OIL PRICE HEADWINDS HIT INDIA

Oil News Commentary: January – February 2018

India

As the crude oil prices rise, the government may ask upstream firms like ONGC to bear a part of the kerosene and LPG subsidies, India Ratings and Research said. Producers ONGC and OIL as well as gas utility GAIL (India) Ltd were in past asked to bear between one-third to half of the under-recovery fuel retailers incurred on selling LPG and kerosene below market rate. This subsidy sharing scheme ended last fiscal. India Ratings said given the sharp increase in international crude price, oil marketing companies may be required to bear a part of the under-recoveries. This would be on the lines of past when the government capped the subsidy burden it was willing to share per kilogram and per litre on LPG and kerosene, respectively. Any under-recovery over and above the level up to which the government can bear is to be borne by upstream and oil marketing companies, it said.

The Indian crude oil basket comprises 73 percent sour-grade Dubai and Oman crudes, and the balance in sweet-grade Brent, closed December 2017 at $62.29/bbl according to the oil ministry. The government remained non-committal on cutting excise duty on petrol and diesel to reduce retail prices. Petrol and diesel prices in India are to a “large extent” aligned to international rates, IOC said in response to the charges of government meddling in fixing of fuel prices. The prices are revised daily based on 15-day rolling average rate of their international benchmark. The prices at petrol pumps of state-owned fuel retailers like IOC were cut by 1-3 paisa every day in the first fortnight of December. They started moving up immediately after polling for assembly elections in Gujarat concluded, leading to speculation that government may have asked oil companies to hold on to the prices. State-owned oil companies in June last year dumped the 15-year old practice of revising rates on 1st and 16th of every month and instead adopted a dynamic daily price revision to instantly reflect changes in cost. Crude oil, natural gas, diesel, petrol and ATF have not been included in the ambit of GST as of now. The CII said till such time that the five are included in GST, C Form should be continued to avoid high tax incidence on these products. As per the earlier provisions of CST Act, a purchaser can make the interstate purchase of the non-GST goods by availing concessional central sales tax rate of 2 percent against Form-C. Hitherto, fertiliser manufacturers, power producers, automobile manufacturers and other industries were buying natural gas and other petroleum products by paying CST of 2 per cent against Form-C. The central government vide Taxation Laws Amendment Act 2017, amended the definition of ‘Goods’ under the CST Act to include only crude petroleum, diesel, petrol, ATF, natural gas and alcoholic liquor for human consumption. This meant that fertiliser companies are not eligible for C Form as the gas is used to manufacture urea and not for manufacture of natural gas. Likewise, automobile manufacturers are not eligible for C Form for inter-state purchase of diesel, petrol or natural gas, which they have to mandatorily fill in the tanks of new vehicles. The industry association said post GST, since Form-C is not available for inter-state purchase of goods and so the extra tax burden will be shifted to the consumer. It suggested that petroleum products, natural gas, electricity, alcohol and real estate should be covered under GST. Alternatively, since VAT is non-creditable tax, VAT rate should be reduced to 4 percent or lower which was the effective rate when credit on VAT was available before July 1.

The Chief Economic Advisor called for petroleum products to be brought under the ambit of the GST. He also made a case for one rate under the GST for all goods and services down the line. Petrol and diesel prices rose to a three-year high across metro cities. Petrol prices in the national capital were at ₹ 72.49/litre, the highest in over three years. Petrol prices in Kolkata, Mumbai and Chennai were at ₹ 75.19, ₹ 80.39 and ₹ 75.18/litre respectively — all three-year highs. Similarly, diesel prices have also been hitting record levels.

The October 2017 excise duty cut cost the government ₹ 260 billion in annual revenue and about ₹ 130 billion during the remaining part of the current financial year that ends on March 31, 2018. The government had between November 2014 and January 2016 raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices. Just 4 states and one union territory have cut local sales tax or VAT on petrol and diesel since the October 2017 decision of the Centre to reduce excise duty on the two fuels. As petrol and diesel prices soared to a three-year high, the Centre on October 3, 2017 reduced excise duty on petrol and diesel by ₹ 2 per litre each and asked states governments to match it with a cut in VAT. The states which reduced VAT following the October 3, 2017 cut in excise duty were Maharashtra, Gujarat, Madhya Pradesh and Himachal Pradesh. The Centre has cut excise duty only once in October 2017 but raised excise duty on nine occasions to take away benefits of sliding international oil prices between late 2014 and January 2016. Prices of petrol and diesel were ‘freed’ from administrative control from June 26, 2010 and October 10, 2014, respectively.

India has the highest retail prices of petrol and diesel among South Asian nations as taxes account for about 40-50 percent of the pump prices. Petrol and diesel account for about half of India’s refined fuel consumption. A cut in excise duty on petrol and diesel in the budget, due to be unveiled on February 1, would pose challenges as the government is struggling to tackle a widening fiscal gap amid falling tax revenues due to the implementation of a GST regime from July. In 2016/17, the petroleum sector contributed around ₹ 5.2 trillion ($81 billion), about a third of total revenue receipts, for federal and state finances. India raised excise duty nine times between November 2014 and January 2016 to shore up federal finances as global oil prices fell, but then cut the tax last October by ₹ 2/litre. The ministry has also sought inclusion of petrol, diesel, jet fuel and natural gas in the GST to help companies claim tax credits against the tax paid on the purchase of equipment meant to produce refined fuel. The oil ministry said the addition of refined products in GST will help reduce retail prices even if the government levies a charge on top of its highest GST rate of 28 percent. The ministry has also sought federal support for laying fuel and gas pipelines in the northeast of the country to give the region a boost. Economic development in India has largely been concentrated in the western and southern states that have better infrastructure and more accessible energy supplies.

States are not in favour of including petrol and diesel into GST at the moment, ruling out any immediate levy of the new indirect tax on these petroleum products. While GST was rolled out on July 1, real estate as well as crude oil, jet fuel or ATF, natural gas, diesel and petrol were kept out of its purview. This meant that the products continued to attract duties like central excise and VAT. The five petroleum items have been kept out of GST as they are considered cash cows, giving both the Centre and states bulk of their tax revenues. But keeping them out has created compliance issues including taking input tax credit.

ONGC completed the acquisition of government-owned fuel retailer HPCL through an all cash deal worth ₹ 369.15 billion, the company said. The company had tied up ₹ 350 billion with seven banks including three private and four public sector banks to fund the acquisition. While ONGC has secured loans for ₹ 350 billion through banks, the details of funding the rest of the acquisition amount, ₹ 19.15 billion, are not in public domain. The combined market value of ONGC and HPCL is estimated to be around ₹ 3119.25 billion, or $49 billion, comparable with Russian energy giant Rosneft’s $61 billion. The acquisition of HPCL by ONGC has paved the way for the country’s first vertically-integrated oil major. As per the government, the ONGC-HPCL merger is an innovative vertical economic integration of companies being done with a motive that goes beyond mere financial consideration. The aim behind the move was not just financial consideration and that the merger decision was taken considering the price volatility in the oil and gas industry which created the need for a company which could cushion the shocks of oil prices. The government has set a disinvestment target of ₹ 725 billion for the financial year 2017-2018, of which ₹ 543.37 billion has been raised so far. India Ratings said ONGC’s acquisition of HPCL will be credit neutral for ratings of HPCL. ONGC, which is 68.94 percent owned by the government, will acquire the government’s 51.11 percent stake in HPCL for ₹ 369.15 billion. Despite the change in ownership, HPCL will continue to operate as a separate entity with a strong brand. Its strategic importance to the government is likely to remain intact, given the company’s role as the State’s extended arm for fuel policy implementation. It could use one or more of the three sources for funding, fresh debt, cash and cash equivalents, and monetisation of its stake in entities such as GAIL, IOC and Petronet LNG Ltd. The combined value of its stake in the three entities is about ₹ 344 billion. For HPCL, the acquisition may result in some synergies in crude oil procurement with Mangalore Refinery and Petrochemicals Ltd, which is 71.63 percent owned by ONGC. HPCL, along with HPCL-Mittal Energy Ltd and MRPL, represented 15.3 percent of India’s total crude import volume of 249 mt. Also, HPCL may be able to capitalise on ONGC’s petrochemical expertise while expanding its footprint in the segment. The combined entity would be the third-largest refiner in India, with a refining capacity of 43.1 mt behind IOC’s 80.8 mt and RIL’s 62 mt. India Ratings said HPCL may have to resort to additional borrowings in case it was to acquire ONGC’s stake in MRPL for cash. ONGC’s stake in MRPL is worth ₹ 164 billion. ONGC-HPCL deal is unlikely to alter government subsidies for kerosene and LPG.

The government’s plan to farm out a 60 percent stake in about 15 fields of ONGC and OIL to private players might lead to a dual system of contracts. The two state-owned companies may have to continue to pay royalties and cess. This is a major dilemma before the policymakers as to whether two parties can have separate sets of contracts for the same fields. The Directorate General of Hydrocarbons has reportedly zeroed in on 15 fields, 11 of ONGC and four of OIL, including ONGC’s four major oilfields in Gujarat like Kalok, Gandhar, Santhal, and Ankleshwar. These 15 are estimated to have a cumulative reserve of 791.2 mt of crude oil and 333.46 bcm of gas. The plan to rope in private companies is part of the government’s production enhancement policy. However, the government is yet to come up with a Cabinet note in this regard. More than 40 fields of state-run producers have been identified for production enhancement through the technical services model.

The government virtually ruled out giving statutory powers to upstream oil and gas regulator DGH saying the sector has not fully developed and needs government support. There are two regulatory bodies in the oil and gas sector – the Petroleum and Natural Gas Regulatory Board, which is a regulator for the downstream activities like laying of pipelines and fuel marketing but without powers to review pricing. The DGH is a technical arm of the oil ministry which overseas upstream oil and gas exploration and production activities. Various committees have suggested creation of an independent, statutory regulator for the upstream oil sector. He said the sector has not developed fully and still looks at the government for reforms. In 2013, a committee, headed by former finance secretary Vijay Kelkar, had recommended hiving off the DGH’s financial oversight function and vesting it with the income tax authorities. The DGH currently manages petroleum resources besides monitoring PSCs, and assists the government in auctioning oil and gas exploration fields. In 2011, a panel led by former finance secretary Ashok Chawla advised the government to turn the DGH into an ‘independent technical office’ attached to the oil ministry and establish an upstream regulator to focus on regulatory functions. It also said the reconstituted DGH as well as the regulator must not have staff on deputation from regulated firms. A similar panel had in 2001 recommended the setting up of an Upstream Hydrocarbon Regulatory Board, giving DGH a techno-administrative role as a part of the oil ministry.

India was scheduled to lift its biggest volume of Iranian crude in nine months in December, helping to shore up the OPEC producer’s oil exports to Asia last month. Asian buyers were scheduled to lift 1.92 million bpd of Iranian crude in December, down 7 percent from the actual loadings in the previous month. India’s scheduled crude oil loadings from Iran, excluding condensate, an ultra-light oil, were about 550,000 bpd last month, up 78 percent from the previous month and the highest since March.

State oil companies have planned a capital spending of ₹ 890 billion ($14 billion) in 2018-19, half of which will go into E&P. In the current fiscal, these companies had targeted an expenditure of ₹ 874 billion, 70% of which has been spent in the first three quarters. The allocation of ₹ 480 billion towards exploration and production in Budget 2018-19 is lower than ₹ 539.6 billion planned for this year. Spending on refining and marketing would rise to ₹ 358 billion from ₹ 312 billion in 2017-18. Investment in petrochemicals would nearly double to ₹ 39.52 billion next fiscal year from ₹ 21.56 billion in the current year. ONGC has planned the highest investment among all state oil firms, with a capex target of a little over ₹ 320 billion in 2018-19. This would go into developing new oil and gas fields and enhancing production from existing fields. For the current year, its planned capex is about ₹ 372 billion, including a $1.2 billion payment for GSPC’s stake in the KG Basin asset. ONGC’s capex figure will get revised upward sharply after factoring in the ₹ 370 billion purchase of government stake in HPCL.

Saudi Aramco, the state oil company of Saudi Arabia, is considering entering India as part of its Asian expansion. The Saudi government has said it plans to sell about 5 percent of Aramco, hoping to raise some $100 billion or more in what would likely be the world’s biggest initial public offer.

Kochi crude oil refinery in Kerala, operated by fuel retailer BPCL has completed its expansion project to become the largest public sector refinery in the country, surpassing the capacity of Paradip and Panipat refineries operated by the largest retailer IOC. BPCL completed the ₹ 165 billion Integrated Refinery Expansion Project (IREP) at Kochi in October last year, ramping up the capacity of the unit to 15.5 mt from the earlier 12.4 mt. That compares with 15 mt capacity each of IOC’s Paradip refinery in Odisha and Panipat refinery in Haryana. The Kochi oil refinery processed 1.2 mt crude in December 2017 as compared to 1 mt processed in the corresponding month a year ago, data from the PPAC, an arm of the oil ministry, shows. India had a total installed crude oil refining capacity of 247.6 mt at the end of December 2017 including 69.2 mt operated by IOC, 36.5 mt operated by BPCL and 27.1 mt operated by the third state-owned retailer HPCL.

India will showcase its oil sector policy reforms and the investment opportunities at the 16th IEF Ministerial, slated for April in New Delhi, where scores of ministers, top officials and industry executives from across the globe are expected to participate. IEF, comprising 72 member countries, is one of the biggest global forum of oil and gas producers and is currently headed by Saudi Arabia. The Ministerial will be held from April 10 to 12. Ninety percent of the oil and gas producers and consumers would be represented at the event, which would therefore be a good opportunity to present India as an investment destination. The issue of ‘reasonable and responsible pricing’ and the long-standing Indian demand of junking the so-called Asian premium will also be discussed at the Ministerial. Oil consumers have become ‘more assertive’ and they will have a bigger say in the global oil market now, Pradhan said referring to how the global oil industry dynamics has changed over the years. A supply glut resulting in lower prices for the last three years has given heavy consumers like India and China a bigger say in the global markets.

The Jammu and Kashmir government said it has achieved a target of 75 percent in the implementation of Pradhan Mantri Ujjwala Yojana by LPG connections to 370,000 below poverty line households in the state. The females from BPL households were provided with sets of chulha, cylinder, gas pipe, regulator and safety manual.

India needs to increase its refining capacity to 600 million mt by 2040 to meet the rising demand for fuel. About $300 billion would be invested in next 10 years in energy and hydrocarbon sectors. India has decided to meet international best practices by leapfrogging to BS-VI norms by April 2020 in the entire country and by April 2018 in NCT Delhi. The government has planned to set up West Coast Refinery cum Petrochemical Complex of 60 mmtpa with an estimated investment of ₹ 2700 billion. Foundation stone for another grass root Refinery cum Petrochemical Complex in Barmer, Rajasthan with an investment of ₹ 43,000 billion was laid in January 2018.

Indian oil consumption in 2017 grew at its slowest in four years, according to government statistics, hit by the government’s demonetisation move and a tax increase that knocked the gain in fuel use back to a modest 2.3 percent. The low growth also coincided with another year of weak, albeit improving, new vehicle sales. India imports almost all of its oil, shipping in around 4.2 million bpd of crude in 2017, according to trade flow data. India saw some structural demand changes that affected the use of refined oil products. A government push for household to use more LPG has India challenging China as the world’s top LPG importer. For 2018, energy consultancy FGE expects India’s oil demand growth to improve to 4.3 percent. India’s slow oil demand growth has surprised many, given the country has often been touted as the next China in terms of rising oil consumption. If an Indian citizen with an average salary buys 10 gallons of gasoline per month, that would represent nearly 30 percent of the person’s income, while the average Chinese would fork out just 5 percent, data from statistics company Numbeo showed.

Rest of the World

Global oil markets are tightening quickly on falling supply from Venezuela, which posted 2017’s biggest unplanned output fall and could see a further decline in 2018, the IEA said. Debt and infrastructure problems cut Venezuela’s December output to 1.61 million bpd, somewhere near a 30-year low. That helped oil prices top $70 per barrel in early January, their highest level in three years. As a result of lower Venezuelan production, the IEA said OPEC’s crude output in December fell to 32.23 million bpd, boosting the group’s compliance with a deal to curb output to 129 percent. OPEC agreed to lower production in 2017 and has agreed to maintain output cuts for the whole of 2018 to help bring oil stocks in OECD industrialized countries down to their 5-year average. The IEA said that if OPEC and its non-OPEC allies maintained good compliance with the output deal, oil markets would balance in 2018. The recovery in oil prices and a decline in global oil stocks has been helped by robust global demand growth in 2017 but it will slow down in 2018, the IEA said. It kept its oil demand growth estimate for 2018 unchanged at 1.3 million bpd, down from 1.6 million bpd in 2017, mainly due to the impact of higher oil prices and changing patterns of oil use in China.

Goldman Sachs raised its Brent crude price forecasts, saying oil markets have rebalanced six months sooner than expected, citing steady demand growth and continuing compliance with OPEC -led supply cuts. The bank’s three, six and twelve-month Brent oil price forecasts were raised to $75, $82.50 and $75 a barrel respectively, from $62 previously. However, Goldman expects the price to dip again as US shale producers pump more oil to benefit from the price reaction to lower global inventories. Goldman sees a global oil market deficit of 0.2 million bpd in 2018, followed by a global surplus of 0.73 million bpd in 2019. Oil prices pared early gains to stay little changed as OPEC’s strong compliance with a supply reduction pact offset news that US production topped 10 million bpd for the first time in nearly half a century.

OPEC and non-OPEC oil producers have a consensus that they should continue cooperating on production after the end of 2018, when their current agreement on production cuts expires. If oil inventories increase in 2018 as some in the market expect, producers may have to consider rolling the supply cut agreement into 2019, but the exact mechanism for cooperation next year has not yet been decided.

In addition to the OPEC and non-OPEC production cuts of 1.8 million bpd that are due to last until the end of 2018, oil prices have found support from eight consecutive weeks of US crude inventory drops. US commercial crude stocks fell by almost 5 million barrels in the week to January 5, to 419.5 million barrels. That was slightly below the five-year average of just over 420 million barrels, the target for OPEC and others cutting output. But the IEA, warned that while oil prices at $65 to $70 per barrel are good for oil producers now, there IEA also said that there might be a further decline in oil production from OPEC member Venezuela in 2018 as its economic crisis hits output.

Surging shale production is poised to push US oil output to more than 10 million barrels per day – toppling a record set in 1970 and crossing a threshold few could have imagined even a decade ago. And this new record, expected within days, likely won’t last long. The US government forecasts that the nation’s production will climb to 11 million barrels a day by late 2019, a level that would rival Russia, the world’s top producer. US energy exports now compete with Middle East oil for buyers in Asia. Daily trading volumes of US oil futures contracts have more doubled in the past decade, averaging more than 1.2 billion barrels per day in 2017, according to exchange operator CME Group. The US oil price benchmark, West Texas Intermediate crude, is now watched closely worldwide by foreign customers of US gasoline, diesel and crude. Iraqi Oil Minister Jabar al-Luaibi said that the OPEC member’s oil output capacity is nearing 5 million barrels per day, but the country will remain in full compliance with its output target under a global pact to cut supplies. Luaibi said the supply cut agreement between OPEC and non-OPEC producers should continue despite a rise in oil prices. The deal between the OPEC and Russia to cut 1.8 million barrels per day of crude, which started in January 2017, is due to last until the end of 2018. Luaibi said current Iraq’s oil production is about 4.3 million barrels per day. Luaibi also said that his ministry plans to conclude three contracts with international gas companies by mid-2018 to utilize gas from Basra, Maysan and Nassiriyah southern provinces.

Mexico has raised the bar on oil contracts in Latin America after sweetening terms to attract international energy firms, luring $93 billion in future investment in the region’s first big auction this year. Mexico awarded 19 of 29 deepwater blocks onoffer, comfortably more than the seven areas expected to be assigned. Anglo-Dutch oil major Royal Dutch Shell emerged as the biggest winner, with nine blocks. Unique for generous terms such as setting a cap on royalties that oil firms can pledge to the government in bids, Mexico faces off this year with Brazil, Argentina, Ecuador and Uruguay. They will all hold auctions for oil and gas fields in 2018 that require billions of dollars in investment from foreign firms. Mexico is due to hold major auctions in March and July. While Brazil’s prolific deepwater presalt oilfields are expected to attract aggressive bidding from oil majors, other regional rivals could be forced to revise the terms of their auctions if Mexico scores another win in its next auction for shallow water areas in March, analysts said. Oil prices have reached three-year highs near $70 per barrel in 2018, giving the world’s top energy companies a cash boost and improving the chances that they will have the funds needed for big-ticket projects in Latin American. After the government of Mexico started auctioning oilfields in 2015, it tweaked the terms of the bidding process several times, following a historic energy reform that ended state oil firm Pemex’s 75-year monopoly over the sector. The liberalization, the most ambitious plank of President Enrique Pena Nieto’s economic policy, started just as oil prices crashed in 2013-2014.

State oil producer Saudi Aramco is expected to launch a tender in July to build facilities to expand its Marjan oilfield while another tender for the Berri oilfield expansion is expected by the third or fourth quarter of this year. The planned projects are further proof that Saudi Aramco is pushing ahead with oil investments to maintain capacity while also meeting domestic demand for gas to fuel industrial growth. International engineering and construction firms have expressed interest in bidding to build oil and gas facilities at Marjan oilfield whose development is expected to cost more than $10 billion. The expansion will increase the capacity of Marjan, currently at 500,000 bpd, by 300,000 bpd of Arab medium crude. A new gas plant in Tanajib which will handle 2.7 billion standard cubic feet per day is due to be built and the capacity of the NGL fractionation plant at Wasit will expand too. As for Berri, development could cost between $6-8 billion. Aramco plans to raise capacity at the field by 250,000 bpd of Arab light and raise production of associated gas. The construction packages for Marjan and Berri are expected to be awarded next year and both projects are expected to be completed in 2022.

China’s NDRC said it will launch a fresh crackdown on oil refiners that expand capacity without official approval, the latest sweeping move by Beijing to curb unfettered growth in fuel output and illicit oil trade. NDRC said it will close refineries with less than 2 mt per year (40,000 bpd) of capacity if they are found to violate regulations. The penalty for larger refineries will be to curb any expansion projects. Even so, China’s refineries have been churning out and exporting bumper volumes of diesel and gasoline, in a race for profits.

Russia held firm as China’s top crude oil supplier in December for the 10th month and racked up its second year as the No.1 supplier to China in 2017, the data from the General Administration of Customs showed, leaving rival exporter Saudi Arabia in second place once more. Shipments from Russia hit 5.03 million tonnes in December, down 0.2 percent from a year earlier, pushing up its full-year supply by 13.8 percent to 59.7 mt, or 1.194 million bpd. Saudi Arabia’s December shipments were up 31.7 percent from a year ago at 4.71 mt, or about 1.11 million bpd. Whole-year shipments from the Kingdom, OPEC’s top supplier, grew 2.3 percent to 52.18 million tonnes, or 1.044 million bpd, the data showed.

Russia’s Sakhalin-1 oil project, led by ExxonMobil, has ditched plans to raise output by a quarter this year after it was ordered by the authorities to return to previous lower production limits. Sakhalin-1 operates under a Production Sharing Agreement struck in the mid-1990s and all plans must be run by local government. ExxonMobil had received preliminary approval for a new quota in December and set output for January at 250,000 to 260,000 bpd, up from 200,000 bpd last year. But the firm was ordered by the authorities this month to return to the old quota of 200,000 bpd. Sakhalin-1 was now operating under the production quota of 200,000 bpd. Russia’s energy ministry said Sakhalin-1 would continue to operate under previous quotas until the Natural Resources Ministry finished approving a new production scheme. The withdrawal of approval for increased production meant Sakhalin-1 shareholders had to reduce their schedule for Sokol crude loadings for January-March. Under the original schedule based on a production rise, 13 cargoes of 95,000 tonnes each were to be loaded from the De-Kastri terminal on Russia’s Pacific coast in January, compared to nine in December, traders said. In February and March, Sokol crude exports had been set at 11 and 12 cargoes, respectively, traders said. After ExxonMobil was instructed to cut production, loading plans were decreased to 11 cargoes in January, nine cargoes for February and 10 cargoes for March, traders said.

NATIONAL: OIL

ADNOC to store crude oil at Mangalore

February 12, 2018. Abu Dhabi National Oil Company (ADNOC) has signed an agreement to store about 6 million barrels of crude oil at India’s maiden strategic oil reserve. The agreement to store crude oil at the Mangalore underground caverns was signed during the visit of Prime Minister Narendra Modi to Abu Dhabi, Indian Strategic Petroleum Reserves Ltd (ISPRL) said. The pact, which was signed by HPS Ahuja, Chief Executive Officer (CEO) & Managing Director (MD), ISPRL and Abdulla Salem Al Dhaheri, Director Marketing, Sales and Trading, ADNOC, envisages storage of 5.86 million barrels of crude by the UAE (United Arab Emirates) firm in the underground storage cavern. ADNOC had last year given up its crude storage lease in South Korea and instead agreed to store oil at Mangalore in a bid to establish ground presence in world’s third largest oil consuming nation. Out of the crude stored, a part would be used for commercial purposes by ADNOC, while a major part would be purely for strategic purposes. ISPRL has built around 39 million barrels (5.33 million tonnes) of strategic crude oil storage at three locations — Padur and Mangalore on the western coast and Visakhapatnam on the eastern coast. The oil stored in the underground rock caverns at the three locations are to be used in an emergency. The Strategic Petroleum Reserves (SPR) at Mangalore consists of two compartments with a total storage capacity of 1.5 million tonnes (11 million barrels). While one compartment has been filled with crude oil through funds made available by the government, the other compartment will be filled by crude supplied by ADNOC. India imports over 80 percent of its crude oil needs, out of which about 8 percent is supplied by the UAE.

Source: Business Standard

BPCL marks entry in highly prospective UAE region

February 12, 2018. An Indian consortium of Bharat PetroResources Ltd (BRPL), a 100% subsidiary of Bharat Petroleum Corp Ltd (BPCL) and its exploration and production arm along with ONGC Videsh Ltd (OVL) and Indian Oil Corp (IOC) has been awarded 10% stake in Lower Zakum Concession, Offshore Abu Dhabi. The Concession awarded by the Supreme Petroleum Council, on behalf of the Abu Dhabi Government to the Abu Dhabi National Oil Company and the Indian consortium, is the first time that Indian oil and gas companies have been given a stake in the development of Abu Dhabi’s hydrocarbon resources. The Indian consortium would contribute a sign up bonus of $600 million to enter the concession for a 10% stake. BRPL through its subsidiary has 30% stake in the SPV of the Indian consortium that holds 10% stake in the Lower Zakum Concession. The current production of this field is about 400,000 barrels of oil per day (bopd). The field profile is set to achieve plateau target of 450,000 bopd by 2025.

Source: Business Standard

India’s oil consumption grows at fastest pace in 14 months

February 12, 2018. Oil demand in India rose 10.3 percent in the first month of 2018, the fourth straight monthly gain. Total oil consumption expanded at the fastest pace in 14 months to 16.9 million tonnes from 15.3 million a year ago, according to the oil ministry’s Petroleum Planning and Analysis Cell. Improvement in road freight transport following the stabilization of the new nationwide sales tax and growing use of cars and scooters boosted the consumption. The growth in demand came over a low base as in January last year the nation’s oil consumption fell the most in 13 years following the government’s crackdown on high-value currency notes.

- Diesel usage gained 14.5 percent to 6.65 million tonnes

- Gasoline consumption rose 15.6 percent to 2.09 million tonnes

- Demand for liquefied petroleum gas increased 4.6 percent to 2.08 million tonnes

- Petroleum coke usage rose 9.2 percent to 1.98 million tonnes

The International Energy Agency sees India to be the center of global oil demand growth until 2030. The nation expects to double gasoline and diesel consumption by that year even as it aspires to sell only electric vehicles in 2030. The two fuels account for more than half of India’s oil usage. The Society of Indian Automobile Manufacturers expects India’s passenger vehicles sales to expand 9 percent in the year ending March. The new goods and services tax does not include oil products at present.

Source: Bloomberg

India plans to raise refining capacity by 77 percent by 2030

February 8, 2018. Refiners in India, the world’s third-biggest oil consumer and importer, have drawn up plans to raise their capacity by 77 percent to about 8.8 million barrels per day (bpd) by 2030 to meet the country’s rising fuel demand. India’s refining expansion plan will ensure the nation’s surplus production of diesel and gasoline will last till 2035, according to a report prepared and released by the oil ministry. India is emerging as one of the key global drivers for refined fuels consumption as its economic expansion and rising industrial activity yields infrastructure improvements and increased energy access for commercial and retail consumers. If current patterns of use continue, India’s fuel demand could rise to as much as 335 million tonnes by 2030, and 472 million tonnes by 2040, from about 194 million tonnes last year, the report said. On the basis of expansion plans submitted by refiners to the government, gasoline production will remain in surplus up to 2035, turning into a deficit in 2040, according to the report. Diesel will remain in surplus until about 2035, beyond which domestic demand will overtake supply, the report said. The report also forecast a growth of 5 percent or more each year in India’s gasoline, diesel and jet fuel demand to 2030. The report recommended the refiners set up petrochemical projects and cut production of petcoke and fuel oil.

Source: Reuters

India to seek lower oil prices from Saudi Arabia, US: Oil Minister

February 8, 2018. India will press Saudi Arabia and the United States (US), the world’s biggest oil producers, this month for a reduction in oil prices to provide relief to fuel consumers, Oil Minister Dharmendra Pradhan said. Saudi Oil Minister Khalid A Al-Falih will visit India on February 23-24 while US Energy Secretary Rick Perry would be here between February 28 and March 1, he said. In meetings with the producers, India, the world’s third biggest oil consumer, would make a case for reasonable pricing of crude and reductions from current high levels, he said. Pradhan was replying to questions as to why the government has not reduced excise duty on petrol and diesel in the Union Budget 2018-19, presented in Parliament, to give relief to consumers. Brent crude has lost around 8 percent in value since reaching a 4-year high to above $71 per barrel in late January. Finance Minister P Chidambaram said the government chose to keep the gains arising from falling crude oil prices between late 2014 and early 2016 to provide for funds for free liquefied petroleum gas (LPG) scheme, road and highway construction, education and healthcare. Chidambaram had asked the government what price of crude had it factored in while framing the Budget and if it will raise retail prices or cut excise duty when international prices cross that level. Petrol prices crossed Rs 73 a litre mark, the highest level since the Bharatiya Janata Party (BJP) government came to power in 2014, while diesel touched a record high of Rs 64.15 a litre.

Source: Business Standard

Union Cabinet approves auction of 60 O&G fields of ONGC, OIL

February 7, 2018. The Union Cabinet approved offering of 60 oil and gas (O&G) fields of Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) in the second auction of Discovered Small Field (DSF) round. Out of the 60 fields, 22 were discovered by ONGC, 5 belong to OIL and 12 are relinquished fields/discoveries from blocks offered in bids rounds under New Exploration Licensing Policy (NELP) since 1999. The remaining 21 are fields that did not receive any bid in the DSF first round last year. These discoveries are estimated to have 194.65 million tons of oil and oil equivalent gas in place. In the first round, contracts for 31 fields were signed last year. The fields signed off in first round envisage a cumulative peak production of around 15,000 barrels per day of oil and 2 millions standard cubic meters of gas.

Source: Hindustan Times

NATIONAL: GAS

Petronet, Japanese co to set up $300 mn LNG terminal in Sri Lanka

February 11, 2018. Petronet LNG Ltd, India’s biggest importer of gas, and its Japanese partners will invest $300 million to set up Sri Lanka’s first liquefied natural gas (LNG) terminal near Colombo, its Chief Executive Officer (CEO) Prabhat Singh said. The Indo-Japanese partnership will set up a 2.6-2.7 million tonnes (mt) a year floating LNG receipt facility off the island’s western coast, bigger than the previously envisaged 1.5-2 mt a year facility. Petronet will hold 47.5 percent stake in the project while Japan’s Mitsubishi and Sojitz Corp will take 37.5 percent stake. The remaining 15 percent will be held by a Sri Lankan entity, he said. Explaining the reasons for setting up a bigger capacity LNG terminal, he said Sri Lanka requires 2.5-3 mt of liquid gas to fire power plants. Sri Lankan government had in September last year issued a Letter of Intent to the company to build a floating LNG import facility to supply gas to power plants and the transport sector in the island nation. The import terminal is to be set up at Kerawalapitiya on the west coast. The terminal in Sri Lanka is part of Petronets vision to own 30 mt per annum of LNG import and regasification capacity by 2020. Petronet already operates a 15 mt per annum import facility at Dahej in Gujarat and has another 5 mt terminal in Kochi in Kerala. It has signed preliminary agreement to build a 7.5 mt LNG terminal in Bangladesh and is also looking at setting up a smaller facility in Mauritius. He said Dahej is also being expanded to 17.5 mt over the next two years. The India-Japan collaboration comes after a string of Chinese successes in Sri Lanka.

Source: Business Standard

H-Energy for shore-based regasification in Haldia LNG project

February 11, 2018. Hiranandani Group-promoted H-Energy, which is executing a Rs 3,500 crore project to import and distribute liquefied natural gas (LNG) in West Bengal, has decided upon the shore-based regasification terminal model to expedite work. The company expects to complete the LNG project at Haldia within the next 18-24 months. Transportation major ‘K’ Line has a 26 percent stake in a joint venture with H-Energy to execute and manage the storage and literage part (FSU) of the imported LNG project valued at USD 300 million, H-Energy Chief Executive Officer (CEO) Darshan Hiranandani said. ‘K’ Line is estimated to supply 155,000 m3 LNG FSU. However, the regasification terminal at the shore near Digha will require about $250 million, which will be executed solely by the Hiranandani Group, he said. H-Energy intends to execute the LNG project in phases, slowly ramping up capacity from 1.0 to 4.0 million metric tonnes per annum (mmtpa). It can be later scaled up to 6.0 mmtpa. The company will construct a station near Haldia to receive LNG by shuttle carriers, where it is stored and regasified in a Floating Storage and Regasification Unit (FSRU), holding approximately 40,000 m3.The initial capacity of this unit will be around 1.0 mmtpa. H-Energy will be constructing pipelines of about 100 kilometre to supply gas in Haldia and West Bengal, Hiranadani said. The natural gas is also proposed to be exported to Bangladesh.

Source: Business Standard

180 villagers protesting against ONGC’s methane project arrested

February 11, 2018. Police arrested over 180 villagers including the anti-methane project movement leader professor K Jayaraman, while they attempted to besiege the work site where the process of establishing oil well is on for extracting natural oil and gas by the Oil and Natural Gas Corp (ONGC) at Kadambangudi in Tiruvarur district. Earlier police arrested three villagers who tried to stall the work. The protestors alleged that hectares of fertile lands in and around the Kadambangudi village had lost its fertility and groundwater table had been depleting, due to ongoing extraction work by the ONGC. Meanwhile, upon hearing the news that the ONGC authorities were in the preparatory works of erecting another oil well, they gathered there and opposed the move. The police also arrested over 180 people including 80 women and 22 school students who protested on the site. In another incident, a section of villagers stated protest against the GAIL (India) Ltd pipeline project near Mannargudi in Tiruvarur. A section of villagers registered their protest against laying of pipelines across their area. The GAIL has been conveying gas through underground pipelines from Nallur to Thirumakkottai, a distance of 9 kilometre (km), since 2001. It is said to be mandatory for GAIL to renovate the works after completion of 15 years. While work was completed for a stretch of 7.5 km, the balance has faced stiff opposition from the landowners.

Source: The Times of India

India plans massive natural gas expansion, LNG imports to soar

February 7, 2018. India’s push to more than double the share natural gas has in its energy mix to 15 percent by 2022 will require a huge increase in imports and the construction of more LNG (liquefied natural gas) terminals. India has four terminals to receive LNG and imports around 20 million tonnes (mt) of the super-chilled fuel a year. But over the next seven year the government plans to build another 11 terminals, Narendra Taneja, spokesman for the ruling Bharatiya Janata Party (BJP), said. That would raise India’s LNG import capacity to more than 70 mt per year in the coming seven years, in what would be one of the fastest gas import expansions since China embarked on its huge gasification programme last year. India would eventually require even more than 15 terminals to meet its demand, Taneja said. India has stated it plans to raise the share of natural gas in its energy mix to 15 percent by 2022 from about 6.5 percent now, he said. The 70 mt a year target a few years later would mean Indian would need to import more than China took last year via both pipelines and tankers, and it would put India close to what top importer Japan currently buys. India plans to electrify millions of households that still burn wood for light, heat and cooking. Like China, it also plans to reduce its heavy reliance on thermal coal, a bigger polluter than gas. Taneja said the gas would also be needed to provide power to electric vehicles, which India plans to account for all new car sales by 2030. India is also pushing for more scooters and motorcycles to run on compressed natural gas (CNG), with pilot schemes recently launched in major cities including New Delhi and Mumbai. Beyond LNG, India is looking to access untapped domestic gas reserves off its east coast. As part of its drive to reduce pollution by increasing natural gas use, Taneja said the government was encouraging Indian railway companies and LNG importers to look at fuelling trains by LNG instead of diesel. India also wants to become a hub for supplying ships that run on LNG, with plans to build more facilities like a fuelling station at Kochi port, Taneja said. LNG as a shipping fuel is being pushed by International Maritime Organization (IMO) rules that come into effect by 2020 and require the use of cleaner fuels.

Source: Reuters

GAIL set up for natural gas transportation: Oil Minister

February 7, 2018. Oil Minister Dharmendra Pradhan on the issue of splitting gas utility GAIL (India) Ltd said a decade- old policy provides for a natural gas transporter not having any interest in marketing of the fuel. Incorporated in August 1984 by spinning off gas business of ONGC, GAIL (India) Ltd owns and operates about 11,000 kilometre (km) of natural gas pipelines in the country. It sells around 60 percent of natural gas in the country. He said in 2006, the Government issued the Policy for Development of Natural Gas Pipelines and City or Local Natural Gas Distribution Networks. Also, the policy and the provisions of the Petroleum and Natural Gas Regulatory Board (PNGRB) Act, 2006 provide for all entities authorised to lay pipelines including GAIL to provide mandatory open access to their gas pipeline infrastructure on common carrier principle at non-discriminatory basis. At present, GAIL has about 11,000 km long gas pipeline network and is also developing about 3,500 km long pipelines projects in the country.

Source: Business Standard

Adani plans to build 5 mtpa LNG terminal in east India

February 7, 2018. A 5 million tonnes per annum (mtpa) LNG (liquefied natural gas) import terminal at Mundra in Gujarat state on the west coast of India, part owned by the Adani Group, will likely be operational in April or May, the company said. The terminal will have receiving, storage and re-gasification facilities for LNG and will be connected to Gujarat State Petronet’s existing pipeline network at Anjaar, Gujarat. Construction on the terminal is completed, but Adani is unable to commission operations due to issues with a 90 kilometre (56 mile) section of pipeline, said Sarthak Behuria, executive director of the company’s LNG and LPG division. Adani’s plans are in line with a broad push in India to more than double the share natural gas has in the country’s energy mix to 15 percent by 2022. India has four LNG terminals now and imports around 20 million tonnes of the super-chilled fuel a year, but the government plans to build another 11 terminals over the next seven years.

Source: The Economic Times

NATIONAL: COAL

CIL target for power sector pegged at 513 mt for next fiscal

February 13, 2018. Coal India Ltd (CIL) would produce 513 million tonnes (mt) of coal in 2018-19 and offer 12 mt via e-auction to meet the power sector’s demand. The balance amount to meet the power industry’s demand of 615 mt of coal would come from Singareni Collieries and captive coal blocks, CIL said. Captive mines allotted to private power developers and states would collectively contribute 105 million tonnes by 2021-22 from 37 million tonnes currently. CIL is expected to close the current financial year with 500 mt production. After facing coal deficit in the last quarter, which led to power generation loss, the ministry of power has asked CIL and the Railways to ensure supply of 615 million tonnes of coal with the movement of 288 rakes every day. CIL charted a company-wise plan for enhanced loading of 288 rakes a day in a recent meeting chaired by Power and Renewable Energy Minister R K Singh. Of the eight subsidiaries of CIL, Mahanadi Coalfields Ltd would load the highest number of rakes per day, at 76. It would be followed by South Eastern Coalfields (57 rakes per day). The power ministry said the production from captive coal blocks awarded to private power developers and states would also improve. The coal ministry auctioned the 29 coal blocks to the private sector and allotted 11 mines to states through India’s first e-auction.

Source: Business Standard

Delhi HC ask CIL to supply coal to Reliance Power’s Butibori Unit-I

February 12, 2018. Reliance Power said Coal India Ltd (CIL) has been directed by the Delhi High Court (HC) to immediately commence coal supplies to the Unit-I of Butibori power project. Reliance Power has set up 2 x 300 MW Butibori Plant near Nagpur through its subsidiary Vidarbha Industries Power Ltd (VIPL), which is supplying its entire power to Reliance Infrastructure Ltd (Distribution Utility), which distributes electricity to over 28 lakh consumers in Suburban Mumbai under a long-term Power Purchase Agreement approved by Maharashtra Electricity Regulatory Commission. While coal is being supplied to Unit 2 by CIL through its subsidiary Western Coalfields Ltd, the supply was not commenced to Unit 1 of the Butibori Plant despite a valid Letter of Assurance (LoA) issued by the CIL subsidiary pursuant to the recommendations of Standing Linkage Committee (Long Term) comprising of coal ministry, power ministry, CIL, Central Electricity Authority and Railways among others, in 2008, the company said. The LoA had promised supply of 1.23 million tonnes per annum of coal for Unit 1, it said. The coal supply issue was pending for nearly four years after the commissioning of the unit and commencement of power supply to Reliance Infrastructure Ltd in April 2014 under a long-term Power Purchase Agreement approved by Maharashtra Electricity Regulatory Commission. The Delhi HC, has noted that the Butibori Plant has fulfilled the pre-requisite of SHAKTI (Scheme for Harnessing and Allocating Koyala Transparently in India) Policy, wherein Fuel Supply Agreements (FSAs) are to be signed with existing LoA holders, and has a case for having an FSA executed in its favour, it said. After the directions of Delhi HC, both units of Butibori Plant would be getting assured coal supplies from CIL subsidiaries under 100 percent FSA/MoU (Memorandum of Understanding) and mitigate the uncertainties in supply of 600 MW quality and reliable power to citizens of Mumbai, it said.

Source: Business Standard

Assam government announces CID inquiry into illegal coal trade

February 12, 2018. The Assam government announced a CID inquiry into illegal coal trade and smuggling in the state. Parliamentary Affairs Minister Chandra Mohan Patowary, replying on behalf of the home minister, made the announcement in the state Assembly, and said the government was determined to root out corruption. Leader of Opposition Debabrata Saikia (Congress) demanded a CBI enquiry into the coal scam, as the matter allegedly involved a mining behemoth and the matter was beyond the mandate of the state CID. The Minister also informed the House that 184 corruption-related arrests, including those in the ‘cash-for-job’ scam of Assam Public Service Commission (APSC), have been made since the BJP-led state government came to power in the state on May 24, 2016.

Source: Business Standard

Government takes steps to boost coal supplies to power plants

February 12, 2018. In order to boost coal supplies to power plants, the government has decided on various steps including the use of dedicated rail transportation and setting up of power projects only within 500 kilometre (km) from coal mines. It has also decided that all power plants within 20 km from pit-head of coal mine will construct elevated closed belt conveyors within next 2 years. The steps were finalised at a meeting headed by Power and Renewable Energy Minister R K Singh. As per the estimates on the basis of power consumption growth, the requirement of domestic coal in 2018-19 would be about 615 million tonnes, which means that 288 rakes of coal per day would be required from Coal India Ltd (CIL).

Source: Business Standard

India’s coal demand growth in non-regulated sector to be higher

February 9, 2018. Coal, as a primary source of energy, will continue for some more time in India and its demand in the non-regulated sector is expected to be higher than the regulated sector like power, the study – ‘Coal Vision 2030’ said. Overall coal demand is estimated to be 900-1,000 million tonnes per annum (mtpa) by 2020 and 1,300-1,900 mtpa by 2030. Coal India Ltd (CIL) has commissioned the study to assess the future demand scenarios for the coal sector in India up to 2030. By 2030, of the overall coal demand, thermal coal demand is estimated to be 1,150-1,750 mtpa and the balance is coking coal demand.

Source: Business Standard

No new coal mines need to be allocated or auctioned beyond current pipeline: Coal Vision Document 2030

February 8, 2018. The Coal Vision Document 2030 suggests that no new coal mines need to be allocated or auctioned beyond the current pipeline. According to the document, total capacity of mines allocated and auctioned, including Coal India Ltd (CIL), Singareni Collieries Company Ltd (SCCL) and Neyveli Lignite, as on date is about 1,500 million tonnes per annum at the current rated capacity. In the short term, coal production is likely to be significantly lower than the potential, although demand may be met. Majority of the mines currently auctioned or allocated (including CIL, SCCL) are scheduled to be completed by FY20. Based on the current status of these blocks, it is estimated that captive or commercial coal blocks may contribute 90-170 million tonnes per annum by 2020. However, this does not exclude the possibility of coal deficit at consumers’ end driven by evacuation constraints, marketing policies and mismatch between regions of production vis-a-vis consumptions. Coal mining companies need to ensure continuous monitoring and portfolio planning to avoid coal deficit.

Source: The Economic Times

Adani asked to prove Carmichael coal mine jobs promises in Australia

February 7, 2018. Adani has failed to meet financial and jobs creation milestones through its $16.5 billion Carmichael coal mine project in Queensland, the Australian state’s premier said and asked the Indian energy giant to fulfil its commitment. Adani Australia disclosed that it was currently employing 800 people working across operations and projects in Queensland and had invested over $3.3 billion in Australia. The Australian government had said it would not finance a vital rail-link project that supports Carmichael coal mine. The Adani Group has for over five years battled the opposition to any expansion of the Abbot Point port, saying it will cut into the Great Barrier Reef World Heritage Area. The Adani group entered Australia in 2010 with the purchase of the greenfield Carmichael coal mine in the Galilee Basin in central Queensland, and the Abbot Point port near Bowen in the north.

Source: Business Standard

NATIONAL: POWER

India to explore foreign markets for surplus power: Singh

February 13, 2018. India will explore foreign markets like Sri Lanka, Nepal and Bangladesh for its surplus power generation capacity, Power and Renewable Energy Minister R K Singh said. His comments assume significance as the average plant load factor or capacity utilisation in India is around 60 percent. He was of the view that there is need to unlock the demand by not just exploring foreign markets but also increasing power demand in the country. He also asked NTPC to explore the possibility of investments in other countries to widen their horizon in view of surplus installed capacity in the country. Singh also said the panel constituted by power ministry on Unchahar power plant accident last year, has submitted its report, which would be reviewed soon.

Source: Business Standard

CCI approves RInfra Rs 188 bn deal with Adani Transmission

February 12, 2018. Reliance Infrastructure (RInfra) said the Competition Commission of India (CCI) has approved sale of its integrated Mumbai power business to Adani Transmission in a ₹18,800 crore deal. RInfra and Adani Transmission had signed a definitive binding agreement for 100 percent stake sale of the integrated business of generation, transmission and distribution of power for Mumbai in December 2017, RInfra said. RInfra will utilise the proceeds of this transformative transaction entirely to reduce its debt. RInfra’s Mumbai power business (known as Reliance Energy) is India’s largest private sector integrated power utility distributing electricity to nearly 3 million residential, industrial and commercial consumers in the suburbs of Mumbai, covering an area of 400 square kilometre, it said. It caters to a peak demand of over 1,800 MW, with annual revenues of ₹ 7,500 crore with stable cash flows. RInfra will focus on upcoming opportunities in asset light EPC (engineering procurement and construction) and defence businesses, it said.

Source: The Hindu Business Line

IIT Madras students develop intelligent street lighting device

February 11, 2018. At a time when the city corporation is set to revamp lighting on streets in the extended zones with LED (light emitting diode) lamps, students from Indian Institute of Technology (IIT) Madras have come with a solution that they say can reduce power consumption. They have developed an IoT (Internet of Things) sensor-based low-cost device that can cut down power consumption by half simply by synchronised dimming of lights after dark when not required. The device also lets electricians keep track of faults from a remote location. The team won an award at the Carbon Zero Challenge competition organised by IIT-M, Industrial Waste Management Association, US Consulate, Chennai, and Polaris, a Virtusa company. The team said Chennai city daily used more than 27 MW of power, which is around 20% of the total energy, on streetlights. This works to nearly 233 tonnes of CO2 getting released into the atmosphere every day. Globally the consumption is at 18% to 38% by street lighting. While dimming of streetlights is already followed in a few countries, the IIT students said they have added a few other features like the ability to keep track of faults in the lights and synchronise the lighting that makes their device different.

Source: The Times of India

Bad news for Adani Power as Jharkhand rejects Rs 120 bn bid to set up SEZ

February 11, 2018. The commerce ministry has rejected Adani Power’s proposal to set up a special economic zone for the power sector in Jharkhand entailing an investment of Rs 150.02 billion as it was inconsistent with the sectoral guidelines. The decision was taken by the Board of Approval, the highest decision making body on special economic zone (SEZ) related matters, in its meeting on February 5. The developer of the zone — Adani Power (Jharkhand) — had sought in-principle approval for setting up a sector specific SEZ at Godda district in Jharkhand over an area of 425 hectares. The developer had informed the ministry that it is in the process of acquiring the land through the state government. Adani Power (Jharkhand) is a step-down subsidiary of Adani Group firm Adani Power, which is mainly into power generation.

Source: Business Standard

Out of 18,450 villages without electricity, over 16,000 now electrified: Singh

February 11, 2018. Power and Renewable Energy Minister R K Singh said that the government was committed to providing electricity to un-electrified households by 2019. He said that out of the 18,450 villages without electricity, more than 16,800 had been given power supply as on date. He said that the “Pradhan Mantri Sahaj Bijli Har Ghar Yojana” also called “Saubhagya”, launched in September last year, was a move towards this goal and that about 4 crore households would benefit from it. He said that under this scheme, all un-electrified households in rural as well as urban areas were eligible, adding that non-poor households would have to pay Rs 500 in ten equal instalments along with their electricity bill every month. He also announced that a 765 kilovolt transmission line facility would be commissioned soon in Vijayawada in Andhra Pradesh.

Source: The Financial Express

NTPC may borrow Rs 160 bn in FY18 to add 6.9 GW capacity by March 2019

February 11, 2018. State-run power giant NTPC Ltd may borrow about Rs 160 billion next financial year for adding 6,900 MW of fresh electricity generation capacity by March 2019. NTPC has planned capital expenditure of Rs 230 billion for 2018-19, which includes both debt and equity, essentially for capacity addition through the greenfield route. This fiscal, NTPC’s capital expenditure is Rs 280 billion. Last fiscal, the capex was Rs 300 billion.

Source: Business Standard

Power Grid Corp to implement electrification works in Kashmir

February 9, 2018. Power Grid Corp said that it has inked agreement with Jammu and Kashmir to develop transmission and rural electrification work worth Rs 915 crore under Prime Minister’s Development Package 2015. Prime Minister’s Development Package 2015, Government of Jammu and Kashmir has entrusted development of Transmission System (project cost Rs 426 crore) and Rural electrification works for eight districts (project cost Rs 489 crore) to Power Grid Corp as project implementing agency, Power Grid Corp said. The agreement for the same has been signed on February 8, 2018 among Jammu and Kashmir’s Power Development Department, Jammu and Kashmir and Power Grid Corp. For transmission system, five new substations (4 nos 220 kilovolt, 1 no 132 kilovolt) will be established by PowerGrid, out of which three substations, namely Chowadhi, Samba, Kathua-II, are in Jammu region whereas two substations, namely Batpora, Khanyar are in Srinagar region. Rural electrification will be done in eight districts viz Udhampur, Reasi, Ramban, Kulgam, Pulwama, Shopian, Leh and Kargil districts.

Source: Business Standard

UP makes application process online for commercial power connections

February 9, 2018. The Uttar Pradesh (UP) government said it has made the application process completely online for people seeking new industrial or commercial power connections. UP Power Minister Shrikant Sharma, who was chairing a review meeting at the Directorate of Electrical Security, also issued instructions to link Directorate of Electrical Security with 1912 helpline. During the meeting, Sharma also instructed officials to ensure that there is uninterrupted power supply during the two-day investors summit being held in Lucknow on February 21 and February 22.

Source: Business Standard

NTPC invites bids for procurement of agro residue for its Dadri power plant

February 8, 2018. NTPC has invited bids for procuring 1,000 metric tonnes per day of agro residue based fuel for its 2,650 MW Dadri power plant in the National Capital Region as part of initiatives to help clean air and provide farmers with an alternate to burning crop residues, a major contributor to pollution. The tender seeks supply for two years. A capping price of Rs 5,500 per metric tonne has been kept for agro residue based pellets and Rs 6,600 per tonne for pellets or briquettes of torrefied agro Residue, the company said. NTPC has initiated a programme to consume agro residue based fuel for firing in their power plants along with coal. Given the success of this tender NTPC is open to using agro residue in power plants across the country.

Source: The Economic Times

Telangana power generation capacity to touch 17 GW by year-end

February 8, 2018. Telangana is set to increase its power generation capacity from 14,200 MW to 15,000 MW by March 2018 and to about 17,000 MW by the year-end. The capacity augmentation will come through the commissioning of 800 MW coal-fired thermal power plant at Kothagudam by March 2018, whose boiler light-up has been completed and additional capacity coming up from 1080 MW Bhadradri power plant and other sources, including renewables. The State managed to add significant capacity over the last three-and-a-half years, up from 6,573 MW in June 2014, when the Telangana State was carved out, to about 14,972 MW following the light-up of the unit seven of Kothagudam thermal power station. Significantly, the unit would be completed in less than 39 months as against the stipulated time of 48 months as provided for by the Central Electricity Authority. Of the proposed upcoming capacity, about 4,000 MW is expected to come up at Yadadri power plant, where works are under way. Two units of Bhadradri project are likely to be commissioned by December 2018.

Source: The Hindu Business Line

No political meddling in power sector’s functioning in UP: UPERC

February 7, 2018. The Uttar Pradesh Electricity Regulatory Commission (UPERC) said that political interference in the functioning of power corporations has come to an end after the Yogi Adityanath-led government assumed power in the state. UPERC chairman Suresh Kumar Agarwal said that with the new administration at the helm in the state, the corporation authorities are taking punitive actions to recover power dues, and this is the perceptible change one can notice in the power sector of UP. He said that in the forthcoming mega investment summit, the UP government would showcase its power strength to investors by way of declaration about plans to set up solar plants of 1,000 MW across the state, permission for open access to power consumers in industrial sector and inter-state open access. Even after launch of UDAY (Ujwal Discom Assurance Yojana), the overall conditions of discoms (distribution companies) have hardly improved as these continue to struggle on financial front and that these still suffer financial losses that they have hardly any money to improve upon their infrastructure, he said.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

NLC India to aggressively bid for railways’ solar projects: Goyal

February 13, 2018. Railways and Coal Minister Piyush Goyal said NLC India plans to aggressively bid for Indian railways’ solar projects. The company was now investing in solar projects so that it becomes a serious player in the renewable energy sector. The company forayed into the renewable energy sector with the commissioning of a 140 MW solar photo voltaic power plant at Neyveli and a 51 MW wind energy plant in Tamil Nadu.

Source: Business Standard

Hartek Power surpasses 1 GW installed solar capacity

February 13, 2018. Punjab-based solar power solutions provider Hartek Group said its power system business surpassed the 1,000 MW capacity milestone in solar installations across the country. Involving 15 substations of up to 220 kilovolt (kV), the 545 MW projects executed in the current financial year include a 100 MW project in Telengana, 50 MW project in MP, 25 MW project in Punjab, six projects totalling 180 MW in Karnataka, two projects of 140 MW in Rajasthan and four projects of 50 MW in Uttar Pradesh. With presence in 18 states, it ventured into the solar power systems domain just six years ago, and is focusing on the Southern markets and new geographies like Jharkhand and Bihar to consolidate its position now, the company said.

Source: The New Indian Express

GUVNL floats 500 MW solar power tender

February 11, 2018. After successfully completing bidding to source 500 MW solar power last year, Gujarat Urja Vikas Nigam Ltd (GUVNL) has floated another tender to procure 500 MW from grid-connected solar photovoltaic power projects through competitive bidding. There is also a greenshoe option for the purchase of an additional 500 MW. GUVNL invited bids for solar power to fulfil its renewable power purchase obligations (RPPO) and to meet future requirements of distribution companies. The minimum project capacity has been set at 25 MW. The last date for submission of bids is March 19, 2018, while technical and financial bids will be opened on March 20 and March 26, respectively. The date for the reverse e-auction will be intimated to eligible bidders after the bids are evaluated.

Source: The Times of India

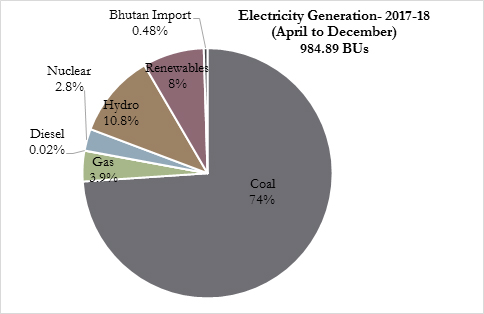

Renewable energy poses threat to coal’s future: CIL

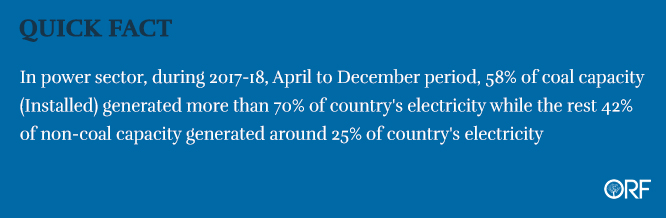

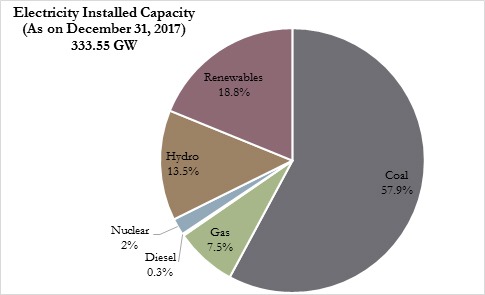

February 9, 2018. Renewable energy will start replacing coal-fired power as solar tariffs are poised to fall below Rs 2 per unit in seven years and storage costs fall, while cheaper international supply can lead to imports of 20 million tonnes, posing a big challenge to domestic suppliers, a document issued by Coal India Ltd (CIL) said. The competitiveness of domestic supplies will be a challenge as costs such as wages rise, according to the document prepared with the help of a consultant hired by the monopoly to assess the future of coal in the era of plunging renewable energy costs and rising concerns about polluting fossil fuels such as coal. The report, on which CIL is seeking public comments, said that unless costly mines are retired and prices of coal corrected downwards, domestic supply may remain stagnant or even fall.

Source: The Economic Times

India, China to lead the emerging nations’ green bonds market in 2018

February 8, 2018. India and China are set to emerge as the leaders in the green bonds market among the emerging nations in 2018, according to Moody’s Investors Service. Global green bond issuance will achieve record heights in 2018 with total issuance set to eclipse $250 billion, up over 60 percent in 2017. Green bonds are issued for funding of specific projects which have positive environmental and climate benefits. Cumulative green bond issuance in India has more than doubled to $6.5 billion since the market regulator Securities and Exchange Board of India (SEBI) issued its green bond regulations in May 2017. Chinese issuance have also risen exponentially to $22.9 billion in 2016, from $1.3 billion a year earlier, following the release of green bond guidelines from the People’s Bank of China and the National Development and Reform Commission (NDRC).

Source: The Economic Times

Government gives administrative approval, financial sanction to build 12 nuclear power reactors

February 8, 2018. The government has accorded administrative approval and financial sanction for construction of 12 nuclear power reactors in the country. Out of these, 10 will be indigenous Pressurised Heavy Water Reactors (PHWRs) with a capacity of 700 MW each and the remaining two will be Light Water Reactors (LWRs). The PHWRs will be set up in fleet mode and the LWRs will be established in cooperation with the Russain Federation, Minister of State in Prime Minister’s Office Jitendra Singh said. Two PHWRs each will be set up in Madhya Pradesh, Karnataka and Haryana, while four will be established in Rajasthan, he said, adding that the two LWRs each having a capacity of 1,000 MW will come up at Kudankulam in Tamil Nadu. The security aspects are being reviewed by the Atomic Energy Regulatory Board (AERB) before giving clearance for various stages of the projects, he said. Currently seven nuclear power projects are being constructed in the country with a combined capacity of 5300 MW of capacity. Besides work for the construction of two nuclear reactors with total capacity 1,400 MW at Gorakhpur in Haryana has commenced, he said.

Source: The Economic Times

Government floats tender for 2 GW wind power projects

February 7, 2018. To achieve the target of having 60 GW of installed wind energy capacity by 2022, the government has invited tenders for 2,000 MW of wind power projects connected to the inter-state transmission system. The Solar Energy Corp of India (SECI) would sign 25-year power purchase agreements (PPAs) with the winning bidders and sell the power to electricity distribution utilities (discoms). The ceiling tariff has been set at Rs 2.93 per unit. A company can bid for a minimum capacity of 50 MW and a maximum capacity of 300 MW. Acquiring land, permissions and other infrastructure to connect the upcoming wind projects to the electricity grid would be the responsibility of the developer. Power And Renewable Energy Minister RK Singh had in November announced the break up of his action plan for completing 28 GW of wind auctions by FY20, leaving a margin of two years to complete the projects by 2022. According to that agenda, another 1.5-2 GW of wind tenders can be expected in the ongoing fiscal. The present wind power installed capacity in the country is nearly 32.5 GW, comprising around 9% of total power generation capacity. Globally, India is at fourth position in terms of wind power installed capacity after China, the US and Germany. Capacity addition of wind energy had ebbed in the first half of FY18 with only 421 MW added in the period after the record 5.5 GW addition in FY17. The Ministry of New and Renewable Energy (MNRE) introduced the competitive bidding system for wind power procurement in February 2017, marking a shift from the feed-in tariff (FiT) regime. The reverse auction mechanism helped SECI discover an unprecedented low price of Rs 2.64 per unit. Later, Gujarat recorded wind power tariffs of as low as Rs 2.43/unit in December 2017, nearly half the average Rs 4.5/unit wind tariff under FiT.

Source: The Financial Express

India needs ecosystem for clean tech to cut emissions, fuel

February 7, 2018. India will need a comprehensive ecosystem that supports cleaner technologies, including electric vehicles, to meet its vision of cutting emissions, reduce dependence on imported fuel and achieve leadership in clean technology, according to Maruti Suzuki India (MSI) MD and CEO Kenichi Ayukawa. The company unveiled its electric concept compact SUV, e-Survivor at the Auto Expo while showcasing a range of technologies to accelerate electrification of powertrains in India, ahead of its planned launch of an electric vehicle in the country by 2020. The e-Survivor concept demonstrates Maruti Suzuki’s efforts in the direction of electric mobility and presents an innovative, futuristic vision, the company said. Ayukawa said products alone will not be enough to realise India’s grand vision of bringing down emissions substantially, reduce dependence on imported fuel, and secure a leadership position in clean technology capability. That ecosystem will include local production of components, capabilities for battery manufacture and recycling. Ayukawa said the company’s parent, Suzuki Motor Corp, has taken a bold step forward by setting up Indias first lithium ion battery manufacturing plant in Gujarat, in partnership with Toshiba and Denso. MSI is also examining various options to support vehicle charging infrastructure in the country, he said. Sourcing raw material, vehicle maintenance, skilling and reskilling of people, disposal and recycling, will all be critical parts of the mega ecosystem, Ayukawa said. MSI will launch its first electric vehicle (EV) in India in 2020, he said. MSI is also showcasing working model of its next generation Suzuki Hybrid system (HEV).

Source: Business Standard

Solar, wind power tariffs may dip below Rs 2 per unit in 2-3 yrs: Sterlite Power

February 7, 2018. As the government continues to focus on increasing renewable energy capacity, solar and wind power tariffs are likely to dip below Rs 2 per unit in the next 2-3 years, Sterlite Power said. The solar power tariff fell to an all-time low of Rs 2.44 per unit during the auction of 500 MW of capacity at Bhadla (III) in Rajasthan. The government had offered viability gap funding (VGF) for the project. Wind power tariff, on the other hand, dropped sharply to Rs 2.43 per unit during an auction conducted by Gujarat Urja Vikas Nigam Ltd (GUVNL) last year. Sterlite Power said with abundant solar and wind potential, southern states like Andhra Pradesh, Telangana, Tamil Nadu and Karnataka, have the opportunity to become exporters of power.

Source: Business Standard

INTERNATIONAL: OIL

Global oil inventories shrinking despite hike in US output: Russian Energy Minister

February 13, 2018. Global oil stockpiles have been on the decline despite a production boost in the United States (US), Russian Energy Minister Alexander Novak said. He also said that the average oil price for this year is expected at close to $60 per barrel.

Source: Reuters

Iraq says $4 bn needed for new downstream oil investments

February 13, 2018. Iraq needs $4 billion for new investments in its downstream oil industry, Oil Minister Jabar al-Luaibi said, outlining plans to expand refining capacity over the next several years. He also said Iraq planned to boost its crude oil production capacity to 7 million barrels per day (bpd) by 2022, from 5 million bpd at present. He said the downstream investment would lift refining capacity to 1.5 million bpd by 2021, with 500,000 bpd of that earmarked for export.

Source: Reuters

Iraq resumes rail transport of oil products to Basra halted after 2003 invasion

February 13, 2018. Iraq has resumed transporting oil products by rail from the Dawra refinery in Baghdad to Basra in the south which was halted after the 2003 US (United States)-led invasion, Oil Minister Jabar al-Luaibi said. This achievement which aims to transport quantities of fuel oil and other products ranging from 1,000 to 4,000 cubic meters a day, will bring about many economic benefits, he said.

Source: Reuters

US supertanker terminal set to export oil for first time