Quick Notes

Projections for power demand in India: Irrational exuberance?

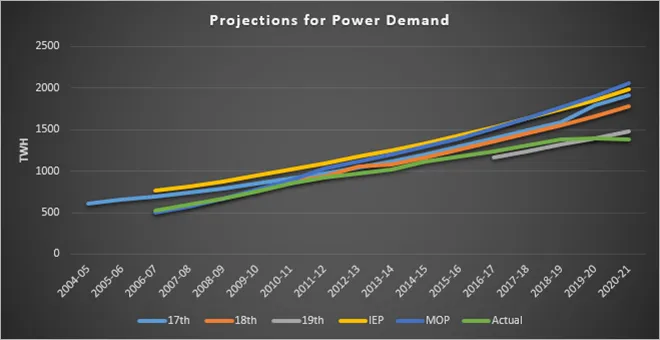

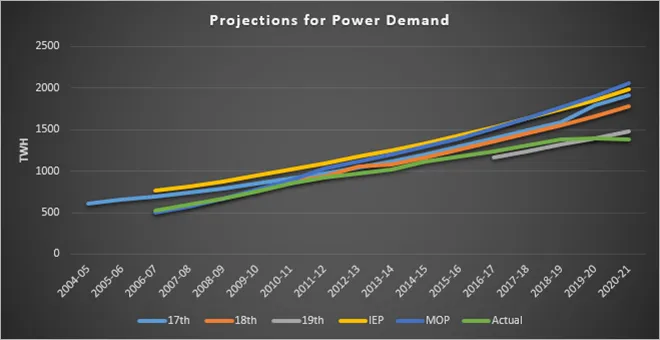

Projected and Realised Demand

In 2006, the integrated energy policy (IEP) report from the Planning Commission (now Niti Aayog) projected an electrical energy requirement (demand) of 2118 terra watthour (TWh) in 2021–22 if the gross domestic product (GDP) grows at an average of 8 percent and that the energy required for a unit of GDP falls at a constant rate. Under an average GDP growth rate of 9 percent, the IEP projected an electrical energy requirement of 2483 TWh in 2021–22. Projections by the Ministry of Power (MOP) were close at 2221 TWh in 2020–21 for an average GDP growth of 8 percent and 2550 TWh for growth rate of 9 percent. The 17th power survey released in 2007 by the Central Electricity Authority (CEA) projected an electrical energy requirement of 1914 TWh in 2020–21 while the 18th power survey of the CEA released in 2011 projected a requirement of 1904 TWh in 2020–21. Projections of the 19th power survey using a partial adjustment model (PAM) were lower at 1471 TWh electrical energy requirement in 2020–21 if the GDP grows at 7.5 percent and a requirement of 1477 TWh if the GDP grows at 8 percent. Other modelling tools used by the 19th power survey gave slightly higher projections for electrical energy requirement.

The actual demand for power in 2019–20 was 1389 TWh and in 2020–21, it was slightly lower at 1381 TWh because of COVID-19 inflicted economic slowdown. The 17th and 18th power survey projections for electricity demand in 2020–21 were about 27 percent higher than actual demand. The IEP projections (lower growth estimate) were 34 percent higher and those of the MOP about 37 percent higher.

Projected and Realised Capacity

The MOP projected an installed capacity of 445 GW (at 8 percent GDP growth) by 2020-21 while the IEP projected installed capacity of 425 GW. The 18th power survey projected an installed capacity requirement of 283 GW in 2020–21 and the 19th power survey 225 GW. The actual power generation capacity as on May 2021 was about 328 GW. The capacity projected by MOP for 2020–21 was about 14 percent more than the installed capacity today while the projected capacity by IEP was 10 percent higher. Projected capacity by the 17th power survey was about 75 percent lower than realised capacity in 2020–21 and that of the 18th power survey was 34 percent lower. The projected capacity by the 19th power survey was 69 percent lower than realised capacity in 2021.

The Cost of Irrational Exuberance

While optimism over economic prospects of India that underpin electricity demand projections is justified, exaggerated optimism or irrational exuberance as Alan Green, the former Chairman of the US Federal Reserve famously put it, can impose economic costs. The fact that expected demand for electricity projected did not materialise along with the fact that investment in capacity for power generation far exceeds technically required capacity are two factors behind most of the financial challenges of the power sector today. As demand growth has not materialised as anticipated, the capacity utilisation or PLF (plant load factor) of thermal plants has fallen from an average of 77.5 percent in 2009–10 to 53.37 percent in 2020–21. Declining capacity utilisation of thermal power plants has led to higher costs, both for the operators of individual power plants and for the Indian economy. It has also meant higher electricity tariff for consumers.

With lower-than-expected effective demand, discoms (power distribution companies) are unable to honour long-term power purchase agreements (PPAs) that they have signed with power generators in anticipation of significant growth in power demand. When a discom does not request for power that it had originally contracted to procure from a power generator, it results in the plant running on low PLF, thus, resulting in unsold electricity (‘un-requisitioned surplus’ ) for the generator. This is the electricity that the power producer is ready to generate but cannot generate because the buyer did not make a request for it. According to a recent paper, in 2019–20, the largest power producer of the country National Thermal Power Corporation (NTPC) could not generate and sell more than 74 billion kWh (kilowatt-hour) of electricity even though an electrical energy deficit of 0.5 percent and a peak deficit of 0.7 percent was reported at the national level. Another factor limiting generation is unrealised demand for electricity from households, farms, and villages that are either not connected to the grid or not supplied with power and low demand from poor households that are unable to consume more than the basic minimum of electricity because of low household incomes. Demand remaining unserved somewhere in the country when power is available with the generator is an economic loss not only for the generator but also for the nation.

Low PLF has also increased overall cost per unit generated. For the given maximum demand, the number of units generated has been low under low PLF. Lower PLF has meant that plants are operating at suboptimal level below with operating parameters worse than design or normative limits, thus causing loss to the generator. The electricity regulator fixes the normative heat rate for various types of power stations. Heat rate is a measure of efficiency and represents how much heat energy is consumed by the power plant to generate one unit of electricity. Higher the heat consumption per unit of electricity produced, higher is the heat rate and lower is the efficiency. When power plants operate at sub-optimal capacities, heat rate of the plant increases which means that the plant uses more fuel to produce a unit of electricity. This affects energy charges— energy charge is the charge which remunerates the power producer for the cost of fuel burnt—the thermal power generator receives through tariff which assumes that the plant is running at this specified efficiency level (normative level).

In addition, operators of thermal power plants are now expected to adjust their output (ramp up or down electricity generation) depending on the extent of renewable electricity (RE) that is fed into the grid. Under the “must-run” provision, RE has preferential treatment which means that RE must be purchased when available even if it means reneging on a PPA with a thermal power generator. In addition, discoms are under obligation to purchase a certain share of electricity from RE generators under the renewable purchase obligations (RPO). While this is welcome from the climate change perspective as it reduces carbon emissions, the fact that this imposes costs on the overall system cannot be ignored.

Low PLF and the consequent inefficient use of generating assets have translated into non-performing assets (NPA) for banks that underwrote the investment in these assets. In 2018, the high-level empowered committee was set up by the government to investigate the issue of financially stressed power generators; it observed that slower than expected growth in demand for power was one of the reasons for the financial stress. According to the report of the Standing Committee on stressed power assets (2017–18) the value of stressed power assets with scheduled commercial banks was over INR 379 billion. Most of the thermal plants were financed through loans from public sector banks that account for 75 to 80 percent of projects costs. The generators are paying interest on loans even though plants remain idle most of the time. This has pushed many projects into the stressed asset category, burdening not only the developers and lenders (banks) but also the Indian economy in the form of lower profitability and low dividends to the government.

Demand forecasts are critical in the design of least-cost generation plans for the power sector, as well as in investment appraisals of individual power-generation projects. But they receive less technical and policy attention than other components of the power sector analysis. Inaccurate forecasts for electricity demand, whether they over-or-under predict demand, can have dire social and economic consequences. Underestimating demand, as it was the case in the past, resulted in supply shortages and forced power outages, with serious consequences for productivity and economic growth. Overestimates of demand for electricity which were subject to optimism bias, driven by the political economy of economic growth and the engineering culture surrounding large investment projects has led to overinvestment in generation capacity, caused financial distress, and, ultimately, higher electricity prices. Careful judgment and common sense should be exercised in applying the forecasts that underpin large investment decisions. Trends shift over time, and forecasts are likely to be less meaningful in India’s power sector that is undergoing major structural shifts.

Source: IEP, MOP, 17th, 18th and 19th Power Survey

Source: IEP, MOP, 17th, 18th and 19th Power Survey

Monthly News Commentary: OIL

Oil demand yet to recover from the second wave of COVID

India

Demand

Indian energy demand is taking a big hit as COVID-19 runs rampant across the country. But uncertainty around when the virus wave will subside, and the lack of a unified government response has left the oil industry in the dark as to how quickly consumption might pick up again. The demand destruction over the last couple of months has been less severe than last year, when the government imposed the world’s biggest national lockdown. However, the lack of a coordinated effort to shut down activity to halt the virus’s spread will likely lead to a longer, although less pronounced, economic slump. Diesel and petrol, which account for more than half of oil consumption in India, are bearing the brunt of localised lockdowns. Sales of the two fuels at the three biggest retailers (IOC, BPCL, and HPCL) are about a third lower so far in May compared with pre-virus levels two years earlier. This time around, more factories have remained open and cargo movements between states haven’t been as badly affected. Indian refiners were hoping to keep processing rates reasonably high this year, encouraged by low stockpiles and export opportunities, even as consumption dropped. May shipments of clean fuels like gasoline and diesel are set to be the highest since January 2020.

India’s petrol and diesel sales fell by about 17 percent in May from a month ago as restrictions clamped to curb the world’s worst outbreak of coronavirus infections stifled demand. Sales of petrol, used in cars and motorcycles, fell to 1.79 million tonnes (mt) in May, the lowest in a year, according to the preliminary data of state-owned fuel retailers. While the consumption was almost 13 percent higher than demand in May 2020, it was 28 percent lower than pre-COVID levels of 2.49 mt. Demand for diesel, the most used fuel in the country, fell to 4.89 mt in May 2021, down 17 percent from the previous month and 30 percent from May 2019. Sales volume of cooking gas LPG (liquefied petroleum gas) fell 6 percent year-on-year to 2.16 mt in May 2021 but was 6 percent higher than 2.03 mt sold in May 2019. LPG was the only fuel to have registered growth during the lockdown last year as the government gave free cylinders as part of the COVID-19 relief package. Declining fuel sales reduced crude intake by refiners, reducing the operating run rate by 85-86 percent.

Prices

Hyderabad became the second metro city after Mumbai in the country to see petrol price crossing INR 100/litre mark after fuel prices were raised yet again. Petrol price was hiked by 29 paise per litre and diesel by 30 paise. The hike—24th in six weeks—pushed fuel prices across the country to new historic highs. In Delhi, petrol hit an all-time high of ₹96.41/litre, while diesel is now priced at ₹87.28/litre. And because of this, petrol retails at over INR 100/litre mark in seven states and union territories, Rajasthan, Madhya Pradesh, Maharashtra, Andhra Pradesh, Telangana, Karnataka, and Ladakh.

The reason for the high inflation in the country is the daily rise in petrol and diesel prices. Retail inflation rose to 6.3 percent in May, breaching the RBI’s comfort level, on the back of costlier food items. The wholesale price-based inflation accelerated to a record 12.94 percent in May, on account of rising prices of crude oil, manufactured goods, and a low base of last year.

Refining

India's private refiner RIL’s secondary unit at its export-focussed refinery in the western state of Gujarat has been shut since June 6, which may delay the shipment of some product cargoes. The refinery, which has the capacity to process 704,000 barrels of crude per day, is part of the world’s biggest refining complex in the city of Jamnagar in Gujarat state. The refining complex in Jamnagar has two refineries.

Indian oil refiners are taking advantage of weak demand due to the virus resurgence to carry out maintenance in anticipation of a revival in fuel consumption in the coming months. BPCL has lined up work at its plants across India, while HPCL is completing pending repairs and an expansion of its Mumbai refinery. Fuel sales plunged about 30 percent in May from pre-virus levels in 2019 as a spike in infections forced people to stay at home and savaged consumption. That led to swelling fuel stockpiles at refineries and storage facilities, forcing plants to cut crude processing by about 15 percent last month. With a steady decline in COVID-19 infections from a peak in early May and a relaxation of restrictions on movement, refiners are expecting fuel demand to start improving. Consumption will be higher in June than last month and should recover to around 90 percent of pre-virus levels in July. India’s economy is likely to see an improvement in activity due to an accelerated pace of vaccination from next quarter. New Delhi and Mumbai, India’s political and financial capitals and two major fuel demand centres, began to ease their lockdowns. Both cities have seen a sharp rise in traffic levels.

The Numaligarh Refinery Ltd (NRL), which was commissioned as per the provisions of the 1985 Assam Accord, would increase its capacity from the existing 3 mt to 9 mt besides bringing 6 mt crude oil to Assam from Odisha. After NRL brings the crude oil from Paradeep in Odisha through pipeline, it would be refined in Assam and then the oil would be exported to Bangladesh, Myanmar, and other Indian states. Crude oil from Paradeep would substantially raise the capacity of the three refineries in Assam Bongaigaon, Guwahati, and NRL. Earlier, Assam’s crude oil used to be sent to Barauni, but now 6 mt crude oil would come to the state.

The Central government proposes to further sugar-coat the BPCL strategic sale deal for the interested investors by giving few more clarifications through a new set of frequently asked questions (FAQ). The Department of Promotion of Investment and Internal Trade (DPIIT) may soon issue a clarification that the BPCL under new private sector owners would be free to bring in FDIs to the tune of the entire 100 percent equity of the company without conditions. Also, after privatisation, BPCL would be free to exercise its right to stay or come out of the joint venture company that plans to build the world’s largest 60 mt integrated refinery-cum-petrochemicals complex in Maharashtra’s Ratnagiri district at an estimated cost of INR 3 trillion. Moreover, the government is also looking to allow BPCL to sell its stake in Petronet LNG and Indraprastha Gas Ltd, where the oil refiner is one of the promoters, before its own strategic sale. BPCL operates four refineries in Mumbai, Kochi, Bina, (Madhya Pradesh) and Numaligarh (Assam), but the facility in Assam has been hived off. The company accounts for 15 percent of India’s refining capacity of close to 250 mt. BPCL distributes 21 percent of the petroleum products consumed in the country and owns a fifth of the 250 aviation fuel stations in India.

Ethanol Blending

To cut pollution and import dependence, the target for mixing 20 percent ethanol in petrol has been brought forward from 2030 to 2025. India is now a proponent of climate change resolution and is amongst the top 10 nations on the Climate Change Performance Index. Ethanol extracted from sugarcane as well as damaged food grains such as wheat and broken rice and agriculture waste has two positives on environment—it is less polluting and its use also provides farmers with an alternate source of income. The government last year, had set a target for blending 10 percent ethanol in petrol by 2022, and 20 percent by 2030. Currently, about 8.5 percent ethanol is mixed with petrol as against 1-1.5 percent in 2014.

Production

Villagers and activists in Pudukottai held a protest against the latest bid by the Union Ministry of Petroleum and Natural Gas to award contract to private companies for oil and natural gas exploration at Vadatheru in Pudukottai—a protected special agriculture zone. On 10 June, the Union ministry had invited companies to bid for development and monetising 32 contract areas comprising 75 oil and gas fields at 11 sites, 20 shallow water off-shore sites and a site located in deep water off-shore. These are for the development of discovered small oil and gas fields under Discovered Small Field Policy through the directorate general of hydrocarbons (DGH). The bid also allows foreign companies and joint ventures to take up the contract. Vadatheru, which comes under Cauvery delta offshore, is one of the sites discovered by the ministry for the award of contract of oil and natural gas exploration.

Vedanta will make an upfront payment of almost US $40 million (about INR 2.92 billion) for the acquisition of Videocon Industries, which will help it become the largest shareholder in the Ravva oil and gas fields in KG basin. The National Company Law Tribunal’s Mumbai bench approved the acquisition of bankrupt Videocon Industries by Vedanta group firm Twin Star Technologies, with the lenders set to take a haircut of about 90 percent. Ravva field produced 22,000 barrels of oil and oil equivalent gas per day.

Retail

Oil companies’ mega expansion plan has collided with the pandemic, creating for petrol pumps a double whammy of increased competition and collapsing fuel demand. In two years, companies have added around 12,500 pumps, increasing the country’s fuel retail network by nearly 20 percent to 77,200 pumps, even as the combined sales of petrol and diesel have plunged about 30 percent in May. The devastating pandemic cut petrol and diesel demand by 7 per cent and 12 percent, respectively, during 2020–21 over the previous year. This was the second straight year of decline for diesel. Even as sales of petrol were normalising as the first COVID wave tapered off, the resurgence of the virus prompted states to impose fresh lockdowns. The pandemic slowed but didn’t stop setting up of new pumps. Two-and-a-half years ago, three state-run oil companies, IOC, HPCL, and BPCL, set off the process to appoint dealers at nearly 80,000 locations across the country, which could have more than doubled their then network of 57,000 pumps. They received applications for 95 per cent of locations and have since appointed 12,500 dealers.

Doorstep diesel delivery is a new revolution in the field of energy distribution in Rajasthan which is easing the lives of the end-consumers without the hassles of diesel procurement. Four fuel entrepreneurs are bringing change in the fuel industry in Rajasthan with this door-to-door delivery model which includes Bikaner-based Hiralal Bhattar Petroleum. It has started the facility of doorstep diesel delivery through their mobile petrol pumps. Barmer-based Shree Mahadev Petroleum has also started the facility of doorstep diesel delivery. Pali-based Manish Kishan Filling Station has also started the facility of doorstep diesel delivery. M/s Sirohi Petroleum has started the facility of doorstep diesel delivery through their mobile petrol pumps in Nagaur. Doorstep diesel delivery is approved by the government and is a new-age concept of effective distribution of diesel. It allows fuel startups to maintain quality and create availability of fuel for the consumers. It will hugely benefit the agricultural sector, hospitals, housing societies, heavy machinery facilities, mobile towers, etc. Earlier, the bulk consumers of diesel had to procure it from retail outlets in barrels which used to cause a lot of spillage and dead mileage in energy procurement. Efficient energy distribution infrastructure was lacking. Doorstep diesel delivery will solve many such problems and will provide diesel to bulk consumers in a legal manner.

Rest of the World

Global

According to British bank Barclays, a gradual oil demand recovery is largely on track as economies re-open, and that it remained constructive on oil prices despite rising coronavirus cases across Asia and potential return of Iranian supplies. It cut demand estimates for the Emerging Markets Asia (ex-China) region, flagging the risk of further downside if the recent surge in infections persisted. If the United States lifted sanctions on Iran, the Middle East nation could boost oil shipments, adding to global supply. Global oil inventories could largely normalise over the next two or three months, given a recent drawdown in inventories and a projected deficit of about 1.5 million bpd a day in the second half.

OPEC+

OPEC and its allies maintained strong compliance with agreed oil output targets in May, when the first part of a gradual production increase took effect. The OPEC and allies, known as OPEC+, complied with 115 percent of agreed output curbs in May. The April figure was 114 percent. OPEC+ is returning 2.1 million bpd to the market from May through July as part of a plan to gradually unwind last year's record oil output curbs, as demand recovers from the pandemic.

The group plans to add back 350,000 bpd in June and 440,000 bpd in July. Saudi Arabia is also gradually adding back 1 million barrels in voluntary cuts it made above and beyond its group commitment. The combined OPEC Plus grouping of members led by Saudi Arabia and non-members, chief amongst them Russia, is facing concerns renewed COVID-19 outbreaks in countries such as India, a major oil consumer, will hurt global demand and weigh on prices. Oil producing countries made drastic cuts to support prices during the worst of the pandemic slowdown in 2020 and must now judge how much additional oil the market needs as producers slowly add more production. But prices have recovered, closing at multi-year highs, and the recoveries in the US, Europe, and Asia are expected to drive energy demand higher in the second half of the year as people travel more and use more fuel. Oil prices have risen more than 30 percent since the start of the year. That has meant higher costs for motorists in the US, where crude makes up about half the price of a gallon of gasoline.

Middle East

Abu Dhabi sold US $2 billion in seven-year bonds in its first foray into the international debt markets this year, raising cash for state coffers despite a recent rebound in oil prices. The oil-rich emirate sold the bonds at 45 basis points (bps) over US Treasuries. That was tightened from initial guidance of 70-75 bps over Treasuries after the debt sale received over US $6.9 billion in orders. The United Arab Emirates, where Abu Dhabi is the capital, was hit hard by the COVID-19 pandemic and last year's crash in oil prices, but a rebound in global crude demand as economies re-open has reduced the urgency to borrow for budget purposes. The budget, however, is based on an oil price assumption of about US $46 per barrel versus roughly US $50 per barrel last year.

USA and North America

Exxon Mobil Corp has made a new discovery at Longtail-3 in the Stabroek Block offshore Guyana, as the US oil major develops one of the world's most important new oil and gas blocks in the last decade. Exxon operates the 6.6 million acre Stabroek Block as part of a consortium that includes Hess Corp and China’s CNOOC Ltd. It began production at the block in 2019. The latest find continues the consortium's long string of discoveries in Latin America’s newest crude producing nation and underscores the importance of Guyana to Exxon for increasing its future oil output.

US announced it was halting petroleum development activity in Alaska’s Arctic National Wildlife Refuge, reversing a move by former President Donald Trump to allow drilling. The announcement deals a blow to the long-contested quest of oil companies to drill in the sensitive territory. The push for development picked up momentum after Trump announced the leasing plan last November shortly after losing re-election to Biden. At a lease sale in January over some 1.6 million acres, US officials auctioned off 11 oil tracts. Major oil companies sat out the bidding, and nine of the leases went to the Alaska Industrial Development and Export Authority, a state agency, while two went to small companies. But the oil industry has long sought to drill in the area, which is thought to potentially hold billions of barrels in oil. Key Alaska lawmakers have strongly backed development. But the American Petroleum Institute said the oil industry knows how to develop responsibly and that the decision will cost Alaska jobs and tax revenue.

US Sanctions

US investment bank Goldman Sachs expects Brent crude prices to reach US $80/b this summer, betting that a recent oil market rally will continue as vaccination rollouts boost global economic activity and demand for the commodity. Brent prices hit US $72.93/b, their highest level in over two years, fuelled by expectations of stronger demand. Goldman, which has longstanding commodity sector expertise, expects recovery in oil demand to continue and sees global demand reaching 99 million bpd in August. Iran and global powers have been negotiating since April to lift sanctions on Tehran, which have hit its economy hard by cutting its vital oil exports.

The US has sold some 2 million barrels of Iranian crude oil after seizing an oil tanker off the coast of the United Arab Emirates (UAE), court documents and government statistics show. The Iranian crude oil showed up in new figures released over the weekend by the US Energy Information Agency (EIA), raising the eyebrows of commodities traders as Tehran remains targeted by a series of American sanctions. The oil came from the MT Achilleas, a ship seized in February by the US off the coast of the Emirati port city of Fujairah. US court documents allege the Achilleas was subject to forfeiture under American anti-terrorism statues as Iran's paramilitary Revolutionary Guard tried to use it to sell crude oil to China. The US has identified the Guard as a terrorist organisation since the administration of former President Donald Trump. The US government brought the Achilleas to Houston, Texas, where it sold the just over 2 million barrels of crude oil within it for US $110 n, or at around US $55/b. The money will be held in escrow amid a court case over it.

South America

Venezuela’s state-run oil company PDVSA has restarted crude blending at its Petrolera Sinovensa facility after a gas supply outage to the Jose oil export terminal halted operations. The resumption comes as a very large crude carrier (VLCC) set sail after delays loading at Jose and a second VLCC prepared to leave, partly alleviating a bottleneck of vessels that had built up due to the gas outage, low inventories, and quality issues. Both super tankers are carrying crude cargoes bound for Asia and a third vessel of the same size is set to depart by the end of the month to cover a similar route. As of 23 May, Petrolera Sinovensa's blending plants, operated by a joint venture between PDVSA and China National Petroleum Corp for converting extra-heavy crude from Venezuela’s Orinoco oil belt into exportable Merey crude, were processing 139,000 bpd. The Petropiar crude upgrader, a facility near Jose that is part of a joint venture between PDVSA and Chevron and which also halted output due to the gas outage, had not yet restarted. The temporary gas outage at Jose resulted from a fire at PDVSA’s Amana Operating Centre (COA) in eastern Monagas state that authorities blamed on lightning.

EU and UK

Royal Dutch Shell is in talks with the Nigerian government to sell the Anglo-Dutch company's stake in onshore oilfields. Shell, the operator of the West African country’s onshore oil and gas joint venture SPDC, has struggled for years with spills in the Niger Delta because of pipeline theft and sabotage as well as operational issues. The spills have led to costly repair operations and high-profile lawsuits. Shell’s Nigerian onshore joint venture SPDC has sold about 50 percent of its oil assets over the past decade. Shell’s stake in SPDC gave it 156,000 barrels per day of oil equivalent in 2020, of which 66,000 barrels were oil.

China

China’s crude oil imports fell 14.6 percent in May from a high base a year earlier, with daily arrivals hitting the lowest level this year, as maintenance at refineries limited consumption of the resource. But refinery utilisation rates are expected to rebound in coming months as refineries resume operations. May arrivals were 40.97 mt data released by the General Administration of Customs showed, equivalent to 9.65 million bpd. That compares to 9.82 million bpd in April and 11.3 million bpd in May last year when Chinese buyers snapped up cheap oil amid the spread of the coronavirus. About 1.2 million bpd of China’s refining capacity was offline in May, up from 1 million bpd in April. China’s crude arrivals are expected to reach 11–12 million bpd in the third quarter and refinery runs rise by 0.5 million bpd from the second quarter. The Chinese government has been ramping up scrutiny of the oil industry by imposing taxes on key blending fuels and investigating crude imports at state energy giants and independent refiners. The tax policy is expected to hit demand of bitumen blend, mostly shipped from Malaysia, which is based on heavy crude from Venezuela and Iran. For refined oil products, customs data also showed exports in May fell to 5.41 mt from 6.82 mt in April but jumped 38.9 percent higher versus a year earlier.

Asia Pacific

Sri Lanka announced an investigation into a possible oil slick reported off its west coast where a Singaporean container ship is submerged after burning for 13 days. Local experts examined an oil patch of about 0.35 square km where MV X-Press Pearl ran aground. Authorities are bracing for a possible oil spill from the submerged wreck or almost 300 tonnes of bunker oil thought to be still in its fuel tanks. The owners of the vessel have already deployed representatives from the International Tankers Owners Pollution Federation (ITOPF) and Oil Spill Response (OSR) to monitor any oil spill and help with the clean-up of beaches. Five vessels, including two Indian Coast Guard ships equipped to deal with oil spills, were anchored around the sinking vessel, but none reported a leakage from the submerged wreck.

Japan’s JX Nippon wants to sell its British North Sea oil and gas assets including stakes in some of the basin's biggest fields in a deal that could fetch up to US $1.5 billion. The sale is the latest deal in the North Sea marking the handover of assets from oil majors to private companies, which they can better exploit remaining reserves than huge companies focusing on the energy transition. Culzean, with its 300 million barrels of reserves, can cover 5 percent of Britain’s gas needs alone, according to Total. The fields produced a net 6,500 barrels of oil equivalent per day for JX Nippon in 2018, before the start of Mariner and Culzean in 2019.

News Highlights: 16 – 22 June 2021

National: Oil

Diesel tops INR 100 per litre in Odisha, Rajasthan on the back of global cues

21 June: The price of diesel has crossed the INR 100 per litre-mark in some parts of the country on the back of global cues and sustained high levels of state and central taxation. Rajasthan’s Sri Ganganagar and Hanumangarh, and Odisha’s Koraput, Nabarangapur, and Malkangiri were some of the districts in the country where diesel sold above INR 100 per litre, while in Madhya Pradesh’s Anupur, the rate was INR 99 a litre. Diesel is expensive in these states as they levy the highest rates of Value Added Tax (VAT) alongside cesses on auto fuels in the country. The price is even higher in these cities because of added freight costs, incurred in transporting diesel, that are also borne by consumers. States such as Andaman and Nicobar Islands, Arunachal Pradesh, and Meghalaya, where diesel is the cheapest have low VAT rates ranging less than 13 percent. The Centre had hiked these duties when global crude oil and benchmark petrol and diesel prices were at lows. The fall in international prices was due to a demand slump in light of the COVID-19 pandemic. But that pessimism seems to have been shrugged off and Brent (the most popular marker for crude oil prices) is well above US $70 a barrel.

Source: Business Standard

Petrol crosses INR 97 in Delhi, diesel nears INR 88 after another price hike

21 June: Petrol price in the national capital crossed INR 97 a litre and diesel neared INR 88 after fuel prices were raised yet again. Petrol price was hiked by 29 paise per litre and diesel by 28 paise, according to a price notification of state-owned fuel retailers. The hike—27th in seven weeks—pushed fuel prices across the country to new historic highs. In Delhi, petrol hit an all-time high of INR 97.22 a litre, while diesel is now priced at INR 87.97 per litre.

Source: The Economic Times

ONGC seeks Tamil Nadu nod to drill 10 oil exploration wells

17 June: Days after Chief Minister (CM) M K Stalin wrote to Prime Minister Narendra Modi urging the Union government not to allow oil and gas exploration in Cauvery delta districts, ONGC (Oil and Natural Gas Corp) has approached the state environmental impact assessment authority (SEIAA) seeking clearance to drill 10 exploration wells in Ariyalur district. The ONGC letter circulated widely attracted sharp criticisms from political parties and farmers who have been up against oil exploration in the agrarian region which had been designated a protected special agriculture zone by the previous government. According to the application dated 15 June submitted to the state government, the oil major plans to drill 10 exploratory wells in Ariyalur district where there is the likelihood of hydrocarbon reserve. ONGC said an environmental clearance application and pre-feasibility report have been submitted for Cauvery Basin. If any oil or gas reserve is found, plans will be afoot to establish development wells by the Cauvery asset section of ONGC in Karaikal that oversees exploration in the delta districts. Last year, the AIADMK government had declared Cauvery delta districts a protected zone for agriculture covering a part of Ariyalur and banned oil exploration activities. Farmers said the state government should not allow such exploration.

Source: The Economic Times

OMCs again resort to alternate day fuel price revision

17 June: Oil Marketing Companies (OMCs) seem to have moved once again towards a revised fuel price mechanism, shifting to the practice of changing petrol and diesel rates after every couple of days rather than undertaking changes on a daily basis. In the last few days, pump prices of petrol and diesel have been revised every two days but the practice had not helped consumers as even under this system prices have only moved up making the fuel dearer. OMCs kept retail price of petrol and diesel unchanged. So petrol still costs INR96.66 per litre and diesel ₹INR .41 per litre in Delhi. In Mumbai, where petrol prices crossed INR 100 mark for the first time ever on 29 May, the prices continued to be at new high of INR 102.58 per litre. Under daily price revision, OMCs revised petrol and diesel prices every morning benchmarking retail fuel prices to a 15-day rolling average of global refined products' prices and dollar exchange rate. However, in a market where fuel prices need to be increased successively, alternate day price revision seems to be the flavour.

Source: The Economic Times

National: Gas

India’s return to LNG spot market hints at post-virus recovery

22 June: India started buying prompt shipments of liquefied natural gas (LNG) from the spot market after a two-month absence, indicating a rebound in demand as the nation exits a deadly phase of the COVID-19 pandemic. Petronet LNG Ltd and Indian Oil Corp awarded tenders for delivery over the next few months, the first spot purchases since March, according to traders with knowledge of the matter. Both cargoes cost more than US $11 per million metric British thermal units, an unusually high level for Indian buyers able to turn to alternatives such as fuel oil and liquefied petroleum gas. Global energy use is quickly recovering from the devastation wrought by the pandemic, and the positive signal from India will help to push natural gas prices higher, though the nation’s demand recovery is still uneven and not all buyers there are eager to boost purchases. India is emerging from the COVID-19 wave that overwhelmed healthcare infrastructure and triggered localised lockdowns, causing a slump in natural gas consumption in the transport, commercial, and industrial sectors. Now, daily cases have sunk back below 60,000 from more than 400,000 at the outbreak’s peak, and curbs are being eased. India’s return to the spot market is in stark contrast to just last month, when companies were seeking to cancel and divert shipments due to a glut at import facilities.

Source: The Economic Times

H-Energy signs agreement with Petrobangla for LNG gas pipeline link

17 June: Achieving a major milestone for supply of re-gasified LNG (R-LNG) from India to Bangladesh, H-Energy signed aMemorandum of Understanding (MoU) with Petrobangla on 16 June 2021. The companies will soon finalise a long-term supply agreement to commence the supply of R-LNG to Bangladesh through a cross-border natural gas pipeline. A portion of the piped gas may also be utilised in West Bengal. H-Energy was authorised by the Petroleum and Natural Gas Regulatory Board (PNGRB), the regulatory body in India, to build, own and operate Kanai Chhata-Shrirampur natural gas pipeline connecting H-Energy’s LNG terminal in West Bengal passing through various regions of the state and further connecting to the Bangladesh border. H-Energy is the only company to have received the authorisation from PNGRB (Petroleum and Natural Gas Regulatory Board) to lay a pipeline till the border for the supply of R-LNG into Bangladesh.

Source: The Economic Times

National: Coal

Vedanta emerges successful bidder for coal block in Odisha during re-bid

21 June: Vedanta has emerged as successful bidder for a coal block in Odisha which was put for re-bid in the second attempt of auction of blocks for commercial mining. With the successful auction of Kuraloi (A) north coal mine in Odisha, the total number of mines successfully auctioned in the first tranche of auction for commercial mining is 20 out of total 38 coal mines offered, the coal ministry said. In the first attempt of auction under 11th tranche of auction under the CM (S) Act 2015 and under first tranche of auction under the MMDR Act 1957, out of the 38 coal mines, 19 have been successfully auctioned. Out of the remaining mines, four coal mines which had fetched single bid in the first attempt were put up for re-auction in a second attempt by Ministry of Coal with the same terms and conditions but with the highest initial offer received in the first annulled attempt of auction as the floor price for the second attempt. The ministry had launched the auction process of 38 coal mines in the first tranche of auction for sale of coal for commercial mining.

Source: The Economic Times

Coal to remain vital source for power generation for at least 20 years: Joshi

19 June: Coal accounted for 74 percent of India’s power generation in 2018 and will continue to contribute 50 percent of the power generated in the country over the next 20 years, Minister for Coal, Mines and Parliamentary Affairs Pralhad Joshi said. He said India’s per capita carbon emissions are one third of the global average and what we need at the moment is growth acceleration and coal is the means to achieve it. He said that in 2020, India’s primary energy demand was 88 million tonnes of oil equivalent with coal being a major source of energy production at 44 percent, oil with 25 percent, natural gas at 6 percent and renewables at 3 percent. He said replacement of coal-based power with renewables has its own limitations and it will cause a number of issues as far as meeting power requirement is concerned. He said the transition away from coal has to be gradual and it has to be managed well keeping in view the needs and aspirations of billions of people.

Source: The Economic Times

Coal India contemplating to hike coal price

18 June: Coal India Ltd (CIL) is debating on hiking coal price for the regulated sector and may take a call soon. Costs are on the rise for the miner but realisation remained muted without revision of coal price for the regulated sector. CIL Chairman Pramod Agarwal during an earnings call said that the company is in "serious discussion" about raising coal price and a decision may be taken soon. The world’s largest miner could see a wage hike by 5-7 percent that will entail a jump in wage cost by 2-3 percent, after taking into consideration the reduction in manpower by 13,000-14,000 employees through retirement, he said. He indicated that the decision to increase coal price was delayed due to the onset of the COVID-19 pandemic. Coal prices in the global market have been on the rise for the last few months. CIL’s revenue remains muted due to lower e-auction coal sales and realisation while its supply to the regulated sector—mainly the power sector—is also much less. The company sells coal to the regulated sector at INR 1,391 per tonne while the e-auction price is INR 1,752 a tonne. The coal production and dispatch targets for the current year remain very optimistic. The company has set a production target of 670 million tonnes (mt) and a dispatch target of 740 mt. In 2020-21, its production was 596 mt and offtake was 574 mt.

Source: The Economic Times

National: Power

Overseas participants on Indian power exchanges to rise soon

21 June: Indian power exchanges may soon host a larger number of buyers and sellers from neighbouring countries with the operationalisation of cross-border sale and purchase of electricity for which regulations have already been issued by the Central Electricity Regulatory Commission (CERC) and Central Electricity Authority (CEA) has notified the procedures. At present, the country’s largest power exchange Indian Energy Exchange (IEX) has begun trading of electricity hosting participants from Nepal on its platform. IEX head of business development, Rohit Bajaj said that potential for cross border power trading was immense and soon its platform could host participants from Bangladesh and Bhutan with whom India already has a power transmission line. After Nepal, the plan is that Indian power exchanges start hosting buyers and sellers from countries such as Bhutan and Bangladesh. This could be followed up by bringing participants from Myanmar and Sri Lanka. Such participation from overseas entities on Indian exchanges would not be direct but through any electricity trading licensee of India. Trading will be through bilateral agreement between two countries, bidding route or through mutual agreements between entities. In case of Nepal, NTPC Vidyut Vyapar Nigam (NVVN) is the trading partner that has enrolled Nepal Electricity Authority (NEA) cross border trading up to 350 MW. Currently, just about 3,000 MW of power is traded in the South Asia region amongst seven countries including India, Bhutan, Bangladesh, Nepal, Pakistan, Sri Lanka, and Myanmar. India annually imports about 1,200-1,500 MW power from Bhutan and exports about 1,200 MW to Bangladesh, 500 MW to Nepal and 3 MW to Myanmar.

Source: The Economic Times

NTPC Barauni unit 9 all set to generate 250 MW more power

21 June: The state is set to further generate 250 MW power as the National Thermal Power Corporation’s Barauni unit successfully completed the 72-hour full load trial run operations of its another new unit. Barauni NTPC corporate communication officer Punita Tirkey said the trial run operations of unit number nine was conducted in total compliance of central electricity regulatory commission norms. The NTPC fulfils nearly 70 percent of the average daily power allocation to the state routed through central utilities. The state’s total power consumption through central utilities ranges between 4,000 and 4,500 MW on an average daily. As per NTPC Ltd, The BTPS came into existence in 1962, with Russian collaboration and Bihar State Electricity Board became its original project proponent. The Barauni power generation unit has seen an upward turn in its fortunes following the NTPC taking its ownership on December 15, 2018.

Source: The Economic Times

India may open derivatives market for power sector next fiscal

21 June: After prolonged delays, India may open derivatives market for the power sector in the next financial year (FY 2022–23), allowing both power generators and consumers to enter into futures contract and use it as a new hedging tool to mitigate price volatility and other associated risks. Introduction of pure play futures and options as products on the power trading platform would be a major reform initiative that would help in developing a robust and vibrant energy market. The introduction of derivate products has got delayed over jurisdictional issues between the Securities and Exchange Board of India (SEBI) and the Central Electricity Regulatory Commission (CERC) and a case pending in the Supreme Court also needs to be cleared. The SEBI and the CERC have reached an understanding to allow futures trading in electricity.

Source: The Economic Times

Ensure staff to clear power bills to get salary: APDCL to Assam government

20 June: The Assam Power Distribution Company Ltd (APDCL) has urged the state government to release the salaries of its employees for June only if they clear their electricity bills. The APDCL managing director has issued a letter to senior officials of the Assam government and requested them to ensure payment of power bills by their employees.

Source: The Economic Times

Assam will try to replicate Gujarat model in power sector: CM

16 June: Assam government will try to replicate the success stories of the Gujarat model in the power sector along with its state-of the art technological interventions to turn three power companies in the state to profitable ventures, Chief Minister (CM) Himanta Biswa Sarma said. Sarma said that in spite of the steps taken so far, the three power companies- Assam Power Distribution Company Ltd (APDCL), Assam Power Generation Corp Ltd (APGCL) and Assam Electricity Grid Corp Ltd (AEGCL)—have not been able to establish themselves as profitable ventures. Measures are now being taken to share the expertise of an energy rich state in the country to help the three power companies of Assam to turn into profit making ventures, he said.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Power ministry extends timeline for transmission charges waiver for RE by two years

22 June: The power ministry announced the extension of the timeline by two years for waiver on inter-state transmission charge for electricity generated from solar and wind Sources. Now, the waiver would be available till 30 June 2025. Earlier, it was applicable till 30 June 2023. Besides, the waiver would now be available for Hydro Pumped Storage Plant (PSP) and Battery Energy Storage System (BESS) projects also. The waiver of inter-state transmission charges on the transmission of the electricity generated from solar and wind sources of energy that was available to solar and wind projects commissioned up to June 30, 2023, has now been extended till June 30, 2025. The buyers of renewable energy (RE) will also have an opportunity to sell their surplus power in the power exchanges or allow in advance the sellers to sell in the power exchange. The order is futuristic as it also allows the waiver of transmission charges for RE trade in the Green Day Ahead Market (as part of the integrated Day-ahead market). CERC, POSOCO, and the power exchanges are working on it in mission mode to operationalise this product in the power exchanges by end of August 2021. This amendment order will be a boost to renewable energy and also a step forward to achieve the targets of the Government of India in meeting the international obligations towards climate change.

Source: The Economic Times

Himachal Pradesh commissions 50 kW rooftop solar project in Solar

21 June: Himachal Pradesh State Electricity Board (HPSEB) inaugurated a 50 kilowatt (KW) capacity solar rooftop project in Solan under the centre's Integrated Power Development Scheme (IPDS) scheme. PFC Ltd said under the ongoing "Go Green" initiative, solar panels are also installed in Uttar Pradesh (10 MWp), Karnataka (8 MWp), Kerala (5 MWp), West Bengal (4 MWp), Uttarakhand (3 MWp) and Himachal Pradesh (1 MWp).

Source: The Economic Times

Solar electric power system emerges as go-to option during COVID in UP’s Prayagraj

21 June: Worried about the overmounting utility bill on account of the use of electric appliances, citizens of Sangam city including owners of big showrooms, farmhouses, community halls and marriage pandals are quickly switching toward solar electric power systems in an attempt to reduce electricity charges. Agencies taking up the installation of solar power systems in Sangam city claimed that the absence of business during the first and second lockdown and business fraternity particularly owners of big showrooms, community halls, and marriage pandals owners who could not be able to earn profits due to hardly any customers showing up during the relaxations, were more enthusiastic to install both battery-based solar power system and on-grid solar power systems. In the past two years, the demand for solar power electric system has also increased in the semi-urban and rural areas and users often turn to it to eliminate their electricity bills. Agencies involved in the installation of solar electric power system claimed that industrial units could also cut their electricity bills in a range between 30 percent and 60 percent by replacing the grid power supply with renewable energy.

Source: The Economic Times

High Court quashes Andhra Pradesh’s 6.4 GW renewable energy tender

18 June: In a major relief to green energy companies, the Andhra Pradesh (AP) High Court quashed the state government’s 6,400 MW bid, saying that all bids had to fall under the Centre’s set guidelines for renewable energy tenders. In July 2019, the State government decided to renegotiate the purchase cost of wind and solar projects already awarded, saying it would not honour power purchase agreements signed by the previous government. The AP High Court had then issued a stay order and directed distribution companies to clear the dues owed after developers took the state to court.

Source: The Economic Times

New plan worth INR 200 billion to solarise agricultural feeders: Singh

18 June: The government is planning to set aside INR 200 billion under a new scheme for solarising agricultural feeders, Power and Renewable Energy Minister R K Singh said. He said that for solarising the entire agricultural sector, 110 GW capacity will have to be installed. He said energy access was a huge challenge for the world and without this energy transition cannot happen. He said the government has already earmarked 17 cities and more are underway. Under this plan, the government has proposed to run entire cities on renewable energy. Commenting on the renewable energy parks, he said that a power evacuation survey had been completed for a 10 GW park in Ladakh. Regarding future clean energy technologies, he said the government plans to invite bids for setting up large-scale green hydrogen projects in the next three to four months. The projects will be based on green hydrogen purchase obligations similar to renewable purchase obligations. India has tripled its renewable energy capacity to 96 GW in the past five years while its solar energy capacity has gone up about 15.5 times.

Source: The Economic Times

11 thermal plants in NCR accounted for 7 percent of Delhi air pollution in October-January

17 June: The 11 coal-fired power plants in the National Capital Region contributed just 7 percent to Delhi’s PM2.5 pollution on an average between October 2020 and January 2021, while vehicles contributed 14 percent, according to a new study. The findings are significant considering that the Delhi government had recently moved to the Supreme Court, seeking closure of the coal-fired power plants in the vicinity of the city using outdated polluting technology. On 1 April, the Union Environment Ministry had issued a notification with amended rules allowing thermal power plants within 10 kilometres of the National Capital Region (NCR) and in cities with more than 10 lakh population to comply with new emission norms by the end of 2022. The share of vehicular emissions to Delhi’s PM 2.5 pollution was 14 percent on an average between October 2020 and January 2021. According to the study, a relatively longer stubble-burning period and unfavourable meteorological conditions were primarily responsible for Delhi's worsening air quality in winters last year. Household heating and cooking were responsible for 40 percent of the pollution burden in December 2020 and January 2021. In its latest analysis, the Council on Energy, Environment and Water (CEEW), a Delhi-based not-for-profit policy research institution, showed the contribution of stubble burning to Delhi’s PM2.5 levels exceeded 30 percent for seven days (between 10 October and 25 November) in 2020 as against three days in 2019.

Source: The Economic Times

Gujarat: Waste-to-energy plant to be ready in Ahmedabad by end of the year

17 June: The waste-to-energy plant, which is being set up by Abelleon Clean Energy, will begin operation by the end of 2021. This is part of city’s zero-waste strategy to generate power from waste with a 14 MW plant in Gyaspur near Pirana. The power generated from the plant will be fed into the national power grid. It will convert 1,000 metric tonnes of waste into energy daily. Ahmedabad Municipal Corp has given 13 acres of land for the project. The AMC said that the project was part of zero-waste strategy to reduce burden on Pirana. The plant, according to AMC, will be using the latest technology and will follow the European standard to generate energy. The AMC said it is setting up a similar plant which will also have the capacity to convert 1,000 million tonnes (mt) of garbage. The AMC plans to set up a third plant and has sought expression of interest. The city generated nearly 4,500 mt of waste, including 500MT of construction waste produced while making paver blocks. The AMC will only use kitchen and garden waste and convert it into energy.

Source: The Economic Times

India’s renewable energy sector requires over US $500 billion investments in next decade

17 June: India’s renewable energy (RE) sector will witness a large part of incoming investments in the areas of indigenous products, innovative start-ups, transmission, and generation space in the coming years, industry experts said. Industry experts said that India’s RE sector requires over US $500 billion in the next decade—in wind and solar infrastructure, expansion and modernisation, and for the indigenisation of batteries, etc.

Source: The Economic Times

Rise in imported solar module prices to impact project returns: ICRA

16 June: The increase in imported photovoltaic (PV) solar module price level by about 15-20 percent over the past four-five months, to about 22-23 cents per watt as on date, is expected to impact returns of solar power project developers, according to ratings agency ICRA. It said that this price rise has been mainly driven by a sharp increase in the price of polysilicon, a key input for cell and module manufacturers. Given the import dependency for PV modules for a majority of the solar power installations in India, such hardening in the price of PV modules, if sustained, remains a near-term headwind, ICRA said. ICRA said that notwithstanding the near-term headwind related to module price levels, the credit outlook on the solar energy sector remains stable.

Source: The Economic Times

International: Oil

China cuts second batch of crude oil import quotas for private refiners

22 June: China has issued 35.24 million tonnes (mt) of crude oil import quotas to non-state refiners in a second batch of allowances for 2021, a 35 percent drop from the same slot last year. The sharp decline comes after a recent crackdown on trading of such quotas as Beijing works to consolidate its bloated refining industry and reduce emissions. Analysts expect the changes in quotas and newly imposed taxes on bitumen feedstock to reduce independent refiners' crude imports and their fuel output in the second half of the year although state refiners will ramp up crude imports and processing rates to reap higher domestic margins. Independent firms, known as 'teapot' refiners, account for about a fifth of crude imports the world's largest oil importer. These refiners are likely to draw on commercial inventories in China while processing fuel oil that they had bought earlier, Liu Yuntao, China analyst at consultancy Energy Aspects, said. The impact on refiners' run rates will become more evident in the fourth quarter as they gradually use up oil in storage, Liu said. A total of 39 companies, led by two large private refiners—Zhejiang Petrochemical Co (ZPC) and Hengli Petrochemical—will receive quotas issued in the second batch for 2021. China’s Ministry of Commerce had said in late 2020 that it would raise the non-state crude oil imports allowance for 2021 by 20 percent from 2020’s total to 243 mt, to meet demand from new mega refineries. In December, it issued 122.59 mt for the first batch for 2021, the highest ever. However, ballooning domestic fuel supplies and depressed sector-wide refining profits so far in 2021 encouraged authorities to launch a probe into the use of crude import quotas and levy new taxes on fuels used by refiners. The second batch of quotas brings China’s total non-state import allowances to 157.83 mt so far this year, compared with 157.71 mt by the same point in 2020.

Source: The Economic Times

Oil steady on summer demand hopes but Iranian supply looms

22 June: Oil prices were largely steady on rising demand in the northern hemisphere's summer driving season, but traders braced for a return of Iranian crude supplies despite a pause in talks to end US sanctions. Brent crude for August lost 24 cents, or 0.3 percent, to US $73.27 a barrel. US West Texas Intermediate (WTI) crude for July was down 17 cents, or 0.2 percent, at US $71.47. Both benchmarks have risen for the past four weeks on optimism over the pace of global COVID-19 vaccinations and expected pick-up in summer travel. The rebound has pushed up spot premiums for crude in Asia and Europe to multi-month highs. Bank of America said that Brent crude was likely to average US $68 a barrel this year but could hit US $100 next year on unleashed pent-up demand and more private car usage. A deal could lead to Iran exporting an extra 1 million barrels per day, or 1 percent of global supply, for more than six months from its storage facilities. Iran has boosted the volume of crude it has stored on oil tankers in recent months, data intelligence firm Kpler said, in what may be preparation for a resumption in exports. However, oil prices have drawn support from forecasts of limited growth in US oil output, giving the Organisation of the Petroleum Exporting Countries (OPEC) more power to manage the market in the short term before a potentially strong rise in shale oil output in 2022.

Source: The Economic Times

Italy’s Eni makes oil discovery in Norway

21 June: Vaar Energi, a majority owned unit of Italy’s Eni, has made a "significant" discovery of new oil resources in the mature Balder area of the southern Norwegian North Sea, the company said. The latest preliminary estimates from exploratory wells showed volumes between 60 million-135 million barrels of recoverable oil equivalents, Vaar said. It was the fifth significant exploration discovery of 2021 for Vaar Energi, it said. Mime Petroleum has a 10 percent stake in the discoveries, with the two firms now assessing a tie-in to the existing infrastructure in the Balder area.

Source: The Economic Times

Global crude oil prices drop, pressured by stronger US dollar

17 June: Crude oil prices fell pressured by a stronger US dollar, but losses were limited by a big drop in crude oil inventories in the US, the world’s top oil consumer. US crude oil futures fell by 69 cents, or 1 percent, to US $71.46 a barrel, after reaching its highest since October 2018 the previous day. Still, oil price losses were limited as data from the Energy Information Administration showed that US crude oil stockpiles dropped sharply last week as refineries boosted operations to their highest since January 2020, signalling continued improvement in demand. Also boosting prices, refinery throughput in China, the world's second largest oil consumer, rose 4.4 percent in May from the same month a year ago to a record high.

Source: The Economic Times

International: Gas

Indonesia to auction off 6 O&G blocks

17 June: Six oil and gas (O&G) blocks worth more than 900 million barrels of oil in Indonesia are up for grabs, government said. The blocks on offer are South CPP, Subagsel and Merangin in Sumatra and Rangkas, Liman and North Kangean in Java. The blocks are estimated to have recovered 917.93 million barrels of oil and 598.09 billion of standard cubic feet gas in total. The South CPP, Rangkas, and Liman blocks will be offered with a cost recovery scheme, where exploration and production costs are reimbursed by the government. The other blocks will be given the flexibility to choose between cost recovery or a "gross split", which would allow contractors to shoulder the cost of exploration and production in exchange for retaining a bigger portion of the oil and gas they recover. Regular bids will be available for Merangin III and North Kangean, while direct offers from the government will be made for South CPP, Sumbagsel, Rangkas, and Liman. Indonesia’s state owned oil company Pertamina was put on a watchlist for removal from JPMorgan’s ESG EMBI index after its scores fell below a required threshold for inclusion.

Source: The Economic Times

China Gas investigating cause of pipeline explosion in central China

16 June: Gas pipeline infrastructure facilities operator China Gas Holdings Ltd said it was investigating the cause of a gas pipeline explosion in central China over the weekend, and results were so far uncertain. Shiyan Dongfeng Zhongran City Gas Development Co Ltd, a non-wholly-owned unit of China Gas, is one of the gas suppliers for the area. China Gas said it had established an emergency response group to work with government departments on emergency measures and to investigate the cause of the incident. China Gas said that the operation right for piped gas in that area was originally owned by a gas company under Dongfeng Motor Corp, which in 2015 contributed the gas pipeline network while a China Gas unit contributed cash to jointly establish Shiyan Dongfeng, the unit in question.

Source: The Economic Times

International: Power

China’s largest manufacturing hub Guangdong facing electricity shortages

22 June: China’s southern province of Guangdong, which is the country’s main manufacturing hub, has been left in the throes of an electricity shortage following scarce rain, rising coal prices and rapid inland industrialisation, casting uncertainty over 10 percent of the country’s economic output. According to Nikkei Asia, the effects are being felt on factory floors and in managers' offices, with one Japanese-owned metal parts supplier sent scrambling to rearrange work schedules after local authorities ordered power cuts. The biggest question emerging is how long the electricity shortage will last. The National Development and Reform Commission, China’s economic planning body, acknowledged in a news conference that Guangdong and other southern provinces face power shortages. During the mandated power cuts, companies can use only enough electricity for essential operations, such as security. Going over the limit results in a penalty in the form of extended hours of restrictions, according to Nikkei Asia. Meanwhile, authorities have attributed the electricity shortage to a drought and elevated summer demand. Nikkei Asia further reported that wider factors in the regional economy are also at work. About 30 percent of the power used in Guangdong comes long-distance from Yunnan and other provinces.

Source: Business Standard

International: Non-Fossil Fuels/ Climate Change Trends

Australia rejects US $36 billion wind, solar, hydrogen energy project

22 June: The Australian government has rejected plans for a US $36 billion wind, solar and hydrogen project in a remote area of Western Australia, leaving what would have been one of the world’s largest green energy projects in limbo for now. Environment Minister Sussan Ley ruled that the project, the Asian Renewable Energy Hub (AREH), "will have clearly unacceptable impacts" on internationally recognised wetlands and migratory bird species. The AREH project, located in the state’s Pilbara region, was designed to initially build 15 GW of renewable energy capacity, eventually to be expanded to 26 GW and produce green hydrogen and ammonia for export. Australia’s Clean Energy Council said it expects the government will work with AREH to assess and address any environmental impacts.

Source: The Economic Times

Iran’s sole nuclear power plant undergoes emergency shutdown

21 June. Iran’s sole nuclear power plant has undergone a temporary emergency shutdown. An official from the state electric energy company, Gholamali Rakhshanimehr, said that the Bushehr plant shutdown began and would last "for three to four days." He said that power outages could result. He did not elaborate but this is the first time Iran has reported an emergency shutdown of the plant, located in the southern port city of Bushehr. It went online in 2011 with help from Russia.

Source: The Economic Times

Proposed global UN roadmap shows universal access to clean energy by 2030

19 June: Everyone in the world could have access to clean, affordable energy within the next nine years if countries modestly increase investments, according to new UN (United Nations) reports released, in advance of a major ministerial meeting on 21–25 June where countries and businesses will begin to announce energy plans for the decade. Annual investments of around US $35 billion could bring electricity access for 759 million people who currently lack it, and US $25 billion a year can help 2.6 billion people gain access to clean cooking between now and 2030. The required investment represents only a small fraction of the multi-trillion-dollar global energy investment needed overall, but would bring huge benefits to one-third of the world’s population. The recommendations on energy access are part of a proposed global roadmap with concrete actions to achieve clean, affordable energy for all by 2030 and net zero emissions by 2050, launched by the UN, to set the groundwork for a large-scale mobilisation of commitments this year. By 2025, 100 countries should establish targets for 100 percent renewable-based power, and there should be no new coal plants in the pipeline globally. The share of fossil fuels in the global mix would fall from the current 60 percent to 30 percent by 2030.

Source: The Economic Times

BP to buy solar projects for up to €500 million in Spain

19 June. Energy giant BP is close to buying solar power projects for between 400 million euros and 500 million euros in Spain from conglomerate Grupo Jorge. Lightsource bp, BP’s solar power unit, would take over a portfolio of photovoltaic power projects with a total potential capacity of 700 MW from Grupo Jorge, a privately held company with assets in pork meat, agriculture, and renewable energy. Spain has become one of the most active markets for solar and wind power. Many large companies including BP’s rivals such as Total, Repsol, and Galp have bought assets in recent months. BP itself had announced in February the acquisition of a portfolio of solar projects with a potential capacity of 845 MW.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV