Quick Notes

Discom reforms in India: Why the inefficiency narrative is inadequate

Background

Joel Ruet, a French Economist who studied the Indian power sector in the early 2000s observed that if socialism was “Soviets plus electricity” according to Lenin, independent India was to a great extent “democracy plus state electricity boards”. Ruet’s observation captures the important role state electricity boards (SEBs) played, in mediating the provision of electricity to consumers initially as an instrument of development policy but eventually as a lever to achieve political objectives. SEBs, now unbundled and recast as distribution companies (discoms) continue to be instruments to meet political ends. This has limited the ability of electricity tariff to reflect the true cost of supplying electricity which is amongst the most important reasons for discom woes. The problem is, however, framed as one of SEB or discom inefficiency and this stalls genuine reform of the distribution segment.

Energy News Monitor

SEBs were set up by state governments in the 1950s and 60s with the mandate to rationalise the production and supply of electricity and for electrical development following the enactment of the Electricity Act 1948. The role of the central electricity authority (CEA), set up by the federal government under the 1948 act was limited to regulating technical inputs in the power sector. Though electricity was a concurrent subject as per the Constitution, establishment of SEBs as vertically integrated monopolies gave state governments greater control of electricity generation, transmission, and distribution. Amendments to the electricity act in 1949 and 1951 allowed state governments to influence appointment of senior staff in SEBs and require SEBs to accept ‘policy directives’ from state governments. In the 1960s and 70s, external political developments allowed state governments to further consolidate their power over SEBs.

Electoral loss of the dominant Congress party in certain key states in 1967 allowed regional parties to become major actors in political and economic negotiations. Though facilitating the accumulation of physical capital by land owning castes and groups remained the central model for political intermediation at the federal and state level, compromises in the form of social capital had to be offered to emerging interest groups such as a sizeable middle class in urban areas and farmers empowered by the green revolution in rural areas. Provision of subsidised electricity through SEBs proved to be a simple way of appeasing both groups. The offer clean and convenient lighting replacing smoky oil lamps for households and pumped water for irrigating agricultural land guaranteed political returns from two large groups. The electoral success of this model led many states to replicate subsidising electricity tariff for households and farmers. To sustain revenues for SEBs, industrial electricity tariff was increased substantially which, until then, was lower that household and agricultural tariff under the policy to promote heavy industry. The widespread use of electricity as a tool to control resource allocation initiated the financial deterioration of SEBs. As per the original plan, SEBs were expected to earn a return of 3 percent on their net fixed assets in services after meeting other financial obligations and depreciation. SEBs did manage to work under these conditions initially but they began to falter financially in the late 1960s and they started depending on subsidies and hand-outs from the respective state governments. Financial liabilities of SEBs increased significantly since the 1970s and they were routinely described as the weak link in the power sector.

Neo-liberal critique on the economic, technical, and managerial “inefficiency” of SEBs was led by the world bank and the International Monitory Fund (IMF) and reiterated by a large body of academic literature when India partially opened its economy to market forces in the 1990s. The solution proposed by the development funding agencies was that of attracting private capital through unbundling of the value chain into generation, transmission, and distribution companies. Framing of the problem as one of inefficiency opened the sector to private (also foreign) capital (primarily in generation) and avoided confrontation with the political parties and the government. But as pointed out by Ruet, SEBs were not inefficient enterprises but administrations whose nature was to pursue objectives that were heterogeneous and so, irreconcilable to judgement by sole economic criteria. Development externalities created by SEB electricity networks at the macro-level included reasonable level of village electrification (driven by electrification of ground water pumping for irrigation) and development in agriculture through the green revolution. This involved financial externalities, but it wasn’t the result of inefficiency. The narrative of SEB efficiency, however, remained dominant as it was politically convenient. As a result, the integrated value chain of the sector was unbundled into generation, transmission, and distribution entities. SEBs recast as discoms were expected to reduce losses and become efficient and financially profitable entities.

Discoms

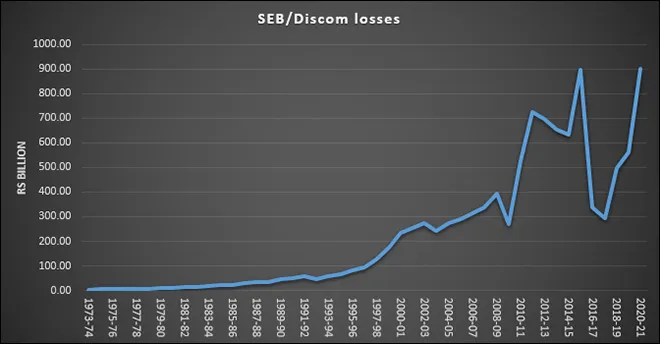

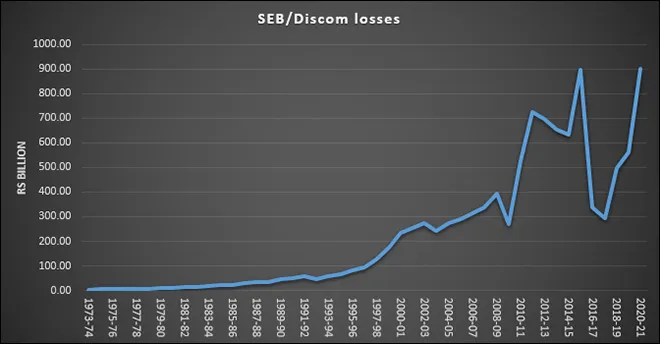

Nearly three decades after discoms were created, the distribution segment of the power sector in India continues to be described as the weakest link in the power sector. In these three decades, several programmes for restructuring discom finances were implemented. The most recent programme implemented in 2015 is the Ujwal Discom Assurance Yojana (UDAY). The UDAY scheme aimed for financial turnaround, operational improvement, and reduction of the cost of generation of power for discoms along with development of renewable energy and improvement of energy efficiency and conservation. In the policy sphere, the Electricity Regulatory Commission Act that created central and state level regulators was implemented in 1998. This was followed by the Electricity Act of 2003 which, amongst other things, provided for discoms to accept policy directives from the federal government and enabled entry of the private sector into power generation. Despite the interventions and substantial improvement in the policy environment, discom finances have not exactly improved. According to the Power Finance Corporation’s projections, book loss of dicsoms in 2019-20 is close to INR 900 billion. This is more than the peak value of losses prior to the implementation of UDAY (chart).

The original sin

Framing the distribution problem in the electricity sector as one of inefficiency masks the problem of political interventions in tariff setting. This arises from the historic failure of the Indian bureaucratic system to provide basic public goods such as electricity (along with education, health care, infrastructure and the social goods essential for development) to the rural poor. This limited their ability to generate income and enhance their purchasing power. The original sin here is the state failure to alleviate widespread poverty and increase incomes of poor households so that they can pay for and consume energy and other services. Ironically politicians capitalise on this failure and fill in as the provider of goods such as subsidised electricity with gratitude to be expressed in votes. Studies by political economists have shown that economic reforms reduced the opportunity for political rent seeking through licenses and permits but replaced it with mass voter appropriation through the dispensation of public resources to the poor who far outnumber the rich in India.

In the last two decades, political parties in electoral contests rarely competed in the space of economic or social policies but rather competed based on promises to use state resources to deliver targeted private benefits such as free or subsidised electricity to potential support bases. Distributing public goods such as electricity as private transfers to individual citizens (voters) is a much more certain means to secure votes than providing broad based services to which many would simultaneously have access. To promote free or subsidised electricity programmes, political parties use the rhetoric of redistribution and social justice that offer them social legitimacy even though power in India at its core, remains an alliance of state and capital. Offering free or subsidised electricity to ‘vote banks’ as Ambedkar aptly labelled them, achieves the short-term goal of winning elections. In the long term, it erodes the financial viability of the electricity distribution sector. This is not a problem of discom inefficiency but rather a problem of political expediency.

Sources: From 1973-74 to 2009-10, various plan documents; from 2010-11 to 2020-21 Power Finance Corporation

Sources: From 1973-74 to 2009-10, various plan documents; from 2010-11 to 2020-21 Power Finance Corporation

Monthly News Commentary: Oil

High retail price of petrol & diesel causes concern

India

Retail Prices

India has taken up the issue of high oil prices with producer nations and Organisation of Petroleum Exporting Countries (OPEC), demanding affordable rates. Petrol and diesel prices have shot up to record highs across the country after relentless price increases since early May. Petrol is retailing above INR 100/litre in more than a dozen states. India imports 85 percent of its oil needs and rates benchmarked to international prices have fuelled inflation. India has in the last few days flagged the issue of high oil prices to Saudi Arabia, UAE (United Arab Emirates), and Qatar. OPEC and its partners reached a deal to increase oil production by 400,000 barrels/day (bpd) each month for the rest of this year and into 2022. The agreement envisages continuing the monthly 400,000 bpd increments to around September 2022 "subject to market conditions", when members would theoretically reach baseline production. Saudi Arabia is the world's largest exporter of crude oil and India's second-biggest source after Iraq. Concerned over the rising oil prices, India has been reaching out to key oil producers in the Middle East. The rebound in international oil prices from lows hit in May on the back of demand recovery has sent petrol and diesel rates to record highs in India.

Industry chamber PHD Chamber of Commerce and Industry (PHDCCI) has suggested that the government take certain measures, such as calibrated price control and inclusion of petroleum products under the goods and services tax (GST), to check rising oil prices. The chamber is of the view that current rise in oil prices has fuelled into a raging issue as it is likely to have a cascading influence on the prices of other essential commodities as well. As per the PHDCCI, it is advisable that the retail prices of auto fuel should not be left open-ended on the basis of international prices, as there should be an inherent and prudent mechanism, which is agreed and approved by both central and state governments, for controlling and checking prices. The central and all the state governments must come forward and hold a GST Council meeting for inclusion of all petroleum products under its ambit. Further, the central government must convince all state governments and bring them on board for controlling and checking prices of petroleum products by ensuring that there is no revenue loss to the states, if any model is mutually agreed and accepted by both the governments.

Petrol prices in the national capital rose to INR 101.19/litre, touching another record high figure. Meanwhile, diesel prices dipped to INR 89.72/litre. There has been an increase in the rate of petrol by 28 paise and diesel fell by 16 paise. In Maharashtra’s capital city, Mumbai, the retail price of both petrol and diesel stood at INR 107.20/ litre and INR 97.29/litre respectively. As for Bhopal, petrol prices soared to INR 109.53/litre and diesel costs INR 98.50/litre. West Bengal’s Kolkata reported INR 101.35/litre for petrol and INR 92.81/litre for diesel. Expressing concern over the rising fuel prices, the government of West Bengal urged the central government to lower the taxes charged by the Centre on petrol and diesel "to check the overall inflation" in the country. Noting that petrol and diesel prices were hiked eight times since May, of which six times were in June alone, the fuel price hike have adversely affected common people and directly impacted the inflation in the country.

Ministry of Road Transport & Highways inaugurated the country’s first commercial liquefied natural gas (LNG) filling station in Nagpur. According to the Ministry, more use of alternate fuels such as LNG, Compressed Natural Gas (CNG), or ethanol would bring respite from surging petrol prices, which are now “agitating” people. The use of ethanol as vehicle fuel would help save at least INR 20/litre despite its lower calorific value compared to petrol. The ministry is likely to announce a policy for flex-fuel engines soon, which will encourage automobile manufacturers to produce them. These engines can run on more than one fuel and also a mixture of fuels. The ministry had urged the government to privatise the petroleum and natural gas sector, which has already been opened up. Last year, the petroleum ministry simplified guidelines for authorisation for bulk and retail marketing of petrol and diesel. This was done to increase private sector participation in the marketing of petrol and diesel.

Ethanol blending

Paving the way for the transformation of the fossil fuel ecosystem in the country, the Ministry of Road Transport and Highways has issued a draft notification for facilitating use of a blend of 12 percent and 15 percent ethanol in gasoline as automotive fuels. Comments have been invited from stakeholders within a period of 30 days. According to the Ministry, the government will take a decision over flex-fuel engines as it is considering making these mandatory for the automobile industry. The ministry had mentioned that automobile makers are producing flex-fuel engines in Brazil, Canada and the US (United States) providing an alternative to customers to use 100 percent petrol or 100 percent bioethanol. The target date for achieving 20 percent ethanol-blending with petrol has been advanced by five years to 2025 to cut pollution and reduce import dependence. The government last year had set a target of reaching 10 percent ethanol blending in petrol by 2022 and 20 percent doping by 2030. According to the ministry, ethanol is a better fuel than petrol, and it is an import substitute, cost effective, pollution-free, and indigenous.

Production

In a major overhaul, DGH (Directorate General of Hydrocarbons) has made it easier for firms to explore and produce oil and gas in the country by limiting the requirement of statutory approvals to only extension of contracts, sale of stake and annual accounts while allowing self-certification and deemed approval for the rest. According to the DGH, the government’s technical arm overseeing upstream oil and gas production procedures and processes for oil and gas blocks awarded under nine bids round of New Exploration Licensing Policy (NELP) and pre-NELP blocks are being simplified and standardised. While ONGC and OIL produce two-third of India's oil and gas from blocks or areas given to them on a nomination basis, the remaining output is from pre-NELP and NELP blocks. DGH undertook a review of processes of various approvals and submission of documents under Production Sharing Contracts (PSC) for NELP and pre-NELP blocks. As many as 37 processes and procedures were required to be followed by a firm exploring oil and gas in a block awarded under NELP or pre-NELP rounds. These have now been cut to just 18. No approval will be needed for any of these processes. DGH has allowed deemed approval on expiry of 30 days of submission of self-certified documents on the annual work programme, appraisal and field development plan or its revision. Prior approval of the block oversight committee, DGH, or the oil Ministry will be required only in cases where extension of the contract or exploration phase is to be granted or the contractor is selling or exiting the block.

Assam state has written to central government requesting it to consider transferring all the assets of ONGC (Oil and Natural Gas Corp) in the northeastern Region to Oil India Ltd (OIL). The move comes amidst petroleum ministry’s directives to the former to sell stake in producing oil fields and hive off drilling and other services into a separate firm to raise production. Assam and Assam Arakan Basin can be considered to be a prolific basin of India with an estimated hydrocarbon resources of 7634 MMTOE (million metric ton of oil equivalent) and holds 5588 MMTOE of Yet-to-Find (YTF) resource potential, which is next only to KG Basin. The state in its letter to PMO, stated that almost the entire production of OIL comes from the Northeastern region, and hence, the focus of OIL on exploration and production in this region is undivided. With more than 90 percent of employees from the region, the company would be able to focus with undivided attention on the company and at the same time be sensitive to the aspirations of local people. The state mentioned that with taking over of Numaligarh Refinery Ltd (NRL), OIL’s net-worth has improved substantially, and it has led to vertical integration and with further expanding the operational areas and production, OIL can aspire to be the "only Maharatna Company of our region and would truly reflect the Act East Policy." The letter also mentioned that if OIL is given the ONGC assets, it can also endeavour to create hydrocarbon sector manufacturing and services hub in Assam which can in the long run aspire to provide services to the far eastern countries.

Imports

The share of Middle Eastern crude in India’s oil imports fell to a 25-month low in May, tanker data provided by trade sources showed, as refiners tapped alternatives in response to the government’s call to diversify supplies. India, the world's third biggest oil importer, in March directed refiners to diversify crude sources after the OPEC and its allies, led by top exporter Saudi Arabia, ignored New Delhi's call to ease supply curbs. The Middle East’s share dropped to 52.7 percent, the lowest since April 2019 and down from 67.9 percent in April. Imports from Saudi Arabia, India’s second-largest supplier after Iraq, slipped by about a quarter from a year earlier, while supplies from the United Arab Emirates, which dropped to No. 7 position from No. 3 in April, fell by 39 percent. Indian refiners bought higher volumes of gasoline-rich US (United States) oil in March, expecting a recovery in local gasoline demand to continue in the months ahead. Strong demand for light crude saw Nigeria improving its ranking by two notches to become the third largest supplier to India in May. Private Indian refiners Reliance Industries and Nayara Energy, however, boosted purchases of Canadian heavy oil to a record 244,000 bpd, equivalent to about 6 percent of India’s overall imports.

India’s crude oil imports in June fell to their lowest in nine months, as refiners curtailed purchases amidst higher fuel inventories due to low consumption and renewed coronavirus lockdowns in the previous two months. India, the world’s third-biggest oil importer and consumer, shipped in about 3.9 million barrels/day (bpd) of crude last month, about 7 percent down from May, but 22 percent higher from year-ago levels, tanker arrival data showed. After an uptick in India’s fuel demand in February and March, the country’s refiners cranked up crude processing and oil imports. However, fuel demand fell sharply in April and May after the government-imposed restrictions to curb a second wave of coronavirus, leaving refiners with high fuel inventories. India’s crude imports between April and June, however, rose 11.7 percent year-on-year to 4.1 million bpd as the lockdown curbs were not as severe as last year when COVID-19 first hit the nation.

India has procured the first shipment of 1 million barrels (bbl) of 'Liza light sweet' crude oil from Guyana, in a significant move marking diversification of its sourcing of petroleum products. The consignment was lifted for the Indian Oil Corp (IOC) from Liza Destiny FPSO and that the purchase reflected the enhancement of bilateral ties. India has been majorly sourcing crude oil from the Gulf countries.

Retail

Bharat Petroleum Corp Ltd (BPCL) has joined hands with Humsafar India—a Delhi-headquartered start-up—for doorstep delivery of diesel in 20-litre jerrycans in the national capital for customers seeking diesel in quantities as low as 20 litres. The doorstep diesel delivery in jerrycans, titled 'Safar20', is expected to benefit small housing societies, malls, hospitals, banks, construction sites, farmers, mobile towers, education institutes along with small industries. Bulk supply of diesel at the doorstep has already started some time back. The new initiative will benefit small requirement customers. Earlier, the consumers of diesel had to procure it from retail outlets in barrels which used to cause a lot of spillage and dead mileage in energy procurement. Efficient energy distribution infrastructure was lacking. Doorstep diesel delivery is expected to solve many such problems and will provide diesel to bulk consumers in a legal manner.

Rest of the World

World

As the International Energy Agency (IEA) global refining runs are expected to continue rising in July and August due to increasing vaccination rates and easing social distancing measures around the world. The Paris-based agency, however, expected the trend will lose momentum in winter due to seasonal maintenance of refineries. Refiners around the world significantly reduced their operations in 2020 as they faced an unprecedented fall in fuel demand brought about by the COVID-19 pandemic and mobility restrictions. The lockdowns at their peak destroyed over 20 percent of global oil demand. The refining runs have been rising since February as widespread vaccination programmes started in several countries and restrictions were eased. After stagnating in May, global refining throughput increased by 1.6 bpd in June. The activity of European refiners is not expected to recover to pre-pandemic levels any time soon. As a result, annual average throughput rates of Chinese refiners are expected to exceed the European rivals by 3 million bpd in 2022. Chinese refiners reached parity with European refineries in 2019 in terms of throughput. IEA is of the view that stalled talks by top oil producers over releasing more supply could deteriorate into a price war just as COVID-19 vaccines are sending demand for oil surging.

As per the Goldman Sachs Commodities Research more oil production is needed from the OPEC and allies (OPEC+) to balance the market by 2022 as supply risk looms elsewhere. The US bank forecast oil demand to rise by an additional 2.2 million bpd by year-end, leaving a 5 million bpd supply shortfall, well in excess of what Iran and shale producers can bring online. The bank sees a base case of 0.5 million bpd supply increase from OPEC+ producers for consecutive months, when the group meets on 1 July to discuss the threat of the Delta COVID variant, the potential return of Iran production and still slow shale response. A deal could lead to Iran exporting an extra 1 million bpd, or 1 percent of global supply, for more than six months from its storage facilities.

Middle East

Goldman Sachs expects an oil supply agreement between Saudi Arabia and the United Arab Emirates (UAE) to be a bullish catalyst for prices over coming months as the US investment bank maintained its summer Brent price forecast at US $80/barrel. Saudi Arabia and the UAE have reached a compromise over OPEC+ policy, in a move that should unlock a deal to supply more crude to a tight oil market. Goldman expects US $2 to US $4/ barrel (bbl) upside risk to its US $80/bbl summer forecast and US $75/bbl for its 2022 Brent price forecast. The bank also noted that a lack of an Iran nuclear deal would increase its 2022 price forecast by US $10/bbl. Iran and global powers have been negotiating since April to lift sanctions on Tehran, which have hit its economy hard by cutting its vital oil exports.

The United Arab Emirates (UAE) pushed back against a plan by the OPEC oil cartel and allied producing countries to extend the global pact to cut oil production beyond April 2022, a rare statement revealing the country's frustration with the group. The Emirati energy ministry called the proposal to extend the agreement for the entirety of 2022 without raising its production quota "unfair to the UAE". One of the group’s largest oil producers, the UAE is seeking to increase its output—setting up a contest with ally and OPEC heavyweight Saudi Arabia, which has led a push to keep a tight lid on production. The combined OPEC Plus grouping of members led by Saudi Arabia and non-members, chief amongst them Russia, failed to reach an agreement on oil output.

OPEC+

OPEC+ is discussing a further gradual increase in oil output from August as oil prices rise on demand recovery, but no decision had been taken on the exact volume yet. The OPEC and allies, known as OPEC+, is returning 2.1 million bpd to the market from May through July as part of a plan to gradually unwind last year's record oil output curbs. OPEC+ meets next on 1 July. The talks mean that OPEC and Russia are likely to find common ground again on oil production policy. Moscow has been insisting on raising output further to avoid prices spiking, while key OPEC producers, such as Saudi Arabia, have given no signals on the next step until now. Crude oil prices rose, with Brent hitting US $75/bbl for the first time since April 2019, as investors remained bullish about recovery in oil demand and concerns eased over a quick return of Iranian crude to the market.

OPEC stuck to its forecast for a strong recovery in world oil demand in the rest of 2021 and predicted oil use would rise further in 2022 similar to pre-pandemic rates, led by growth in China and India. According to the OPEC demand next year would rise by 3.4 /cent to 99.86 millionbpd, averaging more than 100 million bpd in the second half of 2022. Oil demand averaged 99.98 million bpd in 2019, according to OPEC. OPEC also maintained its prediction that demand would grow by 5.95 million bpd in 2021.

South America

Venezuelan Oil Ministry announced that the country has officially consented to the oil market stabilisation agreement drawn up during the 19th ministerial meeting of the OPEC+. According to the Ministry, consensus reached at the meeting demonstrates a long-term strategic vision, adding that it promotes "balance in the oil market and the economic development of the world". In March, OPEC+ members signed an agreement on the stability of the world oil market that aimed for efficient supply and fair return on invested capital.

Ecuador will launch new risk-sharing contracts in an attempt to attract more private investment to its crucial oil sector, part of a plan to boost the Andean nation’s struggling economy. Under risk-sharing agreements, oil companies invest their own capital in developing a field and can recoup a portion of the profits of oil sales. The deals can offer more autonomy and financial upside than joint services agreements, in which the government pays companies a fee to perform services. The nation also announced plans to review Ecuador’s processes for selling its crude, and to study the possibility of creating a blend of the country's main crude grades to potentially find new customers. The country would create a "sustainability fund" with some oil income devoted to social programs in communities close to oil fields, which tend to be some of Ecuador's poorest.

Argentine energy firm Compania General de Combustibles (CGC) had acquired the local operations of China's Sinopec Group, helping it increase its production to over 50,000 barrels of oil equivalent per day. CGC, part of Corporacion America International, would buy Sinopec Argentina. The Chinese-owned unit operates over 20 oilfields in the San Jorge and Cuyo Basins in Argentina with assets covering some 4,600 square kilometre (km). CGC, since it was acquired by Corporacion America in 2013, has invested over US $1.5 billion in the development of energy in Argentina.

News Highlights: 21 – 27 July 2021

National: Oil

India refiners' June crude processing bridled by virus curbs

24 July: Indian refiners' crude throughput in June was little changed from the previous month when it fell to multi-month lows as a severe second wave of coronavirus restrained demand, forcing refiners to reduce runs. Refiners processed 4.50 million barrels per day (18.4 million tonnes) of crude oil in June, provisional government data showed. This compares with 4.49 million barrels per day (bpd) processed in May, which was the lowest since October 2020. Crude oil imports also fell to a nine-month low in June as refiners curtailed purchases amidst higher fuel inventories due to low consumption and renewed lockdowns in the previous two months. Refineries' crude oil throughput last month was still 4.7 percent higher than June 2020 levels. India’s fuel demand also inched higher after slumping to a nine-month low in May as many states in the world's third-biggest oil importer and consumer started easing restrictions and mobility picked up. Indian state fuel retailers' gasoline sales also exceeded pre-pandemic levels in the first fortnight of July, preliminary industry data showed. Indian refiners operated at an average rate of 89.59 percent of capacity in June, down from 92.37 percent of capacity in May, the government data showed. The country’s largest refiner, Indian Oil Corp (IOC), operated its directly owned plants at 93.53 percent capacity, as per the data. Reliance Industries Ltd (RIL), owner of the world’s biggest refining complex, operated its plants at 93.12 percent capacity in June.

Source: The Economic Times

India overhauls petroleum reserve policy to boost private interest

23 July: India has decided to commercialise half of its current strategic petroleum reserves (SPRs) as the nation looks to enhance private participation in the building of new storage facilities. The shift in policy was approved this month by the federal cabinet. Allowing commercialisation of SPRs mirrors a model adopted by countries such as Japan and South Korea which allow private leases, mostly oil majors, to re-export crude. India, the world’s third-biggest oil importer and consumer, imports over 80 percent of its oil needs and has built strategic storage at three locations in southern India to store up to 5 million tonnes (mt) of oil to protect against supply disruption. Private entities taking storage on lease will be allowed to re-export 1.5 mt of oil stored in the caverns in the case of Indian companies refusing to buy the crude, they said. Indian Strategic Petroleum Reserves Ltd, a company charged with building of SPRs, will be allowed to sell 1 mt of crude to local buyers. So far Abu Dhabi National Oil Co (ADNOC) has leased 750,000 tonnes of oil storage in the 1.5 mt Mangalore SPR. India also plans to build strategic storage at Chandikhol in Odisha and Padur in Karnataka for around 6.5 mt of crude to provide an additional cover of 12 days of net oil imports.

Source: The Economic Times

Excise duty collections from petroleum products being used in infra development: Gadkari

23 July: Union Minister Nitin Gadkari said excise duty collected from petroleum products are being used for infrastructure development and other development items. According to the Minister, the logistics cost of transportation through road depends on several factors such as capital cost of the vehicle, salaries, insurance, permit tax, maintenance, fuel, toll tax, and other miscellaneous expenses. The excise collections on petrol and diesel jumped by 88 percent to INR 3.35k billion in the last fiscal ended 31 March 2021, after excise duty was raised to a record high. The excise duty on petrol was hiked from INR 19.98 per litre to INR 32.9 last year to recoup gains arising from international oil prices plunging to a multi-year low as the pandemic gulped the demand.

Source: The Economic Times

National: Gas

India’s gas production jumps 19.5 percent in June on back of KG-D6

23 July: India’s natural gas production jumped 19.5 percent in June, as Reliance Industries Ltd (RIL) and its partner BP Plc ramped up output from their eastern offshore KG-D6 block. India produced 2.77 billion cubic meters (bcm) of natural gas in June, up from 2.32 bcm in the same month last year, as per the data released by the Ministry of Petroleum and Natural Gas. RIL is the operator of block KG-DWN-98/3 or KG-D6 in the Krishna Godavari basin, off the east coast. The firm started producing from the second wave of discoveries in the block in December. D-34 or R-Series was the first field to start, followed by Satellite Cluster. Peak production from R-Cluster will be 12.9 million metric standard cubic meter per day (mmscmd), according to the operators. Satellite fields would produce a maximum of 7 mmscmd. MJ field in the same block will start production in the third quarter of 2022 and will have a peak output of 12 mmscmd. The production from KG-D6 more than made up for a fall in the output from fields operated by Oil and Natural Gas Corporation (ONGC)’s. ONGC produced 5.6 percent less gas at 1.68 bcm.

Source: The Economic Times

National: Coal

Revision of coal royalty every 3 years not mandatory: Centre

23 July: Union Coal Minister Pralhad Joshi said there is no mandatory provision in the Mines and Mineral (Development and Regulation) (MMDR) Act to revise the coal royalty rates every three years though Odisha has been making the demand since long. In a recent reply to Rajya Sabha, Joshi said the rate of coal royalty which is 14 percent at present, was last revised on 10 May 2012. Odisha government, during the 2020-21 financial year, had received coal royalty worth over INR 18.55 billion, the Minister said. Being a major coal-bearing state, Odisha has been continuously demanding revision of coal royalty alleging that it has been facing severe loss due to non-revision of the royalty for years. Chief Minister Naveen Patnaik has also raised the issue in important national platforms.

Source: The Economic Times

National: Power

Hitachi ABB Power Grids commissions Raigarh-Pugalur UHVDC link

26 July: Hitachi ABB Power Grids in India announced commissioning of a 1,800-km long 6 GW ultra-high voltage direct current (UHVDC) transmission link from Raigarh to Pugalur. The 800 kilovolt (kV) transmission link has the capacity to meet the electricity needs of more than 80 million people. It stretches from Raigarh in Central India to Pugalur in the southern state of Tamil Nadu. The link strengthens grid resilience and stabilises the power infrastructure by combining traditional and renewable power generation. It enables further development and integration of sustainable energy, supporting the government's goal of reaching 450 GW of renewable energy by 2030.

Source: The Economic Times

'Turnaround in J&K's power transmission, distribution helps achieve sustainable electricity supply'

24 July: The turnaround in the power transmission and distribution sector in the past one year in Jammu and Kashmir (J&K) has helped in achieving reliable, quality, and sustainable electricity supply, Lieutenant Governor Manoj Sinha said as he dedicated seven power infrastructure projects worth INR101.1 million to the public. The new projects inaugurated by Sinha target four districts of the Kashmir Valley—Pulwama, Bandipora, Ganderbal, and Budgam—and would benefit 30,400 households. He said the UT’s power sector had not seen any development for the past three decades, and further strengthening of the infrastructure will help the government's aim of providing uninterrupted supply to households even in the rural areas. The Lieutenant Governor said that hardly any work was done in the past three decades to strengthen the power infrastructure in the J&K UT and the administration inherited a plethora of problems confronting the power generation, transmission, and distribution sectors. He said that the government is incurring huge losses in the power sector because people are not paying their bills.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Punjab government way behind in installing solar water pumps

26 July: Despite the fact that Punjab has witnessed the worst of power crisis this paddy season and the state government’s burden on account of free power being provided to farmers for operating water pump sets or tubewells has touched INR 67.35 billion this year, the state hasn’t fallen back on solar-powered water pumps too much, which would have otherwise helped tide over the crisis to a great extent. Punjab is way behind its neighbour Haryana in the installation of solar water pumps. Against a total of 14,254 solar water pumps installed in Haryana, Punjab has got hardly 2,925 till date. Under the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM) scheme of the Union ministry of new and renewable energy, 121 such solar water pumps have also been installed in the neighbouring state of Himachal Pradesh. Minister for New and Renewable Energy and Power R K Singh said to install these solar power pumps, the Central government has released INR620 million financial support to the Haryana government, INR 200 million to the Punjab government and nearly INR30 million to the Himachal Pradesh government. In all, a total number of 47,726 solar power pumps have been installed in 13 states till June 30 for which the central assistance of INR3.08 billion has been provided. Rajasthan has installed the highest number of 15,549 solar power pumps followed by 14,254 by Haryana and 7,234 by Madhya Pradesh.

Source: The Economic Times

By 2030, cut per capita emission to global average: India to G20

26 July: At a time when rich nations, backed by the UN climate body, have pitched for bringing all emitters on board to commit to ‘net-zero’ emission goal or carbon neutrality by around mid-century, India has come out with a counter proposal asking them to bring down their own per capita emission to global average by 2030. India’s remarks assume significance at this juncture when the UN climate body has been pushing nations to commit higher emission targets to reach the Paris Agreement goal of keeping the global average temperature rise to well below 2 degrees Celsius by the end of the century and make efforts to keep it at around 1.5 degree Celsius over the pre-industrial level (1850-1900).

Source: The Economic Times

Maharashtra commissions new solar power plant in Dhule district for farmers

25 July: In a unique project, the state government’s power generation and distribution arms have commissioned a 7 MW solar power plant in Dhule district purely for the farmers' agriculture pumps and their domestic uses, which otherwise attract huge cross-subsidy from ordinary consumers (such as in Mumbai) to subsidise their (farmers') billing. Set up close to agriculture feeder Degaon village, the solar power plant has not only reduced transmission and distribution losses for some 2,000 to 3,000 farmers spread over Shindakhede taluka (of Dhule district), but also the wheeling charges mounted on the billing against bringing electricity from distantly-located thermal power plants. The plant is spread over 50 acres of land and has solar modules 'Made in India' along with string Inverters to maintain high uptime. Panasonic Life Solutions India has built this plant for Gro Solar Energy Pvt Ltd, the original contractor of the project appointed by Mahagenco and Mahadiscom under the government's 'Mukhyamantri Saur Krishi Vahini Yojana'. This project will add approximately 15,891 MWh of solar energy and assist in eliminating a total of 14,300 tons of carbon dioxide emissions over the lifetime of this plant.

Source: The Economic Times

Wind power output in Gujarat nears record level

23 July: High wind speed across coastal regions of Gujarat has pushed up electricity generation from wind energy close to record-level. The average wind power generation in Gujarat shot up 106 million units (MUs) or 4,432 MW, which was in striking distance of the all-time high wind power generation of 108 MUs or 4,600 MW recorded across the state in July 2019. The average generation was just 552 MW (13 MUs). According to the Western Regional Load Dispatch Centre (WRLD), a central government entity, the daily peak of wind power generation in Gujarat was recorded at 4,712MW, when the state’s maximum electricity demand was recorded at 14,758 MW. In fact, the state produced more power from wind farms than conventional thermal power plants. Electricity generation from wind energy sources is growing at a faster rate with new projects coming up across Gujarat, which is the second largest producer of wind power (with total installed capacity of 7,542 MW) in India after Tamil Nadu. Despite challenges posed by the COVID-19 pandemic, Gujarat witnessed the highest addition of wind power generation capacity in the country during 2020-21. Wind power projects having cumulative generation capacity of 1,020.3 MW were installed and commissioned in Gujarat from April 2020 to March 2021, shows data compiled by Indian Wind Turbine Manufacturers Association (IWTMA).

Source: The Economic Times

Kerala State Electricity Board ups output at hydropower dams in Idukki

23 July: With rains in the past few days leading to a rise in water level in the dams in the district, Kerala State Electricity Board (KSEB) has increased power generation at power stations in Idukki and Edamalayar to their maximum capacities. KSEB said that the storage levels in hydel dams are higher due to lower power generation. Due to the pandemic and the subsequent lockdown power consumption has largely reduced in the state resulting in an increase in water levels in the hydel dams. The rule curve is applicable for Idukki, Banasura Sagar, Edamalayar, and Kakki dams.

Source: The Economic Times

Rajasthan government to roll out EV policy soon

22 July: Close on the heels of Maharashtra, Delhi, Gujarat and Telangana, Rajasthan is also ready to launch the much-awaited Electric Vehicles (EV) Policy. The state government recently announced a few incentives, including the subsidising of the upfront cost of electric vehicles for early adopters and offering them the reimbursement of the state goods and service tax (SGST) depending upon the battery capacity of the vehicle sold.

Source: The Economic Times

GUVNL withdraws subsidy to 4k solar projects

22 July: Gujarat Urja Vikas Nigam Ltd (GUVNL) has withdrawn subsidy to small-scale distributed solar projects, affecting about 4000 projects with an aggregate capacity of around 2500 MW signed power. The purchase price of power produced was fixed at INR2.83 per unit which was already far lower than other states like Rajasthan and Maharashtra, where they set Power Purchase Agreements (PPA) tariff rates at higher than INR 3.15. In March 2019, the 'Policy for Development of Small Scale Distributed Solar Power Projects' was first announced by the government with the aim of encouraging the distributed generation of solar energy. This scheme was intended to support Prime Minister Narendra Modi’s ambitious renewable energy goals.

Source: The Economic Times

India may oppose carbon border tax at G20 meet

22 July: Developing countries, including India, may during the two-day G20 ministerial meeting on environment and climate change in Naples, Italy, beginning, raise their concerns over the EU (European Union)’s recent proposal on the world’s first carbon border tax. Under this proposal, the 27 EU nations will impose a border tax on imports of carbon-intensive goods. The tax plan, yet to be legally formalised, will come into force from 2026. India’s New Environment Minister Bhupender Yadav will virtually participate in the meet that will focus on how to reach a positive outcome at the crucial 26th session of the UN climate change conference (COP26) in Glasgow, UK in November. Environment ministers of G20 nations will also make interventions during the sessions on natural capital to protect the planet and on making joint efforts for sustainable use of resources. Besides raising usual points of concerns like finance and pre-2020 actions of rich nations, India and other countries are expected to raise the issue of the carbon border tax as any such unilateral move may impact their trade in due course of time.

Source: The Economic Times

BSES signs 510 MW solar, hybrid power agreement with SECI for Delhi

21 July: The BSES discom has signed a 510 MW solar and hybrid power agreement with the Solar Energy Corp of India (SECI), a move that will help provide green and clean electricity to Delhi at "economical rates", the company said. The Reliance Infrastructure-led BSES discoms—BRPL and BYPL—are the first in Delhi to ink an agreement for hybrid power which is a pooled mix of solar and wind power co-located at the same site, the company said. Hybrid power will lead to optimum cost utilisation and enable BSES discoms fulfil their renewable power obligations, the company said. The BSES discoms have already started the process to come out of costly power purchase agreements by petitioning the Delhi Electricity Regulatory Commission, to allow it to exit seven power plants that have completed 25 years of operation or about to do so within a year. Inked for a period of 25 years, the solar and hybrid power is expected to be available to Reliance Infrastructure led BSES discoms 18 months after signing of the agreement at a "very competitive tariff" of INR 2.44 per unit for solar and INR 2.48 per unit for hybrid, the company said.

Source: The Economic Times

NTPC emerges winner for 450 MW solar capacity at Rewa

21 July: NTPC Ltd said its renewable arm has emerged winner at the Rewa Ultra Mega Solar Ltd auction for 450 MW solar projects at the Shajapur Solar Park in Madhya Pradesh. NTPC Renewable Energy has won a capacity of 105 MW and 220 MW, quoting the lowest tariff of INR 2.35 per kWh (kilowatt hour), and INR 2.33 per kWh respectively. The tender received overwhelming response from the bidders with a total of 15 bidders being shortlisted. As a part of its green energy portfolio augmentation, NTPC aims to build 60 GW renewable energy capacity by 2032. Currently, the state-owned power major has an installed capacity of 66 GW across 70 power projects with an additional 18 GW under construction.

Source: The Economic Times

International: Oil

China crackdown could knock crude oil import growth to 20-year low

26 July: Beijing’s crackdown on the misuse of import quotas combined with the impact of high crude prices could see China’s growth in oil imports sink to the lowest in two decades in 2021, despite an expected rise in refining rates in the second half. Shipments into the world's top crude importer and No. 2 refiner could be steady, or increase by up to 2 percent to just over 11 million barrels per day (bpd) this year, consultancies Energy Aspects, Rystad Energy and Independent Commodity Intelligence Services (ICIS) found. That compares to an average annual import growth rate of 9.7 percent since 2015, and would be the slowest growth since 2001, China customs data showed. The flat forecasts coincide with plans by OPEC+ to raise oil output by 400,000 barrels per day (bpd) between August and December. News of the decision by the OPEC and allied producers sparked a sell-off in benchmark prices. China has been the global oil demand driver for the last decade, and accounted for 44 percent of worldwide growth in oil imports since 2015, when Beijing started issuing import quotas to independent refiners. While analysts expect global crude markets to stay in deficit this year despite the OPEC+ output rise, China's investigations into the trading of crude import quotas, and the resulting lower import allocations to independent refiners, have already cooled demand from the group that provides a fifth of China’s imports. China’s crude imports in June fell to the lowest since 2013 after Beijing clamped down on import quota trading as part of a drive to consolidate its refining industry and reduce emissions. Several small refiners did not receive any quotas in a second batch issued in June, while others have already used their full allocations, traders and analysts said.

Source: The Economic Times

Iran inaugurates major oil pipeline to bypass Hormuz Strait

23 July: Outgoing Iranian President Hassan Rouhani has inaugurated a major onshore pipeline that allows the country to bypass the Hormuz Strait for crude oil exports. The pipeline, with some 1,000 km in length, will transfer the pumped oil from facilities in Goureh to the Omani sea port of Jask. The US $2 billion project, the construction of which started two years ago, detours the strategic Hormuz Strait which has long been used as a vital passageway for oil exports of the region. The oil pipeline is able to initially export 300,000 barrels per day (bpd) of crude and will reach the capacity of one million bpd once fully ready in October, according to authorities.

Source: The Economic Times

International: Gas

China’s Guangdong starts building US $1 billion Huizhou gas terminal

26 July: China has begun building a US $1 billion natural gas import and storage base in the southern coastal province of Guangdong, a project in which US (United States) energy major ExxonMobil is advancing discussion with partners for a joint investment. ExxonMobil entered in September 2018 a preliminary deal with Guangdong province to invest billions of dollars’ worth of projects in the manufacturing hub, including a petrochemical complex and an LNG terminal in Huizhou. The new terminal, situated at Huidong county of Huizhou city, has a designed annual receiving capacity of 4 million tonnes (mt) under phase-one investment estimated to cost 6.636 billion yuan (US $1.02 billion). China’s state economic planner, the National Development and Reform Commission, gave the greenlight for the project in early-July. The Huizhou terminal includes a berth that can dock up to 266,000 cubic-meter tankers of liquefied natural gas and three storage tanks each sized 200,000 cubic meters.

Source: The Economic Times

International: Coal

Developing nations need help to quit coal addiction

21 July: Coal-fired power plants are proving hard to shut down in developing economies because they are cheap and convenient, but keeping them going is pumping out carbon dioxide at a rate far beyond the level needed to achieve net-zero emissions by 2050. Coal, which is being phased out of the power system in many industrialised nations, is still a vital fuel for generation in many developing economies and may remain so for decades to come. Countries outside the Organisation for Economic Cooperation and Development (OECD), a grouping of mainly industrialised nations, accounted for 80 percent of worldwide coal consumption in 2019, the last year before the pandemic, BP’s annual energy report said. OECD countries relied on coal to meet less than 13 percent of their total primary energy in 2020. That figure rises to more than 21 percent in the non-OECD outside China and 57 percent in China itself. OECD countries obtained around 27 exajoules (EJ) of energy from coal, rising to 42 EJ in the non-OECD outside China, and another 82 EJ in China itself. For developing countries, coal-fired plants remain cheap to build and easy to add to grids that have limited capacity to cope with the intermittent generation of renewable power. In OECD economies, coal is rapidly being replaced by a mix of wind, solar and gas-fired generation, aided by advanced grid management with battery storage being developed as a backup. Outside the OECD, especially outside China, newer forms of generation are spreading more slowly and coal remains in favour. Coal has become the default choice for the poor, and is set to remain so even as wealthier states shift to new technology. If OECD countries want to cut global coal combustion faster, they must provide more technical and financial help to non-OECD counterparts to overcome barriers and adopt new technology. For OECD policymakers and climate campaigners, the focus has been on restricting coal mine production and the provision of concessional finance to build new coal-fired power stations. Without that kind of assistance, coal-fired generation outside the OECD is unlikely to reduce significantly by 2050.

Source: The Economic Times

International: Power

Brazil sees power generation at limit in November due to drought

24 July: Brazil’s national power grid operator (ONS) said that severe drought is likely to push the country’s power generation capacity to its absolute limit by November, as hydroelectric plants struggle with the water shortages. Latin America’s biggest economy is facing its worst drought in almost a century, which is disrupting hydroelectric dams— Brazil’s main source of power generation. Despite the stretched power system, the ONS said it did not forecast power shortages for consumers.

Source: The Reuters

Japan’s power plan will rattle coal, LNG exporters, especially Australia

22 July: Japan has been largely forgotten as a source of demand for energy commodities, overshadowed by the rapid rise of China, but the country’s new electricity generation targets will shake the market up. For many years Japan has been viewed as a largely steady source of demand for liquefied natural gas (LNG) and thermal coal used in power generation, with small variations in the volumes imported on a year-by-year basis. Australia supplies about two-thirds of Japan's thermal coal requirements, with imports of 70.7 million tonnes (mt) in 2020, out of a total of 105.2 million. Japanese utilities have long favoured Australian thermal coal for its higher energy value and lower impurities compared to other grades available on the seaborne market. If Japan does meet its target of reducing coal from the 32 percent share of power generation in the 2019 fiscal year to just 19 percent by 2030, this implies a reduction of total annual imports to around 62.6 mt, assuming total power generation remains at current levels.

Source: The Economic Times

Spain evaluates measures to cut power bills as prices hit record levels

21 July: The Spanish government is considering additional measures to lower rapidly ballooning electricity bills, Consumer Rights Minister Alberto Garzon said as power prices neared record highs, alarming consumer groups. Consumer protection group Facua has demanded that the government act swiftly to cut prices through a permanent value-added tax reduction, a 50 percent subsidy for low-income families and a cap on what utilities can charge. The government agreed to cut the value-added tax rate on electricity to 10 percent from 21 percent when the average monthly price is above a certain threshold. It also suspended during the third quarter a 7 percent tax on the value of electricity generation, which utilities ultimately pass on to the retail market. Average day-ahead electricity price in Spain and Portugal reached a record 106.57 euros per megawatt-hour, according to OMIE, the Iberian electricity market operator. More than half of the price consumers pay in Spain is made of taxes and mandatory contributions. The rise in electricity prices has coincided with a new formula for calculating household consumption based on the hours of the day, which has upset many Spaniards who believe it is pushing up rates.

Source: The Economic Times

International: Non-Fossil Fuels/ Climate Change Trends

Israel to reduce greenhouse gas emissions to meet global target

26 July: Israel said that by mid-century it would reduce its greenhouse gas emissions by 85 percent from 2015 levels, as part of an international push to limit global warming. The government approved the 2050 target and set an interim target of 2030 to reduce emissions by 27 percent from levels in 2015, the year when global climate accords were agreed in Paris. The Paris deal aims to limit global warming to below 2 degrees Celsius, and preferably by 1.5 degrees Celsius, compared with pre-industrial levels. Israel’s foreign ministry said national targets included a 96 percent reduction in carbon emissions from transport, an 85 percent reduction from the electricity sector and a 92 percent reduction in the municipal waste sector.

Source: The Economic Times

Indonesia to make biomass co-firing mandatory in power plants

23 July: Indonesia plans to make the co-firing of biomass in power stations mandatory as part of its efforts to phase out coal power plants, which account for more than 60 percent of its electricity supplies, the energy ministry said. The Southeast Asian country is the world’s biggest thermal coal exporter and relies heavily the fuel domestically, but authorities have pledged to start phasing out coal under climate change commitments. The government is preparing a regulation to implement the mandatory co-firing, which would apply to state electricity utility PT Perusahaan Listrik Negara (PLN) as well as independent power producers. PLN has said it is planning to gradually retire its coal power plants as part of its ambition to reach carbon neutrality by 2060. The state power company plans to start co-firing at 52 of its biggest coal power plants and has estimated it could replace 9 million tonnes (mt) of coal per year with biomass.

Source: The Economic Times

China’s non-fossil fuel power capacity to outstrip coal power in 2021

23 July: China’s non-fossil fuel power generation capacity is expected to exceed coal-fired power capacity for the first time in 2021, China Electricity Council (CEC) said in a report. CEC estimates China’s total power generation capacity will reach 2,370 gigawatts (GW) by end-2021. Of which, coal-fired power capacity will stand at 1,100 GW, while capacity of non-fossil fuel sources, including solar, wind, hydro, nuclear and biomass, will be around 1,120 GW. China’s solar manufacturing association had forecast that up to 65 GW of solar power capacity will be added in the country this year. China had about 980 GW of non-fossil fuel power capacity in 2020, accounting for 44.8 percent of the country’s total power capacity. The world’s biggest coal consumer has vowed to promote renewable energy use and lower the share of coal consumption in its energy system. But coal will retain a significant role in China's energy security and power supply during the peak demand season, partly due to intermittent renewable power generation and inadequate energy storage facilities to guarantee stable operations on the grid.

Source: The Economic Times

Sunseap to build world’s largest floating solar farm in Indonesia

22 July: Singapore’s Sunseap Group says it plans to spend US $2 billion to build the world’s largest floating solar farm and energy storage system in neighbouring Indonesian city Batam, which will double its renewable power generation capacity. The floating photovoltaic system is expected to have a capacity of 2.2 gigawatt-peak (GWp), and will be located on the Duriangkang Reservoir in Batam Island ning around 1,600 hectares, Sunseap said. The company and Batam Indonesia free zone authority, Badan Pengusahaan Batam (BP Batam), said they signed a Memorandum of Understanding (MoU) for the project. Sunseap Group is a solar energy system developer, owner and operator in Singapore, with over 2000 MegaWatt-peak (MWp) of solar energy projects contracted across Asia. In March, it completed a 5 MWp floating photovoltaic system offshore Singapore along the Straits of Johor. Construction of the project, which will be financed through bank debt and Sunseap capital, is due to begin in 2022 and is planned for completion in 2024, the company said. According to Sunseap, the energy generated and stored will supply non-intermittent solar energy around the clock.

i The Economic Times

MILLION Dastur bags carbon capture project funded by US Department of Energy

21 July: City-based MILLION Dastur and its affiliate companies Dastur International Inc from New Jersey and Dastur Energy Inc have bagged a US department of energy-funded study to design and engineer a carbon-capture project for a large integrated steel producer in North America. This is for the first time an Indian company has taken up an industrial-scale carbon capture project for the steel sector in the continent. The estimated cost of the carbon capture project has been pegged at US $500 million. The project will help in the production of low-carbon emission steel through CO2 (carbon dioxide) capture of up to 2 mtpa (million tonnes per annum) from the available blast furnace gases to meet the demand of energy in a steel plant. The project has become a shot in the arm for the city-based company as it recently won another project to design commercial carbon capture solutions in oil and gas, refining and petrochemical industries. However, the company has kept back the name of the project for certain issues. Along with its partners, Dastur will draw upon its intellectual property on gas conditioning, system design and engineering, steel sector expertise, carbon capture technology and storage and sequestration expertise to engineer a flexible, scalable and cost-effective industrial-scale carbon capture and management solution.

Source: The Economic Times

Japan boosts renewable energy target for 2030 energy mix

21 July: Japan will raise its target for renewable energy in the country’s electricity mix for 2030 as it pushes to cut emissions to meet commitments under international agreements on climate change, according to a draft of its latest energy policy. The country's revised basic energy strategy leaves unchanged its target for nuclear power, even though the country has struggled to return the industry to its former central role after the Fukushima disaster of 2011. The industry ministry’s policy draft released said renewables should account for 36-38 percent of power supplies in 2030, double the level of 18 percent in the financial year to March 2020. The earlier target was for renewables to contribute 22-24 percent of electricity in 2030. The use of coal, the dirtiest fossil fuel, will be reduced to 19 percent from 26 percent under the new plan. Gas, which comes to Japan in the form of imported liquefied natural gas (LNG), will make up most of the rest of the fossil fuel portion of the target energy mix, which was set at 41 percent, down from 56 percent. Japan’s nuclear target was left unchanged at 20–22 percent. New fuels like hydrogen and ammonia will account for about 1 percent of the electricity mix in 2030, the draft said. Japan aims to reduce its reliance on nuclear power as much as possible while it boosts renewable power capacity, but nuclear power will remain as an important base-load power source, the draft said.

Source: The Economic Times

Pandemic recovery to push emissions to all-time high: IEA

21 July: The global rebound from the COVID-19 pandemic is set to drive emissions of greenhouse gases that stoke climate change to all-time highs, the Paris-based International Energy Agency (IEA) said in a report. Spending plans for clean energy allocated by governments around the world in the second quarter add up to US $380 billion, making up just 2 percent of their total stimulus funds in response to the pandemic, the IEA said. The IEA issued its starkest findings yet on climate in a May report which said the world should not invest in new fossil fuel projects if it hoped to reach net zero by 2050. Emissions are set to be 3.5 billion tonnes (bt) higher than the threshold needed to reach that goal, the IEA said.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV