operational and are sufficient to meet around nine-and-a-half days of India’s crude oil requirements. Last year, India bought crude oil at US$19 a barrel to fill up its 5.3 mt of strategic reserves, and in the process, saved US$685.11 million. India also plans to build an additional 6.5 mt of strategic reserves. In comparison, International Energy Agency (IEA) members maintain emergency oil reserves equivalent to at least 90 days of net imports. IEA countries hold 1.55 billion barrels of public emergency oil stocks. In addition, 650 million barrels are held by industry under government obligations and can be released as needed.

India’s crude oil production falls 2.15 percent in October, gas output rises

24 November: India’s crude oil production fell 2.15 percent in October as state-owned firms produced less but, natural gas output rose by a quarter on the back of output from KG-D6 fields of Reliance-BP, government data showed. Crude oil production dropped to 2.51 million tonnes in October, as output from fields operated by Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) dipped. While ONGC produced 4 percent less crude oil at 1.64 million tonnes, OIL output dropped 1.46 percent to 2,53,000 tonnes. India is 85 percent dependent on imports to meet its oil needs and the government has been for long looking at ways to raise the domestic output so as to reduce import dependence. Crude oil is converted into fuels such as petrol and diesel in refineries. Production of natural gas, which is used to fire power plants, run fertiliser units and convert into CNG (compressed natural gas) to automobiles, rose 24.7 percent to 3.01 billion cubic metres (bcm) in October. ONGC, the nation’s largest oil and gas producer, produced 4.4 percent less gas at 1.8 bcm.

National: Gas

India’s gas consumption to jump more than 3 times by 2030: GAIL marketing director

25 November: India’s natural gas consumption is projected to rise to as much as 550 million metric standard cubic meters per day (mmscmd) by the end of the decade from about 174 mmscmd now as the user base expands with the inclusion of newer industries such as steel, GAIL (India) Ltd marketing director E S Ranganathan said. While the government is targeting to increase the share of natural gas in the primary energy basket to 15 percent by 2030 from the current 6.2 percent, the share of the environment-friendly fuel in the total energy demand is only 2 percent. Gas consumption presently is around 174 mmscmd, largely by fertilizer plants, city gas networks and power units. Of this, 49 percent is met by domestic production and the rest through imports in form of liquefied natural gas (LNG). LNG, he said, will continue to play a leading role in meeting India’s gas requirements in spite of a strong and welcome upswing in domestic production. The indigenous production has already jumped around 19-20 mmscmd in the last quarter, he said adding LNG import capacity will rise to 40 million tonnes per annum. India needs to look at LNG for transport the same way it is doing for electric vehicles, Shell Energy India said. Bringing gas under GST (Goods and Services Tax) and reducing the cost of LNG-fuelled trucks can push the use of super-chilled fuel in transport.

Government sets up committee for stable gas price for power units: Oil Secretary

25 November: The government has set up a committee to work out measures need to make natural gas available to power plants at “reasonably stable prices”, Oil Secretary Tarun Kapoor said. India has 24,900 MW of gas-based power generation capacity. But of this, 14,305 MW is stranded due to the non-availability of reasonably priced gas. The average domestic gas supplied to gas-based power plants is just over 25 million metric standard cubic meters per day (mmscmd), which is 70 percent short of the allocation or the requirement. While gas-based power plants act as balancers in the grid, making available gas to power plants is part of a larger plan to increase the share of environment-friendly fuel in India’s primary energy basket to 15 percent by 2030 from the current 6.7 percent, Kapoor said. Natural gas as a fuel is convenient to use and can be easily transported through pipelines. It is cleaner than several other fossil fuels. Of the total gas consumption of about 60 billion cubic meters (bcm), more than half or 33 bcm was imported, he said. In absence of sufficient domestic production, India imports gas in form of liquefied natural gas (LNG). However, in recent weeks, LNG prices shot up to a record high of US$56 per million British thermal units in comparison to US$5-6 per mmBtu rates prevalent previously, he said adding the prices have gone down to US$30 but even this rate is extremely unaffordable. India has some long-term LNG supply contracts, which are indexed to different benchmarks, thereby giving it rates that are much lower than current international prices. The focus is on exploring more areas to find gas reserves as well as raising output from existing fields, he said adding output is likely to rise next year on the back of major discoveries in the KG basin in the eastern offshore coming to production. The increase was mainly because of newer fields in the KG-D6 block of Reliance Industries Ltd being brought to production.

RIL board decides to restructure, repurpose gasification assets

25 November: Reliance Industries Ltd (RIL)'s board decided to implement a ‘Scheme of Arrangement’ to transfer the ‘Gasification’ undertaking into a wholly-owned subsidiary (WOS). According to RIL, repurposing the ‘Gasification’ assets will help use ‘syngas’ as a reliable source of feedstock to produce these chemicals and cater to growing domestic demand, resulting in an attractive business opportunity. Furthermore, with optionality in applications for ‘Syngas’, the nature of risk and returns associated with the gasifier assets will likely be distinct from those of the other businesses of the company. The ‘Gasification’ project at Jamnagar was set up with the objective to produce syngas to meet the energy requirements as refinery off-gases, which earlier served as fuel, were repurposed into feedstock for the ‘Refinery Off Gas Cracker’ (ROGC). Besides, ‘Syngas’ as a fuel ensures reliability of supply and helps reduce volatility in the energy costs. The ‘Syngas’ is also used to produce Hydrogen for consumption in the Jamnagar refinery.

National: Coal

Power generation from coal falls 56 percent in Gujarat

26 November: Gujarat’s production of electricity from the coal-fired thermal power plants halved in October as private sector plants struggled to generate power due to spiralling prices of imported coal. State’s thermal coal-based electricity generation declined by 56 percent to 3,465 GWh (gigawatt hours) in October 2021 from 7,877 GWh during the same month last year, the Central Electricity Authority (CEA)’s report showed. Steep reduction in power generation by private sector plants, including those run on imported coal, brought down the overall electricity generated from the coal-based power plants in October. Private sector’s generation from coal plunged 70 percent to 1,858 GWh from 6,142 GWh. The generation stood at only 32 percent of the targeted generation of 5,839 GWh for October 2021, according to the report.

National: Power

Electricity provided in every village, home in India: Power Minister

26 November: Union Power Minister R K Singh claimed the government has provided electricity in every village and every house in the country and if any settlement or home remains untouched, officials should be informed about it. He said the government has set up 1.59 lakh-km-long power grid. The government has provided electricity in every village and every house in the country. If any house is still left, then let it be known, power will be provided in that household too, he said.

Power firm alerts customers on fraud calls, SMS for bills

25 November: Power distribution company Tata Power Delhi Distribution Limited (TPDDL) has warned its consumers against fraudulent calls and messages seeking payment of electricity bill. The firm caters to consumers in north and northwest Delhi covering a populace of over seven million. The company never asks its customers to call any unknown number or download a third-party app for such activities. The company has lodged an official complaint against suspicious phone numbers. Any consumer-related information can be cross-checked on the company’s official website or by calling company’s toll-free number 19124/1800-208-9124.

Cabinet approves privatisation of electricity distribution in Dadra and Nagar Haveli and Daman and Diu

24 November: The Union Cabinet approved the formation of a special purpose vehicle (SPV) to privatise electricity distribution business in the union territory of Dadra and Nagar Haveli and Daman and Diu. The Cabinet has approved the formation of a SPV to privatize the electricity distribution business in the Union Territory of Dadra and Nagar Haveli and Daman and Diu (DNH&DD), sale of equity shares of the newly formed company to highest bidder and formation of trust(s) for serving employees’ liabilities. In May 2020, the Government of India had announced the ‘AtmaNirbhar Bharat Abhiyan’, to make India self-reliant through structural reforms. One of the key measures planned was to reform the power distribution and retail supply in UTs through privatization of the power distribution utilities, for leveraging private sector efficiency in electricity distribution. A single distribution company, DNH-DD Power Distribution Corporation Ltd, would be incorporated as a wholly-owned government company and trust(s) shall be formed to manage the terminal benefits of the personnel transferred to the newly formed company.

National: Non-Fossil Fuels/ Climate Change Trends

Mahanadi Coalfields to build 50 MW solar plant in Sambalpur for INR 3 bn

27 November: Mahanadi Coalfields Ltd (MCL) is planning to set up a 50 megawatt (MW) solar power plant in Odisha’s Sambalpur district at a cost of INR3.01 bn. The green project is part of the miner’s goal to achieve carbon neutrality by 2024. This project will reduce carbon dioxide emission by 91,020 tonnes per annum and carbon offsets of around 24,824 tonnes per annum, MCL said. MCL, which has its headquarters in Sambalpur, has placed an order with a Chennai-based firm, which will establish this green energy project within 10 months. This plant will cater to the captive power requirement of the coal producing company. The MCL had earlier set-up a 2 MW solar power plant in Sambalpur in 2014. The MCL has set a target of installing 182 MW of solar power by 2024 in order to become a net-zero energy company, aligning itself to use cleaner forms of energy for coal production.

Vedanta’s Sesa Goa iron ore biz pledges to become carbon neutral by 2050

26 November: Vedanta said its Sesa Goa iron ore business is looking to achieve carbon net neutrality by 2050. In line with the country’s larger vision of net zero carbon economy, the company has devised a comprehensive plan to achieve this goal, the company said. To reduce greenhouse gases (GHG) emissions, Vedanta’s Sesa Goa iron ore business has implemented several projects such as pulverized coal injection (PCI), waste heat recovery power plants, massive plantation drives in nearby communities, development of green belts within operation sites and refurbishment of blast furnaces amongst others, the company said. It plans to achieve carbon net neutrality in a phased manner with a target to further reduce greenhouse gas emissions up to 25 percent by 2030. The company aims to install solar power plants up to 10 MW and upgrade turbines in waste heat recovery power plants by May next year to increase clean power generation by 5 MW. The company is also mulling a carbon capture utilisation and storage unit of 10 tonnes per day to make carbon products.

SJVN inks pact with PTC India to develop products for supplying renewable energy

25 November: State-owned power producer SJVN said it has signed a pact with PTC India to develop products for supplying round-the-clock renewable energy. PTC will provide portfolio management services to SJVN, SJVN Chairman and Managing Director (CMD) Nand Lal Sharma said that the primary objective of this MoU is to facilitate the development of energy mix from SJVN’s renewable energy projects for RTC power. PTC will study, explore, prepare and submit a detailed report regarding the supply of power from proposed renewable energy projects of SJVN to potential beneficiaries across India, the CMD said.

Delhi airport to be net zero carbon emitter by 2030: Operator DIAL

24 November: Delhi’s Indira Gandhi International (IGI) Airport announced that it would become a “net zero carbon emission airport” by the year 2030 —well ahead of the 2050 deadline set by the Intergovernmental Panel on Climate Change (IPCC) — the airport operator, Delhi International Airport Limited (DIAL), has announced. India will cut its climate emissions to “net zero” by 2070, the country’s Prime Minister Narendra Modi has told the COP26 summit. While the airport is already utilising renewable energy programmes such as solar rooftop panels, it has also developed green infrastructure and multiple passenger connectivity networks. The airport also has a water and waste treatment plant, along with energy efficient lighting systems, the DIAL chief operating officer Videh Kumar Jaipuriar said. India is currently the world’s third biggest emitter of greenhouse gases, after the United States and China. Speaking at the COP26 summit, Modi had announced that the country would make one billion-tonne reduction in projected emissions from now until 2030. Modi a said India’s emissions intensity, or emissions per unit GDP, will be reduced by at least 45 percent by 2030 from the 2005 levels.

International: Oil

Global jet fuel demand under pressure from Omicron, border curbs

30 November: Global jet fuel markets stayed under pressure as more countries expanded border restrictions to keep the new Omicron coronavirus variant at bay, prompting travellers to reconsider their plans. Jet fuel demand—the biggest laggard in the oil complex—had been forecast to post the strongest growth of 550,000 barrels per day (bpd) to 5.9 million bpd in fourth quarter, according to the International Energy Agency (IEA). But now Omicron pose the greatest risk to jet fuel consumption. Asian refining margins for jet fuel slumped to their lowest in more than two months at US$6.92 a barrel, while the front-month time spread for the aviation fuel in Singapore flipped to a contango for the first time since September end.

OPEC oil output boost in November again falls short of target

30 November: The Organization of the Petroleum Exporting Countries (OPEC) pumped 27.74 million barrels per day (bpd) in November, a survey found, a rise of 220,000 bpd from the previous month but below the 254,000 increase allowed under the supply deal. The increase in OPEC’s oil output in November has again undershot the rise planned under a deal with allies, a survey found, bringing a lack of capacity in some producers into focus ahead of a policy meeting. The OPEC pumped 27.74 million barrels per day (bpd) in November, the survey found, a rise of 220,000 bpd from the previous month but below the 254,000 increase allowed under the supply deal. OPEC and its allies, a group known as OPEC+, are gradually relaxing 2020’s output cuts as demand recovers from the pandemic. But many smaller producers can’t raise supply and others have been wary of pumping too much in case of renewed COVID-19 setbacks. A US-led release of oil stocks by consumer nations to lower prices and the appearance of the Omicron coronavirus variant have cast doubt whether a 400,000-bpd output boost planned in January will go ahead, analysts said.

Japan refiners dust off fuel oil supply chains to meet rising utility demand

25 November: Japanese refiners are dusting off unused supply chains for fuel oil and getting coastal vessels and storage tanks ready after receiving requests from electric utilities to supply more fuel oil this winter amidst a global crunch for power generation fuels. Japan narrowly averted blackouts last winter as liquefied natural gas (LNG) demand and prices soared during a cold snap, and the situation this year may get even tighter as strong use and restocking in Europe and Asia draws down supplies and props up prices near record highs, analysts said. Highly polluting fuel oil, used mainly to power ships, is being considered as a backstop in case of gas shortages for the first time since the aftermath of the Fukushima disaster in 2011. The nation’s top two refiners Eneos Holdings and Idemitsu Kosan are getting higher orders for fuel oil from electric utilities for this winter to ensure adequate power supply during the peak demand season. Japan used to rely heavily on oil-fired power plants in the 1970s, with heavy fuel oil accounting for about a half of refined product demand. The Petroleum Association of Japan (PAJ) said that utilities have asked refiners for extra fuel oil supplies as they try to switch from expensive LNG.

International: Gas

Cheniere to sell US LNG to China’s Foran Group

24 November: US (United States) liquefied natural gas (LNG) company Cheniere Energy Inc said its marketing arm agreed to sell LNG to a unit of Chinese natural gas distribution company Foran Energy Group Co Ltd for 20 years starting in January 2023. Analysts said the deal should move Cheniere closer to making a final investment decision (FID) to build the proposed Stage 3 expansion at its Corpus Christi plant in Texas, which is expected in 2022. The deal is one of several announced in recent weeks as LNG buyers seek to lock in long-term prices and supplies of the super-cooled fuel as global energy shortages have boosted prices to record highs. Utilities around the world are competing for LNG cargoes to fill extremely low gas stockpiles in Europe ahead of the winter heating season and meet insatiable demand for the fuel in Asia where coal and gas shortages have caused power blackouts in China. Over the past couple of months, Cheniere has signed agreements to sell LNG to units of French energy company Engie SA, Anglo-Swiss mining and commodities trading firm Glencore PLC, Chinese gas distribution company ENN Natural Gas Co Ltd and chemical and fertilizer producer Sinochem.

International: Coal

China’s coal prices plunge after government signals more price regulation

29 November: China’s thermal coal futures dropped 5.6 percent after the state economic planner signalled further regulations for prices of the dirty power-generation fuel. The most-active Zhengzhou thermal coal futures contract, for January delivery, was 819.6 yuan (US$128.31) a tonne. It has lost more than 58 percent from a peak of 1,982 yuan a tonne in mid-October following a slew of government interventions to tame the red-hot prices. The National Development and Reform Commission (NDRC) said that it has summoned key coal miners for advices on improving coal prices mechanism. The NDRC has organised several meetings with coal miners and distributors, as well as power firms and legal experts since late October, aiming to set a coal prices target. Some coal miners at top mining regions, Shanxi, Inner Mongolia and Shaanxi, have caped prices at 900 yuan a tonne for 5,500 kilocalories under regulators' pressures.

International: Power

Google signs deal to buy power from Orsted’s German offshore wind farm

30 November: Danish offshore wind developer Orsted said it has secured a 12-year power purchase agreement with Google, which aims to power all its data centres and offices using solely carbon-free electricity by 2030. The US (United States) tech giant will take 50 megawatt (MW) of output from Orsted’s planned 900 MW Borkum Riffgrund 3 wind farm in the German North Sea. While making it possible for big firms to source green power, such deals also provide a reliable revenue stream for asset owners like Orsted as subsidy schemes are being cut or closed by governments around the globe. The Danish company said it aims to make a final investment decision for the wind farm at the end of 2021, with operation then scheduled for 2025.

International: Non-Fossil Fuels/ Climate Change Trends

EU clears US$2.5 billion Greek state aid to boost renewable power

24 November: The European Commission has approved a €2.27 billion (US$2.54 billion) aid scheme proposed by Greece to boost renewable power generation, it said. The measure will help Greece meet its renewable energy targets, without unduly distorting competition, the executive arm of the European Union (EU) said. Greece, aiming for renewables to account for 61 percent of final electricity consumption by 2030 from 29 percent last year, wants to shorten its permitting process to about two to three years. The new scheme that Greece has proposed to support 4.5 GW of installed electricity capacity from onshore wind, photovoltaic, biomass, hydroelectric power and other renewable energy sources includes joint competitive tendering and direct awarding.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV