DIESEL DEMAND FALTERS

Monthly Oil News Commentary: September – October 2020

India

Demand

For decades, diesel has underpinned India’s economic growth and the fortunes of its refiners, but the pandemic has caused the nation’s most consumed fuel to lose some of its lustre. Since Covid-19-lockdowns have eased across India, diesel consumption has trailed the rebound in gasoline with trucks remaining idle amid a softer economy. Motor fuel use, however, has benefited from people choosing their own cars and scooters over public transport to avoid the risk of infection. While diesel is still king in India — fuel sales are double that` of gasoline — the uneven demand recovery has created a unique challenge for India’s refiners, just as more headwinds emerge from the use of hydrogen and natural gas in major guzzlers such as trucks and buses. Refiners are expected to focus on making less diesel and more gasoline and petrochemicals to respond to changing demand. RIL has flagged a shift away from transport fuels, while IOC has signalled greater diversification to reduce its dependence on its fuels business. The price advantage of once cheap diesel has also faded. The fuel costs almost as much as gasoline in some Indian states after being saddled with new taxes over the past six years, prompting some farmers to come up with novel alternatives such as liquefied petroleum gas to run water pumps. Farms account for more than eighth of total diesel consumption in India. The demand shift related to the pandemic and broader energy transitioning means refineries that predominantly produce diesel will need to rethink their current output of products, Nayara Energy Ltd, India’s second-biggest private refiner.

Petrol sales have fully recovered to pre-Covid level and diesel is down just about 6 percent in the first half of September from a year earlier, signalling people and industry were eager to get on with their lives despite a record jump in infection rates. In the first fortnight of September, petrol sales rose 2 percent from a year earlier and 7 percent compared to August. Diesel sales were down 5.5 percent year on year but rose 20 percent month on month, as per sales data from state-run fuel retailers who control nearly 90 percent of the domestic market. India’s petrol sales rose 2 percent in September – the first increase since the country’s lockdown in late March – signalling demand returning to pre-Covid-19 levels. Diesel sales continue to be below normal but have shown a month-on-month increase, according to provisional data from state-owned fuel retailers who control 90 percent of the market. Petrol sales in September rose 2 percent year-on-year and were up 10.5 percent over the previous month. Diesel sales continue to be in the negative territory, with demand falling 7 percent year-on-year. But the demand was 22 percent higher over August 2020. This is the first time that petrol sales in the world’s third-largest oil importer have risen since the 25 March nationwide lockdown crippled economic activity and sent demand plummeting. Petrol sales rose to 2.2 mt in September as compared to 2.16 mt in the same month last year and 1.9 mt during August 2020. Demand for diesel, the most consumed fuel in the country, fell to 4.84 mt from 5.2 mt in September 2019. Sales were 3.97 mt during August this year. BPCL had stated that petrol sales were almost at pre-Covid-19 levels but diesel is lagging.

India’s fuel demand in September rose for the first time since June as easing coronavirus restrictions supported economic activity and travel, but consumption remained weaker than a year earlier. Consumption of refined fuels, a proxy for oil demand, rose 7.2 percent in September from the prior month to 15.47 mt the first monthly increase since June when demand rose to 16.09 mt. However, demand fell 4.4 percent from the same period a year earlier, posting its seventh consecutive year-on-year slide, data from the PPAC of the MoPNG showed. Diesel consumption, a key parameter linked to economic growth and which accounts for about 40 percent of overall refined fuel sales in India, rose 13.2 percent to 5.49 mt last month from 4.85 mt in August.

Tax on Petroleum Products

The Nagaland government has decided to withdraw the steep Covid-19 cess on petrol and diesel. Considering the need to give a boost to economic activities and the woes of the people, the decision to roll back the cess was taken. The Nagaland government imposed the Covid-19 cess of ₹5/litre on diesel and ₹6/litre on petrol and other motor spirits on 28 April, amid a crunch in the state’s finances in the wake of the lockdown following the Covid-19 outbreak. Opposition parties, tribal bodies, civil society groups and student bodies have been demanding a rollback of the cess. Besides, the Dimapur Naga Students’ Union on 19 September had threatened to close down all the petrol pumps in the state if the cess was not withdrawn.

Production

The government may give a ‘Make in India’ push to oil and gas explorers, as it is considering a proposal to halve cess on domestic crude oil to encourage exploration activity and allow Covid-hit oil producers to protect their margins at a time when a glut in the market and suppressed demand is pushing down prices. Cess on domestic crude is currently levied at the rate of 20 percent of the value of oil. This may come to 10 percent if a proposal given by the industry and the oil ministry is accepted by the finance ministry. The oil ministry said that they are looking at extending tax concessions, along with reduction in oil cess and the finance ministry has been apprised of the matter for action. Though the larger view is in favour of halving the cess, the exact quantum would be worked out later. The reduction in the levy has huge revenue implications as ONGC alone pays cess in excess of ₹100 bn annually. The finance ministry had revised oil cess in the FY17 Union Budget, shifting it from specific charge of ₹4,500/tonne of crude to an ad valorem rate of 20 percent. The government is looking to reduce tax burden on oil companies to push up domestic production that has stagnated for past several years at around 30-34 mt. The reduction in oil cess would benefit upstream companies such as ONGC and Cairn India whose production is subjected to the oil industry development cess levied on an ad valorem basis. But under OALP, which provides pricing and marketing freedom to operators along with the power to select the block for exploration, does not attract oil cess. Currently, ONGC and Oil India Ltd pay a cess on crude oil they produce from their allotted fields on a nomination basis. Cairn India has to pay the same cess for oil from the Rajasthan block.

LPG

India is expected to overtake China as the world’s largest cooking gas or LPG residential sector market by 2030 according to Wood Mackenzie. Driven by environmental and health concerns, the government has also been implementing schemes to help lower-income families cope with the cost of switching from dirtier biomass to LPG. Even with subsidy and the initial cost of set-up covered by the government, LPG is more expensive than biomass. Smaller-size LPG cylinders which reduce upfront cash payment required for each refill, more LPG distributors as well as the ‘Give it Up’ campaign where households can voluntarily give up their LPG subsidies from the DBTL scheme to benefit lower-income families. By the end of 2030, India’s LPG demand in the residential sector will account for 82

percent of the country’s total LPG demand while natural gas demand in the same sector will only account for 3 percent of total natural gas demand in India according to Wood Mackenzie.

Hassan district will soon get another LPG pipeline after Mangaluru-Bengaluru pipeline. The 72nd Land Audit Committee meeting held recently has given a green signal to the ambitious HPCL LPG pipeline between Hassan and Cherlapally at Secunderabad in Telangana. This is a 680 km pipeline. According to the proposal, the company will invest ₹6.8 bn in this project which is expected to ease the burden of LPG transport between Hassan and neighbouring Telengana. According to the proposal, HPCL pipeline will go through Arsikere in Hassan, Tiputur and Chikkanayakanahalli in Tumakur, and Hiriur and Sira in Chitradurga. The project is expected to create hundreds of indirect jobs as it is a labour-intensive project.

The issue of continuation of cooking gas or LPG subsidy will be considered before inviting financial bids for BPCL privatisation, Parliament was informed. However, the interest of LPG customers of BPCL would be taken into consideration while deciding on the subsidy issue. The government is selling its entire 52.98 percent stake in India’s second largest fuel retailer and third biggest oil refiner.

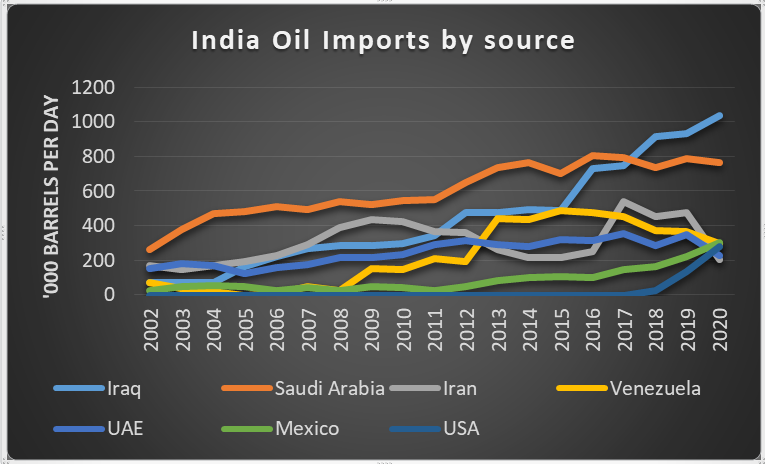

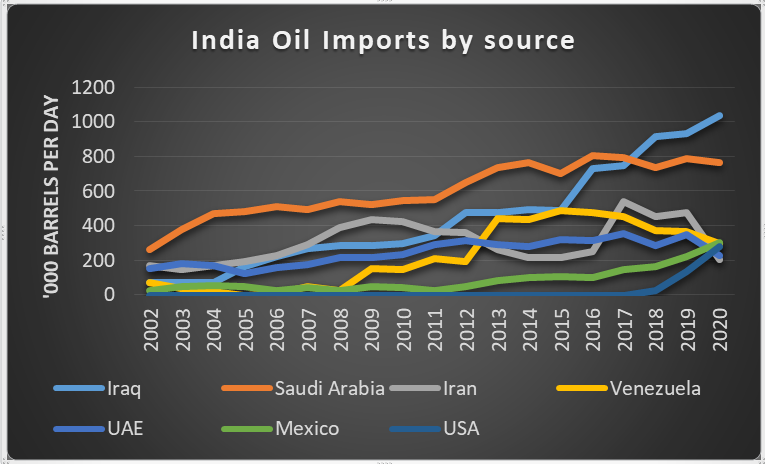

Imports

India’s oil imports from Africa jumped to their highest in 10 months in August as refiners switched out more expensive crude from the Middle East according to shipping data. The world’s third biggest oil importer shipped in about 3.95 mn bpd of oil in August, the highest volume since April, with African nations accounting for about 17.5 percent, or an eleven month high of 688,000 bpd.

Oil imports by India’s RIL the operator of the world’s biggest refining complex, surged in August after over a decade low in July, as the company has resumed normal operation at its export-focused plant after weeks of maintenance shutdown, shipping data showed. RIL’s oil imports in August rose about 58 percent from July to 1.22 mn bpd. The refiner received Venezuelan oil in

August after a gap of two months as it took authorisation from Washington to exchange the oil for fuels. RIL has agreed to purchase 2 mn barrels of Canadian heavy crude per month, as a substitute for dwindling Venezuelan supply. The deal, large for Canada, shows how global buyers are scrambling for new sources of heavy oil. Venezuela’s production has collapsed over the last several years, and US sanctions have squeezed its ability to sell oil to international buyers, including RIL. The Indian refiner, which operates the largest refining facility in the world, is among several companies winding down purchases from Venezuela as a result of US sanctions.

Indian refiner BPCL will continue to import gasoline for the next few months as its crude processing is hit due to lower demand for diesel that accounts for 40 percent-45 percent of its product slate. BPCL is operating refineries at an average of 80 percent capacity. By design BPCL refineries make 2.5 mt of diesel for every 1 tonne of gasoline produced. India’s recent spot demand provided support to the Asian gasoline market. India’s gasoline demand in September recovered to last year’s level as passenger cars sales surged last month and motorists are relying on personal vehicles for commuting amid rising cases of coronavirus. Slowing industrial activity has delayed a recovery in diesel consumption, largely used by commercial vehicles. Diesel demand this month is 8 percent-9 percent lower than year-ago levels. India’s diesel sales could recover next month during the festival season. BPCL will completely stop importing gasoline from April next year when it would start new units at its Kochi refinery to upgrade naphtha into gasoline. BPCL will go back to its pre-Covid product slate in next two-three months, notwithstanding lower demand of jet fuel which is just 4 percent-5 percent of its overall output.

Refining

Fitch Solutions has made a further downward revision to India refined fuels demand forecast for 2020 from minus 9.4 percent to minus 11.5 percent in line with further deterioration in the country’s economic outlook. In response to the pandemic, the government has introduced a number of stimulus measures and, according to Fitch country risk analysts, will likely

continue to boost spending in the face of a persistent revenue shortfall. Demand weakness is spread across the board, with both consumer and industrial fuels set for steep declines. With a nationwide lockdown in place over March to May, domestic demand plummeted, reaching its nadir in April at minus 48.7 percent year-on-year growth for total fuels consumption. Industrial demand as a whole has declined sharply due to restrictions in place on business activities, labour and supply shortages and credit constraints. The one bright spot was LPG demand for which rose by 4.3 percent. Social distancing measures have increased residential demand as a whole while the government’s policy to offer free cylinder refills to low-income households offered an additional boost.

Crude oil processed by Indian refiners slipped 26.4 percent from a year ago in August, the most in four months, as fuel demand remained subdued on skyrocketing coronavirus cases that hindered industrial and transport activity. Indian refiners processed 3.82 mn bpd or 16.15 mt of crude last month, 8.7 percent lower than in July. Crude oil throughput in August recorded its largest year-on-year contraction since April, when it posted its steepest decline since 2003. Weaker refining margins and a slide in fuel consumption have prompted refiners to cut crude processing and lower output. Indian refiners operated at about 76.1 percent of their overall capacity in August compared to 83.3 percent in July. Top refiner IOC operated its directly owned plants at 66.7 percent capacity. The refiner expects local gasoline and gasoil demand to reach pre-pandemic levels in the first half of fiscal 2021 and sought to expand its petrochemical capacity to off-set weaker fuel refining margins. RIL owner of the world’s biggest refining complex, operated its plants at about 75.8 percent capacity.

IOC, the country’s largest refiner, is reviewing its refinery expansion plans because of a gradual rise in use of cleaner fuels and changing demand patterns in Asia’s third-largest economy. In 2018 India set a target for a 77 percent jump in refining capacity to about 9 mbpd by 2030, with IOC raising capacity to 2.6 mn bpd. However, PPAC is revising the supply and demand

scenario for the country. IOC’s focus is on adding higher capacity through expansion of existing units and raising petrochemical capacity to protect margins. IOC will also review expansion of its Paradip refinery when the revised supply and demand figures are available. IOC’s joint venture with other state refiners along with Saudi Aramco and Abu Dhabi National Oil Co to build a 1.2 mn bpd refinery on India’s west coast has also been held up because land has yet to be acquired for the project. Fuel demand in India has recovered in the first two weeks of this month, with IOC selling 1 percent more gasoline than a year earlier while diesel remained down by about 9 percent.

Activities for development of Crude Oil Import facility of Assam based NRL have started in Paradip Port, Odisha. Land filling activity will soon be started by DCI by way of dredging and reclaim. A tripartite MoU was entered into by NRL with Paradip Port Trust and DCI for reclamation of the 200 acres of land allotted to NRL for setting up its crude oil import terminal at Paradip Port. NRL stated that DCI shall start the dredging activity from mid-November 2020 and is expected to complete the reclamation work within a period of 7 months.

Strategic Reserves

India saved over ₹50 bn when the country in April-May used two-decade low international oil prices to fill up its three strategic underground crude oil storages. India, the world’s third-biggest oil importer, has built strategic storages in underground rock caverns at three places to meet any contingency. The average cost of procurement of crude oil was $19/bbl as compared to $60/bbl prevailing during January 2020. While the 5.33 mt of emergency storage — enough to meet India’s oil needs for 9.5 days — was built in underground rock caverns in Mangalore and Padur in Karnataka and Visakhapatnam in Andhra Pradesh by the government, state-owned oil firms were in April asked to buy crude oil when global rates fell to a two-decade low. The storages at Mangalore and Padur were half-empty and there was some space available in Vizag storage as well. The ISPRL built the underground storages at Mangalore and Padur in Andhra Pradesh and Visakhapatnam in Andhra Pradesh as insurance against supply and price disruptions. India meets 85 percent of its oil needs through imports. Its refiners maintain 65 days of crude storage, and when added to the storage planned and achieved by ISPRL, the Indian crude storage tally goes up to about 87 days.

Taking advantage of low prices in major oil-producing centres in Saudi Arabia and UAE India has filled up its strategic crude oil reserves to meet its energy needs in times of emergency and saved a neat $685.11 mn in the process. It bought crude oil at an average price of $19/bbl to fill its reserves in April and May when prices reached an all-time low while the US oil touched negative price levels in futures market. The state-funded reserves are meant to tide over short-term supply disruptions and will take care of India’s oil needs for 9.5 days. The country was already holding half of its total 5.33 mt of oil reserves capacity when the government decided to take advantage of the low crude prices. India’s three petroleum reserve caverns at Visakhapatnam (1.33 mt), Mangaluru (1.5 mt) and Padur (2.5 mt), managed by ISPRL, are now full. Another 6.5 mt facility is coming up at Padur in Karnataka, and Chandikhole in Jajpur. The oil ministry has also told the ISPRL to identify new sites so that the storage facility is increased to ensure oil stock of 90-100 days for use in an emergency at all times.

Overseas Ventures

BPCL has been forced to pay for its defaulting partner Videocon Industries Ltd after it had relied on a rarely used model to acquire stake in five oil blocks in Brazil. In September 2008, BPCL and Videocon Industries had formed a 50:50 joint venture to acquire a Brazilian oil exploration firm for $283 mn.

Rest of the World

Global Trends

World oil demand will rebound more slowly in 2021 than previously thought as coronavirus cases rise according to OPEC. Demand will rise by 6.54 mn bpd

next year to 96.84 mn bpd. The growth forecast is 80,000 bpd less than expected a month ago. A further weakening of demand could threaten plans by OPEC and allies to taper in 2021 the record oil output cuts they made this year. OPEC is keeping an eye on the situation but currently has no plan to cancel the supply boost. Oil prices have collapsed as the coronavirus crisis curtailed travel and economic activity. While in the third quarter an easing of lockdowns allowed demand to recover, OPEC sees the pace of economic improvement slowing again. OPEC has steadily lowered its 2021 oil demand growth forecast from an initial 7 mn bpd expected in July. To tackle the drop in demand, OPEC and its allies including Russia, a group known as OPEC+, agreed to a record supply cut of 9.7 mn bpd starting on 1 May. OPEC output fell by 50,000 bpd to 24.11 mn bpd in September. OPEC forecast demand for its crude will be 200,000 bpd lower than expected next year at 27.93 mn bpd. Assuming global demand rebounds as expected, this in theory leaves room for OPEC members to increase output in 2021 by over 3.8 mn bpd from September’s rate without causing a glut.

USA

US oil output from seven major shale formations is expected to decline by about 68,000 bpd in October to 7.64 mn bpd according to the US EIA. Output at every formation is expected to fall in October, except the Permian basin of Texas and New Mexico, where production is expected to rise by about 23,000 bpd to 4.17 mn bpd. That would be the smallest increase since production declined in May. The biggest decline is expected to come from the Eagle Ford basin in South Texas, where output is expected to fall by nearly 28,000 bpd to 1.13 mn bpd. US oil prices are still down about 40 percent from the peak at the start of the year, due to coronavirus demand destruction. However, US crude futures have gained almost 100 percent over the past five months to around $37/bbl mostly on hopes global economies and energy demand will snap back as governments lift lockdowns. Those higher oil prices have encouraged some energy firms to start adding rigs, an early indicator of future output in recent weeks.

BHP Group signed an agreement to acquire Hess Corp’s entire stake in Shenzi oil and gas field in the Gulf of Mexico for $505 mn. The deal would take its ownership in the oil platform to 72 percent, with Spain’s Repsol SA owning the rest. With the acquisition, BHP said it would be able to add about 11,000 boepd of production to its portfolio and also grow high-margin barrels. The Anglo-Australian company in August put up 50 percent of its stake in the Bass Strait oil and gas venture owned with Exxon Mobil Corp for sale as revenue contribution from the operation dwindled in fiscal 2020 compared to a year ago. Despite a plunge in crude prices this year, BHP remains bullish on oil as it has profitable prospects for at least the next decade.

Middle East & Africa

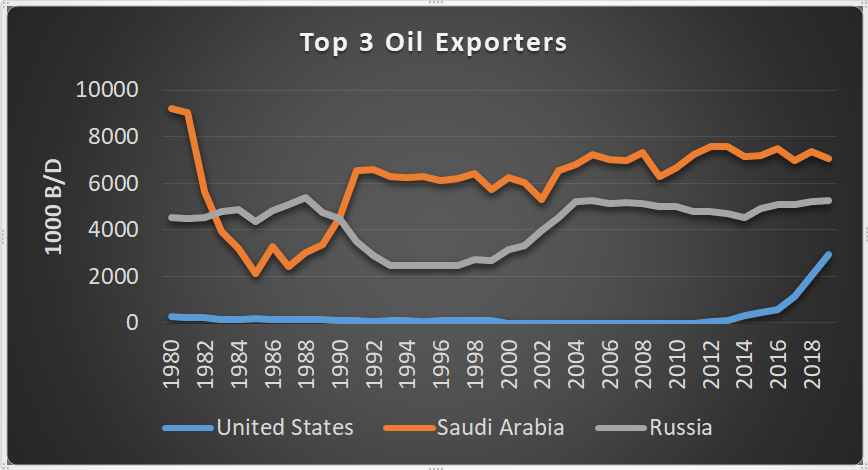

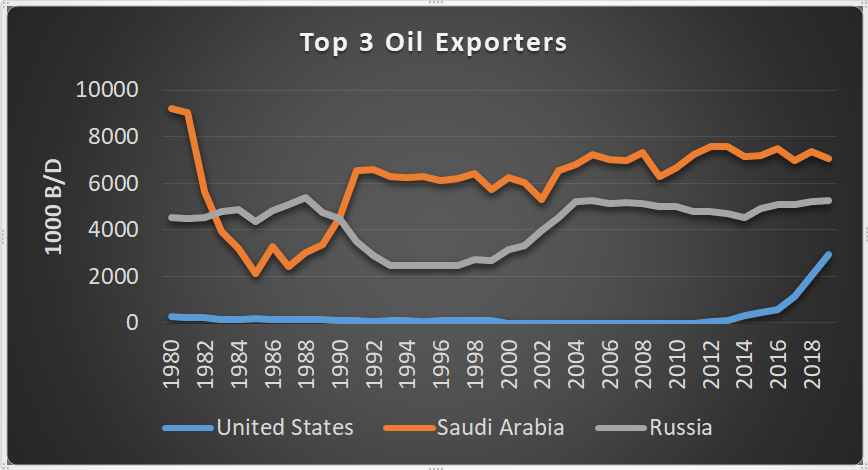

Saudi Arabia’s crude oil exports rebounded in July to 5.73 mn bpd from a record low in June, according to the Joint Organizations Data Initiative data showed. At 4.98 mn bpd, crude exports in June were the weakest on record, according to data. Output from the OPEC rose by more than 1 mn bpd in July as Saudi Arabia and other Gulf members ended voluntary supply cuts, on top of an OPEC-led deal to curb production. An easing of lockdowns and lower supply helped benchmark Brent crude hold above $40/bbl throughout July after plunging to a 21-year low of $15.98/bbl in April, though gains were kept in check by fears of a second wave of Covid-19. Saudi Arabia shipped 6.1 mn bpd of crude oil in September, slightly above August levels, and kept output steady at 8.974 mn bpd. The world’s top oil exporter pumped 8.988 mn bpd and exported 6 mn bpd in August. Saudi oil exports usually rise after the hot summer months, when increased use of crude for power generation restricts oil shipments. The kingdom’s production is in line with market expectations and its OPEC Countries output quota. According to a OPEC survey, Saudi Arabia’s September oil output was steady at 9 mn bpd.

Iraq has proposed forming a company to manage oil production and export operations in the semi-autonomous Kurdish region. The Kurdistan Regional Government and central government in Baghdad have been locked in a long-running dispute over oil and land

rights in the northern Iraqi Kurdish region. Talks on oil issues between the government and authorities in the Iraqi Kurdish region had reached a “positive understanding”. The proposed state company’s management would be technically and administratively linked to the Kurdish regional authorities and federal oil ministry.

Nigeria has passed a long-awaited oil-reform bill and it will be formally presented in the Senate. The legislation has been in the works for the past 20 years, and the main laws governing Nigeria’s oil and gas exploration have not been fully updated since the 1960s because of the contentious nature of any change to oil taxes, terms and revenue-sharing within Nigeria. But reforms and regulatory certainty became more pressing this year as low oil prices and a shift towards renewable energy made competition for investment from oil majors tougher.

Libyan oil production has risen by about 20,000 bpd to reach 290,000 bpd as exports ramp up. The easing of a blockade by eastern forces, which began in January, has allowed the OPEC member to ramp up exports with the reopening of the Marsa El Hariga, Brega and Zueitina terminals, though damage sustained during the shutdown may slow a full resumption of exports. The blockade reduced Libya’s output from more than 1.2 mn bpd to around 100,000 bpd. Exports have yet to resume from the Ras Lanuf and Es Sider oil terminals. The NOC will only resume operations at oilfields and terminals where militants had vacated their positions. The Episkopi oil tanker loaded a 600,000 barrel crude cargo for Austria’s OMV at Zueitina over the weekend and departed for Italy. The port is expected to export 3.8 mn barrels. NOC subsidiary AGOCO said it had resumed operations at the Hamada oilfield, with crude from the field expected to be pumped to the 120,000 bpd Zawia oil refinery, west of Tripoli. Libya’s national oil company announced it is resuming production at the country’s largest oil field as rival officials from eastern and western Libya began peace talks, part of preliminary negotiations ahead of a UN brokered dialogue set to take place next month. The NOC said it has lifted the force majeure that was imposed at the southwestern Sharara oil field after it reached “an honor agreement” with forces loyal to military commander Khalifa Hifter to end “all obstructions” at the field.

Lebanon’s struggling economy will significantly benefit from the revenues from the extraction of oil and gas from the disputed area once the country reaches a border demarcation agreement with Israel. The government has “high hopes” for the upcoming border-demarcation agreements with Israel, which if successful will allow the consortium of companies licensed by the Lebanese government to begin taking the necessary steps towards the extraction of the oil and gas reserves in the disputed Block-9 off the Lebanese coast.

China

Chinese customs said it will amend the way it supervises crude oil imports as part of a broader effort to boost efficiency, allowing cargoes to clear customs before quality inspections have been finalised. Key import oil terminals along China’s coast, including the provinces of Shandong, Zhejiang and Guangdong, suffered severe congestion between May and August as record crude purchases arrived in the country. Effective from 1 October, importers will be allowed to start offloading oil once customs officers have collected key information and a sample of oil, the General Administration of Customs said. Importers will still only be allowed to use or sell the oil once subsequent laboratory tests are completed.

Other Asia

Indonesia will shorten a planned shutdown at its Banyu Urip field and accelerate drilling at the Rokan block in a bid to reach its target for oil and gas lifting this year according to the country’s upstream regulator SKK Migas. These are among the several measures SKK Migas said it would do in the remainder of 2020, aimed at increasing average crude oil lifting for the year by 3,900 bpd and gas by 70 mmscfd. The Banyu Urip field, operated by a unit of Exxon Mobil, is situated in Cepu, the biggest oil-producing block in Indonesia. The regulator is ramping up talks with a Chevron unit for an agreement about drilling of 11 wells at the Rokan block in the fourth quarter. Indonesia’s national crude oil

lifting in January-August was 706,900 bpd, above the government’s revised target of 705,000 bpd for 2020, but slowing from the year’s first half, while its gas lifting in the same period was 5,516 mmscfd, below this year’s revised target of 5,556 mmscfd.

Sri Lanka indicted the Greek captain of an oil tanker, which carried crude oil from Kuwait to India and caught fire off the country’s eastern Ampara coast, for causing an oil spill. The Panamanian-registered New Diamond was carrying 270,000 metric tons of crude oil from Kuwait to India when a boiler explosion in its engine room caused fire on 3 September. The Sri Lanka Navy with the help from the Indian Navy and coast guards doused the fire after three days. Two Sri Lankan naval ships, one Indian naval ship and 3 Indian coast guard vessels were deployed in the operations.

S America

Argentine state energy company YPF has signed an agreement with the key union representing workers at the Patagonian Vaca Muerta shale oil and gas formation, aimed at improving production. With the agreement, YPF will be able to jack up activity in the resource-rich southern province of Neuquen, where the shale play is located.

Venezuela’s state-run oil company PDVSA has begun loading an Iran flagged large tanker with Venezuelan heavy crude for export, as ties have deepened between the two OPEC nations. Venezuela and Iran are under sanctions imposed by the US, hurting their oil industries and hitting crude exports by shrinking the pool of customers and shipping companies willing to send vessels to their ports. Washington has sought to disrupt the deepening bilateral trade between the two countries. The US seized over 1 mn barrels of Iranian fuel bound for Venezuela in July. The Iranian-flagged VLCC arrived in Venezuela’s main oil port of Jose this month carrying 2.1 mn barrels of Iranian condensate to be used as diluent for Venezuela’s extra heavy oil production, according to company documents. The tanker is due to transport up to 2 mn barrels of Venezuela’s heavy Merey 16 crude on its way back, in a sale agreed by PDVSA and the National Iranian Oil Company.

Canada

Canada will spend C$320 mn ($238.56 mn) to support its offshore oil industry in Newfoundland and Labrador, which has struggled as coronavirus pandemic travel restrictions reduced demand, the government said. Newfoundland and Labrador is Canada’s third-largest oil-producing province, pumping 5 percent of the country’s crude in 2018. Low prices have forced producers to cut spending globally. The province, whose economy depends on oil, fishing and tourism, has the country’s highest unemployment rate.

Russia

Russia plans to launch a programme to part build oil wells this year so it can quickly ramp up production when the global deal on output curbs expires in 2022. To ensure Russia does not lose market share when the production cut agreement ends, Moscow has worked out a programme to start drilling the wells, which can be quickly completed and start operating once the deal expires and as oil prices recover. Russia expects its oil production to increase after the current OPEC+ deal on output curbs runs its course in April 2022, the economy ministry data showed. Russia, which the ministry expects to produce 507.4 mt of oil this year, is seen increasing its production over the next three years to 560 mt, or 11.2 mn bpd, in 2023. Ministry data forecasts an increase in oil exports to 266.2 mt by 2023, slightly lower than last year’s exports. The ministry forecast oil exports of 225 mt this year, down from 269.2 mt in 2019.

Output of LPG in the east of Russia is expected to increase by 1.0-1.2 mt next year, according to producers’ plans, although exports to energy-hungry Asia could be limited by a lack of infrastructure. Production of LPG from eastern Russia will account for up to 15 percent of the country’s total output in the next few years. LPG production in Russia totalled 16.9 mt in 2019, while exports, mainly via the Baltic Sea port of Ust-Luga to Europe, stood at 5.7 mt according to Refinitiv Kortes data. Independent company Irkutsk Oil Company is one of the producers in eastern Siberia expected to

contribute to Russia’s LPG output growth. It plans to launch the Ust-Kut gas processing plant, with annual capacity of 800,000 tonnes, next year. Gazprom plans to make its Amur gas processing plant operational in the second quarter of 2021. The plant is set to reach full capacity of 1.5 mt in 2025.

Europe

Some 324 Norwegian offshore oil workers planned to go on strike if annual pay negotiations with employers fail according to trade unions Safe, Industri Energi and Lederne. At Equinor’s Johan Sverdrup field, the largest oil-producing field in Western Europe, 88 workers from Norway pumps more than 4 mn barrels of oil equivalents per day (boed), half in the form of crude and other liquids and half from natural gas, making it a major global energy supplier. The unions are negotiating on behalf of a combined 7,300 workers, while the Norwegian Oil and Gas Association represents oil firms. Oil prices slipped more than 1 percent after the oil worker strike in Norway ended, which should boost crude output even as Hurricane Delta forced US energy firms to cut production. Despite price slide, both benchmarks gained about 9 percent, their first increase in three weeks and the biggest weekly rise for Brent since June. Oil futures climbed due to concerns the strike in Norway and the hurricane headed for the US Gulf Coast would cut crude output.

RIL: Reliance Industries Ltd, IOC: Indian Oil Corp, BPCL: Bharat Petroleum Corp Ltd, mn: million, bn: billion, mt: million tonnes, PPAC: Petroleum Planning and Analysis Cell, MoPNG: Ministry of Petroleum and Natural Gas, ONGC: Oil and Natural Gas Corp, FY: Financial Year, OALP: Open Acreage Licensing Policy, LPG: liquefied petroleum gas, DBTL: Direct Benefit Transfer of LPG, HPCL: Hindustan Petroleum Corp Ltd, bpd: barrels per day, NRL: Numaligarh Refinery Ltd, DCI: Dredging Corp of India, MoU: Memorandum of Understanding, ISPRL: Indian Strategic Petroleum Reserves Ltd, UAE: United Arab Emirates, bbl: barrel, US: United States, OPEC: Organization of the Petroleum Exporting Countries, EIA: Energy Information Administration, boepd: barrels of oil equivalent per day, mmscfd: million metric standard cubic feet per day, NOC: National Oil Corp, UN: United Nations

NATIONAL: OIL

OMCs hold petrol, diesel prices as global oil market remains subdued

20 October. Oil Marketing Companies (OMCs) kept petrol and diesel prices unchanged across the four metros as global oil prices remained subdued and product prices remained steady. Petrol prices have been unchanged for 28 days at a stretch while diesel prices were the same for the 18 consecutive days. Price of petrol in the national capital was at ₹81.06 per litre. In Mumbai, Chennai and Kolkata, the fuel was sold for ₹87.74, ₹84.14 and ₹82.59 per litre, respectively. Diesel prices in Delhi, Mumbai, Chennai and Kolkata were at ₹70.46, ₹76.86, ₹75.95 and ₹73.99, respectively. Domestic fuel prices have been largely subdued off late due to low crude oil prices as global oil demand has been hit amid the pandemic. Retail sales, however, have picked up with the gradual reopening of the economic activities. First time since lockdown, diesel sale in the country has crossed over the pre-Covid level with the country’s most widely consumed fuel witnessing a nine percent year-on-year growth in the first 15 days of October.

Source: The Economic Times

ONGC sells December-loading Russian Sokol crude at wider discount

19 October. First time since lockdown, diesel sale in the country has crossed over the pre-Covid level with the country’s most widely consumed fuel witnessing a nine percent year-on-year growth in the first 15 days of October.

QuIck Comment

Revival in Diesel Demand is a sign of economic revival!

Good!

|

traders said. Prices of Sokol crude, which yields more middle distillates like jet fuel and gasoil from refining, took a hit this year as transport fuel demand slumped due to government measures to contain the Covid-19 pandemic. ONGC and Exxon Mobil sold December-loading Sokol crude cargoes at discounts of around 30-40 cents a barrel to Dubai quotes.

Source: The Economic Times

| Diesel sales out of quarantine, shoots past pre-Covid level in October |

17 October. India consumed nearly 9 percent more diesel in the first fortnight of October than it did in the same period a year ago and petrol sales remained 1.5 percent higher than the previous corresponding period, indicating a strong economic rebound on the back of festive demand. This is the first time after the countrywide lockdown that diesel consumption, an indicator of economic activities, has exceeded last year’s level. Petrol sales had shot past pre-pandemic levels in September as people slowly began overcoming Coronavirus fears and preferred to use personal vehicles to get around. According to latest data, diesel sales in the first fortnight of October jumped more than 24 percent from the same period of September as monsoon receded and festive demand kicked in. Petrol rose 1.5 percent month-on-month as the festive mood set in and people began venturing out. Jet fuel sales too rose more than 2 percent from September as the number of flights increased, but it is still more than 57 percent short of October 2019 level. Predictably, consumption of LPG (liquefied petroleum gas) or cooking gas, continued to rise in the first half of October and was 7 percent higher than the year-ago period, indicating a lot more cooking as families get into the festive groove. Rising fuel sales will help refiners to ramp up operations of their units.

Source: The Economic Times

BPCL tries to cut dependence on LPG from the Middle East

16 October. An Indian buyer of liquefied petroleum gas (LPG) is once again attempting to ease its dependence on Middle East shipments after some supply shocks last year stemming from drone attacks and even a trade war. Bharat Petroleum Corp Ltd (BPCL) is seeking bids from global suppliers for a fifth of its typical LPG needs in 2021, according to a tender. Bidding is still open to Middle East producers, which already provide BPCL with the majority of its contracted needs. India’s second-biggest fuel retailer made an attempt to broaden its sources of supply earlier this year but the tender wasn’t awarded due to a lack of attractive offers, traders said. The Middle East, however, still has the advantage of being the closest major producer to India. Other options for BPCL could include Europe and the US (United States), although both alternatives face the additional cost of longer shipping times. BPCL is seeking bids for about 800,000 tons of LPG in 2021, a fifth of its annual import requirement of about 4 million tons. To reduce freight costs, BPCL will consider taking responsibility for shipping if cargoes are sold free-on-board from the Arab Gulf region, unlike its tender earlier this year, which required the seller to deliver cargoes to India. Offers are to be based on a premium or discount to Saudi contracted prices published every month. LPG has defied a broader demand slump for oil products in India, benefiting from authorities stocking up on supplies for lower-income people and as families spent more time cooking at home amid the world’s biggest lockdown.

Source: The Economic Times

Fitch expects marketing, refining volume of oil firms to fall 15 percent in FY21

15 October. With coronavirus lockdowns pummelling fuel demand in India, Fitch Ratings expects the marketing and refining volume of state-owned oil firms to fall by more than 15 percent in the current fiscal year before a gradual recovery in 2021-22. India’s fuel demand recovered sharply in June from April before slowing due to the reimposition of restrictions in certain cities because of coronavirus and flooding in some regions. Fitch expects gross refining margins (GRMs) to remain under pressure from weak product demand and crack spreads in the near term until the global economy recovers significantly from the coronavirus crisis. It expected marketing margins to normalise from FY22 to below the FY21 level, but remain higher than that of FY20. GRMs of Bharat Petroleum Corp Ltd (BPCL), Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Reliance Industries Ltd (RIL) fell sharply in April-June due to weak industry conditions and inventory losses. The rating agency expected OMCs to defer and potentially re-evaluate the feasibility of large new refining projects in light of the uncertain industry outlook, while investments in marketing infrastructure would continue.

Source: The Economic Times

Diesel RSP in Delhi down ₹2.93 per litre in September: IOC

14 October. Indian Oil Corp (IOC) said that diesel and petrol retail selling prices (RSP) in Delhi have come down in September. The company pointed out that diesel RSP in Delhi was down ₹2.93 per litre in September. Similarly, petrol RSP declined. It fell by 97 paise per litre during September 2020, with corresponding price reduction in other markets across the country. In terms of LPG, the company said that there has been virtually no change in the RSP of cooking gas or LPG (liquefied petroleum gas) in Delhi and other markets across India since 1 July 2020.

Source: The Economic Times

NATIONAL: GAS

India set to lose Farzad-B gas field in Iran

19 October. India has all but lost the ONGC Videsh Ltd (OVL)-discovered Farzad-B gas field in the Persian Gulf after Iran decided to prefer domestic companies over foreign firms for development of the field. OVL had in 2008 discovered a giant gas field in the Farsi offshore exploration block. OVL and its partners had offered to invest up to $11 bn for development of the discovery, which was later named Farzad-B. OVL discovered gas in the block, which was declared commercially viable by National Iranian Oil Co, on 18 August 2008. The Indian consortium has so far invested around $400 million in the block.

Source: The Economic Times

Massive fire breaks out in underground gas pipeline of ONGC in Gujarat

17 October. A massive fire broke out in the Oil and Natural Gas Corp (ONGC)’s gas pipeline passing from an agriculture farm land at Kadodara village Vagra taluka of Bharuch district near the Dahej industrial area. The fire broke out due to the leakage or rupture in the underground gas pipeline of ONGC passing from an agricultural farm land in Kadodara village in Vagra taluka. The authorities from the ONGC Dahej immediately rushed to the spot along with the four fire tenders. The gas supply in the pipeline was stopped with immediate effect.

Source: The Economic Times

Numaligarh Refinery inked pipeline right to use agreement with GAIL

16 October. Assam based Numaligarh Refinery Ltd (NRL) has inked Pipeline Right to Use (RoU) sharing Agreement with GAIL (India) Ltd. NRL said that GAIL is laying its Barauni – Guwahati pipeline (BGPL), which

is a part of Jagdishpur – Haldia & Bokaro – Dhamra Natural Gas (NG) Pipeline Project, popularly known as ‘Pradhan Mantri Urja Ganga’ extended up to Guwahati to supply natural gas to pipelines under North East Gas Grid (NEGG). NRL is also laying its 1,630 km long Paradip Numaligarh Crude Pipeline (PNCPL) crude pipeline, originating from Paradip Port, traversing through the States of Odisha, West Bengal, Jharkhand, Bihar and Assam and terminates at its refinery at Numaligarh (Assam).

Source: The Economic Times

NATIONAL: COAL

CIL subsidiaries to have autonomy in base e-auction price from November

20 October. Coal India Ltd (CIL) subsidiaries will have autonomy in fixing the base price for e-auction coal from November depending on demand. Currently, the base price is kept aligning with the notified price but with the realisation trend improving, the dry fuel miner has decided to allow the respective subsidiaries to fix the base price depending upon their ground situation. The latest e-auctions from Central Coalfields and Eastern Coalfields are fetching high premium and going forward CIL expects 15-20 percent premium from auctions as demand remains strong in September and October. The company said coal allocation under its four e-auction windows registered about 65 percent year-on- year rise during the first half of the current financial year.

Source: The Economic Times

SECL plans 8 projects worth ₹31 bn for improving coal evacuation

18 October. Coal India Ltd-arm SECL (South Eastern Coalfields Ltd) is executing eight ‘first mile connectivity’ projects with an estimated capital outlay of ₹31 bn to evacuate dry fuel, especially incremental production under the proposed plan to scale up the maharatna firm’s output to 1 billion tonnes. The company said because of the move, there would be reduction in the cost of landed price of coal at generators end and retain the foreign exchange by substituting the coal imports with abundant domestic supplies, it said. In the absence of conclusive overall environment benefits at the additional cost of power generation, recently the government had dispensed with the mandatory coal washing to reduce ash in the coal supplies to power plants. Coal India accounts for over 80 percent of domestic coal output. It is eyeing one billion tonnes of output by 2023-24.

Source: The Economic Times

Coal Minister wants Coal India units to set prices independently

14 October. India’s Coal Minister Pralhad Joshi said the units of Coal India Ltd should be allowed to independently set fuel prices in a bid to increase competition and reduce the price of coal in the country. Coal India has seven units and accounts for more than four fifths of domestic production. It sets the price of various grades of coal in India after consultation with stakeholders.

Source: Reuters

NATIONAL: POWER

Adani to complete 1 GW transmission line to Mumbai by December 2022

19 October. Adani Transmission Ltd (ATL) affirmed that it will be able to execute a transmission line and sub-station project at suburban Vikhroli which will enhance the power supply by 1,000 MW to the financial capital, by the end of next year, as per the mandated deadline for it. ATL said there will be growth in power load in the megapolis and the mismatch between generation and load growth, it is committed to executing two critical transmission projects that would help channelise additional power to Mumbai. These capacity enhancement projects will create an additional transmission capacity of 1,000 MW each, thereby easing the existing transmission corridors, it said.

Source: The Economic Times

Power consumption grows 11.45 percent to 55.37 bn units in first half of October

19 October. India’s power consumption grew 11.45 percent to 55.37 bn units in the first half of October this year, mainly driven by buoyancy in industrial and commercial activities, as per government data. Power consumption in the country was recorded at 49.67 bn units during October 1-15 last year, according to the power ministry data. For a full month in October last

year, power consumption was 97.84 bn units. The government had imposed nationwide lockdown on March 25 to contain the spread of Covid-19. Power consumption started declining from March onwards due to fewer economic activities in the country. The Covid-19 situation affected power consumption for six months in a row from March to August this year. Power consumption on year-on-year basis declined 8.7 percent in March, 23.2 percent in April, 14.9 percent in May, 10.9 percent in June, 3.7 percent in July and 1.7 percent in August. The data showed that electricity consumption had grown by 11.73 percent in February. Power consumption has shown an improvement post lockdown easing for economic activities after 20 April.

Source: The Economic Times

Power regulator wants government not to infringe regulatory jurisdiction

QuIck Comment

Compromise of Power Regulators Independence will undermine Reform of the Power Sector!

Bad!

|

18 October. Power regulator Central Electricity Regulatory Commission (CERC) has advised the power ministry against jurisdictional overreach in framing regulations for the power sector that infringes the substantive functions of the Central Commission. The regulator has issued an advisory over the draft rules proposed by the ministry, asking the government to work in harmony by honouring the respective jurisdiction carved out in the Electricity Act 2003. The CERC said that several of the issues contained in the draft regulations fall under the purview of the states and the power ministry should first consult with the state governments before framing rules. The CERC letter highlights that the electricity and tariff policies in the country are to be framed in consultation with the state governments and the regulatory commissions so that the directions given in the policy is universally followed by all segments universally. So under the existing framework, the regulator has indicated to the ministry not to go ahead with framing of rules without taking all segments of the sector together.

Source: The Economic Times

KSEB to sell extra power generated at Moolamattam

15 October. KSEB (Kerala State Electricity Board) has received bids to purchase extra power generated at Moolamattom power plant. Earlier, the board had decided to surrender the power from Central pool and make use of the additional power generated at Moolamattom to tide over the rising water level at Idukki reservoir, KSEB said. After a meeting to discuss power position, the power plant has increased its generation, aiming to reduce the water level in the reservoir.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

MNRE proposes draft policy for promoting distributed renewable energy

20 October. The Ministry of New and Renewable Energy (MNRE) proposed a framework for promoting application of distributed renewable energy (DRE) in rural areas. DRE applications are those which are powered by renewable energy and used for earning livelihoods directly such as solar dryer, solar powered cold storage, solar charkha, solar lighting systems. For the standardisation of research and development, MNRE and other ministries would be helping in development of new devices and applications for the rural economy. MNRE would be pursuing financial institutions for credit facilitation. The market for distributed solar products for rural areas — such as solar lanterns, pump sets and mini-grids — was estimated to grow to ₹101.17 bn by 2023 before the pandemic hit. It is now reeling under financial stress due to lack of liquidity to support operations and government schemes yet to make a visible impact.

Source: The Economic Times

Inox Wind wins 40 MW orders from retail customers

20 October. Inox Wind said it has won orders to supply and install wind turbine generators of 40 MW capacity

from retail customers across various industries. The projects will be executed on a turnkey basis across locations in Gujarat and Karnataka. Inox Wind provides its customers with end-to-end integrated solutions for the entire wind power value chain. The orders are expected to be commissioned by March 2021.

Source: The Economic Times

60-70 polluting power plants to be closed soon: Javadekar

19 October. Union Environment, Forests and Climate Change Minister Prakash Javadekar announced that 60-70 pollution-causing power plants would be identified and closed in the next two years as he discussed steps taken by the Narendra Modi government to tackle the pollution menace. He said that power plants of Badarpur and Sonipat in Delhi-NCR have already been shut down. He said mainly 5-6 aspects contribute to the pollution — traffic, industry, garbage, dust, stubble burning and geographical factors. Listing the steps taken by the Modi government, he said that the use of BS-VI fuel reduces pollution by 25-60 percent, and a key step has been taken to promote BS-VI fuel at a cost of ₹620 bn. He said the cause of pollution in Delhi-NCR is also due to geographical factors. He said the Modi government framed new rules for construction and demolition management in 2016 in Delhi to manage pollution.

Source: The Economic Times

India will fully shift to renewable energy in next few decades: RIL

QuIck Comment

Statements on the shift towards renewables should reflect more than serial infatuation!

Ugly!

|

19 October. India will fully move away from fossil fuels to renewable energy in the next few decades, the chairman of Reliance Industries Ltd (RIL), operator of the world’s biggest refining complex, said. RIL, which operates two giant refineries with a combined capacity of 1.4 mn barrels per day (bpd) in western India, aims to become a net zero carbon company by 2035. India, the world’s third biggest oil importer and consumer, ships in about 80 percent of its oil needs.

Source: Reuters

India to gradually move towards alternative fuels: Oil Secretary

19 October. India will gradually transition from use of fossil fuels towards clean energy resources, Oil Secretary Tarun Kapoor said. He said Ethanol is a big focus area in the government’s plan towards clean energy sources. The government has set a target of 20 percent ethanol blending with petrol by 2030. He mentioned the successful implementation of a bio-ethanol pilot project in Pune and how it is contributing towards fulfilling the targets set by the government. Also, another pilot project for blending 10 percent Hydrogen with CNG (compressed natural gas) will be set up in Delhi to improve efficiency and reduce emissions of vehicles.

Source: The Economic Times

Chandigarh launches used cooking oil initiative to make bio-diesel

19 October. The Food Safety and Standards Authority of India (FSSAI) launched Repurpose Used Cooking Oil initiative to collect and convert used cooking oil into bio-diesel. The FSSAI has issued directions to all the states food authorities to initiate the process of disposal and collection of used cooking oil. More than 50 food business operators from across the city along with authorised aggregators and bio-diesel manufacture were present on the occasion.

Source: The Economic Times

MSEDCL scuttling solar roof top sector though negative policies

18 October. Maharashtra Solar Manufacturers’ Association (MASMA) has charged MSEDCL (Maharashtra State Electricity Distribution Company Ltd) with scuttling the solar roof top industry in the state by adopting negative policies. MASMA said that since April 2019 there was no subsidy scheme for solar roof top in Maharashtra and MSEDCL demanded just 25 MW subsidies for the entire state from the Ministry of New and Renewable Energy (MNRE) last year. According to the solar entrepreneur, when MASMA narrated the entire episode to the newly-appointed Energy Minister Nitin Raut, he intervened and instructed MSEDCL to restart the subsidy process immediately. Maharashtra Energy Development Agency (MEDA) which started phase 1 of the subsidy almost two years ago has more than 700 registered vendors. Currently, the solar fraternity of the state has more than 6000 integrators.

Source: The Economic Times

Andhra Pradesh has commissioned 8.2 GW renewable energy capacity so far

16 October. Andhra Pradesh, a major producer of renewable energy (RE), has installed RE generation capacity of about 8,207 MW till 30 September 2020, according to the latest data. The state had an installed RE capacity of about 8,203 MW till 31 July 2020. Of the 8,207 MW capacity installed till September, wind energy projects took the largest share with 4,080 MW capacity, followed by solar energy with a capacity of 3,535 MW commissioned, according to the New and Renewable Energy Development Corp of Andhra Pradesh (NREDCAP).

Source: The Economic Times

‘Mass movement needed to make Delhi solar capital’

15 October. Stating that Delhi could become the “solar capital of India,” Chief Minister (CM) Arvind Kejriwal inaugurated a 218 kilowatt (kW) solar power plant at Lady Irwin College. The power plant will generate over 3 lakh units of power each year resulting in a reduction in CO2 (carbon dioxide) emission of 274 tonnes annually. The CM said that to strengthen the solar power usage in Delhi, a mass movement was required. Discussing the government’s solar policies, the CM said, under one of them, Delhiites only had to give their rooftops.

Source: The Economic Times

Tata Power to develop 100 MW solar project in Gujarat

14 October. Tata Power has got a letter of award from Gujarat Urja Vikas Nigam Ltd (GUVNL) to develop a 100 MW solar project in Dholera Solar Park of Gujarat. The energy will be supplied to GUVNL under a power purchase agreement valid for 25 years from scheduled commercial operation date. Tata Power won this capacity in a bid announced by GUVNL in March. The project has to be commissioned within 15 months from the date of execution of power purchase agreement. With this award, the cumulative capacity under development in Gujarat will be 620 MW out of which 400 MW will be in Dholera Solar Park.

Source: The Economic Times

INTERNATIONAL: OIL

Saudi crude exports rise to 5.9 mn bpd in August: JODI

20 October. Saudi Arabia’s crude oil exports rose for a second consecutive month to 5.97 mn barrels per day (bpd) in August, from 5.73 mn bpd in July, according to data from the Joint Organizations Data Initiative (JODI). The country’s crude output rose by 500,000 bpd to 8.98 mn bpd in August, according to data. Crude exports from Saudi Arabia, the world’s largest oil exporter, fell to their lowest on record in June, according to data. Saudi domestic crude refinery throughput rose by 23 percent to 2.58 mn bpd in August, while direct crude burn rose by 57,000 bpd to 702,000 bpd.

Source: The Economic Times

Singapore suspends supply licences of Hin Leong shipping fuel unit

20 October. Singapore has suspended the licences to sell ship fuel held by a subsidiary of defunct oil trader Hin Leong Trading Pte Ltd since it could no longer meet the licensing requirements, the Maritime and Port Authority of Singapore (MPA) said. The MPA suspended the licences for Hin Leong’s subsidiary Ocean Bunkering Services Pte Ltd (OBS). MPA typically issues licences to supply bunker, or ship, fuel to vessels and to operate barges to transport the fuel to the ships. In 2019, OBS was the third-largest bunker fuel supplier by volume in Singapore, which is the world’s biggest bunkering hub with about 50 million tonnes (mt) of annual sales volumes.

Source: Reuters

Japan April-September crude import volume fell to the lowest since at least 1979

19 October. Japan’s customs-cleared crude oil imports fell 21.2 percent in the April-September period on year to the lowest since at least 1979 when the comparison data is available, the finance ministry said. The Covid-19 pandemic has hammered fuel demand as millions of people restricted their movements. Japan, the world’s fourth-biggest crude buyer, imported 67.95 mn kilolitres (2.34 mn barrels per day) of crude oil in the first six months of the fiscal 2020 year to March, the preliminary data showed.

Source: The Economic Times

OPEC+ to discuss weakening oil demand outlook

19 October. Oil producer group OPEC (Organization of the Petroleum Exporting Countries)+ will meet to discuss the weakening demand outlook in the face of rising coronavirus infections as well as increased output from Libya but is unlikely to recommend immediate action, OPEC+ said. The OPEC and allies including Russia, collectively known as OPEC+, have been reducing output since January 2017 in an effort to balance the market, support prices and reduce inventories. OPEC+ experts discussed risks of a persisting supply overhang in 2021 in the event of a prolonged and severe second wave of the Covid-19 pandemic.

Source: Reuters

Global oil demand to recover by 2022: Saudi Aramco

14 October. Global demand for crude could recover to pre-coronavirus levels by 2022, Saudi Aramco said, as the International Energy Agency (IEA) projected it could take at least a year longer. The Covid-19 pandemic has plunged the global economy and oil demand into a tailspin and sparked speculation that the world might have reached peak oil demand. the OPEC (Organization of the Petroleum Exporting Countries) oil cartel

predicted crude consumption would continue to grow during the next quarter century, driven in large part by greater use of cars in developing countries. OPEC’s forecast contrasts with that of some industry players, including major oil firms such as BP, which in its latest long-term estimates predicted that oil demand had already peaked or would soon do so thanks to increased use of renewable energy and the impact of the virus.

Source: The Economic Times

INTERNATIONAL: GAS

Japanese sell out of Australian LNG import project

20 October. Australian billionaire Andrew Forrest has taken over full control of a A$250 mn ($176 mn) gas import terminal in New South Wales, buying out stakes held by Japan’s JERA and Marubeni Corp in a push to speed up the project. The deal sees Squadron take full control of the Port Kembla Gas Terminal project that AIE is developing. JERA, owned by Tokyo Electric Power and Chubu Electric Power, said the liquefied natural gas (LNG) import terminal made sense for a region that faced tight gas supply. JERA and Marubeni have indicated they would be open to working with AIE in the future, including lining up LNG supplies and building an associated gas-fired power station. AIE has been pushing to reach a final investment decision on the Port Kembla project this year, in order to start importing LNG by 2022, with construction expected to take 14 to 16 months. The project is one of five aiming to import LNG into southeast Australia to fill a looming shortage expected from 2024 as gas supply from the Bass Strait fields off the coast of Victoria rapidly declines.

Source: Reuters

Bangladesh may cancel November LNG import tender after receiving high offers

19 October. Bangladesh may cancel a tender to import liquefied natural gas (LNG) in November, after receiving offers to supply the shipments that were too expensive. Rupantarita Prakritik Gas Company, which is in charge of LNG imports into the country, received offers from the Asian unit of Vitol and Swiss trader AOT Energy to supply 138,000 cubic metres of LNG for 12-13 November delivery. Vitol submitted the lowest offer but it was still higher than the prices of LNG that Bangladesh pays under long-term contracts with Oman and higher than the price of an earlier spot cargo. Bangladesh imported 3.89 million tonnes (mt) of LNG in 2019 under its long-term contracts with Oman Trading International and Qatar gas, with price ranges of about $5.50 to $6 per million metric British thermal units (mmBtu). However, prices for spot cargoes, or shipments typically for next month delivery, are gaining on expectations that colder weather during the Northern Hemisphere winter will increase LNG demand for heating. The November cargo was expected to be the second one Bangladesh would purchase in the spot market. Rupantarita bought Bangladesh’s first spot LNG cargo ever from Vitol at $3.8321 per mmBtu for delivery over late September to early October. Bangladesh, with a population of about 160 mn people, is set to become a major LNG importer in Asia as domestic gas supplies fall.

Source: Reuters

Greece gets three initial bids for offshore gas storage facility

19 October. Greece has received three initial bids for a contract to develop and run an underground gas storage

facility in the northern Aegean Sea, the agency (HRADF), which manages the concession, said. The agency said the bidders are China Machinery Engineering with Maison Group, Greece’s DESFA with GEK Terna, and Energean Oil & Gas. The contract covers the development and operation of the storage facility, which is in an almost depleted deposit off the northern Greek city of Kavala, for up to 50 years. The almost depleted “South Kavala” gas field, which is run by Energean, has an estimated storage capacity of one billion cubic meters (bcm).

Source: Reuters

Turkey raises Black Sea field’s reserves to 405 bcm: President

17 October. President Tayyip Erdogan said Turkey had raised the estimated reserves in a gas field off its Black Sea coast to 405 billion cubic meters (bcm) after finding an additional 85 bcm. In August, Erdogan announced that the field contained 320 bcm of gas, making it Turkey’s biggest natural gas discovery.

Source: Reuters

Abu Dhabi Pension Fund, ADQ to invest $2.1 bn in ADNOC gas assets

15 October. Abu Dhabi Pension Fund (ADPF) and state holding company ADQ will invest $2.1 bn in Abu Dhabi National Oil Co (ADNOC) gas pipeline assets, ADNOC said. They will take a 20 percent stake in ADNOC Gas Pipelines, it said, a subsidiary with lease rights to 38 gas pipelines covering 982 kilometre (km).

Source: Reuters

INTERNATIONAL: COAL

Poland’s PGE to split coal assets by end of 2021

19 October. Poland’s biggest energy group PGE should separate its coal assets from other activities by the end of 2021, the company said. Poland is the only EU (European Union) state that refuses to pledge climate neutral by 2050, with the ruling Law and Justice (PiS) party claiming that the country needs more time to switch its economy from coal to zero-emission sources. PGE wants to become climate neutral through carving out its coal assets, which include lignite mines and power stations, and through investment in wind farms, offshore and onshore, solar power stations and in energy storages. Separating coal assets will help PGE raise financing from banks, which are reluctant to provide loans to coal-related groups.

Source: Reuters

Chinese coal customers have made deferment requests: BHP

14 October. BHP Group has received deferment requests from Chinese coal customers, Chairman Ken

MacKenzie said, after reports that China had put a freeze on accepting Australian coal amid trade tensions between the two countries. Trade industry reports suggested that some Chinese ports had been told not to accept either type of Australian coal, and that such shipments were being sold along to other markets at the last minute. China’s coal imports had been expected to slow in the second half, after heavy imports earlier this year and weaker than expected demand due to coronavirus-related disruption, spurring China to act to support its domestic industry. Customs data shows that China has taken less coal from Australia and also Indonesia in the past month. China is the biggest importer of Australian coal, taking 27 percent of its metallurgical coal in the year to June and 20 percent of its thermal coal, which the Australian government estimates was worth A$13.7 bn ($9.82 bn) last year behind China’s iron ore imports which were worth A$84.9 bn.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

EU Environment Ministers to agree to make climate neutrality by 2050 binding

20 October. EU (European Union) Environment Ministers are set to agree this week to make the bloc’s pledge to be climate neutral by 2050 legally binding, although tough questions about how deeply to cut emissions over the next decade will be left to leaders to discuss in December. The bloc, which takes big decisions by consensus among its 27 member states, is inching its way towards tighter emissions goals in time for a year-end deadline under the Paris climate agreement to spell out targets for 2030. Over the next decade, the Commission wants to cut emissions by at least 55 percent from 1990 levels. But some countries, especially those that burn coal, want more guarantees

that the economic burden of the transformation will be shared. Leaders agreed at a summit last week to gather more information on how the new target will affect individual countries – a key demand of coal-heavy Poland – before trying to reach a deal in December on the 2030 target.

Source: The Economic Times

US sees $18 bn from purchases in nuclear power agreement with Poland

19 October. The United States (US) and Poland have struck a nuclear power agreement in which Poland will likely buy $18 bn in nuclear technology from US companies, the US energy department said. The US has been competing with China and Russia and other countries to supply nuclear power technology to countries hoping to build their first reactors, or boost their programs. Poland, traditionally a large purchaser of Russia’s natural gas, which competes with nuclear power, aims to halt those purchases after 2022. Over the next 18 months, the US and Poland will work on a report for the program that seeks to build six reactors, as well as potential financing arrangements, the department said.

Source: Reuters

New York approves rules allowing state to procure renewable power

17 October. New York utility regulators approved rules that will allow the state to procure renewable power needed to achieve the goals of the state’s clean energy law. New York has mandated that 70 percent of the state’s electricity come from renewable sources by 2030 and all power come from zero-emission sources by 2040. In 2019, 36 percent of New York’s power came from burning natural gas, 34 percent from nuclear, 23 percent from hydropower, 3 percent from wind and 1 percent each from biomass and other sources, according to federal energy data. The rules announced by New York Governor Andrew Cuomo give the state the authority to

issue requests for proposals for renewable power needed to implement the state clean energy plan. The state said the plan will increase the use of offshore wind from 2,400 MW by 2030 to 9,000 MW by 2035.

Source: The Economic Times

Norway’s Scatec Solar to buy hydropower firm SN Power in $1.1 bn deal

16 October. Norwegian solar firm Scatec Solar said it had agreed to buy state-owned hydropower firm SN Power in a $1.17 bn deal as it transforms itself into a global renewables company. The combined company would have 450 employees and own 3.3 GW of in operation and under construction power plant capacity in 14 countries, and annual production of 4.1 terawatt hours (TWh), Scatec Solar said. Scatec owns and runs solar farms in Africa, Asia, Europe and Latin America, while SN Power builds and operates dams in southeast Asia and Africa. The deal would also help Scatec Solar expand in growth markets for renewable energies such as sub-Saharan Africa and southeast Asia, Scatec Solar said.

Source: Reuters

DATA INSIGHT

Source: Reuters

Source: OPEC

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV