< lang="EN-US" style="color: #0069a6">COAL MINING MAY BE SUBJECT TO MARKET FORCES

Coal News Commentary: August 2019

India

The government of India has approved to permit 100 percent FDI under automatic route for sale of coal, for coal mining activities including associated processing infrastructure with an aim to attract international players to create an efficient and competitive coal market. This would be subject to provisions of Coal Mines (special provisions) Act, 2015 and the Mines and Minerals (development and regulation) Act, 1957 as amended from time to time, and other relevant acts on the subject. As per the present FDI policy, 100 percent FDI under automatic route is allowed for coal & lignite mining for captive consumption by power projects, iron & steel and cement units and other eligible activities permitted under and subject to applicable laws and regulations. Further, 100 percent FDI under automatic route is also permitted for setting up coal processing plants like washeries subject to the condition that the company shall not do coal mining and shall not sell washed coal or sized coal from its coal processing plants in the open market and shall supply the washed or sized coal to those parties who are supplying raw coal to coal processing plants for washing or sizing.

India, the world’s third largest coal consumer, is one of the most appealing market for Australia’s thermal coal to meet its increasing energy requirements, according to 'The Coal in India 2019'' report. According to the report, prepared by the Australia’s Office of the Chief Economist, Australia is not a significant supplier of thermal coal to India despite India's imports growing by 84 mt in the past five years. The report said that India was the world’s third largest coal consumer behind China and the US; and the share of coal in India's electricity mix was rising. Indonesia was main supplier for India for thermal coal while Australian exports were going to China, Japan and South Korea, the report said. The report said that Adani’s Carmichael mine and GVK’s Alpha mine were two advanced projects could provide long term reliable supplies of coal to meet the growing energy needs of India. The report also identified India’s interest in Australia stating that CIL was already interested in working with Australian companies to upgrade the technology employed in their coal sector.

India is working on bridging the coal import gap by about 50 percent in the next three years, CIL said. In the 2018-19 fiscal, the country produced 730 mt of coal, while 955 mt was consumed, leading to a gap of 230-235 mt. CIL plans to produce 53 mt of more coal to 660 mt in the current fiscal, and a similar 50-55 mt incremental production every year will bridge the 115-120 mt gap. CIL had earlier pushed back its 1 bt production vision to 2025-26. The miner, which caters to 80 percent of the country's energy requirement, is also executing rail network from its mine pitheads worth `60-70 bn for high coal evacuation.

CIL’s 54 coal mining projects are facing delay due to various reasons such as contractual issues and delay in green clearances among others. The major reasons for delay in implementation of these projects are delays in obtaining environment clearance, forest clearance, possessions of land and issues related to resettlement and rehabilitation, contractual issues and evacuation facilities among others. The company said that five coal mining projects with a sanctioned capital of `9.89 bn were completed during 2018-19, while two coal projects with a sanctioned capital of `15.02 bn were started during the year. CIL accounts for over 80 percent of domestic coal output. Based on the demand projection in 'Vision 2030' for coal sector in the country and subsequent demand projection on CIL, a perspective plan has been prepared to project production plan in medium and long-term basis up to 2030-31 wherein the company is envisaged to grow at the rate of about 7.6 percent till 2024-25 to meet the coal demand of the country. To achieve projected growth in production, CIL has identified major projects and assessed their related issues, it said.

The centre has decided to auction 27 coal blocks to private companies who can sell 25 percent of the produce in the open market at a premium of 15 percent over their bid price for winning these blocks. Rest of the coal is meant for captive consumption intended for iron & steel, cement, captive power plants. Financial bidding are to be held between 10 October and 8 November while final allotments are likely to happen by 11 November, according to the timeline prepared by the centre. Blocks would be auctioned in three tranches – 8th, 9th and 10th. Under the 8th tranche, 20 blocks are on offer and it is for iron & steel, cement and captive power plants, excluding steel makers using coking coal. Under the 8th Tranche, the centre is offering a total of 20 blocks, 10 blocks from Maharashtra, four each from Chhattisgarh and West Bengal. One each are from Jharkhand and Madhya Pradesh. The 9th Tranche of blocks on offer includes 6 blocks for iron and steel producers only. Under this tranche the centre has offered 5 blocks from Jharkhand and from Madhya Pradesh. The 10th Tranche is for a single block meant for iron & steel, cement and captive power plants, excluding steel makers using coking coal. The centre has offered only one block from Odisha under this tranche. Last year, the centre had floated tenders for auctions blocks for commercial mining under Tranche 6 and 7. However, these were cancelled as bidder wanted more time and elections were nearing.

CIL’s production and despatches dipped 5.1 percent and 2.9 percent respectively in July 2019 against last year’s corresponding month. Production and despatches dipped at four of its subsidiaries. At Bharat Coking Coal production and despatches fell 28 percent each, while at South Eastern Coalfields it dipped 12 percent and percent respectively. Mahanadi Coalfields witnessed a 14 percent fall in production and a 7 percent fall in supplies. At North Eastern Coalfields production fell 82 percent while supplies declined 47 percent against the previous corresponding period. For the four-month period ending 31 July 2019, CIL’s production dipped 1.1 percent against the previous corresponding period while supplies declined 0.8 percent against the previous period.

The coal ministry has relaxed timelines and ironed out policy issues hoping to get a better response to the latest round of coal mine auctions. The Centre will be auctioning 27 coal mines and allocating 15 mines to developers. The old mines are those that have been put up for auction in earlier rounds. It also includes mines like Tokisud North that were bid out and then relinquished by the winner.

The Union power ministry wants the coal ministry to ramp up commercial mining. The power ministry feels that power producers should be able to buy coal from open markets at competitive prices and PPAs should not be a precondition for getting access to coal. A high-level Niti Aayog committee had suggested the coal ministry to conduct auctions only for commercial mining and put an end to captive coal block allocation. Experts have attributed sub-optimal use of captive coal mines to lower requirement at power plants to which they are tied up to, and have argued that such dynamics limit competition and reduce efficiency. The shift from the PPA mechanism to open power market will lead to competition and lower power prices.

The government will use its own coal price index to calculate revenue earned by operators of coal black to ascertain its share of income from 27 blocks being auctioned to the non-regulated sector. The decision will rule out potential disputes over possible under-reporting of revenues by operators, which, the government feels, cannot be audited regularly. Payments by operators are likely to be made on monthly basis and the government has released that keeping a tab on the price/revenue may not be feasible on a regular basis. Winners of the current auction will be selected on the basis of the highest share of revenue offered to the government. In order to reflect market price, the index will be weighted average price for coal available from different sources including CIL’s notified prices, winning prices under forward, special & spot e-auction for different subsidiaries, international coal prices and prices of coal sold by private and public sector entities. Quantities sold under these heads would be the weights, or the relative importance of these sources in the index. For international coal prices, quantity imported into India would be its weights.

The centre is ready to officially handover Deocha Pachami coal block in Birbhum to West Bengal government, however, the state has sought greater clarity on performance guarantee calculations and implementation timeframe for the proposed mine which is believed to be a geologically difficult block. It is the world’s second largest coal block and the state was looking at the possibility of selling a portion of its produce in the open market, if allowed by the centre, which, however, seem unlikely. West Bengal would seek centre’s permission for selling coal in the open market after meeting captive demand. However, according to central government officials it may not be allowed since it was allotted for captive consumption only. During June last year the centre allotted Deocha Pachami to West Bengal Power Development Corp Ltd as a captive block. Operations of the block will be undertaken by Bengal Birbhum Coalfields, a special purpose vehicle floated for purpose. Coal seams in the block lie beneath a 500 meter thick layer of basalt rock that needs to be cracked first to extract coal through underground mining. Basalt is used for a variety of construction work including laying railway tracks and the company could sell it in the open market as well. The centre had earlier planned to allot the block to number of states jointly but none, other than West Bengal, showed interest as preliminary production cost estimates turned out to be very high. The centre finally awarded the block to West Bengal.

NTPC Ltd plans to become India’s second largest coal producer after CIL to ensure long-term fuel security for its power plants. CIL had produced 606 mt of coal and had targeted a milestone of 1 bt by 2025. NTPC had been allotted 11 coal blocks — Pakri-Barwadih, Chatti Bariatu, Kerandari, Dulanga, Talaipalli, Bhalumuda, Banai, Mandakani-B, Banhardih Kundanali-Luburi (in JV with JKSPDC) and Badam Coal Block with geological coal reserves of more than 7.3 bt and a production potential of 113 mtpa. NTPC needs over 160 mtpa of coal for fuelling its 41,580 MW power capacity. NTPC had received a supply of 176.10 mt of coal during FY19.

The central government has cancelled the joint allocation of a coal block in Odisha to NTPC Ltd and JKSPDC. NTPC and Power Development Department, Jammu & Kashmir, had earlier requested the coal ministry for cancellation of the coal block. The coal block, in the Talcher Coalfield of Odisha, has a reserve of 396.10 mt. The coal ministry said there is no provision under the Mines and Minerals (Development and Regulation) Act, 1957, and the rules made thereunder to allocate fresh coal block in lieu of a cancelled coal block.

The coal ministry’s standing committee on linkage has approved fresh fuel supply to upcoming power generation units in Tamil Nadu having capacity of 2,400 MW. The two under-construction power plants — North Chennai Thermal Power Station Stage-III (800 MW) and Uppur Super Critical Thermal Power Project (1,600 MW) — had sought domestic coal linkages under the Centre’s Shakti scheme. The panel has recommended 2 mt of domestic coal supply from the Singareni Collieries, and the rest would be procured from CIL. The two power plants would blend imported and domestic coal on a 50:50 ratio. The Shakti scheme was designed to save power plants who were without adequate fuel supply agreements. Although the North Chennai unit was originally scheduled to be commissioned in December 2019, it is now expected to be ready only by March 2020. Similarly, the expected commissioning of the Uppur project has been delayed to March 2022 from the initial timeline of April 2020. The coal ministry’s committee has recommended the extension of existing bridge linkages to NTPC’s 500 MW Barauni Stage-2 plant (Bihar) and DVC’s units in Mejia (West Bengal) and Chandrapura (Jharkhand). Bridge linkages are temporary supply contracts for state-owned generation units that have been allotted coal blocks, but mines are yet to start production. NTPC Barauni will receive coal under the bridge linkage only for a year from the formal allotment of the Badam coal block. The power plants of DVC are scheduled to get coal from the Khagra Joydev coal block. The Khagra mine was expected to produce coal from June 2015 but it is yet to receive environmental and forest clearances and sort out land acquisition issues. The panel recommended coal linkages from CIL to Gujarat, Uttar Pradesh and Madhya Pradesh under the Shakti scheme. It directed CIL to earmark 10 mt per year of coal for three years for power plants which would sell electricity through the central government’s so-called Pilot scheme-2 to salvage private generating stations without power purchase agreement. However, coal allocation to plants under the Shakti scheme is contingent on approvals of other authorities.

The Telangana State Power Generation Corp Ltd got the go-ahead from the Centre to transport coal by road to Bhadradri thermal power plant. As a result, Telangana will have an additional 1,080 MW of power at its disposal soon. The Bhadradri power plant requires over 13,000 tonnes of coal daily and plans are in place to transport coal by 55 trucks every hour to the plant. As per the original plan, the coal was supposed to be supplied by rail from Singareni Collieries from Manuguru station to the thermal power plant, a 12 km stretch. But, there is no railway line so far. Following the delay in preparation of a detailed project report and other formalities for laying of the railway line, the Telangana government sounded the Union energy ministry on the urgent need to grant permission so that coal could be transported via road and the thermal power plant would not run out of coal.

Meghalaya has hailed as "people’s victory" the Supreme Court directive to lift the NGT ban on coal mining and said the verdict has upheld the rights of indigenous people on land and mineral deposits. The Supreme Court on 3 July set aside the ban on coal mining in Meghalaya imposed by the NGT since April 2014, and allowed mining operations on privately and community-owned land, subject to permissions from authorities concerned. It also directed the Meghalaya government to deposit the `1 bn fine imposed on it by the NGT for failing to curb illegal coal mining. The state has about 576 mt of coal and nearly 9,300 mt of limestone deposits. The Meghalaya government has asked two expert agencies to come up with the 'best options' to restart safe and scientific coal mining in the state. The two expert agencies - Central Mine Planning and Design Institute and Mineral Exploration Corporation Ltd - are on the job. The expert agencies have been entrusted with the task to come up with a model which is feasible to the state. In 2014-15, expert agencies have conducted a study and submitted a report to the Central ministries that mechanised or open cast mining in Meghalaya is not at all feasible and this matter has been closed. Meanwhile, a committee of the NGT committee had asked the state government to explore the possibility of introducing the 'high wall mining method' for extracting coal in the state.

Production at Talcher coal fields in the eastern Indian state of Odisha will resume, fourteen days after protests over the death of four miners halted production. CIL suffered a revenue loss of `2.56 bn ($36.15 mn) and an output loss of 2.52 mt of thermal coal, the company said. The electricity generator had been incurring a daily loss of `110 mn ($1.55 mn) due to the output cut, adding four of its six units were shut because of a lack of supplies

India will overtake China as the largest importer of coking coal by 2025, Fitch Solutions Macro Research said. While China will remain dominant in terms of overall market share, India will become increasingly important in terms of seaborne demand, it said. High frequency indicators show that while the largest importer of Australian coking coal, India, saw a 25.8 percent y-o-y increase in coking coal imports from Australia in the second quarter of 2019, China, the second largest importer of Australian coking coal, decreased imports by 8.8 percent y-o-y in the same period.

High raw material prices including coking coal and iron ore, coupled with weak demand and softening of prices, are set to weaken the prospects for the growth of the steel sector in India in the current financial year. Experts expect the supply of coking coal to be tight in the coming months, with large Australian miners reducing their output.

Rest of the World

China’s coal demand will start to fall in 2025 once consumption at utilities and other industrial sectors reaches its peak, easing pressure on Beijing to impose tougher curbs on fossil fuels. The world’s biggest coal consumer is expected to see total consumption fall 18 percent from 2018 to 2035, and by 39 percent from 2018 to 2050, the CNPC Economics and Technology Research Institute, run by the CNPC, forecast in a report. Cutting coal consumption and replacing it with cleaner energy like natural gas and renewables has been a key part of China’s energy strategy, but it has continued to approve new mines and coal-fired power plants and support new projects overseas. Though the share of coal in the country’s total energy mix fell to 59 percent last year from 68.5 percent in 2012, overall consumption in 2018 rose 3 percent from a year earlier to 3.82 bt. However, the CNPC researchers said they expected the total share of coal to drop to 40.5 percent by 2035 as renewable, nuclear and natural gas capacity continues to increase rapidly. Coal would remain China’s major fuel over the next 15 years, with smaller mines replaced by bigger and more efficient collieries in the west.

China’s coal imports jumped 21.4 percent in July from a month earlier to 32.89 mt customs data showed, boosted by strong demand for electricity as households and businesses cranked up their air conditioning in the face of hot weather. China, the world’s biggest coal user, took in a total 187.36 mt of the fuel in the first seven months of 2019, up 7 percent from the same period last year, data from the General Administration of Customs showed. Traders said that some inland ports in Inner Mongolia also tightened coal imports by reducing the number of trucks that could enter at border checkpoints. The central government has been urging domestic coal miners to ramp up production to ensure sufficient supply of the fuel.

China’s coal output fell in July from June’s record production, despite strong demand from electricity utilities to power air conditioners during the hot summer months. Chinese miners produced 322.23 mt of coal, down 3.3 percent from 333.35 mt in June but well above 281.5 mt in July last year, data from the National Bureau of Statistics showed. Weaker production at domestic mines came as coal imports rose 21 percent in July from the previous month to 32.9 mt. Imports rose even as China’s customs tightened coal imports at several ports by delaying or even halting customs clearance.

China will launch a new round of safety inspections on coal mines across the country from late August until end-September, the National Coal Mine Safety Administration said. The checks follow a spate of fatal coal mine accidents that stirred concerns over poor safety conditions, particularly at small mines. Inspectors would crack down on illegal production and urge miners to improve their ability to deal with major disasters such as gas explosions and floods, the National Coal Mine Safety Administration said.

Germany’s Cabinet approved a plan to spend up to €40 bn ($44.4 bn) by 2038 to cushion the impact of abandoning coal on mining regions. Funds will start flowing once parliament has passed separate legislation setting out the dates and terms of Germany’s exit from coal, likely in the coming months. In January, a government-appointed panel recommended Germany stop burning coal to generate electricity by 2038 at the latest, as part of efforts to curb climate change. Germany gets more than a third of its electricity from burning coal, generating large amounts of greenhouse gases that contribute to global warming. Germany’s last deep-shaft black coal mine closed in December, but open-cast lignite, or brown coal, mines still operate.

Russian President Vladimir Putin has asked the government to review a mineral extraction tax for the Russian coal industry by 31 October. Russia is the world’s third largest coal exporter after Australia and Indonesia. Putin has been a proponent of further expansion of the country’s export infrastructure and seeking new coal markets, with China seen as a particularly important customer. Putin requested the review after a meeting with heads of Russian coal producing regions. It was unclear if the review would bring potentially lower or higher level of taxation for coal miners. The energy ministry said that the country’s annual coal output was expected to rise to 550-670 mt by 2035 from the current 440 mt. Putin also ordered the government to make sure by 1 February that the country’s coal export plans are synchronised with the FSB’s plans to develop border control check points and vehicle and railway access to them. The reason behind this order was not explained in the list. However, the FSB is in charge of border control in Russia, and easier access to the check points on the border with China could make exports to the country more attractive for a nearby coal producing regions. Putin’s orders also included a directive for the energy ministry to prepare measures that would allow advanced processing in coal mining regions, taking particular note of the potential development of liquefied gas and hydrogen production from coal. Russia increased coal production by 30 percent in the last 10 years, while its share of the global coal trade rose to 14 percent from 9 percent, according to the energy ministry estimate.

Coal-fired plants will continue to be in use in Myanmar despite objections by different groups on grounds of health and environmental pollution. The upper house of Myanmar’s national bicameral legislature, that the government intended to go ahead with the construction of coal-fired plants to address the energy shortage in the country. In its latest power mix plan, Myanmar will draw 33 percent of its energy needs from coal. Despite the need for more energy to generate power, coal plants have faced difficulties operating due to objections by villagers worried about its health implications. Last year, the government scrapped a $2.8 bn coal-fired plant to be built near the Karen State capital of Hpa-An by Toyo-Thai Co Ltd, a joint venture involving Thai and Japanese engineering and construction firms.

Indonesia plans to review its regulations on DMO for coal to support gasification of coal. Current DMO rules include requiring coal miners to sell 25 percent of their output to domestic buyers, such as state power company PT Perusahaan Listrik Negara. The government aims to expand its downstream industry for natural resources, including processing coal into dimethyl ether to substitute for imported LPG.

Australian Pacific Coal said it was considering its options after a state regulator refused to extend the life of a mothballed coal mine, partly due to a lack of information around the proposed mine’s carbon emissions. Australian Pacific applied last year to restart a thermal coal mine in New South Wales. The ruling is the second this year to signal Australian authorities are tightening up coal mine approvals after the state’s land court ruled against developers planning to build a mine in the same region in February. The Dartbrook mine was placed on care and maintenance in late 2006 due to operational difficulties and lower coal prices. Coal miner Whitehaven also requires planning commission approval for a proposed expansion of its Vickery coal mine.

Botswana’s privately owned coal mine has produced its first saleable coal that has been exported to South Africa and Namibia. The Masama Coal Mine has extracted roughly 39,000 tonnes of coal since July and aims to ramp up production to 100,000 tonnes per month of saleable coal by next year. The open cast mine and associated coal wash plant is located 60 km (37 miles) northwest of Botswana’s capital Gaborone and was developed at a cost of 400 mn pula ($37 mn). The Masama mine, the first privately-owned coal mine in Botswana, is estimated to hold 390 mt of coal reserves. Despite Botswana’s huge estimated coal resources of 212 bt Minergy’s Masama mine is one of only two operating coal mines in the country. The other is state-owned Morupule Coal Mine.

Vietnam is considering importing coal from the US to meet rising demand for the fuel for power generation, as the Southeast Asian country plans to build more coal-fired power plants. Executives from state-run coal producer Vinacomin and Pennsylvania-based Xcoal Energy & Resources met in Hanoi to discuss the possibilities of shipping US coal to Vietnam. Vietnam has recently become a net coal importer, with most of its shipments coming from Australia and Indonesia. Coal is expected to account for 42.6 percent of Vietnam’s power generating capacity by 2030, up from 38.1 percent currently, according to the Ministry of Industry and Trade. It said Vinacomin, formally known as Vietnam National Coal-Mineral Industries Corp, annually produces about 40 mt of coal from domestic mines. The Ministry of Industry and Trade said that Vietnam will contend with severe power shortages from 2021 as electricity demand outpaces construction of new power plants, adding that it will have to import 680 mt of coal to feed its power plants during the 2016-2030 period.

A Polish district court has ruled as invalid last year’s decision by state-run utility Enea to join a project to build a 1 GW coal-fueled power plant in cooperation with peer Energa, Enea said. The planned power plant at Ostroleka in north-east Poland was supposed to be the last coal-based project in the coal-dependent country, the energy ministry said. The project, which is expected to be completed in 2023 at a cost of 6 bn zlotys ($1.5 bn), has been opposed by environmentalists who say it only strengthens Poland’s reliance on coal and is not economically justifiable. The plan to build the plant was initially revived by Energa, another state-run energy group, in 2016 in response to a government policy to keep using coal as the basic source of energy over the long term.

| mt: million tonnes, bt: billion tonnes, FDI: Foreign Direct Investment, CIL: Coal India Ltd, mn: million, bn: billion, PPAs: power purchase agreements, JV: joint venture, mtpa: million tonnes per annum, JKSPDC: Jammu & Kashmir State Power Development Corp, MW: megawatt, km: kilometre, NGT: National Green Tribunal, y-o-y: year-on-year, CNPC: China National Petroleum Corp, FSB: Federal Security Service, DMO: domestic market obligation, LPG: liquefied petroleum gas, US: United States |

To read article ‘Creating a Market for Quality Coal’ please refer to India Energy Analysis

NATIONAL: OIL

India and Nepal open South Asia’s first cross-border oil pipeline

10 September. India and Nepal officially opened South Asia’s first cross-border oil pipeline, a project seen as part of New Delhi’s efforts to increase its influence in the Himalayan nation where China is also making deep inroads. India funded the Rs3.24 bn ($45 mn) pipeline project, which has an annual capacity of 2 mn metric tonnes and will enable Nepal to import fuel from India at a lower cost. India is Nepal’s sole supplier of oil which is currently carried on tankers via road to the land-locked country. The 69 km (43 miles) pipeline, built by Indian Oil Corp (IOC) in cooperation with Nepal Oil Corp, was completed 15 months ahead of schedule. The pipeline will supply oil from Motihari in the eastern Indian state of Bihar to Amlekhgunj in Nepal. Nepal consumes about 2.66 million tonnes (mt) of oil and about 480,000 tonnes of cooking gas, currently carried in trucks from half a dozen Indian depots to different points in Nepal.

Source: Reuters

IOC’s Gujarat refinery ready to make IMO 2020 fuels by October

10 September. Indian Oil Corp (IOC)’s Gujarat oil refinery will be ready to produce 700,000 tonnes per year of low-sulphur marine fuel starting in October, the company’s Director for Refineries S M Vaidya said. IOC’s Haldia refinery will start in December to produce 300,000 tonnes per year of marine fuels that meet the new low-sulphur specifications, he said. India’s marine fuel demand is about 1 million tonnes (mt) per year, Vaidya said. Vaidya also forecast that India will add 190 mt per year of refining capacity over the next 11 years.

Source: Reuters

LPG imports from Bangladesh to ease supply crunch in North East

9 September. Liquefied Petroleum Gas (LPG) or cooking gas supplies from Bangladesh are expected to ease the availability of cooking gas in North East India, according to a presentation by the Ministry of Petroleum and Natural Gas. The presentation said that this is reflective of the government’s ‘Neighbourhood first’ vision for energy security and connectivity.

Source: The Hindu Business L ine

OMCs told to cancel Rs50 bn tender for buying LPG cylinders

9 September. The government has ordered three state-run Oil Marketing Companies (OMCs) Indian Oil Corp (IOC), BPCL (Bharat Petroleum Corp Ltd) and HPCL (Hindustan Petroleum Corp Ltd) to cancel Rs50 bn tender for purchase of cooking gas or liquefied petroleum gas (LPG) cylinders following detection of several discrepancies in the buying process. OMCs had recently floated a tender to buy 37.7 mn liquefied petroleum gas (LPG) cylinders to serve new customers, which have almost doubled in the past five years. Many conditions prescribed in the tender, including the pricing and preference for vendors from eastern India, triggered several complaints to the Prime Minister’s Office (PMO), which then sought a wider examination of the matter. One important issue highlighted by the government in the tender is that of higher rates for cylinders compared with the purchase price in 2017. The government also questioned the efficacy of the price band mechanism companies have followed in the tender. In 2017, cylinders were purchased for about 1,350 a piece. At that rate, the current tender for 37.7 mn cylinders would have been worth Rs50.89 bn. The government has asked oil companies to make sure that cooking gas supply to customers is not affected due to tender cancellation and delayed purchase of new cylinders.

Source: The Economic Times

Raid unearths hoarding of kerosene in Meerut, 70k litres seized

9 September. Blowing the lid off a big scam, the district administration unearthed 70,000 litre of kerosene oil stored in illegal underground tankers in Meerut’s Partapur area. The seized kerosene was in excess of sanctioned limit of 48,000 litre to the firm. The crackdown comes close on the heels of adulterated petrol scam where more than 2 lakh litres of adulterants was seized from a firm on 20 August in Partapur area.

Source: The Economic Times

OMCs flag roadblocks in government’s plan of rationalising taxes on jet fuel

8 September. Oil Marketing Companies (OMCs) have cited issues like sales tax as a barrier to the Civil Aviation Ministry’s plan to rationalise additional charges that airlines have to pay while uplifting jet fuel or aviation turbine fuel (ATF) at airports across India. Currently, airlines have to pay taxes for certain services, such as 'throughput charges', 'into-plane charges' and 'fuel-infrastructure charges' when they take the ATF at any airport for their planes. According to government estimates, if a direct-billing mechanism is implemented, airlines would be able to save around Rs4 bn per year. In India, ATF accounts for almost 40 percent of any airline’s total expenditure. During one of the meetings of the committee, the OMCs -- Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) -- stated that the state governments would be reluctant to let go of the tax revenues that come from the circuitous billing.

Source: Business Standard

BPCL, HPCL buy more gasoline to plug supply gaps

5 September. Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) continue to import gasoline to plug a persistent supply gap as their refineries undergo maintenance and upgrade to produce cleaner fuels. BPCL bought 20,000 tonnes of gasoline for 16-18 September arrival at Kandla at premiums of about $4 a barrel to Singapore quotes on a cost-and-freight (C&F) basis. HPCL has a larger appetite for the fuel, buying more than 155,000 tonnes for September and October, with its most recent purchase made on 29 August from Total. HPCL also has an outstanding tender to buy another 30,000 tonnes for 10-12 October arrival at Visakhapatnam. HPCL had been actively seeking gasoline since December last year but results of its earlier buy tenders were not clear. India remains a gasoline exporter despite the buying spree, although its net gasoline exports between January and July this year have been reduced to a monthly average of 950,000 tonnes compared with 1.11 million tonnes (mt) for the same period last year. Demand from India alone has been insufficient to drive the Asian gasoline market higher due to expanding refinery capacities in China, where gasoline shipments in July at 1.56 mt were 75 percent higher than a year ago.

Source: Reuters

NATIONAL: GAS

Punjab slashes VAT on natural gas

10 September. The Punjab government slashed value added tax on natural gas to 3.3 percent from 14.3 percent earlier to encourage industries to shift to the eco-friendly fuel. However, the VAT (Value Added Tax) on compressed natural gas, used mainly as auto fuel, will remain at 14.3 percent. The major consumer of gas is National Fertilisers Ltd (NFL), which uses the gas at its plants at Bathinda and Nangal. Before March 2015, the VAT rate on natural gas was 6.05 percent. From March 2015 onwards, it was increased from 6.05 percent to 14.3 percent. Due to increase in VAT rate, NFL started interstate billing of natural gas, due to which VAT collection on natural gas decreased.

Source: Business Standard

Cabinet nod to gas exchange in September, GAIL not to get majority

10 September. The government has decided against giving gas transportation company GAIL (India) Ltd majority stake in the proposed gas exchange to prevent conflict of interest seeping into the latest reform initiative that would pave the way for free trading of natural gas - both short-term and long-term - through dedicated exchanges. Petroleum and Natural Gas Regulatory Board (PNGRB) said that draft regulations on gas exchanges has already been finalised by it that clearly specifies that a gas pipeline company will not be allowed to take majority stake in these new exchanges. The proposed gas trading hub will come up in the country early next year (first quarter of FY21) as PNGRB would take at least six to eight months to finalise regulations. Rating agency CRISIL has been appointed to assist the regulator and the government in framing rules for the exchange. The Ministry of Petroleum and Natural Gas is expected to approach the Cabinet to set up a gas exchange. The move is aimed to provide market-driven pricing gas and pool domestic natural gas with imported liquefied natural gas (LNG). The gas exchanges could evolve both physical or virtual trading hub. The location will depend on where the major pipelines are connected. The major pipelines are currently connected in Gujarat, Maharashtra and Kakinada in Andhra Pradesh. The government is looking to unbundle marketing and transportation operations of gas in the country, a move that would end up splitting GAIL, which owns most of nation’s natural gas transportation network. The government is hoping to raise the share of natural gas in the country's energy mix to 15 percent by 2030 from the current 6 percent. It is also planning to double its gas pipeline network and gas import terminal capacity over the next few years.

Source: The Economic Times

H-Energy signs pact for setting up LNG terminal at Kakinada port

9 September. Realtor Hiranandani’s energy arm, H-Energy said it has signed agreement to set up a liquefied natural gas (LNG) import terminal at Kakinada port in Andhra Pradesh, its third LNG import facility in the country. Kakinada Seaports Ltd (KSPL) has the concession for Kakinada deep water port from Andhra Pradesh government. It will develop an LNG hub at the Kakinada Port catering to the needs of domestic customers in Andhra Pradesh, H-Energy said. LNG imported at Kakinada would be shipped to H-Energy’s upcoming Kukrahati terminal in West Bengal and neighbouring countries like Bangladesh and Maynmar through small LNG vessels. H-Energy is setting up an LNG terminal at Jaigarh in Maharashtra and also developing a natural gas pipeline of more than 1,000 kilometre (km), connecting its import facilities to the downstream gas markets. The company said it will start the commercial operation of its FSRU (floating storage and regasification unit)-based LNG receiving terminal at the Jaigarh port in Maharashtra by end of 2019 along with a 60 km natural gas pipeline to Dabhol. It is also laying a 635 km natural gas pipeline from Jaigarh to Mangalore, which will connect to gas customers in Maharashtra and Karnataka and a 242 km line from Kanai Chhata to Shrirampur (at India-Bangladesh border), which will supply re-gasified LNG to customers in West Bengal and Bangladesh.

Source: Business Standard

RIL seeks minimum $5.4 per unit for new natural gas find from KG-D6 block

8 September. Reliance Industries Ltd (RIL) is seeking a minimum price of $5.4 per unit for the natural gas it plans to produce from newer fields in the Bay of Bengal block KG-D6 (Krishna Godavari Dhirubhai 6) as it changed parameters to suit government policies. RIL and its partner BP Plc of the UK (United Kingdom) have sought bids from potential users for the 5 mn standard cubic metres per day of natural gas they plan to produce from the R-Cluster Field in KG-D6 block from second quarter of 2020, according to the bid document. It set a floor or minimum quote of 9 percent of dated Brent price -- which means bidders would have to quote 9 or a higher percentage for seeking gas supplies. At $60 per barrel price, the gas price comes to $5.4 per million metric British thermal unit (mmBtu). E-bidding would happen on 10 October 10, the bid document said. The rate compares to the government mandated $3.69 rate that its currently producing Dhirubhai-1 and 3 fields in KG-D6 block are getting. The government gas pricing policy however provides for a higher cap price for future gas produced from difficult fields like those in deepsea. This cap currently is fixed at $9.32 per mmBtu. RIL and BP are developing three sets of discoveries in KG-D6 block -- R-Cluster, Satellites and MJ by 2022. The document said the gas price would be lower of the quoted rate or the government mandated ceiling for the difficult fields. The formula Reliance is using to price gas for R-Series fields is different from its last price discovery it made for the coal-bed methane (CBM) from its Sohagpur CBM blocks in Madhya Pradesh. For Sohagpur CBM, it had in 2012 sought bids at a benchmarked rate at 12.67 percent of JCC, or Japan Customs-Cleared Crude, plus $ 0.26 per mmBtu. At $60 per barrel oil price, CBM from its Madhya Pradesh block was to cost $7.8. RIL ended up buying the CBM gas from its block after it bid deducting $1.836 per mmBtu, lower than $3.156 bid by rival Piramal Glass and $3.495 bid by GAIL (India) Ltd.

Source: Business Standard

< style="color: #faf5f5">QuIck Comment

< style="color: #faf5f5">Emergence of a gas exchange will transform the gas sector!

< style="color: #faf5f5">Good! |

Torrent Gas acquires 3 firms to expand CGD business

4 September. Torrent Gas, a part of the Torrent Pharma Group, is expanding its city gas distribution (CGD) business by acquiring three companies. This is in addition to the 13 geographical areas it won in bidding. The fresh acquisitions take the company’s reach to 16 geographical zones in 32 districts and 7 states. The company plans to invest around Rs100 bn in the business. The company has acquired Mahesh Gas in Pune from the Mahesh Group. It took over Siti Energy in Moradabad and Dholpur CGD from Essel Group. Mahesh Group could not start operations in Pune and exited the business with the sale to Torrent.

Source: The Financial Express

NATIONAL: COAL

HC notice to MSMC over ‘fixed’ coal washery tender

10 September. Maharashtra State Mining Corp (MSMC)’s criteria for selecting a washery to wash coal and supply it to MAHAGENCO (Maharashtra State Power Generation Company) has run into trouble. A coal washery operator has moved Nagpur bench of Bombay High Court (HC), alleging that the tender was tweaked to favour two hand-picked companies. The petitioner, Bhatia Coal Ltd, in its petition before HC questioned the very rationale behind prescribing turnover of Rs850 mn to Rs1.4 bn for ‘A’ category work, and between Rs2.4 bn to Rs4 bn for ‘B’ category. It alleged that this was done to prevent competition from all eligible operators from Vidarbha region. MSMC had invited tender on 16 August 2019, for washing coal and supplying it to Chandrapur, Koradi, Khaparkheda, Nashik, Bhusawal, Parali and Paras thermal power stations of MAHAGENCO for next five years. The successful bidder has to lift 22 mn metric tonne coal per annum from Western Coalfields Ltd (WCL), Mahanadi Coalfields Ltd (MCL) and South Eastern Coalfields Ltd (SECL) mines and wash the raw coal at the washery plant. The washed coal is to be supplied to seven power plants via railways. The last date for submission of bids was 31 August. However, it was extended till 6 September. The total value of tender is Rs2.52 bn per year. The petitioner claimed that the prospective coal to be washed would cost only a fraction of the turnover demanded, and hence the number had been jacked up only to accommodate respondent bidders who were active in other states where coal washeries ran during last six-seven years. In Maharashtra, coal washeries lost business following a bitter dispute with MAHAGENCO over washed coal and reject quantity. The petitioner also wondered why tendering authority had filed a caveat.

< style="color: #faf7f7">QuIck Comment

< style="color: #faf7f7">Domestic coal supply shortage illustrates the failure of captive production by the private sector!

< style="color: #faf7f7">Ugly! |

Source: The Economic Times

Coal likely to remain in short supply until 2024, CIL tells government

9 September. Coal is likely to remain in short supply until 2024, national miner Coal India Ltd (CIL) has informed the coal ministry in a recent note. Considering the current fuel supply agreements (FSAs) and several MoUs (Memorandum of Understandings) for coal supply, CIL said the current year will witness a deficit of 168.45 million tonnes (mt); the next year’s shortfall will be 71.25 mt. CIL said the deficit may widen to 262.4 mt in the current financial year, if the Centre brings in more schemes. And if such a scenario prevails, the deficit will be 111.27 mt for the next financial year. In the current financial year, CIL has set a production and sales target of 660 mt, which it plans to scale up to 710 mt in the next financial year. During 2024-25, the company aspires to achieve a production of 940 mt of coal. CIL expects a spurt in demand of coal as more households get electricity connections and industrial demand bounces back. Coal offtake to the power sector increased by 29.3 tonne during the last 11 months, thereby improving the coal stock situation at power units. CIL sold 411.5 mt coal to the power sector during the April-February period last year.

< style="color: #fafafa">QuIck Comment

< style="color: #fafafa">Arresting discom losses will require political rather than economic interventions!

< style="color: #fafafa">Bad! |

Source: Business Standard

NATIONAL: POWER

Government mulls new power tariff policy, UDAY 2.0 for resolving discoms losses

9 September. The government is in the process of rolling out a new tariff policy and UDAY 2.0 to address the issue of losses of discoms (distribution companies), which is the "only difficulty" in ensuring round the clock electricity supply for all, Power Minister R K Singh said. According to the PRAAPTI portal, the total outstanding of the discoms to gencos as of July this year stood at Rs734.25 bn, including the overdue amount of Rs552.76 bn. The dues to discoms become overdue after 60 days of non-payment of the bill, allowing gencos (generating companies) charge penal interest on that. About the steps being taken by the government, the minister said that the central government has already made it mandatory for discoms to open letters of credit for getting supply from gencos, excluding state government power plants from 1 August 2019. He said that new tariff policy has already gone to the Cabinet for vetting and approval while the power ministry is working on the UDAY 2.0 scheme which would be launched this fiscal only. He said that under the new tariff policy, the discoms would have to pay a surcharge for delayed payment, which would be equal to the commercial rate of interest. Under the new tariff policy, a provision for standards of service which would provide timeline for various services like time period for replacing a burnt transformer etc. Singh said that the tariff policy provides that the Central Electricity Authority (CEA) would set standards of service and there would be a penalty for not meeting those standards. He also said that UDAY 2.0 provides that the funds from the Centre would only be released if the discom takes steps to reduce losses. The Centre in November 2015 had launched the Ujwal Discom Assurance Yojana (UDAY) to bring about operational and financial turnaround of debt-laden power distribution companies. Finance Minister Nirmala Sitharaman in her budget speech in July had said, Our government launched UDAY in 2015 aimed at financial and operational turnaround of discoms.

Source: Business Standard

Mohali department owes Rs85 mn power dues

9 September. The water supply and sanitation department tops the list of power bill defaulters in the district, owing Rs85 mn to the Punjab State Power Corp Ltd (PSPCL). The PSPCL has put up a list of 110 defaulters on its office notice board as a name-and-shame exercise. The total dues amount to Rs105.7 mn. The Mohali unit of vigilance department has not paid Rs17 lakh electricity bills for two to three months, while police stations owe Rs14 lakh and primary, middle and high schools of Manauli, Sohana, Kambala, Bhagomajra and Raipur Kalan Rs7 lakh. The issue of non-recovery of outstanding bills has been flagged in the annual audit report.

Source: The Economic Times

Delhi discoms regulatory assets down by Rs30.2 bn in 5 yrs

8 September. The power sector in Delhi has seen a steady decline in regulatory assets to Rs83.77 bn over the last five years, helping the AAP government keep tariffs under check. The transformation of the Delhi’s power sector is best captured by the fact that tariff rates have continuously reduced in the last five years and are now the cheapest in the country, with round the clock power supply in all parts of Delhi, Delhi Dialogue and Development Commission Vice-Chairman Jasmine Shah said. Since 2008-09, the combined regulatory assets (RAs) of the three discoms (distribution companies) in Delhi- BYPL, BRPL and TPDDL shot up drastically from Rs9.37 bn to Rs114.06 bn in 2014-15, Delhi government’s power department said. The RAs have registered a steady decline over the last five years from Rs114.06 bn in 2014-15 to Rs83.77 bn in 2018-19, showing a decline of Rs30.29 bn in that period. The Delhi government has fully subsidised monthly consumption of up to 200 units of electricity and extended 50 percent subsidy to consumers in the range of 201-400 units.

Source: The Economic Times

NTPC commissions first 660 MW unit of Nabinagar plant

8 September. NTPC Ltd commissioned the first 660 MW unit of a 1,980 MW power plant in Nabinagar, Bihar. Nabinagar Power Generating Company is a wholly-owned subsidiary of NTPC. NTPC currently operates 53 power stations in total out of which 22 are coal-based, seven are of combined gas-liquid fuel cycle, two hydro as well as one wind project. Apart from this, there are 11 solar projects also operational under NTPC. It further owns nine coal and one gas station in joint ventures taking the capacity to 55,786 MW. NTPC is aiming to achieve a total installed capacity of 130 GW by the year 2032.

Source: The Economic Times

Private sector investments need to increase for cross-border power trading: Power Secretary

5 September. Private sector investment should increase to create a more robust integrated cross-border power trading market, Power Secretary S C Garg said. He urged the private sector to invest and jointly cooperate in the 2.5 lakh potential that exists in the South Asian region and to make mantra of 'One World, One Sun One Grid' a reality. GMR Energy Chief Executive Officer (CEO) S N Barde said India is a leading power-generating country among the BBIN (Bhutan, Bangladesh, India and Nepal) nations. Barde welcomed the announcement of the new cross-border trade regulations released by the Central Electricity Regulatory Commission (CERC) and that it is a big milestone in providing optimisation of tariffs which will invariantly benefit all member nations.

Source: Business Standard

Haryana waives surcharge on electricity bill for tubewells

4 September. Haryana government announced to waive surcharge on electricity bills of tubewells. Besides, it also announced to give relief ranging from 9 percent to 45 percent to plot holders of Haryana Shehri Vikas Pradhikaran (HSVP) under the Enhancement Recalculation Scheme. After three settlement schemes for loanee farmers of cooperative banks, the state government has now decided to provide relief to tubewell consumers having electricity connection and plot holders of HSVP, Haryana Chief Minister Manohar Lal Khattar said. He said 6.10 lakh farmers in the state have taken electricity connection for the tubewells. Out of this, about 2.44 lakh connections have become defaulters and an amount of Rs1.47 bn is outstanding towards them.

Source: The Economic Times

UP government defends power tariff hike

4 September. Uttar Pradesh (UP) Energy Minister Shrikant Sharma defended his government’s decision to hike the power tariff for various consumer categories in the state. His statement came after the Uttar Pradesh Electricity Regulatory Commission (UPERC) approved up to 12 percent increase in power tariff for various consumer categories. BSP chief Mayawati had strongly condemned the new electricity tariff hike and lambasted the BJP government for approving the hike in rates. Sharma said that the electricity companies suffered huge losses under SP-BSP rule. Sharma said that the BJP government had made significant improvements in the conditions of electricity supply in the state and cited the drawbacks under the previous governments. The UPERC has approved a hike of 8 to 12 percent in power tariffs. The Industrial Sector category will have to shell out more money in the range of 5-10 percent. The electricity tariffs have also been hiked in urban and rural areas.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Tamil Nadu government to set-up 20k solar panels connected to water pumps by October 2020

10 September. In an effort to bring down Tamil Nadu farmers' dependence on electricity, the state government has planned on a trial basis to set-up 20,000 solar systems that will be connected to water pumps. The project which is being implemented by Tamil Nadu Energy Development Agency (TEDA) comes under the Central renewable energy ministry's scheme KUSUM. As per the scheme, 10 lakh agriculture pumps in India that are currently connected to the electricity grid will be connected to a solar PV (photovoltaic) panel which will in turn set-up by each state government at the ground level. According to Tamil Nadu Electricity Regulatory Commission, there are around 21 lakh agriculture pumps in the state which can consume as much as 8,900 MW. Out of 29,859 MW of electricity generated in the state in 2017, 30 percent was used only by these pumps. Experts in the renewable energy sector said that this number can be cut down by more than half of the pumps work on solar energy. TEDA will be installing 20,000 solar panels connected to the pump across seven to eight regions in the state, free of cost. The Ministry of New and renewable Energy (MNRE) has also fixed a target of installing 18 lakh stand-alone solar pumps and setting up 10,000 MW of decentralised solar power plants across the country.

Source: The New Indian Express

India halfway through its 175 GW renewable energy goal: Javadekar

9 September. Union Minister for Environment, Forest and Climate Change, Prakash Javadekar said that India has already achieved half of its renewable energy production target. The government plans to achieve 175 GW of renewable energy capacity by 2022 as part of its climate commitments. Reportedly, India currently has an installed renewable energy capacity of around 80 GW.

Source: The Economic Times

CSE launches solar energy initiative for schools in Shimla

9 September. Centre for Science and Environment (CSE), a New Delhi-based research and advocacy body, recently said it has launched a special initiative called 'Solar in Schools' in Shimla in partnership with the Himachal Pradesh Council for Science, Technology and Environment. The GSP 2018 environmental audit of 1,700 schools revealed that only 13 percent of schools operate on solar energy. In Himachal Pradesh, of the 114 schools that participated in the GSP Audit 2018, only 16 claimed to have installed solar energy systems. Many of the schools were burning biomass or wood mainly for cooking mid-day meals. The programme will be piloted first in Shimla, and will be rolled out in phases. The participating schools will submit an energy audit of their schools to identify the sources of energy used. Himachal Pradesh is also one of the 11 special category states that can claim 70 percent of the project cost as Central Financial Assistance under the National Solar Mission.

Source: The Economic Times

Project for solar power on farmland to kick off in Delhi

8 September. Delhi government’s plan to generate solar energy on agricultural land is set to take off. The power department will soon float tenders to invite companies to set up the solar plants under the Mukhyamantri Kisan Aay Badhotari Solar Yojana under the public-private participation model. The scheme was approved by the government in July last year, but picked up speed only after Delhi Electricity Regulatory Commission (DERC) notified the net metering guidelines. The energy generated through the renewable source will be exported to the grid and then supplied to the areas. Under the scheme, the private companies under the RESCO (Renewable Energy Service Company) model will be allowed to install solar panels on not more than one-third of the total land owned by a farmer.

Source: The Economic Times

MNRE to enlist eligible models and manufacturers for solar PV modules

6 September. The Ministry of New & Renewable Energy (MNRE) has decided to enlist approved models and manufacturers of solar photovoltaic (PV) cells and modules complying with the Bureau of Indian Standards (BIS) norms, according to the latest MNRE notification. The Approved List of Models and Manufacturers (ALMM) will consist of two lists. List-I will specify models and manufacturers of solar PV modules, and list-II will specify models and manufacturers of solar PV cells. The effective dates for operationalising of these lists has been set as 31 March 2020 after which, only the models and manufacturers included in ALMM lists (of solar PV cells and modules) will be eligible for use in government and government-assisted projects, and schemes and programmes, to be implemented across the country. All projects for which bids have been finalised before the issuance of order shall stand exempted from the mandatory requirement of procurement of cells and modules enlisted in the ALMM order.

Source: The Economic Times

PM Modi wonders if India can become solar power battery hub

6 September. Amid his thrust on renewable energy, Prime Minister Narendra Modi wondered whether India could become a hub of solar power battery manufacturing, which can play a major role in the march towards clean energy. Modi was responding when asked for his comments on the global challenge of climate change after he addressed the Eastern Economic Forum (EEF) in presence of Russian President Vladimir Putin, Japanese Prime Minister Shinzo Abe, Malaysian Prime Minister Mahathir Mohamed and Mongolian President Kjhaltmaagin Battulga. He said India, as part of its aspiration to generate 175 GW of clean energy by 2022, is focusing on solar power in a big way. He said if solar power was used for cooking in the country, there was scope for 250 mn batteries, which in turn could benefit the electric vehicle market through cross-subsidy.

Source: The Economic Times

Arunachal Pradesh to develop power sector with focus on clean energy

6 September. The Arunachal Pradesh government is committed to all-round development of power sector with emphasis on clean energy, Deputy Chief Minister (CM) Chowna Mein has said. Calling upon engineers of the power and hydropower departments to work in close coordination for optimally harnessing the hydro potential of the state, the Deputy CM said, all forms of energy resources should be harnessed for developing the power sector. Concerted efforts have to be made to draw maximum power from the hydro power stations of the state, which would help in renewable energy accreditation.

Source: The Economic Times

Solar installations in first half of 2019 at 3.2 GW, down 35 percent

5 September. Solar installations in India, during the first half (H1) of 2019 reached 3.2 GW. This is a 35 percent decline in capacity, compared to 5.1 GW added in H1 of 2018, according to Mercom India. In its report on Q2 2019, titled India Solar Market Update, Mercom found that the total installations in the Indian solar market declined by 14 percent in the second quarter, reaching 1,510 MW as against 1,761 MW in Q1 2019. Installations were also lower year-over-year (YoY) compared to 1,665 MW in Q2 2018. In Q2 2019, large-scale installations totalled 1,218 MW compared to 1,498 MW in Q1 2019 and 1,250 MW installed in Q2 2018. The large-scale solar project development pipeline has increased to 22 GW.

Source: The Hindu Business Line

INTERNATIONAL: OIL

CNPC skips Venezuelan oil loading for second month

10 September. China National Petroleum Corp (CNPC), a leading buyer of Venezuelan oil, will skip cargo loadings for a second month in September as the state oil giant looks to avoid breaching US (United States) sanctions. CNPC made a surprise halt in loading Venezuelan oil after the Trump administration in early August froze Venezuelan government assets in the US and officials warned companies against dealing with Venezuela’s state-run oil company, Petróleos de Venezuela, SA (PDVSA). The move comes as Russian state oil major Rosneft has become the main trader of Venezuelan crude, shipping oil to other buyers and helping Caracas offset the loss of traditional dealers who are avoiding it for fear of breaching US sanctions. Most deliveries of Venezuelan crude oil and refined products to CNPC are to repay billions of dollars Beijing lent to Caracas through oil-for-loan pacts. Chinese customs data showed China’s Venezuelan crude imports plunged 40 percent in July to just over 700,000 tonnes, the lowest monthly amount in nearly five years.

Source: Reuters

Goldman Sachs cuts 2019 oil demand growth forecast to 1 mn bpd

10 September. Goldman Sachs has lowered its forecast on 2019 oil demand growth, citing reduced demand from India, Japan, other non-OECD (Organization for Economic Cooperation and Development) Asian regions, the Middle East and Latin America. The Wall Street bank revised its forecast down to 1 mn barrels per day (bpd), from 1.1 mn bpd but left its 2020 demand growth estimate broadly unchanged at 1.4 mn bpd. However, it stuck to its 2020 price forecast for Brent crude at $60 a barrel, flagging the willingness of the Organization of the Petroleum Exporting Countries (OPEC) to sacrifice market share. Crude oil prices have shed nearly 20 percent from 2019 highs hit in April, partly because of an escalating trade war between the United States and China, which is expected to hurt the global economy and, in turn, demand for oil. Other banks, including Morgan Stanley and Barclays, have also flagged risks to oil demand as a result of economic uncertainties. Morgan Stanley lowered its oil price and demand forecasts for the rest of the year, citing a weaker economic outlook, faltering demand and higher shale oil output.

Source: Reuters

Russia’s central bank does not rule out 2020 oil price at $25 per barrel in risk scenario

9 September. Russia’s central bank in its risk scenario does not rule out oil prices falling to $25 per barrel in 2020, it said. The risk scenario could be triggered in case of lower demand for energy products around the globe and worsening prospects for global economic growth, it said.

Source: Reuters

Iraq will cut oil output from October: Oil Minister

8 September. Iraq’s Oil Minister Thamer Ghadhban said it would reduce oil production from October. He said Baghdad’s talks over unifying oil exports with the semi-autonomous Kurdistan Region were in “advanced stages”.

Source: Reuters

BP expects oil demand to grow by less than 1 mn bpd in 2019

4 September. Global oil demand is expected to grow by less than 1 mn barrels per day (bpd) in 2019 as consumption slows, BP Chief Financial Officer Brian Gilvary said. Mounting trade tensions between the United States and China and increased signs of global economic recession are also set to weigh on oil refining margins, which BP expects will soften in the fourth quarter of the year, Gilvary said.

Source: Reuters

INTERNATIONAL: GAS

US natural gas output, demand seen rising to record highs in 2019

10 September. US (United States) dry natural gas production will rise to an all-time high of 91.39 billion cubic feet per day (bcfd) in 2019 from a record high of 83.39 bcfd last year, the Energy Information Administration said. The latest output projection for 2019 was up from EIA’s 91.03 bcfd forecast in August. EIA projected US gas consumption would rise to an all-time high of 84.51 bcfd in 2019 from a record 82.07 bcfd a year ago.

Source: Reuters

Iraq resists US pressure to reduce Iranian gas imports

10 September. Iraq will struggle to generate enough electricity unless it continues to use Iranian gas for three to four more years, Electricity Minister Luay Al Khateeb said, resisting US (United States) pressure to stop the imports from its Middle East neighbour. Iraq has a US waiver to import Iranian gas, but Washington has been pressing Baghdad to phase them out. Exports of gas to Iraq and exports of refined products to global markets remain an important source of revenues for Iran. Iranian gas imports could be reduced if Iraq used more of its gas reserves rather than flaring it, or burning off the associated gas that is produced during oil extraction. Oil Minister Thamer Ghadhban said four projects were underway to help convert 1.2 billion cubic feet (bcf) of associated gas into liquids and significantly reduce flaring.

Source: Reuters

Plans for Israeli gas exports to Egypt on track: Egyptian Petroleum Minister

10 September. Plans to start exporting gas from Israel to Egypt are on track but further steps are still needed before exports can commence, Egyptian Petroleum Minister Tarek El Molla said. The gas will be supplied via the East Mediterranean Gas (EMG) subsea pipeline following a landmark $15 bn export deal struck last year. The pipeline operator has signed a deal to use a terminal belonging to Israel’s Europe Asia Pipeline Company (EAPC), one of the final hurdles before starting exports, the companies said. Molla said Egypt’s Damietta liquefied natural gas (LNG) plant would restart operations as planned before the end of the year. The plant in northern Egypt has been idled for years due to lack of gas supply amid a dispute with Union Fenosa Gas (UFG), a joint venture between Spain’s Gas Natural and Italy’s Eni. Egypt’s gas production will rise by next year to around 7.5 billion cubic feet (bcf) per day from 7 bcf per day for the current year, Molla said.

Source: Reuters

Putin pushes idea of Russian gas supplies to China via Mongolia

9 September. Russian President Vladimir Putin told the head of state-controlled Gazprom to consider making Russian gas exports to China via Mongolia, the Kremlin said. Gazprom is due to start exporting gas to China in December via the eastern Power of Siberia pipeline.

Source: Reuters

Bangladesh to buy 1 mt of LNG on spot market in 2020, lured by price slide

9 September. Bangladesh’s state oil and gas company Petrobangla plans to buy more than 1 million tonnes (mt) of liquefied natural gas (LNG) on the spot market next year, seeking to capitalise on lower prices for the super-chilled fuel. Asian spot LNG prices are currently seasonally at their lowest in years due to new supply entering the market from the United States (US), and as demand growth slows in major economies. Petrobangla, in charge of LNG imports into the South Asian country, plans to issue a spot tender some time over January or February next year, the Federation Of Bangladesh Chambers Of Commerce and Industry director Mohammed Riyadh Ali said. Petrobangla will buy eight cargoes of 140,000 tonnes each, or a total of about 1.1 mt, in 2020, he said. According to Riyadh Ali, the purchase will mark Bangladesh's first spot tender for LNG. The nation of 160 mn people is expected to become a major LNG importer in Asia, alongside Pakistan and India, as domestic gas supplies fall. Bangladesh currently has two floating storage and regasification units (FSRUs) with a total regasification capacity of 1 billion cubic feet per day - equal to about 7.5 mt a year. Petrobangla already imports about 300-400 mn cubic feet per day of LNG - equivalent to 3.5 mt per year in total - through two long-term contracts with Oman and Qatar.

Source: The Economic Times

Russia and Moldova close to gas price agreement

7 September. Russia and Moldova are close to reaching agreement on gas supplies. Moldova purchases gas from Russian gas giant Gazprom as part of an accord signed in 2008 that expires on 31 December. It currently pays $240 per 1,000 cubic metres. Based on Moldova’s current annual gas consumption of 3 billion cubic meters (bcm), the 30 percent price reduction would be equal to $200 mn.

Source: Reuters

Pakistan LNG buy tender attracts Asian sellers but Gunvor dominates

6 September. Commodity trader Gunvor offered the lowest prices to supply liquefied natural gas (LNG) to Pakistan for the majority of the cargoes the importer sought between October and December, despite attracting interest from Asian companies. Gunvor submitted the lowest offers for six cargo delivery slots with DXT Commodities, Vitol, a unit of PetroChina and Socar Trading submitting the lowest bids for the remaining four delivery slots, a Pakistan LNG document showed. Nine companies in all qualified in the tender to supply four cargoes in October, two in November and four in December. They included Japan’s JERA Global Markets, part of the world’s biggest LNG buyer JERA, and a unit of China’s top oil and gas company PetroChina Company Ltd. Despite being big buyers of LNG, Asian firms such as JERA and PetroChina have sought to expand their portfolio trading to optimise costs and as demand in Japan and China remained lacklustre this year. But seasoned LNG trader Gunvor, which submitted the lowest offers in all the previous tenders but one this year, came out top again. Pakistan LNG does not announce awards of its tenders, only the lowest bidders. Pakistan’s LNG tenders are eagerly watched by traders because it reveals the prices offered, shedding light on an often opaque market. The prices are expressed as a percentage of Brent crude price. The prices in this tender ranged from 8.3 percentof Brent crude oil prices for a late October cargo, submitted by Vitol, to 10.9 percent of Brent for a late December cargo, submitted by Gunvor. At oil prices of about $60 a barrel, that equates to $4.98 per million metric British thermal units (mmBtu) for the cheapest October cargo and $6.54 per mmBtu for the most expensive December cargo. Asian spot LNG prices were heard at $4.30 to $4.50 per mmBtu for October and at $5.20 to $5.50 for November.

Source: Reuters

UK regulator fines Engie unit for gas price manipulation by trader

5 September. UK (United Kingdom) regulator Ofgem has fined a unit of France’s Engie for market abuse after one of its traders manipulated wholesale British gas prices over a three month period in 2016. The regulator said it had not found more widespread market manipulation but it had fined EGM (Engie Global Markets) £2.1 mn ($2.6 mn) because it did not have enough measures to prevent or detect the market abuse. Ofgem said EGM had fully cooperated with its investigation and has since taken measures such as increasing surveillance of its traders. British gas prices, especially its day-ahead and month-ahead contracts, are seen as benchmark for European gas prices, alongside the Title Transfer Facility (TTF) Dutch gas prices.

Source: Reuters

INTERNATIONAL: COAL

Greenpeace 'Rainbow Warrior' blocks coal ship in Poland

10 September. Iconic Greenpeace ship the Rainbow Warrior prevented a cargo of coal from being unloaded at Poland’s port of Gdansk as activists demanded authorities end coal use within a decade, the environmental group said. Under the 2015 Paris climate treaty, the EU (European Union) pledged to reduce its carbon emissions by 40 percent below 1990 levels by 2030. Greenpeace activists also painted "stop coal" in large white letters on the side of the cargo vessel carrying the shipment of coal from Mozambique. Poland's right-wing Law and Justice (PiS) government plans only a gradual reduction in dependence on coal for electricity production, from around 80 percent to 60 percent in 2030.

Source: The Economic Times

Indonesia sets September coal benchmark price at near 3-year low

9 September. The Indonesian government lowered the coal benchmark price (HBA) for September to $65.79 per tonne, the lowest since October 2016, the energy ministry said. The weaker September benchmark was due to pressure from increased coal supply in China and India, as well as falling demand from the European continent, the ministry said. State utility PLN will purchase coal from miners at the HBA price level, instead of the $70 price cap the government imposed on thermal coal sold domestically to power stations, the ministry said. PLN has estimated it would consume 97 million tonnes (mt) of coal in 2019 and 109 mt in 2020.

Source: Reuters

Colombia coal output down year-on-year in second quarter

6 September. Colombia, the world’s fifth-largest exporter of coal, produced 18.9 million tonnes (mt) of the fuel in the second quarter, down 4.5 percent from the same period in 2018, the government said. Coal production in the South American country was 19.8 mt between April and June last year. Leading coal companies have forecast that production and exports are likely to remain stable in 2019. The Andean country produced 84.3 mt over the course of 2018. Coal is the second-largest generator of foreign exchange in Colombia, behind oil, and its top mining export.

Source: Reuters

Germany to start closing black coal plants in 2020

5 September. Germany plans to shut down its first power plants that use black coal in 2020, a draft law showed, as part of a planned phase-out of coal by 2038 expected to cost at least €40 bn ($44 bn). Black coal, also known as hard coal or anthracite, is a top grade coal with a high energy density. Lower grade brown coal, or lignite, is also used by some power plants. The government will announce far-reaching steps on climate protection on 20 September, including details on the implementation of its coal exit, which envisages that by 2022 an estimated 12 hard coal plants would be shut down, leaving about 30 feeding some 15 GW into the grid. Some 45 plants run either fully or partially on hard coal, according to the Federal Environment Agency. The government wants to reach a deal with utilities on a timetable to shut down brown coal plants and agree a framework for compensation.

Source: Reuters

INTERNATIONAL: POWER

Iraq power system requires investments of at least $30 bn

10 September. Fixing and upgrading Iraq’s power system requires investments of at least $30 bn, Electricity Minister Luay al-khateeb said. Iraq continues to suffer electricity shortages, 14 years after the US (United States)-led invasion that toppled Saddam Hussein.

Source: The Economic Times

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

US refiner Valero Energy begins cost review of renewable diesel plant in Texas

9 September. US (United States) refiner Valero Energy Corp said it has started a cost review of a new plant in Port Arthur, Texas, along with food processor Darling Ingredients Inc. The facility, which aims to tap into the growing global demand for renewable diesel, is expected to produce 400 mn gallons of diesel and 40 mn gallons of renewable naphtha a year. The final investment decision on the project is expected in 2021. If approved, the construction of the first renewable diesel facility in Texas could begin in the same year, with expected operations starting in 2024.

Source: Reuters

Saudi Arabia’s ACWA Power to focus more on renewable energy projects: CEO

9 September. Saudi Arabia’s ACWA Power plans to focus more on renewable energy projects, lifting their share of its portfolio to 70 percent over the next decade, its Chief Executive Officer (CEO) Paddy Padmanthan said. The current value of the Saudi Arabian utility developer’s portfolio is more than $42 bn, with renewables accounting for 23 percent. The company has assets in 12 countries and has bid for renewable energy projects in five new countries – Ethiopia, Tunisia, Cambodia, Azerbaijan and Uzbekistan.

Source: Reuters

Gas plants will get crushed by wind, solar by 2035

9 September. Natural gas-fired power plants, which have crushed the economics of coal, are on the path to being undercut themselves by renewable power and big batteries, a study found. By 2035, it will be more expensive to run 90 percent of gas plants being proposed in the US (United States) than it will be to build new wind and solar farms equipped with storage systems, according to the report from the Rocky Mountain Institute.

Source: Bloomberg

Australia set to beat 2020 clean energy target

4 September. Australia has met its 2020 target for generating electricity from large-scale renewable energy a year ahead of plan, the country’s clean energy regulator said, even as wind and solar investment has slowed. The renewable energy target was achieved despite more than a decade of climate policy uncertainty in Australia which has led to soaring power prices and unreliable supply. The target, launched in 2001 by a conservative government and reduced in 2015 with rare bipartisan support, was for Australia to generate 33,000 gigawatt hours (GWh) of power from large-scale renewable energy by 2020. Australia’s total power generation is currently around 260,000 GWh.

Source: Reuters

China solar installations to slow as subsidy cuts bite

6 September. China’s new installations of solar power are expected to slow considerably this year and over the next five years as the industry comes to terms with a new subsidy-free era, GCL System Integration Technology (GCL) said. China’s new solar installations hit a record 53 GW in 2017, but slowed to 41 GW in 2018 after the government announced a massive scaling-back of subsidies in order to ease pressures on the transmission system and reduce a subsidy payment backlog estimated at more than 100 bn yuan ($14 bn).

Source: Reuters

Global renewables investment to triple this decade: UN

5 September. Global investment in new capacity for renewable energy is on course to reach $2.6 trillion by the end of this decade, more than triple the amount of the previous decade, a report commissioned by the UN (United Nations) Environment Programme said. Solar power has attracted the most investment this decade at $1.3 tn. By the end of this year, there will be more solar capacity installed this decade - 638 GW - than any other power generation technology.

Source: Reuters

DATA INSIGHT

Bio Fuel Scenario in India

Ethanol Bio-Refineries Planned by PSUs

| PSUs/Company |

Number of Plants |

| Indian Oil Corporation Limited |

3 |

| Bharat Petroleum Corporation Limited |

3 |

| Hindustan Petroleum Corporation Limited |

4 |

| Numaligarh Refinery Limited |

1 |

| Mangalore Refinery and Petrochemicals Limited |

1 |

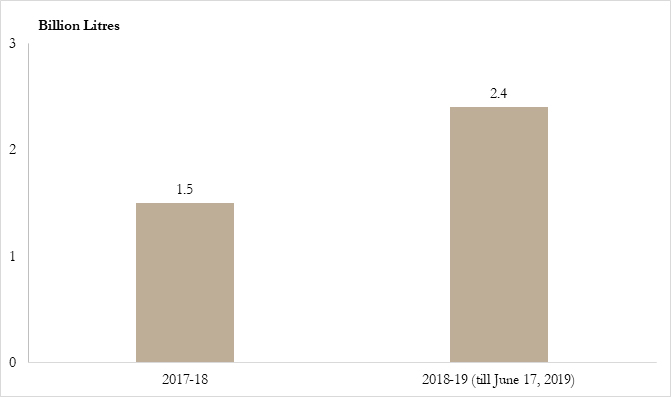

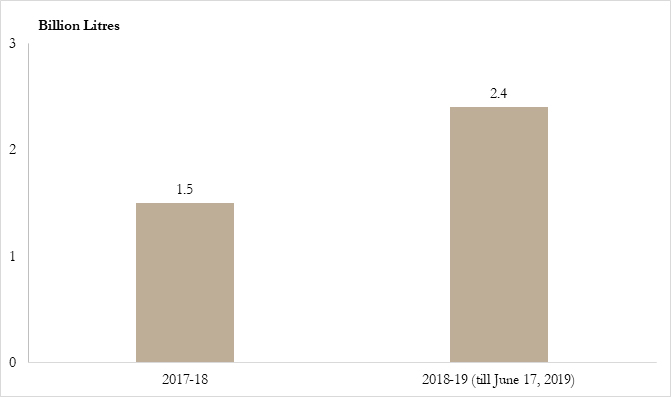

Ethanol Procured/Contracted by PSUs

Source: Parliament Questions for Ministry of Petroleum & Natural Gas

Source: Parliament Questions for Ministry of Petroleum & Natural Gas

Note: The 2017-18 year denotes the Ethanol Supply Year from 1 December 2017 to 30 November 2018).