SUMMER PEAK TOUCHES NEW HIGH

Power News Commentary: May 2019

India

The power demand in the capital has been soaring this year with the month of April-May recording a 22 percent growth over the corresponding period in 2018. The peak power demand in April 2018 was 5,200 MW. This year, the demand in April crossed the 5,200 MW mark five times, peaking at 5,664 MW on 30 April. The power demand in April 2019 has been higher on 19 occasions than the corresponding days last year. On 22 April, it was 3,828 MW in 2018 and 4,588 MW in 2019 - an increase of 20 percent. Again on 25 April, it was 4,438 MW in 2018 and 5,552 MW in 2019 - an increase of 19 percent, the discom said. The trend continues in May 2019. Of the first 24 days of this month, the power demand has been higher than on 13 corresponding days of last May, increasing by up to 22 percent on 10 May 2019, when it touched 5,985 MW as against 4,899 on 10 May 2018, the discom said. However, the power demand between 15 and 24 May 2019, has been marginally less than the power demand on the corresponding days last year as temperatures remained relatively pleasant because of the western disturbances. The peak power recorded in May 2018 was 6,442 MW on 30 May. The capital's peak power demand during the summers of 2019 may clock 7,400MW. Last summer, peak demand breached 7,000 for the first time - peaking at 7,016 MW. This expected peak power demand of 7,400 MW in Delhi is an increase of over 250 percent over the peak power demand of 2,879 MW in 2002. It is interesting to note that Delhi’s peak power demand is substantially more than that of several cities and states. It is more than the power demand of Mumbai and Chennai put together, thrice than Kolkata, and nearly 2.5 times of the seven northeastern states put together. Arrangements have been firmed up by BSES discoms to source adequate electricity to meet the power demand of over 4.2 million consumers.

MAHAGENCO reported a record generation of 10000 MW. While 7577 MW was generated from its thermal capacities, wind energy contributed 270 MW, hydro 2100 MW and solar 119 MW, it said. Currently, the demand for electricity in the state has peaked at 22300 MW due to the rising temperatures. This is met with generation of 17336 MW, which also includes power from private players. Also, the state gets nearly 5357 MW from the central grid.

Average spot power price is unlikely to breach the ₹3.50 per kWh level in May on account of sufficient coal stock for thermal plants and enhanced supplies from clean energy sources, according to experts. According to the CEA out of 127 thermal power plants monitored by it, two power stations had super critical coal situation as on 9 May 2019. These two plants had coal stock of less than four days and there was only one plant which had critical coal situation with stock of less than a week. So, dry fuel shortage is not affecting power generation. Average spot power price at IEX was Rs3.3 per kWh unit till May 10, 2019, which was far lower than ₹4.67 per kWh in May 2018. The peak demand of power this month was 178 GW due to summer season. High peak demand of 178 GW was recorded in September 2018.

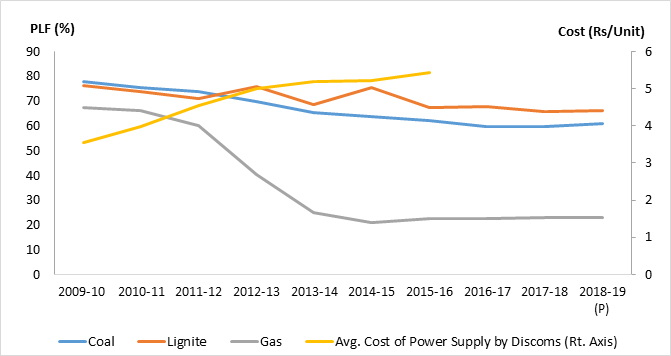

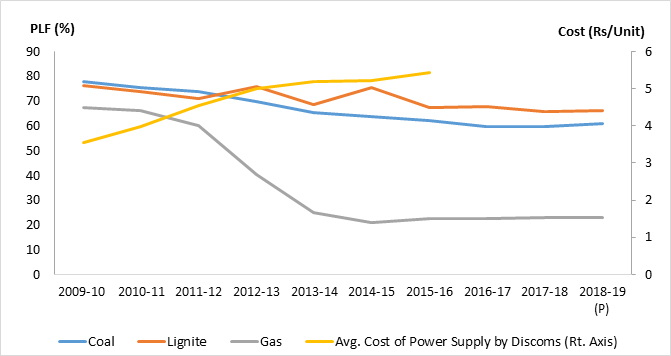

Electricity generation in India is expected to grow by 5-6 percent in FY20, analysts at CARE Ratings said. The country had generated 1,307 bn units of electricity in FY19, recording an annual growth of 5.3 percent. Care Ratings also projected that coal production to grow steadily by 6-7 percent during the ongoing fiscal. Domestic coal production grew by 7.3 percent to 739.4 mt in FY19, much faster than the 2.6 percent growth rate seen in FY18. The rating agency’s forecast are much lower than that of the CEA, which expects generation to touch 1,330 bn units from the conventional power sources (excluding renewables) in FY20. Though the estimates sound positive for private power plants running at low plant load factors, actual generation from private power plants in FY19 has risen only 2.2 percent annually.

The combined outstanding regulatory assets for the thermal power sector stands at ₹769.63 bn, India Ratings and Research said in a report, which sees a potential to securitize these receivables through bonds. Of these, the report suggested, 97 percent of the outstanding regulatory assets are due to state distribution companies, while the remaining are due to private and independent power producers like Reliance Infrastructure, Tata Power and Tata Steel. Recoverable costs arising due to a significant variance in the generated tariff based on actual cost of power consumption and the estimated tariff for the annual revenue requirements initially approved by the SERC are recoverable through a regulatory asset component in future tariff orders. State-wise, the report suggested, UP, Maharashtra and Jharkhand - account for approximately 87 percent of the current regulatory assets market. India Ratings expects a two percent growth for the Indian corporate bond market if distribution companies chose to securitise these pending regulatory assets.

While the CEA proposes to allow Indian entities to import electricity from neighbouring countries only through bilateral agreements, export of power can now be done through spot power markets as well. The CEA has framed the draft procedural guidelines for firms to participate in cross-border electricity trade, a move that could open up an annual potential market of additional 5-6 billion units of electricity. While the CEA proposes to allow Indian entities to import electricity from neighbouring countries only through bilateral agreements, export of power can now be done through spot power markets as well. The ‘draft conduct of business rules of the designated authority for facilitating the cross border trade of electricity’ clarified that plants with CIL fuel linkage or captive mines cannot sell power outside India. Only the power plants which generate electricity using coal sourced through import, spot e-auctions (at premium rates) or commercial mining can export electricity. The Cabinet has recently allowed the sale of 25 percent produce of captive coal mines to the open market on a commercial basis. The power ministry had removed restrictive riders which discouraged neighbouring countries to buy power from India’s spot power markets last December. The earlier guidelines allowed cross border trade only through the ‘term ahead’ market and did not allow trading in the more attractive ‘day-ahead’ market. After that the CERC had also revised the regulations to ease trading norms.

Multilateral funding agency ADB said it has signed an agreement to provide $750 mn equivalent in Indian rupee long-term financing to electrify railway tracks in India. It is the largest single non-sovereign loan ever committed by ADB to IRFC to fund the railways track electrification project, ADB said. As part of a broad modernisation programme that will help India’s railway sector transition to electric power and away from dependence on fossil fuels, it said. IRFC will use the proceeds from the loan to install electric traction equipment along about 3,378 kilometres of existing railway lines to enable migration of passenger and freight traffic from diesel to electric traction. The electrification assets will be leased to Indian Railways, the country's national railway system, under a long-term lease agreement, ADB said. The electrification of railway tracks is part of this master plan, which is critical for the movement of goods and people within the country, ADB said.

Power consumers in Punjab will have to shell out more for electricity as the SERC announced an average tariff hike of 2.14 percent across categories for 2019-20. Besides, the state power regulator also raised fixed charge for the domestic category of consumers by ₹10 per kW according to the new power tariff. In the tariff order which was released, the Punjab SERC has assessed the net aggregate revenue requirement of the Punjab State Power Corp at ₹323.27 bn, including ₹13.29 bn for Punjab state transmission corporation for 2019-20. The new tariff will be effective from 1 June. The combined average cost of supply for 2019-20 worked out to be 662.98 per kWh as against 655.49 per kWh during last fiscal. In the new tariff order for domestic consumers, the per unit cost of electricity for 100 units has been increased from ₹4.91 to ₹4.99 per kWh; from ₹6.51 to ₹6.59 for 101 to 300 units and from ₹7.12 to 7.20 for 301 to 500 units for supply up to 2 kW. The fixed charges for 2 kW load have been increased from ₹25 to 35 per kW, ₹35-45 for 2-7 kW and ₹40-50 kW for 7 kW-50 kW. For agricultural pumpsets, tariff has been increased from ₹5.16 per kWh to ₹5.28 per kWh. For industrial category, the power tariff has been increased by 0.08 per kWh as per the order. The fixed charges for non-residential category and industrial category have been hiked in the range of ₹5 per kVAh and ₹20 per kVAh, as per the order. Any consumption in excess of threshold limit of the last two financial years shall continue to be billed at a reduced energy charge of ₹4.45 per kVAh to encourage use of surplus power by the industry, as per the tariff order.

The Punjab and Haryana High Court questioned the practice of providing free or subsidised electricity to rich farmers in Punjab and Haryana for agricultural pump sets. Faced with the observations of the bench, the law officers of both Haryana and Punjab sought adjournment to reconsider the entire issue of electricity subsidy to rich farmers and to file an appropriate affidavit in the matter. The issue would now come up for hearing on 6 August. The matter is pending before the Punjab and Haryana High Court in the wake of a petition on a plea seeking exclusion of affluent farmers of the states of Punjab and Haryana from the benefits of subsidized electricity for agricultural pump sets in the state.

UPs effort to strengthen the power supply infrastructure in all 75 districts has resulted in 58 percent increase in total power transmission capacity in the past three years. In the same period, the total transfer capacity has seen a jump of over 95 percent. Ahead of the peak summers, the UP Power Transfer Corp Ltd has managed to achieve 12,850 MW total transfer capability of electricity. Northern Regional Load Dispatch Center, Delhi has approved the increased capacity of transmission in UP. The state has set target to increase the power transmission capacity up to 30,000 MW by 2024.

Joint Electricity Regulatory Commission - the power regulator for Union Territories has issued nine tariff orders for 2019-20, which were held up due to imposition of model code of conduct for the Lok Sabha polls. Tariff orders are prescribed rates of electricity for various categories of consumers including domestic ones. The tariff orders including multi-year annual revenue requirement for control period 2019-20 to 2021-22, for Goa, Chandigarh, Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andman and Nicobar Islands and Lakshdweep were issued. The Commission was all set to issue the order by 31 March, but due to imposition of model code of conduct it was held back. The new tariff will be applicable from 1 June.

Transmission Corp of Telangana Ltd (TS-Transco) has asked the NTPC Ltd to defer the second phase of Telangana Super Thermal Power Project at NTPC’s existing power plant at Ramagundam. NTPC is establishing the first phase 1,600 MW (2×800 MW) at its 2,600 MW Ramagundam plant. The second phase for 2,400 MW (3 x 800 MW) has now been asked to be kept on hold. TS-Transco said many States are not taking costly power from NTPC plants in view of the high power generation costs. The additional energy requirement for Kaleshwaram project would be met by new plants being established by Power Generation Corp of Telangana Ltd (TS-Genco) at Bhadradri (1,080 MW), Damaracherla (4,000 MW), renewable power (1,400 MW) and market purchases.

Maharasthra government plans to distribute 77 mn LED lamps in the state by the end of the current year as part of a larger plan in the works with EESL to save electricity. The centre had launched the ambitious Unnat Jyoti by Affordable LEDs for All (UJALA) scheme in 2015 as the world’s largest domestic lighting programme. Under the scheme, EESL procures the appliances and provides them to consumers at a rate of ₹70 per LED bulb and ₹220 per LED tube light, much below the market price.

Assam based NRL inked an MoU with AEGCL for construction of facilities for importing of 120 MW Power from 220 kV Grid owned by AEGCL. The project includes drawing of 220 kV Overhead power transmission lines of 15 km length and setting up of 220 kV Sub-Station (S/S) near Numaligarh Refinery. According to NRL the MoU will facilitate un-interrupted power supply for seamless refinery operations. It will also help meet the additional power requirement of almost 74 MW for NRL’s upcoming mega Refinery expansion project from existing 3 mtpa to 9 mtpa.

Rest of the World

China Southern Power Grid completed the first spot trading of electricity in the country’s southern provinces. The trades involve 123 power distribution companies, 190 power generators and three major users. Average ex-plant power prices were reported at 0.263 yuan ($0.0381) per kWh during the pilot transactions; Prices for low-demand night hours were 0.082 yuan per kWh and those for peak-demand hours at 0.362 yuan/kWh. The government said last year it would launch spot power trading in eight regions, including Guangdong, western Inner Mongolia, Zhejiang, Shanxi, Shandong, Fujian, Sichuan and Gansu, as part of the efforts to liberalise power prices currently set by the state.

Canadian Utilities Ltd said it has agreed to sell its entire Canadian fossil fuel-based electricity generation portfolio for about $835 mn, ending a strategic process for the assets that the company began last year. The agreement with Heartland Generation Ltd, an affiliate of Energy Capital Partners, includes 11 partly or fully owned natural gas-fired and coal-fired electricity generation assets located in Alberta, British Columbia, and Ontario, with a combined generating capacity of about 2,100 MW. Following the closing of the agreements, Canadian Utilities will have about 250 MW of electricity generation assets located in Canada, Mexico and Australia.

Egypt is considering offers from a Blackstone Group unit and Edra Power Holdings Sdn Bhd of Malaysia to take over three power plants co-built by Siemens AG — a move that could cut the North African nation’s debts while bringing in much-needed foreign investment. Both Blackstone’s Zarou Ltd and Edra have voiced interest in the state-owned facilities. The plants, which have a total capacity of 14.4 GW, were inaugurated in July as the latest in a series of large-scale infrastructure projects. The plants cost €6 bn ($6.7 bn) to build and were mainly financed by a consortium of lenders led by Deutsche Bank AG, HSBC Holdings Plc and KfW-IPEX Bank AG. If a deal went ahead, a power-purchasing agreement would be signed with either Edra or Zarou and the company would sell the electricity produced to the government while working alongside Siemens.

Greece moved closer to cutting Crete’s reliance on oil to generate power as grid operator ADMIE signed a €178 mn ($200 mn) European Investment Bank loan to partly fund undersea cables to the mainland. The 132 km interconnection of Crete to the Peloponnese peninsula is key to ensuring the power supply on the island which relies solely on oil-fired plants and will help Greece ramp up its renewable energy capacity, ADMIE said. The project, budgeted at €350 mn, consists of two undersea cables, and is expected to be completed next year. Greek grid operator ADMIE launched two tenders to build two undersea cables linking the island of Crete to mainland Attica, the energy ministry said. The €915 mn ($1.02 bn) project will be completed within 2022. Greece has said that the power link is key to the energy security supply of Crete which is now relying on three oil-fired plants that will need to ramp down production in the coming years.

Japanese utilities Chugoku Electric Power Company and Shikoku Electric Power Company will invest in the operation of a gas-fired power plant in Myanmar in a bid to cash in on the growing electricity demand in the emerging economy. The two regional utilities in western Japan said they have sealed a deal on the acquisition of a 28.5 percent stake each in the operator of the Yangon plant via their subsidiaries, marking their first investments in Myanmar. Under the project, the Ahlone thermal power plant, which began operation in 2013 with an installed capacity of 121,000 kW, is supplying electricity to the Electric Power Generation Enterprise under the Ministry of Electricity and Energy for a term of 30 years till 2043. The Japanese power companies said they will provide expertise in operation and maintenance and expect to gain long-term stable investment revenue. In Myanmar, electricity demand is forecast to grow to 14.5 mn kW in 2030 from 2.8 mn kW in 2016. Last year, hydropower generation accounted for about 70 percent of the country’s total electricity output, according to the ministry. Shikoku Electric also has participated in power projects in Chile, Qatar and Oman.

Japan’s Toyota Tsusho Corp and JERA said they would sell their shares in the Goreway thermal power station in Ontario, Canada to Capital Power Corp for a total of about 32 bn yen ($289 mn). The transaction is expected to be completed in or around June this year, JERA, a fuel purchasing and thermal power generation joint venture of Tokyo Electric Power and Chubu Electric Power, said. The two Japanese companies have invested in the 875 MW gas combined cycle thermal power project since 2009 and currently own 50 percent stake each in the project.

Zimbabwe’s state power utility imposed the worst rolling blackouts in three years, with households and industries including mines set to be without electricity for up to eight hours daily. The power cuts could stoke mounting public anger against the government as Zimbabweans grapple with an economic crisis that has seen shortages of US dollars used as the official currency, fuel, food and medicines as well as soaring inflation that is eroding earnings and savings. The Zimbabwe Electricity Transmission and Distribution Company, citing reduced output at its largest hydro plant and ageing coal-fired generators, said power cuts started and would last up to eight hours during morning and evening peak periods. The southern African country last experienced such serious blackouts in 2016 following a devastating drought. Mining accounted for more than two-thirds of Zimbabwe’s $4.8 bn in total export earnings last year and any power cuts in the sector will affect production and exports. In the past, some of the big mines, including platinum and gold producers, have resorted to directly importing electricity from neighbouring countries like Mozambique and South Africa. The power utility’s holding company ZESA said it had applied to the national energy regulator to raise its tariff by 30 percent for maintenance of its grid and after the price of inputs like diesel went up. Zimbabwe, now producing 969 MW of electricity daily against peak demand of 2,100 MW, is entering its peak winter power demand season, which will only increase power consumption.

The government of Brazil is considering issuing a decree that would guarantee high revenues for the operator of a proposed electricity transmission line to the state of Roraima. Roraima is not connected to the rest of Brazil’s electricity grid and has relied on Venezuela for electricity, with the state experiencing cuts to the power supply as its neighbour’s economy collapses. Electricity firm Alupar Investimento SA and a subsidiary of Eletrobras (Centrais Eletricas Brasileiras), banded together to win a bid for the project in 2011, but it has yet to receive an environmental license. Using methodology that electricity regulator Aneel has used in similar cases would indicate the annual revenue should rise to 200 mn reais annually.

Developers have presented more than 150 proposals for power plants ahead of an auction this month to supply electricity to the Brazilian state of Roraima, which has struggled with a rash of blackouts due to reliance on the shaky Venezuelan power grid. Roraima, which is not connected to Brazil’s national grid, has begun depending on expensive emergency fuel-burning plants in the absence of reliable power from its northern neighbour, which has sunk into a profound economic and political crisis. In the auction, the bidders offering the lowest price for electricity will win the chance to build the projects in two years and begin delivering power in June 2021. Together the projects in the running would be enough to generate almost 6 GW, but the government is likely to award the rights to between 200 MW and 250 MW.

French energy regulator CRE and its Irish counterpart CRU said they are backing a bid by the Celtic Interconnector undersea power cable project to get at least 60 percent of its €930 mn investment from European Union grants. The 700 MW high-voltage power cable project, led by French power grid operator RTE and Ireland’s EirGrid, will be the first interconnector linking Ireland to France. The regulators said that in the context of Britain’s exit from the European Union, the project will establish a direct power link between Ireland and the European internal energy market. It would also improve Ireland’s security of supply.

Puerto Rico’s power utility struck a deal with a group of creditors that seeks to allow the bankrupt US commonwealth to restructure more than $8 bn of bonds, according to an announcement by government authorities. A group of PREPA bondholders, bond insurer Assured Guaranty Corp, along with the island’s government and federally created financial oversight board, reached a restructuring support agreement that would reduce the utility’s debt by up to 32.5 percent. The move paves the way for a plan of adjustment for PREPA, which filed for a form of bankruptcy in July 2017 after a previous restructuring deal fell apart. The latest agreement, which requires support from at least 67 percent of voting bondholders to materialize, would shed about $3 bn in debt service payments over the next decade. The privatization of PREPA is under way, with transmission and distribution contracts with private companies expected to be in place by the second quarter of 2020.

Italy has signed a €30 mn soft loan agreement with Myanmar as part of a World Bank-funded national electrification programme that will bring power to half a million people, the foreign ministry said. Some 100,000 households will get electricity under the accord focused mainly on Chin State and surrounding areas, which are among Myanmar’s poorest and most remote regions, the ministry said.

German industrial conglomerate Siemens cleared a hurdle in its race with US-based General Electric to rebuild Iraq's electricity grid, signing a "roadmap" at a Berlin meeting with top ministers. Under deal, Siemens secured contracts worth €700 mn ($785 mn) to build one power plant, upgrade 40 gas turbines and install substations and transformers "across Iraq". Both Siemens and General Electric signed non-binding memorandums of understanding with the Iraqi government last year on rebuilding and repairing electricity infrastructure. Iraq’s electricity ministry said the deal would be implemented over four years, adding up to 11 MW of electricity to the grid. Baghdad is under pressure — at home and abroad — to rebuild its energy grid.

| MW: megawatt, GW: gigawatt, kW: kilowatt, discom: distribution company, MAHAGENCO: Maharashtra State Power Generation Company, kWh: kilowatt hour, CEA: Central Electricity Authority, FY: Financial Year, mn: million, bn: billion, tn: trillion, mt: million tonnes, Coal India Ltd, CERC: Central Electricity Regulatory Commission, SERC: State Electricity Regulatory Commission, ADB: Asian Development Bank, IRFC: Indian Railway Finance Corp, kVAh: kilovolt-ampere, UP: Uttar Pradesh, LED: light emitting diode, EESL: Energy Efficiency Services Ltd, NRL: Numaligarh Refinery Ltd, MoU: Memorandum of Understanding, AEGCL: Assam Electricity Grid Corp Ltd, kV: kilovolt, mtpa: million tonnes per annum, km: kilometre, IEX: Indian Energy Exchange, PREPA: Puerto Rico Electric Power Authority, US: United States |

NATIONAL: OIL

IOC-BPCL-HPCL joint venture to build longest LPG pipeline

4 June. State-run oil refiners Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) have signed a pact with Indian Oil Corp (IOC) to take 25 percent stake in the 2,757 kilometre (km) cross-country pipeline, billed as the world’s largest LPG (liquefied petroleum gas) pipeline, to be laid from Kandla in Gujarat to Gorakhpur in Uttar Pradesh at a cost of nearly Rs100 bn. The pipeline will source LPG supplies from Kandla and other LPG import terminals on the West Coast and two refineries at Koyali in Gujarat and Bina in Madhya Pradesh. It would directly link 22 LPG bottling plants in Gujarat, Uttar Pradesh and Madhya Pradesh, owned by the three State-run oil firms. It would also feed another 21 LPG bottling plants by using a fleet of trucks. The pipeline would carry up to 6 million tonnes (mt) of LPG annually. Prime Minister Narendra Modi had earlier laid the foundation stone for this pipeline, but lack of funds with IOC was holding up the work on it.

Source: The New Indian Express

NCDRC asks IOC, dealer to pay Rs12 lakh to kin of woman killed in cylinder explosion

4 June. Apex consumer commission NCDRC (National Consumer Disputes Redressal Commission) has directed Indian Oil Corp (IOC) and its dealer to pay over Rs12 lakh compensation to the next of kin of a woman who died in a cylinder explosion, saying the accident occurred due to manufacturing defect. The NCDRC held IOC and Alok Gas Agency liable for the gas cylinder explosion which claimed the life of Neena Jhamb, a housewife, and seriously injured her mother-in-law. The commission said the onus was on IOC to conduct inquiry into the defect as there was no evidence of negligence by the consumer. The order came on an appeal filed by IOC, the gas agency and an insurance company against the Delhi state consumer forum’s order directing them to pay the victim's kin Rs12,21,734 along with interest. The commission, while dismissing the appeal, also imposed a cost of Rs25,000 on IOC. The complaint against the PSU (Public Sector Undertaking) and its dealer was filed by the deceased's husband and children who had said that on 3 April 2003, Neena was cooking in the kitchen along with her mother-in-law Kanta when the cylinder exploded. According to the complaint, as soon as they replaced an exhausted cylinder with a new one, there was leakage of gas leading to an explosion in which Kanta suffered 65 percent burns whereas her daughter-in-law was admitted to a hospital with 90 per cent burns. Neena died after 24 days. IOC resisted the complaint saying that the complainant was not a 'consumer' as the supply of gas was done by the dealer and IOC had rendered no service. It also said that the fire was caused by the negligent act of the complainants. The dealer contended that no FIR was lodged with the police neither any forensic examination of the site was done, without which it cannot be said that the cause of accident was only due to defective cylinder. The apex consumer commission rejected the contentions of IOC and its dealer while dismissing their appeal.

Source: Business Standard

OMCs raise subsidized LPG prices by Rs1.23 per cylinder

1 June. Oil Marketing Companies (OMCs) have raised the prices of subsidized cooking gas or liquefied petroleum gas (LPG) by Rs1.23 per cylinder beginning. Post the revision, consumers will pay Rs497.37 for every LPG cylinder in Delhi as compared to Rs496.14 in May. While the price of Non-Subsidized LPG at Delhi will increase by Rs25 per cylinder in June 2019 mainly due to increase in international price, the actual impact on subsidized domestic LPG customers is only Rs1.23 per cylinder, which is mainly due to GST (Goods and Services Tax) on the above, Indian Oil Corp (IOC) said. The subsidy transfer in the customers’ bank account has been increased to Rs240.13 per cylinder in June 2019 as against Rs216.36 per cylinder in May 2019, IOC said. IOC said that this is meant to protect the domestic subsidized LPG customers against the increase in prices of LPG.

Source: The Economic Times

Opening 1,750 new petrol pumps in Kerala: HC declines to interfere

1 June. The Kerala High Court (HC) has dismissed two petitions challenging oil marketing companies’ move to establish 1,750 petroleum retail outlets in the state, in addition to the 2,200 retail outlets in existence now. Justice Shaji P Chaly considered petitions filed by Petroleum Traders Welfare and Legal Service Society, whose members are petroleum outlet dealers, and four dealers of oil companies who belong to scheduled castes and tribes. Oil companies named as respondents in the cases included Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL), and Bharat Petroleum Corp Ltd (BPCL) as well as state-level coordinator of oil companies. It was contended by the petitioners that the oil companies have invited applications for new dealerships in spite of sufficient number of retail outlets and without making any assessment, feasibility, and viability study. The oil companies submitted that a decision to grant new dealerships was taken as sale of petrol and diesel is growing in Kerala at the rate of 8 percent and 4 percent, respectively. Moreover, such a move will create more employment and business generation opportunities, resulting in economic development, the companies told the court. While dismissing the petition, the court cited the contention of the oil companies that they have conducted feasibility studies and said it cannot be believed that the companies have not done so as they have to make substantial investments.

Source: The Economic Times

Post elections, petrol and diesel prices are on the boil again

29 May. Petrol and diesel prices started rising soon after the last phase of the general election concluded, and have increased by 70-80 paisa per litre in the past nine days. Prices have been on the rise since May 20, a day after the final phase of polling for the Lok Sabha elections ended. The price of petrol has risen by 83 paise per litre in the nine days and diesel by 73 paise, according to price notifications of state-owned oil companies. Rates were largely range-bound during April and May despite a rise in oil prices in the international market. Petrol price was raised by 11 paise and diesel by 5 paise. In Delhi, petrol now costs Rs71.86 per litre, up from Rs71.03 price on 19 May. Similarly, a litre of diesel costs Rs66.69, up from Rs65.96 a litre on May 19. Petrol in Mumbai costs Rs77.47 per litre and diesel is priced at Rs69.88. While state-owned fuel retailers Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) had in the past completely frozen rates during times of elections, they during the Lok Sabha polls moderated the revision by not passing on all of the desired increase in rates to consumers.

Source: The Economic Times

IOC to provide fuel on credit to Punjab farmers

29 May. In a first of its kind, oil major Indian Oil Corp (IOC) signed a MoU (Memorandum of Understanding) with Punjab to set up 15 petrol pumps to provide fuel to farmers on credit that will be repaid after the harvesting of crops. For this, the Cooperation Department inked a pact with IOC in the presence of Cooperation Minister Sukhjinder Singh Randhawa and Additional Chief Secretary Viswajeet Khanna. Under the pact, IOC would open its retail outlets on vacant plots of the cooperative sector institutions. Randhawa said this initiative would provide direct benefit to the farmers. The empty spaces of Markfed, Milkfed, Sugarfed and the rural cooperative societies would see the opening of the petrol pumps. The Minister said this initiative would lead to the supply of diesel and petrol to farmers on credit for which they would pay after harvesting their crops. Besides, the farmers wouldn't have to go very far for getting the fuel. The capital investment for setting up the outlets would be borne by IOC whereas the land would be provided by the state. IOC would also set up food courts and departmental stores at these outlets for the sale of products manufactured by Markfed, Milkfed and Sugarfed. The Minister said cooperative sugar mills would also provide diesel and petrol on credit to sugarcane growers in the sugar mills itself and the price would be adjusted in the pricing of sugarcane.

Source: Business Standard

NATIONAL: GAS

Natural gas not to drive ONGC’s profitability in near term: Moody’s

4 June. India’s top oil and gas producer ONGC (Oil and Natural Gas Corp) will not see natural gas contributing heavily to its profitability in the near term despite the company aiming to raise output over the next few years, Moody’s Investors Service said. National oil companies (NOCs) worldwide are currently retailoring their business strategies in response to climate-change imperatives and developing energy transition changes, Moody’s said in a report that studies how state-sponsored oil companies are preparing against energy transition risk. As India’s largest NOC, ONGC is aligned with the government’s aim to reduce India’s dependence on energy imports, which make up more than 80 percent of its oil consumption and more than 40 percent of its natural gas consumption, it said. Moody’s said although natural gas made up 44 percent of ONGC’s sales, it only accounted for about 17 percent of total sales revenue. The government has mandated a maximum price of $3.69 per million metric British thermal unit (mmBtu) for most of the gas that ONGC produces during April to September 2019 period. This rate is below the cost of production for most fields. Moody’s said the recent acquisition of a stake in Russia's Vankorneft fields increases ONGC’s crude reserves in that country. Also, ONGC has acquired a majority stake in refining and marketing company Hindustan Petroleum Corp Ltd (HPCL).

Source: Business Standard

Amit Shah, ministers review BPCL’s Mozambique investment plan

4 June. An informal ministerial group that included Home Minister Amit Shah reviewed Bharat Petroleum Corp Ltd (BPCL)’s $2.2-2.4 bn investment proposal in a giant gas field in Mozambique as the government attempted to do deeper scrutiny of overseas investments to avoid the fiasco of the past. Oil Minister Dharmendra Pradhan had in the past been critical of the nearly $6 bn spent by the Indian public sector firms to take 30 percent stake in the Rovuma Offshore Area-1 in Mozambique during the Congress-led UPA regime, as falling oil and gas prices did not justify such huge investment. About 75 trillion cubic feet of natural gas has been discovered in the field and the same will be in phases converted into liquefied natural gas (LNG) for sale to overseas customers in ships. In the first phase, $22-24 bn is to be spent by partners in Mozambique project to develop the field and build two LNG trains of 12.88 million tonnes (mt). BPCL holds 10 percent stake in the project and its share of investment comes to $2.4 bn. Of this $800 mn would be as equity - the single largest investment in an upstream project by the company ever. BPCL had paid $703 mn to buy the 10 percent stake in Rovuma Offshore Area-1 concession in the Cabo Delgado province in northern Mozambique.

Source: Business Standard

India’s green vision to see full duty exemption on LNG

30 May. In a bid to promote a gas-based economy, the new Government may cut customs duty on liquefied natural gas (LNG) to zero percent from 2.5 percent, to cut cost of power further and aid city gas distribution (CGD) projects besides boosting fertiliser production. LNG is a clean fuel and its imports currently attract 2.5 percent basic customs duty. In addition, a social welfare surcharge of 10 percent is levied that takes the effective customs duty on LNG to 2.75 percent. This adds up to the cost of imported gas as LNG requires additional cost for reconversion into gas and transportation. The Union Budget 2017-18 halved duty on LNG from 5 percent. The industry and the petroleum ministry have been pitching for exempting LNG from import duty for some time now as there is a shortage in domestic production. The Centre has exempted domestic power generators using gas as fuel to import LNG without payment of any duty. Cheaper access to LNG is expected to keep power tariff low while also allowing the government to save on fertiliser subsidy as cost of production will reduce. Spot rates of LNG are down at this juncture due to subdued global demand. The rates have fallen sharply since the beginning of this year with LNG prices coming down to $6 per million metric metric British thermal unit (mmBtu). With customs exemption, the situation would provide a bonanza to user industries and accelerate adoption of cleaner fuel. With stagnant domestic production, the demand for imported LNG is on the rise. In 2018-19, availability of domestic gas for sale rose merely 0.4 percent while import of LNG went up 2.6 percent. The share of LNG in total gas consumption in the year was 51 percent. India, the world’s fourth-biggest importer of LNG, does not have a free market regime for gas. Natural gas is sold on the basis of a government-mandated formula that links the local price to international rates, while most long-term import contracts are linked to crude oil. The country has, however, liberalised gas production regulations for new fields as well as deep sea and difficult blocks.

Source: Business Standard

NATIONAL: COAL

CIL e-auction fetches 44 percent higher prices

4 June. Coal India Ltd (CIL) recorded a 44 percent rise in 2018-19 e-auction prices, up from 20 percent a year ago, thanks to a spurt in demand and higher international rates. In 2018-19, the state-run miner got premiums of 58-92 percent in forward and spot markets over the notified price and the average price per tonne of coal hit Rs2,653 from Rs1,841. For the quarter ended March 31, 2019, the average realisation was up 30 per cent to Rs2,754 a tonne from the year-ago period. Jayanta Roy, head of corporate sector ratings at ICRA, said spot e-auction volume fell because CIL had to meet its obligations to long-term customers having fuel-supply agreements. CIL had 76.42 million tonnes (mt) of coal, or 12.56 percent of its total sales, at auctions in 2018-19. CIL’s average price from coal sold through fuel supply agreements rose 8.45 percent to Rs1,348 per tonne during the year.

Source: The Economic Times

Power producers want CIL to step up coal supply through rail wagons

2 June. Power generating companies have asked Coal India Ltd (CIL) to increase the supply of the dry fuel from Korba area in Chhattisgarh through rail wagons to help them reduce transportation cost as well as tariffs for end-consumers. Korba region serves 20 percent of the domestic coal supply but CIL-arm South Eastern Coalfields Ltd (SECL) is able to meet only 55 percent of its demand from the region through rail, according to Association of Power Producers (APP). The APP in a letter to CIL chief Anil Kumar Jha mentioned that power producers are incurring around 25 percent higher costs to move coal by road as against rail mode. Against a demand of 45 rakes per day, Korba area is currently loading only 25 rakes per day, the APP said. Due to lack of supply through railways, power producers are compelled to bank on inefficient and expensive truck transportation for coal procurement. One rake can load 4,000 tons of coal, which means producers have to ply 135 trucks carrying 30 tonnes each. The SECL controls Chhattisgarh Korba coal field that produces close to 130 million tonnes (mt) of coal that can fire 32,000 MW of electricity generation capacity. India has close to 200 GW of power generation capacity dependent on coal that often struggles to procure the desired quality and quantity of fuel in a time-bound manner.

Source: Business Standard

India’s coal imports set to grow between 8 percent and 10 percent

29 May. Analysis firm Care Ratings expects coal production to grow between 6 percent and 7 percent and imports to grow between 8 percent and 10 percent during 2019-20. Domestic coal production grew by 7.3 percent to 739.4 million tonnes (mt) during FY19 versus 2.6 percent in FY18. Coal imports stood at 240.2 mt and grew at a sharper pace of 12.9 percent in FY19 versus 8.9 percent recorded in FY18. Higher coal imports was triggered by shortage in domestic coal supply to captive and non-power coal consumers like cement, metals and other power intensive industries. Coal imports continued to grow at a healthy pace during the year. Power and manufacturing industries like cement and metals were major importers of thermal coal. Cement production clocked a multi-year high of 13.3 percent volume growth in FY19. Overall coal offtake from the state-run miners continued to be higher than the annual production for the second year in a row. Offtake in FY18 was 2.5 percent more than production and in FY19 it is was marginally higher (0.7 percent). State miners like Coal India Ltd and Singareni Collieries Company Ltd continued to account for nearly 91 percent of the coal produced in the country. Rest of the coal is produced by captive coal mines of power plants. Dispatch to power sector has grown at 7 percent in FY19 versus 6.4 percent in FY18. The supply of coal to thermal power plants in the country has improved in FY19 vs FY18 but supply-chain constraints persist.

Source: The Economic Times

NATIONAL: POWER

Increased power supplies keep prices under control: Ind-Ra

4 June. Increased power supplies from various sources, in comparison to demand, has subdued its prices at the exchanges over the last two months, India Ratings & Research (Ind-Ra) has said. According to Ind-Ra, short-term power prices did not see any major movement during May 2019, as hydro generation remained strong due to a better snow season in FY19. With improvement in coal inventory, the number of power stations with subcritical levels of coal inventory decreased to two in April 2019 from 28 in April 2018. Improvement in private sector capacity utilisation can be attributed to improvement in Adani Power Ltd’s Mundra plant’s owing to reduction in their coal costs. Capacity utilisation of the Mundra plant, which has a capacity of 4620 MW, rose to 83.43 percent in April 2019 (April 2018: 3.88 percent). In April 2019, as energy supply increased at a slightly higher rate than energy demand, energy deficit and peak deficit narrowed to 0.4 percent (April 2018: 0.5 percent) and 0.3 percent (0.9 percent), respectively. With the onset of summer season, energy demand increased 1.4 percent on a month-on-month basis.

Source: The Economic Times

Delhi’s peak power demand touches 6.5 GW

3 June. Amid soaring temperatures, the peak power demand in Delhi touched 6,560MW, the State Load Dispatch Centre (SLDC) reported. This was higher than the annual peak load of 2017 — 6,526 MW on 6 June 2017. The power demand crossed the 6,000 MW mark and has been rising since then. Last year on 1 June, Delhi’s power demand hit an all-time high of 6,651 MW. In July, it created another new record with a demand of 7,016 MW.

Source: Business Standard

Punjab to daily provide 8-hour power to farmers

3 June. Punjab Chief Minister (CM) Amarinder Singh assured farmers of eight hours of power supply every day for the ensuing paddy season, beginning on 13 June, while promising 24-hour supply of power to all other categories of consumers. At a meeting to review the preparations by power companies for supply of power during summer and paddy season, the CM said his government was committed to the supply of quality power, in addition to 100 percent cost subsidy for agriculture and free power to various categories of consumers. The power companies briefed the CM about the arrangements made for meeting the demand of 14,000 MW even though the demand anticipated by Punjab State Power Corp Ltd (PSPCL) was likely to be 13,500 MW. The CM directed the companies to ensure round-the-clock supply during summer and paddy season to all areas of the state.

Source: Business Standard

Telangana power capacity tops 16.2 GW, up from 7.7 GW in 2014

2 June. The Telangana power transmission network has doubled from 14,059 MVA (megavolt-ampere) to 28,884 MVA and the contracted capacity has gone up to 16,203 MW from 7,778 MW in the past five years since the state’s formation in June 2014, thereby, enabling round-the-clock power supply without power cuts. The network would play a critical role in the Telangana government’s schemes and in supplying power to industries under the TS-iPASS Policy, 24-hour power to the agriculture sector, the Mission Bhagiratha-Telangana Water Grid Project, and lift irrigation schemes and providing uninterrupted 24x7 supply to all categories of consumers. TS Genco has synchronised the 800 MW super critical unit at the Kothagudem VII Stage within 41 months, as against the standard norm of 48 months. In an endeavour to become self-sufficient on the power front, TS Genco is adding 5080 MW of thermal capacity at Manuguru (4x270 MW), Damarcherla (5x800 MW) and the works are on at a hectic pace. The Boiler Light-up of the first unit of the 270 MW Bhadradri Thermal Power Station was done on 25 March and the first unit is expected to be synchronised by the end of July 2019.

Source: The Hindu Business L ine

CERC directs Tata Power arm to get discoms’ consent for Mundra PPA revision

30 May. The Central Electricity Regulatory Commission (CERC) has asked Coastal Gujarat Power (CGPL), the Tata Power arm that runs the troubled 4,150 MW Mundra ultra mega power plant, to send its proposal for tariff revision to all the electricity distribution companies (discoms) that procure power from its imported coal-based generating station. The company, on 17 May, had sent such a proposal to Punjab State Power Corp Ltd (PSPCL), which is currently evaluating the proposal. CGPL had earlier requested the electricity regulator to direct the discoms to adopt revised power purchase agreements (PPA) to facilitate pass-through of future fuel price escalation, which CERC had not agreed to. The Tata Power unit had then sought more time to get the discoms’ consent for tariff revision for its imported coal based unit. The Mundra plant, where Tata Power has invested Rs149.86 bn, has PPAs with Gujarat, Maharashtra, Haryana, Rajasthan and Punjab.

Source: The Financial Express

No increase in power tariff in Haryana: HERC

29 May. In a good news for some 65 lakh power consumers in Haryana, the state’s power regulator has ruled out any increase in the electricity tariff for this year. In neighbouring Punjab, discom (distribution company) Punjab State Power Corp Ltd had hiked electricity rates by over 2 percent across the board. Increase in Punjab power rates came soon after the model code of conduct was lifted. However, in Haryana Chief Minister Manohar Lal Khattar had announced in 2017 that there would be no increase in power tariff under his regime. The state government had last year reduced tariff as the discoms had shown profits for the year 2018-2019. The details emerged in the tariff order for the current financial year that was released by the power regulator Haryana Electricity Regulatory Commission (HERC). HERC said that the decision to not increase the electricity rates was taken in March but could not be announced as the model code of conduct was in force. Meanwhile, HERC also directed the discoms, Uttar Haryana Bijli Vitran Nigam and Dakshin Haryana Bijli Vitran Nigam, to ensure that the tubewell connections for which applications were received till 31 March are released by in first week of June.

Source: The Economic Times

BESCOM men restore power to 14k cyclone Fani-hit homes

29 May. A total of 317 powermen and engineers from Bangalore Electricity Supply Company (BESCOM) have restored power supply to over 14,000 consumers spread across villages in Odisha, said. They recently travelled to Bhubaneswar to provide assistance in repairing and restoring electric utilities damaged during Cyclone Fani. As per reports, over 1.5 lakh poles were uprooted and other electrical infrastructure was damaged after Cyclone Fani swept through the Odisha capital. Several areas of the city went without power for many days.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

NTPC to piggyback ISA to expand solar footprint

4 June. NTPC Ltd has urged the International Solar Alliance (ISA) to appoint it a consultant for 1,000 MW of rooftop solar projects the latter plans to implement across several countries. NTPC proposes to charge 6-10 percent of the project cost as upfront consultancy fees, depending on the capacities of the solar installations. ISA is a treaty-based intergovernmental organisation headquartered in India, which plans to mobilise more than $1,000 bn of investments by 2030 to promote solar technology in countries lying between the tropics of cancer and capricorn. As on date, 52 countries have signed and ratified the ISA framework agreement. NTPC, along with other PSUs (Public Sector Undertakings) like SECI, IREDA, PGCIL, REC, PFC, CIL and PFC, has contributed $1 mn each toward ISA funding. NTPC, the twelfth largest power producer in the world, has more than 900 MW of solar and wind generation units in its portfolio. By 2030, it plans to have a total power production capacity of 1,30,000 MW, out of which, solar would comprise 30,000 MW. In the international market, the company already has its presence as a power project consultant in places such as Nigeria, Kenya, Saudi Arabia, Kuwait and the United Arab Emirates. The first assembly of the ISA had provisionally approved the prospective annual budget of $9 mn for calendar years 2019 and 2020. India has put in $16 mn to the ISA in a one-time corpus, apart from the annual commitment of $2 mn in the first five years. Private companies such as Japan’s SoftBank have funded $2 mn and China’s CLP has given $1 mn to the organisation. ISA has also recently floated a tender for procuring 2.7 lakh solar water pumping systems for 22 member countries.

Source: The Financial Express

₹24 bn due from Telangana clouds prospects of solar-power companies

4 June. In the scorching summer months when the solar power industry should be at its best, it is plagued with financial woes. The total outstanding dues of solar-power companies supplying power to Telangana have shot up to ₹24 bn, plunging them in a financial crisis. The State, which has a solar installed capacity of about 3,600 MW and is on the verge of offering another 1,100 MW for development, has not been making payments since July 2018. According to representatives of solar-power producers in the State, the last payment pertaining to the supply made in June 2018 was made in the first week of April this year, after a delay of nine months. The previous bill (for power supplied in May 2018) was paid in December 2018. In all, 200 solar power projects totalling 3600 MW have been installed in Telangana as at end-April, and account for about 30 percent of the power required by the State.

Source: The Hindu Business L ine

Mahindra Susten and Mitsui to co-invest in distributed solar power projects in India

3 June. Mahindra Susten, a leading player in the Indian solar energy sector, has entered into a partnership with Mitsui & Co., of Japan to jointly develop and operate distributed solar power generation projects in India. Mahindra Susten will continue to hold 51 percent stake in Marvel Solren (Marvel), with Mitsui holding the balance equity. Marvel currently operates four distributed solar projects in India with a combined capacity of 16 MW that help private clients reduce their carbon footprint by providing renewable energy through long-term power purchase agreements of 10-25 years. Compared to power generated through an average Indian coal-fired power plant, the four projects can collectively reduce CO2 (carbon dioxide) emissions by about 20,000 tons per year and will contribute to the Indian government's renewable energy targets.

Source: Business Standard

Increasing share of renewables in energy sector poses regulatory challenge: Moody’s

3 June. The increasing share of renewables in the total energy mix of the country may lead to an increase in regulatory risk for coal-based projects in the long term, global ratings agency Moody’s Investors Service said. The higher share of renewable energy in the total energy mix presents a key regulatory challenge in terms of integrating new renewable capacity, while protecting investments already made in coal-based capacity, it said. Despite the mounting pressure to move to a lower carbon economy, the agency does not consider this risk high, at least over the next 3-5 years.

Source: The Economic Times

Visakhapatnam plans e-vehicles for city to fight climate change

1 June. The Greater Visakhapatnam Municipal Corp (GVMC) is planning to introduce e-rickshaws for public transportation as well as to transport garbage. The project is being taken up with the financial assistance of the Asian Development Bank (ADB). A total of 25 e-rickshaws will be procured under the project. Of these, 15 e-rickshaws will be used to transport garbage, and the other 10 will be used as public transport. The e-rickshaws allocated for public transport will run on the RK Beach Road. Four e-buses will also be procured as under the project. Two charging stations will be developed for the four e-buses and five charging stations will be set up for the e-rickshaws. In another project, the GVMC has already conducted a trial run of e-buses with the plan to procure 58 e-buses and operate them on the BRTS corridor. The GVMC has been provided with an urban climate change resilience trust fund under the Visakhapatnam-Chennai industrial corridor project. The fund is slated to be used to develop and provide climate change resilient infrastructure and services in the city.

Source: The Economic Times

NHPC’s takeover plan of crisis-hit Teesta-VI hydro power unit faces hiccups

31 May. NHPC Ltd’s takeover plan of Lanco Teesta Hydro Power’s beleaguered hydro power unit in Sikkim Teesta-VI (500 MW) is facing hiccups, after approval from the Cabinet. The National Company Law Tribunal (NCLT), which approved the bid of NHPC, will hear the matter again over the issue of escalated cost. NHPC emerged the highest bidder with a bid amount of Rs9.07 bn. The investment proposal for an estimated cost of Rs57.48 bn was approved by the Cabinet Committee of Economic Affairs (CCEA) in March 2019. NHPC said Bihar, West Bengal and Jharkhand have given in-principle nod for buying power from Teesta-VI. However, an earlier agreement with Maharashtra is also posing a problem. NHPC is looking at more stressed hydro units but only through the NCLT route.

Source: Business Standard

India becomes lowest-cost producer of solar power

30 May. India has finally bagged the tag of the lowest cost producer of solar power globally. The country-wise average for the total installed costs of utility scale solar PV (photovoltaic) in 2018 ranged from a low of $793 per kilowatt (kW) — around Rs55 mn per megawatt — in India to a high of $2,427 per kW in Canada, the International Renewable Energy Agency (IRENA) said. Further, IRENA conducted an analysis of the decline in the cost of setting up solar PV projects between 2010 and 2018 across eight major markets including China, France, Germany, India, Italy, Japan, United Kingdom and the United States. The costs were found to have dropped at the fastest pace – 80 percent — in India. Typically, the cost of hardware — including modules, inverters and racking and mounting — account for more than a half of the total cost of setting up a solar PV project in India while installation and soft costs like financing and system design account for the rest. Experts attribute India’s status of lowest-cost producer of solar power to multiple reasons including high solar potential that leads to improved asset utilization and lower cost of modules sourced from China.

Source: The Economic Times

Tata Power arm TPREL to develop 100 MW solar power project in Gujarat

30 May. Tata Power said its arm Tata Power Renewable Energy Ltd (TPREL) will develop a 100 MW solar power project in Raghanesda Solar Park of Gujarat. The power generated from the project will be supplied to GUVNL under a power purchase agreement (PPA) valid for 25 years from the scheduled commercial operation date. The company has won this capacity in a bid announced by GUVNL in March 2019. The project has to be commissioned within 15 months from the date of execution of the PPA. With this win, TPREL's capacity under implementation would become 500 MW which is in addition to the operating capacity of 2,268 MW. The plant is expected to generate 250 million units (MUs) of energy per year and will annually offset about 250 mn kilogram of carbon dioxide.

Source: Business Standard

Substitute LPG by setting up biogas plants: Environment ministry

30 May. Industries should focus on setting up biogas and bio-methanation plants to substitute LPG, the environment ministry said while asserting that with the rise in demand, it is imperative that new and alternate mode of energy is put to use. Additional secretary of the environment ministry, A K Jain said biogas plants and biomethanation plants should be set especially in the cities. He said that in the last decade, the demand for energy has increased drastically and it is imperative that new and alternate mode of energy should be used.

Source: Business Standard

Maruti to set up solar power plant of 5 MW in Gurgaon plant

29 May. To harness solar power for its energy needs Maruti Suzuki India Ltd - country’s largest vehicle manufacturer- announced setting up of a solar power plant with a capacity of 5 MW in its manufacturing facility in Gurugram. The company will invest around ₹240 mn, and will offset carbon dioxide (CO2) emissions to the tune of over 5390 tonnes annually, for the next 25 years. This is the second grid based solar power plant for Maruti Suzuki. The first solar power plant was set up in 2014 at Manesar, with 1 MW capacity. In 2018, this solar power plant was further expanded to 1.3 MW, Maruti Suzuki said. The power generated from the solar power plant will be synchronised with the captive power plant to cater to the internal energy needs of the Gurugram facility.

Source: Livemint

INTERNATIONAL: OIL

France’s Total declares force majeure on jet fuel at Germany’s Leuna refinery

4 June. France’s Total declared force majeure on the production of jet fuel at its Leuna refinery in Germany following the supply of contaminated crude from Russia. Total said that due to ongoing problems with crude supply through the Druzhba pipeline, the Leuna refinery was still operating at a reduced rate using crude oil from stocks and alternative supply routes via Gdansk port.

Source: Reuters

Norway negotiators work overtime in bid to avert oil industry strike

4 June. Norwegian oil workers and their employers have extended their pay talks past a midnight deadline in a bid to avert a strike that would reduce the country’s oil and gas output, negotiators said. The Lederne trade union has threatened to strike at offshore fields operated by Equinor, Aker BP and others, which the oil firms said would curb production by some 440,000 barrels of oil equivalents per day.

Source: Reuters

No impact to Carson oil storage facility after fire: Kinder Morgan

4 June. Kinder Morgan Inc said that there was no impact to its crude and petroleum products storage facility in Carson, California after a fire on its truck rack earlier in the day. The fire was extinguished, which also injured a truck driver, and the crude and petroleum products storage terminal in Carson was evacuated, the company said. The explosion occurred while jet fuel was being loaded onto a tanker truck.

Source: Reuters

Goldman Sachs sees oil prices steadying at current levels

3 June. Crude oil prices are likely to remain steady around current levels, as growing macro uncertainties, rising US (United States) output and large availability of core OPEC (Organization of the Petroleum Exporting Countries) nations’ spare capacity will offset supply constraints from Iran and Venezuela, Goldman Sachs said. The US spooked markets worldwide with oil supply worries last month after it reimposed trade sanctions on Iran, one of the major global oil suppliers, bringing focus back on the OPEC. Crude markets posted their biggest monthly losses in six months in May amid stalling demand and as trade wars fanned fears of a global economic slowdown. Oil prices dropped to their lowest in three months, with Brent marking $60.55 per barrel and US crude reaching $52.11 per barrel.

Source: Reuters

Russia will keep oil output in June in line with agreements: Energy Minister

3 June. Russian Energy Minister Alexander Novak said Russia would keep its oil production in June in line with a global output agreement. He said that Russia cut its oil output by 317,000 barrels per day (bpd) in May on average from October 2018 levels.

Source: Reuters

BP agrees to sell Egyptian oil assets to Dubai’s Dragon Oil

3 June. BP said it had agreed to sell its interests in the Gulf of Suez oil concessions in Egypt to Dubai-based Dragon Oil for an undisclosed sum. Under the terms of the agreement, Dragon Oil will purchase producing and exploration concessions, including BP’s interest in the Gulf of Suez Petroleum Company. BP was nearing the sale of the Egyptian assets to Dragon Oil for over $600 mn. The deal, which is subject to the Egyptian Ministry of Petroleum and Mineral Resources’ approval, is expected to complete during the second half of 2019, BP said. It is part of BP’s plan to divest over $10 bn over the next 2 years, it said.

Source: Reuters

Saudi Arabia deepens oil output cut in May

3 June. Saudi Arabia pumped 9.65 mn barrels of oil per day, cutting deeper than its production target under a global pact to reduce oil supply. The world’s top oil exporter’s output target under an OPEC (Organization of the Petroleum Exporting Countries)-led supply cut agreement is 10.3 mn barrels per day.

Source: Reuters

China demand for Angolan crude oil stalls as buyers hold out for lower prices

3 June. African crude oil sales into China, the world’s biggest importer, have stalled as buyers wait for spot sale offers from top supplier Angola to fall in line with slumping benchmark prices. Chinese refiners are in the market for Angolan imports in August, but they have been slow to finalize orders in the hope that the slide in Brent crude oil futures will lead to weaker cargo prices. In late April Brent was almost 20 percent below its 2018 peak. Chinese independent refiners account for a fifth of the country’s crude imports, and have increased imports by about 300,000 barrels per day (bpd) in the first four months this year compared with the same period in 2018, up to 2.15 mn bpd, Beijing-based consultancy SIA Energy’s Seng Yick Tee said.

Source: Reuters

Iran warns any clash in the Gulf would push oil prices above $100

2 June. US (United States) military vessels in the Gulf are within range of Iranian missiles, a top military aide to Iran’s Supreme Leader Ayatollah Ali Khamenei said, warning any clash between the two countries would push oil prices above $100 a barrel. Iran and the US have been drawn into starker confrontation in the past month, a year after Washington pulled out of a deal between Iran and global powers to curb Tehran’s nuclear programme in return for lifting international sanctions. Washington re-imposed sanctions last year and ratcheted them up in May, ordering all countries to halt imports of Iranian oil.

Source: Reuters

Iraq lifts state of emergency at Majnoon oil field

1 June. Iraq lifted a state of emergency which was declared at the Majnoon oil field in the south of the country because of floods, Oil Minister Thamer Ghadhban said. The floods did not impact production at the field, which runs at 240,000 barrels per day (bpd), he said. Basra Oil Company took over the operations at the field after the withdrawal of Royal Dutch Shell last year. Iraq has announced plans to boost output from Majnoon to 450,000 bpd in 2021.

Source: Reuters

INTERNATIONAL: GAS

Natural gas flaring hits record high in first quarter in US Permian Basin

4 June. Natural gas flaring and venting in the top US (United States) oil field reached an all-time high in the first quarter of the year due to the lack of pipelines, at a time of increased focus on environmental concerns about methane emissions. Producers burned or vented 661 million cubic feet per day (mmcfd) in the Permian Basin of West Texas and eastern New Mexico, the field that has driven the US to record oil production, according to a new report from Rystad Energy. The Permian’s first-quarter flaring and venting level more than doubles the production of the US Gulf of Mexico’s most productive gas facility, Royal Dutch Shell’s Mars-Ursa complex, which produces about 260 to 270 mmcfd of gas. The Permian is expected to flare more than 650 mmcfd until the second half of the year when the Gulf Coast Express pipeline comes online. The Gulf Coast Express is designed to transport up to 2 billion cubic feet of natural gas and is scheduled begin operations in October.

Source: Reuters

Pakistan LNG seeks 240 cargoes for 10-year delivery period

4 June. Pakistan LNG, a subsidiary of state-owned Government Holdings Ltd, is seeking to buy 240 liquefied natural gas (LNG) cargoes for delivery over a 10-year period, a document on the company’s website showed. It is seeking two cargoes a month of 140,000 cubic metres each of the super-chilled fuel on a delivered ex-ship basis at Port Qasim in Karachi, Pakistan, according to the document.

Source: The Economic Times

Cheniere signals new LNG pricing structure with Apache deal

3 June. Cheniere Energy Inc said it would buy natural gas from Apache Corp’s Permian assets using a price mechanism linked to the liquefied natural gas (LNG) it ends up selling and not the typical US gas benchmark. The deal is the first sign Cheniere, by far the largest US LNG seller, may move away from its signature LNG pricing mechanism in future offtake agreements with LNG buyers by decoupling from the Henry Hub price used for US gas. To service its LNG sale agreements, Cheniere buys US gas to use as feedstock for its two LNG plants in Texas and Louisiana. It then sells LNG to long-term buyers who pay about 115 percent of the Henry Hub price plus a liquefaction fee of around $3 per million metric British thermal units (mmBtu). This formula protects Cheniere from fluctuating US gas prices and covers its cost to transform gas into LNG through the liquefaction fee. By striking the agreement with Apache to buy gas at an LNG-indexed price, however, Cheniere is giving itself flexibility to sell LNG using a different pricing structure. It is another sign that US LNG producers are expanding the ways they attract buyers in a global market that is growing fast but is far from being as liquid and transparent as the crude market.

Source: Reuters

YPF prepares first shipment of LNG from Argentina

3 June. Argentine oil company YPF SA said that it began loading the first shipment of liquefied natural gas (LNG) for export from Argentina. The shipment includes 30,000 cubic meters of LNG from the Vaca Muerta shale play, YPF said. The export of LNG will generate revenues of more than $200 mn a year, which represents 10 percent of its total fuel and energy exports, according to YPF data. Argentina seeks to become one of the few exporting countries of LNG through international sales of leftover gas in summer periods when local demand is lower, boosting the flow of dollars into the country.

Source: Reuters

Bulgaria makes first US gas purchases with two LNG cargoes

31 May. Bulgaria has agreed to buy US (United States) natural gas for the first time, signing a deal for a delivery in the second quarter and another in the third, the Bulgarian Energy Minister Temenuzhka Petkova said. Dutch-registered trader Kolmar NL will deliver a 90 million cubic meters (mcm) cargo of liquefied natural gas (LNG) and a second of 50 mcm. The first LNG shipment is from US producer Cheniere and the second one is from the US unit of BP, Petkova said. Bulgaria signed a contract in April with Greek DEPA for another small gas shipment, part of efforts to reduce an almost complete dependence on supplies from Russia’s Gazprom. Bulgaria said it would diversify after a 2009 row with Moscow disrupted winter supplies. The new contracts covered about 10 percent of Bulgaria’s gas needs and priced at a level to gas prices in Bulgaria to be cut in the third quarter, state gas wholesaler Bulgargaz said. Bulgaria plans to launch its own natural gas trading bourse in October and said Kolmar NL had expressed interest to offer about 500 mcm of LNG a year for the bourse over five years, Petkova said.

Source: Reuters

China utility buys first spot LNG cargoes, uses CNOOC import terminal

29 May. Guangdong Energy Group emerged as a first-time spot buyer of liquefied natural gas (LNG), as the Chinese utility secured access to a receiving terminal in southern China. The utility bought two cargoes of the super-chilled fuel totalling 120,000 tonnes, both from Malaysian state oil and gas producer Petronas. The utility for the first time exercised a right to use the Guangdong Dapeng LNG terminal in Shenzhen operated by China National Offshore Oil Company (CNOOC).

Source: Reuters

INTERNATIONAL: COAL

Montana tribe rips Trump administration over federal coal leasing

30 May. A Montana tribe blasted the Trump administration for seeking to overturn an Obama-era moratorium on federal coal leasing without consulting it, saying the move violated its treaty rights and would have major impacts on its land. Former President Barack Obama had imposed the coal moratorium pending a government study on the impacts of coal mining on public land, cheering environmentalists but upsetting parts of the coal industry. Approximately 426 million tonnes (mt) of federal coal are located near the Northern Cheyenne Reservation at the Decker and Spring Creek mines in Montana.

Source: Reuters

China expects to hit 2020 coal cap targets

29 May. China expects to achieve its national coal consumption cap targets in 2020, but the country’s aggressive goals could be tempered due to solid demand from power, steel and petrochemical industries. China, also world’s biggest coal consumer, has aimed to reduce the proportion of coal in its energy mix to below 58 percent by 2020. Coal accounted for only 59 percent of China’s overall energy consumption last year, down 1.4 percentage points from 2017, while gas, nuclear power and renewable energy combined accounted for 22.1 percent, up 1.3 percentage points. Last year, coal consumption in China grew by 34 million tonnes (mt) from a year earlier to 3.83 billion tonnes (bt). Beijing has kept a target for coal usage at 4.1 bt by 2020. Researchers have asked the government to promote coal consumption-control targets in different industries, as some manufacturers are shifting from key coal-controlled regions to places that do not fall under the national targets. Expanding coal-fired utilities and record-level crude steel output have helped to ratchet up coal consumption, a study under China Coal Consumption Cap Plan and Policy Research Project showed. The expansion of coal-chemical and petrochemical industry in China are expected to further boost the usage of coal in the country. By 2018, China installed coal-fired power capacity of 1,144 GW, up 3 percent from 2017.

Source: Reuters

INTERNATIONAL: POWER

Lebanon electricity reform plans stalled by court appeal

4 June. Lebanon’s constitutional court ruled to halt part of a power sector reform plan that seeks to reduce state subsidies which have led to one of the world’s heaviest public debt burdens. Lebanon’s decades-old electricity crisis has pushed it to the brink of financial ruin. Power cuts have long hobbled the economy and subsidies helped rack up public debt equivalent to 150 percent of Gross Domestic Product (GDP). Steps toward fixing the power sector are seen as a critical test of the government’s will to launch reforms which would help Lebanon unlock billions of dollars of foreign support pledged last year. The Lebanese government approved a reform plan in April that aims to boost generation capacity, reduce losses in transmission and eventually raise consumer electricity tariffs. The court accepted an appeal regarding a key part of the plan, a move that stops the tendering process for the construction of six new power plants.

Source: Reuters

Oman-based Sohar’s new $1 bn power plant starts operation

3 June. Shinas Generating Company (SGC) has announced the commencement of commercial operations at its power plant in Oman's Sohar Industrial Port Area. The power plant (Sohar-3), the second largest power plant in the sultanate, generates 1,710 MW. SGC CEO (Chief Executive Officer) Eng Abdullah bin Ali Al-Nofli said the plant is built using advanced, reliable and efficient combined cycle technologies and this makes Sohar-3 one of the most efficient power plants in the sultanate from an operational prospective. The project sponsors (Mitsui, Acwa and DIDIC) have invested around $1 bn to complete this project, he said. SGC has entered into a 15-year power purchase agreement with Oman Power and Water Procurement Company. Sohar-3 is connected to a newly constructed 400 kilovolt electricity transmission network and to the Main Interconnected System to serve commercial and industrial establishments.

Source: Zawya

France rules out electricity tax cut, to review prices in 2020

3 June. The French government ruled out lowering value added tax on electricity prices but will review the calculation method for state-controlled utility EDF’s regulated tariffs next year, Environment Minister Francois de Rugy said. Regulated power prices rose 5.9 percent - the sharpest increase in years - after the government had blocked the rise for months in order to appease the “yellow vest” protest movement against the high cost of living. The government plans to review the power price calculation so that power bills more closely reflect the relatively low cost of EDF’s nuclear production and are less driven by wholesale market prices. Asked whether the government could lower value-added taxes on electricity to compensate for higher prices, the Minister said that cutting VAT (Value Added Tax) on power from 20 to 5.5 percent would cost the state some €1.5 to 2 bn.

Source: Reuters

Bangladesh sees highest ever power generation

29 May. The Bangladesh Power Development Board (BPDB) registered a whopping 12,893 MW production, setting a new record for the country. According to the BPDB, the record-breaking generation took place against the forecasted demand of 14,796 MW, followed by the previous highest production of 12,539 MW on 21 May. Bangladesh’s power sector first crossed the 12,000 MW mark on the 24 June, with the third highest generation of 12,057 MW. Prior to that, 11,534 MW was the maximum power generation recorded on 17 September last year, with the previous highest generation being 11,387 MW on 18 July. Bangladesh’s power sector touched the 11,000 MW mark on 7 July the same year. Earlier, Bangladesh crossed the 10,000 MW mark for the first time on 19 March 2017, before which the country generated 9,000 MW of power for the very first time on 30 June 2016. Bangladesh’s installed power generation capacity, including captive power and renewable energy, is 21,419 MW. The BPDB has taken up an extensive capacity expansion plan to add about 11,600 MW over the next five years, aiming to generate 24,000 MW of electricity by 2021, and 40,000 MW by 2030, for which a mammoth investment of around $80 bn is needed. The government is committed to ensuring 100 percent electricity coverage by 2021. Currently, 90 percent of the population has access to electricity.

Source: Dhaka Tribune

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

South Korea confirms plans to step up shift to renewable power

4 June. South Korea’s energy ministry said it had finalised plans to raise the share of the country’s power output generated from renewable sources to as much as 35 percent by 2040. The plan was largely unchanged from a draft released in mid-April that aimed to boost renewable power generation more than four-fold from current levels, while reducing coal and nuclear power. Asia’s fourth-largest economy is shifting toward cleaner energy amid growing criticism over its air quality. At present, coal power accounts for about 40 percent of the country’s total electricity needs, while renewable power makes up nearly 8 percent.

Source: Reuters

France wants EU to seek end to jet fuel tax exemption to curb emissions

3 June. The French government wants new European Union (EU) executives to push for an end to the global tax exemption for jet fuel to reduce CO2 (carbon dioxide) emissions but has dismissed opposition calls for a ban on some domestic flights to encourage train travel. The 1944 Chicago Convention on Civil Aviation exempts kerosene from taxation, but environmental activists say the aviation fuel should be taxed to reduce air travel and limit the emissions that are causing global temperatures to rise. Earlier attempts by the EU to tax CO2 emissions by airlines have not succeeded. A 2011 proposal that would have forced airlines to buy carbon emission permits for flights in and to the EU foundered over resistance from China and other countries.

Source: Reuters

China reiterates support for Iran’s nuclear deal