Quick Notes

Retail price of petrol and diesel in India: Crude calculations

Impact of Taxes

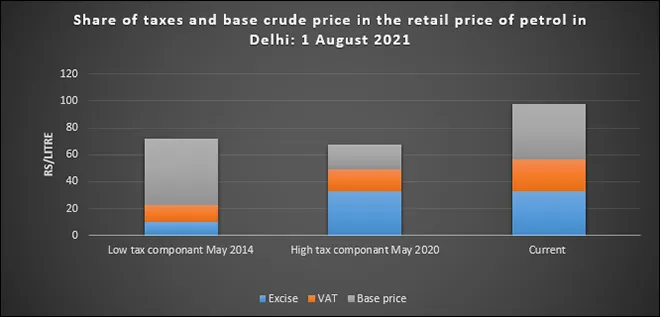

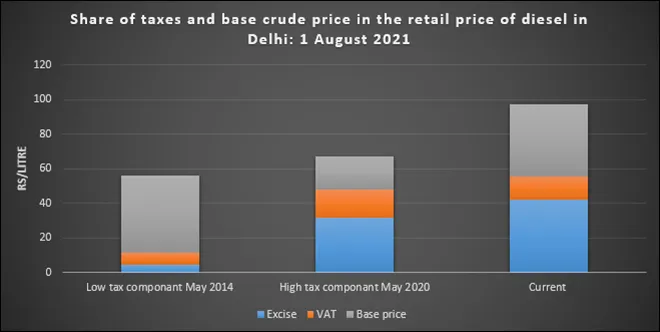

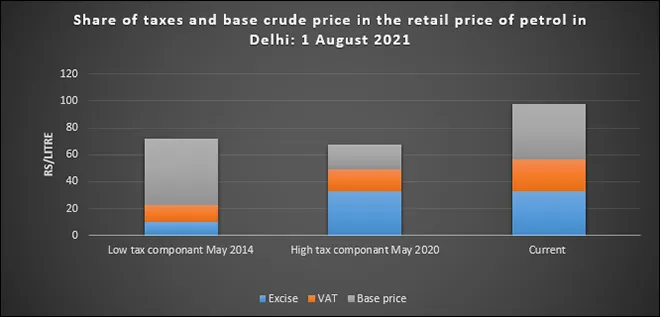

The retail price of petrol was INR 101.84/litre (l) and diesel INR 89.97/l in Delhi on 1 August 2021. For petrol, the base price was INR 41.24/I or about 40.4 percent of the prices, central excise was INR 32.90/l or 32.3 percent of the retail price and state value added tax (VAT) was INR 23.50/l or about 23 percent of the price. Freight and dealer commission at INR4.2/l was about 4.1 percent of the retail price. Overall central and state taxes accounted for about 55.3 percent of the retail price of petrol in Delhi. For diesel the base price was INR 42/l or 46.7 percent of the retail prices, central excise at INR42.33/l was about 47 percent of the taxes, state VAT at INR 13.14/l was about 14.6 percent of the retail prices. Fright and dealer commission was INR 2.93/l or 3.2 percent of the retail price. Overall central and state taxes accounted for about 50 percent of the retail price of diesel in Delhi.

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

The share of taxes in the retail price of petrol in Delhi since March 2014 was lowest in June 2014 at 30.8 percent and highest at 69.35 percent in May 2020. Between May 2014 June 2020, central excise on petrol increased by over 216 percent but since then excise decreased marginally by 0.24 percent. VAT on petrol in Delhi increased by over 33 percent between May 2014 and May 2020 and by over 42 percent since then.

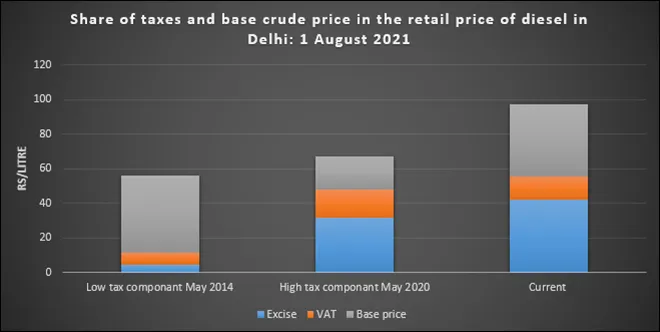

The share of taxes in the retail price of diesel in Delhi was lowest in May 2014 at 18.7 percent in May 2014 and highest in May 2020 at 69.3 percent. Central excise increased by over 600 percent between May 2014 and May 2020 and by over 3 percent since then. VAT in Delhi increased by over 144 percent between May 2014 and May 2020 and by over 44 percent. Though VAT has increased more since May 2020 in Delhi, the increase in excise between 2014 and 2020 is much greater.

The centre shares only the revenue from basic excise duty on petrol and diesel with the states. Of the current basic excise on petrol of INR 1.4/l, only 42 percent or INR 0.58/l out of the total excise of INR 32.9/l is shared with the states. For diesel only about INR 0.75/l out of the total excise of INR 42.33/l is shared with the states.

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

Source: Petroleum Planning & Analysis Cell (PPAC) & Indian Oil Corporation

Impact of Crude Price

In May 2014, when the share of taxes in the retail price of petrol was the lowest, the base price of crude in a litre of petrol was INR 47.12/l or 66 percent of the retail price of petrol. In May-June 2020, when the share of taxes in the retail price of petrol and diesel were the highest, the base price of crude in a litre of petrol was INR 18.28/l or 25.6 percent of the retail price of petrol. Today the base price of crude in a litre of petrol is INR 41.24/l or over 40 percent of the retail price of petrol. The base price of crude fell by over 61 percent between May 2014 and May 2020, but it has increased by over 125 percent since then.

The base price of crude in a litre of diesel was INR 44.98/l or over 75 percent of the retail price of diesel in May 2014 (when share of taxes was lowest since 2014) and the base price of crude in a litre of diesel in May 2020 when the share of taxes was the highest was INR 18.78/l or just over 27 percent of the retail price. Today, the base price of crude in a litre of diesel is INR 42/l or 47 percent of the retail price of diesel. The base price of crude in diesel fell by over 58 percent between May 2014 and May 2020 but increased by over 123 percent since then.

At present the price of crude accounts for almost as much as the central excise in a litre of petrol and diesel.

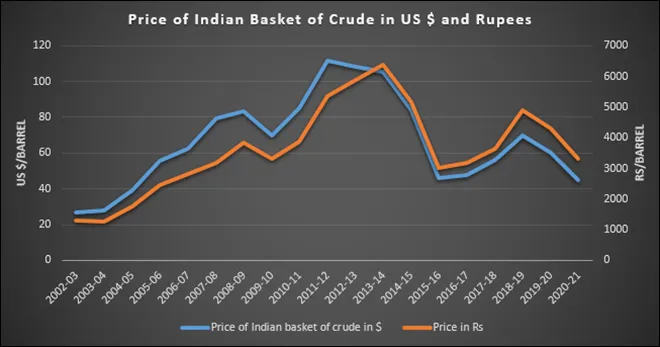

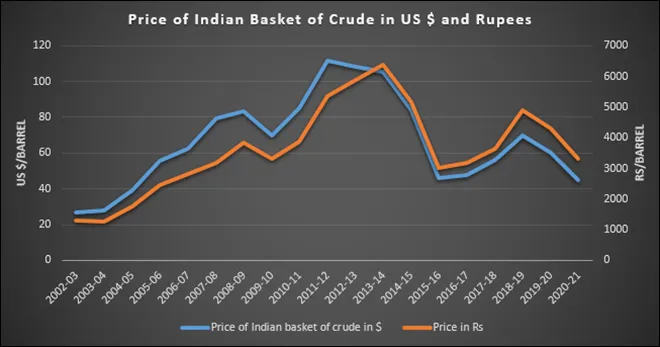

Impact of Exchange Rate

The value of the rupee fell by 22 percent between 2013-14 and 2020-21. In this period, the price of crude (Indian basket) in dollars (and rupees) fell by just over 47 percent from US $105.52/b to US $44.82/b. Since April 2021, the price of crude (Indian basket) has increased from US $63.40/barrel (b) to US $73.54/b, an increase of over 15 percent and the value of the Indian rupee fell marginally by just over 1 percent. Overall, the fall in the value of the rupee since 2014 only had a marginal effect on the retail price of petrol and diesel in India.

Source: Petroleum Planning & Analysis Cell (PPAC) & Reserve Bank of India

Source: Petroleum Planning & Analysis Cell (PPAC) & Reserve Bank of India

Crude Calculations

Since 2014, the largest beneficiary, in terms of revenue take from the increase in taxes on petrol and diesel accommodated by fall in crude prices was the centre. The steep increase in central excise since 2014 accounted for most of the increase in the retail price of petrol and diesel followed by the increase in VAT. The dramatic fall in crude prices, initially on account of global economic slowdown but later account of the pandemic opened the space for increase in taxes. Since April 2021, this space is being retaken by the increase in the price of crude. The centre’s crude calculations in increasing the component of excise taxes on petrol and diesel that is not shared with the states may backfire if the increase in crude oil prices continues.

Monthly News Commentary: Coal

Coal block auctions take-off

India

Coal Block Auctions

The coal block in Odisha allotted to Vedanta Ltd, once operational, will provide fuel security, improve power availability and further strengthen the company’s aluminium operations. Vedanta emerged as the successful bidder for the Kuraloi (A) North coal block located in Jharsuguda district, Odisha which was put up for re-bidding in the second auction of blocks for commercial mining. The coal block is an optimal fit for the company’s Jharsuguda smelter. The mine has geological reserves of 1,680 million tonnes (mt) and an estimated per annum capacity of 8 mt.

With the successful auction of Kuraloi (A) north coal mine in Odisha, the total number of mines successfully auctioned in the first tranche of auction for commercial mining is 20 out of total 38 coal mines offered. In the first attempt of auction under 11th tranche of auction under the CM(S) Act 2015 and under first tranche of auction under the MMDR Act 1957, out of the 38 coal mines, 19 have been successfully auctioned. Out of the remaining mines, four coal mines which had fetched single bid in the first attempt were put up for re-auction in a second attempt by Ministry of Coal with the same terms and conditions but with the highest initial offer received in the first annulled attempt of auction as the floor price for the second attempt. The ministry had launched the auction process of 38 coal mines in the first tranche of auction for sale of coal for commercial mining.

Goa’s ambitious plan to extract coal from the Dongri Tal II coal block appears to be staring at a setback as the Centre has yet to agree to Goa’s plea for time to complete the formalities and pay the ₹1.63 billion performance guarantee. It has been more than two months since Goa Industrial Development Corp (GIDC) wrote to the Union ministry of coal asking for additional time. With no favourable reply forthcoming, the process to appoint a mine developer-cum-operator (MDO) is stuck in a limbo. Though the Dongri Tal-ll coal block was allocated to GIDC in September 2019, major milestones for the coal mine were missed as the state government dragged its feet in complying with norms laid down by the coal ministry. The Dongri-Tal II coal mine at Singrauli in Madhya Pradesh has a 2.9 million tonnes per annum (mtpa) capacity, but the state’s attempts to exploit the coal mine has been thwarted by “political tussles” and “amateurish decisions”. GIDC issued the tender to appoint a MDO for the coal mine in March and with the Centre’s deadline about to lapse, sought an extension on 28 March. GIDC did organise a pre-bid meeting with potential coal mine developers and even answered some of their queries, but with no clarity about the coal block itself, GIDC has decided not to proceed with the tender process.

E-auction of coal

CIL e-auction sales registered a growth of 52.5 percent at 21.5 mt in the first two months of the ongoing fiscal year. CIL’s total allocated quantity under the five auction windows was at 14.1 mt in April-May 2019-20. The company's total allocated quantity this fiscal year till May 2021 moved up to 21.5 mt, under the five auction windows. With the demand for coal gathering steam, CIL could garner 16 percent add-on over the notified price during April-May compared to seven percent of same period last financial year. To encourage coal consumers, lift additional coal quantities, reserve price under all e-auction windows was kept at par with notified price during the first six months of the last fiscal year. CIL scripted an all-time high of 124 mt in e-auction sales in 2020-21 posting 88 percent growth over the preceding year.

Imports

CIL has allowed domestic coal consumers including traders to export coal procured under two categories of e-auction schemes. The company has tweaked its e-auction coal sale policy after its Board gave the nod. The country’s largest coal producer and supplier has lifted the embargo on exporting coal procured through spot e-auction and special spot e-auction outlets. This is a first of its kind development since the introduction of spot e-auction in 2007. The existing clause ‘coal procured under e-auction is for use within the country and not for export’ has now been amended, opening the door for export of the dry fuel in two auction categories. Allocation under spot e-auction and special spot e-auction together accounted for 46 mt of coal in FY’21 which was 37 percent of the total allocated quantity of 124 mt during the year under. Spot e-auction at 42.5 mt was the highest allocated quantity under all the five auction windows, in FY21, fetching record 25 percent add on over the notified price. The special spot e-auction netted a premium of 13 percent over the notified price. In case of export the requirement of complying with the government rules all statutory guidelines, regulations and legal obligations shall lie solely with the coal buyer and exporter. Spot e-auction is meant for all categories of Indian coal buyers including traders. Special spot e-auction introduced in 2016 is similar in every way but the booked quantity of coal could be lifted over an extended time.

Demand

Coal accounted for 74 percent of India’s power generation in 2018 and will continue to contribute 50 percent of the power generated in the country over the next 20 years. India’s per capita carbon emissions are one-third of the global average and what India needs at the moment is growth acceleration and coal is the means to achieve it. In 2020, India’s primary energy demand was 88 million tonnes of oil equivalent (mtoe) with coal being a major source of energy production at 44 percent, oil with 25 percent, natural gas at 6 percent and renewables at 3 percent. Replacement of coal-based power with renewables has its own limitations and it will cause several issues as far as meeting power requirement is concerned. The transition away from coal must be gradual and it has to be managed well keeping in view the needs and aspirations of billions of people.

The Ministry of Power has allowed flexibility in utilisation of domestic coal for reducing the cost of power generation. According to the ministry, states can use their linkage domestic coal, under flexible utilisation of coal, in the Case-2 Scenario-4 power plants leading to reduction in cost of power. The Case-2 Scenario-4 power plants are those power plants which have been bid based on the Net Heat Rate and the power generated from such power plants is supplied to the state itself. Entire savings shall be passed on to the electricity consumers. At present, consumers in Punjab, Haryana and Uttar Pradesh will benefit from this. The expected savings in Punjab alone is going to be INR 3 billion per annum. This will also help reduce import of coal and is aligned to the Atmanirbhar Bharat initiative. It will also reduce the carbon emission as the coal will be used in the more efficient power plants with lower Station Heat Rate. Under the flexibility in utilisation of domestic coal, states can also use their aggregated linkage coal i.e Aggregated Annual Contract Quantity (AACQ) in the power plants which have been established through competitive bidding under Case-2 Scenario-4. The Case-2 Scenario-4 power plants have been established through a bidding process under the guidelines issued by Ministry of Power under Section 63 of the Electricity Act 2003. While transferring the linkage coal by the state, it may be ensured that these plants are more cost-efficient vis-à-vis the state owned plants leading to savings in the cost of power purchase. The entire savings due to the use of such linkage domestic coal of the state will automatically be passed to the discoms (distribution companies) and ultimately to the consumers. These power plants will utilise the transferred coal only for generation of electricity for supply to the state.

Much of India’s 33 giga watt (GW) of coal-fired power capacity currently under construction and another 29 GW in the pre-construction stage will end up stranded due to competition from renewables. In the past 12 months no new coal-fired power plants have been announced, and there has been no movement in the 29 GW of pre-construction capacity. Despite these headwinds, the Central Electricity Authority had projected that India would reach 267 GW of coal-fired capacity by 2030 which would require adding 58 GW of net new capacity additions—about 6.4 GW annually. According to the Institute for Energy Economics and Financial Analysis (IEEFA) coal-fired capacity in India to peak at 220-230 GW by 2025 and with additions of 2-3 GW of net new coal-fired capacity annually in this five-year window—and only then if financing can be found amid the accelerating global retreat from coal.

Coal Prices

CIL is debating on hiking coal price for the regulated sector and may take a call soon. Costs are on the rise for the miner, but realisation remained muted without revision of coal price for the regulated sector. CIL The world’s largest miner could see a wage hike by 5-7 percent that will entail a jump in wage cost by 2-3 percent, after taking into consideration the reduction in manpower by 13,000-14,000 employees through retirement. The decision to increase coal price was delayed due to the onset of the Covid-19 pandemic. Coal prices in the global market have been on the rise for the last few months. CIL’s revenue remains muted due to lower e-auction coal sales and realisation, while its supply to the regulated sector—mainly the power sector—is also much less. The company sells coal to the regulated sector at INR 1,391/tonne while the e-auction price is INR 1,752/tonne. The coal production and dispatch targets for the current year remain very optimistic. The company has set a production target of 670 mt and a dispatch target of 740 mt. In 2020-21, its production was 596 mt and offtake was 574 mt.

Rest of the World

China

Chinese steelmaking ingredients and other ferrous futures rose, with coking coal and coke both on course for a more than 5 percent weekly gain against the backdrop of strong demand at mills and supply tightness. The most-traded coking coal futures on the Dalian Commodity Exchange, for September delivery, inched up 0.3 percent to 2,056 yuan (US $318.04) a tonne. Coking coal inventories held by 100 coking plants and 110 steel mills, surveyed by consultancy Mysteel, fell 3.2 percent to 15.7 mt, from a week earlier due to a supply crunch amid environmental and safety production inspections.

Rest of Asia and Asia Pacific

The Australian government needs to help fund coal-fired power producers because finance and insurance for coal plants is becoming unaffordable or too hard to secure, power producer Alinta Energy. The issue is coming to a head as investors and activists pressure banks and insurers to stop backing coal-fired plants while the country still needs at least some coal plants for steady power supply to back up wind and solar power. Coal-fired plants generated 55 percent of the country's power in the year to June 2020, down from 62 percent from five years ago. That is expected to continue to decline with the growth of renewables. The state of Victoria agreed in March to provide aid to keep a coal plant open to 2028 after its owner, EnergyAustralia, a unit of Hong Kong's CLP Holdings, pushed to shut the plant four years earlier than planned.

Indonesia set its coal benchmark price higher in June at US $100.33 per tonne, driven by strong demand from China. This is US $10.59, or 11.8 percent, more than May’s benchmark price for coal and the highest since October 2018, when it stood at US $100.89.

South America

Diversified miner Glencore will become the sole owner of the Cerrejon thermal coal mine in Colombia by buying out partners BHP and Anglo American, boosting its coal assets at a time when others are looking to exit the sector. Glencore expects to pay US $230 million for the combined 66 percent stake owned by BHP Group and Anglo when the deal completes in the first half of 2022. It sees production volumes at the mine declining materially by 2030. Mining companies have been reviewing their ownership of thermal coal assets as they transition out of polluting fossil fuels to meet emissions targets and shift towards sustainable investments. But global demand for coal is expected to jump 4.5 percent in 2021, after a record pandemic-led drop last year. An increase in coal-fired power generation in Asia, where many countries including China are still building new capacity, accounts for three-quarters of the rebound, the International Energy Agency (IEA). Glencore plans to become a net-zero emission company by 2050 and has set a goal of managing the depletion of its coal mines by the mid-2040s, rather than selling them.

News Highlights: 30 June – 6 July 2021

National: Oil

West Bengal CM writes to PM, urges him to reduce tax charged by Centre on petrol and diesel

6 July: Expressing concern over the rising fuel prices, West Bengal Chief Minister (CM) Mamata Banerjee wrote to Prime Minister (PM) Narendra Modi urging him to lower the taxes charged by the Centre on petrol and diesel "to check the overall inflation" in the country. Noting that petrol and diesel prices were hiked eight times since May, of which six times were in June alone, she said the fuel price hike have adversely affected common people and directly impacted the inflation in the country.

Source: The Economic Times

India procures 1 million barrels of crude oil from Guyana

6 July: India has procured the first shipment of 1 million barrels of 'Liza light sweet' crude oil from Guyana, in a significant move marking diversification of its sourcing of petroleum products. The Indian High Commission in the South American nation said the consignment was lifted for the Indian Oil Corp (IOC) from Liza Destiny FPSO and that the purchase reflected the enhancement of bilateral ties. India has been majorly sourcing crude oil from the Gulf countries. It is learnt that the consignment from Guyana may reach India's Paradip port on 6 August. The High Commission said the procurement is a reflection of enhanced bilateral cooperation between India and Guyana.

Source: The Economic Times

Petrol, diesel price rise paused, retail rates unchanged

1 July: After a longer break, the Oil Marketing Companies (OMCs) have kept the retail prices of petrol and diesel unchanged for the second consecutive day. Accordingly, petrol continues to be priced at INR 98.81 a litre and diesel at INR 89.18 a litre in the national capital. Across the country as well the fuel prices remained unchanged. The price rise pause has come not before the fuel rates have reached new highs across the country through numerous increases in the last two months. Starting from a price line of INR 90.40 a litre on 1 May, petrol is now priced at INR 98.81 a litre in the national capital, rising by a sharp INR 8.41 per litre in the last 60 days. Similarly, diesel price in Delhi also rose by INR 8.45 per litre in the past two months to reach INR 89.18 a litre. Fuel prices are already touching new highs every day. Petrol is most expensive in Rajasthan’s Sri Ganganagar where it is now retailing at INR 109.67 a litre. Even diesel in the city is priced at a high of INR 102.12 a litre. In the city of Mumbai, where petrol prices crossed INR 100 mark for the first time on 29 May, the fuel price reached new high of INR 104.90 per litre. It remained at the same level. Diesel prices also increased in the city to reach INR 96.72 a litre, the highest amongst metros.

Source: The Economic Times

Government issues draft notification on ethanol blending in petrol

30 June: Paving the way for the transformation of the fossil fuel ecosystem in the country, the Ministry of Road Transport and Highways has issued a draft notification for facilitating use of a blend of 12 percent and 15 percent ethanol in gasoline as automotive fuels. Comments have been invited from stakeholders within a period of 30 days. Recently, Road Transport and Highways Minister Nitin Gadkari had said the government will take a decision over flex-fuel engines as it is considering making these mandatory for the automobile industry. Gadkari had mentioned that automobile makers are producing flex-fuel engines in Brazil, Canada and the US (United States) providing an alternative to customers to use 100 percent petrol or 100 percent bio-ethanol. Recently, Prime Minister Narendra Modi said the target date for achieving 20 percent ethanol-blending with petrol has been advanced by five years to 2025 to cut pollution and reduce import dependence. The government last year had set a target of reaching 10 percent ethanol blending in petrol by 2022 and 20 percent doping by 2030. Gadkari had said ethanol is a better fuel than petrol, and it is an import substitute, cost effective, pollution-free and indigenous.

Source: The Economic Times

National: Gas

India’s natural gas consumption to rise 4.5 percent in 2021: IEA

6 July: India’s natural gas consumption will rise 4.5 percent while global demand will rebound by 3.6 percent in 2021, the International Energy Agency (IEA) has forecast. By 2024, the global gas demand is forecast to be up 7 percent from 2019’s pre-COVID levels, according to the IEA’s latest report. Global demand dropped by 1.9 percent in 2020 due to an exceptionally mild winter in the northern hemisphere and the impact of the COVID-19 pandemic. COVID-linked lockdowns and high LNG (liquefied natural gas) prices hurt demand also in the second quarter.

Source: The Economic Times

National: Power

Discoms permitted to relinquish entire allocated power from 25-year-old projects

6 July: In a major relief for power distribution companies (discoms), the government has now given them the freedom to terminate or continue drawing power from a project that has completed 25 years of operations. In a letter to the state governments and the heads of central generating stations (CGS), the power ministry said that as per the guidelines of power purchase agreements (PPAs), discoms are eligible to terminate the entire allocated power from a power project that has completed 25 years of operations since its commissioning. It has also said that discoms, if so they so wish, may also continue to draw power from such old power stations, exercising the first right of refusal available to them under the terms of long-term PPAs. The changes are path-breaking for the power sector as they will help discoms terminate an old PPA that has not remained economical in terms of power tariff. Also, termination of PPAs may allow shutting down operations of old and polluting power stations. The ministry has said that while flexibility will be given to discoms to terminate old PPAs, such a move should be complete and not done in parts. So, if there is a PPA for bulk purchase from a power station, the entire quantity would have to be relinquished by the discoms after 25 years and not just a portion of it. If the PPAs are extended beyond 25 years, they cannot go beyond a five-year period. Also, power generating stations losing old PPAs would be free to sell such relinquished power in the open market through exchanges, tie-ups with other buyers desiring to go for long term or medium term PPAs or get the power reallocated to the willing buyers.

Source: The Economic Times

Congress MP asks Punjab government why it did not renegotiate power purchase agreements

6 July: As Punjab reeled under an unprecedented power shortage, Congress MP Partap Singh Bajwa asked the Amarinder Singh government why it did not take steps till now to renegotiate power purchase agreements (PPAs). The Congress government in Punjab had that it would soon announce a legal strategy to counter the "ill-conceived" power purchase agreements (PPAs) signed during the SAD-BJP rule. Bajwa said that the Central Electricity Regulatory Commission (CERC) allowed BSES, a power distribution company in Delhi, to renegotiate its PPA with the NTPC-Dadri power plant on 1 July 2021. The Punjab government must renegotiate these agreements immediately to stop the continued "organised loot" of the state exchequer, Bajwa said. Notably, the Congress party, before coming to power in 2017, had promised that it would renegotiate the existing PPAs to ensure low-cost power. Punjab has been reeling under an unprecedented power shortage with urban and rural areas facing long hours of load shedding amid scorching heat.

Source: The Economic Times

Punjab State Power Corp buys more power to meet rising demand

6 July: To meet rising demand of electricity in the ongoing paddy season, Punjab State Power Corp Ltd (PSPCL) chairman and managing director (CMD) A Venu Prasad visited the state load dispatch centre (SLDC) and reviewed the power supply situation for all categories of consumers. He said PSPCL was purchasing maximum available power from the energy exchange market. On 4 July, PSPCL purchased 1,178 MW at ₹4.07 per unit, he said.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

SJVNL completes tunnel excavation work of Naitwar Mori Hydro Power Project

6 July: SJVN Ltd said it has completed excavation work of 4.3 km long head race tunnel of 60 MW Naitwar Mori Hydro Electric Project in Uttarakhand. The Naitwar Mori Hydro Electric Project has the potential to generate 265.5 million units of electricity every year and the state of Uttarakhand will get 12 percent free power as a royalty. The project would further accelerate the Government of India’s commitment of providing round the clock energy to our nation and will also lead to achievement of shared vision of SJVNL, for becoming a 25,000 MW company by 2040. SJVNL is constructing its own transmission line of about 37 km for transmission of electricity generated from the project which is targeted to be completed by April 2022. Commissioning of the project will benefit the area and particularly project affected families as they will be provided an amount equivalent to the cost of 100 units of electricity per month for 10 years.

Source: The Economic Times

No plans to expand in thermal: Tata Power chairman

6 July: Tata Power aims to grow its renewable capacity to 15 GW by 2025, chairman N Chandrasekaran said. It has sharpened its focus on renewables amid the industry shifting from the highly polluting coal-fired electricity generation to green energy resources such as solar and wind. The renewables sector will also see increased competition with Reliance Industries set to throw its hat in the ring. Tata Power hopes to have 60 percent of its electricity generation from renewables by 2025 and about 90 percent by 2030. The company is focusing on building scale in consumer renewables, that is, in rooftop solar, solar pumps, electric vehicle charging systems and home automation. In the distribution business, Tata Power currently supplies electricity across Mumbai, Delhi, Ajmer and Odisha (it recently acquired the distribution license for the eastern state).

Source: The Economic Times

Tata Power eyes 15 GW renewable capacity

6 July: Tata Power plans to add renewable energy projects to grow to 15 GW company in the coming few years, its chairperson Natarajan Chandrasekaran said. In the consumer renewables business, the company would focus on building scale in its rooftop solar, solar pumps, electric vehicle charging systems and home automation businesses, he said. The company’s website showed an operating capacity of 1839 MW renewable energy capacity comprising 907 MW wind power and 932 MW solar power. Another 373 MW of wind and solar capacity is under development. He said the company is witnessing strong growth in rooftop solar and solar pumps segments.

Source: The Economic Times

NTPC, ONGC to boost development of offshore wind energy

5 July: NTPC Ltd and upstream oil firm ONGC (Oil and Natural Gas Corp) have planned to boost the development of offshore wind energy in India, which is blessed with a coastline of about 7,600 km surrounded by water on three sides and has good prospects of harnessing this clean source. Earlier in May last year, NTPC and ONGC had signed a Memorandum of Understanding (MoU) to accelerate their footprint in the renewable energy space. As per the MoU, NTPC and ONGC will explore the setting up of offshore wind and other renewable energy projects in India and overseas. The MoU assumes significance in view of, almost doubling the target of renewable energy capacity addition to 60 GW by 2032 by NTPC. According to the Ministry of New and Renewable Energy (MNRE) portal, offshore wind turbines are much larger in size (in range of 5 to 10 MW per turbine) as against 2-3 MW of an onshore wind turbine. The MNRE has set a target of 5 GW of offshore wind installations by 2022 and 30 GW by 2030.

Source: The Economic Times

GAIL eyes 1 GW renewable energy capacity, to set up biogas, ethanol plants

1 July: GAIL (India) Ltd will invest about INR 50 billion to build a portfolio of at least 1 GW of renewable energy and set up compressed biogas as well as ethanol plants as it steps up efforts to expand the business beyond natural gas. As part of a push to embrace cleaner forms of energy, GAIL will be laying pipeline infrastructure to connect consumption centers to gas sources and spend as much as INR 40 billion on renewable energy, GAIL chairman and managing director (CMD) Manoj Jain said. While electricity generated from solar energy or through wind power is the cleanest form of energy, converting municipal waste into compressed biogas will supplement the availability of cleaner fuel to automobiles and households. Also, it plans to set up ethanol units that can convert agriculture waste or sugarcane into less polluting fuel that can be doped in petrol, helping cut India’s import dependence, he said. India, which imports 85 percent of its crude oil needs, is stepping up efforts to explore new forms of energy to clean up the skies and reduce dependence on imported fuels. GAIL will bid for a 400 MW solar power capacity being auctioned by SECI (Solar Energy Corp of India) in Rewa, Madhya Pradesh. GAIL has signed up with state-run power gear maker BHEL for renewable energy foray. The tie-up looks to leverage the competitive strengths of both companies.

Source: The Economic Times

RIL on a hiring spree for its new clean energy business

30 June: Reliance Industries Ltd (RIL) has started setting up teams for its newly created clean energy business at a breakneck speed, appointing multiple chief executive officers and executive assistants (EAs) to the chairman's office at top salaries, people aware of the development said. Executive search firms have been mandated to hire specialists in different segments of clean energy business from across geographies and McKinsey has been roped in to help prepare a blueprint for each of these businesses, they said. RIL chairman Mukesh Ambani had announced investments of INR 750 billion over the next three years to build a new clean energy business to fuel the conglomerate’s commitment to be net carbon neutral by 2035.

Source: The Economic Times

International: Oil

UAE rebuffs plan by OPEC, allies to extend production agreement

5 July: The United Arab Emirates (UAE) pushed back against a plan by the OPEC (Organisation of the Petroleum Exporting Countries) oil cartel and allied producing countries to extend the global pact to cut oil production beyond April 2022, a rare statement revealing the country's frustration with the group. The Emirati energy ministry called the proposal to extend the agreement for the entirety of 2022 without raising its production quota "unfair to the UAE". One of the group’s largest oil producers, the UAE is seeking to increase its output - setting up a contest with ally and OPEC heavyweight Saudi Arabia, which has led a push to keep a tight lid on production. The combined OPEC Plus grouping of members led by Saudi Arabia and non-members, chief amongst them Russia, failed to reach an agreement on oil output.

Source: The Economic Times

Argentine energy firm CGC buys local unit of China’s Sinopec

1 July: Argentine energy firm Compania General de Combustibles (CGC) said it had acquired the local operation of China's Sinopec Group, helping it increase its production to over 50,000 barrels of oil equivalent per day. CGC, part of Corporacion America International, said it would buy Sinopec Argentina, without giving details on the size of the deal. The Chinese-owned unit operates over 20 oilfields in the San Jorge and Cuyo Basins in Argentina with assets covering some 4,600 square km. CGC said that since it was acquired by Corporacion America in 2013, the firm had invested over US $1.5 billion in the development of energy in Argentina.

Source: The Economic Times

More OPEC+ supply needed to balance oil market: Goldman

30 June: Goldman Sachs Commodities Research said more oil production is needed from the Organisation of the Petroleum Exporting Countries (OPEC) and allies (OPEC+) to balance the market by 2022 as supply risk looms elsewhere. The US (United States) bank forecast oil demand to rise by an additional 2.2 million barrels per day (bpd) by year-end, leaving a 5 million bpd supply shortfall, well in excess of what Iran and shale producers can bring online, it said. The bank sees a base case of 0.5 million bpd supply increase from OPEC+ producers for consecutive months, when the group meets on 1 July to discuss the threat of the Delta COVID variant, the potential return of Iran production and still slow shale response. A deal could lead to Iran exporting an extra 1 million bpd, or 1 percent of global supply, for more than six months from its storage facilities.

Source: The Economic Times

International: Gas

Russia eyes Mongolia as shortcut to China for supplying natural gas

4 July: Mongolia, land-locked between two countries -- Russia and China, could soon serve as an important transit country for Russian natural gas and its related supply chains. Once completed, the Soyuz Vostok gas pipeline will become an extension of Russia's Power of Siberia 2 natural gas pipeline in Mongolian territory. In other words, this ambitious project is meant to provide supplies of Russian gas across Mongolia and into China.

Source: The Economic Times

Gazprom holds back exports via Ukraine, pressing case for Nord Stream 2

2 July: Kremlin-controlled gas giant Gazprom has held off from booking additional capacity for gas supplies via Ukraine to meet surging demand in recent months, sending a clear sign it is waiting for the Nord Stream 2 pipeline to be commissioned, analysts said. Nord Stream 2, which runs on the bed of the Baltic Sea from Russia to Germany, bypassing Ukraine, has faced criticism from the United States, which said it will increase European reliance on Russian gas. Washington imposed sanctions on the project in 2019, slowing its progress. The project is set to double the annual capacity of the existing Nord Stream pipeline to 110 billion cubic meters (bcm), more than Russia’s total gas exports to Europe for half a year. The first line of the double-lined pipeline is completed and the project is expected to be commissioned this year. Sergiy Makogon, head of Ukraine’s gas pipelines operators aid that gas prices have exceeded US $400 per 1,000 cubic metres on the European gas hubs, reflecting Gazprom's decision not to use additional capacity. Natural gas prices have shot to multi-year highs, with high temperatures driving up demand for power generation in the northern hemisphere for air conditioning and as traders in some regions replenish stocks ahead of winter.

Source: The Economic Times

Shell plans to exit California JV with Exxon Mobil

1 July: Royal Dutch Shell Plc plans to leave Aera, its California-based oil and gas-producing joint venture (JV) with Exxon Mobil Corp. Shell has divested numerous carbon intensive assets this year, selling its refinery in Washington state to Holly Frontier Corp and its stake in a Houston-area refining joint venture to Petroleos Mexicanos as it shifts new investments to renewables and power. Aera produces about 125,000 barrels of oil and 32 million cubic feet of natural gas each day, accounting for about 25 percent of the state’s oil and gas production. California still produces roughly 360,000 barrels of oil per day even as it has introduced the most stringent state-level rules on greenhouse gas emissions.

Source: The Economic Times

International: Coal

Indonesia sets coal benchmark price at highest in a decade on Chinese demand

5 July: Indonesia set its coal benchmark price at the highest in more than a decade, the energy and minerals ministry document showed, supported by sustained demand from China. The ministry set the benchmark coal price at US $115.35 per tonne in July, higher than the US $100.33 per tonne in June and the highest since US $117.6 per tonne in May, 2011, Refinitiv data showed. China unofficially banned imports from its top supplier Australia last year, with Chinese buyers informally told by custom officials not to purchase Australian coal. China signed a deal worth around US $1.5 billion to buy Indonesian thermal coal last year.

Source: Reuters

Africa’s top emitter seeks US $10 billion for shift from coal

30 June: South African state power utility Eskom, Africa’s biggest greenhouse gas emitter, is pitching a US $10 billion plan to global lenders that would see it shut the vast majority of its coal-fired plants by 2050 and embrace renewable energy. Eskom, which generates more than 90 percent of the country’s electricity chiefly by burning coal, is looking for around US $7 to US $8 for every tonne of carbon dioxide equivalent it cuts from its greenhouse gas emissions. Eskom currently emits around 213 million tonnes of CO2 (carbon dioxide) equivalent a year. The idea is to line up some of the funding before the COP26 climate conference in Glasgow in November. The utility is already looking at "repowering" its Komati coal plant using solar and battery storage and could present the project at COP26 to show it is serious about curbing emissions.

Source: Reuters

International: Non-Fossil Fuels/ Climate Change Trends

Iran’s sole nuclear power plant up and running after closure

4 July: Iran’s sole nuclear power plant is back online following an emergency shutdown two weeks ago. The country’s energy ministry said the Bushehr plant "returned to production energy" after the completion of needed maintenance. Authorities had warned of Bushehr’s possible closure because of American sanctions barring Iran from procuring equipment for repairs. Bushehr is fuelled by uranium produced in Russia, not Iran, and is monitored by the United Nations' International Atomic Energy Agency. The 1,000 MW plant feeds the grid with enough energy for a tiny part of Iran's nationwide 64,000 MW consumption.

Source: The Economic Times

Top court gives French government nine months to act on climate change

2 July: France’s highest administrative council told the government to act now against climate change to ensure it meets comments on reducing greenhouse gas emissions, or else it could face potential fines. The Conseil d'Etat, which acts as a legal adviser to the executive and as the supreme court for administrative justice, last November, gave the government three months to show it was enacting climate policies that make attainable a target of reducing greenhouse gases by 40 percent of their 1990 levels by 2030. The Conseil d'Etat's stance has raised questions about credentials of President Emmanuel Macron as a champion of fighting climate change ad affirms the binding nature of greenhouse gas reduction targets contained in legislation. The rate of decline in greenhouse gas emissions in France between 2015-2018 was about half as fast as needed to be on the right trajectory to achieving its 2030 target. Meanwhile, the decrease in greenhouse gas emissions in 2020 were mainly due to the COVID-19 induced downturn in economic activity, a report issued by the independent High Council for Climate. Prime Minister Jean Castex’s office said the government took note of the council’s order and that government subsidies for electric cars and more energy-efficient housing, as well as climate-related legislation passing through parliament, were evidence of its commitment to curbing emissions.

Source: The Economic Times

Xinjiang forced labour claims unfounded: China solar association

2 July: Claims that Chinese solar firms are benefiting from forced labour in Xinjiang are unfounded and unfairly stigmatise firms with operations there, the country’s solar association said. The United States (US) banned imports from five Chinese solar companies accused of using forced labour in Xinjiang including Hoshine Silicon Industry Co and a unit of GCL New Energy Holdings. The China Photovoltaic Industry Association said that it had recently inspected solar industry production facilities in Xinjiang and the US assertions had no factual basis. Xinjiang, home to China’s predominantly Muslim Uyghur population, is responsible for as much as 45 percent of the global production of polysilicon, a key ingredient in the manufacturing of solar panels.

Source: The Economic Times

Spain earmark 1.3 billion euros in aid to renewable power generation for private consumption

30 June: The Spanish government approved a 1.3 billion euros (US $1.55 billion) plan to finance investments in renewable power generation for private consumption with the rescue funds to be disbursed by the European Union (EU). Spain is due to receive about 140 billion euros over six years from EU to kick-start the economy to recover from the contraction caused by the COVID-19 pandemic.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV