< style="color: #0069a6;letter-spacing: 0.7pt">COAL SUPPLY CRITICAL TO POWER SUPPLY DESPITE RE PUSH

Coal News Commentary: November 2018

India

That a large part of NTPC Ltd’s reported under-recoveries of Rs 2.10 billion in Q2FY19 was due to unavailability of coal exacerbated the coal supply crisis in the country. The company had reported Rs 14 billion of under-recovery in FY18, of which Rs 8 billion was due to coal shortage. The company’s net profit slipped 1.1% year-on-year to Rs 24.17 billion in the quarter. Fuel stock at NTPC’s power plants remains low with current coal stock of 3.7 mt from a high of 6.9 mt. In the first half of FY19, NTPC’s under-recovery due to coal shortage at 2,320 MW Mouda plant, 2,000 MW Simhadri station and 2,400 MW Kudgi unit was Rs 1.56 billion, Rs 780 million and Rs 250 million respectively. NTPC had received 168.5 mt coal in FY18, which includes 0.32 mt of imports. Requirement for FY19 is estimated to be 196.3 mt. NTPC has already extracted 2.5 mt coal from Pakri Barwadih mine in the first six months of FY19, against the annual production target of 6.3 mt. Additionally, 4,000 tonne have been produced from the Dulanga mine, which expects to produce 1.7 mt in FY19. NTPC has also floated a tender to import 2.5 mt of coal, but the state-owned company risks being seen as an import driver as the country desperately tries to cut import bills amid the rupee devaluation. India’s coal import went up from 171 mt in FY14 to 208 mt in FY18.

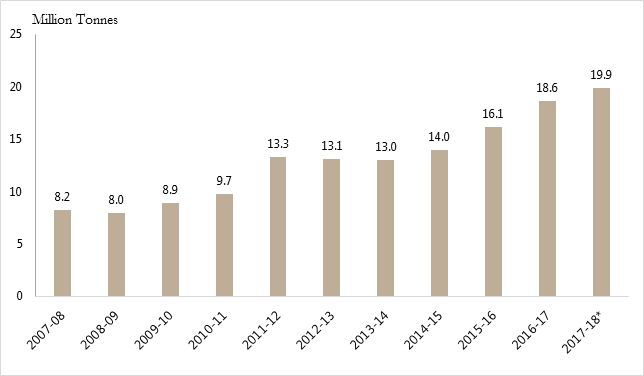

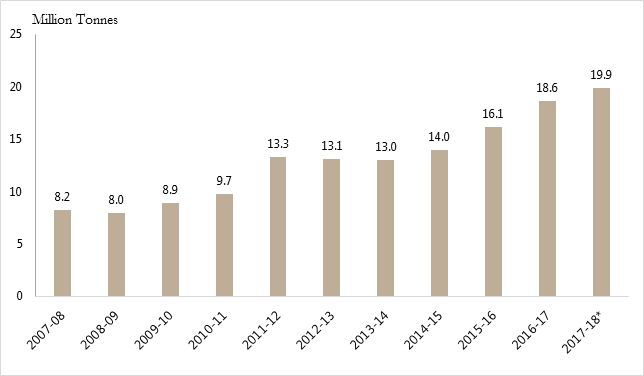

CIL said it produced 306.24 mt of coal in the first seven months of the ongoing fiscal, registering an increase of 10 percent as compared to the year-ago period. In the April-October period of 2017-18, the company's coal production was 278.03 mt, CIL said. CIL supplied 22.2 mt more coal to the power sector during the period under review as compared to the corresponding year-ago seven months, it said. Rake loading to power sector grew 8.2 percent during April-October 2018. The company as whole liquidated 34.57 mt of its pit-head stock during the first seven months, as the stock pile stood at around 21 mt by October-end. Overall offtake during the reported period was 340.81 mt, clocking 7.4 percent growth as compared to 317.28 mt in the year-ago seven months, it said. CIL accounts for over 80 percent of domestic coal output.

CIL is ready to renew its 5 mt offer of additional coal to NTPC, which could not lift any quantity after it was offered the fuel with a 30-day deadline. NTPC said transporting the coal was a big hurdle. However, the company may not be able to keep the offer open for long as the coal that has been made available will deteriorate in quality with time or may catch fire. NTPC was offered coal after its stocks dipped sharply. It was offered 1.5 mt from Central Coalfields, 0.5 mt from Bharat Coking Coal and 0.5 mt from Northern Coalfields among others. NTPC said the company had to arrange for road transportation of the coal from pit head to railways’ loading facilities.

CIL has relaxed the norms for "mine-specific coal supply" policy, which would ease availability of the dry fuel to consumers having less than 1 mt of requirement per annum. The move would benefit a large number of the mining major's linked small consumers, the company said. The policy was conceived in 2011 to enable the consumer to benefit from assured supply from a preferred source, and gain from reduction in logistic costs. However, the old policy was applicable to consumers having a minimum requirement of 1 mt of coal per annum. Further, the mine from which the coal was sourced had to have a capacity of 2.5 mtpa. The relaxed norms brings down the eligibility from 2.5 mtpa production capacity to 1 mtpa.

CIL aims to raise output from its troubled Rajmahal mine in Jharkhand to 60,000 tonnes a day by March 2019, having resolved land-acquisition related problems which had crimped production to 20,000 tonnes per day. Coal from the Rajmahal mine helps NTPC run close to 4,200 MW of power generation plants in eastern India, which supply power to Bihar, Jharkhand and West Bengal, and also to northern India including Delhi and Uttar Pradesh. NTPC’s generation capacities were faced with depleting coal stocks and lower power generation as supplies from Rajmahal dwindled. Reserves at Rajmahal within the land acquired by CIL were almost exhausted and required expansion to keep production levels intact. However, land acquisition at two villages – Bansbiha and Taljhari—ning 160 hectares, adjacent to the existing project turned out to be a lengthy process, as sorting out ownership issues resulted in inordinate delay. It led to drastic fall in supplies and stocks at the coalfield, as well as at two critical power plants in the region—at Farakka and Kahalgaon. At present, CIL is using 15 goods trains to transport coal from the Rajmahal mine to power stations in the region. One goods train can load up to 3,500 tonnes of coal. CIL is sending five loaded goods trains from West Bengal’s Ranigunj coalfields to augment supplies at power stations.

Reduced e-auction offerings CIL have contributed to an increase of one-and-a-half times in coal prices in the past year. This is twice as much as the increase in international rates. Analysts said the other factors were increased demand for coal from power plants and non-availability from regular channels for non-power companies, including captive power plants. Between April and September this year, CIL offered 37 mt of coal through its e-auction platform, 19 percent less than that in the year-ago period. This increased its average realisation 50 percent to Rs 2,491/tonne during the period. Despite offering less coal, the company saw a near 21 percent increase in its income from e-auction to Rs 92 billion during the period from Rs 76.52 billion in the year-ago period, as prices shot up owing to lower availability.

India is projected to overtake Australia and the US in early 2020s to become the world’s second-largest coal producer in energy terms behind China, IEA has said in its latest World Energy Outlook 2018 report. India is estimated to produce 955 Mtce in 2040 as compared to 395 Mtce produced in 2017, growing at an annual rate of 3.9 percent, the report said. Also, the report projects that India will become the largest coal importer, overtaking China through 2020s. The country’s coal imports are expected to reach 285 Mtce in 2040 from 172 Mtce in 2017. It said India has set ambitious targets for domestic coal production but imports nonetheless rise, especially for coking coal as domestic resources are insufficient to meet growing demand from the iron and steel industries. Under the IEA’s New Policies Scenario, cumulative capital spending in the coal supply chain is estimated to amount to $1 trillion up to 2040, with an annual average capital spending of $43 billion per year. Coal’s share in India’s electricity generation is expected to go down to 48 percent in 2040 from 74 percent in 2017. In the meantime, share of renewable energy in the country’s electricity generation is expected to go up to 38 percent in 2040 from 16 percent in 2017. According to IEA’s analysis, there are a number of potential bottlenecks in India which could affect the pace of coal production capacity expansion and the delivery of adequate quantities to various users. The report states that despite an overhaul of the coal allocation system, as of April 2018, more than 50 mt of coal is stockpiled at mines awaiting transportation, leading to imports.

India's coal imports rose by 7.9 percent to 134.46 mt in the first seven months of the current fiscal, according to mjunction services. The country imported 124.57 mt of coal in the corresponding period of previous fiscal. However, there was a 6.8 percent drop in coal and coke imports in October as compared to 19.77 mt imported during the same month last financial year. Coal and coke imports during October through 31 major and non-major ports are estimated to have increased by 3.55 percent over September in the ongoing financial year. The government had earlier said that during 2017-18, coal imports increased to 208.27 mt due to increase in demand by consuming sectors.

Niti Aayog plans to come out with a policy prescription on how India should meet its demand for coal in domestic power and non-power sectors to cut imports of the fossil fuel over the next 10 years. The government’s policy think tank has invited bids for research/ study on linking coal production and consumption requirements in the country based on which the Aayog is expected to draft a comprehensive policy. The study/research will be funded under the research scheme of the Aayog. The moves comes as India battles frequent coal supply issues for domestic power generation. Coal-based power plants account for more than half of the country’s power generation capacity. This would be a comprehensive policy for production and consumption of coal in the country within the framework of the National Energy Policy which is being worked out by the NDA government since 2015.

Indian Railways allotted at least 4,300 goods trains or rakes in the past 12-15 months on instruction from CIL for supplying about 17 mt of coal to the state-run miner’s non-power consumers including captive power plants, that were never loaded by CIL and the allotted rakes remain pending. The estimated value of this coal is at least Rs 22 billion and a portion of this has been already deposited in advance with CIL. Of late, CIL has stopped asking for additional rakes since it is not in a position to clear the entire backlog which touched 5400 a month ago as coal scarcity continues at power houses. At present, the largest number of pending rakes are from CIL subsidiary South Eastern Coalfields, at around 2,200, followed by Mahanadi Coalfields at around 1,000.

Captive power producers coming from sectors like aluminium, steel and copper have been complaining the issue of coal supply to run their plants. Supply of coal is a long standing issue for the captive power producers who unlike the independent power producers don't produce it for commercial purpose. In the monsoon requirement shot up and coal production could not keep pace. The Union Coal Minister urged CIL to pledge self-sufficiency in production to eliminate import of the dry fuel, and look at reviving the 1 bt output aim.

GIDC proposes to make a fresh attempt for coal blocks and is in the process of applying to the Union ministry of coal seeking allocation of a coal block, outside Goa, under the government route or captive route. The coal from these blocks shall be utilized for generation of power for industries in the state, GIDC said. According to GIDC, the Union ministry wrote to the state government a few months ago informing that new coal blocks were in the process of being allocated to states and state government corporations. This July, the coal ministry issued directions to allocate 27 more coal mines including two coal mines for state governments or state-run corporations. An earlier attempt to source coal and then supply it to a private power company failed miserably in 2014 when the Supreme Court quashed the allocation of the Gare Pelma sector-III coal block in Chattishgarh, along with many others on the grounds that the allocations were done in an arbitrary, non-transparent manner and were against public interest. The block, which was allotted on 12 November 2008, was supposed to take care of the state’s power needs – both domestic and industrial – for five to 10 years. The Supreme Court’s decision to cancel the allocation poured cold water on GIDC’s dreams which had to relinquish the Gare Pelma sector-III coal block. In January this year, the NDA-led government at the Centre allotted 11 large coal blocks to three CIL subsidiaries, including five blocks which were de-allocated by the Supreme Court in 2014.

The West Bengal government is keen on entering commercial coal mining and intends to sell 25% to 30% of its output in the open market from the world’s second largest block allotted to the state earlier this year. Commercial sale is expected to provide economies of scale to the operation bringing down costs which, otherwise, are expected to be high due to difficult geological build of the block. During June this year, the Centre allotted Deocha Pachami to Bengal’s power generation company West Bengal Power Development Corp Ltd as a captive block. Preliminary estimates suggests it is may hold 2.1 billion tonnes of reserves. Operations of the block will be undertaken by Bengal Birbhum Coalfields, a special purpose vehicle floated for purpose. The Centre had earlier planned to allot the block to a number of states jointly but none, other than West Bengal, showed interest as preliminary production cost estimates turned out to be very high. The Centre finally awarded the block to West Bengal.

The GSI said it has found 44 new coal blocks in four states of Eastern India. Spread across West Bengal, Jharkhand, Bihar and Odisha, the estimated coal resource of these 44 new blocks is close to 25,000 mt GSI said. Of these 44, 15 coal blocks belong to West Bengal.

Rest of the World

China’s coal imports are set to slump in December as traders and utilities wind back purchases following signals from Beijing that it will stop clearing shipments until next year, trading companies and utilities said. Coal imports by the world’s top consumer of the material used for heating and steelmaking rose in the first 10 months of 2018 to 252 mt up 11 percent from a year ago and not far below last year’s total of 279 mt. However, domestic coal prices have eased in recent months, even as China enters its peak demand season over winter, with utilities sitting on record coal stocks amid a slowdown in electricity demand growth. China National Building Materials International, a major buyer of Indonesian and Australian coal, will stop buying foreign supplies in December for its utility clients, the company said. China has in the past imposed coal import restrictions, which has had the effect of increasing local prices by lowering competition. Earlier this year it banned smaller ports from receiving coal and it has also carried out strict inspections on low-quality coal.

China National Coal Group agreed supply deals for thermal coal with six state power utilities that totalled more than 500 mt to be delivered across five years starting from 2019, according to the NEA. Under the agreements, China National Coal Group will supply in 2019 more than 97 mt of coal to the six utilities, with volumes rising in each subsequent year of the deals, the NEA said. Prices for the 2019-2021 supplies will be adjusted monthly using 535 yuan ($77)/tonne as a base price, and prices for the 2021-2023 period will be negotiated between the contractual parties based on market trends.

Australia’s New Hope Corp Ltd will buy a further 10 percent stake in the Bengalla thermal coal mine in Hunter Valley, New South Wales from Japan’s Mitsui & Co Ltd for A$215 million ($155.7 million). New Hope will own up to an 80 percent interest in Bengalla. The mine contributed more than half of the company’s profit last year and is expected to continue producing for more than 20 years. The Mitsui transaction comes three months after Wesfarmers Ltd struck a deal to sell its stake in the Bengalla mine to New Hope, which held a 40 percent stake in the mine at the time. New Hope said Taiwan’s Taipower, which currently holds a 10 percent stake in the mine, will buy another 10 percent from Wesfarmers.

Germany should take care in closing coal-fired power plants to avoid disruption and spread risks evenly, power utility Uniper said. Uniper had proposed including hard coal plants in a security reserve of 2.7 GW of brown-coal fired capacity. A commission is working on a roadmap for phasing out coal as an energy source, similar to Germany’s plan to exit nuclear power. The commission by year-end is due to present its first proposals on enforcing further cuts to carbon emissions from the coal sector. Legal certainty up to 2030 for the operations of gas-fired plants will support investment in that sector and allow voluntary coal plant closure tenders.

Germany has postponed until February a decision on how fast Europe’s largest economy should phase out brown-coal-fired power plants and whether the government should compensate utilities as well as regions that could face job losses, the coal commission said. With brown coal mines the only truly domestic resource in a country reliant on energy imports, Germany faces wrangling over when to abandon coal-burning to meet ambitious climate goals by 2030, as it also wants to be free of nuclear energy by 2022. The German cabinet has appointed a 24-strong group, the coal commission, to find a compromise deal. It was expected to present an exit plan by the end of the year. Postponement of the decision could increase the chances for a broader acceptance of the coal exit plan.

Britain’s Banks Mining has won a high court challenge to the government’s decision to reject its application to develop a new coal mine in northeastern England, the company said. Northumberland County Council agreed last year that the mine’s developer, Banks Mining, a division of The Banks Group, could extract 3 mt of coal by cutting an open cast, or surface, mine near Druridge Bay, Highthorn. Supporters of the project had said it could bring much-needed jobs to the region, and help to reduce Britain’s reliance on coal imports. Britain plans to close all coal-fired power stations by 2025 unless they are fitted with technology to capture and store carbon dioxide emissions, as part of efforts to cut greenhouse gases by 80 percent from 1990 levels by 2050.

Slovakia will phase out subsidies for coal mines supplying one of the country’s most polluting power plants from 2023, sooner than expected. The Slovak government subsidises mining at the country’s only coal company, privately owned Hornonitrianske Bane Prievidza (HBP), paying around €100 million ($114 million) a year, which helps maintain thousands of jobs. The company produced 1.8 mt of brown coal last year, supplying the Novaky power plant in central Slovakia. The facility is operated by Slovenske Elektrarne, a utility co-owned by the state, Italy’s Enel and Czech energy group EPH. Slovenske Elektrarne said this year that extending the life of the 266 MW Novaky plant beyond 2023 would require significant investment. China will offer financial support to improve safety at coal mines in 2019-2020, the NDRC said. That comes after several fatal accidents at coal mine in the country. Coal mines facing a tough financial situation or actively enforcing capacity cuts will be given more financial support, the NDRC said.

Spanish utility Endesa plans to close two of its coal plants in Spain, representing around two-fifths of its coal-fired generating capacity in the country, the company said. As companies globally move towards a lower carbon economy, Endesa’s Italian parent company Enel, is phasing out coal-fired power plants and focusing on electricity grids, renewable energy and its retail business. Endesa’s coal capacity is currently much larger than peers Iberdrola and Naturgy, who respectively run 874 MW and 2,010 MW in Spain.

January-September 2018 coal exports were at 8.7 mt for Indonesian coal miner PT Bukit Asam, up from 6.2 mt in the same period of last year. Over the first nine months of this year, Bukit Asam produced 19.7 mt of coal, up from 16.9 mt in the same period in 2017. Indonesia's Energy and Mineral Resources Ministry plans to revise rules on mining rights held by miners under Coal Contract of Work. Under proposed changes, miners can apply for extensions to mining rights between five years and one year before contracts expire. Existing rules only allow miners to apply for extensions between two years and six months before contracts expire.

South Africa’s cash-strapped power utility Eskom said the risk of nation-wide electricity outages had increased significantly due to a sharp fall in coal stockpiles at five of its power stations. Eskom said the power firm was using diesel generators to keep the power grid stable. In 2015 Eskom, whose total output of 45,000 MW accounts for 90 percent of electricity supply in the country, carried out controlled outages — known as load-shedding — as low cash flows and administrative issues affected operations. The power firm was also forced to cut power supplies for a few days in July due to a strike by some of its workers. Eskom said the main problem behind the latest threat to power supply were the coal power stations in Mpumalanga province, east of Johannesburg, supplied by commodities firm Tegeta Exploration and Resources, which has halted operations. Heavy rain forecast for coming months would affect coal supplies and quality, Eskom said.

Mongolia aims to complete a railway from its Tavan Tolgoi coal project to the Chinese border by 2021. The rail link from Tavan Tolgoi would have the capacity to deliver 30 mt of coal a year to China. Mongolia expects demand for high quality coking coal from China’s steel sector to increase, but many analysts in China believe steel production is nearing its peak and could start to fall. Tavan Tolgoi is the world’s largest undeveloped coking coal mine with 7.4 bt of estimated reserves. Mongolian coal would only be competitive in southern China, where more imports were required. Poland’s hard coal output in September fell to a record monthly low of 4.89 mt data from the Industrial Development Agency (ARP) showed. Monthly coal production has remained above 5 mt throughout 2018, and September’s output was down from 5.42 mt the previous month. However, Poland’s coal output has been shrinking for months because of the closure of some loss-making mines and reduced investment in an effort to reduce costs. The country has increased coal imports, mostly from Russia, to cover any shortfalls, though government policy is to reduce reliance on Russian supplies. Data showed that Poland’s 2018 coal imports from Russia are on track to be the highest ever.

The World Bank told Kosovo it would no longer support a planned 500 MW coal-fired power plant. Other Balkan countries rely on coal to produce power, with Serbia and Bosnia generating 70 percent and 60 percent respectively in ailing coal-fired plants, and both are in the process of adding new coal capacities. The two old power plants Kosova A and Kosova B are among Europe’s worst polluters. The government said the new plant, to replace Kosova A, would burn 40 percent less coal and release 20 times less emissions.

Greek power utility PPC will receive binding bids for three coal-fired plants and a license for a new one by the middle of next month. PPC, which is 51 percent state-owned, is selling the plants in northern and southern Greece after a European court ruled it had abused its dominant position in the coal market. The utility has shortlisted all six investors interested in the plants.

FY: Financial Year, mt: million tonnes, bt: billion tonnes, MW: megawatt, GW: gigawatt, CIL: Coal India Ltd, mtpa: million tonnes per annum, US: United States, IEA: International Energy Agency, Mtce: Megatonne of coal equivalent, GIDC: Goa Industrial Development Corporation, GSI: Geological Survey of India, NEA: National Energy Administration, NDRC: National Development and Reform Commission, PPC: Public Power Corp

NATIONAL: OIL

IOC issues five-year tanker tender to import Iraqi oil

4 December. Indian Oil Corp (IOC) has issued a global tender to charter scrubber-fitted oil tankers for at least five years to import Iraqi oil, a tender document showed. IOC and Bharat Petroleum Corp Ltd (BPCL), last year issued similar tenders seeking vessels for five years. The two refiners, however, could not award the tenders as there were very few bids by shippers because at the time they were seeking clarity on the new fuel emissions requirements. The International Maritime Organization (IMO) is introducing the rules on marine fuels from the beginning of 2020, limiting the sulfur content to 0.5 percent, down substantially from the current 3.5 percent, to curb shipping pollution. IOC’s tender document is seeking global bids for a very large crude carrier (VLCC) capable of carrying Iraqi Basra Light and Basra Heavy crude for five years and grants Indian shippers the right of first refusal. BPCL will soon issue a domestic tender seeking to hire Suezmax tankers capable of carrying up to 1 million barrels of oil for a five-year period. The duration of the IOC contract can be extended by another two years to a total of seven, the tender document showed. The tender will close on 7 January and bids will remain valid until 11 March, the document showed.

Source: Reuters

Petrol, diesel to soon cost less in Delhi than UP on bigger duty reductions

4 December. Petrol and diesel may soon again become cheaper in Delhi as compared to adjoining cities of Uttar Pradesh (UP) as ad valorem duty structure has translated into a bigger reduction in daily prices in the national capital. While petrol and diesel traditionally have been cheaper in Delhi than most states in the country, due to lower local sales tax or VAT (Value Added Tax), the 5 October cut in the VAT by Bharatiya Janata Party (BJP)-ruled states led to fuel being available at cheaper rates in places such as Ghaziabad and Noida -- the UP towns that adjoin the national capital. However, the difference that had peaked to over Rs 3 per litre in case of petrol and about Rs 2.3 in diesel on 5 October, has now come down to just 44-57 paisa in petrol and about Rs 1 in diesel, an analysis of the daily price revision notification issued by state-owned oil firms showed. Petrol prices in Delhi stood at Rs 71.72 a litre as compared to Rs 71.15 in Ghaziabad and Rs 71.28 in Noida. A litre of diesel in the national capital is priced at Rs 66.39 as opposed to Rs 65.31 in Ghaziabad and Rs 65.44 in Noida. The Union government slashed the petrol and diesel price by Rs 2.50 by reducing excise duty and asking state-owned oil firms to bear subsidy. This was matched by several states which reduced local sales tax. BJP-ruled UP too followed suit. Prior to the cut, it levied 26.80 percent or Rs 16.74 a litre, whichever is higher as VAT on petrol and 17.48 percent or Rs 9.41 a litre on diesel. Petrol price had touched a record high of Rs 84 per litre in Delhi and Rs 91.34 in Mumbai on October 4. Diesel on that day had peaked to an all-time high of Rs 75.45 a litre in Delhi and Rs 80.10 in Mumbai. Many states including Maharashtra matched that with a reduction in local sales tax.

Source: Business Standard

Government’s petroleum subsidy expenditure crosses 83 percent of budgeted target within first 6 months

4 December. The government’s expenditure on petroleum subsidy in the first six months of the current financial year crossed 83 percent of the budgeted allocation of Rs 24,933 crore for the fiscal, fresh data published by the oil ministry’s statistical arm data showed. This mostly includes under-recovery on liquefied petroleum gas (LPG) and Kerosene apart from natural gas subsidy for northeast. The total subsidy expenditure went up 82.10 percent to Rs 20,672 crore during the first six months (April-September) of the current financial year, as compared to an expenditure of Rs 11,352 crore incurred in the corresponding period a year ago. The government had budgeted for an overall petroleum subsidy of Rs 24,933 crore for financial year 2018-2019, a mere 1.93 percent increase over Revised Estimate of Rs 24,460.48 allocated for 2017-2018. According to K Ravichandran, Senior Vice President at research and ratings agency ICRA, the budgeted petroleum subsidy for 2018-2019 should be around Rs 45,000-50,000 crore considering Brent crude price at $70 per barrel for the year and an exchange rate of Rs 65 against the dollar. He said that the budgeted petroleum subsidy could fall short by around Rs 20,000-25,000 crore.

Source: The Economic Times

LPG cylinder now used by 89 percent households

4 December. Nine out of 10 Indian homes now use cleaner cooking gas, a record improvement over just about five in 10 homes four years ago, as a result of the Modi government’s relentless effort at popularising cleaner fuel and subsidising subscription to poor families. State oil companies, pushed by the oil ministry, have added record 10 crore consumers since April 2015, expanding the active consumer base by two-thirds. This has increased access to cooking gas, or liquefied petroleum gas (LPG), to 89% of the country’s households by October end, a sharp jump from 56.2% on 1 April 2015. The increased LPG coverage has primarily been driven by the government’s determination to take cleaner fuel to more and more homes, which forced state oil companies to reach out to potential customers and simplify subscription process. A subsidy for fresh LPG connection to poor families helped fuel demand. Rural areas still have untapped potential with more than half of all consumers, or about 13.6 crore, residing in urban areas. India has a total of 24.9 crore active customers, of which 22.9 crore receive subsidy. Those with double cylinders comprise barely half of the consumer universe—one reason why new customers do not entirely give up polluting fuels as they are forced to fall back on their traditional fuel while refill is on way. Companies are beefing up distribution infrastructure, which has been slow to expand compared with the consumer base, becoming another hurdle in smooth delivery of services. Northern states have the highest 99.9% LPG coverage ratio, with Punjab (136%) and Delhi (126%) leading the table. Chandigarh, Haryana, Himachal Pradesh, J&K, and Uttarakhand have recorded more than 100% subscription while Uttar Pradesh (89.7%) and Rajasthan (95.4%) have lower coverage. The government calculates LPG coverage ratio by factoring in the number of subscribers and the current population, which is estimated by adding certain growth rate to 2011 census figures. Due to increased migration, some of the states like Delhi and Punjab end up having population that’s higher than the estimates, resulting in an LPG coverage ratio of more than 100%. Overall, Goa has the highest coverage ratio of 139%. Telangana, Puducherry, Kerala and Mizoram are other states with higher than 100% coverage. Southern states together have a coverage of 99.7% while western states have 81.9%. With 74.6% coverage, the eastern states are at the bottom of the pile although they have come a long way from their traditionally poor access to clean energy. The worst among major states are Jharkhand (65.4%), Bihar (67%) and Odisha (66.9%). In Gujarat too, the LPG coverage ratio is 66.6% but that’s more because the state is already well connected to the alternative piped natural gas. Most north-eastern states have less than 80% coverage.

Source: The Economic Times

IOC reduces jet fuel prices to lowest in 7 months

3 December. Indian Oil Corp (IOC), the country’s biggest fuel retailer, cut jet fuel prices for domestic and international carriers. The price in Delhi for domestic airlines was cut to Rs 68,050.97 a kiloliter on 1 December, an 11% reduction from a month earlier, according to a statement by the state-run company. That is the lowest since 1 May, IOC data show. The rate reached a five-year high in November.

Source: Livemint

Vedanta seeks US oil services consortium for new India blocks

30 November. India’s Vedanta Resources wants US (United States) oilfield services companies to set up consortia to help develop the 41 blocks in India acquired this year by its Cairn Oil & Gas unit. Vedanta Chairman Anil Agarwal and Cairn Chief Executive Sudhir Mathur met with executives from 70 services companies in Houston to encourage the firms to organise consortia to compete for contracts, Agarwal said. The company won 41 of the 55 blocks auctioned under India’s first licensing round for small discovered fields earlier this year. It expects the blocks will eventually produce 500,000 barrels per day of oil equivalent, Mathur said. Vedanta hopes to speed up development of the blocks by getting the oilfield firms to organise consortia that would deliver integrated services.

Source: Reuters

LPG cylinder prices likely to decrease soon: Petroleum ministry

29 November. Busting rumours that LPG (liquefied petroleum gas) cylinder prices are likely to be hiked to Rs 1,000 per cylinder, the petroleum ministry said domestic LPG cylinder rates are likely to be reduced in the coming days. It said because of a fall in international fuel prices, domestic LPG prices are also likely to fall down in the coming days. At present, subsidised LPG costs Rs 507 in Delhi and non-subsidised Rs 942 per cylinder. LPG prices are revised at the beginning of each month but for the month of November, the price hike came twice — by Rs 2.94 and then Rs 2. The rates of non-subsidised LPG cylinders have been increased by Rs 60 in Delhi already and for the sixth consecutive time in as many months. The government absorbs any increase in international prices of LPG as subsidy. Only a subsequent increase, if any, on GST (Goods and Services Tax) is passed on to the consumers. Rates of LPG cylinders differ by a few rupees from state to state because of transportation cost and local taxes. The government subsidises only 12 cylinders of 14.2 kilogram each per household in a year by transferring the subsidy amount directly into the bank accounts of LPG consumers.

Source: Livemint

Maharashtra puts land purchase for Saudi Aramco refinery on hold

29 November. Maharashtra has put on hold the process to buy land for the country’s biggest oil refinery that state-run oil companies are building with Saudi Aramco, Chief Minister Devendra Fadnavis said, after strong opposition from farmers. The $44 billion refinery was seen as a game changer for both parties - offering India steady fuel supplies and meeting Saudi Arabia’s need to secure regular buyers for its oil. But thousands of farmers are refusing to surrender land, fearing it could damage a region famed for its Alphonso mangoes, vast cashew plantations and fishing hamlets that boast bountiful catches of seafood. RRPL (Ratnagiri Refinery & Petrochemicals Ltd), a joint venture between Indian Oil Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp, has said suggestions the refinery would damage the environment were baseless.

Source: Reuters

NATIONAL: GAS

GAIL proposes swap of Cove Point LNG cargoes in first quarter

30 November. GAIL (India) Ltd is proposing to swap three liquefied natural gas (LNG) cargoes across the first quarter of next year. The Indian importer has 20-year deals to buy 5.8 million tonnes a year of US (United States) LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site. With few LNG tankers available to ferry the fuel to India, GAIL has already struck swap deals for a chunk of its Sabine Pass and Cove Point volumes. Under the proposed swap, GAIL would sell its share of output from US export plant Cove Point in return for taking delivery of LNG into India. GAIL is offering a cargo a month from Cove Point for loading in the first quarter of next year in exchange for corresponding deliveries to India.

Source: Reuters

GEECL to invest $2 bn in Raniganj block to tap into shale reserves

29 November. London-listed coal-bed methane (CBM) producer Great Eastern Energy Corp Ltd (GEECL) announced it plans to invest $2 billion in its Raniganj (South) block to exploit shale reserves. The company had announced a resource upgrade at its Raniganj (South) block in West Bengal, saying it has found prospective shale resources with a valuation of over $2.78 billion. GEECL currently produces gas from its flagship Raniganj (South) block in West Bengal, with 9.25 trillion cubic feet (tcf) of Original Gas-in-Place. The company holds a second licensed area in the Mannargudi block of Tamil Nadu, with 0.98 tcf of Original Gas-in-Place, the Mannargudi block is currently under arbitration with the Government.

Source: The Economic Times

Operational and connectivity issues pull down RIL CBM block output

28 November. Gas output at Reliance Industries’ coal-bed methane (CBM) block has fallen way short of the planned ramp-up due to a combination of operational issues and poor pipeline connectivity. Production at RIL (Reliance Industries Ltd)’s CBM block in Madhya Pradesh contracted to 0.94 million metric standard cubic meter per day (mmscmd) in July-September from 1 mmscmd in the April-June period. The poor show by RIL’s CBM block, its depleting KG-D6 block, along with Focus Energy’s underperforming block in Rajasthan, resulted in a 13% decline in natural gas output from fields controlled by private players between April and October, according to the oil ministry’s monthly report on production data. Oil India Ltd (OIL)’s gas production also declined 7% this year from last year but ONGC (Oil and Natural Gas Corp) increased gas output by 3%. India’s natural gas output fell 1% in April-October from last year. Production is also hurt due to limited pipeline access. RIL has agreements with itself to use its CBM output at its facilities in Gujarat and Maharashtra, but doesn’t yet have access to a pipeline that can pump gas from its fields to its plants. So, it has reached an understanding with GAIL, which takes CBM to fertiliser-maker Iffco, the single customer connected to the pipeline, and in turn delivers imported liquefied natural gas (LNG) to RIL’s facilities in western India. Iffco is GAIL’s customer and variation in the fertiliser maker’s gas requirement impacts the amount of gas RIL’s CBM fields can produce or its facilities can receive from GAIL. Once more customers join the pipeline, RIL plans to undertake drilling of new wells and build additional infrastructure to boost its coal bed methane output. Another help would come when a pipeline gets ready to pump gas from RIL’s fields to the western states. At present, gas only travels from the western coast to interiors. CBM wells also yield a lot of water and RIL has undertaken dewatering process to achieve the ramp-up, which typically takes 18-36 months.

Source: The Economic Times

NATIONAL: COAL

Gujarat’s imported coal order to push up tariff in 5 states

4 December. Power tariffs in Gujarat, Maharashtra, Haryana, Rajasthan and Punjab are set to rise following the Gujarat government’s order allowing the Tata, Adani and Essar groups to pass on to consumers the higher cost of imported coal used in their power plants in the state. In an order issued, the state government asked its distribution company (discom) to reset its agreement with the power plants and seek regulatory approval for higher tariffs. The discom was also advised to circulate the revised agreement with other beneficiary states for vetting. The two consumer interest NGOs had in October told the Supreme Court (SC) that the panel’s bailout package would extend Rs 1.9 lakh crore benefit to the power producers at the cost of consumers. The power plants, located in Mundra, have run up a combined outstanding debt of Rs 22,000 crore after they were not allowed to raise tariff to cover the increased cost of imported coal.

Source: The Economic Times

Phasing out coal power would benefit Indian consumers, taxpayers

30 November. Renewable source of energy can provide more power in much less cost than new coal-powered power plants in India, and it costs more to run 62 percent of the country's coal capacity than to build new renewable power generation facilities, according to a new study. The study titled 'Navigating the economic and financial risks in the last years of coal power' by financial think tank Carbon Tracker, states that phasing out coal power would benefit consumers and taxpayers because India is a regulated market where state support keeps uneconomic plants profitable. However, it is the state which ultimately underwrites investment risk in regulated markets, where coal is sheltered from competition, it said. In countries such as China, India, Japan and parts of the US typically approve the cost of generation and pass it on to consumers. Backing coal in the long-term will threaten economic competitiveness and public finances, because politicians will be forced to choose between subsidising coal power or increasing power prices for consumers, the study said. In India, the study found that it costs more to run 62 percent of the country's coal capacity than to build new renewable energy generation facilities and by 2030 that will rise to 100 percent. It also found that new renewables can supply more cheap power than new coal plants in India. Also, phasing out coal power would benefit consumers and taxpayers because India is a regulated market where state support keeps uneconomic plants profitable.

Source: The Economic Times

Supreme Court pulls up Centre for re-allotting cancelled coal block to Adanis

28 November. The Supreme Court issued notices to the Centre on a petition alleging that a cancelled coal block had been re-allotted to Adani Enterprises via a joint venture. The top court had scrapped the allocation of 214 blocks en masse in August 2014 on ground of illegality. The court had also ruled that any joint venture made in a manner so as to transfer the mining rights to a private company was illegal under the Coal Mining Nationalisation Act, 1973. The court had accordingly cancelled all joint ventures with the private sector, including the Parsa East & Kanta Basan block in Chhattisgarh allotted to Rajasthan Rajya Vidyut Utpadan Nigam Ltd (RRVUNL) in 2007. According to the petition, RRVUNL has 26% in the joint venture and Adani Enterprises has 74%. RRVUNL, the petition claimed, has continued the mining and delivery agreement of 16 July 2008, with JV ParsaKente Collieries. Under this arrangement, Bhushan claimed, the PSU (Public Sector Undertaking) was buying coal at a price higher than the rate notified by Coal India Ltd. According to the petition, the block is located in a dense forest, was an elephant habitat and was declared a “No Go” area for mining after a joint study by the ministries of coal and environment & forests.

Source: The Economic Times

NTPC awards transport contract for 1.3 mt CIL coal offered under 5 mt offer

28 November. Seeking to bolster its coal stocks, NTPC Ltd has moved quickly and awarded a contract for transporting 1.3 million tonne (mt) of the 5 mt additional fuel offered by Coal India Ltd (CIL) to tide over supply crunch. While the Fuel Supply Agreement (FSA) provides for coal transport by CIL from mine end to railway sidings and its loading on the wagons, NTPC was asked in the last week of October to arrange for transport of 5 mt of coal by itself from the pithead to loading facilities. Post that, an NTPC team visited various areas and surveyed the total coal offered to them, NTPC said. NTPC was offered coal recently after its stocks dipped sharply. It was offered 1.5 mt from Central Coalfields Ltd (CCL), 0.5 mt from Bharat Coking Coalfields Ltd (BCCL) and 0.5 mt from Northern Coalfields Ltd (NCL), among others. NTPC had earlier failed to lift any coal within the 30-day deadline as part of the 5 mt offer by CIL as transportation was a major hurdle. CIL then renewed the offer which is meant to allow the power generator to build its inventory during winter, ahead of summer, after which demand for power rises and so does the demand for coal from thermal power plants.

Source: The Economic Times

NATIONAL: POWER

Goa’s power department to clear doubts over digital meters

4 December. Goa’s Power Minister Nilesh Cabral said the government will continue installing digital electricity meters, but added that people’s doubts and apprehensions about over billing would be cleared by way of allowing those opposing the change to retain both the old and new meters to allow them to check for variation, in any, in bills generated. Cabral said those opposing the change would be allowed to retain their old analogue meter along with the new digital meter. Cabral said some, including panchayats, are ignorant about the functioning of digital meters, which is why they are opposing it. After completing installating digital meters in Bicholim, the department will start replacing old meters in Mapusa. With the new meters the department expects a surge in revenue plus accuracy in meter readings.

Source: The Economic Times

JBVNL for steep hike in power tariff

4 December. Residents and commercial establishments, particularly those in rural areas across the state, will have to pay higher electricity bills from next year if a proposal as per an Annual Revenue Requirement (ARR) Petition of the Jharkhand Bijli Vitaran Nigam Ltd (JBVNL), the state owned power distribution company, is passed next year. The last time power tariffs were hiked was on 1 May, this year. As per the ARR petition, power tariffs for Kutir Jyoti or tribal beneficiaries below poverty line presently being fixed at Rs 4.40 per unit has been proposed to be hiked to Rs 6 per unit, a jump of over 36 percent. Similarly fixed charges now at Rs 20 per month has been proposed to be hiked to Rs 75 per month. For other rural consumers, power tariff has been proposed to be hiked from the present Rs 4.75 per unit and a fixed charge of Rs 35 per month, to Rs 6 per unit, with an enhanced monthly fixed charge of Rs 75. For urban domestic consumers, the present tariff of Rs 5.50 per unit has been proposed to be hiked to Rs 6.00 per unit with no change in fixed charge of Rs 75 per month. Similarly for commercial establishments located in rural areas, the power tariff, standing at Rs 5.25 per unit and a fixed charge of Rs 60 has been proposed to be hiked to Rs 7 per unit and a fixed charge of Rs 225 per month. For commercial establishments located in urban areas, the present tariff of Rs 6.00 per unit has been proposed to be hiked to Rs 7.00 per unit with no change in fixed charge of Rs 225 per month.

Source: The Economic Times

Adani Transmission, Power Grid Corp selected for transmission projects in Uttar Pradesh

4 December. The Uttar Pradesh (UP) Cabinet approved selection of Adani Transmission and Power Grid Corp for setting up transmission networks for evacuation of power from two thermal power projects —2×660 MW Obra-C project and 2×660 MW Jawaharpur project. Both these projects, which have been awarded through the tariff-based competitive bidding process, will bring an investment of Rs 1,401 crore in the state. Both the transmission projects are being primarily constructed to establish transmission system for evacuation of power from the projects once they are ready. Two 400 kilovolt (kV) sub-stations are also being built. While the Obra-C project will also involve setting up of a 400 kV sub-station in Badaun, the Jawaharpur project will have a 400 kV sub-station in Firozabad.

Source: The Financial Express

All Maharashtra villages to have electricity by December end

3 December. Maharashtra has become load shedding free and by December end, all villages across the state would be electrified under Saubhagya Scheme, Maharashtra State Electricity Distribution Company Ltd (MSEDCL) director Vishwas Pathak claimed. Pathak claimed that the MSEDCL has invested Rs 11,000 crore in its various projects during the last four years. Farmers are being given electricity at Rs 1.50 per unit and it is being done under cross-subsidy basis, Pathak said.

Source: The Economic Times

Adani Energy faces State audit after power bills shoot up in Mumbai

2 December. Just three months after it began operations, Adani Energy is drawing flak from consumers whose bills have shot up to unprecedented levels. Some consumers claim their bills for September and October have shot up by as much as 100 percent. Previously known as Reliance Energy, the Mumbai distribution company of Reliance Infrastructure, was acquired by the Adani Group earlier this year. Chief Minister Devendra Fadnavis directed Energy Minister Chandrashekhar Bawankule to look into the matter and conduct an audit of past three months’ billing process at Adani Electricity Mumbai Ltd. The distribution company has been maintaining that the spike in bills was caused by a change in the weather condition, which in turn reportedly led to a change in the consumption pattern. According to consumer groups and analysts, an average tariff hike approved ranges from 2-8 percent depending on the distribution circle as well as the consumer category. However, the hike could be even more pronounced after April 2020. The protests, supported by the Congress and other political parties, has prompted Adani Electricity to set up a 24x7 helpline that has promised a response to all the queries related to billing within 24 hours. The company has also organised several camps to respond to queries related to billing.

Source: The Hindu Business L ine

Raje government paid Rs 60 bn in excess to private power companies: Congress

1 December. The outgoing state BJP (Bharatiya Janata Party) government committed a corruption of over Rs 6000 crore in the purchase of power from two private electricity companies, the Congress alleged. The opposition party accused Rajasthan Chief Minister (CM) Vasundhara Raje of promoting cronies at the cost of state exchequer. Congress spokesperson Randeep Singh Surjewala claimed that the Raje-government paid nearly double the rate at which it had agreed to purchase power from one of the two private companies during 2013-18.

Source: The Economic Times

'Haryana to launch drive to collect pending power bills'

1 December. Uttar Haryana Bijli Vitran Nigam CMD (Chairman and Managing Director) Shatrujeet Singh Kapoor said that in a week they would provide a list of electricity defaulters to village Sarpanches and zila parishad members, as part of a new campaign to be launched in Jind district. He said that nearly Rs 1,500 crore is pending from unpaid electricity bills by more than one lakh consumers in the district. He said that the consumers can take advantage of the Bijli Niptan Yojna and pay in instalments and that interest on the pending bill would be waived off. The deadline for the scheme is 31 December.

Source: The Economic Times

Every household to be electrified by 31 December under Saubhagya: Power Minister

29 November. The government's focus is on providing electricity connection to every household in the country under the Saubhagya scheme instead of achieving a set of numbers, Power Minister R K Singh said. He asserted that the target of 100 percent electrification would be achieved by 31 December. He dismissed contentions that household electrification has led to an increase in aggregate, technical and commercial losses of power distribution utilities. He said about 21 million households have already connected and eight states have achieved 100 percent saturation (in household electrification)-- Madhya Pradesh, Tripura, Bihar, Jammu & Kashmir, Mizoram, Sikkim, Telangana and West Bengal. He said that states that are close to achieving 100 percent household electrification are Maharashtra, Uttrakhand, Himachal Pradesh, Arunachal Pradesh and Chhattisgarh. Some states were already 100 percent electrified, inlcuding Gujarat, Goa, Andhra Pradesh, Tamil Nadu, Kerala, Punjab and the Union Territories. Saubhagya Pradhan Mantri Sahaj Bijli Har Ghar Yojana' was launched in September 2017 with the objective to provide access to electricity to all the remaining households in the country.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Solar power tariffs drop lower in UP auction

4 December. A generous commissioning deadline for solar projects provided by the Uttar Pradesh (UP) government in its latest auction has resulted in surprisingly low winning tariffs. The offer of 550 MW of projects by the UP New and Renewable Energy Development Agency attracted bids between Rs 3.04 and Rs 3.08 per unit. NTPC, the lowest bidder, quoted Rs 3.04 per unit to win 85 MW. The bids were lower than the winning tariff of Rs 3.17 a unit at the auction in October, which itself was fairly low, considering that UP’s power distribution companies are in poor financial health. Solar radiation in UP is also low compared with that in Rajasthan, Gujarat and Andhra Pradesh. Solar tariffs have been rising ever since the finance ministry imposed safeguard duty of 25% on imported solar panels and modules for a year from end-July in an effort to support local manufacturing. The duty will be lowered to 20% for the next six months and to 15% for another six months. More than 90% of the solar panels used in Indian projects are imported because local manufacturers cannot match those in China and Malaysia on price. The UP agency has set a project commissioning deadline of 21 months from the date of signing of the power purchase agreement. Most such deadlines vary between 13 and 21 months. UP’s July auction of 1,000 MW at the height of the confusion over impending safeguard duty had seen winning tariffs of Rs 3.48-3.55 per unit. The auction was later cancelled, without any official reason assigned.

Source: The Economic Times

NGT slaps Rs 250 mn fine on Delhi government

3 December. The National Green Tribunal (NGT) asked the Delhi government to deposit Rs 25 crore with the Central Pollution Control Board (CPCB) for their failure to curb the problem of pollution in the city. The green panel said that even after more than four-and-a-half years, the complaint of the aggrieved parties is that the pollution caused by the unregulated handling of plastic continues to remain unabated. The tribunal was hearing pleas filed by Mundka village resident Satish Kumar and Tikri-Kalan native Mahavir Singh alleging pollution caused by burning of plastic, leather, rubber, motor engine oil and other waste materials and continuous operation of illegal industrial units dealing with such articles on agricultural lands in Mundka and Neelwal villages. The tribunal had earlier directed the Delhi chief secretary to co-ordinate with the concerned municipal authorities, police authorities and other officers responsible for compliance of orders of this tribunal already passed referred to ensure compliance at the ground-level forthwith.

Source: Business Standard

India to play constructive, balanced role in UN climate summit: Environment Minister

3 December. Indian Environment Minister Harsh Vardhan said the high level of greenhouse gas emission was a major concern and reaffirmed that India would play a "positive, constructive and balanced role" in the UN (United Nations) climate summit. He said that India wanted to see the UN climate summit as a success. The Paris agreement urged each country outline, update and communicate their post-2020 climate actions, known as nationally determined contributions (NDCs), reflecting the country's ambition for reducing emissions, taking into account its domestic circumstances and capabilities. India's progress on two of its three Paris agreement commitments were to achieve 40 percent of electric power installed capacity from non-fossil fuel by 2030 and to reduce the emissions intensity of its GDP (Gross Domestic Product) by 33-35 percent by 2030 from the 2005 level. IEEFA (Institute for Energy Economics and Financial Analysis) found that India was likely to achieve these two goals 10 years before the 2030 deadline. For the first goal, IEEFA predicted that installed non-fossil fuel capacity in India will exceed 40 percent by the end of 2019. And at the current rate of two percent reduction per year in emission intensity of its GDP, India is likely to achieve 33-35 percent of emission intensity reduction targets a decade ahead of target. He said India wanted to see COP24 to be successful and added that New Delhi would play a "positive, constructive and balanced role" in the summit.

Source: Business Standard

BHEL dispatches 40th Nuclear Steam Generator to NPCIL

1 December. Bharat Heavy Electricals Ltd (BHEL) has dispatched its 40th Nuclear Steam Generator to the Nuclear Power Corp of India (NPCIL). The Steam Generator, to be installed in NPCIL's Rajasthan Atomic Power Project (RAPP), was flagged off on 1 December 2018 from BHEL's Trichy plant in the presence of senior officials of BHEL and NPCIL. The first stage of the indigenous nuclear power program of the country has attained maturity with 18 operating PHWRs (Pressurised Heavy Water Reactors). Twelve PHWRs accounting for 74% of the Nuclear Power capacity are equipped with BHEL-supplied Steam Turbine Generator sets (10 units of 220 MW each and two units of 540 MW).

Source: Business Standard

Punjab Municipal Corp to identify more government buildings for solar plants

28 November. Having completed the first phase of installing rooftop solar power plants at government buildings in the city, the Punjab Municipal Corp (MC) would start identifying more government buildings where such plants could be set up. For this, the MC is going to carry out a survey of government buildings in the city. In the first phase, the civic body installed solar plants in 20 buildings and these systems have already started producing electricity. In all, the power-generation capacity of the existing plants is 470 kilowatts. The MC has not set a date for starting the survey. It has also not set a target for the number of buildings it plans to identify and the total capacity of solar plants it wants to install.

Source: The Economic Times

NTPC invites 1 GW renewable energy tenders

28 November. To avail the benefits of the Central government’s flexible-generation scheme, NTPC has called for tenders from 1,000 MW of existing solar and wind generation plants to supply power to the company for one year. The ceiling tariff for the reverse auction for choosing solar/wind power plant has been kept at Rs 2.67/unit. The power ministry, in April this year, had allowed thermal power generation companies (gencos) the flexibility of using renewable energy sources to meet their contractual generation obligations. The new mechanism allows thermal gencos to set up renewable power plants at their existing power stations, or anywhere else, thus allowing discoms to meet their renewable purchase obligations (RPOs) through existing PPAs (power purchase agreements). The scheme was seen to allow companies such as NTPC to avail of the benefits of this policy, given that some of the power stations located far from pithead have an energy charge higher than Rs

3/unit. The minimum offered capacity of a solar/wind power plant will have to be 50 MW and in multiples of 10 MW thereafter, NTPC said. Only renewable power plants having inter-state transmission system connectivity shall be eligible for selection, it said. Industry experts are sceptical about the expected response to the invitation, since most of the large wind/power plants are built after signing PPAs through government nodal agencies.

Source: The Financial Express

Shapoorji Pallonji bags country’s first large-scale floating solar project

28 November. India’s first large-scale floating solar project is on its way with Shapoorji Pallonji winning the first block in Solar Energy Corp of India’s auction of 150 MW of such projects on the Rihand Dam, along the Uttar Pradesh (UP)-Madhya Pradesh border. Shapoorji Pallonji won the reverse auction for 50 MW quoting a tariff of Rs 3.29 per unit. The remaining 100 MW will also be shortly auctioned in blocks of 50 MW. Since then, solar tariffs have fallen dramatically, with those of ground mounted projects dropping to Rs 2.50-3.50 per unit. In UP, where solar radiation is not as strong as in states like Rajasthan, the average tariff has been more than Rs 3 per unit. The Rihand floating projects will not have any such issues, and they can use the same transmission facilities as the hydropower station of the dam.

Source: The Economic Times

NGT slaps Rs 50 mn fine on West Bengal for failing to curb air pollution

28 November. The National Green Tribunal (NGT) has slapped a Rs 50 million fine on the West Bengal government for "failing to comply" with its two-year-old directive to improve air quality in Kolkata and Howrah. The NGT Eastern Zone principal bench comprising Judges S P Wangdi and non-judicial member Nagin Nanda said the fine should be paid within two weeks of the order to the Central Pollution Control Board (CPCB), failing which, the government will have to pay an additional Rs 10 million as fine for every month's delay to the CPCB. In the order, the NGT had recommended measures like introducing alternative mechanism to put a lid on high number of polluting diesel vehicles in the twin cities of Kolkata and Howrah, introducing remote sensing device (RSD) to monitor smoke emission, increasing number of computerised air monitoring stations from the existing ones. The other measures include introducing the system of allowing private vehicles with odd and even registration numbers on specific days in the week, monitoring entry of non-BS 4 commercial vehicles to twin cities, stop burning of waste in dumping sites in different parts of state. The green body in subsequent sittings in the intervening period of two years had sought to know if the West Bengal government's Environment department and the West Bengal Pollution Control Board had taken any steps towards the direction.

Source: Business Standard

INTERNATIONAL: OIL

Exxon, Chevron seek to exit Azerbaijan’s oil after 25 yrs

4 December. Exxon Mobil and Chevron are seeking to sell their stakes in Azerbaijan’s largest oilfield, marking the retreat of the US (United States) majors from the former Soviet state after 25 years as they re-focus on domestic production. Exxon is hoping to raise up to $2 billion from the sale of its 6.8 percent in the Azeri-Chirag-Gunashli (ACG) field in the Caspian Sea. Rival Chevron said it had also decided to launch the sale of its 9.57 percent stake in ACG as well as its 8.9 percent interest in the Baku-Tbilisi-Ceyhan (BTC) pipeline. For both companies, the sale would mark the end of a 25-year involvement. Exxon and Chevron were among five US oil companies that helped create Azerbaijan’s current oil industry soon after the collapse of the Soviet Union, and acquiring a stake in ACG in 1994.

Source: Reuters

OPEC has problems with some oil producers, reasons for Qatar's exit must be examined: Iranian Oil Minister

4 December. OPEC (Organization of the Petroleum Exporting Countries) has problems with some oil producers, and the reasons for Qatar’s exit from the organization must be examined, Iranian Oil Minister Bijan Zanganeh said. Qatar said it will quit OPEC to focus on gas in a swipe at Saudi Arabia, the de facto leader of the oil exporting group which is trying to show unity in tackling an oil price slide.

Source: Reuters

Exxon expects 25 percent more oil from Guyana's offshore block

3 December. Exxon Mobil Corp and its partners expect the large Stabroek oil block offshore Guyana to contain 25 percent more recoverable oil than previously estimated, the companies said. Exxon and Hess Corp said more than 5 billion barrels of oil equivalent could be recovered from the Stabroek block, which is part of one of the biggest oil discoveries in the world in the last decade. The companies had previously estimated 4 billion barrels of oil equivalent could be recovered from the block.

Source: Reuters

No hard figures on possible oil output cuts: Russian President Vladimir Putin

2 December. Russian President Vladimir Putin said he had no concrete figures on possible oil output cuts, though his country would continue with its contribution to reducing global production. Russia, one of the world’s major crude producing nations, has been bargaining with OPEC (Organization of the Petroleum Exporting Countries)’s leader, Saudi Arabia, over the timing and volume of any reduction. OPEC and its allies will be meeting amid concerns over a slowing global economy and rising oil supplies from the United States. Oil prices had their weakest month in more than 10 years in November, losing more than 20 percent as global supply has outstripped demand. Losses were limited, however, on hopes of a production cut agreement.

Source: Reuters

Taiwan’s Formosa Petrochemical to buy Basra crude oil in new Iraq deal

29 November. Taiwanese refiner Formosa Petrochemical has secured a new term contract with Iraq to buy Basra Light crude oil in 2019, the company said. The Iraqi term supply will replace part of Formosa’s spot crude purchase as well as term supplies from Iran, the company said. Formosa is unlikely to resume Iranian oil liftings soon as there is no mechanism to pay Iran for the oil, the company said.

Source: Reuters

PetroChina aims to triple crude output at new Xinjiang oilfield

29 November. Top Chinese oil and gas firm PetroChina is aiming to raise the annual crude oil output to 3 million tonnes in 2021 at a newly discovered oilfield in the remote northwestern Xinjiang region, triple this year’s estimated rate. Mahu, in the Junggar basin, is named as one of the largest discovery in China after more than a decade of work. PetroChina is keen to boost output at Mahu to 5 million tonnes in 2025. One of the recently drilled wells, Mahu-015, produced 405.6 cubic metres of oil and 36,000 cubic metres of natural gas a day in test production. China’s top two onshore producers Sinopec and PetroChina are speeding up exploration and production from major shale oil and gas formations in the country’s western regions to boost domestic output. China’s crude oil output rose 0.3 percent on year to 16.09 million tonnes, or 3.79 million barrels per day, the second year-on-year increase recorded this year.

Source: Reuters

INTERNATIONAL: GAS

Norway’s Equinor to start talks with Tanzania over LNG project

4 December. Norway’s Equinor is ready to start talks with Tanzania on developing a liquefied natural gas (LNG) project based on a deepwater offshore discovery, the company said. Tanzanian President John Magufuli has asked his government to proceed with negotiations to set out the commercial and fiscal framework for the LNG project, Equinor, a majority state-owned energy company formerly known as Statoil, said. Tanzania said in 2014 that a planned LNG export plant could cost up to $30 billion. Royal Dutch Shell, which operates deepwater Blocks 1 and 4, adjacent to Equinor’s Block 2, previously sought to develop the LNG project in partnership with Equinor and Exxon Mobil.

Source: Reuters

'Eni’s Indonesia gas project to start up in 2021 under new contract'

4 December. Energy company Eni aims to start output of natural gas from its offshore Merakes project in Indonesia in 2021, the country’s deputy energy minister Arcandra Tahar said. Initial production at Merakes would be 155 million cubic feet of natural gas per day, rising to a forecast peak output of 391 million cubic feet of natural gas per day, Tahar said. Eni said in April it had obtained approval for plans to pipe natural gas from Merakes to the Bontang liquefied natural gas (LNG) processing facility in East Kalimantan. The amendment would be first time a conventional cost-recovery production-sharing contract in Indonesia is converted to use the gross split scheme, Tahar said. Tahar said the Merakes project has an estimated 814 billion cubic feet of natural gas reserves and an economic lifetime of around nine years.

Source: Reuters

LNG buyers try to ditch US gas commitments

4 December. Several large liquefied natural gas (LNG) players have tried to offload their obligation to buy future cargoes from the United States (US), shedding excess commitments made years ago in the rush for new sources and commercial terms for the fuel. The sale of multi-year “strips” of LNG cargoes represent portfolio adjustments by the buyers rather than backlash against US gas, several Asian and Europe-based traders said. But it was a timely reminder that there is only so much US LNG, which can be more commercially attractive than gas from other regions, that the market can absorb, even as new investment is being prepared for more US export plants.

Source: Reuters

Groningen gas production to drop 75 percent by 2023

3 December. Gas production at the earthquake-prone Groningen field will drop by at least 75 percent in the next five years, ahead of schedule towards the projected end of extraction. The Dutch government decided this year to shut down in 2030 what was once Europe’s largest natural gas field because decades of extraction had caused dozens of earthquakes each year, damaging thousands of homes and buildings. Production will drop below 5 billion cubic meters (bcm) per year from 2023, the Dutch government said, as measures to reduce demand for Groningen gas are working better than planned. Demand for Groningen gas will be reduced by building extra capacity to convert high-caloric foreign gas to the low-caloric gas needed for the Dutch network, and by cutting exports to Germany.

Source: Reuters

Oil firms chosen to expand Qatar’s north field gas reservoir to be named mid-2019: Energy Minister

3 December. The oil companies that Qatar selects to expand its north field natural gas reservoir will be announced in mid-2019, the country’s Energy Minister Saad al-Kaabi said. Qatar plans to build four additional liquefied national gas trains in mid-2019, he said.

Source: Reuters

Gazprom looks at booking capacity in expanded Bulgarian gas system

30 November. Russian gas group Gazprom said it was considering whether to book capacity in the Bulgarian gas transportation system which is being expanded, the company said. However, the decision will be made taking into the account the booking conditions, Gazprom said.

Source: Reuters

Polish, Danish grid firms give final nod to pipeline link to Norway gas fields

30 November. The Polish and Danish gas grid operators have taken a final investment decision to build a gas pipeline linking Poland to Norwegian fields via Danish territory and the Baltic Sea, Poland’s state-owned Gaz-System said. The 900 kilometre (560 mile) pipeline, known as the Baltic Pipe, aims to reduce Poland’s reliance on Russian gas. The Baltic Pipe is expected to be ready in 2022 when Poland’s long-term deal with Russian gas company Gazprom expires. The pipeline’s capacity will be 10 billion cubic meters (bcm) a year, with almost all of it booked by Polish state-run gas firm PGNiG. The company plans to produce 2.5 bcm a year of gas from holdings in Norwegian deposits. Polish Energy Minister Krzysztof Tchorzewski said that Baltic Pipe was part of the North-South Gas Corridor a project to link Poland to a liquefied natural gas (LNG) terminal in Croatia, via the Czech Republic, Slovakia and Hungary. Norway meets about a quarter of Europe’s natural gas needs and is the second largest supplier after Russia. Most of its deliveries are via a network of offshore pipelines to Britain, Germany, France and Belgium.

Source: Reuters

US slams Russia's Yamal LNG transfers in Norwegian waters

30 November. Allowing ship-to-ship transfers in Norwegian waters from Yamal in Arctic Russia, one of the world’s largest liquefied natural gas (LNG) terminals, undercuts Europe’s energy diversification efforts, the US (United States) State Department said. By transferring LNG to more conventional tankers in Norway, the Arctic vessels cut in half the distance they would cover to deliver gas to Europe, enabling more frequent shipments from the Novatek terminal and increasing Russia’s gas exports. The first such transfer took place off the Norwegian Arctic port of Honningsvag. The US has been pressing Europe to cut its reliance on cheap Russian gas and buy much more expensive US LNG instead, which many European countries, including industrial heavyweight Germany, have so far resisted. Norway, Europe’s second-largest supplier of gas after Russia, said it was not “concerned” by the ship-to-ship transfers.

Source: Reuters

Greece's DEPA buys out Shell's stake in domestic gas supplier

28 November. Greece’s state-controlled DEPA gas company has concluded the acquisition of Shell’s 49 percent stake in a domestic gas supplier and in a gas distributor in Athens, becoming the sole stakeholder in the two companies, it said. The deal to buy stakes in EPA Attikis and EDA Attikis, clinched in the summer, is worth €150 million ($174 million). DEPA, which mainly imports Russian gas, as a sole owner of the companies will focus on speeding up network expansion for the benefit of Greek consumers, it said. DEPA has already agreed to back out from another domestic supplier in northern Greece. Both moves are part of Greece’s post-bailout commitment to eliminate potential conflicts of interest between DEPA and domestic gas suppliers to help unbundle gas supply from distribution and boost competition.

Source: Reuters

INTERNATIONAL: COAL

China state planner orders miners, utilities to sign long-term coal deals

30 November. Chinese utility firms need to fix 75 percent of their coal purchases in 2019 through medium- to long-term contracts with coal producers, China’s central state planner, the National Development and Reform Commission (NDRC), said. The NDRC said it encouraged coal producers and utility firms to sign coal supply contracts with fixed prices and volumes that run for at least two years.

Source: Reuters

French insurer CNP joins AXA in curbing investments in coal sector

28 November. French insurer CNP unveiled new plans to scale back its investments and exposure to the coal industry, mirroring a similar move by larger rival AXA and other insurers which are changing policies to help the environment. CNP said that in future it would refrain from investing in companies which had more than 10 percent of their turnover linked to thermal coal. CNP said it would no longer invest in companies heavily involved in the development of new coal-fired power plants. Reducing insurance coverage of the coal industry raises costs for coal power generation, which could increase pressure on utilities to switch to cleaner energy.

Source: Reuters

INTERNATIONAL: POWER

French power companies consider legal challenge to price freeze

4 December. French independent power vendors association ANODE is considering making a legal challenge to a government freeze on state-owned EDF’s electricity prices, it said. ANODE president Fabien Chone said the proposed freeze on EDF’s regulated tariffs threatens the survival of some of its members. These operators all compete against EDF, which has an 80 percent share of the retail power market. The government should lower power taxes or introduce support measures for ANODE’s members, it said. Prime Minister Edouard Philippe said that from 15 December to 1 March the government would organize a nationwide debate on energy and that power and gas prices would not increase in the meantime. Retail services specialist Colombus Consulting expects French power prices to rise by between 2 percent and 8 percent next year. Even at 5 percent, it would be the highest increase in years.

Source: Reuters

Crimea power stations in sanctions row may face new delay

4 December. Russia may delay until March the official launch of its power stations in Crimea, the stations’ engineering firm said, the latest hitch to the plants where Russia is accused of installing German-designed electricity turbines in contravention of sanctions. Russia began building two power stations on Crimea to provide electricity to the peninsula which it annexed from Ukraine in 2014, but the facilities became embroiled in a row over sanctions. The company, Tekhnopromeksport, said the first stage of the power stations will be ready by the end of this year, but that it had requested that the launch of the second phase be delayed until to March.

Source: Reuters

South Africa faces more power cuts, raising Ramaphosa reform risk

3 December. South Africa faces more power cuts, electricity utility Eskom warned as it sought to prevent the collapse of its power grid in a test for President Cyril Ramaphosa’s reforms. Eskom implemented a fifth day of controlled power cuts, putting more strain on an economy already mired in recession only months before a national election. Eskom, which is battling a severe financial crisis, coal shortages and breakdowns of its power plants, said it would cut up to 2,000 MW power from the grid. Ramaphosa has made reforming Eskom a priority, but he has been hampered by fiscal constraints in a blow to his plan to woo investors who can help grow the economy ahead of an election likely to be held in May next year. BNP Paribas South Africa senior economist Jeff Schultz said prolonged power cuts would likely hurt economic growth in the first quarter of 2019, although a slowdown in manufacturing over the Christmas period will buy Eskom some time.

Source: Reuters

Doosan Babcock and Drax Power sign $76 mn deal for UK power plant

3 December. Doosan Babcock announced it has signed a new long term contract worth 60 million Pounds ($76 million) with Drax Power for providing maintenance and outage services for UK (United Kingdom)’s largest power station. It said the new partnership, with the option for a further four years extension, will strengthen workforce collaboration and improve efficiencies in maintaining and extending the life of the plant which is responsible for providing 7 percent of the UK’s electricity.

Source: The Economic Times

Strikes cuts French electricity output by 1.3 GW

29 November. A nationwide strike at French state-controlled utility EDF power plants has reduced electricity generation by 1.3 GW at two nuclear reactors and a gas-fired plant, the RTE grid operator said. Power generation at EDF’s 1,300 MW Nogent 1 nuclear power plant was cut by 735 MW, while at the 900 MW Gravelines 1 reactor, output was down 37 percent. The RTE said generation at the 585 MW Bouchain 7 gas-fired plant was reduced by 285 MW. The grid operator did not give reasons for the strike, but France’s hard-left trade union CGT has called for a nationwide strike at EDF to protest over stalled wage negotiations and a possible government-led restructuring of the company.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Russia signs nuclear deal with Argentina, competing with China