HOPES REVIVE FOR A GAS BASED ECONOMY

Gas News Commentary: January – February 2018

India

India’s push to more than double the share natural gas has in its energy mix to 15 percent by 2022 will require a huge increase in imports and the construction of LNG terminals. India has four terminals to receive LNG and imports around 20 mt of the super-chilled fuel a year. But over the next seven year the government plans to build another 11 terminals. That would raise India’s LNG import capacity to more than 70 mt per year in the coming seven years, in what would be one of the fastest gas import expansions since China embarked on its huge gasification programme last year. India would eventually require even more than 15 terminals to meet its demand. India has stated it plans to raise the share of natural gas in its energy mix to 15 percent by 2022 from about 6.5 percent now. The 70 mt a year target a few years later would mean Indian would need to import more than China took last year via both pipelines and tankers, and it would put India close to what top importer Japan currently buys. India plans to electrify millions of households that still burn wood for light, heat and cooking. Like China, it also plans to reduce its heavy reliance on thermal coal, a bigger polluter than gas. Gas would also be needed to provide power to electric vehicles, which India plans to account for all new car sales by 2030. India is also pushing for more scooters and motorcycles to run on CNG with pilot schemes recently launched in major cities including New Delhi and Mumbai. Beyond LNG, India is looking to access untapped domestic gas reserves off its east coast. As part of its drive to reduce pollution by increasing natural gas use the government was encouraging Indian railway companies and LNG importers to look at fuelling trains by LNG instead of diesel. India also wants to become a hub for supplying ships that run on LNG, with plans to build more facilities like a fuelling station at Kochi port. LNG as a shipping fuel is being pushed by International Maritime Organization rules that come into effect by 2020 and require the use of cleaner fuels.

IGS an equal joint venture of BP and RIL in 2011 plans to begin selling imported LNG to Indian customers in 12-18 months to cater to the rising natural gas demand in the country. India Gas Solution administers the existing gas sales contracts to customers for production from the RIL-BP’s KGD6 block and is actively pursuing opportunities for marketing the proposed output from R-Series field in the KG Basin. R-Series is expected to begin producing 12 mmscmd from 2020. The firm was in talks with all the players in the value chain, including customers, suppliers, pipeline owners and the regasification terminal operators, and everything would come together soon. BP has a huge presence globally in the LNG trading business, is hoping to lean on that experience and network to bring Indian gas consumers a competitive deal. By entering LNG supply business in India, India Gas will directly compete with state-run suppliers such as GAIL (India) Ltd, Indian Oil and Petronet LNG.

RIL and BP Plc, partners in a gas block in the KG basin, have started approaching prospective customers to sell gas that will start flowing from their R-series field in 2020. The firms will sell gas through IGS for the sourcing and marketing of gas. New gas production from the D6 field in the KG block will flow from 2020 and is expected to bring a total 30-35 mmscmd phased over 2020-22. So far, only the D6 field in KG block is producing gas. The R-Series and other satellite fields are yet to be developed. The six satellite fields include D2, 6, 19, 22, 29 and 30, in the KG block. While the development of the six satellite fields would be taken up together, D-34 or R-Series and D-55 (MJ) would be developed separately. RIL and BP announced an investment of ₹ 400 billion in their satellite fields, R-Series and MJ gas discoveries, to reverse flagging production from the KG block. This investment will boost production as much as fivefold over the next three to five years. IGS is also pursuing options to import and market LNG into India and looking to pick up stake or administer capacity in LNG regasification facilities and gas transportation pipelines. RIL and BP are partners in the KG block, which currently produces around 7-8 mmscmd. While RIL holds a 60% stake in the gas block, BP owns 30%. Canada-based Niko Resources Ltd owns the rest. The D6 field began gas production in April 2009 and was to hit a peak output of 69.43 mmscmd in March 2010. However, water and sand ingress forced the closure of some wells, leading to a drop in production. BP and RIL began their partnership in 2011, when BP picked up a 30% stake in RIL’s 21 oil and gas blocks for $7.2 billion.

ONGC’s gas production rose 7.9% and crude output went up 1.5% in the first nine months of the current fiscal against the previous corresponding period. The ONGC board had approved projects worth over ₹ 780 billion in the last three years. These projects will lead to additional oil and gas output of over 180 mtoe. The acquisition of government’s 51.11% stake in HPCL will make ONGC India’s third-largest refiner and the first fully vertically integrated energy company, straddling the entire hydrocarbon value chain. The acquisition of HPCL will bolster the kitty of MRPL, ONGC’s refining subsidiary that processed a record 16.5 mt of crude.

Hiranandani Group-promoted H-Energy, which is executing a ₹ 35 billion project to import and distribute LNG in West Bengal, has decided upon the shore-based regasification terminal model to expedite work. The company expects to complete the LNG project at Haldia within the next 18-24 months. Transportation major ‘K’ Line has a 26 percent stake in a joint venture with H-Energy to execute and manage the storage and literage part (FSU) of the imported LNG project valued at $300 million. ‘K’ Line is estimated to supply 155,000 m3 LNG FSU. However, the regasification terminal at the shore near Digha will require about $250 million, which will be executed solely by the Hiranandani Group. H-Energy intends to execute the LNG project in phases, slowly ramping up capacity from 1.0 to 4.0 mtpa. It can be later scaled up to 6.0 mtpa. The company will construct a station near Haldia to receive LNG by shuttle carriers, where it is stored and regasified in a Floating Storage and Regasification Unit, holding approximately 40,000 m3. The initial capacity of this unit will be around 1.0 mtpa. H-Energy will be constructing pipelines of about 100 km to supply gas in Haldia and West Bengal. The natural gas is also proposed to be exported to Bangladesh.

India put on auction a record exploration acreage for prospecting of oil and gas, from 55 blocks, in the first bid round in eight years. Each block on offer has been carved out by prospective bidders under the open acreage licensing of the new Hydrocarbon Exploration and Licensing Policy. Blocks would be awarded to the company which offers highest share of oil and gas to the government as well as commits to do maximum exploration work by way of shooting 2D and 3D seismic survey and drilling exploration wells. Increased exploration would lead to more oil and gas production, helping the world’s third largest oil importer to cut import dependence. India had in July last year allowed companies to carve out blocks of their choice with a view to bringing about 2.8 million square kilometres of unexplored area in the country under exploration. Under this policy, companies are allowed to put in the EoI for prospecting of oil and gas in any area that is presently not under any production or exploration licence. The EoIs can be put in at anytime of the year but they are accumulated twice annually. The blocks or areas that receive EoIs at the end of the cycle are put up for auction with the originator or the firm that originally selected the area getting a 5-mark advantage. The 55 blocks have a total area of 59,282 square km. This compares to about 1,02,000 square km being under exploration currently. ONGC and Cairn India – a unit of Vedanta Ltd, had put in 41 out of 57 bids received in November last year. Private player Hindustan Oil Exploration Company bid for one area in a round. Of the 57 EoIs put only 55 blocks were cleared for bidding after eliminating areas that are under no-go zone or overlapping with existing mining lease. He said the opening up of 2.8 million square km of sedimentary basins for oil and gas exploration will help raise domestic production and cut excessive dependence on imports. The new policy replaced the old system of government carving out areas and bidding them out. It guarantees marketing and pricing freedom and moves away from production sharing model of previous rounds to a revenue sharing model where companies offering maximum share of oil and gas to government are awarded the block. Till now, the government has been selecting and demarcating areas it feels can be offered for bidding in an exploration licensing round.

The government has approved RIL and British energy giant BP plc acquiring their cash-strapped partner Niko Resources’ 10% stake in gas discovery block NEC-25 in the Bay of Bengal. Niko had in mid-2015 chosen to withdraw from the NEC-25 block and relinquish its interest to the remaining stakeholders. RIL is the operator of the block with 60% interest while BP of the UK has the remaining 30% stake. The 10% stake has been split between RIL and BP in proportion to their equity stake. Gas discoveries in North-East Coast block NEC-0SN-97/1 (NEC-25) hold recoverable reserves of 1.032 trillion cubic feet. The Canadian company has been facing cash problems and had even put up for sale its interest in NEC-25 as well as 10% stake in RIL’s Krishna Godavari basin oil and gas producing block KGDWN-98/3 or KG-D6. It could not find a buyer though. Last year, RIL had stated that the block oversight panel, called Management Committee, has reviewed the declaration of commerciality of gas find D-32 in the block. RIL in March 2013 had submitted a $3.5 billion Integrated Field Development Plan for producing 10 mmscmd of gas from the discoveries D- 32, D-40, D-9 and D-10 in NEC-25 by mid-2019.

Shell India, the operator of the Panna-Mukta-Tapti fields, a joint venture, has shelved its plan to sell its 30% stake in the Panna and Mukta oil fields. Panna and Mukta are oil fields while Tapti is a gas field located near ONGC’s Mumbai High complex. Shell and RIL hold 30% stake each in the PMT joint venture, while ONGC holds the remaining 40%. PSC for the PMT fields is scheduled to expire in December 2019 and the three partners have not applied for an extension of the same. During the third quarter of this fiscal, the Panna-Mukta fields produced 1.32 million barrels of crude oil and 15.2 billion cubic feet of natural gas, a drop of 10% in crude oil and 3% in natural gas on an on-year basis. The Tapti field is being abandoned due to a significant drop in reserves. It will be the first offshore field to be abandoned in India.

A 5 mtpa LNG import terminal at Mundra in Gujarat state on the west coast of India, part owned by the Adani Group, will likely be operational in April or May. The terminal will have receiving, storage and re-gasification facilities for LNG and will be connected to Gujarat State Petronet’s existing pipeline network at Anjaar, Gujarat. Construction on the terminal is completed, but Adani is unable to commission operations due to issues with a 90 km section of pipeline, executive director of the company’s LNG and LPG division. Adani’s plans are in line with a broad push in India to more than double the share natural gas has in the country’s energy mix to 15 percent by 2022. India has four LNG terminals now and imports around 20 mt of the super-chilled fuel a year, but the government plans to build another 11 terminals over the next seven years.

Petronet LNG Ltd, India’s biggest importer of gas, and its Japanese partners will invest $300 million to set up Sri Lanka’s first LNG terminal near Colombo. The Indo-Japanese partnership will set up a 2.6-2.7 mt a year floating LNG receipt facility off the island’s western coast, bigger than the previously envisaged 1.5-2 mt a year facility. Petronet will hold 47.5 percent stake in the project while Japan’s Mitsubishi and Sojitz Corp will take 37.5 percent stake. The remaining 15 percent will be held by a Sri Lankan entity. Explaining the reasons for setting up a bigger capacity LNG terminal, he said Sri Lanka requires 2.5-3 mt of liquid gas to fire power plants. Sri Lankan government had in September last year issued a Letter of Intent to the company to build a floating LNG import facility to supply gas to power plants and the transport sector in the island nation. The import terminal is to be set up at Kerawalapitiya on the west coast. The terminal in Sri Lanka is part of Petronets vision to own 30 mt per annum of LNG import and regasification capacity by 2020. Petronet already operates a 15 mt per annum import facility at Dahej in Gujarat and has another 5 mt terminal in Kochi in Kerala. It has signed preliminary agreement to build a 7.5 mt LNG terminal in Bangladesh and is also looking at setting up a smaller facility in Mauritius. Dahej is also being expanded to 17.5 mt over the next two years. The India-Japan collaboration comes after a string of Chinese successes in Sri Lanka.

GAIL incorporated in August 1984 by spinning off gas business of ONGC, GAIL owns and operates about 11,000 km of natural gas pipelines in the country. It sells around 60 percent of natural gas in the country. In 2006, the Government issued the Policy for Development of Natural Gas Pipelines and City or Local Natural Gas Distribution Networks. Also, the policy and the provisions of the PNGRB Act, 2006 provide for all entities authorised to lay pipelines including GAIL to provide mandatory open access to their gas pipeline infrastructure on common carrier principle at non-discriminatory basis. At present, GAIL has about 11,000 km long gas pipeline network and is also developing about 3,500 km long pipelines projects in the country.

GAIL has placed an order worth ₹ 4.4 billion for laying 350 km pipeline from Vijaipur in Madhya Pradesh to Auraiya in Uttar Pradesh. The company said this is part of the spurline of 665 km from Vijaipur to Phulpur in Uttar Pradesh to the existing upgradation pipeline system. The pipeline laying contracts for the 315 km stretch from Auraiya to Phulpur was awarded in November 2016. The Vijaipur to Phulpur pipeline will provide the gas feed to the ongoing 2,655 km long Jagdispur-Haldia-Bokaro-Dhamra Pipeline project of GAIL, also known as the ‘Pradhan Mantri Urja Ganga’ project. Chairman and Managing Director of GAIL BC Tripathi, also said that all of GAIL’s group companies have made detailed plans for expansion of City Gas Distribution infrastructure in coming years.

The downstream regulator is reworking city gas licensing rules, readying to launch 100 new city gas distribution licences, and cut myriad litigations it’s been caught in with gas companies, to rebuild itself into a more effective and credible watchdog that can help country achieve its target of raising the share of natural gas in the energy mix from 6% to 15% by 2030. PNGRB has often been criticised in the past for less than optimal rules needed to support the development of the gas sector in the country. PNGRB will announce the names of 100 more districts for which it intends to award licences. The choice of districts will be such that more highways have gas coverage, making inter-city commute for CNG vehicles possible, he added. So far only 91city gas licences have been awarded in the country, including 14 delivered in the last one month. Before the auction for 100 new licences are launched by March, PNGRB plans to rework bidding norms, hoping to plug the loopholes in the existing rules often blamed for poor growth of city gas. As per the draft guidelines, open to stakeholder consultation, winner will be chosen on the basis of the number of consumers connection and CNG stations, and the length of gas pipeline bidders promise to achieve in a given time frame.

After “one paisa” bids spoilt the initial auction rounds, oil regulator PNGRB has proposed to radically change the bidding parameters for obtaining a licence to retail CNG and piped cooking gas in cities. The PNGRB has proposed to conduct future auctions by asking companies to quote the tariff they will charge for transportation of CNG and piped natural gas or PNG within the city, with lowest rate getting preference. They would also be asked to quote the number of CNG stations and households proposed to be connected within a given timeframe, according to PNGRB. Besides, bidders will also have to quote how much pipeline would they lay on winning the licence. PNGRB has so far held eight rounds of bidding where companies were asked to quote the tariff for pipeline that carries gas within the city limits. This bidding criteria did not include the rate at which an entity would sell CNG to automobiles or piped natural gas to households using the same pipeline network, leading to companies offering one paisa as tariff to win licences. PNGRB in the notice invited comments on the draft bidding regulations by February 2 after which it will finalise the criteria.

Rest of the World

BP expects gas to overtake oil as the world’s primary energy source in around 2040 as demand for the least polluting fossil fuel grows. Emery highlighted estimates for demand growth for gas in China of around 15 percent year-on-year last year and said BP expects overall gas demand to grow around 1.6 percent a year for years to come, compared with 0.8 percent for oil. In terms of demand for gas from different sectors, industry is especially resilient and transport is fast-growing, albeit from a low base, at annual rates of three to four percent. BP is due to reveal more details in its next energy outlook on February 20. In its last outlook it said it saw gas overtaking coal’s share in the primary energy market to become the second-largest fuel source by 2035. BP’s previous forecast to 2035 forecast oil’s share shrinking from around 33 percent to around 30 percent and gas’ share grow from the low 20s to the mid 20-percentage range. One of the biggest challenges for the gas industry was reducing methane leakages from pipelines, which he said was estimated at around 1.3 to 1.4 percent.

BP has commenced gas production from the $1 bn Atoll phase one field offshore Egypt, seven months ahead of schedule. Located in the North Damietta Concession offshore Egypt in the East Nile Delta, the Atoll field was discovered by BP in March 2015. It is being developed in phases. BP estimates the Atoll field’s main reservoir to hold 1.5 trillion cubic feet of natural gas and 31 million metric barrel of condensates. The project, which is now producing 350 million cubic feet of gas a day and 10,000 barrels a day of condensate, was delivered 33% below the initial cost estimate, BP said. The Atoll Phase One involved the recompletion of the original Atoll exploration well to a producing well as well as drilling of two more production wells. Production from the Atoll gas field is being exported to the existing onshore West Harbor gas processing plant. Located offshore on the border between Mauritania and Senegal, the Tortue/Ahmeyim gas field is estimated to contain 15 trillion cubic feet of gas resources.

Cheniere Energy Inc said LNG production from its Sabine Pass export plant in Louisiana will not be affected following an order to shut two cracked storage tanks that leaked the super-cold fuel. The US Department of PHMSA ordered Cheniere to shut two LNG storage tanks after plant workers discovered a one-to-six foot long crack at one tank that leaked the fuel into an outer layer. The order comes as Cheniere is preparing to expand another LNG export facility at Corpus Christi in Texas that is under construction after signing a multi-year deal to sell fuel to a company in China. During the investigation of the Sabine site, PHMSA discovered a second tank had also experienced releases of LNG from the inner tank, raising the possibility that similar leaks may have occurred in multiple tanks, it said. Cheniere’s Sabine Pass terminal in Louisiana is currently the only big LNG export facility operating in the country. Several other companies are building other trains at six sites which is expected to make the United States into the third biggest LNG exporter by capacity in 2018.

Russia’s oldest natural gas buyer is ready to break up after more than 74 years. Poland, which relies on Kremlin-controlled Gazprom PJSC for about two-thirds of its gas, says diversification trumps potential price cuts it could leverage from building an import link to access Norwegian fuel. That comes after the eastern European nation in 2016 completed a liquefied natural gas terminal to diversify away from the Russian gas it’s been buying since 1944. Poland is also vying with Gazprom over the Russian company’s plan to expand its Baltic Sea gas pipeline to Germany, called Nord Stream 2. Poland argues that the project would make countries like Ukraine more vulnerable if Russia decided to shut down gas links running across its territory to western Europe. PGNiG gets 10 bcm a year under the Gazprom contract. It doubled its LNG purchases from Qatar as of this year to about 3 bcm and signed a mid-term deal for US deliveries. The LNG terminal’s capacity is set to rise 50 percent to 7.5 bcm a year after 2020. At the same time, the Polish company committed to transit 8.78 bcm a year via the Baltic Pipe when it starts. Additionally, the country produces more than 4 bcm of its own gas a year and in order to export an excess it may have post-2022 it’s building links with neighbouring countries including Slovakia, Lithuania, the Czech Republic and Ukraine.

The Nord Stream 2 pipeline project has received a permit for construction and operation in German territorial waters and the landfall area around eastern Germany’s Lubmin, the project’s operator said. Nord Stream 2 said it has fulfilled all requirements and expects permits to be issued by other countries in time for construction to begin as scheduled in 2018. Nord Stream 2 would double the existing Nord Stream pipeline’s current annual capacity of 55 billion cubic meters. Nord Stream runs on the bed of the Baltic Sea from Russia to Germany.

Mozambique’s council of ministers approved the development plan for Anadarko Petroleum Corp’s LNG project in the north of the nation, an investment estimated at about $20 billion. Anadarko and its partners have agreed the price and volumes for 5.1 million metric tons a year of gas production, out of the 8.5 million tons required to reach financial close, the company said. During the last quarter of 2017, it signed an agreement with Tohoku Electric Power Co. of Japan to sell it gas. Anadarko said it’s already started resettling communities from the land where it plans to build its LNG plant. Exxon Mobil Corp and Eni SpA are developing another gas project near Anadarko’s. The development of Mozambique’s gas deposits could make the southeastern African nation the world’s fourth-biggest natural gas exporter.

Croatia will pass a special law to speed up the construction of a LNG terminal in the northern Adriatic. Croatia produces more than half of its gas consumption, some 2.5 bcm a year. Once the LNG terminal is built it hopes to be able to supply both its own market as well as central and eastern European countries. The European Union has decided to put the floating LNG terminal on the island of Krk on its list of projects of common interest since it wants to diversify sources of supply and reduce dependence on Russian gas. Brussels will invest € 101.4 million, or 28 percent of the project’s assessed value. Croatia aims to bring a final investment decision this year and plans to make the terminal operational in early 2020. Croatia’s plan is to construct a terminal with an initial capacity of 2.6 bcm of gas a year, which could be gradually expanded to as much as 7.0 bcm a year.

China announced retroactive adjustments in reference prices for importers to use as a base for tax rebates, part of a long-standing policy started in 2011 to give importers some respite on tax payments. Reference prices for LNG will be set at 26.64 yuan ($4.21) for each Joule (GL), retroactive from October 1 of last year, and pipeline gas at 0.94 yuan per cubic metres, according to the finance ministry. Between July and September last year, LNG reference prices were set at 27.49 yuan per GL and pipeline gas at 0.97 yuan per cubic metre.

Tehran is ready to file a case with the International Court of Arbitration over the quality and price of gas it receives from Turkmenistan, the Iranian oil minister said, as a dispute between the two nations over payments escalates. The Central Asian nation stopped gas exports to Iran in January 2017, saying it was owed $1.5 billion to $1.8 billion for gas it had delivered to Iran. Iran, which disputes the claim, has imported Turkmen gas since 1997 to supply its northern region, especially in winter, even though it has large gas fields in the south of the country. Iran was ready to take the dispute over price to the International Court of Arbitration. The National Iranian Gas Company had said in December that Tehran would prefer dialogue to resolve the disputes rather than resorting to international arbitration.

Bangladesh signed an agreement with Indonesia to import LNG as the South Asian country turns to the supercooled fuel to fill a shortfall of domestic natural gas. A letter of intent was signed between two state energy companies, Petrobangla and Pertamina, after a meeting between Prime Minister Sheikh Hasina and Indonesian President Joko Widodo. Bangladesh, a country of more than 160 million people, may import as much as 17.5 mt of LNG a year by 2025, as its domestic gas reserves dwindle and demand grows. Petrobangla is finalising several floating storage and regasification units, the first of which is expected to commence operations in April 2018.

JAPEX said it would book an impairment loss of $608 million on its shale gas project in Canada in the October-December quarter. The loss will hurt its net income in the April-December period by $311 million, but the company is still assessing an impact on its full-year earnings, JAPEX said.

Iraq agreed a deal with US energy company Orion to process natural gas extracted at its giant Nahr Bin Omar oilfield. The memorandum of understanding, signed in Baghdad by representatives of the oil ministry and the US company, will allow Orion Gas Processors to build facilities to capture the gas from the field located in southern Iraq and to transform it into usable fuels. Nahr Bin Omar, operated by Basra Oil Company, is producing more than 40,000 bpd and 25 million cubic feet a day of natural gas. Iraq continues to flare some of the gas extracted alongside crude oil at its fields because it lacks the facilities to process it into fuel for local consumption or exports. Orion will capture and process 100 million to 150 million cubic feet/day of gas. The gas captured will be used to feed power stations and to produce up to 10 million liters of gasoline, equivalent to 32 percent of Iraq’s total imports of the fuel, he said. Gas flaring across Iraq should end by 2021.

Woodside Petroleum expects to reveal plans for expanding its prized Pluto LNG project and connecting it to the North West Shelf LNG complex soon. Talks with the owners of the Scarborough gas resource off Western Australia, led by ExxonMobil Corp, as well as drilling of an exploration well, Ferrand-A, around March, and other tie-ins could help underpin the expansion. Some analysts had speculated that recent drilling disappointment on Woodside’s Swell exploration well could limit any expansion. Woodside said that it has looked at a range of options for expanding Pluto LNG by up to 1.5 mt a year. Pluto, Wheatstone – run by Chevron Corp – and the North West Shelf, Australia’s biggest LNG plant – run by Woodside – are all candidates for processing gas from a number of undeveloped assets off Western Australia, either for expansions or for supplying gas when their existing fields dry up. Woodside is still targeting growth in Myanmar, where it discovered gas last year and expects to drill three wells this year, starting around March or April, even amid a humanitarian crisis involving Rohingya refugees.

NATIONAL: OIL

Confidence Petroleum arm to market composite LPG cylinders

February 19, 2018. Confidence Futuristic Energtech, a subsidiary of Confidence Petroleum, would market composite LPG (liquefied petroleum gas) cylinders in Kolkata from next month, the company said. Confidence Petroleum, a listed entity, is a major supplier of steel gas cylinders to oil PSUs (Public Sector Undertakings) for LPG retailing. Prasenjeet Chatterjee, head (east zone) of Confidence Futuristic, claimed that the composite cylinders, made of a special category of plastics, were blast-proof and light-weight unlike steel cylinders. Its parent company imports LPG from the Middle East for distribution in India from 58-odd bottling plants located in various parts of the country. The company has a bottling plant in Burdwan district in West Bengal, he said. Chatterjee said the composite cylinders would be available in various sizes like two, five, 10 and 20 kilogram (kg), except 14.2 kg, which only the PSUs can distribute. The company has already launched the product under the brand ‘GoGas Elite’ in Bangalore and Chennai, he said.

Source: Business Standard

Rs 5 bn petroleum terminal to come up in Nagpur by 2020

February 19, 2018. The state government signed a MoU (Memorandum of Understanding) with IOT Infrastructure and Energy Services (IOT) to set up a Rs 500 crore petroleum terminal in Borkhedi, around 40 kilometre (km) from the city. The proposed plan envisions a mega inland terminal by 2020 that will stock petroleum products of Indian Oil Corp (IOC) and Hindustan Petroleum Corp Ltd (HPCL). IOT is a joint venture between IOC and Oiltanking GmbH (Germany), one of the world’s leading independent tank terminalling companies. Upon completion, Nagpur can stake claim to be the only second such facility in the country, after Raipur, as it will stock petroleum product for more than one company. The proposed terminal would provide services to the two state oil companies th its throughput capacity of 1.4 million kilolitres. Fuel would be supplied at the terminal through tank wagons by railway and be distributed through tank trucks to the districts of Nagpur, Bhandara, Gondia, Gadchiroli and parts of Wardha. As on date, IOT is operating 15 terminals in India through various business models The MoU was signed at the Magnetic Maharashtra conference at Mumbai, which was held to attract investments in state.

Source: The Economic Times

Private Indian refiners likely to get stake in crude oil reserves

February 19, 2018. The government is planning to take private Indian refiners as partners for the next phase of building strategic crude oil reserves. The project, estimated to cost Rs 100 billion, is likely to be done on a public-private partnership mode. Private refiners Reliance Industries and Essar might join hands with the government to build and run these reserves. Cabinet clearance would be required to take private refiners as partners. Indian Strategic Petroleum Reserves (ISPRL), that runs these underground caverns, has already received interest from some of these companies. India has oil stored in three underground rock caverns at Visakhapatnam (1.33 million tonnes), Mangaluru (1.5 million tonnes) and Padur (2.5 million tonnes). The second phase is to come up at Chandikhol in Odisha and through an extension in Padur. One of the earlier locations was Bikaner in Rajasthan, but this was later shifted to Padur for strategic reasons. For private participation, the government would appoint a consultant soon. A bidding process would follow. At present, India has refining capacity of 247.6 million tonnes, expected to rise to 414.35 million tonnes by 2025. This makes India the third largest petroleum consuming country, with 80 percent of its crude oil requirement being met through import.

Source: Business Standard

IOC to invest Rs 700 bn to expand refining capacity

February 18, 2018. Indian Oil Corp (IOC) will invest Rs 70,000 crore to raise its oil refining capacity by about a quarter by 2030 as it takes the lead to meet rising energy needs of the country. IOC will expand its refining capacity to 116.55 million tonnes per annum (mtpa) by 2030 from the current 80.7 mtpa with an investment of about Rs 70,000 crore. India’s current refining capacity of 247.6 mtpa exceeds consumption but with demand growing at a compounded annual growth rate of 3.5-4 percent, it will need to add more capacity to meet the rising fuel needs. The oil ministry estimates fuel demand to rise to 335 mt by 2030 and has planned to raise the country’s refining capacity to 415 mtpa by 2020 from the current 247.6 mtpa. In 2040, the refining capacity is projected to rise to 439 mtpa. The investment planned by IOC also includes in upgradation of major units at existing refineries to help produce cleaner Euro-VI or BS-VI grade petrol and diesel by April 2020. Besides, IOC plans to raise the capacity of its Panipat refinery in Haryana to 25 mtpa from current 15 mtpa while Koyali refinery in Gujarat would be expanded to 18 mtpa from 13.7 mtpa. The recently-commissioned 15 mtpa Paradip refinery in Odisha will see a capacity addition of 5 mt while 3 mt will be added in IOC’s Barauni refinery in Bihar. A 1.2 mtpa capacity addition is planned for Uttar Pradesh’s Mathura refinery to take its capacity to 9.2 mtpa.

Source: Zee News

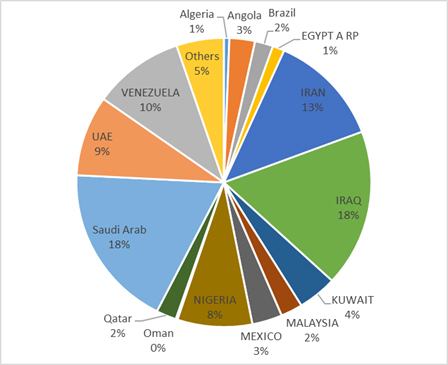

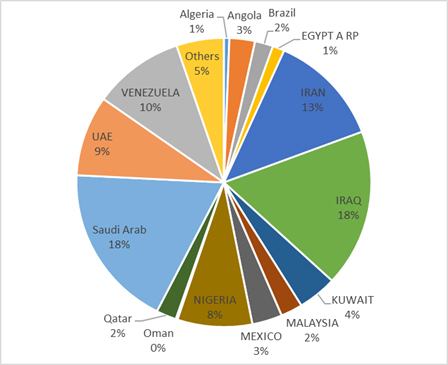

Iran deepens freight discount to boost oil sales to India

February 18, 2018. Iran has offered to raise the freight discount on oil sales to India in return for New Delhi agreeing to boost imports, as the OPEC (Organization of the Petroleum Exporting Countries) member is keen to eat into the market share of other producers including top rivals Saudi Arabia and Iraq. Iran is pushing to retain customers for its oil in Asia, hoping concessions will boost the appeal of its crude compared with other Middle Eastern suppliers, even as the threat looms of potential further US (United States) sanctions on the country. For 2017/18 Tehran had reduced the discount to 62 percent of the formula from 80 percent, but Iran has offered to change this if Indian refineries step up purchases. Iran said it expected Indian orders to grow. Oil Minister Dharmendra Pradhan said India had also sought a stake in Iran’s South Azadegan oil field. India recently offered a development plan worth about $6 billion for Farzad B and sought gas pricing of about $4 per million metric British thermal units (mmBtu) to earn double-digit returns. Since local gas prices in Iran are about $2.1 per mmBtu, India has asked for a stake in a producing oil field in Iran in addition to Farzad B to improve its average return on investment.

Source: Reuters

Abandoned ONGC pipeline cracks, oil spills into river

February 16, 2018. An abandoned pipeline, belonging to the Oil and Natural Gas Corp (ONGC) at Erukattur, reportedly cracked causing oil sludge spill in Pandavaiyaru river in Tiruvarur district. ONGC said that there was no environmental hazard due to the spill and claimed that they notified the same to the pollution control board. The crack was only of pinhole sized and that oil sludge spill was minimal. In Nagapattinam and Tiruvarur districts, ONGC conducts crude oil extraction process. The oil, that is extracted, gets transported to the refinery at Narimanam in Nagapattinam district. Reportedly, of the four pipelines at Erukattur, only three are being used for the oil transportation process. At this point of time, one underground pipeline, which has not been suspended from functioning for the past few months, cracked in the morning. It is said that some amount of oil sludge, which still remained, started to spill. Since the pipeline is along the banks of Pandiyaru, the oil got mixed with water. Farmers and local residents from the nearby area soon thronged the place and checked the water and the level of oil spill.

Source: The Times of India

NATIONAL: GAS

KG block production may be delayed due to regulatory changes: ONGC

February 19, 2018. Oil and Natural Gas Corp (ONGC) said it may miss the June 2019 target for starting production from its KG-D5 block due to regulatory policy changes. ONGC is investing $5.07 billion in KG-DWN-98/2, which sits next to Reliance Industries’ flagging KG-D6 block in Bay of Bengal, with the target of bringing out first gas in June next year and oil in March 2020. ONGC said that after its board in March 2016 approved the field development plan (FDP), it began procuring goods and services such as drilling, completion of wells, creation of production and processing facilities and transportation pipelines. The company did not give details of regulatory policy changes. The delay will be for the second time due to government policies. ONGC had in 2014 announced plans to start gas production from 2018 and oil by 2019 but a final investment decision was made contingent upon government approving a remunerative price for the deepsea block as the prevalent rates were uneconomical. But it was not before March 2016 that the government announced a new pricing formula for difficult areas, giving developers a more than double the domestic rate. Immediately after that ONGC board approved the investment plan for Cluster-II group of discoveries in KG-D5. The 7,294.6 square kilometre (sq km) deepsea KG-D5 block has been broadly categorised into Northern Discovery Area (NDA – 3,800.6 sq km) and Southern Discovery Area (SDA – 3,494 sq km). The NDA has 11 oil and gas discoveries while SDA has the nation’s only ultra-deepsea gas find of UD-1. These finds have been clubbed in three groups – Cluster-1, Cluster-II and Cluster-III. Gas discovery in Cluster-I is to be tied up with finds in neighbouring G-4 block for production but this is not being taken up currently because of a dispute with Reliance Industries Ltd (RIL) over migration of gas from ONGC blocks. From Cluster-II a peak oil output of 77,305 barrels per day (bpd) is envisaged within two years of start of production. Gas output is slated to peak to 16.56 million standard cubic meters per day by end-2021. Cluster-2A mainly comprises of oil finds of A2, P1, M3, M1 and G-2-2 in NDA which can produce 77,305 bpd (3.86 million tonnes per annum) and 3.81 mmscmd of gas. Cluster 2B, which is made up of four gas finds — R1, U3, U1, and A1 in NDA — envisages a peak output of 12.75 mmscmd of gas. Peak output is likely to last 7 years. Cluster-3 is the UD-1 gas discovery in SDA. UD-1 lies in water depth of 2400-3200 meters and its development would be taken up after an appropriate technology is found.

Source: Business Standard

Government to auction seven O&G blocks in Gujarat

February 16, 2018. After receiving overwhelming response to the first round of bidding under Discovered Small Field (DSF) policy, the central government will auction 60 oil and gas (O&G) blocks to private firms in the second round, which also includes 5 onshore and 2 offshore fields in Gujarat. The 60 blocks hold 195 metric million tonnes (mmt) of oil and oil equivalent gas reserves. As far as Gujarat is concerned, 5 onshore fields having 10 mmt reserves are located in Cambay basin. Two offshore blocks (one each in Kutch and Cambay offshore basins) have reserves of around 5 mmt. A total 55 small O&G blocks, including 12 on-land, and three shallow-water fields in Gujarat, were put on offer under Open Acreage Licensing Programme (OALP) and the government received 134 bids. Director General of Hydrocarbons (DGH) and the ministry officials also conducted a workshop in Ahmedabad to apprise prospective investors and bidders about the features of the policy and e-bidding process. The Union Cabinet chaired by the Prime Minister Narendra Modi has recently given its approval for extending the DFS policy to identified 60 discovered small fields/un-monetised discoveries and auction them to private players.

Source: The Economic Times

GAIL to buy CBM gas from Essar in West Bengal at $8 per unit

February 15, 2018. GAIL (India) Ltd has won a contract for buying coal-bed methane (CBM) gas produced from Essar Oil’s Raniganj block in West Bengal. The gas will be supplied based on the three-month daily average price of Brent crude oil, which works out to around $8 per million British thermal unit (mBtU) now. Based on current prices, the 15-year contract will be around Rs 7 billion on an annual basis. This comes a few months after Reliance Industries Ltd (RIL), which began commercial production of CBM from its two blocks in Madhya Pradesh, started buying CBM at around $7.8 mBtu. Essar’s price is more than double the price of domestic natural gas set by the government till March 2018, which is $2.89 per mBtu. Great Eastern Energy and ONGC (Oil and Natural Gas Corp) are the only CBM producers other than RIL and Essar. GAIL has outbid other contenders like Matix Fertilisers, Graphite India and Positron Energy to buy CBM gas from Essar Oil and Gas Exploration and Production. In March last year, the government had allowed marketing and pricing freedom to CBM producers. At present, CBM is being sold at prices ranging from $3.4-15.5 per unit in the country. Many CBM players were not producing due to lack of clarity over pricing till then. Essar has invested about Rs 40 billion so far in the Raniganj East CBM block towards drilling wells, setting up supply infrastructure and laying customer pipelines to Durgapur and nearby industrial areas. The block has 348 completed CBM wells, alongside gas and water handling capacity. At present, Essar owns CBM rights for five blocks — including Raniganj in West Bengal, Talcher and Ib Valley in Odisha, Sohagpur in Madhya Pradesh, and Rajmahal in Jharkhand. The government had formulated CBM policy in 1997. Under that, 33 exploration blocks were awarded. Out of these, 14 are operational, 15 are under relinquishment and five have been relinquished. Out of 14 operational blocks, five are under production or incidental production.

Source: Business Standard

NATIONAL: COAL

Cabinet ends CIL monopoly, allows commercial mining by private firms

February 20, 2018. Private companies would soon be able to mine and sell coal in India, alongside Coal India Ltd (CIL). Four years after enabling commercial mining and sale of coal through the Coal Ordinance (Special Provisions), 2014, the Cabinet approved a bidding process for commercial mining. Coal Secretary Susheel Kumar said the auction would be on a transparent online platform. Kumar said the Centre would not get any share from commercial mining. The government would conclude the auction in 2018-19, so that production can start in two to three years. He said the mines and auction platform had not been identified. In 2015, the government had allowed allotment of coal mines to states for mining and commercial sale to medium, small and cottage industries. Kumar said commercial mining would have no bearing on CIL’s production targets. CIL aims to touch one billion tonnes of production in 2019-20. CIL has been the dominant commercial miner in India for 41 years and has a market share of 80 percent. Another permitted player is Singareni Collieries, a venture of CIL and the Telangana (earlier Andhra) government. The rest of the requirement is met through import and production from captive mines.

Source: Business Standard

Tuticorin port sets new record in coal handling

February 20, 2018. The V O Chidambaranar (VOC) Port in Tuticorin has created a new record by handling 45,396 metric tonnes of coal in 24 hours at IX berth from the vessel MV Sea Hope. Thus, it has surpassed the previous record of 41,376 metric tonnes of coal in 24 hours at IX berth from the vessel MV Shi Dai-11 on November 13, 2014. Chairman of port trust, I Jeyakumar said the port is continuously striving to achieve improvement in performance and productivity in order to attract more volume of traffic through the Port. He thanked all the stakeholders, officers and the employees of the port who have contributed to achieve this record. He also requested all the concerned to continue to improve the performance in future also. Berth IX is one of the bulk handling berths of the port equipped with conveyor belts enabling to move the coal to coal storage in port premises.

Source: The Times of India

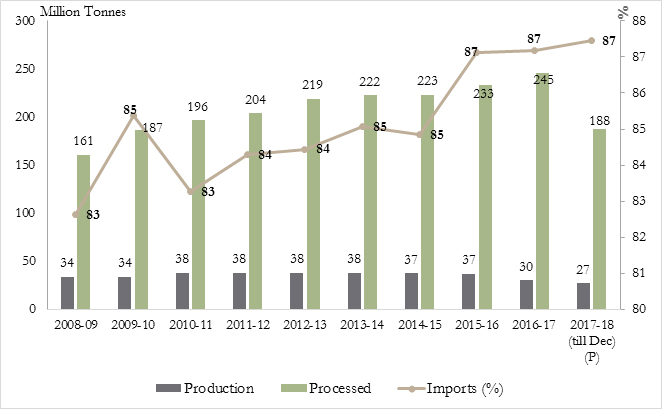

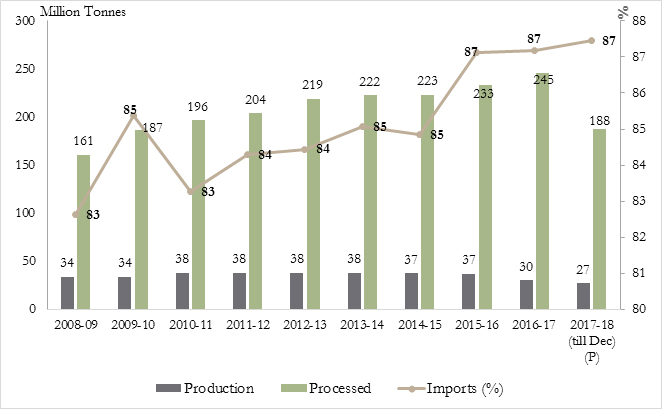

India’s coal imports rose 12 percent to 18 mt in January

February 18, 2018. The country’s coal import increased by 12.4 percent to 18.49 million tonnes (mt) in January, against 16.44 mt in the same month of the previous fiscal, according to m-junction, a leading name in the e-auction space. On a month-on-month basis, however, there was a flat growth in non-coking coal, it said. Overall, coal and coke imports in April-January of 2017-18 stood at 179.5 mt, marginally lower than 180.8 mt recorded for the same period last year. World Coal Association CEO (Chief Executive Officer) Benjamin Sporton said that in the coming fiscal India will see rise in coal imports.

Source: The Economic Times

CIL reduces output cost 5 percent despite Rs 10 bn wage hike in Q3

February 16, 2018. Coal India Ltd (CIL)’s production cost has come down by nearly 5% as the world’s largest miner gets ready for private competition by modernizing operations and transforming HR (human resources) practices to improve productivity. Data shows production cost declining to Rs 1,140 per tonne in the third quarter (Q3) of the current fiscal from Rs 1,193 per tonne in the previous corresponding period, marking a reduction of Rs 53 per tonne. The reduction comes in spite of wage bill rising by Rs 1,200 crore in the quarter due to higher additional payouts due to wage revisions under the National Coal Wages Agreement (NCWA). Cost reduction would have been higher but for a Rs 68 crore provision for executive salary revision. CIL is also trying to plug a major annual outgo of Rs 2,500 crore on account of over-time and Sunday duty through staggered weekly off system to optimise surplus staff. Under this system, employees get weekly off on different days. Salaries and wages account for 35% of CIL’s overall costs against 10-12% for private miners, who exited the NCWA in 2008. CIL is loading 300-plus rakes daily. Loading for power plants has increased to 226 rakes a day in February. Loading in the current month has jumped nearly 14% to 227 rakes a day against 200 rakes in February last year. The record loading, made possible on the back of steadily rising coal production, has taken Coal India’s total supplies to power plants to 372 million tonnes (mt) in the last 10 months of the fiscal, marking a 6.8% increase over the previous corresponding period.

Source: The Economic Times

Will resume coal mining if voted to power in Meghalaya: BJP

February 15, 2018. Wooing coal miners to vote for the Bharatiya Janata Party (BJP) in the upcoming Meghalaya Assembly polls, the BJP promised to resume mining in the state, if voted to power. In its Vision Document released by Defence Minister Nirmala Sitharaman, the BJP promised to put back on track the coal mining issue in 180 days of forming the government. Coal mining in Meghalaya is ostensibly part of the “customary tribal rights” that has been temporarily banned by the National Green Tribunal in the state from April 17, 2014, after tribal Dimasa groups filed an application before it alleging that the water of the Kopili river was turning acidic due to coal mining in Jaintia Hills.

Source: Business Standard

India’s Adani looking for foreign coal mines despite challenges in Australia

February 14, 2018. Indian resources conglomerate Adani Enterprises Ltd is looking to buy mines in countries such as Indonesia, the company said, despite its struggles to develop a controversial coal project in Australia. The company already owns a coal mine in Indonesia, but has been unable to secure financing for the long-delayed Carmichael mine in Australia amid numerous court challenges from environmental groups concerned about climate change and potential damage to the Great Barrier Reef. Rajendra Singh, chief operating officer of Adani’s coal trading business, said there was “opportunity in the US.” as well given that India imports coal from there. Singh, however, did not say if any deal was in the works. Adani is also India’s biggest trader of coal, with volumes of 81 million tonnes in the fiscal year that ended on March 31, 2017, sourced mainly from Indonesia and Africa. India, the world’s second biggest coal importer after China, brought in a total of 190 million tonnes last fiscal year. Singh said the company’s market share in coal trading in the country was going to increase after it extended to retail markets, especially brick kilns and sponge irons. The company has also recently started trading coal in Sri Lanka and Bangladesh, in addition to its operations in Thailand, Taiwan, Vietnam and China, he said.

Source: Reuters

NATIONAL: POWER

Sterlite Power sells 3 transmission assets to IndiGrid for Rs 14.1 bn

February 20, 2018. India Grid Trust (IndiGrid), the country’s first infrastructure investment trust (InvIT), acquired three transmission assets from its sponsor Sterlite Power Grid Ventures for a consideration of Rs 1,410 crore. The acquisitions include RAPP Transmission Company, Purulia, Kharagpur Transmission Company, and Maheshwaram Transmission, all from Sterlite Power Grid Ventures, a move which has helped increase its assets under management to Rs 5,300 crore. IndiGrid has also agreed to invest Rs 230 crore into third-party assets owned by Techno Electric & Engineering in Patran Transmission Company. The acquired assets-spread across Rajasthan and MP, Telangana, Bengal and Jharkhand-consist of five transmission lines totalling 1,425 circuit kilometres.

Source: The Economic Times

PVVNL lodges 3,271 FIRs against power thieves in Ghaziabad

February 19, 2018. The Paschimanchal Vidyut Vitaran Nigam Ltd (PVVNL) has lodged as many as 3,271 FIRs against power thieves in Ghaziabad between April 2017 and January 2018, even as it fined 449 consumers and recovered Rs 60 lakh in compounding fees during the same period. However, an assessment of the loss caused by the power thieves to the department during the past 10 months has been peged at Rs 8 crore, and out of that officials have been able to recover only Rs 2.4 crore so far. Over 56,000 electricity connection points were checked during the past 10 months and discrepancies were found in 3601 cases. The maximum number of 1059 cases have been registered in Loni area, followed by Meerut Road (561) and Vijay Nagar (487). To ensure that offenders do not slip off their hands, the department is also conducting raids in the early hours when people are fast asleep at home, so that they can be caught red-handed. The raids are being conducted just before the sunrise when people are sleeping at home. Struggling with the bane of power thefts for decades, the Yogi Adityanath’s government had last year announced that people caught stealing electricity could face a jail term of up to five years, and which would be doubled for the second offence. However, in Ghaziabad no person has been arrested for this offence so far.

Source: The Times of India

Delhi witnessed lowest ever power cuts this fiscal

February 18, 2018. The national capital witnessed its lowest ever power cuts in the current financial year that also saw the highest ever peak power demand, according to a Delhi government data. The government said reduction in power cut points towards improvement in processes and systems of electricity supply and transmission. Delhi’s peak power demand shot to 6526 MW on June 6, 2017, the highest ever. BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL) together supply electricity to nearly two-third area of Delhi. Tata Power Delhi Distribution Ltd supplies electricity to north and northwest Delhi. The distribution companies (discoms) attributed the decrease in power cuts to coordination among various stakeholders, strengthened network capacity, use of latest technology and adequate power purchase agreements to meet the city’s electricity needs.

Source: The Indian Express

Around 2.3 lakh Vidarbha farmers never paid power bills

February 16, 2018. According to MSEDCL (Maharashtra State Electricity Distribution Company Ltd) data, around 2.28 lakh farmers in Vidarbha have never paid electricity bills. They collectively owe Rs 983 crore to the distribution company (discom). Farmers collectively owe around Rs 20,000 crore to the MSEDCL and the amount is increasing every month. MSEDCL has launched an amnesty scheme for them. If the defaulting farmer clears his principal amount then the discom would waive off the interest component, which is sometimes more than the principal. Despite this, the response to this scheme has been very poor. In Vidarbha, only 17% of farmers have opted to clear their dues and so far they have paid only 1.5% of the default amount. Most of the defaulters in Vidarbha are from the western part. About 53,500 farmers from Buldhana district have never paid electricity bills and they owe Rs 254 crore to the discom. Around 46,000 farmers of Amravati district owe Rs 251 crore and over 40,000 Yavatmal district farmers owe Rs 228 crore. Washim district is next with 21,000 farmers and Rs 101 crore dues. In Nagpur district, nearly 12,687 farmers owe Rs 31.35 crore in rural areas of the district, while 1,297 farmers owe Rs 4.55 crore in Nagpur city. The default by farmers leads to constant and steep hikes in power tariff. Recently, MSEDCL had filed a petition in Maharashtra Electricity Regulatory Commission (MERC) seeking to increase the industrial power tariff by 25% to 30%. Industrial power tariff of the state is already among the highest in the country. It will become the highest if MERC okays the proposal and state’s industries will find it difficult to compete with units in other states.

Source: The Economic Times

PGCIL emerges as lowest bidder for Rs 10 bn transmission project

February 16, 2018. Power Grid Corp of India Ltd (PGCIL) has emerged as the lowest bidder for a project worth Rs 1,000 crore to set up Vindhyachal-Varanasi 765 kilovolt (kV) transmission line. PGCIL has emerged as the successful bidder to establish Vindhyachal Varanasi 765 kV transmission line as part of New WR-NR 765 kV Inter-Regional Corridor.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Telangana plans to store solar power in batteries

February 20, 2018. Beating all Indian states, Telangana has topped the country by achieving 3,250 MW solar power capacity. Telangana is followed by Rajasthan with 2,250 MW, Andhra Pradesh with 2,045 MW and Gujarat with 1,715 MW solar power. Gujarat has decided to call for auctions for another 500 MW of solar power. Telangana is now planning to develop solar power storage with the help of battery assisted system. Since, there is a mismatch between peak demand and electricity generation period for solar power, the state needs new technologies to store solar energy and utilise it at the time of increased demand. Solar panels cannot produce energy at night or during cloudy periods but rechargeable batteries can solve this problem.

Source: The Times of India

Cabinet to vet Rs 480 bn KUSUM scheme for solar power by March

February 20, 2018. The Rs 48,000 crore KUSUM (Kisan Urja Suraksha Evam Utthaan Mahaabhiyan) scheme to promote the use of solar power among farmers would be placed before the Cabinet by next month, Power and Renewable Energy Minister R K Singh said. KUSUM aims to incentivise farmers to run solar farm water pumps and use barren land for generating solar power to have extra income. The total cost of the capacities under this scheme would be Rs 1.4 lakh crore. The Centre will provide Rs 48,000 crore financial assistance under the scheme. KUSUM will also improve the present scheme for rooftop solar systems. The government is enlarging the scope of the existing scheme and its mechanism, he said. The government is thinking of beginning KUSUM with 7.5 lakh solar pumps. As much as 30 percent of the cost of solar pumps was provided by the government in the earlier scheme. The new scheme would be more broad-based like incentives for distribution companies to buy power from farmers and financial assistance of 60 percent to buy solar pumps which would be equally shared by the Centre and state. The Rs 48,000 crore incentives under KUSUM will aid total solar power generation capacity of 28,250 MW entailing an investment of Rs 1.4 lakh crore over the next 10 years, Singh had said.

Source: Business Standard

Renew Power inks pact with Maharashtra government for Rs 140 bn investment

February 19, 2018. Clean energy firm ReNew Power said it has signed a pact with the Maharashtra government to facilitate a proposed investment of Rs 14,000 crore in the state for commissioning renewable energy plants. The proposed investment has the potential to create direct employment for 7,000 people. As per the MoU (Memorandum of Understanding), in the next five years, ReNew Power Ventures proposes will invest in three broad categories solar power (Rs 6,000 crore), wind power (Rs 6,000 crore) and waste to energy (Rs 2,000 crore).

Source: Business Standard

IGL, M&M join hands to stop stubble burning

February 19, 2018. Indraprastha Gas Ltd (IGL), the sole supplier of clean-burning natural gas as automotive and kitchen fuel in the NCR (National Capital Region), has stepped in to help stop crop stubble burning, identified as a major cause of air pollution in the city and its suburbs. The company joined hands with Mahindra Waste to Energy Solutions Ltd (MWESL), a subsidiary of automaker Mahindra & Mahindra (M&M), for designing and developing plants for producing gas from crop stubble and organic waste, providing cultivators a remunerative alternative to burning farm waste. IGL is the second company to join efforts at stopping stubble burning. NTPC Ltd started the process of procuring farm stubble pellets to fuel its Dadri power plant with the aim of giving farmers a profitable alternative to burning crop residue and opening up a new market for rural entrepreneurship. The MoU (Memorandum of Understanding) signed by IGL and MWESL envisages setting up such plants in Delhi and other cities such as Noida, Greater Noida, Ghaziabad and Rewari, Gurugram and Karnal where IGL supplies CNG (compressed natural gas) and PNG (piped natural gas). The plants in Gurugram and Karnal are set to start operations shortly. The project aims at converting paddy/wheat straw into gas which can be used to run generators for lighting up villages or boost IGL’s supplies for meeting its expanding consumer base. The leftovers will be used as organic fertiliser to improve soil quality.

Source: The Times of India

UP cabinet clears biofuel policy to address crop burning

February 18, 2018. The state cabinet cleared the UP (Uttar Pradesh) Biofuel Policy which is expected to address the crop residue burning issue to a large extent. An MoU (Memorandum of Understanding) worth Rs 8,000 crore has already been signed under this policy, the details of which will be revealed during the upcoming UP Investors’ Summit. Industrial Development Minister Satish Mahana said that the policy would look at converting crop residue, bagasse and agricultural waste into electricity and biogas. Crop burning has also become a massive problem in the state which is resulting in a spike in air pollution taking it to hazardous levels. Firms could explore the possibility of extracting crop stubble from the fields, an expensive and laborious process because of which farmers usually burn it, and then use it to produce power and biogas.

Source: The Economic Times

SunSource energy plans to build 200 MW solar park in UP

February 17, 2018. SunSource Energy, a solar EPC player in India, is boosting its portfolio with plans to develop a 200 MW solar park in Uttar Pradesh (UP) entailing an investment of Rs 900 crore. The company has also received funding from State Bank of India (SBI)-led Neev Fund, which a top executive said will help it reach its target of 1.5 GW project capacity by 2025. The Neev Fund is a joint initiative of the SBI and UK (United Kingdom)’s Department for International Development (DFID) to develop projects in states with low capital investment. SunSource has 200 MW of solar projects in India and overseas. The company has a short-term target of reaching 300 MW of project capacity by 2020.

Source: The Economic Times

BHEL commissions 18 MW HEP in Punjab

February 16, 2018. Bharat Heavy Electricals Ltd (BHEL) said it has commissioned 18 MW Mukerian hydro-electric project (HEP) in Punjab. Located on the Mukerian canal in Hoshiarpur district of Punjab, the 18 MW Mukerian project is a surface powerhouse of Punjab State Power Corp Ltd (PSPCL). The first unit of the Mukerian HEP was commissioned in May last year.

Source: Business Standard

Green cars in spotlight as India eyes electric vehicles revolution

February 16, 2018. Electric cars bask in the limelight at India’s flagship auto show, where an ambitious plan to phase out polluting clunkers has manufacturers racing to lure millions of new drivers to their green vehicles. Prime Minister Narendra Modi’s government wants all new cars on India’s roads to be electric by 2030 to combat smog that routinely eclipses dangerous levels in the nation of 1.25 billion. Some auto giants at the motor show in New Delhi have expressed reservations about the aggressive roll out when so little of India is equipped to charge electric cars and most drivers cannot afford the hefty price tags. But few are willing to risk a golden opportunity in the world’s fifth-largest car market, where owning a four-wheeler is a status symbol. The Indian auto firm is a “pioneer in e-mobility”, investing $75 million in its electric fleet since 2010 with another $90 million earmarked as production ramps up in the next three years, Mahindra Electric CEO (Chief Executive Officer) Mahesh Babu said. Others are racing to produce competing models at lower prices, with Maruti Suzuki — India’s biggest maker of passenger vehicles — promising to launch an electric car in 2020. Banking on big sales, Maruti has poured $180 million into a new plant to construct lithium-ion batteries in partnership with Japan’s Denso and Toshiba. Tata Motors, part of the sprawling tea-to-steel conglomerate, in September won a contract to supply 10,000 electric cars for the government. Tata Motors is also experimenting with electric buses and is looking to revamp its popular small Nano model as a battery-powered vehicle.

Source: The Economic Times

ArcelorMIttal mulling setting up 600 MW solar farm in Karnataka

February 16, 2018. ArcelorMIttal, which submitted a bid to acquire Essar Steel, has said it exploring the possibility of establishing a 600 MW solar farm by utilizing the land in Karnataka originally allotted to it for a proposed $6.5 billion project to set up a 6 million tonne greenfield steel plant. Arcelor said this would contribute to the mitigation of Karnataka’s power crisis and to the participation in the National Solar Energy mission of the Government of India.

Source: The Economic Times

Topaz Solar to set up solar module plant in Odisha

February 15, 2018. The city-based Topaz Solar will set up a 500 MW solar module plant in Odisha for an investment of Rs 240 crore. Of the Rs 240 crore investment, the promoters and investors will chip in with Rs 80 crore while the remaining Rs 160 crore will be raised through debt, Company Chairman Ganesh Natarajan said. Topaz has entered into strategicc partnerships with French, German and Polish firms for setting up the plant that will come up near Cuttack. In the second phase, the company will set up a 700 MW module which will take the total solar module-cum-cell production capacity of the Odisha plant to 1,200 MW in the final stage, he said.

Source: Business Standard

Chhattisgarh village gets electricity for first time

February 15, 2018. The residents of Chhattisgarh’s Bhalupani village in Balrampur finally got electricity connection for the first time after the district administration installed solar panels for every family. Being a Naxal prone area, the initiatives taken by the government failed to reach the village, as a result, the residents had to spend their lives in darkness for a very long time. The village with a population of about 150 people, the locals saw the lights in the house for the first time. The students, who found it difficult to study at night, seemed elated with the electrification of their village.

Source: Business Standard

Japan ready to help India in addressing air pollution: Vardhan

February 15, 2018. Environment Minister Harsh Vardhan met Japanese Ambassador to India Kenji Hiramatsu during which the envoy expressed his country’s readiness to help India in addressing the issue of air pollution. During the meeting, Vardhan also shared information about future events including the Regional 3R forum of Asia and Pacific to be held in Indore in April and science and technology in society forum ‘India-Japan Workshop’ in Delhi on February 28. He said, Japan was facing same problem in 60s & 70s. Vardhan also met Fiji’s Attorney-General and Minister Aiyaz Sayed-Khaiyum and discussed various issues related to climate change issues while acknowledging that the issue was a global threat and needed urgent action.

Source: Business Standard

India’s transition to renewable would need strong policy support: ETC

February 15, 2018. Energy Transition Committee (ETC), in a report last year suggested India not to make any new investment in the coal sector. ETC is now willing to work with policymakers and redesign policies, which traditionally have been ‘coal-centric’. ETC is launching two major initiatives this year, one is de-carbonising core infrastructure sectors globally and other is to take the vision of transition to renewable in India. ETC is a diverse international group that has members across the energy landscape. It was convened to help identify pathways for change in energy systems to ensure both better growth and a better climate. This is inspired by the work of the New Climate Economy. ETC has collaborated with TERI in India to publish the report, which focuses on de-carbonisation of core manufacturing sectors such as steel, thermal power, manufacturing, automobiles etc and also suggest a transition in the Indian electricity space. In India, ETC is expecting to face the dilemma of energy access and renewable based energy security, along with cost efficiency. ETC and TERI in their report bat for renewable as the cheaper and more efficient option than coal. In the Paris Climate Change commitment, India has set a target of 40 percent of its energy demand would come from non-fossil fuel sources. The Indian government, however, has maintained that coal would remain the primary source and base power for the country. The ETC report observed that India has a 10-year window of opportunity to overcome the challenges to large-scale and economically preferential adoption of renewable energy.

Source: Business Standard

Wind tariffs end descend, edge up to Rs 2.44 per unit

February 14, 2018. Fall in wind power tariffs seem to be have bottomed out as the price inched up to Rs 2.44 per unit in the latest auction for 2000 MW capacities. The auction was conducted by Solar Energy Corp of India (SECI). As many as six firms, including Torrent Power, Inox Wind Infrastructure Services, Green Infra Wind Energy, and ReNew Power emerged as the lowest bidders for 2000 MW wind capacities. They said these four firms quoted a tariff of Rs 2.44 per unit while Adani Green Energy and Alfanar Company quoted Rs 2.45 per unit. Earlier in December, the wind power tariff had dropped to an all time low of Rs 2.43 per unit in an auction conducted by Gujarat Urja Vikas Nigam Ltd (GUVNL). The tariff last year started its descend to touch a low of Rs 3.46 in the first round of auction for 1GW capacity by the SECI. The price fell further to Rs 2.64 in the second round of auction for 1 GW by the SECI in October 2017. The firming up of wind tariff will boost clean energy in view of India’s target of having 60 GW wind energy capacities by 2022. At present, India has an installed wind capacity of 32.7 GW. The government has planned to auction 10 GW each in 2018- 19 and 2019-20.

Source: Business Standard

Tamil Nadu among nine global market leaders in renewables

February 14, 2018. A new research by US (United States)-based Institute for Energy Economics and Financial Analysis (IEEFA) showed how nine major global power markets, including India’s Tamil Nadu, have achieved an outsize share of wind and solar generation while assuring the security of supply. They are providing compelling examples of the fast-moving evolution of electricity generation. The report, ‘Power-Industry Transition, Here and Now’, includes case studies of markets — ranked by relative share of reliance on variable renewables — that include Denmark, South Australia, Uruguay, Germany, Ireland, Spain, Texas, California and the Indian state of Tamil Nadu. Wind and solar accounted for 14.3 percent of Tamil Nadu’s total electricity generation in 2016-17. The state leads India in variable renewables market share. It also leads India in installed renewable energy capacity. Of the total 30 GW of installed capacity across the state as of March 2017, variable wind and solar power accounted for 9.6 GW or 32 percent of the total. Firm hydroelectricity added another 2.2 GW or seven percent, nuclear eight percent and biomass and run of river three percent. As such, zero emissions capacity represents a leading 50 percent of Tamil Nadu’s total. With much of Tamil Nadu’s renewable energy coming from end-of-life wind farms installed 15-25 years ago, average utilisation rates are a low 18 percent, making the contribution of variable renewables to total generation even more impressive, the report said.

Source: The New Indian Express

INTERNATIONAL: OIL

Iraq invites bids for construction of Mosul oil refinery

February 20, 2018. Iraq has invited foreign companies and investors to bid for the construction and operation of a new 100,000 barrel per day (bpd) refinery near Mosul in the northern province of Nineveh, the oil ministry said. Bidding documents provide for two investment models – build-own-operate and build-operate-transfer, the ministry said. Documents for the bidding process will be available until April 1 and the bidding will close on May 15, the ministry said.

Source: Reuters

Energen’s oil production forecast misses estimates amid proxy fight

February 20, 2018. Oil and gas company Energen Corp, under pressure from Keith Meister-led Corvex Management to sell itself, reported a better-than-expected quarterly profit, but its expectations for oil production this year fell short of analysts’ estimates. Activism in the US (United States) oil and gas sector has increased as investors get impatient and look for ways to increase the value of energy companies, hurt by the oil crash of 2014. Energen has been shedding non-core assets for five years to concentrate on the Permian basin, which has the highest oil production in the US. The company set a three-year timeline to better production. The company said it expects to spend in the range of $1.6 billion to $1.8 billion for drilling and development in 2020 as part of that plan, up from $1.1 billion to $1.3 billion expected in 2018. Energen said it expects to produce 555,000-585,000 barrels of oil per day (bbl/d) in 2018.

Source: Reuters

OPEC, non-OPEC allies to study long-term oil cooperation in June: UAE

February 20, 2018. OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC oil producers, including Russia, will discuss extending their cooperation for many more years when they meet in June as they seek to avoid major market shocks, the United Arab Emirates (UAE) energy minister Suhail al-Mazroui said. Mazroui, who holds OPEC’s presidency this year, said leaders of the UAE, OPEC’s biggest producer Saudi Arabia and non-OPEC member Russia support extending energy cooperation beyond 2018. OPEC has agreed to extend oil supply cuts with Russia and other producers until the end of 2018. Mazroui said that he hoped a plan could be put to Ministers at OPEC’s next meeting in June in Vienna, which non-OPEC producers participating in the supply-reduction agreement are expected to attend. He said it was too early to say how cooperation will work exactly and whether oil production management would be maintained. Mazroui said the global oil industry needs around $10 trillion of investment by 2040 to meet future demand growth.

Source: Reuters

Budget delays may lower oil production: Libya’s NOC

February 20, 2018. Libya’s National Oil Corporation (NOC) is suffering ongoing delays in receiving budget money from the government and this could reduce production, the head of the state company Mustafa Sanalla said. The NOC, which has raised Libya’s oil production to more than 1 million barrels per day (bpd) from lows of around 200,000 bpd in 2016, receives its budget through the central bank and the internationally recognised government in Tripoli.

Source: Reuters

US refiners turn to export markets as gasoline growth slows at home

February 20, 2018. US (United States) gasoline consumption has leveled off as the stimulus provided by low and falling oil prices between 2014 and 2016 has faded, so refiners are increasingly turning to diesel and customers in emerging markets. US gasoline consumption is forecast to rise by just 40,000 barrels per day (bpd) in 2018, after remaining essentially unchanged last year, according to the US Energy Information Administration. The nationwide weighted-average retail price of gasoline was $2.67 per gallon in January, an increase of more than 60 cents per gallon compared with two years previously. If oil prices continue to climb through the remainder of 2018 and into 2019 as the price cycle matures, US gasoline consumption growth will likely slow even further.

Source: Reuters

January compliance with oil reduction pact 133 percent: OPEC Secretary General

February 19, 2018. OPEC (Organization of the Petroleum Exporting Countries) Secretary General Mohammad Barkindo said the organization registered 133 percent compliance with agreed output reduction targets in January across all participating OPEC and non-OPEC countries. Barkindo said compliance last year stood at 107 percent and that OPEC and non-OPEC producers would hold a technical meeting in June. Commercial oil stocks for the OECD (Organization for Economic Cooperation and Development) rose in January 2018 and were about 74 million barrels over the latest five-year average, Barkindo said. Global oil demand for 2018 is estimated to grow 1.6 million barrels per day due to an “encouraging environment”, Barkindo said.

Source: Reuters

US sets largest offshore oil, gas lease auction for March

February 17, 2018. The Trump administration said it would offer the largest oil and gas offshore auction in US (United States) history on March 21 for areas in federal waters off the Gulf Coast, less than a year after a similar sale yielded little corporate interest. The Interior Department said it would offer 77.3 million acres (31.3 mn hectares) offshore Texas, Louisiana, Mississippi, Alabama and Florida for oil and gas development, an auction that includes all available unleased areas in the Gulf of Mexico. The blocks are from 3 to 231 miles (5 to 372 kilometre) offshore and in waters 9 to 11,115 feet (3 to 3,390 meters) deep. The department announced the auction in October, without an exact date. The sale is in support of President Donald Trump’s so-called America First Offshore Energy Strategy, which aims to reduce energy imports and boost jobs in the industry. But offshore drilling is expensive in a time of relatively low oil prices held in check partially by plentiful supplies of onshore petroleum, which is cheaper to produce.

Source: Reuters

INTERNATIONAL: GAS

Papua New Guinea LNG partners set plans for big expansion

February 20, 2018. Global giants ExxonMobil Corp and France’s Total SA have reached broad agreement on plans to double gas exports from Papua New Guinea, their partner Oil Search Ltd said. The plan to expand the ExxonMobil-operated Papua New Guinea liquefied natural gas (LNG) plant to around 16 million tonnes per annum (mtpa) would see it rival Australia’s biggest LNG projects, at a cost of around $13 billion, according to analysts. Oil Search said the companies plan to add three new LNG units, or trains, with two underpinned by gas from the Elk-Antelope fields, run by Total, and one underpinned by existing fields and the new P‘nyang field, run by Exxon. Australia’s other major LNG plant is the Woodside-operated North West Shelf, which has annual production of around 16 mtpa. The partners in Papua New Guinea are racing to start producing from the new trains by around 2023 or 2024, when the LNG market is expected to need new supply due to rapidly growing demand in Asia and a lack of other new projects.

Source: Reuters

Argentina eyes Bolivia gas contract changes as Vaca Muerta output grows

February 20, 2018. Argentina wants to change the terms of a key gas import contract with neighbouring Bolivia, which would allow it to reduce or even eliminate costly liquefied natural gas (LNG) imports while boosting its own production, Daniel Redondo, secretary of energy planning in Argentina’s energy and mining ministry, said. Redondo said the government wants to modify the take-or-pay contract with its northern neighbour, which expires in 2026, to permit seasonal shifts that could drastically reduce costly LNG imports in the Southern Hemisphere’s winter. Argentina, once a net energy exporter, currently imports around 20 percent of its natural gas needs, Redondo said.

Source: Reuters

Egyptian firm to buy $15 bn of Israeli natural gas