US CRUDE FLOWS TO INDIA

Oil News Commentary: July – August 2017

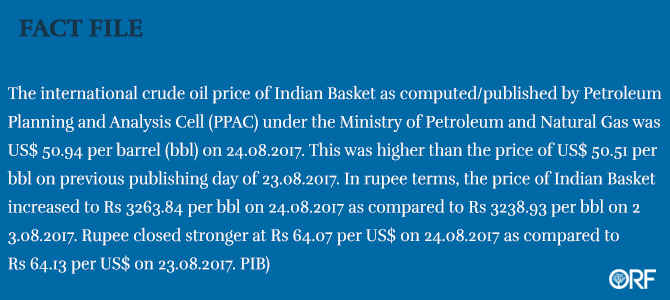

India

Outlook for the Indian upstream sector remains negative for the near to medium term due to soft crude prices, rating agency ICRA said. The rating agency expects the profitability of domestic upstream companies, to be subdued in the near to medium term. OPEC had in November agreed to cut total crude oil production of its member countries by 1.2 mbpd from January 2017 which had led to a spike in global crude oil prices by 15-20 percent to levels of $55-57/barrel. The rating agency does not see any tailwinds for the gas segment in India. Weak crude prices, however, is expected to lead to a further decline in gross under recoveries for oil marketing companies.

India’s upstream petroleum regulator DGH has received as many as 45 EoI in a little over a month for various fields to be bid out under the mega O&G auctions in what analysts called an “encouraging response”. The oil ministry had made the auction live on 1 July, offering over 85 percent of the country’s 3.14 million square kilometres of hydrocarbon sedimentary area under a new bidding mechanism – OALP, and a revamped HELP. The government aims at awarding fields under the new regime by December this year. The new OALP bidding mechanism under HELP allows investors to bid for oil and gas fields throughout the year. The current auction under HELP follows the just-concluded DSF bidding rounds under which 31 blocks were awarded to around two dozen mostly small-sized firms.

Set with a steep target to cut India’s oil imports by 10 percent by 2022, the oil ministry has formed an inter-ministry monitoring and advisory body to achieve the mark through a combination of raising domestic output and relying on alternate fuel sources. The first meeting of the newly formed IMAC was held wherein the progress on import reduction of oil and gas was reviewed. India’s reliance on imports for meeting its oil needs is to be reduced by 10 percent to 67 percent by 2022. IMAC was envisaged to facilitate better coordination and comprehensive strategy for all energy resources by focusing on supply and demand side management.

IOC has bought the country’s first shale oil from the US and is looking to step up imports from America as part of its crude diversification strategy. IOC bought 1.9 million barrels of US crude in its second import tender seeking oil from the Americas. IOC had last month sealed a deal to import 1.6 million barrels of Mars crude from the US and 400,000 barrels of Western Canadian Select oil for delivery at its Paradip refinery in Odisha, the first ever such purchase of US crude by an Indian state-run refiner. The first cargo was loaded on ships on August 7 and would after a 40-day journey reach Paradip sometime around September 20. IOC has received government nod for buying one cargo (or shipload) of US oil every month till March 2018. India allows import of crude oil only on Indian carriers but US oil can be imported only on foreign vessels. So a special permission is needed for using foreign-flagged ships for ferrying the oil.

As per present policy, when a domestic refiner tenders to buy a crude from foreign nation, Indian shipping lines get the first right of refusal by virtue of they being allowed to match any lowest bidder for transportation of crude oil. Only when they waive their right can the oil firms use a foreign line. Transporting US crude needs very large crude carriers and can be done only by foreign shipping lines. And to do that, oil companies have to obtain permission of the shipping ministry. BPCL has bought two of the US cargoes. A few days ago it bought 1 million barrels of US WTI Midland sweet crude for delivery in October – its first purchase of the sweet variety from the US. In July, it bought 500,000 barrels each of Mars and Poseidon varieties of medium-to-high-sulphur crude for delivery to its Kochi refinery between September 26 and October 15. HPCL is also looking at buying US crude oil. Buying US crude has become attractive for Indian refiners after the differential between Brent and Dubai crude has narrowed. Even after including the shipping cost, buying US crude is cost competitive to Indian refiners.

India is the latest Asian country to buy US crude, following South Korea, Japan, China, Thailand, Australia and Taiwan, after OPEC cuts drove up prices of Middle East heavy-sour crude, or grades with a high sulphur content. Indian refiners are diversifying their crude import sources as arbitrage opportunities have opened due to global oil supply cuts. Some experts said that these purchases were motivated by political rather than market forces as they were the result of US president requesting the Indian PM to buy more US energy products.

The country’s fuel demand grew by over 1 percent in July as consumption of diesel and petrol rose. Fuel consumption in July totalled 15.8 mt as compared to 15.63 mt in the same month of last year, data from the PPAC showed. The growth was higher than the 0.4 percent recorded in June when consumption of industrial fuel had dipped. Oil demand has been erratic this fiscal, growing by 6.1 percent in May and 2.4 percent in April. For July, diesel sales were up 8.5 percent at 6.3 mt while petrol consumption was up 11.6 percent at 2.14 mt. With a record number of free cooking gas connections being doled out, LPG sales were up 12.5 percent to 1.92 mt. Since launch of the scheme to provide free LPG connections to women of poor households in May last year, more than 26 million connections have been given. Naphtha sales fell 30 percent to 833,000 tonnes. Consumption of bitumen, used for making roads, also dipped 8 percent to 255,000 tonnes. Oil demand had plunged 5.9 percent in January, the most in 13 years, after the shock demonetisation of high-value currency notes in November. Demand fell 3.1 percent in February and 0.7 percent in March before rebounding in April.

India’s state oil refiners – long focused on churning out transport and cooking fuels – are planning a $35 billion push into petrochemicals to meet an expected surge in demand for goods ranging from plastics to paints and adhesives. The drive comes as the government seeks to promote durable, cheaper materials in industries such as farming and food packaging, while refiners eye long-term threats to their business from renewable energy and a shift to electric vehicles. The government wants to set up petrochemical clusters in the eastern, western and southern regions around refineries. The government is formulating a national policy for petrochemicals after a white paper that proposed a fund to boost investment and encouraging the use of plastics in areas like packaging and farming wasn’t taken forward. However, India’s big three state refiners, IOC, BPCL and HPCL already plan to spend about $35 billion to boost their petrochemicals business.

The Supreme Court held that the process of bottling of LPG cylinders meant for domestic use is an activity which amounts to ‘production’ and ‘manufacturing’ and is liable for income tax deductions. The apex court also accepted the views expressed by various high courts from time to time that bottling of gas into cylinder amounts to production and liable for claim of deduction under Sections 80HH, 80-I and 80-IA of Income Tax Act. The Income Tax Appellate Tribunal order, which was also affirmed by the high courts, has held that LPG produced in the refineries cannot be directly supplied to households without bottling of the LPG into the cylinders and insofar as LPG bottling is concerned, it is a complex activity, which can only be carried out by experts. The apex court noted that after the bottling activities at the plants, LPG is stored in cylinders in liquefied form under pressure and when the cylinder valve is opened and the gas is withdrawn from the cylinder, the pressure falls and the liquid boils to return to gaseous state. The court said that it is apparent that the LPG obtained from the refinery undergoes a “complex technical process” in the assessees’ plants and is clearly distinguishable from the LPG bottled in cylinders and cleared from these plants for domestic use by customers.

Home-delivery of petrol and diesel will be a reality soon with the government-owned fuel retailers in advanced talks with PESO on formulation of safety norms and issuance of licenses. ANB Fuels, under the brand MyPetrolPump, had launched first-of-its-kind home delivery of diesel in Bengaluru with three delivery vehicles in June. The company had to suspend its operation within four days of its launch due to a circular issued by PESO to oil companies directing it not to supply fuel to the start-up citing safety reasons.

The government has taken further steps to gradually reduce subsidy on kerosene, continuing the series of market-oriented reforms that have galvanised the petroleum sector and attracted big-ticket investment after an era of excessive controls, controversies and untargeted subsidies that made it difficult for private companies to operate. In a recent communication, it has asked state oil companies to keep raising prices of subsidised kerosene by 25 paise every fortnight until the subsidy is eliminated, or until further orders. The oil ministry had earlier ordered a similar increase only up to July this year. The fuel is still heavily subsidised but demand for kerosene is falling sharply because villages are being rapidly electrified and the government has supplied cooking gas connections to crores of poor people in the past three years. Delhi and Chandigarh are already kerosene-free cities. Subsidised kerosene is also misused to adulterate diesel. After diesel and LPG, government to now end subsidy on kerosene. The price of cooking gas is also being increased gradually to eventually align it with market rates. The government has been aggressively discouraging use of subsidised kerosene, mainly used by the rural poor for lighting and cooking, as it is a polluting fuel and sometimes ends up as an adulterant at petrol pumps. By cutting subsidies, the government is bringing the commodity closer to the market price, which will eventually stop diversion for adulteration as well as encourage consumers to switch to the cleaner LPG. Kerosene and cooking gas are the only fuels currently subsidised by the government.

The government’s latest move to increase subsidized LPG prices by ₹ 4/cylinder/month is a major positive move and would lead to savings of the order of ₹ 30 billion annually, according to research and ratings firm ICRA. The OMCs have been allowed to hike the prices till the reduction of government subsidy to nil or till March 2018 or till further orders. As per the existing under-recovery sharing formula, the centre bears the domestic LPG subsidy up to ₹ 18/Kg (around ₹ 255/cylinder) under the Direct Benefit Transfer for LPG (DBTL). For the month of July 2017, the subsidy on domestic LPG was ₹ 86.5/cylinder, which is lower than the threshold level of ₹ 255/cylinder due to low international prices and regular retail price increase in the recent past, providing comfort to PSU oil companies. As domestic LPG under-recoveries up to ₹ 255/cylinder are expected to be borne by the centre, the major benefit from the fall in GURs on domestic LPG would accrue to the government. Also, the benefit of lower GURs due to the move would increase with the rise in subsidised LPG consumption volumes, which has consistently shown double digit growth over the last few years due to various promotional initiatives by the centre. As the centre aims to deregulate LPG prices by reducing subsidy level to nil, the risk related to material under-recovery burden on OMCs or PSU upstream companies in a high crude price scenario has reduced significantly, which is a major positive for PSU oil companies in case oil prices increase beyond $65 per barrel over the long term. The step to gradually increase subsidised LPG prices is a positive move for the OMCs as they would gain from the marginal savings on interest burden due to lower GURs. Besides, the domestic LPG subsidy was expected to touch the threshold level of ₹ 255/cylinder at an Indian Basket crude oil price of $65 per barrel and beyond that level of crude oil prices either consumers or upstream or downstream oil companies would have borne GURs on domestic LPG.

Mjunction services limited, one of the country’s largest e-commerce companies and a 50:50 joint venture between Steel Authority of India Ltd and Tata Steel, has been appointed by the DGH to build a platform for e-bidding, e-evaluation of bids, and e-allocation of O&G fields. This will enable transparent allocation of natural resources, and help reduce the country’s oil import bill by $8 billion annually, mjunction said. DGH is the nodal agency under the oil ministry for allocation of O&G fields to interested bidders for exploration and production activities. mjunction will customise its e-bidding software to provide facilities to electronically receive and evaluate bids and to automatically allocate O&G fields under the HELP framework, which was introduced in 2015. HELP replaced the 18-year-old NELP, and is expected to remove its various limitations which led to inefficiencies in exploiting natural resources.

Rest of the World

World oil demand will grow more than expected this year, helping to ease a global glut despite rising production from North America and weak OPEC compliance with output cuts, the IEA said. The agency raised its 2017 demand growth forecast to 1.5 mbpd from 1.4 mbpd in its previous monthly report and said it expected demand to expand by a further 1.4 mbpd next year. The OPEC is curbing output by about 1.2 mbpd, while Russia and other non-OPEC producers are cutting a further 600,000 bpd until March 2018 to help support oil prices. The IEA said OPEC’s compliance with the cuts in July had fallen to 75 percent, the lowest since the cuts began in January. The IEA also revised historic demand data for 2015-2016 for developing countries, cutting it by 0.2-0.4 mbpd. As a result of those historic revisions, the IEA cut baseline demand figures for 2017-2018 by around 0.3-0.4 mbpd and hence lowered demand for OPEC crude by the same amount.

OPEC oil output has risen this month by 90,000 bpd to a 2017 high, a survey found, led by a further recovery in supply from Libya, one of the countries exempt from a production-cutting deal. A dip in supply from Saudi Arabia and lower Angolan exports helped to boost OPEC’s adherence to its supply curbs to 84 percent. While this is up from a revised 77 percent in June, compliance in both months has fallen from levels above 90 percent earlier in the year. The extra oil from Libya means supply by the 13 OPEC members originally part of the deal has risen far above their implied production target. Libya and Nigeria were exempt from the cuts because conflict had curbed their production. As part of a deal with Russia and other non-members, the OPEC is reducing output by about 1.2 mbpd from January 1, 2017 until March next year.

Saudi Arabia wants to do more to boost crude oil prices by taking a razor to its exports, but the kingdom is already doing much of the heavy lifting in Asia, where it is surrendering market share in the world’s top importing region. Saudi Arabia would limit crude oil exports to 6.6 mbpd in August, almost 1 mbpd below levels a year ago. This commitment is belated recognition that OPEC and its non-OPEC allies, including Russia, have to do more than just comply with their November agreement to cut output by a combined 1.8 mbpd. For the output restrictions to work by draining global oil inventories, the producers will also have to curb exports. Vessel-tracking data and other service providers suggest that cuts to exports in the first half of 2017 by OPEC and its non-OPEC allies haven’t matched the reductions in stated output. However, data from Asia’s top two oil importers, China and India, show that Saudi Arabia is already taking much of the pain by cutting the amount of crude it supplies. China imported the equivalent of 8.56 mbpd of crude in the first half of 2017, up 13.8 percent on the same period a year earlier, according to calculations based on customs data. Of this Saudi Arabia supplied 1.07 mbpd, a gain of just 0.5 percent over the first half of 2016. This meant that Saudi Arabia, which was China’s top supplier in 2015 and was only just pipped by Russia last year, has now slipped to third. Russia supplied 1.18 mbpd in the first half, an increase of 11.3 percent from a year ago that saw it maintain its top position, while Angola leapfrogged into the second spot with 1.09 mbpd, a jump of 22 percent from the first half of 2016. Both Russia and Angola are party to the agreement to restrict output, as is Iraq, which boosted its supplies to China by 5.6 percent in the first half to about 720,000 bpd, becoming the fourth-largest source of oil imports.

Global oil demand could peak as early as 2024 if there are more efficiency gains in vehicles, greater market penetration by electric cars, lower economic growth and higher fuel prices, Goldman Sachs said in a research note on refining. Economic expansion in emerging markets may stave off reaching a peak until 2030, although demand growth will still slow over the next decade given improving mileage in cars and trucks and the greater use of electric vehicles, research analysts from the investment bank said. The global electric fleet, for instance, is expected to grow more than 40-fold to 83 million vehicles by 2030, from 2 million in 2016, the researchers said in the note. Goldman Sachs projects annual oil demand growth between 2017 and 2022 at 1.2 percent, slowing to 0.7 percent by 2025 and to 0.4 percent in 2030. Oil demand grew by an annual average rate of 1.6 percent over 2011 to 2016. Over the period to 2030, the transport sector will contribute less to oil demand growth. Petrochemicals will instead become more central, although with more feedstock coming from outside the refining system, such as from natural gas liquids, refiners’ share in oil demand will fall, they said. The analysts also said there will likely be a surplus of refined oil products for the next five years due to higher capacity additions and slowing demand growth, implying lower global utilization rates and poorer margins. The impending 2020 global sulphur limit set by the IMO on high sulphur fuel oil is also expected to reshape the refining industry, the bank’s analysts said. If fully implemented, the limit will boost diesel demand and widen the sweet-sour crude differential, which is positive for the profitability of complex refineries, they said. Meanwhile, jet fuel and LPG are gaining market share at the expense of products like fuel oil. Demand growth for LPG, fastest among all oil products, is being driven by petrochemicals and use in India as a cooking fuel in homes, the analysts said. The share held by gasoline and diesel in the overall oil demand mix between 2016 and 2030 will stagnate, they said.

The US is considering financial sanctions on Venezuela that would halt dollar payments for the country’s oil. The move could severely restrict the OPEC nation’s crude exports and starve its socialist government of hard currency. Sanctions prohibiting any transaction in US currency by Venezuela’s state-run oil firm, PDVSA, are among the toughest of various oil-related measures under discussion at the White House. The US measures under discussion are similar to those that were imposed against Iran over its nuclear program – which halved Iran’s oil exports and prevented top crude buyers from paying for Iranian oil. The US bought 780,000 bpd of Venezuelan crude and refined products in the first four months of 2017, according to the Energy Information Administration, nearly 8 percent of total imports. PDVSA is a major supplier to Valero Energy, Phillips 66, Chevron Corp and PBF Energy. PDVSA’s cash flow has plummeted in recent years, in part due to the Venezuelan government’s deals to barter its oil to other nations in exchange for fuels, services and loans.

Asia would be the biggest beneficiary of any potential sanctions by US on Venezuela’s oil sector, traders and analysts said, as exports from the South American OPEC member could be redirected to the region, filling a vacuum left by producer supply cuts. An embargo against Venezuelan crude could block imports of about 740,000 bpd to the US. Asian refiners would welcome the so-called heavy, or higher density, crude since production cuts by the OPEC have mainly curtailed this type of oil. At the same time, the start-up of new refining capacity is boosting demand. China and India, the two biggest buyers of Venezuelan crude after the US, have room to increase imports while other north Asian refiners, with equipment sophisticated enough to handle heavy Venezuelan oil, are seeking opportunities to tap this supply, analysts and traders said. In the first quarter of 2017, Venezuela delivered to Chinese companies about 485,000 bpd of crude and oil products to repay loans extended since 2007, according to internal documents from state-run oil company PDVSA. Russian oil firms Rosneft and Lukoil are also receiving about 250,000 bpd to repay loans, according to the PDVSA. PDVSA has cut sales to US refining unit Citgo Petroleum since May to increase its supply to Rosneft in order to catch up on overdue Russian deliveries.

Tankers carrying LPG are floating off Singapore for the first time this year as traders wait for opportunities to offload the fuel at more lucrative prices. At least one VLGC, the Pacific Binzhou, is anchored in Singapore carrying LPG, shipping data showed. The ship docked more than five days ago. One other VLGC had recently left for China after anchoring off Singapore for some time, but this could not be independently verified. LPG supply is not as excessive as last year, trade sources said, due to demand from India and China this year. In August last year, more than 10 ships were holding LPG – whose uses include heating, cooking and petrochemicals production – off Singapore for months before they could find buyers in winter. There is less incentives to store LPG this year as the contango is not more than $2 versus last year when it was more than $15, traders said.

The EIA said it expects US crude oil production in 2018 to rise by less than previously expected. The agency forecast that 2018 crude oil output will rise by 560,000 bpd to 9.91 mbpd. Last month, it expected a 570,000 bpd year-over-year increase to 9.9 mbpd. For 2017, it forecast a rise of 500,000 bpd to 9.35 mbpd. Last month, it expected a 460,000 bpd increase to 9.33 mbpd, according to the EIA. Meanwhile, the agency forecast that US oil demand for 2017 is set to grow by 340,000 bpd compared with a 310,000 bpd previously. For 2018, oil demand is expected to rise by 330,000 bpd vs 360,000 bpd previously.

World trade is growing again which will give a big boost to middle distillates such as diesel used in the high-power engines that move almost all freight. World trade volumes grew by 5 percent in the three months to May compared with the same period a year earlier, according to the Netherlands Bureau for Economic Policy Analysis (CPB). Trade growth came close to a standstill in the first quarter of 2016 but has been accelerating gradually since then especially from the fourth quarter onwards. Volumes are now rising at the fastest rate for six years though growth is still comparatively slow in historical terms. Growth has accelerated in all regions, with the exception of Africa and the Middle East, where economic activity is still depressed owing to low oil prices.

Oil price agency S&P Global Platts is mulling changes to its Singapore gasoline price assessments ahead of more stringent fuel standards being considered in Malaysia and Indonesia. Platts, a unit of S&P Global Inc, said it is reviewing the specifications of its assessments for free-on-board Singapore gasoline 92-octane, 95-octane and 97-octane. Malaysia is targeting October 1, 2018, to implement Euro 4M gasoline specifications for its 95-octane gasoline that would limit sulfur to 50 ppm from the current 500 ppm, Platts said. Asia’s top gasoline importer Indonesia is expected to move to Euro 4 gasoline specifications from Euro 2 by October 2018, the pricing agency said. That would also limit sulfur to a maximum of 50 ppm. Implementation in Indonesia, however, could take longer as state-owned Pertamina said in June that it plans to delay some refinery upgrades and a new project due to financing issues. Platts last made changes to gasoline specifications in July of last year. The company is requesting for feedback from its clients by September 29.

Russia’s attempts to establish a futures market for its flagship Urals oil grade are faltering due to lack of support from international trading houses and the scarcity of oil on offer. Russia launched trading of a futures contract for Urals oil URL-E in Moscow in November, to secure greater prominence for its export blend. But the taxation and clearing process have not been fully thought through. Russia had long called for the creation of a Urals futures contract, because Urals is sold at a discount to benchmark Brent crude. For Western trading houses, it is much easier to buy oil directly from producers via tenders or pre-financing operations, which often promise discounts and guaranteed volumes. Vitol, Glencore and Trafigura are key global oil traders working on the Russian market, taking more than half of Urals’ seaborne export volumes from Russia. The Urals’ futures market was launched at a time when Russia has been the target of economic sanctions imposed by United States and European Union over its actions in eastern Ukraine, although oil trading is not under sanctions.

PetroChina is unloading the first Chinese purchase of crude oil from US strategic petroleum reserves at a port in eastern China, according to shipping data. The move comes as China, the world’s No.2 oil consumer, steps up imports from the Americas to diversify supply sources. PetroChina unit, PetroChina International America Inc, bought the 550,000 barrel cargo of Bryan Mound sour crude in a sale from US strategic petroleum reserves in March for $28.8 million. Supertanker Cosrising Lake, chartered by PetroChina, is unloading the US oil at Qingdao port in Shandong province, shipping data showed. PetroChina is one of the key players moving Americas crude to Asia. It recently sold India that country’s first US crude import via an Indian Oil Corp tender.

NATIONAL: OIL

ONGC board gives approval to acquire 51.11 percent stake in HPCL

August 22, 2017. Oil and Natural Gas Corp (ONGC) board gave ‘in-principle’ approval to acquire government’s 51.11 percent stake in Hindustan Petroleum Corp Ltd (HPCL), the company said. The board at its meeting constituted a committee of directors to “examine various aspects” of the acquisition and “to provide its recommendations to the board of directors”, it said. The government had approved sale of its 51.11 percent stake in oil refiner HPCL to India’s largest oil producer ONGC. Prior to the merger, HPCL is likely to take over Mangalore Refinery and Petrochemicals Ltd (MRPL) to bring all the refining assets of ONGC under one unit. ONGC currently owns 71.63 percent of MRPL while HPCL has 16.96 percent stake in it. ONGC will not have to make an open offer to minority shareholders of HPCL as the government’s holding is being transferred to another state-run firm and the ownership isn’t changing. The deal will be completed within a year. HPCL will become a subsidiary of ONGC and will remain a listed company post the acquisition, the source said adding the board of the refining and marketing company will continue to remain in place. The government has also constituted a committee — headed by Finance Minister Arun Jaitley and comprising Oil Minister Dharmendra Pradhan and Road Minister Nitin Gadkari to work out the modalities of the sale. Jaitley had in his Budget for 2017-18 talked about creating an integrated oil behemoth. After that oil companies were asked to give their options. ONGC had evaluated options of acquiring either HPCL or BPCL — the two downstream oil refining and fuel marketing companies. It found the nation’s second-biggest fuel retailer BPCL too expensive and conveyed its choice to the parent oil ministry. The transaction is likely to be completed within this fiscal year. HPCL will add 23.8 million tonnes of annual oil refining capacity to ONGC’s portfolio, making it the third-largest refiner in the country after IOC and Reliance Industries Ltd (RIL).

Source: The Economic Times

Cairn adds another $249 mn to compensation claim from India

August 22, 2017. British oil explorer Cairn Energy plc has added another $249 million to the compensation it is claiming from India after the government set off a tax refund due to it to settle part of a retrospective tax demand. Cairn had before an international arbitration tribunal in July last year sought $5.6 billion in compensation from the Indian government for raising a retrospective tax demand of Rs 10,247 crore on a decade old internal reorganisation of its India unit. In its half-year financial and operations statement, the company said the government had raised Rs 18,800 crore as interest on the principal tax demand. To recover this, the tax department “seized” $104.7 million of dividend income due to it from Vedanta Ltd, where it holds about 5 percent stake, Cairn said. The company said based on detailed legal advice, it is confident that it will be successful in such arbitration.

Source: The Times of India

India’s Essar Oil refinery to double throughput: Rosneft

August 21, 2017. India’s Essar Oil plans to double the throughput of its refinery and create a petrochemical facility in the long-term, Russia’s largest oil producer Rosneft said. Rosneft, which bought a 49 percent stake in Essar Oil, said that Essar will increase the number of filling stations to 5,500 from current 3,500 stations in the medium term. The deal will give Rosneft and its partners control over the 400,000 barrels per day Vadinar refinery in India.

Source: Reuters

BPCL lines up Rs 180 bn for refinery expansion

August 21, 2017. Bharat Petroleum Corp Ltd (BPCL) is set to invest at least Rs 18,000 crore on expansion of its refineries in the next five years, in order to add another 19 million tonne (mt) refining capacity. This will be part of the company’s overall road map to spend Rs 1.08 lakh crore till 2021-22. As part of the expansion, the company is planning to have at least 15 mt capacity in each of its refineries, including Mumbai, Kochi and Bina (Madhya Pradesh). It also plans to expand capacity of the Numaligarh refinery in Assam from 3 mt to 9 mt per annum. The company also has retail expansion plans of adding more than 1,000 outlets a year. BPCL is the third-largest crude refiner and marketer of petroleum products in India. While it has more refining capacity than its close competitor Hindustan Petroleum Corp Ltd (HPCL), its retail outlets are lesser than it. Of the total 59,595 fuel retail outlets in India, Indian Oil Corp (IOC), HPCL and BPCL run more than 54,000. Of this, the share of BPCL comes to about 14,000.

Source: Business Standard

West Bengal, northeast to have IOC’s jumbo 450 kg LPG pack this financial year

August 18, 2017. Indian Oil Corp (IOC) is going to launch its 450 kg jumbo pack of liquefied petroleum gas (LPG) in entire West Bengal this financial year keeping bulk consumers as target buyers. After introducing couple of months back in Coimbatore, IOC has given the jumbo pack ‘Mini-Bulk,’ to few buyers at Kolkata metro area as test cases. As the plan goes, after refilling at IOC’s Budge-Budge bottling plant at south Bengal, the mini bulk pack will be transported to the buyers in entire state. According to the IOC, ‘Mini-Bulk’ is an alternative to usual multi cylinder chain set up commonly used by high volume consumers like big hotels, housing complexes, shopping malls etc. At present priced around 23,296 per pack at Coimbatore, this 450 kg pack brings better pricing and convenience option to these buyers. However, they agreed that existing ‘Bullet,’ a captive storage cylinder of few thousand kg at the buyer’s premises that gets filled up on spot by IOC’s mobile LPG carrier, is more economical. After its introduction in 1970, IOC’s LPG, under brand name Indane, has become prime fuel in near 10 crore Indian household. Beside its compact 5kg pack for rural, hilly and inaccessible areas, Indane has 14.2 kg, 19 kg and 47.5 kg packs for common users and Bullet for heavy users. In addition, now 450 kg is there for intermediary consumers. IOC rolls out two million cylinders a day through its over 90 bottling plants throughout the country that makes it world’s second largest LPG marketer.

Source: The Economic Times

Odisha CM and Oil Minister Dharmendra Pradhan meet on oil refinery tax dispute

August 18, 2017. The scheduled meeting between Odisha Chief Minister (CM) Naveen Patnaik and Union Oil Minister Dharmendra Pradhan at New Delhi has not only fuelled speculation over its political implications in Odisha, but also given rise to expectations of a solution to the tax dispute between the State Government and Indian Oil Corp (IOC) over the Paradip refinery. The State Government and IOC had signed a Memorandum of Understanding (MoU) on February 16, 2004 for setting up an oil refinery at Paradip. One of the conditions in the MoU was the deferred VAT (Value Added Tax) payment for 11 years on sale of products of Paradip oil refinery. Paradip Oil Refinery, which started its production from September 22, 2015, had collected VAT amounting to Rs 1,485 crore by selling its products in Odisha till December, 2016. The State Government had issued a demand note of Rs 1,485 crore to IOC on February 27 and directed to repay the same after serving a notice. The IOC had challenged State Government order in the Orissa High Court. A division bench of the High Court on March 16, 2017, had kept the demand notice of the State Government in abeyance and directed the working group comprising officials from the State Government, Petroleum Ministry and IOC to resolve the issue.

Source: The New Indian Express

Finance Minister urges states to reduce VAT on petroleum products used for making goods

August 18, 2017. Finance Minister Arun Jaitley urged state governments to reduce Value Added Tax (VAT) on petroleum products used for making goods which attract Goods and Service Tax (GST). The move is aimed at easing tax burden on manufacturing sectors using petroleum products. The GST regime rolled out on 1 July excludes crude oil, natural gas, petrol, diesel and jet fuel while other products such as kerosene, liquefied petroleum gas and naphtha are included in GST. In the pre-GST regime, both petroleum products and final goods produced attracted VAT and hence input tax credit of petroleum products used as inputs by manufacturers was allowed to varying extent by different states. However, in the post-GST regime, the manufactured goods attract GST while the inputs of petroleum products like natural gas, petrol and diesel used in manufacturing of the products attract VAT which leads to stranded taxes and cascading of taxes.

Source: The Economic Times

Crude oil shipment opens new vistas in India-US relationship

August 17, 2017. The first shipment of American crude oil+ is likely to reach India in the last week of September, opening new vistas in the Indo-US ties. With this India, the world’s third-largest oil importer, joins Asian countries like South Korea, Japan and China to buy American crude after production cuts by OPEC (Organization of the Petroleum Exporting Countries) drove up prices of Middle East heavy-sour crude, or grades with a high sulphur content. The first lot of two million barrels costs $100 million, but given the volume being contemplated by Indian companies, this new development is expected to boost the bilateral oil trade to $2 billion. Consignments of American crude oil left the Unites States (US) shores between August 6-14 and is likely to reach Paradip (Odisha) in the last week of September. While the 40-year-old ban on export of American oil was lifted by the then US President Barack Obama in December 2015, the real move started during the maiden meeting between Prime Minister Narendra Modi and US President Donald Trump on June 26 when the two leaders agreed to deepen the engagement in the energy sector. Soon thereafter, Indian companies started purchasing crude from the US. Two Indian oil giants, Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL), placed orders for over four million barrels. The development was welcomed by Trump in his phone call with Modi. IOC said that buying US crude has become attractive for Indian refiners after the differential between Brent (the benchmark crude or marker crude that serves as a reference price for buyers in western world) and Dubai (which serves as a benchmark for countries in the east) has narrowed. Even after including the shipping cost, buying US crude is cost competitive to Indian refiners, IOC said. Over the next 20 years, India’s energy consumption growth is projected to be the fastest among all major economies. And by 2035, China and India will have the largest share of global demand (35 percent). While this is the first crude oil import from the US, Indian companies have made significant investment in purchasing energy assets in the US. Four Indian public and private sector companies have invested approximately $ 5 billion in shale assets in the US. Indian companies have also contracted 9 million metric tonnes per annum (mmtpa) of LNG from the US and the first shipment is expected in Jan 2018. Of this, GAIL has contracted 5.8 mmtpa, including 3.5 mmtpa of LNG from Sabine Pass Liquefaction terminal (Louisiana) and 2.3 mmtpa from Cove Point LNG liquefaction project (Maryland).

Source: The Times of India

NATIONAL: GAS

GAIL in 3 time-swap deal for US LNG

August 22, 2017. GAIL (India) Ltd has signed three time-swap deals to sell some of its US (United States) liquefied natural gas (LNG) as it rejigs the supply portfolio in line with domestic demand. Under the deals, the company will buy LNG from international companies this year and sell equivalent amount of Henry Hub-indexed volumes during 2018-19, GAIL said. It is also seeking destination swaps to cut shipping costs of US LNG. GAIL has a deal to buy 3.5 million tonnes a year of LNG for 20 years from Cheniere Energy of US and has also booked capacity for another 2.3 million tonnes at Dominion Energy’s Cove Point liquefaction plant. The company said it had contracted LNG from US to meet the demand of growing Indian economy with power sector being considered as a major buyer. But electricity produced using imported LNG is not finding buyers due to cheaper alternatives including renewables, leading to stranding of significant capacity out of 25,000 MW of installed gas based power plants. Under the agreement, it will get 15 cargoes or about 0.8 million tonnes of LNG from an unnamed trader this year. In return, GAIL will sell 10 cargoes or about 0.6 million tonnes next year from Sabine Pass on the US Gulf coast. GAIL had separately signed a deal with Royal Dutch Shell to sell about 0.5 million tonnes of its US LNG. The LNG that GAIL will receive this year between April and December under the time-swap deal will be at oil-linked prices. The sale of US gas next year will be at a premium to its pricing formula on a free-on-board (FOB) basis. GAIL said it is trying to market LNG to anchor customers such as refineries, steel plans along planned and existing pipelines. It is also in talks to supply LNG to new fertiliser plans and expect firm agreements in 2017.

Source: The Times of India

India to seek investments for O&G auctions at mega hydrocarbon event in UK

August 18, 2017. The government will seek global investor participation for its ongoing mega oil and gas (O&G) auction during the international Society of Petroleum Engineers (SPE) Offshore Europe conference to take place in Aberdeen, UK (United Kingdom) next month. The four day-conference that will begin on 5 September will include technical sessions, conferences, workshops, exhibitions from industry players across the value chain of the O&G sector and include a special event by the Indian government on Open Acreage Licensing Programme (OALP), National Data Repository (NDR) and the latest investment opportunities in the Indian O&G sector. Oil Minister Dharmendra Pradhan had called upon the global investor community to participate in India’s current O&G bidding round at the World Petroleum Congress (WPC) held in Istanbul, Turkey last month. The move by the government has the potential to attract investors in the auction which has already received over 45 Expression of Interest (EoI) in more than a month, according to Directorate General of Hydrocarbons (DGH). The oil ministry is offering over 85 percent of the country’s 3.14 million square kilometres of hydrocarbon sedimentary area under the new bidding mechanism of OALP and a revamped exploration policy HELP (Hydrocarbon Exploration & Licensing Policy). The new OALP bidding mechanism under HELP allows investors to bid for acreages throughout the year. The current auction under HELP follows the just-concluded Discovered Small Fields (DSF) bidding rounds under which 31 blocks were awarded to around two dozen mostly small-sized firms.

Source: The Economic Times

Petronas eyeing stake in Indian LNG import terminal: IOC

August 16, 2017. Malaysian state oil firm Petroliam Nasional Berhad (Petronas) is looking to buy a stake in Indian Oil Corp (IOC)’s Ennore liquefied natural gas (LNG) import terminal, IOC said. IOC aims to start operating the 5 million tonnes a year terminal in the southern state of Tamil Nadu in 2018-19. Petronas sees significant growth potential for LNG sales to India, Pakistan, Bangladesh and some parts of Southeast Asia. India has plans to raise its annual LNG import capacity to 50 million tonnes in the next few years from 21 million tonnes now.

Source: Reuters

NATIONAL: COAL

NTPC to secure 33 percent of coal requirements from own mines by 2030

August 21, 2017. NTPC Ltd plans to secure around a third of its coal requirement through its own captive coal blocks by 2030, the company said. NTPC has been allotted 10 coal blocks with a peak production capacity of more than 100 million tonnes per annum. With these, the company envisages being one of the largest captive coal mining companies in India. As per its long term corporate plan, NTPC has envisioned to reach a total installed capacity of 130 GW and annual generation of more than 600 billion units by 2032.

Source: The Economic Times

India’s coal imports declined 6.3 percent to 192 mt last financial year

August 20, 2017. Import of coal saw a decline of 6.37 percent to 191.95 million tonnes (mt) in 2016-17 on higher production by Coal India Ltd (CIL) that saw the country move to a regime of surplus coal. Comparatively, in 2015-16 fiscal, coal imports stood at 203.95 mt, as per official data by the government. As against the demand of 884.87 mt of coal, the total domestic production stood at 659.27 mt. The Centre has announced plans to boost CIL’s annual production to the level of 1 billion tonnes by 2019 to meet the growing fuel demand. Under the provisions of the Coal Mines (Special Provisional) Act, 2015, 30 mines have been allocated to private sector companies by way of auction for specified end uses till date. The ongoing fiscal also shows a declining trend, especially of thermal coal. Thermal and steam coal imports have fallen 17.37 percent at the top 12 major ports to 29.82 mt during April-July this fiscal, according to the Indian Ports Association (IPA). The ports, under the control of the Centre, had handled 36.09 mt of thermal and steam coal during the same period of the previous fiscal. Thermal coal is the mainstay of India’s energy programme as 70 percent of power generation is dependent on the dry fuel. Handling of coking coal, used mainly in steel-making, has also dipped 4.45 percent to 16.51 mt, as per the latest data released by the IPA. These ports had handled 17.27 mt of coking coal in April-July period of 2016-17. Together, they handled 46.33 mt coal during April-July this fiscal as against 53.36 mt in the same period of the previous year. India is the third-largest producer of coal after China and the United States (US) and has 299 billion tonnes of resources and 123 billion tonnes of proven reserves, which may last for over 100 years. The country has 12 major ports – Kandla, Mumbai, JNPT, Marmugao, New Mangalore, Cochin, Chennai, Ennore, V.O. Chidambarnar, Visakhapatnam, Paradip and Kolkata (including Haldia) which handle approximately 65 percent of the country’s total cargo traffic.

Source: The Economic Times

No trace of trapped CCL miners

August 19, 2017. Two workers of the Central Coalfields Ltd (CCL) — Ashok Sinha and Pravesh Nonia — are still trapped in the Barka-Sayal underground mine, after a large quantity of water seeped into the underground mine. The rescue teams of CCL, Bharat Coking Coal Ltd (BCCL) and Eastern Coalfields Ltd continued with their search operations in the to track the missing workers. The CCL authorities has set up a control room with well-equipped communication system at the site to coordinate with the rescue teams and other experts deployed inside the mine for relief and rescue operations.

Source: The Times of India

Completion of key rail link projects to improve coal supplies from next fiscal

August 16, 2017. Coal supplies will improve significantly beginning 2018, riding on the completion of key rail projects in Odisha, Chhattisgarh, Madhya Pradesh, Uttar Pradesh and Jharkhand. In Odisha, the Coal India Ltd (CIL)-financed 53.5 km Jharsuguda-Barapali rail link is expected to be ready by December; paving the way for moving nearly 80 million tonnes of additional fuel from the vast Ib Valley reserves in Sundergarh district. The Railways is on course to resuming work on the 30 km Talcher-Angul loopline to pace up supplies from the

Talcher coalfields. The project has been stalled the last five years due to land acquisition issues for a 3 km stretch. The Railways has finally made some headway in land acquisition. The project is now expected to be completed next year. The loopline will help circular movement of rakes, thereby increasing the pace of evacuation from Talcher by 50-60 percent. CIL now despatches 30-35 rakes a day from Talcher. The loopline is expected to increase this to 50 rakes a day. According to CIL, construction is apace and should link up the opencast mines at Chhal and Baroud by next year, adding approximately 20 million tonnes to the miner’s annual throughput. This line is to be extended to the prolific Gare Palma coalfields. The coal ministry has asked the Railways to double the 25 km single-line connectivity between Shakti Nagar in UP and Karela in MP. Karela is located on the Katni-Chopan line connecting eastern India with the North. This will help improve supplies by approximately 30 million tonnes annually from Northern Coalfields, a subsidiary of CIL.

Source: The Hindu Business Line

62 ongoing coal projects delayed: CIL

August 16, 2017. Coal India Ltd (CIL) said that 62 coal projects, out of 120 ongoing projects, were not running on schedule mainly due to delay in obtaining forest clearances, acquiring land and issues related to rehabilitation and resettlement (R&R). Out of 71 non mining projects, 27 are delayed, CIL said. As many as eight coal mining projects for an ultimate capacity of 56.25 million tonnes per year and a total capital investment of Rs 8,931.05 crore have been sanctioned by CIL board during the last financial year.

Source: Business Standard

NATIONAL: POWER

UP power shortage adds to humidity woes

August 19, 2017. Uttar Pradesh (UP) is facing an acute shortage of power as the demand for electricity has peaked due to humid conditions. The power demand has touched a high of 20,275 MW while the maximum availability for now is 17,700 MW, leaving a gap of 2,575 MW. The UP Power Corp Ltd (UPPCL) have blamed the huge demand for power on the dry spell in some areas and high humidity levels. Another major reason for power disruption are the heavy rains occurring in the hill state of Uttarakhand, from where many hydro-power projects supply electricity to the state. Technical glitch has hit the production at Bara, two units of the four at Roza power plant are also dysfunctional. The power crisis comes at a time when the UPPCL claims to have purchased a record 360.9 million units in August against 296.5 million units last year in the same month. Engineers however point out that power cuts were averaging three to four hours in the cities and villages were getting only 15 hour power supply and the cities 17 hours.

Source: The Economic Times

GMR finds buyer for its barge-mounted power plant for $63 mn

August 18, 2017. The GMR Group, which owns a 220 MW gas based power plant in Andhra Pradesh’s Kakinada, will sell its barge-mounted power plant to a buyer for $63 million. GMR Energy Ltd (GEL) will enter into a definitive agreement with the buyer soon. According to GMR, the plant is operational since November 2001 and redeployed at Kakinada since April 2010. The company is exploring various commercial options for the plant, which did not generate power since 2013 due to shortage of natural gas. According to the latest investor presentation of GMR Infrastructure, said the project cost of the plant was $90 million (Rs 600 crore).

Source: The Times of India

Power Grid inks $500 mn loan pact with ADB

August 18, 2017. State-run power transmission utility Power Grid Corp said it will get a loan of $500 million from the Asian Development Bank (ADB) for its various projects. According to the Power Grid, the proceeds of the loan are proposed to be utilised for funding of Green Energy Corridor (Part D); 800 kilovolt High Voltage Direct Current (HVDC) bipole link between Western Region (Raigarh, Chhattisgarh) and Southern Region (Pugalur, Tamil Nadu) and 320 kilovolt HDVC link between Pugalur and North Trichur (Kerala).

Source: The Hindu Business Line

India enters global smart-meter race to fight utility losses

August 17, 2017. India is aiming to help its ailing power distribution companies by buying five million smart meters for two of its northern states in a global tender to be conducted later this month. Energy Efficiency Services Ltd (EESL), the government agency responsible for running the country’s energy efficiency programs, will conduct the tender, Managing Director Saurabh Kumar said. “This is a pilot project where four million smart meters will go to Uttar Pradesh and the rest to Haryana,” Kumar said. If successful, the program could be adopted by a large number of states, he said. For India, smart meters represent a possible game-changer by handing power distribution companies the ability to address billing inefficiencies that have contributed to their losses and debt burden. A smart-meter is an electronic device that records electricity consumption at short intervals and communicates it back to a utility for monitoring and billing. Most of India’s power distribution companies (discoms) lose money on every unit of power sold due in part to theft, inadequate billing and selling below cost to poor and agricultural consumers. State-run distributors held combined debt of 4.3 trillion rupees ($67 billion) as of September 2015, the latest year of available data. The debt levels limit their ability to adequately meet the power demands of existing customers or add new consumers in a country where millions of households don’t have electricity, but where power plants also remain underutilized. The average technical and commercial losses at discoms in 24 states who’ve signed up under a reform plan currently stand at 21 percent, according to the government. Last year, the Indian government said it’s aiming to outfit approximately 35 million customers with smart meters by the end of 2019.

Source: Bloomberg

Petrol pumps to sell EESL’s energy efficient bulbs, fans

August 16, 2017. Energy efficient appliances will now be sold in fuel retail outlets of Public Sector Oil Marketing Companies (OMCs). The petrol pump dealers will directly do business with Energy Efficiency Services Ltd (EESL) and would get about 10 percent margin, Oil Minister Dharmendra Pradhan said. The scheme will be rolled out at petroleum retail outlets in a phased manner. In the first phase, distribution will commence from Uttar Pradesh and Maharashtra. Consumers can purchase an LED (light emitting diode) Bulb at ₹ 70, a 220 W LED tubelight at ₹ 220 and a 5-star Ceiling Fan at ₹ 1,200. As part of the agreement, EESL will make the entire upfront investment for ensuring availability of the products at the outlets and no upfront capital cost will be borne by the OMCs barring manpower and space. An official statement also said that over 25.5 crore LED bulbs, over 30.6 lakh LED tubelights and around 11.5 lakh energy efficient fans have been retailed in the country under the UJALA scheme. This will lead to an annual energy savings of over 3,340 crore kilowatt hour (kWh) and result in avoidance of over 6,725 MW of peak demand. Through the scheme the estimated cumulative cost reduction in bills of consumers annually is over ₹ 13,346 crore and is leading to reduction of approximately 2.7 crore tonnes of CO2 every year.

Source: The Hindu Business Line

Tamil Nadu cuts power rates for industrial consumers

August 16, 2017. Tamil Nadu has reduced electricity tariffs for industrial and commercial consumers. The Tamil Nadu Electricity Regulatory Commission (TNERC) has brought down cross-subsidy surcharges (CSS) to the range of Rs 1.6-2.5 a unit, the lowest among industrial states. The National Tariff Policy 2016 suggested a new formula for determination of CSS and capped it at 20 percent of the tariff. It also introduced an additional surcharge for these consumers when they shifted to sources other than the state’s distribution companies (discoms). Thus, while states where the industrial rates were low increased tariffs, Tamil Nadu, where commercial consumers were already paying high rates, decided to reduce the burden. CSS is levied by state discoms to recover the cost of supplying subsidised power to a section of the population. In the last financial year, CSS across a dozen states increased 30 percent to 600 percent. In a group captive scheme, one party develops a power plant and many commercial consumers benefit from it. The Commission also did not levy any additional surcharge on industry or increase energy and demand charges.

Source: Business Standard

Indian company wins tender to construct CASA-1000 power project

August 16, 2017. An Indian company has won the tender for construction of 1000 Electricity Transmission and Trade Project for Central Asia and South Asia (CASA). The company, which has won the tender Afghanistan’s Ministry of Water and Energy (MoWE), said it will complete the construction of the project in three years. The construction phase of the project will cost around $404 million, of which 80 percent will be funded by the World Bank and the remaining 20 percent will be paid by the Afghan government, Afghanistan’s Energy and Water Minister Abdul Basir Azimi said. The Casa-1000 project will include a 750 km high voltage direct current (DC) transmission system between Tajikistan and Pakistan via Afghanistan, together with associated converter stations at Sangtuda (1,300 MW), Kabul (300 MW) and Peshawar (1,300 MW). The 477 km 500 kilovolt alternating current facility will run between the Kyrgyz Republic (Datka) and Tajikistan (Khoujand).

Source: The Financial Express

First power utility to use QR code for bill payment: Tata Power

August 16, 2017. Tata Power said it has become the first power utility to introduce a QR code based bill payments system in India. The company said though this functionality of bill payments through a QR code has been introduced in other service industries, it will be launched in the power industry for the first time in India by Tata Power. According to the company, the QR code linked to Unified Payments Interface (UPI) will be printed on the electricity bills. The customers can scan the QR code with BHIM app or any other UPI linked bank app and pay their bills without any hassle, it said. The bill details will be displayed on the app, post which the customer can authorise the payment within a few seconds and his bill will be paid instantaneously. Some of the advantages of QR code service are that the consumer need not visit any Tata Power bill collection/ customer relation centre or any other payment avenues and can make the payment from the comfort of his home/office or on-the-go. Besides, all bill details will be auto captured while scanning the QR code and the consumer has to pay using a single tap on his smartphone. The consumer also need not remember his debit/credit or net banking account and IFSC code details.

Source: India Today

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

IBC SOLAR signs contract with SECI for 20 MW solar plant in Odisha

August 22, 2017. Germany-based solar company IBC SOLAR AG has signed a Power Purchase Agreement (PPA) for a 20 MW solar plant with Solar Energy Corp of India (SECI), a company of the Ministry of New and Renewable Energy, the company said. The project is part of a 270 MW solar power plant tender in the state of Odisha which was assigned to IBC SOLAR through a competitive auction process during 2016. The photovoltaic (PV) system is planned to be put into operation by late 2017, the company said.

Source: The Economic Times

RIL mulls power storage with BP

August 22, 2017. Reliance Industries Ltd (RIL) is considering entering the power-storage business with its partner BP Plc. to expand into the country’s growing renewable energy sector. The companies are considering a plan to set up energy-storage projects near solar- and wind-energy installations. A decision on investment and implementation will be taken by December. The push into power storage dovetails with Prime Minister Narendra Modi’s efforts to boost the country’s reliance on renewable power and set it on track to sell only electric cars by 2030. Global oil majors such as Royal Dutch Shell Plc, Total SA and Exxon Mobil Corp are investing in new-energy technologies to improve electricity grids and develop fuels from renewable resources. RIL has been seeking to enter the business since 2009, when it first announced plans for alternative-energy businesses. RIL and BP in June said they were extending their partnership to sell conventional fuels as well as explore opportunities in clean energy. RIL is planning to sell liquefied natural gas at its fuel-retailing outlets and set up charging stations for electric vehicles. LNG and electric-vehicle charging would be an extension of RIL’s current retail fuel business, though the company hasn’t firmed up a business plan as the market is at a nascent stage. India’s solar-power capacity has surged fourfold since December 2014 to about 13 GW. Wind installations reached almost 33 GW from 22.5 GW over the same period. Modi’s government is seeking an additional 87 GW of solar and 28 GW of wind power by 2022 to expand India’s total renewable capacity to 175 GW.

Source: Bloomberg

Government brings in new norms on solar power procurement

August 22, 2017. The government has implemented new rules for buying power from grid-linked solar power projects through competitive bidding under the National Solar Mission to improve transparency and standardise auctions. These guidelines, prepared by the Ministry of New and Renewable Energy (MNRE), cover the grid-connected solar photovoltaic (PV) power projects with a size of 5 MW and above. The norms provide that the minimum power purchase agreement tenure (PPA) will be 25 years that will help ensure lower tariffs. Besides, unilateral termination or amendment of PPA is not allowed. The new framework also contains provision for force majeure. Now, the PPA would have provisions with regard to force majeure definitions, exclusions, applicability and available relief as per the industry standards.

Source: The Economic Times

Declining air quality due to greenhouse gases biggest global challenge: Goyal

August 22, 2017. Checking the rapid decline in environment quality caused by increasing greenhouse gas emissions globally has perhaps become the most important challenge for humanity, Power, Coal, New and Renewable Energy and Mines Minister Piyush Goyal said. He strongly emphasised the need to further promote clean energy and reduce greenhouse gas emissions, failing which the global economy will slip into deceleration. He said that India is taking steps on the global platform to address the challenge, which include the International Solar Alliance (ISA), the Mission Innovation, global engagements on rapid de-carbonisation of the energy space, the African Renewable Energy initiative and efforts by the G20 energy ministers.

Source: The Economic Times

India to have 155 GW non-hydro renewable capacity by 2026: BMI

August 21, 2017. A Fitch Group Company BMI Research revised upward the non-hydro renewable energy capacity in India to 155 GW from 130 GW by 2026 on the back of higher than expected solar installation and successful wind auctions. This view is underpinned by Prime Minister Narendra Modi’s strong support for renewable energy, including the ambitious targets adopted for sector growth and the policies implemented to encourage developers into the market, it said. Positive developments in the renewables sector over the last six months, specifically in the wind and solar segments, have led us to upwardly revise our non-hydro renewables capacity forecasts, it said. The BMI Research expects wind capacity to total 35.5 GW by end 2017, up from its previous estimate of just over 31 GW. By 2026, it forecasts the Indian wind capacity to reach 68 GW, a revision from its previous forecast of nearly 54 GW. It has revised its solar forecasts upwards, with solar capacity totalling 19.2 GW by end 2017 and 71.5 GW by 2026. This is from a previous 17 GW and 64.7 GW previously, over the same time period.

Source: The Economic Times

CREST resumes installing solar plants

August 20, 2017. Chandigarh Renewal Energy, Science and Technology Promotion Society (CREST) has started the process of installing solar power plants. CREST is going to install rooftop solar power plants (SPV) of total capacity of 2350 kilowatt peak (kWp) at two different locations. The society intends to install an SPV of 1250 kWp at Sector 32 water works at estimated cost of Rs 7.82 crore, while 1100 kWp plant will be installed at Sector 37 water works at a cost of Rs 6.91 crore. CREST has already floated tenders for hiring a firm for installing the solar power plant. Chandigarh has been selected by the central government to be developed as a ‘model solar city’ and has set an ambitious target of generating 50 MW of solar energy -both residential and government- by 2022. In the past three years, CREST has generated 20.36 million units (MU), equivalent to reduction of 1,410 metric tonne of CO2 and planting a total of 15.3 lakh trees. Of 20.36 MU, bulk of power has been produced by plants on government buildings.

Source: The Times of India

Tuirial hydro power project to be commissioned in October: Mizoram CM

August 18, 2017. Mizoram Chief Minister (CM) Lal Thanhawla said the 60 MW Tuirial Hydro Electric Power Project would be commissioned in October. Lal Thanhawla said that the 20 MW solar power project near Vankal village in Champhai district would be completed next year.

Source: The Economic Times

Climate change costs India $10 bn every year: Government

August 18, 2017. Extreme weather events are costing India $9-10 billion annually and climate change is projected to impact agricultural productivity with increasing severity from 2020 to the end of the century. In a recent submission to a parliamentary committee, the agriculture ministry said productivity decrease of major crops would be marginal in the next few years but could rise to as much as 10-40% by 2100 unless farming adapts to climate change-induced changes in weather. Wheat, rice, oilseeds, pulses, fruits and vegetables will see reduced yields over the years, forcing farmers to either adapt to challenges of climate change or face the risk of getting poorer. Adaptation will need different cropping patterns and suitable inputs to compensate yield fluctuations. The challenge is particularly urgent for Indian agriculture where productivity for crops like rice does not compare even with neighbours like China. The possibility of a further dip due to climate change will be particularly worrying as it could turn India into a major importer of oilseeds, pulses and even milk. By 2030, it may need 70 million tonnes more of foodgrains than the expected production in 2016-17. The quantum of loss will increase substantially in future if one takes into account the impact of climate change on farm productivity. The ministry also noted possible decrease in yields of certain crops in traditional sown areas but an increase elsewhere due to change in weather pattern. It also observed that increasing food demand due to an increasing population, expanding urbanisation and rising income may require India to depend on import if it does not act on time to increase production and productivity of major food crops, pulses, oilseeds and milk by adapting to climate change.

Source: The Economic Times

Draft emission norms for diesel locomotives in 2 weeks: CPCB

August 17, 2017. The Central Pollution Control Board (CPCB) has told the National Green Tribunal (NGT) that the draft emission standards for diesel locomotives will be finalised within two weeks. The apex pollution monitoring body told a bench headed by NGT Chairperson Justice Swatanter Kumar that it would place the interim norms before August 30, the next date of hearing. The lawyer appearing for CPCB said the emission standards for diesel locomotives were still to be decided and they would send to the Ministry of Environment & Forests (MoEF) after finalisation. The submission came in the wake of the green panels direction to set standards in this regard and ensure that the railway locomotive engines dont cause pollution. The CPCBs interim report, titled “Exhaust Emission Benchmarks for Diesel Locomotives on Indian Railways”, aims to fix standards and protocols for the sector to achieve the targets submitted by India under the Paris climate change agreement. According to the report, the contribution of emissions from the transport sector on the whole has risen 3.5 times since 1990 to stand at 250 million tonne carbon dioxide, or 13.5 percent of the total emissions in 2013. The Railways contributed 9.7 percent of this figure (24.7 million tonne). Globally, however, only 3.5 percent of the emissions from the transport sector are attributed to the rail sector, CPCBs report said. Earlier, the tribunal had directed MoEF to hold a meeting with the CPCB and Railways and submit a report on emission standards for diesel locomotive within six weeks. The Railways had earlier submitted international standards for emissions from diesel locomotive railway engines and filed a data sheet indicating the emissions from 30 railway engines. According to the data sheet, the emission levels in the tested 30 railway engines were much above international standards.

Source: India Today

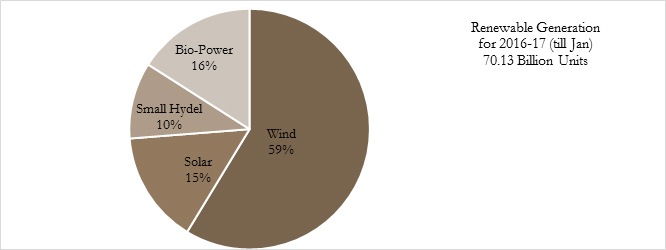

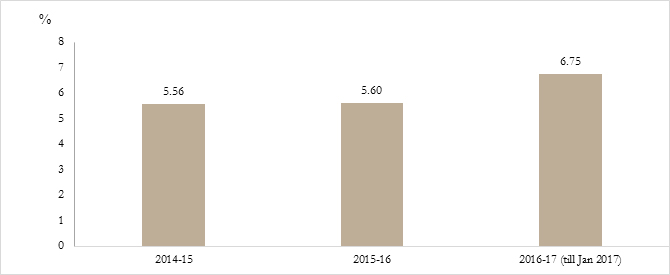

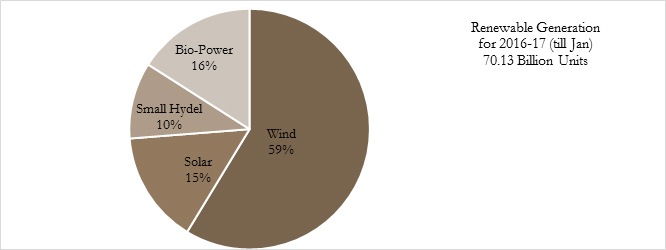

Indian thrust on renewables will affect thermal projects: CEA

August 17, 2017. Overemphasis on renewable energy would result in reducing viability of coal-fired thermal power plants in India, adding to the massive non-performing assets (NPAs) of state-run lenders, Chief Economic Adviser (CEA) Arvind Subramanian said. The declining viability of thermal power plants and the rising NPAs of state-run banks, which have lent to power companies “seems a double whammy for the government,” he said. For India, which is struggling to provide basic electricity to about 25 percent of its population, coal will provide about 60 percent of the country’s power needs until 2030, he said. India’s total renewable generation capacity has crossed 57 GW, with an increase of 24.5 percent being registered in the last fiscal year. The capacity addition in solar energy last year stood at 81 percent.

Source: Business Standard

Centre to finalise hydropower development fund

August 17, 2017. The Centre is set to finalise the creation of a Rs 16,000 crore hydropower development fund to revive stalled projects in the country. Central Electricity Authority’s member (Hydro) K.K. Arya said the hydropower policy was almost in its final stage. The power ministry was bringing out the policy to revive the sector that has gone “sluggish”. The policy would include a proposal for considering hydropower as renewable energy, he said.

Source: The Economic Times

DMRC’s Rewa solar power plan runs into trouble

August 16, 2017. A June order by the power ministry on inter-state electricity transmission charges could affect DMRC (Delhi Metro Rail Corp)’s plan to buy power from one of the world’s largest solar power project at a single site in Madhya Pradesh, forcing both DMRC and the state government to seek relief from the ministry of new and renewable energy. DMRC may have to bear an additional 91 paise per unit cost due to inter-state transmission charges and losses from the marque project, thereby increasing the tariff from Rs 3.30 per unit to Rs 4.21per unit from the 750 MW plant at Rewa, Madhya Pradesh. The 14 June order of the power ministry limits the waiver of inter-state electricity transmission charges to distribution companies (discoms) meeting their renewable purchase obligations. Since DMRC is not a discom, it will have to pay this additional tariff referred to as the Inter-State Transmission System (ISTS) charges. The power purchase agreements (PPAs) for the project were inked on 17 April. The record low-winning bids of Rs 2.97 per kilowatt hour (kWh) at Rewa in February marked a turning point for India’s solar power sector with the delivered cost of electricity to DMRC being Rs 3.30 per kWh. The Rewa project is also India’s first solar project to conduct inter-state sale of electricity with its PPA accepted by the union government as a standard model to help achieve lowest electricity tariff rates through competitive bidding.

Source: Livemint

IEX plea for spot trading of renewable energy shot down by CERC

August 16, 2017. The Central Electricity Regulatory Commission (CERC) did not approve the proposal of the Indian Energy Exchange (IEX) to introduce spot trading of renewable energy on its platform. While the IEX expected the mechanism to provide more options to fulfill renewable purchase obligations (RPO) of discoms, encourage new capacity addition and address the uncertainties around signing of long term PPAs (Power Purchase Agreements) and cost recovery issues for renewable energy players, CERC felt that the current market condition is not yet ready for the product. The proposed green day-ahead-market (G-DAM) was based on the existing framework in regular day-ahead-market, which is also known as spot-market in market parlance. IEX said that renewable energy traders could trade solar or wind power in regular spot market if bids in G-DAM were partially cleared. Under the scheme, renewable energy sellers would have got equivalent amount of renewable energy certificates (REC) for bids cleared in the spot market. One REC is treated as equivalent to one thousand units of green electricity. CERC said that since there is no substantial data available which can reflect the quantity of surplus renewable power, it is not advisable to introduce this instrument in the power exchange for trading. CERC also said that G-DAM would come in conflict with the existing products such as feed-in tariff and REC. Renewable energy is traded through the REC mechanism in the spot market. It aims to address the mismatch between availability of renewable energy resources in the states and the requirement of the obligated entities to meet their RPO, which mandates that all electricity distribution licensees should purchase or produce a minimum specified quantity of their requirements from renewable energy sources. REC trading is supposed to take place once in a month in the exchange.

Source: The Financial Express

INTERNATIONAL: OIL

OPEC to discuss ending or extending production cut in November: Kuwait’s Oil Minister

August 22, 2017. OPEC (Organization of the Petroleum Exporting Countries) will discuss at a meeting in November whether to extend or end production cuts, Kuwait’s Oil Minister Essam al-Marzouq said. He said oil inventories in recent weeks fell more than expected and that one-week forecasts were two million barrels a day, down from 6.5 million.

Source: Reuters

Iraq plans major change to oil pricing for Asia

August 21, 2017. Iraq has informed its customers that it plans to switch its price benchmark for Basra crude in Asia to DME (Dubai Mercantile Exchange) Oman futures from January, dropping the average of Platts’ Oman-Dubai quotes, in a major shift in the way it prices its oil. The proposal by state-oil marketer SOMO would mark a significant change by OPEC (Organization of the Petroleum Exporting Countries)’s second-largest producer away from fellow members Saudi Arabia, Kuwait and Iran, which have been using price assessments from global agency S&P Global Platts as their benchmark for decades. It throws down the gauntlet on setting prices for more than 12 million barrels per day of Middle East crude in Asia, challenging the role of the world’s top exporter Saudi Arabia. It asked customers for opinions on the plan by August 31.

Source: Reuters

Total deepens North Sea exposure with $7.5 bn Maersk Oil deal

August 21, 2017. Total is buying Maersk’s oil and gas business in a $7.45 billion deal which the French major said would strengthen its operations in the North Sea and raise its output to 3 million barrels per day by 2019. For Danish company A.P. Moller Maersk, the sale of Maersk Oil, with reserves equivalent to around 1 billion barrels of oil, fits with a strategy of focusing on its shipping business and other activities announced last year. The world’s top oil companies have been back on the takeover trail over the last year, helped by signs of a recovery in the oil market. Total has been betting on new rather than mature fields in the North Sea and the acquisition gives it further economies of scale by making it the second largest player in the region with production of about 500,000 barrels of oil equivalent per day.

Source: Reuters

OPEC oil supply set for sharp drop in August: PetroLogistics

August 21, 2017. OPEC (Organization of the Petroleum Exporting Countries) oil supply is set to fall by 419,000 barrels per day (bpd) this month, a company that tracks OPEC shipments forecast, reflecting plans for lower exports by Saudi Arabia and reductions by other producers. The 14-member OPEC has agreed to cut output by about 1.2 million bpd until March 2018 in an effort to reduce inventories and support prices. Compliance with the deal has been high so far but OPEC production hit a 2017 peak in July, in part on increased output from Libya and Nigeria, which were exempted from the pact due to production-sapping unrest. Geneva-based PetroLogistics is among a number of consultancies that estimate OPEC supply by tracking tanker shipments. Supply refers to a country’s crude exports plus its domestic use, rather than to production. PetroLogistics did not specify which countries were exporting less crude in August. However, top exporter Saudi Arabia has said its exports would drop to 6.6 million bpd this month, almost 1 million bpd below levels a year ago. Tanker data suggests shipments from No. 2 exporter Iraq have also fallen this month.

Source: Reuters

Libya’s Sharara oilfield shut by pipeline blockade

August 20, 2017. Libya’s Sharara oilfield, the country’s largest, has been shut down because of a pipeline blockade. National Oil Corporation (NOC) declared force majeure on loadings of Sharara crude from the Zawiya oil terminal. Sharara had been producing up to 280,000 barrels per day (bpd) in recent weeks. The field has experienced several temporary shutdowns because of protests by armed groups and oil workers since it reopened last December after a two-year pipeline blockade. Sharara’s production is key to a revival in Libya’s oil output, which surged above 1 million bpd in late June, about four times higher than its level last summer.

Source: Reuters

Vietnam crude oil imports to hit record as refinery gets ready to start

August 18, 2017. Vietnam’s crude oil imports will soar to record highs in August as the country ramps up fuel refining at a time when local crude output is dwindling. August will mark the first month on record in which Vietnam is a net importer of crude oil, according to shipping data. The surge in overseas orders comes as Vietnam’s 200,000 barrels per day (bpd) Nghi Son refinery, its second such facility, prepares to produce liquefied petroleum gas, gasoline, diesel, kerosene and jet fuel, mainly for the domestic market, likely starting later this year or in early 2018. With local oil production stalling, traders said the country of over 90 million people and 6-percent annual economic growth would gradually increase its crude imports. Shipping data shows that Vietnam will import around 100,000 bpd of crude in August, on three tankers, versus exports of 70,000 bpd. September tanker imports are scheduled at similar levels. Vietnam’s orders are still small compared with Asian’s top buyers, China and India, which import around 8 million and 4 million bpd of crude per day respectively. Vietnam’s oil production peaked in the early 2000s at around 400,000 bpd. The country is exploring new oil fields in several areas of the South China Sea, but this has seen several delays as the country clashes with its bigger neighbour China.

Source: Reuters

Mexican government raises Pemex deductions to continue oil output