CITY-GAS GATHERS MOMENTUM

Monthly Gas News Commentary: February - March 2019

India

AG&P plans to invest ₹100 bn in its city gas business in India over eight years. AG&P plans to haul LNG via tankers from import terminals to planned satellite terminals in its licence areas to quickly launch CNG services without waiting for pipelines to be built. GAIL (India) Ltd operates a satellite LNG station in Bhubaneswar to serve customers in the absence of a pipeline. The Philippines company plans to launch a few CNG stations by the end of this year and piped gas services by next year-end. AG&P is confident of meeting its target of connecting 12 mn households, building 1,500 CNG stations and laying 17,000 inch-km of steel pipeline over eight years, allaying apprehension that the company had been over-ambitious in its bids for licences.

In the last bid round, it had managed to bag just 5 out of the 86 GAs put on offer. In the previous 9th round which was awarded just a few months back, Adani Gas had won city gas licences for 13 cities on its own and nine in a joint venture with IOC. IOC had won licences for seven cities on its own. Bharat Gas Resources Ltd had walked away with 11 cities while Torrent Gas had made 10 winning bids. Sholagasco Pvt Ltd bid for 9 out of the 50 GAs put on offer in the 10th round while Gujarat Gas bid for seven and Petronet LNG Ltd put in bids for five areas. PNGRB had at the close of bidding on 5 February stated about 225 bids were received for licence to retail CNG to automobiles and piped natural gas to households in 50 GAs offered in the 10th CGD bidding round. It had not revealed the names of the bidders then. Eight out of the 50 GAs received single bids, with IOC being the only applicant for six areas in Bihar and Jharkhand while other two single bidders were Bharat Gas Resources Ltd and GAIL Gas Ltd for one area each. In the 10th round, bidders were asked to quote the number of CNG stations to be set up and the number of domestic cooking gas connections to be given in the first eight years of operation. Also, they had to quote the length of pipeline to be laid in the GA and the tariff proposed for city gas and CNG according to PNGRB.

IOC has emerged as the biggest bidder for city gas licences in the 10th bid round that also saw Adani Group, HPCL and Indraprastha Gas Ltd as the other prominent bidders, according to the PNGRG. IOC is looking to diversify into natural gas distribution business big time, bid for licences to retail CNG to automobiles and piped natural gas to households in 35 out of the 50 cities put on offer for the 10th round and another seven in partnership with Adani Gas. Adani Gas bid for 19 cities on its own and seven in partnership with IOC, the PNGRB said after opening of bids between 7 and 9 February. HPCL, a subsidiary of ONGC emerged as the third largest bidder, putting in bids for 24 towns and cities while Gujarat-based Torrent Gas applied for 20 areas. Indraprastha Gas Ltd, which retails CNG and piped cooking gas in the national capital, put in bids for 15 areas while Bharat Gas Resources Ltd, a subsidiary of state-owned BPCL bid for 14 cities. GAIL, which is country's biggest gas marketer and transporting company, put in bids for just 10 areas through its subsidiary GAIL Gas Ltd.

Oil regulator PNGRB has rejected Adani Gas Ltd’s application for authorisation to retail CNG to automobiles and piped natural gas to households in Jaipur and Udaipur, saying the company was not in compliance with regulations for a licence. PNGRB gave detailed reasons for rejecting Adani Gas Ltd’s claim of having 'deemed authorisation' to operate CGD network in the two cities before the regulator came into existence. Adani Gas had, in response to a November 2005 invitation of Rajasthan government, bid for setting up the CGD network in Udaipur and Jaipur. The state government on 20 March 2006 gave a no objection certificate, subject to certain conditions, to the company for retailing CNG and piped natural gas in Udaipur and Jaipur. Adani Gas in the same month deposited the commitment fee of ₹20 mn. PNGRB said Adani Gas meets the minimum eligibility criteria but did not comply with the requirement of making committed investments and physical progress in rollout of CGD network in both the cities. Also, it had not tied up gas for supply through the CGD networks.

A ₹90 bn gas-grid project has been approved to transport natural gas among northeastern states and West Bengal. ONGC said the North East Gas Grid is a joint venture of five oil and natural gas companies – GAIL, IOC, OIL, NRL and ONGC. Huge onshore gas reserves have been found in Assam, Gujarat, Andhra Pradesh, Tamil Nadu and Tripura, which is also the number one gas producing state for ONGC. Use of Tripura's gas reserve would also improve revenue and income of the state, he said. ONGC has been working in Tripura for the past five decades. It has drilled 225 wells and found gas in 116. A 726 MW power plant in southern Tripura is already using local reserves.

India is looking to expedite discovery efforts to establish the country’s shale O&G potential and has asked companies to submit a plan. In late 2013, India gave rights to ONGC to explore for shale O&G reserves. However, after years of exploratory reserves, it has failed to find significant resources. In January, India’s O&G regulator DGH held a meeting with representatives from various private and government companies to urge them to pursue shale resources in the O&G blocks already held by them. All CBM developers were invited to the meeting in January. Currently CBM gas is produced by three companies in India - Reliance Industries Ltd, Essar O&G Exploration and Production Ltd and Great Eastern Energy Corp Ltd. CBM is a kind of natural gas which is found in coal deposits. ONGC has CBM blocks. Currently the most promising region of shale deposits is around the eastern part of India called as Damodar Valley basin, where the first exploration for shale is expected to start.

To better prospects for upstream players, the government is likely to raise the price of domestically produced natural gas by over 10 percent to over $3.72 per mmBtu with effect from 1 April. The price of gas produced from difficult fields will rise to about $9 per mmBtu from current $7.67 per mmBtu. The increase in price will boost earnings of producers but will also lead to a rise in price of CNG, which uses natural gas as input. It would also lead to higher cost of natural gas piped to households for cooking purposes as well as of feedstock cost for manufacturing of fertilisers and petrochemicals. India imports half of its gas which costs more than double the domestic rate. Natural gas prices were last hiked on 1 October 2018, by 10 percent when rates moved up to $3.36 per mmBtu from $3.06. The increase will translate into a higher cap price based on alternate fuels for undeveloped gas finds in difficult areas like deep sea, which are unviable to develop as per the existing pricing formula. The price for such fields from 1 April would be about $9 per mmBtu for six month beginning 1 April as compared to $7.67 currently. All of its gas, as well as that of OIL and private sector RIL’s KG-D6 block, are sold at the formula approved in October 2014. This formula, however, does not cover gas from fields like Panna/Mukta and Tapti in western offshore and Ravva in the Bay of Bengal.

The government plan to offer PSUs special incentives for natural gas discoveries in difficult and unviable areas will help raise India’s natural gas production as it will unlock output in a dozen fields of ONGC and OIL. India currently produces about 90 mmscmd of natural gas and has ambitious plans to double output by 2022 to reduce its reliance on imports and replace some of the polluting liquid fuels to cut emissions. ONGC and OIL have a dozen discoveries, which are unviable at current government mandated gas price. ONGC and OIL have not been able to develop the discoveries or bring them to production as the current gas price of $3.36 per mmBtu is way lower than the cost of production. ONGC has about 35 bcm of recoverable reserves in discoveries in the shallow sea off Andhra Pradesh on the east and off Gujarat and Mumbai on the west coast blocks. The three blocks in KG basin, Gulf of Kutch and Mumbai offshore can produce about 10 mmscmd of gas and an equivalent amount can be produced from its onshore discoveries in blocks like Bantumili, Mandapeta and Bhuvanagiri. About 5 mmscmd of production can be added by making some investment in existing fields like Mumbai High South, Neelam and B-127 Cluster in the Arabian Sea. OIL has an onland discovery in the KG basin in Andhra Pradesh with over 3 bcm of recoverable reserves, but needs a higher price to bring it to production. ONGC and OIL want a price of over $6 per mmBtu to help them produce the gas without suffering any losses. The government had in October 2014, evolved a new pricing formula using rates prevalent in gas surplus nations like US, Canada and Russia to determine price in a net importing country. Prices using this formula are calculated semi-annually. While the government has allowed a higher rate of $7.67 per mmBtu for gas fields in difficult areas like the deep sea, ONGC’s KG basin block KG-OSN-2004/1, which has about 15 bcm of recoverable reserves, is in shallow waters and does not qualify as a 'difficult field'. Similar is the fate of Mumbai basin block MB-OSN-2005/1 on the western side. The block GK-28/42 in Gulf of Kutch is a nomination block which does not qualify for higher rates. The onland discoveries of ONGC and OIL, too, do not qualify for the higher rates. While ONGC's KG block can produce a peak output of 5 mmscmd, the same from GK-28/42 is expected to be around 2.5 mmscmd. Peak output from MB-OSN-2005/1 is expected to a little less than 3 mmscmd. The cost of production of natural gas in the prolific KG basin is between $4.99 to $7.30 per mmBtu.

Though ONGC is digging appraisal wells at the DDW field it acquired from GSPC, it is still to submit the FDP and has sought time till December 2019 from the empowered committee of secretaries. ONGC was initially supposed to submit the FDP by February 2018. ONGC completed the acquisition of GSPC’s 80 percent in DDW in August 2017. According to the DGH-approved FDP submitted by GSPC, commercial production was to start by 2011. However, trial gas production started in 2014 and commercial production in April 2016. ONGC has got assurance from the Gujarat government that the PSU (Public Sector Undertaking) will get at least $6 per mmBtu for the gas from the DDW block in the first year of production. The price will see staggered increments every year to reach $6.9 per mmBtu in the fifth year and remain at that level during the remaining life of the asset. In case, the government-determined gas prices are higher than that offered by the Gujarat government, ONGC will realise the higher price from the market. For the October 2018-March 2019, the price for gas discoveries deepwater, ultra deepwater and high-pressure-high-temperature areas has been fixed at $7.67 per mmBtu. ONGC and its joint venture partners have struck long-term agreements to sell 9.5 mtpa of LNG from their Mozambique Rovuma Offshore Area 1 project, and will take a final investment decision for the project in the first half of 2019, the state-run explorer said. Indian companies together own 30 percent participating interest in the Mozambique project, with ONGC owning 16 percent, OIL 4 percent and BPCL 10 percent. Anadarko is the operator of the project with 26.5 percent participating interest. ONGC and other project developers have entered into agreement with Tokyo Gas and Centrica LNG Company for sale of 2.6 mtpa from the start of production until the early 2040s.

Petronet LNG Ltd may invest in Tellurian Inc’s proposed Driftwood LNG liquefaction and export facility near Lake Charles, La., Tellurian reported. Petronet is India’s largest LNG importer, operating 20 mtpa of receiving terminal capacity with an additional 2.5 mtpa of capacity under construction at its Dahej expansion and a further 5 mtpa proposed at Gangavaram. Petronet is exploring a possible Driftwood equity investment under a memorandum of understanding that it has signed with Tellurian. The approximately 27.6 mtpa Louisiana project would also include natural gas production, gathering and processing infrastructure as well as the 154.5 km Driftwood Pipeline.

GAIL has set up a satellite LNG terminal in Bhubaneswar to supply local customers in the absence of a gas pipeline — an innovative model that may get replicated by other city gas distributors eager to quickly start supply in new licence areas where gas pipelines are yet to reach. City gas licences have proliferated lately in the country: the downstream regulator offered 86 licences last year, and the process to award another 50 is under way. Just a year ago, licences were limited to 92 geographical areas that covered just a fifth of country’s population. After the current round of licensing is complete in a month or so, 70% of the country’s population will have been covered. But taking gas to people can take much longer than distributing licences. GAIL, which has a licence to supply gas to Bhubaneswar, decided last year not to wait for the gas pipeline, which is expected to connect the city next year. It started using gas cascades to supply natural gas to homes, shops and vehicles. This involved bringing in gas cascades from Andhra Pradesh to serve local demand, which is about 3,800 kilogram a day. GAIL switched its supply method. It started operating a satellite LNG storage and regasification terminal in Bhubaneswar, which can cater to 3,000 CNG vehicles and 1,000 homes. This is the first such operation in the country but satellite LNG terminals are quite popular in several countries to supply gas to areas where laying gas pipelines are difficult or economically unviable.

GAIL has terminated a contract given to IL&FS for laying pipeline in Bokaro-Durgapur section due to poor project progress. The company said that the Bokaro-Durgapur section (124 km) is now re-tendered and awarded to three different contractors to expedite construction efforts. Besides, GAIL also informed that the project consultant, Engineers India Ltd, was replaced by Metallurgical & Engineering Consultants (India) Ltd for overseeing the project activities in this crucial stretch.

In a swift move to safeguard project schedule of the Pradhan Mantri Urja Ganga natural gas pipeline to eastern India states, GAIL as the owner and operator of the project under execution has offloaded the pipe laying contract from IL&FS due to poor project progress driven on account of acute financial crisis, GAIL said.

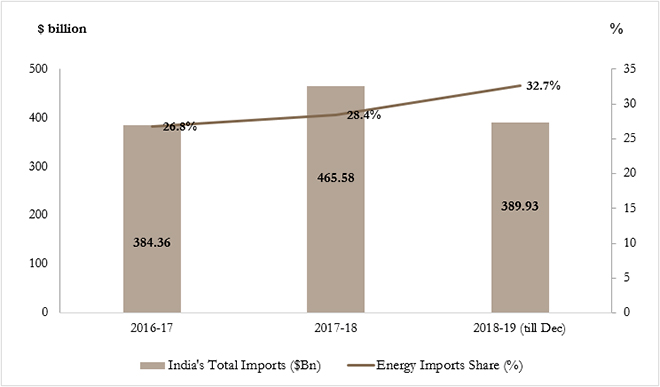

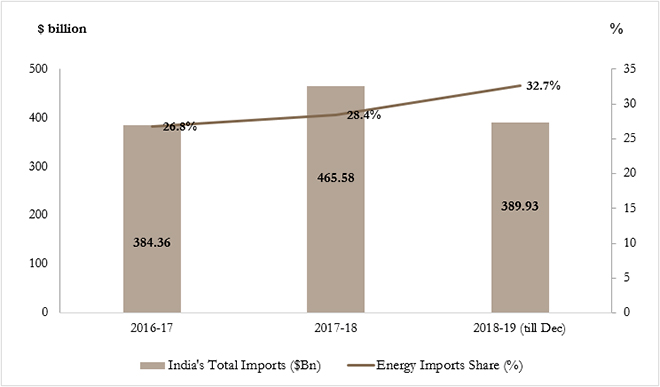

India’s plan to increase the share of natural gas to 15 percent of the country’s total energy mix by 2030, from 6 percent currently, seems “increasingly ambitious”, research and consultancy firm WoodMac said. Wood Mackenzie, said that CGD will be a major driver of natural gas demand in the country and will account for 15 percent of the overall gas market, up from 7 percent currently. WoodMac projects the CGD sector to attract over $1.3 bn in investments in the coming decade. WoodMac said that re-gasification infrastructure remains a concern as Jaigarh floating storage regasification unit and Mundra and Ennore regasification terminals were not commissioned as expected in 2018, reducing expectations of demand in the later part of the year. The research and consultancy firm has projected India’s LNG demand to increase to 25 mtpa in 2019, an 8.7 percent increase over 2018. On the natural gas supply front WoodMac said that domestic gas production failed to grow in 2018 and growth is expected to remain moderate through to 2020. KG basin is expected to witness frenzied construction and installation activities in next two years. ONGC and RIL awarded major contracts for their deep-water fields in the KG basin through 2018. This includes ONGC’s KG-98/2 cluster-2 fields and RIL’s R-series and Satellite fields in the KG-D6 block. WoodMac said a majority of gas produced in the country is priced below $4 per thousand cubic feet and a move towards market-driven pricing for production of natural gas would lead to monetisation of 1.5 trillion cubic feet of shallow-water gas immediately.

Rest of the World

Global LNG trade will rise 11 percent to 354 mt this year as new facilities increase supplies to Europe and Asia, Royal Dutch Shell said in an annual LNG report. Shell, the largest buyer and seller of LNG in the world, said trade rose by 27 mt last year, with Chinese demand growth accounting for 16 mt of those volumes. Shell’s forecasts, which see LNG demand climbing to 384 mt next year, reflect a burgeoning industry with new production facilities opening in Australia, the United States and Russia and more countries becoming importers by constructing receiving terminals. Due to the uneven progress of developing liquefaction-export facilities on the one hand and regasification-import terminals on the other, many analysts see the global market becoming oversupplied if not this year then next year. But most also see a supply crunch around the mid-2020s because, at the moment, there are not enough liquefaction facilities being planned, financed and built. Such projects are underpinned by long-term supply contracts struck years in advance by their operators. Between 2014 and 2017 buyers were signing shorter-duration contracts for smaller volumes, making financing difficult to complete. However, Shell said the duration of contracts signed last year had on average more than doubled to 13 years.

Europe is expected to be the fastest-growing market for LNG this year and will absorb the fuel despite Russia supplying record-high volumes by pipelines. The region is seen getting 20-30 mt more LNG this year, about double the increase in Asia, Royal Dutch Shell Plc said. Asia’s growth won’t be as strong as in the last two years and there will be a “resurgence” of LNG flowing into European markets, according to Shell, which controlled about 22 percent of global LNG last year. Europe needs additional imports of gas to make up for declining domestic production. It can fill the shortfall with imports from Russia, its biggest supplier, or LNG, where global supply is expected to grow almost 35 mt this year, or more than 10 percent of last year’s demand. Shell is not only a major LNG player but also a financial backer of the Nord Stream 2 pipeline that would increase Russia’s ability to ship its low-cost gas directly to Germany. As the LNG market is expected to tighten in the early 2020s before new plants start producing, Europe may struggle to attract cargoes because other regions may scramble for gas.

The EU reached a provisional deal on new rules governing import gas pipelines, casting doubt over the operating structure of Russia’s planned Nord Stream 2. The Russian pipeline already faces uncertainty after Denmark’s potential ban on its planned route through its territorial waters and sanction threats by the United States. The draft law calls for all import pipelines to meet EU rules by not being directly owned by gas suppliers, applying non-discriminatory tariffs and transparent reporting and opening at least 10 percent of capacity to third parties. EU is closing a loophole as its dependency on natural gas imports increases.

Russia’s Gazprom increased its share of the European gas market last year despite a rising challenge from imports of US LNG the company said. Gazprom’s share of the European gas market rose to a record high 36.7 percent last year from 34.7 percent in 2017, the company said. Gazprom has also faced a rise in imports of US LNG into Europe, which saw a near fivefold increase this winter. Europe accounts for around two-thirds of Gazprom’s gas sales. Gazprom’s average gas price in Europe was $245.50 per 1,000 cubic meters last year and it expects a price of $230-$250 this year. In Russia, Gazprom competes with oil producer Rosneft and private gas firm Novatek. Both have long lobbied for the right to export gas by pipeline but for now are limited to LNG sales. As for Gazprom, it plans to build a third line at its Sakhalin-2 plant in Russia’s Far East in 2023-2024.

Gazprom is looking to gain an even larger gas market share in Europe following record-high 2018 exports, expecting a decline in Europe’s gas output combined with rising demand, the company said. Last year it sold more than 200 bcm of gas to Europe, including Turkey, while its gas market share in the region rose to more than a third. EU gas production will halve by 2040, the Paris-based International Energy Agency has said. Moscow has piped gas to Europe from its fields in Siberia and northern Russia for more than 50 years. It can ill afford losing the lucrative market for Kremlin-run Gazprom, whose sales account for over 5 percent of Russia’s $1.6 trillion economy.

Gazprom will start gas supplies to China from 1 December, a month earlier than planned, the gas producer said. Deliveries of gas to China via the Power of Siberia pipeline were due to begin at the end of December 2019, but the project is only expected to reach full capacity in 2025.

Russia was ready to keep gas transit through Ukraine after 2019, despite the construction of Nord Stream 2 pipeline, which is to be built in the Baltic Sea. Russia can use Ukraine for gas transit in the future “under certain conditions.” Russia’s planned doubling of capacity on the Nord Stream pipeline across the Baltic Sea to Germany could help Moscow bypass exports via Ukraine.

Uzbekistan is seeking a $300 mn loan from Russia’s Gazprombank as it wants to increase output at its state-run Shurtan gas and chemical complex, the president’s office said. The complex is operated by Uzbekistan’s state oil and gas company Uzbekneftegaz, a strategic partner of Russian state gas company Gazprom which is a major shareholder in Gazprombank. Gazprom has been operating energy projects in Uzbekistan since 2002. Gazprombank, Russia’s third biggest lender by assets, said that it aimed for further development of mutually beneficial relations with Uzbekistan in various areas including energy and was considering the $300 mn loan as part of cooperation with Uzbekneftegaz.

Total has agreed to buy a 10 percent stake in the Arctic LNG 2 project from Russia’s Novatek, as the French energy group looks to build up its presence in the area to service a fast-growing Asian market. The companies said Total would also have the opportunity to buy a 10-15 percent direct interest in all Novatek’s future LNG projects on the Yamal and Gydan peninsulas. Novatek said that, as well as paying for the 10 percent stake, Total would provide some financing through capital investment for Arctic LNG 2, adding it expected preliminary capex for the project to be $20-21 bn. Total said the LNG would be delivered to international markets by a fleet of ice-class LNG carriers using the Northern Sea Route and a trans-shipment terminal in Kamchatka for cargoes to Asia, and one close to Murmansk for European cargoes. A final investment decision to go ahead with the project is expected to be taken in the second half of 2019, with plans to start up the first liquefaction train in 2023, Total said.

Royal Dutch Shell aims to boost output and recoverable reserves from its Ormen Lange gas field off Norway by installing subsea compressors. Output from Shell-operated Ormen Lange, Norway’s second-largest gas field and one of the key external gas supply sources for Britain, has been gradually declining since its 2012 peak. The company postponed plans to artificially increase the field’s pressure to pump out more gas in 2014 due to high costs. Ormen Lange produced 15.7 bcm of natural gas in 2018, down from a peak of 22.2 bcm in 2012. Shell, which sold its shares in the Draugen and Gjoea fields to OKEA, planned to keep its stakes in the Ormen Lange field, Nyhamna gas processing field as well as Norway’s largest gas field Troll.

Royal Dutch Shell aims to increase LNG exports from Egypt this year as it ramps up production from a West Delta field. The company shipped 12 LNG cargoes from the Idku plant last year and is “hoping for more” this year. Shell was among companies that won new exploration rights in Egypt. It secured five of 12 concessions offered in a bidding round, according to results announced by Petroleum Minister Tarek El Molla. Idku has capacity of about 1.2 bcf per day.

Royal Dutch Shell and PetroChina are at loggerheads over gas sales pricing at their Arrow Energy joint venture, holding up development of Australia’s biggest coal seam gas resource. PetroChina, the listed arm of China National Petroleum Corp, is eager to start developing Arrow’s 140 bcm of gas in the Surat Basin in Queensland to turn around loss-making Arrow Energy, one of its key overseas assets. It is at the mercy of venture partner Shell, however, as the Anglo-Dutch oil company is also majority owner of Arrow’s biggest potential customer, QCLNG, a LNG plant on an island off Queensland state. Shell and PetroChina acquired the Surat gas resource in a $2.5 bn takeover of Arrow in 2010. They had expected to reach a final investment decision on the Surat project in 2018, with first production around 2020, after the Arrow venture signed a 27-year deal at end-2017 to supply gas from Surat to QCLNG. PetroChina, though, is unhappy with the price in the sales agreement with QCLNG and the technical plan for developing the gas. Shell still hopes to secure approval in time to deliver first gas in 2021. PetroChina’s takeover of Arrow with Shell in 2010 was its first investment in Australia’s coal seam gas sector, seen as a key acquisition at the time, but it has been a big loss-maker. QCLNG is one of three LNG export plants built in Queensland, all fed by coal seam gas. QCLNG and one of its rivals are struggling to operate at full capacity as coal seam gas wells have proven to be less productive than expected.

Germany imported 9.7 percent more gas in 2018 than the year before and raised its import bill by 23.4 percent. The volume of imports from January through to December was 126 bcm according to trade statistics office BAFA, which releases data with a time lag. German importers paid €23.7 bn ($26.70 bn) for gas in the year, mirroring a rise in oil prices. Traders of gas, power and carbon watch winter gas imports especially as possible imbalances in supply and demand can drive up prices and volumes in all three markets. Europe’s biggest economy uses gas for industry, heating homes and power generation. Germany’s gas supply is mainly imported from Russia, Norway, the Netherlands, Britain and Denmark via pipelines. Europe on the whole is increasingly absorbing volumes of LNG arriving on specialised vessels from the world market, namely the United States, a trend which has boosted storage levels and pushed down price spreads.

The Netherlands will remain a heavy user of natural gas for years to come, despite big production cuts at its Groningen field, gas trading company GasTerra said. The Dutch have been one of the major gas suppliers in Europe for decades, exploiting what once was Europe’s largest gas field in the northern region of Groningen. But the Dutch government last year said it would end production at Groningen by 2030 after a string of earthquakes directly related to gas extraction damaged thousands of houses and buildings. The Dutch still rely on natural gas for about 40 percent of their total energy needs and are not expected to end their gas dependency soon. Most of the gas will come from abroad, GasTerra said, as the Groningen production cuts turned the Netherlands into a net importer of gas for the first time since the 1950’s two years ago. Imported gas covered almost 55 percent of the total Dutch gas need in 2017, Statistics Netherlands said last year. The growing demand for foreign gas has so far been mainly met by Norway, with its exports to the Netherlands up by a third in 2017. GasTerra is the sole buyer of Groningen gas, which is extracted by a Royal Dutch Shell and Exxon Mobil joint venture. The company also trades gas in the Netherlands and beyond from smaller Dutch fields and from Norway and Russia. Groningen output has already been cut by 60 percent since its 2013 peak of 53.8 bcm per year and dropped by a fifth in the most recent year, to 20.1 bcm. Extraction is set to fall to 15.9 bcm in the year through October 2020, the government said.

Gas transmission operators of Finland, Latvia and Estonia signed an agreement to set up a single gas transmission tariff zone for the three countries from the start of 2020. The agreement unifies entry point tariffs on the external borders of the region and removes commercial interconnection points between countries. The deal is expected to lead to higher market liquidity by making it easier for shippers and traders to sell gas to the whole region. Gas between the Baltic states and Finland will be piped across the Baltic Sea by 1 January 2020, when a 7.2 mcm per day pipeline called Balticconnector is due to start up. The pipeline is being built to link the countries and help diversify the region’s gas supplies, which largely come from Russia, by creating more links with other gas projects in Europe. The agreement reached between the three operators outlines the cost structure for transmission and how related compensation and entry revenues will be distributed amongst them.

Venture Global LNG said it had received approval to export LNG from its Louisiana facility to non-free trade agreement countries. The company said the US Department of Energy’s Office of Fossil Energy had authorized it to export up to 620 bcf per year of natural gas (1.7 bcf per day) for a period of 25 years. Venture Global’s Calcasieu Pass facility, which is located in Cameron Parish, Louisiana, can produce about 10 mtpa of LNG, or about 1.3 bcf per day of natural gas.

ExxonMobil added another giant gas discovery to the east Mediterranean region after finding a gas-bearing reservoir offshore Cyprus but infrastructure bottlenecks and geopolitical disputes mean output from the field could be far off. Exxon, together with partner Qatar Petroleum, estimated in-place gas resources in the reservoir at 5 to 8 tcf of gas, similar order of magnitude to the Aphrodite and Calypso gas finds nearby, also in Cypriot waters. The region’s gas output has begun to soar thanks to older discoveries finally bearing fruit. Israel’s Leviathan field, found in 2010 with around 22 tcf, will fully come online in November, though the 2015 Zohr discovery offshore Egypt with up to 30 tcf is already producing. Exxon’s Vice-President of Exploration for Europe, Russia and the Caspian, Tristan Aspray, said the company will now analyze data from drilling the reservoir, known as Glaucus-1. Exxon owns a 60 percent of the block, Block 10, with QP holding the rest. Industry consultants Wood Mackenzie said they estimated recoverable resources of Exxon’s field to be 4.55 tcf. That compares to its 6.4 tcf estimate for Calypso, found by Italy’s ENI and France’s Total last year. The new discoveries have prompted Egypt, which has the ability to liquefy and regasify gas for LNG trade, to try to establish itself as a regional hub. It also provided a degree of energy security to Israel.

Chevron USA Inc, a subsidiary of Chevron Corp, has signed a SPA with South Korean oil refiner GS Caltex Corporation. The long-term agreement, which is for delivery of LNG to South Korea from Chevron’s global supply portfolio, will start in October of this year. Chevron has an existing LNG sales and purchase agreement with GS Caltex executed in 2009. This SPA involves LNG supplied from Chevron’s Gorgon project delivered to GS Caltex for up to 20 years.

US independent energy producer Anadarko has notched up another long-term commitment to buy LNG from its proposed Mozambique terminal, moving closer to approving the multi-bn dollar project. Anadarko and Exxon Mobil are expected to sanction two separate but neighbouring LNG projects in Mozambique this year after finding giant offshore gas deposits, turning the African nation into a major global gas exporter. The company said it had struck a sales and purchase agreement with India’s Bharat Petroleum Corp Ltd for 1 mtpa for 15 years.

The US is trying to get Hungary to diversify away from Russian energy by encouraging ExxonMobil to proceed with long-stalled plans to develop the Domino-1 gas field in the Black Sea. Production from Domino-1 which is controlled by Exxon and Romania’s Petrom, a subsidiary of Austrian firm OMV is likely to start. Discovered off Romania in 2012 with estimated gas reserves of 1.5-3 tcf, the companies have since sought greater clarity from Romanian authorities before developing the field. Hungary could import the gas via a pipeline Romania is building from the Black Sea through an interconnector between the two countries, which will be capable of handling reverse flows. Last year Hungary agreed to buy 4 bcm of natural gas from Russia in 2020.

The discovery of a major new natural gas field in Indonesia may push back the day the country’s gas consumption outpaces its production and reduce its reliance on imported LNG. A consortium led by Spain’s Repsol found new gas resources at the Sakakemang block in South Sumatra in Indonesia estimated to contain at least 2 tcf the company said. Repsol claims the find is among the 10 largest made in the world over the past year. If the new find at the group’s Kali Berau Dalam-2 well shows good results, Indonesia may be able to push back the current estimate for when it has a natural gas deficit, or when consumption is greater than domestic supply, from 2025. To protect against the looming deficit, Indonesia’s state-owned energy company Pertamina recently signed a long-term contract with Anadarko Petroleum Corp to buy 1 mt per year of LNG for 20 years from Mozambique. Anadarko is expected to make a final investment decision this year on the project, which is expected to be operational by 2024.

Indonesia plans to sell 10 cargoes of LNG to spot market in the first half of 2019. There will be 1 cargo in April and 2 cargoes in May from Bontang LNG plant, 4 cargoes in June from Tangguh LNG plant, and 3 cargoes in March, May, and June from Donggi Senoro LNG Plant. Indonesia has 40 excess cargoes of LNG until 2025.

Australia’s gas prices are so high they could force the imminent shutdown of some manufacturing on the east coast, the nation’s competition watchdog said, urging gas producers to step up output and offer reasonable prices. The warning comes three years after the Australian Competition and Consumer Commission first flagged prices were rising amid uncertainty over domestic gas supply, due to the start-up of LNG exports from the eastern state of Queensland, cuts in exploration spending and drilling bans. While gas price offers to manufacturers have dropped to around A$10 to A$12 a GJ from as much as A$22 per GJ in 2017, they are still two to three times higher than they were before LNG exports began pulling gas out of the domestic market. Businesses and manufacturers dependent on gas for their operations have told the watchdog they are increasingly likely to move from the east coast or shut operations, Australian Competition and Consumer Commission Chairman Rod Sims said. The Australian government succeeded two years ago in pressuring the three east coast LNG exporters - led by ConocoPhillips and Origin Energy, Royal Dutch Shell and Santos Ltd - to boost local gas supply. But Sims said producers now need to “provide immediate price relief to the manufacturing sector”. States also need to do more to encourage new gas development by lifting blanket drilling bans. The high gas prices and prospects of a supply shortage have attracted five proposals to import LNG into southeastern Australia, even as Australia is poised to become the world’s top LNG exporter.

A consortium led by Repsol has found new gas resources in Indonesia estimated at least 2 tcf the Spanish oil and gas firm said, equivalent to around two years’ worth of Spanish demand. The discovery at the Sakakemang block in South Sumatra is among the 10 largest finds worldwide in the last 12 months, and the biggest in Indonesia for 18 years, Repsol said. Following its strategy to maximize the use of gas as major economies phase out carbon, Repsol plans to drill another appraisal well in the area in the coming months, it said.

Ethiopia and Djibouti have signed a deal to build a pipeline to transport Ethiopian gas to an export terminal in the Red Sea state. Ethiopia found extensive gas deposits in its eastern Ogaden Basin in the 1970s. China’s POLY-GCL Petroleum Investments has been developing the Calub and Hilala fields there since signing a production sharing deal with Ethiopia in 2013. The agreement between Djibouti and Ethiopia comes more than a year after POLY-GCL signed a memorandum of understanding with Djibouti to invest $4 bn to build the natural gas pipeline, a liquefaction plant and an export terminal to be located in Damerjog, near the country’s border with Somalia. Africa’s eastern seaboard could soon become a major global producer of liquefied natural gas, with other planned projects based on big gas finds made in Tanzania and Mozambique.

Egypt’s gas output will get a boost this year as the country’s huge Zohr field nears peak production and with $1.8 bn in investment from BP, as Egypt returns to export markets and positions itself as a regional hub. Egypt hopes to leverage its strategic location and well-developed infrastructure to become a key international trading and distribution center for gas, a potentially remarkable turnaround for a country that spent about $3 bn on annual LNG imports as recently as 2016. Egypt is hoping to tap long underutilized liquefaction plants, where gas is turned into LNG, to export supplies across the Mediterranean along with that of its neighbors, like Israel, which said it would pipe gas to Egypt later this year. Egypt imported its final natural gas shipment last September, and said it will begin exporting to Jordan this year, though the exact level of shipments and timeline is still unclear. Its domestic production level stands at about 6.6 bcf per day. Total production at BP’s West Nile Development will soar to nearly 1.4 bcf per day after the project’s third field, Raven, comes online. About 700 mcf per day will come online by April from the first two, Giza and Fayoum. The country’s top gas asset, Zohr, discovered by Eni in 2015, will near peak production of about 3 bcf per day from 2.1 bn currently by the end of 2019. Results of two exploration tenders held last year for 27 blocks would be announced during the three-day forum, and that it had seen “high turnout” from international companies.

Chinese coal miner Huainan Mining Group has won provincial approval to build a terminal along the Yangtze river to receive LNG. The terminal, which the company claims is the first one to be built along the Yangtze, will have a handling capacity of 2 mtpa and will cost about $442.71 mn to build, according to the report. The terminal, to be located at the port of Sanshan in the inland city of Wuhu in Anhui province, is slated for completion in 2022. Huainan Mining is already partnering with China National Offshore Oil Corp for a planned LNG receiving terminal at the coastal port of Yancheng in Jiangsu province.

Britain’s government has no plans to review regulations for fracking gas in the country, it said, following calls from industry to revisit the rules. Chemical giant Ineos and fracking firm Cuadrilla said current restrictions around seismic events at fracking sites could force the industry to close. Cuadrilla said its test drilling in northwest England showed a rich reservoir of high quality and recoverable gas.

| AG&P: Atlantic Gulf & Pacific Company of Manila Inc, LNG: liquefied natural gas, CNG: compressed natural gas, km: kilometre, GAs: geographical areas, IOC: Indian Oil Corp, PNGRB: Petroleum and Natural Gas Regulatory Board, HPCL: Hindustan Petroleum Corp Ltd, CGD: city gas distribution, OIL: Oil India Ltd, MW: megawatt, O&G : oil and gas, DGH: Directorate General of Hydrocarbons, CBM: coal-bed methane, ONGC: Oil and Natural Gas Corp, mmBtu: million metric British thermal units, RIL: Reliance Industries Ltd, PSUs: Public Sector Undertakings, mmscmd: million metric standard cubic meter per day, bcm: billion cubic meters, KG: Krishna-Godavari, US: United States, DDW: Deen Dayal West, GSPC: Gujarat State Petroleum Corp, FDP: field development plan, mtpa: million tonnes per annum, BPCL: Bharat Petroleum Corp Ltd, WoodMac: Wood Mackenzie, mt: million tonnes, EU: European Union, mn: million, bn: billion, QCLNG: Queensland Curtis LNG, mcm: million cubic meters, mcf: million cubic feet, bcf: billion cubic feet, tcf: trillion cubic feet, SPA: sale and purchase agreement, GJ: gigajoule |

NATIONAL: OIL

Oil India valuations suggest investors are pricing in worries by the barrel

12 March. Oil India Ltd announced that it won two blocks in discovered small field (DSF) round-II bidding. Any excitement about this development is premature at this point. That’s because it will be a good 4-5 years for monetization to reflect in the numbers, analysts said. Sure, the Oil India stock increased by 2 percent. Investors have feared that upstream companies, including Oil India and larger peer, Oil and Natural Gas Corp (ONGC), will bear a portion of the subsidy burden. Indeed, Oil India’s net profit for the nine months ended December increased as much as 55% over the same period last year to nearly ₹28 bn. During this time, crude price realizations increased by 34 percent year-on-year to $70.66 a barrel. Oil India’s financial performance was also helped by strong growth in other income. Crude oil production declined by almost 1 percent whereas gas production decreased by 3 percent.

Source: Livemint

US presses India to stop buying oil from Venezuela

10 March. The United States (US) is pressing India to stop buying oil from Venezuelan President Nicolas Maduro’s government, Washington’s top envoy for Venezuela, Elliott Abrams, said. The Trump administration has given the same message to other governments, Abrams said, and has made a similar argument to foreign banks and companies doing business with Maduro. The Indian market is crucial for Venezuela’s economy because it has historically been the second-largest cash-paying customer for the OPEC (Organization of the Petroleum Exporting Countries) country’s crude, behind the US, which through sanctions against Maduro has handed control of much of that revenue to Guaido. The talks over Venezuela come as trade tensions rise between Washington and New Delhi, and when the US is also pushing India to cease buying Iranian oil. The US is planning to end preferential trade treatment for India that allows duty-free entry for up to $5.6 bn worth of its exports to the United States. Manuel Quevedo, Venezuela’s Oil Minister, attended a conference in New Delhi in mid-February seeking to “double” the country’s crude exports to India while boosting Venezuelan imports of Indian refined products. He also said he was open to barter payments. But Venezuela’s exports to India remained relatively stable in the month since the Trump administration slapped sanctions on Venezuela’s oil company PDVSA , meaning shipments were not nearly enough to make up for the fall in US sales. Venezuela directly exported 297,000 barrels per day (bpd) of crude to India in February, according to Refinitiv Eikon data, which does not include barrels first shipped to other ports such as Singapore or Rotterdam.

Source: Reuters

Oil companies maintain check, petrol and diesel may remain soft till elections end

10 March. Rising retail price of petrol and diesel prices is unlikely to become a problem for the ruling NDA government in the coming general elections as it seems to have tempered its policy of market-determined retail pricing of petroleum products that were hitherto being revised on a daily basis based on international prices. The move has been necessitated to prevent any consumer outrage that could erupt if there are frequent increases in retail price of petrol and diesel - an upshot in petroleum product prices could have adverse fallout for the ruling BJP during the elections. State-owned oil marketing companies (OMCs) have been told by senior government functionaries to keep the daily price movement of the two petroleum products in check between now and end of elections. This could be done by absorbing a portion of the price rise if the increase is consistent in view of global factors. Though OMCs have not been issued any written order on retail prices the government, being its largest shareholder, has exercised its control to make sure that consumers are prevented from paying abnormally higher prices. Between 1 January and now, there have been 10 instances when retail prices of petrol and 12 occasions when diesel prices have been left unchanged by OMCs - between two days at a stretch to a week. Oil sector experts said this is impossible given that oil prices change by the minute and hour and there is no question it would remain static for days. In fact, since 9 February, there has been a consistent increase in the retail price of the two petroleum products on global cues, but OMCs have held back any increase on six occasions, the longest being for four days between 5-8 March. Petrol prices rose 7 paise per litre in Delhi to ₹72.31 while diesel remained at the earlier level of ₹67.54 a litre on 9 March. The product prices are dependent on global oil and product prices, refinery margins and currency exchange rates, all of which are highly volatile. To the advantage of the government, global oil prices have stabilized over the last month or so hovering between $65-66 a barrel. If this price level is maintained or even if there is a minor spike, OMCs would well be a position to absorb the loss without the government having to take any other measure. Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp switched to daily price revision from a fortnightly pricing system in June 2017 as the government sought to further the pricing reforms in the sector when prices remained subdued.

Source: The Economic Times

As petrol prices spike before polls, Pradhan seeks Saudi help to cool rates

10 March. With oil prices on the boil just as general elections are announced, Oil Minister Dharmendra Pradhan has asked world's largest oil exporter Saudi Arabia to play an active role in keeping rates at a reasonable level. Petrol and diesel prices have risen by over ₹2 per litre in last one month as international rates have risen on hopes of the United States and China ending a trade war that has slowed down the global economic growth and OPEC (Organization of the Petroleum Exporting Countries) ally Russia saying it would ramp up its crude supply cuts. Pradhan raised the issue of rising oil prices with the visiting Saudi Oil Minister Khalid Al-Falih and sought a role of the Kingdom in cooling rates. Both ministers discussed about the possible adverse impact of recent geopolitical developments on global oil market. Petrol and diesel prices, which are revised daily, have been on the rise for the last one month or so. Petrol price in Delhi has increased by ₹2.12 a litre to ₹72.40, while diesel rates have risen by ₹2.03 to ₹67.54 per litre. Saudi Arabia is the second largest supplier of crude and LPG (liquefied petroleum gas) to India. In 2017-18, India’s crude oil imports from Saudi Arabia were 36.8 mt, accounting for 16.7 percent of its total imports.

Source: Business Standard

70 mn LPG connections distributed under Ujjwala Yojana in 34 months

8 March. LPG (liquefied petroleum gas) connections distributed under the Pradhan Mantri Ujjwala Yojana touched the 70 mn mark with Geeta Devi becoming the 70th mn beneficiary of the scheme. Launched in 2016, the flagship scheme has achieved this "milestone" in just 34 months. The scheme was launched on 1 May 2016, by Prime Minister Narendra Modi with an initial target of 50 mn, which was later revised upward to 80 mn connections. Congratulating the women beneficiaries, Oil Minister Dharmendra Pradhan said they have been the main driving force behind this accomplishment.

Source: Business Standard

India wants to keep Iran oil purchases at 300k bpd in extended waiver

< style="color: #ffffff">Quick Comment

< style="color: #ffffff">Sanctions on oil producers extracts a subsidy from poor oil consumers to support foreign policy of rich countries!

< style="color: #ffffff">Ugly! |

7 March. India wants to keep buying Iranian oil at its current level of about 300,000 barrels per day (bpd), as it negotiates with the Washington about extending a sanctions waiver past early May. India has reduced its purchases of Iranian oil but has been in talks on extending its sanctions waiver. New Delhi is asking to be allowed to still buy Iranian oil at current levels of around 1.25 mt per month, or about 300,000 bpd. Iran was India’s seventh biggest oil supplier in January compared with its position as third biggest a year ago before the reimpostion of sanctions.

Source: Reuters

NATIONAL: GAS

Ennore LNG terminal to help IOC fast-track city gas project

8 March. India’s first east coast LNG (liquefied natural gas) import terminal at Ennore in Tamil Nadu will help Indian Oil Corp (IOC) fast-track its city gas distribution plans, Wood Mackenzie said. The 5 million tonnes per annum (mtpa) liquefied natural gas (LNG) import and regasification terminal, built by IOC at a cost of ₹51.5 bn, was commissioned. India plans to double its LNG import and regasification capacity to 56.5 mtpa by 2025 to meet the energy needs of a fast-growing economy. In order to supply natural gas to various consumers, IOC is laying a 1244 kilometre pipeline for evacuation of gas from Ennore terminal. The pipeline from the terminal will go up to Madurai, Trichy and Tuticorin in Tamil Nadu and branch out to Bengaluru via Hosur in Karnataka. Imported gas at the terminal will meet fuel requirement of Chennai Petroleum Corp, Madras Fertilisers, Tamil Nadu Petroproducts and Manali Petrochemicals. Ennore LNG terminal is part of India's plan to raise the share of natural gas in the country’s energy basket to 15 percent by 2030 from current 6.2 percent. IOC has additional plans to connect remaining refineries to gas pipelines, which will likely at least double its gas demand. IOC has signed a 0.7 mtpa contract with Mitsubishi for 20 years, with supply coming from Cameron LNG in the United States. India has four LNG import and regasification terminals on the west coast -- 15 mtpa Dahej plant in Gujarat operated by Petronet LNG, Shell’s 5 mtpa Hazira terminal in the same state, GAIL (India) Ltd’s 1.2 mtpa plant at Dabhol in Maharashtra and Petronet’s 5 mtpa terminal at Kochi in Kerala.

Source: Business Standard

City gas distribution projects in Jharkhand worth ₹12 bn

7 March. The city gas distribution (CGD) projects in Jharkhand’s Seraikela-Kharswan and West Singhbhum districts are worth around ₹12 bn, GAIL Gas Ltd said. GAIL Gas is a wholly owned subsidiary of GAIL (India) Ltd. Under the CGD project GAIL Gas would supply CNG for transport sector, piped natural gas (PNG) for household and Industries and Commercial units. GAIL Gas said Seraikela-Kharswan CGD project will cover 2,657 square kilometre area and will have 41 CNG (compressed natural gas) stations. Approximately 6,028 households will be connected with PNG in the first phase. Currently, GGL operates 70 to 80 CNG stations, supply piped natural gas to 3,800 commercial units and 600 industrial houses in the country.

Source: Business Standard

ONGC wins back Chinnewala Tibba gas field

7 March. Oil and Natural Gas Corp (ONGC) signed a contract for the prolific Chinnewala Tibba gas field in Rajasthan, which it had discovered around 15 years ago but was taken away and auctioned by the government. ONGC won back five out of the 23 discovered oil and gas fields that the government took away from the state-owned firm and Oil India Ltd (OIL) for auctioning in the second round of discovered small field (DSF). The 72 square kilometre field near Jaisalmer in Rajasthan has 1,900 mn standard cubic metres of reserves, the Directorate General of Hydrocarbons said. The 23 fields, made up of some 57 discoveries by ONGC and OIL, hold 190 mt of oil and oil-equivalent gas resources. Oil Minister Dharmendra Pradhan said DSF bid rounds are aimed at raising domestic production to cut dependence on imported oil.

Source: Business Standard

NATIONAL: COAL

Illegal coal trade sees a spurt in Jharkhand

12 March. Illegal coal business is on the rise in Bokaro causing a huge loss to state exchequer. A police team headed by Bermo deputy superintendent of police R Ramkumar seized two trucks loaded with illegal coal while conducting a raid at an illegal coal depot at Bodiya Basti under Bermo Thermal police station. Three persons were arrested while other members of the team managed to flee from the spot. Police seized around 30 tonne of coal which were stolen and stocked by the coal thieves from the abandoned coal mines of Central Coalfield Ltd (CCL). Thousands of tonnes of coals, which are excavated illegally from forest lands, abandoned CCL mines of rural areas of Bokaro and Dhanbad, are being smuggled to West Bengal through the Chandankyari area of the district. The coal mafias of both Jharkhand and West Bengal run this illegal trade jointly.

Source: The Economic Times

Government scraps sixth and seventh rounds of coal mine auction

10 March. The Centre has cancelled the sixth and seventh rounds of coal mines auction under which it was planning to put on sale 19 blocks. However, the government did not specify the reasons for the cancellation. Under the sixth round, the government had earlier announced the auction of 13 blocks for the regulated sectors, including iron and steel, cement and aluminium. The mines were Brahampuri, Bundu, Gondkari, Gondulpara, Jaganathpur A, JaganathpurB, Khappa and Extn, Bhaskarpara, Marki Mangli IV, Sondiha, Chitarpur, Jamkhani and Gare Palma IV/1. While in the seventh tranche the coal ministry had said it would auction six coking coal blocks for iron and steel sector. The blocks were Brahmadiha, Choritand Tilaiya, Jogeshwar and Khas Jogeshwar, Rabodh, Rohne and Urtan North. The successful allottees of the 19 coal blocks will be allowed to sell up to 25 percent of the actual production in open market at prices fixed by Coal India Ltd (CIL). The government had last month allowed sale of 25 percent of coal production from captive mines in the open market, a move aimed at increasing competitiveness and making future auction of blocks attractive. The decision was taken during a meeting of the Cabinet Committee on Economic Affairs under the chairmanship of Prime Minister Narendra Modi. The allottee of a coal mine for specified end use or own consumption was not permitted to sell coal in open market earlier.

Source: Business Standard

Odisha CM demands immediate hike of royalty on coal to 20 percent

10 March. Odisha Chief Minister (CM) Naveen Patnaik demanded that the Centre immediately take steps to hike coal royalty from 14 percent to 20 percent, and complete sand stowing in closed mines of the state to check soil subsidence. In a letter to Union Coal Minister Piyush Goyal, the CM said it is disheartening to learn that the final recommendation of the study group on coal royalty revision submitted on 5 February 2018 is still under consideration of the central government. Odisha produces about one-fifth of the total coal production in the country, the CM said. The Mines and Minerals (Development and Regulation) Act permits revision of royalty on coal every three years, but it has remained unchanged during the last six years, the CM said. However, the rate of clean energy cess levied on coal by the central government has been raised from ₹50 per tonne to ₹400 per tonne during this period, the CM said. The CM urged Goyal to direct the Mahanadi Coalfields Ltd (MCL) to pay urgently the compensation amount of ₹82.97 bn towards the cost of about 180 mt of coal extracted in excess of the permissible limits under environment clearance. In two underground mines, closed respectively since 1998 and 2006, the MCL has just completed sand stowing work of 5.38 lakh cubic metre against the total requirement of over 9.15 lakh cubic metre, the CM said.

Source: Business Standard

CCL to use technology to curb coal pilferage

8 March. The Central Coalfields Ltd (CCL), the largest coal producer of Jharkhand, is trying to curb coal pilferage and theft through deployment of latest technology in its mines. CCL said every year hundreds of tonnes of coal are lost due to pilferage leading to revenue loss for the company.

Source: Business Standard

Poland to partner India for one of world’s biggest coal blocks

8 March. Recognized as one the leading mining nations in the world Polish government has prepared ‘West Bengal Project’ that was discussed recently during Bengal Global Business Summit. Poland was partner country of the summit for a third time in a row. Poland looks for collaboration with both PSUs (Public Sector Undertakings) and the biggest private players. During a recent meeting with senior executives of the West Bengal Power Development Corp Ltd (WBPDCL), Polish companies restated their readiness to provide their Indian counterparts with innovative technologies and solutions for the development of the coal mining sector in India, with particular regard to the Deocha Pachami coal block. The meeting followed the signing of a Memorandum of Understanding (MoU) between the Ministry of Energy of the Republic of Poland and the Ministry of Coal of the Republic of India to increase cooperation in the mining sector. The MOU was signed by the State Secretary in the Ministry of Energy of the Republic of Poland, Grzegorz Tobiszowski, and the Union Minister of State of Coal & Mines of the Republic of India, H.P. Choudhary in Delhi, on 4 February. During the meeting, Polish companies expressed their willingness to offer assistance in all aspects of the development of the Deocha Pachami coal block, from the initial exploration of coal reserves, to the development of underground coal mining operations and coal production and extraction. The Deocha Pachami coal block, has estimated coal reserves of over 2 billion tonnes (bt) – being the largest coal block in Asia, and was recently awarded to the WBPDCL by the union government. As India endeavors to fulfill its ambitious targets to increase domestic coal production to 1 bt annually, Poland stands committed to provide its global expertise and know-how to assist their Indian counterparts in meeting this goal. Poland and India have a long history of collaboration in coal mining. One of the first underground coal mines in India, situated in Moonidih in the present day state of Jharkhand, was developed and operationalized with assistance of Polish mining sector companies in the 1960s.

Source: The Economic Times

Ranchi-based institute prepares action plan for resumption of coal mining in Meghalaya

8 March. An action plan has been prepared by Ranchi-based Central Mine Planning and Design Institute for resumption of coal mining in Meghalaya in line with the directions of the National Green Tribunal (NGT), Governor Tathagata Roy said. The state government has also framed guidelines for coal mining, Roy said. The state government had launched a crackdown on illegal coal mining despite a ban imposed by the NGT in 2014 after a major disaster in East Jaintia Hills district when 15 diggers got trapped in a rat-hole mine. Roy said the Central Mine Planning and Design Institute (CMPDI) has started exploration activity in 1 square kilometre coal block of Khliehriat-Sutnga for preparation of Geological Report and Feasibility study. The government has framed guidelines for coal mining and an action plan has been prepared by the CMPDI to start coal mining in line with the direction of NGT, Roy said. The state government had announced ₹1 lakh interim relief to each of the identified miners trapped in the coal mine owned by Krip Chullet, who was arrested on the following day of the accident.

Source: Business Standard

MDO model catches up in coal sector to meet rising demand

6 March. With the private sector not allowed to do merchant mining of coal, the mine developer and operator (MDO) model is likely to dominate the Indian coal sector once all the mines allocated become operational in 5-6 years. Over 40 mines with an annual capacity to produce more than 500 million tonnes (mt) of coal have been allocated to state and central governments besides public sector units through competitive bidding. Currently, coal for merchant mining is not allowed to the private sector and the only available route for them to enter the sector is through the mine developer-cum-operator route. Coal India Ltd (CIL) last year produced over 550 mt of coal but the MDO model is fast catching up with the PSU (Public Sector Undertaking) that is struggling to meet rising demand from power producers and other industries. Steel producer SAIL, power generator NTPC, CIL subsidiaries, besides state governments of West Bengal, Odisha, Rajasthan, Telangana, Madhya Pradesh, Andhra Pradesh and Gujarat have adopted the MDO model instead of venturing into mining on their own in the past decade. India meets close to 80 percent of its electricity needs through coal-fired power plants. It is heavily dependent on imports to meet its needs despite having the fifth largest recoverable coal reserves in the world. For a country, which imported over 156 mt coal between April-November 2018, MDO model can reduce import dependency and meet India's surging energy needs and save foreign exchange. MDO, with its technical expertise, enables faster operationalisation of the coal blocks.

Source: Business Standard

NATIONAL: POWER

CERC allows power plants to claim higher compensation for loss in fuel quality of coal

12 March. Central Electricity Regulatory Commission (CERC) has allowed power plants (selling electricity under the ‘cost plus’ system) to receive higher compensation for loss in fuel quality while coal is ferried and stored. Additionally, for computing tariff of power from such plants, the electricity regulator maintained the base return on equity at 15.5 percent. The latest regulations will impact the electricity tariff for 76 GW power plants that sell power under the ‘cost-plus’ system between FY19 and FY-24. CERC kept the definition of ‘useful life’ for coal power plants intact at 25 years.

Source: The Financial Express

Kalpataru bags orders worth ₹12.8 bn

11 March. Kalpataru Power Transmission Ltd (KPTL) said it has bagged new orders worth ₹12.88 bn. The company's transmission and distribution (T&D) business has secured projects of ₹7.71 bn primarily in international markets, KPTL said. It is executing several contracts in India, Africa, the Middle East, CIS, SAARC and the Far East.

Source: Business Standard

India to save 3 bn units of electricity by 2030 with new star rating programme

9 March. India is likely to save an estimated 3 bn units of electricity by 2030 as a result of the newly launched star rating programme for microwave ovens and washing machines. The power ministry has expanded its ambitious Standards & Labeling (Star Rating) program for energy efficiency for appliances to cover the two appliances. The programme has been formulated by the Bureau of Energy Efficiency. It will be initially implemented for the two appliances on a voluntary basis and will remain valid till 31 December, 2020. Power secretary A K Bhalla said the initiative will promote technology and energy efficiency in microwaves ovens, a popular household gadget.

Source: The Economic Times

This Chhattisgarh village gets electricity for the first time since Independence

9 March. Jhalpi Para village in Chhattisgarh’s Balrampur district got electricity connection for the first time. The region was deprived of power supply since independence. The discontent of residents of the village over the absence of power supply there even while claiming that they received electricity bills regularly. The villagers alleged that there is no electricity connection in the houses but meters have been installed due to which they are receiving electricity bills. The district administration, however, denied the claim of villagers receiving electricity bill while assuring that power supply will be provided in the area very soon. In March last year, the Government of India had stated that out of 18,452 villages in India that were power deprived 3 years ago, 17,181 have been electrified. Others are uninhabited or classified as grazing reserves.

Source: Business Standard

Approval of HLEC recommendations positive for resolution of stressed power plants: ICRA

8 March. Ratings agency ICRA has termed approval of High-Level Empowered Committee (HLEC)’s recommendations for resolution of stressed thermal power plants as a positive move. Use of domestic linkage coal would enable generators to offer more competitive tariffs for short-term sale, which is also likely to benefit discoms (distribution companies) given that they are purchasing larger volumes through short-term power purchase agreements (PPAs). While the Cabinet Committee on Economic Affairs (CCEA) has recommended a regular auction of coal linkages and increase in quantity of coal for special forward e-auction, this would require significant ramping up of production and supplies by Coal India Ltd (CIL). ICRA estimates that this increase in output would have to be at least 8 percent higher than the current levels under the assumption of the aforesaid 16 GW capacity operating at 50 percent power load factor under the short-term/medium-term PPAs (power purchase agreements). The government is focused on the medium-term PPA route to resolve the issue of lack of PPAs for coal-based independent power producers (IPPs) as seen from the first 2.5 GW pilot scheme executed in 2018 and the second 2.5 GW scheme announced in January 2019.

Source: The Economic Times

Kerala State Electricity Board seeks regulator’s nod to pay ₹1.6 bn

7 March. Kerala State Electricity Board (KSEB) has approached the power regulator seeking permission to utilize around ₹1.68 bn for meeting compensation claims of landowners in the Edamon-Kochi sector, where a 400 kilovolt (kV) power line is being built for sourcing power from Kudankulam nuclear power station to Madakkathara (Thrissur) substation. The total compensation amount to be distributed has been pegged at ₹47.30 bn. Power Grid Corp Ltd, which is building the line, the state government and the KSEB would jointly share the costs. The transmission line, for which work had begun in 2008, hit a series of roadblocks after landowners, especially planters, raised protests. As per the original schedule, Thirunelveli-Madakkatara transmission line was to be completed by 2010. After the failure in meeting the deadline, the KSEB is currently drawing its share of power from Kudankulam through Udumalpetta in Tamil Nadu. The winding line causes heavy transmission loss and a host of practical difficulties to the state power utility. The new line traverses through Kollam, Pathanamthitta, Kottayam and Ernakulam districts. The work came to a grinding halt after rubber growers, especially in Kottayam, came up against building the power line over rubber plantation.

Source: The Economic Times

Chandigarh seeks report on steps taken to meet summer power supply demand

6 March. The UT (Union Territory) administration has sought report from the electricity department for arrangements to meet the demand of power supply in the peak summer season. Meanwhile, the UT electricity department has already started discussions with different power exchanges and states to purchase additional power. According to the estimates, the peak power demand in the coming summers will touch 404 MW. Besides, the peak power demand in Chandigarh will jump to 448 MW in the financial year 2021-22. The UT electricity department in its multi-year tariff petition filed before the Joint Electricity Regulatory Commission (JERC), has submitted details about the peak hour demand, the period of high consumer demand in the coming years. With population projected to grow at a high rate, the UT electricity department is already facing a tough challenge of providing uninterrupted power supply to the city residents. The UT electricity department plans to improve its power infrastructure.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Government modifies solar park scheme to ease land, evacuation constraints

12 March. The government has modified the existing scheme for development of solar parks and ultra mega solar parks in a bid to ease constraints related to availability of land and evacuation infrastructure. Under the new guidelines, called Mode-7, SECI (Solar Energy Corp of India) will make both government and private land available for successful bidders for setting up projects with the assistance of state government. The state government would be paid a facilitation charge of ₹0.02 per unit of power being generated in these parks. This facilitation charge would be paid by renewable energy project developers for setting up projects in these lands in addition to any land cost. Also, no fund from Central Financial Assistance (CFA) would be used for the procurement of land, said the modified guidelines. SECI would act as a Solar Power Park Developer (SPPD) and will get the external power evacuation infrastructure of the parks developed by the External Transmission Development Agency such as transmission utilities. The existing solar park scheme provides for CFA of ₹20 lakh per megawatt (MW) or 30 percent of the project cost, whichever is less, for setting up of both the internal and external evacuation infrastructure. The Ministry of New and Renewable Energy (MNRE) said that about 16,650 MW capacity is still to be allocated under the scheme and the entire CFA available for this spare capacity under the solar park scheme would now be utilised for Mode-7. Under the new guidelines, SECI would also set up a Payment Security Mechanism to make setting up of renewable projects in such parks more attractive. The idea is to ensure continuous payment to developers and mitigate risk due to default in payments by discoms (distribution companies). India currently has 34 solar parks operating in 21 states with a total capacity of 20,000 MW.

Source: The Economic Times

SECI to meet solar developers over 7.5 GW tender in Leh & Ladakh

11 March. Solar Energy Corp of India (SECI) is likely to conduct a follow-up meeting with solar industry representatives to discuss the details of its tender for 7.5 GW solar energy projects in Leh and Ladakh region of Jammu & Kashmir. The tender, which is part of the government’s ambitious plan to build 23 GW solar power projects in Ladakh, had been issued by SECI on 31 December 2018 with last date set for 30 April. As per the Request for Selection (RfS) document, two solar power projects will be built in the Phase-1 — a 2.5 GW project in the Zangla region of Kargil and a 5 GW project in the Pang region of Leh.

Source: The Hindu Business Line

NHPC aims to boost capacity to 10 GW by 2022: Chairman

11 March. India’s state-run hydroelectricity producer NHPC Ltd plans to raise its capacity by about 30 percent to 10 GW by 2022, its Chairman Balraj Joshi said. Thermal power accounts for about two-thirds of India’s overall 347 GW electricity generation capacity. New Delhi has set a target to install 175 GW of renewable energy capacity by 2022. The company’s current generation capacity is about 7.1 GW, he said. NHPC plans a capital expenditure of ₹38 bn ($543.79 mn) for the fiscal year to March 2020, compared to about ₹20 bn spent so far in this fiscal year, he said.

Source: Reuters

Renewable power status along with budgetary support positive for hydropower sector: ICRA

11 March. The recently granted renewable power status and budgetary support for infrastructure associated with large hydro projects is a major positive move, research agency ICRA said. The centre has declared large hydro power projects with capacity of more than 25 MW as renewable energy projects. It has approved a separate hydropower purchase obligation (HPO) under non-solar renewable power obligation (RPO) to cover large hydro power projects commissioned post notification of the norms. The government has approved HPO and tariff rationalisation norms with the objective to promote large hydro projects, given the slowdown in addition of new capacities in this segment over the past few years. The annual HPO trajectory will be notified by the ministry of power with required amendments to the existing tariff policy and regulations. The tariff rationalisation measures include providing flexibility to the developers to back-load tariff, increasing debt repayment period to 18 years and escalating tariff by two percent. Also, the budgetary support for funding cost of supporting infrastructures such as roads and bridges will be on a case-to-cases as per actuals, subject to a limit of ₹15 mn per MW for hydro power projects up to 200 MW and ₹10 mn per MW for hydro power projects above 200 MW. Budgetary support will also be provided for funding flood moderation component of hydro power projects on a case-to-case basis.

Source: The Economic Times

Himachal CM hails PM Modi’s boost to hydropower sector

10 March. The Centre has decided to include power generated by large hydel projects (HPO) in the non-solar renewable purchase obligation (RPO) of states and UTs, giving a boost to the hydropower sector in Himachal Pradesh, Chief Minister (CM) Jai Ram Thakur said. He said he was thankful to PM Narendra Modi for approving measures to promote the hydropower sector.

Source: The Economic Times

ASSOCHAM welcomes Centre’s nod for hydropower policy

8 March. Industry body The Associated Chamber of Commerce and Industry of India (ASSOCHAM) welcomed the Union Cabinet’s approval of a national policy for hydropower announced. ASSOCHAM President BK Goenka has expressed happiness on the cabinet approval of National Policy on Hydropower, the decision reflects the Narendra Modi-led government's resolve to push reforms. Hydropower is the cleanest form of renewable energy having a multitude of benefits including lowest lifecycle cost per kilowatt hour (kWh). With the highest ramping rate, it is critical for reintegration and shaping intra-day and seasonal dynamics. The much-awaited policy shall provide a fillip to hydropower as also aid financial closures for several stranded hydropower projects in the country. ASSOCHAM recommendations cited are hydro projects regardless of nature & capacity should be treated as ‘renewables’. The requirement for long tenure debt availability and hydro-purchase obligation required for PPAs (power purchase agreements) and financial closures for stranded projects. Hydro cost could be competitively provided it is treated at par with other renewable (solar and wind). Hydro should be considered as a compulsory ancillary for any other energy mix. HPO with Cost Plus until 2030 OR Bundling of such selected hydropower with renewable/ others to make it more viable/lucrative for discoms to buy. Government of India can also mandate a separate hydro purchase obligation under tariff policy. Further a higher forbearance price of ₹2 per kWh. The state government is to be provided 12 percent of free power as royalty from any Hydro Power Project to be developed in the state. Free power should be waived. Alternatively, deferment of free power share for at least initial years of repayment of the loan period.

Source: The Economic Times

Cabinet approves renewable status for large hydropower projects

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Renewable status for large hydropower projects is long overdue reward!

< style="color: #ffffff">Good! |

7 March. To boost hydropower generation, the government approved a slew of measures including providing renewable energy status for large hydel projects and new funding provisions. Earlier, hydro projects up to 25 MW capacity were considered as renewables and were eligible for various incentives like financial assistance and cheaper credit. With the government's decision, hydro projects above 25 MW can also avail the benefits. The Cabinet decision has also paved the way for adding hydro capacities of about 45 GW to the renewable energy basket of existing 74 GW which includes solar, wind and small hydro. India is aiming 175 GW of renewable energy by 2022. With addition of large hydro to clean energy segment, India is poised to have 225 GW of renewable energy by 2022. With the new measures, large hydro projects would be allowed back loading (reducing) of tariff after increasing project life to 40 years, increasing debt repayment period to 18 years and introducing escalating tariff of 2 percent. At present, hydropower tariff is expensive than other sources. These measure would help rationalise the tariff by hydro power projects.

Source: Business Standard

Government nod to Khurja thermal power plant in UP big blow to public health and wealth: Greenpeace India

7 March. Greenpeace India termed the government's nod to a super thermal power plant in Uttar Pradesh's Bulandshahr district "a double blow" to the health and wealth of public. The environment NGO’s reaction came hours after the Cabinet Committee on Economic Affairs (CCEA) approved investment of ₹110.89 bn for setting up the 1,320 MW Khurja Super Thermal Power Plant in Bulandshahr district. A report from Greenpeace India stated that over 20 of the 30 most polluted cities in the world were this country and among them the NCR (national capital region) is most polluted. Seven of the 30 most polluted cities in the world are in Uttar Pradesh, the state in which the Khurja plant will be located, it said.

Source: Business Standard

Government nod to NHPC acquiring Lanco’s Teesta hydro project