COAL DEMAND PICKS UP WITH SUMMER HEAT

Monthly Coal News Commentary: June 2019

India

India’s annual coal demand rose 9.1% to 991.35 mt during the year ended March 2019. Coal is among the top five commodities imported by India, one of biggest importers of the fuel despite having the world’s fifth largest reserves. Consumption by India’s utilities, which accounted for three-fourths of the total demand, rose 6.6% to 760.66 mt. Imports rose to 235.24 mt in 2018-19 from 208.27 mt in 2017-18. Domestic supplies rose to 734.23 mt during the year ended March 2019. India’s supply shortfall more than doubled to 23.35 mt, mainly because of CIL’s inability to cater to demand from the cement and sponge iron industries. Demand from the cement sector rose 70% to 37.22 mt while coal demand from the sponge iron industry rose by over two-thirds to 41.33 mt. A ban on the use of petroleum coke, a dirtier alternative to coal, in some parts of the country, and CIL’s focus on power sector ahead of the elections amid a promise to electrify all rural households in the country led to a rise in imports. CIL is prioritising starting production at mines with a capacity of more than 10 mt per year and improving mechanisation to increase output. CIL’s output rose 7% to 606.89 mt in 2018-19, and is targeting a production of 660 mt in 2019-20.

CIL targets more than 8% growth in production at 660 mt in 2019-20 compared to 607 mt in the last fiscal and plans a capital expenditure of ₹100 bn in the current fiscal. The target for revenue from operations (net) has been fixed at ₹1 tn for FY2019-20. The targets were fixed during a meeting between the coal ministry and CIL held recently. As laid down in the MoU 2019-20, CIL has to ramp up its coal production growth to 8.75% over the previous year. CIL closed 2018-19 with a coal production of 606.88 mt, against the MoU target of 610 mt. CIL which accounts for over 80% of domestic coal output had set an internal aspirational target of 652 mt FY2018-19, but could not go closer to it as things did not fructify as perceived. Coal imports rose by 9.5% to 18.33 mt in September, after having registered year-on-year decline for five months in a row, as some power plants faced fuel shortages. There was a revival of coal demand post monsoon rains. At present the buyers are looking for restocking for the approaching winter months. The healthy growth in coal-fired generation of late has raised coal demand in the country, resulting in higher off-take from domestic sources as well as imports of the material. Of the 18.3 mt of coal imported in September, 12 mt was non-coking coal, followed by coking coal at 4.1 mt and 1.4 mt pet coke among others. In April, the first month of the ongoing fiscal, India’s coal imports declined marginally to 19.08 mt as against 19.63 mt in the same month of 2016-17. In May, they came down to 18.38 mt as against 19.38 mt a year ago. In June the imports again dropped to 18.22 mt, against 21.50 mt a year-ago. In July, they were at 14.64 mt, down from 19.15 mt. In August, the import of coal were down to 18.80 mt as against 19.75 mt same month of 2016-17. Import of coal saw a decline of 6.37% to 191.95 mt in 2016-17 on higher production by CIL that saw the country move to a regime of surplus coal. CIL accounts for over 80% of the domestic coal production.

CIL plans to hire merchant bankers to carry out financial due diligence for acquiring equity stakes in identified mines and companies in Australia as part of its plan to meet the growing dry fuel demand in the country. The company has identified coal assets in Australia for acquiring equity stakes along with offtake rights in an asset or a company, CIL said in a notice inviting proposals from investment bankers. CIL looks to acquire assets abroad as it expects that domestic production would not be sufficient to meet coking coal and high-grade fuel demand from various sectors. The demand-supply gap in India is high due to enhanced requirements from various sectors, including power and steel. CIL accounts for over 80% of domestic coal output. India’s coal import increased by 8.8% to 233.56 mt in 2018-19. Non-coking coal imports were at 164.21 mt in 2018-19, about 13.25% increase over 144.99 mt recorded in 2017-18. Coking coal import was almost flat at 47.73 mt last fiscal compared to 47.22 mt in 2017-18. CIL is targeting more than 8% growth in production at 660 mt in 2019-20. CIL is looking for minority stakes in operational coking coal mines in Russia, Canada and Australia. Based on its experience it may gradually increase stakes, following which it may buy them out, and then look for new blocks in these countries, CIL said. The company has renewed its effort to acquire foreign coking coal assets as the fuel is getting unpopular in many countries, which can help the Indian company get a good price. Large banks in these countries have backed out from financing coal mines and thermal power plants. Many bankers have stayed away from such deals. CIL wants to grab this opportunity by using internal accruals to finance such acquisitions. After merchant bankers are appointed the company will finalise the assets, in which CIL may buy a minority stake to begin with. Many bankers such as Goldman Sachs and Merill Lynch stayed away from the tender as the asset is considered dirty but ANZ, BNP Paribas, JP Morgan and some others have shown interest. CIL’s past experience in acquiring foreign assets is not a happy one. It had acquired a exploratory block in Mozambique in August 2009. It gave away the block as preliminary exploration showed that the block did not have good quality reserves

CIL has decided to offer 21.5% additional coal this fiscal to power generators through forward e-auctions, while it will reduce offerings in the spot auction market from 2018-19 level by almost 4%. The company will offer 33 mt of coal through forward e-auctions in 2019-20 compared with 27.14 mt in 2018-19. About the same quantity will be offered through the spot auctions market during the year compared with 34.34 mt in 2018-19. For the non-power sector, CIL will offer about 64 mt of additional coal for long-term supply contracts through an auction mechanism. The rest of the coal, estimated at about 530 mt, will go to power producers with long-term supply contracts. According to a special forward auction calendar for 2019-20 prepared by CIL, the highest quantity of 8.5 mt will be offered by CIL subsidiary South Eastern Coalfields Ltd, followed by MCL at 8 mt. Northern Coalfields Ltd plans to offer about 5 mt while Central Coalfields Ltd will be offering 3.85 mt. Western Coalfields Ltd plans to offer 2.9 mt. In September this year, CIL plans to offer 6.3 mt of coal– the highest in any month during the year. Spot and forward auctions offer CIL better realisation on the coal it sells. In 2018-19, it managed to command premiums that were 92% more than the notified prices of coal in the spot auction market, since it sold 38% less coal than the previous corresponding period. Premiums were 72% more than the notified price in the special forward auction market for power during 2018-19. Prices at exclusive e-auctions for the non-power sector were on an average 58% higher than their notified rates.

CIL recorded a 44% rise in 2018-19 e-auction prices, up from 20% a year ago, thanks to a spurt in demand and higher international rates. In 2018-19, the state-run miner got premiums of 58-92% in forward and spot markets over the notified price and the average price per tonne of coal hit ₹2,653 from ₹1,841. For the quarter ended March 31, 2019, the average realisation was up 30 per cent to ₹2,754 a tonne from the year-ago period. Spot e-auction volume fell because CIL had to meet its obligations to long-term customers having fuel-supply agreements. CIL had 76.42 mt of coal, or 12.56% of its total sales, at auctions in 2018-19. CIL’s average price from coal sold through fuel supply agreements rose 8.45% to ₹1,348 per tonne during the year. For the March quarter, it was ₹1,460 per tonne — a 4.06% rise over the previous corresponding period. This year, CIL will offer 60-70 mt in spot and forward auctions.

Power generating companies have asked CIL to increase the supply of the dry fuel from Korba area in Chhattisgarh through rail wagons to help them reduce transportation cost as well as tariffs for end-consumers. Korba region serves 20% of the domestic coal supply but CIL-arm SECL is able to meet only 55% of its demand from the region through rail, according to APP. The APP in a letter to CIL mentioned that power producers are incurring around 25% higher costs to move coal by road as against rail mode. Against a demand of 45 rakes per day, Korba area is currently loading only 25 rakes per day, the APP said. Due to lack of supply through railways, power producers are compelled to bank on inefficient and expensive truck transportation for coal procurement. One rake can load 4,000 tons of coal, which means producers have to ply 135 trucks carrying 30 tonnes each. The SECL controls Chhattisgarh Korba coal field that produces close to 130 mt of coal that can fire 32,000 MW of electricity generation capacity. India has close to 200 GW of power generation capacity dependent on coal that often struggles to procure the desired quality and quantity of fuel in a time-bound manner. The APP has said that electricity consumers are compelled to pay higher tariffs since this cost burden is passed on to them. Last year in December, the coal ministry and CIL announced to take requisite steps to improve infrastructure at coal mines to ensure 100% supply of coal to power plants through the rail mode.

MCL said it will more than double production to 300 mt by 2026 with long-term planning and inclusion of new technology. MCL, a subsidiary of mining major CIL produced around 144 mt during 2018-19 and has set a target of 160 mt this fiscal. Out of the 300 mtpa coal production target set by MCL, 200 mt will be produced by Talcher coalfields alone.

RPower has started the process to sell its coal mines in Indonesia and is expected to close the deal in few months. The deal, if completed, is expected to fetch the financially troubled group $150-200 mn. RPower holds three coal concessions that are fully explored and are ready to produce coal. The total capacity for these mines includes 1.4 bn metric tonnes coal and 450 mn metric tonnes of coal reserves. RPower was among those Indian power companies who aimed to secure coal supply from Indonesia as coal prices soared in 2010. However, with the crash in commodity prices in the following years, most of these acquisitions turned unviable for Indian power companies.

India’s Adani Enterprises received the go-ahead to start construction of a controversial coal mine in outback Australia, after a state government approved a final permit on ground water management. First acquired by Adani in 2010, the project is slated to produce 8-10 mt of thermal coal a year and cost up to $1.5 bn, but has been mired in court battles and opposition from green groups. The approval potentially paves the way for half a dozen new thermal coal mines to come on line in Australia by opening up Queensland’s remote Galilee basin with rail infrastructure to the coast 320 km away at Abbot Point. Holders of other coal deposits in the basin include some of Australia’s wealthiest iron ore magnates such as Gina Rinehart, who has a joint venture with India’s GVK Group, and controversial one-term politician Clive Palmer. The decision comes as other developed nations step up strategies to meet Paris Agreement emissions targets, and as many banks and insurers scale back exposure to coal and to new thermal coal mines in particular. Adani has scaled back initial plans for a 60 mtpa mine and has said that it will self-fund the project, backed by ready buyers in its own Indian power plants and its trading business.

Rest of the World

Northern China’s Shanxi province ordered 82 coal mines in the first five months of the year to either stop production or construction after uncovering hidden safety dangers at their sites. The authorities carried out 2,167 inspections in Shanxi over the January-May period, with 32,612 hidden dangers and 99 major hidden dangers found, the Shanxi Coal Mine Safety Administration and the provincial emergency management department said. Shanxi is China’s second-biggest coal-producing region after Inner Mongolia, with an output of over 893 mt in 2018, according to the National Bureau of Statistics. At the end of May, Shanxi had 988 coal mines in operation, according to the Shanxi Coal Mine Safety Administration. China has been stepping up inspections on its coal mines after a spate of recent accidents, including a mine collapse in neighbouring Shaanxi province that killed 21 miners in January. In May, China’s state planner, the National Development and Reform Commission, said it would ramp up closures of small coal mines to boost safety and reduce pollution, and that it plans to cut the number of small coal mines nationally to less than 800 by 2021.

China’s National Energy Administration said it will curb output by 20% at coal mines at risk of “bumps”, or sudden jolts inside a mine that often lead to serious damage and injuries. China has 400 mt a year of coal mining capacity at risk of bumps - more than 10% of the country’s total capacity of 3.53 bt. The administration said that production curbs would be implemented on mines that are more than 1,000 meters deep. The move follows an announcement from the National Coal Mine Safety Administration last month capping output at mines deemed at risk of ‘bumps’ to 8 mt. Coal mining safety in China remains poor, with several deadly accidents every year, despite frequent inspections and support from Beijing to improve conditions. Nearly two-thirds of mines at risk for bumps are located in regions with lean coal resources, making them key to ensuring sufficient coal supply in those areas.

Commodity trader Noble Group sees thermal coal prices coming under pressure over the next few years given an oversupply and waning demand from Europe where natural gas and renewables are gaining a greater market share. Futures prices for coal and natural gas also point to gas remaining as a more economical source of power generation, further depressing the outlook for coal. In South Korea, coal and gas generation have both lost ground to nuclear generation.

The Indonesian government has set its coal benchmark price (HBA) for June at $81.48 per tonne, energy ministry website showed, down from $81.86 per tonne for May. June marked a tenth straight monthly drop for the benchmark price and the lowest price since July 2017, according to Eikon Refinitiv data. The Indonesian benchmark price has been under pressure in recent months due to import restrictions in markets like China and India, although the decline rate in June slowed from the previous month’s rate.

An Australian state granted mining leases for a coal mine controlled by Korea Resources Corp, clearing the way for a project that green groups and some local communities have battled for more than a decade. The final approval from the New South Wales state government follows a surprise victory for the pro-coal conservative government in an Australian election in which climate change had been a key issue. The election outcome has put pressure on state governments that had been opposed to new coal mines to clear the way for projects that have long been held up, to create new jobs. Korea Resources Corp, leading the Wyong Areas Coal Joint Venture, plans to dig an underground mine to produce up to 5 mt a year of thermal coal for power stations over 28 years, aiming to start production in late 2022 or early 2023.

Ausralian-based diversified miner South32 Ltd said it has lowered the estimated coal reserves at its Illawarra Metallurgical Coal project. The company said coal reserves for the Bulli seam have been reduced by 22 mn wet metric tonnes to 114 metric tonnes following conclusion of a commercial agreement to relinquish a portion of its mining lease in the Appin area. Coal reserves for the Wongawilli seam were unchanged, it said. The Illawarra project accounts for nearly all of South32’s coking coal output. Scores of Kenyans protested a project to build a coal power station near the Lamu archipelago, a popular tourist spot that includes a UNESCO World Heritage site and vibrant marine life. A group of about 200 protesters carrying black coffins emblazoned with white skulls, as well as a miniature chimney spewing smoke, marched through downtown Nairobi chanting "coal is poisonous!" Campaigners argue the project is a costly and damaging venture that makes little sense at a time when most of the world is turning away from coal plants and investing in increasingly cheaper renewable energies. It will be the first coal-fired power station in East Africa, and will import coal from South Africa until Kenya begins mining operations its own mining operations.

Developers of coal mines and coal-fired power plants in Asia are facing difficulties growing their businesses as global financial institutions refuse to back their projects to avoid criticism over climate change, industry participants said. More than 100 major financial institutions have divested from thermal coal projects by February, along with more than 20 significant insurers, according to the Institute of Energy Economics and Financial Analysis. Indonesia is planning to add 35 GW of power capacity by 2024 of which 54% will come from coal-fired plants. The lack of funding may delay plants in other markets where thermal coal demand is expected to grow, including India and Vietnam, which are depending on low-cost coal-fired power to support their developing manufacturing sectors. Japan’s Mizuho Financial Group Inc and Mitsubishi UFJ Financial Group both said they would tighten their financing policies for coal-fired power projects to tackle global climate change. For miners, the withdrawal of financing is also threatening new thermal coal supply, particularly for smaller companies.

Eight of the EU’s 28 countries have pledged to phase out coal for electricity production by 2030 to reduce greenhouse gas emissions. The European Commission, the EU’s executive arm, received the pledges as contributions to the bloc’s efforts to deliver on the 2015 Paris climate agreement. EU climate and energy commissioner said that among the European Union countries introducing or confirming such timelines, France intends to phase out coal by 2022 -- before Italy and Ireland by 2025. Under the 2015 Paris treaty, the EU pledged to reduce its carbon emissions by 40% below 1990 levels by 2030. Referring to coal plants, the EU commissioner said it is "pretty clear" that fossil fuels have no place in a carbon-neutral economy the commission hopes EU countries endorse for 2050.

Norway’s $1 tn sovereign wealth fund may have to sell its $1 bn stake in commodities giant Glencore, among other companies that derive more than 30% of their revenue from coal, to meet proposed tighter ethical investing rules. Under the center-right government’s plan, expected to be adopted by Norway’s parliament, the world’s largest fund would no longer invest in companies that mine more than 20 mt of coal annually or generate more than 10 GW of power with coal. Uniper said its generation capacity globally was less than one third coal-based.

Greece’s PPC said that a €1.4 bn ($1.6 bn) coal-fired plant project is at risk without a capacity remuneration mechanism, following a jump in carbon emissions costs. Capacity mechanisms are measures introduced by some EU member states to compensate power producers for making available electricity. Greece has been in talks with the European Commission for a capacity mechanism for PPC, which is 51% owned by the Greek state. The mechanisms must conform with EU guidelines on state aid.

Talen Energy said it will retire two units at its Colstrip coal-fired power plant in Montana at the end of 2019 for economic reasons. That planned retirement is about two and a half years earlier than previously expected. In the past, Talen said it planned to shut Colstrip Units 1 and 2 in mid-2022. The units are two of dozens of coal plants expected to shut this year as cheap natural gas from record shale production has kept electric prices low in recent years, making it uneconomic for some generators to continue operating older, less efficient coal plants. The total capacity of Units 1 and 2 is 614 MW. Talen said the two other units, 3 and 4, at Colstrip will remain in service.

Three US senators urged the IRS to crack down on a $1 bn-a-year subsidy for burning chemically treated refined coal, after a new study showed some power plants using the fuel produced surging amounts of mercury and smog instead of cutting pollution. Companies can qualify for the subsidy by showing pollution cuts in lab tests. Pending legislation in the Senate would extend the coal subsidy program another decade, costing taxpayers at least $10 bn at current consumption levels. The IRS, which oversees the tax credit program, allows large companies to qualify for the tax credits by burning relatively small amounts of refined coal during one-day tests in a laboratory in lieu of real-world testing at power plants. The IRS requires certified results that show burning refined coal cuts either mercury or sulfur dioxide pollution by at least 40% and nitrogen oxide by at least 20%. Certified results from a lab unlock a tax credit of $7.17 for each ton of refined coal burned at a power plant.

| CIL: Coal India Ltd, FY: Financial Year, mt: million tonnes, mn: million, bn: billion, tn: trillion, MoU: Memorandum of Understanding, APP: Association of Power Producers, SECL: South Eastern Coalfields Ltd, MCL: Mahanadi Coalfields Ltd, RPower: Reliance Power, km: kilometre, mtpa: million tonnes per annum, bt: billion tonnes, GW: gigawatt, EU: European Union, PPC: Public Power Corp, US: United States, IRS: Internal Revenue Service |

NATIONAL: OIL

IOC close to deal for Panama-flagged vessel as Indian vessels fail to match

2 July. Indian Oil Corp (IOC) is close to chartering a Panama-flagged ship rather than an Indian vessel in its first tender to hire an oil tanker with scrubbers that remove sulphur emissions. In December last year, IOC issued a global tender and offered Indian shippers a first right of refusal as the nation seeks to boost its shipping industry. India, the world’s third biggest oil importer, wants to promote the market share of its vessels in bringing in crude imports. But it is the Panama-flagged very large crude carrier (VLCC) Bright Pioneer, owned by Nissen Kaiun Co Ltd, that has emerged as the likely winner for a daily rate of $30,000-$32,000. Indian companies, including SCI, Great Eastern and Seven Island Shipping participated in the IOC tender. IOC will be using Bright Pioneer from January for at least five years, giving its Singapore-based operator Global United Shipping Company a period of six months to install the scrubbers. The duration of the IOC contract can be extended by another two years to a total of seven.

Source: Reuters

Indian oil companies’ output from foreign assets up

2 July. Oil and gas output from Indian assets overseas is roaring while domestic production is on a decline. Indian oil companies’ share in production from the overseas oilfields rose two-and-a half times in five years to 24.7 million metric tonnes of oil equivalent (mmtoe) in 2018-19. In the same period, local production fell 6% to 67.1 mmtoe. Investments in producing assets in Russia and the UAE (United Arab Emirates) in recent years have primarily led to the spike in overseas production, according to ONGC Videsh Ltd, the overseas arm of Oil and Natural Gas Corp (ONGC) that is mandated to scout for investment opportunities overseas as part of India’s energy security strategy. A participating interest in foreign oilfields gives Indian companies the ownership of the oil and gas produced from such fields in proportion to their stakes. But Indian companies rarely get their share of produce to India since it is uneconomical to ship that from far-off oilfields. But such investments act as a financial hedge for the country when oil prices rise. In some cases, though, companies do carry home their share of oil such as in the case of UAE’s Lower Zakum Concession where ONGC, Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL) together purchased 10% stake last year.

Source: The Economic Times

Proposal to stop supply of kerosene to section of ration card

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Stopping supply of kerosene to users of electricity and gas will contribute to emission reduction!

< style="color: #ffffff">Good! |

1 July. A proposal to snap supply of kerosene to ration card holders having electricity and cooking gas connections was opposed in the Rajya Sabha, with a member saying it would severely impact fishermen who use the fuel to fire their boats. The issue was raised in the Upper House of Parliament by Jose K Mani of the Kerala Congress (M) through a Zero Hour mention. In Kerala, more than 85 lakh ration cardholders have power connections. Only 60,128 families have no cooking gas or power connections. At present, ration cardholders who do not have power connection are provided with 4 litres of kerosene at subsidised rates. Mani said the move by the Union Ministry of Petroleum and Natural Gas is based on the premise that subsidised kerosene is to be used only for cooking and lighting purpose. But this would adversely impact fishermen who use kerosene in their fishing boats, he said.

Source: Business Standard

LPG refills to be cheaper by ₹100

1 July. Your LPG bill will go down by ₹100.50 for each refill and the effective payout will come down to ₹494.50 after adjusting the subsidy from the government due to softening prices in the international market and a favourable dollar-rupee exchange rate. According to the country’s largest fuel retailer Indian Oil Corp (IOC), the price of unsubsidised domestic LPG (liquefied petroleum gas) cylinder will come down to ₹637 from ₹737.50. The government will transfer ₹142.65 as subsidy directly into the bank account of the consumer for each cylinder. The reduction comes a month after nearly 4% increase in the price, amounting to an increase of ₹25 per cylinder. The international prices and rupee exchange rate have a lag before taking effect. The government subsidises 12 cylinders of 14.2 kilogram (kg) each per household in a year. For any additional purchases, the consumer has to bear the market price. The extent of the subsidy varies from month to month, depending on changes in the average international benchmark LPG prices and foreign exchange rate.

Source: The Economic Times

Cairn stops paying royalty on Rajasthan oil after differences with ONGC

1 July. Cairn Oil & Gas, a vertical of mining Vedanta Ltd, has stopped paying for its share of royalty on oil produced from its Rajasthan block following differences with partner ONGC on cost recovery. As much as $400 mn of royalty dues since July 2017 have not been paid to Oil and Natural Gas Corp (ONGC). ONGC is the licensee of the Barmer block in Rajasthan, home to India’s biggest onland oil discovery to date, and is responsible for payment of royalty at the rate of 20% of the oil price on the entire output from the field irrespective of its stake. However in 2011, when ONGC gave its nod to Cairn being taken over by Vedanta, it was agreed that the two partners would pay for royalty in proportion to their share -- so Cairn was to pay for royalty on its 70% share of oil and ONGC on 30%. The government had a few years back allowed exploration for oil and gas within an area that already has an oil or gas discovery and has been earmarked as production area.

Source: The Economic Times

Oil India seeks partners for ramping up production from ageing fields

29 June. Oil India Ltd, the country’s second-largest state-owned petroleum explorer, has floated a tender seeking technology partners for ramping up production from two of its old and ageing fields in Assam and Rajasthan. The partner is expected to enhance output from the marginal fields including Digboi in Assam and Baggitibba in Rajasthan with total in-place hydrocarbon volume of around 49 million tonnes (mt) of oil equivalent. The new technology partner will infuse a new & appropriate fit for technology to increase the production and a notice inviting the offer is available at the company’s e-tender portal. The offer is valid till 20 December 2019.

Source: The Economic Times

PM Modi seeks steady oil supplies from Saudi Arabia amid Gulf tensions

29 June. Prime Minister (PM) Narendra Modi held bilateral talks with Crown Prince of Saudi Arabia Mohammed bin Salman and discussed deepening cooperation in trade and investment, energy security and counter-terrorism with the "invaluable strategic partner" in Osaka. Modi, who is in Japan for the G20 Summit, met with the Saudi Prince on the margins of the summit after the informal BRICS leaders' meeting. Saudi Arabia is India’s top supplier of crude oil but the two countries have expanded their relationship beyond energy, and their governments have agreed to build a strategic partnership.

Source: The Economic Times

NATIONAL: GAS

GAIL issues tender to sell and buy LNG

2 July. GAIL (India) Ltd has offered two cargoes of liquefied natural gas (LNG) for loading from the Cove Point plant in the United States in August and November. The cargoes will be offered on a free-on-board (FOB) basis. GAIL is also seeking an LNG cargo for India’s Dahej terminal for late December delivery on a delivered ex-ship. The tender for the swap deal closes on 3 July.

Source: Reuters

India lowers tariff for KG basin gas pipeline network by 64%

1 July. India has fixed about 64% lower tariff for the Krishna-Godavari (KG) basin gas pipeline network at ₹16.14 per million metric British thermal units (mmBtu), according to an order by the Petroleum and Natural Gas Regulatory Board (PNGRB). The previous tariff was ₹45.32 and India’s biggest pipeline operator, GAIL (India) Ltd, had proposed a revision to ₹47.20 per mmBtu for the pipeline network that begins from Krishna Godavari basin in the east coast, the order said. However, the Board has fixed tariffs for Jagdishpur-Haldia-Bokaro-Dhamra pipeline and Hazira-Vijaipur-Jagdishpur pipeline in line with GAIL’s proposal.

Source: Reuters

Mahanagar Gas to raise CNG, piped gas prices in Mumbai from 1 July

30 June. Mahanagar Gas Ltd (MGL) will hike prices of compressed natural gas (CNG) and Domestic piped natural gas (PNG) in Mumbai and the surrounding area by 32 paise per kilogram (kg) and 23 paise per standard cubic meter (scm), respectively, with effect from 1 July. The price of CNG will be hiked to ₹51.99 per kg. The cost of domestic PNG will be revised to ₹31.79 per scm (slab 1) and ₹37.39 per scm (slab 2). The company cited an increase in tariff at its Trombay RCF and Uran-Thal-Usar pipelines for the increase in the base prices of gas. The hike in the CNG price is expected to have a slight impact on the running costs of autos and taxis, raising it by 1 paise per km and 2 paise per kilometre (km), respectively. MGL last raised the cost of CNG and domestic PNG on 4 April.

Source: Moneycontrol.com

ONGC seeks partners to raise output from 64 small fields

28 June. Oil and Natural Gas Corp (ONGC) invited proposals from firms willing to partner with it in raising oil and gas production from its 64 marginal fields. These 64 fields have been clubbed into 17 onshore contract areas that have a cumulative 300 million tonnes (mt) of oil and oil equivalent natural gas reserves, the company said. ONGC wants partners who can raise output beyond a pre-agreed baseline and will share revenues from such incremental production with them. ONGC invited bids under the production enhancement contract (PEC) from the interested companies who can bring in technology for raising the output. The company will hold a pre-bid meeting on 17 September and bidding will close on 20 December 2019. The government has been unhappy with ONGC over its stagnant oil and gas production and inducting partners in small and marginal fields was a way of raising output that was agreed to in a meeting with Prime Minister Narendra Modi on the issue last year. ONGC had previously experimented with PEC contracts for two fields but has not been able to select a partner because of receiving conditional bids.

Source: Business Standard

Gujarat HC upholds rise in gas transmission charges

26 June. The Gujarat High Court (HC) has lifted its stay on the Petroleum and Natural Gas Regulatory Board’s decision to hike gas transmission charges and ordered Torrent Power Ltd to pay the charges accordingly since 2012. A part payment was made by the power company, but with the revision of gas transmission tariff in December 2018, the HC stayed the recovery by the Gujarat State Petronet Ltd (GSPL) as well as payment of increased rate for gas transportation. With the interim order by the HC upholding the Board’s decision to raise transmission charge to ₹34 per million metric British thermal units (mmBtu), the GSPL can recover the pending amount from Torrent and levy increased charges. The HC has also lifted a stay on the Board’s tariff order with regard to South Gujarat Small Gas Consumers Association, which draws gas from GAIL (India) Ltd. Torrent has challenged the Board’s decision to increase gas transportation charges through its December 2018 tariff order by contending that the Board cannot raise charges at its whims, but this exercise can be done only through regulations.

Source: The Economic Times

NATIONAL: COAL

Coal mining to be resumed in Arunachal Pradesh after 7 yrs

2 July. The Arunachal Pradesh government decided to resume coal mining in the state, which has been suspended since May, 2012 after a direction by the Centre following involvement of insurgent groups in the extraction process. The Supreme Court in a recent judgement lifted the suspension from Namchik-Namphuk, the lone coalfield in the state, in Changlang district. Chief Minister Pema Khandu directed the officials to settle the matter by paying an additional levy of ₹320 mn imposed by the coal ministry. The decision would revive the Arunachal Pradesh Mineral Development & Trading Corp Ltd (APMDTCL), a state government undertaking. The Namchik-Namphuk coalfield was allocated to the APMDTCL on 28 October 2003 by the coal ministry.

Source: Business Standard

CIL supply to power sector drops 3% in first two months of FY20

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Domestic coal supply falling at a time of increased demand is not a sign of strength for the industry!

< style="color: #ffffff">Bad! |

30 June. Supply of coal to the power sector by Coal India Ltd (CIL) declined by 2.6% to 80.9 million tonnes (mt) in the first two months of the ongoing fiscal, government data showed. This comes amid coal imports rising 12.9% to 235.2 mt in FY'19 over 208.2 mt imported in FY18. CIL had supplied 83.1 mt of coal in April-May period of FY18, according to government data. In May, coal dispatch by CIL dropped 4.9% to 40.6 mt from 42.7 mt in May 2017-18. CIL, which accounts for more than 80% of domestic coal output, is targeting more than 8% growth in production at 660 mt in 2019-20 compared to 607 mt in the last fiscal.

Source: Business Standard

SC to hear coal ministry’s plea on closure of Madhya Pradesh coal mines

28 June. The Supreme Court (SC) agreed to hear a plea by coal ministry against National Green Tribunal (NGT) order to close down units of Northern Coalfields Ltd (NCL) in Madhya Pradesh and ban on the transport of coal already extracted on 1 July. The NGT had passed the order to close down units of NCL and the embargo on transport of coal already mined as the safety precautions to ensure safe disposal of fly ash from the coalfield were not taken.

Source: Business Standard

NTPC in coal supply pact with Singareni

28 June. Singareni Collieries Co Ltd (SCCL) and NPTC Ltd have entered into a coal supply agreement. Under the deal, SCCL will supply 8 million tonnes (mt) of coal in 2019-20 to NTPC’s thermal stations. With SCCL seeking to step up output by tapping new mines, both in Telangana and in other States, it is also making arrangements for evacuation and dispatch of coal to various locations with the South Central Railways.

Source: The Hindu Business L ine

India imported coal worth ₹1.7k bn in FY19

26 June. India imported 235.2 million tonnes (mt) of coal in 2018-19 valued at ₹1.7k bn, Parliament was informed. During 2017-18, the country imported 208.2 mt of the dry fuel valued at ₹1.3k bn, Coal Minister Pralhad Joshi said. In 2016-17, the Minister said, India imported 190.9 mt of coal valued at ₹1k bn, the Minister said. Further, power plants designed on low ash imported coal will also continue to import coal for their requirements, the Minister said. The total estimated coal resources in the country is 319.02 billion tonnes (bt). Every year about 3-5 bt of proved resources were being added through fresh exploration of the coal inventory in India. If present rate of extraction prevails in the country, coal would last for several decades, the Minister said.

Source: Business Standard

NATIONAL: POWER

23% of power demand remains unmet at Indian Energy Exchange

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">If demand is ignored additional power generation capacity may become unproductive!

< style="color: #ffffff">Ugly! |

2 July. Almost 23% of the demand for power remained unmet for supplies between 8 pm and 12 midnight at the Indian Energy Exchange since prices offered by utilities were higher than average during the period. Prices were high as suppliers offered to sell 20% less power than demand during the period. While utilities wanted to buy a total of 43 mn units of power during the period. Generators offered to sell 34 mn units only. Trade was settled for 32.84 mn units only. The power was traded at prices ranging between ₹4.26 per unit and ₹5 per unit. During the rest of the day, supply offers were more than demand and average power price for the day was ₹3.02 per unit. During the day a total of 229.42 mn units of power was offered for sale while demand was 161.43 mn units only. Trade for 138.77 mn units were settled. Demand for power was lowest for the morning slot 7 am to 8 am when trade for power was settled at ₹1.01 per unit and demand was around 4.09 mn units while on offer was about 9.7 mn units. Demand for power was highest for the slot 10 pm and 11 pm when demand for power was 11.8 mn units while on offer for sale was 8.72 mn units. Trade was settled for 8.42 mn units at ₹5 per unit – highest during the day. For the slot 9 pm and 10 pm, generators offered to sell 10.78 mn units while demand was 8.6 mn units. Trade was settled for 8.3 mn units at ₹4.93 per unit – the second highest during the day.

Source: The Economic Times

Delhi electricity demand touches record 7.2 GW

1 July. Delhi’s electricity demand touched an all-time high of 7,241 MW. This year’s stats broke the previous record of 7016 MW recorded on 10 July 2018, and according to electricity distribution companies (discoms) the electricity consumption is expected to go up to 7400 MW in the ongoing summer season. BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL), however, were able to successfully meet the all-time high peak power demand. Along with them, Tata Power Delhi Distribution Ltd (Tata Power-DDL) was also able to meet the demand of 2,014 MW in its areas of supply. Delhi’s peak power demand first crossed the 6000 MW barrier in 2016 (6216 MW on 1 July) while in this year, the demand crossed the mark on 24 days. Delhi’s peak power demand is more than thrice of that of Kolkata and is also more than the power demand of both Mumbai and Chennai put together. Running of air conditioners, coolers and fans is the main reason behind the increase in power demand in the national capital, according to experts. BSES and other companies have invested heavily over the years to build the necessary infrastructure for providing electricity to consumers around the city with minimal losses of power.

Source: Business Standard

Power ministry proposes reverse e-auction for gas-run plants

1 July. The power ministry proposes to conduct reverse e-auction to select gasfired stations that will be offered subsidised imported fuel under a bailout package for 24,000 MW stressed projects. The ministry will soon approach the Union Cabinet to seek approval for the scheme recommended by a high-level empowered committee on stressed assets. The proposal, for three years starting this fiscal, is an extension of the previous rounds of subsidised gas auction schemes to power plants. The operating power plants will have to increase their supply to existing buyers. Giving power plants an option to sell power on power bourses is also being explored. Power companies have been urging the government to restart the scheme as about 8,000 MW capacity is completely stranded while the rest is stressed. Data available with the Central Electricity Authority showed the gas-based power stations in the country operated at a capacity of 24% in May.

Source: The Economic Times

Kerala faces a huge power crisis as water level in reservoirs depletes due to less rains

30 June. After Tamil Nadu battling the water crisis, the neighbouring Kerala may plunge into darkness if it doesn’t rain in ten days. As the water level in major reservoirs is inching closer to dead storage, the Kerala State Electricity Board (KSEB) is facing an unprecedented electricity crisis. Idukki reservoir which is a major reservoir for Kerala’s electricity generation is seeing water level plummeting to 2,305 feet (ft), which is 44 ft below the level recorded on the same day last year. The average consumption of power in the state is around 75 mn units per day and with more air-conditioned installed due to harsher and prolonged summer season, the power consumption peaks to 82 mn units a day. If the weather continues to be harsher, the consumption of electricity will increase the timing of the load shedding, KSEB chairman NS Pillai said. The 147 kilometre (km) long Edamon-Kochi 400 kV (kilovolt) power transmission line has been delayed which has affected the KSEB’s efforts to enhance power availability, he said. The delay in commissioning the 147-km-long Edamon-Kochi 400 kV power transmission line is posing hurdles to the KSEB’s efforts to enhance power availability in the state, he said.

Source: India Times

People to pay more for power from 1 July in Himachal Pradesh

30 June. In Himachal Pradesh, domestic consumers, except below poverty line consumers, will have to pay additional 5 paise power tariff from 1 July as the Himachal Pradesh Electricity Regulatory Commission has revised the power tariff. The fixed charges for all consumers not covered under demand based fixed charges have been increased by ₹10 per month to cover the fixed costs of the Himachal Pradesh State Electricity Board Ltd (HPSEBL). For new Industrial category of consumers coming into production after 1 July this year, commission has approved energy charges at 15% lower than the notified tariff for the respective categories for a period of three years beginning 1 July this year. The commission has approved the proposal of the HPSEBL to allow a rebate of 15% discount on energy charges for additional power consumption beyond the level of FY 2018-19 for existing industrial units.

Source: The Economic Times

Rajasthan’s commercial electricity rates highest in the country

29 June. In power surplus Rajasthan, the rates should normally be cheaper. But ironically, they are one of the highest in the country. Notwithstanding the already high rates, the discoms (distribution companies) raised fuel surcharge by a steep 56 paisa, not seen in last so many years. A comparison of commercial electricity rates in six states reveals that power tariffs in Rajasthan have shot up to ₹7.93 per unit without the surcharge, more than what the industry pays even in Maharashtra, an industrially advanced state. In its bid to attract investment and provide policy stability, Punjab has capped the power tariffs at ₹5 per unit for next five years. States like Telangana, Andhra Pradesh and Madhya Pradesh extend tariff subsidies up to ₹2 per unit to the industry. Moreover, Rajasthan has ample scope to bring down its power cost as it has lot of potential for cheaper solar and wind energy.

Source: The Economic Times

Farmers protest against proposed hike in power tariff by UPERC

28 June. Annoyed by the proposal of Uttar Pradesh Electricity Regulatory Commission (UPERC) to hike power tariff by 25%, farmers throughout the state staged protests at sub-division offices under the banner of Bharatiya Kisan Union (BKU). In Agra, farmers associated with BKU and other organisations, met at Fatehabad and Sadar tehsils. They handed over a memorandum to sub-divisional magistrates, demanding free power supply for running private tubewells used for irrigation. Farmer leaders also demanded state government to curb stray cattle menace, declare ₹1,200 as minimum support price (MSP) for potato, a potato processing unit in Agra, construction of a barrage on river Yamuna and immediate roll back of cases registered against farmers who staged protests.

Source: The Economic Times

India mulls mass rollout of smart meters to revive utilities

27 June. India is considering a plan to install smart meters in every home and business as part of its ongoing effort to turn around the country’s ailing power sector. The plan under consideration would require 300 mn smart meters over three years. The federal power ministry has begun discussions with manufacturers on supplying the meters, which improve efficiency by monitoring and transmitting power use data. As part of the plan, the federal government is mulling providing subsidies to partially cover the costs. Preliminary estimates by the government put the cost for the meters at about ₹2,000 ($29) a piece, or $8.7 bn in total. That’s partly based on an expectation that prices would be lower than a smaller government tender for 5 mn smart meters in 2017 at ₹2,503. Widespread use of smart meters could be a gamechanger for ailing Indian distribution utilities. These distributors lose nearly one-fifth of their revenue through various technical and commercial reasons including power theft or inefficient billing and collecting, according to the power ministry. Poor financial health prevents utilities from supplying uninterrupted power countrywide, which is needed to fulfill Prime Minister Narendra Modi’s power-for-all goal.

Source: Bloomberg

Power demand peaks, setting new records in Punjab, Haryana

27 June. The sultry weather conditions prevailing across the region has pushed the power demand in Punjab and Haryana to new peaks. Punjab power demand exceeded 12,700 MW, breaking last year’s record demand of 12,542 MW achieved on 9 July. In Haryana, the maximum power demand of the season touched 10,127 MW, surpassing last year record of 10,126 MW of 28 June. In Punjab all four units of Ropar thermal and three units of Lehra Mohabbat are generating power. Punjab generated 6,290 MW and drew 6,352 MW from central sector units and other sources, according to power purchase agreements.

Source: The Economic Times

Rajasthan government decides against divesting 2 power plants

26 June. The Rajasthan government reversed the previous BJP dispensation’s decision to disinvest the Kali Sindh and Chhabra power plants. A proposal in this regard was passed in a cabinet meeting chaired by Chief Minister Ashok Gehlot. The decision to not divest was taken because of the improvement in operational efficiency and financial condition of the Chhabra and Kalisindh thermal power plants. The previous Bharatiya Janata Party government, led by Vasundhara Raje, had decided to disinvest the Chhabra and Kalisindh plants, located in Baran and Jhalawar districts respectively, in order to reduce the losses of power companies.

Source: Business Standard

India to add 131.31 GW power generation capacity till 2022

26 June. India will add 131.31 GW of power generation capacity during 2019 to 2022, Parliament was informed. India’s total installed power generation capacity was 3,56,817.6 MW as on 31 May 2019. Union Power Minister R K Singh said that in 2018-19, all India electrical energy requirement was 1274.59 bn units and energy supplied was 1267.52 bn units. The all India peak demand was 177.022 GW and peak demand met was 175.528 GW for 2018-19 (shortage of 0.6%). As per 'National Electricity Plan - Generation' issued in January 2018, the projected peak demand is 226 GW and energy requirement is estimated at 1,566 bn units at the end of 2021-22. The Plan projected peak demand at 299 GW and energy requirement at 2,047 bn units at the end of 2026-27.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Tirupati International Airport goes solar

2 July. The Airports Authority of India (AAI) inaugurated a one megawatt peak (MWp) solar plant at Tirupati’s Renigunta International airport in Andhra Pradesh. With this, Tirupati has joined the league of solar-powered airports in south India, along with Cochin, Trivandrum and Vijayawada, said distributed solar developer Fourth Partner Energy, who commissioned it. Tirupati’s ground-mounted solar plant has been installed across four acres of land, parallel to the airport runway and its isolation bay. Excess power generated at Tirupati airport will then be routed back to the national grid via net metering, in line with Andhra Pradesh’s renewable energy policy, the Hyderabad-based solar company said.

Source: The Economic Times

Solar products makers want government to rationalise GST

2 July. The solar equipment makers are a puzzled lot as they have to deal with a higher GST (Goods and Services Tax) rate for the components and lower rates for the end product. To put an end to this practice, the association of solar equipment makers have gone to the finance ministry. The Pune-based Solar Thermal Federation of India (STFI) have also been writing letters to the revenue officials and to those of the renewable energy department to demand the 5% rate on solar-related products are equally implemented. There continues to be some confusion on the ground with customs officials interpreting it differently. Much of the equipment is imported and a higher tax on these impacts the product’s end price.

Source: The Economic Times

ONGC, IOC join hands to reduce carbon emission, enhance oil recovery

2 July. Oil and Natural Gas Corp (ONGC) has teamed up with Indian Oil Corp (IOC) for enhanced oil recovery by injecting carbon dioxide captured from IOC’s Koyali refinery in Gujarat. The Memorandum of Understanding (MoU) is aimed to establish a framework for mutually beneficial cooperation in carbon dioxide-based enhanced oil recovery as a mode of carbon capture utilisation and storage (CCUS). CCUS is known to be an effective method of enhanced oil recovery globally and is playing an increasingly important role in achieving the mission of carbon neutrality. The idea of the MoU is to replicate the global success story in India. The collaboration under this MoU focuses on development of carbon dioxide capture plant at IOC’s Koyali refinery with appropriate carbon capture technology, development of business model, increasing domestic oil production through carbon dioxide-based enhanced oil recovery in Gandhar field. Besides, inclusion of this project as part of a national emission curtailment measure is aimed at supporting country's low-carbon development goals. The project will add up a new dimension towards national vision of CCUS and will infuse a new life to the depleted matured oil fields of ONGC. The learning curve from this endeavour will create a knowledge base to further expand deployment of CCUS in India.

Source: Business Standard

India sees boosting green power by 2030, overtaking climate goal

1 July. Solar and wind energy projects may constitute over half of India’s total power capacity of by 2030, according to a draft report by the country’s power-planning body, which sees the country surpassing its climate goals. Solar and wind projects are seen constituting 440 GW of capacity out of the projected 831 GW in more than a decade, the Central Electricity Authority (CEA) said in the report. All non-fossil fuel sources will form 65% of the total installed capacity and contribute around 48% of gross electricity generation. The share of coal in overall capacity is likely to drop to a third from about 56% now. Still, the polluting fuel will continue to produce half of the country’s electricity by 2030, compared with about 72% now. Prime Minister Narendra Modi’s climate target of having 40% non-fossil fuel powered capacity by 2030 will be exceeded if the projections hold true. As per the current plan, the government aims to install 175 GW of renewable capacity by 2022. India had 80 GW of renewable capacity as of May-end. The report, which is yet to adopted by the government, identifies the intermittent nature of renewable generation as a limiting factor and advocates adoption of grid-scale battery storage. India is projected to overtake the United States as the world’s second-biggest emitter of carbon dioxide (CO

2) from the power sector before 2030, as the nation’s electricity demand skyrockets, the International Energy Agency said. CO

2 emissions from the Indian power sector are likely to be 1,154 million tonnes (mt) by 2029-2030, the CEA said.

Source: Bloomberg

Biodiversity parks along Ganga to battle pollution by solar energy-driven technique

1 July. Cleaning Ganga through phytoremediation is what the Yogi government has on its mind. It is a lowcost, solar energy-driven technique that uses plants to remove pollutants from water. To clean a river, the water must be channelled through boulders to filter it and then held up in retention ponds. These ponds have certain naturally growing plant species that help increase the level of dissolved oxygen in water. The government, following directives from National Green Tribunal (NGT), has preliminarily identified sites in at least 22 of the 27 districts through which the Ganga flows. Biodiversity parks complete with retention ponds will be developed at these sites, which are also likely to boast tourist attractions such as nature trails and butterfly parks. The state pollution watchdog is expected to submit a detailed project report (DPR) on biodiversity parks in all the 27 concerned districts by August. Before that and acting on NGT orders, the government will notify the floodplain area of Ganga by 15 July. A floodplain is the maximum area that a river has flooded in 25 years. Though the river may not rise that high every year, demarcating it in a way marks the area that a river may engulf. The area also needs protection against squatters. The irrigation department and the Central Water Commission conducted a survey to demarcate Ganga’s floodplain in the state. Once the area is marked and notified, not only will it help remove encroachment but also define activities that will be illegal in the area. It may result in more space for biodiversity parks that are meant to generate awareness. The parks will be developed by the forest department. In several districts, the department has its own land. For instance in Moradabad, a deer park on the banks of Ramganga can be further developed into a biodiversity park.

Source: The Economic Times

EU, India step up cooperation in solar energy

28 June. The European Union (EU) delegation in India and the Ministry of New and Renewable Energy (MNRE) have jointly launched standard operation procedures and monitoring tool for Indian solar parks. Solar parks are key for India to achieve its target of 100 GW from solar energy by 2022, contributing to this target with 40 GW. The EU has been collaborating closely with India in deployment of climate friendly energy sources including solar energy.

Source: Business Standard

To become a global leader in renewable energy India needs to update its climate targets

28 June. The extreme heatwave that recently saw temperatures soar across India was a stark reminder that this region is one of the most vulnerable to the impacts of climate change. As countries start to declare climate emergencies, following the urgent call for decarbonisation in last year’s Intergovernmental Panel on Climate Change report, it is now, more than ever, in the hands of companies and governments to find solutions. As Prime Minister Narendra Modi takes charge of his new term, he must renew his commitment to addressing this climate emergency. It is essential that the Indian economy provides an ambitious and viable pathway to a net-zero carbon economy by 2050 at the latest. Encouragingly, business in India, and globally, are taking action on the climate. By cutting greenhouse gas emissions in line with the Paris Agreement goals, businesses are helping to fight climate change and reduce air pollution. India is moving into a strong position to lead globally as an early mover - having already overtaken the United States (US) to become the second largest solar power market in the world in terms of solar installations.

Source: The New Indian Express

Dal Khalsa opposes proposal to set up nuclear power plant in Punjab

27 June. Dal Khalsa has strongly opposeed union government’s proposal to set up atomic power plants in Punjab and has urged all the political parties of the state including the ruling party to reject this move in one voice. Minister of state in the department of atomic energy Jitendra Singh said the government was exploring new sites near Bathinda and Patiala to set up nuclear power plants in Punjab. Pointing out that in 2016 too, the Centre looked for possible sites in Punjab for setting up nuclear power plants, the Sikh groups held that the then Punjab government of BJP (Bharatiya Janata Party)’s ally Shiromani Akali Dal and all other political parties including the Congress had rejected the proposal. Present day Punjab -the border state sandwiched between two hostile nuclear-ready nations presented a disturbing possibility of being converted into a theatre of war.

Source: The Times of India

Chandigarh administration extends deadline for installation of solar plants

26 June. The Chandigarh administration has once again extended the deadline for three months for the installation of solar plants. This is the third extension given by the UT (Union Territory) administration. The Chandigarh Renewal Energy, Science and Technology Promotion Society (CREST), the nodal agency for installation of solar plants in Chandigarh, had recently proposed to extend the deadline to install solar plants by three months. The administration, in a notification issued on 18 May 2016, had made installation of rooftop solar power plants mandatory in residential houses measuring 500 square yards and above and group housing societies. There are around 10,000 such houses in different parts of the city, including sectors 8 (417 houses), 11 (493 houses), 33 (643 houses), 35 (419 houses) and 36 (417 houses). Till date, only 29% of houses have installed solar plants.

Source: The Economic Times

India revises solar manufacturing tender specs to attract investors

26 June. More than a year and 10 extensions later, the Union government has revised the tender specifications for the first solar manufacturing-linked power plant project in the country. Hoping to attract more investor interest, the tariff cap has been set at ₹2.75 per unit. Solar Energy Corp India (SECI) issued a request for a selection (RfS) notice for selecting solar power developers. This will be for setting up 6 GW (per annum) of solar power plants linked to 2 GW of solar manufacturing plant. A bidder can quote any capacity up to 1.5 GW of solar power projects linked to 0.5 GW of solar manufacturing capacity, corresponding to one project. A total of four such projects have been put up for bidding. A company can bid for one or all four. In an interesting amendment introduced in the new RfS, SECI has allowed using imported solar modules at the power plant and not necessarily the ones manufactured at the linked unit set up by the company. Earlier, this was mandatory. The tender, however, has not included the long-awaited demand of the industry to include the existing solar manufacturing units. After several extensions, the Central government, in January, decided to cancel the lone bid that came for setting up solar panel manufacturing along with a solar power plant. The single bid came from Azure Power in tie-up with Waaree Energies. The government re-issued the tender in March and it was also extended again. The latest global tender closes in August 2019.

Source: Business Standard

Uttar Pradesh plans to commission 1.5 GW solar projects by next year

26 June. Uttar Pradesh plans to commission 1500 MW solar capacity power plants by next year, state minister for department of additional sources of energy Brajesh Pathak said. The Centre has set a target of installing 175 GW of renewable energy capacity by 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro-power. Uttar Pradesh government has set a target of producing 10,700 MW renewable energy by 2022, he said.

Source: Business Standard

INTERNATIONAL: OIL

Venezuela’s June oil exports recover to over 1 mn bpd

2 July. Venezuela’s oil exports recovered in June from a sharp drop the month before, helped by increased deliveries to China, which is now oil firm PDVSA’s primary destination for its crude, according to company records and Refinitiv Eikon data. PDVSA and its joint ventures exported 1.1 mn barrels per day (bpd) of crude and refined products last month, a 26% increase over May. Chinese buyers took 59% of the shipments, followed by India with 18% and Singapore with 10%. Venezuelan oil exports to China have risen consistently since the sanctions hit, the data showed. In February, the volume shipped was 233,000 bpd, and in June it almost tripled to 656,000 bpd. However, PDVSA’s exports to India, another large receiver, have declined to 200,000 bpd, while deliveries to Europe have remained around 85,000 bpd in recent months. Under oil-for-loan agreements with China and Russia that have supplied billions of dollars to Venezuela in the last decade, PDVSA must deliver the largest portion of its oil exports to China National Petroleum Corp and Russia’s Rosneft to repay the credits. Another share of the exports is exchanged for fuel purchases.

Source: Reuters

US crude to trickle onto new Gulf Coast lines as connections, storage opens

2 July. A year-old bottleneck of crude in West Texas is shifting east as new pipelines prepare to begin operations without enough connections or storage for the smooth movement of shale oil to a US (United States) Gulf Coast export hub, according to traders and analysts. The US exported a record 3.8 mn barrels per day (bpd) of crude in late June after Congress lifted a 40-year export ban in late 2015. New oil pipelines typically are quick to fill as producer commitments and connections allow. However, at least one of the new lines, owned by EPIC Crude Pipeline LP, does not yet have all the connections and storage to handle the full 400,000 bpd capacity.

Source: Reuters

Russia cut June oil output by more than required in global pact

1 July. Russia reduced oil production in June by more than the amount agreed in a global deal to cut output, the energy minister Alexander Novak said, as the sector still felt the impact of a contaminated crude crisis that crippled exports. Novak said that Russian oil output last month fell by 278,000 barrels per day (bpd) from an October 2018 baseline of 11.41 mn bpd, indicating output in June of about 11.13 mn bpd. Under a deal reached with OPEC (Organisation of the Petroleum Exporting Countries) and other oil producers, Russia had agreed to reduce output by 228,000 bpd from the October 2018 baseline, indicating it should keep total output around the 11.17 mn-11.18 mn bpd level. OPEC and its allies look set to extend supply cuts at least until the end of 2019 as Iran joined top producers Saudi Arabia, Iraq and Russia in endorsing a policy aimed at propping up the price of crude amid a weakening global economy.

Source: Reuters

Mexico’s oil regulator approves BP's offshore drilling plan

26 June. Mexico’s oil regulator approved a $97 mn plan for drilling in an offshore area operated by British supermajor BP in the southern Gulf of Mexico. The four-year exploration plan approved by the national hydrocarbons commission (CNH) covers a 700,000 square kilometre shallow water block, located north of the coast of Tabasco state. BP won the rights to drill last June, along with its partner French oil major Total. BP’s contract is one of over 100 awarded since a sweeping energy reform was finalised in 2014, championed by Mexico’s previous government in a bid to reverse years of declining crude production.

Source: Reuters

INTERNATIONAL: GAS

California proposes changes to SoCalGas Aliso natural gas storage withdrawal rules

2 July. California utility regulators proposed changing when Southern California Gas Co (SoCalGas) can withdraw natural gas from its Aliso Canyon storage facility in Los Angeles to address energy reliability and price impacts in Southern California. The current withdrawal protocol has been in effect since 2 November 2017, following a leak at the facility between October 2015 and February 2016, the California Public Utilities Commission (CPUC) said. Under the proposed new withdrawal protocol, SoCalGas would be able to pull gas out of Aliso if the amount of fuel in the region’s pipelines is low, Aliso is over 70% full during February or March, or the amount of gas in two of the utility’s other storage fields is low.

Source: Reuters

Gazprom braces for tough talks with Ukraine on gas transit to EU

28 June. Alexei Miller, the head of Russian gas giant Gazprom, warned of difficult talks with Ukraine on gas transit to Europe once the current deal expires at the end of the year. Gazprom, the main supplier of natural gas to Europe, halted gas transit via Ukraine twice since 2006 at the height of winter, in rows over gas prices and transit. More than one third of Russia’s gas exports to the European Union (EU) cross Ukraine, providing Kiev with valuable income. Europe, where Gazprom has a 36% gas market share, is closely following talks between Moscow and Kiev. Some European countries, such as Bulgaria, are completely dependent on Russian gas to heat households in winter. Russia wants to bypass Ukraine by installing gas pipelines via the Baltic and Black seas, the Nord Stream-2 and TurkStream projects, as relations between the two ex-Soviet countries soured following Moscow’s annexation of Crimea. Miller said Russia will build Nord Stream-2 despite that Denmark has yet to issue permission for the construction of the pipeline via its waters in the Baltic Sea.

Source: Reuters

US may become third largest seller of LNG

28 June. This year, the US (United States) will surpass Malaysia to become the world’s third largest seller of LNG (liquefied natural gas). The country could even eclipse Qatar and Australia to take the top spot by 2024. This is truly staggering growth considering that LNG exports from the contiguous 48 just began in February 2016, when Cheniere Energy’s flagship Sabine Pass terminal in Louisiana first came online. US LNG has thus far reached over 30 nations, with South Korea, Mexico, Japan, and China receiving the most. By the end of 2019, the US will have doubled its export facilities to six. And the country will have expanded its capacity to ~9 billion cubic feet (bcf) per day, more than 20% of current LNG demand. Although China has now put a 25% tariff on US LNG, the expectation is that the trade war will eventually be worked out, reopening the door to the world’s most vital incremental customer. US LNG is expanding the short-term, spot market, now accounting for just 30% of global trade.

Source: Rigzone

INTERNATIONAL: COAL

China’s Shandong province plans further coal usage cuts over next 5 yrs

2 July. China’s eastern province of Shandong aims to cut its coal consumption by 50 million tonnes (mt) in five years, the provincial government said, to reduce greenhouse gas emissions and upgrade its energy structure. The province set a target for 2018 consumption of 377.58 mt per year, meaning the cut announced would reduce coal usage by 13.2% from that level. It is not clear if Shandong met the target. Reducing coal consumption in Shandong would further Beijing’s goals of cleaning up the country’s air and reduced its carbon dioxide emissions. Shandong produced 96% of its power from thermal sources, such as coal, in 2018. The province ordered tighter coal quality specifications for the fuel.

Source: Reuters

US insurer Chubb pulls back from coal

1 July. Chubb Ltd will become the first US (United States) insurer to phase out its coal investments and insurance policies, saying it will no longer sell insurance to or invest in companies that make more than 30% of their revenue from coal mining. Chubb will also stop underwriting the construction of new coal-fired power plants. The company said for existing coal plants, insurance coverage for risks that exceed the 30% threshold will be phased out by 2022, and for utilities beginning in 2022. Additionally, it will also not invest in companies that generate more than 30% of revenue from thermal coal mining or energy production from coal. Chubb said the exceptions to the new policy will be considered until 2022, taking into account an insured company’s commitment to reduce coal dependence and also regions that do not have practical near term alternative energy sources.

Source: Reuters

Eskom woes to hit coal production: South Africa’s Exxaro

26 June. South African miner Exxaro Resources expects its coal production to fall by 5% by volume in the first half of 2019, mainly due to reduced demand from struggling power utility Eskom, it said. It expects domestic coal demand and pricing to remain stable for the remainder of the year, but does not see a recovery from the international price/ demand situation.

Source: Reuters

INTERNATIONAL: POWER

Uzbekistan to provide $45 mn for Afghanistan power transmission project

2 July. The Prime Minister of Uzbekistan Abdulla Aripov in a meeting with Afghanistan Chief Executive Abdullah Abdullah in the northern Afghan province of Balkh on 1 July vowed to provide $45 mn for a power transmission project in Afghanistan. Abdullah said that time has come to implement the agreements which have been signed between the two countries. He said trade volume between the two countries is good but added that it has the potential to improve.

Source: Times of Central Asia

Japan to lend $1.3 bn for Matarbari power plant

1 July. Japan has agreed to lend Bangladesh $1.31 bn under the 40

th official development assistance (ODA) loan package for the construction of the Matarbari ultra-supercritical coal-fired power plant. The objective of installing the 1,200 MW plant at Maheshkhali upazila in Cox’s Bazar is to meet the growing electricity demand and ensure stable power supply, the Economic Relations Division (ERD) said.

Source: The Daily Star

Ukraine imports electricity from Slovakia and Hungary

1 July. The first ever electricity import from Slovakia and Hungary to Ukraine was implemented by ERU Trading, a subsidiary of US (United States)-based ERU Corp, according to the company. The import was done through the so-called Burshtyn Energy Island (BEI), the power plant with several substations in the west of Ukraine. Energy export from Europe was implemented thanks to the European trading partners and the European Commission. Company representatives believe that electricity import through BEI is the next step in Ukraine's integration into the European energy markets and the guarantee of fair prices for the Ukrainian consumer. The expansion of ENTSO-E, the European Network of Transmission System Operators, by connecting the Ukrainian power system, will ensure the integration of Ukraine’s electricity market into the internal EU (European Union) energy market, experts said. ENTSO-E currently represents 43 electricity transmission system operators from 36 countries across Europe.

Source: Xinhua

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Portugal extends deadline for solar power auction on strong demand

2 July. Portugal has extended the deadline for a mega-auction of new solar energy capacity by a week to 7 July due to a strong interest by about 300 investors, Environment and Energy Transition Minister Joao Pedro Matos Fernandes said. The auction, for 1,400 MW of solar energy, is the largest licensing auction of any kind of energy launched in Portugal and represents more than double the current installed capacity of solar energy in the country. Portugal’s government is aiming to reach about 9,000 MW of installed solar energy capacity by 2027.

Source: Reuters

First commercial solar power plant launched in Myanmar

1 July. State Counsellor Daw Aung San Suu Kyi launched the first phase of Myanmar’s first commercial solar power plant in Minbu, Magwe Region, adding 40 MW of power to the national grid. The Minbu Solar Power Plant project, which will be completed in four phases, will have the capacity to generate 170 MW of power and produce 350 mn kilowatt hours per annum, which is sufficient to electrify about 210,000 households.

Source: Myanmar Times

Dutch government presents measures to cut carbon emissions

29 June. The Dutch government presented a wide-ranging raft of measures - from a carbon tax for business to more bicycle parking at railway stations - that aim to slash by a half by 2030 the Netherlands' emission of carbon. The carbon tax will likely start at €30 ($34) per ton of carbon emissions in 2021 and rise to as much as €150 ($170) per ton in 2030, according to the government. The package aims to put the Netherlands on track to meet its commitments under the 2015 Paris climate accord. Under the accord, countries have to submit fresh targets by 2020 for reducing greenhouse gases. The Dutch government said last year it aims to make electricity production in the Netherlands 100% carbon neutral in 2050 and generate 70% of energy using from wind and solar by 2030.

Source: The Economic Times

Weaning US power sector off fossil fuels would cost $4.7 tn

27 June. Eliminating fossil fuels from the US (United States) power sector, a key goal of the “Green New Deal” backed by many Democratic presidential candidates, would cost $4.7 tn and pose massive economic and social challenges, according to a report released by energy research firm Wood Mackenzie. The report is one of the first independent cost estimates for what has become a key issue in the 2020 presidential election, with most Democrats proposing multi-trillion-dollar plans to eliminate US carbon emissions economy-wide. The report focuses solely on what it would cost to green the US power sector, a top contributor to greenhouse gas emissions – but does not include costs for other sectors like transport, agriculture or manufacturing. The study said 900 GW of energy storage would be required to make sure wind and solar assets can work reliably even when the weather isn’t cooperating, 900 times more than is currently installed.

Source: Reuters

DATA INSIGHT

LPG Scenario in India: Consumption & Imports

Sale of LPG by Oil Marketing Companies for 2018-19

| State/UT |

Thousand Tonnes |

State/UT |

Thousand Tonnes |

| Chandigarh |

38 |

Jharkhand |

313 |

| Delhi |

731 |

Odisha |

480 |

| Haryana |

735 |

West Bengal |

1577 |

| Himachal Pradesh |

138 |

Chhattisgarh |

248 |

| Jammu & Kashmir |

193 |

Dadra & Nagar Haveli |

8 |

| Punjab |

857 |

Daman & Diu |

6 |

| Rajasthan |

1187 |

Goa |

47 |

| Uttar Pradesh |

3018 |

Gujarat |

945 |

| Uttarakhand |

251 |

Madhya Pradesh |

928 |

| Arunachal Pradesh |

21 |

Maharashtra |

2454 |

| Assam |

401 |

Andhra Pradesh |

1054 |

| Manipur |

35 |

Karnataka |

1368 |

| Meghalaya |

21 |

Kerala |

797 |

| Mizoram |

25 |

Lakshadweep |

0 |

| Nagaland |

21 |

Puducherry |

36 |

| Sikkim |

14 |

Tamil Nadu |

1742 |

| Tripura |

48 |

Telangana |

781 |

| Andaman & Nicobar Islands |

10 |

Bihar |

1197 |

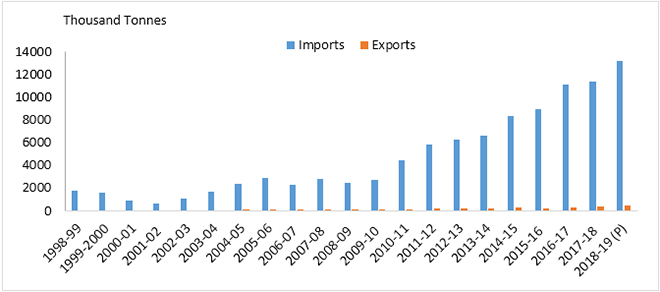

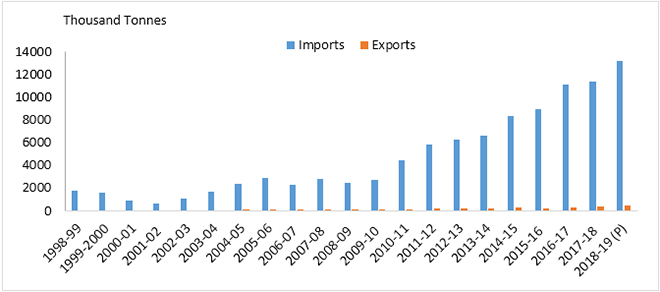

LPG Imports and Exports

P: Provisional

Source: Compiled from PPAC and Lok Sabha Question for Ministry of Petroleum & Natural Gas

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

P: Provisional

Source: Compiled from PPAC and Lok Sabha Question for Ministry of Petroleum & Natural Gas