GAS PIPELINES EXPAND INTO NEW MARKETS

Gas News Commentary: December 2018

India

The Centre will initially spend Rs 700 billion to spread gas pipelines across the country, and is working out plans to expand gas network to Myanmar through Bangladesh. The central government is promoting gas-based economy which needs a massive network of pipelines for transportation of natural gas to various corners of the country. India is planning to expand gas pipeline network to Myanmar through Bangladesh.

The ₹ 34 bn Bokaro-Angul gas pipeline will help pave the way for supply of natural gas for households, vehicles and industries across 11 districts of Odisha and Jharkhand, oil ministry said. The Bokaro–Angul section, part of the larger 2,650 km Jagdishpur–Haldia & Bokaro-Dhamra (JHBDPL) pipeline, popularly known as the Pradhan Mantri Urja Ganga project. The Bokaro–Angul section is being constructed by GAIL (India) Ltd and will have a total length of 667 km, of which 367 km will be in Odisha and 300 km in Jharkhand. It will cover five districts in Odisha -- Angul, Sundargarh, Jharsuguda, Sambalpur and Debagarh -- and six districts in Jharkhand -- Bokaro, Ramgarh, Ranchi, Khunti, Gumla, Simdega. The project is scheduled to be completed by December 2020. The Pradhan Mantri Urja Ganga is slated to pass through Uttar Pradesh, Bihar, Jharkhand, West Bengal & Odisha. The pipeline is further being extended from Baruani in Bihar to Guwahati Assam with a length of 730 km. It is expected to act as a gateway for pipeline infrastructure in North East. PNGRB has already awarded the Geographical Areas for development of City Gas Distribution networks in these 11 districts to different entities and the Bokaro–Angul section will help expand the supply of natural gas to these areas. GAIL has already placed the order for line pipes for the section and delivery has commenced at the site. Work will be executed in five sections and five contractors have been engaged for the purpose. This year, Delhi and Mumbai crossed the one million mark in piped natural gas connections. Beyond the two cities, access to the fuel will grow further to 402 districts across 27 states and Union Territories, covering 70 percent of the country’s population, once the area under the tenth round of bidding is connected. This is a long way from 1857, the year of the great revolt against the Raj, when a British joint stock company called Oriental Gas Company started offering piped natural gas supplies in Calcutta (now Kolkata) for commercial and domestic purposes. After that, parts of Gujarat and Tripura also had piped gas networks, owing to the local availability of natural gas in these areas. In fact, BG, now merged with Shell globally, set up Gujarat Gas Company in 1980 to develop CGD networks in Surat and Bharuch. BG exited Gujarat Gas by offloading its stake to Gujarat State Petroleum Corp in 2013 and subsequently exited MGL, its joint venture with GAIL and the Maharashtra government. But such exits do not reflect the steady growth of the CGD business in India. Going forward, however, CGD providers may struggle to replicate Delhi and Mumbai’s numbers, principally because smaller cities may not have the same population sizes. Besides, the model that worked for these two cities evolved even before CGD rights were bid out. IGL, a joint venture of GAIL, BPCL and the Delhi government, has held the rights to the CGD network in Delhi since 1999, seven years before the legal framework for the business was laid out under the PNGRB Act in 2006. Prior to that, GAIL was managing gas supply business in Delhi. MGL, the BG-Shell joint venture till the multinational exited in 2018, also had equity participation from GAIL and the Maharashtra government. It was formed four years before IGL in 1995. The government plans to increase the share of natural gas to 15 percent in the overall fuel basket of the country. A major challenge for CGD players, however, is sourcing natural gas. For players like GAIL and Adani, which have access to natural gas and pipelines, it may be easier to supply gas to their subsidiaries. For Delhi and Mathura, there is the advantage of a Supreme Court order that gives them preference in natural gas allocation because of the fuel’s environmental benefits. Though use of bio gas as CNG for vehicles will improve gas availability for CGD networks, pricing and demand will continue to be the deciding factors.

With nearly 3,000 new compressed natural gas-run vehicles added on city roads every month, authorities at MNGL are concerned about meeting the growing demand. The company currently has 55 CNG stations in Pune. According to MNGL, at least 25 new CNG stations are required in the city to keep up with the rising demand. While the Pune Municipal Corp offered nine parcels of land to develop CNG stations, MNGL said that most plots are not feasible. According to MNGL, the CNG stations running at optimal capacities coupled with the long lines are also coming in the way of more conversions.

Top Indian gas importer Petronet LNG Ltd is looking to sign a deal in a year’s time to buy at least 1 mt of US natural gas annually for a period of up to 10 years, as it pushes to diversify its supply sources beyond the Middle East. As part of any deal, the firm could potentially take a stake in a US LNG project. Petronet currently runs a 15 mtpa LNG regasification site at Dahej in the western state of Gujarat and a 5 mtpa plant at Kochi in southern India. It has long-term deals to buy 10 mtpa of LNG, with 8.5 mtpa of that coming from Qatar’s RasGas. Petronet is in talks with various companies including Tellurian Inc about a potential US deal. Singh had said in November that Petronet and ONGC Videsh Ltd were jointly in talks to buy a stake in Tellurian’s proposed Driftwood project in Louisiana. Natural gas accounts for about 6.5 percent of India’s overall energy needs, far lower than the global average. The government wants to lift that to 15 percent in the next few years. A glut of natural gas in the US in the wake of the rapid development of shale fields there has kept benchmark US prices for LNG at almost half Asian levels. Petronet is in talks to invest in exploration and LNG projects in Qatar, as well as continuing to scout for opportunities in Bangladesh and Sri Lanka.

Petronet plans to invest ₹ 21 bn to expand its terminal capacity in Dahej, Gujarat, from 15 mtpa to 20 mtpa in the next two or three years. Of the total, ₹ 13 bn would be used to expand the Dahej terminal, while ₹800 crore will be spent on building LNG storage tanks. Petronet LNG, which built India’s first LNG receiving and regasification terminal at Dahej, operates another terminal in Kochi. The Kochi terminal has a capacity of 5 mtpa. The company is in the process of building a third terminal, at Gangavaram, Andhra Pradesh.

India is considering building emergency stockpiles of natural gas, on the lines of strategic oil reserves, to deal with supply disruption amid the country’s growing dependence on fuel and its import. The government wants domestic consumption of natural gas, a cleaner fossil fuel, to rise two-and-a-half times by 2030 and is encouraging big public and private investments in gas production, import, transport and distribution infrastructure. Local demand increased 5.5% between April and October to 35.1 billion cubic meters, increasing dependence on imports to 47% of total consumption from 44% a year earlier. The person is part of a panel formed by the petroleum and natural gas ministry to evaluate the need for strategic gas storage and prepare a plan to go about building and managing these. The panel has representatives from ONGC, GAIL and Oil Industry Development Board. Most heavy gas consuming countries already have natural gas storage in place, primarily for supply security. About 30% of gas storage capacity is in the US, a major producer and consumer of natural gas. Russia, Ukraine, Canada and Germany together account for another 40%. China, a late entrant to the game, too is fast building gas storage facilities. About three-fourths of underground gas storage is in depleted gas and oil fields while the balance is distributed between salt caverns and aquifers. The first storage in India could come up at a site connected to a pipeline. The reserve would store imported gas, which could be released when needed in the domestic market.

ONGC and OIL spent over ₹ 130 billion on 115 oil and gas discoveries which were taken away from them by the government for auctioning to private companies. The government took away so-called idle small and marginal discoveries of ONGC and OIL and auctioned them to private firms under DSF bid rounds. Under DSF bid round-1, 67 discoveries, mostly of ONGC, were auctioned, while in the second round, bids for which are due next month, another 48 finds are being auctioned. ONGC and OIL are not compensated for the amount they had spent on discoveries of these oil and gas reserves. Unlike state-owned firms, the private players are allowed pricing and marketing freedom to make these discoveries viable. ONGC and OIL have stated that they could not produce from the discoveries as they are uneconomically at current cap prices. Under DSF-I, 47 companies participated in the bidding process.

Rest of the World

China is expected to consume 270 bcm of gas in 2018. China’s capital will use as much as 130 mcm/day during the peak winter heating period. Beijing is now the world’s second largest gas-consuming city. China’s LNG imports hit record levels in November, customs data showed, with traders rushing to buy the fuel as households and businesses crank up their heating over the freezing winter months. LNG imports totalled 5.99 mt in November, up 48.5 percent from the same month last year, data from the General Administration of Customs showed. That surpassed the previous record of 5.18 mt hit in January this year. China has been pushing to switch parts of the country to gas for heating, shifting away from coal as it pushes to clean up its environment. For the first 11 months of 2018, LNG imports were up 43.6 percent from a year earlier to 47.52 mt, on track to beat 2017’s annual record of 38.13 mt. Meanwhile, Chinese exports of gasoline and diesel fell in November from the year before, the data showed, with local refiners reducing production as profit-margins fall. China exported 1.23 mt of diesel in November, down 37.5 percent year-on-year.

Several large LNG players have tried to offload their obligation to buy future cargoes from the US shedding excess commitments made years ago in the rush for new sources and commercial terms for the fuel. The sale of multi-year “strips” of LNG cargoes represent portfolio adjustments by the buyers rather than backlash against US gas, several Asian and Europe-based traders said. But it was a timely reminder that there is only so much US LNG, which can be more commercially attractive than gas from other regions, that the market can absorb, even as new investment is being prepared for more US export plants.

US LNG export capacity is on the brink of doubling in 2019, which will boost the super-cooled fuel’s influence on the US natural gas market, where volatility surged in 2018 after several years of slumber. LNG exports have been the fastest growing source of US natural gas demand since the country started ramping up exports in 2016, and is expected to expand deliveries in coming years as several more export terminals enter service. Its imprint is being felt in the US gas futures market, which in November experienced its longest stretch of extreme volatility in nine years due to demand, low inventories and unseasonably cold US weather. LNG currently accounts for just a small amount of overall domestic gas demand. But as the country opens more facilities for export to meet growing needs abroad, analysts said more ups and downs in prices are expected. The US is on track to export about a trillion cubic feet of LNG by year-end, or about 3 percent of overall US gas demand in 2018. But LNG exports are expected to rise to 5 percent of overall US gas demand in 2019 and to 10 percent in 2024, according to the US Energy Information Administration, boosting LNG’s potential to affect prices.

Implied volatility for US natural gas futures tumbled 40 percent an all-time high a month ago as weather forecasts for the rest of the year turned warmer, reducing the risk that the amount of gas in storage will run short this winter. The market worried the cold would cause consumers to burn more gas than usual for heat, forcing utilities to pull large amounts of the fuel from already depleted storage facilities.

Tellurian, which is developing a LNG export project on the US Gulf Coast, has signed a preliminary deal to supply LNG to commodities trader Vitol. The deal prices the LNG against Platt’s Japan Korea Marker, the first time the daily assessment of spot LNG prices in northern Asia has been used for a long-term offtake agreement, according to S&P Global Platts. In the US, such long-term deals, critical to the financing of export terminals, are priced against the US Henry Hub gas price. Most deals elsewhere are priced against oil, while some are priced against other natural gas hubs. The MoU is Tellurian’s first preliminary offtake deal for its Driftwood LNG project. An MoU usually leads to a binding Sales and Purchasing Agreement. Vitol aims to buy 1.5 mtpa of LNG from Driftwood for 15 years once operations begin. The export terminal in Louisiana aims to have a capacity of 27.6 mtpa and to start operations by 2023. Tellurian had previously said it was in talks with about 25 prospective customers including Total, General Electric and Bechtel, which has a $15.2 billion contract to build the LNG terminal.

US oil major Exxon Mobil Corp has withdrawn its WCC LNG export terminal in Canada from the environmental assessment process, it said, signaling that the project has been shelved. The decision to pare its LNG project portfolio follows the go-ahead of a giant Royal Dutch Shell-led project in British Columbia, and Exxon’s focus on LNG projects in Asia, the Middle East and the US. Global LNG demand is expected to double to 550 mtpa by 2030, as countries like China move away from coal to cleaner fuels. The top import market for LNG is northeast Asia. Exxon Mobil Corp and the world’s top miner BHP Billiton said they approved development of the West Barracouta gas field in the Gippsland Basin in Australia, to bring fresh gas to Australian domestic markets. Exxon said the project, located off the shore of the state of Victoria, is part of its continuing investment in the Gippsland Basin, an area rich in oil and gas. BHP will invest about A$200 million ($144.36 million) in the gas field, the miner said. Rising natural gas prices has become a political issue in Australia as households and manufacturers complain of higher costs, especially in the country’s more populous east coast. The Gippsland Basin joint venture continues to supply about 40 percent of east coast Australian domestic gas demand, Exxon said, adding that front-end engineering design work for the project was completed and key contracts awarded.

Russian gas giant Gazprom said it had begun operations at a third and final unit at its Bovanenkovo gas field on the Arctic Yamal peninsula, allowing it to boost natural gas production. Gazprom said it had increased the capacity of the Ukhta-Torzhok gas pipeline, aimed at facilitating Russian gas exports to northern Europe, including via the Nord Stream pipeline. Gazprom plans to export record-high natural gas volumes of 200 bcm to Europe this year. The company said that with the launch of the final unit, Bovanenkovo will reach a projected capacity of 115 bcm of gas per year. The gas field with reserves of just under 5 trillion cubic meters - on par with global annual gas demand - is key to the company’s efforts to tap new deposits, apart from its traditional producing region of Western Siberia. Last year, it produced 82.8 bcm of gas.

Russia’s largest non-state natural gas producer Novatek will start producing LNG on the shore of the Baltic Sea in February, the contractor, Atomtekhenergo, said. Novatek, along with Gazprombank, is building an LNG plant and terminal in the Baltic Sea port of Vysotsk with a capacity of 660,000 tonnes of the frozen gas per year. The plant’s capacity could be expanded to 800,000 tonnes in 2021. Novatek is the main owner of Russia’s largest LNG project, Yamal LNG, with produces gas at the rate of 16.5 mtpa.

Australia overtook Qatar as the world’s largest exporter of LNG for the first time in November, Refinitiv Eikon data showed. In November, Australia loaded 6.5 mt of LNG for exports while Qatar exported over 6.2 mt the data showed. Qatar plans to boost its LNG capacity by early 2024 to 110 mtpa up from its current production of 77 mtpa by adding a fourth LNG production line. Qatar, which exports around 600,000 barrels per day of crude oil, said it would leave the OPEC to focus on gas. Wood Mackenzie analyst Nicholas Browne said the drop in Qatari LNG exports in November was due to maintenance, making Australia’s time at the top limited. However, Australia’s hold on the top spot could be fairly short as LNG exports are being blamed for rising domestic gas prices, which has become a political issue in the country. The oil companies that Qatar selects to expand its north field natural gas reservoir will be announced in mid-2019. Qatar plans to build four additional LNG gas trains in mid-2019.

Iraq needs at least two years to boost the country’s gas production to stop importing Iranian gas used to feed its power stations. Iraq’s gas output is expected to reach 1.3 mcf/d by the end of 2020, an increase of 400 mcf/d from current levels. The US said that Iraq can continue to import natural gas and energy supplies from Iran for a period of 45 days as long as Iraq does not pay Iran in US dollars. Sanctions on Tehran’s oil sector took effect on 5 November. The expected rise in gas production would come from two new projects, including a $367 million deal with General Electric reached in April to process natural gas extracted alongside crude oil at two fields in southern Iraq. The project is expected to start producing 160 mcf/d in two years, Abdul Ghani said. Iraq is expected to sign another deal in early 2019 to build the Artawi gas plant in the south which is planned to produce around 300 mcf/d by end 2019. Iraq’s gas development plans have long focused on BGC, a $17 billion joint venture between Royal Dutch Shell, state-run South Gas Company and Mitsubishi. Iraq is seeking to reach gas production of around 2000 mcf/d by the end of 2023, including 1.43 mcf/d from the Basra Gas Co. and additional 500 mcf/d from other future projects in the south. South Gas Co is still in talks with US energy company Orion Gas Processors over the economic and technical aspects of a final deal to capture and process 100 million to 150 mcf/d of natural gas extracted from Nahr Bin Omar southern oilfield. Iraq signed a Memorandum of Understanding with the US company to build facilities to capture the gas from the field located in southern Iraq and to transform it into usable fuels.

Israel, Greece and Cyprus will sign an agreement early next year to build a pipeline to carry natural gas from the eastern Mediterranean to Europe, while the United States pledged its support for the ambitious project. The $7 billion project, expected to take six or seven years to complete, promises to reshape the region as an energy provider and dent Russia's dominance over the European energy market. Israel has been developing natural gas fields off its Mediterranean coast for the past decade. Its "Tamar" field already is operational, while the larger "Leviathan" field is expected to be operational next year. While most of its gas is used domestically, it has signed export deals with Egypt and Jordan and has its eyes on the larger European market. The proposed pipeline would allow Israel and Cyprus to export their recently discovered offshore reserves to Italy and eventually to the rest of Europe. Greece, which would act as a conduit for the gas to the continent, could also use the pipeline to convey any hydrocarbons potentially found in its own waters.

A line to connect a planned German terminal for LNG in Brunsbuettel to the bigger gas grid needs to be build by the project company, not the gas grid operator, Germany’s network regulator Bundesnetzagentur (BnetzA) said. The regulator, following the completion of its €6.9 billion ($7.9 billion) gas network expansion plan for 2018-2028, said the move did not preempt a decision on whether the planned terminal was needed or could be realised. German LNG Terminal, a joint venture of gas network operator Gasunie, tank storage provider Oiltanking, and storage tank company Vopak, plans to make an investment decision on the Brunsbuettel terminal next year.

Poland’s dominant gas firm PGNiG said that it had finalised a 20-year deal for deliveries of LNG from the US to Poland’s terminal in the Baltic Sea. PGNiG said that annual supplies of 2 million tonnes of LNG, which will be delivered free-on-board, will start no sooner than 2023 when the Port Arthur production facility in Texas will be completed. The contract is the result of an agreement PGNiG signed with US. Port Arthur in June. Poland has increased supplies of LNG in the past few years in order to reduce its reliance on Russian gas. Poland consumes around 17 bcm of gas annually and more than half of it comes from Russia’s Gazprom under a long-term deal which expires in 2022 and which Warsaw does not plan to extend.

Energy group Uniper entered agreements with Japanese shipping group Mitsui OSK Lines to handle potential deliveries of LNG into Germany. Discussions about LNG have flared up recently as the German government wants to diversify away from pipeline gas arriving from Russia, Norway and the Netherlands. Suppliers, most notably Qatar and the US have expressed interest. In its efforts, Uniper is banking on Wilhelmshaven - which is close to its storage facilities - as the site for a German LNG terminal and has previously said that it was in talks with interested parties to build a FSRU. Uniper said that Mitsui intended to own, operate and fund the FSRU, which has a planned send-out capacity of 10 bcm/year and LNG storage capacity of 263,000 cubic meters. The unit could be in operation as early as the second half of 2022, Uniper said. Uniper said it also entered into a binding transportation agreement with Mitsui, under which the group will provide Uniper with 180,000 cubic meters of LNG shipping capacity from December 2020. It will use the capacity partly to optimize LNG volumes from Freeport in the US, the company said.

The French government said it had asked utility Engie to take hedging positions to ensure gas prices do not rise until June next year. Unlike power prices, which typically move once a year, gas prices move every month in France and are set using a formula that takes into account production costs. Many French governments have postponed tariff increases to protect consumers and their own approval ratings in the past, but legally the government has no authority to set prices. The environment ministry said it wanted to ensure Engie’s gas prices do not change until June 2019 but gave no explanation on the new timeframe of the requested price freeze.

BP in Trinidad and Tobago gave the go-ahead to two new gas developments, Cassia compression and Matapal, offshore Trinidad, it said. BP will build a new platform, Cassia C, and first gas from the facility is expected in the third quarter of 2021. Matapal will be a three-well subsea tie-back to the Juniper platform. With production capacity of 400 million standard cubic feet of gas per day, first gas from Matapal is expected in 2022, BP said.

Royal Dutch Shell said it would expand the Shearwater gas hub in the British North Sea, its seventh project to get the green light in the aging basin this year. The project, a joint venture with Exxon Mobil and BP, will include a modification of the Shearwater platform to allow production and processing of wet gas as well as the construction of a 37 kilometre pipeline from the Fulmar Gas Line to Shearwater, Shell said. The pipeline installation, which will enable wet gas to flow into the Shell Esso Gas and Associated Liquids pipeline, is scheduled for 2019, while the platform expansion is scheduled for the following year, according to Shell. At peak production, the wet gas export capacity of the Shearwater hub is expected to be around 400 million standard cubic feet of gas a day, or roughly 70,000 barrels of oil equivalent per day.

Pakistan LNG said commodity traders Trafigura and Gunvor had made the lowest bids in a tender to supply three cargoes of LNG between late January and late February. It said Trafigura made the lowest bid to supply a cargo on 21-22 January at 14.4 percent of Brent crude oil prices, Gunvor’s bid for the 3-4 February cargo was at 15.8 percent and Trafigura again bid the lowest for 21-22 February at 14.8 percent. Vitol Bahrain had bid to supply two cargoes but at higher prices, according to a Pakistan LNG commercial evaluation document. BB Energy had sent in bidding documents but they did not technically qualify. The prices, expressed in the document as crude oil slope or the numerical percentage of Brent crude price, are a valuable pointer for the opaque spot LNG market. A cargo priced at 14.4 percent of Brent is about $8.66/mmBtu. Spot Asian LNG prices for January were heard at $9.80/mmBtu although they have since fallen to closer to the $9.00/mmBtu mark. Pakistan LNG launched a tender for the three cargoes in November, the first for LNG since June.

A South Korea-based company has proposed building a terminal on Australia’s east coast to import LNG the fifth proposal for such a project in the world’s No.2 LNG exporter. The proposals have come after three new LNG export plants on the east coast have sucked gas out of the southeastern market and nearly tripled wholesale gas prices in places such as Sydney over the past two years. EPIK, a newly-formed LNG FSRU project development company, said it had signed an agreement with the Port of Newcastle to do preliminary work on a proposed FSRU that it estimated would cost up to $430 million, including onshore infrastructure.

Tokyo Gas Co has signed a joint development agreement with Philippines’ First Gen Corp to build and operate a LNG receiving terminal in the Philippines, its first foray into energy infrastructure development in Southeast Asian country. The Philippines in October had short-listed three different groups of companies, including the Tokyo Gas partnership with First Gen, to build and operate its first LNG import terminal. First Gen, which owns about 60 percent of the gas-fired power plants in the Philippines, is the biggest natural gas user in the country, Tokyo Gas said.

Bulgaria plans to set up a state-owned company by the end of the year to operate a natural gas bourse, with liquidity secured through an agreement with Austria’s natural gas trading hub. Petkova said Sofia will sign a memorandum for cooperation with the Vienna-based CEGH as it pushes forward with plans for a gas trading hub in the Black Sea city of Varna. CEGH is a trading platform for the central European Baumgarten hub, the arrival point for Russian gas flowing into Europe via Ukraine and through the Nord Stream pipeline across the Baltic Sea. The new company will be a unit of state-owned gas network operator Bulgartransgaz, Petkova said. Bulgartransgaz plans to seek binding bids from shippers by 16 January for a new link to transport gas from its border with Turkey in the south-east to Serbia in the west, which will carry mainly Russian natural gas to central Europe.

Norway’s Equinor is ready to start talks with Tanzania on developing a LNG project based on a deepwater offshore discovery, the company said. Tanzanian President John Magufuli has asked his government to proceed with negotiations to set out the commercial and fiscal framework for the LNG project, Equinor, a majority state-owned energy company formerly known as Statoil, said. Tanzania said in 2014 that a planned LNG export plant could cost up to $30 billion. Royal Dutch Shell, which operates deepwater Blocks 1 and 4, adjacent to Equinor’s Block 2, previously sought to develop the LNG project in partnership with Equinor and Exxon Mobil.

Energy company Eni aims to start output of natural gas from its offshore Merakes project in Indonesia in 2021. Initial production at Merakes would be 155 mcf/d rising to a forecast peak output of 391 mcf/d. Eni said in April it had obtained approval for plans to pipe natural gas from Merakes to the Bontang LNG processing facility in East Kalimantan. The amendment would be first time a conventional cost-recovery production-sharing contract in Indonesia is converted to use the gross split scheme. Merakes project has an estimated 814 bcf of natural gas reserves and an economic lifetime of around nine years.

Gas production at the earthquake-prone Groningen field will drop by at least 75 percent in the next five years, ahead of schedule towards the projected end of extraction. The Dutch government decided this year to shut down in 2030 what was once Europe’s largest natural gas field because decades of extraction had caused dozens of earthquakes each year, damaging thousands of homes and buildings. Production will drop below 5 bcm/year from 2023, the Dutch government said, as measures to reduce demand for Groningen gas are working better than planned. Demand for Groningen gas will be reduced by building extra capacity to convert high-caloric foreign gas to the low-caloric gas needed for the Dutch network, and by cutting exports to Germany.

km: kilometre, CGD: city gas distribution, PNGRB: Petroleum and Natural Gas Regulatory Board, BPCL: Bharat Petroleum Corp Ltd, BG: British Gas, MGL: Mumbai Gas Ltd, IGL: Indraprastha Gas Ltd, CNG: compressed natural gas, MNGL: Maharashtra Natural Gas Ltd, mt: million tonnes, LNG: liquefied natural gas, US: United States, mtpa: million tonnes per annum, ONGC: Oil and Natural Gas Corp, OIL: Oil India Ltd, DSF: Discovered Small Field, bcm: billion cubic meters, mcm: million cubic meters, MoU: Memorandum of Understanding, mcf/d: million cubic feet per day, bcf: billion cubic feet, FSRU: Floating Storage and Regasification Unit, mmBtu: million metric British thermal units, CEGH: Central European Gas Hub

NATIONAL: OIL

Petrol, diesel prices dip further on New Year's eve

31 December. Fuel rates continued to decline on New Year's eve amid falling crude oil prices and appreciation in the rupee against the US (United States) currency. Petrol price was further reduced by 20 paise to its lowest level in 2018 while diesel rates were cut by 23 paise to a nine-month low. Petrol price in Delhi was cut to Rs 68.84 from Rs 69.04 per litre while diesel dipped to Rs 62.86 from Rs 63.09, according to notifications of state-owned oil firms. Petrol prices have been on a decline since October 18 except for one day. Diesel rates are at their lowest since March. In last 2 months, price of petrol rose just once, by 10 paise In all, petrol price has fallen by Rs 13.79 per litre since 18 October, more than negating all of the hike that was witnessed in the two-month period starting mid-August. Diesel prices have declined by Rs 12.06 per litre in two and half months. Petrol price had touched a record high of Rs 84 per litre in Delhi and Rs 91.34 in Mumbai on October 4. Diesel on that day had peaked to Rs 75.45 a litre in Delhi and Rs 80.10 in Mumbai. Prices had started to climb from 16 August. Between 16 August and 4 October, petrol price was hiked by Rs 6.86 per litre and diesel by Rs 6.73.

Source: The Economic Times

India’s diesel demand to double by 2029-30: Oil Minister

31 December. India's diesel demand is likely to double to 163 million tonne (MT) in 12 years as consumption rises in the world's fastest-growing economy, Oil Minister Dharmendra Pradhan said. He said as per the International Energy Agency's World Energy Outlook 2018, the country's oil demand is projected to jump by 61 percent to 350 million tonnes (mt) of oil equivalent by 2030, from 217 mt in 2016. India is the world's third-largest oil consumer. The country's compound annual growth rate (CAGR) of 3.47 percent in oil demand compares with 1.92 percent projected for China during the 2016-2030 period. During this period, the US (United States) and Japan are likely to witness a contraction of demand, while Russia may just manage a positive growth with consumption rising from 149 mt to 154 mt, he said. As per the report of a working group constituted by the oil ministry on enhancing refining capacity by 2040, the demand for petrol is likely to rise from 26.2 mt in 2017-18 to 49 mt in 2029-30, he said. For diesel, the demand is projected to grow from 81.1 mt in 2017-18 to 163 mt in 2029-30, he said. India saw oil consumption rise from 197.8 mt in 2015 to 217.1 mt in 2016 and 222.1 mt in 2017, he said. He said to meet the rising demand, the government has taken several steps to enhance exploration and production of oil and gas in the country. He said oil PSUs (Public Sector Undertakings) have identified land for a 60 mt integrated refinery-cum-petrochemical complex in Maharashtra.

Source: Business Standard

India exempts rupee payments for Iran oil from hefty taxes: Government order

31 December. India’s finance ministry has exempted rupee payments made to the National Iranian Oil Company (NIOC) for crude oil imports from a steep withholding tax, according to a government order. The exemption, put in place 28 December but backdated to 5 November, will allow Indian refiners to settle about $1.5 billion of outstanding payments to NIOC. Those have been building up since Tehran was put under stringent US (United States) sanctions in early November. The two countries on 2 November signed a bilateral agreement to settle oil trades through an Indian government-owned bank, UCO Bank, in the Indian currency, which is not freely traded on international markets. However, the income of a foreign company that is deposited in an Indian bank account is subject to a withholding tax of 40 percent plus other levies, leading to a total take by the authorities of 42.5 percent. That made the agreement unworkable for Iran and led to the freeze in payments by the refiners until the exemption could be introduced. Iran will be able to use the rupee funds for a range of expenses - including imports from India, the cost of its missions in the country, direct investment in Indian projects, and its financing of Iranian students in India, according to another government document. India, Iran’s top oil client after China, has turned to paying for Iranian oil in rupees as major banking channels dealing in global currencies are closed off by the US sanctions. The direct investment provision could help Iran in participating in Indian oil refiner Chennai Petroleum Corp Ltd’s expansion plans.

Source: Reuters

Tripura hikes VAT and cess on petroleum products to boost revenue

30 December. In the wake of gradual fall in prices of petrol and diesel in the last two months, the Tripura government has hiked VAT (Value Added Tax) and cess on petroleum products in the state to boost revenue, Deputy Chief Minister Jishnu Dev Varma, who is also in charge of finance, said. He said that VAT was slashed to give respite to people.

Source: The Economic Times

More than 1k BPL families get LPG connections over 2 yrs

29 December. Over 1,000 families falling BPL (Below Poverty Line) have been provided with LPG (liquefied petroleum gas) connections over the past two years under a central government scheme meant for women members of BPL households. The programme was availed by 745 families in North Goa and 277 in South Goa. A majority of the 1,054 BPL households to whom connections were provided are located in Pernem, Ponda, Dharbandora and Canacona, the Hindustan Petroleum Corp Ltd (HPCL) said. HPCL said 38% of beneficiaries who could not afford to make upfront payments for purchase of gas stoves and refills were provided loan facilities. Under the Pradhan Mantri Ujjwala Yojana, families have also been given the option of applying for 5 kilogram (kg) cylinders, especially those that cannot afford the standard 14.2 kg cylinders. In Goa, a majority of connections have been given to families included in the scheduled castes, scheduled tribes and Antyodaya Anna Yojana categories. The scheme was aimed at helping families switch to clean cooking fuels and reduce emissions of pollutants such as methane, black carbon and organic carbon that are released when food is cooked with firewood, agriculture waste, biomass and kerosene. However, the release of connections 1,054 between 2016 and 2018 under the scheme in Goa, when there are around five lakh LPG connections for a population of 15 lakh is low when compared to other states.

Source: The Economic Times

NATIONAL: GAS

RIL, BP get key ship on KG-D6 for expediting gas output

30 December. Reliance Industries Ltd (RIL) and its partner BP plc of the UK (United Kingdom) have brought a deepsea pipeline laying ship to their Bay of Bengal block KG-D6 to help bring newer gas finds to production by 2020-21, the British firm said. RIL-BP are targeting to bring to production the R-Series and satellite fields in KG-D6 block by 2020, just around the time KG-D6 block's currently producing Dhirubhai-1 and 3 (D1 and D3) fields cease to produce. These fields along with the ultra deep MJ find are to produce 30-35 million standard cubic metres per day of peak natural gas. McDermott's DLV2000 vessel will install deepsea pipelines to connect the R-Series and satellite cluster discoveries to production system. RIL is the operator of KG-D6 block with 60 percent interest while BP plc holds 30 percent stake. Niko Resources of Canada holds the remaining 10 percent. The D1 and D3 fields, the first of the one-and-a-half dozen gas discoveries in KG-D6 that were brought to production in April 2009, will cease to produce by end-2019 or early 2020. This shutdown will coincide with upgradation, modification, and preparation of facilities and operating system to connect new fields. The R-Series is likely to give first gas in mid-2020 while satellite and MJ field may begin output in 2021 and 2022.

Source: Business Standard

Mohali and Chandigarh to get more gas distribution stations

28 December. Chandigarh, Mohali to get fully-developed City Gas Distribution (CGD) stations networks. This was declared during the Petroleum and Natural Gas Regulatory Board (PNGRB) road show for promoting 10th city gas distribution (CGD) bidding round in Chandigarh. Mohali already has one such operational CGD and by 19 January, two more CGD will be made operational. Similarly, in Chandigarh one CGD is already operational and city will get one more by 10 February. Whereas by 19 March, the remaining CGD will be made functional in Mohali and Chandigarh. Petroleum and Natural Gas Regulatory Board (PNGRB) is the nodal agency for facilitating economic activities in natural gas distribution with the objective to promote competitive markets, create infrastructure and increase share of natural gas in country’s energy mix. PNGRB has so far concluded 9 CGD bidding rounds for selection of authorised entities for development of CGD networks in their geographical areas (GAs). The recently concluded ninth bidding round for 86 GA’s covering 174 districts in 21 states/ UTs was a huge success attracting interest from investors in all offered GAs. CGD authorisation has been given by PNGRB in 13 GAs in state of Haryana covering 16 districts namely Sonipat, Panipat, Yamunanagar, Rewari, Rohtak, Karnal, Ambala, Kurukshetra, Panchkula, Bhiwani, Charkhi Dadri, Mahendragarh, Hisar, Jind, Nuh and Palwal. In the 10th CGD bidding round, 2 GAs covering 3 districts of Sirsa, Fatehabad and Kaithal are being offered. It may be noted that a total of 4 GAs are on offer for both the state combined with Sirsa, Fatehabad (Haryana) and Mansa (Punjab) Districts grouped in 1 GA. After the 10th round, Punjab and Haryana and Chandigarh would be fully authorised for the development of CGD Networks.

Source: The Economic Times

IOC may drop plan to buy stake in Mundra LNG terminal

26 December. Indian Oil Corp (IOC) may drop its plan to acquire as much as 50% stake in the Mundra LNG terminal in Gujarat. In August 2017, IOC said it has received an in-principle approval from its board to buy a 50% stake in the 5 million tonnes per annum terminal (mtpa) for around ₹ 750 crore. The ₹ 5,000 crore project is being built by GSPC LNG Ltd, a unit of Gujarat State Petroleum Corp (GSPC). Currently, GSPC owns a 50% stake in the project, while Adani group holds 25%. Adani and GSPC were looking at inducting a strategic partner such as IOC. It is, however, not clear if IOC would still book LNG import capacity in the terminal. In October, Prime Minister Narendra Modi inaugurated the Mundra LNG terminal, the third LNG (liquefied natural gas) re-gasification project in Gujarat after Petronet LNG’s Dahej LNG terminal and the Hazira project of Shell Gas BV, a unit of Royal Dutch Shell Plc. The Mundra LNG terminal, whose capacity can be expanded to 10 mtpa, is designed to have a berth for receiving LNG tankers and storage tank facilities for regasification and gas evacuation. Gujarat already has a 15 mtpa import facility operated by Petronet LNG at Dahej and another 5 million tonnes terminal at Hazira that is run by Shell. Indian Oil has also acquired a 39% stake in the proposed 5 mtpa LNG import terminal at Dhamra, Odisha. Adani Group has a 50% stake in the project and the remaining 11% is with GAIL (India) Ltd.

Source: Livemint

NATIONAL: COAL

India’s coal production has grown 10 percent to 433 mt in current fiscal so far

31 December. India’s domestic coal production grew 9.8 percent to 433 million tonne (mt) in the first eight months (April to November 2018) of the current financial year as compared to 394 mt produced in the same period last fiscal. Coal India Ltd (CIL), which alone accounts for 82 percent of domestic output, reported production of 358 mt during the April-November 2018 period, an 8.8 percent increase over its production in the corresponding period last year, the coal ministry said. Thanks to the growth in production, the number of power plants with critical and super-critical coal stocks fell from 28 at the end of March 2018 to 23 at November end. However, the number of days of coal stocks left with the plants facing shortages has dropped from 10 in March to 8 currently.

Source: The Economic Times

CIL to supply 25 percent coal to non-power sector

31 December. Coal India Ltd (CIL) has decided to supply 25% of its planned production to the non-power sector, while the rest would be supplied to the 'high-priority' thermal power generators. The dry fuel supplier is expected to supply 680 million tonnes (mt) of coal during the current fiscal. Between January and March, it is scheduled to produce a minimum of 170 mt, 25% of this is about 42 mt. At present, anything between 85% and 90%, and in certain cases the entire production, is sent to power sector for days together. In the recent past, CIL subsidiaries had received directions from government and railways to load their entire production for certain period to the power sector when the sector was facing acute coal shortage due to higher power demand. Over the past 14-16 months, Indian Railways on instruction from CIL, allotted at least 5500 goods train (rakes) for supplying some 21 mt of coal to its non-power consumers, including captive power plants which was never loaded by the fuel supplier and allotted rakes remain pending. Minimum estimated value of this coal is around Rs 27 bn. Of late, CIL was forced to stop asking for additional rakes for these customers since it is not in a position to clear the entire backlog.

Source: The Economic Times

Illegal coal mining inseparable part of Meghalaya politics

31 December. The public furore over 15 labourers trapped inside a rat-hole mine in Meghalaya’s East Jaintia Hills district since 13 December has sharpened focus on illegal coal mining in the state despite a ban clamped by the National Green Tribunal (NGT) in 2014 which is said to have contributed to the Congress defeat in the recent assembly election. Political analysts said that the Congress suffered the ire of mine owners and workers following the NGT ban, although the government run by the party had appealed to the tribunal to withdraw its order. National People’s Party (NPP) promised voters that it would ensure that mining starts again in the state. The BJP (Bharatiya Janata Party) in its manifesto said that the party would resolve the contentious issue of coal mining within 180 days if it formed the government in the state. After coming to power, the six-party alliance government in Meghalaya led by NPP formed a group of ministers to study the status of the NGT ban on coal mining. The Supreme Court on 4 December allowed transportation of an estimated 176,655 tonnes of coal already extracted till 31 January. Meghalaya has 576 million tonnes of sub-bituminous coal spread across South Garo Hills, West Khasi Hills, East Garo Hills, Jaintia Hills and East Khasi Hills.

Source: The Economic Times

Coal allocation by CIL to power sector under e-auction drops 20 percent in April-November

30 December. Coal India Ltd (CIL) allocated 21.91 million tonnes (mt) of the dry fuel under special forward e-auction to the power sector in April-November 2018, registering a decline of 20.1 percent over the year-ago period. CIL had allocated 27.43 mt of coal in the April-November period of 2017-18, according to the latest monthly summary for the Cabinet by the coal ministry. Coal allocation dropped sharply by 51.7 percent on yearly basis to 1.53 mt in November. CIL had earlier said it would put on offer a little over 45 million tonnes of coal under the special forward auction in the current fiscal. With coal demand from the power sector exceeding supply in 2018, the government had recently said it was hopeful of higher output in the new year from already allocated mines and it plans to further allot 10 mines to state-owned behemoth CIL in 2019. Of the 85 mines already allotted, 23 have started production and the coal ministry expects 20 more mines to begin production in the current financial year ending March 2019 or early in the next fiscal.

Source: Business Standard

WCL to augment coal despatches from mines

29 December. In order to give a boost to coal despatches for its consumers, Western Coalfields Ltd (WCL) will be augmenting and maximising coal despatches from WCL mines through rail, road and other modes. WCL will be leveraging the "RailCoal Synergy" by observing RailCoal Week from 1-7 January 2019, it said. The Rail-Coal Week is being organised for the first time in any subsidiary of Coal India Ltd. It will help increase coal stocks in different linked power houses of WCL. It said that major portion of railway rakes of WCL is despatched through Central Railway followed by South East Central Railway and South Central Railway. WCL has been given a target to dispatch 28-29 rakes per day which is already being achieved. Now, the company is aiming to despatch 32 rakes and more, in a synergy by joining hands with three railway zones, it said. During Coal Dispatch Fortnight, the company has made a plan to increase despatches from the current rate of 1.70 lakh tonnes per day to over 2.0 lakh tonnes per day. WCL supplies coal to state power houses in Maharashtra, Madhya Pradesh, Gujrat, Karnatka, Haryana and to other private power producers through fuel supply agreement (FSA), linkages and auctions.

Source: Business Standard

Odisha CM slams centre over the issue of coal royalty

26 December. Slamming the Centre over the issue of coal royalty, Odisha Chief Minister (CM) Naveen Patnaik said there has been no revision in coal royalty. Mahandi Coalfields Ltd (MCL) is making a profit of Rs 200 bn but Odisha is getting "pollution," he said. Though it was highly publicised that Odisha would gain over Rs 700 bn from coal mine auction, the entire campaign turned out to be hollow as the state got only Rs 3.70 bn from the process, he said.

Source: The Economic Times

NATIONAL: POWER

4 days before deadline, Maharashtra achieves 100 percent electrification

1 January. With the last of the nearly 11 lakh households without electricity in the latest census getting power supply, Maharashtra has achieved 100% electrification, the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) said. The Maharashtra government had set itself a deadline of 31 December 2018 for 100% electrification under the Centre’s Saubhagya Yojna, launched in September 2017. MSEDCL supplies electricity to 1.25 crore agriculture, industrial and commercial consumers. Households from the economically weaker section were given free connections while others were charged Rs 500. The Rs 500 will be recovered in ten instalments in electricity bills of the consumers. Under the scheme, the highest number of connections (1.5 lakh) were provided in Pune district. The MSEDCL had a major achievement in February when it provided electricity supply to Gharapuri island (Elephanta) — which received supply for the first time since independence.

Source: The Economic Times

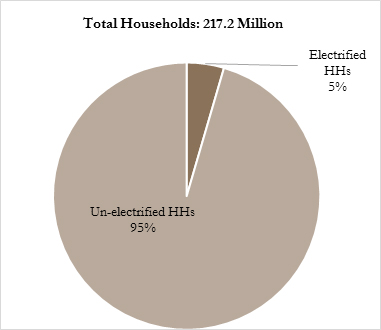

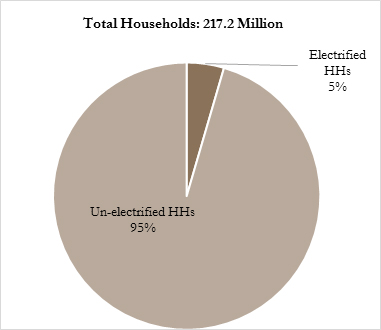

PM Modi misses power goal with 1 mn homes still in the dark

1 January. Indian Prime Minister Narendra Modi’s government missed a self-imposed target to electrify every home, delaying the success of a marquee $2.3 billion development goal that his party plans to showcase before national elections early this year. After bringing electricity connections to 23.9 million households across 25 states, about 1.05 million homes in four states still lack power, the government’s Press Information Bureau said, the year-end deadline. Power Minister R K Singh reaffirmed as recently as late November that the government would meet its 31 December target, which had earlier been moved up by three months. Achieving full energy access has been one of Modi’s key reforms amid his outreach to rural communities, where his Bharatiya Janata Party (BJP) has been challenged by dissatisfaction and joblessness. Electrification success would be a political boon for Modi and the BJP as they face national elections in the coming months. The central government has set several milestones for its rural electrification plan since Modi came to power in 2014 -- bringing connections to all villages by May 1, then to all homes by the end 2018. After full electrification is achieved, the next goal will be to ensure reliable uninterrupted supplies by 31 March. Modi’s government in September 2017 set out to electrify nearly 40 million homes, a target that has been shrinking and shifting along the way. The deadline was brought forward from its original 31 March. The government said the states of Assam, Rajasthan, Meghalaya and Chhattisgarh are still to be electrified, made no mention of the 31 December target. It also mentioned that the state of Uttar Pradesh started a campaign to identify any “left out” households and provide electricity connections.

Source: Bloomberg

100 percent household electrification to be achieved ahead of Republic Day

31 December. The government is likely to achieve its 100 percent household electrification target in the country ahead of Republic Day as it has already energised 23.9 mn out of the targeted 24.9 mn households under Rs 163.20 bn Saubhagya scheme. However, the State Power Ministers meet chaired by Power Minister R K Singh in Shimla in July 2018, had resolved to complete the task of energising all households in the country by 31 December 2018, against the deadline of 31 March 2019. The power ministry said India has achieved yet another milestone in the power sector with completion of electrification in hundred percent households in 25 states at the year-end. It said that only about 10.48 lakh households are left to be electrified in 4 states like Assam, Rajasthan, Meghalaya and Chhattisgarh. These states are also taking all concerted efforts to achieve, at the earliest, saturation of household electrification in their respective states. On this occasion Power Minister R K Singh took note of volume of electrification work that was completed in Uttar Pradesh and lauded its efforts in a meeting with its Energy Minister Shrikant Sharma. Since the launch of Saubhagya in Uttar Pradesh, 74.4 lakh households have been electrified and the state has declared saturation of all 75 districts. The government of Uttar Pradesh has launched a special campaign in all parts of the state to identify any left out un-electrified households and to provide electricity connections to such households. Under the campaign, a special vehicle 'Saubhagya Rath', is moving around in villages/towns and any left out households may approach them to avail electricity connection under the scheme. Any left out household requiring electricity connection may dial 1912 to avail the facility. The Centre had launched Saubhagya scheme in September, 2017, to achieve the goal of universal household electrification in the country by 31 March 2019. The scheme envisages to provide last mile connectivity and electricity connections to all remaining households in rural as well as urban areas.

Source: Business Standard

Bihar CM inaugurates Rs 541.9 mn grid station in Nawada

30 December. Bihar Chief Minister (CM) Nitish Kumar inaugurated a 132/33 kV (kilovolt) Grid sub-station at Warsaliganj and a transmission line in Nawada district. The 132/33 kV grid at Warsaliganj, which has been built by Bihar State Power Transmission Company Ltd at a cost of Rs 541.9 mn, and related transmission line would ensure better and quality power supply in the district. Kumar inspected switch gear room and control and relay room after inaugurating the grid. Energy department principal secretary Pratyaya Amrit informed the CM about the benefits of the grid sub-station and also the status of other Grids especially which are under construction in the state. Amrit informed the CM that the voltage has improved with the inauguration of Warsaliganj Grid and it would also sort out the problem of low voltage in adjoining areas. There were 45 grid sub-stations in the year 2005, the year when Kumar took over the reins (in November 2005), which has increased to 142 at present, Amrit said. The number of grids will increase to 170 by 2022. The CM, who later inspected a transformer installed for irrigation purpose at Puraini village in Pahlauwa panchayat under Giriyak block, was informed about the power supply being made from the transformer for irrigation purpose only. Kumar distributed papers among farmers for power connection for agriculture purpose. Kumar inspected an 'exhibition' put up by various departments at Wasaliganj Grid Sub-Station premises.

Source: Business Standard

Gujarat asks CERC to raise Adani plant tariff

29 December. The Gujarat state electricity board has approached the Central Electricity Regulatory Commission (CERC), seeking its approval to amend the terms of the power purchase agreement (PPA) for 2,000 MW signed with Adani Power for procuring electricity from the company’s imported coal-based plant in Mundra. The development comes after the Supreme Court extended a lifeline to the three troubled imported coal-based power plants of Tata, Adani and Essar in Gujarat by allowing the CERC to facilitate pass-through of future fuel price escalation, as per the recommendations of a high-level committee. The Gujarat government had constituted the committee in July this year to assess if the power plants could be revived through appropriate financial and contractual restructuring. The power regulator has asked Adani Power and Gujarat Urja Vikas Nigam to address them by 14 January 2019. Adani Power had signed two PPAs with Gujarat (1,000 MW each) in 2007 at Rs 2.89/unit and Rs 2.35/unit. Gujarat’s average power purchase price is Rs 3.49/unit. Analysts have noted that if the CERC approves the high-level committee recommendations, Adani Power’s tariff would rise by Rs 0.80/unit.

Source: The Financial Express

Industrial demand for power rises, but discoms continue to struggle

28 December. The aim of the power sector in 2018 was electrification of all villages in the country. And, 19,000 villages were electrified in a record two years in the last stage. Saubhagya, the ambitious project of electrifying 23 million houses, has completed 99 percent of its target. But the problems of power distribution companies (discoms) continue. The Aggregate Technical and Commercial (AT&C) losses — an indicator of operational performance – of many large states remains high, and way behind the target of 15 percent. With industrial demand for power improving, connecting more households will only increase demand further. So, coal supply has to improve to meet the demand.

Source: Reuters

Government eases power exports to neighbouring nations

27 December. The government has removed restrictive riders which discouraged neighbouring countries to buy power from India’s spot power markets. It barred plants with Coal India Ltd (CIL) fuel linkage or captive mines from selling power outside India, a move that could help imported coal-based units in the private sector to have a larger pie of the markets in neighbouring countries. The 2016 guidelines allowed cross border trade only through the ‘term ahead’ market and did not allow trading in the more attractive ‘day-ahead’ market. The latest guidelines for cross-border electricity trade issued by the power ministry, have removed such conditions. However, foreign entities would be required to participate in power exchanges only through Indian power trading entities. Independent power producers had asked the power ministry to clarify if fuel sourced from CIL linkage or captive mines can be used to export power. The clarity was sought after NTPC Vidyut Vyapar Nigam (NVVN), a wholly owned arm of NTPC Ltd, had emerged as the successful bidder in the auction for power supply to Bangladesh. The Association of Power Producers had said that exporting power using domestic coal would be “hampering domestic consumer interest”. NVVN had won contracts for supply of 300 MW power to Bangladesh till May 2033 from power stations of the DVC. As much as 7,203 million units were supplied to Nepal, Bangladesh and Myanmar in FY18. Bangladesh is the largest buyer of Indian power. Adani Power has signed a 25-year power purchase agreement with the Bangladesh Power Development Board (BPDB) to supply a net capacity of 1,496 MW to the neighbouring country from the firm’s upcoming 1,600 MW imported coal-based plant in Godda, Jharkhand. Sembcorp Gayatri Power, which runs a 1,320 MW imported coal-based power plant in Andhra Pradesh, had received letters of intent from the BPDB to supply 250 MW to the neighbouring nation for 15 years.

Source: The Financial Express

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Tamil Nadu wind power companies get jolt as tariff plummets

1 January. Tamil Nadu wind power developers are an aggrieved lot with the tariff falling below all expectations. The latest tariff of 2.65 per unit is the lowest and wind companies have appealed against the tariff in Appellate Tribunal for Electricity stating that present tariff is too low and Tamil Nadu Electricity Regulator Commission (TNERC) has not taken into consideration the total cost for setting up a wind power tower. The TNERC set a feed in tariff for wind power of Rs 2.80 per unit with depreciation benefit and Rs 2.86 per unit without it. Subsequently, it also approved a proposal by TANGEDCO (Tamil Nadu Generation and Distribution Corp), to conduct a wind auction of 1,500 MW at a ceiling price at Rs 2.65 per unit. The Indian Wind Turbine Manufacturers Association (IWTMA) has petitioned the Appellate Tribunal for Electricity (APTEL) that TNERC’s feed in tariff was low as it has grossly underestimated several of the costs incurred in setting up wind projects, and that its decision to allow TANGEDCO to set an even lower tariff was worse still for developers. The investments in wind power will increase the tax revenue for the state government. But on the flip side, the cost of setting up a wind power tower is increasing and it is only due to that we have approached APTEL. The tariff is not covering our cost, he said.

Source: The Economic Times

SECI invites bids for 2,400 MW renewable energy generation plants

1 January. Solar Energy Corp of India (SECI) has invited renewal energy companies to put forward bids for setting up wind and solar plants of 1,200 MW each. The FY19 renewable capacity addition target had been set at 15,600 MW, comprising 10,000 MW and 4,000 MW of wind and solar, respectively. About 11,778 MW of renewable power was added in FY18, failing to achieve the target of 14,500 MW. To promote inter-state sale of renewable power, the government has waived off the inter-state transmission charges and losses for wind and solar projects to be commissioned by March 2022. The country has set the target of achieving 175 GW of renewable capacity by 2022. This is the sixth tranche of competitive bidding for wind power held by SECI. The capacity of wind power projects offered in the previous tranche of competitive bidding was slashed to 1,200 MW in August from the original proposal of 2,500 MW. Inadequate transmission infrastructure in wind-rich states of Gujarat and Tamil Nadu has been cited as the tepid response to wind tenders. SECI had also cancelled 2,400 MW bids from the 3,000 MW solar auctions held in July. Solar and wind power developers had also displayed a muted response to SECI’s bid to set up 1,200 MW of wind-solar hybrid plants, with only two firms putting forward their bids, offering 1,050 MW in total. The capacity offered under this tender was also cut down to 1,200 MW from the original proposition of 2,500 MW. The invitation for 10,000 MW manufacturing-linked solar tender had got bids for only 2,000 MW.

Source: The Financial Express

BHEL bags Rs 3,500 crore order for setting up West Bengal thermal unit

31 December. BHEL (Bharat Heavy Electricals Ltd) said it has bagged an order worth Rs 3,500 crore for setting up a 660 MW supercritical thermal power plant in West Bengal. The order by West Bengal Power Development Corp (WBPDCL) entails setting up a 660 MW Sagardighi Thermal Power Project at Manigram village in Murshidabad district of West Bengal, BHEL said. The BHEL has so far contributed over 80 percent of the total coal-based generating capacity of WBPDCL. BHEL is a leading manufacturer of power generation equipment with an installed base of over 1,83,000 MW of power plant equipment globally.

Source: Business Standard

PSPCL eyes Rs 2.6 bn in profits with revival of Jalkheri biomass-based power plant

31 December. The reverse auctioning biding for the revival of the Jalkheri biomass-based power plant of 10 MW capacity, the tenders of which were recently floated by the Punjab State Power Corp Ltd (PSPCL), has enabled the powercom to eye a Rs 260 crore in profits over the next 20 years. Efforts to revive the Jalkheri power plant, which was shut down in September 2007, had been recently conceived by the power corporation for which it had been decided to revive the plant on renovate, operate and transfer (ROT) basis for a period of 20 years. The technical bid of tender to lease out the plant was opened on 22 November 2018, in which three firms have participated. During the reverse auction, a tariff rate of Rs 5.84 per unit was quoted by one of the participant bidders. While, according to the 9 September 2018 order, the Punjab State Electricity Regulatory Commission has fixed the per unit tariff for biomass-based power plants between Rs 8.25 to 8.36 per that are tendered by Punjab Energy Development Authority.

Source: The Economic Times

PM Modi's green hamper to wean Andamans off diesel, provide 24X7 power

31 December. PM (Prime Minister) Narendra Modi unveiled a hamper of green initiatives for improving quality of life and preserving the pristine air quality in the Andaman & Nicobar Islands, known for its beaches, world-class diving and isolated location. The PM laid the foundation stone at Hope Town for a Rs 3.88 bn gas-based power plant to be built at Ferrarganj tehsil by NTPC Vidyut Vyapar Nigam, a fully-owned subsidiary of NTPC Ltd. With 24X7 power in sight, the PM ushered in e-mobility for greening public transport in the islands by flagging off 20 electric vehicles. He also distributed solar induction cook stoves at Chouldari village, introducing 99 tsunami shelter homes to a clean, comfortable and easy cooking option. The power plant will be ready in 18 months to energise Port Blair and South Andaman. The Andamans burn tonnes of diesel to generate costly power and run public transport. The new power plant will rid the tourist hot spot of polluting diesel generators, reduce cost of power and ensure reliable supply to boost economic activity. The government estimates solar induction stoves scheme to save around 1.2 lakh units of energy, leading to annual savings of Rs 22 lakh. It will reduce kerosene use by 13,800 litres or consumption of 700 LPG cylinders per year, curtailing CO2 (carbon dioxide) emission by 124,300 kilogram (kg).

Source: The Economic Times

'15k tonnes of uranium needed to achieve supply security of fuel for nuclear plants'

30 December. A stockpile of 15,000 tonnes of uranium is required for achieving supply security of fuel for nuclear plants in the country, the Department of Atomic Energy (DAE), which manages atomic energy installations, has told a parliamentary panel. Currently, a major portion of domestic production of uranium comes from the Jaduguda mines of Jharkhand, which are "old" and the ore is found at "great depths." Moreover, the high extraction cost makes it "unviable" as compared to imported uranium, the panel noted. Besides the Jaduguda mines, the uranium is extracted from the Tummalapalle mines in Andhra Pradesh. Apart from Jaduguda, uranium reserves are available in Meghalaya, Andhra Pradesh, Rajasthan, Haryana, Karnataka and Tamil Nadu. India has 22 nuclear power reactors and domestic uranium is used in nuclear plants which are not under the international nuclear energy watchdog, International Atomic Energy Agency (IAEA). India currently imports uranium from Kazakhstan, Canada and Russia. The government plans to build a Strategic Uranium Reserve to ensure that there is no shortage of uranium for its power reactors.

Source: Business Standard

Lucknow University solar push to pare power bills by Rs 10 mn

30 December. Lucknow University will now be saving around Rs 10 mn in electricity bills after the installation of solar panels on its campus for generating power. The university has installed solar panels collectively generating 1 MW of power in 18 buildings on its campus. The solar plant will generate 3,900 units of electricity every day and 14.5 lakh units in a year. Lucknow University annually pays an electricity bill of Rs 80 mn but by switching to solar power it will have to pay around Rs 10 mn less.

Source: The Economic Times

Solar industry demands uniform GST rate of 5 percent

30 December. The Solar Power Developer Association (SPDA) has demanded the GST (Goods and Services Tax) rate be kept uniform at 5 percent on solar power generating system (SPGS) saying recent recommendations of the GST Council are inconsistent with the government's policy of promoting clean energy. The total incidence of tax on the SPGS would increase to 8.9 percent with implementation of the GST Council recommendations finalised on 22 December 2018, which would be effective from 1 January 2019. The government has set a target of 175 GW of renewable power by 2022 which includes 100 GW of solar power. It said that the GST Council recommendations shall lead to increase in cost of electricity not only for future projects but also for many operating plants wherein the power purchase agreement executed between discoms (distribution companies) and solar developers provides pass-through on the GST implication.

Source: Business Standard

India on track to meet its Paris pledges despite growing emission

29 December. India continues to grow its carbon footprints with energy sector being the largest contributor, shows the country’s latest emission inventory of greenhouse gases (GHG) which is part of its second ‘Biennial Update Report’ to the UN climate body. The second BUR, whose submission was approved by the Union cabinet, shows that India had emitted 2.607 billion tonnes of CO2 (carbon dioxide) equivalent of GHG in 2014 when its energy sector polluted the most (73% of total emission) followed by agriculture (16%), industries (8%) and waste (3%). India had submitted its first BUR to the United Nations Framework Convention on Climate Change (UNFCCC) in January 2016. It had contained the national GHG inventory of the country for the year 2010 when India had emitted 2.136 billion tonnes of CO2 equivalent of the GHG. The submission of BUR is a requirement towards fulfilment of the reporting obligation of the country’s emission inventory under the Convention. Currently, India’s annual emission is one-fourth of China’s emission and half of what the US (United States) emits. Similarly, India’s share in cumulative historical global emission is merely about 3% of the world total where the US figured at the top. As per India’s second BUR, about 12% of the country’s emission were offset by the carbon sink action of forests, crop land and settlements.

Source: The Economic Times

MSEDCL to set up 1 GW floating solar plant

29 December. Maharashtra Energy Minister Chandrashekhar Bawankule is going ahead with his green energy mission full steam. After tying up for 1,000 MW solar power at lowest rate in the country, he has asked MSEDCL (Maharashtra State Electricity Distribution Company Ltd) to set up a 1,000 MW floating solar plant in Ujani dam (district Solapur) on built own operate transfer (BOOT) basis. The distribution company has floated tenders for developing this plant through a private partner. The company has finalized ten locations in the dam where panels having total capacity of 100 MW would be installed. Floating solar plants in the country are a rarity. MAHAGENCO (Maharashtra State Power Generation Company) had planned to set up a floating solar plant in its Irai dam (district Chandrapur). However, the consultant appointed by it found the proposal to be costly and the company dropped the project. However, Maharashtra Energy Development Agency (MEDA) is developing a 270 kW (kilowatt) floating plant in Wadgaon dam (district Nagpur). MSEDCL said that it would sign a power purchase agreement (PPA) with the developer for buying power for 25 years. Bawankule has set a target of installing 7,500 MW solar power plants in the state. Of this 2,500 MW will be developed by MAHAGENCO with private help and remaining will be set up by other agencies including MSEDCL. Maharashtra Electricity Regulatory Commission (MERC) had cleared the proposal on 18 December and the tender was floated on 24 December. The bids will be opened on 29 January.

Source: The Economic Times

India received $3.2 bn FDI in renewable energy sector over past 3 yrs

28 December. India received Foreign Direct Investment (FDI) worth $3,217 million in the renewable energy sector during the past over three years between April 2015 and June 2018. The year-wise inflows rose from $776 million in 2015-16 to $783 million in 2016-17 and further to $1,204 million in 2017-18, according to fresh data from the FDI cell of the Department of Industrial Policy and Promotion (DIPP), an arm of the commerce ministry. In the first three months of the current financial year (2018-19), Rs 4.52 bn of FDI had already flown in, Power Minister R K Singh said. He said the total renewable energy generation in the country between April and November 2018 stood at 81 billion units. He informed India had the world’s fourth largest base of renewable energy generation capacity at the end of 2017.

Source: The Economic Times

China only undertaking run-of the-river hydropower projects on Brahmaputra: Government

28 December. India has consistently conveyed its concerns over the Brahmaputra river to China and urged the country to ensure that interests of downstream states are not harmed by any activities in the upstream areas, the government informed the Lok Sabha. Minister of State for Water Resources and River Development Arjun Ram Meghwal said the Chinese side has conveyed to India on several occasions that they are only undertaking run-of the-river hydropower projects, which do not involve diversion of water of the Brahmaputra. Various issues relating to trans-border rivers, including construction of hydropower dams, are discussed with China under the ambit of an institutionalised expert level mechanism which was established in 2006, he said.

Source: The Economic Times

INTERNATIONAL: OIL

Global crude oil prices post first year of losses since 2015

1 January. Oil prices ended with full-year losses for the first time since 2015, after a desultory fourth quarter that saw buyers flee the market over growing worries about a supply glut and mixed signals related to renewed US (United States) sanctions on Iran. For the year, US West Texas Intermediate crude futures slumped nearly 25 percent, while Brent tumbled more than 19.5 percent. The market had been on track for solid gains for the year until October, when the US granted larger-than-expected waivers to importers of Iran's oil, and as demand in emerging economies started to sag. That combination dragged down both benchmarks from four-year highs above $76 a barrel and $86 a barrel, respectively, and even a late-year decision by the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia, known collectively as OPEC+, to ratchet down output was not enough to restore bullish sentiment. Oil prices fell more than a third this quarter, the steepest quarterly decline since the fourth quarter of 2014. Analysts have turned bearish on 2019, according to a poll. A survey of 32 economists and analysts forecast an average Brent price of $69.13 next year, more than $5 below analyst projections a month ago, and compared with an average real price of $71.76 in 2018. Brent, the global benchmark, rose by almost a third between January and October, to a high of $86.74. That was the highest level since late 2014, the start of a deep market slump amid bulging global oversupply. OPEC+ opened its taps in autumn as demand reduced global inventories, then reversed course as priced tumbled. U.S. drillers added about 138 oil rigs in 2018, the second year in a row of boosting the rig count. But North American producers will likely begin to reduce spending on drilling in 2019 as prices fall below break-even levels for new wells in the Permian Basin and the Eagle Ford shale field in Texas, analysts said. Still, prices could stagnate for weeks until OPEC's cuts begin to affect global supplies in mid-January and early February.

Source: The Economic Times

US October crude oil production sets record high: EIA

31 December. US (United States) crude oil output hit an all-time high of more than 11.5 million barrels per day (bpd) in October, according to government data. Crude production rose 79,000 bpd in October to 11.537 million bpd, the US Energy Information Administration said. The EIA revised its September oil production figure down by 17,000 bpd to 11.458 million bpd. US oil production broke its 1970 record of 10.04 million bpd in November 2017, and has set monthly record highs for five straight months since June. The US has become the world’s leading crude producer, surpassing Russia and Saudi Arabia. Production rose to 4.7 million bpd in Texas, 1.37 million bpd in North Dakota and 772,000 bpd in New Mexico. Output in the offshore Gulf of Mexico fell to 1.74 million bpd.

Source: Reuters

Libyan oil revenue dips to $2.4 bn in November: NOC

28 December. Libya’s oil and gas revenue dipped to $2.4 billion in November from $2.87 billion in October, but full-year revenue is expected to surge by 76 percent to $24.2 billion, state oil firm NOC said. Although lower than the previous month, November revenue was the third highest monthly figure in 2018, NOC said. Despite recurrent security problems that have affected output from Libyan oilfields, NOC’s revenue has been boosted by higher oil prices and production. Libya currently produces about 1.15 million barrels per day of oil. NOC and the internationally recognized government agreed on a security plan to protect the 315,000 barrel per day El Sharara field including setting up green zones inside the site to stop anyone entering without a permit and removing all unauthorized people.

Source: Reuters

New Mexico oil producers brace for tighter regulation as output jumps

28 December. Crude oil output has more than doubled in New Mexico over the last four years, making it the No. 3 producer among US (United States) states, but a January change in state leadership to Democratic control has industry executives fearing tougher regulations are coming. New Mexico’s oil output has more than doubled to 712,000 barrels per day (bpd) in the last four years. The state accounts for about one-fifth of the production of the giant Permian Basin, the country’s largest oilfield, which produces more than 3.7 million bpd, according to US Energy Department figures.

Source: Reuters

Iraq's Kirkuk oil exports to stay restricted

26 December. Exports from Iraq’s northern Kirkuk oilfields to the Turkish port of Ceyhan will stay at between 80-90,000 barrels per day (bpd) as most of the crude produced is being diverted to feed refineries in the north, Iraq’s Oil Minister Thamer Ghadhban said. Current production at the Kirkuk oilfields stands at around 370,000 bpd, the head of Iraq’s North Oil Company, Farid al-Jadir, said. Jadir said a BP technical team was now operating in Kirkuk and would prepare a study reviewing plans for increasing production by the end of 2019.

Source: Reuters

INTERNATIONAL: GAS

Brazil unit of Royal Dutch Shell, YPFB sign natural gas supply pact