< style="color: #0069a6;letter-spacing: 0.8pt">RENEWABLE GROWTH UNABATED BY POWER SECTOR WOES

Non-Fossil Fuels News Commentary: November - December 2018

India

The World Bank praised India's success in renewable energy auctions that delivered record-setting low prices for solar power and said that the number of countries with strong policy frameworks for sustainable energy more than tripled -- from 17 to 59 -- in the eight years till 2017. Many of the world's largest energy-consuming countries significantly improved their renewable energy regulations since 2010, said the World Bank's report -- Regulatory Indicators for Sustainable Energy 2018, charting global progress on sustainable energy policies. While countries continue to be focused on clean energy policies for electricity, policies to decarbonize heating and transportation, which account for 80 percent of global energy use, continued to be overlooked. The report contained a warning that without accelerated adoption of good policies and strong enforcement, the world's climate goals and Sustainable Development Goal 7 were at risk. By last year, 84 percent of countries had a legal framework in place to support renewable energy deployment, while 95 percent allowed the private sector to own and operate renewable energy projects.

India has become the largest market globally for auction of new renewable energy generation projects and the second-largest destination attracting clean energy investments. These are the findings of the latest Climatescope 2018 report by BNEF. India has secured second place in the global ranking driven by its policy thrust towards renewables and increasing investments in the clean energy sector. The country is the second-largest renewable energy investment market among all Climatescope countries, attracting $9.4 billion in new investments in 2017. Renewable energy installations in India exceeded those by coal power plants for the first time in 2017 as the country moved closer towards its target to install 175 GW of renewables by 2022. India’s installed power generating capacity stood at 346 GW in June 2018, with renewables (excluding large hydro) accounting for 71 GW. With coal taking a share of almost 60 percent, challenges with domestic coal supply are resulting in increased coal imports. However, the government has reduced its coal capacity target for 2027 by 11 GW to 238 GW as the country seeks to replace coal with renewables through auctions. The report said India’s renewable auctions market is the largest in the world and auctioned capacity has ramped up by 68 percent since 2017.

India currently has renewable energy projects of 46,500 MW capacity in the pipeline for capacity addition. This includes projects which are currently under construction and those likely to be offered for bidding soon. India has made a commitment to the world that by 2030, 40 percent of its electric power generation capacity would come from non-fossil fuels and it will install 175 GW of renewable energy capacity by 2022, the MNRE said. The target includes 100 GW of solar, 60 GW of wind and 10 GW of small hydro power. The government expects to overachieve the 175 GW renewable energy target on the back of new schemes for floating solar power, awarding manufacturing-linked solar projects and offshore wind energy projects.

India has declared the trajectory of bidding 60 GW capacity of solar energy and 20 GW capacity of wind energy by March 2020, leaving two years’ time for execution of projects, the MNRE said. A total of about 73.35 GW renewable energy capacity has been installed in the country as of October, 2018, from all renewable energy sources. This includes about 34.98 GW from wind, 24.33 GW from solar, 4.5 GW from small hydro power, and 9.54 GW from bio-power. Further, projects worth 46.75 GW capacity have been bid out under installation. According to the Paris accord on climate change, India had pledged that by 2030 40 percent of installed power generation capacity shall be based on clean sources. And determined that 175 GW of renewable energy capacity to be installed by 2022. This includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro power. India has fifth global position for overall installed renewable energy capacity, fourth position for wind power and fifth position for solar power. The country registered lowest ever solar tariffs in India of ₹ 2.44/kWh in reverse auctions carried out by the SECI in May 2017, for 200 MW and again in July, 2018, for 600 MW.

SECI has decided to continue with the solar panel manufacturing-linked power project tender despite only one bid. It had invited tender for setting up 3 GW of solar panel manufacturing, along with 10 GW of power plant. The bid was submitted by NYSE-listed Azure Power to set up 600 MW of manufacturing as well as 2,000 MW of power project. The bidding happened after being extended for six times, owing to lack of bidders. Major players shied away from the bidding citing lack of funding push from the Centre, thereby reducing viability of solar manufacturing in India. Earlier, the industry had expressed reservations over the tender.

The MNRE is preparing a database to identify the land available for solar and wind energy projects in the country. Plans are on to introduce location-specific bids to strengthen transmission facilities. MNRE officials visited states, including, Gujarat, Telangana, Andhra Pradesh, Madhya Pradesh, etc. and are in the process of doing the assessment in Tamil Nadu and Karnataka. Knowing the availability of land and the potential for renewable energy in the location would help in better bids and improve confidence in investors. The prices, discovered through the solar and wind power auctions, are globally competitive. The apprehensions that these projects would not be viable have been proved wrong. The offshore energy project near Thoothukudi, Tamil Nadu, is facing protests from the local fishermen. The state should take steps to allay the apprehensions of the fishermen, and help the ministry proceed further.

The MNRE will approach the Union cabinet in the next 30-45 days seeking approval for the solar rooftop scheme SRISTI or Sustainable Rooftop Implementation for Solar Transfiguration of India. The scheme, part of the larger grid-connected RTS power programme, aims to bring discoms to the forefront in the implementation of rooftop solar projects by providing them financial support which will be linked to their performance in facilitating the deployment of RTS. The second phase of the original solar rooftop scheme is designed to boost the adoption of rooftop in the residential space and would use the network of distribution companies. The government has set a target to install 40,000 MW of rooftop solar power capacity by 2022. India added new rooftop solar capacity of 1,538 MW in the current Financial year between April and September 2018, which is around 75 percent above the previous year. The scheme aims to also bridge the knowledge gap that exists related to the agencies to be approached, installation of plant equipment and the long-term benefits of solar rooftop. The scheme is being proposed to streamline the system by making the discoms and its local offices as the nodal points for implementation of the programme.

The NABARD signed an agreement with GCF to infuse $100 million into the project designed to unlock private sector initiatives for the creation of rooftop solar power capacity across India. The $250 million project, to be executed by Tata Cleantech Capital Ltd, will receive the GCF support through NABARD, which is the National Implementing Entity for the UNFCCC-promoted Fund that supports the efforts of developing countries to respond to the challenge of climate change, the bank said. The agreement with GCF was signed at an event held on the side-lines of ongoing COP24 in Katowice, Poland, it said. Notably, India, which hosts International Solar Alliance, has an ambitious vision of creating 100 GW solar power capacity it said. NABARD has been financing solar power projects and installations in various other programmes as well.

The latest approval of GST claims for solar power developers by CERC is a major positive development but timely payments by the off-takers remains crucial, according to research and ratings agency ICRA. Around 10.9 GW of solar power capacity has been commissioned between July 2017 and September 2018, with most of the projects being awarded prior to July 2017. Considering 75 percent of the capacity commissioned during this period to be under the competitive bidding regime awarded prior to July 2017, the one-time compensation towards GST impact to be paid by discoms to solar developers is estimated at ₹ 20 bn on all India level. CERC issued an order in October 2018 approving the claims raised by solar power developers related to the impact of the introduction of GST on the capital cost of solar power projects. The regulator has approved the claims under a change in law provision allowing the relief which is required to be recovered as a one-time payment on GST front from the off-takers.

NTPC Ltd said it has won 85 MW of solar capacity in a reverse auction held by the UP government. NTPC participated in the 550 MW tender floated by Uttar Pradesh New and Renewable Energy Development Agency for grid-connected solar projects. In the reverse auction held on 3 December 2018, NTPC participated for 85 MW solar capacities and has won the entire capacity bid by it, at a levelised tariff of ₹ 3.02/unit, applicable for 25 years, the company said. The above 85 MW of solar projects shall be set up by NTPC and shall add to the installed capacity of NTPC, the company said.

To avail the benefits of the Central government’s flexible-generation scheme, NTPC has called for tenders from 1,000 MW of existing solar and wind generation plants to supply power to the company for one year. The ceiling tariff for the reverse auction for choosing solar/wind power plant has been kept at ₹ 2.67/unit. The power ministry, in April this year, had allowed thermal power gencos the flexibility of using renewable energy sources to meet their contractual generation obligations. The new mechanism allows thermal gencos to set up renewable power plants at their existing power stations, or anywhere else, thus allowing discoms to meet their renewable purchase obligations through existing PPAs. The scheme was seen to allow companies such as NTPC to avail of the benefits of this policy, given that some of the power stations located far from pithead have an energy charge higher than ₹ 3/unit. The minimum offered capacity of a solar/wind power plant will have to be 50 MW and in multiples of 10 MW thereafter, NTPC said. Only renewable power plants having inter-state transmission system connectivity shall be eligible for selection, it said. Industry experts are sceptical about the expected response to the invitation, since most of the large wind/power plants are built after signing PPAs through government nodal agencies.

India’s Shapoorji Pallonji Group In the country's first solar-wind hybrid auction conducted by the SECI has yielded the lowest highly competitive tariff of less than ₹ 2.70/kWh, the government said. The government has embarked on the development of non-conventional renewable energy sources, while the first round of auctions for floating solar projects had successfully discovered tariffs as low as ₹ 3.22/kWh. India's first large-scale floating solar project is on its way with Shapoorji Pallonji winning the first block in Solar Energy Corp of India’s auction of 150 MW of such projects on the Rihand Dam, along the UP-Madhya Pradesh border. Shapoorji Pallonji won the reverse auction for 50 MW quoting a tariff of ₹ 3.29/kWh. The remaining 100 MW will also be shortly auctioned in blocks of 50 MW. Since then, solar tariffs have fallen dramatically, with those of ground mounted projects dropping to ₹ 2.50-3.50/kWh. In UP, where solar radiation is not as strong as in states like Rajasthan, the average tariff has been more than ₹ 3/kWh. The Rihand floating projects will not have any such issues, and they can use the same transmission facilities as the hydropower station of the dam. Shapoorji Pallonji Group plans to seek about $1 billion by bringing outside investors into its solar unit, as it embarks on a series of asset sales across the 153-year-old conglomerate to reduce debt. The group will sell as much as 30 percent in the solar engineering arm of Sterling & Wilson Pvt. The funds would be raised through a pre-listing stake sale followed by a public offering. The solar unit, which provides engineering, procurement and construction services, will generate ₹ 95 billion of revenue for the year ended March 2019. The business is now building its presence in the United States and Australia, where the market potential may be about $10 billion for solar contracts.

Users of Yamuna expressway may have to pay more toll as the YEIDA has decided to set up solar lights on the 165 km stretch connecting Greater Noida to Agra and recover the cost from them. The cost of the project is nearly ₹ 940 mn which will be met by increasing the toll tax. Jaypee Infratech, the concessionaire will install lights on the entire stretch. Jaypee has agreed to the project and requested YEIDA to revise the toll to recover the project cost. Once approved, Authority will facilitate in opening an escrow account to ensure the money is invested properly in the project implementation. The project will be completed by 31 March 2019.

A generous commissioning deadline for solar projects provided by the UP government in its latest auction has resulted in surprisingly low winning tariffs. The offer of 550 MW of projects by the UP New and Renewable Energy Development Agency attracted bids between ₹ 3.04 and ₹ 3.08/kWh. NTPC, the lowest bidder, quoted ₹ 3.04/kWh to win 85 MW. The bids were lower than the winning tariff of ₹ 3.17/kWh at the auction in October, which itself was fairly low, considering that UP’s power distribution companies are in poor financial health. Solar radiation in UP is also low compared with that in Rajasthan, Gujarat and Andhra Pradesh. Solar tariffs have been rising ever since the finance ministry imposed safeguard duty of 25% on imported solar panels and modules for a year from end-July in an effort to support local manufacturing. The duty will be lowered to 20% for the next six months and to 15% for another six months. More than 90% of the solar panels used in Indian projects are imported because local manufacturers cannot match those in China and Malaysia on price. The UP agency has set a project commissioning deadline of 21 months from the date of signing of the power purchase agreement. Most such deadlines vary between 13 and 21 months. UP’s July auction of 1,000 MW at the height of the confusion over impending safeguard duty had seen winning tariffs of ₹ 3.48-3.55/kWh. The auction was later cancelled, without any official reason assigned.

The EEREM centre, Delhi government’s nodal agency for rooftop solar projects, launched a tender for setting up 35 MW grid-connected rooftop solar projects in the capital under the Mukhyamantri Solar Power Program. The tender invites e-bids for installation of rooftop solar projects across residential, social and institutional sectors to be developed in eight parts under both CAPEX and RESCO models. Of the tendered capacity, 10 MW will be developed under the CAPEX mode and remaining 25 MW under RESCO. The government has appointed IPGCL to oversee the proceedings of the tender and project execution on behalf of EEREM. Under the RESCO model, a developer finances, installs, operates and maintains the rooftop solar power plant on the consumer’s roof. The developer signs a PPA with the rooftop owner. The rooftop owners consume the electricity generated from the solar plant for which they have to pay a pre-decided tariff that includes the Operation and Maintenance cost to the RESCO developer on a monthly-basis for the tenure of agreement. The government is offering incentives to the developers and consumers. The developers will be eligible for a subsidy at the rate of 30 percent calculated at L1 project cost or the MNRE benchmark cost, whichever is lower under the CAPEX model, and fixed subsidy according to the MNRE benchmark cost for the RESCO Model, only after acceptance of the project by IPGCL. Delhi government is also giving a generation-based incentive of ₹ 2/kWh on solar generation for a five-year period to residential consumers under the scheme.

To incentivise production of solar power in the state, the Goa government has proposed a 50% subsidy for small prosumers (consumers and producers of solar power) as an amendment to the Goa State Solar Energy Policy, 2017. Instead of granting an interest-free loan that would be recovered in instalments from small prosumers, the government proposes to provide a 50% subsidy on capital costs to prosumers in the residential, institutional and social sector categories that have solar plants with a capacity of up to 100 kW. If the amendment is allowed, the Centre will bear 30% of the subsidy’s cost and the state, 20%. Also, such a subsidy will be released to the prosumer only six months after the solar power project is connected to the grid. A single-window clearance portal for grid-connected rooftop solar installations has already been readied for consumers in Goa, but is yet to be launched.

After the success of a pilot project, the Maharashtra government plans to extend the agricultural solar feeder scheme in the rest of the state. The pilot project of the scheme was introduced last year in two places in Ralegan Siddhi in Ahmednagar and Kolambi in Yawatmal. Under this programme, the farmers are supplied power during the day with the help of solar generation.

Surat, which aims at becoming the first solar city of the country, will have 25 MW of installed capacity of solar power by February 2019. It already has 15 MW of installed capacity of solar power and tops the chart in the country. In all, 4,000 solar panels of different capacities were installed in the city which produce 15 MW of solar power. The city administration had received 4,500 applications from residents and commercial establishments in the first phase until 24 September. It received another 1,000 applications in the second phase that began from 24 September and ends next year in the same month. The MNRE has increased subsidy on solar panels to encourage use of clean energy. The Energy and Resources Institute had carried out a survey 18 months ago and it found that Surat had a potential to generate about 418 MW of solar energy from panels installed on rooftops. Rooftops of houses in the city can generate 179 MW, commercial establishments 210 MW, educational and health organizations 23 MW and government offices 6 MW of solar power. Solar panels on SMC buildings already help produce 5 MW of solar power. Surat expects to produced 50 MW of solar power by September 2019.

The PSPCL is going to set up a 60-65 MW paddy straw-based power plant at the cost of ₹ 1.50 bn. PSPCL’s BoD in a meeting cleared the proposal for the project at the Guru Nanak Dev Thermal Power plant in Bathinda. It will be one of the largest straw-based plants and around 4 lakh tonne paddy straw would be used annually to generate electricity. So far, straw-based power plants of up to 45 MW capacity are operational. The BoD cleared another proposal to set up 100 MW solar power plant was also cleared. The proposals have been sent to the state government for final approval.

With the deadline for installing rooftop solar power plants at residential properties in Chandigarh expired on 17 November, only 50% of households have applied for the same. The Chandigarh administration, in a notification issued on 18 May 2016, had made installation of rooftop solar power plants mandatory in residential houses measuring 500 square yards and above and group housing societies. There are around 10,000 such houses in different parts of the city, including sectors 8 (417 houses), 11 (493 houses), 33 (643 houses), 35 (419 houses) and 36 (417 houses). However, till date only 50% of these households have applied for installing solar plants. Earlier the deadline was set for 6 May that was later extended to 17 November. The CREST said those who had applied would have to install solar plants within six months. The UT administration will hold a meeting in this regard where it would decide the future course of action. Meanwhile, those who have not applied for solar power plant installation, will be issued notice by the UT estate office. The Union government had in 2008 selected Chandigarh to be developed as a model solar city with a target of generating 69 MW of solar energy by the year 2022 through net and gross metering. The CREST has only managed to install a solar power plant with a capacity of 24 MW in last six years. It will have to ensure generation of 45 MW within four years to meet the goal.

GAIL (India) Ltd might be interested in buying some of the wind assets of debt-laden IL&FS but has yet to have any discussion on the matter. GAIL would not consider buying the entire wind energy assets of IL&FS unless offered at a steep discount. IL&FS has an installed wind energy capacity of 775.2 MW, while GAIL, which wants to expand its renewable energy portfolio, owns 128 MW.

Solar power generation has gone up significantly in Kochi with many big firms switching over to solar energy. Kochi Metro, Cochin University of Science and Technology, Government Medical College, Ernakulam are some of the big institutions installing solar plants. Moreover, a majority of the 10,000 applicants who have registered with the KSEB’s Soura rooftop solar power plant project are from Kochi. The medical college is all set to commission a 153 KW solar power plant. According to KSEB, registrations as part of the Soura project is going on. Under the Soura project, the KSEB is planning to generate 1,000 MW of energy in the next couple of years. The KSEB would install the panel in the residential premises of consumers. The consumers can bear the cost or the KSEB would spent the amount, which should be paid back in instalments along with the electricity bills.

UP government will give subsidy up to 70% for solar pumps for irrigation purpose to the farmers under a state government scheme. Solar energy-driven pump set is an emerging alternative of electrical and diesel pump systems in farm irrigation. Under the solar pump voltaic irrigation pump scheme 10,000 units will be given to farmers at a subsidised rate during 2018-19 on the basis of first come first serve basis. Government of India will take necessary measures and encourage state governments to put in place a mechanism that state run power utilities purchase surplus solar power at reasonably remunerative rates from farmers using solar pumps for irrigation. Solar Pumps are a boon to the electricity, banking, water and agriculture sectors, solar power pump makers said.

The Maharashtra government plans to give 5 horsepower solar agricultural pumps worth ₹ 350,000 at a subsidised rate of ₹ 20,000 and 3 horsepower pumps costing ₹ 150,000 at ₹ 15,000 to farmers. He said the state government had set a target of distributing 100,000 solar pumps of which 10,000 had already been given out. Another 25,000 solar pumps will be provided to farmers in the next three months.

The authorities in Jammu and Kashmir have dewatered one of the tunnels of the KHEP for laying of cable to Gurez valley in Bandipora district. The task of dewatering the 650-metre-long Adit-1 tunnel of the KHEP started on 19 November is complete. The district administration took a risk during winters to dewater the Adit tunnel of KHEP so that it could be used to lay BSNL cables, which was the only option left to connect the habitations of Kanzalwan, Bagtore, Izmarg and adjoinning villages. Hindustan Construction Company said it was a difficult task to dewater the tunnel, that too in chilling cold, but the logistical support by the deputy commissioner made the task easier for them as the task was completed in record 21 days.

NHPC Ltd has bagged debt-laden Lanco's 500 MW Teesta hydro power project under insolvency proceedings for a tentative value of ₹ 9 bn. NHPC is expected to complete the takeover in the next three to four months and can finish the project in three to four years as its construction is almost 50 percent complete. However, the company said this would be subject to final approval by the NCLT. Lanco Teesta Hydro Power is building a 500 MW (125 MWX4) hydropower project on the Teesta river in Sikkim. As per the procedure, the NCLT would call for objections on the deal before approving it. Once approved by the NCLT, NHPC would seek approval of the Public Investment Board and the Cabinet Committee on Economic Affairs. NHPC has installed generation capacity of 7071 MW while 3800 MW is under construction.

The power ministry has sought Cabinet approval for a policy change categorising large hydro projects as renewable energy sources. Currently, only hydro projects under 25 MW are identified as renewable energy. Apart from helping the country attain the target of having 175 GW renewable capacity by 2022, the renewable energy tag would help hydro power get a priority over thermal electricity while being dispatched to the consumers. The hydro sector would also get additional leg-up as the states can fulfil their mandatory renewable purchase obligations by buying electricity from these power plants. The power ministry note seeks the Cabinet approval for introducing a separate ‘hydropower purchase obligation’ category. To reduce hydro power tariffs, the ministry wants the cabinet to approve, modify existing norms and not let the host states receive free power from hydro power plants till five years from commissioning. As per existing provisions, developers have to contribute 12% free power to state governments.

Hydro power in India is likely to see a boost with projects of close to 10 GW to either restart or commence construction. Along with this, the Centre is moving a policy for promoting hydro power, which aims at reducing the cost of construction. The policy is likely to do away with any requirement for creating irrigation facilities, allied assets or any social infrastructure in order to bring down costs. Government said hydro power would be promoted and incentivised as peaking power. Peaking power is the power supply that meets the sudden increase in demand or supply shortage. While coal is used as base load, solar and wind power have intermittent supply. India has added more than 20 GW of solar and 15 GW of wind in the past five years. Uttarakhand, which decided to forgo 4 GW of hydro projects following ecological issues, and the Supreme Court directive to stop constructing dams, had sought financial support from the Centre.

Himachal Pradesh government has allotted the 780MW Jangi-Thopan-Powari hydro electric project in Kinnaur district to SJVN Ltd on build, own, operate and transfer (BOOT) basis for a period of 70 years. SJVN has necessary infrastructure and that the current installed generation capacity of SJVN is 2,003.2 MW (comprising of 1,912 MW hydro, 85.6 MW wind power and 5.6 MW solar power). SJVN is in the process of implementing various projects, which are in different stages of development, which on completion would add an additional 4,018 MW of capacity. Projects with a potential of 1,572 MW generation capacity are under construction, 1,848 MW under pre-construction and investment approval and 598 MW capacity is in the investigation stage. SJVN had earlier implemented 1,500 MW Nathpa Jhakri hydro power station in Himachal Pradesh. It is also executing hydro projects in Nepal, Bhutan and Uttarakhand.

BHEL has dispatched its 40th Nuclear Steam Generator to the NPCIL. The Steam Generator, to be installed in NPCIL's Rajasthan Atomic Power Project, was flagged off on 1 December 2018 from BHEL's Trichy plant. The first stage of the indigenous nuclear power program of the country has attained maturity with 18 operating PHWRs. Twelve PHWRs accounting for 74% of the Nuclear Power capacity are equipped with BHEL-supplied Steam Turbine Generator sets (10 units of 220 MW each and two units of 540 MW).

The warming of the Indian Ocean due to global climate change may be causing a slow decline in India's wind power potential, according to a study. India, the third largest emitter of greenhouse gases behind China and the US, is investing billions in wind power and has set the ambitious goal to double its capacity in the next five years, researchers from the Harvard John A Paulson School of Engineering and Applied Sciences, said. The majority of wind turbines are being built in southern and western India to best capture the winds of the summer Indian monsoon, the seasonal weather pattern then brings heavy rains and winds to the subcontinent. The study, published in the journal Science Advances, found that the Indian monsoon is weakening as a result of warming waters in the Indian Ocean, leading to a steady decline in wind-generated power. The research calculated the wind power potential in India over the past four decades and found that trends in wind power are tied to the strength of the Indian Summer Monsoon. In fact, 63 percent of the annual energy production from wind in India comes from the monsoon winds of spring and summer, researchers said. Over the past 40 years, that energy potential has declined about 13 percent, suggesting that as the monsoon weakened, wind power systems installed during this time became less productive, researchers said. Western India, including the Rajasthan and Maharashtra states, where investment in wind power is the highest, has seen the steepest decline over that time period, researchers said. However, other regions, particularly in eastern India, saw smaller or no decline, researchers said. The researchers aim to explore what will happen to wind power potential in India in the future, using projections from climate models.

Rest of the World

California became the first state in the nation to require homes built in 2020 and later be solar powered, following a vote by the Building Standards Commission. The unanimous action finalises a previous vote by the Energy Commission and fulfils a decade-old goal to make the state reliant on cleaner energy. Homebuilders have been preparing for years to meet a proposed requirement that all new homes be "net-zero" meaning they would produce enough solar power to offset all electricity and natural gas consumed over the course of a year.

China will aim to launch a new renewable power quota system before the end of the year, part of efforts to make better use of its renewable energy resources and reduce waste. The NDRC said in a new 2018-2020 plan for the clean electricity sector that it would work to cut renewable power wastage rates to 5 percent by 2020 from as high as 12 percent this year. The new quota system will set minimum renewable power consumption targets for each region. Companies covered by the scheme will receive renewable energy certificates when they buy renewable power and will be forced to buy additional certificates if they fail to reach their targets. The NDRC promised to create new mechanisms and price-setting policies, and would also implement a system that would force local governments to give renewable electricity sources priority access to the power market. According to a draft NEA proposal, the central government would start to set minimum targets of renewable energy consumption by region from 2019. Local authorities would monitor compliance by power companies and consumers, according to the draft. The draft outlines setting regional quotas based on their renewable energy resources, with hydropower-rich Sichuan province in southwest China required to bring renewables to 80 percent of total power consumption, compared with only 9.5 percent in coal-dependent Shandong province in the east. The quota system, opposed by traditional coal-fired power companies, has been under discussion for some time. The draft proposal follows two earlier drafts issued in March and September. The March version proposed a quota of 91 percent renewable power consumption in Sichuan and 8.5 percent in Shandong. The system aims to lower the rate of wasted renewable power by giving clean energy generators priority access to the grid. Power from wind, solar and hydropower plants is often lost because its intermittent nature makes it difficult to schedule without disrupting grid operations. The final quota for each region will be handed out in the first quarter of 2019 and the assessment of policy compliance will start from 1 January. The quota will be increased in 2020 when China looks to increase the portion of renewable energy use in its total energy mix, the NEA said. Beijing has set a national target to raise clean energy use to 15 percent by 2020 and 20 percent by 2030. It was at 13.8 percent in 2017.

Germany intends to increase energy production from wind and solar farms by a further 8 GW over the next three years as the government tries to compensate for its decision to abandon strict emissions targets. Chancellor Angela Merkel’s conservatives and their Social Democrat (SPD) junior coalition partners this year dropped plans to lower carbon dioxide emissions by 40 percent from 1990 levels by 2020. The decision was based on expectations that Germany would miss its national emissions target for 2020 without any additional measures because of strong economic growth and higher than expected immigration. The Bundestag lower house approved government plans to boost green energy production. For the past few years, Germany has been increasing power capacity from wind and solar by 5 GW each year. The 8 GW increase between 2019-2021 is additional to that. The government has set a new goal of increasing the share of renewable energy in Germany’s electricity consumption to 65 percent by 2030 from roughly a third last year.

Strong gusts evening helped Britain’s wind farms to produce a record amount of electricity, trade group Renewable UK said. Britain aims to increase its renewable output and close its coal-fired power plants by 2025 as part of efforts to meet climate targets. Overall wind generated 32.2 percent of the country’s electricity more than any other electricity source. The figure beat the previous record of 14.5 GW set on 9 November. The country’s renewable electricity capacity overtook that of fossil fuel generators such as gas and coal for the first time this year. The world’s largest offshore wind farm, Orsted’s Walney Extension, opened off the northwest coast of England in September.

Brazil’s latest policy to boost biofuels use has improved the outlook for ethanol production and should attract new investment in plants. Brazil is advancing with additional regulation for the policy, called RenovaBio and expected to be enacted in 2020, Lindenhayn said. RenovaBio will mandate fuel distributors to gradually increase the amount of biofuels they sell. The program aims to double the use of ethanol by 2030 from around 26 billion litres currently. The program also targets increases for other renewables such as biodiesel.

Finnish state-owned gas firm Gasum plans to expand the processing capacity of its biogas plant in the city of Turku, making it the second largest such facility in the country, the firm said. As a result of the expansion, which is scheduled to be completed by September 2019, the plant will be able to produce some 60 GWh of biogas annually, Gasum said. Increasing the production of biogas for use in business and transport is one of Finland’s energy and climate policy goals as it seeks to gradually phase out the use of coal. The plant is currently able to process about 75,000 tonnes of organic waste. From September 2019, its capacity will be as high as 110,000 tonnes. Gasum owns twelve biogas plants across Finland and expanded production in Sweden with the acquisition of Swedish Biogas International a year ago, a move that made it the biggest biogas producer in the Nordics.

Zambia is seeking proposals from potential developers of solar power projects with a combined 200 MW capacity as it tries to diversify its energy mix away from hydroelectric power. The 200 MW would be split into small projects, each with a maximum size of 20 MW. Zambia is heavily dependent on hydropower and faced electricity shortages following a drought in 2016, forcing Africa’s No.2 copper producer to ration power to its mines. Enel Green Power had started building five wind power projects in South Africa, which would add 700 MW of electricity to its output when completed in the next few years.

The EU regulators approved €600 million ($679 million) worth of French state aid for innovative solar power installations, saying it would support the bloc’s climate ambitions. The European Commission said that the scheme was aimed at adding 350 MW of additional capacity through small installations at ground level or on buildings that would be picked through tenders by the end of this year.

Malaysian state-owned oil and gas firm Petroliam Nasional Berhad (Petronas) has set up a new business within the group to make a push into renewable energy. Petronas has expressed interest over the last year to diversify into renewables amid low oil prices. Petronas will explore new business areas including new energy and that the company will assess opportunities in solar power. Petronas is the latest oil and gas major to look into the renewables space. Top oil companies including Royal Dutch Shell, BP and Total are investing more in cleaner energy sources such as solar and wind power and electric vehicle technology. IRENA said Southeast Asia is a potential hotspot for renewable energy, yet the region has not met expectations because it lacks policy frameworks that would encourage investment. Global renewable capacity, excluding hydro, has soared from under 100,000 MW in 2000 to more than 1 million MW in 2017, according to IRENA data.

France plans to triple its onshore wind power capacity by 2030 and multiply by five its solar power generation, enabling it to boost the share of renewables in its energy mix to 40 percent, according to the energy plan presented. The government would increase spending on renewables development to €8 billion ($9.05 billion) annually from 5 billion to take total spending to €71 billion between 2019 to 2028. Nuclear-dependent France has lagged behind other European nations with only around 20 percent of electricity consumption coming from renewables. France is on track to meet its target of 15 GW of installed wind power capacity by the end of the year, but installation of solar panels would likely fall short of the 10.2 GW target by the end of the year. The government would make sure power prices from renewables projects are kept low for consumers while developing more power interconnectors with European neighbours so as to always benefit from the least-cost power.

The EU’s progress towards increasing the use of renewable energy and improving energy efficiency is slowing, putting its ability to meet its 2020 and 2030 targets at risk, the EEA said. Rising energy consumption, particularly in transport, is to blame for the slowdown, the EEA said in an annual report on EU efforts on its renewables and energy efficiency targets. Renewable energy, such as wind and solar, accounted for a 17.4 percent share of gross final energy consumption in the EU last year, according to the EEA’s preliminary data, up from 17.0 percent in 2016. Preliminary EEA data for 2017 showed 20 member states were on track to reach their individual targets on renewable energy by 2020, a decline from 2016 when 25 countries were on track. On energy efficiency, both primary and final energy consumption were above the trajectory needed towards 2020. By the end of this year, member states must submit the first draft of their national energy and climate plans to help them achieve targets for 2030.

Norwegian gas system operator Gassco and Canadian energy firm Enbridge are working on reviving a 350 MW offshore wind project to boost power supply security at Norway’s Nyhamna gas processing plant, they said. The project, which would be the country’s first offshore wind farm, is called Havsul 1 and was fully licensed by Norwegian energy regulators in 2009 before being abandoned in 2012 due to profitability concerns and insufficient subsidies. Initially Havsul 1 was part of a larger plan to construct three offshore wind farms, with around 1,500 MW capacity, but Norway’s regulator rejected the other farms.

French energy group EDF and Nawah Energy have signed a deal to operate and maintain the delayed Barakah power plant, which will be the first nuclear energy plant in the Arab world. The $24.4 billion Barakah power plant in the United Arab Emirates is the world’s largest nuclear project under construction but has been marred by delays related to training issues. The plant was originally expected to begin operations in 2017. EDF and Nawah said that their deal, a 10-year commitment, would help Barakah prepare for operations of the first of its four 1,400 MW units. Earlier this year, the Barakah plant was due to open in 2019. France aims to reduce the share of electricity produced by nuclear reactors to 50 percent from 75 percent now by 2035. The French government has long outlined plans to shrink the country’s reliance on nuclear energy to 50 percent, though the deadline for that goal had remained less clear. A long-awaited government update on France’s long-term energy strategy is expected to be released later this month, setting out in greater detail how it will cut the share of nuclear in its power generation.

Poland expects its first nuclear power plant to start operating after 2030 as the country aims to cut its use of coal in producing electricity. The east European country, which hosts global climate talks in December, generates around 80 percent of its electricity from coal in outdated power plants, many of which will have to close in the coming decade. Poland has considered building a nuclear power plant for years, but has yet to take a binding decision on the project. Poland would talk with France, the United States, Japan and South Korea about nuclear technologies. The energy ministry is expected to publish Poland’s long-term energy policy by the end of the year, likely at the UN climate conference in Katowice, the heart of the coal industry in the south of the country. 25 GW or 44 percent of Poland’s installed power capacity in 2030 will be based on coal while the remaining energy sources will be wind, some photovoltaic and gas. In its draft energy strategy to 2040, a document keenly awaited by market players and analysts, the ministry said the first planned nuclear power plant will have a capacity of 1-1.5 GW. Ultimately the ministry expects Poland to have a total of 6-9 GW of nuclear power by 2043, which will account for around 10 percent of power generation. Poland has considered building a nuclear power plant for years, but the government has yet to take a binding decision on the project. Poland plans to reduce carbon emissions by 30 percent by 2030 as compared to 1990, the ministry said. The most polluting lignite coal will almost disappear by 2040 with a growing share of photovoltaic and wind farms. Poland already has onshore wind farms and its first offshore ones are expected to be built after 2025. Warsaw and Washington signed a declaration on enhanced energy security cooperation, including nuclear power. Poland wants to finance the power plant project on its own, said foreign capital might be necessary because the investment is costly. A nuclear program might cost in the region of 70-75 billion zlotys ($19.94 billion).

Russia signed a new nuclear cooperation agreement with Argentina, which is already negotiating with China about building nuclear reactors. State-owned Russian reactor builder Rosatom said that the two countries had signed a “strategic document” confirming their partnership in nuclear energy at the G20 summit in Buenos Aires. The deal is not a contract to build nuclear reactors, but a framework agreement like ones Russia has signed with many countries. Such agreements do not always lead to firm contracts and are often reconfirmed every few years. Russia has signed earlier nuclear agreements with Argentina, most recently in 2015. The South American country already has three reactors - two German-built, one Canadian-built - which together generate about five percent of its electricity and have combined capacity of 1.6 GW, World Nuclear Association data show. Rosatom said the new agreement outlined the development of large and small reactors in Argentina, possible joint projects in third-world countries and the possibility of jointly operating Russian floating nuclear plants. At home, China has 45 nuclear reactors in operation and about 15 under construction and it wants to build reactors abroad, but it lags way behind Russia in nuclear export.

Bulgaria plans to open a tender to pick a strategic investor for its revived Belene nuclear power project on the Danube and to pick a winner by the end of 2019. China’s CNNC, France’s Framatome - a unit of EDF - and Korea Hydro & Nuclear Power Co have expressed interest in the project to build two 1,000 MW nuclear reactors at Belene. An invitation to become a strategic investor would also be extended to Russia’s Rosatom. Bulgaria plans to keep a blocking stake in the venture. Bulgaria has been sitting on unused nuclear equipment since paying Rosatom more than €620 million ($712 million) for scrapping the project six years ago. Bulgaria will not commit more public funds to Belene, or extend state or corporate guarantees or offer investors power supply contracts at preferential rates.

MNRE: Ministry of New and Renewable Energy, MW: megawatt, GW: gigawatt, kW: kilowatt, kWh: kilowatt hour, GWh: gigawatt hour, BNEF: Bloomberg New Energy Finance, SECI: Solar Energy Corp of India, RTS: Rooftop Solar, discoms: distribution companies, NABARD: National Bank for Agriculture and Rural Development, GCF: Green Climate Fund, UNFCCC: United Nations Framework Convention on Climate Change, GST: Goods and Services Tax, CERC: Central Electricity Regulatory Commission, UP: Uttar Pradesh, gencos: generation companies, PPAs: power purchase agreements, YEIDA: Yamuna Expressway Industrial Development Authority, km: kilometre, EEREM: Energy Efficiency & Renewable Energy Management, CAPEX: capital expenditure, RESCO: renewable energy service company, IPGCL: Indraprastha Power Generation Company Ltd, PSPCL: Punjab State Power Corp Ltd, BoD: Board of Directors, CREST: Chandigarh Renewal Energy, Science and Technology Promotion Society, UT: Union Territory, IL&FS : Infrastructure Leasing and Financial Services, KSEB: Kerala State Electricity Board, KHEP: Kishanganga Hydro Electric Project, NCLT: National Company Law Tribunal, BHEL: Bharat Heavy Electricals Ltd, NPCIL: Nuclear Power Corp of India Ltd, PHWRs: Pressurised Heavy Water Reactors, US: United States, NDRC: National Development and Reform Commission, NEA: National Energy Administration, UK: United Kingdom, EU: European Union, IRENA: International Renewable Energy Agency, EEA: European Environment Agency, UN: United Nations, CNNC: China National Nuclear Corp

NATIONAL: OIL

ONGC’s $1.7 bn deep sea award perks up oilfield services market

18 December. ONGC (Oil and Natural Gas Corp)’s $1.7 billion work package, one of the biggest deep sea contracts offered in recent years, for its largest offshore block has perked up a listless global oilfield services industry and is likely to see fabrication of crucial underwater kits in the country for the first time. The state-run explorer has awarded the contract, its single-largest ever, to a consortium of BGHE (Baker Hughes, a GE company), McDermott International and LTHE (L&T Hydrocarbon Engineering) for block KG-DWN-98/2 off the Andhra coast. The block has the potential to reduce India’s import dependence for oil and gas by 10 percent. India currently imports 82 percent of oil need and 45 percent of gas requirement. ONGC expects to start producing gas by December 2019 and oil by March 2021. Total peak gas production rate is projected at 16 million cubic meters per day and peak oil output is pegged at 80,000 barrels a day.

Source: The Economic Times

Nagaland government signs MoU to amend oil regulations

16 December. Nagaland government and the Lotha Hoho, the apex body of Lotha Nagas, have signed an MoU (Memorandum of Understanding) to amend the Nagaland Petroleum and Natural Gas Regulations and Rules, 2012 with certain terms and conditions. The main oil belt of Nagaland is situated in the Lotha Naga areas. The State Assembly had enacted the Nagaland Petroleum and Natural Gas Regulations and Rules, 2012. However, around three years after it was enacted the Kohima bench of Gauhati High Court issued a stay order against the permit given to Metropolitan Oil and Gas Private Ltd (MOGPL) following a PIL (public interest litigation) filed by the Lotha Hoho. The PIL raised issues involving “controversial” MOGPL which bagged the lucrative oil zones in Wokha district. Other issues included the fixing of eight percent royalty in addition to other Excise tax by the State Government on the plea of sharing the revenue with non-oil bearing districts. According to the Nagaland Petroleum and Natural Gas Regulations and Rules, 2012, the State Government set up the Nagaland Petroleum and Natural Gas Regulations and Rules Board to monitor all activities related to oil and natural mining.

Source: The Assam Tribune

RIL plans to expand Jamnagar refinery capacity to 41 mt from 35.2 mt

14 December. Reliance Industries Ltd (RIL) is looking at expanding the production capacity of it’s Special Economic Zone (SEZ) refinery at Gujarat’s Jamnagar to 41 million tonnes per annum (mtpa) from the present 35.2 mtpa. RIL’s current refinery complex in Jamnagar has a cumulative capacity to process 68.2 mtpa of crude oil. After expansion, RIL’s total crude oil processing capability would increase to 74 mtpa, overtaking Indian Oil Corp (IOC)’s cumulative capability of 69.2 mtpa. RIL had increased the SEZ refinery’s capacity to 35.2 mtpa in financial year 2017-2018 from 27 mtpa in financial year 2016-2017. According to oil ministry’s committee on refinery expansion report, India is projected to increase its total oil refining capacity by 76 percent to 438.65 mtpa by 2030 from the current 249.4 mtpa.

Source: The Economic Times

India’s LPG consumption drops for the first time in 5 yrs

13 December. India’s monthly petroleum products consumption dropped 1.7 percent to 17,273 in November primarily due to a decline in usage of liquefied petroleum gas (LPG), Diesel, Kerosene and Petcoke, data from Petroleum Planning and Analysis Cell (PPAC) showed. LPG consumption, which had been recording growth for 62 straight months, declined for the first time in November. It dropped 7.34 percent to 1,842 tonne during the month as compared to 1,988 tonne recorded in November 2017, data from PPAC showed. Consumption of cooking gas has been buoyant over the past few years mainly due to increased LPG penetration under Pradhan Mantri Ujjwala Yojana (PMUY). According to the PMUY, Oil Marketing Companies (OMCs) have distributed 5.84 crore LPG connections under the scheme. LPG penetration in the country has gone up to 88.5 percent in 2018 as compared to 56.2 percent in 2015, according to data.

Source: The Economic Times

'Land for Ratnagiri refinery should be available by 2019'

13 December. The process of acquiring land for the ambitious Ratnagiri refinery project in Maharashtra should be over by end 2019 as work on the ground for the refinery has to start by 2020, B Ashok, Chief Executive Officer (CEO) of Ratnagiri Refinery & Petrochemicals Ltd (RRPCL) said. The project, to come up at Babulwadi village, would be the world’s largest green-field refinery-cum-petrochemical complex when commissioned. It is expected to cost $40 billion. The refinery would require 15,000 acres of land, According to RRPCL. The pre-feasibility study of the 60 million tonnes per annum (mtpa) refinery has been completed. It will be capable of processing 1.2 million barrels of crude oil and around 18 mtpa of petrochemicals. According to RRPCL, the project is expected to be commissioned by 2025.

Source: The Economic Times

India needs to have a good oil hedging policy: Rajan

12 December. With geo-political factors impacting crude prices, India needs to have a good oil hedging policy as the volatility will continue to rise, former Reserve Bank of India (RBI) governor, Raghuram Rajan said. Rajan said the issue has been discussed in the past and it began with a strategic petroleum reserve, but beyond that there is a need to think about hedging oil prices especially when it comes to levels such as now. The problem is many who are entrusted with this, fear the chance of oil prices falling even further if you hedge it, but that has to be taken as a national consequence of the hedging programme.

Source: Livemint

NATIONAL: GAS

ONGC, OIL spend Rs 130 bn on 115 O&G discoveries government took for auctioning: Pradhan

17 December. Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) spent over Rs 130 billion on 115 oil and gas (O&G) discoveries which were taken away from them by the government for auctioning to private companies, Oil Minister Dharmendra Pradhan said. The present BJP-led NDA government took away so-called idle small and marginal discoveries of ONGC and OIL and auctioned them to private firms under Discovered Small Field (DSF) bid rounds. Under DSF bid round-1, 67 discoveries, mostly of ONGC, were auctioned, while in the second round, bids for which are due next month, another 48 finds are being auctioned, he said. ONGC and OIL are not compensated for the amount they had spent on discoveries of these oil and gas reserves. Unlike state-owned firms, the private players are allowed pricing and marketing freedom to make these discoveries viable.

Source: Business Standard

Government plans to increase share of natural gas to 15 percent in India's fuel basket

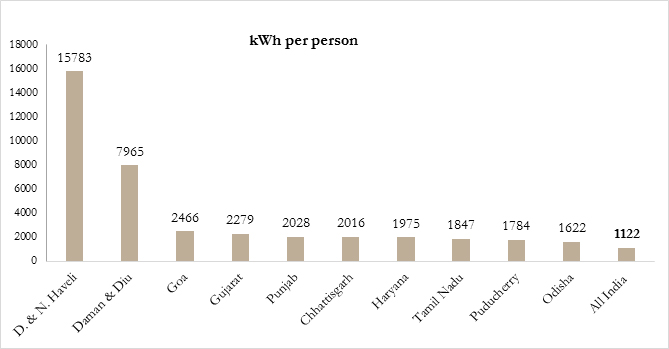

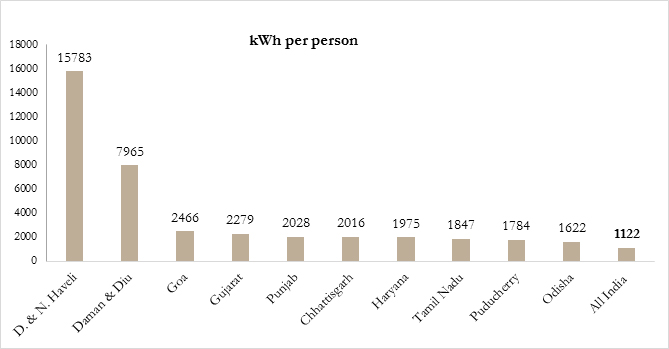

13 December. This year, Delhi and Mumbai crossed the one million mark in piped natural gas connections. Beyond the two cities, access to the fuel will grow further to 402 districts across 27 states and Union Territories, covering 70 percent of the country’s population, once the area under the tenth round of bidding is connected. This is a long way from 1857, the year of the great revolt against the Raj, when a British joint stock company called Oriental Gas Company started offering piped natural gas supplies in Calcutta (now Kolkata) for commercial and domestic purposes. After that, parts of Gujarat and Tripura also had piped gas networks, owing to the local availability of natural gas in these areas. In fact, British Gas (BG), merged with Shell globally, set up Gujarat Gas Company in 1980 to develop CGD (city gas distribution) networks in Surat and Bharuch. BG exited Gujarat Gas by offloading its stake to Gujarat State Petroleum Corp in 2013 and subsequently exited Mumbai Gas Ltd (MGL), its joint venture with GAIL (India) Ltd and the Maharashtra government. But such exits do not reflect the steady growth of the CGD business in India. Going forward, however, CGD providers may struggle to replicate Delhi and Mumbai’s numbers, principally because smaller cities may not have the same population sizes. Besides, the model that worked for these two cities evolved even before CGD rights were bid out. IGL (Indraprastha Gas Ltd), a joint venture of GAIL, Bharat Petroleum Corp Ltd (BPCL) and the Delhi government, has held the rights to the CGD network in Delhi since 1999, seven years before the legal framework for the business was laid out under the Petroleum and Natural Regulatory Board Act in 2006. Prior to that, GAIL was managing gas supply business in Delhi. MGL, the BG-Shell joint venture till the multinational exited in 2018, also had equity participation from GAIL and the Maharashtra government. It was formed four years before IGL in 1995. The government plans to increase the share of natural gas to 15 percent in the overall fuel basket of the country. A major challenge for CGD players, however, is sourcing natural gas. For players like GAIL and Adani, which have access to natural gas and pipelines, it may be easier to supply gas to their subsidiaries.

Source: Business Standard

NATIONAL: COAL

MAHAGENCO to import coal, can lead to increase in tariff

17 December. The state government-owned power generation utility Maharashtra State Power Generation Company (MAHAGENCO) is forced to buy imported coal as the central government owned Coal India Ltd (CIL) is unable to supply coal to MAHAGENCO’s plant. This will result in a tariff hike of 15 to 20 paisa per unit. The MAHAGENCO requires around 4.8 million tonnes of coal every year. However, CIL, in the first nine months of current year, managed to supply 2.6 million tonnes or 56 percent of the total amount needed. The shortage of coal in October when temperatures were soaring and the state was reeling under the heat wave, MAHAGENCO was forced to shut its four plants whose combined capacity was 1,700 MW. The MAHAGENCO has decided to import two million tonnes of coal. Though imported coal has high calorific value compared to Indian coal, it is also costly. While Indian coal costs around Rs 2800 per tonne, the imported coal costs around Rs 7100 per tonne. This will increase MAHAGENCO’s coal purchase bill by Rs 700 crore and tariff hike of 15 to 20 paisa per unit.

Source: The Economic Times

Sonar system fails to detect trapped coal miners in Meghalaya

15 December. The National Disaster Response Force (NDRF) used sonar system and underwater camera to detect 13 miners, who have been trapped inside a coal pit filled with water in Meghalaya's East Jaintia Hills district. However, the system failed to locate any of the trapped miners in the main well of the 370-feet coal pit because of poor visibility. Meghalaya Police arrested Jrin alias Krip Chulet, the owner of the coal mine from Narwan village. The accident inside the coal pit at Lumthari area was of significance, especially after the National Green Tribunal (NGT) had ordered an interim ban on "rat-hole" coal mining in the state from 17 April 2014. Meghalaya has a coal reserve of 640 million tonnes. The coal is high in sulphur content and is mostly of sub bituminous type.

Source: Business Standard

'Value of India's coal imports up 38 percent at Rs 1.3k bn in FY18'

12 December. India's coal imports rose by 38.2 percent to Rs 1384.77 bn in monetary terms last fiscal, Parliament was informed. In quantity terms, the coal imports increased by 9.1 percent to 208.27 million tonnes (mt) from 190.95 mt. Coal and Railways Minister Piyush Goyal said upsurge in value of coal imports is primarily due to rise in international price leading to greater value increase as compared to absolute quantity increase in 2017-18. The Minister said many thermal power stations are configured to use imported coal and as such imports by these are inevitable. During April-October 2018, these power plants have imported 22.27 mt of coal.

Source: Business Standard

NATIONAL: POWER

120 government schools reeling under lack of power in UP

18 December. In a recent audit by the government, it has been found out that as many as 120 government schools in Bijnor district still lack power connections. The students in these schools have no other choice but to study without fans in the scorching heat and without light in low visibility and foggy winter days. According to the data provided by the basic education department, around 120 government schools including 70 primary and 50 upper primary, are in the district running without power supply. The data emerged only after education department collected reports from entire district. Now, the basic shiksha adhikari has instructed the concerned persons to apply for power connection in these schools. It is not yet clear if these schools ever applied for power connection or not. It is worth mentioning that 14 districts of west UP (Uttar Pradesh) including Bijnor, Moradabad, Rampur, Sambhal, Amroha, Meerut, Ghaziabad, Gautambudhnagar, Bulandshahar, Hapur, Saharanpur, Muzaffarnagar, Shamali etc were declared completely electrified on 31 October. A teacher who wished to remain anonymous said that the terrain of many schools isn’t conducive to lay a power line, which is why many schools are reeling under lack of power supply.

Source: The Economic Times

Gujarat government waives Rs 6.2 bn energy bill dues of rural users

18 December. The Vijay Rupani-led BJP government in Gujarat announced a complete waiver of Rs 6.25 bn in unpaid electricity bills, under its one-time settlement scheme for over 6 lakh people living in rural parts of the state. The move comes a day after the newly-formed Congress governments in Madhya Pradesh and Chhattisgarh announced farm loan waivers, fulfilling a promise made by the party ahead of the Assembly polls. Gujarat Energy Minister Saurabh Patel said the state government scheme would also benefit those who had been booked for electricity theft and subsequently lost their power connection. Under the scheme, irrespective of the due amount, including principal and interest, people living in rural areas can get back their electricity connection by paying just Rs 500, Patel said. Those who were either booked for electricity theft in the past or lost their connection for any other reason, can take benefit of this scheme, which will be effective till February-end. According to Patel, this scheme will help farmers, the poor and middle class citizens living in rural parts.

Source: Business Standard

India loses $86 bn annually to power sector distortions: World Bank

17 December. What could be the total economic cost imposed by distortions in the power sector on the Indian economy annually? The figure was a staggering $86.1 billion, or roughly 4.13 percent of the Gross Domestic Product (GDP) in financial year 2015-16, according to the World Bank. The economic cost of distortions was one order of magnitude higher than the fiscal cost of subsidies to distribution utilities which was worth $8.8 billion (0.42 percent of GDP) in 2015-16. The excessive health cost borne by the population and external costs due to excessive emissions of global warming gases are estimated at $35.4 billion a year. These distortions are followed by regulatory distortions upstream, including the under-pricing of coal and the cross-subsidisation of passenger railway service from freight, both of which exacerbate coal shortages, resulting in a combined welfare loss of 0.19 percent of the GDP. Further, groundwater depletion induced by electricity subsidies costs 0.12 percent of GDP; inefficient electricity generation and distribution cost the economy an estimated 0.1 percent of GDP a year; and electricity cross-subsidies, which undermine the international competitiveness of manufacturing, cost 0.1 percent of GDP, the bank said.

Source: The Economic Times

No power tariff hike in 2019-20, declares Chandigarh administration

15 December. In a major relief to city residents, the UT electricity department has not proposed any hike in power tariff for the next financial year 2019-20. The department in its power tariff petition submitted before the Joint Electricity Regulatory Commission (JERC) stated that there will be total surplus of Rs 186.5 mn with the department for the period between financial year 2017-18 to 2019-20, therefore the department did not propose any power tariff hike. The JERC had marginally increased rates in domestic and commercial categories while it had reduced the tariff in the industrial category for financial year 2018-19. In the domestic category, the rates were increased from Rs 2.55 to Rs 2.75 in the slab of 0-150 units, while there was no change in the rate of Rs 4.80 in the slab of 151-400 unit. In the slab of above 400 units, the rate was increased from Rs 5 to Rs 5.20 per unit. Along similar lines, a small increase in tariff in the commercial consumer category was made last time. In the commercial category, there was no change in the rate of Rs 5 in the slab between 0-150, while in the slab of 151-400, rates were increased from Rs 5.20 to Rs 5.30 per unit. In above 400 slab, rates were increased from Rs 5.45 to Rs 5.60 per unit.

Source: The Economic Times

Gujarat power distribution company faces ire over poor service

15 December. The engineers of state owned distribution company (discom) Paschim Gujarat Vij Company Ltd (PGVCL) had to face the ire of people of Tativela village in Veraval taluka of Gir Somnath over allegedly poor electricity service. Farmers of Tativela village of Veraval had lodged a complaint of fault in the feed line a few days back. They claimed that when they called the customer care number they got a rude reply.

Source: The Economic Times

Household electrification under Saubhagya to be completed before March deadline: Power Minister

14 December. Complete household electrification in the country under the Rs 163.20 bn Saubhagya scheme would be completed latest by February, ahead of the March deadline, Power Minister R K Singh said. However, it was unanimously resolved at the state power ministers' meet chaired by Singh in July this year that all households in the country would be electrified under the scheme by 31 December 2018. According to the latest information on the Saubhagya portal, as many as 2.21 crore households have been electrified under the scheme and 78.65 lakh families are to be energised in the programme. The Pradhan Mantri Sahaj Bijli Har Ghar Yojana - Saubhagya scheme was launched by Prime Minister on 25 September 2017.

Source: Business Standard

Haryana government starts new scheme to recover pending power dues

12 December. The Haryana government has started a new scheme for defaulters who have not cleared their pending electricity dues since 2005. Under the scheme, which will end on 31 December, the Dakshin Haryana Bijli Vitran Nigam (DHBVN) is giving relaxation to consumers falling under 20 kilowatt (kW) domestic and up to 5 kW non-domestic categories. Pending bills prior to 2005 have been waived off in view of the provisions of the waiver scheme.

Source: The Economic Times

Government sets up GoM on stressed power assets

12 December. The government has constituted a Group of Ministers (GoM) headed by Finance Minister Arun Jaitley to vet the recommendations of a high-level panel on stressed power projects, as per an official order. The panel, headed by Cabinet Secretary P K Sinha, had submitted its report. According to a report by the Department of Financial Services, as many as 34 coal-based thermal power projects, mostly private with a total capacity of 40,130 MW, were considered 'stressed' by the Ministry of Power as on 22 March 2017.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

NPCIL’s Kaiga Unit-1 creates world record for continuous operation

17 December. A 220 MW unit of Nuclear Power Corp of India Ltd (NPCIL)’s Kaiga Atomic Power Station has created a world record for continuous operation for 941 days, BHEL (Bharat Heavy Electricals Ltd), which supplied equipment for the unit, said. The previous world record of 940 days held by Heysham 2 Unit-8 of the UK, BHEL said. Earlier in October 2018, the unit surpassed the world record of 894 days for continuous operation among all pressurized heavy water reactor. The complete steam turbine generator set and all the steam generators for the NPCIL unit have been manufactured and supplied by BHEL.

Source: Business Standard

Mumbai Metro commissions solar power generator atop Metro Depot

17 December. Reliance Infrastructure Ltd promoted Mumbai Metro One has installed and commissioned a 612 kilowatt peak (kWp) capacity roof-top solar power plant atop the Metro Depot in D.N. Nagar, Andheri west. A total of 2,000 rooftop solar panels have been installed on the Metro Depot along with associated supporting and cabling works. The Metro Depot solar project has been set up on Renewable Energy Service Co model with a power purchase agreement for 25 years, besides operations and maintenance for the entire period.

Source: Business Standard

NTPC acquires 720 MW Barauni Thermal Power Station in Begusarai, Bihar

17 December. NTPC Ltd has acquired Barauni Thermal Power Station (720 MW) in District Begusarai, Bihar from Bihar State Power Generation Company effective on 15 December 2018. The 720 MW coal-based power station has 2 units of 110 MW each (under R&M) and 2 units of 250 MW each (Under Construction). The units of the power station will be progressively put under commercial operation.

Source: Business Standard

India, France review status of Jaitapur nuclear power project

15 December. India and France held discussions on deepening the bilateral strategic partnership through cooperation in the Indo-Pacific region, defence, space and civil nuclear energy sectors. French Minister of Europe and Foreign Affairs Jean-Yves Le Drian said he and External Affairs Minister Sushma Swaraj reviewed the status of the European Pressurised Reactor (EPR) project in Jaitapur in coastal Maharashtra. In March, India and France inked an agreement to expedite the Jaitapur nuclear power plant project, with the aim of commencing work at the site by year-end. The Indo-French nuclear agreement was signed in 2008 to build a nuclear power plant in Jaitapur, some 600 kilometre south of Mumbai. The power plant will have six reactors with a capacity of 1,650 MW each Once installed, the Jaitapur project will be the largest nuclear power plant in the world, with a total capacity of 9,600 MW.

Source: Business Standard

Odisha has potential to establish 500 compressed biogas plants: OMCs

14 December. Odisha has a potential to establish 500 compressed biogas (CBG) plants out of 5000 such plants targeted to be set up across the country. The plants are estimated to have an annual CBG production of 15 million tonnes by 2023. The target of putting of 5000 CBG plants is expected to attract Rs 1.7 trillion in investment. The Union government has launched Sustainable Alternative Towards Affordable Transportation (SATAT) to promote CBG production. The SATAT initiative aims to boost availability of more affordable transport fuels, better use of agricultural residue, cattle dung and municipal solid waste besides providing an additional source of revenue to farmers. As part of SATAT, the OMCs (Oil Marketing Companies) are inviting expression of interest (EOI) to procure CBG from potential entrepreneurs and make available CBG in the market for use as automotive fuel.

Source: Business Standard

Karnataka awards solar power projects of 80 MW capacity to TEPSOL

13 December. The Karnataka government has awarded solar power projects of 80 MW capacity to TEPSOL Projects, a joint venture between Think Energy and EverStream Capital. This takes the firm's Karnataka portfolio to over 176 MW including 1 MW of rooftop projects spread across seven locations, the firm said. The company said it is developing 200 MW of solar projects in Maharashtra including 5 MW of rooftop projects spread across multiple locations.

Source: The Economic Times

Centre drops plan to install 12 GW solar capacity through NTPC

13 December. The government has dropped its plan to install 12 GW of solar capacity out of total 15 GW envisaged through NTPC Ltd as solar tariff dipped recently, Parliament was informed. Earlier, the government had planned to install 15 GW of solar energy capacity through NTPC, which was to be bundled with thermal power supply to specific states. The power company has already completed auction of 3 GW capacity out which 2.75 GW is installed and 0.25 GW is under construction. The government has set a target for installing 175 GW of Renewable Energy capacity by the year 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from Biomass and 5 GW from Small Hydro power, Power and New & Renewable Energy Minister R K Singh said.

Source: Business Standard

India’s solar power installations drop 30 percent to 1.5 GW in Q3 2018

12 December. Total solar power installations in India dropped 30 percent to 1,589 MW in the third quarter (July-September) of the calendar year 2018 as compared to 2,278 MW recorded in the same quarter last year. The capacity was 4 percent down over 1,659 MW installed in the previous quarter (April-June 2018), consultancy firm Mercom said in a report. In the third quarter of 2018, large-scale installations totalled 1,154 MW, down 43 percent over 2,013 MW installed in Q3 2017, and 7.2 percent over 1,244 MW of Q2 2018. Also, rooftop installations in Q3 2018 accounted for 435 MW, which was a 64 percent increase as compared to 265 MW installed in Q3 2017 and a 5 percent increase from 415 MW installed in Q2 2018. India’s solar installations have reached 6,600 MW year-to-date with large-scale projects making up 5,382 MW and rooftop installations accounting for 1,240 MW. Overall, cumulative solar power installed capacity totalled 26,000 MW at the end of third quarter of 2018 with large-scale solar projects accounting for 89 percent and rooftop solar making up the remaining 11 percent. Mercom is forecasting total solar installations of around 8,000 MW in calendar year 2018.

Source: The Economic Times

INTERNATIONAL: OIL

Libya’s NOC declares force majeure on operations at biggest oilfield

18 December. Libya’s National Oil Company (NOC) has declared force majeure on operations at El Sharara oilfield, it said. NOC said that oil production from Libya’s biggest oilfield will only restart after “alternative security arrangements are put in place”. The NOC declared force majeure on exports from the 315,000 barrels per day oilfield located in the south of the North African country after the field was earlier seized by a local militia group.

Source: Reuters

Colombia cancels 2 oil exploration auctions, to relaunch in 2019

18 December. Colombia has canceled two auctions of rights to explore for oil in dozens of areas of the Andean nation and plans to relaunch bidding early next year, the government said. The Sinu-San Jacinto round of bidding on 15 blocks in northern Colombia was scrapped after interested companies withdrew, and a round known as the Permanent Competitive Procedure was canceled because of a judicial ruling, the National Hydrocarbons Agency said. It plans to relaunch bidding in February. Colombia last held auctions in 2012 and 2014, when it awarded 76 blocks. The government subsequently held off further auctions because of low international oil prices. Colombia needs to boost foreign investment to revive its stagnant crude and gas production. The nation has 1.78 billion barrels of reserves, equivalent to about 5.7 years of consumption but wants to increase that to at least 10 years of consumption. It produces some 860,000 barrels per day (bpd) of crude, half for export. The government expects to increase output to 900,000 barrels of oil equivalent a day this year.

Source: Reuters

Oil market is correcting: UAE Energy Minister

17 December. The global oil market is “correcting”, UAE energy minister Suhail al-Mazrouei said. He said at an event in Dubai that he expects “everyone” to cut oil supply under a agreement reached earlier this month in Vienna between OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC exporters.

Source: Reuters

OPEC has shown it can reach deal despite splits: Iranian Oil Minister

16 December. Iranian Oil Minister Bijan Zanganeh praised OPEC (Organization of the Petroleum Exporting Countries) for what he said was the producer group’s ability to reach agreement despite intense internal political differences. The OPEC and its Russia-led allies agreed to cut output by more than expected, despite pressure from US President Donald Trump to reduce the price of crude. The OPEC deal had hung in the balance for two days - first on fears that Russia would cut too little, and later on concerns that Iran, whose crude exports have been depleted by US (United States) sanctions, would receive no exemption and block the agreement.

Source: Reuters

Brazil’s Ouro Preto cuts bid for Petrobras oilfield clusters

15 December. Ouro Preto has cut its bid for two shallow water mature oilfield clusters from Brazil’s oil company Petroleo Brasileiro, flagging a drop in oil prices in recent months. Ouro Preto entered exclusive talks with Petrobras in July after presenting the highest offer for the Pampo and Enchova clusters, located in the Campos basin off the coast of Rio de Janeiro state. At the time, the fields were seen fetching around $1 billion. Lower oil prices could hamper efforts by Petrobras to offload some other assets it intends to sell.

Source: Reuters

Norway postpones decision on Arctic oil terminal

14 December. The Norwegian government has postponed a decision on whether to mandate the construction of an oil processing terminal near the Arctic tip of northern Europe until the third quarter of next year, it said. If built, the onshore Veidnes terminal would receive crude via a pipeline from Equinor’s offshore Johan Castberg oilfield, which is expected to start producing in late 2022. Equinor originally ditched plans for an onshore terminal in order to save costs, preferring instead to load oil on to crude tankers at the field before exporting it to global markets.

Source: Reuters

Oman to cut oil output by 2 percent for 6 months

14 December. Oman will be cutting oil output by 2 percent from January for an initial period of six months, according to a letter sent to customers of Omani oil by the country’s oil and gas ministry. Organization of the Petroleum Exporting Countries and its Russia-led allies agreed to slash oil production by more than the market had expected despite pressure from US (United States) President Donald Trump to reduce the price of crude.

Source: Reuters

Angola’s Sonangol, Exxon Mobil sign oil exploration agreement