STATES IMPORT COAL WHILE CIL LOOKS FOR EXPORTS

Coal News Commentary: August - September 2018

India

CIL wants a policy on coal exports before it could finalise commercial contracts for exporting the dry fuel. Earlier, government was planning to export coal with high ash content or of higher grades. CIL was scouting for export opportunity at the time when pithead coal stock was high as close to 70 mt in May 2017. Pithead coal finds comparatively low interest due to evacuation and cost issues. With sudden spiralling demand from the power sector, the pithead stock had reduced to 23 mt now. In the recent months the miner was failing to fulfil coal demand for power and non-power sectors like aluminium and cement sector. CIL had revised its internal production target to 652 mt against 630 mt fixed earlier following pressure from the ministry to increase production. Notwithstanding CILs foray into exports domestic users of coal are facing shortages.

Power supply to North India including Delhi and Uttar Pradesh, Bihar, Jharkhand and West Bengal is vulnerable to disruptions as fuel supply to 4,200 MW of generation capacity that feeds these states has fallen sharply heightening the risk of a shutdown from events like heavy rain. CIL’s supply has fallen because the mine supplying coal to NTPC Ltd’s large plants in the east has almost run out of pit head stock, while land acquisition problems have stymied expansion. CIL’s supply from Rajmahal mines in Jharkhand has fallen to 40,000 tonnes a day from about 55,000 tonnes. On a rainy day, the supply halves. At NTPC’s Farakka plant, stocks have plummeted to 4,000 tonnes from 2.5 lakh tonnes almost two months ago, NTPC said. CIL said reserves at Rajmahal mines is almost depleted but it can be replenished by acquiring land in two villages, Bansbiha and Taljhari adjacent to the existing project. CIL hopes to expand slowly with the help of some land that has been recently acquired. It hopes to resolve the issue in two months.

With MAHAGENCO deciding to import coal, the claims of WCL and other coal companies regarding supply of adequate coal have fallen flat. The generation company has recently floated tenders for importing 2 mt coal for new units of Koradi, Chandrapur and Bhusawal power plants. Imported coal is costlier than domestic coal and consumers will have to pay for it by way of higher power tariff. MAHAGENCO has not been importing coals since the last three years. NTPC is also bringing in coal from abroad after a gap of four years. This happens at a time when the coal ministry has claimed the country has produced record coal. Import of coal also raises question mark over MAHAGENCO’s decision to sell coal to private power companies. The coal meant for one unit each in Bhusawal and Nashik power plants has been provided to Dhariwal plant (185 MW) near Chandrapur and Ideal Energy plant (250 MW) at Bela (Nagpur district). The tender process will be completed in September and the imported coal will reach MAHAGENCO’s power plants in late October or November. WCL had claimed in an affidavit before the high court that coal dispatch to power plants should be 119 railway rakes (wagons) per day. Central Railway had earlier claimed there was an increase of 29% in coal rakes (wagons) supplied by it to WCL in 2017-18 as compared to 2016-17. The number of rakes supplied to Parli power station in Marathwada increased by 773% from 26 to 227 while the increase for Koradi was 148%. The overall loading for MAHAGENCO power stations by Nagpur division of Central Railway had risen from 9.6 rakes per day in 2016-17 to 12.4 rakes per day in April-January of 2017-18.

CIL said it has increased the coal supply to NTPC's Kahalgaon and Farakka power plants as the units were operating at higher than the targeted level, resulting in additional consumption of fuel. Both the plants, put together, have generated 9.795 billion kWh against the target of 9.191 billion kWh during April-July 2018. Both Kahalgaon and Farakka power plants, it said, were operating at higher than the targeted level of generation during the current year, resulting in higher consumption of coal. The company has already stepped up the supplies, and has supplied more than 45,000 tonnes of coal from Rajmahal and above 20,000 tonnes from non-Rajmahal fields to Farakka and Kahalgaon for maintaining their coal stock. Coal stock position at linkage based thermal power stations in the country stood at 14.69 mt as of the referred date. In the northern region, only one power plant is listed as critical. With majority of the plants of NTPC situated at the pit-heads and based on captive modes of transport of coal, there is no major issue for movement of coal, it said. Coal stock at NTPC's Badarpur TPS could have been comfortable, had it not restricted the supplies during the lean generation season, it said.

CIL has drawn up a plan to send 16 rakes per day to TANGEDCO in view of its increased demand for the dry fuel. The state-run-miner's subsidiaries, Mahanadi Coalfields Ltd, Eastern Coalfields Ltd and CCL will supply 13 rakes, two rakes and one rake, respectively. TANGEDCO reportedly asked for 20 rakes of coal per day. The Tamil Nadu government has decided to import about 3 mt of coal for its generation units, supply of which is expected to start from October. India's coal import is to the tune of about 200 mtpa. CIL has also requested Indian Railways to supply more rakes to ensure delivery of coal to TANGEDCO.

The Kawai plant has not imported any coal in March-April this year, while it had imported 2.8 mt and 1.6 mt of coal in FY17 and FY18 respectively. Adani Power has shut down a 660 MW unit at its Kawai power plant in Rajasthan due to shortage of coal. The shutdown underscores the ongoing issue of coal shortage at power plants, mainly due to insufficient railway rakes to ferry the fuel. The Kawai power plant was one of the ten electricity generation stations to receive assurance on coal supply under the scheme to harness and allocate koyla transparently in India (Shakti scheme), which was specifically designed to salvage power plants with power purchase agreements but without fuel supply agreements. Under Shakti, linkages have been granted to 10 power plants with 11,549 MW capacity. The power ministry had claimed that since five stressed projects with 8,490 MW capacity would receive coal under Shakti, these plants should be taken out of the list of the 34 stressed assets (38,870 MW). To be sure, the Kawai plant is not among the 34 stressed power projects. The Rajasthan Electricity Regulatory Commission allowed Adani Power Rajasthan, which runs the 1,320 MW Kawai power plant, to recover the additional cost on account of having to import coal due to reduced supplies from CIL. The company estimated the additional cost due to coal shortage to be ₹ 12.21 billion per annum since 2014.

One of the standout commodity performers this year has been thermal coal, but not all coal is created equal and disparities in pricing may help explain why India’s imports have stayed strong despite the higher costs. The main benchmark for thermal coal in Asia is priced at Australia’s Newcastle Port, the world’s largest coal-export harbour. The price has gained 11.8 percent so far this year, to close at $114.66/tonne in the week to 2 September. What has been somewhat surprising is that India, the world’s second-largest coal importer behind China, has defied its prior history of being a price-sensitive buyer and boosted its imports this year. But delving into the detail offers an explanation as to why this is the case, the price of the bulk of the coal India imports has been declining, especially in recent months. India imported 128.7 mt of coal in the first eight months of the year, up 10.6 percent on the same period last year, according to vessel-tracking and port data. India tends to import lower quality coal from Indonesia, with a typical grade being fuel with an energy rating of 4,200 kilocalories per kilogram. Given the recent difficulties state-controlled CIL has experienced in meeting domestic requirements, it’s little surprise that Indian buyers have ramped up purchases from Indonesia. It’s also worth noting that India hasn’t increased the amount of coal it buys from other top suppliers. Australia is India’s second-largest supplier, but it ships almost exclusively coking coal used in steelmaking, and is thus not a competitor with Indonesia.

Higher demand for thermal power and lower-than-required growth in domestic coal output may push up coal imports to 62 mt this fiscal, Credit rating agency Ind-Ra said. According to Ind-Ra, imported coal requirement is likely to increase to 62 mt this fiscal from 56 mt in FY18 to meet the incremental power generation. According to Ind-Ra, in a scenario of lower-than-required growth in domestic coal output, short-term power prices would remain firm and are likely to be determined by the marginal cost of energy production undertaken using imported coal.

India's coal import rose 11.9 percent to 78.7 mt in the first four months of the current fiscal. The country had imported 70.3 mt coal in April-July period of the last fiscal, mjunction services, a joint venture between Tata Steel and SAIL, said. The country's coal import in July increased by 42 percent to 20.79 mt (provisional), over 14.64 mt (revised) in the same month previous year. The increase in coal and coke imports in July is mainly due to a 12.9 percent growth (month-on-month) in non-coking coal shipments, it said. The government earlier said that during 2017-18 coal imports increased to 208.27 mt due to increase in demand by consuming sectors. The country's coal import fell from 217.7 mt in 2014-15 to 190.9 mt in 2016-17.

CIL which is looking to rationalise its underground mines in view of safety and financial viability, could close about 53 such mines this year. Manpower would "not be retrenched" if any mine is closed and workers would be re-trained and re-skilled for getting employed in other mines. CIL has 369 mines at the beginning of the current fiscal, of which 174 are underground, 177 opencast and 18 mixed mines. Coal production from underground mines in 2017-18 was 30.54 mt compared to 31.48 mt during 2016-17. Production from opencast mines during 2017-18 was 94.62 percent of total raw coal production. However, the miner is also taking up new coal mining projects. A total of 11 coal blocks have been allotted to Eastern Coalfields, Bharat Coking Coal and WCL and these new blocks will help these subsidiaries produce more than 100 mt of coal per annum in the near future. Four coal mining projects with an ultimate capacity of 24.6 mtpa and a total capital investment of ₹ 41.55 billion were approved. There are 26 operational mines which are contributing more than 55-60 per cent of total production. CIL has undertaken rail infrastructure projects for planned growth in production and sales and as many as 13 projects for coal evacuation have been identified. Two coking coal washeries were commissioned and plans are on the anvil to set up a non-coking coal washery in Odisha's Ib-Valley for which a letter of intention was issued.

The coal ministry along with CIL and Singareni Collieries have decided to bring 70,000-odd coal contract workers under the ambit of the CMPFO. CIL said bringing contract workers under CMPFO will offer them social security and give them higher returns apart from helping the fund itself, which is facing an asset-liability mismatch. CMPFO is an organisation meant for coal workers and its operation is similar to the EPFO. Members of the fund contribute a monthly amount, which is matched by their employer. At present, the minimum wage for workers on CIL’s payroll is around ₹ 1,200 per day while contract workers would be getting around ₹ 800 following the recent hike. Currently, some coal contract workers are covered by EPFO but a large number of them have remained uncovered. To start with, the government is planning to transfer workers covered by EPFO in the coal mining industry to CMPFO. This will be followed by bringing contract workers that are not members of any provident fund organisation under the ambit of CMPFO.

CIL subsidiary South Eastern Coalfields Ltd produced a record 144.71 mt of coal in 2017-18, according to its annual report. The production rose by 3.36 mt in 2017-18 against 140 mt in 2016-17. The 2017-18 financial year witnessed a record production of 144.71 mt which is not only the highest coal production amongst all subsidiaries of CIL but also accounts for more than 21 percent of the total coal production of India, the company said. The company is operating 75 opencast and underground mines spread over the states of Chhattisgarh and Madhya Pradesh. From opencast mines, the company produced 130.25 mt coal, registering a rise 3.83 percent as against 125.45 mt in the preceding fiscal. However, it witnessed a fall of 0.62 percent from underground mines at 14.46 mt as against 14.55 mt in 2016-17.

CIL arm CCL said its 17 out of the 21 ongoing mining projects worth ₹ 40.95 billion are facing delays due to various reasons including non-grant of green clearances. Of the 21 projects, Parej East and Hurilong projects could not be started due to non-grant of environment and forest clearances, CCL said. Kalyani open cast project, one of the ongoing projects, will be started after green clearances, it said. As on 31 March 2018 there are 21 ongoing and 34 completed mining projects under CCL with sanctioned capacity of 112.85 mt it said.

The opposition party asked the government to appoint a special counsel in the Bombay High Court in the case of alleged over-invoicing of coal imports by the Adani group. It observed that the Gujarat government has accepted the recommendations of a three-member panel to raise the cost of power purchased from three private entities including Essar, Tatas and Adanis that will cost ₹ 1.30 trillion in the next 30 years. The opposition party said a special counsel to defend the DRI for accepting its Letters Rogatory to seek information on the alleged ₹ 290 billion scam in over-invoicing of coal imports from Singapore. In March 2016, the DRI had initiated probe against some Adani Group firms for alleged overvaluation of coal imports from Indonesia between 2011 and 2015. The DRI had alleged that the companies inflated the price of coal they were importing from Indonesia to siphon off money abroad and to avail higher power tariff compensation. The documents required to prove the ₹ 290 billion coal scam are with Singapore branch of the State Bank of India. A show cause notice has been served on four companies importing coal but not on Adani group, which is importing 80 percent of the total coal imported.

Earlier, a Singapore court had rejected Adani Global's plea, seeking a stay to produce documents pertaining to coal imports to India mostly from Indonesia. After that, the group moved the Bombay High Court on August 28.

The ISRO will help India’s largest power generation utility, NTPC, to use its technology to reduce pilferage of coal when transporting them on wagons on railway tracks. Following the successful pilot project undertaken by ISRO on one such coal wagon train through its NavIC or Indian Regional Navigation Satellite System, NTPC wants to incorporate this on a permanent basis. This seven-satellite system aims at providing India a satellite system so that it becomes independent of the GPS of the US. The problem of coal being stolen has been a perennial problem with NTPC, particularly in areas in Bihar, Jharkhand and West Bengal. Many police cases have been booked in these states for coal thefts by unknown persons. Despite Railway Protection Force personnel providing security, the large numbers who come to take away the coal when stoppages occur far outnumber the security provided. The pilot done by ISRO on one train heading to West Bengal for nearly a year by attaching a NavIC system onto the wagon revealed where exactly the train had an unscheduled stop and the number of minutes it halted too. The issue of coal thefts plagues energy companies in the Eastern part of the country with a coal mafia said to rule roost. Coal is stolen enroute as well as when loading them. The largest state-owned producer of coal, CIL has deployed vehicle tracking systems and GPS at its mines to handle the issue. Some companies have applied for permission to use drones to tackle the menace. NavIC Systems are now being deployed across different spheres.

Rest of the World

Australian miner New Hope Corp said thermal coal prices would push higher in coming months, extending a rise that helped boost its profits in the last financial year. The company said its full-year pre-tax profit climbed 6 percent to $107.49 million from $140.6 the year before, as markets for thermal coal priced in Australian dollars soared on the back of pollution-linked output curbs in major supplier China. Australian spot thermal coal cargo prices in recent months hit their highest in six years, and at $120/tonne remain a third above lows in seen in April. New Hope, one of Australia’s main coal miners, is waiting on approval to extend its Acland operations in the state of Queensland, with regulators set to consider the move in early October. New Hope sells most of its coal to Japan and Taiwan, ahead of China. It has also seen a pick-up in demand from Vietnam.

Australia’s WICET obtained court approval for a $3.2 billion debt refinancing plan, offering respite to its owners who would have had to start repayments. The Queensland-based terminal, known as WICET, is 40 percent owned by miner and commodities trader Glencore and was built to service a consortium of eight coal companies during a period of high commodity prices. It will now have the maturity of $2.6 billion in senior debt extended from this month until September 2026, court documents showed. Glencore and its four partners faced a tight deadline to refinance the loan or start repayments. Glencore and seven partners began negotiations to build WICET in 2008 near the height of a coal boom, but as prices plunged, three of the partners became insolvent, leaving Glencore to foot an increasing share of the liability.

South African power utility Eskom said that it had less than 20 days of coal supplies at 10 of its 15 coal-fired power stations, posing a threat to national power supplies. Cash-strapped Eskom is critical to Africa’s most industrialised economy as it supplies more than 90 percent of its power and is one of its most indebted state firms.

German utility RWE, its works council and trade unions say they oppose plans to end coal-fired power generation in Germany around 2035, raising questions over a possible compromise between a government commission and environmentalists. Coal-to-power production both from brown coal and imported hard coal accounts for 40 percent of Germany’s total power production, making the exit from coal difficult while maintaining reliable supply to industries and households. Utility companies such as RWE and Uniper have said they are prepared, having absorbed declining coal plant revenues due to competition from renewable power and developed their own phase-out plans stretching into the 2040s. The commission will try to broker compromises and help allocate federal funds to bring new industries into regions that are now dependent on coal mining.

Russia has resumed coal supplies through the North Korean port of Rajin. Rajin has in the past been a transit point for Russian coal exports to South Korea. Andrey Tarasenko, the acting head of the Primorsky region, said the move did not violate Western sanctions against Pyongyang.

Botswana’s Minergy Ltd said it has started construction at its Masama Coal Mine, which is set to be the country’s first privately-owned coal mine, following government approval. Botswana has an estimated resource of 212 bt of coal but has only one operating coal mine, the state-owned Morupule Coal Mine that produces 3.5 mtpa. Commissioning of its 400 million pula ($37 million) Masama Coal Mine is scheduled for January 2019, and production of first saleable coal slated for the following month. Most off-site construction for Masama mine, which will produce 2.4 mtpa is already complete with some of the funding already secured. In November 2017 the company - which will export its coal to South Africa and Asia - will list on AIM on the London Stock Exchange after receiving a mining licence.

A vessel hauling a shipment of coal from the US switched its destination to South Korea from China, according to ship tracking data, a day after China imposed 25 percent tariffs on the US fuel. The Underdog was loaded with 63,000 tonnes of coal on 23 July in Long Beach, California, and sailed to China, where it arrived off the coast of Nanshan on 17 August. The Underdog was one of several US cargoes that have rerouted amid the US trade dispute with China. Last month, a coal cargo on the Navios Taurus shifted to Singapore after originally heading to China. US coal exports to China dropped in July, with only two other tankers, the Navios Altair I and Glory, departing from California to China, and carrying a combined 128,000 tonnes of coal. No ship with US coal departed for China in August. The US shipped 3.2 mt of coal to China last year, up from less than 700 tonnes in 2016, making it China’s seventh largest supplier.

CIL: Coal India Ltd, mt: million tonnes, bt: billion tonnes, MW: megawatt, MAHAGENCO: Maharashtra State Power Generation Company, CCL: Central Coalfields Ltd, WCL: Western Coalfields Ltd, kWh: kilowatt hour, TANGEDCO: Tamil Nadu Generation and Distribution Corp, mtpa: million tonnes per annum, FY: Financial Year, Ind-Ra: India Ratings and Research, CMPFO: Coal Mines Provident Fund Organisation, EPFO: Employees Provident Fund Organisation, DRI: Directorate of Revenue Intelligence, ISRO: Indian Space Research Organisation, NavIC: Navigation in Indian Constellation, US: United States, GPS: Global Positioning System, WICET: Wiggins Island Coal Export Terminal

NATIONAL: OIL

India’s oil demand to climb to 500 mt per year by 2040: IOC

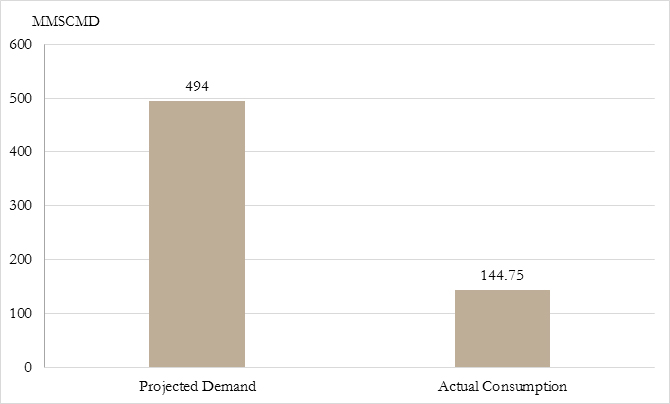

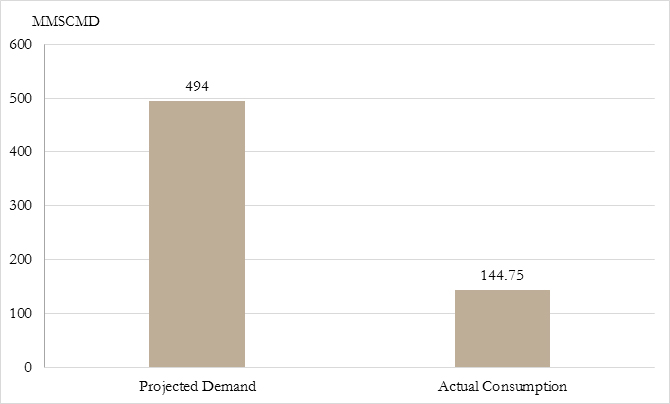

25 September. India’s crude oil demand is forecast to grow to 500 million tonnes (mt) per year by 2040, but persistent increases in oil prices might act as a dampener for the rate of growth, Partha Ghosh, an executive director at Indian Oil Corp (IOC) said. That would be equivalent to around 10 million barrels per day (bpd), up from about 4.7 million bpd in 2017. Globally oil demand will increase by 15.8 million bpd from now until 2040, he said. India’s growth of 5.9 million bpd will make up about 24 percent of the overall gain, he said. India’s refining capacity would increase to about 439 mt per year by the financial year of 2030 as new and existing refineries continue enhancing their infrastructure, while domestic demand is forecast to increase to 356 mt per year over the same period, Ghosh said. Higher refining capacity will mean India could export more refined oil products to countries in the region. The rate of oil demand growth, however, will slow down by 2024 to 2025. India is a major buyer of Iranian oil and is seeking a waiver on the sanctions the United States is set to impose on the country in November. However, IOC will be able to manage even if it does not gain an exemption, Ghosh said.

Source: Reuters

India’s oil demand growth to slow down over next decades: RIL

25 September. India will continue to depend on oil as a mainstay of its energy but its oil demand growth will likely slow as the government pushes for cleaner energy and renewables, Harish Mehta, President, Refining & Marketing at Reliance Industries Ltd (RIL) said. However, oil consumption will still increase to 480 million tonnes (mt) by 2040 as the renewable push will not completely halt oil demand growth, he said. To meet that consumption, India has been boosting its overall refining capacity with first production from its upcoming West Coast refinery expected in 2022. India has plans to add 190 mt per year of refining capacity over the next 10 years to its existing 228 mt per years, he said. Mehta said he is optimistic about the possibilities in the Indian retail fuel sector because of a conducive regulatory environment in the country at the moment.

Source: Reuters

Petrol breaches Rs 90 mark in Mumbai

24 September. No relief lies in store for Maharashtra’s residents, where petrol prices breached the Rs 90 mark. Petrol price climbed to Rs 90.08 per litre in Mumbai and stood even higher in many parts of the state. The new rate came into effect after a hike of 11 paise was implemented. This resulted in petrol costing Rs 91.91 per litre in Parbhani, Rs 91.61 per litre in Nanded, Rs 91.31 per litre in Amravati, Rs 91.14 per litre in Ratnagiri and Rs 91.01 per litre in Jalgaon. Diesel was priced at Rs 78.58 per litre in Mumbai, Rs 79.15 per litre in Parbhani, Rs 80.53 per litre in Aurangabad, Rs 79.90 per litre in Amravati and Rs 79.25 in Solapur. The rise in fuel prices began in August, when crude oil prices rose and the value of the rupee fell. Now, petrol is priced at Rs 82.72 per litre in Delhi, Rs 84.54 per litre in Kolkata and Rs 85.99 per litre in Chennai. Meanwhile, diesel prices were Rs 74.02 per litre, Rs 75.87 per litre and Rs 78.26 per litre in Delhi, Kolkata and Chennai respectively.

Source: Bangalore Mirror

As oil forecasts call for $100, India considers cutting back crude imports

24 September. With oil traders forecasting crude oil to rise to $100 a barrel by the end of the year, Indian refiners are considering cutting back their imports and relying more on cheaper crude already stored in inventories, according to industry executives. Benchmark Brent crude oil futures surged 2 percent to over $80 a barrel as markets have tightened ahead of the start of sanctions by the United States on Iran, with commodity merchants Trafigura and Mercuria predicting $100 oil by the end of 2018. The soaring oil prices are occurring at the same time emerging market currencies, such as India's rupee, are under pressure. That combination means Indian crude imports are 47 percent more expensive this year in rupee terms. To cope with the higher costs, India, the world’s third-biggest oil importer, is considering cutting its imports and relying on stockpiled crude. Indian Oil Corp (IOC) Chairman Sanjiv Singh confirmed the plan to cut imports in favour of stockpiled crude was discussed at a meeting attended by refinery officials. Indian refiners must pay for their crude in dollars and the soaring import costs are becoming a headache for Prime Minister Narendra Modi’s government ahead of general elections next year. India’ petrol prices are among the highest in the world in terms of how much it costs as a portion of gross domestic product per person. India imports more than 80 percent of its oil needs. The country imported 4.4 million barrels per day (bpd) oil in August, costing about $12 billion, according to government data. Using up crude inventories could save Indian refiners short-term import costs but poses the risk that if prices do not ease later on the companies will have to import more later at higher prices.

Source: Reuters

'Energy savings exceed 30 percent of target under PAT scheme'

24 September. Energy savings are 30 percent more at 8.67 million tonnes of oil equivalent (mtoe) than the target in the first phase of the energy conservation scheme Perform, Achieve and Trade (PAT), Power Minister R K Singh said. Under PAT Cycle I, more than 400 large industries from key energy intensive sectors in India took measures to improve energy efficiency during the last three years which resulted in energy savings worth Rs 9,500 crore annually, he said. The PAT scheme is mandatory for all designated consumers notified by the Bureau of Energy Efficiency (BEE) and it is one of the major initiatives under the National Mission for Enhanced Energy Efficiency (NMEEE). The scheme has been extended to over 800 designated consumer covering 13 sectors with the inclusion of refinery, discoms (distribution companies), Railways, Petrochemical and Commercial Buildings (Hotels). The projected target under this scheme is over 15 million tonnes of oil equivalent by 2019-20. Under PAT Cycle I, more than 400 large industries from key energy intensive sectors in India have made exemplary efforts towards improving energy efficiency during last three years. He released outcome report for the study conducted by the BEE which demonstrated energy savings of 8.67 mtoe against target of 6.686 mtoe which is 30 percent excess over the targeted energy saving.

Source: Business Standard

Centre working to combat fuel price hike: HPCL Chairman

21 September. Hindustan Petroleum Corp Ltd (HPCL) Chairman Mukesh Kumar Surana has said that the Centre is working towards increasing local production of oil and gas with an aim to combat the rising fuel prices. Surana said that the devaluation of the Indian rupee against the US (United States) dollar is responsible for the hike in fuel prices in the country. Fuel prices vary from state to state because of local taxes, but since past few days, they are touching new heights across the country. The Union government has been facing flak over the past few weeks for not turning the rising prices. The Centre, however, has maintained that external factors, including a rise in international crude oil prices, are influencing domestic fuel prices.

Source: Business Standard

India, Russia may seal oil field deal in October’s annual summit

21 September. India and Russia are expected to conclude a deal during their 5 October annual summit to increase Delhi’s investments in Russian oil fields. India is eyeing to develop energy ties as a key pillar of the strategic partnership. Indian hydrocarbon firms, which over the last two years have invested in Russia's Vankorneft oil field, are expected to further invest in Vankor cluster. The annual summit between President Vladimir Putin and Prime Minister Narendra Modi is expected to reach a new agreement for additional investments in Russian oil fields. Indian public sector firms have already invested $15 billion in picking up stakes in Russian oil and gas projects like Sakhalin-1. Oil PSUs (Public Sector Undertakings) are scouting for discovered oil and gas fields in Russia. Addressing an Indo-Russia conference, Oil Minister Dharmendra Pradhan recalled that Soviet oil and gas experts had helped ONGC (Oil and Natural Gas Corp) strike Bombay High in the Arabian Sea in the 1960s and that Soviet technology had also helped in the refining sector in 1960s and 1970s. India and Russia have deeply strengthened their hydrocarbon engagement and built an “energy bridge” between the two nations, he said.

Source: The Economic Times

OMCs ask Air India to clear dues amid rising oil prices

21 September. State-run Oil Marketing Companies (OMCs) have asked loss-making Air India to clear its dues towards daily billing amid rising oil prices. Air India group, which comprises Air India, Air India Express and Alliance Air, currently operates 475 flights per day to 78 domestic and 44 international destinations with a combined fleet of 161 aircraft. It is the only domestic carrier which flies long and ultra-long haul flights or flights which are up to 16 hours duration. Air India said that the oil companies have sought to increase the payment amount. The government-run airline lifts jet fuel from three oil marketing firms -- Indian Oil Corp, Bharat Petroleum Ltd and Hindustan Petroleum Ltd -- worth Rs 6 billion per month on an average.

Source: Business Standard

RIL permanently shuts down MA oil field in KG-D6 block

21 September. Reliance Industries Ltd (RIL) said it has permanently shut down its only oil field in the flagging KG-D6 block after production declined to nil. RIL had till date made 19 oil and gas discoveries in the KG (Krishna-Godavari) basin. Of these, D26 or MA -- the only oil discovery in the block -- was the first field to began production in September 2008. Dhirubhai-1 and 3 (D1 and D3) fields went onstream in April 2009. Post-cessation, activities related to the safe shutdown of the field are underway. For Q1 FY19, MA field contributed less than 0.1 percent in terms of revenue at RIL consolidated level. RIL said the Dhirubhai-26 (D26) oil, gas and condensate deep-water discovery was made in 2006. The discovery was developed and put on production in September 2008. The field had in the first month produced 39,976 tonnes of crude oil and peaked to 1,08,418 tonnes in May 2010, according to data available from the upstream regulator, the Directorate General of Hydrocarbons (DGH). Output has been declining since then it produced 0.14 million barrels (1960 tonnes) in April-June quarter this year.

Source: Business Standard

Indian oil refiner part-owned by Iranian company cancels Iran oil imports

20 September. India’s Chennai Petroleum will stop processing Iranian crude oil from October to keep its insurance coverage once new sanctions by the United States against Iran go into effect. Iran’s Naftiran Intertrade Company Ltd, a trading arm for National Iranian Oil Company, owns a 15.4 percent stake in Chennai Petroleum, which has two refineries with a total combined capacity of 230,000 barrels of oil per day. United India Insurance has informed Chennai Petroleum that its new annual policy that is set to take effect from October will not cover any liability related to processing crude from Iran. Chennai Petroleum’s reduced demand will further cut India’s imports from Iran to about 10 million tonnes in October, lower than previous estimates. Chennai Petroleum, a subsidiary of the country’s biggest refiner Indian Oil Corp (IOC), has a deal to buy up to 2 million tonnes, or 40,000 barrels per day, of oil from Iran in the fiscal year 2018/19. Hindustan Petroleum Corp Ltd (HPCL) has already halted purchases due to insurance problems, while Bharat Petroleum Corp boosted Iranian purchases earlier this year and expects to sharply cut Iranian flows once the sanctions take effect. Nayara Energy is also preparing to halt Iranian imports from November, while Reliance Industries Ltd and HPCL-Mittal Energy Ltd have already stopped buying Iranian oil.

Source: Reuters

Petroleum products may not be brought under GST soon

20 September. Petroleum products are unlikely to be brought under the Goods and Services Tax (GST) in the near future, despite a few central government ministers batting for their inclusion as states are opposed to the idea at present. States are of the view that inclusion of petroleum products under GST is unlikely to reduce their prices as states have powers to levy a tax over and above the peak GST rate. The Union finance ministry is unlikely to push for its inclusion as it believes that states will not favour such a measure. The burden of the high fuel prices on the common man had triggered demands for a reduction in excise duties levied by the centre. Fuel prices have been rising rapidly over the last few months. The cost of the Indian basket of crude oil rose to $77.86 a barrel on 19 September, according to Petroleum Planning and Analysis Cell. To this, taxes at the central and state levels are added, besides dealers’ commission, to arrive at the retail price. The Indian basket represents the average of Oman, Dubai and Brent crude. As of now, petroleum is among the few items kept out of the GST net. Inclusion of petroleum needs the nod of the GST Council. Petroleum taxes roughly account for a third of tax revenue for state governments. States are reluctant to bring these items under GST as these are among the very few items on which they have the liberty to raise taxes without consulting the GST Council. The Union government raised excise duty on petrol and diesel several times since November 2014 when global price of these commodities started softening. At present, petrol attracts central taxes of ₹ 42.64 a litre and diesel of ₹ 33.16, combining excise duty and customs duty. In the current context of a weaker rupee, restricting fuel consumption makes sense for policy makers as crude oil imports is a major contributor to India’s import bill.

Source: Livemint

Petrol prices in Bihar 2nd highest across country

20 September. Fuel prices continue to soar in Bihar as petrol was sold at Rs 88.38 per litre in Patna. Muzaffarpur registered the highest petroleum prices in state with petrol at Rs 88.90 and diesel at Rs 80.04 per litre. Industry experts claimed petrol prices in Bihar are among the highest in the country. According to daily price notification by oil companies, petrol was priced at Rs 82.25 per litre in Delhi, Rs 89.63 in Mumbai, Rs 85.43 in Chennai and Rs 84.01 per litre in Kolkata. The only silver lining was that the prices of both diesel and petrol remained unchanged in the state over the last 24 hours. The continuous surge in petrol prices have irked the city consumers. Bihar Petroleum Dealers Association president Prabhat Kumar Sinha said the northward movement of fuel prices could be controlled only with the intervention of central as well as state governments. The VAT (Value Added Tax) imposed by Bihar government on petrol is 26% with additional 20% surcharge on VAT. Similarly, the VAT imposed by Bihar government on diesel is 19% with additional 10% surcharge on it.

Source: The Economic Times

NATIONAL: GAS

IGL to set up 60 CNG stations, give 2 lakh connections in FY19

19 September. Indraprastha Gas Ltd (IGL), India's biggest city gas retailer, plans to add a record 60 CNG (compressed natural gas) dispensing stations and give piped cooking gas connections to at least 2 lakh households this fiscal as it steps up efforts to achieve the government's target of a gas-based economy. IGL Managing Director E S Ranganathan said the company, which retails CNG to automobiles and piped cooking gas to household kitchens in Delhi and its suburbs, has adopted a dealer-franchise model in the push for rapidly expanding the network. The company, with 452 CNG stations in Delhi, Noida, Greater Noida, Ghaziabad and Rewari, has started to give the franchise to dealers who own lands. Ranganathan said the company opened 30 CNG stations last year and in the current financial year running from April 2018 to March 2019 it has a target to open 50. The government is aggressively pushing for use of CNG as a transportation fuel to cut on use of polluting liquid fuels like diesel. Ranganathan said IGL is committed to achieving the targets in the push towards a gas-based economy.

Source: Business Standard

NATIONAL: COAL

Tamil Nadu to import 20 lakh tonnes of coal for power plants

24 September. In a bid to tide over coal shortage, the Tamil Nadu Generation and Distribution Corp (TANGEDCO) will import a total of 20 lakh tonnes of steam coal between November 2018 and May 2019. Tamil Nadu receives coal mostly from Ib Valley in Odisha, Mahanadi in Chattisgarh, and Raniganj in West Bengal. However, supply from these coal mines has drastically reduced in the last one month. Bad weather was a reason for the shortfall in supplies from Ib Valley. Coal India Ltd has stepped up supplies in the last few days, but the state government is not taking any chance and has opted to import steam coal to address the shortfall and meet the generation target for the thermal stations of TANGEDCO. A TANGEDCO tender stated that delivery of the imported coal will be between November 2018 and May 2019 at Kamarajar port at Ennore (near Chennai). A total of 26 shipments will supply 20 lakh tonnes that will come in Panamax vessels. Tangedo has the right to change the port of call to either Kamarajar port or VOC port. Tamil Nadu has been reeling under severe coal shortage in the last 20 days that warranted Chief Minister Edapaddi K Palaniswamy to write a letter to Prime Minister Narendra Modi to intervene in the matter and increase coal supplies to thermal plants in the State to avoid outages. Palaniswamy said TANGEDCO’s power plants, on an average, require 72,000 tonnes of coal daily to maintain continuous generation. This translates into at least 20 rakes on a daily basis. However, on an average, TANGEDCO was receiving only seven rakes daily due to reduced supplies from the coal companies.

Source: The Hindu Business Line

CIL aims to supply 17.5 mt coal a year to captive power producers

24 September. Coal India Ltd (CIL) plans to supply 17.5 million tonnes (mt) of coal annually to captive power producers for five years through an auction that started and is slated to conclude on 10 October. The average base price for the fuel on offer is around ₹ 1,343 per tonne while premiums offered by consumers for a variety of coal from South Eastern Coalfields have touched a high of ₹ 650 per tonne. For the current round of auction for captive power producers Northern Coalfields has offered 5.18 mt of coal, followed by Mahanadi Coalfields at 3.65 mt and South Eastern Coalfields at 3.6 mt. Central Coalfields is offering around 2.85 mt, followed by Western Coalfields at 1.6 mt. Bharat Coking Coal and Eastern Coalfields are offering 3.5 lakh tonnes and 2.7 lakh tonnes, respectively. During the first three days CIL offered 44.25 lakh tonnes of coal, of which 34 lakh tonnes was booked. The highest premium so far has been received by South Eastern Coalfields, which offered 4 lakh tonnes of coal from its Kushmunda open cast mines at ₹ 1,145 per tonne. It received a 57% premium and the entire volume was booked. About 5 lakh tonnes of G13 grade coal offered at ₹580 per tonne by Mahanadi Coalfields from its Kulda Opencast mine received a similar 57% premium. CIL has firmed up plans of offering a mix of 30 mt of thermal and coking coal at its recently announced fourth tranche of long-term supply contract meant for the non-power sector. According to plans, South Eastern Coalfields would be offering 9 mt of coal, followed by Central Coalfields at 6.11 mt and Northern Coalfields at 6.3 mt.

Source: The Economic Times

PM Modi dedicates NTPC’s Odisha coal mine to the nation

22 September. Prime Minister (PM) Narendra Modi dedicated to the nation Dulanga Coal Mining Project of NTPC Ltd in Sundargarh district of Odisha. This is the second mine of the state-run company to be operational and its first in the state. Coal produced from this mine will be used in the under-construction 1600 MW Darlipali Super Thermal Power Plant of NTPC in Sundargarh district. Modi inaugurated the Garjanbahal open cast mine of Mahanadi Coalfields Ltd (MCL), which has coal block reserves of 230 million tonnes (mt) with an annual production capacity of 13 mt. It will generate direct employment opportunity for 894 people and indirect job opportunities for 5,000.

Source: The Economic Times

Primary aluminium producers facing severe coal crisis, high power cost: AAI

20 September. A sharp fall in availability of coal has left aluminium producers having captive plants with no option but to import the dry fuel, thereby sharply increasing the cost of production, Aluminium Association of India (AAI) said. Another issue which the industry is facing is high rates of power. Players who are buying power from states are buying it at spot prices, AAI said. The price for production of one tonne of aluminium has gone up by $237 per tonne due to increase in power costs and imported coal, AAI said. Power constitutes 40 percent of overall production cost for aluminium producers. The government must come forward to address the two prime issues the industry players are facing at the moment, AAI said.

Source: Business Standard

Meghalaya babus allowing illegal coal mining: Wildlife group

19 September. A wildlife and environment protection group in Meghalaya's Jaintia Hills districts has urged the state government to initiate criminal proceedings against officials allegedly allowing illegal coal mining, despite a ban imposed on it by the National Green Tribunal (NGT). The group demanded auditing be conducted on all cement factories in East Jaintia Hills District to find out the source of coal being supplied to them. Meghalaya should initiate criminal proceedings against the errant officials who are responsible for allowing illegal coal mining to happen in their jurisdiction, group convener Sajay Laloo and B Buam said in a letter submitted to Chief Minister Conrad K Sangma. The NGT had imposed a blanket ban on coal mining in Meghalaya since April 2014, and while disposing off the matter on 31 August, reconfirmed the ban on mining and transportation of already-extracted coal. In the letter, Laloo and Buam said there are brisk coal mining activities and environmental destruction taking place all over the state.

Source: Business Standard

NATIONAL: POWER

Haryana consumers to pay less for power from 1 October

25 September. Power distribution company Dakshin Haryana Bijli Vitran Nigam has slashed electricity tariffs as the CM (Chief Minister) had announced. The new rates come into effect from 1 October. According to the revised rates, consumers using up to 50 units per month will be charged at Rs 2 per unit compared with Rs 2.70 per unit levied now. Similarly, residents who restrict their power consumption within 200 units per month will be billed at a rate of Rs 2.50 per unit instead of Rs 4.50 per unit earlier. Power consumption in the 200-250 and 250-500 units ranges will be charged at Rs 5.25 and Rs 6.30, respectively. However, the reduced tariff is only applicable for those households where the power consumption is below 500 units per month. If the consumption exceeds the limit, the existing rate will continue which is Rs 4.50 per unit for the first 200 units.

Source: The Economic Times

Assam government introduces Electricity Duty (Amendment) Bill, 2018

24 September. Assam Government proposed to replace fixed "electricity duty" of 20 paise per unit with an ad-valorem rate of five percent on overall energy charge, having a scope to further increase it to 10 percent. Introducing the Assam Electricity Duty (Amendment) Bill, 2018, Finance Minister Himanta Biswa Sarma said the government plans to have the electricity duty at an ad-valorem duty of five percent. Currently, "electricity duty" is charged at 20 paise per unit and there is no scope to raise it beyond this amount. Once the bill is passed by the Assembly and notified by the government, this step will effectively increase the electricity bill of the consumers.

Source: Business Standard

Six years on, administration fails to execute power reforms in Chandigarh

24 September. The UT (Union Territory) electricity department has failed to implement power sector reforms, especially preparing the online data of consumers, power connections and entire power infrastructure of the city. The work on this programme was started in 2012 but is far from completion. The Restructured Accelerated Power Development and Reforms Programme (RAPDRP) project has been initiated to bring down the transmission and distribution (T&D) losses by upgrading the power infrastructure and introduction of the Information Technology (IT). As per the proposal, the UT electricity department had planned to implement power reforms, including the introduction of management integrated system, geographical information system among other initiatives to boost e-governance in the working of the department. Under the proposed plan, computerisation of the UT electricity department will be done. A round-the-clock call centre for consumer grievance redress will also be set up. With the computerisation, the UT electricity department will be able to create a database of the information, including electrical loads, sanctioned connections, consumers’ grievances, billing etc. As per the plan, the UT will put in place the management integrated system (MIS) to speed up day-to-day work procedures in the department. With the introduction of MIS, the department will adopt the use of IT applications for meter reading, billing, collection, energy accounting, auditing, redressal of consumer grievances etc. Around six 66 kilovolt (kV) sub-stations have crossed their life and the number of such sub-stations will continue to grow. As per the plan, a total of 12 new 66 kV grid sub-stations will be established while all the existing 66 kV sub-stations will be upgraded in next 10 years. The department has set a deadline of 10 years for completion of the work.

Source: The Economic Times

India plans power sector mergers to raise ₹ 200 bn

24 September. India is planning to sell its stake in SJVN Ltd and Power Finance Corp to other government-controlled companies in deals that may fetch the federal government about ₹ 20,000 crore, helping it to rein in the fiscal deficit amid growing risks of a slippage. The government plans to sell its 63.8% stake in hydropower producer SJVN to NTPC Ltd, the nation’s largest thermal power producer, to garner about ₹ 8,000 crore. The other deal being considered will see Rural Electrification Corp Ltd buying the federal government’s 65.6% ownership in Power Finance Corp Ltd.

Source: Livemint

Uttar Pradesh government asks Agra for data on power saved from LED installation

23 September. The Uttar Pradesh government has sought details from Agra Municipal Corp (AMC) regarding how much it has saved on power consumption by installing light emitting diode (LED) bulbs across 100 municipal wards on the city. Under the Street Light National Program, a total 30,509 LED street lights were installed in the city. On orders of the state government, the Agra Municipal Corp (AMC) had assigned work for replacing old street lights with energy-efficient LED bulbs to Energy Efficient Services Ltd (EESL), a joint venture company of PSUs (Public Sector Undertakings) of the union power ministry. But after installation of the bulbs, the civic body did not share details of savings on power consumption made with the state government. The AMC is responsible for maintaining 38,567 street lights in the city. According to ESSL, the installation of LEDs will help AMC to save over 3,955 kilowatt per hour (kWh) deemed units’ demand annually which is over 60%

of power consumption of conventional street lights. This means electricity bills will be reduced by Rs 8 crore a year.

Source: The Economic Times

4 GW additional power supply by 2022 in Tamil Nadu: Electricity Minister

22 September. Power generation capacity of the state has to be increased by 1,000 MW every year to ensure uninterrupted power supply and efforts are under way to add 4,000 MW to the power generation capacity by 2022, Electricity Minister P Thangamani said. He said that the proposed 14-day power cut for nine hours a day in areas covered under Palayamkottai sub-division in Tirunelveli district has been stopped.

Source: The Economic Times

JSW Energy to supply 275 MW power to Maharashtra for two months

21 September. JSW Energy will supply 275 MW power to Maharashtra for October and November for Rs 4.41/unit, as electricity demand in the state rises mainly on account of higher agricultural consumption amid a dry spell. Maharashtra’s power demand touched an all-time high of 22,252 MW. JSW would be supplying the power from its imported coal-based, 1,200 MW Ratnagiri plant. The contract to supply the power was part of the tender called by Maharashtra for buying short-term power for three months till 31 December. The company would, however, be supplying only 20 MW to the state through the contract in December.

Source: The Financial Express

SBI hopes to resolve 7-8 stressed power assets by 11 November: Chairman

21 September. State Bank of India (SBI) hopes to resolve 7-8 stressed power assets with an exposure of around Rs 170 billion during the breather given by the Supreme Court till 11 November, SBI Chairman Rajnish Kumar said. The Supreme Court has asked the banks to maintain status quo and not to initiate insolvency proceedings against defaulting power companies till 11 November 2018, when it would hear the case again. During this period lenders would be able to resolve stressed assets.

Source: Business Standard

ABB to enhance power quality for India's longest freight train network

21 September. Industrial technology provider ABB said it will supply equipment to enhance power quality at rail line along the country's longest freight corridor, helping trains run at optimum speed. ABB will supply fixed and dynamic reactive power compensation panels at 23 traction substations. The solution will be implemented in the western segment of the DFC (Dedicated Freight Corridor) between Mumbai and Dadri that covers a distance of more than 1,500 kilometre. The DFC will run between the four cities known as the Golden Quadrilateral - Delhi, Mumbai, Chennai and Kolkata - and will be developed by the Dedicated Freight Corridor Corporation of India Ltd (DFCCIL). DFCCIL expects to transport up to 15,000 tonne of load for long distances and will have a container capacity of 400 units per train, among the highest in the world. To cope with the volume, DFCCIL is pioneering the operation of double stack containers on electrified routes in India. The potential risk of non-compliance to grid codes can also lead to financial penalties. By improving the reliability of the grid and reducing downtime, ABB's innovative PQCR (Power Quality Compensator Reactive) technology will help DFCCIL optimise the operating costs of its freight network.

Source: Business Standard

Tata Power, India Power Corp bid for Odisha discom

20 September. Tata Power and India Power Corp Ltd have bid to acquire Odisha’s Central Electricity Supply Utility (CESU), being privatised again after 17 years. This is first discom (distribution company) privatisation after licences for Delhi Vidyut Board were handed over to Tata Power Delhi Distribution Ltd and BSES Delhi discoms. Orissa Electricity Regulatory Commission (OERC) had called bids for the sale of CESU in December last year. The successful bidder will manage, invest and operate the company for 25 years. CESU distribution area comprises 19% of the state with major cities of Bhubaneswar, Cuttack, Paradeep, Angul and Talcher and a revenue potential of about Rs 3,000 crore. Odisha was the first state to privatise power distribution sector by dividing the state into four companies.

Source: The Economic Times

Power demand in Gujarat hits record 17.6 GW

20 September. Increased demand in agriculture coupled with a rise in temperature has pushed up electricity consumption across Gujarat. The power demand in the state touched a record high of 17,652 MW. Industry experts attribute the spike in demand from agriculture sector to daily temperature rising to 36 degrees in the wake of inadequate rainfall. The demand is even higher than the summer months. The state usually witnesses the highest demand in September-October period. Recently, the state Energy Minister Saurabh Patel had said that electricity consumption in agriculture sector has crossed the ‘10 crore units a day’ mark, which normally remains between 6 to 7 crore units during September-October. Among all the Indian states, Gujarat has provided the highest amount of power to agriculture sector.

Source: The Economic Times

Uttar Pradesh will have to be lightning fast to power 1 crore homes

19 September. The Yogi Adityanath government is staring at this gigantic target, as Prime Minister Narendra Modi’s promise to electrify each house in the country by 31 December under Saubhagya scheme hinges on UP (Uttar Pradesh)’s performance. Of the 1.75 crore households yet to be electrified in the country, almost one crore are in UP alone. The state has achieved barely 25% of its target so far, having electrified about 35 lakh houses since the scheme was launched about a year ago. UP’s Power Minister Shrikant Sharma, however, exuded confidence that the state would be able to meet the target, said that neither funds nor availability of meters was an issue. As per the scheme’s online dashboard, UP electrified about 6.6 lakh houses last month and another 6.2 lakh so far this month.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Goa can harness wind energy for power needs

25 September. As a coastal state, Goa has immense potential to harness wind and solar energy but despite favourable conditions, the state has failed to harness these renewable sources of energy, industry stakeholders said. Prohibitive costs and maintenance issues have either prevented or derailed efforts to utilize and harness wind and solar energy, they said. The Goa Chamber of Commerce and Industry (GCCI) has tied up with a company to promote a hybrid wind turbine which harnesses both wind and solar energy. The company has joined hands with GCCI to explore the renewable energy potential in Goa.

Source: The Economic Times

India could substitute fossil fuels by cleaner hydropower from Nepal, Bhutan: World Bank

25 September. India has the potential to more than triple its trade with its South Asian neighbours to $62 billion against its actual trade of $19 billion, a World Bank report said. For India, the deeper regional trade and connectivity could reduce the isolation of Northeast India, give Indian firms better access to markets of South and East Asia and allow it to substitute fossil fuels by cleaner hydropower from Nepal and Bhutan.

Source: The Economic Times

Cochin Smart Mission signs pact with BHEL for solar power project

25 September. Cochin Smart Mission Ltd has entered into an agreement with Bharat Heavy Electrical Ltd (BHEL) for installation of rooftop solar system for select government buildings. Installation of solar panels is one of the projects under Smart City Mission with a project cost of Rs 5.7 crore. BHEL is expected to complete the work in six months and there would be an annual maintenance contract for five years. Smart roads project includes upgradation of footpaths, provision for cycle tracks, road markings, street furniture, bus bays, street landscaping, electrical works and shifting of utilities. As per the existing condition and requirement, other roads will be upgraded with drainage facilities and provision of footpath and surface improvement. Uninterrupted electricity supply with at least 10% of the smart cities’ energy requirement meeting from solar is an essential feature envisaged under the mission.

Source: The Economic Times

Renewables may account for 18 percent of total power generation by 2022: Moody's

25 September. The share of renewable energy in the country's electricity generation mix is likely to rise to around 18 percent by 2022, from 7.8 percent at present, owing to the continuous focus on capacity addition from solar and wind, Global ratings agency Moody's Investors Service in its report said. The report said India is taking positive steps to align its power generation mix with its Nationally Determined Contribution (NDC) commitments under the Paris Climate Agreement. The report said that large companies have also announced plans to make their operations more energy-efficient and source more renewable energy. According to the agency, renewable energy's share in the electricity generation mix is likely to rise to around 18 per cent by 2022, from close to 7.8 per cent as of March 2018. It said that eventually, the share of fossil fuel-based generation capacity is likely to fall to 50-55 percent by 2022, from 67 percent currently. India is targeting 40 percent of cumulative capacity from non-fossil fuel-based sources by 2030, in line with its NDC commitments, which compares with total non-fossil fuel power generation capacity (including nuclear) of 35 percent as of June.

Source: Business Standard

West Bengal to commission floating solar plants next year

22 September. The West Bengal government is the process of commissioning floating solar power plants by next year, state Minister for Power and Non-renewable Energy Sobhandev Chattterjee said. The two plants would come up at Sagardighi and Mukutmanipur with generating capacities of 5 MW and 100 MW respectively. Chatterjee said detailed project report (DPR) of the projects has been already prepared. Chatterjee said that in the last seven years, industrial demand had increased 27.22 percent. Regarding old coal-based power plants like Bandel, he said talks were on with foreign companies to implement new technology for checking carbon emission and to keep it operational for another 25 years.

Source: Business Standard

Community kitchen in Delhi Gurdwaras to switch to biogas

22 September. Delhi’s Gurdwara management committee has planned to switch from piped natural gas to biogas to run its langar kitchen in ten shrines, including Bangla Sahib and Rakab Ganj Gurdwara. The move is aimed at reducing carbon footprint, cut fuel cost and making the shrines environment friendly, Delhi Sikh Gurdwara Management Committee (DSGMC) president Manjeet Singh GK said. Initially, the bio gas plants would be set up at Rakab Ganj and Bangla Sahib that generate largest quantity of biodegradable waste, he said. The community kitchen in these Gurdwaras serves food to around 30,000 visiting devotees every day. Each plant would have the capacity to manage four quintal of kitchen waste per day, he said. The community kitchens of remaining eight Gurdwaras will switch to bio fuel by the end of 2019 in a phased manner, Harjit Singh, who heads renewable energy wing of DSGMC, said.

Source: Business Standard

Punjab government approves 4 GW thermal plant at Rupnagar

21 September. The Punjab government has approved a super critical thermal plant of 4,000 MW capacity for Rupnagar, state Power Minister G S Kangar said. Besides, a 60 MW biomass plant and a 100 MW solar plant are also coming up soon, he said. He sought to clarify that closure of 880 MW thermal units in Bathinda and Rupnagar by the government earlier would lead to dominance of private players in the power sector in times to come.

Source: Business Standard

NHPC to develop 40 MW solar power project in Odisha for Rs 1.9 bn

21 September. Hydropower generation company NHPC Ltd will put up a 40 MW solar plant in Odisha with an investment of about Rs 1.96 billion. The solar power project will come up on about 180 acres of land in the Ganjam district and NHPC is impressing upon the state's bulk power purchaser, Gridco, for buying the power produced. NHPC had evinced interest for setting up a 100-200 MW solar project in Odisha for the supply of power to Gridco so that the latter could fulfil its renewable energy purchase obligation with assured power purchase agreement. The central PSU (Public Sector Undertaking) has already commissioned a 50 MW solar project in Tamil Nadu and another 50 MW wind power project in Jaisalmer, Rajasthan. Odisha plans to develop a solar park with a production capacity of 1,000 MW. But, land availability is the key hurdle as the mega park needs around 5,000 acres of land. The Ministry of New and Renewable Energy (MNRE) has allowed the state government to develop a truncated solar park of 400 MW capacity under the Scheme for Development of Solar Parks and Ultra Mega Solar Power Projects. The development of the park assumes significance as the state government, in its newly approved Renewable Energy Policy-2016, plans to add 2,200 MW capacity of solar energy by 2022. The state has about 175 MW of installed capacity of solar power.

Source: Business Standard

ACME commissions 200 MW solar plant at Bhadla in Rajasthan

21 September. Independent power producer ACME said it has commissioned its 200 MW solar power plant at Bhadla in Rajasthan. With the commissioning of the Bhadla solar park, it's total operating capacity in solar power stands at 2,400 MW and the company's total portfolio of solar projects stands at over 5,500 MW making it the largest solar power portfolio in the country, it said. The company won the contract for developing 200 MW at the Bhadla solar project at a low tariff of Rs 2.44 per unit till and it has so far invested Rs 980 crore in setting up the plant, it said.

Source: Business Standard

Government steps in to arrange funds for green projects

20 September. The Ministry of New and Renewable Energy (MNRE) stepped in to keep funds flowing for green energy projects by assuring banks and lending institutions the tariffs being discovered through bidding were viable investments to fund. At a meeting with project developers and lenders, the ministry responded to a litany of funding woes narrated by promoters saying it would examine whether Indian Renewable Energy Development Agency could finance the impact of safeguard duty on projects as an interim arrangement. The meeting comes in the backdrop of lenders shunning renewable power projects as they fear the low tariffs could financially cripple promoters from servicing loans, which then would turn into NPAs (non-performing assets) as has happened in the thermal power industry. The lenders are also worried over the weak financial health of state utilities and their poor record in fulfilling statutory obligation to buy power from renewable projects.

Source: The Economic Times

India contributes $1 mn to UN's ambitious solar project

20 September. India has contributed a whopping $1 million for the installation of solar panels on the roof of the imposing UN (United Nations) building at the world body's headquarters. The contribution will help reduce carbon footprint and promote sustainable energy, India's Permanent Representative to the UN Ambassador Syed Akbaruddin said. He said that India is the "first responder" to Secretary-General Antonio Guterres' call for climate action. He said that India intends to partner with the UN Secretariat to use renewable solar energy at the UN premises.

Source: Business Standard

Biofuel processing plant to be established in Rajasthan

20 September. Biofuel authority of Rajasthan, with the help of Indian Railways, is planning to establish a biofuel processing plant in Rajasthan, with ‘buy back assurance’, which means that the processed fuel will be bought by the railways. The plant will have the capacity of eight tonne per day and will cost about Rs 5 crore. The biofuel authority has decided to tie up with the railways as for many years, the state did not have its own processing unit. Oil extracted from the seeds of Jatropha plant are used for the production of Biofuel. There are more than three crore Jatropha plants cultivated in Rajasthan. It is being cultivated on the wastelands and can survive harsh, rocky terrain. Jatropha is suitable for a desert state like Rajasthan, facing water scarcity.

Source: The Economic Times

INTERNATIONAL: OIL

Asia's oil deficit to widen by 2025: French’ Total

25 September. Asia’s oil deficit will widen to 35 million barrels per day (bpd) by 2025, up about 30 percent from the current 27 million bpd, amplifying global trade flow imbalances, French oil and energy group Total said. At the same time, Europe’s imports will be cut by 10 million bpd, while exports from North America and the Middle East will increase, Total said. The United States will export shale oil, but its refineries will continue to import medium and heavy sour grades, Total said.

Source: Reuters

US-China trade war poses oil demand shock in 2019: BP

25 September. US (United States) sanctions on Iran will tighten global oil supplies sharply until the end of the year, but a threat to world demand looms in 2019 from the US-China trade war, Janet Kong, chief executive of Integrated Supply and Trading Eastern Hemisphere at BP, said. Sanctions on Venezuela are also exacerbating a production decline there, while outages in Nigeria and Libya have further crimped supplies, Kong said, with Brent supported at above $80 a barrel. The world’s two largest economies, China and the United States, have imposed tariffs on each other’s imports in an escalating trade war that has rattled global markets and raised concerns of a slowdown in world economies and commodities demand next year.

Source: Reuters

Iranian oil tankers go dark with 1 1/2 months to go to sanctions

25 September. Iran’s oil tankers are starting to disappear from global satellite tracking systems with just under six weeks to go until US (United States) sanctions are due to hit the country’s exports, making it harder to keep track of the nation’s sales. No signals have been received by shore stations or satellites from 10 of the Persian Gulf nation’s crude oil supertankers for at least a week, according to tanker tracking. The most likely explanation is that the vessels’ transponders have been switched off, making it more difficult to track the their movements. When they were last seen, the 10 vessels, which are listed below, were holding around 13 million barrels of crude and condensate, a light form of crude extracted from gas fields. If they’re now full, that would rise to about 20 million barrels. The disappearance of Iran’s tankers will make it increasingly difficult to monitor ship movements as the 4 November deadline looms for buyers to halt purchases of Iranian crude and condensate or face being blocked from the US financial system. The three full vessels last seen heading out of the Persian Gulf were all showing destinations in China.

Source: Bloomberg

China's surplus oil refining capacity to hit 136 mt a year in 2020: CNOOC

25 September. China’s refining capacity will grow to 880 million tonnes (mt) a year, equivalent to 17.6 million barrels per day, by 2020, 14 percent higher than 2017, Xu Yugao, director general, policy research office at CNOOC, said. This will exceed demand for fuels by the world’s largest energy consumer, creating surplus refining capacity of 136 mt a year, Xu Yugao said.

Source: Reuters

Saudi Aramco Trading aims for 50 percent rise in oil trade volume in 2020

24 September. Saudi’s Aramco Trading Company (ATC) expects to increase its oil trading volume to 6 million barrels per day (bpd) in 2020, 50 percent higher than current levels, President and Chief Executive Officer (CEO) Ibrahim Al-Buainain said. About 50 percent of the 2.5 million bpd of oil products it trades currently are hedged, he said. The company is also looking at building its capacity in trading liquefied natural gas (LNG), using its Singapore office as a trading hub, he said. ATC plans to set up its European office in either Geneva or London and also aims to have an office in Fujairah to manage oil storage, he said.

Source: Reuters

Japanese refiner Cosmo Oil replaces Iran oil with other Mideast supplies

24 September. Japanese refiner Cosmo Oil has replaced its Iranian crude oil imports with supplies from other Middle Eastern producers ahead of US (United States) sanctions on Iran in November, Cosmo Oil President Shunichi Tanaka said. Refiners in Japan, the world’s fourth largest crude oil importer, halted oil imports from Iran in mid-September, the country’s refinery association said, allowing time for payments before sanctions are imposed. Saudi Arabia, the United Arab Emirates and Kuwait are supplying more crude to Cosmo Oil to replace its 10,000 barrels per day (bpd) shortfall from Iran, or 5 percent of the refiner’s imports, he said. The Organization of the Petroleum Exporting Countries (OPEC) and other oil producers are considering raising output by 500,000 bpd to counter falling supply from Iran. Cosmo Oil, a unit of Japan’s Cosmo Energy Holdings, is the country’s third-largest oil refiner by sales.

Source: Reuters

World oil demand, refining growth to peak in 2035: China’s Unipec

24 September. World oil demand will peak at 104.4 million barrels per day (bpd) in the mid-2030s, up from just below 100 million bpd currently, as new technologies gradually eat into oil use, China’s Unipec said. Improved energy efficiency and technological changes, including the rise of renewables, meant global oil demand growth would slow in coming years before peaking in 2035, Unipec President Chen Bo said. This in turn will slow growth in global oil refining capacity, which is set to hit 5.6 billion tonnes per year in 2035, Chen said. Despite the trade dispute, Chen said US (United States) crude supply was an important new source for Chinese refiners as it allowed diversification from Middle East and African crudes. Beijing has excluded US crude imports from its tariffs list so far, but most Chinese buyers are staying away from US oil as the trade war shows no signs of cooling.

Source: Reuters

High oil prices benefit no one: Russian Energy Minister

24 September. Russian Energy Minister Alexander Novak said that high oil prices are not beneficial to anyone, after the OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC group of oil-producing countries ruled out any immediate increase in crude output.

Source: Reuters

Iran appears to soften stance on OPEC oil output increase

23 September. Iran appeared to soften its stance on potential increases in OPEC (Organization of the Petroleum Exporting Countries) oil output, saying it was the group’s responsibility to balance the market if production from Iran or any other member declined. Tehran had previously said no OPEC member was allowed to grab market share from rivals, such as Venezuela or Libya, whose production had declined due to unrest or a lack of investment. Iran itself faces the prospect of much lower oil exports and output in coming months due to fresh US (United States) sanctions.

Source: Reuters

ENOC’s jet fuel storage plans show how Iranian sanctions upending oil market

21 September. Emirates National Oil Company (ENOC) has chartered at least one vessel to store jet fuel to ensure supply to airlines in Dubai as pending US (United States) sanctions on Iran have cut off its access to feedstocks for producing the aviation fuel. The company will store jet fuel onboard at least one of the vessels, which can store about 100,000 tonnes of jet fuel. Jet fuel differentials in the Middle East have been trading at low levels due to high refining run rates and weak demand from Europe. So, ENOC’s demand for fuel to fill the ships could boost the differentials. While the ship-borne storage will help ENOC ensure an immediate supply of jet fuel for Dubai International Airport, the stockpiling also highlights ENOC’s lack of access to Iranian condensate, an ultra-light crude oil, used to produce jet fuel. The United Arab Emirates (UAE) government asked ENOC to replace its Iranian condensate purchases with other grades such as Eagle Ford from the US after the announcement of the US sanctions against Iran. ENOC processes Iranian condensate at its 140,000 barrels per day condensate splitter at the UAE port of Jebel Ali, which typically yields about 20 percent jet fuel.

Source: Reuters

Brazil OKs second diesel subsidy payment of $173 mn to Petrobras

21 September. Brazilian oil industry regulator ANP approved an additional payment of 706 million reais ($173.19 million) to state-controlled oil company Petróleo Brasileiro SA (Petrobras) to compensate for diesel subsidies. ANP said it green-lighted a payment of 877 million reais to Petrobras, the first for the company since the subsidy program was unveiled in late May to end a truckers’ strike over high diesel prices. The subsidy plan raised fears of further state meddling in Petrobras, the world’s most indebted oil company, and has spurred criticism of the government’s subsidy program and lack of timely payment of compensation.

Source: Reuters

INTERNATIONAL: GAS

French’s Total makes major offshore UK gas discovery

24 September. French oil and energy group Total said it had made a major gas discovery on the Glendronach prospect, located off the coast of the Shetland islands in the North Sea. Total said preliminary tests on the new gas discovery confirmed good reservoir quality, permeability and well production deliverability, with recoverable resources estimated at about one trillion cubic feet. It said Glendronach, located near its Edradour field, will be tied back to the existing infrastructure and developed quickly and at low cost. Total said the discovery will extend the life of the West of Shetland infrastructure and production hub which includes the Laggan, Tormore, Edradour & Glenlivet fields, as well as the Shetland Gas plant, all of which contribute to about 7 percent of the UK (United Kingdom) gas consumption. Wood Mackenzie North Sea research analyst Kevin Swann said it was the largest conventional discovery in the UK since Culzean in 2008, and it could contribute as much as 10 percent of the UK’s annual gas production in its early years.

Source: Reuters

Woodside to supply LNG to Germany's Uniper for 4 years from 2019

20 September. Woodside Energy Trading Singapore said it signed a heads of agreement (HOA) with Germany’s Uniper Global Commodities for the supply of up to 0.6 million tonnes of liquefied natural gas (LNG) per annum. The agreement is for a period of four years starting from 2019, the company said. The LNG will be supplied from Woodside’s portfolio sources to markets in Europe and Asia, Chief Executive Peter Coleman said. Woodside said the HOA is conditional on the execution of a fully termed LNG sales and purchase agreement.

Source: Reuters

US LNG to China cheaper than other origins despite tariff

19 September. Shipments of liquefied natural gas (LNG) from the United States (US) to China remain cheaper than other sources despite a 10 percent tariff that was imposed on the cargoes this week in the trade war between the two nations. But political risks may still deter Chinese buyers from US cargoes even if they are a lower price. China said it would tax US products worth $60 billion effective 24 September in retaliation for tariffs imposed by US President Donald Trump. This includes a 10 percent tariff on LNG shipments from the US, although this was less than the 25 percent it had threatened to impose. Shipments of LNG from the US to China work out at least 9 percent cheaper than the delivered price into China compared with those loading from other key suppliers.

Source: Reuters

INTERNATIONAL: COAL

Poland's last coal project gets another approval despite objections