Quick Notes

From “phase-up” to “phase-down” of coal

Background

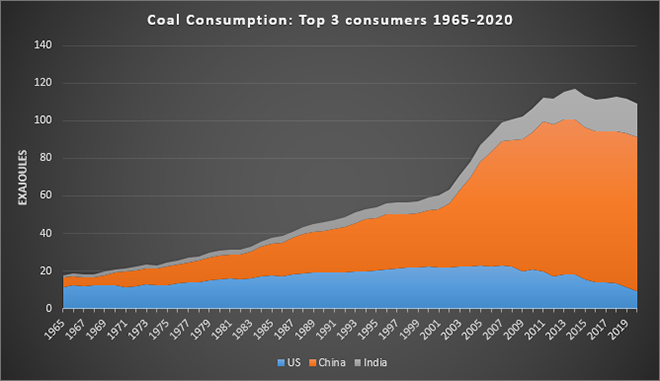

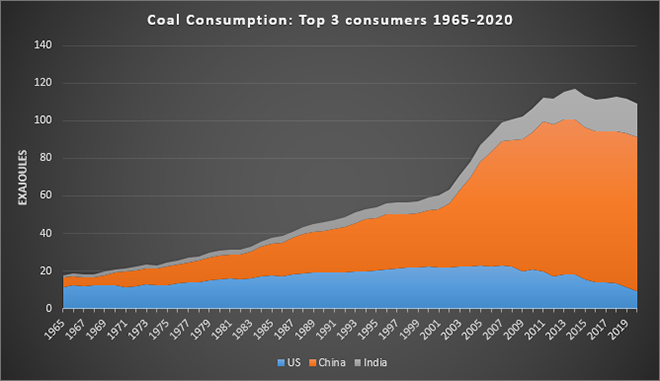

At COP26 in Glasgow, India’s last-minute intervention to change, “phase-out of unabated coal power and inefficient fossil fuel subsidies” to “phase-down of unabated coal power and inefficient fossil fuel subsidies” in the draft text of the Glasgow climate pact received widespread criticism. Many missed the fact that India merely introduced the term “phase-down” from the text of the agreement between China and the US made earlier at Glasgow. Even without India’s intervention, the draft text contained sufficient legal ambiguity in the words “unabated” and “inefficient” to get away with continued use of coal and subsidies for fossil fuels. More importantly, the text did not specify a date by which coal and fossil fuel subsidies would have to be phased out which meant that the use of coal and fossil fuel subsidies could continue indefinitely. India became the convenient villain in the emotion-driven climate activism that requires one to sustain itself. But not long ago, the wealthier world “phased-up” coal in the energy mix of the developing world.

The coal-nuclear strategy

Reports that emerged in the early 1980s from high profile global conferences such as the Workshop on Alternative Energy Strategies, the Istanbul World Energy Conference and the voluminous report ‘Energy in a Finite World’ by the International Institute for Applied Systems Analysis (IIASA), which included the contribution of over 250 scientists, concluded that the most important development in the 21st century would be the exponential growth of the developing world—then labelled the third world—energy needs.

By year 2000, developing countries were expected to be consuming energy of the same order of magnitude as Western European or US consumption in 1980s. A vicious cycle of growth in developing world energy needs that leads to heavier demand on the petroleum market which increases oil prices which in turn aggravates wealthier economies and limits growth in the developing countries was anticipated. This trend towards catastrophic world energy growth gave rise to a common consensus to accelerate nuclear programmes and the exploitation of coal in both industrialised and industrialising countries by year 2000. Once this was accomplished, the developing world, including the Organisation of Petroleum Exporting Countries (OPEC) were expected to be net importers of energy and the Organisation for Economic Cooperation and Development (OECD) countries net energy exporters. This reversal of energy flows was based essentially on the exploitation of coal and nuclear technology that the wealthy world would export to the poorer world. Most of known reserves of coal and most of the technologies to exploit coal and nuclear power were with western countries.

Energy forecasts

The fundamental implication was that the future of energy growth was already fully determined and that the only possible path-namely, a coal-nuclear strategy must be pursued without fail. The proposals called for a mechanical transposition of the solution that had been applied in the industrialised countries: reduction of the demand for traditional energies, and the introduction of commercial energies with priority given to large inter-connected grids for electricity. This outlook clearly neglected many aspects that were important for future projections for the developing world: (1) the specific features of the energy service needs and links between energy and specific development paths of industrialising countries (2) the relevance of taking energy as a homogeneous product the requirements of which were linked to economic growth by a technical elasticity coefficient (3) the versatility of oil as a fuel and its competitiveness vis-à-vis other fuels.

Western economies looked at the traditional sector of developing countries strictly as a technical reality that would progressively disappear following the introduction of commercial energy sources. They estimated energy demand in synthetic units (tonnes of oil equivalent or megawatts ) that masked the real composition of energy needs and limited the possibilities of modulating energy profiles.

In general, long-run forecasting models assumed that there exist underlying structural relationships in the economy that vary in a gradual fashion. In the real world, discontinuities and disruptive events abound as demonstrated, most recently by the pandemic and earlier by the global financial crisis. The longer the time frames of the forecast, the more likely it is that key events will change the underlying economic and behavioural relationships that all models attempt to replicate.

Though the projected reality from models did not materialise, development in the Western mould has transferred the general pattern of Western economic growth and affluence to the developing world. Increase in the price of oil made developing countries increasingly dependent on developed countries for additional foreign currency to pay for petroleum products. Countries with oil and gas resources remained dependent on Western capital and technologies for developing their resources. Despite the rule of the market, the system of international interdependencies remained one of hierarchical dependence, one of asymmetric vulnerability, i.e., unequal ability of the interacting units (countries) to inflict damage on one another, therefore, making the welfare of some countries dependent on the will of others. The World Energy Outlook brought out annually by the International Energy Agency (IEA) routinely predicts a supply crunch in oil followed by a dramatic increase in the price of oil. This is a hidden call on OPEC to invest in increasing oil production. When OPEC obliges, the West along with the rest of the world benefits even though this means risky capital investment by OPEC that critically depends on higher oil prices.

Sustaining hierarchies

Past energy forecasts may not have been accurate, but they shaped and colonised the future in which the industrialised world came up on top. Today, energy forecasts predict sinking of small island states and even world extinction caused by rising fossil fuel use and the resulting climate calamity. The call to confine coal to history by COP26 at Glasgow is driven by such forecasts. Coal dependent countries are forced to call for financial assistance and technology-transfer from developed countries so that their shift towards renewable energy sources can be accelerated. Rather than climbing on top of the energy hierarchy to become owners of knowledge and patents for transformative energy technologies developing countries are once again lining up to become large consumers of new and expensive energy technologies imported from the wealthier world.

Source: BP Statistical Review of World Energy 2021

Source: BP Statistical Review of World Energy 2021

Monthly News Commentary: Coal

Coal Supply Bottlenecks Continue

India

Coal Supply Shortage

CIL warned the adviser to the federal power ministry in February of an impending fuel shortage as utilities tapped inventories and curbed purchases despite rising coal-fired power output, documents show. India, which has the world’s fourth largest coal reserves, is facing a shortage of the fuel and has urged utilities to import coal as supplies at several plants run low. CIL generally asked utilities to stock up before the annual monsoon season when rains squeeze output and make transport more difficult. But the company was more worried this year as coal-fired power output picked up with coronavirus-related restrictions easing, while utilities tapped stockpiles instead of buying fresh supplies. Coal-fired power output grew nearly a fifth during the first eight months of 2021, outpacing overall generation growth of 13.2 percent. Coal accounts for more than 70 percent of India’s power capacity.

Fuel supply by CIL to the power sector rose by 11.4 percent to 38.61 mt. The development assumes significance in the wake of thermal power plants in the country grappling with coal shortage. CIL which accounts for 80 percent of the country's coal output had supplied 34.64 mt of coal in August last fiscal. Fuel supply by CIL in the April-August period of the current fiscal increased by 27.2 percent to 205.90 mt over 161.87 mt in the year-ago period. The supply of coal by Singareni Collieries Company Ltd (SCCL) in August increased by 73.2 percent to 4.08 mt over 2.36 mt of coal supplied in August last fiscal. SCCL supplies to the power sector in the April-August period increased by 84.2 percent to 22.16 mt from 12.03 mt a year ago. CIL has been writing to power generating companies since October last year urging them not to regulate the intake of coal and build up stock at their end, so that the electricity production does not suffer during summer and monsoon seasons. CIL had earlier said that it had launched a multi-pronged effort to help build up coal stocks at power plants, and stressed that supply to the electricity units carrying stock of zero to six days had been prioritised by preparing a contingency supply plan to increase their stock.

India’s massive fleet of coal plants are running dangerously low on stockpiles, which may force the nation to buy expensive shipments of the fuel or else risk blackouts. Stockpiles have fallen to the lowest since November 2017, data from the Central Electricity Authority showed. Electricity demand from India’s state distribution utilities rose more than 10 percent in July and 18 percent in August as economic activity rebounded after a second wave of the pandemic receded and more citizens were vaccinated.

Indian utilities are scrambling to secure coal supplies as inventories hit critical lows after a surge in power demand from industries and sluggish imports due to record global prices push power plants to the brink. Over half of India’s 135 coal-fired power plants have fuel stocks of less than three days, government data shows. Prices of power-generation fuels are surging globally as electricity demand rebounds with industrial growth, tightening supplies of coal and liquefied natural gas. India is competing against buyers such as China, the world’s largest coal consumer, which is under pressure to ramp up imports amidst a severe power crunch. Rising oil, gas, coal and power prices are feeding inflationary pressures worldwide and slowing the economic recovery from the COVID-19 pandemic. India’s average weekly coal imports during August through late September—when global coal prices rallied over 40 percent to all-time highs—dropped by over 30 percent from the average for the first seven months of the year. This September, Indonesia’s coal price benchmark was as much as seven times higher than similar quality fuel sold by CIL to Indian utilities. According to CIL, higher global prices of coal and freight rates have pushed utilities dependent on imported coal to curtail power production, resulting in higher dependence on domestic coal-fired plants. India is the world’s second largest importer of coal despite having the fourth largest reserves. Utilities make up about three-fourths of its overall consumption, with CIL accounting for over 80 percent of the country’s production.

Delhi Chief Minister wrote a letter to Prime Minister (PM) claiming that there is a coal shortage situation that has affected the power generation plants supplying power to NCT and requested him to intervene in the matter. The letter also mentions that with the coal stock situation depleting in power generating stations, the dependence on Gas stations supplying the power to Delhi increases. But, even the gas station supplying power to Delhi does not have adequate APM gas to run at full capacity. He requested PM to direct necessary instructions to the concerned Ministries/Offices to ensure adequate coal and APM gas supply to power generating plants that supply power to Delhi. He also, requested that the maximum rate of power sold through exchange should be capped.

The Utkal Chamber of Commerce & Industry Ltd. (UCCI), an association of industries, has urged the Odisha government to ensure adequate supply of coal to State-based industries which are facing an acute shortage of dry fuel to run their units. Since these units with small and medium industries of the State provide employment to lakhs of people, the UCCI apprehended that the coal shortage situation may give a deadly blow to the continuance of the employment of these people. As per the UCCI, though the State is blessed with abundant coal reserves, Odisha-based local industries are facing a coal deficit and forced to import coal/power as they are not getting enough share of coal. The State has coal reserves (about 25 percent of country deposits), and Coal India Ltd. (CIL)’s subsidiary Mahanadi Coalfields Limited (MCL) produces 150 mt of coal. The Odisha-based power plants (16,000 MW) requires 90-95 mt of coal per annum, which is 60 percent of Odisha’s coal production for cost-effective sustainable industry operations. However, over 65 percent of Odisha’s coal is being supplied to power plants based in other States. The UCCI also requested the state government to communicate to the coal ministry to give necessary direction to MCL and CIL to step up supply of coal to local industries in the State so that stock out of coal is obviated and safe level of coal stock is maintained in critical units to prevent any eventualities in operations.

Amidst reports of coal shortage in the country, the Chhattisgarh government said South Eastern Coalfields Limited (SECL) will ensure the supply of 29,500 metric tonnes of coal per day for thermal power plants in the state. Coal extracted from the mines of Chhattisgarh is supplied to various states of the country. At present, SECL is supplying 23,290 metric tonnes of coal to Chhattisgarh.

Production

CIL’s coal production registered a marginal rise to 40.7 mt in September. The development assumes significance in the wake of country's power plants grappling with coal shortages. CIL production had stood at 40.5 mt in September 2020. CIL’s production in the April-September 2021 period increased 5.8 percent to 249.8 mt, compared with 236 mt in the year-ago period. The company's offtake also increased to 48.3 mt last month, over 46.7 mt in the corresponding month of the previous financial year. Its offtake in the April-September 2021 period also increased to 307.7 mt over 255.1 mt in the year-ago period. Coal India, which accounts for over 80 percent of the domestic coal output, is eyeing one billion tonne of production by 2023-24.

Coal Block Auctions

The coal ministry is planning to come up with a scheme to permit coal block allottees to surrender mines that they are not in a position to develop due to technical reasons. The proposed scheme will allow surrender of coal blocks without imposition of financial penalty or penalty on merit basis after examining the proposal by a scrutiny committee. Coal blocks surrendered under this scheme will immediately be offered for auction for commercial mining for putting the block to production early. The move would help in boosting the production of coal from the mines allocated through auction route. According to the Ministry of Coal, to meet the increased demand for coal in the country, a scheme is being formulated to allow allottees to sell up to 50 percent of the produced fuel after meeting its captive needs. The incentive to allottees will spur them to produce more coal and sell in the market. India’s total coal production registered a marginal decline of 2.02 percent to 716.084 million tonnes (mt) during the last fiscal year. The country had produced 730.874 mt of coal in FY'20, according provisional statistics of 2020-21 of the coal ministry. Of the total coal production, 671.297 mt was non-coking coal and the remaining 44.787 mt was coking coal. Public sector produced 685.951 mt while the remaining 30.133 mt was produced by the private sector.

According to the Ministry of Coal, the next round of auction of coal mines for commercial mining will be launched in October or November. As per the ministry, the details of most of these mines are already available in public domain, and some more mines will be added in the list. The coal ministry will very soon come out with tender document for second attempt of sale of 11 coal mines in the ongoing auction round for the mines which have received single bids. Eight coal mines have been successfully auctioned with the winning percentage of revenue share ranging from 6 to 75.5 percent with an average percent revenue share of 30 percent.

Mining leases for three coal blocks were granted in Meghalaya’s East Jaintia Hills by the union coal ministry in a major boost for the sector in the state after a ban was imposed by the Nation Green Tribunal (NGT) in 2014. The mining leases were granted in the name of Labour Lyngdoh, a resident of Rymbai village, and Dapmain Shylla of Byndihati village. The works for preparation of the Mining Plan may start as soon and it is expected that by the early part of 2022 or by March 2022 mines opening should take place and coal production will once again start from Jaintia Hills. The NGT ban on coal mining in Meghalaya has displaced thousands of families dependent on the sector. The Supreme Court had in July 2019 lifted the ban imposed by the NGT after marathon hearings. The SC had in its order mentioned that in Meghalaya, the tribal people who are the local residents are the owners of their land and also the minerals below their land. It had said that if coal mining is done under the Mines and Minerals (Development and Regulation) Act and the Mineral Concession Rules 1960, the ban imposed by the NGT will not be applicable. The Ministry of Coal had on May 6 allowed the start of mining in Meghalaya by approving five coal mining applications submitted by the state government.

Rest of the World

China

China is paying a high price for policies that curbed domestic coal output and imports, and led to a shortage of the fuel that still largely powers the world’s second-largest economy. The good news for Beijing is that while the scarcity of coal will cause problems for energy-intensive industries, such as steel and aluminium, the situation is likely to be resolved relatively quickly. Looking at the domestic coal situation first, it’s clear that supply has become an issue in 2021. Australia used to be China’s second-biggest supplier of coal, with roughly 60 percent of its shipments being thermal coal, used for power generation and by industries such as cement, and about 40 percent coking coal, used to make steel.

Rest of Asia and Asia Pacific

Australia’s Resources Minister has proposed setting up a government-run A$250 billion (US $180 billion) lending facility for the country's coal industry in return for supporting a net zero carbon emissions target for 2050.. Prime Minister of Australia has come under increasing pressure to adopt a zero emissions target but has been stymied by opposition from the party's junior partner. Resources Minister's proposal is a first sign of what that support might cost. The loan facility proposal was not a policy of the National Party, which represents rural Australians for whom jobs in coal producing regions are a major concern, but it was up for discussion. Australia’s coal industry is suffering from dwindling access to finance and insurance, raising the costs of doing business and threatening the longevity of an industry that accounts for the country's second-most-valuable exports, submissions to a parliamentary inquiry showed in May. According to the resource minister, coal will be a major contributor to Australia’s economy well beyond 2030 given growth in global demand, after a United Nations envoy called on the country to phase out the fossil fuel.

Africa

Zimbabwe has allowed the export of 200,000 tonnes (0.2 mt) of excess power coal because of limited intake at its biggest coal-fired power plant, which is beset by frequent breakdowns, according to the coal producers association. The southern African nation’s six coal miners have a standing arrangement to supply 300,000 tonnes of coal to Hwange Power Station every month but constant breakdowns of ageing equipment mean the plant is taking in less coal. As per the association, the coal would be exported to other countries in southern Africa but producers could look beyond the region if port facilities were available. Zimbabwe does not usually allow the export of power coal to ensure adequate domestic supply.

America & Europe

The United States (US) and Britain welcomed China’s promise to end funding for coal projects overseas, but voiced hope the world's largest emitter would also do more at home on climate change. China told the UN General Assembly that it will stop backing coal overseas, all but drying up the world's foreign assistance to the dirty form of energy in developing countries after similar announcements by South Korea and Japan. British Prime Minister, seeking to rally international support for strong climate action ahead of UN climate talks in Glasgow in November, voiced hope for a complete global end to coal by 2040. UN scientists said that warming of 1.5 degrees Celsius (2.7 Fahrenheit) above pre-industrial levels is a threshold at which the planet can avoid the worst ravages of climate change including increasingly severe weather, droughts and flooding.

According to Norway’s state-owned coal company Store Norske Spitsbergen Kulkompani (SNSK), it will close its last mine in the Arctic Svalbard archipelago in 2023, causing the loss of 80 jobs and ending 120 years of exploitation. While SNSK has shut its major mines in the islands over the past two decades, it had kept the smaller Mine 7 open, primarily to ensure supplies to a local coal-fired power plant, as well as some exports. Russia operates a coal mine at its Barentsburg settlement, supplying a local power plant.

News Highlights: 13 – 19 October 2021

National: Oil

India plans refiners' joint oil deals to cut import bill

19 October: India is forming a group that brings together state-run and private refiners to seek better crude import deals, Oil Secretary Tarun Kapoor said, as the country grapples with soaring oil prices. The world’s third largest oil importer and consumer, India depends on imports for about 85 percent of its crude and buys most of it from Middle East producers. Initially the group of refiners will meet once in a fortnight and exchange ideas on crude purchases. Indian state refiners already jointly negotiate some crude oil purchases. Kapoor said the Organisation of the Petroleum Exporting Countries (OPEC) and its allies, together known as OPEC+, should raise production to bring down global oil prices. India is already reducing the share of OPEC oil in its crude mix as refiners, that have invested billions of dollars in refinery upgrades, are tapping cheaper oil. High oil prices are spurring investment in upstream activities, that could lead to higher production from regions other than the Gulf, Kapoor noted.

High oil prices to hurt world economic recovery: India to OPEC

18 October: India, the world’s third-largest energy consumer, has told Saudi Arabia and other OPEC (Organisation of Petroleum Exporting Countries) nations that high oil prices will hurt the nascent economic recovery the world is witnessing after the devastating pandemic and that they have to price oil at reasonable levels. Petrol and diesel prices have shot up to record highs across the country after relentless price increases since early May. India, which imports almost two-thirds of its oil needs from West Asia, has told crude oil producers, including the OPEC, that high oil prices will hasten the transition to alternate fuels and such rates will be counter-productive for the producers. Oil Minister Hardeep Singh Puri has flagged the issue of high oil prices to Saudi Arabia, the UAE, Kuwait, Qatar, the US, Russia and Bahrain. Puri, in his meetings with the Secretary-General of OPEC and his counterparts in Saudi Arabia and other nations, conveyed India’s serious concerns over crude oil price volatility. He conveyed India’s strong preference for responsible and reasonable pricing which is mutually beneficial for consumers and producers. India is again likely to raise the issue of high oil prices when global leaders meet for the India Energy Forum by CERAWeek. India is 85 percent dependent on imports to meet its oil needs and relies on overseas shipments to meet 55 percent of its gas requirement. Not just price, India also wants better commercial terms like optional volumes in yearly supply contracts and larger time to pay for oil bought.

Karnataka CM Basavaraj Bommai hints at reducing taxes on fuel

17 October: Karnataka Chief Minister (CM) Basavaraj Bommai hinted at reducing cess and sales tax on petrol and diesel in the state to ease the fuel prices, which have touched an all-time high. Bommai had earlier outrightly rejected any tax cuts on fuel in the state. The petrol price has reached INR109.16 per litre and diesel price has touched INR100 in Karnataka. Opposition Congress has demanded a reduction in taxes on fuel on the lines of the Tamil Nadu government, which had reduced the taxes on petrol by INR3 per litre.

Kolkata Port carries ship-to-ship LPG lighterage at Sandheads

17 October: For the first time, Kolkata Port has successfully handled ship-to-ship (STS) lighterage operation of liquid petroleum gas (LPG) of BPCL at Sandheads. Syama Prasad Mookerjee Port said the first-ever STS operation of LPG in the Indian Coast was undertaken by Bharat Petroleum on October 15 and a quantity of 23,051 million tonnes (MT) of cargo was transferred to the daughter vessel in 17 hours. The mother vessel, MT Yushan, with a parcel load of 44,551 MT cargo carried out the STS operation with daughter vessel, MT Hampshire, at Sandheads. For BPCL, this ship-to-ship lighterage operation under Haldia Dock System will save time by seven to nine days and US $3,50,000 (INR26 mn) per voyage. Import of LPG from the port had more than doubled in the last five years.

National: Gas

India presses Qatar for delayed LNG as power crisis

18 October: India, grappling with its worst power crisis in five years, has asked Qatar to expedite delivery of 58 delayed liquefied natural gas (LNG) cargoes. Asia’s third largest economy is suffering its worst power shortage since March 2016 due to a crippling coal shortage amidst high global energy prices. Infrastructure maintenance at supplier Qatargas prevented it from delivering 50 LNG cargoes to India this year, prompting India’s oil ministry to write a letter seeking delivery of those cargoes. The ministry is also seeking eight additional cargoes which were delayed last year at New Delhi’s request after COVID-induced lockdowns lowered demand for the super-cooled fuel. India’s top gas importer, Petronet LNG, has long-term deals to buy 7.5 million tonnes per year (mtpa) of LNG from Qatar and 1.44 mtpa from Exxon’s Gorgon project in Australia. Indian customers in August started deferring imports of spot LNG due to high prices, Petronet LNG CEO A K Singh said. He said the Indian power sector reduces its intake of LNG once prices rise above about US $10 per mmBtu.

National: Coal

East Coast Railway supplies record 66 rakes of coal in a single day

19 October: East Coast Railway (ECoR) said it has set a record in single-day coal loading as it supplied 66 rakes of the dry fuel from Odisha’s Talcher to different parts of the country. ECoR supplied 2.6 lakh tonne of coal to Delhi, Punjab, UP (Uttar Pradesh), Maharashtra, Tamil Nadu, Karnataka, West Bengal and Andhra Pradesh from Talcher loading points. ECoR general manager Vidya Bhushan congratulated all employees for their commitment and urged them to continue with their efforts to increase the supply of coal to thermal power plants.

Coal supplies to non-power sector plants may be kept suspended

14 October: Even as supplies of coal are being ramped up at power plants, supplies to non-power sector plants may be kept suspended. Southern Eastern Coalfields, a subsidiary of Coal India Ltd (CIL) has finalised the supply matrix of coal rakes to critical power plants after a meeting held by the coal ministry. The power plants where coal rakes will be provided are Rajpura, HRVUNL, Kawai, Akaltara, Binjkote, DSPM, Pathad, Sabarmati, GSECL, Uchpanda, Annupur, Seoni, MPPGCL, Amrawati, Warora, Dhariwal, Tirora, NTPC, and Mahagenco. Since the supplies of SECL are yet to be normalised, the supply of coal will be done equitably to these power plants. Meanwhile, the Aluminium Association of India (AAI) has written to CIL on the alarming situation for the industry due to critical coal shortage and urgency for immediate resumption of coal supplies for survival of domestic industry. Despite untiring efforts of the coal ministry and the CIL to support the industry, the current acute coal crunch due to various factors which has created an immensely precarious situation, majorly for the highly power intensive industries like aluminium wherein coal accounts for 40 percent of the production cost. The recent decisions for stoppage of secured coal supplies and rakes for non-power sector is detrimental for aluminium industry and will jeopardise the sustainability as these continuous process-based plants are not designed for ad hoc shut down and start of operations. Moreover, the ongoing global aluminium shortage due to supply demand mismatch is also adding to the woes for industry with the current coal situation in India. Adding to the plight of industry, the exponentially rise in coal prices have created a double whammy as the global coal prices have gone up exponentially and are on an upward trend while the ocean freight rates are also at all-time high.

NLC India making efforts to ramp up coal output from Odisha mine

13 October: NLC India is making efforts to ramp coal output from one of its mines in Odisha to up to 10 million tonnes per annum this year (mtpa). The company aims to increase the coal production to up to 20 million tonnes per annum (mtpa) from next year onwards. NLC India said has taken steps to achieve the target of 6 mtpa from its original schedule of four mtpa during the current year. Considering the high demand of coal, the company is taking all out efforts to augment the coal production of Talabira Mine up to 10 mtpa for the current year and up to 20 mtpa from next year onwards. The coal produced is being transported to its one of the end use plant, NLC Tamil Nadu Power Ltd’s 2 x 500 MW plant at Tuticorin, Tamil Nadu. Accordingly, the permission from the coal ministry has been sought to sell the excess coal.

National: Power

Sterlite Power wins order for INR3.2 billion transmission project

19 October: Sterlite Power said it has bagged Nangalbibra -Bongaigaon inter-state power transmission project worth INR3.24 billion (bn). The project elements consist of a new 220/132 kV substation at Nangalbibra and laying of 130 km of 400kV D/c transmission line connecting Bongaigaon in Assam to Nangalbibra in Meghalaya across the river Brahmaputra, it said. The project will also have 20 km of 132kV D/c line connecting Hatsinghmari in Assam to Ampati in Meghalaya. Sterlite Power has a track record of executing complex projects successfully with the use of technology and innovative solutions. The company has completed the NER-II project, an inter-state transmission scheme ning across the north-eastern states of Assam, Arunachal Pradesh and Tripura.

Buying power at INR22 per unit, won’t let power crisis spoil festivities: UP CM

18 October: Uttar Pradesh (UP) Chief Minister (CM) Yogi Adityanath said that his government was buying electricity from energy exchange and other sources at a cost up to INR22 per unit as it was unwilling to let the ongoing festivities get affected by shortage of power in the aftermath of a nationwide coal crisis. Private power producers and some state transmission utilities appear to be making a killing by selling electricity on the exchanges where rates have tripled owing to lower generation as a result of coal shortage, even as power secretary Alok Kumar asked states to watch out for generators gaming the State transcos, pvt gencos make a killing on power exchanges. Earlier, the CM had asked the power officials to coordinate swiftly with the Centre and the Coal India Limited (CIL) to mitigate the crisis which was threatening to worsen the situation of the financially ailing UP Power Corporation Limited (UPPCL)—it was already running at an accumulated loss of INR900 bn.

India’s October power shortage worst since March 2016

13 October: India is suffering its worst power shortage in October since March 2016 due to a crippling coal shortage, federal grid regulator POSOCO data showed. Power supply fell about 750 million kilowatt hours short of demand during the first 12 days of October, a deficit of 1.6 percent that was the worst in five and a half years, the data showed. The October shortfall was already the biggest in absolute terms for a single month since November 2018, even with 19 days of October still left. The shortfall this month already accounts for 21.6 percent of the total deficit this year. Northern states such as Rajasthan, Punjab, Haryana and Uttar Pradesh, and the eastern states of Jharkhand and Bihar, were the worst affected, registering supply deficits of 2.3-14.7 percent. Increased economic activity after the second wave of the coronavirus pandemic has driven up demand for coal leading to a supply shortage, forcing northern states such as Bihar, Rajasthan and Jharkhand to cut power for up to 14 hours a day. India’s power ministry said the capacity of power plants under outage because of a coal shortage had fallen nearly to 6 gigawatts (GW), from 11 GW.

National: Non-Fossil Fuels/ Climate Change Trends

Indian agricultural waste recycling project wins Prince William’s Earthshot Prize

18 October: A Delhi-based entrepreneur’s agricultural waste recycling project was named amongst the winners of Prince William’s inaugural Earthshot Prize, dubbed the “Eco Oscars”, at a gala ceremony in London. Vidyut Mohan led Takachar was named the winner of the GBP 1 million prize for its cheap technology innovation to convert crop residues into sellable bio-products in the “clean our air” category. It was amongst five worldwide winners of the prize, created by Prince William, the Duke of Cambridge, to reward people trying to save the planet. Takachar was named a winner for its technology which reduces smoke emissions by up to 98 percent, aimed at helping improve the air quality that currently reduces the affected population’s life expectancy by up to five years. If scaled, it could cut a billion tonnes of carbon dioxide a year, described as “a win for India’s farmers will be a win in the fight against climate change”. The final five winners were connected to the eco-friendly awards ceremony by global broadcast, and no celebrities flew to London for the ceremony, no plastic was used to build the stage. Each year for the next decade, the prize is awarding GBP 1 million each to five projects that are working to find solutions to the planet’s environmental problems.

Climate financing continues to be an area of worry: Finance Minister

16 October: India’s Finance Minister Nirmala Sitharaman said climate financing continues to be an area of worry as she flagged concerns over funding mechanism and technology transfer. It is unclear how the US$100 billion per year commitment given in the wake of COP21 has been extended, Sitharaman said after the conclusion of her meetings at the International Monetary Fund (IMF) and the World Bank. India's more than done it, and also submitted a report to show that this is what we have done. What had to be achieved by 2030, we have achieved already almost achieved, and now we've scaled up our expectations on renewable, we are touching 450 GW, she said.

India most cost-effective globally in rooftop solar power

15 October: A global study has found that India is the most cost-effective country for generating rooftop solar energy at US$66 per megawatt-hour, while the cost in China is marginally higher at US$68 per megawatt-hour. Due to the lower cost, rooftop solar photovoltaics (RTSPV) technology, such as roof-mounted solar panels used in homes, and commercial and industrial buildings, is currently the fastest deployable energy generation technology. This, according to this global study, is projected to fulfil up to 49 percent of the global electricity demand by 2050. With an additional capacity installation of 41 GW, RTSPV currently accounts for 40 percent of the global cumulative installed capacity of the solar energy and nearly one-fourth of the total renewable capacity additions since 2018, which is more than the combined new installed capacities of both coal and nuclear. According to the study, India has a significant solar rooftop potential of 1.7 petawatt-hour per year. This is against the country’s current electricity demand of 1.3 petawatt-hour per annum, it said. The Rooftop solar photovoltaics technology as a subset of the solar photovoltaic electricity generation portfolio can be deployed as a decentralised system either by individual homeowners or by large industrial and commercial complexes, the study said.

Goa to set up floating solar plants on 4 dams

13 October: The state government has decided to set up a floating solar power plant on four dams in the state and has invited expression of interest (EoI) for selection of solar power developer for setting up of a grid connected floating solar power plant at these sites. The solar power plants will be set up on Selaulim, Amthanem, Anjunem and Chapoli dams on a design, built, finance and operate model for a period of 25 years. The objectives of the EoI includes solar power generation, conservation of water due to less evaporation, creation of employment to the rural community and higher solar generation due to maintained temperature of solar panels. Since the solar power project will be installed on the water surface, the other land surfaces for the same capacity of the project can be utilised for other purposes and land cost is not applicable. The salient feature of the EoI is that the department of new and renewable energy (DNRE) will assist in providing the required area at all the four sites from the water resources department (WRD) for installation of floating solar power plant projects.

International: Oil

Oil prices fall as weaker China growth, US output stoke demand concerns

19 October: Oil prices fell with Brent down a second straight day, after Chinese data showed slowing economic growth and US (United States) factory output dropped in September, raising fresh concerns about demand amidst a patchy recovery from the coronavirus pandemic. US oil fell 33 cents, or 0.4 percent, to US$82.11 a barrel, having risen 0.2 percent in the previous session and nearly 10 percent. Factory output in the US dropped the most in seven months last month as a global shortage of semiconductors slowed auto production, further evidence that supply constraints are a strain on economic growth. In China, the world’s second-biggest economy, bottlenecks also contributed to a decline in the growth rate to a one-year low as energy shortages and sporadic outbreaks of coronavirus hit the country. China’s daily crude oil processing rate fell again last month to the lowest level since May last year. But with temperatures falling as the northern hemisphere winter approaches, prices of oil, coal and gas are likely to remain elevated, analysts said.

International: Gas

China looks to lock in US LNG in energy crunch

15 October: Major Chinese energy companies are in advanced talks with US (United States) exporters to secure long-term liquefied natural gas (LNG) supplies, as soaring gas prices and domestic power shortages heighten concerns about the country's fuel security. At least five Chinese firms, including state major Sinopec Corp and China National Offshore Oil Company (CNOOC) and local government-backed energy distributors like Zhejiang Energy, are in discussions with US exporters, mainly Cheniere Energy (LNG) and Venture Global. The discussions could lead to deals worth tens of billions of dollars that would mark a surge in China’s LNG imports from the United States (US) in coming years. At the height of a Sino-US trade war in 2019, gas trade briefly came to a standstill. LNG export facilities can take years to build, and there are several projects in North America in the works that are not expected to start exporting until the middle of the decade. Natural gas prices in Asia have jumped more than fivefold this year, sparking fears of power shortages in the winter. The new purchases will also cement China’s position as the world's top LNG buyer, taking over from Japan this year. Jason Feer, global head of business intelligence with consultancy Poten & Partners said Chinese companies are heavily exposed to Brent-related pricing for LNG and the US purchases give some diversity to the pricing.

International: Coal

China coal hits record high amidst tight supplies

19 October: China coal prices hit a record high buoyed by a widening power crunch and cold weather despite Beijing’s efforts to bolster supply. Thermal coal for January delivery, the most actively traded contract on the Zhengzhou Commodity Exchange, hit a record high of 1,982 yuan per tonne. Prices are up more than 260 percent year to date. Shortages of coal, high fuel prices and booming post-pandemic industrial demand have sparked widespread power shortages. China took its boldest step in power reform by allowing coal-fired power plants to pass on higher costs to some customers, with an aim to encourage power plants to generate more electricity and ease their profitability pressures. Beijing has enacted measures to increase the output of coal, which fuels nearly 60 percent of its power plants, with government data indicating some increase to supply. Daily coal output recently hit 11.5 million tonnes (mt), up more than 1.2 mt from mid-September, the National Development of Reform Commission (NDRC) said.

International: Power

Global power cost surge wrecks Singapore’s electricity market

18 October: The global energy crunch which has sent natural gas prices to record highs and caused power shortages in many parts of the world is now spilling over to the island state of Singapore which is dependent on gas for power generation. Three energy providers in Singapore are exiting the market, and according to company sources at least two others have stopped accepting new clients amidst rocketing wholesale energy prices that retailers are unable to pass on to customers. Singapore’s energy regulator Energy Market Authority (EMA) said it was working closely with retailers facing challenges from volatile electricity prices—which rose to record high levels—and said there will be no disruption to their customers' electricity supply. Singapore is one of few countries in Asia with a fully liberalised electricity retail market. Power generation firms in Singapore sell electricity in the Singapore Wholesale Electricity Market (SWEM) every half hour, with the price determined by supply and demand at that time. Electricity retailers buy electricity in bulk from the wholesale market and compete to sell electricity to consumers.

Cyprus and Egypt sign deal to pursue electricity hookup

16 October: Cyprus and Egypt signed an accord to pursue links between the electricity transmission networks of the two countries. A Memorandum of Understanding (MoU) was signed by the energy ministers of Cyprus and Egypt, setting out a framework of cooperation from planning to implementation. Greece and Egypt signed a similar agreement, which sets the stage for an undersea cable that will transmit power produced by renewables from North Africa to Europe, the first such infrastructure in the Mediterranean.

International: Non-Fossil Fuels/ Climate Change Trends

Portugal’s EDP to invest up to US$17.65 billion in UK wind and solar by 2030

18 October: Power company Energias de Portugal (EDP) plans to invest 12.86 billion pounds (US $17.65 billion) in wind and solar projects in Britain by 2030 as the country strives to lower its emissions to net zero by mid-century. EDP plans to invest via its subsidiary EDP Renovaveis (EDPR), the world’s fourth largest renewable energy producer, which has 1 gigawatt (GW) of offshore wind capacity under construction and 0.9 GW under development in Britain. EDP’s joint venture, Ocean Winds, submitted bids in the tender and is targeting a minimum of 3.9 GW between a floating and fixed offshore wind project. Britain has the largest offshore wind market in the world, with around a third of all installed offshore wind capacity at the end of 2020. It plans to generate a third of its electricity from offshore wind farms by 2030 as part of its own efforts to reach net zero carbon emissions by 2050. The UK government announced the biggest auction round of its renewable energy support scheme, which will open in December, and will include onshore wind and solar for the first time.

Japan’s Mitsubishi to spend US$17.5 bn by 2030 to drive decarbonisation

18 October: Japan’s Mitsubishi Corp will invest 2 trillion yen (US$17.54 billion) by 2030 in alternative energies such as renewables and hydrogen to drive its decarbonisation efforts and cut emissions, it said. Mitsubishi, a trading house and mineral resources company with energy and metals assets worldwide, aims to halve its greenhouse gas emissions by 2030 on 2020 levels, and to achieve net zero emissions by 2050, it said. The move comes as oil and coal producers and consumers worldwide accelerate a move away from fossil fuels by investing in cleaner energy and developing technology to eliminate climate-warming gases. Of Mitsubishi’s 2 trillion-yen budget, about half will be spent on expanding its renewable energy assets, mainly wind power, while the rest will go to hydrogen and ammonia, liquefied natural gas (LNG) and metals used in electrification and batteries. The Japanese company will keep investing in LNG as it believes it will play an important role as a transitional energy, but plans to use carbon capture and storage (CCS) and other technology to cut CO2 emissions in the LNG supply chain.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV