CHANGE IN CHINA’S RENEWABLE SUBSIDY POLICY EXPECTED TO BE POSITIVE FOR INDIA

Non-Fossil Fuels News Commentary: May – June 2018

India

India may be the biggest beneficiary of solar industry reforms in China that are poised to reduce prices for photovoltaic panels. China announced it was halting approvals of some new solar projects this year and cutting subsidies to developers to ease its pace of expansion. That’s expected to slow demand in the world’s biggest market, weakening prices, and force the country’s manufacturers to ship more panels overseas. Tariffs in India’s next solar auction scheduled for mid-June may fall below the ₹ 2.44/kWh record set May 17 last year, Solar Energy Corp of India said. India is seeking to boost its clean energy generation as India has pledged to double India’s renewable power capacity to 175 GW by 2022, a target second only to China, as part of his plan to spearhead global efforts to combat climate change. India’s maximum annual solar-cell manufacturing capacity is about 3 GW while average yearly demand is 20 GW, meaning the remainder needs to be procured on the international market, according to India’s Ministry of New & Renewable Energy.

But China’s decision to scale down its solar energy targets and subsidies will deliver another blow to Indian manufacturers who are already facing an onslaught of cheap imports from the neighbouring country. Domestic manufacturers say they are already rattled by the ripple effects of further dumping by the Chinese manufacturers in India, once their internal demand is met. The module prices in India are likely to come down by up to 25%, industry experts say, which would render the equipment manufacturers in India uncompetitive. Indian Solar Manufacturers’ Association last year filed a safeguards petition to probe the solar imports from China and Malaysia. Some experts suggested that this may amount to welcoming dumping of Chinese solar panels in India.

Madhya Pradesh is implementing 26 MWp rooftop solar programme via RESCO mode. The projects are being implemented largely in the government buildings using the subsidy of Central and state governments, MPUVNL said. Under the RESCO model, the project developer invests, builds and operates the rooftop solar project using its own funds and/or taking debt to generate electricity and sell it to the beneficiary. This programme is in line with India’s ambitious target to achieve 40 GW of solar rooftop installation by 2022. MPUVNL said the second pre-bid meeting for this tender will be held in New Delhi on June 22. RESCOs from across the country are expected to participate in this meeting. Bids for the tender are to be submitted by July 9, 2018. Under the provisions of the tender, the rooftop projects are targeted for commissioning within 9 months from the date of execution of power purchase agreement with the beneficiary procurers.

Each government house of the city having an area of 1 kanal and above will have to shell out ₹ 250 per month for 1 kilowatt solar plant. Punjab governor and UT administrator has approved the rate. The administration has decided to install at least two kilowatts solar power plant in each government house, so that it could be viable for residents to generate power. Around 350 to 400 government houses are located in 11 sectors of the city and all have ample space on their rooftops to install solar panels. All houses have an area of 1 to 6.5 kanals. According to renewable energy department, two kilowatts solar panel would generate between 200 to 250 units of power on a monthly basis. As per initial estimates, this will reduce the power bill by ₹ 1,000 to ₹ 1,200. The UT has again re-advertised the tender after making some changes in the rates and given 21 days’ time for interested parties to participate. The administration has planned make all government houses having an area of 1 kanal and above a solar energy-friendly house.

In a bid to reduce evaporation of reservoir water and increase sourcing of solar power, Tamil Nadu is looking at the feasibility of setting up a floating solar power. Experts said that that all governments are under pressure to adopt the canal top model to signal success of the model that originated in Gujarat when the current PM was heading the Gujarat government. Tamil Nadu Generation and Distribution Corp and another company will study the feasibility of setting up 250 MW floating solar power plant at an outlay of ₹ 11.25 billion. The government will come out with a new Energy Policy that is favourable to the central government’s policies. The state’s Solar Power Policy will be aligned with the Vision Tamil Nadu 2023 document that has set a target of 8,884 MW of solar power capacity by 2023.

President Ram Nath Kovind launched the Solar Charkha Mission on June 27, which will entail a subsidy of ₹ 5.5 billion in the initial two years for 50 clusters. The scheme also aims at linking 50 billion women across the country to the initiative.

Amazon India has launched a new initiative to generate clean energy through installation of solar panels on the rooftops of its fulfilment centres and sortation sites in India. The company said it has already installed close to 1600 kilowatt of solar power panels at its two fulfilment centres in Delhi and Hyderabad. Amazon plans to further deploy large-scale solar panel systems on rooftops of an additional five fulfilment centres and two sortation sites located in Bengaluru, Mumbai and Chennai while further expanding existing capacity in Delhi. With this deployment, by the end of 2018, Amazon India will be able to generate solar energy close to 8,000 kilowatt, the company said. Installations at these fulfilment and sort centres would cover an area of approximately 1 million square feet, reduce CO2 emission by around 9000 tons a year and provide energy to support the building’s annual energy needs. Amazon has also has set up solar energy systems in four Amazon Cares Community and Resource Centres in Haryana, which provide solar power to support the community programs in these centres all year round. The company has also donated solar energy systems to 19 government schools and 1 mini-planetarium in Bhiwandi, Maharashtra.

Infosys, India’s second largest software services firm, saw over 43 percent of its electricity requirements being met through renewable energy sources during 2017-18. As per Infosys’ 11th Annual Sustainability Report, 43.7 percent of the company’s electricity requirements — equating to more than 100 million units — is sourced from renewable sources. The company has an installed capacity of 46.1 MW of solar energy across the country, it said. The company said that it is in the process of adding another 12 MW off-site solar power plant in Karnataka and around 7 MW of on-site solar plants in Hyderabad, Bengaluru, Mangaluru, Mysuru, Thiruvananthapuram and Chandigarh campuses.

Solar installations in India increased by 34 percent to 3,269 MW in the Q1 of 2018 compared with the fourth quarter of 2017, according to Mercom Communications. Mercom Communications said that the surge in installations in first quarter of ongoing calendar year was primarily on account of completion of projects which were scheduled for commissioning the previous quarter, but had experienced delays due to grid connection issues. This was the first quarter of over 3 GW installed in the Indian solar market and the fifth quarter in a row where at least 2 GW of solar installations. The cumulative solar installed capacity totalled 22.8 GW at the end of Q1 2018.

India added 269.64 MW of renewable energy capacity last month taking the total grid connected clean energy capacity to 70,053.81 MW as on April 30, according to the MNRE report. According to the report, India added 34,165 MW of wind energy, 21,885.1 MW solar energy including rooftop solar, 4,489.80 MW small hydro (of up to 25 MW) and 8,700.80 MW Biomass (Bagasse) Cogeneration as on April 30. The nation also witnessed 674.81 MW of Biomass (non-bagasse) Cogeneration)/Captive Power and 138.30 Waste to Power till April 30. India also installed off grid clean energy of 40 MW in April taking the total installed capacity in this segment to 1046.93 MW at April end this year. Under the grid connected renewable capacity, India did not add any capacity of Waste to Power and Biomass (Bagasse) Cogeneration. Similarly, under the off grid clean energy capacity, nothing was added in waste to energy and biomass gasifiers segment. However as much as 40 MW of solar photovoltaic capacity was added in April this year. India has set and ambitious target of having 175 GW of renewable energy capacity including 100 GW of solar and 60 GW of wind energy by 2022.

India’s renewable energy sector attracted investments of over $42 billion over the past four years and green energy projects have created over 10 million man-days of employment per annum over the period. These figures are part of the list of 4-years achievements of the MNRE. It said that 100 percent foreign investment as equity qualifies for automatic approval and the government is also encouraging foreign Investors to set up renewable energy-based power generation projects on build-own-operate basis. The ministry said the country’s renewable power installed capacity has already reached over 70 GW and over 40 GW of renewable capacity is under construction or has been tendered. MNRE also said that trajectories for bidding 115 GW renewable power projects up to March 2020 have been announced and the country is well on track to achieving 175 GW target of installed renewable energy capacity and trends suggest that the target will not only be achieved but exceeded. Among the other key achievements listed by the ministry are reduction in solar and wind power tariffs to historic lows through transparent tariff based competitive bidding, waiver on inter-state transmission charges, notifying Renewable Purchase Obligation trajectory up to 2019 and notifying a new wind-solar hybrid policy.

The MNRE announced medium and long-term offshore wind energy target of 5 GW by 2022 and 30 GW by 2030, respectively, to provide confidence to the industry. The MNRE recently invited Expressions of Interest for the first 1 GW offshore wind project in India, which has evoked a keen response from the industry, both global and Indian, the MNRE said. In order to give confidence to the wind industry, the ministry has declared medium and long-term target for offshore wind power capacity additions, which are 5 GW by 2022 and 30 GW by 2030, the MNRE said. While this may look moderate in comparison to India’s on-shore wind target of 60 GW and its achievement of 34 GW, and solar target of 100 GW by 2022, this would still be challenging considering the difficulties in installing large wind power turbines in open seas, the MNRE said. The MNRE had notified National Off-Shore Wind Policy in October 2015 to realise the offshore wind power potential in the country. Preliminary studies have indicated good wind potential for off-shore wind power both in the southern tip of Indian peninsula and west coast.

High wind velocity in coastal areas of Saurashtra region has increased state’s wind power generation which reached a record level of 4,280 MW. The higher generation of electricity from wind has also helped GUVNL reduce its dependence on open market to meet power demand in the state. As against the 5,574 MW installed capacity, wind power generation stood at 3,000 MW. With no resumption of contracted power supply under power purchase agreements by two private sector companies, GUVNL has been forced to manage power from open market. The apex utility had to purchase upto 72 million units on June 1 from Indian Energy Exchange. However, with higher contribution from wind energy, GUVNL’s electricity purchase from the exchange stood at around 23 million units on June 17.

Tamil Nadu’s power demand has once again touched 15,000 MW in June. The power demand comes down after May as the summer heat subsides, but this year, especially in the last few days, the demand has been on the rise, touching 14,997 MW. Due to availability of wind and hydro power, thermal units of Tamil Nadu Generation and Distribution Corp took a break and the generation from these units reduced to 3000 MW. Some areas within Chennai city faced problems like power cuts and low voltage, but they were mostly due to problems in transformers and cables.

India aims to partner with the UN to use solar energy at the world body’s premises as part of the efforts to protect and preserve environment. India was the global host for the World Environment Day celebrations this year. Marking the day, the Indian government announced its pledge to eliminate by 2022 all single use of plastics in India. It also committed to making a 500-metre area around 100 historic monuments, including the iconic Taj Mahal litter-free and free from plastic pollution through the Taj Declaration. By next year’s World Environment Day commemoration, solar energy will be part of the energy mix used in the UN headquarters. A series of efforts were being undertaken in India to reduce the single-use-plastic pollution. The University Grants Commission in India, the body that oversees Universities in the country, directed all institutions of higher learning to stop the use of plastic cups, plastic packaging, plastic bags, disposable food service cups, plates, containers made in polystyrene foam and plastic straws on their campuses and restrict single-use plastic water bottle and encourage the use of refillable bottles. Fishermen in Kerala were helping reduce, collect and recycle the plastic while in Mumbai, government and local community have come forward to undertake huge efforts to clean beaches. Kochi airport became the first airport in the world in 2015 to run completely on solar power. A symbol of multi-lateral unity, the International Solar Alliance, launched by India and France in 2015, now has more than 60 member states.

The first ever scientific study in India of SHPs in Western Ghats has revealed that despite being promoted as clean energy, they have significantly impacted ecology and caused alterations in the course of streams. Also, quality of water and freshwater fish too has taken a hit. Western Ghats represent a continuous band of natural vegetation extending over a distance of 1,500 kilometre and is spread across the six states of Gujarat, Maharashtra, Goa, Karnataka, Kerala and Tamil Nadu. SHPs are hydroelectric plants with relatively smaller power-generating capacity compared to larger ones. They are often promoted as a cleaner and greener alternative as it is assumed that they have little or no environmental impact. In India, they are defined as those that generate power up to 25 MW. There has been a proliferation of SHPs in India, especially in biodiversity-rich areas such as the Western Ghats and Himalayas. As of 2012 there were 1,266 projects commissioned while another 6,474 are waiting to be undertaken.

HCC announced that its joint venture with MAX Group has won a ₹ 7.37 billion contract from Russia for a nuclear power plant in Bangladesh. The contract includes civil works of Turbine Island for Unit 1 of Rooppur NPP. The Rooppur NPP will be built with Russian technology and is equipped with two VVER reactors of 1,200 MW each. These reactors are similar to the Kudankulam NPP in Tamil Nadu. HCC has become the first Indian company to participate in the international civil nuclear market. Recently, India signed an agreement with Bangladesh for civil nuclear cooperation, under which India has extended expertise and project support for Bangladesh’s first NPP. India not being a member of Nuclear Suppliers Group cannot participate directly in the construction of atomic power reactors. But Indian companies can be involved in construction and installation works and in the supply of equipment of non-critical category.

Rest of the World

China’s unexpected move to slash incentives for solar power has sent stocks into a free fall and prompted analysts to lower forecasts for global installations this year amid expectations that a glut of excess panels would send prices tumbling. China announced on June 1 changes to the subsidies that has underpinned its rise to become the world’s largest solar market in recent years. IHS Markit, a market research firm, was preparing to lower its global solar installation forecast for this year by between 5 and 10 GW, or up to 9 percent. The impact in China, which accounts for half the global market, could be up to 17 GW, the firm said. Another market research firm, Wood Mackenzie, said that China’s capacity additions would likely be about 20 GW lower than it had expected. An oversupply of cheap Chinese-made panels that had been destined for domestic projects will help boost demand for solar in other countries and sop up some of the demand lost in China, IHS said. But a drop in prices will leave manufacturers with razor-thin margins as they seek to unload their products.

The Bangladesh government has signed a $55 million financing agreement with the World Bank to expand renewable energy uses in rural areas. The additional financing to the Second Rural Electrification and Renewable Energy Development (RERED II) Project will install 1,000 solar irrigation pumps, 30 solar mini-grids and about 4 million improved cooking stoves in rural areas, the Washington-based lender said. Since 2003, the World Bank said it has been helping Bangladesh expand solar-powered electricity in remote and rural areas. The country has one of the world’s largest domestic solar power programmes, covering 14 percent of the population, it said.

New US solar installations in 2018 will stay at the same level as last year due to weakness in several major residential markets and a slowdown in big projects after a rush to beat a tax credit deadline, GTM Research said in the report commissioned by the Solar Energy Industries Association. The zero-growth forecast came despite a 13 percent rise in the first quarter to 2.5 GW, accounting for 55 percent of total US generating capacity added, the report said. New solar installations, which surged for much of the last decade, fell almost 30 percent in 2017 to 10.8 GW because developers in 2016 completed a slew of projects ahead of a scheduled expiration of a key tax credit that ultimately was extended, the report said. Government policies that supported renewable energy and a sharp fall in the price of the technology propelled expansion. The tariffs will be felt mostly next year and beyond, GTM said, reducing its 2019 utility-scale forecast by 600 MW. This sector will grow about 5 percent in 2019, but will be flat in 2021 and 2022 due to tariff-related project delays, it said.

The world’s major industrial democracies spend at least $100 billion each year to prop up oil, gas and coal consumption, despite vows to end fossil fuel subsidies by 2025, a report said ahead of the G7 summit in Canada. Britain, Canada, France, Germany, Italy, Japan and the US – known as the Group of Seven (G7) – pledged in 2016 to phase out their support for fossil fuels by 2025. But a study led by Britain’s Overseas Development Institute found they spent at least $100 billion a year to support fossil fuels at home and abroad in 2015 and 2016. Researchers scrutinised and scored each country against indicators such as transparency, pledges and commitments, as well as their progress towards ending the use, support and production of fossil fuels. France was ranked the highest overall, scoring 63 out of 100 points, followed by Germany (62), Canada (54) and the UK (47), the report said. The US scored lowest with 42 out of 100 points due to its support for fossil fuel production and its withdrawal from a 2015 global pact to fight climate change. President Donald Trump announced a year ago he was ditching the deal agreed upon by nearly 200 countries over opposition from businesses and US allies. The 2015 Paris agreement committed nations to curbing greenhouse emissions and keeping the global hike in temperatures “well below” 2 degrees Celsius (3.6 Fahrenheit) above pre-industrial times. Britain scored the lowest on transparency for denying that its government provided fossil fuel subsidies, even though it supported tax breaks for North Sea oil and gas exploration, the report said.

Cambridge University said it would keep investing in funds that hold shares in fossil fuel companies, despite public pressure from hundreds of its academics. One of the most eminent academic institutions in the world, Cambridge University has an endowment fund (CUEF) of just under 3 billion pounds ($3.98 billion), the vast majority of which is invested indirectly through funds. Any weakening in the performance of the fund would mean less support to academic activities, it said. It had no direct investment in fossil fuel companies and wanted to avoid any direct investment in coal and tar sands, while keeping any indirect investment in those areas to a minimum. In April, about 350 Cambridge academics signed a letter to the university and its colleges, which are largely independent from the university’s central administration and have their own investments, urging them to excise fossil fuel investments. Cambridge Zero Carbon Society, a divestment campaign group, has called for the resignations of members of the University finance office who formerly worked for BG, now part of Shell.

Some Chinese biomass and waste-to-energy plants will no longer be eligible for renewable energy subsidies, the country’s finance ministry said, as it bids to resolve a huge payment backlog. The ministry said that a series of co-fired plants burning a mixture of coal, forest waste and household refuse would no longer be entitled to financial support. The ministry has been struggling to find the funds to pay a subsidy backlog now amounting to an estimated 120 billion yuan ($18.71 billion), following a rapid surge in solar and wind capacity.

The Trump administration is expected to announce changes in biofuels policies, including a plan to count ethanol exports toward federal biofuels usage quotas and allowing year-round sale of fuels with a higher blend of ethanol. After hosting several meetings between representatives of the corn and refining industries, the administration was in the “last stages” of formally proposing changes to biofuels regulations intended to appease both sides. The changes are aimed at easing tensions between the oil and corn industries, which have been clashing for months over the future of the US RFS – a law that requires refiners to add increasing amounts of biofuels into the nation’s gasoline and diesel. While the RFS has helped farmers by creating a 15 billion-gallon-a-year market for corn-based ethanol, oil refiners have increasingly complained that complying with the law incurs steep costs and threatens the very blue-collar jobs President Donald Trump has promised to protect. The administration is expected to announce that it plans to allow exports of biofuels like ethanol to count toward the annual biofuels volume mandates under the RFS – which could ease the burden on domestic refiners by reducing the amounts they would have to blend domestically.

France’s EDF said workers had gone on strike at the utility’s hydroelectric plants and that a fall in power output was possible, although latest data from the grid operator showed no dip for the moment. Earlier, EDF said it had received notice from employees of their plans to launch a 10-day strike, the latest in a series of walkouts to hit the transport and energy sectors of the euro zone’s second biggest economy. State-controlled EDF did not give more details on the impact of the industrial action. Hydropower accounted for 10.1 percent of France’s power supply in 2017.

French gas and power group Engie said that unscheduled outages at its Belgian nuclear reactors will have an impact of €250 million ($289.15 million) on its 2018 core and net profit. The company said that it was confident that it would be able to compensate this negative impact on the back of the commercial dynamic of group activities, as well as the performance of its midstream gas business and hydropower assets in France. Engie’s Belgian unit Electrabel announced a revised maintenance schedule for its nuclear reactors, including an extension of the closure of the Tihange 3 plant because of problems with deteriorating concrete. Engie said that the various outage schedule revisions add up to seven months of additional outage for a second-generation reactor.

CNNP said that two deals signed with Russian state nuclear company Rosatom for the construction of four nuclear power units in China were worth a combined $3.62 billion. Rosatom said it would construct two units each at the Xudabao and Tianwan nuclear plants. All four units will feature Russia’s latest Gen3+ VVER-1200 reactors. The reactors and all other necessary equipment will be developed and supplied by Russia. CNNP said that the framework contracts will go into effect after approval from both Chinese and Russian authorities. The four units were expected to be equipped with China-made nuclear steam turbine generators, it said.

Toshiba Corp said it was scrapping a plan to build two nuclear reactors at a US power plant after long delays in which it failed to find investors because of sharply lower electricity rates and increased global regulation. Toshiba America Nuclear Energy Corp, the Japanese company’s wholly owned US subsidiary, reached an agreement in March 2008 to build the third and fourth reactors for utility NRG Energy Inc’s South Texas Project. The plant has two 1,280 MW reactors. The project is part of the Nuclear Innovation North America, which is 90 percent owned by New Jersey-based NRG and 10 percent owned by Toshiba. The Fukushima nuclear disaster, the worst since Chernobyl in 1986, forced a reassessment of atomic power, and cheap shale gas and coal has led to the closure of several older plants in the US.

Uzbekistan proposed Russia to build a nuclear power plant in the Navoi region. The agreement creates a legal basis for bilateral cooperation between Russia and Uzbekistan regarding the peaceful use of atomic energy.

The start-up of the Baraka nuclear energy plant in Abu Dhabi’s Al Dhafra region has been delayed to the end of 2019 or early 2020, according to Nawah Energy Company, the plant’s operator. Nawah said it has completed a “comprehensive operational readiness review” to determine the updated start-up date. Barakah One is a joint venture between the Emirates Nuclear Energy Corp and the Korea Electric Power Corp. The $24.4 billion plant is the world’s largest nuclear project under construction, and the first in the Middle East and North Africa.

The United States is leading an initiative with several other governments to promote nuclear power and encourage investment in new nuclear technologies. The US nuclear industry is battling competition particularly from natural gas, while many national governments want to reduce their dependency on the energy source after the nuclear accident at Japan’s Fukushima plant in 2011. The group of nations aims to promote areas such as improved power system integration and the development of technologies like hybrid nuclear-renewable systems. Clean Energy Ministerial is a global forum of 24 countries and the European Union which together account for 75 percent of global greenhouse gas emissions. Japan released a draft of an updated basic energy policy, leaving its ideal mix of power sources for 2030 in line with targets set three years ago, despite criticism that it placed too much emphasis on unpopular nuclear power.

FirmSys, China’s first indigenously-developed Integrated Digital I&C System (DCS) solutions for nuclear power plants, started functioning at Yangjiang Nuclear Power Co of China General Nuclear Power Corp, allowing China to end its reliance on other countries’ in this area. The application of the nuclear-grade DCS product with proprietary intellectual property rights was significant in the field of equipment manufacturing for China’s nuclear power apparatus. DCS works as a nuclear power station’s “nerve center,” playing an important role in safe and stable operations. For a long time, only some advanced countries had core technologies of the nuclear-grade DCS which safely shuts down a nuclear reactor and handles accidents. In 2003, the Davis-Besse Nuclear Power Station in the US state of Ohio was infected with the Slammer worm, which led to a five-hour loss of safety monitoring at the plant. In 2010, Iran’s first nuclear power plant, Bushehr Nuclear Power Plant, was attacked by the powerful Stuxnet virus, which led to a shutdown of the nuclear program. International nuclear security experts said that none of the previous major nuclear accidents in the world involved failure of the control system. However, if something went wrong with the control system, national security could be threatened.

The Philippines splashed out $2.3 billion on the 621 MW Bataan Nuclear Power Plant, but mothballed it after the collapse of a dictatorship and the devastating Chernobyl disaster. Now, there’s a chance that the plant is back in action. As power demand soars in one of the world’s fastest-growing economies, the Philippines’ energy ministry is looking seriously again at nuclear power and urging the President to fast-track its revival. Previous attempts to pursue nuclear energy in the Philippines have failed due to safety concerns and because central to the plan is the revival of the Bataan plant, built during dictator Ferdinand Marcos’ rule. Marcos ordered the Bataan nuclear plant built in 1976 in response to an energy crisis, convinced nuclear energy was the solution to the Middle East oil embargo of the early 1970s. Completed in 1984, the government mothballed it two years later following Marcos’ ouster and the deadly Chernobyl nuclear disaster.

kWh: kilowatt hour, MWp: megawatt peak, GW: gigawatt, MW: megawatt, RESCO: Renewable Energy Service Company, MPUVNL: Madhya Pradesh Urja Vikas Nigam Ltd, CO2: carbon dioxide, Q1: first quarter, MNRE: Ministry of New and Renewable Energy, GUVNL: Gujarat Urja Vikas Nigam Ltd, UN: United Nations, SHPs: small hydropower projects, HCC: Hindustan Construction Company, NPP: Nuclear Power Plant, US: United States, UK: United Kingdom, RFS: Renewable Fuel Standard, CNNP: China National Nuclear Power

NATIONAL: OIL

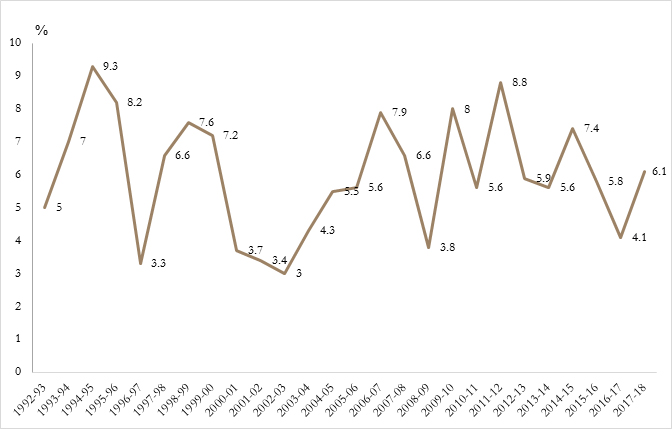

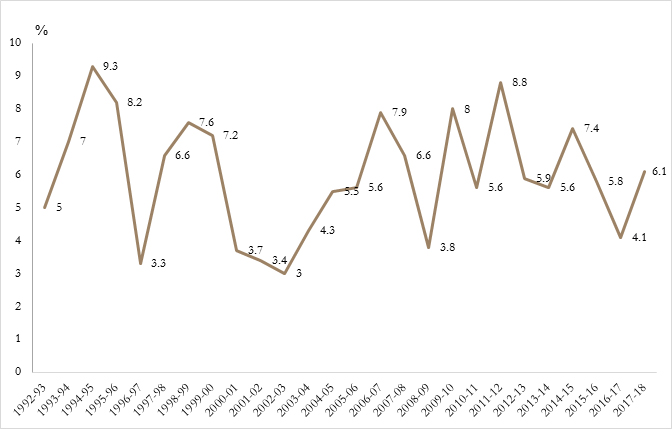

Oil Minister blames Congress for fuel price hike

26 June. Oil Minister Dharmendra Pradhan blamed the Congress-led United Progressive Alliance (UPA) government for the skyrocketing fuel prices in recent times. The Centre had in recent times received a lot of flak from people across the nation for the continuous hike in fuel prices. However, the hike was halted on May 30, when for the first time in 16 days, fuel prices were slashed. The latest petrol prices in metro cities now stand at Rs 75.55 in Delhi, Rs 78.23 in Kolkata, Rs 78.40 in Chennai and Rs 83.12 in Mumbai. The latest diesel rates are Rs 67.38 in Delhi, Rs 69.93 in Kolkata, Rs 71.12 in Chennai and Rs 71.52 in Mumbai.

Source: Business Standard

RIL, government oil companies in dogfight over jet fuel sales

26 June. Reliance Industries Ltd (RIL) and state-run oil refiner-retailers are locked in a dogfight over selling jet fuel to carriers as India is poised to become the world’s third-largest aviation market by 2020. Mumbai airport has become their latest battleground, with RIL complaining to authorities and regulators that Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) were creating entry barriers by not allowing other jet fuel sellers access to their pipelines feeding the airport. Faced with the situation, the Petroleum and Natural Gas Regulatory Board has invited public comments, announcing its intention to declare the present pipelines as common carrier. Mumbai accounts for more than 20% of jet fuel consumption in the country. The airport is fed jet fuel from BPCL and HPCL refineries in the city’s periphery through two separate pipelines and storage facilities inside and outside the airport. Indian Oil Corp (IOC) gets its supplies from these two refineries under a barter arrangement. RIL said jet fuel accounts for 40% of airlines operating costs and competition will help bring this down.

Source: The Times of India

Government’s plan to hedge crude oil price risk hits bureaucratic wall

25 June. The government’s move to get oil companies to hedge crude oil price risk as part of the rejig plan for pump prices has run into a bureaucratic wall. The government was considering a series of steps, including a reduction in levies and hedging of bets that would have covered the risk of prices going below or above a certain level. While the plan has not been junked, a decision will be announced at an “appropriate time”. After the Karnataka elections, the government had faced flak as retail prices of petrol and diesel repeatedly went past record levels, putting pressure on household budgets, prompting the government to deliberate on a strategy to combat the impact of a jump in global crude oil prices, which have softened over the last few weeks. The proposal for oil companies to hedge their bets was part of the plan based on experience in other countries such as Mexico. The plan entails paying a premium to cushion the impact above or below a certain level. Alternatively, there can be a delivery-based mechanism where the prices are locked three months in advance with no premium to be paid. India imports nearly 80% of its crude oil requirement and is particularly vulnerable to a jump in international prices. Not only does it impact buyers but also pushes up inflation and overall economic growth. Amid demands for a reduction in duties on petrol and diesel, the government has indicated that it will not take a rash decision and the outcome will factor in the impact on its finances, crucial for its spending plans in an election year.

Source: The Economic Times

Bringing petrol and diesel under GST impractical: NITI Aayog Vice Chairman

25 June. Petroleum is the taxation milch cow for the central and the state governments and it is unlikely to be brought under the Goods and Services Tax (GST) any time soon. Several senior ministers have demanded that petroleum products — basically petrol and diesel — be brought under the new taxation regime. NITI Aayog Vice Chairman Rajiv Kumar said that both the central and the state governments should start the process of weaning themselves away from their dependence on oil taxation. Ever since the new tax legislation was rolled out on July 1 last year, there had been talk of bringing it under the GST with top government officials and ministers supporting the need for such a move. The Opposition parties, of course, have been clamouring for it. In December last year, Finance Minister Arun Jaitley had told the Rajya Sabha that the Central government was in favour of bringing petroleum products under the ambit of GST after building a consensus with states. More recently, in April, when the international crude oil prices were going up sharply, pushing the domestic petrol prices to record levels, BJP President Amit Shah told a rally in Mumbai that efforts were on to bring petrol and diesel under the GST. From Road Transport and Highways Minister Nitin Gadkari to Petroleum and Naural Gas Minister Dharmendra Pradhan, almost every senior BJP (Bharatiya Janata Party) minister has favoured bringing petroleum products under the GST. Among states, Maharashtra Chief Minister Devendra Fadnavis has also expressed willingness to bring petrol and diesel under GST in his state if a consensus was brought about on it.

Source: Business Standard

Indian oil companies to gain from higher OPEC output

23 June. In a step that is beneficial to India, the Organization of Petroleum Exporting Countries (OPEC) decided to raise its output at a meeting held in Vienna. Though the producer group did not specify the increase, it may be in the range of 1 million barrels per day (bpd), or 1 percent of the global supply. The increase in production happened after consumers like the United States, China and India knocked on the door of the producer lobby to avoid an oil deficit. For India, every $1 a barrel increase in crude oil prices will have an impact on its current account deficit by around $1 billion. Industry sources say the output rise may bring down prices to the level of $70 a barrel. After the decision, Brent crude oil prices were seen at $74.11 a barrel, up 1.45 percent from the previous day. The move will ease supply constraints, which were in place since January last year and had led to a rise in international crude oil prices. Though OPEC had planned a cut of 1.8 million barrels per day, its output dropped further to 2.8 million bpd owing to decline in production in Venezuela. According to an estimate, every $1 increase in international crude oil prices demands an increase of at least 63 paise a litre in Indian fuel rates. India is the third-largest consumer of crude oil in the world with around 4.14 million barrels per day or 4 percent of global consumption. The current rise in production has come in the backdrop of resistance by producers like Iran, Venezuela and Iraq. The rising prices increased India’s import bill by 25 percent in 2017-18 to $109.11 billion over the previous financial year.

Source: Business Standard

India’s crude oil production drops 3 percent in May

21 June. India’s crude oil production dropped 3 percent to just over 3 million tonnes (mt) in May on the back of dip in output from fields operated by ONGC (Oil and Natural Gas Corp). ONGC produced 1.84 mt of crude oil in May as compared to 1.93 mt in the same period last year. The firm’s output in April-May dipped 4.3 percent to 3.62 mt. This resulted to a drop in the country’s oil production to 5.9 mt from 6.03 mt in April-May of 2017. Natural gas output dropped 1.4 percent to 2,768 billion cubic meters in May as private sector firms like Reliance Industries Ltd (RIL) produced less. Oil refineries, however, produced 6.8 percent more fuel at 22.24 mt in May with private sector units of RIL and Nayara Energy operating at over 100 percent capacity.

Source: Business Standard

NATIONAL: GAS

Government may award contracts for first OALP O&G field auction in July

25 June. The government is likely to award contracts for the first round of oil and gas (O&G) auctions under its Open Acreage Licensing Policy (OALP) in the first week of July. Vedanta, OIL (Oil India Ltd) and ONGC (Oil and Natural Gas Corp) would be getting blocks. During the round, Vedanta managed to take 40 of the 55 on offer; OIL and ONGC got the remaining blocks. ONGC, despite bidding for 30 blocks, got less than OIL. The 55 blocks are spread across 10 sedimentary basins, covering 60,000 square kilometre. The second round of Discovered Small Field (DSF) auctions will be held by the end of July. During the first round of DSF, a total of 30 contracts were awarded, 23 on land and seven offshore areas. The blocks are expected to see cumulative peak production of 15,000 barrels and two million standard cubic metres a day of gas. The government hopes to reduce import by 10 percent by 2022.

Source: Business Standard

NATIONAL: COAL

Sufficient electricity for Delhi, but coal stock still low: Delhi Power Minister

22 June. Power supply in the national capital is “sufficient” and the level of load shedding faced in June was the “lowest” when the city’s electricity demand hit an all-time high, Delhi Power Minister Satyendar Jain. Jain also said, the power subsidy scheme for tenants is also likely to be announced soon. Delhi’s peak electricity demand had hit an “all-time high” of 6,934 MW this summer at 3:28 pm on June 8. Jain, however, again cautioned that coal stock in plants had “risen” but still below ideal requirement. The city government has been planning to extend power subsidy scheme to tenants through “prepaid electricity meters”. Under the power subsidy scheme, the Delhi government provides 50 percent subsidy on electricity tariffs up to 400 units on domestic electricity connections for all residents of Delhi.

Source: The Times of India

NATIONAL: POWER

Haryana CM accords approval for installation of 10 lakh smart power meters

25 June. Haryana Chief Minister (CM) Manohar Lal Khattar has accorded approval for installation of 10 lakh smart power meters in five districts of the states. A Memorandum of Understanding between Energy Efficiency Services Ltd (EESL), a joint venture of PSUs (Public Sector Undertakings) under Union Ministry of Power, and Haryana Power Distribution Utilities would be signed soon. The decision was taken to improve the financial condition of power distribution companies, to encourage energy conservation and to tackle problems relating to payment of electricity bills. In the first phase old meters of five districts–Panipat, Karnal, Panchkula, Faridabad and Gurugram would be replaced with smart meters by EESL.

Source: The Financial Express

MSEDCL yet to restore supply for over 18k consumers

24 June. The failure in power infrastructure caused due to heavy rain since June 1 across Nashik zone, comprising Nashik and Ahmednagar districts, affected as many as 66,010 consumers of which power is yet to be restored for a total of 18,489 patrons. The pre-monsoon rainfall that lashed parts of Nashik and Ahmednagar districts uprooted poles of the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) providing electricity in the two districts. The MSEDCL is still struggling to restore normalcy, especially in rural areas and more so in the remote villages for lack of access, material, time and manpower. The MSEDCL, however, has been able to erect only 767 electricity poles and it will take long time before the entire network is successfully restored.

Source: The Times of India

DERC penalises BSES Rajdhani for violation of rules

24 June. Delhi Electricity Regulatory Commission (DERC) has slapped a Rs 20,000 penalty on a distribution company for “violation” of rules in a 10-year-old case of power theft. DERC imposed the penalty on BSES Rajdhani Power Ltd (BRPL) on a petition filed by director of A. K. Mehta and Company, alleging violations of provisions of the Delhi Electricity Supply Code and Performance Standards Regulations, 2007. The Commission in its order on June 14 found that respondent BRPL has violated provisions of Regulations 52(viii) and 53(ii) of the Delhi Electricity Supply Code and Performance Standards Regulations, 2007. Regulation 52 (viii) of Supply Code, 2007, said that in case of suspected theft of power, the authorised officer will remove the old meter under a seizure memo and seal it in the presence of the consumer or his representative.

Source: Business Standard

Over 5k government staffers not paying power bills

23 June. Government employees are supposed to be a notch above others as far as civic sense is considered. However, this does not seem to be the case. An SNDL survey has found out that over 5,000 government and civic employees are not paying power bills and some are also pilfering power. SNDL said the survey was done in Tajbagh Teachers’ Colony, Borkar Colony, Sweeper Colony, Thakkargram, Police Line Takli, CPWD Quarters and Gandhibagh Police Colony. Not only were these employees not paying bills, many of them were pilfering power too. MSEDCL (Maharashtra State Electricity Distribution Company Ltd) also faces problems due to erring government employees. Many of them stop paying power bills when they get transferred and then MSEDCL has problems in recovering the amount. Meanwhile, a serious failure by SNDL has come to light. There are over 4,600 old electro-mechanical meters still in use in the city. These meters are slow and cause a huge revenue loss to SNDL. On its failure to replace them with electronic meters, SNDL said the consumers had resorted to violence when franchisee teams went to their residence to install new meters.

Source: The Times of India

Sampla accuses Punjab government of discontinuing free electricity scheme for gaushalas

23 June. Union Minister and BJP (Bharatiya Janata Party) leader Vijay Sampla accused the Punjab government of discontinuing free electricity scheme for ‘gaushalas’ (cow shelters). Sampla asked State Power Minister Gurpreet Singh Kangar as to why PSPCL (Punjab State Power Corp Ltd) is sending bills worth Rs 5.32 crore to the 472 gaushalas registered in the state despite getting cow cess on electricity bills. The bills should have been waived off according to the state policy, he said.

Source: Business Standard

Use of LED bulbs in Haryana government offices mandatory by August 15

23 June. The use of LED (light emitting diode) bulbs and tube lights has been made mandatory in all offices of Haryana. In this direction, all Administrative Secretaries, Head of Departments and Managing Directors of Boards, Corporations and Public Undertakings have been directed through a written communication to ensure replacing all inefficient lighting with LED lamps or tube lights by August 15, 2018, the new and renewable energy department said. As per directions of the Chief Minister Manohar Lal Khattar, all halogen, sodium bulbs and tube lights will be replaced with energy-efficient LED bulbs and tube lights.

Source: Business Standard

Axis Bank puts up Lanco Kondapalli Power projects for sale

22 June. Axis Bank has put up for sale Lanco Kondapalli Power, which owns and operates 1476 MW gas based power plants as the power producer failed to pay dues. Without mentioning the name of the company Axis Bank called Expression of Interest (EoI) for the sale of three gas-based power projects with a combined capacity of 1476 MW. The power projects are of Lanco Kondapalli, which was once a subsidiary of beleaguered Lanco Infratech Ltd. The lenders have to find a suitable resolution for their debts before September 16, lest the creditors approach the National Company Law Board for a resolution. Lanco Kondapalli a 368 MW gas-based plant is operational since October 2000. Phase-II 366 MW is operational since December 2009 and Phase-III 742 MW is operational since January 2016. While Phase-I is operating with limited gas supplies, Phase II and III are not producing any power due to lack of gas supplies. Axis Bank sought in case of strategic investors, sought bids from parties who have net worth of Rs 300 crore as on March 2017 or later.

Source: The Hindu Business Line

Power ministry may make 24°C as default setting for air conditioners

22 June. Power Minister R. K. Singh said that the government will consider making 24 degrees Celsius (24°C) as mandatory default setting for air conditioners within a few months. At a meeting with the Minister, AC makers were also advised to have labelling indicating the optimum temperature setting for the benefits of consumers both from financial and their health points of view, the power ministry said. The temperatures settings in ACs will be in the range of 24 to 26 degrees celsius. Singh launched a campaign to promote energy efficiency in the area of air-conditioning. He was of the view that setting the temperature in the range of 18 to 21 degrees celsius compels people to wear warm clothing or use blankets; therefore, this is actually wastage of energy. Some countries like Japan have put in place regulation to keep the temperature at 28 degrees celsius. Therefore, he said that under the guidance of ministry of power, the Bureau of Energy Efficiency (BEE) has carried out a study and has recommended that the default setting in the air-conditioning should be at 24 degrees celsius. The new campaign will result in substantial energy savings and also reduce greenhouse gas emission, he said. After an awareness campaign of 4 to 6 months, followed by a survey to gather public feedback, the power ministry would consider making this mandatory, he said. The power ministry estimates indicate that if all the consumers adopt, this will result in savings of 20 billion units of electricity in one year alone. BEE informed that, considering the current market trend, total connected load in India due to air conditioning will be 200 GW by 2030 and this may further increase as today only about 6 percent of households use ACs. As per the BEE’s current estimate total installed air conditioner capacity is 80 million TR (ton of refrigerator) in the country, which will increase to about 250 million TR by 2030. Considering this huge demand, India can save about 40 million units of electricity usage every day. The targeted commercial buildings will include airports, hotels, shopping malls, officers and government buildings.

Source: The Times of India

PSPCL to kick off underground power cabling work in city soon

20 June. In a city that loses much of its electricity in theft, the Punjab State Power Corp Ltd (PSPCL) has shown a way out by pushing distribution cables underground and deploying technology to track illegal connections. With the introduction of underground cables, illegal usage of electricity and power losses will reduce. PSPCL is undertaking many projects to make Ludhiana a smart city and more efficient in terms of power. The reason why the electricity department wanted to go for an underground cable network is to prevent instances of electrocution, which are common when cables snap during rains and windy conditions. Underground cables also help avoid low voltage complaints, a persistent issue among residents of suburbs in the city. Underground cables are one of the major tasks undertaken by the PSPCL department. Now, 66Kb cables are installed underground from Amlathas to Kakowal — a distance of around 2 kilometre. This is the first time this type of project has been completed in Ludhiana city. The reason for starting underground cables is because there are many problems that occur when high wattage wires start functioning on poles. The central government has sanctioned Rs 37 crore under the Smart City project for better infrastructure in terms of electricity in Ludhiana. In this project — expected to begin soon — the distribution of underground cables will take place on National Road, Ghumar Mandi, and Phase 2 within a few months.

Source: The Times of India

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Plan afoot to set up solar panels on all government buildings: Bareilly DM

26 June. In order to achieve a target set by the state government to generate 4,300 MW of electricity by 2022, district authorities have been instructed by principal secretary, Uttar Pradesh government, Alok Kumar to install rooftop solar panels on all government, semi-government and public buildings. Bareilly district magistrate (DM) VK Singh said the National Renewable Energy Development Agency (NEDA) has been tasked to figure out all possible sites where rooftop solar plants can be installed. The solar panels will be installed by Renewable Energy Supply Company (RESCO). The company will bear all installation expenses and will not charge any maintenance and operational fee for the next 25 years. The office concerned on whose building the solar panel will be installed will get power supply on a lower tariff than the current electricity charges of UP Power Corp Ltd. RESCO will sign a memorandum with each office to install rooftop solar power plants. If the power is generated in excess than the requirement of the office concerned, that would be transmitted to the grid. It will again benefit the office as the cost of transmitted electricity will be deducted from the electricity bill. NEDA said that for purchasing electricity from RESCO, government has fixed a tariff rate at Rs 3.91 per unit which is lower than the rates of conventional electricity supply — which is Rs 4.90 to Rs 6.50 per unit. Besides, there is also a provision that if in the future conventional electricity rates go down, the given tariff will automatically be revised.

Source: The Times of India

Maharashtra government forms study committee for floating solar power plant

26 June. The Maharashtra government has set up a committee to study issues related to the development of a 1,000 MW floating solar power plant at Ujani dam in Solapur district. Among other things, the committee will study the environmental impact of the project and monitor the month-wise water level of the dam. Ujani, located in Madha taluka of Solapur, around 300 kilometres from Mumbai, is among the largest dams in Maharashtra. The dam was built on a flat land and is easily accessible from all sides, which is an advantage as the solar panels required to be monitored. The dam has proved to be a lifeline for arid regions of Solapur and Pune districts.

Source: Business Standard

IIT Madras joins project to provide solar power, drinking water in villages

26 June. The Indian Institute of Technology (IIT) Madras has partnered with Chennai Petroleum Corp Ltd (CPCL) to provide solar power, clean drinking water and create better sanitation conditions in the villages of Vellalapakkam, Gopurajapuram and Panangudi in Nagapattinam district in a project at a cost Rs 14.49 crore, which will be executed over the next 2 years in coordination with the Tamil Nadu government. Solar Power for households, compost yard construction, skill development and health care activities would also be undertaken.

Source: The Economic Times

HFE goes global, to enter renewable market in 7 countries

26 June. Hero Future Energies (HFE), the clean energy arm of the Hero Group, is expanding its presence in seven countries including South East Asia and Africa which are opening up their renewable energy market. HFE plans to add one GW of solar and wind power projects every year, of which 20 percent of the capacity would come from its international projects. HFE is the first Indian independent renewable power producer to expand its business in other countries. The company has targeted to add 5 GW by 2022. The current capacity stands at 2 GW and another 500 MW under construction. HFE also plans to open two branch offices in London and Singapore. HFE is entering developing markets such as East and North Africa, Philippines, Indonesia and matured ones such as Thailand and some European countries. HFE is also planning a 2 MW solar plus storage power project on pilot basis in India. HFE set up India’s first solar-wind hybrid power project of 78 MW (28 MW solar plus 50 MW wind) in Karnataka, this year. HFE, which was launched in 2012, has grown to be the one of the top five renewable companies in the country. Initially into wind power, the company has expanded in solar. In 2016, HFE issued India’s first certified climate bond for expansion of its wind portfolio, through its wind holding entity.

Source: Business Standard

‘Biogas plants in Punjab helping save trees’

25 June. A total of 1.75 lakh biogas plants set up in the state so far since 1994-1995 are helping save lakhs of trees from getting axed, Punjab’s Power and Renewable Energy Minister Gurpreet Singh Kangar said. He said maximum rural and semi-urban households were being brought under the ambit of the National Biogas and Manure Management Programme (NBMMP) to safeguard women from the harmful effects of smoke that a chulha, a traditional stove, generates. The NBMMP is aimed at providing clean cooking fuel to households. He said the centrally sponsored scheme was garnering good response in Punjab. Under this scheme, rural and semi-urban households are facilitated to set up biogas plants of 4-6 cubic metre, he said. 3,050 biogas plants had been set up in 2017-18. He asserted that biogas can prove to a be a viable alternative to traditional cooking fuels.

Source: Business Standard

Renewable energy certificates to continue face regulatory challenges: Ind-Ra

25 June. The renewable energy certificates (RECs) will continue to face regulatory challenges and obligated entities may prefer to buy clean energy directly, India Ratings and Research (Ind-Ra) said. Solar REC trading was further affected following Central Electricity Regulatory Commission (CERC)’s decision to reduce the floor and ceiling price of solar and non-solar RECs in March 2017. In April 2018, Appellate Tribunal of Electricity (APTEL) upheld CERC’s decision. The floor and ceiling prices of RECs determined by CERC methodology usually reflect the price discovered through renewable power reverse bids. It said that trading volume in solar renewable energy certificates (RECs) had declined over 70 percent y-o-y (year on year) on account of the stay on solar REC trading in May 2017. The trading has been restarted from April 2018, only after APTEL upheld CERC’s order. The stay order on trading non-solar RECs was lifted in July 2017 on the appeal of Indian Wind Power Association. The non-trading of solar RECs during FY18 resulted in a positive complementary effect on the trading of non-solar RECs which grew 120 percent y-o-y in FY18, it said. Regulatory uncertainties coupled with higher supply of RECs and lower floor prices have further increased the revenue risks for those renewable projects, which depend on RECs for part of the revenue, Ind-Ra said. The increasing renewable energy penetration (excluding large-scale hydro power) into the Indian grid system (12% in FY12 to 19% in FY18 of the all India installed power capacity) and lower non-compliance of renewable purchase obligations by state utilities have been the major reasons for lower/stagnant REC trading at power exchanges, it said.

Source: Business Standard

Centre plans 25 percent greenhouse gas emission cut by 2020: Vardhan

25 June. Emission of greenhouse gases that lead to global warming and climate change would be reduced by 20-25% in India by 2020 and 33-35% by 2030, Union Minister for Environment, Forest and Climate Change Harsh Vardhan said. He also claimed that the Centre has targeted to make contribution of clean energy in total energy production in the country up to 40% by 2030. He said India would produce 175 GW electricity through different sources of green energy by 2020, out of which 100 GW would be solar energy. He also reiterated India’s commitments at the Paris Agreement and said the country would potentially achieve the target before the deadline.

Source: The Economic Times

Indian solar power companies fear being eclipsed by foreign biggies

25 June. Foreign firms will bag major upcoming contracts for solar energy projects, leaving local companies in the lurch because of the terms and conditions of the upcoming auctions, Indian developers including the Adani and Hero groups have complained. Six leading solar developers have protested the decisions of Solar Energy Corp of India (SECI) and NTPC Ltd to set the maximum capacity that a single bidder can bid for at 1800 MW and 2000 MW respectively in their forthcoming auctions. SECI recently amended its bid documents for the auction of 3000 MW of solar projects, raising the maximum limit to 1800 MW from 750 MW. So did NTPC, which has set the single bidder limit at 2000 MW for its forthcoming auction of 2000 MW.

Source: The Economic Times

Solar power dawns for Gujarat farmers

24 June. To deal with the murmurs from farmers in Gujarat, the state government plans to woo agriculturists with a Rs 870 crore bonanza, promising to double their incomes, ahead of the 2019 Lok Sabha elections. Chief Minister (CM) Vijay Rupani announced the Suryashakti Kisan Yojana (SKY), considered the first of its kind in the country, through which 12,400 farmers in 33 districts, on a pilot project basis, will generate solar power, use part of it power for irrigation and feed the surplus to the grid and earn money. Rupani said farmers will have to invest 40% of the cost of the system while 60% will be provided as a subsidy from the Centre and state. Deputy CM Nitin Patel said that farmers can begin small by generating up to 5MW of electricity. Rupani said the scheme will include more farmers after the pilot project is complete. Rupani also said that the state government will provide loans covering 35% of the investment at low interest rates for terms of seven years. Farmers are expected to recover their investment in eight to 18 months. Energy Minister Saurabh Patel said that with solar energy generation, farmers can use 12 hours of electricity instead of the eight hours available. Rupani said the scheme will contribute to Prime Minister Narendra Modi’s goal of doubling farmers’ income by 2022.

Source: The Times of India

Safeguard duty on solar equipment may hit India’s 100 GW target: Industry

24 June. Solar power developers have expressed concerns that safeguard duty on solar equipment may jeopardize India’s target of installing 100 GW capacity by 2022 as it would directly affect 25 GW volume under various stages of implementation and hit thousands of jobs in the segment. The Directorate General of Trade Remedies (DGTR), a recently created umbrella authority for trade matters, is scheduled to hold a public hearing in the national capital with regard to imposition of 70 percent safeguard duty on imported solar equipment. This has led to some confusion among the industry players since the standing committee on safeguards under the finance ministry had decided that no such duty was required to be imposed. Industry experts are of the view that availability of solar power at competitive rates (below Rs 3/unit) will not sustain long as the project cost expected to be increased by almost 40 percent with existing recommendations of DG safeguard for imposing the duty on the import of solar modules.

Source: The Hindu Business Line

Climate change affecting agriculture in Bihar: CM

24 June. Bihar Chief Minister (CM) Nitish Kumar said climate change has been affecting the state over the years and its impact is visible, with monsoon getting delayed every year and the volume of rain also showing a downward trend. Although the state had hardly contributed to the phenomenon of global warming, it had to face the impacts of climate change, he said. He said climate change was posing a new challenge to Bihar’s agriculture and water resources. Kumar and Union Minister for Environment, Forest and Climate Change Harsh Vardhan together inaugurated the climate change conclave. He also raised the issue of increasing siltation in the river Ganga and urged Harsh Vardhan to take up this issue on priority. According to him, siltation in Ganga is the result of construction of several dams, including Farakka dam, which are interrupting the river’s natural flow at the bottom, leading to deposition of silt. Bihar Deputy Chief Minister Sushil Modi said that the state government had set a target of either generating or buying 2,000 MW of solar power by 2022 in order to cut carbon emission.

Source: Business Standard

Developers to get 2 yrs now for implementing solar project

22 June. The government has decided to increase to 2 years the time given to developers for setting up solar energy projects, a move which is expected to lead to competitive tariffs. The power ministry has amended the guidelines for tariff based competitive bidding process for procurement of power from grid connected solar PV (photovoltaic) power projects on June 14, 2018. The amendments are related to providing longer time-frame to set up solar projects. Under the new norms, the developers would have to commission solar projects of 250 MW and above within 24 months from the date of signing power purchase agreement (PPA) as against the previous time frame of 15 months. Similarly, projects with capacities of less than 250 MW would be commissioned in 21 months from the date of inking PPA as against the previous time-frame of 13 months. The new norm would not be applicable to already bid out projects which are under various stages of implementation. The industry expects that the state authorities to adopt the similar timelines for all the future projects. The amended norms also provide that solar power generators would have to achieve financial closure (tie up for funds) within one year from the date of execution of PPA as compared to earlier norm of 7 month. The amended guidelines also extended time-frame for 100 percent land acquisition to one year from 7 months earlier. Industry bodies including Solar Power Developers Association (SPDA) have been demanding that the time-frame should be increased by as much as nine months in view of issues being faced by them. In a submission to the Ministry of New and Renewable Energy, the SPDA had said that the developers have been unable to meet the existing deadline for implementing solar projects as they face delay in land acquisition and regulatory approvals in land acquisition/mutation. India has set a target of having 100 GW of solar power capacities in the country by 2022.

Source: Business Standard

60 firms at Madhya Pradesh 28 MW rooftop solar pre-bid meet

22 June. Over 60 prospective bidders from across the country attended the second pre-bid meeting convened by the Madhya Pradesh government for its 28 megawatt peak (MWp) rooftop solar project, according to the Madhya Pradesh Urja Vikas Nigam Ltd (MPUVNL). MPUVNL is implementing the project under the Renewable Energy Service Company (RESCO) mode. While bids for the tender are to be submitted by July 9, the financial bid will be opened on July 19, MPUVNL said. As per the tender provisions, the rooftop projects are targeted for commissioning within 9 months from the date of execution of power purchase agreements with the beneficiary procurers.

Source: Business Standard

Gujarat government announces hybrid power policy

21 June. To boost solar and wind power generation in the state, the Gujarat government has announced a new Wind-Solar Hybrid Power Policy. Energy Minister Saurabh Patel and Minister of State for Energy Pradeepsinh Jadeja said that the policy is meant to promote the production of wind and solar power simultaneously. Under the policy, developers can set up wind power unit on the land meant for a solar power unit, or vice versa. The policy allows the establishment of wind-solar hybrid power producing units. The objective of the new policy is the optimum utilization of land and grid land for clean energy. The electricity produced from such hybrid wind and solar units will be exempted from electricity duty, allowing land use for dual purpose. The new policy has the provision for 50% exemption from electricity duty for selling electricity to a third party. For hybrid captive plants, total exemption will be given from cross-subsidy surcharge and additional surcharge, and 50% relief in wheeling charges and distribution loss. Those who already have third party sale agreement with Gujarat Urja Vikas Nigam Ltd can continue with the arrangement in line with their capacity. New developers can decide the capacity of the wind-solar hybrid unit in accordance with the renewable power purchase agreement with the consumer. Moreover, group captive companies can set up hybrid projects with 100% investment share in the same ratio for the consumption. Gujarat currently produces approximately 5,500 MW of wind power and 1,600 MW of solar power, totalling 7,100 MW of green energy.

Source: The Times of India

Bio-CNG plants in rural India soon: Oil Minister

21 June. Oil Minister Dharmendra Pradhan said there are plans to set up bio-compressed natural gas (CNG) plants in India. He made this comment after visiting a bio-CNG plant in Stuttgart, Germany, where he was briefed by officials on how agricultural waste can be converted into energy. Pradhan said that the Centre is working to ensure the doubling of farmers’ income by 2022. Asked where the central government was planning to set up such plants on a pilot basis in India, Pradhan said it could be done in some big villages and towns.

Source: Business Standard

NMC, PGCIL to set up floating solar panels in Gorewada lake

20 June. In the first-of-its-kind project in the state, Nagpur Municipal Corporation (NMC) and Power Grid Corp of India Ltd (PGCIL) plan to generate power from floating solar panels in Gorewada lake. The solar power will be utilized to run the civic body’s water treatment plants (WTP) located adjacent to the lake. The plan is to generate 3 MW solar power from the project expected to cost Rs 18 crore. As per NMC officials, three WTPs — Pench-I, II and III situated adjacent to Gorewada lake can run entirely on the 3MW solar power during daytime, saving huge expenses of NMC. NMC’s plan to set up solar power generation units of 42 MW for running all its establishments like WTPs, hospitals, community halls, libraries, street light, administrative offices etc on solar power. This floating solar power project will be in addition to the earlier project. Under the project, power generating solar photovoltaic cells will be installed on the surface of the water in the lake. Such projects have proved successful in other parts of the state like Kerala and West Bengal in the past.

Source: The Times of India

Uttar Pradesh plans reverse auction for over 1 GW solar project by July end

20 June. Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA) plans to conduct reverse auction for its first large solar project of over 1,000 MW capacity by July end. The tender document for internationally competitive bidding was initially issued in January, but was amended and reissued in April this year. The tender generated strong interest from domestic and foreign investors which led to participation by around 13 bidders with over 37 bids for 1,870 MW capacity. The entire cost of transmission including the cost of line construction, wheeling charges and losses will be borne by the developer. The successful developers will enter Power Purchase Agreements (PPAs) with Uttar Pradesh Power Corp Ltd (UPPCL) for a period of 25 years. The UPNEDA has also specified that it will penalise project developers for delay in project commissioning. If for any contract year it is found that the developer has not been able to generate minimum energy as per agreement, the developer shall pay a penalty equal to 25% of the project tariff to the procurer, for such shortfall in units, the tender document said.

Source: The Financial Express

INTERNATIONAL: OIL

Saudi Arabia plans record crude oil production in July

26 June. Saudi Arabia is planning to pump a record amount of crude in July, embarking on one of its biggest-ever export surges to cool down oil prices. State oil company Saudi Aramco is aiming to boost production next month to about 10.8 million barrels a day.

Source: Reuters

Gabon oil workers threaten 15-day strike at Total facilities

26 June. Gabon’s oil workers’ union ONEP plans to start a 15-day strike at the facilities of French oil firm Total if its demands for higher pay and other benefits are not met, it said in a letter to Total Gabon. Total Gabon had fully consulted workers’ representatives about recent changes in the company’s strategy and that discussions were continuing to resolve the dispute. The strike would affect all of Total’s facilities in Gabon, including in the capital Libreville and oil hub of Port Gentil. The threat of strike action follows the company’s failure to respond to the union’s earlier demands made in May, the letter said. The Central African nation produces about 200,000 barrels per day (bpd) of crude, according to the US Energy Information Administration, but output from the OPEC (Organization of the Petroleum Exporting Countries member)’s ageing fields has plummeted from a 1997 peak of 370,000 bpd. A steep fall in oil prices in 2014 and 2015 cut much needed revenue and forced companies to lay off thousands of oil workers. Total produces about 54,000 barrels of oil equivalent per day in Gabon.

Source: Reuters

OPEC agreement did not specify oil production increase: Iranian Oil Minister

26 June. Iranian Oil Minister Bijan Zanganeh said that OPEC’s oil output agreement did not specify a production increase and that a figure of 800,000 barrels per day (bpd) was an interpretation by some members of the group. The Organization of the Petroleum Exporting Countries (OPEC) and other top crude producers, meeting in Vienna, agreed to raise output from July, but the agreement failed to announce a clear target for the output increase, leaving traders guessing how much more OPEC will actually pump. Zanganeh said some countries want to send “positive signals to the market or to the United States”, but that is not related to OPEC’s decision. The United States (US), China and India had urged oil producers to release more supply to prevent an oil deficit that could undermine global economic growth. Iran, OPEC’s third-largest producer, had demanded OPEC reject calls from US President Donald Trump for an increase in oil supply, arguing that he had contributed to a recent rise in prices by imposing sanctions on Iran and fellow member Venezuela. Market watchers expect Iran’s oil output to drop by a third by the end of 2018. That means the country has little to gain from a deal to raise OPEC output, unlike arch-rival Saudi Arabia.

Source: Reuters

Minnesota regulators question demand for expanded Enbridge oil pipeline

26 June. Commissioners on a Minnesota regulatory board questioned crude oil demand for Enbridge Inc’s Line 3 pipeline, ahead of an expected decision this week on whether work can proceed on a proposed expansion of the line. Enbridge wants to replace the aging 1,031 mile (1,660 kilometre) pipeline that runs from Alberta to Wisconsin, but it needs approval from the Minnesota Public Utilities Commission, which must decide whether the project is needed, and the route. Bottlenecks in Alberta have steepened a price discount for its heavy crude this year. Line 3, placed into service in 1968, operates at half its capacity due to integrity concerns. Its replacement would allow it to return to approved capacity of 760,000 barrels per day (bpd). Commissioner Dan Lipschultz said he felt “frustration” having to rely on forecasts provided by Enbridge based on rising oil production, rather than on refiners’ demand. Enbridge lawyer Eric Swanson noted that global demand is growing, and that Enbridge apportions demand on Line 3 – transporting less oil than shippers request. Lipschultz asked Swanson whether it would be reasonable to approve Line 3 for lesser capacity of 500,000 bpd, to which Swanson said ‘no.’ Commissioner Matt Schuerger said data for state refineries suggest little idle capacity, although the state’s largest refiner, Flint Hills Resources, has said Line 3 is badly needed.

Source: Reuters

EIG, Warburg Pincus bid for mature Petrobras oilfield clusters

26 June. Warburg Pincus- and EIG Global Energy-backed firms have placed bids for shallow water mature oilfields being sold by Brazil’s state-controlled producer Petroleo Brasileiro SA (Petrobras). The clusters located in the Campos basin off the coast of Rio de Janeiro state are likely to fetch proposals of around $1 billion in total, which would help boost a wider effort by Petrobras to sell assets and reduce debt. Trident Energy, a Warburg Pincus-backed firm specializing in mid-life oil assets, also bid for the clusters. A win by either group would represent those private equity firms’ debut in the oil production business in Brazil, but not a first for the sector. First Reserve Corporation and Riverstone Holdings both are investors in Brazil’s Barra Energia. According to Petrobras, the Enchova cluster, which includes the Marimba, Enchova, Bonito, Enchova Oeste Bicudo and Pirauna fields, has 32 wells producing 25,100 barrels of oil equivalent per day. With 27 wells, the Badejo, Pampo, Linguado and Trilha fields of the Pampo cluster produce 13,500 barrels of oil equivalent per day. Petrobras is selling the rights to the fields until 2025. Both Enchova and Pampo began producing in the 1980s.

Source: Reuters

No change to Syncrude oil sands facility restart timeline: Suncor

26 June. Production at Syncrude Canada’s oil sands facility near Fort McMurray, Alberta is likely to remain offline at least through July, Suncor Energy Inc said. The facility, which can produce up to 360,000 barrels per day, was hit by a power outage, sending the front-month US (United States) crude spread CLc1-CLc2 surging to the widest in nearly four years. Traders expect the Syncrude outage to tighten Canadian supplies and reduce crude flows to Cushing, Oklahoma, the delivery point of the US crude futures contract.

Source: Reuters

Russian oil bought by PDVSA for Cuba discharges in the Caribbean

25 June. A tanker that for more than a month was unable to deliver Russian crude to Venezuela’s PDVSA amid a dispute between the state-run firm and ConocoPhillips has discharged its cargo in the Caribbean, and a second vessel is soon to follow. Conoco in May got court orders to seize PDVSA’s assets, inventories and oil cargoes in the Caribbean to satisfy a $2 billion arbitration award. The measures were later partially revoked, but PDVSA has been unable to fully use its refining and storage facilities in the region, diverting cargoes that have contributed to export delays. PDVSA exported 765,000 barrels per day of crude and refined products to customers in the first two weeks of June, a 32 percent decline compared with May, excluding shipments by two of the company’s joint ventures, which export separately. Manuel Quevedo, Venezuela’s Oil Minister and the state-run firm’s president, said the country expects to recover a portion of its lost crude output this year. But there are no early signs of a reversal in the declining trend. The number of active rigs fell to 28 in May versus 54 in the same month of 2017.

Source: Reuters

Mexico’s Lopez Obrador open to more private oil investment