Quick Notes

Energy trends in 2022: ‘Known’ knowns and the ‘known’ unknowns

Global

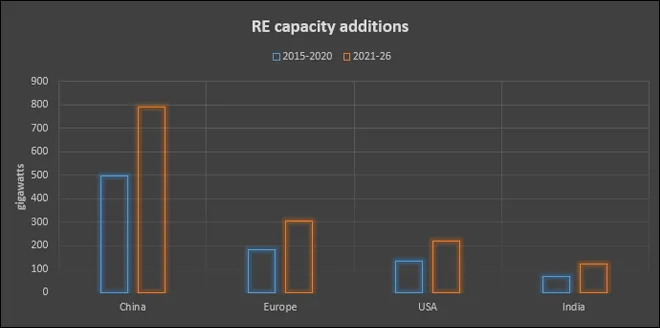

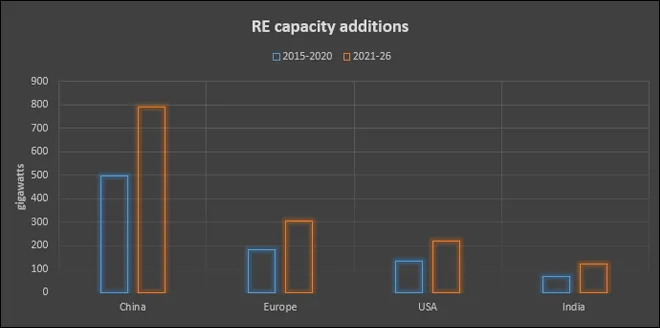

Optimistic forecasts for renewable energy (RE) capacity additions, particularly for photovoltaic (PV) power generation capacity and less optimistic forecasts for fossil fuel investment are two key threads that run through most reports on energy sector expectations for 2022. Unwavering policy and public support along with financial and non-financial subsidies for RE (for capacity additions and for research & development) in most of the developed world and in large markets like India make optimistic forecasts for RE capacity additions a ‘known’ known.

RE is expected to account for 90 percent of global capacity additions and PV capacity is expected to touch 162 GW (gigawatts) in 2022. Growth of wind energy capacity additions is expected to slow down in 2022 but grow faster than the average growth of the sector in 2017-19 with 80 GW of capacity addition. RE capacity addition of 49 GW in 2022 is expected in Europe on account of continued policy support and corporate power purchase agreements (PPAs) with RE producers. Prospects for decentralised RE are projected to be bright in the USA although most reports express some uncertainty over setting of carbon mitigation targets. RE capacity addition in China is projected to decelerate in 2022 primarily because of impending subsidy phase-outs but even then RE capacity addition is expected to increase by 58 percent. Given that China accounts for over 50 percent of wind turbine manufacturing capacity and almost 70 percent of solar panel output, tight global supply chains are expected to challenge global RE capacity additions in 2022.

Carbon prices in compliance markets, including the EU’s Emissions Trading System (EUETS) and China’s National Emission Trading Scheme are expected to increase in 2022 on the back of policy support. In industrialised countries, governments are expected to increase carbon tax rates and introduce new taxes to meet their decarbonisation pledges. On voluntary carbon markets corporate entities with ambitious net-zero targets are expected to drive up demand for high quality carbon offsets.

In 2022, electric vehicles (EV) are expected to take a double-digit share of the global market for the first time and EV sales are expected to touch 5.8 million. Some projections are more optimistic with sales of over 7.8 million units. While Europe is expected roll-out its super-credit for EVs subsidy reductions are forecast for China. Though production costs of EVs are expected to increase as cost of lithium, aluminium, and copper are anticipated to increase, these price increases are not likely to be passed on to consumers as the EV price must remain below price caps set by government EV incentive schemes.

India

India’s RE capacity additions are expected to set new records in 2022 as delayed projects from various competitive auctions are completed. Despite this, growth of RE capacity additions are expected to be far lower than the annual capacity addition of 40 GW required for India to reach the target of 500 GW pledged at the COP26. The target of the government is to achieve 227 GW of RE capacity (including 114 GW of solar capacity and 67 GW of wind power capacity) by 2022, more than its 175 GW target as per the Paris Agreement. India’s renewable energy sector is expected to attract investment worth US$ 15 billion in 2022.

‘Known’ Unknowns

Global

Investments in fossil fuels that used to be determined largely by market fundamentals are increasingly influenced by climate change related disincentives, pressure from activist investors, and government policies to mitigate carbon emissions. In 2014, investors with just US $52 billion assets under management had pledged to shift investments away from fossil fuels. In 2021, as many as 1,485 institutional investors, representing a massive US $39.2 trillion of assets under management, committed to at least some form of divestment from fossil fuels. Banks now view lending to fossil fuel companies as carrying political risk. All this has decreased investment in supply of fossil fuels but this has not translated into decrease in demand.

Towards the end of 2021, global economic recovery from the pandemic increased demand for fossil fuels leading to unanticipated surge in the price of fossil fuels. What this suggests is that while the pressure to shift away from fossil fuels by constraining supply is known, how the global energy market that still depends on fossil fuels to meet 83 percent of demand remains unknown. The IEA’s (International Energy Agency) simultaneous call to stop investment in fossil fuels in its net zero report and to the OPEC (organisation of petroleum exporting countries) for opening its taps to keep oil markets well supplied best illustrates this contradiction.

In North America and Europe, gas demand has increased as replacement of coal-fired power generation. However, the decline in coal-fired generation has removed an important buffer for gas demand and prices. The result is less elastic gas demand, soaring natural gas prices, increase in price volatility and ironically a return to coal in some markets. After falling in 2019 and 2020, global power generation from coal is expected to jump by 9 percent in 2021 to an all-time high of 10,350 TWh (terawatt-hours). Depending on weather patterns and economic growth, overall coal demand is projected to reach new all-time highs in 2022 with global production touching an all-time high of over 8 billion tonnes (BT) in 2022 and remain at that level for the following two years, underscoring the importance of energy security. Diversifying energy supply with RE may insulate the energy sector from the impulses of market forces to some extent but increase dependence on more volatile natural forces such as the weather.

In 2022, fossil fuel companies’ investment in technologies like carbon capture, utilisation & storage (CCUS) and low carbon hydrogen may coalesce into the beginning of an RE versus RE race with the solar plus batteries camp pitched against the CCUS and hydrogen camp. Incentives in advanced markets such as the production credit of US $3 per kilogram of low carbon hydrogen and 45Q tax credit for blue (hydrogen derived from fossil fuels with CCUS) hydrogen could level the RE playing field for the two camps adding momentum to the competition.

India

For India, the perennial ‘known’ unknown of efforts to reform the bankrupt discoms will continue in 2022. The fate of the draft electricity amendment bill (2020) will add to the ‘unknown’ component. With GDP (gross domestic product) projected to grow at over 9-10 percent, electricity demand and demand for coal are projected to increase substantially in 2022. The largest increase in coal production of 163 million tonnes is expected from India in 2022 with overall production crossing the 1 BT mark. But hitting this target depends on the big unknown of how the pandemic plays out and how the economy responds. 2022 may pose another challenge for India’s RE capacity addition which is underpinned by its cost competitiveness over coal. While inputs for coal are declining, the spike in global demand for critical minerals required for solar, wind and storage technologies have increased their capital costs. This may have a negative impact on capacity additions for RE. In addition, the substantial increase in RE capacity expected in 2022 may drive down tariff compromising the economic viability of RE projects.

Overall, 2022 is likely to hail the beginning of interesting times highlighting the tension between ‘known’ known energy outcomes that are the result of state-led policy decisions to increase RE investments and ‘known’ unknowns that are market response to the state-led interventions primarily from the fossil fuel sector.

Source: International Energy Agency

Source: International Energy Agency

Monthly News Commentary: NON-FOSSIL FUELS

Bio-fuels production gathers momentum

India

Biomass/Biofuels

Union Ministry for Petroleum and Natural Gas asserted that India is on the right track as far as its transition from a fossil-fuel based economy to a green one is concerned. This comes just days after the COP26 climate summit, where India pledged to cut emissions to net zero by 2070, reduce carbon emissions by one billion tonnes (bt) by 2030, and raise the share of renewables in the energy mix to 50 percent, amongst others, before staging a last-minute climbdown opposing a commitment to "phase out" coal. Yet the Ministry held that India is moving ahead with its plans on biofuel and green energy, stating that in 2014, "only 1 percent or less of ethanol blending was taking place".

Praj Industries Limited (Praj) and IOC have inked a MoU to explore opportunities in the production of alcohol to jet (ATJ) fuels, 1G & 2G ethanol, compressed bio-gas (CBG) and related opportunities in the biofuels industry. Exploring these green energy horizons will be crucial for India to achieve carbon neutrality by 2070. The MoU will boost ATJ fuel production capacity and its use in India which will in turn help curb emissions emanating from the airplanes as per The International Air Transport Association (IATA)’s mandate. As per the MoU, Indian Oil and Praj will also collaborate to set up biofuel production facilities, including CBG, biodiesel and ethanol.

Invest Punjab signed a MoU with Punjab State Office-Renewable Gas Association of India (PSO-RGAI) for the promotion of setting up biofuel projects and compressed biogas plants (bio-CNG) in Punjab. Renewable gas could emerge as one of the most promising industrial sectors with sustainable and an all-inclusive growth for Punjab. With an annual surplus volume of 20-25 million tonnes (mt) of agricultural residue, most of which is burnt, leads to 31 mt of GHG emissions in a of less than 75 days (mid-Sep to end-November).

The efforts taken by the Indore Municipal Corporation (IMC) to keep the city clean not only earn it bragging rights as India’s cleanest city in Madhya Pradesh year after year but also some hard cash. Indore was adjudged the cleanest city for the fifth year in a row in the Union government's annual survey. The IMC earns INR80 mn (US$1.06 mn) annually from the plants which convert waste into useful products such as bio-CNG. The corporation employs about 8,500 sanitary workers in three shifts from 6 am to 4 am -- 22 hours a day -- to keep the city clean. The city generates 300 million litres per day (MLD) of sewage water. Of this, 110 MLD water is reused to water public gardens, farms and also for construction activities.

RE Policy and Market Trends

The Goa state government has started preparing a 100 percent renewable energy plan with the assistance of the Union government to achieve the goal of cent percent use of renewable energy. State Environment Ministry, in a letter to the Union government, stated that Goa is in the process of preparing a 100 percent renewable energy plan with assistance from the Union ministry of new and renewable energy (MNRE). Goa requires approximately 540 MW power during the day and 640 MW during peak hours, 6pm to 11pm. The government has notified a solar policy with 50 percent subsidy on benchmark cost. However, till date, only about 15 MW installations have been completed. The state government has decided to set up floating solar power plants at Selaulim, Amthanem, Anjunem and Chapoli dams on a design, build, finance and operate model for a period of 25 years and has invited expression of interest (EoI) for selection of solar power developers.

Indian Oil Corporation (IOC) and NTPC Ltd have signed an agreement for collaborating on renewable energy. NTPC Group posted a net profit of US$1.85 billion (bn) in FY21. It has also set an aim of a 10 percent reduction in net energy intensity. NTPC has an installed capacity of about 67 GW across 70 power projects, with 18 GW under construction. It has set an ambitious aim of 60 GW renewable energy capacity by 2032 from the existing 4.7 GW. NTPC has won 4.32 GW of renewable energy bids since the last financial year. It plans to invest INR1 trillion (US$13.12 bn) between 2019 and 2024 to become a 130GW power producer by 2032.

By 2030, Kolkata will mostly run-on non-fossil fuel, Kolkata’s outgoing mayor told an online meeting that connected Kolkata with the COP26 Climate Summit in Glasgow. From 2030, the city’s public transport will mainly run on CNG (compressed natural gas) and electricity. Already 100 e-buses are plying and another 1,000 will be added to the fleet soon. The state government planned to set up 3,500 charging stations in greater Kolkata and promised that piped CNG would reach the city in two years. Kolkata is one of the more polluted cities in India and much of the filthy air is because of diesel-driven public transport.

Utility Scale Solar Projects

Azure Power has signed Power Purchase Agreements (PPAs) for 600 Megawatt (MW) ISTS (interstate power transmission system) connected solar power projects with Solar Energy Corporation of India (SECI), under its 4 Gigawatt (GW) manufacturing linked projects, which will supply power for 25 years at a fixed tariff of INR2.54/kWh. The projects will be constructed in Rajasthan, the highest solar insolation state in India, for which connectivity approval is in place and land is fully identified and is under acquisition. The commissioning timeline for the projects as per the agreement is Q3 FY 2024.

Mahanadi Coalfields Ltd (MCL) is planning to set up a 50 MW solar power plant in Odisha’s Sambalpur district at a cost of INR3.01 bn (US$39.95 million). The green project is part of the miner’s goal to achieve carbon neutrality by 2024. This project will reduce carbon dioxide emission by 91,020 tonnes per annum and carbon offsets of around 24,824 tonnes per annum.. MCL has placed an order with a Chennai-based firm, which will establish this green energy project within 10 months. This plant will cater to the captive power requirement of the coal producing company. The MCL had earlier set-up a 2 MW solar power plant in Sambalpur in 2014. The MCL has set a target of installing 182 MW of solar power by 2024 in order to become a net-zero energy company, aligning itself to use cleaner forms of energy for coal production.

The foundation stone was laid for the 600 MW Ultramega Solar Power Park at Garautha in Jhansi. The park is being constructed at a cost of over INR30 bn (US$398 mn) and will help provide the dual benefits of cheaper electricity and grid stability.

The Bihar state cabinet approved the government’s proposal to establish solar power plants at Kajra in Lakhisarai and Pirpainty in Bhagalpur district on the land earlier acquired for the thermal power plants. The cabinet allowed to amend the energy department’s resolution of 12 December 2010 under which chunks of land had been acquired for the establishment and opening of thermal power plants.

Hydro Power

In a bid to achieve the target of installing 500 GW renewable energy capacity by 2030, India needs to tap its hydro resources. The power ministry has directed NHPC Ltd to exploit hydro resources in the country to become one of the largest hydro power companies in the world. NHPC is directed to set up as many hydro capacities as possible and bring in NHPC in the list of top hydro power companies in the world. NHPC presently has an installation base of 7071.2 MW from 24 power stations including 2 projects in JV mode. Besides, the company is also making progress in the solar and wind energy sectors. It has commissioned 103.13 MW of solar, rooftop solar and wind energy projects at various locations in India. NHPC is presently working on projects totaling 6,000 MW and another 9,000-10,000 MW is in the pipeline. The company will meet its 50,000 MW energy capacity which includes solar, within time.

State-owned power producer Satluj Jal Vidyut Nigam (SJVN) has signed a pact with PTC India to develop products for supplying round-the-clock renewable energy. As per the SJVN, PTC will provide portfolio management services to SJVN. The primary objective of this Memorandum of Understanding (MoU) is to facilitate the development of energy mix from SJVN’s renewable energy projects for RTC power. PTC will study, explore, prepare and submit a detailed report regarding the supply of power from proposed renewable energy projects of SJVN to potential beneficiaries across India.

After 15 years, Himachal Pradesh is going to change its hydro power policy to address fresh challenges in hydro, biomass and solar power development. The state has prepared a draft energy policy 2021 that aims to promote green, clean and sustainable generation of energy to enable quick harnessing of full potential of Himachal Pradesh. It also aims to harness and commission 10,000 MW of hydro energy by 2030 to have an operational capacity of 20,948 MW beside upgrading the existing run of river hydro plants for pumped storage plants/hybrid power plants. The hydro power policy 2006 of the state has served its objectives well and over the last 15 years, there has been a paradigm shift in energy scenario of the country. The country is moving towards renewable energy that is total green energy as per the Paris Agreement signed in December 2015. The solar and wind power share is increasing at a faster rate than the hydro. Hydro power along with hybrid, battery and pumped storages and hydrogen energy is going to be the focus areas in coming years. Himachal Pradesh is blessed with hydro potential of 24,587 MW distributed over five river basins, out of which 10,948 MW has been harnessed (as on 31 October this year) and out of 13,639 MW, maximum potential will be harnessed by 2030. Himachal Pradesh is leader in hydro power generation in the country and contributing nearly one-fourth of total hydro generation in the country. Approximately 45 percent of total hydro potential in the state has been harnessed and in next 10 years, nearly 10,000 MW renewable energy will be added.

Wind Power

Inox Wind has bagged an order for a 150 MW wind power project from NTPC Renewable Energy Limited. As part of the order, the company will supply and install DF 113/92 - 2.0 MW capacity Wind Turbine Generators with 113 meters rotor diameter and 92 meters hub height. Inox Wind will provide comprehensive operation and maintenance (O&M) for the lifetime of the project.

Hydrogen

Adani’s logistics-to-energy conglomerate, Adani Green Energy Ltd (AGEL), will invest US$70 bn over the next decade to become the world’s largest renewable energy company and produce the cheapest hydrogen on the Earth. AGEL, the world’s largest solar power developer, is targeting 45 gigawatts of renewable energy capacity by 2030 and will invest US$20 bn to develop a 2 GW per year solar manufacturing capacity by 2022-23. Adani Transmission Ltd (ATL), India’s largest private sector power transmission and retail distribution company, is looking to increase the share of renewable power procurement from the current 3 percent to 30 percent by FY 2023 and to 70 percent by FY 2030. Adani Group already is the world’s largest solar power developer. Stating that green hydrogen, produced from renewable energy, is a miracle fuel and a miracle feedstock and that India’s exponential growth in renewables, producing green hydrogen cheaply could transform the nation into a net exporter of green energy.

Rest of the World

Middle East & Africa

Abu Dhabi National Oil Company (ADNOC) and Abu Dhabi National Energy Company PJSC (TAQA) have formed a strategic partnership on clean energy, aiming to have 30 GW of renewable capacity by 2030. The move comes at a time when Gulf oil-producing countries are trying to diversify their economies by creating new sectors and revenues, including through a big push in renewable energy. The collaboration will focus on domestic and international renewable energy and waste-to-energy projects, as well as the production, processing and storage of green hydrogen and ancillary activities. ADNOC and TAQA’s green hydrogen development projects will now come together, bringing TAQA’s expertise in renewable power and ADNOC’s efforts to create a hydrogen value chain.

Asia Pacific

Australia will set up a A$1 bn (US$740 mn) fund to invest in companies to develop low-emissions technology. The country seeks to cut carbon emissions and hit net-zero targets by 2050. Under the plan, the federal government will commit A$500 mn to the fund, matched by private investors, which will be used to back early stage companies in developing technologies including carbon capture and storage. The federal government will introduce legislation to establish the fund, in order to allow the Clean Energy Finance Corp to fund carbon capture and storage, which is not allowed under its existing terms. The move came a day after the federal government pledged A$178 mn (US$132 mn) to ramp up the rollout of hydrogen refuelling and charging stations for electric vehicles. Australia, heavily reliant on exports of coal and gas, has been targeting carbon capture and storage, and hydrogen development to help cut emissions, while still allowing for the use of gas and coal. Australia will target net-zero carbon emissions by 2050 to ease international criticism, but added it would not legislate the goal and instead rely on consumers and companies to drive emission reductions.

More than 20 countries agreed to phase out coal power at the UN (United Nations) climate talks in Glasgow, but not Japan - a "leap backwards" for a country that once led the way on the Kyoto Protocol to reduce greenhouse gas emissions. The pact was amongst a raft of pledges made at the COP26 summit. Japan, the world’s third-biggest importer of the dirtiest fossil fuel, declined to sign because it needed to preserve all its options for power generation. Critics called that short-sighted, even as new the Prime Minister has agreed to step up other environmental measures. The criticism highlights the shift in Japan’s circumstances. It led climate change efforts during the 1990s Kyoto Protocol era, but has been burning more coal and other fossil fuels after the Fukushima disaster 10 years ago left many nuclear plants idle. Japan has pledged billions of dollars for vulnerable countries and to support building infrastructure in Asia for renewables and cleaner-burning fuels. It has also cut targets for coal use and raised those for renewables.

EU & UK

The European Commission has approved a €2.27 bn (US$2.54 bn) aid scheme proposed by Greece to boost renewable power generation, it said. The measure will help Greece meet its renewable energy targets, without unduly distorting competition, as per the executive arm of the European Union (EU). Greece, aiming for renewables to account for 61 percent of final electricity consumption by 2030 from 29 percent last year, wants to shorten its permitting process to about two to three years. The new scheme that Greece has proposed to support 4.5 GW of installed electricity capacity from onshore wind, photovoltaic, biomass, hydroelectric power and other renewable energy sources includes joint competitive tendering and direct awarding.

RWE plans to invest €50 bn (US$57 bn) through 2030 to double its green energy capacity to 50 GW, as Germany’s largest power producer outlined its plan to become a global renewables heavyweight. The investment plan, unveiled and the largest in RWE's 123-year history, comes as rival utilities and cash-rich oil majors are muscling in on the renewables sector, all hoping to shift to wind and solar capacity and away from fossil fuels. RWE's strategy update follows a major restructuring that saw it take over the renewables activities of former division Innogy and E.ON, turning it into one of Europe’s largest renewables players in the process. RWE’s nuclear and coal-fired power plants in 2020 accounted for 31 percent of the group’s 40.7 GW total installed capacity.

News Highlights: 1 – 7 December 2021

National: Oil

IOC renews deal to buy up to 2 mt of crude from Russia’s Rosneft

7 December: Indian Oil Corporation (IOC) has renewed a deal to buy up to 2 million tonnes (mt) of crude oil in 2022 from Russia’s Rosneft, the Russian oil producer said. IOC had in February 2020 signed a deal with Rosneft Oil Company to import up to 2 mt of oil via the port of Novorossiysk. In 2021, the deal envisaged supply of up to 1.7 mt of crude oil but IOC bought just on parcel or shipload as the cost of transporting the oil made it uneconomical, when compared to alternatives. For 2022, the deal is for the supply of up to 2 mt of oil from the Black Sea port of Novorossiysk. India has tied up supplies from Russia to the US (United States) in a bid to diversify its oil import basket, cutting reliance on the Middle East to meet its oil needs. The signing took place during the visit of Russian President Vladimir Putin to India, during which he met with Prime Minister Narendra Modi and held bilateral talks in an expanded format. IOC also signed a Statement of Intent of Collaboration with Russian petrochemicals company SIBUR to explore the feasibility of setting up a dual-feed cracker along with downstream units at its 15 million tonnes a year Paradip refinery in Odisha.

Stepping up ethanol production may help reduce crude oil import: PM

7 December: Prime Minister (PM) Narendra Modi said stepping up ethanol production can help reduce the import of crude oil and prove to be an extra means of earning for sugarcane farmers. He claimed that before the BJP came to power, only 200 mn litres of ethanol was being sent to oil companies from Uttar Pradesh, which now increased to around 1 bn litres. The PM said the country earlier spent thousands of crores to import edible oils.

Indian Oil Skytanking to set up fuel farm at Noida International Airport

7 December: Noida International Airport (NIA) has awarded Indian Oil Skytanking Ltd (IOSL) a 30-year concession to design, build, and operate fuel infrastructure, including multi-user fuel farm and hydrant system for the airport. Accordingly, the partnership will help NIA provide aviation turbine fuel cost-efficiently and under an open access model to its airline partners. According to Christoph Schnellmann, Chief Executive Officer of Yamuna International Airport (YIAPL), the fuel farm will provide for sustainable aviation fuel. YIAPL is a 100 percent subsidiary of Zurich Airport International AG, which has been incorporated as a 'Special Purpose Vehicle' (SPV) to develop the greenfield Noida International Airport. The state government of Uttar Pradesh has signed the concession agreement with YIAPL to develop Noida International Airport (NIA) at Jewar.

India fully committed to timely completion of oil refinery project in Mongolia: President

1 December: President Ram Nath Kovind said India is fully committed to the timely completion of an oil refinery project in Mongolia as it will greatly increase its "spiritual" neighbour's energy security. Welcoming a parliamentary delegation from Mongolia to India, he said the two countries share civilisational, historical, spiritual and cultural ties. He expressed confidence that this visit will add to the vibrancy of India’s and Mongolia's bilateral relationship. Speaking about the developmental projects undertaken by India in Mongolia, the president was also happy to note the progress on the oil refinery project in Mongolia. He said that this project is a symbol of strong cooperation and the strategic partnership of India and Mongolia.

Commercial LPG gas cylinder price hiked by INR100 in Delhi

1 December: The national oil marketing companies have increased the price of commercial 19 kg (kilogram) LPG (liquefied petroleum gas) cylinder by INR100.50, taking the new price to INR2,101 in Delhi. This is the second-highest price of 19 kg commercial cylinder after 2012-13 when it used to cost around INR2,200 per cylinder. However, there has been no increase in the prices of other domestic cylinders weighing 14.2 kg, 5 kg, 10 kg composite or 5 kg composite cylinders. The difference between prices of 14.2 kg domestic cylinder and 19 kg commercial cylinder has been increased. Presently, a 14.2 kg domestic cylinder in the national capital costs INR899.50 while the 19 kg cylinder commercial cylinder comes for INR2,101. This may increase the diversion of 14.2 kg domestic gas cylinder into restaurants, tea stalls etc. which constitute the largest user segment of the 19 kg cylinder. LPG cylinder rate is revised monthly for all the states and Union territories in India. Earlier on 1 November, the price of 19 kg commercial cylinder saw a steep rise of INR266 taking its cost to INR2,000.50. On 1 October, the price of 19 kg commercial cylinder was increased by INR43 and then decreased by INR2.50 on 6 October. On 1 September, the price of these cylinders were increased by INR75.

National: Coal

India’s coal production increased to 67.8 mt in November

7 December: India’s coal production increased by 10.35 percent to 67.84 million tonnes (mt) in November from 61.47 mt in November 2019, the union coal ministry said. This comes in the backdrop of fuel stocks at coal-fuelled power projects building up after depleting to 7.23 mt on 8 October. India’s power plants burn around 1.85-1.87 mt of coal every day to generate electricity. The depleted fuel stocks at power plants had led to concerns about a possible electricity shortage. This assumes significance given that coal-fuelled power projects totalling 202.22 gigawatts (GW) remain the mainstay of India’s power generation and account for more than half of India’s power generation capacity. India has the world’s fourth-largest reserves and is the second-largest producer of coal. While Coal India Ltd (CIL)’s annual production target is 660 mt for the current financial year, the coal off take is expected to be 740 mt.

Government undertakes 14 railway projects worth INR220 bn in Eastern India to reduce time & cost of coal transportation

4 December: The central government has undertaken 14 railway projects spread across Eastern Indian states to augment the process of coal transportation. The total cost incurred will be INR220.67 bn. This project will reduce the time and cost incurred in the transportation of the dry fuel and will evacuate up to 410 million tonnes per annum (mtpa), the coal ministry. The projects will over a distance of about 2,680 km covering Jharkhand, Odisha and Chhattisgarh, the largest coal-producing states. The new railway lines, will provide better connectivity and reach for the transportation of coal. Moreover, Coal India Ltd (CIL) is infusing an estimated INR142 bn for the first-mile connectivity (FMC) projects by 2023-24, in two phases for its 49 FMC projects. CIL has placed the rapid loading system in 19 of its mines constructing 21 additional railway sidings at an estimated investment of INR33.70 bn across four of its subsidiaries. These fresh and existing projects, will be commissioned by 2023-24. The company is aiming to move about 555 mt of coal per year through mechanised means by FY24.

National: Power

IEX power trade volume grows nearly 54

6 December: Electricity trade volume at Indian Energy Exchange (IEX) rose nearly 54 percent year-on-year (yoy) in November this year to 9,477 million units. The Day-Ahead Market achieved 4,719 mn units volume in November seeing a 3 percent yoy decline. The average monthly price at Rs. 3.1 per unit saw a significant 62 percent month-on-month price reduction mainly due to increased liquidity on the supply-side with the sell-bids at 1.8X of the cleared volume. This ensured ample availability of power and competitive price of power thereby providing optimisation opportunities to the distribution utilities. The Term-Ahead Market comprising intra-day, contingency, daily and weekly contracts traded 302.7 mn units during the month and recorded 23.4 percent yoy growth.

India to supply 20 percent more power to Bangladesh

5 December: India will supply 20 percent more power to Bangladesh as the two countries renewed the contract for another five years. Tripura State Electricity Corporation Limited (TSECL) will supply 192 MW power to Bangladesh, an increase from the earlier 160 MW it supplied, as per the renewed agreement. India and Bangladesh inked an agreement on 11 January 2010 for power trading at a mutually agreed price. The agreement had expired on 16 March 202. The new agreement came into effect from 17 March 2021 and would be in force till 16 March 2026.

Arunachal Pradesh successfully implementing rural electrification schemes: Deputy CM

4 December: Arunachal Pradesh Deputy Chief Minister (CM) Chowna Mein said the state has successfully implemented the Centre’s rural electrification schemes like Saubhagya and Deendayal Upadhyay Grameen Ujwala Yojana. Attending the review meeting of Revamped Distribution Sector Scheme (RDSS) for the North-Eastern states at Guwahati, Mein said that all projects under the rural electrification schemes would be completed within the current financial year. The RDSS involves a compulsory smart metering ecosystem across the distribution sector, starting from electricity feeders to the consumer level. Mein said the power department had already installed 24,874 pre-paid energy meters at the premises of consumers in Itanagar and Naharlagun towns in the state capital complex and the revenue collection through the pre-paid energy meters are very encouraging.

November power demand hits a new peak in Delhi

3 December: At 3,831 MW, the capital’s peak power demand this November was the highest ever recorded for the month, discom (distribution company) said. While last year's November peak was 3,769 MW, the figure stood at 3,631 MW for the month the previous year. Similarly, the city’s peak power demand this October, at 5,388 MW, was higher than the previous two years - it was 4,769 MW in October 2020 and 4,553 in 2019. The power distribution companies have already warned that Delhi’s peak power demand this winter season could surpass that of 2019 (5,021 MW) and 2020 (5,343 MW) and go up to 5,400 MW. BSES has made long-term agreements with including hydro- and gas-based power generating stations. It is also receiving more than 440 MW of solar power from Solar Energy Corporation of India, 250 MW of wind power from a plant and 25 MW from another waste-to-energy set-up.

National: Non-Fossil Fuels/ Climate Change Trends

India hits target of 40 percent power generation capacity from non-fossil sources

2 December: India has achieved the target of 40 percent of its installed electricity generation capacity being from non-fossil energy sources. The country’s installed renewable energy (RE) capacity stands at 150.05 GW, while its nuclear energy-based installed electricity capacity is 6.78 GW. The government is committed to achieving 500 GW of installed electricity capacity from non-fossil fuel sources by 2030.

India will not send spent nuclear fuel to Russia: Government

2 December: India will not be sending back the spent fuel generated at the nuclear power plants located in Tamil Nadu’s Kudankulam as it considers it as a material of resource, Union Science and Technology Ministe Jitendra Singh has said. He said there is a need to have a deep underground geological disposal facility for spent nuclear fuel in the near future. Singh said the India-Russia Inter-Governmental Agreement of 2010 facilitates storage and reprocessing of spent nuclear fuel generated at Kudankulam Nuclear Power Project (KNPP). India’s atomic power plant operator Nuclear Power Corporation of India Ltd (NPCIL) has two 1,000 MW plants (Units 1 and 2) at Kudankulam, while four more are under construction (Units 3, 4, 5 and 6). All the six units are built with Russian technology and equipment supplied by that country’s integrated nuclear power operator, Rosatom. The AERB had given its consent to site the AFR for storing the spent fuel generated from nuclear power plants 1,2, 3 and 4 of 1,000 MW each.

International: Oil

Iraqi Oil Minister expects oil to reach over US$75

7 December: Iraq’s Oil Minister Ihsan Abdul-Jabbar said that he expects oil prices to reach over US$75 a barrel. He said that OPEC is trying to "control the energy market, in a positive way" that maintains the interests of all parties, consumers and producers. He said that current oil prices are unfitting for producers and that he expects them to return to a stable level in the coming months. Oil climbed more than 4 percent on hopes that the Omicron variant of the coronavirus will have a less damaging economic impact if its symptoms prove to be mostly mild and as the prospect of an imminent rise in Iranian oil exports receded. Brent crude rose US$3.20 to settle at US$73.08 a barrel. US (United States) crude settled up US$3.23 at US$69.49 a barrel. Despite signs of a drop in consumption, OPEC stuck to its existing policy of increasing oil supply on a monthly basis because it aims at offering stable oil supplies and because it believes that the drop is unreal and that the market should witness a recovery, He said.

OPEC will continue with supply adjustments for oil market: Secretary General

4 December: The Organisation of the Petroleum Exporting Countries (OPEC) will continue with its supply adjustments for the oil market, the OPEC Secretary General Mohammad Barkindo said. Oil prices fell after OPEC and its allies stuck to their existing policy of monthly oil output increases despite fears a release from US (United States) crude reserves and the new Omicron coronavirus variant would put renewed pressure on prices. He said in terms of oil demand the estimate at the moment was for a growth of 5.7 million barrels per day. He said the uncertainty and volatility on the markets was also due to extraneous factors such as the ongoing COVID pandemic and not necessarily the fundamentals of oil and gas. He said that the forecast was for oil and gas to account for more than 50 percent of the global energy mix in 2045 or even to mid century.

Shell pulls out of controversial Cambo oil project in Scotland

4 December: Royal Dutch Shell has pulled out of a controversial oil project near Scotland’s Shetland Islands, saying the project no longer makes economic sense for the company. Shell had a 30 percent stake in the Cambo project, which is opposed by environmental groups who say Britain should stop developing new oil and gas fields as part of its efforts to combat global warming. The Cambo field will produce up to 170 million barrels of oil and 53.5 billion cubic feet of natural gas over 25 years, according to Siccar Point.

International: Gas

Saudi Aramco, BlackRock sign US$15.5 bn gas pipeline deal

7 December: Saudi Aramco said it has signed a US$15.5 billion lease and leaseback agreement for its gas pipeline network with a consortium led by BlackRock Real Assets and Hassana Investment Company in its second major infrastructure deal this year. The deal signed underscores how Aramco -- the kingdom’s cash cow -- is seeking to monetise its once-untouchable assets to generate revenue for the Saudi government as it accelerates efforts to diversify the oil-reliant economy. In June, Aramco sold a 49 percent stake in its oil pipeline business to a consortium led by US-based EIG Global Energy Partners for US$12.4 billion. Under the new deal, a newly formed subsidiary, Aramco Gas Pipelines Company, will lease usage rights in Aramco’s gas pipeline network and lease them back to Aramco for a 20-year period, the Saudi oil firm said. In return, Aramco Gas Pipelines Company will receive a tariff payable by Aramco for the gas products that flow through the network, backed by minimum commitments on throughput.

Russia’s Arctic LNG signs loan deals worth US$10.8 bn

1 December: Russian gas producer Novatek said its Arctic LNG 2 future plant has signed loan agreements with foreign and Russian banks worth €9.5 billion (US$10.8 billion), securing necessary external financing for the project. It said the Chinese financial institutions signed credit facility agreements totalling up to €2.5 billion.

International: Coal

China may raise coal contract prices in 2022 after squeeze

3 December: China plans to raise the benchmark price for long-term coal contracts in 2022 after a supply scare earlier this year. The National Development and Reform Commission (NDRC) drafted a plan to set the benchmark rate for thermal coal at 700 yuan (US$110) a ton for long-term contracts, allowing prices to rise or fall within a 150 yuan band around it in monthly adjustments. China’s benchmark coal futures surged on the plan, as it would be the first increase since the contracts were introduced in 2017. Higher coal prices will likely mean steeper electricity costs for industrial customers after the government in October gave utilities the ability to raise or lower their rates within a 20 percent band around benchmark prices.

International: Non-Fossil Fuels/ Climate Change Trends

UAE's Masdar, Engie to invest US$5 bn in renewables, hydrogen

5 December: The UAE (United Arab Emirates)’s clean energy firm Masdar and France’s Engie plan to invest US$5 billion to develop 2 GW of renewable and hydrogen projects by 2030 as OPEC’s third biggest producer seeks to implement its net zero emissions pledge by 2050. The agreement between Masdar and Engie was signed during French President Emmanuel Macron’s official state visit to the UAE. Emirates Nuclear Energy Corp, which is in charge of the UAE’s nuclear power plants, signed an agreement with Électricité de France to invest in research and development of low-carbon hydrogen. The UAE was the Middle East’s first country to commit to a net-zero emissions target by 2050, with AED 600 billion (US$163 billion) in planned renewables investments.

Chinese firm to implement Bangladesh’s first waste-to-energy project

2 December: A Chinese firm has signed four project investment agreements on a waste-to-energy project with its Bangladeshi partners. According to the agreements signed, China Machinery Engineering Corporation (CMEC) will set up a 42.5 megawatt (MW) waste-to-energy power plant at Aminbazar on the outskirts of capital Dhaka. Bangladesh has long been pursuing a waste-to-energy project to ensure proper municipal waste management in Dhaka. According to the project document, the waste to energy power plant has a capacity of 42.5 MW and processes around 3,000 tonnes of fresh waste per day collected from the capital area.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV