SIGNS OF FINANCIAL DISTRESS IN RE SEGMENT

Non-Fossil Fuels News Commentary: May - June 2019

India

In the scorching summer months when the solar power industry should be at its best, it is plagued with financial woes. The total outstanding dues of solar-power companies supplying power to Telangana have shot up to ₹24 bn, plunging them in a financial crisis. The State, which has a solar installed capacity of about 3,600 MW and is on the verge of offering another 1,100 MW for development, has not been making payments since July 2018. According to representatives of solar-power producers in the State, the last payment pertaining to the supply made in June 2018 was made in the first week of April this year, after a delay of nine months. The previous bill (for power supplied in May 2018) was paid in December 2018. In all, 200 solar power projects totalling 3600 MW have been installed in Telangana as at end-April, and account for about 30% of the power required by the State.

Poor cash flow and credit profiles of power discoms of Telangana and Andhra Pradesh have adversely affected the financial health of many renewable energy projects, Ind-Ra has said. In its first report on the renewables sector, Ind-Ra said the soaring receivables from the discoms of the Telugu states have weakened the internal liquidity of many projects in the fledgling renewable market and kept them hostage to state utilities. Ind-Ra said projects with resourceful sponsors and adequate internal liquidity are likely to withstand the emanating stress and ride over this difficult period.

One of India’s biggest renewable energy producing states, Tamil Nadu, will stop conducting auctions for wind and solar energy projects following poor response to its tenders which set limits on tariffs. Instead, it will buy clean power from the SECI to fulfil Renewable Purchase Obligation. SECI is the renewable energy ministry’s nodal agency through which it holds wind and solar auctions. Tamil Nadu has been one of the leading states in the country so far in setting up renewable energy assets. It has the highest wind energy capacity in the country with 8,631 MW (as of end-2018), with another 2,055 MW of solar capacity. However, the response to the last two auctions conducted by its agency, TANGEDCO, has been disastrous. Earlier this year it issued a 500 MW solar tender, setting a ceiling tariff of Rs3 per kWh for which no bids were received. It also called for techno commercial submissions for a 500 MW wind tender at a tariff cap of Rs2.80 per kWh which again saw no participation. Hence it has decided to procure renewable power from SECI in future. SECI will soon call for bids for the same 500 MW solar tender once the poll results are out and the election code of conduct is removed.

The increasing share of renewables in the total energy mix of the country may lead to an increase in regulatory risk for coal-based projects in the long term, global ratings agency Moody’s Investors Service said. The higher share of renewable energy in the total energy mix presents a key regulatory challenge in terms of integrating new renewable capacity, while protecting investments already made in coal-based capacity, it said. Despite the mounting pressure to move to a lower carbon economy, the agency does not consider this risk high, at least over the next 3-5 years.

SECI again extended bids submission deadline for manufacturing-linked 3 GW solar power tender till 31 May. On 22 April, SECI had extended the last date of bid submission for tender till 14 May. According to the notice, the last date of bid submission is extended till 31 May 2019 (till 1600 hours). The techno-commercial bid opening shall be carried out from 1700 hours on the same day. SECI had floated the fresh tender for the 3 GW manufacturing-linked solar power tender in January this year. Initially, the bidders were to submit their bids by 18 March. SECI had extended deadline for bid submission to 4 April, from 18 March. Again, the deadline was extended from till 22 April. India is expected to add about 80 GW of renewable energy capacity in the next five years, according to a survey by consultancy Bridge To India. About 47 GW will be from utility scale solar, 21 GW from wind, 8 from rooftop solar and 3 GW from floating solar projects, the survey said. About 73% of the respondents are optimistic about the growth prospects of the Indian renewable industry, it said. Around 78% of the respondents feel that the government has propelled industry growth by increasing the renewable target to 175 GW. The government aims to achieve the renewable energy target of 175 GW by 2022 of which 100 GW would be solar energy and 60 GW through wind energy. About 90% of the participants feel that the bidding environment in the sector is aggressive, but the ratio of "irrationally aggressive" responses is down from 70% to 49%, it said.

India has finally bagged the tag of the lowest cost producer of solar power globally. The country-wise average for the total installed costs of utility scale solar PV in 2018 ranged from a low of $793 per kW – around Rs55 mn per MW -- in India to a high of $2,427 per kW in Canada, the IRENA said. Further, IRENA conducted an analysis of the decline in the cost of setting up solar PV projects between 2010 and 2018 across eight major markets including China, France, Germany, India, Italy, Japan, United Kingdom and the United States. The costs were found to have dropped at the fastest pace – 80% – in India. Typically, the cost of hardware -- including modules, inverters and racking and mounting -- account for more than a half of the total cost of setting up a solar PV project in India while installation and soft costs like financing and system design account for the rest. Experts attribute India’s status of lowest-cost producer of solar power to multiple reasons including high solar potential that leads to improved asset utilisation and lower cost of modules sourced from China.

The renewable energy industry wants the government to continue with a sharp focus on policy stability to spur growth, gaining from the likely continuity in administration. While the sector has witnessed some positive movement in the last year, with the implementation of safeguard duty, de-linked manufacturing tender and introduction of the KUSUM scheme, the government is expected to continue its support with primary focus on domestic manufacturers. Based on the overall direction of recent policy initiatives, the industry believes the government’s primary focus would be on reducing the import of solar equipment from foreign countries including Thailand, China and Vietnam, thus strengthening rupee denomination and contributing to the nation’s gross domestic product.

According to the data released by the CEA solar power accounted for over 11.4 bn units of electricity produced in Q1 2019. This marks a growth of 34% yoy from the 8.5 bn units generated in the Q1 2018. During FY 2018-19, India produced approximately 39.2 bn units of solar power, an increase of nearly 52% compared to the preceding FY 2017-18. Of the total electricity generation in FY 2018-19, over 90% came from non-renewable sources followed by renewables which stood at just 9%. According to Mercom’s India Solar Project Tracker, solar installed capacity in the country at the end of FY 2018-19 reached 30 GW, a 32% increase compared to 22.7 GW installed as of FY 2017-18. Even with impressive yoy growth, solar accounted for just 2.85% of the total power generated in the country and still has a long way to go. India’s transition towards renewable energy presents an incredible opportunity but also challenges.

NTPC Ltd has urged the ISA to appoint it a consultant for 1,000 MW of rooftop solar projects the latter plans to implement across several countries. NTPC proposes to charge 6-10% of the project cost as upfront consultancy fees, depending on the capacities of the solar installations. ISA is a treaty-based intergovernmental organisation headquartered in India, which plans to mobilise more than $1,000 bn of investments by 2030 to promote solar technology in countries lying between the tropics of cancer and capricorn. As on date, 52 countries have signed and ratified the ISA framework agreement. NTPC, along with other PSUs like SECI, IREDA, PGCIL, REC, PFC, CIL and PFC, has contributed $1 mn each toward ISA funding. NTPC, the twelfth largest power producer in the world, has more than 900 MW of solar and wind generation units in its portfolio. By 2030, it plans to have a total power production capacity of 130,000 MW, out of which, solar would comprise 30,000 MW. In the international market, the company already has its presence as a power project consultant in places such as Nigeria, Kenya, Saudi Arabia, Kuwait and the United Arab Emirates. The first assembly of the ISA had provisionally approved the prospective annual budget of $9 mn for calendar years 2019 and 2020. India has put in $16 mn to the ISA in a one-time corpus, apart from the annual commitment of $2 mn in the first five years. Private companies such as Japan’s SoftBank have funded $2 mn and China’s CLP has given $1 mn to the organisation. ISA has also recently floated a tender for procuring 270,000 solar water pumping systems for 22 member countries.

Mahindra Susten, a leading player in the Indian solar energy sector, has entered into a partnership with Mitsui & Co., of Japan to jointly develop and operate distributed solar power generation projects in India. Mahindra Susten will continue to hold 51% stake in Marvel Solren (Marvel), with Mitsui holding the balance equity. Marvel currently operates four distributed solar projects in India with a combined capacity of 16 MW that help private clients reduce their carbon footprint by providing renewable energy through long-term power purchase agreements of 10-25 years. Compared to power generated through an average Indian coal-fired power plant, the four projects can collectively reduce CO2 emissions by about 20,000 tons per year and will contribute to the Indian government's renewable energy targets.

To harness solar power for its energy needs Maruti Suzuki India Ltd - country’s largest vehicle manufacturer- announced setting up of a solar power plant with a capacity of 5 MW in its manufacturing facility in Gurugram. The company will invest around ₹240 mn, and will offset CO2 emissions to the tune of over 5390 tonnes annually, for the next 25 years. This is the second grid based solar power plant for Maruti Suzuki. The first solar power plant was set up in 2014 at Manesar, with 1 MW capacity. In 2018, this solar power plant was further expanded to 1.3 MW, Maruti Suzuki said. The power generated from the solar power plant will be synchronised with the captive power plant to cater to the internal energy needs of the Gurugram facility.

CREST has come up with a plan to promote solar energy and transfer its benefit to all the stakeholders. According to CREST the residents will be given the option to permit RESCO model companies to install the SPV power plant on their rooftops and, in lieu of this, the residents will be charged much lesser tariff for the solar-produced electricity in the tariff bills as compared to the normal tariffs. In a period of a maximum of 25 years, the house owner will be given the power plant. The SPV power plant would be installed under Net Metering Mode where the surplus or net power should be exported to the discom which would release the payment as per Joint Electricity Regulatory Commission regulations to the RESCO company.

Major urban centres around the world are embracing renewable energy sources to power homes and businesses, but Bengaluru is unlikely to feature in that hallowed list anytime soon. Since 2014, only 1,750 solar panels have been installed atop complexes in the city, with the least number of units coming up at government buildings. The dismal record is reflected in the data compiled by BESCOM, and it has complicated the utility’s target of generating 1,200 MW of electricity through solar panels till 2020. To date, it has achieved only 106 MW. Now, BESCOM is looking to install rooftop solar units at nearly 400 government buildings in the city, including Vidhan Soudha; MS Building, which houses the state secretariat; Raj Bhavan, police stations and public hospitals. Currently, there are only 57 units at government-owned properties. Residential buildings top the list with 1,260 solar-panel units, followed by commercial establishments (226), industrial plants (118), and educational institutions (103). The tender for installation of more solar panels at government buildings was issued earlier this year and the contract will be awarded within six months.

After the successful pilot project undertaken by PMPML where a solar power plant was installed on the rooftop of Swargate bus depot, the city transport provider has decided to install similar plants at 11 depots in the city. The electricity consumption at the Swargate bus depot has reduced by 80% since the solar power plant was installed on its rooftop in October 2018. According to PMPML, the hybrid solar power plant at Swargate depot is first of its kind in the city. A wind and solar hybrid non-conventional energy project at Swargate depot consists of the systems of a capacity generation of 20 kW wind and 15 kW solar energy. The entire system can generate average 80 kWh energy daily during the trial phase which can be increased to average 110 kWh daily. A wind and solar hybrid non-conventional energy project at Swargate depot consists of the systems of a capacity generation of 20 kW wind and 15 kW solar energy. The entire system can generate average 80 kWh energy daily during the trial phase which can be increased to average 110 kWh daily.

Delhi Metro – the lifeline of the national capital has taken sustainable development with energy-efficient solutions to an international level. Along with curbing pollution and giving more importance to green solutions, Delhi Metro is expected to set a record of utilisation of solar energy. The DMRC has started utilising around 100 MW of solar energy after receiving solar energy supply from the Rewa district of Madhya Pradesh. The metro trains in Phase-3 network are utilising more solar energy and with this, the metro operator has been able to save electricity by a huge amount. The 750 MW solar power plant in the Rewa district has been supplying solar energy since 18 April, last month. At that time, DMRC received around 27 MW of solar power. With this, DMRC started running the operations of Delhi Metro Violet Line completely through solar energy. It was said then that slowly and steadily, the supply of solar energy will increase from Rewa. Delhi Metro is to receive around 99 MW solar energy supply from the solar power plant of Rewa on a daily basis. In this way, DMRC will be able to receive 345 million units of solar power at affordable cost on a yearly basis.

Solar EPC player, Oriano Solar, said it has completed nine projects for Cleantech Solar totalling 13.75 MWp across seven states and union territories in the past six months. The states included Madhya Pradesh, Andhra Pradesh, Maharashtra, Tamil Nadu, Karnataka, and Rajasthan, along with Puducherry. These plants will generate clean energy that will offset annual carbon dioxide emission of 29,300 metric tons and have already created more than 310 jobs. Currently, Oriano is executing 134.5 MWp of solar projects to be commissioned by September 2019 and will surpass cumulative installation of 350+ MWp by the end of this financial year.

Amplus Solar said that it has secured approval from the Haryana government for two power projects of 150 MW for supplying clean energy to industries. Amplus Solar expects to make a capital investment of Rs7.5 bn for these open access projects, the company said. Under the open access route, industrial and commercial users can source electricity from the open market. They can purchase power from a number of suppliers and can also meet their Renewable Purchase Obligations. The company had signed an MoU with the Department of Renewable Energy, Government of Haryana, in 2016 to invest Rs10 bn in the solar sector in line with the Haryana Solar Policy that has a target of 3,200 MW of solar projects. Gurgaon-headquartered Amplus will set up these projects under group captive model in Sirsa and Bhiwani districts where it has already acquired 575 acres of land under a long-term lease. Construction of the plants is expected to begin soon and will be operational this year. The company has developed several marquee rooftop projects of over 15 MW under RESCO model in Haryana and is already supplying solar energy to customers like Mahindra Defense, Rapid Metro, Motherson Group, Fortis hospital, Yamaha and several others. Amplus is a 100% subsidiary of Petronas Holdings, Malaysia and has regional offices in Bengaluru, Bangkok, Dubai, Kuala Lumpur, Mumbai and Pune.

Tata Power’s subsidiary, Tata Power Renewable Energy Ltd, emerged winner in an auction conducted by Gujarat for 1000 MW of projects to be built at Dholera solar park. Tata Power and GIPCL were the only bidders who bid for 250 MW and 50 MW respectively at a tariff of Rs2.75 per kWh. Tata Power was chosen as the winner through draw of lots since GUVNL will be allotting only 250 MW. Developers have turned reluctant to auctions conducted by Gujarat because it had, earlier this year, cancelled the results of a solar auction held for 700 MW of projects to be constructed at Raghanesda solar park because the state felt tariffs quoted were too high. The auction was conducted again for the second time last month. Earlier, it also cancelled a 500 MW auction held in March last year at which the lowest price reached was Rs2.98 per kWh.

As many as eight renewable energy companies bagged contracts to develop wind power projects in Gujarat, aggregating 745 MW. Anisha Power Projects Pvt Ltd bid the lowest tariff of Rs2.80 per unit for 40 MW. GUVNL had in March invited bids for supply of 1,000 MW from wind power projects to be set up in Gujarat. The state-run power utility received bids for 931.4 MW, against the tendered capacity of 1,000 MW. According to the tender rules, GUVNL conducted a reverse auction for 745 MW. Among the other successful bidders, Powerica Ltd bagged 50.60 MW at a tariff of Rs2.81 per kWh. Vena Energy Shivalik Wind Power Private Ltd and Virdi Clean Alternatives Ltd won contracts for 100 MW each at Rs2.81 and Rs2.95 per kWh respectively. Sarjan Realities Ltd quoted Rs2.87 per kWh for 100.80 MW. Renew Wind Energy Pvt Ltd quoted Rs2.95 per kWh for the highest capacity of 200 MW and Inox Wind Ltd received a contract for 40 MW at the same tariff. Although Adani Renewable Energy Park (Gujarat) Ltd bid for 300 MW, it bagged only 113.6 MW. Some 459.65 MW of wind power capacity was installed in Gujarat in 2018-19. With 6,073.07 MW, the state ranks second in terms of wind power capacity after Tamil Nadu (installed capacity 8,968.91 MW). Gujarat Industries Power Company Ltd and Tata Power Renewable Energy Ltd quoted Rs2.75 per kWh for 50 MW and 250 MW solar power projects at the Dholera solar park. GUVNL had invited bids for 1,000 MW but the tender remained undersubscribed as it received bids only for 300 MW.

In order to provide a leg-up to the power storage industry — which is still in a nascent stage in the country — the government is coming up with 400 MW of renewable energy tenders for round-the-clock electricity supply. The MNRE said that storage-backed power from these sources would be supplied to the New Delhi Municipal Council and Dadra and Nagar Haveli. The development comes at a time when the government is gradually training its focus to promote storage technologies. In March, the union Cabinet approved the setting up of a national mission on transformative mobility and battery storage, aimed at boosting the deployment of electric vehicles and setting up of adequate battery-making capacity. According to India Energy Storage Alliance, the market for energy storage would grow to over 300 GWh during 2018-25 and India is expected to attract investment over $3 bn in the next three years.

Piramal Enterprises is in talks with PTC India to acquire its subsidiary PTC Energy’s 290 MW wind assets as part of their strategy to expand investments in renewable sector – wind and solar. Piramal Group is planning to acquire the entire wind portfolio of PTC India across Madhya Pradesh, Karnataka and Andhra Pradesh, which is likely to cost the company around Rs22 bn. PTC India recently mandated KPMG to advise on various fund-raising options where it may sell a major stake in the wind power business to a strategic investor or look at complete sale of assets. While PTC India is looking to exit its wind power portfolio, Piramal Enterprises has been investing into renewable portfolios across India as renewable sector is witnessing significant consolidation. In the last three years, the group has invested close to Rs28 bn in renewable companies such as Renew Power, Essel Infrastructure, and ACME Solar through its global investment partners. Piramal signed an MoU with Canadian Pension Plan and Investment Board to co-sponsor an infrastructure investment trust to invest in renewable assets with a corpus of $600 mn (Rs42 bn).

The government is mulling to increase the subsidy on rooftop solar panels from the present 30%, the New and Renewable Energy Development Corp of Andhra Pradesh said. The solar power is catching up especially among the commercial and service sectors with many schools, colleges, hospitals and other business establishments saving big on power tariff by installing rooftop solar panels on their premises. More than 60% of the commercial and service organisations have installed on-grid rooftop solar power system and are utilising the power for water heating and cooking. However, the installation of rooftop panels has been dismal in the domestic sector. Under the new policy, however, they say the subsidy component for the commercial establishments might be slashed. Soft loan is also available under the priority sector lending scheme for individuals for installation of the solar power system which costs around ₹60,000 per 1 kV.

India fell far behind Pakistan in new hydropower installed capacity with only 535 MW addition in 2018, as compared to Pakistan’s 2,487 MW, according to a recent report titled ‘2019 Hydropower Status Report’. Out of the top 20 countries, China topped the list with the highest installation of 8,540 MW, followed by Brazil at second position with 3,866 MW. Pakistan was ranked third, followed by Turkey with 1,085 MW new capacity addition and Angola with 668 MW, the report showed. The bottom five comprised Tajikistan at 605 MW, Ecuador at 556 MW, India with 535 MW, Norway with 419 MW and Canada with 401 MW, according to the report

NHPC Ltd’s takeover plan of Lanco Teesta Hydro Power’s beleaguered hydro power unit in Sikkim Teesta-VI (500 MW) is facing hiccups, after approval from the Cabinet. The NCLT, which approved the bid of NHPC, will hear the matter again over the issue of escalated cost. NHPC emerged the highest bidder with a bid amount of Rs9.07 bn. The investment proposal for an estimated cost of Rs57.48 bn was approved by the Cabinet Committee of Economic Affairs in March 2019. NHPC said Bihar, West Bengal and Jharkhand have given in-principle nod for buying power from Teesta-VI. However, an earlier agreement with Maharashtra is also posing a problem. NHPC is looking at more stressed hydro units but only through the NCLT route.

Industries should focus on setting up biogas and bio-methanation plants to substitute LPG, the environment ministry said while asserting that with the rise in demand, it is imperative that new and alternate mode of energy is put to use. Biogas plants and biomethanation plants should be set up in the cities. Tata Power said its arm TPREL will develop a 100 MW solar power project in Raghanesda Solar Park of Gujarat. The power generated from the project will be supplied to GUVNL under a PPA valid for 25 years from the scheduled commercial operation date. The company has won this capacity in a bid announced by GUVNL in March 2019. The project has to be commissioned within 15 months from the date of execution of the PPA. With this win, TPREL’s capacity under implementation would become 500 MW which is in addition to the operating capacity of 2,268 MW. The plant is expected to generate 250 mn units of energy per year and will annually offset about 250 mn kg of carbon dioxide.

The CERC has settled a dispute regarding the tariff determination of a hydro project in Himachal Pradesh. The CERC was hearing a petition filed by Sutlej Jal Vidyut Nigam Ltd for a 1,500 MW (6 units of 250 MW each) Nathpa Jhakri hydro-electric power project for the revision of tariff for the period between 1 April 2009 and 31 March 2014, including truing up of tariff determined by the commission’s order dated 20 June 2014. The commission has asked the petitioner to calculate the difference between the annual fixed charges it has already recovered, and the charges determined by the commission’s current order, and then settle it as per the 2009 Tariff Regulations. In the order, the CERC stated that the petitioner is entitled to claim interest on working capital in terms of Regulation 18 of the 2009 Tariff Regulations. In a recent review petition, the HPPC, had asked the Haryana Electricity Regulatory Commission to review its order in which it had allowed the deletion of an exit clause in the power purchase agreement. The petition was for a 36 MW hydropower project which HPPC purchased power from.

The MNRE has cancelled proposals submitted by 50-odd private companies seeking Central Financial Assistance for their small hydro power projects. The MNRE has closed the files pertaining to 53 such projects on the back of non-compliance of provisions in their schemes. The 53 proposals with a combined capacity of 438 MW were submitted for projects across multiple states. Some of the big companies whose project proposals stand cancelled as a result of the decision include Meenakshi Power, SRS Energy, Trident Power, Krishna Hydro Energy, Venika Hydro, Ramky Enviro subsidiary Chhatisgarh Energy Consortium. Small hydro power plants are those with power generation capacity of up to 25 MW. India has an estimate potential of generating 20,000 MW power from such projects. A bulk of this potential lies in the Himalayan states. The government is working on a plan to harness around a half of this capacity over the next decade. SHP programme is mainly driven by the private sector investment.

In a review petition, the HPPC, had asked the HERC to review its order passed on 8 March 2019, in which it allowed the deletion of an exit clause in the power purchase agreement. The petition was for a 36 MW hydropower project which HPPC purchased power from. The project is owned by IA Hydro Energy Pvt Ltd. Recently, Maharashtra Electricity Regulatory Commission passed an order reprimanding the Maharashtra State Electricity Distribution Company Ltd for not paying the interest accumulated on its principle dues to a small hydro project developer in the state.

The government has restricted the import of bio-fuels including ethyl alcohol, bio-diesel and petroleum oils for all purposes and their import will require import licence from the Directorate General of Foreign Trade. So far, import was allowed only for non-fuel purposes subject to actual user condition. The restriction will affect the import of ethyl alcohol and other spirits, denatured, of any strength, petroleum oils and oils obtained from bituminous minerals (other than crude, through an amendment in import policy) and bio-diesel. It had in August last year, amended the import policy to restrict the free import of biofuels. In May last year, the Cabinet had approved the National Policy on Biofuels, which allows doping of ethanol produced from damaged food grains, rotten potatoes, corn and sugar beet with petrol, in a move to reduce oil imports.

The first 220 MW nuclear power plant at KAPS-1 will be synchronised with the grid and power generation will be increased after that, NPCIL said. The KAPS-1 unit/reactor attained criticality, or initiation of controlled self-sustaining nuclear fission chain reaction, following the replacement of the entire coolant channel, feeder replacement and safety upgrades. India’s atomic power plant operator NPCIL has two 220 MW units pressurised heavy water reactor at KAPS. Following the heavy water leak, unit 1 was under cold shut down. Similarly, the renovation and modernisation of KAPS-2 was completed in 2018 and is operating at full capacity.

After being idle for six months owing to prolonged maintenance and an overhaul of the turbine generator, the first 1,000 MW VVER reactor of the KKNPP, built with Russian assistance, got synchronised with the Southern Grid. The reactor was shut down on 19 November 2018. KKNPP said that inspection and maintenance of turbine bearings and journals and a overhaul of the turbine generator were planned during the shutdown. The tasks were to be carried out indigenously by NPCIL through Indian contractors. Unit-2 is presently operating at around 580-600 MW.

ExxonMobil Corp, the world’s most valuable energy company, may shortly form a partnership with GAIL (India) Ltd to set up a green energy platform in India. The proposed ExxonMobil-GAIL tie-up comes against the backdrop of Infrastructure Leasing and Financial Services Ltd agreeing to sell its 874 MW operational wind energy portfolio to the state-run gas utility for ₹48 bn in its first asset sale since it started defaulting on payments last year. With the biggest expense being the cost of capital in the green energy business, the financial heft of global oil majors will help India’s clean energy sector. India has been working on the largest clean energy programme and has an installed renewable energy capacity of 74.79 GW. Of this, solar and wind power accounts for 25.21 GW and 35.14 GW, respectively.

With the aim of reducing emissions, power behemoth NTPC will for the first time commission a 660 MW unit based on ultra-supercritical technology by June. The ultra-supercritical technology burns coal at a much higher efficiency. Across the country, most of the power plants are based on sub-critical technology, which has a 38% thermal efficiency. It means that 38% of thermal energy gets converted into electrical energy. In the ultra-supercritical plant, this efficiency is 44%. The power unit is a part of the Khargone Power Plant in Madhya Pradesh, which is still under-construction. The second unit of the plant is also with the same technology. The total plant capacity would be 1,320 MW, which will require an investment of about ₹99 bn.

Rest of the World

A steep decline in nuclear energy capacity will threaten climate goals and power supply security unless advanced economies find a way to extend the life of their reactors, the IEA said. Nuclear is currently the world’s second-largest source of low-carbon electricity, behind hydropower, and accounting for 10% of global electricity generation. But nuclear fleets in the United States and Europe are on average more than 35 years old and many of the world’s 452 reactors are set to close as cheap gas and tighter safety requirements make it uneconomical to operate them. Over the past 20 years, wind and solar capacity has increased by 580 GW in advanced economies. Despite that, however, IEA estimates that the 36% share of clean energy sources in global power supply in 2018 was the same as two decades ago because of the decline in nuclear. In order to offset the expected decline of nuclear in the next two decades, renewables investment would have to grow fivefold, but that would not only be hugely expensive, but would also hit public resistance and require major power grid investment, IEA said. IEA said that the agency is not asking countries who have exited nuclear to reconsider, but said that countries who did decide to keep nuclear should do more to support the industry. Birol said the low-carbon nature of nuclear and its role in energy security are currently not sufficiently valued for existing nuclear plants to operate profitably and that new nuclear projects have been plagued by cost overruns. Nuclear is more expensive to build new wind and solar than to extend the life of existing reactors, which require investment of $500 mn to $1 bn per GW of capacity. Many United States reactors have already seen their life extended to 60 from 40 years. French utility EDF - the world’s largest single operator of nuclear plants - also wants to make its reactors last longer. The Botswana Power Corp has cancelled a tender in which it was seeking private investor partners to build a 100 MW solar power plant, and plans to reissue the tender to make the project fully private owned. The tender in the southern African country had received 166 bids from both local and international power producers. The state power supplier forecasts energy demand to more than double to 1,359 MW by 2035 from around 600 MW currently, and is modernising its power grid and sources to meet the surge.

China has reiterated its support for Iran’s 2015 nuclear deal with world powers and said that implementing it is the only way to resolve the Iran nuclear issue. In May 2018 President Donald Trump pulled the United States out of the accord between Iran and six powers including Britain, France, Germany, Russia and China, then re-imposed tough United States sanctions on Iran, saying the deal was flawed. Under the agreement, reached before Trump took office, Iran reined in its uranium enrichment programme in exchange for a lifting of most international sanctions imposed on the Islamic Republic.

French nuclear regulator ASN said that utility EDF had a significant amount of work to do before it starts loading fuel into its Flamanville 3 EPR nuclear reactor that is under construction in northern France. In parliament, the head of the nuclear watchdog told lawmakers the regulator would examine the state-controlled utility’s proposals to resolve welding anomalies at the reactor, adding a decision on those proposals will be made in June. In its report, the regulator reiterated it would make a generic ruling on the extension of the life of EDF’s 900 MW reactors at the end of 2020.

China will allocate 3 bn yuan ($434.55 mn) worth of subsidies for new solar projects this year, the NEA said. Of the total, 750 mn yuan will be allocated to rooftop power projects with a combined capacity of 3.5 GW, and the rest will be assigned for solar stations. For the first time, Beijing will set an annual cap on solar subsidies, in the nation’s latest bid to limit the capacity of subsidised solar projects and ease a payment backlog that stands at 120 bn yuan. The subsidies will not be applicable for under-construction solar projects which are unable to connect to power grids by the end of this year, the NEA said. Solar operators are required to submit applications for subsidies to the NEA by 1 July, stating their expectations on installed capacity and annual operating hours of projects. Beijing has been striving to boost competition in the solar industry by getting rid of low-efficiency projects, amid a plunge in equipment costs and surge in production capacity. China, the world’s biggest emitter of greenhouse gases, plans to end subsidies for new onshore wind power projects at the start of 2021, a milestone for the renewable energy sector that has traditionally relied on preferential policies to encourage developers to build plants.

China set mandatory renewable power quotas for each of its region for 2019 and 2020, the NEA said, in an attempt to promote the use of clean energy in the country. Local grid companies will have to purchase a certain volume of electricity from renewable energy generators, the NEA said. The targets, setting as a portion of renewable energy use in total energy mix, vary from 10% in eastern province of Shandong to as high as 88% in southwestern province of Sichuan in 2019 based on their energy structure. The draft plan was launched in November. Apart from checks from local authorities, central government will also deploy inspectors to monitor the implementation of the policy, the NEA said.

China will end subsidies for new onshore wind power projects at the start of 2021, with renewable projects set to compete on an equal footing with coal- and gas-fired electricity, the NDRC said. The move is a milestone for the renewable energy sector, which has traditionally relied on subsidies and other preferential policies to encourage developers to build plants. China pays a relatively high tariff per kWh of electricity produced by wind or solar projects, but it has been promoting what is known as ‘grid price parity’ with traditional sources of power such as coal. The NDRC said tariffs paid to onshore wind projects will be cut to as low as 0.29 yuan ($0.0420) per kWh in 2020, while grid price parity will apply to all new projects from 1 January 2021. China has been scaling back subsidies for both wind and solar projects after a rapid fall in equipment and construction costs, as well as a huge subsidy payment backlog for existing projects. China also launched a series of subsidy-free wind and solar projects in January, noting that solar construction costs in China fell 45% from 2012 to 2017, while wind project costs dropped 20% over the same period.

There are now more than 2 mn solar installations in the United States, a milestone reached just three years after hitting the 1 mn mark. United States solar installations now produce enough electricity to power more than 12 mn homes, the SEIA said in a joint statement with energy research firm Wood Mackenzie. The number of installations in the United States is forecast to double to 4 mn in 2023, Wood Mackenzie said. Solar energy has boomed in the United States over the last decade thanks to rapidly falling prices on the technology, state mandates that require utilities to source large amounts of renewable energy and a federal tax credit worth 30 percent of the cost of a system. Solar is now a $17 bn industry, SEIA said. Yet despite this growth, solar is still a small part of the United States energy mix compared with fossil fuels. This year solar, wind and other renewables excluding hydropower are expected to provide 11 percent of United States electricity generation, compared with 37 percent for natural gas and 24 percent for coal, according to the United States Energy Information Administration.

Electricity generated by onshore wind and solar PV technologies will in the next year be consistently cheaper than from any fossil fuel source, a report showed, boosting the case for energy sources that don’t emit carbon. The trend for cut-price renewable energy is already set but the report by the IRENA gives fresh evidence of the speed of the decline, driven by increased production runs and technology improvements. The global weighted average cost of electricity generated by concentrated solar power fell by 26 percent last year from a year earlier, data compiled by the agency showed. Bioenegy fell by 14 percent, solar PV and onshore wind by 13 percent, hydropower by 12 percent and geothermal and offshore wind by 1 percent. Costs of $0.03 to $0.04 per kWh for onshore wind and solar PV are already possible in some parts of the world. Record-low auction prices for solar PV over the past couple of years in Chile, Mexico, Peru, Saudi Arabia, and the United Arab Emirates for example have seen a cost as low as $0.03 per kWh, IRENA found. Over three quarters of onshore wind and four fifths of large-scale solar PV capacity to be commissioned next year shows lower prices than the cheapest new coal-fired, oil or natural gas sources, the report said. At the start of last year, IRENA forecast the global average cost of electricity could fall to less than $0.049 per kWh for onshore wind and $0.055 per kWh for solar PV by 2020.

South Korea’s energy ministry said it had finalised plans to raise the share of the country’s power output generated from renewable sources to as much as 35 percent by 2040. The plan was largely unchanged from a draft released in mid-April that aimed to boost renewable power generation more than four-fold from current levels, while reducing coal and nuclear power. Asia’s fourth-largest economy is shifting toward cleaner energy amid growing criticism over its air quality. At present, coal power accounts for about 40 percent of the country’s total electricity needs, while renewable power makes up nearly 8 percent.

GFG Alliance, a privately held conglomerate run by Britain’s Gupta family, said it had linked up with Chinese energy company Shanghai Electric to build a solar farm in the state of South Australia. The 280 MW Cultana solar project would power GFG’s Whyalla steelworks, as well as other industrial and corporate customers. GFG did not put a price tag on the solar farm, but said it was part of a promise made by GFG Chairman Sanjeev Gupta to spend $1 bn in renewables in Australia, which includes a hydropower dam and a large battery hub. GFG said it plans to invest in up to 10 GW of large-scale solar and other renewables projects across Australia.

Finland faces having to import biomass because, despite being Europe’s most densely forested country, it will be unable to meet an expected 70 percent rise in demand for the fuel after it phases out coal. Finland approved in February banning the use of coal in energy production by May 2029, which means utilities will have to find alternatives to keep Finns warm as coal currently accounts for around 20 percent of the energy used for household heating. Poyry consultancy - which advises the government on energy, industry and infrastructure needs - calculate that Finland will need 64 TWh worth of biomass in 2030 just for energy production, up from 38 TWh currently. Domestic supply of biomass on the other hand, is forecast to grow by only 8 TWh between now and 2030, according to Poyry. Poyry said the country will have to import biomass as well as improve forest management and ensure greater utilisation of harvest residues. Finland’s largest energy lobby group Energia also projects large increases in the use of biomass in coming years.

Norwegian cruise ship operator Hurtigruten has signed a 7.5-year deal to buy liquefied biogas made from dead fish and other organic waste to help power its vessels, the firm said. Under the contract with Biokraft, Hurtigruten ships will start receiving near-daily supplies of liquefied biogas, with the first delivery taking place in 2020, it said. The company last year said it would invest about $800 mn to refit six vessels to partly run on the renewable fuel. The hybrid ships will run on a combination of electric power from batteries, LNG and liquefied biogas. Biogas is already used as fuel in parts of the transport sector, especially in buses. It can be produced by using organic waste, such that from fisheries and forestry, which the Nordic region has in abundance.

A consortium led by French EDF Renewables won a tender launched by the Moroccan agency for sustainable energy (Masen) to build an 800 MW solar plant in Morocco’s Atlas Mountains, Masen said. The consortium to build the 7.57 billion dirham ($781.5 mn) plant also includes UAE’s Masdar and Morocco’s Green Energy of Africa, Masen said. The project, dubbed Noor Midelt 1, is the first phase of a larger project in the Atlas Mountains region of Morocco as the country plans to exceed 52 percent of renewable energy in the national energy mix by 2030. Masen has chosen a hybrid system for Noor Midelt 1 that uses CSP and photovoltaic technologies. The project is funded by European Investment Bank, the French Development Agency, the European Commission, the World Bank, the African Development Fund and the Clean Technology Fund, Masen said. The new plant will be larger than the already operating 580 MW Noor Ouarzazate CSP plant in southeastern Morocco.

France’s Total said it had started up commercial operations at its second solar power plant in Japan, as Total builds up its presence in the renewable energy sector. The Miyako plant, on Japan’s Honshu Island, will generate enough clean and reliable electricity to serve over 8,000 Japanese households. The plant is 50 percent owned by Total and 50 percent owned by Chubu Electric Power Company.

A sharp fall in output from French hydropower plants weighed on total renewable power generation in the Q1 of the year despite record electricity production from solar panels across France,. French hydropower generation fell nearly 30 percent in the first three months of the year compared with the same period a year ago due to low rainfall. Electricity generated by solar plants surged 56.6 percent during the period, compared with the Q1 of 2018, while wind power output rose 5.3 percent. Total power from renewable sources fell 15.7 percent in the first quarter of the year versus the first quarter of 2018.

Cuba began investing in renewable energy in 2014 and is ramping up its efforts in a push to make renewables its principal source of electricity by 2030. China is one of the leading investors in Cuba’s renewable energy program. The goal is for Cuba to derive 24 percent of its electricity from renewables such as sugarcane biomass, solar panels, wind farms, and small hydroelectric plants by 2024. Ovel Concepcion, director of renewable sources at the island’s Electric Union, said his organisation expects to install 700 MW of renewable solar power by 2030. Argentina has requested that the United States accelerate its review of anti-dumping duties it currently slaps on biodiesel imports from the South American nation, one of the world’s top exporters of the fuel. Argentina, South America’s second largest economy, had requested a review last November of United States tariffs imposed at the end of 2017 due to allegations of subsidies and dumping, which in effect shut off access for Argentine exporters to the United States market. Argentine exports of biodiesel to the United States before anti-dumping measures came into effect totaled some $1.5 billion per year, which in 2016 was a quarter of the total value of Argentine exports to the United States. Argentina’s biodiesel sector in recent years has been hit by trade sanctions for allegations of unfair competition. In February, the European Union, which had also imposed tariffs on the country’s biodiesel, authorised eight Argentine-based producers to export the fuel to the bloc without paying duties as long as they agreed to a minimum set price.

Indonesia’s second largest coal producer PT Adaro Energy, through its subsidiary PT Adaro Power, plans to complete its first commercial renewable energy power plant with a battery capacity of 6.5 MW to electrify two islands in Central Sulawesi, Paku and Umbele Morowali. The renewable energy project is a joint venture with French electricity company Électricité de France (the EDF Group). The joint venture with the EDF Group was a hybrid off-grid project that combined biomass, PV and battery storage that would provide a 24-hour electricity supply. Once the power plant was operational, the electricity rate would be more affordable than the existing rate for electricity supplied through a diesel generator.

Poland is preparing to build its first nuclear power units in the Pomerania region in the north of the country. The government plans to build a nuclear power plant by 2033. The communities living there have been preparing themselves for its construction, having observed nuclear power plants in operation elsewhere, and so the government has "societal approval" to build one. The fuel required for a nuclear power plant is very small compared to a coal plant. Poland’s government has yet to approve a programme to fund construction of the six reactors. He said the energy ministry, as part of discussions about national energy policy and the plan for energy and climate, had decided that Poland should consider having nuclear energy in its energy mix.

Israel’s Energix Renewable Energies said it will purchase $120 mn of solar panels from United States-based First Solar. The deal will help advance Energix’s plans to build PV projects in Israel and the United States, the company said. Energix said it will pay a $5 mn down payment followed by a further $60 mn in the second half of 2019.

| MW: megawatt, GW: gigawatt, kWh: kilowatt hour, GWh: gigawatt hour, TWh: terawatt hour, mn: million, bn: billion, tn: trillion, kW: kilowatt, discoms: distribution companies, Ind-Ra: India Ratings and Research, SECI: Solar Energy Corp of India, yoy: year-over-year, TANGEDCO: Tamil Nadu Generation and Distribution Corp Ltd, PV: photovoltaic, IRENA: International Renewable Energy Agency, CEA: Central Electricity Authority, Q1: first quarter, FY: Financial Year, ISA: International Solar Alliance, PSUs: Public Sector Undertakings, CO2: carbon dioxide, CREST: Chandigarh Renewal Energy, Science and Technology Promotion Society, RESCO: renewable energy service company, SPV: solar photovoltaic, BESCOM: Bangalore Electricity Supply Company, PMPML: Pune Mahanagar Parivahan Mahamandal Ltd, DMRC: Delhi Metro Rail Corp, MWp: megawatt peak, MoU: Memorandum of Understanding, GIPCL: Gujarat Industries Power Company Ltd, GUVNL: Gujarat Urja Vikas Nigam Ltd, MNRE: Ministry of New and Renewable Energy, kV: kilovolt, NCLT: National Company Law Tribunal, LPG: liquefied petroleum gas, TPREL: Tata Power Renewable Energy Ltd, PPA: power purchase agreement, kg: kilogram, CERC: Central Electricity Regulatory Commission, HPPC: Haryana Power Purchase Center, HERC: Haryana Electricity Regulatory Commission, NPCIL: Nuclear Power Corp of India Ltd, KAPS: Kakrapar Atomic Power Station, KKNPP: Kudankulam Nuclear Power Plant, IEA: International Energy Agency, NEA: National Energy Administration, NDRC: National Development and Reform Commission, SEIA: Solar Energy Industries Association, LNG: liquefied natural gas, CSP: concentrated solar plant, UAE: United Arab Emirates |

NATIONAL: OIL

Centre sets up committee headed by Kirit Parikh to review LPG marketing

11 June. After increasing the penetration of liquefied petroleum gas (LPG) over the last four years, the oil ministry is looking to review the existing structure of LPG marketing in India — a move seen as an effort to bring in more private players. To review the existing marketing structure, the Centre has set up a five-member committee headed by economist Kirit Parikh. Based on the LPG (Regulation of Supply and Distribution) Order, 2000, private players are eligible to operate as parallel marketeers of LPG. The new committee, set up on 30 May, will look into issues related to definition or quality standards of LPG being marketed. Its terms of reference also include scope for liberalising government policies for private participation. The committee is expected to submit its report by end-July. Based on the LPG control order, domestic LPG should be supplied to Oil Marketing Companies (OMCs) only. Later in 2015, Reliance Industries Ltd (RIL) had stated in an investor presentation that it has forayed into cooking gas retailing, by launching a 4 kilogram (kg) LPG cylinder on pilot basis in four districts. As of 1 April, the LPG coverage in India was seen at 94.3 percent, up from 56 percent in 2014. The three OMCs — Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), and Hindustan Petroleum Corp Ltd (HPCL) —have 265.4 mn active LPG customers in the domestic category, which are being served by 23,737 LPG distributors. The success of Pradhan Mantri Ujjwala Yojana (PMUY) over the last three years was considered to be instrumental in increasing LPG penetration. Of the total 45.51 mn new domestic customers enrolled by OMCs in 2018-19, 36.29 mn were enrolled under PMUY.

Source: Business Standard

Budget to hike Ujjwala bar towards 100 percent household LPG coverage

10 June. The Union Budget 2019-20 is likely to renew the focus on the NDA government’s flagship Ujjwala scheme with the aim of increasing access to cooking gas, or liquefied petroleum gas (LPG), to all the country’s households before the year-end. The finance ministry may first propose to complete the targeted 80 mn connections under the Pradhan Mantri Ujjwala Yojana (PMUY) in first 100 days of the government. So far, Ujjwala connections have reached the 71.9 mn-mark. In addition, another 10-20 mn new LPG connections would be given in the subsequent months to cover all poor households, as part of a cabinet decision taken late last year. These measures are expected to increase access to cooking gas to 100 percent of the country’s households from present level of about 93-94 percent. Under PMUY, gas connections are provided to below poverty line (BPL) families with a support of Rs1,600 for each connection. The LPG connection is provided in the name of the female member of the family.

Source: Business Standard

Oil Minister discusses crude oil price volatility with US Energy Secretary

10 June. Oil Minister Dharmendra Pradhan said that he discussed with the United States (US) Energy Secretary Rick Perry, crude oil price volatility and its impact on the Indian consumer. Pradhan discussed crude oil price volatility, its impact on Indian consumer and the role of the US in bringing global price stability.

Source: Business Standard

LPG price hiked again, crosses Rs700 in Mumbai

10 June. LPG (liquefied petroleum gas) prices have gone up by Rs25 from a month ago, and each 14.2kg cylinder is now retailing at Rs709.5. At the same time, petrol and diesel rates have fallen by up to Rs2.5 over the last 30 days. The price of non-subsidised LPG cylinders has risen steadily for three months, though is still over Rs200 less than last November's high of Rs912. It dropped to Rs780 in December, and further to Rs660 in January. After a Rs30 drop in February, the price has gone only upwards, first to Rs673 in March, then to Rs678 in April, and Rs684.5 in May. In March 2015, Prime Minister Narendra Modi launched the 'Give Up Subsidy' campaign, under which more than a crore Indians gave up their concessions or they were withdrawn automatically in cases of high-income individuals. In comparison, the rate of subsidised LPG has gone up by just a rupee this month, the retail price being Rs495 per cylinder. Though all LPG consumers buy the fuel at its market price, the government subsidises 12 cylinders of 14.2 kilogram (kg) each per household a year by providing the subsidy amount directly in the bank accounts of eligible users.

Source: The Economic Times

ONGC to spend Rs35 bn in drilling 100 wells in Assam blocks

7 June. Oil and Natural Gas Corp (ONGC) is planning to drill 100 wells in 21 onshore Petroleum Mining Lease (PML) blocks in Sivasagar district at a cost of Rs35 bn. The 21 onshore PML blocks in Sivasagar district will cover major oil producing fields of Lakwa, Rudrasagar and Geleki, where the company has already drilled more than 500 wells, ONGC said. The company had in January applied for drilling 200 wells in Sivasagar at a cost of Rs60 bn. ONGC’s crude oil production from Assam blocks rose 2 percent to 993 thousand tonne last financial year, while natural gas production dropped 5 percent to 483 million cubic meter.

Source: The Economic Times

IOC, HPCL to contest over Rs40 bn tax demand on sale of ethanol blended petrol

6 June. Oil refiners Indian Oil Corp (IOC) and Hindustan Petroleum Corp Ltd (HPCL) said they will contest tax authorities demand for over Rs40 bn in excise duty on ethanol used for doping petrol, saying the sugarcane extract for mixing in fuel is exempt from tax. IOC said it is a responsible corporate and law abiding entity, which is one of the largest contributors to the national exchequer in the form of duties and taxes. India is over 83 percent dependent on imports to meet its oil needs. HPCL said it is following a legally tenable established practice which is in line with oil industry and it does not envisage any additional duty liability.

Source: Business Standard

NATIONAL: GAS

RIL, BP to develop deepest gas discovery in KG-D6 block by 2022

11 June. Reliance Industries Ltd (RIL) and its partner BP plc of UK (United Kingdom) announced sanction for development of their deepest gas discovery in the eastern offshore KG-D6 block. MJ, or D55, development is the third project that the partners have taken up to revive flagging natural gas production from KG-D6 block. These projects together, when fully developed, will bring about 1 bn cubic feet a day of new domestic gas onstream, phased over 2020-2022, they said.

Source: Business Standard

Petronet expands Dahej import terminal capacity

10 June. Petronet LNG Ltd, India’s largest natural gas importer, said it has expanded its Dahej import terminal capacity to 17.5 million tonnes (mt) per annum from current 15 mt. Petronet had more than one-and-a-half decade ago started operations of India’s maiden liquefied natural gas (LNG) import facility at Dahej in Gujarat with a nameplate capacity of 5 mt per annum.

Source: Business Standard

RIL seeks three LNG cargoes for July, September, October

7 June. Reliance Industries Ltd (RIL) is seeking three liquefied natural gas (LNG) cargoes for delivery, with one a month in July, September and October. The company sought one cargo for 10-15 August delivery, which a third source said was awarded at $4.45 to $4.55 per mmBtu (million metric British thermal units).

Source: Reuters

PNGRB fixes lower pipeline tariff for GAIL

6 June. PNGRB (Petroleum and Natural Gas Regulatory Board) has fixed transportation tariff of GAIL (India) Ltd’s main trunk natural gas pipeline at half of what the state-owned firm wanted, sending its stock nosediving. PNGRB in its transportation charge order for the 3,452 kilometre (km) long pipeline originating from Hazira in Gujarat and going up to Jagdishpur in Uttar Pradesh via Vijaipur in Madhya Pradesh (called HVJ pipeline) fixed levelised tariff for the integrated pipeline at Rs41.11 per mmBtu (million metric British thermal units).

Source: Business Standard

NATIONAL: COAL

CIL to hire merchant bankers for buying stakes in Australian assets

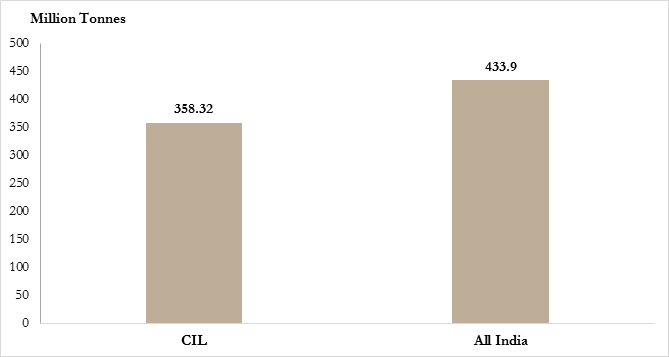

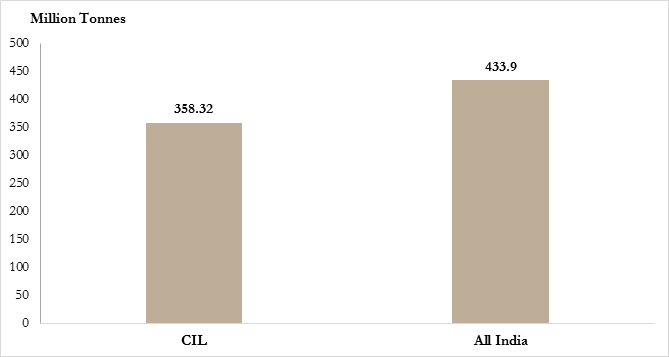

9 June. Coal India Ltd (CIL) plans to hire merchant bankers to carry out financial due diligence for acquiring equity stakes in identified mines and companies in Australia as part of its plan to meet the growing dry fuel demand in the country. The company has identified coal assets in Australia for acquiring equity stakes along with offtake rights in an asset or a company, CIL said in a notice inviting proposals from investment bankers. CIL looks to acquire assets abroad as it expects that domestic production would not be sufficient to meet coking coal and high-grade fuel demand from various sectors. The demand-supply gap in India is high due to enhanced requirements from various sectors, including power and steel. CIL accounts for over 80 percent of domestic coal output. India’s coal import increased by 8.8 percent to 233.56 million tonnes (mt) in 2018-19. Non-coking coal imports were at 164.21 mt in 2018-19, about 13.25 percent increase over 144.99 mt recorded in 2017-18. Coking coal import was almost flat at 47.73 mt last fiscal compared to 47.22 mt in 2017-18. CIL is targeting more than 8 percent growth in production at 660 mt in 2019-20.

Source: Business Standard

CIL targets 8 percent growth in output, lines up Rs100 bn capex in FY20

5 June. Coal India Ltd (CIL) targets more than 8 percent growth in production at 660 million tonnes (mt) in 2019-20 compared to 607 mt in the last fiscal and plans a capital expenditure of Rs100 bn in the current fiscal. The target for revenue from operations (net) has been fixed at Rs1 tn for FY2019-20. The targets were fixed during a meeting between the coal ministry and CIL held recently.

Source: Business Standard

NATIONAL: POWER

Delhi electricity tariff to be revised by July end

11 June. The Delhi Electricity Regulatory Commission (DERC) has decided to revise power tariffs by the end of July. According to the Delhi government, this year’s revision will bring relief to households whose power bills had increased due to last year’s hike in fixed charges. After inviting suggestions and objections on petitions filed by distribution companies from stakeholders, the DERC has decided to hold a public hearing next month. As keeping power tariffs low was a key poll promise of the Aam Aadmi Party (AAP), electricity charges have not been hiked in the capital in the last three years. With Assembly elections due in Delhi next year, an increase in tariff at this time is unlikely. Chief Minister Arvind Kejriwal had announced that the Delhi government has asked the city’s power regulator for a reduction of fixed charges. If accepted by the DERC, it would mean a possible reduction in the power bills. In last year’s revision, the power regulator had increased the fixed charges for every consumer, while decreasing the energy costs. Fixed charge, a part of the electricity bill, is the cost a consumer has to pay even if she does not consume any power. In last year’s revision, the fixed charges were increased across all slabs — for 2-5 kilowatt (kW), from ₹35 to ₹140; for 5-15 kW, from ₹45 to ₹175; for 15-25 kW, from ₹60 to ₹200; and for more than 25 kW, from ₹100 to ₹250. The government has started a survey of families of victims of 1984 anti-Sikh riots to find out those left out of the subsidy scheme offered to them.

Source: Hindustan Times

Jammu and Kashmir power department launches crackdown on illegal connection holders, books 825 people

9 June. As power crisis worsened in the sweltering summer, the authorities launched a crackdown on people having unauthorised electricity connections in Jammu. During a drive, power department officials booked 825 defaulters and disconnected 450 illegal connections. People in Jammu reeled under blistering heatwave as the mercury soared to 43.1 degrees Celsius, resulting in massive power crises in Jammu west. Executive Engineer, South Jammu, Sanjay Sharma, said such inspection drives will now be a regular feature and no one indulge in power theft will be spared. He said a total penal amount of Rs25.50 lakh was imposed on the defaulters during the drive.

Source: Business Standard

Delhi only city in country to enjoy 24 hour power: CM

9 June. Chief Minister (CM) Arvind Kejriwal claimed that Delhi was the only city in the country that enjoyed 24-hour electricity supply. The remarks came during his padyatra in Malviya Nagar when people complained about power outages. Kejriwal assuaged them by ordering the installation of transformers in the area to prevent distribution problems.

Source: The Economic Times

Power firms welcome RBI notification on stressed assets

8 June. Power companies have welcomed a fresh notification issued by the Reserve Bank of India (RBI) on stressed assets, calling it a workable framework. The APP (Association of Power Producers) was one of the parties that have fought a legal battle for 14 months with the RBI over a February 12, 2018 circular, which had put very stringent guidelines for banks to treat stressed assets, including compulsory referral to the bankruptcy court on defaults. The new circular has relaxed compulsory referral to the bankruptcy court. It has restored the discretion to bank boards over the resolution path.

Source: The Economic Times

Non-stop power supply, sector’s sustainability main challenges before new government

7 June. The key challenges before the new government in the power sector include ensuring uninterrupted supply across the country and improving the financial health of the state-owned electricity distribution companies (discoms). The Ujwal Discom Assurance Yojana (UDAY) for revival of discoms has not met the targets — cumulative financial losses of discoms grew 44 percent to Rs216.58 bn at the end of FY19, reversing the declining trend since the scheme was launched in November 2015. Financially-weak discoms trigger a domino effect in the sector, as they are unable to pay power producers on time, who in turn fail to service their debt. While assuming charge of the power ministry, R K Singh, who held the portfolio in the previous government as well, said the next target would be to ensure 24×7 power for all. The government had failed to achieve the initial target of ensuring “24×7 affordable and quality power for all by March 2019”, with many major states providing only 17-18 hours of electricity a day to rural consumers.

Source: The Financial Express

Punjab in a fix over 9 percent annual growth of power subsidy bill

7 June. The ever-increasing power subsidy bill seems to have turn into a quagmire for the state government, which ended up paying an interest of Rs5.93 bn only on delayed payment of subsidies to the Punjab State Power Corp Ltd (PSPCL) during the last fiscal. The power subsidies in Punjab are increasing by 9 percent every year and the government has been unable to clear the entire subsidy bills for the last five years. The defaulting amount to be paid by the government to the PSPCL is increasing and is pushing the power corporation to go for short-term loans to meet the day-to-day expenses since timely release of subsidy payment is closely linked to the financial position of the utility. Punjab is among the few states in India that are providing power subsidies to almost all categories of consumers barring a few domestic and non-residential connections. Despite, electricity regulator asking the PSPCL to impose a full tariff in case the government fails to release the subsidy amount in advance monthly instalments, the government has been delaying the release of subsidies amounts for the last five years. During the financial year 2019-20, Punjab government had paid Rs4.19 bn and the provisional amount of electricity duty while infrastructure development fund amounting to Rs5 bn for the period up to May end has been adjusted by the PSPCL against the due amount of Rs22.86 bn, leaving a gap of Rs13.61 bn. According to Padamjit Singh, a former chief engineer and patron of the All India Power Engineers Federation (AIPEF), the taxes that are collected along with the power bills by the state government should be ploughed back into the system for the development of electricity infrastructure, but there is no transparency as to what the government does with the amount collected.

Source: The Economic Times

Maharashtra government mulls power sop for farmers ahead of assembly elections

6 June. Keeping the assembly elections in mind, the state government has asked energy and finance department to prepare a proposal for providing free electricity to farmers. If implemented, the Maharashtra government may have to foot a bill of Rs30 bn per annum over and above the subsidy it is already paying. The state power distribution utility Mahavitaran’s average cost of supplying power is around Rs6 per unit but the agriculture sector gets it at Rs1.50 per unit and the state pays Rs50 bn per annum to the distribution utility to keep the rates artificially low. Though the annual power bill of the agriculture sector is about Rs30 bn, only around Rs5 bn is recovered. Ahead of the 2004 assembly elections, the then Congress-NCP government announced free electricity for farmers but ended the scheme within three months of coming back to power.

Source: The Economic Times

May spot power price falls 29 percent to Rs3.34 per unit

6 June. Average spot power price fell by 29 percent to Rs3.34 per unit in May compared to the year-ago month, the Indian Energy Exchange (IEX) said. With trading of 3,772 mn units of electricity, the volume in the day ahead market (DAM) fell 6 percent on month-on-month basis, while the fall was 23 percent on year-on-year basis. On a daily average basis, around 122 mn units were traded in May 2019, the IEX said. According to the NLDC (National Load Dispatch Centre) data, the all India peak demand met reached a new high of 183 GW in May 2019, an increase of 7 percent over 171 GW peak demand met in May 2018. On an all India basis, the energy met was 118 bn units in May 2019. It is a rise of 4 percent compared to 113 bn units last year. The electricity market at IEX the DAM and term ahead market (TAM) combined traded 4,090 mn units saw 21 percent decline over 5,169 mn units traded in May 2018.

Source: Business Standard

52 electricity transmission towers collapsed between October 2016 to March 2018: CEA

5 June. As many as 52 electricity transmission towers collapsed between October 2016 and March 2018, according to the latest report by the Central Electricity Authority (CEA), which also points out rampant irregularities on the part of transmission companies leading to collapsing of the assets. Of the 52 dysfunctional towers, 41 failed within five years of commissioning. Most of the failed towers belonged to Power Grid Corp of India Ltd (PGCIL), followed by Sterlite Power, L&T, Adani Transmission and Essel Infra. PGCIL, which owns more than 37 percent of the transmission lines in the country and ferries about 50 percent of the total electricity generated, recorded 38 tower failures in the aforementioned period. Sterlite and L&T lost five towers each while one tower belonging to Adani and Essel, respectively, failed.

Source: The Financial Express

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Government mulling payment security mechanism to tackle solar power dues

11 June. Power and New and Renewable Energy Minister R K Singh said the government is building a payment security mechanism under Solar Energy Corp of India (SECI) to tackle the issues of delayed payment for solar power developers. Singh said that the government is confident of achieving the 175 GW target for green energy capacity by 2022. He discussed the government's emphasis on a solar power scheme for farmers, an extension of the existing KUSUM scheme. He said through this scheme, a farmer can generate up to 2 MW of solar energy on barren land and the government will purchase it.

Source: The Economic Times

BHEL bags order worth Rs4.4 bn from NPCIL for nuclear power project in Tamil Nadu

11 June. BHEL (Bharat Heavy Electricals Ltd) said it has bagged an order worth over Rs4.4 bn from Nuclear Power Corp of India Ltd (NPCIL). BHEL has secured an order for the erection work of the upcoming 2x1000 MWe (megawatt electrical) turbine generator (TG) island units 3 and 4 at Kudankulam Nuclear Power Project in Tamil Nadu being set up with foreign cooperation (Russia), it said. Significantly, for the same project, BHEL has emerged as the lowest bidder for erection of the reactor side equipment. Earlier, BHEL had successfully executed the erection work of TG island for units 1 and 2 at Kudankulam. BHEL is currently executing TG packages for 4 units of 700 MWe, 2 units each at Kakrapar and Rawatbhata.

Source: Business Standard

BHEL bags Rs5.3 bn orders for setting up Solar PV power plants

10 June. Bharat Heavy Electricals Ltd (BHEL), the country’s largest power equipment manufacturer, announced it has won three orders worth Rs5.3 bn for setting up solar photovoltaic (PV) power plants on Engineering, Procurement and Construction (EPC) basis in Maharashtra and Gujarat. The orders for a total of 135 MW capacity have been placed by Maharashtra State Power Generation Company, Gujarat State Electricity Corp and Gujarat Narmada Valley Fertilizers & Chemicals. The order received from MAHAGENCO is for setting up a 50 MW solar plant at Kaudgaon in Maharashtra’s Osmanabad district.

Source: The Economic Times

Solar-powered Kochi airport inspiring model for energy guzzlers: PM Modi

9 June. Impressed by the fully solar-powered operations at the Cochin International Airport, Prime Minister (PM) Narendra Modi has said it should be an inspiring model for energy guzzlers and suggested that stadiums can tap the natural resource for achieving power neutrality. Modi hailed the Cochin International Airport Limited (CIAL) for being the world's first fully solar-powered airport, the CIAL said. The possibilities of laying solar panels at probable locations needed to be explored. Modi instructed the CIAL to render its expertise for a massive deployment of solar energy, in tune with the International Solar Alliance (ISA), an organisation of 78 countries which was formed by his initiative. The CIAL at present is one of the largest green energy companies in the country with a total installed capacity of 40 megawatt peak (MWp). The airport, on an average, receives 1.62 lakhs units of power a day from the solar plant, whereas the daily consumption stands at around 1.52 lakhs units.

Source: The Economic Times

Renewable energy capacity target of 175 GW will be achieved: Singh

9 June. Power and New and Renewable Energy Minister R K Singh has exuded confidence that the renewable energy target of 175 GW by 2022 would be achieved. Singh, who took the charge of the ministries in the second term of Modi government, said 80 GW of renewable energy has been established while another 24 GW is under installation. He said the top priority will remain to achieve the targets set by the government. The government has set an ambitious target of installing 175 GW of renewable energy capacity by 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydropower. Various research reports, however, have cautioned that India is unlikely to meet the energy targets for wind and solar power. India is likely to install 54.7 GW of wind capacity by 2022 against the 60 GW target set by the government, Fitch Solutions Macro Research has said in a report.

Source: The Economic Times

Supreme Court committee approves waste-to-energy plant in Agra

8 June. A two-member committee appointed by the Supreme Court has given the green signal for setting up a waste-to-energy plant in Agra. The plan was pending for the past three years. According to the Agra Municipal Corp (AMC), after court orders, permission will be sought from Taj Trapezium Zone (TTZ) authority for developing the advanced municipal solid waste (MSW) processing plant at the Kuberpur landfill site. AMC administration will also have to secure clearance from the Archeological Survey of India (ASI). In February, the Supreme Court had directed the Central Pollution Control Board (CPCB) and National Environment Engineering Research Institute (NEERI) to conduct a joint inspection and prepare a report concerning viability of AMC’s plan to set up a waste-to-energy plant at the Kuberpur landfill site which lies in the eco-sensitive TTZ. The joint inspection committee was asked to suggest whether the waste-to-energy facility will help in reducing pollution. Last year in October 2017, a power purchase agreement (PPA) was signed in Lucknow between Uttar Pradesh Power Corp Ltd (UPPCL) and Spark Bresson Private Ltd, a Czech company, contracted by the AMC to set up and operate the waste-to-energy facility. Under the agreement, UPPCL agreed to purchase electricity produced at the waste-to-energy plant in Agra. Under the plan, AMC will have to provide at least 500 metric tonnes of solid waste to the company every day, out of which it will produce 10 MW of electricity. The amount of electricity produced will increase with the addition in quantity of garbage supplied. The electricity produced out of waste will be transmitted to a local substation. From there, electricity will be channelised to the power grid for further distribution.

Source: The Economic Times

GIPCL commissions 75 MW solar power project in Gujarat

7 June. Gujarat Industries Power Company Ltd (GIPCL) said it has commissioned a 75 MW solar power project in Gujarat in a phased manner. GIPCL had emerged as one of the successful bidders for the 75 MW solar power project in the e-reverse auction conducted by the Gujarat Urja Vikas Nigam Ltd in September 2017 for 500 MW solar power projects in the state. GIPCL has commissioned the solar power project at Gujarat Solar Park, Village Charanka, District Patan, Gujarat, in a phased manner on 4 June 2019, the company said.

Source: Business Standard

OFB generates solar power, reduces power consumption cost

7 June. The Ordnance Factory Board (OFB) has significantly reduced cost of electricity consumption by generating solar power in its various units across the country. The OFB is working towards achieving the goal of meeting 45 percent of its total energy requirements through the solar power route. The use of solar power has significantly reduced OFB’s cost of electricity consumption from Rs463.22 lakh during 2015-16 to Rs163.78 lakh during 2018-19. The installation of grid-connected solar power projects in various OFB units have resulted in generation of approximately 1,47,12,072.14 units of electrical power till November 2018.

Source: Business Standard

Solar energy target a tough task in Chandigarh

6 June. While the UT (Union Territory) administration is putting its best efforts to promote installation of solar plants to replace it with other energy sources, but the desired results are still far from reality. The administration, in a notification issued on 18 May 2016, had made installation of rooftop solar power plants mandatory in all residential houses measuring 500 square yards and above and group housing societies. There are around 10,000 such houses in different parts of the city, including Sector 8 which has around 417 houses measuring above 500 square yards, Sector 11 has 493 houses, Sector 33 has 643 houses, Sector 35 has 419 houses and Sector 36 has 417 houses. Despite extending the deadline twice, with final deadline being 30 June, around 55 percent of the houses have installed solar plants till date. Earlier, the deadline was set for 6 May 2018, but was later extended to 17 November 2018. Finally, the deadline was extended to 30 June this year. The Chandigarh Renewal Energy, Science and Technology Promotion Society (CREST), the nodal agency for installation of solar plants in Chandigarh, also organised awareness camps with traders, industrialists, residents welfare associations, hoteliers etc.

Source: The Economic Times

'Telangana has become second-largest producer of solar power'