Quick Notes

LPG subsidies: A quiet phase-out?

Status

According to the Petroleum planning & Analysis Cell (PPAC), 99.8 percent of households In India have liquefied petroleum gas (LPG) connections based on active domestic connections and the number of estimated households. This may not be an accurate figure as it is the result of dividing the number of domestic connections by the number of households estimated by the extrapolation of census 2011 data on the number households. A simple adjustment to the projected number of households can give the desired percentage for LPG access. Notwithstanding this inaccuracy, subsidies for LPG access and consumption has remained one of the driving forces behind increase in household adoption of LPG for over four decades.

The recent increase in the retail price of LPG and the absence of direct benefit transfer payments (DBT) for over a year suggests that LPG subsidies have been phased out quietly. However, in repose to a question in the Lok Sabha in August 2021 on whether LPG subsidy has been phased out, the Minister for Petroleum & Natural Gas (MOPNG), stated that the government continued to modulate the effective price of domestic LPG and that the subsidy on LPG depended on both the international product price and government decision. However, according to data from the PPAC, the last subsidy pay-out for domestic LPG in the form of DBT was made in July 2019. Since then, the retail price of domestic LPG is the same as the basic price plus dealer commission and GST (goods and services tax). For example, In October 2021, the price before taxes and subsidies of LPG was INR 780.52/cylinder and the retail price charged to the domestic consumer INR 884.5/cylinder that included a dealer commission of INR 61.84/cylinder and GST of INR 42.14/cylinder.

Subsidy Trends

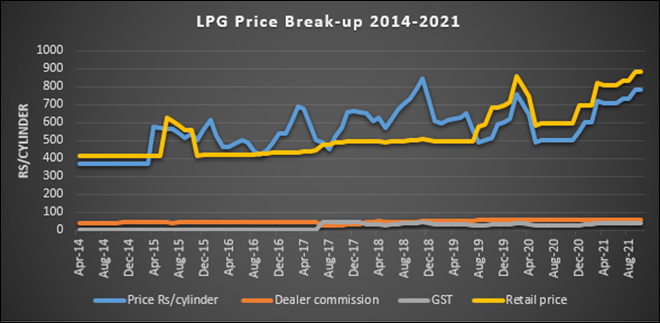

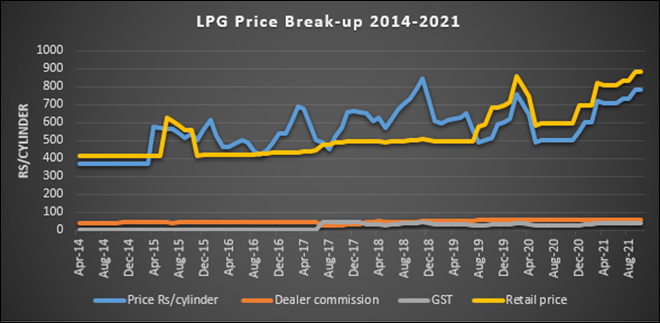

Since April 2014, the retail price of LPG has increased by almost 113 percent from INR 414/cylinder to INR 884.5/cylinder in October 2021. Under the “burden sharing” programme that was in place between December 2015 and October 2017, the largest burden (amongst oil companies) was carried by the upstream company ONGC (oil and natural gas commission) that peaked at about INR 50/cylinder in December 2015. Price support from the government (either through a price discount at the retail end or as DBT) touched a peak of INR 435/cylinder in November 2018 after which it fell to about INR140/cylinder in July 2019. After July 2019, there is no record of LPG subsidy pay-outs from the government.

Source: Calculated from PPAC reports 2014 to 2021

Source: Calculated from PPAC reports 2014 to 2021

Subsidy Phase-out

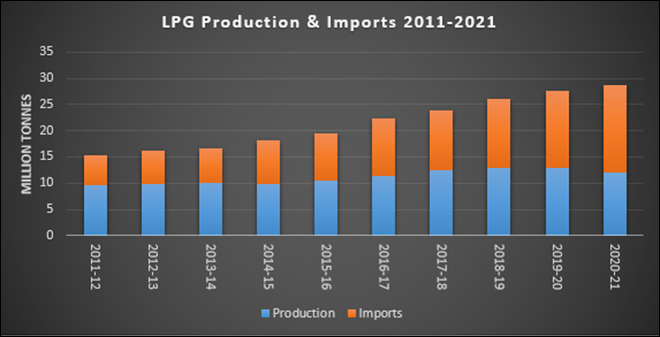

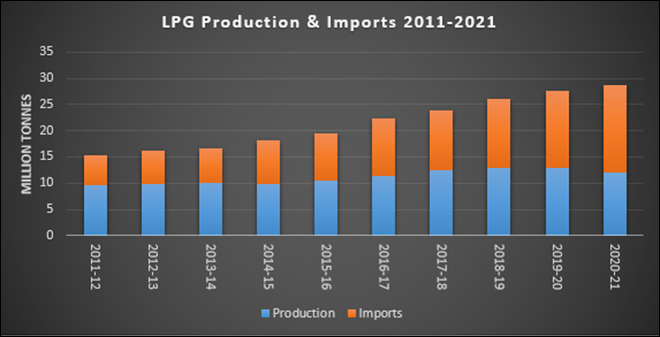

In response to a Lok Sabha question in August 2021 as to why the retail price of LPG has remained high despite the fall in global prices, the Minister of State for Petroleum & Natural Gas offered an ambiguous response that did not explicitly state that subsidies to LPG have been withdrawn. Other responses by the representatives of the Government to questions over the price of LPG at the Lok Sabha or through media outlets focussed on assigning blame on the increase in international price of LPG. Though the international price of LPG has started to increase after the end of the pandemic-related lockdowns, the price was falling in the previous six years. Between 2013-14 (financial year) and 2019-20, the international price of LPG fell by 48 percent and between 2013-14 and 2020-21, it fell by about 31 percent. The retail price of LPG increased by over 110 percent between April 2014 and October 2021. The international price of LPG matters as the share of LPG imports in total LPG consumption has increased from about 37 percent in 2011-12 to over 57 percent in 2020-21.

Between 2013-14 and 2015-16, government subsides under the burden sharing programme fell by over 64 percent from INR 746.1 billion to 263 billion and oil company share fell by over 98 percent from INR691.28 billion to about INR12.68 billion. DBT pay-out fell by over 86 percent from INR275.7 billion in 2015-16 to about INR36.58 billion in 2020-21.

Issues

The government has taken credit both for reducing LPG subsidies for the rich and for introducing LPG subsidies for the poor under the ‘Pradhan Mantri Ujjwala Yojana’ (PMUY) scheme. But both claims are contested. In 2016, the government claimed that it has reduced LPG subsidy burden through the “give it up” scheme, though only about 5 percent of households voluntarily opted out of LPG subsidies. More significantly the CAG (comptroller auditor general) discredited the claim, observing that though the decrease in the offtake of subsidised LPG cylinders made a small contribution, fall in crude prices was by far the main factor in reducing LPG subsidies. The CAG also pointed out inconsistencies in the methodologies adopted by the Ministry of Petroleum & Natural Gas and oil companies to estimate savings from reduction of LPG subsidies.

According to many early studies, the PMUY scheme did not result in widespread adoption of LPG in poor households as the primary cooking fuel. The scheme was short-term oriented with one-time subsidies that targeted voters in poll bound states. Spending on PMUY fell by more than 50 percent from INR29.9 billion in 2015-16 to about INR12.93 billion in 2019-20. As there was no improvement in incomes of households receiving LPG connections under PMUY, they were unable to purchase replacement cylinders. Phasing out of subsidies for LPG has made it even more difficult for PMUY recipients to purchase refill cylinders. This often means reverting to burning biomass. Giving poor households LPG connections is one step but for meaningful energy transformation poor households must be enabled to modernise, industrialise and urbanise so that they no longer need government subsidy programmes for LPG access.

Distributing public goods such as access to energy (LPG connections or electricity) as private transfers to individual citizens (voters) as the means to secure votes rather than providing broad-based services to which many would simultaneously have access used to be called populism. Now the same is recast in positive light as “new welfarism” and celebrated for its environmental and health benefits. The rationale is that LPG access reduces use of biomass in households and consequently eliminates smoke that affects the lungs of women who spend time in smoke filled rural kitchens. If there is genuine long-term concern over the environment and women’s health, it is important that energy access programmes do not become means for political ends. For this the politician needs to see beyond elections and budgetary provisions look beyond electoral cycles.

Source: Calculated from PPAC reports 2011 to 2021

Source: Calculated from PPAC reports 2011 to 2021

Monthly News Commentary: Power

Coal Supply lags Electricity Demand Growth

India

Demand Growth

India is suffering its worst power shortage in October since March 2016 due to a crippling coal shortage, federal grid regulator POSOCO data showed. Power supply fell about 750 million kilowatt hours (kWh) short of demand during the first 12 days of October, a deficit of 1.6 percent that was the worst in five and a half years, the data showed. The October shortfall was already the biggest in absolute terms for a single month since November 2018, even with 19 days of October still left. The shortfall this month already accounts for 21.6 percent of the total deficit this year. Northern states such as Rajasthan, Punjab, Haryana, and Uttar Pradesh, and the eastern states of Jharkhand and Bihar, were the worst affected, registering supply deficits of 2.3-14.7 percent. Increased economic activity after the second wave of the coronavirus pandemic has driven up demand for coal leading to a supply shortage, forcing northern states such as Bihar, Rajasthan and Jharkhand to cut power for up to 14 hours a day. According to ministry of power, the capacity of power plants under outage because of a coal shortage had fallen nearly to 6 gigawatts (GW), from 11 GW.

Uttar Pradesh (UP) Chief Minister (CM) said that his government was buying electricity from energy exchange and other sources at a cost up to INR 22 per unit (kWh) as it was unwilling to let the ongoing festivities get affected by shortage of power in the aftermath of a nationwide coal crisis. Private power producers and some state transmission utilities appear to be making a killing by selling electricity on the exchanges where rates have tripled owing to lower generation as a result of coal shortage, even as the Union Power Secretary asked states to watch out for generators gaming the State transcos, privatet gencos make a killing on power exchanges. Earlier, the CM had asked the power officials to coordinate swiftly with the Centre and the Coal India Limited (CIL) to mitigate the crisis which was threatening to worsen the situation of the financially ailing UP Power Corporation Limited (UPPCL)—it was already running at an accumulated loss of INR900 bn (US$12.08 bn).

Kerala’s Power Minister said that the government will decide on imposing loadshedding after 19 October. The minister said that Kerala is facing a shortage of 100 MW currently. He said that the government will have to resort to loadshedding in case shortage of power from the Central pool continues. He said Kerala received only 30 percent of its daily quota from Koondankulam. The Kerala State Electricity Board (KSEB) said that a shortage of 15 percent was manageable but once the shortage exceeds beyond 20 percent then the department will have to think about load-shedding. Meanwhile in Delhi, Power Minister said the National Thermal Power Corporation(NTPC) plants halved power supply to the Capital. Punjab Chief Minister vowed not to let power cuts affect his state and said that he has asked Centre to ensure adequate supply of coal.

Electricity Trade

According to India Ratings and Research (Ind-Ra), short-term power prices are likely to remain elevated in the near term on account of a continued increase in imported coal prices. It noted that a large part of the increased power generation would continue to be met through coal-based plants, although coal output is not increasing to the desired level. This is reflected in low inventory stocks at power plants, and therefore, a part of the increased energy demand will have to be met through imported coal. It stated, in light of the expected high imported coal prices, the short-term power prices in India are likely to remain elevated.

Discom Reform

The power ministry has mandated energy accounting of distribution companies (discoms) to reduce electricity losses. The regulations in this regard have been issued by the Bureau of Energy Efficiency (BEE) with the approval of the Ministry of Power, under the provisions of the Energy Conservation Act, 2001. The notification stipulates quarterly energy accounting by discoms through a certified energy manager within 60 days. There will also be an annual energy audit by an independent accredited energy auditor. Both these reports will be published in the public domain. Energy accounting reports will provide detailed information about electricity consumption by various categories of consumers and the transmission and distribution losses in various areas. It will identify areas of high losses and theft and enable corrective actions. This measure will also enable the fixation of responsibility on officers for losses and theft. The data will enable the discoms to take appropriate measures for reducing their electricity losses. The discoms will be able to plan for suitable infrastructure upgradation as well as demand-side management (DSM) efforts in an effective manner. This initiative will further contribute towards India's climate actions in meeting our Paris Agreement goals. These regulations have been issued under the ambit of the Energy Conservation Act, 2001, with an overall objective to reduce distribution sector inefficiency and losses, thereby, moving towards the economic viability of discoms.

Soon, electricity consumers in Telangana may have to pay more as the state government is expected to clear the proposals on enhancing power charges in the next cabinet meeting. Telangana Chief Minister, who held a review meeting on the RTC and electricity department, asked the officials to come up with proposals on enhancement of charges. The government has not revised the electricity tariff in the last seven years after formation of the state. The power distribution companies generally submit their aggregate revenue requirement (ARR) to the Telangana State Electricity Regulatory Commission (TSERC) in November every year and any hike will come into effect from the next financial year. But, the discoms may seek the permission of the TSERC to permit them to increase the tariff immediately. Both the Telangana Southern Power Distribution Company Limited and Telangana Northern Power Distribution Company Limited have been facing a huge revenue gap due to rising power cost and losing revenue towards power subsidies for agriculture and other sectors.

The Jharkhand government has granted retrospective exemption in electricity duty for five years from 2016 to industrial units having captive power plants for a period of five years from the date of commissioning of the power plant, according to a gazette notification by the commercial tax department. The exemption from 100 percent electricity duty has been granted in retrospect to new or existing industrial units. It said the notification shall be deemed to be effective from 1 April 2016 and shall be in force till 31 March 2021.

Transmission

Sterlite Power has bagged Nangalbibra -Bongaigaon inter-state power transmission project worth INR3.24 billion (US$43.5 mn). The project elements consist of a new 220/132 kV substation at Nangalbibra and laying of 130 kilometres of 400kV D/c transmission line connecting Bongaigaon in Assam to Nangalbibra in Meghalaya across the river Brahmaputra. The project will also have 20 km of 132kV D/c line connecting Hatsinghmari in Assam to Ampati in Meghalaya. Sterlite Power has a track record of executing complex projects successfully with the use of technology and innovative solutions. The company has completed the NER-II project, an inter-state transmission scheme ning across the north-eastern states of Assam, Arunachal Pradesh and Tripura.

Regulation and Governance

In a major announcement of welfare schemes for the farmers, Tamil Nadu Chief Minister (CM) distributed 100,000 free power connection certificates to the farmers. He further said that the electricity board department has resolved 90 percent of grievances since the formation of the DMK government.

Rest of the World

Global

The global energy crunch which has sent natural gas prices to record highs and caused power shortages in many parts of the world is now spilling over to the island state of Singapore which is dependent on gas for power generation. Three energy providers in Singapore are exiting the market, and according to company sources at least two others have stopped accepting new clients amidst rocketing wholesale energy prices that retailers are unable to pass on to customers. Singapore’s energy regulator Energy Market Authority (EMA) said it was working closely with retailers facing challenges from volatile electricity prices—which rose to record high levels—and said there will be no disruption to their customers' electricity supply. Singapore is one of few countries in Asia with a fully liberalised electricity retail market. Power generation firms in Singapore sell electricity in the Singapore Wholesale Electricity Market (SWEM) every half hour, with the price determined by supply and demand at that time. Electricity retailers buy electricity in bulk from the wholesale market and compete to sell electricity to consumers. Of the total 22 licensed electricity retailers in Singapore, 12 provide power to residential consumers and the rest to only businesses.

China

China’s energy crisis is shaping up as the latest shock to global supply chains as factories in the world’s biggest exporter are forced to conserve energy by curbing production. Local governments are ordering the power cuts as they try to avoid missing targets for reducing energy and emissions intensity, while some are facing an actual lack of electricity. The disruption comes as producers and shippers race to meet demand for everything from clothing to toys for the year-end holiday shopping season, grappling with supply lines that have been upended by soaring raw material costs, long delays at ports and shortages of shipping containers. Chinese manufacturers warn that strict measures to cut electricity use will slash output in economic powerhouses like Jiangsu, Zhejiang and Guangdong provinces—which together account for almost a third of the nation’s gross domestic product—and possibly drive up prices. With the power crisis moving from the factory floor to people’s homes, electricity utility State Grid Corporation of China said it will try its best to avoid power cuts to meet basic residential demand.

Other Asia Pacific

Afghanistan’s state power company has appealed to a United Nations (UN)-led mission to give US $90 million to settle unpaid bills to Central Asian suppliers before electricity gets cut off for the country given that the three-month deadline for payments has passed. Since the Taliban took control of Afghanistan from mid-August, electricity bills haven’t been paid to neighbouring countries that supply about 78 percent of its power needs. This poses another problem for a new government that is grappling with a cash crunch in the economy in part due to US (United States) and other allies freezing the country’s overseas reserves. Afghanistan usually pays US$20 million to US$25 million a month in total to Uzbekistan, Tajikistan, Turkmenistan, and Iran and now unpaid bills stand at US$62 million.

Cyprus and Egypt signed an accord to pursue links between the electricity transmission networks of the two countries. A Memorandum of Understanding (MoU) was signed by the energy ministers of Cyprus and Egypt, setting out a framework of cooperation from planning to implementation. Earlier Greece and Egypt signed a similar agreement, which sets the stage for an undersea cable that will transmit power produced by renewables from North Africa to Europe, the first such infrastructure in the Mediterranean.

News Highlights: 20 – 26 October 2021

National: Oil

Indian refiners willing to join forces for cheaper oil imports

22 October: India’s private oil refiners are willing to work with state-run peers to bargain collectively for better oil import deals, Oil Minister Hardeep Singh Puri said, as the nation looks to cut its import bill. India is forming a group bringing together state and private refiners to seek better crude import deals. He said the private companies are "enthused" by the plan. India is the world’s third-largest oil importer and consumer, reliant on imports for about 85 percent of its crude and buying most of that from Middle East producers. Private companies including Reliance Industries (RIL), operator of the world’s biggest refining complex, and Nayara Energy, partly owned by Russian oil major Rosneft, control about 40 percent of India’s 5 million barrel per day (bpd) refining capacity. With local gasoline and gasoil prices rising to record highs in India’s worst power crisis for years, the nation wants to redouble efforts to buy wisely. India’s trade deficit last month surged to a record US$22.6 billion, its highest in at least 14 years, driven by expensive imports. India has repeatedly asked the Organization of the Petroleum Exporting Countries (OPEC) and its allies, together known as OPEC+, to boost output to bring down global oil prices.

Diesel price inches closer to the century mark in Kolkata

21 October: A litre of diesel is only INR2 shy of a century in Kolkata at present as fuel prices in the city rose again, with diesel reaching INR98.03 per litre and petrol selling at INR106.78 per litre in yet another all-time high. Fuel prices in the country have been hovering at record levels since April this year. While diesel used to sell at INR77.41 at the start of the year and had a INR6 rise in the first four months, it has shot up by close to INR15 per litre in six months and is set to climb further according to fuel station operators in the city. State-run oil refiners such as Indian Oil, Bharat Petroleum and Hindustan Petroleum revise the fuel rates on a daily basis based on crude oil prices in international markets and the rupee-dollar exchange rates. Any changes in petrol and diesel prices are implemented with effect from 6am every day. Fearing the soaring fuel prices will lead to hike in prices of essential and non-essential goods across several categories, petrol pump owners’ association demanded the Centre and the state to reduce taxes—which constitute to more than 50 percent of the total price we pay for a litre of fuel.

Indian Oil’s refineries running at 90 percent capacity utilisation: Chairman

21 October: Refineries of Indian Oil Corporation (IOC) are running at nearly 90 percent capacity according to company chairman Shrikant Madhav Vaidya. Vaidya said that the refineries will soon be operating at 100 percent capacity as demand for most fuels cross or reach pre-pandemic levels. He noted that under a business-as-usual scenario, around 30 percent of IndianOil’s ATF (Aviation Turbine Fuel) sales are to these international flights. IndianOil is the country’s largest fuel refiner and retailer, commanding close to a third of India’s 5 million barrels per day crude oil refining capacity. Hindustan Petroleum Corporation (HPCL) chief M K Surana said that, at a group level, his refineries are running at full capacity while petrol demand at better than pre-pandemic levels.

National: Gas

RIL to press KG-Basin for higher revenues after government hikes gas price

25 October: Reliance Industries Ltd (RIL) is reaping the benefits of an increase in production from its oil and gas assets. The higher production from RIL-BP controlled Dhirubhai-6 (D6) block in the Krishna Godavari (KG) Basin will coincide with the government significantly hiking the price allowed for selling domestically produced natural gas. RIL’s share of production from the KG-D6 basin sequentially rose by 18.4 percent to 39.2 billion cubic feet equivalent (BCFe) during the quarter ending 30 September of the current financial year. This stood at 33.1 BCFe in April-June 2021. There was nil production from this asset in July-September 2020. The gas produced from this asset, awarded under the New Exploration Licensing Policy (NELP) regime, is priced in line with a government approved formula instituted in March 2016. The KG-D6 asset is enlisted under the Deepwater, Ultra Deepwater, and High Pressure-High Temperature area (collectively called difficult discoveries) category. This allows RIL and BP marketing freedom including pricing freedom, subject to a ceiling price on the basis of landed price of alternative fuels. The landed price is calculated once in six months and applied prospectively for the next six months. According to the Ministry of Petroleum and Natural Gas, the price data used for calculation of ceiling price in US$ per million metric British thermal units (mmBtu) shall be the trailing four quarters data with one quarter lag. Under this pricing regime, RIL-BP was allowed to sell natural gas produced from KG-D6 subject to a price ceiling of $3.62 per mmBtu during the first half of financial year 2021-22 (till 30 September 2021). This drove up RIL’s revenue from the oil and gas business sequentially by 28.3 percent to INR16.44 bn in Q2FY22. However, these earnings are expected to multiply when the year closes since the notified gas price ceiling has been almost doubled to US$6.13 per mmBtu for the remaining six months of the current financial year. In addition to the existing production, first gas is expected from the KG D6 – MJ Field by Q3FY23. RIL-BP expects to produce 1 BCF of gas per day, in a phased manner, from the integrated development of KG-D6 by 2023. This will be approximately 25 percent of India’s production and 15 percent of demand.

India to bargain undelivered cargoes for renewing LNG contract with Qatar

24 October: India will bargain for supply of undelivered gas quantities of past years when it negotiates renewal of its multi-billion dollar LNG import deal with Qatar. Petronet LNG Ltd’s 7.5 million tonnes (mt) a year liquefied natural gas (LNG) import deal with Qatargas is ending in 2028. Renewal, if any, has to be confirmed 5 years ahead of that. Talks for renewal will start next year and will be conditioned on Qatargas delivering in 2022 the 50 cargoes or shiploads of LNG that weren’t taken in 2015, Petronet said. As regards the cargoes that were not taken, it was decided that India can see the cargoes anytime during the remainder of the contract that ends in 2028. In case, Qatar is unable to meet the request, the deferred cargoes can be delivered in 2029.

National: Coal

Coal Consumers Association writes to government seeking immediate resumption of supply to non-power sector

24 October: Amidst the ongoing coal crisis, Coal Consumers Association of India (CCAI) has written to the coal ministry seeking immediate resumption of coal supply to the captive power plants and other steel, aluminium and paper companies. Due to low stock positions at several power plants, Coal India Ltd (CIL) has asked its subsidiaries to refrain from conducting any e-auction of coal, except special forward e-auction for the power sector, till the situation stabilizes. CIL said that due to low stock position in power houses and a spurt in economic activity the coal supply is temporarily prioritized to the power sector. Some of India’s top metals and cement makers are facing severe coal shortages as CIL’s Southern Eastern Coalfield (SEC) has said that they will be suspending all the coal supplies and rakes to a non-power sector. CIL has been saying that it is working towards augmenting its production to ease the situation.

NTPC floats coal import tender

22 October: NTPC Ltd has floated a tender to procure 1 million tonnes (mt) of imported coal after a gap of more than two years amidst the ongoing shortage of dry fuel at electricity generating projects across the country. The state-run company had last floated a tender to procure imported coal in August, 2019. According to the tender document available on the web portal of NTPC, the coal procured under this tender would be used by various plants of the company. The tender assumes significance in view of ongoing coal shortage at thermal power plants in the country.

National: Power

Goa will achieve 100 percent household electrification by year-end: Power Minister

26 October: Power Minister Nilesh Cabral said that Goa would achieve 100 percent household electrification by the end of this year. The proposal will be put before the cabinet shortly, and after the cabinet approval, a contractor will start the work, he said. The problem arose due to the houses’ inaccessibility from the grid. The electricity department has provided such houses with basic plug points through renewable energy sources.

Power ministry comes out with rules to ensure sustainability of sector

23 October: The power ministry announced new rules to sustain economic viability of the sector, ease financial stress of various stakeholders and ensure timely recovery of costs involved in electricity generation. The ministry notified rules for the sustainability of the electricity sector and promotion of clean energy to meet the India's commitment towards climate change. Investors and other stakeholders in the power sector had been concerned about the timely recovery of the costs due to change in law, curtailment of renewable power and other related matters. The rules notified by the Ministry of Power under Electricity Act, 2003 are in the interest of the electricity consumers and the stakeholders, it said.

Exempt industries from electricity duty: UP Power Minister

22 October: UP (Uttar Pradesh) Power Minister Srikant Sharma pressed for industrial consumers getting exemption from electricity duty. The Minister asked the officials to ensure that the online consumer services are simplified and the consumers get benefits. He directed all the MDs of distribution companies to ensure that facilities should be increased according to the increasing investment and demand in the industrial areas of the state. Chairman UPPCL should continuously monitor and review it regularly, he said. The Directorate of Electrical Safety should clear the pendency of about 250 pending cases in the next one month. The process, he said, will be monitored by the state government. He pitched for regular patrolling officers of industrial and commercial areas themselves to do it. In line with the ever-increasing demand, the process of necessary capacity addition should be done continuously. He reiterated that the industrial and commercial consumers be given prior information about shutdown.

National: Non-Fossil Fuels/ Climate Change Trends

India ranked 9th in VC funding for climate tech globally

26 October: India ranks at the ninth spot globally for climate tech investment, with the country’s climate tech firms receiving US$1 billion in venture capital funding between 2016 and 2021. Venture capital (VC) investment in climate technology companies has gone up globally since 2016, as per the report jointly prepared by international trade promotion agency London & Partners and Amsterdam-based database management company Dealroom.co. The top 10 countries for climate tech VC investment between 2016 and 2021 are – United States (US$48 billion), China (US$18.6 billion), Sweden (US$5.8 billion), UK (US$4.3 billion), France (US$3.7 billion), Germany (U$2.7 billion), Canada (US$1.4 billion), Netherlands (US$1.3 billion), India (US$1 billion) and Singapore (US$700 million).

SJVN shows keen interest in hydro power projects in Uttarakhand

23 October: SJVN chairman and managing director (CMD) Nand Lal Sharma met Uttarakhand Chief Minister (CM) Pushkar Singh Dhami at Dehradun and expressed keen interest to invest in more hydropower projects in the state. Sharma said SJVN was on an exponential growth drive in the field of developing Energy and at present, it is working in the field of hydro, wind, solar and thermal sector. Besides, SJVN was developing projects across the country and also operating in the neighbouring countries of Nepal and Bhutan. He informed Dhami that the 60 MW Naitwar Mori Hydroelectric project, which was under construction in Uttarkashi district of Uttarakhand was in advanced stages and was likely to be completed by June 2022. SJVN has requisite expertise in construction and operation of hydro projects in Himalayan terrain and requested to allot more projects in Tons and Yamuna Valley to SJVN.

India’s 450 GW renewable energy goal by 2030 doable: Kerry

20 October: US (United States) Special Presidential Envoy for Climate John Kerry said India’s goal of reaching 450 GW of renewable energy (RE) by 2030 is doable as it has already crossed the 100 GW RE mark. The IPCC’s Sixth Assessment Report asserts that the contribution of greenhouse gas emissions from various activities is the scientific basis for global warming and climate change.

International: Oil

Lanka IOC hikes fuel prices by INR5 per litre

22 October: Lanka IOC (LIOC), the subsidiary of Indian Oil Corporation in Sri Lanka, has hiked the retail prices of both petrol and diesel by INR5 per litre in the wake of the rising global oil prices. Accordingly, a litre of petrol now costs INR162 and diesel INR116. The hike came days after the LIOC urged the government to allow them to increase the prices, although it has no obligation to ask the government in determining their retail prices. LIOC managing director Manoj Gupta said that though the retail price determination is at the company’s discretion, it is consulting the Sri Lankan government due to the prevailing condition in the country. The Lankan government, which is facing a severe foreign exchange crisis, has put on hold the expected retail price hike of fuel despite increasing the prices of cooking gas and other essentials. LIOC’s competitor, the state-run fuel distributor Ceylon Petroleum Corporation (CPC), is yet to take any decision on increasing the fuel prices, however, it has also urged the government to approve price hikes. Gupta had said that the company was expecting an increase in petrol price by INR20/litre and diesel by INR 30/litre. He said that the crude oil price in the international market now fluctuates between US$83-94 per barrel from being around US$65 four months ago. As a result, the LIOC has suffered huge losses. Meanwhile, with the LIOC raising the fuel prices, people queued at the CPC-run petrol stations, however, most of them had put up ‘no petrol’ signboards, which motorists claim was caused by the anticipated government’s decision to raise oil prices. However, Energy Minister Udaya Gammanpila has ruled out increasing retail fuel prices. LIOC has been in operation in Lanka since 2002, and maintains over 200 retail fuel stations catering to about 12 percent of the country’s fuel market. CPC has sought a US$500 million credit line from India to pay for its crude oil purchases amidst a severe foreign exchange crisis in the island nation. Energy minister Gammanpila had earlier warned that the current availability of fuel in the country can be guaranteed only till next January.

Global oil prices won’t decline until 2023: World Bank

21 October: The stunning recent run-up in global oil prices could threaten economic growth, and is unlikely to retreat until 2023, the World Bank said. Average crude prices are expected to end the year at US $70 a barrel, 70 percent higher than in 2020, according to the latest Commodity Markets Outlook. Oil prices in recent weeks have surged above US$80 a barrel, the highest point in years, as economies reopen following the pandemic shutdowns and amidst shipping bottlenecks. The 2022 average is projected to rise to US $74 before falling to US $65 in 2023, the World Bank said.

International: Coal

South Africa seeks over US$27 bn of finance for shift from coal

21 October: South Africa is seeking cheap finance for more than 400 billion rand (US$27.6 billion) of electricity infrastructure as part of its plans to move away from heavily polluting coal. Through a funding facility backed by rich nations and development finance institutions, South Africa hopes to build more than 180 billion rand of cleaner power generation, 120 billion rand of transmission equipment, as well as substations, transformers and distribution technology. More than 80 percent of the country’s electricity is currently generated by burning coal, making it the world’s 12th biggest carbon emitter. But last month the government adopted a more ambitious emissions reduction target ahead of the United Nations COP26 climate summit in November. State power company Eskom has said it is seeking up to US$12 billion (180 billion rand) from global lenders for the transition away from coal. Eskom plans to decommission between 8,000 and 12,000 MW of coal over the next decade, it said.

China coal futures slump as government signals intervention to ease power crisis

21 October: China’s thermal coal futures fell by their trading limit for the third evening session in a row, extending losses triggered by signs Beijing may intervene to cool surging prices and ease a widespread power crunch. China is pushing miners to ramp up coal production and is increasing imports so that power stations can rebuild stockpiles before the winter heating season, but analysts say shortages are likely to persist for at least another few months. The state planner, the National Development and Reform Commission (NDRC), said it was studying ways of intervening to lower coal prices and would take all necessary steps to bring them into a reasonable range. Despite recent swings in coal prices, higher energy, labour and other costs are now expected to persist and be passed on to end-consumers, economists and analysts have said. The NDRC said it had mobilised its regional arms as well as key coal enterprises to conduct a special survey on coal output and distribution costs and prices as part of its research into how to intervene. The NDRC had said it would ensure coal mines operate at full capacity and aim to raise output to at least 12 million tonnes per day. China’s securities regulator has asked futures exchanges to raise fees, restrict trading quotas and crack down on speculation in response to high coal prices. China’s State Grid said that coal stocks at power plants in the northeast had climbed to 78 percent of last year’s level as of 16 October, but it did not provide outright volumes.

International: Non-Fossil Fuels/ Climate Change Trends

Greenhouse gas build-up reached new high in 2020: UN

26 October: Greenhouse gas concentrations hit a record last year and the world is "way off track" on capping rising temperatures, the United Nations said, showing the task facing climate talks in Glasgow aimed at averting dangerous levels of warming. A report by the UN (United Nations) World Meteorological Organization (WMO) showed carbon dioxide levels surged to 413.2 parts per million in 2020, rising more than the average rate over the last decade despite a temporary dip in emissions during COVID-19 lockdowns. WMO Secretary-General Petteri Taalas said the current rate of increase in heat-trapping gases would result in temperature rises "far in excess" of the 2015 Paris Agreement target of 1.5 degrees Celsius above the pre-industrial average this century. The Scottish city of Glasgow was putting on the final touches before hosting the climate talks, which may be the world’s last best chance to cap global warming at the 1.5-2 degrees Celsius upper limit set out in the Paris Agreement. Saudi Arabia's crown prince said that the world’s top oil exporter aims to reach "net zero" emissions of greenhouse gases, mostly produced by burning fossil fuels, by 2060 - 10 years later than the US (United States). He said it would double the emissions cuts it plans to achieve by 2030. Australia’s cabinet was expected to formally adopt a target for net zero emissions by 2050 when it meets to review a deal reached between parties in Prime Minister Scott Morrison's coalition government. The ruling coalition has been divided over how to tackle climate change, with the government maintaining that harder targets would damage the A$2 trillion (US$1.5 trillion) economy. In Berlin, officials from Germany and Canada were set to present a plan about how rich countries can help poorer nations finance the overhaul needed to address climate change. Wealthy countries have so far failed to deliver their 2009 pledge to provide $100 billion per year in climate finance to poorer countries by 2020.

Power grid to be supplied by nuclear, solar energy: UAE’s Adnoc

26 October: Abu Dhabi National Oil Co (Adnoc) has signed a deal with a local utility to supply up to 100 percent of its power grid with nuclear and solar energy sources, the Abu Dhabi government said. The supply deal follows the oil producing United Arab Emirates (UAE) announcing plans to achieve net zero emissions by 2050.

China aims to cut fossil energy use to below 20 percent by 2060

24 October: China is targeting an ambitious clean energy goal of reducing fossil fuel use to under 20 percent by 2060. The document follows a pledge by President Xi Jinping to wean the world’s biggest polluter off coal, with a target of peaking carbon emissions by 2030 and achieving carbon neutrality 30 years later. But the country has been criticised for pushing ahead with opening dozens of new coal power plants. The guidelines also reiterated an earlier aim for carbon emissions per unit of GDP to fall 18 percent in 2025, from 2020 standards.

Major oil producer Saudi Arabia announces net-zero emissions by 2060

23 October: One of the world’s largest oil producers, Saudi Arabia, announced it aims to reach net zero greenhouse gas emissions by 2060, joining more than 100 countries in a global effort to try and curb man-made climate change. The announcement was made by Crown Prince Mohammed bin Salman in brief scripted remarks at the start of the kingdom's first-ever Saudi Green Initiative Forum. The kingdom made the announcement a little over a week before the global COP26 climate conference starts in Glasgow, Scotland that will draw heads of state from across the world to try and tackle global warming and its challenges. The kingdom’s oil and gas exports form the backbone of its economy, despite efforts to diversify away from reliance on fossil fuels for revenue. It has resisted efforts to curb its investments in oil. Although the kingdom will aim to reduce its own emissions, it will continue to aggressively pump and export fossil fuels to Asia and other regions.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV