Quick Notes

Can the success of the Gujarat Gas Industry be replicated across the Country?

Current status

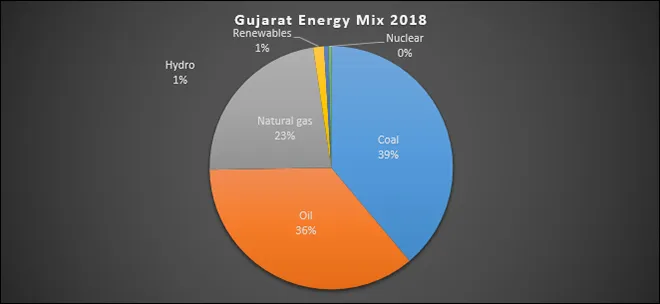

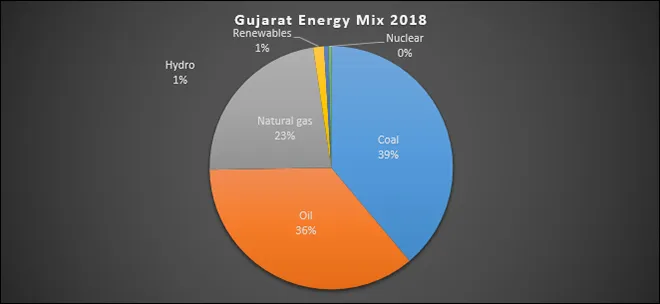

The share of natural gas in Gujarat’s primary energy mix is about 23 percent close to the global average of 24 percent and four times the share of gas in India’s primary energy basket. Gujarat has the most extensive gas pipeline network in the country with over 3370 kilometres (km) of main lines that accounts for about 20 percent of gas pipelines of length 16,324 km in the country. Gujarat’s per capita natural gas consumption at 191 kgoe (kilogram oil equivalent) is 400 percent higher than the national average of 39 kgoe. Consumption of 662,000 tonnes of compressed natural gas (CNG) by Gujarat in 2018-19 accounted for roughly 22 percent of total CNG consumption, the third highest in the country after Delhi NCR (national capital region) at 37 percent (just over 1.1 million tonnes) and Maharashtra with 23 percent (702,000 tonnes). Gujarat accounts for about 40 percent of domestic connections for piped natural gas (PNG), 67 percent of commercial connections and 56 percent of industrial connections. Gujarat has the second largest number of CNG vehicles with over 27 percent of the total at the national level after Delhi NCR which had a share of 37 percent.

The success of Gujarat’s gas industry can be traced to the discovery of gas in Gujarat in the 1960s. This geographic proximity to gas supplies along with the enthusiasm of the then Government of Gujarat to enlist industrial consumers with favourable prices which in turn led to investment in an extensive gas pipeline network were critical for the success of the gas industry in Gujarat.

Proximity to Supplies

Oil and Natural Gas Corp (ONGC) discovered oil in the Cambay basin, Gujarat 1958 and in Ankleshwar, Gujarat in 1960, just a few years after ONGC was set up. In fact, ONGC began exploration in Gujarat only after Oil India Limited (OIL) which was developing oil discoveries in Digboi in Assam in 1889 refused to work in Gujarat. Since ONGC’s front-end activity was exploration, the discipline of geology enjoyed great prestige in the early years and was central to strategic planning in the company. This led to discoveries in regions that were not thought to be attractive petroleum prospects by mature oil companies. The first major oil-find of ONGC in Ankleshwar located about 80 km south of Vadodara and nearly 160 km south of Khambhat was so productive that the then Prime Minister of India Jawaharlal Nehru called it a ‘fountain of prosperity’. With Ankleshwar, Gujarat became one of the earliest oil & gas producing states in the country. Many oil & gas discoveries followed and now Gujarat receives natural gas from six gas producing areas in Ahmedabad, Mehsana, Kadi, Kalol, Ankleshwar and Gandhar. Besides, it also receives offshore gas from Bassein field off the Mumbai coast and other satellite gas fields amounting to 40 percent of gas produced in India. The LNG (liquid natural gas) import capacity of 27.5 million tonnes per annum (MTPA) in Gujarat accounts for more than 52 percent of total LNG import capacity in India but in terms of actual imports LNG terminals in Gujarat account for over 95 percent of total gas imports into India.

Investment in Infrastructure

All countrywide major gas pipelines originate from the costal locations of Gujarat. Besides, gas companies have also developed smaller pipelines from gas producing fields to specific consumers in the area. Gujarat is the only state where the gas pipeline network is operated by more than one player, GAIL (India) Ltd, GSPL (Gujarat State Petronet Limited) and Gujarat Gas Limited (GGL). GAIL primarily serves consumers who have been allocated natural gas by the Ministry of Petroleum & Natural Gas (MOPNG) with several customers connected on HVJ (Hazira-Vijaipur-Jagdishpur) Pipeline, DVPL (Dahej-Vijaipur) and DUPL (Dahej-Uran-Panvel) pipelines. GSPL is the nodal pipeline agency in Gujarat with the mandate to set up a gas grid operating on common carriage basis. GSPL pipelines serves consumers in the Hazira, Vapi, Halol, Bharuch, Vadodara, Ahmedabad, Morbi, Rajkot, Jamnagar, Mehsana, Himmatnagar & Kutch regions. The pipeline obtains gas from the GSPC (Gujarat State Petroleum Corporation) owned onshore gas fields in Hazira. The network also obtains gas from Cairn at Mora from its Suvali gas complex, imported gas from Petronet and Hazira LNG terminals and domestic gas from fields such as the Panna-Mukta and Tapti (PMT) and ONGC Olpad fields. GSPL pipeline network is connected to the East West Pipeline that transports gas from KG D6 field in Andhra Pradesh to Gujarat at Attapardi (Vapi) and Bhadbhutt (Bharuch).

Consumer Friendly Pricing

One of the earliest consumers of natural gas produced in and around Gujarat was the Gujarat state electricity board, whose Dhuvaran Project used the gas for power generation. Though this was seen by experts as a gross misuse of the gas and waste of a valuable natural resource (as opposed to using the gas that was rich in higher hydrocarbons for fertiliser production in the Baroda fertiliser plant which was burning naphtha from the Koyali refinery) burning gas for electricity generation continued as it was thought to be a cost-effective substitute for coal which had to be transported across thousands of kilometres. It was the 1960s and gas was a relatively new form of energy which initiated a debate over how to price natural gas for consumers such as the Gujarat state electricity board. Speaking on behalf of the electricity board, the state fertiliser company and smaller private companies that were potential users of gas, the Gujarat government demanded a price of ₹0.02-0.03 per cubic meter (m

3) much lower than of ₹0.08-0.10/m

3 that ONGC wanted. The argument made by the government was that Gujarat had suffered on account of its great distance from coal mines and that it should be allowed to benefit from a new local source of energy. The price should, the government demanded, be fixed on a cost-plus basis. The government of Gujarat also cited the far lower price of ₹0.009/m

3 charged by OIL in Assam and challenged the substitution principle that pegged the gas price to the prices of naphtha and fuel oil. The government of Gujarat also noted that being associated gas (produced along with more valuable oil) the cost of gas production was negligible for ONGC. The dispute between ONGC & the government of Gujarat ended in arbitration and price of ₹0.05/m

3 awarded was closer to the price demanded by the Gujarat government on behalf of consumers. This price was questioned by economists who argued that ONGC must be run on a commercial basis and the development of Gujarat need not be subsidised by ONGC, a public corporation. In the absence of direct competition between fuels, the economists pointed out, the rational price of a fuel must bear some relation not only to the investment made on it but to the price of the next most easily available fuels (which were naphtha and fuel oil). But gas pricing settled at a level that favoured consumers at the expense of the producer, ONGC. Lack of competitive parity, in relation to other fuels and alternative end-uses, has for long distorted fuel policy in India. The error was compounded in natural gas and it continues till today. Domestic gas production (ONGC and other private sector producers) is penalised with regulated low price. But in the early years, low prices relative to substitutes such as coal and fuel oil boosted consumption of natural gas in Gujarat. It is very unlikely that competitive pricing of natural gas comparable to substitutes would have created a vibrant gas market in Gujarat.

Expansion of Distribution

Gujarat Gas Limited (GGL) was incorporated under the name of Gujarat Amico Chem Limited by promoters Mafatlal Fine Spinning & Manufacturing Company Limited and Gujarat Industrial Investment Corporation (GIIC) in the 1980s to distribute gas production by ONGC from fields in Gujarat. GGL was so optimistic about the prospects for gas distribution that it signed an agreement with a Qatar based subsidiary of Enron for importing and transporting LNG for a power plant. In the 1990s, British Gas acquired a stake in GGL which was divested in the 2010s. Today GGL is India's largest city gas distribution (CGD) player with presence spread across 22 districts in Gujarat and union territory of Dadra Nagar Haveli and Thane which includes Palghar district of Maharashtra. The company has India's largest customer base in major user segments. In 2015, GGL executed a gas purchase contract for re-gasified LNG with GSPC. In 2016, the PNGRB (petroleum and natural gas regulatory board) granted authorisation to the company to lay build operate or expand CGD networks for the geographical area of Amreli, Baruch, Dahod Panchmahal, Anand and Ahmedabad districts in Gujarat. As per the provisions of the PNGRB, GGL was granted 300 months of infrastructure exclusivity valid up to May 2041 and 60 months of marketing exclusivity valid up to 26 May 2021 for the CGD network. GGL’s projects are almost entirely based on its own know-how and technology and indigenously available plant and equipment. This has helped in minimising the project cost and thus reduced cost of distribution to a level lower than that of other existing and planned gas distribution projects.

Even when critical drivers such as security of supply, low prices relative to alternatives and investment in pipeline infrastructure were in place, the development of a gas market in Gujarat took nearly five decades. This was the case even in much larger and more transparent gas markets in the USA and Europe. In the case of India security of domestic supplies is uncertain. Though there is a liquid global market for LNG, there is uncertainty over price especially in comparison to alternatives such as domestic coal. Investment in infrastructure is progressing but there is much ground to cover. Overall replicating the success of Gujarat’s gas market across the country to increase the share of natural gas in India’s primary energy basket by 2030 will be difficult but not impossible.

Source: Roadmap to a Robust Gas based Economy in India, India Energy Forum, 2019

Source: Roadmap to a Robust Gas based Economy in India, India Energy Forum, 2019

Monthly News Commentary: Oil

LPG Subsidy Reduction affects Consumption

India

LPG

LPG (liquefied petroleum gas) cylinders consumption has improved amongst PMUY (Pradhan Mantri Ujjwala Yojana) customers despite the recent price rise in LPG prices, according to IOC (Indian Oil Corp). According to IOC a surge of 23.2 percent in LPG consumption was noted in the initial quarter of this fiscal, which was attributed to the three free LPG refills given to the PMUY beneficiaries. IOC noted that improvement in the overall LPG consumption has continued for the three-month period December 2020 to February 2021 and has registered a growth of 7.3 percent for all domestic LPG customers (PMUY+non-PMUY). LPG consumption amongst PMUY customers registered a growth of 19.5 percent, from 845,310 MT (million tonnes) in the comparable period in the last fiscal to 1,010,054 MT in the current fiscal for the said three-month period. Compared year-on-year, the overall domestic LPG sales have registered a handsome growth of 10.3 percent during the current fiscal (till February 2021). Driven by the vigorous thrust of the central government on making accessible the clean energy to all Indians, LPG has emerged as the preferred kitchen partner for almost every Indian. This is evident from the fact that the LPG penetration in India has improved from 55 percent in 2014 to more than 99 percent as of 10 March 2021. Moreover, to alleviate the problems faced by the marginalized during the Covid 19 Pandemic, PMUY beneficiaries were provided with three free LPG refills. A total of ₹96.7 bn was transferred to the bank accounts of the beneficiaries directly. Oil Minister Dharmendra Pradhan refuted reports that claimed that the central government has stopped providing subsidies on LPG cylinders.

The next leg of the Pradhan Mantri Ujjwala Yojana (PMUY) is going to focus on affordability of LPG or cooking gas refills. According to the oil ministry, this will be in line with the government's efforts to increase adoption of LPG through behavioural shifts among lower income households. There is a fresh target to add another 10 mn more PMUY beneficiaries to the existing 80 mn. This will take the total number of LPG consumers in the country closer to 300 mn by March 2022. According to the IOC, modalities for the release of 10 mn more PMUY connections were under finalization by the oil ministry. Currently on a per kg basis, the LPG in a 14.2 kg domestic cylinder costs around ₹60/kg. But it costs roughly ₹75/kg in a 5 kg FTL (free trade LPG) cylinder. The higher cost per kg dissuades consumers that are anyway price sensitive. These issues are soon expected to be addressed. PMUY beneficiaries buy LPG cylinders at full cost and oil companies recover the loaned amount from the subsidy that is accrued on domestic (14.2 kg) LPG cylinders. On an average, the PMUY beneficiaries use three cylinders in a year. This is less than half the usage of non-PMUY cooking gas connection users. The low number of cylinder refills makes it difficult for the oil companies to recover the loan amounts. To improve affordability of cylinders, the oil companies deferred recovery of loans for up to six-cylinder refills from March 2018. Under the present domestic LPG cylinder pricing regime, there is negligible subsidy on cooking gas but higher freight costs, for customers located away from depots, continue to be subsidised by the centre. This results in a subsidy of around ₹20 to ₹30/domestic cylinder that costs upwards of ₹800/cylinder in the country.

After raising cooking gas or LPG prices by ₹125/cylinder last month, state-owned oil firms announced a ₹10/cylinder cut in LPG rates on softening international oil prices. A 14.2-kg LPG cylinder -- both for subsidised and market price users -- will cost ₹809 from 1 April as against ₹819 currently. The price cut, which traditionally is announced on the day the change is effective -- four times the rates went up in a of one month -- was announced a day ahead of the second phase of voting in West Bengal. However, due to growing worries about rising COVID cases in Europe and Asia and concerns over the side effects of the vaccine, prices of crude oil and petroleum products in the international market softened in the second fortnight of March 2021. LPG prices had gone up by ₹125 per 14.2-kg cylinder since the beginning of February, price data from state-owned oil marketing companies showed. LPG is available only at one rate, market price, across the country. The government, however, gives a small subsidy to select customers. However, this subsidy has been eliminated in metros and major cities through successive price increases over the past couple of years. So, in places like Delhi, there is no subsidy paid to customers since May 2020 and all LPG users pay the market price, which has now been reduced to ₹809.

Only half of the urban slum households in the states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Rajasthan, and LPG Uttar Pradesh use exclusively, according to the Council on Energy, Environment and Water (CEEW) study. The company in its report marked that 86 percent of households in these six states have an LPG connection. These states also account for a quarter of India's slum population. Further, the report said that 16 percent of the households are still using firewood, dung cakes, agriculture residue, charcoal, and kerosene as their primary fuel and over a third are also stacking LPG with these polluting fuels. This also increases exposure to indoor air pollution for such households. The study, done by CEEW also found that 45 percent of households in these six states use LPG as their primary fuel in winter. Also, three-fourth of households using polluting fuels, cook inside the main house and two-thirds do not have a ventilation system. CEEW analysis suggests leveraging platforms like LPG Panchayats to increase awareness regarding the process of subsidy calculation and disbursement of households.

Retail Prices

Central taxes on petrol and diesel rose by over 307 percent in the last six years, allowing the Union government to mop up a sum of ₹2,940 bn through taxes on fuel between April 2020 and January 2021. Even when global crude prices went down, central excise duty maintained an upward trajectory touching 12.2 percent in 2020-21, up from 5.4 percent in 2014-15. Cumulatively, central taxes on petrol, diesel and natural gas as a percentage of the budget estimates of gross total revenue increased by nearly 126 percent since 2014-15. Global crude oil prices had touched a two-decade low during the pandemic. The amount of tax collected as a percentage of the gross tax revenue had increased over the years. Data given by the government showed that in the last six years, overall collections through central excise duty on petrol and diesel rose by a 307.3 percent with collections from petrol alone growing at 206 percent and diesel by 377 percent. In actual terms, excise duty on petrol has gone up from ₹9.48 per litre in 2014 to ₹32.90 a litre at present. For diesel, the increase is from ₹3.56 a litre to ₹31.80 during the same period.

OMCs (Oil Marketing Companies) have decided to pause price revision as they want to watch the crude price movement that has fallen to around $62.5/bbl (barrel) from remaining above this level. Across the country as well the petrol and diesel prices remained static but its retail levels varied depending on the level of local levies on respective states. In Mumbai, petrol continues to be priced at ₹96.98/l diesel at ₹87.96/I. Premium petrol, however, continues to remain over ₹100/l in the city as is the case with several cities across the country.

India strongly pitched for easing cuts in crude oil production saying high oil prices are hurting the consumption-led recovery of several countries including it. At the same time India has noted announcements by OPEC (Organization of the Petroleum Exporting Countries) and OPEC Plus to affect a slight easing of crude production cuts. The OPEC is an influential entity that plays a key role in policy formulations relating to crude production.

Karnataka is expected to oppose the proposal to bring petrol and diesel within the ambit of GST (Goods and Services Tax) arguing that such a move will lead to substantial revenue loss for states. It will share its opinion at the forthcoming GST Council meeting. The council comprises representatives of all states and decides on policy and indirect tax rates. Currently, both state and central governments impose taxes on fuel. High retail prices have prompted discussions about whether including petrol and diesel in the GST structure can make them more affordable. The highest GST rate is 28 percent, much lower than the applicable rates of state and central taxes on fuel. States are concerned that the switch to GST will take away their power to levy tax on fuel. Currently, petrol and diesel cost consumers ₹94.2/l and ₹86.3/l, respectively. If a 28 percent GST rate is applied, the retail price of petrol may come down to ₹47.2/l and diesel to ₹48.3/l. But this will mean huge revenue loss for the Centre and states.

The Goa government may reduce the state's share of VAT imposed on fuel prices amid a sustained spike in prices of petrol and diesel over the last few months. The price of diesel and petrol in Goa is approximately ₹85.68/l and ₹88.27/l respectively.

Refining

India’s crude oil processing fell to its lowest in four months in February, retreating from a near one-year high hit in the prior month hurt by higher crude prices and weaker fuel demand in the country. On a monthly basis throughput fell 5.6 percent. There is a variation in percentage change as February 2020 had 29 days. Fuel consumption in the country also fell to a five-month low in February as higher retail prices dented demand. Indian state refiners have been planning to cut oil imports from Saudi Arabia by about a quarter in May due to rising oil prices. Indian refiners operated at an average rate of 97.13 percent of capacity in February, down from 110.7 percent in the same month last year and from January’s 102.8 percent, the government data showed. The country’s largest refiner, IOC operated its directly owned plants at 100.8 percent capacity. RIL operated its plants at 93.2 percent capacity in February. On an annual basis, crude oil production was unchanged at 610,000 barrels per day (2.32 million tonnes), while natural gas output fell 1.4 percent to 2.31 BCM.

A fall in crude oil price and Aramco’s $75 bn annual dividend commitment may have delayed Saudi company picking a stake in RIL's oil-to-chemical unit (O2C). The deal was to conclude by March 2020 but has been delayed for reasons not disclosed by either company. Besides refineries and petrochemical plants, the O2C business also comprises a 51 percent stake in the fuel retailing business. It, however, does not include the upstream oil and gas producing assets such as the flagging KG-D6 block in the Bay of Bengal.

Imports

Indian state refiners are expected to buy 36 percent less oil from Saudi Arabia in May than normal, in a sign of escalating tensions with Riyadh even after the Kingdom supported the idea of boosting output from OPEC and allied producers. Energy relations between India, the world’s third-biggest oil importer and consumer, and Saudi Arabia have soured as global oil prices spiked. New Delhi blames cuts by the Saudis and other oil producers for driving up crude prices as its economy tries to recover from the pandemic. State-run refiners have placed orders to buy 9.5 mn barrels of Saudi oil in May, compared with the previously planned 10.8 mn barrels. The refiners – IOC, BPCL, HPCL & MRPL - normally buy 14.8 mn barrels of Saudi oil a month. India suggested that refiners look for energy alternatives to Gulf oil, its main source of crude.

IOC has made its first purchase of Norway's Johan Sverdrup crude, buying 4 mn barrels via a tender as it speeds up diversification of crude imports. IOC will take delivery of 2 mn barrels of the North Sea crude in each of May and June. Further details on the trades were not yet clear. India last discharged a 1 mn barrel cargo of Johan Sverdrup crude in September 2020, the data show. Indian refiners, meanwhile, are looking at crude from the United States, West Africa, South America and the Mediterranean as alternative options as they diversify away from Middle Eastern oil.

MRPL has bought its first ever cargo of Brazilian Tupi crude oil in a tender. The 1 mn barrel cargo was sold by Royal Dutch Shell for May delivery.

Demand

Indian state retailers' gasoline and gasoil sales in March rose by 27.4 percent and 28.6 percent, respectively, from the low base of last year, when a nationwide lockdown to stem the spread of the coronavirus hit consumption. State companies IOC, BPCL & HPCL own about 90 percent of India's retail fuel outlets. The three companies sold 2.47 MT of gasoline and 6.41 MT of gasoil.

Indian state fuel retailers’ diesel sales rose 7.4 percent to 2.84 MT in the first fortnight of March from a year earlier. Petrol sales rose 5.3 percent to 1.05 MT in the same period from a year earlier. This is the first annual rise in gasoil sales in the country since October. Fuel sales in India took a hit in March last year as the government imposed a nationwide lockdown to curb the spread of the novel coronavirus. India’s economy returned to growth in the three months to December and the recovery is expected to gather pace as consumers and investors shake off the effects of the COVID-19 pandemic. The rise in gasoil sales, which account for about two-fifths of the country’s overall fuel demand, comes despite record-high local retail prices and points to rising industrial production in the country. State retailers sold 3.3 percent less cooking gas in the first half of March than a year ago to 1.01 mt as a significant reduction in subsidies curtailed demand for the fuel.

India's diesel consumption increased 7 percent from a year ago in the first fortnight of March but demand for LPG, household cooking gas supplied in cylinders, dropped more than 3 percent to coincide with a steep rise in refill prices and removal of subsidy. Data from state-run fuel retailers, who dominate 90 percent of the market, show petrol sales rising over 5 percent from a year ago, boosted by car sales snapping the pandemic blues in February and people going back to using their personal vehicles on resurgence of COVID-19 cases in several states. This is the first yearly growth in diesel sales since October 2020, reinforcing the view that the economy is on its way to recovery as its consumption is one of the key indicators of economic activity. In February, diesel demand had slid 8 percent and petrol consumption declined 2 percent in February from a year ago. In December, sales had for the first time since October recorded a monthly decline at 6 percent. Jet fuel sales were down more than 36 percent from a year ago in March fortnight. However, this can be seen as a sign of recovery since February when consumption was more than 40 percent lower than the pre-pandemic level.

BPCL announced it has started doorstep delivery of diesel for industrial and bulk consumers in Faridabad and adjoining areas in Haryana. The service uses mobile application Humsafar. BPCL has started delivery of the fuel from Auto Grit, a BPCL fuel pump on Delhi-Badarpur border. The service can be used by housing societies, malls, hospitals, banks, large transporters and construction sites, mobile towers and industries. Customers can book diesel through the Fuelkart or Humsafar app and have it delivered to a given location. The fuel-delivery vehicle comes fitted with a mobile dispenser and fuel tank. The company plans to add six diesel-at-doorstep units by end 2021. The service was launched by Midha and Goel. It will cover multiple areas including Tigaon, Ballabgarh, Prithla, Faridabad NIT and Badhkal.

Production

The Delhi High Court (HC) set aside a single judge order directing the Centre to extend till 2030 its production sharing contract (PSC) with Vedanta Ltd and ONGC to produce oil from the Barmer oil field in Rajasthan. The central government had claimed that the PSC with Vedanta will fall under the new policy for such contracts. The contention was opposed by the company. The single judge had held that Vedanta was entitled to extension of its contract, which was to expire in 2020, for a further period of 10 years on the same terms and agreements when it was first entered into in 1995. While the government's appeal was pending, the PSC was being extended from time to time for brief periods since May 2020. The 31 May 2018 order had come on Vedanta's plea for extension of the PSC which the company and the ONGC have with the government to extract oil from the Barmer block in Rajasthan. ONGC had communicated its approval for extension of the PSC in July 2016, after which the Centre had assured the court it would positively take a decision by October of the same year.

Rest of the World

World

Oil prices rose early as a drop in the US dollar made crude a more attractive buy, paring losses of more than 4 percent incurred overnight on the prospect of producers returning more than 2 mbpd (million barrels per day) of supply to the market by July. US WTI crude futures rose 80 cents, or 1.4 percent, to $59.45/bbl after sliding 4.6 percent. Saudi Arabia is also set to phase out its extra voluntary cut of 1 mn bpd over those three months. At the same time OPEC member Iran, exempt from making voluntary cuts, is boosting supply. The push by OPEC+ to add supply came despite concerns about a rise in COVID-19 cases.

Oil prices fell 1 percent on concerns that new pandemic curbs and slow vaccine rollouts in Europe will slow a recovery in fuel demand and as producers cut prices, indicating ample oil supply. US WTI crude futures for May delivery fell 62 cents, or 1 percent, to $60.94 a barrel at 0149 GMT. The April contract expired at $61.55, up 13 cents, after plunging more than 6 percent. Germany, Europe’s biggest oil consumer, is expected to extend restrictions on shopping and travel to contain a third wave of COVID-19 infections, which has led economists to cut their growth forecasts. The Paris-based IEA cut its forecast for crude demand in 2021 by 2.5 mbpd while the US EIA forecast global oil supply would surpass demand in the second half of 2021. Nigeria, Africa’s biggest oil producer, cut its official selling prices for April-loading cargoes, suggesting that suppliers are trying to encourage sales. Angola, the continent’s second-biggest producer and a key supplier to China, still has some April cargoes that remain unsold, indicating a lack of interest from Chinese refiners.

Goldman Sachs sees the oil price pullback as a buying opportunity and forecasts Brent crude reaching $80/bbl this summer even as the recent rally in prices “takes a big breather.” Despite the sharp drop in prices, Goldman expects rapid oil market rebalancing in the coming months.

According to Goldman Sachs, potential recovery in Iran oil exports won't come as an "exogenous" shock to the oil market and full recovery won't occur until summer 2022, as US and Iranian officials were due to begin indirect talks in Vienna on the Iran nuclear deal. The US expects the talks with Iran, about both sides resuming compliance with the 2015 Iran nuclear deal, to be "difficult" and does not foresee any early breakthrough. A normalization in Iranian exports before the end of 2021 would reduce Goldman's year-end 2021 and 2022 Brent forecast of $75 per barrel by $5, while the lack of an agreement in 2022 would create more than $10 upside risk. Oil prices rose as investors looked for bargains after prices plunged more than 4 percent on rising output from OPEC+, and as strong economic data from the US and China brightened recovery prospects. The OPEC, Russia and their allies, a group known as OPEC+, agreed to gradually ease its oil output cuts from May. Goldman expects a significant rebound in oil demand this summer even after expecting an additional 2 mn barrels per day increase in OPEC+ production after July.

OPEC+

Saudi Arabia is prepared to support extending oil cuts by OPEC and allies into May and June and is also ready to extend its own voluntary cuts to boost oil prices amid a new wave of coronavirus lockdowns. With oil prices making steady gains earlier this year, OPEC and allies, known as OPEC+, had hoped to ease output cuts. The cuts involve OPEC led by Saudi Arabia as well as non-OPEC producers led by Russia. Together their cuts currently stand at just over 7 mbd plus an additional 1 mbpd voluntary reduction by Saudi Arabia. Last year, cuts touched a record 9.7 mbpd, or about 10 percent of world output. OPEC+ had already surprised the market on 4 March by deciding to hold output broadly steady. Russia and Kazakhstan were allowed to slightly raise production. Industry benchmark Brent crude futures, which this month reached their highest since before the pandemic at $71 a barrel, have since fallen to about $65. Another reason for caution is rising Iranian oil exports, which have also weighed on prices. Iran has managed to boost shipments in recent months despite US sanctions.

Saudi Arabia took a cautious view of any increase in oil production as members of the OPEC cartel met with allied non-member countries to decide production levels. The approach taken at the alliance's gathering to leave production levels largely unchanged had been correct, given the ongoing uncertainty about the course of the COVID-19 pandemic. The OPEC meeting with non-members - dubbed OPEC Plus - has decided to meet monthly to review the production cuts of just over 7 mbpd imposed to restrain the decline in oil prices due to the pandemic recession, which has cut the demand for fuel. On top of that, Saudi Arabia has been keeping 1 mbpd off the market as part of voluntary cuts on its own.

USA

US senators have introduced a bipartisan bill aimed at boosting taxpayer returns from federal oil and gas leasing, the latest in a string of moves in Washington seeking to reform drilling on public lands. The Biden administration will launch a review of federal oil and gas leasing to address widespread criticism that the program is not yielding adequate public revenue as well as contributing to climate change. While the bill proposed would not deliver on President Joe Biden’s campaign promise to stop issuing new leases to fight global warming, it could be applied to existing leaseholders if passed into law. Oil and gas production on public lands accounts for nearly a quarter of all US greenhouse gas emissions.

US Sanctions

Venezuelan farmers have asked the government to allow them to import diesel themselves to alleviate shortages of the fuel that are hindering food production and distribution. Diesel has become scarce in the crisis-stricken OPEC nation amid very low output at state oil company Petroleos de Venezuela’s 1.3 mbpd efining network, and escalating US sanctions barring foreign oil companies from swapping fuel for Venezuelan crude. Venezuela’s hydrocarbons law reserves the right to international trade in crude and refined products to the state and state-owned companies. But groups representing ranchers and milk producers were seeking temporary authorization due to the current crisis.

Asia Pacific

The rise of China’s mega-refineries was always going to make life tougher for their competitors across Asia. But the fallout from COVID-19 is hastening the impact and accelerating consolidation across the region. A frenzy of refinery building in China is set to make the nation the world’s largest crude processor this year. At the same time, a drive to de-carbonize Asia’s biggest economy means demand for fuels like diesel and gasoline will decline, potentially leading to more exports from the new facilities. China’s refining capacity has nearly tripled since the turn of the millennium and the IEA forecasts it will overtake the US this year. Crude processing will climb to 1 bn tonnes a year, or 20 mbpd by 2025 from 17.5 mn barrels at the end of 2020, according to China National Petroleum Corp’s Economics & Technology Research Institute.

Crude oil producers from Europe, Africa and the United States faced difficulties selling to Asia, especially China, as buyers took cheaper oil from storage while refinery maintenance has reduced demand. Chinese independent refiners, which account for a fifth of the country’s imports, have slowed imports in the second quarter because of refinery maintenance, strong Brent prices and a large influx of supplies, including Iranian oil, in first quarter. These buyers and others in Asia are lapping up cheap oil offered by traders under pressure to clear storage after Brent crude flipped into backwardation, with prices for prompt delivery higher than those for future months. As a result traders were forced to sharply reduce prices for spot cargoes loading in April and May from Europe, Africa and the United States for delivery to Asia. Lockdowns in Europe have also reduced demand.

The oil and gas industry in Australia launched an effort to work on ways to cut the costs of dismantling offshore oil and gas facilities at the end of their lives, a task estimated at A$50 bn ($38 bn). Backed by BHP Group, Chevron Corp, Exxon Mobil Corp’s Esso Australia, Santos Ltd and Woodside Petroleum and others, the Centre of Decommissioning Australia (CODA) aims to help the industry build local expertise, come up with dismantling plans, and cut costs. More than half of that work needs to begin within the next 10 years, according to a study done for NERA (National Energy Resources Australia).

EU & UK

Swiss-based trader Proton Energy Group SA, Rosneft's exclusive supplier of diesel and LPG to Ukraine, will suspend shipments to Ukrainian buyers from April. Proton Energy Group SA decided to terminate cooperation and stop supplying petroleum products to the Ukrainian market from 1 April 2021. Pipeline and rail exports of diesel oil of Rosneft origin to Ukraine totalled some 1.75 MT in 2020, according to traders' estimations. LPG exports from Rosneft's plants to Ukraine reached 496,900 tonnes in 2020, while supplies in January-February 2021 totalled 78,900 tonnes.

News Highlights: 7 – 13 April 2021

National: Oil

Oil Marketing Companies to explore fuel price revision post elections

13 April: Fuel prices in the country remained unchanged with Oil Marketing Companies (OMCs) continuing on the pause mode and keeping petrol and diesel prices static for a fortnight now. Accordingly, pump prices of petrol and diesel remained at the previous day's level of ₹90.56 and ₹80.87 a litre respectively in the national capital. However, the two petroleum products may see revision again post conclusion of ongoing state elections. With crude remaining below $65 a barrel, any softening on global oil in wake of fresh wave of the pandemic and rising oil stocks in US (United States) could actually mean lower petrol and diesel prices for consumers in India. Before the long drawn pause, petrol and diesel fell by 22 paisa and 23 paisa per litre respectively on 30 March. The OMCs have decided to pause price revision since then as they want to watch the crude price movement that has now fallen to around $63.5 a barrel. Across the country as well the petrol and diesel prices remain static but its retail levels varied depending on the level of local levies on respective states. In Mumbai, petrol continues to be priced at ₹96.98 a litre and diesel at ₹87.96 a litre. Premium petrol, however, continues to remain over Rs 100 a litre in the city as is the case with several cities across the country.

Source: The Economic Times

BPCL partners Accenture to transform its sales, distribution network

13 April: Bharat Petroleum Corp Ltd (BPCL) has partnered with Accenture Plc to transform its sales and distribution network digitally. The IT consulting firm will use its capabilities in data, artificial intelligence (AI) and cloud technologies to build, design and implement a digital platform, called IRIS. This platform will integrate real-time data from across BPCL’s countrywide network, including more than 18,000 fuel retail outlets, 25,000 tank trucks, 75 oil installations and depots, 52 liquefied petroleum gas (LPG) bottling plants and 250 additional industrial and commercial locations, to provide a consolidated view of its extensive operations. Driven by analytics based on AI and machine learning technologies, the IRIS platform will subsequently trigger automated alerts and actions, including rapid response to equipment failures or hazardous situations. It will also empower the BPCL workforce of more than 100,000 employees across India to make faster and more accurate decisions, including preventative maintenance. This can help increase sales at fuel retail outlets by minimising infrastructure downtime and ensuring consistent fuel quality, as well as improve the experience for customers. Accenture said that it would help BPCL optimise its operational performance and efficiency, enhance security and safety and deliver a superior experience for its retail and commercial customers across the country. BPCL’s field workforce and partner network will have a seamless experience thanks to support from a portal, mobile app and call centers in Noida and Chennai. The digital sales and distribution platform will use BPCL’s cloud infrastructure, making it more agile and scalable, Accenture said.

Source: The Economic Times

Petrol usage jumps in March as Indian commuters prefer cars

12 April: Gasoline demand in India rose to a four-month high in March as millions of people favored cars over public transport, with one of the world’s most populous nations seeing a resurgence in virus cases. Motor fuel demand rose to 88,380 tons per day last month, the highest level since November last year. Gasoline sales surged 27 percent from March last year, when local demand collapsed due to the roll-out of strict lockdowns to stem the spread of COVID-19. India’s daily overall consumption of oil products fell in March from February, as demand for diesel, the most popular fuel, declined. While the pandemic has provided a shot in the arm for gasoline use -- more people are opting for private transport over buses and trains -- the roll-out of lockdowns as India suffers a second wave of coronavirus infections may hamper the oil demand recovery.

Source: The Economic Times

India becomes largest buyer of US crude in first quarter of 2021

12 April: India has emerged as the top buyer of US (United States) crude in the first quarter of calendar year 2021 from second-biggest buyer last year as the world’s third largest oil consumer looks at alternate sources of crude amidst a spat with Saudi Arabia, the world’s largest producer, to lift output curbs, and rein in prices. Indian refiners were the second largest buyer of US crude in calendar year 2020 snapping up 287,000 barrels per day which was 26 percent more than 2019, accounting for just below a tenth of the total US crude exports in 2020, according to industry data and state-run oil firms. As Saudi Arabia staved off India’s request to boost production to cool prices, Indian refiners replaced some of the Saudi volumes with US cargoes at the behest of the government, an executive with one of the state-run oil refiners said. India imports 85 percent of its oil needs and Oil Minister Dharmendra Pradhan had in recent days urged OPEC (Organization of the Petroleum Exporting Countries) and its allies, known as OPEC+, to pump more crude to check galloping prices that was hurting India’s economic recovery. As part of its crude sourcing diversification strategy, Indian refiners have recently bought crude from new producers such as Guyana. Iraq is India’s top supplier of crude. Middle East has been the favourite crude sourcing destination for Indian refiners because of close proximity and lower freight rates. In comparison, the voyage distance is more than eight times longer from the US Gulf to India than from the Middle East, translating into longer transit times and higher freight costs.

Source: The Hindu Business Line

COVID disruptions push down fuel demand in decades

12 April: The COVID-19 pandemic is now bringing out the real impact it had on demand compression and economic activity in various sectors. Fuel consumption, an important barometer of the health of an economy, had shown contraction for the first time in two decades falling by a big margin of over 9 percent in FY21 as pandemic related lockdowns curbed economic activity and reduced the movement of goods and services across the country. According to oil ministry’s Petroleum Planning and Analysis Cell (PPAC), country’s total consumption off petroleum products fuel two 195 million tonnes (mt) in 2020-21 as against 214 mt in previous financial year.

Source: The Economic Times

Punjab government approves proposal to set up 12 retail outlets of IOC on jail land

9 April: Chief Minister (CM) Amarinder Singh accorded approval to a proposal by the Punjab Prisons Development Board (PPDB) to set up 12 retail outlets of Indian Oil Corp (IOC) on land owned by the prisons department. Chairing the first meeting of the newly-constituted PPDB, the CM said that this project, besides giving employment to 400 released prisoners, would generate an expected revenue of ₹40 lakh per month.

Source: The Economic Times

RBI Governor calls for coordinated action to give tax relief on petroleum products

7 April: Reserve Bank of India (RBI) Governor Shaktikanta Das put onus on both Centre and the States to ensure that through coordinated policy measures the cost build up in the petroleum products does not escalate further. While seeking a cut in excise and VAT (Value Added Tax) levies, the RBI Governor said that such a measure could provide relief on top of the recent easing of international crude prices and help lessen pressure on inflation. Petrol and diesel prices in the country have reached historic high levels. Apart from global movement in crude prices, high indirect taxes on the two products have contributed to its retail prices getting elevated. Though softening of crude prices from a high of over $70 a barrel early last month to about $63 a barrel now has provided some relief. A modest cut in petrol and diesel prices could provide consumers more relief and protection against price volatilities. He said that though headline inflation at 5.0 percent in February 2021 remains within the tolerance band, some underlying constituents are testing the upper tolerance level. In this, he cited that some respite from taxes on petroleum products could be helpful.

Source: The Economic Times

National: Gas

India’s 1st floating LNG storage & regasification unit arrives in Maharashtra

13 April: India’s first Floating Storage and Regasification Unit (FSRU) has arrived at H-Energy’s Jaigarh Terminal in Maharashtra. H-Energy said the FSRU 'Hoegh Giant', which sailed from Keppel Shipyard, Singapore, was berthed at Jaigarh terminal in Maharashtra. The LNG (liquefied natural gas) regasification terminal will be ready to start testing and commissioning activities soon.

Source: The Economic Times

ONGC seeks buyers for KG gas, wants minimum $6.6 price

12 April: Oil and Natural Gas Corp (ONGC) invited bids for the sale of initial 2 million metric standard cubic meter per day (mmscmd) of gas from its KG basin fields at a minimum price of $6.6 per million metric British thermal units (mmBtu). According to the tender document, ONGC intends to start natural gas sale from its KG-DWN-98/2 block, which sits next to Reliance Industries Ltd (RIL)-BP Plc operated KG-D6 fields, from June-end. Initially, 2 mmscmd of gas has been offered for sale through an e-auction. ONGC has sought bids indexed to Brent crude oil. Bids have been sought at a minimum of 10.5 percent of the three-month average Brent crude oil price. At the current Brent crude oil price of $63, the minimum price comes to $6.6 per mmBtu. This price, however, will be subject to the ceiling or cap fixed by the government for deepsea fields every six months. The cap for six months beginning 1 April is $3.62 per mmBtu.

Source: The Economic Times

Small-scale LNG price competitive with diesel, LPG in India

7 April: Small-scale liquefied natural gas (LNG) could be delivered at prices competitive with diesel and Liquefied Petroleum Gas (LPG) used in the industry, according to Council on Energy, Environment and Water (CEEW) study. Small-scale LNG systems transport the gas from LNG import terminals in containers and re-gasify the fuel at consumer sites, instead of relying on transmission pipelines. The study said that in locations currently served by city gas distributors, who get infrastructure exclusivity and charge high prices, LNG can offer a cheaper alternative. It said that the distributors can enable new CGD (city gas distribution) networks in locations without existing gas transmission pipelines thereby accelerating the government’s mission to connect 100 new cities to natural gas. The study recommends measures for the promotion of small scale LNG use and the expansion of natural gas access in India including standards for intermodal containerised transport of LNG, special railway tariffs for LNG transport, provisions in the Sagarmala initiative for the use of small scale LNG as a fuel in waterway transport, and reduced VAT (Value Added Tax) on natural gas consumption for small consumers.

Source: The Economic Times

National: Coal

Coal-fired power plant development to remain growth driver in India: Fitch

13 April: Coal-fired power plants will be the primary driver of infrastructure investment in India's power sector over the next decade, Fitch Solutions said. The country hosts 40 coal-fired power plant projects currently under construction involving a combined investment of $40.2 bn and accounting for 61 GW of capacity. Additionally, the country is home to 73 coal-fired power plant projects currently in planning involving over $80 bn in investment and adding up to 124 GW of capacity. Coal-fired power development in India will also benefit from a supportive policy environment with the government having advanced a number of policies in recent years to support the continued development of thermal capacity and coal-fired power plants in particular in the market. Among these moves, Fitch highlighted Prime Minister Narendra Modi's 2020 proposal to waive carbon taxes on coal in a bid to alleviate debt levels in the coal sector.

Source: The Economic Times

Coal India firms up ₹400 bn domestic coal evacuation plan

10 April: In a bid to give a fillip to the Centre’s Aatmanirbhar Bharat programme, Coal India Ltd (CIL) has drafted plans to ramp up domestic coal evacuation facilities at a cost of ₹400 bn. The miner will execute 35 projects to improve first-mile connectivity and coal handling plants as well as create more rail lines and sidings. Coal handling capacity of these 35 projects is estimated to be close to 405 million tonnes per annum (mtpa) by FY24. Each of the mining projects would have production capacity of 4 mtpa and above. In June last year, the finance minister — under the Aatmanirbhar Bharat Abhiyan package of ₹20 tn — allocated ₹500 bn for creating coal evacuation infrastructure. It included ₹180 bn for mechanised coal transport. The move was in line with the Centre’s efforts to bring down coal imports. Under phase-I of the first-mile connectivity or transport of coal from mine’s end to dispatch points, CIL will increase rail connectivity projects to 24. They are 11 currently. These points would also have coal handling plants at mines with rapid loading systems. In the second phase, CIL will set up 14 more first-mile connectivity projects. Mahanadi Coalfields, one of the subsidiaries of CIL, inaugurated its 10

th railway siding at Talcher Coalfields in Odisha. The company said it will enhance the deptach capacity of the mine to 4 mtpa. CIL is currently increasing the capacity of two key rail lines — Jharsuguda-Sardega in Odisha and Tori-Shivpur in Jharkhand. Along with this, it is also planning to construct the Shivpur-Kathautia rail link through a joint venture for transporting coal through the Kathautia-Koderma circuit in Jharkhand.

Source: Business Standard

Coal’s share in India’s power mix hits highest in over two years

8 April: Coal’s share in India’s electricity generation rose to the highest level in at least nine quarters during the first three months of 2021, government data showed, reversing a trend of renewable energy gaining at coal’s expense. The share of coal and lignite rose to 78.9 percent during the quarter ending 31 March, compared with 75.9 percent in the same period last year, the federal grid regulator POSOCO data showed. Coal’s contribution to India’s annual electricity generation fell for the second straight year in 2020, the data shows, marking a departure from decades of growth in coal-fired power. Recovery in coal-fired generation coincided with India’s overall electricity demand returning to growth: the country’s power demand and share of coal-fired power rose for seven straight months starting September, data showed. India’s annual electricity demand fell for the first time in at least 35 years in the fiscal year to March, with electricity consumption declining for six straight months ending August.

Source: Reuters

National: Power

Andhra Pradesh to emerge as number one in quality power supply: Energy Minister

13 April: The energy department has set a target to make Andhra Pradesh the number one state in the country in providing 24x7 quality power to its consumers by Ugadi 2022. Energy Minister Balineni Srinivas Reddy has asked power utilities to focus on strengthening safe, reliable and cheap electricity supply to consumers in future as well as in becoming the most consumer-centric utilities in the country. The government has agreed to bear a burden of ₹90.91 bn for 2021-22 as subsidy for providing free power to agriculture consumers and some other weaker sections and subsidy for domestic consumers as well.

Source: The Economic Times

Power tariffs rise for consumers in Ahmedabad, Gandhinagar

13 April: TPL (Torrent Power Ltd)’s consumers having electricity consumption of more than 50 units in Ahmedabad and Gandhinagar will have to pay more for the electricity they consume during 2021-22. There will, however, be no increase in tariff for consumers of the state-run Uttar Gujarat Vij Company Ltd (UGVCL). Gujarat Electricity Regulatory Commission (GERC) has approved raising of the energy charges for TPL’s residential consumers having monthly consumption between 51 to 200 units per month by 5 paise per unit. The revised tariffs are applicable to TPL’s Ahmedabad and Gandhinagar supply area. GERC, however, has kept the power tariffs unchanged for below poverty line (BPL) consumers and small residential consumers in Ahmedabad and Gandhinagar who consume power upto 50 units per month. About 18 percent of TPL’s total consumers are covered under this category.

Source: The Economic Times

Government to frame new electricity policy

12 April: The power ministry has set up an expert panel to prepare the Draft National Electricity Policy 2021. The Central government, from time to time, in consultation with states, reviews and revises the National Electricity Policy and Tariff Policy under the Electricity Act, 2003. The government had notified the National Electricity Policy in February 2005. The Working Group on Power for the 12

th Plan had made recommendation for amendment in National Electricity Policy in addition to Electricity Act 2003 and Tariff Policy.

Source: The Economic Times

Pandemic causes India’s first drop in annual power demand in 15 years

10 April: India’s annual electricity demand contracted for the first time in at least 15 years, as one of the world’s strictest lockdowns slashed power consumption during the early months of the year ended March. Demand from state distribution utilities dropped 1.1 percent, marking the first such decline in records going back to 2006, data from the Central Electricity Authority show. Peak demand during the year rose to 190.2 GW, about half of the country’s installed capacity, from almost 184 gigawatts in the prior year. Consumption fell as businesses, offices and factories were shuttered after a nationwide lockdown was imposed in March last year. Still, power demand has rebounded as India became one of the few major economies to post growth in the last quarter of 2020, helped by a boost in government spending and the reopening of the economy. Strong demand is key for India to draw investors to its power industry as it seeks fresh capital for its clean-energy transition.

Source: The Economic Times

Electricity sub-station commissioned in Bihar’s Purnea

9 April: The North Bihar Power Distribution Corp Ltd (NBPDCL) in association with the Power Finance Corp (PFC) inaugurated a 2x10 MVA GIS sub-station in Purnea district. The GIS sub-station will benefit approximately 3.26 lakh people of Purnea and the surrounding areas. It will further reduce the land requirement, lower the operational and maintenance cost and provide safe working environment for the attending personnel.

Source: The Economic Times

Tata Power DDL introduces Narrow-Band IoT technology in smart meters

8 April: Tata Power Delhi Distribution Ltd (DDL) announced it has introduced Narrow Band-Internet of Things (NB-IoT) technology in its smart meters. The private power distributor has so far installed 230,000 smart meters on the Radio Frequency (RF) technology. The company said the "first-of-its-kind" technology integration has been done involving meter manufacturers and NB-IoT service of Reliance-Jio Network. The new technology is also expected to enable more number of remote meter readings, thereby ensuring the safety of consumers during pandemic times.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Adani Green Energy’s arm commissions 50 MW solar plant in Chitrakoot

13 April: Adani Green Energy Ltd said its subsidiary, Adani Solar Energy Chitrakoot One Ltd (ASECOL), has commissioned a 50 MW solar power plant in Chitrakoot, Uttar Pradesh. In a regulatory filing Adani Green Energy Ltd (AGEL) said the plant has a 25 years power purchase agreement with the Uttar Pradesh Power Corp Ltd (UPPCL) at ₹3.07/kWh (kilowatt hour). This commissioning takes AGEL’s total operational renewable capacity to 3,520 MW, a step closer to its vision of 25 GW capacity by 2025. With the successful commissioning of this plant, AGEL has an operational solar generation capacity of over 3 GW. AGEL has a total renewable capacity of 15,240 MW including 11,720 MW that have been awarded and are at different stages of implementation. With this 50 MW, AGEL marks the beginning of this year’s commissioning plan with full commitment from its team, amidst continuing challenges of the COVID-19 outbreak.

Source: The Economic Times

Delhi government to organise conference on reducing air pollution: Environment Minister

12 April: Delhi Environment Minister Gopal Rai announced the city government will hold a digital round-table conference on April 12-13 to address the issue of air pollution in the national capital. He said that theme of the conference will be "Measures to be taken to reduce air pollution in Delhi before winter 2021". He said that the Delhi government has set the target to reduce the city’s pollution level by a third over the next five years.

Source: The Economic Times

Huge core catcher installed at Kudankulam nuclear power unit 4

10 April: The fourth 1,000 MW atomic power plant coming up in Tamil Nadu's Tirunelveli districtattained a milestone with the installation of core catcher or core melt localisation device, Russian company Rosatom said. Russia’s integrated nuclear power player Rosatom said the core melt localisation device, or core catcher, has been installed in the design position under the reactor pit of power unit 4 of Kudankulam Nuclear Power Project (KNPP) which under construction. The reactor is of VVER-1000 design, similar to the two 1,000 MW units that have started commercial power generation long back. The core catcher weighing over 160 tons is a unique equipment that is supposed to contain the molten core material (corium) in case of a nuclear reactor meltdown. India’s atomic power company, the Nuclear Power Corp of India Ltd (NPCIL) is building four more plants - Units 3, 4, 5 and 6 - of 1,000 MW each at Kudankulam.

Source: The Economic Times

Maharashtra government plans Pumped Hydro Storage plants to support renewables

10 April: In what is described to be a gamechanger in stabilizing the power grid, the state government has set its focus on Pumped Hydro Storage (PHS) plants. Since supplies from solar and wind power plants are unpredictable and not completely reliable, it would result in fluctuations in the grid’s stability. In order to overcome these disadvantages, the grid needs a reliable fall back arrangement to compensate for variability of wind and solar power and to store excess or unusable energy from renewable sources, and therefore allow for better integration of these types of renewable energy into the grid. The state government has decided to promote PHS power projects at all feasible locations both on river and off-river to generate power to balance the variable renewable energy power and to meet the peak energy demand. Energy Minister Balineni Srinivasa Reddy said that the state government has decided to promote renewable energy projects on multiple grounds--meeting growing energy demand, attracting investments, providing 24x7 power supply and maintaining grid balance. He said that RE power projects would help increase tax revenue by attracting huge private investment.

Source: The Economic Times

Partial relief on cards for rooftop solar power projects in Rajasthan

10 April: In a partial relief to the rooftop solar industry, the Union power ministry proposed to allow net metering benefits to projects having loads up to 500 kilowatt (kW). In the December Electricity (Rights of Consumers) Rules, 2020, it had restricted the net metering benefits to projects with load of 10 kW which invited an avalanche of representations from the industry for a review. Following the ministry guidelines issued earlier, Rajasthan Electricity Regulatory Commission (RERC) had also capped the net metering to projects upto 10 kW which triggered widespread protests by the industry.

Source: The Economic Times

ReNew Power commissions 110 MW solar capacity in Rajasthan

8 April: ReNew Power said it has commissioned a 110 MW solar generation facility in Rajasthan. As part of the project, ReNew has signed a power purchase agreement with Solar Energy Corporation of India at a tariff of ₹2.49/kWh (kilowatt hour) and will provide clean energy to the state. The solar project in Jaisalmer district is a part of an eventual 2300 MW of solar capacity that ReNew is bringing in Rajasthan, the company said. The balance of the 2300 MW capacity will generate electricity to be fed into the national grid, helping India achieve the target of 450 gigawatts of clean energy by 2030. With this commissioning, ReNew’s total solar capacity in Rajasthan stands at 500 MW.

Source: The Economic Times

Ladakh begins carbon neutral drive with 50 MW solar storage plant

7 April: Ladakh begins its quest for carbon-neutral status with a first-of-its-kind battery storage-based solar project of 50 MW capacity to make Leh, the union territory’s nerve centre, self-sufficient in power. SECI (Solar Energy Corp of India), the central agency implementing the National Solar Mission, and Ladakh Autonomous Hill Development Council signed land agreement for the project that will supply power at ₹2 per unit, among the cheapest in the country. SECI said a solar-storage project of such a large capacity was being built for the first time in the country and will help fulfil Prime Minister Narendra Modi’s vision of a carbon-neutral Ladakh. The project will ensure a minimum of 16 hours of supply in non-sunny condition.

Source: The Economic Times

International: Oil

Global oil prices to climb above $70 per barrel by mid-2021: Platts

13 April: Global oil prices will climb above $70 per barrel around mid-2021 as improved supply and demand fundamentals beginning May lead to substantial stock draws through to August, according to S&P Global Platts. It said these very low oil prices along with the energy transition push have accelerated supply concerns. Also, as OPEC+ starts to raise output to meet growing oil demand, the amount of spare capacity in the system begins to dwindle. The firm expects the amount of crude that can be sustainably produced at short notice halving by September to less than 4 mn barrels per day with most of that left in the hands of Saudi Arabia.

Source: The Economic Times

Texas oil pipelines face dry months as production languishes

13 April: Nearly half of all oil pipelines from the Permian basin, the biggest US (United States) oilfield, are expected to be empty by the end of the year, analysts said. Pipeline companies went on a construction spree throughout 2018 and 2019 to handle blistering growth in US crude production to a record 13 mn barrels per day (bpd). However, the coronavirus pandemic crushed both fuel demand and oil production, and neither have recovered fully, leaving many pipelines unused. Major pipeline companies are exploring ways to ship other products in those lines and considering selling stakes in operations to raise cash. The coronavirus pandemic upended the global energy supply system and worldwide fuel demand. US gasoline consumption is now estimated to be past its peak and as refiners process less crude, producers are not filling pipelines used to transport it. By the fourth quarter, total utilization of the largest oil pipelines from the Permian is expected to drop to 57 percent, consultancy Wood Mackenzie said. The nadir during the last market bust in 2016 was roughly 70 percent. US crude output is currently about 11 mn bpd, and is not expected to grow much until 2022. But more pipelines were already set to come online, growing the gap between production and capacity covered by long-term contracts to a record over 1 mn bpd in February, according to energy research firm East Daley Capital.

Source: The Economic Times

Saudi Arabia meets May crude supply for most Asian buyers

12 April: Top oil exporter Saudi Arabia will meet most Asian customers' requirements for May-loading crude after some buyers had asked for lower volumes partly because of refinery maintenance and higher prices, traders said. The demand for lower volumes comes just as the kingdom is set to phase out additional voluntary production cuts over the next few months under plans agreed by the Organization of the Petroleum Exporting Countries (OPEC) and their allies including Russia to ease supply cuts. State-owned energy giant Saudi Aramco notified customers of their May term supplies. Saudi Aramco cut the supply of April-loading crude to at least four north Asian buyers by up to 15 percent. The Saudi oil supply cuts to Asia are not likely to have a major impact on Asia’s crude markets as supplies from other regions remain ample. Under plans by OPEC and its allies to ease supply cuts, Saudi plans to gradually ease its output cuts by 250,000 barrels per day (bpd) in May, 350,000 bpd in June and 400,000 bpd in July.

Source: The Economic Times

Sri Lanka seeks $17 mn from Greek ship owner over oil spill

9 April: Sri Lanka lodged a claim for $17.38 mn with the Greek owners of an oil tanker that caught fire and left a spill stretching 40 kilometre (25 miles) off the South Asian island. The New Diamond vessel was travelling from Kuwait to India with 270,000 tonnes of crude oil on board in September when a fire broke out as it passed Sri Lanka’s east coast. The crude being carried as cargo was unaffected by the blaze but some of the tanker’s fuel leaked into the Indian Ocean.

Source: The Economic Times

International: Gas

PipeChina starts building $1.3 bn gas trunk line in north China

13 April: China Oil and Gas Pipeline Network, or PipeChina, said it began laying a natural gas trunkline in north China that links an import terminal in Tianjin and a new economic area Xiongan near the capital Beijing. The 413.5 kilometre (256.94 miles) line with maximum diameter of 1.106 meters costs 8.6 bn yuan ($1.31 bn) to build, PipeChina said. The project, one of the new investments by PipeChina since its launch last October, has a designed transport capacity of 6.6 billion cubic meters, roughly 2 percent of China's total gas consumption. It will also be connected to several key projects including Shaanjing pipelines that transport gas from fields in China’s northwest to Beijing, as well as with the Power of Siberia project that sends Russian gas to China, the firm said.

Source: The Economic Times

Uzbekistan to launch gas-to-liquids plant within months

9 April: Uzbekistan is set to launch its first gas-to-liquids (GTL) plant in the second half of this year, project contractor Enter Engineering said. The $3.6 bn plant, originally expected to be launched in 2020, will allow the Central Asian nation to use its large natural gas reserve to produce more fuels such as diesel which it currently imports due to declining crude oil output and insufficient refinery capacity. The plant will refine 3.6 billion cubic meters of gas a year and produce 1.5 million tonnes of fuel, its management said when the project was initiated in 2018.

Source: The Economic Times

Shell sells Norwegian LNG business to Spain’s Molgas

9 April: The Norwegian subsidiary of energy firm Shell has sold its downstream liquefied natural gas (LNG) subsidiary Gasnor to Madrid-based Molgas Energy Holding for an undisclosed sum, it said. Gasnor is a downstream LNG company with small scale LNG production facilities headquartered in Avaldsnes, Norway. The sale of Gasnor has no effect on the operations or organisation of Norske Shell, it said. The divestment also does not affect Shell’s interests in Shell’s LNG Gibraltar terminal, where Gasnor will continue to provide operator services.

Source: The Economic Times

Chevron to supply LNG to Japan’s Hokkaido Gas

7 April: Chevron Corp’s unit will supply liquefied natural gas (LNG) to Japan’s Northern Hokkaido prefecture, via a deal with Hokkaido Gas Co Ltd, the oil major said. Chevron USA will supply about a half million tons of LNG over a period of five years starting April 2022 to Japan-based Hokkaido Gas, the company said. The second-largest US oil producer said its partnership with Hokkaido Gas will broaden its customer base in Japan, a market that is foundational to Chevron’s LNG business.

Source: Reuters

International: Coal

Anglo American to spin off South African thermal coal assets

8 April: Anglo American plc said it would spin off its South African thermal coal business into a new company listed in Johannesburg and London, as it moves to transition out of assets that mine the most polluting fossil fuel. The London-listed miner said the transaction would be subject to shareholder approval in May. The anticipated move comes as mining companies are under pressure to stop mining coal from investors and governments keen to switch to cleaner fuels. Anglo is also looking to exit its Cerrejon thermal coal mine in Colombia within 1-1/2 to 2 years, boss Mark Cutifani previously said.

Source: The Economic Times

International: Power

Britain will have enough electricity over summer: National Grid

8 April: Britain should have enough electricity to meet demand over the summer months, the country’s National Grid Electricity System Operator (ESO) said, even though peak demand could be slightly higher than last year. Electricity demand is not likely to be as low as last year when Britain was in strict lockdown during the spring and early summer due to COVID-19 and will be more in line with previous years, National Grid ESO said. Peak electricity demand is expected to be 32 GW, 500 MW higher than last summer. This compares to around 50 GW in winter months. Minimum electricity demand is forecast to be 17.2 GW, but not as low last summer's 16.2 GW, as COVID-19 restrictions are expected to be gradually relaxed in Britain from April to June, it said. Last year, in spring and early summer, minimum electricity demand fell as much as 17 percent compared to pre-coronavirus expectations. National Grid’s annual summer outlook report is designed to help the power market prepare for the summer period.

Source: The Economic Times

International: Non-Fossil Fuels/ Climate Change Trends

Japan’s greenhouse gas emissions fell 2.9 percent in 2019/20 to record low

13 April: Japan’s greenhouse gas emissions fell to a record low in the year ended March 2020, government figures showed, a result of a wider use of renewable energy and lower electricity demand from manufacturing industry. The 2.9 percent decline marks six consecutive years of cuts and comes against a surge in global greenhouse emissions to a record in 2019. Emissions for 2019/20 fell to 1.21 billion metric tonnes of CO

2 (carbon dioxide) equivalent, from 1.25 billion tonnes (bt) the previous year, to hit their lowest since 1990/91, when Japan began compiling data on greenhouse gas emissions, the environment ministry data shows. Japan, the world’s fifth-biggest carbon emitter, has set a goal to cut emissions by 26 percent to 1.04 bt by 2030 compared with 2013 levels. The latest figure represents a reduction of 14 percent from the 2013/14 levels, data showed. The government is considering raising its 2030 target in light of the ambitious long-term goal of becoming carbon neutral by 2050. Japan’s emissions surged after the 2011 nuclear disaster at Fukushima led to the closure of nuclear power plants and boosted reliance on fossil fuels, but have declined from the peak of 1.41 bt hit in 2013/14.

Source: The Economic Times

Saudi inaugurates first renewable energy power plant

9 April: Saudi Arabia’s Crown Prince Mohammed bin Salman has inaugurated the Sakaka IPP PV power plant, the country’s first renewable energy project. The launch of the Sakaka plant, with an output capacity of 300 MW, in northwestern Al-Jouf region represents the kingdom’s "first steps to utilize renewable energy in the Kingdom" the Crown Prince said. The opening also witnessed the signing of power purchase agreements for seven other renewable energy projects in a number of regions with 12 Saudi and international companies. The new projects are in Al Madinah, Sudair, Qurayyat, Shuaibah, Jeddah, Rabigh, and Rafha. The total capacity of these projects, in addition to the two projects of Sakaka plant and Doumat Al Jandal wind energy project, is 3,670 MW, Energy Minister Abdulaziz bin Salman said. The Minister affirmed the role of the private sector in the kingdom’s renewable energy sector that aims to reduce the use of liquid fuel in electricity generation and to optimize the national energy mix.

Source: The Economic Times

Canada’s move away from fossil fuels threatens 450k jobs

7 April: Three-quarters of Canada’s oil and gas sector workers - 450,000 people - could lose their jobs by 2050, economists said, urging action to ensure they find other types of work. The extraction and distribution of oil and gas accounts for more than one-quarter of Canada’s planet-warming greenhouse gas emissions, making it a prime target for job cuts in the shift to renewable energy and clean fuels. Canada has committed to reach net zero by 2050 - meaning any climate-warming emissions that cannot be eliminated will be removed from the atmosphere, such as by planting trees or using technology to capture and store the gases.

Source: Reuters

Biden tax plan replaces US fossil fuel subsidies with clean energy incentives

7 April: US (United States) Treasury Secretary Janet Yellen released details of a tax hike proposal that would replace subsidies for fossil fuel companies with incentives for production of clean energy in President Joe Biden’s infrastructure plan. A Treasury Department office estimated that eliminating subsidies for fossil fuel companies would boost government tax receipts by more than $35 bn in the coming decade. One of the top fossil fuel breaks is called intangible drilling costs, which allows producers to deduct most costs from drilling new wells. The Joint Committee on Taxation, a nonpartisan congressional panel, has estimated that ditching it could generate $13 bn over 10 years. The Biden tax plan would advance clean electricity production by providing a 10-year extension of the production tax credit and investment tax credit for clean energy generation, such as wind and solar power, and energy storage such as advanced batteries. It also creates a tax incentive for long-distance transmission lines to ease movement of electricity from clean energy generators. The plan would restore a tax on polluters to pay for Environmental Protection Agency costs associated with Superfund toxic waste sites, addressing harm caused by fossil fuel production. Unwinding tax breaks on fossil fuel companies could face opposition from Biden’s fellow Democrats in the US Congress from energy-producing states. Greenpeace, an environmental group, said the plan does not go far enough, citing a study here calculating that US fossil fuel companies get $62 bn a year in implicit subsidies for not having to pay for damage their products do to the climate and human health.

Source: Reuters

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG/2004/ 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Roadmap to a Robust Gas based Economy in India, India Energy Forum, 2019

Source: Roadmap to a Robust Gas based Economy in India, India Energy Forum, 2019 PREV

PREV