TARIFF BARRIERS MAY CHALLENGE COMPETITIVENESS OF THE SOLAR SECTOR

Monthly Non-Fossil Fuels News Commentary: June 2020

India

Tariff Barriers

In what will make solar cells, modules and inverters imported from China expensive, India is set to impose a basic customs duty as soon as the safeguard duty, currently in place, expires on 29 July. To impose this 20 percent tariff barrier on imports of green energy equipment, the ministry of new and renewable energy will soon write to the ministry of commerce and industry. The government had imposed the safeguard duty on solar cells and modules imported from China and Malaysia on 30 July 2018. India currently has a domestic manufacturing capacity of 3 GW for solar cells and recently awarded a manufacturing-linked solar contract that will help in establishing additional solar cell and module manufacturing capacity.

The MNRE is likely to clarify the matter of BCD on imported solar equipment within the next two months. A 20 percent basic customs duty had been announced in the last budget, but has not been imposed yet. Developers have been keenly awaiting such a clarification since the duty will impact their cost of setting up a project and thereby the tariff they charge for the power generated. Local solar manufacturing remains what it was two years ago, and Indian solar developers continue to meet 80-85 percent of their equipment needs through imports as before. BCD, unlike safeguard duty which is limited to two years, would be enforced for an extended period of time. However, developers are worried about the impact BCD will have on solar tariffs and the consequent acceptability of such power by distribution companies.

India’s leading solar manufacturers have extended support to the government’s Atma Nirbhar Bharat Abhiyan and sought the Prime Minister’s support to provide a level-playing field for realising the full potential of the sunrise sector. Industry players such as Vikram Solar, Webel Solar, and Renewsys said the government should support manufacturing units located in SEZs. About 63 percent of cell manufacturing capacity and 43 percent of module manufacturing facilities in India are located at the SEZs.

Growth of the Solar Sector

India added only 989 MW of solar power generation capacity in the Q1 of 2020 due to Covid-19 disruption, taking the total installed capacity to 37,916 MW by 31 March 2020, according to the report titled ‘India Solar Compass Q1 2020’ by clean energy consultancy Bridge To India. It said that 1,864 MW of utility scale solar capacity was scheduled to be commissioned in Q1 2020. According to the report, the new capacity addition was split 70:30 between utility scale solar – 689 MW and rooftop solar – 300 MW. It said that the total utility scale, rooftop solar, and off-grid solar capacity stood at 32,176 MW, 5,740 MW and 978 MW, respectively, while the total project pipeline stood at 28,972 MW as on 31 March 2020. According to the report, rooftop solar has also been hit badly with only 300 MW of estimated capacity addition in the busiest quarter of the year. Power demand had begun to inch up gradually in January and February but then fell by as much as 25-30 percent towards the end of March as the lockdown took effect. It said that if demand remains depressed then renewable power prospects would be seriously affected. Despite the execution slowdown, tender issuance in Q1 was high with SECI issuing 9,414 MW of tenders. Total tender issuance and auctions during the quarter stood at 14,293 MW and 8,241 MW, respectively, the report said. India’s total solar and wind power capacity addition in the next five years is expected to reach only 35 GW and 12 GW, respectively, down from previous estimates due to Covid-19 disruptions. The earlier base case solar and wind power capacity addition estimates over 2020-2024 were of 43 GW and 15 GW, respectively, the report said. Regarding the short-term impact of the pandemic on the sector, the report said that there would be a loss of 2-3 GW capacity addition in 2020 along with a higher working capital and operational costs for developers and contractors.

India’s solar power generation plunged about a third during the solar eclipse. Power grid operators, however, handled the sharp drop and surge in generation during the celestial event, underscoring the country’s ability to manage its growing green energy generation and the impact on the national grid. The drop in solar power generation was expected to be around 11,943 MW on 21 June. Eclipses occur every year, but annular solar eclipses are not common. India has experienced three solar eclipses in the past 10 years—on 22 July 2009, 15 January 2010, and 26 December 2019. The eclipse this year also comes against the backdrop of the lockdown to contain the spread of coronavirus, which has led to a drastic fall in pollution and has improved solar radiation. India has 34.6 GW of solar power, and aims to have 100 GW of solar capacity by 2022. Also, it has one of the largest interconnected power grids, capable of transferring 99,000 MW of electricity from any corner of the country.

The NSEFI, an organisation of all solar energy stakeholders of India, has requested the MNRE for extending the waiver of ISTS charges and losses for renewable energy projects in wake of the Covid-19 pandemic. The power ministry in its Order dated 30 September 2016, had notified the waiver under the Tariff Policy, 2016. It had also extended the applicability of this scheme for projects commissioned till 31 December 2022 in a separate Order issued later. The waiver on solar and wind capacity commissioned up to December 2022 is largely perceived as a potent tool to encourage setting up of the projects in states that have a greater resource potential and availability of suitable land. According to NSEFI, the waiver of ISTS charges is, in effect, socialisation of cost among the market participants, instead of being borne by the purchaser of the renewable power. At present, India’s renewable generation capacity stands at 79 GW, which includes 35 GW wind and 26 GW solar. The Central Government in its second term has also reiterated the renewable energy targets of 175 GW to be achieved by 2022.

Auctions

The SECI has for the second time extended the deadlines for submission of bids for three separate tenders with a total project capacity of 81 MW to be set-up at different locations of the SCCL in Telangana. The earlier submission deadlines were 12 June and 13 May. The project will be situated at Chennur and Kothagudam. The project will be located at SCCL’s overburden dump at Ramagundam and Dorli sites in Telangana. For the 15 MW floating solar project to be located at its thermal power plant storage reservoir and Dorli open-cast project, the fresh deadline for submission of bids has been extended till 1 July. Earlier, the deadlines were 17 June and 18 May.

Utility Scale Solar Projects

The Andhra Pradesh cabinet approved a proposal to set up a 10,000 MW mega solar power project to ensure uninterrupted 9-hour power supply to farmers during daytime, besides establishing an IREP. As part of the IREP, 550 MW of wind power, 1200 MW of hydropower and 1000 MW of solar power would be generated.

Tata Power will develop a 100 MW solar project in Maharashtra. Currently, India has about 35,000 MW of total installed capacity of solar power, which is less than 10 percent of India’s total power generation at 3,70,348 MW, inclusive of wind energy, coal energy etc. Under the latest project, Tata Power will supply energy to Maharashtra State Electricity Distribution Company Ltd under a power purchase agreement which will be valid for a period of 25 years from scheduled commercial operation date. The project is required to be commissioned within 18 months from the date that power purchase agreement was executed. The plant is likely to generate about 240 mn kWh of energy per annum, and will annually offset approximately 240 million kg of CO2. With the latest project, Tata Power’s renewable capacity will increase to 3,557 MW, out of which 2,637 MW is operational and 920 MW is under implementation. This includes 100 MW won under this letter of award. Meanwhile, Tata Power Renewable Energy Ltd will supply energy to Gujarat Urja Vikas Nigam Ltd under a power purchase agreement which is valid for a period of 25 years from scheduled commercial operation date.

NTPC Ltd said it has incorporated a JV firm NTPC EDMC Waste Solutions for developing and operating waste to energy project. In its endeavour to transform solid waste to energy, the NTPC has collaborated with municipalities of East Delhi Municipal Corp along with Kawas, Varanasi, Indore and Mohali. The municipal solid waste is segregated and recycled to utilise combustion fraction for power generation, production of methane gas and the residue is used for construction purpose.

Maruti Suzuki India Ltd has announced that it has commissioned a 5 MW capacity carport style photovoltaic solar power plant in Gurugram. This project comes with an investment of more than ₹200 mn. The power plant is capable of offsetting 5,390 tonnes of CO2 emissions per year, for the next 25 years. This power project will give an output of 7,010 MWh of power annually. Back in 2014, Maruti Suzuki set up its first solar power plant with 1 MW capacity at the Manesar facility, which was further upgraded to 1.3 MW in 2018. With the latest project, Maruti Suzuki’s total solar power capacity has increased to 6.3 MW.

India’s Adani Green Energy Ltd said it won a government contract to build solar plants in the country which will have a total capacity of 8 GW and entail an investment of $6 bn over the next five years. The renewable energy developer said the first 2 GW of generation capacity will come online by 2022 and the rest will be added in annual 2 GW increments through 2025 in various parts of the country. The Adani Group will establish a solar cell and module manufacturing capacity of 2 GW by 2022 as a part of the contract won from SECI.

CREST will now install solar plants under RESCO model that UT has approved. CREST will soon float a tender and rope in companies under the model, where they will install solar plants on private properties. In return, the building owner will be charged a much lesser tariff (₹3.44/kWh) for the solar-produced electricity in the bills as compared to normal electricity tariffs (₹2.75 to ₹5.20/kWh). The plant will be installed for 15 years (the details of exact years will be finalised after tender process), and after that the house owner will be given the power plant, he said. The building owner and private company will sign an agreement. The plant will be installed under net metering mode, whereby a solar power system is connected to the electrical connection of a building owner and solar energy exported to the grid is adjusted in terms of units imported from the electricity department during a billing cycle. The building owner will have to pay ₹3.44/kWh fixed tariff for 15 years, whereas in the current scenario there is a power tariff hike every year. Besides, a solar plant has a life of around 25 years, which means, after 15 years for the next 10 years, the building owner will not pay even a single penny for power consumption.

Wave Power

The Kerala state government, with the support of MNRE will explore the possibility of setting up a wave energy generation unit off Vizhinjam coast. A US company (Oscilla Power) which claims to have developed a unique technology for harnessing energy by attenuating the waves using a floating devise. The Union power department had in early 1990s experimented the wave energy potential of sea off Vizhinjam cost. In the pilot project, a 150 kW floating plant would be set up near the proposed international container terminal station. If the technology proves to be a success in all important aspects, the state government, though ANERT, would set up a 1 MW wave energy plant off Vizhinjam.

Rest of the World

Global

Plunging costs of renewables mark a turning point in a global transition to low-carbon energy, with new solar or wind farms increasingly cheaper to build than running existing coal plants, the IRENA said. IRENA said the attractive prices of renewables relative to fossil fuel power generation could help governments embrace green economic recoveries from the shock of the coronavirus pandemic.

Europe and UK

The EU looks set to slightly beat its goal to get a third of its energy from renewable sources by 2030, but public support will be needed to offset a drop in clean power investment due to Covid-19. EU countries’ latest energy policy plans would see the bloc reach a 33 percent share of renewable energy by 2030, surpassing its target by one percentage point. Renewable sources including wind, solar, hydropower and bioenergy made up just under 19 percent of final EU energy consumption in 2018. The IEA expects global growth in new renewable energy capacity to slow for the first time in two decades this year, as the pandemic causes financing challenges and delays construction of projects. Countries may have to revise their policy plans further as the Commission is considering setting tougher renewable energy targets next year, as it strives to reduce net EU greenhouse gas emissions to zero by 2050.

Norway announced plans to tighten rules for onshore wind power developments to better protect nature, a move that is likely to slow surging growth in the sector. The country has seen a boom in wind power development in the past few years, but has also seen public protests with environmental campaigners accusing some developers of building larger turbines than originally approved, obscuring landscapes and endangering birds. Last year Norway put on hold the approval of any new wind power projects after police had to intervene to stop protesters from vandalising some construction sites, although the development of existing licenses continued. The country produces almost all its electricity from renewable sources, mainly hydropower. Norway has opened two areas for offshore wind power developments in the North Sea, including one along its maritime border with Denmark. Western Europe’s largest oil and gas producer generates most of its electricity from hydropower and normally has a surplus, but wants to develop offshore wind to make room for more industry as well as exports. The decision to open new areas means that developers could apply for project licenses, with the two areas offering a possibility to develop up to 4,500 MW of capacity. The 88 MW project could help to reduce CO2 emission by up to 200,000 tonnes per year by replacing electricity generated by gas power turbines.

France is unlikely to experience electricity blackouts this winter despite an expected tight supply situation with several of its nuclear reactors expected to be offline. French winter electricity consumption is expected to be at around the same level as the previous year. France may have to import power during the winter to guarantee supplies, while electricity supply for the summer was secured. At the height of the pandemic, there was a 15 GW supply deficit, which should drop to around 6 GW in November and December 2020. The new coronavirus outbreak has disrupted utility EDF’s nuclear reactor maintenance plans, delaying the start of several reactors. French state-controlled utility EDF warned in mid-April it expected a sharp drop in its domestic nuclear power output to a record low in 2020 as a result of the fall in business activity caused by the coronavirus crisis.

The Vatican urged Catholics to disinvest from the armaments and fossil fuel industries and to closely monitor companies in sectors such as mining to check if they are damaging the environment. The Vatican bank has said it does not invest in fossil fuels and many Catholic dioceses and educational institutions around the world have taken similar positions.

Spanish utility Iberdrola will invest up to €4 bn ($4.5 bn) over the next four years in France to develop renewable energy. Iberdrola is already investing €2.4 bn in the Saint-Brieuc offshore wind farm in France and plans to invest in new onshore wind, solar photovoltaic and participate in future offshore wind capacity auctions.

Germany’s government has set a target to expand offshore wind power capacity by 2040 to 40 GW from 15 GW currently. By 2030, the government aims to add 20 GW in capacity, raising a target of 15 GW agreed by the government as part of a wide-ranging climate package last year. Wind power on the North and Baltic Seas provides significantly more electricity than on land as on average the wind blows more strongly and steadily.

USA

New US solar installations will increase by a third this year, according to the report by the US Solar Industries Association and energy research firm Wood Mackenzie, as soaring demand by utilities for carbon-free power more than outweighs a dramatic decline in rooftop system orders for homes and businesses due to the coronavirus pandemic. The solar industry will install 18 GW this year, enough to power more than 3 mn homes, according to the report by the US Solar Industries Association and energy research firm Wood Mackenzie.

A US development agency proposed lifting restrictions that bar the financing of advanced nuclear energy projects abroad, a move the US administration hopes will help the industry compete with state-owned companies in China and Russia. The US International Development Finance Corp, late opened a 30-day comment period on the proposal. The idea was included in the US administration’s Nuclear Fuel Working Group report released in April, on ways to modernize nuclear energy policy. Russia’s state-owned nuclear energy company Rosatom is also looking to sell nuclear technology.

The US EPA has received 52 new petitions for retroactive biofuel blending waivers that, if granted, would help bring oil refiners into compliance with a court ruling this year, EPA data showed. The new pending applications for blending exemptions are for compliance years 2011 through 2018. The waivers exempt oil refiners from US laws that require they blend billions of gallons of biofuels into their fuel pool. Under the US RFS, oil refiners must blend billions of gallons of biofuels into their fuel, or buy credits from those that do. Small refiners that prove the rules would financially harm them can apply for exemptions.

South America

Royal Dutch Shell Plc is ready to start negotiating with potential clients the sale of future solar power on Brazil’s free energy market from its first farms due to start operating in 2023. The startup date would depend on the negotiations and was part of Shell’s strategy to move into renewable energy, betting on industries’ increasingly wanting to sign long-term clean energy contracts. The majority of companies seeking clean energy contracts were multinational corporations with which Shell could negotiate internationally, while it also has a local sales unit negotiating in the local market in Brazil.

Middle East & Africa

Israel’s energy ministry unveiled an 80 bn shekel ($22.8 bn) plan to increase the use of solar power over the next decade as the country’s population and energy demand are set to surge. Though awash with sunlight, at the end of last year Israel was producing just 5 percent of its electricity from solar energy. About 64 percent came from natural gas and the rest from coal. The new target is to outpace rising demand and have solar power production grow to 30 percent by 2030, or about 16,000 MW. Most of the money will go into solar energy facilities to be built by the private sector. Other costs include upgrading the national grid and investing in energy storage.

South Africa’s energy ministry began consultations with industry on preparations for a proposed 2,500 MW nuclear power plant building programme, which has faced opposition from environmental campaigners. South Africa wants to supplement its power capacity because of problems at state utility Eskom’s fleet of coal-fired power plants, some of which will be decommissioned over the next two decades. South Africa, which operates the continent’s only nuclear power plant near Cape Town, said that it planned to procure 2,500 MW of new nuclear capacity by 2024. South Africa’s long-term energy plan, released in October, listed nuclear power as an option in the longer term or in case a long-delayed hydropower project in the Democratic Republic of Congo does not materialise.

| MNRE: Ministry of New and Renewable Energy, BCD: basic customs duty, mn: million, bn: billion, SEZ: Special Economic Zone, MW: megawatt, GW: gigawatt, Q1: first quarter, SECI: Solar Energy Corp of India, NSEFI: National Solar Energy Federation of India, ISTS: inter-state transmission system, SCCL: Singareni Collieries Company Ltd, IREP: Integrated Renewable Energy Project, kWh: kilowatt hour, CO2: carbon dioxide, JV: joint venture, MWh: megawatt hour, CREST: Chandigarh Renewal Energy, Science and Technology Promotion Society, RESCO: Renewable Energy Service Company, UT: Union Territory, US: United States, kW: kilowatt, IRENA: International Renewable Energy Agency, UK: United Kingdom, EU: European Union, IEA: International Energy Agency, EPA: Environmental Protection Agency, RFS: Renewable Fuel Standard |

NATIONAL: OIL

Government order to companies for stocking up 2 months' LPG supply in Kashmir sparks speculations

29 June. J&K government’s orders on stocking up LPG (liquefied petroleum gas) sufficiently in Kashmir and asking district administration in Ganderbal, which connects the Valley with Ladakh, to vacate school buildings for forces have sparked speculation in the Union Territory, especially in the wake of the tension along the Line of Actual Control. The order said the matter was “most urgent” and directed the concerned department to stock up LPG, which can last for at least two months, owing to frequent landslides along Srinagar-Jammu national highway.

Source: The Economic Times

Operation at oil well in Assam suspended due to heavy rainfall

29 June. Ongoing operation at oil well No 5 of Baghjan in Assam's Tinsukia was suspended after floodwater inundated the area following heavy rainfall. All connecting roads to the well site have been badly hit by flood. The approach road via Talap-Daisajan-Kordoiguri-Badarkhati-Baghjan which was being repaired along with APWD is also affected by flood water in number of places. A recce is underway for exploring approach road to the well site, Oil India Ltd said.

Source: The Economic Times

India bets oil demand will recover fast from lockdown shock

27 June. India, the third-biggest oil consumer, expects fuel demand to return to normal earlier than projections by the IEA (International Energy Agency) and OPEC (Organization of Petroleum Exporting Countries). The world’s biggest lockdown put in place on 25 March in India pummeled demand for transportation and industrial fuels by as much as 70 percent, forcing a reduction in crude processing and oil imports by refiners. The IEA and the OPEC expect India’s demand to not normalize until the end of this year. Oil Minister Dharmendra Pradhan expects India’s energy demand to grow multifold over the next decade upon emerging from the pandemic and is looking at all energy sources to meet the expanding appetite. The country would need refining capacity of 439 million tonnes (mt) a year by 2030 and 533 mt by 2040 from about 250 mt, he said. Expanding fuel demand is attracting oil suppliers such as Saudi Aramco to target refining deals in India. The government is offering refiner Bharat Petroleum Corp Ltd (BPCL) to global investors. Pradhan said the pandemic hasn’t changed the government’s plan on privatization of BPCL and the finance ministry will decide on the timing of the sale. The government, meanwhile, has deferred the deadline for submitting initial bids for the company twice to 31 July.

Source: The Economic Times

Diesel price nudges ₹80 & petrol ₹87 in Mumbai

27 June. Fuel prices rose for the 19th day in a row in the city, with diesel rates inching close to ₹80 a litre at ₹78.51 and petrol at ₹86.91. Diesel prices have risen over ₹12, which is a cause for concern for transporters who said they may be compelled to hike freight charges on transportation, which could increase the cost of essential commodities in the coming days.

Source: The Economic Times

Subsidised LPG prices rise 20 percent in a year while crude oil falls 40 percent

26 June. Cooking gas or LPG (liquefied petroleum gas) subsidy has fallen to zero for many customers as the net price paid by domestic users has risen 20 percent in the past year even as crude oil rates are down 40 percent. Some customers are still getting a small subsidy as the final price depends on local transportation cost. Monthly increase in the net price for subsidised consumers and the recent collapse in global rates has helped end the subsidy. With kerosene subsidy already eliminated since March, the end of the subsidy on LPG is a relief for the government at a time its revenue collection is stressed by the impact of the pandemic on the economy. The price of a subsidised 14-kg LPG cylinder in Delhi has risen from ₹497 in June last year to ₹593. The subsidy for a customer in Delhi has fallen from ₹240 to zero in the same period. However, this can change if LPG costs rise. In a year, the market price of an LPG refill is down from ₹737.5 per cylinder to ₹593, primarily due to an oil price crash caused by a severe destruction of demand due to the coronavirus pandemic. LPG is derived from crude oil. In the same period, the subsidised prices have risen by ₹96 per cylinder to ₹593 as state oil companies, on the directive of the government, have raised prices every month for all customers since August. The price for customers who obtained gas connection under the Ujjwala scheme rose by ₹8 in August while for others the rise was ₹29. Since then the refill rates for Ujjwala customers have also been rising but has stayed at a discount of ₹21 to other customers. Prices have risen by ₹19 per cylinder since March for other customers, while Ujjwala beneficiaries have the option to get three free refills between April and June. Of the total 280 mn LPG customers in the country, about 15 mn customers do not receive subsidy and another 80 mn are Ujjwala beneficiaries. In 2019-20, the LPG subsidy amounted to ₹226.35 bn, down from ₹314.47 bn in the previous year.

Source: The Economic Times

Diesel costlier than petrol in Delhi due to VAT increase by state government: IOC

25 June. Diesel price for the first time in living memory crossing the rate of petrol in the national capital was a result of a steep hike in VAT (Value Added Tax) by the state government, Indian Oil Corp (IOC) chairman Sanjiv Singh said, pointing to lower rates across other cities. According to a price notification of state oil marketing companies, petrol price was unchanged after 17 consecutive increases, while diesel rates were hiked by 48 paise per litre, the 18th daily increase in a row across the country. Diesel now costs ₹79.88 per litre in Delhi as compared to petrol price of ₹79.76. Rates differ from state to state depending on the incidence of VAT. However, diesel is costlier than petrol only in the national capital where the state government had raised local sales tax or VAT on the fuel sharply. This massive hike in VAT resulted in rates going up by ₹1.67 per litre for petrol and by a record ₹7.10 for diesel on a single day. Singh said diesel in all other cities is priced lower than petrol -- the difference between the two being as high as ₹9.50 per litre in Pune and over ₹3.50 in most state capitals and major cities. IOC and other firms Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) too held the rates for volatility to end. Singh said the companies returned to revising rates after international markets stabilised. Diesel in Delhi is the second most costliest in the country. It costs ₹80.68 in Rajasthan but even there the difference between diesel and petrol is ₹6.17 per litre. Petrol costs ₹86.54 a litre in Mumbai and diesel is priced at ₹78.22. In Chennai, a litre of petrol comes for ₹83.04 and diesel for ₹77.17. In Kolkata, petrol is priced at ₹81.45 per litre and diesel costs ₹75.06. In Bengaluru, petrol comes for ₹82.35 a litre and diesel for ₹75.96. In Hyderabad, petrol is priced at ₹82.79 a litre and diesel at ₹78.06. Traditionally, diesel was priced ₹18-20 a litre lower than petrol due to lesser taxation. But over the years, the taxes have increased, narrowing the gap.

Source: The Economic Times

NATIONAL: GAS

India’s Petronet close to signing long-term LNG deal around spot prices

30 June. In a first, India’s biggest LNG importer Petronet said it is close to signing a long-term LNG deal benchmarked to daily or spot prices, which generally are lower than standard rates of such contracts. India bought liquefied natural gas (LNG) under long-term contracts from Qatar and Australia at an average of $3.5-4.5 per million metric British thermal units in the current quarter. Spot or current prices of LNG - gas turned into liquid at sub-zero temperature for ease of transporting in ships - are in the range of $2. Petronet had in February sought bids from suppliers for 1 million tonnes (mt) of LNG per year for 10 years, starting 2024. The company wanted 1 million tonnes per annum (mtpa) of LNG on a delivered ex-ship (DES) basis. Currently, Petronet buys close to 10 mtpa of LNG through contracts with ExxonMobil and Qatar Petroleum. These contracts are priced at an average of benchmark crude oil rates of a particular period. GAIL (India) Ltd has contracted 5.8 mt of LNG from the US (United States) benchmarked to prevailing rates on Henry Hub plus a fixed portion.

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">End of central control of gas prices will transform the gas industry!

< style="color: #ffffff">Good! |

Source: Business Standard

RIL pushes back KG-D6 production to September-October

28 June. Reliance Industries Ltd (RIL) has pushed back the start of production from the second wave of discoveries in its eastern offshore KG-D6 (Krishna Godavari Dhirubhai 6) block to September-October after the Covid-19 lockdown imposed unprecedented constraints in execution of the deepwater project. The company, along with its partner BP Plc of the UK (United Kingdom), was initially targeting the start of production from the R-Series field in the Krishna Godavari block in May but pushed it back to June-end due to the lockdown. The lockdown has further pushed the start of production to mid of 2020-21 fiscal, RIL said. RIL said the key focus for 2019-20 was to monetise the about 3 trillion cubic feet equivalent of discovered resources in KG-D6 deepwater. Combined production from these three fields is expected to be 30 million metric standard cubic meter per day (mmscmd) by FY2024. The output is equal to a third of India’s current natural gas production. The company’s D1 and D3 fields in the KG-D6 block ceased to produce in February this year after being in production for a decade. R-Cluster will have a peak output of 12.9 mmscmd while Satellites, which are supposed to begin output from mid-2021, would produce a maximum of 7 mmscmd. MJ field will start production in the second half of 2022 and will have a peak output of 12 mmscmd. RIL said with a significant gas resource base, it is poised to be a premier contributor to India’s gas-based economy. The peak production from the three fields is expected to reach about 15 percent of India’s projected demand that year, it said. The D1-D3 field was India’s first deepwater gas field to be put on production in April 2009. The KG-D6 Block has so far produced an overall 3 trillion cubic feet equivalent of gas, oil and condensate.

Source: Livemint

India to end central control of gas prices, lift LNG transport use

26 June. India will gradually end central controls on gas pricing as it seeks to attract foreign investment and technology to lift local output, Oil Minister Dharmendra Pradhan said. India, which is a large emitter of greenhouse gases and has multiple gas pricing regimes, aims to raise the share of gas in its energy mix to 15 percent by 2030, from 6.2 percent. To boost gas usage, India is expanding infrastructure including building new liquefied natural gas (LNG) import plants and connecting households with an expanding gas pipe network. New Delhi said recently that no authorisation was needed to set up LNG dispensing facilities for vehicles. India’s top gas importer Petronet LNG said it wants to partner with fuel and gas retailers on LNG stations along highways for long-haul trucks and buses. Petronet wants to set up 5 LNG stations in the fiscal year ending March 2021, and 300 by 2023. It eventually aims to have 1,000 LNG stations across India, it said. Meanwhile, Indian Oil Corp (IOC), the country’s top refiner and fuel retailer, said it wants to start LNG retailing through its fuel pumps. GAIL (India) Ltd’s executive director Rajeev Mathur said his firm is looking for partners to set up LNG dispensing facilities. Mathur said India’s gas demand is expected to rise by 3-4 percent between October 2020 and March 2021, after witnessing a huge fall in April-May due to a coronavirus lockdown. Imported LNG accounted for about half of India’s 60.8 billion cubic meters of gas consumption in the fiscal year to March 2019.

Source: Reuters

NATIONAL: COAL

Indian private firms seen developing 15 mt capacity coal mines this year: Joshi

30 June. India’s private companies could start developing coal mines with an annual capacity of 15 million tonnes (mt) by the end of March, the country’s Coal Minister Pralhad Joshi said, a move that would end the near-monopoly of Coal India Ltd (CIL). Prime Minister Narendra Modi officially launched the auction of 41 coal mines to companies including those in the private sector, with an annual production capacity that is nearly one third of national total output. India’s consumption of coal fell 3.3 percent to 958 mt in the year ended March 2020, and is expected to fall further this fiscal year due to the coronavirus, Joshi said. Ratings agency Moody’s Indian unit ICRA said it expects domestic coal demand is estimated to grow at 2.9 percent between fiscal years 2021 and 2027, nearly half the rate seen in the preceding seven years.

Source: Reuters

Mahanadi Coalfields sets 263 mt production target by 2023-24

30 June. Mahanadi Coalfields Ltd (MCL), an Odisha-based subsidiary of Coal India Ltd (CIL), said the company has set a target of producing 263 million tonnes (mt) of coal by 2023-24 and employees must ensure normal mining operations to achieve the goal. In the current financial year, MCL has been assigned with a target of 173 mt of coal but the company is lagging behind in its production and overburden removal targets, Chairman-cum-Managing Director B N Shukla said. Various coal trade unions have given a call for a three-day nationwide strike against the government’s move to open the coal sector to private players. He observed that the key demands of the trade unions pertain to policy decisions beyond the purview of the company, and said that no coal block allotted to MCL is going to be auctioned. CIL, including MCL, had been declared as Public Utility Services under the provisions of Industrial Dispute Act, 1947, and statutory restrictions have been prescribed against any strike in such organisations, he said.

Source: The Economic Times

Government nod to finalise Madhya Pradesh coal block deal awaited

28 June. The 60-day extension granted by the Centre to Goa Industrial Development Corp (GIDC) to complete the formalities for the Dongri-Tal II coal block will come to an end in just over a month. GIDC is still waiting for clearance from the state government to appoint a transaction advisor who will help select a mine developer-cum-operator for the coal mine in Madhya Pradesh. With austerity measures in place and a fund crunch staring at the state, GIDC could lose out a second time on the coal block. GIDC had moved a file seeking approval from the state government for a request for proposal to select a transaction advisor to select the mine developer-cum-operator for the coal block as well as a separate consultant to assist in the auction of 5 lakh square metres of land recovered from the Special Economic Zone promoters.

Source: The Economic Times

Reconsider decision allowing 100 percent FDI in coal mining: Mamata to PM

26 June. Expressing reservations about the central government allowing 100 percent foreign direct investment (FDI) in the coal sector, West Bengal Chief Minister (CM) Mamata Banerjee has written to Prime Minister Narendra Modi requesting him to reconsider the decision. The CM described the move of the coal ministry to shift the desk offices of four of its subsidiary companies from the state as an "abrupt decision" and requested the prime minister to intervene in the matter.

Source: The Economic Times

CIL not to give away any block for commercial mining

26 June. Coal India Ltd (CIL) chairman Pramod Agarwal confirmed that there should be no cause of concern as there was no proposal to give away any coal block of the PSU (Public Sector Undertaking) giant for commercial mining. The Maharatna company has sufficient number of coal blocks with abundant resource capacity to continue as a commercially viable entity even in the competition era, he said. CIL has 447 coal blocks, mostly explored, under its disposal. In addition to these, 16 more blocks were allocated to CIL — 10 under the Coal Mines (Special Provision) Act and six under Mines and Minerals (Development and Regulation) Act — making it the largest holder of coal resource in the country. Combined capacity of these 463 blocks is close to 170 billion tonnes. Most of the allocated16 blocks have a minimum 10 million tonnes (mt) per annum production capacity. Their combined peak rated capacity is 264 mt.

Source: The Economic Times

Maharashtra government to oppose coal mining near Tadoba reserve

25 June. Maharashtra Relief and Rehabilitation Minister Vijay Wadettiwar said that the state government would oppose the Centre’s proposal to conduct coal mining near Tadoba-Andhari Tiger Reserve (TATR) in Chandrapur district, as it would "destroy" the habitat of tigers. Bander coal block, located close to TATR, is one of the 41 mining sites in the country for which the Centre has invited bids for an auction. According to the forest department, the Bander coal block falls in Chimur tehsil under Bramhapuri forest division. It is located very adjacent to the buffer zone boundary of the TATR. Prime Minister Narendra Modi had launched the auction process of 41 coal blocks for commercial mining.

Source: The Economic Times

NATIONAL: POWER

MERC has directed power companies to show transparency in billing: Maharashtra CM

30 June. Maharashtra Chief Minister (CM) Uddhav Thackeray said that the Maharashtra Electricity Regulatory Commission (MERC) has directed power companies to show transparency in their billing procedures and redress consumer complaints immediately. The power regulatory authority had issued directives to the utility firms because of a growing number of complaints. MERC had stated that if a consumer’s bill is more than double of the average for the amount charged between March and May, then he would be given the option of paying it three equated monthly instalments (EMIs). The reading of electricity metres has been suspended since the nationwide lockdown restrictions were enforced from 25 March to contain the spread of the coronavirus disease (Covid-19) outbreak. Consumers are being billed on the basis of an average consumption based on three months prior to March, or the winter season, when the consumption of electricity is typically low.

Source: Hindustan Times

Village in Chhattisgarh’s Balrampur gets electricity under Saubhagya scheme

28 June. After years of being forced to live without electricity, residents of Kanda village in Balrampur district have received the gift of electricity under the Saubhagya scheme. Under Saubhagya scheme 269 homes have been provided with light and fan and they will run through solar panels installed on their houses. The area is secluded and is surrounded on all sides by wilderness, the lights will bring about a drastic change in the lives of the villagers, Chhattisgarh Renewable Energy Development Agency said.

Source: The Economic Times

Haryana: 1k villages to get 4-hour power supply

27 June. The Haryana government has decided against no power cuts from noon to 4pm in about 1,000 villages having less than 60 percent line loss. The decision also aims to ensure smooth power supply this summer so that people do not face any problem. Also, under the ‘Mera Gaon Jagmag Gaon Yojana’, 24-hour power supply is being provided in about 4,500 villages of the state. Haryana Power and New and Renewable Energy Minister Ranjit Singh said complaints regarding power cut schedule were reported from several parts of the state over the last few days. Since it is paddy sowing season in the state, therefore power cuts are scheduled as farmers need more water, he said. The Minister clarified there will be 24-hour power supply in 4,500 villages and no electricity cut in these 1,000 villages for four hours. Besides, there will be uninterrupted power supply in all the villages at night.

Source: The Economic Times

Government agency chooses Deloitte to help UT in privatising power department

27 June. The privatisation of electricity department has gained pace as the government-owned Power Finance Corp Ltd (PFC) has appointed private company Deloitte as a consultant. Finance Minister Nirmala Sitharaman had said that electricity distribution companies in Union Territory (UT) will be privatised. Earlier, the UT had engaged PFC to unbundle the department and transform it into a corporate. Meanwhile, the power department employees continued with their protest against the move. As Chandigarh does not have its own power generation, the state transmission utility will be responsible for ensuring smooth transmission of power in the city. State load dispatch centre will be the apex body to ensure integrated operation of the power system.

Source: The Economic Times

Maharashtra cabinet nod for power duty concession, pay hike for ASHA staff

26 June. The Maharashtra cabinet approved a proposal to give concession in electricity duty for industrial consumers. The electricity duty will now be 7.5 percent instead of the present 9.3 percent, a statement from the Chief Minister’s Office (CMO) said. The state will face a revenue loss of ₹4.4 bn annually due to the decision, but the industrial consumers will get electricity at low tariff. In another decision, the Accredited Social Health Activists (ASHA) workers will get a pay hike of upto ₹2,000 from 1 July.

Source: The Economic Times

Consumers seek more relief as MSEDCL allows instalments

25 June. MSEDCL (Maharashtra State Electricity Distribution Company Ltd) has decided to allow consumers to pay their electricity dues in instalments, a move hailed by people but amid demand for correction of bills and discounts as well in view of the economic slowdown. The state power utility has been at the receiving end of consumers ever since it delivered the bills for the month of June, with many alleging that the same were inflated and wrong. Another issue that has been raised is that the lockdown in view of the coronavirus pandemic has affected the incomes of people. MSEDCL said that consumers have failed to understand the bill in which the average units were deleted in the from of payments made for two previous months. MSEDCL has decided to accept payment of bills in three instalments to reduce the burden on consumers. Consumers are happy about the instalment facility but want the bills to be “corrected” or discounts offered at the same time.

Source: The Economic Times

UP CM Yogi Adityanath bans use of Chinese power meters

24 June. The Yogi Adityanath government in Uttar Pradesh (UP) has imposed a ban on the installation of new China-made electricity meters by the state Power Department. The All India Power Engineers Federation president Shailendra Dubey has welcomed the decision. He said their association demands that equipment used in power plants be purchased from public sector company Bharat Heavy Electricals Ltd (BHEL). It has been quite some time since consumers have been complaining about the working of Chinese metres and even demanding their replacement.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Enel to build first solar plant in India after winning tender

30 June. Italy’s biggest utility Enel said it had won its first photovoltaic tender in India and would be spending around $180 mn to build its first solar plant in the country. The group said its green energy unit had won the right to sign a 25-year energy supply contract for a 420 MW solar project in the State of Rajasthan. Enel Green Power, through EGP India, owns and operates 172 MW of wind capacity in India.

Source: Reuters

Lack of backward integration will hinder domestic solar manufacturing: ICRA

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Lack of backward integration will hinder domestic solar manufacturing!

< style="color: #ffffff">Bad! |

26 June. The Centre may have increased its focus on domestic solar module manufacturing through a host of “Make in India" initiatives, but lack of scale and backward integration in the process for a majority of such producers are likely to pose constraints in executing orders, credit ratings agency ICRA has said. The Centre’s efforts are likely to result in a favourable order pipeline of about 35-40 GW over the next three-five years for domestic solar original equipment manufacturers. The government has formulated various schemes in the last one year such as the Central Public Sector Undertaking (CPSU) Scheme which envisages installation of 12 GW solar power capacities by FY2023 with a defined sourcing requirement from domestic module manufacturers. Besides, the Ministry of Railways has a plan to meet 10-15 percent of its energy requirements through solar power over the medium term by setting up about 3 GW of projects on barren land available alongside the railway tracks. In addition, there has been a greater thrust on the domestic manufacturing linked orders by Ministry of New and Renewable Energy (MNRE).

Source: Livemint

Five cities of Uttar Pradesh to get green power booster

26 June. To promote green energy in the state, five cities of UP (Uttar Pradesh), including Prime Minister Narendra Modi’s parliamentary constituency Varanasi and Chief Minister Yogi Adityanath’s home district Gorakhpur, will be switched over to solar power completely. UP will be the first state in the country to promote solar power in such a big way. In the first phase, the green energy campaign would be launched in Varanasi, Gorakhpur, Prayagraj, Ayodhya and Mathura. The ambitious project will be fully implemented by 2024 and for this a special drive will be launched by Energy Minister Shrikant Sharma soon. During the lockdown, Sharma has introduced various reforms in the power sector, including categorising feeders in red, orange and green categories on the basis of transmission and distribution losses.

Source: The Economic Times

Avaada Energy to set up 350 MW solar plant in Maharashtra

25 June. Solar projects developer Avaada Energy said it will set up a 350 MW solar plant in Maharashtra. The project has been awarded by Maharashtra State Electricity Distribution Company Ltd (MSEDCL), Avaada said. The energy will be supplied to MSEDCL under a power purchase agreement from scheduled commercial operation date. The project, which is expected to be commissioned by January 2022, would generate about 525 mn units annually, it said.

Source: The Economic Times

Import duty on solar modules to rise to 40 percent in a year

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Import duty on solar modules will make industry less competitive!

< style="color: #ffffff">Ugly! |

25 June. The government will raise the basic customs duty on solar modules to 40 percent in a year, after initially levying 20-25 percent from August, Power and Renewable Energy Minister R K Singh said. For solar cells, the customs duty will start with a 15 percent levy this August, and will be raised to 30 percent. The move will be a big blow for China, which supplies 85-90 percent of equipment used in the rapidly expanding solar energy sector in the country. The Minister said that by 2030, he expects the share of established non-fossil energy generators to overcome the traditional thermal generators. Currently in 2020, non-conventional power generation capacity has a share of 37 percent.

Source: The Economic Times

India to overachieve UNFCCC 2030 target, share of non-fossil fuels to increase to 64 percent by 2030

25 June. The percentage of non-fossil fuel in India’s electric power installed capacity is estimated to increase to 64 percent in March 2030, according to a recent report by the Central Electricity Agency. The report on optimal generation capacity mix for 2029-30 added that the percentage of non-fossil fuel in installed capacity stood at 49 percent and 36.5 percent in March 2022 and March 2019, respectively. According to the Intended Nationally Determined Contribution (INDC) to the UN Framework Convention on Climate Change (UNFCCC) target, the goal is to achieve about 40 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030. In October 2015, India had submitted its INDC to UNFCCC. Another aim of the INDC target is to reduce the emissions intensity of its gross domestic product by 33 to 35 percent by 2030 from 2005 level. It has also set a target of creating an additional carbon sink of 2.5 billion tonnes to 3 billion tonnes of carbon dioxide equivalent through additional forest and tree cover by 2030. India is taking several steps to achieve its INDC targets for increasing renewable energy share such as its ambitious target of achieving 450 MW renewable energy capacity by 2030, one of the largest such expansion plans in the world, is already underway. Other plans include creating green energy corridors, solar parks, implementation of the National Smart Grid Mission, rolling out of solar-wind hybrid and battery storage tenders, and introduction of innovative technologies to promote energy efficiency.

Source: The Economic Times

NTPC awarded project management contract for 500 MW solar park in Mali

25 June. NTPC Ltd has been awarded the project management consultancy contract for the development of 500 MW solar park in the Republic of Mali, the Ministry of New and Renewable Energy (MNRE) said. Earlier, the Republic of Togo had engaged NTPC for similar support for development of 285 MW solar park. NTPC plans to anchor 10,000 MW of solar parks in ISA member countries in the next two years.

Source: The Economic Times

INTERNATIONAL: OIL

CNOOC announces new discovery in South China Sea

29 June. CNOOC Ltd, a listed branch of China National Offshore Oil Corp, said it had made a significant discovery in the eastern part of the South China Sea. The field, named Huizhou 26-6, was tested to produce around 2,020 barrels of oil and 15.36 mn cubic feet of gas each day. CNOOC expect Huizhou 26-6 to become the first mid-to-large sized condensate oil and gas field in the shallow water area of the Pearl River Mouth Basin.

Source: Reuters

Iraq to review some oil contracts at high-cost fields

28 June. Iraq is reviewing oil contracts with some companies operating fields where costs are high, in order to reduce expenses while cutting production, Oil Minister Ihsan Abdul Jabbar said. It is in OPEC (Organization of the Petroleum Exporting Countries) member Iraq’s interest to cooperate with the OPEC+ group to raise the market value of oil, the Minister said. Iraq told OPEC+ - a group comprised of the OPEC and allies - that it would start an urgent plan to cut its oil production gradually to fully comply with its quota, after the group demanded that Baghdad and other laggards adhere to a pact on output curbs.

Source: Reuters

Venezuela tightens grip on fuel stations after subsidy reform

28 June. Venezuelan state oil firm PDVSA has told independent gas station operators it can revoke their licences “at any time”, only weeks after it cut generous fuel subsidies and as widespread shortages take hold, a notification PDVSA sent to the operators showed. PDVSA has a monopoly over the wholesale fuel distribution market and owns almost all of the country’s 1,200 service stations, although most are operated by private companies through commercial licences. The shift is a new sign of the desperation of President Nicolas Maduro’s government for hard currency as the Covid-19 pandemic and US (United States) sanctions have reduced Venezuela’s capacity to earn export revenue from oil shipments.

Source: Reuters

Trump administration opens sensitive Arctic areas to oil development

26 June. The Trump administration released its plan to open environmentally sensitive areas in Arctic Alaska to oil development, overturning some protections that go back decades. The plan released by the Interior Department’s Bureau of Land Management (BLM) revokes an Obama-era management system for a huge swathe of federal land on the western North Slope, the National Petroleum Reserve in Alaska. The Trump plan, contained in a final environmental impact statement, opens 18.7 mn acres of the 23 mn-acre reserve to development. The Obama-ere plan in effect since 2013 allowed oil development on about half of the reserve. The new National Petroleum Reserve plan allows oil development on all of Teshekpuk Lake, the biggest lake on the North Slope, famous for its migratory bird and caribou populations. The new plan could result in up to 20 years of new oil production of up to 500,000 barrels per day, supported by 240 miles of pipelines, 250 miles of roads and assorted drill pads and other industrial sites, the BLM’s document said.

Source: Reuters

China’s record US crude imports in July underscores trade deal failure

25 June. A record amount of crude oil is heading from the United States (US) to China, but rather than signalling that the trade deal between the two countries is working, it serves to underscore just how far Beijing is from meeting its commitments. A total of 31.02 mn barrels of crude on 26 vessels is due to arrive in China from the US in July, according to vessel-tracking and port data. This equates to about 1 mn barrels per day (bpd) and is more than double the previous best month of 466,000 bpd in June 2018. In the first six months of 2020, China imported just 5.55 mn barrels of US crude, or about 41,500 bpd.

Source: Reuters

Russia takes a leaf out the US shale oil playbook

25 June. Russia is taking a leaf out of the US (United States) shale playbook so it can ramp up oil production quickly and hang on to its share of the global market when demand finally recovers after the coronavirus pandemic. At least two state-owned banks, Sberbank and VEB, plan to lend oil firms some 400 bn roubles ($6 bn) at effectively almost zero interest rates to drill about 3,000 unfinished wells. Once oil prices recover, the wells can be finished off faster than starting from scratch so Russia can get its output back to levels reached before it agreed along with other leading producers to cut supply because of the fallout from Covid-19. US shale producers tend to drill but not complete wells when oil prices are low, rather than freezing all activity, so they can finish off the wells and quickly boost production when demand picks up. A geologist advising Russian oil firms said the new wells would add at least 200,000 barrels per day (bpd) to output based on average flow rates but if their assumptions about large reserves pan out the wells could boost output by 2 mn barrels.

Source: Reuters

Occidental warns of up to $9 bn asset writedown on bleak oil price outlook

25 June. Occidental Petroleum Corp warned of asset writedown of up to $9 bn in the second quarter and said it would restructure some of its debt to avoid a possible default. The oil producer said it will buy back a part of its $9.12 bn outstanding senior notes due in 2021 and 2022 by issuing new high-yielding notes, while also looking to remove some covenants and events of default from the old notes. The company said it expects preliminary oil and gas production from continuing operations for the second quarter to lean toward the high-end of range of 1.3 mn - 1.4 mn barrels of oil equivalent per day.

Source: Reuters

Saudi oil exports down by $12 bn year on year in April

25 June. The value of Saudi Arabia’s oil exports dropped by 65.4 percent in April when compared to the same month a year earlier, or a fall of about $12 bn. Compared to March, total exports - including non-oil exports of goods such as chemicals and plastics - decreased by 23.5 percent, or about $3 bn, the General Authority for Statistics said. Amid a drop in demand and oil prices, in the first quarter the value of Saudi Arabia’s oil exports plunged by 21.9 percent year on year to $40 bn, corresponding to a decline of about $11 bn. The world’s largest oil exporter could see its economy shrink by 6.8 percent this year, the International Monetary Fund said.

Source: Reuters

Iran plans oil exports from the Gulf of Oman to secure crude flow

25 June. Iran plans to export oil from a port on its Gulf of Oman coast by March, Iranian President Hassan Rouhani said, a shift that would avoid using the Strait of Hormuz shipping route that has been a focus of regional tension for decades. Iran has often threatened to block the Strait if its crude exports were shutdown by US (United States) sanctions, a move Washington has said would cross a “red line” and would demand a response. Rouhani said Iran aimed to export 1 mn barrels per day (bpd) of oil by March from Bandar-e Jask, a port on Iran’s Gulf of Oman coast, just south of the Strait of Hormuz. Hit by US sanctions, Iran’s oil exports are estimated at 100,000 to 200,000 bpd, down from more than 2.5 mn bpd that Iran shipped in April 2018. The Islamic Republic’s crude production has halved to around 2 mn bpd. The Strait is a narrow channel at the mouth of the Gulf through which about a fifth of the world’s oil passes from Middle East producers to markets in Asia, Europe, North America and beyond. Iran’s oil revenues, already hit by US sanctions, have fallen further as global crude demand has tumbled due to the coronavirus crisis. Iran said oil revenues fell to $8.9 bn in the year to March, Iranian media reported, comparing it to $119 bn earned almost a decade earlier, in 2011.

Source: Reuters

INTERNATIONAL: GAS

China Gas fuel sales growth slows as lockdown batters demand

26 June. China Gas Holdings Ltd, one of China’s largest independent piped gas distributors,said gas sales in its latest financial year rose just 2.9 percent, a sharp fall from the previous year as the coronavirus pandemic hit fuel demand. China Gas sold 25.4 billion cubic meters of gas in the year ended 31 March, equivalent to roughly 8 percent of China’s total gas demand, but the rate of growth collapsed from a 32 percent surge in the year earlier period. The company said it had completed construction of a gas transmission pipeline network with a total length of 402,381 kilometre (km). The firm expected its distribution network in northeast China to generate 500 million cubic meters of gas sales this year, due to its proximity to the Russia-China Power of Siberia project that started pumping gas to China in late 2019.

Source: Reuters

INTERNATIONAL: COAL

China approves coal mine projects with 3.6 mt annual capacity

24 June. China, the world's top consumer of coal, has approved two new coal mine projects in the northwestern regions of Xinjiang and Gansu with combined annual capacity of 3.6 million tonnes (mt) at a total investment of 4 bn yuan ($566 mn). China, which produced 3.75 mt of the fossil fuel in 2019, has been shutting small and outdated mines to launch bigger ones in its coal-rich regions, such as Shanxi, Inner Mongolia, Shaanxi and Xinjiang. The National Energy Administration (NEA), which approved the projects, reaffirmed its commitment to building a clean, green and efficient coal industry and to cap the number of coal mines at 5,000 in 2020. To do this, it will hasten efforts to phase out mines with annual capacity below 300,000 tonnes, it said.

Source: The Economic Times

INTERNATIONAL: POWER

Rio Tinto reaches power supply deal with Mongolia for Oyu Tolgoi mine

29 June. Rio Tinto said that Mongolia would build a coal-fired plant that would supply power to its giant Oyu Tolgoi copper mine in the country, with construction set to start by this time next year. The mining giant said it will amend its current power supply agreement with the Mongolian government by March 2021, under which the government will begin construction of a coal-fired power plant at Tavan Tolgoi by July 2021. The notice confirms that Rio will not have to build its own 300 MW coal power plant, which it had earlier estimated could cost $924 mn. The plant is expected to come on stream within the next four years. Until then, power supply to the mine and the underground project, which is sourced from China, will continue under the current terms, it said.

Source: Reuters

China’s NDRC extends power price cut to boost economy

28 June. China’s National Development and Reform Commission (NDRC) said a policy to cut electricity prices by 5 percent will be extended until the year-end to aid companies struggling because of the impact of the Covid-19 pandemic. During the early stage of China’s outbreak in February, China’s National Development and Reform Commission (NDRC) announced measures to cut electricity prices from 1 February to 30 June. NDRC said companies will continue to enjoy lower prices between 1 July and 31 December, as the government works to lower companies’ operating costs and protect jobs.

Source: Reuters

World Bank approves $750 mn loan for Nigeria’s power sector

24 June. The World Bank has approved a $750 mn loan for Nigeria’s power sector, the first release of funds after years of stalled talks over long-term reforms, it said. Nigeria’s decrepit power sector has hobbled the growth of Africa’s largest economy for decades. The loan will cut tariff shortfalls, protect the poor from price adjustments, and increase power supplied to the grid, the World Bank said. Nigeria’s low tariffs, imposed by the government, have forced the central bank to spend billions of dollars making up the difference owed by power distributors to companies generating electricity.

Source: Reuters

China’s power consumption to grow 7.1 percent in Q3, 6.8 percent in Q4

24 June. China’s electricity consumption is expected to grow 7.1 percent and 6.8 percent year-on-year, respectively, in the third quarter (Q3) and fourth quarter (Q4) of 2020, as the coronavirus outbreak eases and Beijing’s economic stimulus policies take effect, according to an expert from the State Grid. The world’s second-biggest economy had seen year-on-year growth in total power consumption for the first time this year in May following the relaxation of anti-coronavirus measures and the resumption of business. For the first five months of this year, however, power consumption in China fell 2.8 percent from the same period in 2019. Electricity consumption growth in the upcoming six months will be mainly driven by demand in the secondary industry and residential users, with increase rates at 5.9 percent and 10 percent respectively. Shan also expects China’s full-year power consumption to reach 7.44 tn kilowatt hours (kWh) in 2020, up 3 percent from the level in 2019.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Japan’s NTT aims to expand renewable energy capacity to 7.5 GW by 2030

30 June. Japan’s Nippon Telegraph and Telephone (NTT) plans to boost its renewable energy capacity manifolds to 7.5 GW by 2030 as the telecommunications giant steps up its energy business to drive growth. The move comes as companies step up investment in green energy to tackle climate change and may boost competitions in Japan’s electricity market which has been liberalised since 2016. NTT Anode Energy, the group’s energy unit formed last year, has said it would spend 100 bn yen ($928 mn) per year through 2025 to reinforce renewable energy and energy infrastructure. NTT Anode Energy and trading house Mitsubishi Corp said they would collaborate in renewable energy and energy management services using electric vehicles and storage batteries.

Source: Reuters

Climate fund targets $2.5 bn in clean energy investment for Southeast Asia

29 June. A new climate fund backed by philanthropic donors is aiming to trigger $2.5 bn of clean energy investment in Southeast Asia and aid the region’s green recovery after the coronavirus. The South East Asia Clean Energy Facility (SEACEF) is managed by Singapore-based Clime Capital, with an initial investment of $10 mn and a focus on getting new projects underway in Vietnam, Indonesia and the Philippines. Last year, researchers said Southeast Asian countries must end their reliance on coal power and switch to clean energy, to meet pledges to curb climate change and tackle air pollution. But the region is struggling to wean itself off abundant, locally produced cheap coal in favour of clean alternatives to burning fossil fuels, the main contributor to climate change. China is the world’s biggest emitter of greenhouse gases blamed for global warming. SEACEF describes itself as a “first-of-its-kind” philanthropic initiative to tackle climate change, focused on the high-risk funding needed to get new clean energy projects up and running. The fund, which hopes to attract an additional $40 mn in capital from foundations and development banks, aims to mobilise more than $2.5 bn in clean energy investment from the private sector.

Source: Reuters

Norway wants more renewable power for oil platforms, major industry

26 June. Norway could cut its carbon dioxide emissions by 4 million tonnes (mt) per year, or nearly 8 percent of the total, by providing more renewable electricity for major industrial plants and offshore oil and gas platforms. While Norway is a major producer of petroleum, it has also signed up to the Paris Agreement on climate change, pledging earlier this year to cut its domestic emissions of greenhouse gases in half by 2030. By the mid-2020s, half of all oil and gas output in Norway could come from platforms receiving renewable power from land, rather than from generators run on diesel or natural gas, petroleum industry regulator NPD said.

Source: Reuters

EU countries agree their green transition fund will not pay for move to nuclear or fossil gas

25 June. European Union (EU) countries agreed that the bloc’s flagship fund to wean regions off fossil fuels should not finance nuclear or natural gas projects, despite calls from some Eastern countries for gas to be eligible for EU funding. The European Commission, the EU’s executive, wants to set up a €40 bn Just Transition Fund, comprised of €30 bn from an EU coronavirus recovery fund and €10 bn from its budget for 2021-27. The fund aims to encourage a shift from high-carbon industries that would help coal miners to retrain and find new low-carbon jobs, and support regions whose economies depend on polluting sectors to build new industries. Ambassadors from the EU’s 27 member states agreed that the Just Transition Fund should not support the decommissioning or construction of nuclear power plants, nor investments related to fossil fuels.

Source: Reuters

DATA INSIGHT

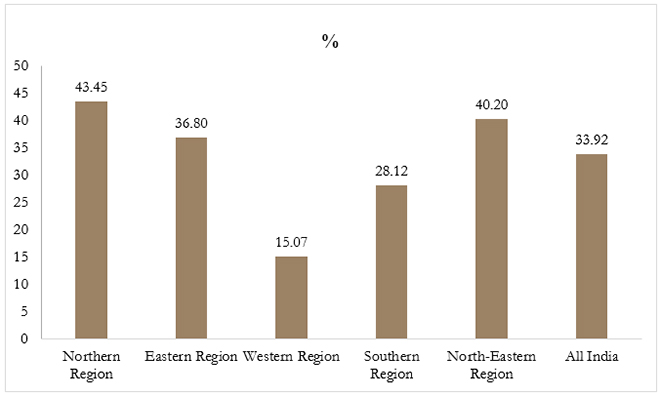

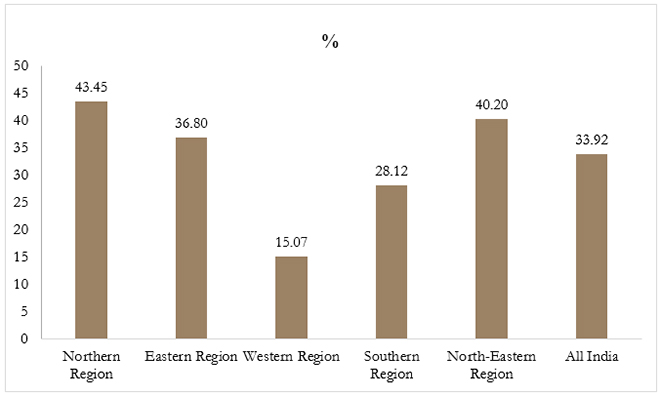

Hydroelectric Power Projects: Capacity, Generation & Utilisation Factor

As on 29 February 2020

| Electricity Regions |

Installed Capacity (MW) |

Electricity Generation (MU) |

| Northern Region |

19,023.27 |

76,170.33 |

| Eastern Region |

5,862.45 |

19,937.57 |

| Western Region |

7,392.00 |

16,664.94 |

| Southern Region |

11,694.50 |

29,229.92 |

| North-Eastern Region |

1,727.00 |

4,665.54 |

| Total (India) |

45,699.22 |

14,6668.3 |

Capacity Utlisation Factor of Hydro Projects for 2018-19

*all above figures for Hydro Projects of 25 MW and above.

*all above figures for Hydro Projects of 25 MW and above.

Source: Lok Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

*all above figures for Hydro Projects of 25 MW and above.

*all above figures for Hydro Projects of 25 MW and above. PREV

PREV