Quick Notes

The Energy Cost of Trust in Blockchain Technology

Technology Basics

In his 2008 white paper that first proposed bitcoin, the author Satoshi Nakamoto concluded that the system he proposed for electronic transactions will not rely on trust. What he probably implied was that his proposed system will not rely on trust underwritten by morals or reputational codes between friends or peers, or trust in contracts between unknown entities enforced by institutions (such as governments or courts) or trust in intermediaries (such as credit card systems) that allows untrusting buyers and sellers to engage in commerce. Instead, the system will put its trust on blockchain technology and computational algorithms. The trust in technology will reduce mediation costs but it is very likely that it will reappear as energy costs.

Trust in Blockchains

Blockchains are one form of distributed ledger technology (not all distributed ledgers employ a chain of blocks to provide a secure and valid distributed consensus as in the case of blockchains). In other words, every blockchain is a distributed ledger, but not every distributed ledger is a blockchain. A ledger is a collection of accounts that records one’s current rights of ownership of a particular asset. A distributed ledger is a database of accounts that is spread across several nodes or computing devices.

In applications of the blockchain technology, participating computers (‘nodes’) store a copy, or more precisely, a replica, since there is no distinguished master of the associated ledger. Each participant node of the network organizes data in blocks, and updates the entries using an append-only structure. The nodes then vote on these updates to ensure that the majority agrees with the conclusion reached. This voting and agreement on one copy of the ledger is called consensus, and is conducted automatically by a consensus algorithm. Once consensus has been reached, the distributed ledger updates itself and the latest, agreed-upon version of the ledger is saved on each node separately.

Distributed ledgers broadly, and blockchains specifically, are conceptual breakthroughs in managing information. Distributed ledger technologies reduce the cost of trust as they exist without a centralized authority or server managing it, and its data quality can be maintained by database replication and computational trust.

Computational trust that underpins blockchains reduces dependence on middlemen including large corporations, banks, governments, lawyers, notaries and regulatory compliance officers. The need for trust in middlemen in centralised systems allows large corporations like Google, Facebook, and Amazon to turn economies of scale and network effects into monopoly profits. Widespread blockchain adoption could enable distributed users (rather than centralised entities) to capture value by economising on the cost of trust.

Proof of Work: Energy Intensive by Design

As there is no centralised, trusted authority, the blockchain uses a consensus mechanism to ensure trust across the network. Consensus is achieved by a method called ‘Proof-of-Work’ (PoW), where computers on the network, known as ‘miners’, compete with each other to solve a complex computational puzzle. Each guess a miner makes at the solution (key to the block) is known as a ‘hash,’ (a 64-digit hexadecimal number) while the number of guesses taken by the miner each second is known as its ‘hash-rate.’ Once the puzzle is solved, the latest ‘block’ of transactions is approved and added to the ‘chain’ of transactions. The first miner to solve the puzzle receives a reward which typically consists of a certain amount of the associated cryptocurrency (such as bitcoin) and the fees for the associated transactions. The reward provides an incentive to participate in mining. The more computational power one has, the bigger the share of all distributed rewards that go to that miner. To keep the flow of rewards stable, the network self-adjusts the difficulty of hash calculations, so new blocks are only created once every 10 minutes on average. Nakamoto compared the creation of new blocks in this way with gold mining and noted that the cost of mining blocks is computer time and electricity. Effectively electricity accounts for about 60 percent of the cost in performing large number of hash calculations towards the ultimate goal of processing transactions without trust in intermediaries.

The electricity use of the blockchain is a function of a few inter-related factors such as mining hardware specifications, notably electricity consumption and hash-rate; network hash-rate, the combined rate at which all miners on the network are simultaneously guessing solutions to the puzzle; difficulty in solving the puzzle, which is adjusted in response to the network hash-rate to maintain the target block rate of one block every 10 minutes; and energy consumption by non-IT infrastructure, such as cooling and lighting.

Electricity use for mining is orders of magnitude higher than the energy consumption required to maintain the nodes (computers). For example, in a 1 MB block used in bitcoin, there can only be a maximum of around 2000 transactions which involve 4000 hash value computations and a similar number of corresponding database manipulations and signature checks. By comparison, finding a single block currently involves around 1023 hash computations to solve the puzzle. According to latest estimates (made prior to the surge in the price of bitcoin) all devices in the bitcoin network were estimated to consume between 78 and 101 terawatt-hours (TWh) of electricity annually. This is equal to the electricity generation on the Philippines or Kazakhstan in 2019. Another estimate observes that a single blockchain transaction needs enough electrical energy to meet the needs of the average size German household for months.

High energy consumption of PoW blockchains are neither the result of inefficient algorithms nor of outdated hardware. Such blockchains are “energy-intensive by design”. It is their high energy consumption that protects PoW blockchains from attacks: Depending on the scenario, an attacker must bear at least 25 to 50 percent of the total computing power that participating miners use for mining and, thus, the same proportion of the total energy consumption (under the assumption of equal hardware) to be able to successfully manipulate or control the system. Consequently, the more valuable a PoW asset (such as cryptocurrency) is, the better it is protected against attacks, confirming that PoW is, thoughtfully designed to be energy intensive. The energy use of the blockchain network is therefore both a security feature and a side effect of relying on the ever-increasing computing power of competing miners to validate transactions through PoW. It is important to note that blockchain technology is far from homogeneous and blanket statements about its electricity consumption must be interpreted with caution, due to methodological issues, limited data availability and highly variable conditions across the industry.

Carbon Emissions

As of April 2020, China accounted for more than 75 percent of bitcoin blockchain operation around the world. But mining facilities are concentrated in remote areas of China with rich hydro or wind resources (cheap electricity), with about 80 percent of Chinese bitcoin mining occurring in hydro-rich Sichuan province. These mining facilities may be absorbing overcapacity in some of these regions, using renewable energy that would otherwise be unused, given difficulties in matching these rich wind and hydro resources with demand centres on the coast. Globally, one analysis estimates that the bitcoin is powered by at least 74 percent renewable electricity as of June 2019. Another analysis of data from 93 mining facilities (representing 1.7 GW, or about a third of global mining capacity) estimates that 76 percent of the identified energy mix includes renewables.

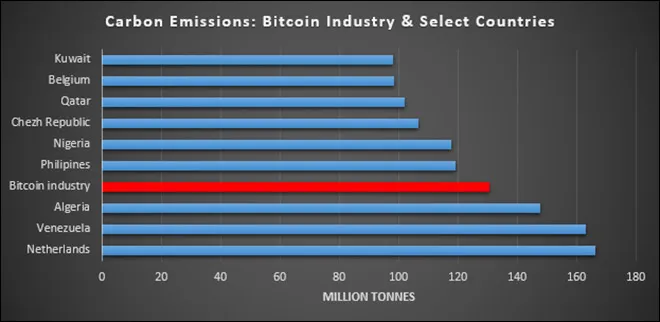

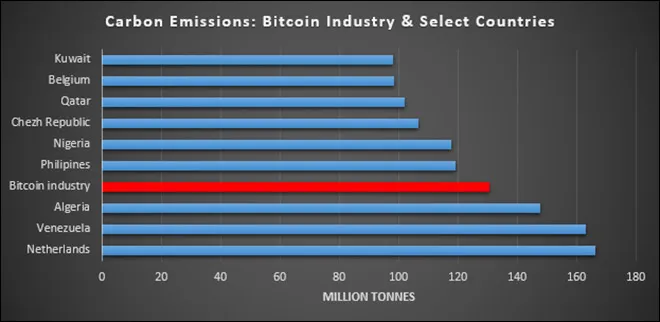

According to the International Energy Agency (IEA), bitcoin mining is likely responsible for 10‑20 Mt CO2 per year, or 0.03-0.06 percent of global energy-related CO2 emissions which is not a cause for concern. However, a recent paper published in Nature Communications on electricity consumption and CO2 emissions in China gives figures that are an order of magnitude higher (see chart). While electricity consumption by blockchains is large compared to the number of transactions they can operate, there is no need for alarm over future electricity consumption because the electricity consumption of PoW blockchains does not increase substantially when they process more transactions. Moreover, the PoW consensus mechanism that was designed to be energy-intensive is not the only way to achieve trust through consensus in a distributed system. There are much less energy intensive alternatives such as the Proof-of-Stake (PoS) mechanism which depends on capital rather than energy or the Proof-of-Authority (PoA) mechanism that involves different levels of security, from mathematically proven mechanisms to heuristically-secure algorithms.

Source: Jiang, Shangrong et al (2021), Policy Assessments for the Carbon Emission flows and Sustainability of Bitcoin Blockchain operation in China, Nature Communications

Source: Jiang, Shangrong et al (2021), Policy Assessments for the Carbon Emission flows and Sustainability of Bitcoin Blockchain operation in China, Nature Communications

Monthly News Commentary: Coal

Domestic Coal Production accelerates towards Self-Sufficiency

India

Domestic Production & Demand

Host of measures taken by CIL (Coal India Ltd) has helped cut 71 MT (million tonnes) of costly coal imports in the April-February period of the current financial year. CIL has also waived-off performance incentive for power sector consumers, for supply of coal beyond the trigger level since the beginning of the fiscal. This helped the consumers in opting for additional quantities of coal at lower cost from CIL. The consumers who gained from the initiatives included CESC, Andhra Pradesh Power Development Corp, Adani Power and GMR Group in the power sector, and Vedanta, Jindal Steel & Power, NALCO, Hindalco and Tata Steel in the non-regulated sector. To enhance coal production and reduce imports, CIL has identified 15 new projects with a capacity to produce 160 MTPA (million tonnes per annum). CIL aims to achieve 1 BT (billion tonnes) of coal production by 2023-24. In order to enhance domestic production, 25 percent of coal production has been allowed for the sale of coal for the newly-allocated captive coal blocks. In order to enhance coal production and achieve coal production targets, CIL has initiated a number of steps, including introduction of mass production technology in underground coal mines. Another coal producing company Singareni Collieries Company Ltd (SCCL) is planning to open 11 new mines, including two in Talcher in Odisha. To reduce coal imports, the Annual Contracted Quantity (ACQ) of the power plants have been increased up to 100 percent of the normative requirement in those cases where the ACQ was earlier reduced to 90 percent of normative.

Coal Block Auctions for Commercial Mining

The government is trying to "consult and convince" the Jharkhand government about benefits of commercial coal mining policy which is designed to boost domestic production and reduce imports. According to the government it is a "big sin" that India despite having the largest coal reserves is dependent on import of thermal coal used in power generation. The dependence on imports was due to restriction on allocation of coal blocks, which has been eased out after deep consultation with the state governments. After consultations with states, the central government has brought a commercial coal mining policy under which coal blocks are opened to private investors through auction for commercial purpose. The coal ministry on a day-to-day basis monitors and is changing the norms to withdraw such blocks which are not operational. It takes 2-3 years to start actual production after allocation of coal or mine blocks. However, many measures have been taken to speed up and begin the production at the earliest.

Coal Transport

CIL has signed a pact with the Centre for Railway Information Systems (CRIS), a wing under the railways ministry, for monitoring the movement of rakes laden with fossil fuel and coal despatch activity. The first-of-its-kind data sharing offers CIL a bouquet of benefits that help it in rationalising the entire coal supply matrix through rail mode, according to the company. Primarily, it is a handshake of freight operation information between the networks of CIL and CRIS regarding CIL’s rail movement of coal. Up to 20 February of the ongoing fiscal, CIL’s coal movement through rail mode from its own sidings, goods sheds and private washeries at 302.51 MT accounted for 61 percent of the total off-take quantity.

Import & Export

India's coal import registered a drop of 11.59 percent to 180.84 MT in the first 10 months of the ongoing fiscal. India imported 204.55 MT of coal in April-January period of the previous fiscal year, according to provisional data compiled by mjunction services. However, India’s coal imports in January increased to 20.05 MT as against 18.67 MT in year-ago period. Coal import was, however, 7.4 percent higher in January 2021 as compared to 18.67 MT in the year-ago period. Of the total imports in January 2021, non-coking coal was at 12.77 MT while coking coal import was 5.62 MT. During April-January 2020-21, non-coking coal import was at 119.84 MT as compared to 140.65 MT in the same period a year ago. Coking coal import was recorded at 39.16 MT lower than 41.15 MT imported during the same period a year ago.

The government proposes to allow CIL to export surplus coal for the first time since its inception while clubbing all spot auctions held by the state-owned miner for various consumers for trading on one exchange. The state-run miner is likely to set up a special e-auction window for export of coal which cannot be sold in India. The coal ministry has also proposed a single auction trading platform for all coal consumers of Coal India. According to the government, coal prices to power and non-power CIL consumers who hold long term linkages will remain unchanged. Presently, CIL sells 20-25 percent of its coal through several exclusive auctions to power consumers, non-power consumers and coal importers. The proposal to allow CIL hold single e-auction would require change in present policy and an approval from the Union Cabinet. Next year CIL targets production of 740 MT of coal against about 640 MT now, ensuring adequate coal availability. CIL registered 77 percent growth in e-auction sales in April-November of the ongoing fiscal, booking 68.3 MT. The government has auctioned 19 coal blocks in the first tranche of commercial coal auctions. Another 75 mines with reserves of over 38,000 MT are proposed to be offered in the current tranche of the auctions. The coal blocks do not have any end use restrictions and coal produced from the mines can be exported by the developers to other countries.

Governance

After a lengthy delay of over a year, Goa Industrial Development Corp (GIDC) has issued the tender to appoint a mine-developer-cum-operator (MDO) for the Dongri-Tal II coal mine, which has a 2.9 MTPA capacity. The MDO will be responsible for extracting the coal, which will be subsequently auctioned by GIDC through an online route according to the RFP issued by GIDC. In December the Request for Proposal would be issued within 15 days for the coal block. The Dongri Tal–II coal block has been allotted by the Union ministry of coal for commercial mining to GIDC. As per the terms of the allotment agreement, which was signed in October 2019, at least 25 percent of the coal extracted in a financial year has to be sold to the MSME sectors in Madhya Pradesh and balance coal to other buyers across India.

Madras High Court (HC) has refused to set aside ₹13.3 bn coal import tender floated by TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd). Refusing to intervene in the order passed by a single judge dated 24 February, upholding the tender process, the court dismissed the plea moved by Ind Vigo Coal Pvt Ltd. On 24 February, a single judge of the court rejected the plea moved by the petitioner challenging the tender. The court, however, directed the power distribution corporation to extend the last date to submit bids by 15 days and publish the same in the Indian Trade Journal. TANGEDCO further submitted that only companies with a turnover of ₹3.35 bn in any one of the financial years between 2017-18 and 2019-20 and those that had supplied 500,000 tonnes of imported steam coal to public sector undertakings or private power utilities in any of those three years were eligible to submit their bids.

In Meghalaya 95 persons have been arrested and 250 cases registered so far over illegal mining and transportation of coal. The National Green Tribunal banned coal mining in the state in 2014, making it illegal. Cases of illegal mining are being registered under section 21 of the Mines and Minerals (Development and Regulation) Act, 1957.

Rest of the World

China

China Huadian Corp aims to close more than 3 GW (gigawatt) of coal-fired power capacity in the next five years and increase renewables to make up half of its total power generation mix. Huadian, China’s third largest power generator by capacity, aims to add 75 GW renewable power capacity over the 2021-2025 period and to bring its carbon emissions to a peak by 2025. Huadian did not disclose non-coal power assets in 2019 but its thermal capacity was 108 GW, which includes coal and gas. China’s coal consumption is expected to continue rising in 2021 despite Beijing’s pledges to boost the use of clean energy and curb greenhouse gas emissions according to the China National Coal Association. China, the world’s biggest coal consumer, saw overall consumption of the fossil fuel increase by 0.6 percent in 2020 from a year earlier to around 4.04 BT. It also forecast China’s coal output would increase in 2021, with the launch of new and advanced coal capacity in major coal mining regions such as Shanxi, Shaanxi, Inner Mongolia and Xinjiang. But central Chinese regions such as Hunan and Jiangxi will continue shut down their outdated coal mines. China churned out 3.84 BT of coal in 2020, the most since 2015. Coal imports, however, are expected to remain at last year’s level, although the sources of coal shipments will be more diverse. China has increased coal imports from Russia, Mongolia and Indonesia after Beijing stopped allowing any coal cargos from Australia to pass customs clearance in the fourth quarter last year. Coal imports totalled 303.99 MT last year, a record high. The association also expects Chinese policymakers to aim to limit coal consumption to around 4.2 BT by 2025, compared with the goal of 4.1 BT set for the end of 2020.

China cut its coal use to 56.8 percent of energy consumption at the end of 2020, maintaining its target of below 58 percent, but overall coal consumption continued to rise amid record industrial output and the completion of dozens of coal-fired power plants. Coal consumption in the world's biggest coal user and greenhouse gas emitter grew 0.6 percent last year, the fourth consecutive increase according to the National Bureau of Statistics. Energy consumption increased by 2.2 percent to 4.98 BT of standard coal equivalent last year, with crude oil demand growing by 3.3 percent and natural gas by 7.2 percent. China has pledged to halt the rise in its carbon emissions before 2030 with targets to control energy consumption, especially coal-burning, and improve energy efficiency.

Divestments

UN (United Nations) called on wealthy nations to end coal use by 2030 so the world can meet its goals to curb global warming, urging G7 nations to make that commitment before or at a leaders’ summit in June. Emissions-cutting pledges by governments fell far short of what is needed to limit climate heating to 1.5 degrees Celsius above preindustrial levels. UN expected all 37 countries in the OECD (Organization for Economic Cooperation and Development), a group of mainly high-income nations, to promise to stop using coal by 2030, and the rest by 2040. The Powering Past Coal Alliance was formed by Canada and Britain in 2017 to bring together governments and business to accelerate the phase-out of “unabated” coal power, where there is no technology in place to remove carbon emissions.

Britain has ordered a public inquiry into a planned deep coal mine, with the government performing a U-turn before hosting a key climate summit. The PM, who will host the COP26 climate summit in Glasgow in November, ran into fierce criticism from environmental campaigners over his January decision to delegate approval for the carbon-intensive facility to the local authority. The proposed coastal project, whose developer is Australian-owned West Cumbria Mining, would be located near the town of Whitehaven in northwest England and supply European and UK (United Kingdom) steelmakers with metallurgical coal.

The US (United States) Congress is investigating a multibillion-dollar subsidy for chemically treated coal that is meant to reduce smokestack pollution, after evidence emerged that power plants using the fuel produced more smog not less. Over the past decade, a who’s who of American companies have reaped at least several billion dollars in benefits from investing in refined coal operations. Just last year, some 150 MT of refined coal was burned in the US, according to the US Energy Information Administration. Producers get a tax credit of $7.30 for each ton burned. The Internal Revenue Service, which oversees the tax credit program, allows the companies to qualify by testing relatively small amounts of refined coal in a laboratory once a year, in lieu of real-world emissions measurements at power plants.

Indonesia

Indonesia is removing royalty payments for coal used in its downstream sector in a bid to boost its coal processing industries. The world’s top exporter of thermal coal aims to develop its coal processing industry to replace energy imports, such as refining coal to gas to reduce its LPG (liquefied petroleum gas) imports, while optimising the use of its domestic coal. Companies usually pay 2 percent to 7 percent of calorific value of the coal to the central government in royalties, depending on the calorific value of the coal and if it has been mined from underground or open pit mines. The energy ministry will issue a further regulation clarifying which coal processing activities are eligible to pay 0 percent royalties.

News Highlights: 17 – 23 March 2021

National: Oil

India’s MRPL buys Brazilian Tupi crude for first time

22 March: India’s Mangalore Refinery and Petrochemicals Ltd (MRPL) has bought its first ever cargo of Brazilian Tupi crude oil in a tender. The 1 mn barrel cargo was sold by Royal Dutch Shell for May delivery. The price was not immediately known.

Source: Reuters

India’s crude oil throughput hits four-month low in February

19 March: India’s crude oil processing fell to its lowest in four months in February, retreating from a near one-year high hit in the prior month hurt by higher crude prices and weaker fuel demand in the country. On a monthly basis throughput fell 5.6 percent. There is a variation in percentage change as February 2020 had 29 days. Fuel consumption in the country also fell to a five-month low in February as higher retail prices dented demand. Indian state refiners have been planning to cut oil imports from Saudi Arabia by about a quarter in May due to rising oil prices. Indian refiners operated at an average rate of 97.13 percent of capacity in February, down from 110.7 percent in the same month last year and from January’s 102.8 percent, the government data showed. The country’s largest refiner, Indian Oil Corp (IOC), operated its directly owned plants at 100.8 percent capacity, the data showed. Reliance Industries Ltd (RIL), owner of the world’s biggest refining complex, operated its plants at 93.2% capacity in February. On an annual basis, crude oil production was unchanged at 610,000 barrels per day (2.32 million tonnes), while natural gas output fell 1.4 percent to 2.31 billion cubic meters (bcm), the data showed.

Source: Reuters

States like Maharashtra should reduce taxes on fuel to give relief to people: Pradhan

18 March: Oil Minister Dharmendra Pradhan said states like Maharashtra should reduce taxes on fuel to give relief to consumers and remained non-committal on cutting central taxes. Pradhan was responding to Shiv Sena leader Anil Desai's query why the government was increasing percentage of ethanol blending and not taking immediate steps like decreasing taxes on fuel. On ethanol blending, the minister said the scheme was launched during the tenure of Atal Bihari Vajpayee but later it was kept aside. Now, the current government is giving priority to this programme. Earlier, ethanol blending target was 20 percent till 2030, but later the target year was revised to 2025.

Source: The Economic Times

Diesel sales top pre-COVID levels by 7 percent, but LPG slips

17 March: India's diesel consumption increased 7 percent from a year ago in the first fortnight of March but demand for LPG (liquefied petroleum gas), or household cooking gas supplied in cylinders, dropped more than 3 percent to coincide with a steep rise in refill prices and removal of subsidy. Data from state-run fuel retailers, who dominate 90 percent of the market, show petrol sales rising over 5 percent from a year ago, boosted by car sales snapping the pandemic blues in February and people going back to using their personal vehicles on resurgence of Covid-19 cases in several states. This is the first yearly growth in diesel sales since October 2020, reinforcing the view that the economy is on its way to recovery as its consumption is one of the key indicators of economic activity. In February, diesel demand had slid 8 percent and petrol consumption declined 2 percent in February from a year ago. In December, sales had for the first time since October recorded a monthly decline at 6 percent. Jet fuel sales were down more than 36 percent from a year ago in March fortnight. However, this can be seen as a sign of recovery since February when consumption was more than 40 percent lower than the pre-pandemic level.

Source: The Economic Times

National: Gas

Gas price for ONGC to inch up to $1.82, fall below $4 for RIL-BP

23 March: Government-dictated price for natural gas produced by companies such as ONGC (Oil and Natural Gas Corp) is likely to inch up marginally to $1.82 while the same for difficult fields like one operated by RIL-BP may fall below $4. The price of gas, which is used to generate electricity, make fertiliser and convert into CNG for automobiles and cooking gas for households, is due to bi-annual revision. The rates paid for gas produced from fields given to ONGC and Oil India Ltd (OIL) are most likely to go up to $1.82 per million metric British thermal units (mmBtu) for six month period beginning April 1 from a decade low of $1.79 currently. Simultaneously, the price for gas produced from difficult fields such as deepsea, which is based on a different formula, is likely to fall below $4 per mmBtu from the current price of $4.06. This is the maximum price that Reliance Industries Ltd (RIL) and its partner BP plc are entitled to for gas they produced from deepsea blocks they won under New Exploration Licensing Policy (NELP). While the government sets the price of gas produced by ONGC from fields given to it on a nomination basis, it bi-annually announces a cap or maximum price that operators who won exploration acreage under NELP can get. RIL-BP had in recent price discovery for new gas from their Krishna Godavari basin block, got rates of over$ 6 per mmBtu but they would get less than $4 as per the pricing formula. Natural gas price is set every six months -- on 1 April and 1 October -- each year based on rates prevalent in surplus nations such as the US, Canada and Russia.

Source: The Economic Times

Kolkata gets its first CNG pumps

23 March: Kolkata joined the league of cities having clean automotive fuel with the commercial launch of two CNG (compressed natural gas) pumps. While Indian Oil Corp (IOC) set up a pump in New Town, the other was launched by BPCL (Bharat Petroleum Corp Ltd) in Garia. The CNG is being supplied by the Bengal Gas Company, a joint venture between GAIL (India) Ltd and the West Bengal government. The Bengal Gas Company has installed the dispensers, while the oil marketing companies have provided space and other infrastructure. Another five-six CNG pumps are expected to be unveiled very soon. IOC will set up another 20 pumps in FY22, while BPCL and HPCL (Hindustan Petroleum Corp Ltd) are also expected to add a similar number of pumps together.

Source: The Economic Times

National: Coal

CBI summons businessman in coal pilferage scam

17 March: The CBI (Central Bureau of Investigation) has summoned businessman Amit Agarwal in connection with the multi-crore coal pilferage scam. The CBI is probing the scam over illegally mined coal from the abandoned mines of Eastern Coalfields, estimated to be worth thousands of crores of rupees.

Source: The Economic Times

National: Power

33 percent more power for Mumbai as Adani to add 1 GW

23 March: Maharashtra Electricity Regulatory Commission (MERC) granted a transmission licence to Adani Electricity Mumbai Infra Ltd for 25 years, enabling the firm to bring 1,000 MW, or 33 percent more electricity, to Mumbai to cater to increasing demand. Mumbai consumes 2,500-3,000 MW during peak load, which goes up to 3,500 MW in summer. Power expert Ashok Pendse said while the cost for consumers will rise by 6-7 paise per unit, with the demand set to increase in the coming months, it will help the city to have more power. Adani to set up high-voltage DC link of 80 km. Since 1981, the city has been protected by ‘islanding’ system, for which citizens pay ₹4.5-5 bn each year through electricity bills. This is to ensure Mumbai gets constant supply even if there is power outage in MMR or elsewhere in the state. While Tata Power generates 1,337 MW, Adani generates 500 MW in Dahanu. Experts said this was not sufficient to meet demand.

Source: The Economic Times

Essar Power shuts power supply to GUVNL from Salaya plant

21 March: Essar Power Gujarat Ltd (EPGL) has decided to shut down its 1,200 MW imported coal-fired power at Salaya near Jamnagar citing financial viability issues. The company approached the state government earlier this week and informed about its decision to stop power supply to Gujarat Urja Vikas Nigam Ltd (GUVNL) after a revised supplemental power purchase agreement (PPA) with the state electricity company is pending clearance by the state government. The state power regulator, Gujarat Electricity Regulatory Commission (GERC) had last year approved a supplemental PPA between EPGL and GUVNL with some conditions. EPGL is a subsidiary of Essar Power Ltd (EPL).

Source: The Economic Times

In four years, 1.2 lakh villages were electrified in Uttar Pradesh

20 March: Nearly four years after signing the ambitious ‘Power for All’ agreement with the Centre, the Uttar Pradesh (UP) government has electrified over 1.21 lakh hamlets having population of 250 and above. According to state government data, the number of newly-electrified villages rose from 1.28 lakh in 2017 to 2.49 lakh in 2021. This is besides over 12 mn consumers, mainly in rural areas, being covered under Saubhagya Scheme envisaging free electricity connection. UP provided the most number of connections under the Saubhagya scheme in last four years. According to UP Energy Minister Shrikant Sharma, power supply to rural areas increased by 54 percent in four years. Data shows that the number of electricity connections increased by around 63 percent between 2017 and 2020 (till December). UP had 18 mn registered consumers in 2017 and the number has now gone up to 29.3 mn. The number of consumers grew by over 10 percent, from 25.9 mn in 2019 to 29.3 mn in 2020. UP Power Corp Ltd (UPPCL) said the revenue recovery was very important for the maintenance of power distribution system. At the same time, the state government has expedited separation of rural feeders to reduce load and increase the quantum of power supplied. Data show that the number of rural feeders increased from 8,760 in 2017 to 11,794 in 2021. This has ensured around 18 hours of power supply to rural areas. As per the power supply roster, tehsils and districts are scheduled to get 21 hours and 24 hours of power supply. The state government has also managed to bear the peak load demand which increased from 18061 MW in 2017 to 23867 MW in 2020.

Source: The Economic Times

Gram Ujala scheme to offer LED bulbs for ₹10 per piece in rural areas

20 March: EESL arm Convergence Energy Services Ltd (CESL) launched the Gram Ujala programme under which high quality energy efficient LED (light emitting diode) bulbs will be given for ₹10 per piece in certain villages of five states in the first phase. In the first phase of this programme, 15 mn LED bulbs will be distributed across villages of Aarah (Bihar), Varanasi (Uttar Pradesh), Vijaywada (Andhra Pradesh), Nagpur (Maharashtra), and villages in western Gujarat. The programme will be financed entirely through carbon credits and will be the first such programme in India. The Gram Ujala programme will be implemented in villages of the five districts only and consumers can exchange a maximum of five LED bulbs. These rural households will also have metres installed in their houses to account for usage.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Rajasthan to develop green energy corridor, generate 6.3 GW power by 2023

23 March: The state plans to generate 6,311 MW of green energy by 2023 and Rajasthan Vidyut Prasaran Nigam Ltd will develop the necessary infrastructure for intra-state green energy corridor by setting up 765 kilovolt (kV) grid sub-station at Jodhpur, 400 kV grid sub-station at Pokhran, Lohawat, 200 MW station at Sawa, Panchu. The 120 kV grid sub-station at Sanwareej will be upgraded to a 220 kV sub-station. Nigam CMD (Chairman and Managing Director) Dinesh Kumar said western Rajasthan is the hub of wind and solar power production in the state. These production centres had to be linked to the load centre and national transmission network for distribution of the green energy produced. Since western Rajasthan is far off from the national grid and load centre, these locations had to be connected by transmission networks.

Source: The Economic Times

Basic customs duty to cost ₹9 bn annually for distribution companies: Ind-Ra

23 March: The imposition of basic customs duty (BCD) on solar cells and modules with effect from 1 April 2022 would lead to an increase in solar tariffs, reducing the overall attractiveness of solar projects to off-takers and finally end-consumers, according to India Ratings and Research (Ind-Ra). Ind-Ra senior analyst Asmita Pant said that this amount would increase exponentially with the commissioning of new projects, till the time the duty is in place or import costs and cost of local manufacturing achieve parity and is likely to also affect the government’s target of 280 GW solar capacity by 2030.

Source: The Economic Times

Goa government signs renewable energy MoU with German company

22 March: The state government has signed a Memorandum of Understanding (MoU) with the German-based Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH for developing a state energy plan and 100 percent renewable energy roadmap for Goa under the Indo-German program on Access to Energy in Rural Areas. Aimed at creating a strategic unit to develop, maintain and implement the multi-sectoral energy action plan, the MoU has been inked on the advice of the Union ministry for new and renewable energy. The electricity department will coordinate with key departments and steer the process of developing the renewable energy roadmap as well as state energy plan in consultation with GIZ and its partners.

Source: The Economic Times

BHEL secures order for first ever overseas solar power project

22 March: BHEL (Bharat Heavy Electricals Ltd) said it has bagged its first ever overseas order for a grid- connected solar power project in Mauritius. The project will be set up by BHEL at Tamarind Falls, Henrietta (Phase II), Mauritius on Engineering, Procurement and Construction (EPC) basis, BHEL said. The contract has been awarded to BHEL by CEB (Green Energy) Co. Ltd, Mauritius, a wholly-owned subsidiary of Central Electricity Board, Government of Mauritius. The project is funded under Government of India's Line of Credit and has been secured by BHEL through a competitive bidding process. The project will be executed by BHEL’s Solar Business Division, Bengaluru and International Operations Division, New Delhi. It marks the consolidation of BHEL’s presence in Africa, where it has been active for more than four decades with electricity generation projects (approximately 2,100 MW) and equipment supplies in 23 African countries.

Source: The Economic Times

Renewable electricity needs to grow 55-fold to achieve zero emission in India by 2050

22 March: Renewables in electricity must increase 55-fold for India to achieve net-zero emissions by 2050, according to a report by Council on Energy, Environment and Wate (CEEW). India will need to generate at least 83 per cent of its electricity from (non-hydro power) renewable energy sources by 2050 to achieve net-zero greenhouse gas emissions by mid-century, according to the study. This would mean a massive 55-fold increase in the use of non-hydro renewables in electricity generation within the coming three decades, from only 160 terawatt hour (TWh) (10 percent) in 2019, CEEW said. Further, to achieve net-zero by 2050 the share of electricity in India’s industrial energy use must rise three-fold, from 20.3 per cent in 2018 to 70 percent in 2050, the study said. To meet net-zero, India will need to either eliminate greenhouse gas (GHG) emissions or balance these by sequestering GHG emissions. The study is the first exercise to outline multiple pathways for India to attain net-zero emissions, rather than fixating on a single scenario or a single year.

Source: The Economic Times

Bihar becomes first state to have own ethanol policy for biofuel

20 March: The state industries minister, Syed Shahnawaz Hussain, launched the much-touted Ethanol Production Promotion Policy, 2021. The state cabinet approved it, making Bihar the first state in the country to have an ethanol promotion policy under the National Policy of Biofuels, 2018. The state ethanol policy allows the extraction of ethanol, which was restricted to sugarcane, from surplus quantities of maize as well. An investor will get an additional government subsidy of 15 percent of the cost of plant and machinery up to a maximum of ₹50 mn, in addition to the existing incentives under the Bihar Industrial Investment Promotion Policy, 2016. Shahnawaz said a tripartite agreement between investors, banks and oil manufacturing companies will act as collateral for secured loans for establishing greenfield standalone ethanol manufacturing units in the state. Shahnawaz said the policy will create employment and help reduce pollution as currently, bioethanol blending in petrol in India stands at 6.2 percent, and the government has set a target of 20 percent bioethanol blending of petrol by 2030.

Source: The Economic Times

India's methane emissions from coal mines rising

19 March: The climate impact of methane emissions, including by India that is among the top five emitters, from proposed coal mines worldwide could rival the CO2 (carbon dioxide) emissions from all the US coal plants, warned a new report by Global Energy Monitor. For India, the report estimates methane emissions to be at 45 million tonnes (mt) of CO2 equivalent emissions over a 20-year horizon and estimates proposed new coal mines to be 52. The first-of-its-kind analysis surveyed 432 proposed coal mines globally and modelled methane emission estimates at the individual mine level. Unless mitigated, methane emissions from these proposed mines would amount to 13.5 mt of methane annually, a 30 percent increase over current methane emissions. According to the report, coal mines currently under development would leak 1,135 mt of annual CO2-equivalent (CO2e) on a 20-year horizon and 378 mt of annual CO2e on a 100-year horizon. The countries with the highest amount of methane emissions (CO2e20) from proposed coal mines are China (572 mt), Australia (233 mt), Russia (125 mt), India (45 mt), South Africa (34 mt), the US (28 mt), and Canada (17 mt).

Source: The Economic Times

India facing high fossil fuel consumption challenge

19 March: India is facing a "challenge of high fossil fuel consumption", stressing the need for adopting non-polluting electric vehicles to contribute to energy goals. Climate change is a growing challenge the world over and there is increasing momentum for the transition towards a low carbon economy, the power ministry said. India is importing more than 80 percent of petroleum products for its requirement. From the perspective of energy security also, there is a need to give impetus to electric mobility, the ministry said. Countries like the US, UK, Germany, Japan and China, among others, have already taken a lead in electric vehicle technologies. However, India is fortunate to be a part of this group which is committed to leading the e-vehicle technological initiatives, the ministry said. The country is already collaborating with some nations to meet its e-vehicle aspirations. India is a signatory to the Paris Agreement. Under the agreement signed in 2015, India has committed to cut GHG (greenhouse gases) emissions intensity of its GDP by 33-35 percent, increase non-fossil fuel power capacity to 40 percent from 28 percent in 2015, add carbon sink of 2.5-3 billion tonnes CO2 (carbon dioxide) per annum by increasing the forest cover, all by 2030.

Source: The Economic Times

Only 18 percent of India’s urban people live with renewable targets

19 March: Eighteen percent of India's urban population is living in cities with renewable energy targets, said the 2021 edition of REN21's Renewables in Cities Global Status Report. For India, the report has particular significance as several "smart cities" have embraced renewables, seeing a significant growth in on-site generation of solar PV (Photovoltaic). Thirteen cities have renewable energy targets or policies in 2020. This covered 67.6 mn people. It highlights the tangible steps and investments into renewable energy that cities have taken around the world in order to battle emissions to prevent climate change and air pollution. The report is also the only stock-taking of cities' energy transition efforts worldwide, and reveals that the number of cities that have enforced partial or complete bans on fossil fuels jumped fivefold in 2020. Over one billion people around the world live in cities with a renewable energy target or policy. For the second year, REN21 takes the temperature of how cities worldwide use renewable energy to battle emissions to prevent air pollution and climate change. Cities must transition to renewables and set end dates for fossil fuels in all sectors, the report said.

Source: The Economic Times

International: Oil

Oil drops on concerns European COVID-19 issues to crimp demand

23 March: Oil prices fell 1 percent on concerns that new pandemic curbs and slow vaccine rollouts in Europe will slow a recovery in fuel demand and as producers cut prices, indicating ample oil supply. US (United States) West Texas Intermediate (WTI) crude futures for May delivery fell 62 cents, or 1 percent, to $60.94 a barrel at 0149 GMT. The April contract expired at $61.55, up 13 cents, after plunging more than 6 percent. Germany, Europe’s biggest oil consumer, is expected to extend restrictions on shopping and travel into April to contain a third wave of COVID-19 infections, which has led economists to cut their growth forecasts. The Paris-based IEA (International Energy Agency), cut its forecast for crude demand in 2021 by 2.5 mn barrels per day, while the EIA (Energy Information Administration) forecast global oil supply would surpass demand in the second half of 2021. Nigeria, Africa’s biggest oil producer, cut its official selling prices for April-loading cargoes, suggesting that suppliers are trying to encourage sales. Angola, the continent’s second-biggest producer and a key supplier to China, still has some April cargoes that remain unsold, indicating a lack of interest from Chinese refiners.

Source: Reuters

Goldman sees oil price pullback as buying opportunity

19 March: Goldman Sachs sees the oil price pullback as a buying opportunity and forecasts Brent crude reaching $80 per barrel this summer even as the recent rally in prices “takes a big breather.” Oil prices are set to drop about 9 percent this week after growing worries about weak demand in Europe and a strengthening US (United States) dollar sent Brent futures down about 7 percent. Brent jumped above $70 a barrel on 8 March for the first time since the COVID-19 pandemic began. It was trading around $63.47 a barrel. Despite the sharp drop in prices, Goldman expects rapid oil market rebalancing in the coming months.

Source: Reuters

Venezuelan farmers seek permission to import diesel amid shortages

18 March: Venezuelan farmers said that they had asked the government to allow them to import diesel themselves to alleviate shortages of the fuel that are hindering food production and distribution. Diesel has become scarce in the crisis-stricken OPEC (Organization of the Petroleum Exporting Countries) nation amid very low output at state oil company Petroleos de Venezuela’s 1.3 mn barrel per day (bpd) refining network, and escalating US (United States) sanctions barring foreign oil companies from swapping fuel for Venezuelan crude. Venezuela’s hydrocarbons law reserves the right to international trade in crude and refined products to the state and state-owned companies. But groups representing ranchers and milk producers said they were seeking temporary authorization due to the current crisis.

Source: Reuters

International: Gas

Brazil authorizes Shell, Gerdau to import LNG

18 March: The Brazilian government has authorized the local unit of energy company Royal Dutch Shell to import liquefied natural gas (LNG) from several countries into the Brazilian market, according to a notice in the official gazette. The authorization was granted by the mines and energy ministry for a total volume of up to 36.5 million cubic meters. The permit is valid through 31 March 2024 and limited to liquefied gas, the notice said. Royal Dutch Shell is expected to import LNG by sea and sell the product to operators of thermal power plants, gas distributors and consumers in the unregulated natural gas market. Other companies also received authorization to import LNG, including a unit of Brazilian steelmaker Gerdau SA.

Source: The Economic Times

Vopak joins queue to build LNG import terminal in Australia

17 March: Dutch oil storage company Vopak wants to build an LNG (liquefied natural gas) import terminal in Australia’s Victoria state, vying with five other proposed projects to fill a looming gas supply gap in the country’s southeast. Vopak said it wants to dock a floating storage and regasification unit (FSRU) in Port Phillip Bay near Melbourne. It hopes to submit a proposal to the Victoria state government in the third quarter of 2021. It aims to have first imports after 2024, when the market is expected to face a gas shortfall as the ageing fields that have long supplied the state’s needs are rapidly drying up. Vopak expects the terminal to be able to import up to 50 LNG cargoes annually, with an open access model providing services to LNG suppliers and gas market customers.

Source: Reuters

International: Coal

Australian coal exports disrupted as deluge shuts rails, slows port

22 March: Coal deliveries to Australia’s Port of Newcastle, the world’s biggest coal export port, have been halted because flooding in the Hunter Valley region has shut rail lines, with heavy rains also slowing ship movements at the port. The Port of Newcastle, which last year shipped 158 million tonnes (mt) of coal, said bad weather had slowed vessel movements into and out of the port, but operations were continuing. Newcastle Coal Infrastructure Group, which operates one of the coal terminals at the port, confirmed that coal deliveries into the port had been suspended. The Hunter Valley rail network serves mines run by BHP Group Ltd, Glencore PLC, New Hope Corp Ltd, Whitehaven Coal, and Yancoal Australia Ltd, among others. Yancoal said it has suspended operations at its Mount Thorley Warkworth and Stratford Duralie mines. New Hope said it was experiencing only a minor disruption and was still able to get a limited amount of coal to port.

Source: Reuters

Worker unions take out procession in Pakistan demanding safety of coal miners

22 March: After seven people were killed in a coal mine blast in Balochistan recently, several workers' unions in Pakistan took out a procession urging the government to ensure the safety of coal miners. On 16 March, at least five coal miners and two rescuers died due to suffocation after a methane gas fire broke out in the southwestern Pakistprovince of Balochistan. Hundreds of workers under the aegis of All Pakistan Workers Confederation (APWC) and All Pakistan Wapda Hydro Electric Workers Union (CBA) from Bakhtiar Labour Hall expressed their condolences over the tragic killings of seven coal miners. The protestors demanded that Prime Minister Imran Khan and the province Chief Minister should intervene to prevent such tragic accidents in coal mines in future. According to participants in the procession, 100 coal miners were killed in 2020 alone. Earlier this year, unidentified gunmen stormed a coal mine in Machh town near Quetta, pulling out ethnic Hazaras, members of Pakistan's Shia minority community, from their homes and opening fire on them. In 2020, at least 99 coal miners and labourers were killed in 72 incidents in Balochistan, Al Jazeera reported citing government data.

Source: The Economic Times

International: Power

VinaCapital, GS Energy to invest $3 bn in LNG power plants in Vietnam

22 March: VinaCapital, one of the largest investment and asset management firms in Vietnam, said it would jointly invest up to $3 bn in a LNG-to-power complex in the country with its South Korean strategic partner GS Energy. The first phase of the 3,000 MW complex in the southern province of Long An should be operational from the end of 2025, VinaCapital said. Prime Minister Nguyen Xuan Phuc welcomed GS Energy’s investment in the province as he visited the site of the planned complex in Long An, the government said. Vietnam plans to raise the proportion of gas-fired electricity in its power mix to 21 percent by 2030 and to 24 percent by 2045 from 13 percent currently, according to a draft of the government’s master power development plan expected to be officially released later this year.

Source: Reuters

International: Non-Fossil Fuels/ Climate Change Trends

China to inspect renewable power consumption to improve offtake

23 March: China’s energy administration, as part of a drive to reduce greenhouse gas emissions, will inspect renewable power consumption across the country, with the goal of reducing power wastage from non-fossil fuel sources. China, the world’s biggest emitter of greenhouse gases, has pledged to bring emissions to a peak by 2030 and propel solar and wind power generating capacity to 1,200 GW from 535 GW in 2020. The inspection, which will run until October, will focus on how much electricity generated by hydropower plants, wind farms and solar stations was not absorbed by power grids during last year and the first half of this year, National Energy Administration (NEA) said. China has strived to increase consumption of renewable power by setting the minimum level of power purchased from non-fossil fuel sources at each region, but typically grids lack capacity to absorb all the electricity generated from these sources. A draft document from the NEA in February showed that grid companies are asked to steadily increase their purchases of non-fossil fuel power to 40 percent by 2030 from 28.2 percent in 2020.

Source: Reuters

Malaysia’s biodiesel exports in 2021 seen falling to four-year low

23 March: Malaysia’s exports of palm-based biodiesel are likely to fall this year to their lowest since 2017 due to European Union restrictions and the coronavirus pandemic, the Malaysian Biodiesel Association (MBA) said. Exports from Malaysia are estimated to fall to 350,000 tonnes from 378,582 tonnes in 2020, MBA president U R Unnithan said. The European Union accounts for nearly 80 percent of Malaysia and Indonesia’s exports of palm methyl ester (PME), the bio component of biodiesel that comes from palm oil. Exports, however, have slowed since the bloc in 2019 moved to cap the use of palm oil for transport fuel at 2019 levels due to deforestation concerns, with an aim to phase out its use by 2030. Some member states will also phase out palm biodiesel before the 2030 deadline, Unnithan said.

Source: Reuters

BP reports 9 percent drop in greenhouse gases from its 2020 fossil fuel output

23 March: BP Plc’s greenhouse gas emissions from oil and gas it produces and sells at station pumps dropped by 9 percent in 2020 from a year earlier, partly as a result of a sharp drop in energy demand due to the coronavirus pandemic, the company said. BP, which aims to produce net zero emissions from its own oil and gas production by 2050, said in its annual report that total greenhouse gas emissions reached 328 million tonnes (mt) of carbon dioxide equivalent. BP includes emissions from the combustion of its products when its clients, for example motorists, use them but it excludes gases from oil products BP sells to customers but which it bought from other producers.

Source: The Economic Times

TechnipFMC, Norway’s Magnora to develop floating wind power

18 March: TechnipFMC and Norway’s Magnora will join forces to develop floating wind power projects, the offshore technology provider and renewable energy firm said. The partnership, called Magnora Offshore Wind, plans to apply for acreage off Scotland and Norway in tenders this year and will explore production of emissions-free hydrogen. Scotland’s ScotWind leasing program is expected to attract interest from offshore wind developers and oil producers seeking to increase their renewable power portfolios. Norway is also planning to award concessions for offshore wind power in two areas in the North Sea, including one suitable for floating wind turbines.

Source: Reuters

USAID, DFC announce $41 mn loan guarantee programme for rooftop solar projects

18 March: United States Agency for international development (USAID) and US international development finance corporation (DFC) are jointly sponsoring loan portfolio guarantee to enable Indian small and medium enterprises (SMEs) to access reliable power and cut costs. The loan worth $41 mn (about ₹2.97 bn) will help finance investments by SMEs in renewable energy solutions, inclusion rooftop solar installations. USAID will continue its support by providing technical assistance to address quality and safety concerns in the rooftop solar market. Once these credit guarantees lower the financial hurdle for installing rooftop solar, India will realise numerous benefits resulting from transition to this green technology.

Source: The Economic Times

China’s climate pledge to create tectonic shift, enhance energy security: Woodmac

18 March: China’s goal to become carbon neutral in 2060 will require $6.4 tn of investment in new power generating capacity, leading to a tectonic shift in manufacturing and commodity imports while boosting its energy security, consultancy Wood Mackenzie (Woodmac) said. China has been grappling with rising oil and gas import dependency while facing increasing geo-political tensions that threaten its energy security. Its plans to shift to renewable energy would greatly enhance its independence from foreign energy sources while ensuring that the energy transition is stamped “Made in China”, Wood Mackenzie’s analysts Huang Miaoru and Zhou Yanting said in a report. Oil demand in the world’s largest importer could fall by half by 2040 compared with its base case, and nearly eliminate the country’s need for the fossil fuel by 2050, they said, enhancing its energy security. Without carbon-reduction goals, China’s oil-import dependency would exceed 80 percent by 2030, while half of its natural gas supply would be imported, Woodmac said. As China expands renewable power generation, the leading supplier of solar panels, wind turbines and batteries will also consolidate its position in the renewable energy sector. However, its ambitions of grasping a bigger share of the clean power supply chain could be impeded by access to five metals - copper, aluminium, nickel, cobalt and lithium.

Source: Reuters

Vietnam to cut rooftop solar feed-in tariff in bid to ease grid pressure

17 March: Vietnam plans to cut the feed-in tariff for rooftop solar panels by 30.8-37.9 percent in a bid to reduce pressure on the national power grid following a recent boom in installed capacity. Vietnam has had one of the fastest growing renewable energy markets in Asia in recent years, but the development of its transmission system has lagged, leaving several of its new solar power plants operating below designed capacity. The Ministry of Industry and Trade is planning to cut the tariff to 5.2-5.8 US (United States) cents per kilowatt hours (kWh) from 8.38 cents. The new tariff is expected to be effective from April. Rooftop solar installation had boomed over the past three years, with Vietnam’s total installed rooftop solar panel capacity rising to 925.8 MW from 377.9 MW at the end of 2019. Under the plan, Vietnam would raise its total installed power generation capacity to 137.2 GW by 2030 from 69 GW at the end of 2020. The proportion of non-hydro renewable would be raised to 29 percent by 2030 and 44 percent by 2045.

Source: Reuters

US renewable fuel credits hit multi-year high as oil group urges EPA to act

17 March: US (United States) renewable fuel credits this week hit fresh multi-year highs, while an oil refining trade group urged the Biden administration to use its authority to help stabilize the market. Prices for so-called Renewable Identification Numbers (RINs) have climbed all year as costs for feedstocks such as soybean oil increase and as market participants bet on reduced exemptions granted to oil refiners that would waive them from U.S. biofuel blending requirements. The American Fuel & Petrochemical Manufacturers group argued in a letter to the Environmental Protection Agency (EPA) that uncertainty around blending obligations for 2021 - which have been delayed since a 30 November deadline - have contributed to rising RIN costs.

Source: Reuters

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Jiang, Shangrong et al (2021), Policy Assessments for the Carbon Emission flows and Sustainability of Bitcoin Blockchain operation in China, Nature Communications

Source: Jiang, Shangrong et al (2021), Policy Assessments for the Carbon Emission flows and Sustainability of Bitcoin Blockchain operation in China, Nature Communications PREV

PREV