Natural Gas in India: cruising for Take Off?

Gas News Commentary: February 2017

India

India has the potential to become a much larger producer and consumer of natural gas by 2022 when it is expected to surpass China in terms of population, a US Congressional report on India’s natural gas said. India’s current assessment of total resources that are economically and technically viable under existing market conditions are estimated to represent less than one percent of the global natural gas, the report said. As India attempts to shift away from coal and oil over the coming decades, natural gas production, especially from offshore resources, is seen as a way to increase domestic supply, the report said. Combined with improving infrastructure for imported LNG, India could become a bigger natural gas consumer in the future, the report said. The report said in the past decade, India has incentivised foreign access to its upstream sector as a way to increase domestic production. Some of India’s energy companies are also investing more in US energy projects and have signed contracts to import US LNG, the report said. The question that comes to mind is, are US gas exporters looking for larger markers for their gas?

Keeping up with the spirit of optimism BP Plc said new natural gas production from the flagging eastern offshore KG-D6 block will start after 2020, three years later than previously planned schedule. RIL-BP currently produce gas from Dhirubhai-1 and 3 field and oil and gas from MA field, three of the over one-and-half dozen discoveries made in KG-D6 block. The fields, which began gas production in April 2009, hit a peak output of 69.43 MMSCMD in March 2010 before water and sand ingress shut down well after well. The block currently produces around 8.7 MMSCMD.

However there was some positive news on production growth for natural gas. India was reported to have produced 2,738 MMSCMD of natural gas in January 2017, registering a growth of 12 percent over the same month last fiscal. This was the highest growth recorded in the past 30 months, or two-and-a-half-years. Total monthly output has grown from 2,488 MMSCM in April 2016 to 2,738 MMSCM in January 2017. PPAC attributes the historic growth to low base effect as production from Oil and Natural Gas Corp, the private sector and from the joint ventures had decreased dramatically in January 2016.

Mixed views emerged on taxing natural gas at a recent forum. GAIL (India) Ltd sought waiver off customs duty on LNG and wanted gas to be included in the GST fold. Consumers of natural gas wanted natural gas to be out of GST. The Finance Minister has already obliged GAIL by halving the import duty on LNG to 2.5 percent, a move that will help cut cost of power and fertiliser production.

Rest of the World

Global demand for LNG which reached 265 MT in 2016, is set to grow to 2030, according to Royal Dutch Shell plc. China and India, which are expected to continue driving a rise in demand, were two of the fastest growing buyers, increasing their imports by a combined 11.9 MT of LNG in 2016, Shell said. This boosted China’s LNG imports in 2016 to 27 MT and India’s to 20 MT. Egypt, Jordan and Pakistan were among the fastest growing LNG importers in the world in 2016. Due to local shortages in gas supplies, they imported 13.9 MT of LNG in total, Shell said.

China’s soaring demand for LNG is sparking industry hopes that a supply overhang causing a slump in prices will end sooner than initially anticipated. China’s imports of LNG in January rose 39.7 percent from a year earlier to 3.44 MT. It was the second-highest monthly import level, behind a record 3.73 MT. The steep growth rate in 2016 imports mean that China is challenging South Korea to become the world’s second-biggest LNG importer, after Japan. The LNG industry is banking on China’s growing demand to end a global supply overhang triggered by a wave of new production especially in Australia and the United States. The glut has driven Asian spot LNG prices down by almost 70 percent since their 2014 peak to $6.40/mmBtu. China’s growing demand, much of it coming from import facilities called floating storage regasification units, means that supply and demand in the LNG market could come into balance by around 2021-2022, about a year earlier than previously expected, the Australian oil and gas major Woodside Petroleum said.

On prices the anticipated discount of US LNG did not materialise. Japan was reported to have paid nearly twice as much for LNG derived from US shale gas as it did for its cheapest imports. Shale gas from the USA had been touted as a panacea to Japan’s energy crisis after the Fukushima nuclear disaster nearly six years ago. Japan, the world’s biggest importer of LNG, received 211,237 T of US LNG at an average cost of $645/T. By contrast, the lowest it paid was $337/T for 64,246 T of LNG from Angola. The country paid an average of $386/T for all 8.3 MT of LNG it imported last month. The 428,626 T of LNG imported from Brunei, at $416/T were the second highest-priced supplies. Australia was Japan’s biggest supplier in January, sending 2.01 MT at a cost of $384/T.

Asian spot prices for LNG delivery in March fell to parity with European gas benchmarks, while importers in India, Thailand and Mexico finalised purchases amid healthy supply. Traders said Asian prices for March delivery fell 25 cents to about $7.50/mmBtu matching the UK’s National Balancing Point trading hub levels. Traders said they had heard GAIL (India) had bought supplies in the low $8/mmBtu range, while Thailand’s PTT bought a cargo in the high $7/mmBtu possibly from Chevron. Mexico purchased two cargoes for February delivery. Steady cargo demand was seen coming from Spain.

There were some activity on the acquisition front. Total was said to be in talks to buy a multi-billion dollar stake in Iran’s partly built LNG export facility, Iran LNG. The French oil major, the first of its peers to strike deals in Iran after sanctions, seeks entry into Iran LNG at a discount to the pre-sanctions price in exchange for reviving the stalled project. The Iranian part of the field, known as South Pars, contains over 14 TCM of gas.

China’s state-run Zhenhua Oil was also reported to have signed a preliminary deal with Chevron to buy its natural gas fields in Bangladesh that are worth about $2 billion. Bangladesh, though, holds the right of first refusal on the assets and could block the transaction. The country, via its national oil company Petrobangla, is keen to buy the gas fields and is talking to international banks to raise financing.

Qatar Petroleum was reported to have has joined an international consortium of major US, European and Japanese energy companies to develop a LNG import project in Pakistan. The consortium, which includes US ExxonMobil, France’s Total, Japan’s Mitsubishi, and Norway’s Hoegh, will develop a project that includes a floating storage and regasification Unit, a jetty and a pipeline to shore to provide natural gas supply to Pakistan, Qatar Petroleum said.

All this activity makes one wonder how and why Indian companies missed opportunities in the neighbourhood.

Finally, it appears that the Trump effect is likely to touch gas as well. Bank of America Merrill Lynch said the enactment of a prospective US border adjustment tax could lash US natural gas prices if Mexico retaliates. A similar border tax scheme, if implemented by Mexico, could spark a wider trade war the investment bank said. The US currently sends 5 percent of its annual gas production via pipelines to Mexico, and the country is the biggest buyer of US LNG.

NATIONAL: OIL

Govt approves oil storage pact with ADNOC

March 6, 2017. The Cabinet approved a pact on oil storage and management between Indian Strategic Petroleum Reserve Ltd (ISPRL) and Abu Dhabi National Oil Company (ADNOC) of UAE (United Arab Emirates). According to the agreement, ADNOC will fill up 0.81 million metric tonnes or 5,860,000 million barrels of crude oil at ISPRL storage facility at Mangalore, Karnataka. The investment by ADNOC is a major investment from the UAE under the High Level Task Force on Investment and the first investment by the Gulf nation in India in the energy sector.

Source: India Today

Petrol up by Rs 3.78, diesel by Rs 1.70 as Tamil Nadu revises VAT

March 6, 2017. Prices of petrol and diesel in Tamil Nadu went up by Rs 3.78 and Rs 1.70 respectively, following the state government revising the Value Added Tax (VAT) on these products. Tamil Nadu Petroleum Dealers Association protested the move, saying the hike would affect all sections of society and demanded an immediate rollback. Following the hike, the petrol price had touched the Rs 75 mark in Chennai while additional costs like transportation would add a little more to rates in other cities and towns such as Tiruchirappalli, Thanjavur and Cuddalore, Association President K P Murali said. Diesel prices was around Rs 63.96 following the VAT revision, he said. On a comparative note, petrol and diesel are priced at Rs 68.13 and Rs 60.18 respectively in neighbouring Puducherry, a Union Territory, he said.

Source: The Economic Times

IOC may take Odisha govt to court on Paradip refinery tax sops withdrawal

March 5, 2017. Indian Oil Corp (IOC) may drag the Odisha government to court for reneging on its promise to give tax concessions to its Rs 34,555 crore Paradip refinery in the state. Less than two months after serving the first show-cause notice, the Odisha government wrote to its single-biggest investor saying it is withdrawing the promised 11-year deferment on payment of sales tax on Paradip refinery products sold in the state. The Odisha government is basing the withdrawal on two grounds—that the project was delayed by six years and the size of the refinery has been changed to 15 million tonnes a year from the previously agreed 9 million tonnes. The withdrawal of Value Added Tax (VAT) exemption will cost Rs 2,000 crore to IOC this year and will progressively increase every year as more petrol and diesel as well as petrochemicals are sold within the state. Odisha had originally offered the tax incentives to IOC and its then partner Kuwait Petroleum Corp (KPC) in December 1998 to invest in setting up a refinery in the state.

Source: Livemint

AIDWA wants Centre to roll back hike in non-subsidised LPG rates

March 3, 2017. Terming the hike in the prices of a non-subsidised cooking gas cylinder by Rs 86 as “savage”, the All India Democratic Women’s Association (AIDWA) has demanded an immediate rollback to ease the “severe strain” in household budgets. AIDWA said household budgets were under “severe strain”, making it difficult for women to keep the home fires burning. It said the NDA government’s move to shift household kitchens from using firewood, coal, or even kerosene stoves to liquefied petroleum gas (LPG) stoves was being “vitiated by the current government policies that are driving up LPG costs to new heights”.

Source: The Hindu Business Line

Non-subsidised LPG cylinder price increased by Rs 86

March 2, 2017. State-run oil marketers have raised the price of non-subsidised liquefied petroleum gas (LPG) by a steep Rs 86 a cylinder. A non-subsidised 14.2 kg cylinder will now cost Rs 737.50 in Delhi. Oil companies also raised the price of subsidised cooking gas by a marginal 13 paisa to Rs 434.93 per 14.2 kg cylinder. The rates of aviation turbine fuel were also raised by Rs 214 a kilolitre to Rs 54,293.38 a kl. Rates vary at airports as per local taxes.

Source: The Hindu

‘Govt looking at creating 2-3 integrated oil, gas units’

March 1, 2017. Towards realising a proposal contained in the Union Budget for 2017-18 for merging state-run oil and gas companies into a single entity, the government is looking at creating two to three integrated units according to an energy expert. Following Finance Minister Arun Jaitley’s budget proposal in February of a merger, reports said Oil and Natural Gas Corp may acquire state-run fuel refiner Hindustan Petroleum Corp Ltd for about Rs 44,000 crore. The government thinking is that a much bigger entity will give bigger negotiating power in activities globally such as the purchase of crude, technology, R&D expertise, as well as faster decision making and economies of scale.

Source: The Economic Times

NATIONAL: GAS

India looks for ‘right prices’ to boost LNG, crude imports from US

March 6, 2017. India might increase imports of liquefied natural gas (LNG) from the United States (US) at the right price, the Oil Minister Dharmendra Pradhan said, even though some buyers in the South Asian country are trying to get rid of costly US supplies. GAIL (India) Ltd signed a swap deal with trader Gunvor to sell some of its US LNG as the firm tries to cut costs for price-sensitive customers after a sharp fall in Asian spot prices made its US gas unattractive. GAIL has contracted for most of the capacity from one of Sabine Pass’ liquefaction trains in the US Gulf Coast, with deliveries expected to start in late 2017. But Pradhan said supplies of LNG and even crude from the US might increasingly flow to India at the right prices. GAIL in 2011 signed a 20-year sales agreement with Sabine Pass Liquefaction LLC, a unit of Cheniere Energy Inc, for the supply of 3.5 million tonnes per year. Under the recent agreement between GAIL and Gunvor, the trading firm will supply 15 cargoes or about 800,000 tonnes of LNG for India’s west coast from April through December, while GAIL will sell about 600,000 tonnes in 2018 from Sabine Pass at a premium to its pricing formula. Pradhan said India’s current booking capacity for LNG is around 6 million tonnes per year. Its current crude imports are around 4.5 million barrels per day.

Source: Reuters

Tamil Nadu yet to tap natural gas potential

March 3, 2017. Tamil Nadu is yet to tap the benefits of using natural gas as a fuel for home and industry despite its huge manufacturing base and urbanised environment. According to the oil ministry, a phased roll out of City Gas Distribution network covering 28 cities and towns, including Chennai and other major corporations, was envisaged over five years back. But this proposal continues to exist only on paper. Whether Coal Bed Methane project, GAIL’s gas pipeline project or efforts to tap oil and gas in Discovered Small Fields, all have been stalled in the State due to public outcry. Piped gas would have been available to households in the western region of Tamil Nadu. Interestingly, Vision 2023, the strategic plan for infrastructure development in Tamil Nadu announced by the State government in its previous tenure, envisages investments of ₹16,000 crore between 2014 and 2023 to establish a State-wide gas grid and a city gas network.

Source: The Hindu Business Line

GAIL awards tender for April LNG shipment

March 1, 2017. Gail (India) Ltd has awarded a tender for a liquefied natural gas (LNG) shipment delivering in April at a price of around $6 per million metric British thermal units (mmBtu), traders said. Estimates of the transaction price by traders ranged from slightly below to slightly above that level.

Source: Reuters

NATIONAL: COAL

Coal gas can help lower import bill by $10 bn in 5 yrs: Coal Secretary

March 6, 2017. Domestic coal gas can be used as a feedstock for producing urea and other chemicals that can help reduce the country’s import bill by $10 billion in five years and cut carbon emissions, Coal Secretary Susheel Kumar said. He said that India’s dependence on petroleum and natural gas can be reduced or done away with if the country is able to get gas from coal. If the country is able to gasify coal and use that for production of chemicals, including urea and methanol, it would lead to reduction in import bill manifold by 2030. The indigenous coal gasification will not only reduce the emission intensity but would also lessen the adverse environmental impact, he said. Underground coal gasification is a method of converting coal underground into gaseous mixture of hydrogen, carbon dioxide, carbon monoxide and water that can be used in place of natural gas as fuel or feedstock. As far as the India’s international commitment is concerned, the country should gradually reduce its emission intensity and for doing so India has to produce power which is non-coal, he said. The government is planning to come up with a series of pilot projects in areas like coal gasification and coal-to-polychemicals next fiscal. Once the projects are successful, government will push for commercial use of technology for utilisation of country’s huge coal reserves.

Source: The Economic Times

Central Coalfields approves Rs 10 bn share buyback plan

March 4, 2017. Coal India Ltd said its arm Central Coalfields Ltd has approved a share buyback plan worth Rs 1,001.88 crore. The equity shares proposed to be bought back by Central Coalfields Ltd represent 5.54% the total number of equity share capital in the paid up share capital of the company, it said. Coal India accounts for over 80% of the country’s domestic production.

Source: Livemint

Shree Cements secures 60k tonnes per annum coal supply

March 4, 2017. Shree Cement said it has secured supply of 60,000 tonnes per annum of coal from Coal India Ltd (CIL) arm Southern Eastern Coalfields. The company participated in the auction for coal linkage from South Eastern Coalfields for cement sector and won the coal linkage in Chhattisgarh, Shree Cement said.

Source: The Economic Times

Laxmi Hebbalkar owns coal mine in Indonesia, alleges BJP

March 3, 2017. The BJP charged state Congress women wing’s president Laxmi Hebbalkar with owning a coal mine in Indonesia from where the Karnataka Power Corp was buying coal for its thermal power projects. This comes after the party alleged that she got Rs 215 crore from seven cooperative banks against a total security of 51 acres of industrial land in Belagavi.

Source: The Times of India

NATIONAL: POWER

Madhya Pradesh residents complain about regular interruptions in power supply

March 7, 2017. With the summer round the corner, many areas of the city are witnessing interrupted supply. Though residents are not complaining about long power cuts, but they complained about regular short interruptions in supply. Residents of areas like Ajay Baag Colony, Radio Colony, Musakhedi, Sukhliya, Jinsi, Bada Ganpati and others are complaining about unscheduled power cuts. Some expressed their annoyance over the power cuts with approaching summer. A resident of Ajay Baagh said that it’s a regular affair now. A resident of Radio Colony said that as the summer is approaching, it’s a major problem for us. However, Madhya Pradesh Paschim Kshetra Vidyut Vitaran Company Ltd claims that disconnection of power supply is due to ongoing development works of civic body. Supply in some part of the city is also being affected as the distribution company has started shifting poles and underground supply lines due to road widening work. The civic body had sought permission for shifting of poles on various areas like Bada Ganpati, Jinsi square, Mhow naka, Tori Corner etc.

Source: The Economic Times

Haryana govt proposes lower fuel surcharge on electricity bills

March 7, 2017. Haryana Chief Minister Manohar Lal Khattar has proposed to lower fuel surcharge allowance (FSA) on power tariff by 50-60 paise per unit. An electricity consumer is paying Rs 1.24 to Rs 1.43 per unit as FSA levied by the electricity distribution companies – Uttar Haryana Bijli Vitran Nigam and Dakshin Haryana Bijli Vitram Nigam, revealed Khattar. FSA component forms one fourth of the electricity bills of the consumers, hence the announcement may bring relief to all sectors. Khattar said the concerned officials had already taken appropriate steps to reduce the FSA.

Source: The Economic Times

No commercial tariff for power consumed in common areas: KERC

March 6, 2017. A septuagenarian’s fight against unfair tariff imposition by electricity supply company (Escom) has resulted in an amendment to a contentious clause in the Karnataka Electricity Regulatory Commission (KERC) Regulations 2004 Act. This clause talks about imposition of commercial power tariff rates for power used in common areas for a building with mixed power load if some conditions are not met. This amendment, which has been brought about due to the efforts of James Victor D’Mello, 74, a former council member of the city corporation, is applicable to all such cases in Karnataka. The 2004 Act had a clause, which burdened building owners having both domestic and commercial loads. The clause states if the requisition load/sanctioned commercial load (treating power load as commercial load) is 25% or less than the total combined load of the entire building irrespective of ownership, then it shall be considered as residential building for application of tariff for common area loads and for application of arranging power on HT basis. D’Mello had his building completed in 2015 which had commercial space on the first and the next three floors for residential use. The power bill he received gave him a shock as the local power supplier Mescom (Mangalore Electricity Supply Company Ltd) had charged commercial rates stating that his use of commercial power was more than 25% of the total sanctioned.

Source: The Times of India

Rs 90.6 bn worth power bought from private units

March 4, 2017. The government purchased 31,805 million units power worth Rs 9,064.43 crore from private sector companies in 2016 at an average rate of Rs 2.85 per unit. In 2015, the government had purchased 31,997 million units from five private sector power plants. The government said that apart from the per unit charge, fixed charges were paid to China Light and Power India Pvt Ltd. In 2015, China Light was paid Rs 393 crore and in 2016, it was paid Rs 400 crore. The government said that the 11 power units run by the Gujarat State Electricity Company produced 17,413 million units in 2015, while the production was 15,162 million in 2016.

Source: The Times of India

Tripura to export 60 MW more power to Bangladesh

March 4, 2017. Tripura, a power surplus State, is all set to sell additional 60 MW power to neighbouring Bangladesh very shortly, Power Minister Manik Dey said. Dey said Tripura State Electricity Corp Ltd (TSECL) has been selling 100 MW power to Bangladesh since last year based on the power generated from OTPC’s Palatana power plant in Udaipur. Now, 60 MW more power will be exported to Bangladesh from North Eastern Electric Power Corp (NEEPCO)’s Manarchak power plant in Sepahijala district. Although Manarchak power plant is producing 75 MW power for the past few months after Oil and Natural Gas Corp started supplying gas to NEEPCO, formal inauguration of the power project is yet to be made. Dey said the Centre has already given a green signal to sell 60 MW power to Bangladesh.

Source: The Assam Tribune

Kudankulam power transmission lines to be completed by 2018

March 3, 2017. The setting up of the Kudankulam-Kochi 400 kv power transmission line for power evacuation from the Kudankulam Nuclear Power Project has gained speed and is expected to be completed next year. According to P Vijayakumari, director, Transmissions and System Operations, KSEB Ltd, the transmission lines will be completed by December 2018. She said that the power lines are necessary for the state not only for the power supply from the nuclear project but also for maintaining a power system in the state. The KSEB is planning three substations along the route of the power lines. The proposed line passes through Kollam, Pathanamthitta, Kottayam and Ernakulam districts. The major opposition faced by the project in the state was in Kottayam district. There are around 140 Tower stations in the district alone. Though the work for setting up the power lines began 11 years back, due to stiff opposition from the affected persons, only 88 tower points could be located and out of them only the foundations of eight were completed.

Source: The Economic Times

Essar Power’s Hazira plant attains 100 percent capacity utilisation

March 3, 2017. Essar Power said its Hazira plant has attained 100 percent capacity utilisation within three months of commissioning. The company had commissioned the second unit of the plant three months ago. The plant can run on multiple fuels like coal, corex fines and corex gas, simultaneously.

Source: The Economic Times

In Odisha, 3.5 mn homes yet to get electricity: Energy Minister

March 2, 2017. More than 35 lakh households in the state are yet to have electricity connection, the series of steps taken by both the Centre and state government notwithstanding. State Energy Minister Pranab Prakash Das said that of the families living without power, 15 lakh belong to the below poverty line (BPL) category. He said that there are 984 villages where power connection has not reached yet. He said the state government has decided to provide electricity to all homes by 2019. He said that the Centre has given more than Rs 1,224 crore to cover the villages without electricity. Das said Ganjam, Koraput, Sundargarh, Kalahandi, Balangir and Puri districts have more than one lakh BPL families who do not have electricity connection. He said that Rayagada district has 187 villages — the highest in the state — that are yet to get power. Kalahandi, Koraput, Mayurbhanj and Sundargarh districts, each with more than 90 villages, face a similar situation. Jharsuguda, Puri, Bhadrak, Cuttack, Jagatsingpur, Kendrapada, Khurda and Sonepur are the districts where all villages have electricity.

Source: The Economic Times

PMO steps in to give Dabhol Power Project a new lease of life

March 2, 2017. The Prime Minister’s Office (PMO) has stepped in to keep afloat Ratnagiri Gas and Power, the second avatar of the jinxed Dabhol power project. It has called a meeting of key stakeholders to resolve issues plaguing the company, convince the Railways to enter into a power purchase agreement, and expedite the demerger of the liquefied natural gas (LNG) division. The PMO may ask the Maharashtra state government to waive off state-wise transmission charges and transmission losses, and waive off the tax on gas to the project to make the power more viable. The plan for the demerger of the LNG regasification unit from the power unit has been approved by lenders but certain issues raised by Power Finance Corp and LIC have to be sorted out.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Renewable energy capacity grew 26 percent in April-January: Govt

March 7, 2017. Generation of renewable energy grew 26 percent in Apr-Jan 2017 as compared to that of previous corresponding period. Generation of power from renewable sources grew to 55,518.3 units in Apr-Jan as against 70,129.15 units during the same period last year. Strong focus on renewables is driving up total electricity generation figures. In 2017 alone, for Apr-January 17, electricity generation growth was 5.04 percent excluding generation from renewable sources. However, if renewable generation is included then total generation for the same period became 6.25 percent, the government said. During the same period, generation from conventional sources grew over 5 percent to 922,299.71 units from 968,780.44 units a year back. Conventional sources of energy account for over 70 percent of India’s current energy mix. In February alone, generation from conventional sources of energy stood at 3.57 percent. The government wants to take up the renewable energy capacity of the country to 175 GW by 2022 with solar alone accounting for 1 GW.

Source: The Economic Times

India moves to phase out refrigerants HCFC which cause ecological damage

March 7, 2017. Adhering to its global commitment, India launched the country’s latest plan to phase out one of the key refrigerants, Hydrochlorofluorocarbon (HCFC), under its ultimate goal to end use of ozone-depleting substances (ODS) which have harmful effects on the environment and human health. Though the fresh plan is meant for the 2017-23 period, the final goal is to phase out consumption and manufacturing of the ozone-depleting refrigerant under an accelerated plan by 2030. HCFCs are currently used in various sectors including refrigeration, air-conditioning and foam manufacturing. Over 190 countries had in 1987 reached an agreement under Montreal Protocol to phase out the ODS in a time-bound manner. Under the Protocol, India has already successfully phased out the earlier generation of refrigerants, Chlorofluorocarbons (CFCs) and Halon. The country is currently phasing out HCFCs in a gradual manner. A multilateral fund, set up under the Protocol, has approved $44.1 million for India’s HCFC management plan for the 2017-23 period. The money will be used to help industries to switch over to alternatives and train manpower. Domestic industries are, however, expected to invest in research & development (R&D) to discover clean alternatives. Addressing stakeholders including refrigerant industries’ representatives, Environment Minister Anil Madhav Dave recalled how India had acted pro-actively to reach a fair deal in Kigali, Rwanda in 2016 to phase out another refrigerant, hydrofluorocarbon (HFC), which is currently being used as an alternative to ODS like HCFC. He insisted that the government had worked hard to protect interests of domestic industries and it’s time for industry to invest in research to develop cutting-edge technology that can be used in future.

Source: The Economic Times

Hatsun Agro Product set to tap into renewable energy with wind power plants

March 7, 2017. Private dairy Hatsun Agro Product (HAP) has commissioned wind power plants with a capacity of 24 MW in Tuticorin. A solar plant with a capacity of 550 KW will be commissioned later this month in Dindigul district. With an investment of Rs 180 crore, the wind and solar projects are expected to generate around 73 million units of electricity per annum and will meet 75% of the power requirements of HAP. The wind power project commissioned by Gamesa India comprises of 12 wind turbine generators with a capacity of 2 MW each.

Source: The Economic Times

Gamesa bags order for 50MW wind plant from IL&FS

March 7, 2017. Gamesa, a renewable energy player, announced that it has secured an order from IL&FS, an infrastructure development and finance company, for a 50 MW wind farm project at Amba, Madhya Pradesh. The order to be commissioned this month is a turnkey project and the first to be won from Infrastructure Leasing & Financial Services Ltd (IL&FS). As a part of this contract, Gamesa will supply, erect and commission 25 units of its G114 – 2.0 MW wind turbines. This order forms part of the 278 MW consolidated orders announced for India.

Source: The Times of India

Govt’s solar park plan a lifeline for power transmission business

March 6, 2017. The government’s decision last month to double solar park capacity to 40,000 MW in three years has opened up a new business opportunity worth up to Rs 20,000 crore for power transmission companies. Adding new 50 ultra-mega solar parks to the 34 under construction in 21 states, as decided by the cabinet, will need to significantly widen the green energy corridor—the transmission network for the solar parks—Solar Energy Corp of India (SECI) said. The ongoing Rs 13,000 crore green energy corridor-II project connecting the 34 parks under construction and new transmission projects will be identified keeping in mind the location of the new parks, SECI said. According to Power Grid Corp Ltd, which prepared the road map for the green energy corridor-II, not all the proposed new solar parks may come up at new locations and many could be in the solar and land resource rich states such as Madhya Pradesh, Rajasthan, Tamil Nadu and Gujarat, where such parks are already operating. Under the green energy corridor project-II, 32 transmission projects—Rs 8,041 crore of inter-state networks and Rs 4,745 crore of intra-state network—are being constructed. According to India Smart Grid Forum, a public-private partnership of the power ministry, the real challenge of integrating renewable energy into the gird is in the roof-top segment.

Source: Livemint

Cabinet okays pact on clean energy with Portugal

March 6, 2017. The Centre approved a Memorandum of Understanding (MoU) on renewable energy signed with Portugal. The MoU will help strengthen bilateral cooperation between the countries. Both sides aim to establish the basis for a cooperative institutional relationship to encourage and promote technical bilateral cooperation on new and renewable issues on the basis of mutual benefit equality and reciprocity.

Source: India Today

Rajendra Agricultural University develops new solar irrigation system

March 6, 2017. Rajendra Agricultural University, Pusa (Samastipur) has developed a boat-based solar pumping system to irrigate fields. The boat is equipped with a two horsepower submersible pump powered by the solar panel. Farmers can irrigate their fields in diara areas with river water by using the system. The University said farmers of the diara areas spread over 15 lakh hectares of land face the calamity of floods and drought every year. They struggle to irrigate their fields despite a river flowing alongside due to absence of any permanent irrigation system.

Source: The Economic Times

KVIC created employment opportunities in Varanasi through solar charkhas

March 6, 2017. Distribution of solar charkhas and looms and training of women were among the initiatives taken by the Khadi commission to create job opportunities in the Prime Minister (PM)’s adopted villages in Varanasi. A survey by the Khadi and Village Industries Commission (KVIC) said that sustainable employment has been created in Jayapur, Sewapuri and Kankariya villages of PM’s constituency. In last one year, KVIC has created job opportunities in Varanasi, particularly in the Prime Minister’s adopted villages of his parliamentary constituency. Apart of it, 20 new model charkha (spinning wheels) and five looms were given to Krishak Vikas Gramodyog Sansthan in village Jayapur, the survey said. It said that 50 local women were given training to use these charkhas. A solar charkha training centre was established in January in village Kankariya where 25 solar charkha and five looms provided by KVIC in which more than 100 women have been trained so far.

Source: The Economic Times

India’s thermal power generation to reduce by half in next 5 yrs

March 4, 2017. Coal-fired power generation is expected to grow 4.05 percent during 2017-18, suggests Central Electricity Authority (CEA) in its latest estimates. Hydel on the other hand is expected to grow 5.52 percent, while nuclear will grow only about 2.43 percent during the same year. CEA has estimated that coal-fired power plants are likely to generate 9,58,444 million units of power in 2017-18. In contrast it had estimated a total generation of 9,21,129 million units of power in 2016-17. About 89 percent of the estimated power generation from coal-fired power plants has already been achieved between April 1, 2016 and January 2017. The estimate pegs growth of conventional power generation, which includes thermal, nuclear, hydel and import from Bhutan, at 4.35 percent during 2017-18. Around 12,29,400 million units of power is likely to be generated from the conventional sources in 2017-18 against 11,78,000 million units in 2016-17. Nevertheless, CEA has also estimated that all coal-based thermal power plants need to brace for drastic fall in capacity utilisation to as low as 48 percent by 2022 as additional non-thermal electricity generation capacities come on stream. CEA has predicted that by 2022 many plants may get partial or no schedule of generation at all – meaning many thermal power plants may have to be kept idle for lack of demand.

Source: The Economic Times

BEML inaugurates 200 KW rooftop solar power project in Mysore

March 3, 2017. State-run BEML announced inauguration of a 200 KW grid-connected rooftop solar project in Mysore. As part of its renewable energy drive, BEML had set up a 5 MW windmill project in Karnataka which is generating power since 2007. It also set up 18 MW windmill project in Koppal and Bagalkot districts in Karnataka from which 9 MW electricity is being produced. A 9 MW project is also under commissioning stage.

Source: The Economic Times

INTERNATIONAL: OIL

China’s February crude oil imports hit second highest on record

March 7, 2017. China’s crude oil imports rose to the second-highest level on record in February, as strong demand from independent “teapot” refiners continues to drive growth. February’s imports came in at 31.78 million tonnes or 8.286 million barrels per day (bpd), up 3.5 percent on a year ago, Chinese customs data showed. Daily shipments were only behind December’s record 8.57 million bpd, but up on 8.01 million bpd in January. Imports are expected to ease from March when several major plants begin scheduled maintenance. One of China’s largest refineries, PetroChina’s Dalian refinery, will shut for 45-60 days starting at the end of the first quarter. China’s refined fuel products exports in February rose to 4.26 million tonnes from 3.04 million tonnes in January, the customs data showed.

Source: Reuters

Ghana mulls doubling capacity of planned second oil refinery

March 7, 2017. The operator of Ghana’s sole oil refinery said the planned capacity of a proposed second plant could be doubled as the West African nation targets exports to neighbouring countries. Tema Oil Refinery will complete studies next year to build a 200,000 barrel a day plant in the port city, 30 kilometers east of the capital, Accra. Output at the existing 45,000 barrel a day plant has been slashed by an explosion at its crude distillation unit in January. Nations in the region such as Togo, Burkina Faso and Mali have no oil-refining capacity. Former President John Mahama said that a new plant would be designed with a capacity of 100,000 barrels a day. Ghana’s output of crude, which started in 2010, is forecast to reach more than 240,000 barrels a day by 2021 as operators such as Tullow Oil Plc increase output. For now, production from the existing Tema refinery has been limited to 28,000 barrels a day.

Source: Bloomberg

BHP hunts for oilfield stakes to cash in on market rebalance

March 7, 2017. BHP Billiton, fresh from signing a joint venture to develop an oilfield off Mexico, remains on the lookout for more oil assets, as it is more bullish on oil than gas over the next few years, its petroleum chief Steve Pastor, said. The global miner, which also has a large petroleum business, has long flagged that copper and oil are its two main targets for growth over the next few years, as it sees potential supply shortfalls emerging for those commodities. BHP agrees with the International Energy Agency’s outlook, released, which warned that world oil demand may outstrip supply after 2020 following a sharp decline in investment in new production. BHP is focused on the $9 billion Mad Dog phase 2 oil development in the deep-water Gulf of Mexico, drilling the Trion prospect with state-owned Petroleos Mexicanos in their side of the Gulf, and exploring off Trinidad and Tobago, while looking for more high quality oil assets, he said.

Source: Reuters

Iran crude oil exports hits 3 mn bpd: Oil Minister

March 7, 2017. Iran’s crude oil exports hit a record 3 million barrels per day (bpd) in the Iranian month of Esfand (late February to late March). Iranian Oil Minister Bijan Namdar Zanganeh credited Iran’s nuclear agreement with Western powers in 2015, which removed a number of sanctions in exchange for curbs on the Islamic Republic’s nuclear program, for the boost in exports. Iran’s oil exports have, on average, more than doubled since that time, Zanganeh said.

Source: Reuters

Oranto Petroleum to invest $500 mn in South Sudan’s oil block

March 7, 2017. Nigerian firm Oranto Petroleum is set to invest around $500 mn to develop Block B3, which covers an area of about 25,150 km², in South Sudan. The company has entered into an exploration and production sharing agreement with the South Sudan’s government to develop the block, which is part of Block B. Oranto has launched a comprehensive exploration campaign at the block that is expected to hold reserves with about three billion barrels of oil. Atlas Petroleum International and Oranto Petroleum, which are the sister firms of the Atlas Oranto Group, own and operate 20 oil and gas acreages in 10 African countries.

Source: Energy Business Review

Saudi cuts to lighter crude prices show shifting oil market

March 7, 2017. A decision by Saudi Aramco to cut the price of its benchmark Arab Light crude to Asian refiners for April-delivery cargoes has prompted speculation that the world’s top oil exporter is chasing market share. Perhaps a better approach is to look at whether the move in the official selling prices (OSP) goes beyond what might be justified by changes in the market structure for crude oil in Asia, the region that buys about two-thirds of Saudi oil. The Saudi cuts for its lighter crudes is a response to that dynamic, and it’s worth noting that Aramco kept the OSP for its Arab Heavy grade for April unchanged at a discount of $2.60 a barrel to Oman-Dubai.

Source: Reuters

Oil output cuts past June must include non-OPEC members: OPEC Secretary General

March 7, 2017. Any decision to extend OPEC (Organization of the Petroleum Exporting Countries) production cuts past June would have to include the continued participation by the non-OPEC members of the November accord, OPEC Secretary General Mohammad Barkindo said. The group held talks in recent days with shale oil producers and hedge fund executives, he said during a media conference at the CERAWeek energy conference in Houston. This is the first time OPEC held bilateral meetings with shale producers and investment funds, Barkindo said. OPEC plans to hold an event to consider the impact of oil futures on physical crude markets, he said. The November deal to reduce output, which was joined by non-OPEC countries including Russia and Kazakhstan, is intended to reduce global output by about 1.8 million barrels per day, and help reduce a glut. The six-month agreement took effect on January 1.

Source: Reuters

Canada federal help on table for ‘orphan’ oil wells in Alberta

March 7, 2017. The Canadian province of Alberta may get federal aid to help clean up the rising number of oil wells whose owners have gone bankrupt, with federal officials acknowledging the relevant provincial agency lacks sufficient funds. The number of so-called orphan wells in Canada spiked after the 2014 oil price crash as companies went bankrupt, prompting provincial officials and industry to seek federal help for remediation. Alberta, which produces about 80 percent of Canada’s crude, has more than 1,500 orphan wells, up from 26 in 2012.

Source: Reuters

Maersk could land Danish North Sea oil deal within days

March 7, 2017. Oil and shipping conglomerate A.P Moller-Maersk could land a deal with the Danish government on oil and gas operations in the North Sea within days. The deal will secure continued production in the Danish part of the North Sea and is seen as crucial for Maersk as it seeks to focus its operations on the North Sea and spin off its energy assets via a listing or merger. The Danish state has agreed to improved fiscal terms. That would allow Maersk to continue operations at Denmark’s largest gas field, Tyra, where more than 90 percent of the country’s gas production is processed. However, Maersk would have to agree that if the oil price goes above $75 per barrel the company would pay 5 percent more of its profit to the state. If the oil price rises above $85 per barrel, this would be 10 percent. The current tax rate is 52 percent.

Source: Reuters

Shell accelerates plan to boost US shale output

March 7, 2017. Royal Dutch Shell is ramping its North American shale output earlier than planned to lock in quick returns from what has become one of its most profitable businesses, the head of Shell’s unconventional energy business, Greg Guidry said. The Anglo-Dutch company plans to make shale oil and gas in the United States (US), Canada and Argentina a key engine of growth in the next decade, targeting output of around 500,000 barrels of oil equivalent per day (boepd), Guidry said. A drive to cut the cost of producing oil and gas from US shale deposits has proven so effective that Shell has accelerated development plans, Guidry said. It aims to boost output by 140,000 boepd over the next three years in the Permian basin in West Texas and the Duvernay region in Canada, Guidry said. Shell had previously expected to hit that target after 2020. Shell produces 280,000 boepd in shale- a tenth of the company’s overall output of 2.8 million boepd in 2016. The firm is targeting an increase in global output to around 4 million boepd by 2020. Shell’s shale output is profitable with oil prices at $40 a barrel, with the most productive wells at an even lower breakeven, Guidry said.

Source: Reuters

Oil market fundamentals improving: Saudi Energy Minister

March 7, 2017. Saudi Energy Minister Khalid al-Falih said that oil market fundamentals were improving after an agreement struck with top oil producers to curb supply and end a two-year glut took effect. The kingdom led a pact between the Organization of the Petroleum Exporting Countries and other major producers, including Russia, Mexico and Kazakhstan, to cut global crude output by about 1.8 million barrels per day (bpd) from January 1, and bring supply closer to demand. Saudi Arabia had cut beyond what it had pledged in the agreement and brought the kingdom’s output below 10 million bpd, he said. Suppliers participating in the curbs have cut more than 1.5 million bpd, he said, exceeding what he called the market’s low expectations. Global oil demand would grow by 1.5 million bpd in 2017, and increased output from the United States, Brazil and Canada would be more than offset by natural declines in aging fields, he said.

Source: Reuters

Angola’s Sonangol in talks to deploy two new oil rigs

March 6, 2017. Angola’s Sonangol is in talks with oil majors about deploying two new oil rigs it commissioned from South Korea’s Daewoo Shipbuilding and Marine Engineering in 2013, the state firm said. Sonangol said it was in talks with Exxon Mobil, Chevron, BP, Eni and Total about leasing the rigs to help boost exploration and production off the coast of the southwest African nation. The two rigs, the first to be owned by Sonangol, will enter service soon, the company said.

Source: Reuters

Mexico to launch two annual oil auctions beginning in 2018

March 3, 2017. Mexico’s oil regulator will organize two annual oil auctions beginning in 2018, in a bid to further boost the number of private and foreign producers operating in the country. Part of an ongoing overhaul of Mexico’s energy sector, the post-2018 auctions will follow three previously announced ones set for later this year, covering two shallow water tenders and a separate onshore tender. The deep-water auction is set for December and will now also feature so-called unconventional onshore shale fields. The inclusion of shale fields in the auction, most likely near Mexico’s northern border with the United States (US), will mark a first for Mexico, where development of its own shale basins badly lags booming US fields next door. A four-year-old landmark energy overhaul ended the decades-long exploration and production monopoly enjoyed by Pemex while allowing private and foreign oil companies to operate fields on their own for the first time.

Source: Reuters

Macquarie to buy Cargill’s global oil business

March 3, 2017. Australian bank Macquarie Group Ltd is planning on buying Cargill Inc’s global oil business, marking the second energy business the global commodities trader has shed this year. Terms of the deal have been agreed upon, but the integration could take several weeks or longer. The deal comes as Cargill has spent the past year streamlining its business amid a nearly three-year slump in global commodity prices. In January, Cargill sold its US (United States) gas and power business to commodities trader and investor TrailStone Group.

Source: Reuters

Russian cuts to oil production stall in February

March 2, 2017. Russia’s oil output stayed unchanged in February from the previous month, with cuts at just a third of the levels pledged by Moscow under a global deal to reduce production, the energy ministry data showed. The country’s oil and gas condensate output remained at 11.11 million barrels per day (bpd) last month, down 100,000 bpd from levels agreed as the starting point for the accord. OPEC and other large producers led by Russia agreed late last year to reduce their total oil output by almost 1.8 million bpd in the first half of 2017 to boost the price of crude, a key source of revenue. Of that, Russia pledged to cut 300,000 bpd, with 200,000 bpd of reductions in the first quarter. This compares to output of more than 11.2 million bpd in October last year, taken as the baseline for the global deal. In January, Russia cut output by around 100,000 bpd month-on-month, its first reduction since August. It kept that magnitude of output curbs in February. Russian oil pipeline exports in February declined to 4.311 million bpd, from 4.409 million bpd in the first month of the year. Russian natural gas production was at 58.53 billion cubic meters (bcm) last month, or 2.09 bcm a day, versus 66.11 bcm in January.

Source: Reuters

Brazil oil exports hit new record in February

March 2, 2017. Brazilian oil exports hit their second consecutive record in February, with shipments almost double the level of the same period in 2016, as new offshore production continues to come on stream, government data showed. Oil exports rose to 6.23 million tonnes (roughly 45.7 million barrels), 94 percent higher than in February of last year and 12 percent higher than in January, according to data from Brazil’s trade ministry. The sharp increase is the result of rising production from Brazil’s offshore area known as the subsalt, where massive discoveries have been made since the end of the last decade. The Paris-based International Energy Agency expects Brazil’s 2017 output to rise 230,000 bpd on the year to 2.84 million bpd. New lighter crude from the subsalt area is increasing output and changing Brazil’s production mix, reducing the need to import light crude for its refineries.

Source: Reuters

OPEC members must lower costs to compete with shale: Nigeria Oil Minister

March 1, 2017. Members of the Organization of the Petroleum Exporting Countries must lower production costs to compete better with shale producers, Nigeria’s Oil Minister Emmanuel Ibe Kachikwu said. Kachikwu said he was confident that an output reduction agreement agreed in November would see oil prices hold. Nigeria, which relies on crude sales for around two-thirds of government revenue, saw its economy shrink 1.5 percent in 2016 – the first full-year contraction in 25 years – largely due to lower oil receipts. Eleven of OPEC’s 13 members along with 11 non-OPEC countries agreed to make cuts for the first half of 2017, although Nigeria and fellow OPEC member Libya were exempt due to production setbacks suffered last year. The November 30 agreement to cut production prompted oil prices to rise $10 a barrel, although they have been trading in a narrow $3 range in the last few weeks. But analysts said that a revival in US (United States) shale production is likely to limit any major price recovery in crude oil.

Source: Reuters

INTERNATIONAL: GAS

LNG projects must control costs to stay competitive at current prices: JERA

March 7, 2017. Global liquefied natural gas (LNG) projects must control their costs to be profitable at current LNG prices to compete against coal and renewable power, JERA Co President Yuji Kakimi said. Projects should be profitable below $10 per million metric British thermal units (mmBtu) or the assumption that emerging market demand for LNG will rise could be called into question, Kakimi said. Companies struggled to move towards final investment decisions (FID) last year as lower LNG prices combined with rising costs in addressing environmental concerns put a question mark on project viability. JERA has led the way in pushing for changes in contracts that restrict the resale of LNG cargoes and the linkage to oil prices. JERA received Japan’s first LNG cargo derived from US (United States) shale gas in January but paid nearly twice as much for fuel as its cheapest imports.

Source: Reuters

US natural gas output seen up in 2017, but still below 2015 record: EIA

March 7, 2017. The United States (US) Energy Information Administration (EIA) projected dry natural gas production would rise in 2017 after falling in 2016, while gas consumption would decline in 2017 after rising to a record high last year. EIA projected production would rise to 73.69 billion cubic feet per day (bcfd) in 2017 from 72.31 bcfd in 2016. EIA projected US gas consumption would fall to 73.65 bcfd in 2017 from a record 75.13 bcfd in 2016. EIA’s 2017 consumption projection in March is down from the 74.68 bcfd it forecast for the year in its February report. EIA projected both production and consumption would rebound in 2018 to record highs with output hitting 77.80 bcfd and usage reaching 76.58 bcfd. EIA said the US would become a net exporter of gas on an annual basis in 2018 as sales of liquefied natural gas and pipeline flows to Mexico increase, while imports from Canada ease. The country was last an exporter on an annual basis in 1957.

Source: Reuters

Resolute Energy to buy $160 mn worth O&G assets in Delaware Basin

March 6, 2017. Resolute Energy has agreed to purchase certain producing and undeveloped oil and gas (O&G) assets from undisclosed private sellers in the Reeves County of Texas, US (United States), for around $160 mn. Under the deal, Resolute will acquire about 4,600 net acres in Reeves County, including 2,187 net acres next to its existing operating area in Reeves County and 2,405 net acres in southern Reeves County.

Source: Energy Business Review

Israel begins gas exports to Jordan: Delek

March 2, 2017. An Israeli company Delek Drilling said it has started exporting gas from an offshore field to Jordan, marking the country’s first ever exports of natural gas. The exports to Jordan began in January, Delek said. Jordanian firms Arab Potash and Jordan Bromine signed a deal in 2014 to import 2 billion cubic metres (around 70 billion cubic feet) of gas from Israel’s Tamar field over 15 years. Detractors of the gas deal, including Jordan’s main opposition Islamist party, reject any cooperation with a country they regard as an enemy. Israel historically had few natural resources but has discovered a series of offshore gas fields in recent years.

Source: The Economic Times

INTERNATIONAL: COAL

US coal miner Peabody Energy agrees to collateral for mine cleanup costs

March 7, 2017. The United States (US) coal miner Peabody Energy Corp said it has agreed to set aside collateral to cover future mine cleanup costs as part of its bankruptcy reorganization plan, ending its controversial use of “self-bonds.” For decades the largest US coal companies have used a federal practice known as “self-bonding,” which exempts companies from posting bonds or other securities to cover the cost of returning mined land to its natural state, as required by law. Concerns over how Peabody would finance about $1 billion in self-bonds when it emerges from bankruptcy protection had led a series of complaints over its reorganization plan. A year ago, a slump in coal prices had driven some of the largest US coal companies into bankruptcy.

Source: Reuters

China will not force big coal output cuts if prices reasonable: NDRC

March 6, 2017. China will not force coal mines to cut output on a large scale if prices remain within a reasonable range, the National Development and Reform Commission (NDRC) said. NDRC said provincial governments and relevant agencies will decide whether to implement cutbacks at mines that are not considered “advanced”. It did not say what price range it would consider reasonable.

Source: Reuters

China’ coal power plants exposed to write-downs, bankruptcy

March 1, 2017. An Oxford University study warns that China’s utilities could write down between $449 billion and $1.047 trillion in assets over the next 20 years, exposing them to financial risks as the country enacts more intensive pollution controls. The possible write-downs came as China’s top leaders plan massive capacity cuts across industrial sectors and reign in the construction of coal-fired power projects across the country. China Huaneng Group, China’s largest utility, has more than 22,720 MW of new coal generation capacity under construction. These assets face possible devaluations as a result of China’s tightening pollution controls and intense price competition for surviving and new power plants, the study said. Other companies such as China Datang Corp, China Guodian Corp and China Huadian Group are subject to similar risks as they plan to build more than 45,000 MW of new capacity, the study said.

Source: The Economic Times

INTERNATIONAL: POWER

Brazil to auction power transmission licenses on April 24

March 7, 2017. Brazil’s energy regulator Aneel said it will auction next month new licenses to build and operate 7,400 kilometers of power transmission lines requiring up to 13.1 billion reais ($4.2 billion) in investment. The regulator said the power lines would pass through 20 Brazilian states and should enter operation in the five years after the auction, scheduled for April 24. Power generator Engie Brasil Energia SA and distributor Energisa SA have already expressed interest in bidding. Industry analysts expect the power transmission licenses auction to be successful, following good results for another sale in October.

Source: Reuters

Hungary and Slovakia will promote joint power grid links

March 6, 2017. Slovakia and Hungary have announced they will bolster links between their power grids by 2020 within the framework of a joint plan. Both countries will jointly build two 400 kV interconnectors, expected to cost respectively €60 mn for Slovakia and €20 mn for Hungary. The Slovak main biggest utility company Slovenske Elektrarne will be able to sell power to Hungary thanks to the agreement once the interconnectors built and once it completes the extension of its Mochovce nuclear power plant by late 2017 or in 2018.

Source: Enerdata

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Jinko Solar will build a 1.2 GW solar power plant in Abu Dhabi

March 6, 2017. Jinko Solar established a consortium with the Abu Dhabi Water and Electricity Company and Marubeni Corp for the joint construction of a 1.177 MW solar power plant in Sweihan, close to Abu Dhabi. The consortium will build, operate and maintain the power plant for 25 years. The financial agreements for the construction are expected to be closed in April 2017 and the commissioning of the plant could begin in 2019.

Source: Enerdata

US ethanol group clashes with Icahn over details of biofuels negotiation

March 3, 2017. The head of the Renewable Fuels Association (RFA) said billionaire investor Carl Icahn told him President Donald Trump was about to issue an order overhauling the United States (US) biofuels program – something both Icahn and the White House have denied. Confusion over Trump’s plans for the Renewable Fuel Standard (RFS), which requires increasing volumes of biofuels to be added to gasoline and diesel each year, triggered gyrations in the energy and agricultural markets and reopened questions about Icahn’s role shaping the president’s regulatory policy.

Source: Reuters

Solar companies agree on deal with Arizona’s biggest utility

March 2, 2017. Solar installation companies and Arizona’s largest utility said that they had reached a long-sought deal under which new rooftop solar systems would be compensated at a lower rate for the energy they send to the grid. The settlement agreement between Arizona Public Service, a division of Pinnacle West Capital Corp, and solar installers including Sunrun Inc, must be approved by state utility regulator the Arizona Corp Commission. Sunrun said the deal would enable it to continue to do business in the state, but said it should not be a model for other states. Under the deal, new solar systems will receive 12.9 cents per kilowatt-hour for the excess electricity sent back to the utility. Previously, they had received the full retail rate, which in Arizona ranges from 13 cents to 14 cents, according to Sunrun. The bill credit for excess energy, a policy known as net metering, is key to making an investment in solar panels work financially.

Source: Reuters

South African coal truck drivers protest against renewables

March 1, 2017. Thousands of coal truck drivers descended on South Africa’s capital Pretoria to protest against the country’s renewable energy program, after President Jacob Zuma expressed support for the sector. Zuma said state utility Eskom would sign new renewable energy contracts, angering coal transport workers who say such contracts will lead to 30,000 job losses in the coal industry. Coal is used to generate the lion’s share of South Africa’s power supply and job cuts are a particularly thorny issue in a country where the unemployment rate is almost 27 percent. Coal Transportation Forum said about 2,000 protesters marched to Zuma’s offices in Pretoria and handed over a list of demands. As the protest took place, however, Eskom’s acting Chief Executive Matshela Koko said the utility would not renew the contracts of coal transporters supplying coal to Eskom. Eskom said a coal agreement it has with the truck drivers will not be renewed when it expires in May 2018. The utility said the trucks only supply a portion of its coal, most of which is transported to its power plants from mines through conveyer belts and by rail. Producers of solar and wind power have put pressure on Eskom to sign more new renewable energy contracts. Industry experts have said that Eskom slowed the pace of agreeing new renewable energy contracts after power supply in South Africa stabilized last year, following shortages in 2015 that led to power cuts across the country.

Source: Reuters

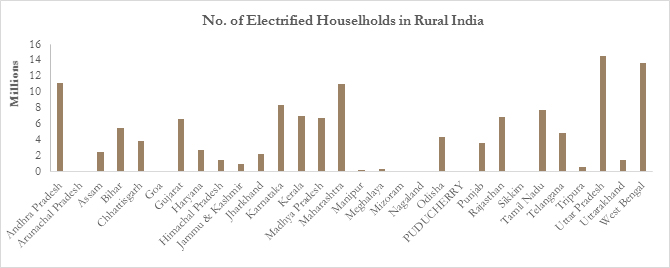

DATA INSIGHT

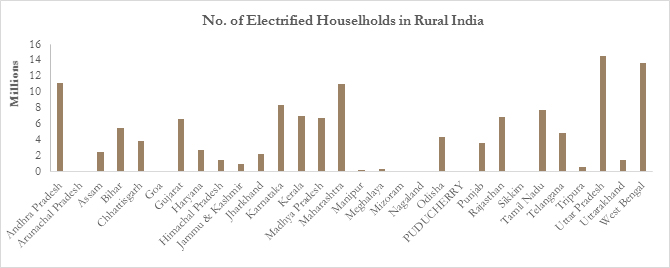

Rural India: Scenario of Electrified Households

| State |

Total Households |

% of Electrified Households |

State |

Total Households |

% of Electrified Households |

| Andhra Pradesh |

11170682 |

100 |

Manipur |

365559 |

75.06 |

| Arunachal Pradesh |

194990 |

73.74 |

Meghalaya |

463022 |

69.92 |

| Assam |

4815919 |

53.25 |

Mizoram |

105234 |

93.39 |

| Bihar |

12194840 |

44.8 |

Nagaland |

159661 |

44.93 |

| Chhattisgarh |

4517319 |

85.55 |

Odisha |

8097579 |

54.99 |

| Goa |

128207 |

100 |

Puducherry |

101788 |

99.63 |

| Gujarat |

6681625 |

100 |

Punjab |

3688646 |

100 |

| Haryana |

3417304 |

79.15 |

Rajasthan |

9081633 |

75.49 |

| Himachal Pradesh |

1455491 |

99.05 |

Sikkim |

37281 |

84.9 |

| Jammu & Kashmir |

1287783 |

79.02 |

Tamil Nadu |

7796907 |

99.19 |

| Jharkhand |

5678835 |

39.4 |

Telangana |

6006033 |

81.4 |

| Karnataka |

9605229 |

87.36 |

Tripura |

795501 |

71.87 |

| Kerala |

7089210 |

99.04 |

Uttar Pradesh |

30119248 |

48.21 |

| Madhya Pradesh |

11356666 |

59.51 |

Uttarakhand |

1721733 |

86.71 |

| Maharashtra |

14252425 |

77.74 |

West Bengal |

14488877 |

94.43 |

| All India |

176875227 |

73.19 |

Source: GARV Dashboard, Government of India

Publisher: Baljit Kapoor

Editorial advisor: Lydia Powell

Editor: Akhilesh Sati

Content development: Vinod Kumar Tomar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV