< lang="EN-US" style="color: #0069a6">COAL DEMAND FALLS AS POWER DEMAND FALTERS

Coal News Commentary: February 2020

India

Domestic Production & Demand

CIL’s coal supply to the power sector registered a decline of 6.8 percent to 377.86 mt in the April-January period of the ongoing fiscal. The commodity despatch by CIL to the power sector in the year-ago period was 405.61 mt. However, the coal despatch by CIL to the power sector in January registered an increase of 2.9 percent to 43.20 mt, over 42 mt in the corresponding month of the previous fiscal. The supply of dry-fuel by SCCL, a state-owned coal miner, in the April-January period also registered a decline of 2.6 percent to 44.03 mt, over 45.22 mt in the year-ago period. Stating rain as the 'enemy of the coal sector', a government official had earlier blamed extended monsoon for the loss of coal output for a few months (from July) in the current fiscal. CIL saw its production decline by 3.9 percent to 451.52 mt in April-January period, over 469.65 mt in the year-ago period. CIL had earlier announced that it will produce 750 mt of coal in the next financial year. The firm will further produce 1 bt of coal by FY2024 according to the coal ministry.

India’s annual electricity generation from coal-fired utilities fell in 2019 for the first time in a decade, government data showed. India is the second largest consumer, importer and producer of coal behind China. The world’s third largest greenhouse gas emitter consumed nearly 1 bt of the fuel in 2018/19, with utilities accounting for over three-quarters of the total demand. While greater adoption of renewable energy contributed to lower output from coal-fired utilities, weak economic growth added to a slowdown in overall demand for electricity. According to analysts and power sector executives the fall in annual coal-fired generation was a blip and largely due to a broader economic slowdown. Electricity generation from coal-fired utilities fell about 2.5 percent to 965.53 bn kWh in 2019, an analysis of fuel-wise electricity generation data by the CEA showed.

Coal production by CIL has dropped 4 percent to 451.5 mt in the current financial year so far, latest data shared by the coal ministry for the April-January period showed. Production stood at 469.6 mt in the same period last fiscal. Coal dispatch by the company also dropped 5 percent in the April-January 2019-20 period. Offtake, too, declined 4.8 percent to 473.3 mt. Overall coal production of the country, including SCCL and captive production, also registered a drop of 2.2 percent at 555 mt from 567 mt recorded during the same period last year. Overall coal offtake registered a downfall of around 4 percent to 576 mt. According to the coal ministry this was largely due to heavy rainfall witnessed in the coal mining areas in the current year which was around 25 percent more than the previous year. The focus of the government is on accelerating domestic production of coal through allocation of more coal blocks, pursuing with state government for assistance in land acquisition and coordinated efforts with railways for movement of coal. CIL is working on a production target of 660 mt for the current financial year. The company wants to ramp up output to 1 bt by 2024.

Coal stocks at power plants peaked to 34.25 mt on 26 January, equivalent to 19 days' consumption, and up by 77 percent as against 19.36 mt, equivalent to 12 days' consumption at the same time last year. Thrust has been also given to augment coal supplies to non-power sector by holding regular auction for coal linkages where the consumers have been given the flexibility to choose nearest mine, quality (grade, size) etc. To facilitate easy availability of coal to all the sectors, Coal Companies are also offering increased coal under spot and exclusive e-auction.

CIL is keen to tap non-power consumers to feed its incremental production post the monsoon period. The miner is looking to ramp up production to meet its targets for the current fiscal at a time when the economic slowdown is impacting demand for the dry fuel by power plants. Coal despatch to the power sector in the first nine months of the current fiscal was down by 8.1 percent at 334.27 mt as against the figure in the corresponding period a year ago. Coal allotted for spot e-auction, however, was 5.07 mt in December, nearly a 50 percent jump over the same month a year ago. The miner is banking on sectors like cement and sponge iron for incremental coal. CIL had set a production target of 660 mt for 2019-20, but production is likely to be in the range of 625-635 mt.

Imports

India’s coal import increased by 7.6 percent to 185.88 mt in the April-December period of the current fiscal. Coal imports in December rose by 13.3 percent to 20.52 mt compared to 18.10 mt in the year-ago month, according to provisional data by mjunction services. Non-coking coal imports were at 14.21 mt in December 2019 against 12.5 mt in December 2018. Coking coal imports were at 4.47 mt against 3.76 mt imported in December 2018. During the April-December period, coal and coke imports were at 185.88 mt, up by 7.66 percent compared to 172.65 mt in the same period last year.

The Centre aims at self-sufficiency in the coal sector by 2024 and the changes in the coal mining policy have been effected to achieve the same. India stood fifth in terms of coal reserves. The move towards self-sufficiency is likely to create an efficient energy market and bring in more competition as well as reduce coal imports. In 2018, the government allowed commercial mining by private entities and set a mining target of 1.5 bt by 2020. Out of this, 1 bt was set to be from CIL while 500 mt was to be from non-CIL entities. This target has now been revised to 1 bt by 2023-24.

Auction and Allocation

Auction of coal linkages under the SHAKTI policy to independent power projects will have a positive impact on coal-based power plants according to ratings agency ICRA. The Central government had recently notified the third round of auction for award of coal linkages under SHAKTI (Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India) to independent power projects having long-term PPAs according to ICRA. The latest discount is higher than ₹0.01/kWh base discount set under the first round of auction held in September 2017 and ₹0.04/kWh base discount set under the second round of auction for coal linkages held in May 2019. According to ICRA the availability of coal linkage would enable the plants to declare normative availability allowing recovery of fixed charges and improve their merit order position.

The Union coal ministry has issued a stern warning to the Goa government saying that Goa could lose a coal block for the second time if it does not complete the formalities to take over the Dongri Tal II coal block at Singrauli in Madhya Pradesh. Goa has sought a grace period of 100 days to arrange the funds required to pay the performance guarantee for the coal block that Goa Industrial Development Corp plans to operate. The expectation was that the state would sign the agreement for this block by 30 October. The corporation has already identified a committee to spearhead the process to formally utilise the coal block, which was allocated to the state through a bidding process. The corporation intended to rope in validated consultants to help the state with the coal block utilisation and with the auction of the industrial land returned by the special economic zone promoters. The Dongri Tal II coal block at Singrauli was allotted to Goa as part of the fifth tranche of allotment by the coal ministry. However, the cash-strapped corporation needs to pay ₹1.96 bn to exploit the coal block. Coal mines have been allotted to state governments for sale of coal under the Coal Mines (Special Provisions) Act, 2015. The central government will accept upfront payments in three instalments from successful bidders, along with the performance guarantee — equivalent to a year’s royalty — prior to the formal signing of the Coal Mine Development and Production Agreement. The corporation had also applied to CIL for yet another coal block as part of the sixth tranche of coal mines allocation.

Industry has sought easier norms for commercial coal blocks, including lesser payment and more lenient requirement of minimum production. Potential bidders want upfront payment to be halved and computed on the basis of extractable reserves in a block and not on the total reserves estimate. The draft rules provide for minimum 70 percent production on an average over a three-year period, while yearly minimum production has to be 50 percent. Potential miners want this changed to 60 percent average production in a five-year period and no yearly production stipulations. Prayas Energy Group, a non-government organisation working in the power sector, suggests yearly production stipulation may be too restrictive given the uncertainty of future coal demand, particularly considering that mine life is likely to be upwards of 25 or 30 years.

Coking Coal

India will require 180 mt of coking coal by 2030-31 to cater to the steel industry, which is aiming to produce 300 mt of steel by then. The coal ministry has been asked to make sure 35 percent of the demand for coking coal be met indigenously. According to CIL’s exploration arm CMPDIL ₹1.9k bn was spent on the imported coal and hence utilizing domestic coking coal in metallurgical sector was the need of the hour. However, the quality of coking coal reserves in the country was very poor in terms of ash and is difficult to beneficiate. Majority of coking coal produced in India is of Washery Grade-V and beyond. The plan is to receive integrated association of washery operators and consumers with coal producers to work on optimization of available resources. Increased coordination among academia-research institutions and coal industry would facilitate realistic solutions for critical problem in bridging demand and supply gap of coking coal and thus saving of foreign exchange.

Regulatory Environment

LCB in Maharashtra has intensified probe into the alleged coal scam and has dispatched four teams to industries that are suspected to be involved in sale of subsidized coal in open market at premium rates. LCB informed that cops had summoned representatives of the industries that had lifted the coal from mines for questioning. However, as none of the industries responded, a team each has been dispatched to four separate districts to investigate the records of subsidized coal taken and utilized by the beneficiary units. LCB team had detained 26 trucks loaded with subsidized coal at a private coal depot near Nagada village. The coal was allotted to seven industries by MSMC at subsidized rate for industrial use. However, the coal was taken to the private depot where the LCB team conducted the raid. MSMC allocates quota of subsidized coal to hundreds of industries across the state every month. There is possibility that many of these companies are seeking excessive quota, while a bunch of them might be closed and still claiming the coal and selling it in the open market through traders.

Coal Transport

With the railways witnessing significant decline in transport of coal, which has impacted its revenue from the freight segment, the state-run transporter is targeting a five-fold increase in its share of transporting automobiles by 2025. The total coal transported by railways stood at nearly 606 mt in 2018-19 and as per the revised estimate of 2019-20, it’s set to reduce to 592 mt. According to the budget document, freight loading by railways in 2019-20 is likely to be 1,223 mt by March and nearly 50 percent of this is coal. But during 2020-21, this share is estimated to reduce to 40 percent.

Budget Allocation

The Budget allocation for the coal ministry has registered a decline of 5.4 percent to ₹8.82 bn in 2020-21, from ₹9.33 bn in 2019-20. The decline has been over the revised estimates of the 2019-20 Budget, according to Budget documents. While the expenditure was at ₹11.59 bn for 2019-20, in case of 2018-19 (actual) it was ₹7.08 bn. The expenditure budget of ₹8.82 bn in the 2020-21, includes ₹8.19 bn on central sector schemes/projects and ₹223.5 mn on Coal Mines Pension Scheme. The investment in public enterprises, including CIL has increased from ₹184.67 bn in budget 2020-21, over the revised estimate of ₹181.21 bn in 2019-20.

Rest of the World

China

Chinese coal traders and small coal-fired utilities are scrambling to lock in supplies of fuel from miners, worried about the prospects of market tightness as downstream users return to work after an extended national holiday. Coal consumption is expected to pick up as work resumes at factories such as cement makers and chemical plants but the market worries increasing downstream demand will outstrip the pace of recovery in production by coal mines. Medium- and small-sized coal-fired utilities not bound by long-term contracts with coal mines are scrambling for spot market purchases, as concern grows about supply in coming weeks, according to analysts and four coal traders. Benchmark thermal coal with energy content of 5,500 kilocalories a kg in China stood at 576 yuan ($82.56)/tonne, its highest since mid-October. Production has resumed at 57.8 percent of coal mines according to the National Development and Reform Commission. The direct impact on metallurgical coal imports by China is, initially at least, likely to be relatively muted, predicts analysis firm Wood Mackenzie. In the very near term, impacts on domestic metallurgical coal supply are likely to be bigger than demand. Coal supply usually recovers as employees return after the holidays, but many miners will now face restrictions – some self- imposed. Mongolia exported 24.8 mt of coking coal into China in 2019, which can be translated into 2 mt of low-sulphur HCC supply into China every month. However, there will be an inevitable decline in steel demand which will affect steel prices and margins, and metallurgical coal demand between March and May is expected to be lower than it would have been.

Japan

Japan will launch a review by the end of June aimed at tightening conditions for the export of coal-fired power plants. The move follows global criticism over the Japanese government’s support for building coal-fired plants in countries like Indonesia and Vietnam, as well as the roll-out of new plants in Japan. Global criticism of Japan’s “addiction to coal” was hitting home, but the Japanese environment ministry is yet to win wider support to reduce backing for fossil fuels. The environment ministry had agreed the review with other ministries, including the finance ministry and the powerful industry ministry, which has traditionally held more sway over coal policy. Under its current policy, Japan supports coal-fired power plant projects if and when a country which needs to choose coal as a power source requests Japan to provide its highly-efficient coal power technology. Japan, a big financier of new coal plants in Southeast Asia, is seen as an outlier among industrialized countries as it is the only G7 nation still be building coal-fired plants at home.

Rest of Asia

Indonesian coal exports are being disrupted because the government has not issued technical guidance on the implementation of new shipping rules. Indonesia, the world’s biggest thermal coal exporter, in 2018 issued regulations requiring its coal and palm oil exporters to use domestic insurance and shipping companies. The insurance requirement was implemented last year and the shipping requirement will begin in May. Most coal sales from Indonesia are under free-on-board contracts, so overseas buyers who are in charge of securing vessels are still waiting for the Trade Ministry to issue technical guidance according to the Indonesia Coal Miners Association. Some buyers, such as those from Japan, have started to divert their coal purchases to other countries due to the unclear protocol for vessel use. Miners have welcomed proposed changes to Indonesian mining rules under a new law aimed at boosting investment, though critics are concerned that the changes could underpin an expansion in polluting coal and threaten environment protection. Indonesia is a top exporter of thermal coal, tin and nickel products, but overall mining investment dropped from 79 tn rupiah ($5.8 bn) in 2017 to 59 tn rupiah ($4.3 bn) last year, data from its investment board showed. Miners are most supportive of a provision in the bill that would set a mining area’s size based on a work plan submitted for government approval. The measure would replace current rules that would limit the size of coal mines to 15,000 hectares and other mineral mines to 25,000 hectares when miners convert their contracts to a new license. The bill would also allow miners to receive an initial 30-year mining permit that could be extended periodically for as long as the mine’s life but only if the miner invests in downstream ore smelting or coal gasification projects. Indonesia has been trying to squeeze more out of its mineral resources and the new bill would also exempt royalties for miners adding value by processing or smelting ore or coal. The government wants miners to process coal into gaseous dimethyl ether to replace liquefied petroleum gas imports. Indonesia’s largest coal miner PT Bumi Resources is conducting a study on a gasification project that could be worth more than $1 bn.

Europe

Polish state-run power producers will halt coal imports after protests by mining trade unions over foreign supplies they say are a threat to the domestic industry. Poland generates most of its electricity from coal, but domestic output has fallen because of cost-cutting and geological problems in old mines, which had led to higher imports, mostly from Russia. Around 100 miners blocked trains carrying coal to a power plant in the southern town of Laziska Gorne in protest at imports from Russia by state-run energy groups, including PGE and Tauron. According to trade unions increased imports, together with falling demand following a mild winter, have increased coal stockpiles, threatening normal operations of Poland’s coal mines. The government cannot ban coal imports for private companies, for which the imported coal is cheaper and of higher quality than domestic production. Trade unions at Poland’s biggest coal mining firm PGG have not ruled out a strike to demand a pay rise and address the issue of stockpiles. In 2018 Poland imported almost 20 mt of coal. Poland is also under pressure from the European Commission to use less coal. Management at Poland’s biggest coal producer, the state-run PGG, agreed to increase its miners’ salaries by 6 percent after the company’s trade unions threatened to stage a protest in Warsaw. The PGG miners held a two-hour warning strike to demand a 12 percent increase in salaries and a clear national energy plan guaranteeing a future role for coal. According to Poland’s ruling Law and Justice (PiS) party, which is keen to secure coal miners’ votes in a presidential election in May Poland will continue to use coal as its main fuel for years to come. PiS rose to power in 2015 partly on promises to sustain the then troubled coal mining. Since then the industry has recovered, as coal prices rebounded and the government closed some of the most loss-making mines. Last year, however, the Polish coal industry started to face new problems because of increased coal imports and falling demand, leaving coal-mining companies with unsold stocks. Shares in Polish state-run utilities Energa and Enea gained after they froze financing of their joint project to build 1 a GW coal-fueled power unit, citing difficulties raising funds due to environmental concerns. The ruling conservative Law and Justice Party (PiS) revived the long-dormant project in 2016 after winning an election the year before on a pledge to sustain Polish coal mining.

North Macedonia is planning to end its use of coal for energy production by 2040 at the latest and sees a phase-out by 2025 as the cheapest option in two of three scenarios according to environmental groups. A final decision on which pathway the country will take will be made later this year. While Western Europe has been moving away from coal to meet climate goals, the Western Balkans remains home to seven of the ten most polluting coal-fired power plants in Europe. About 1,600 people are estimated to die prematurely every year as a result of exposure to air pollution in North Macedonia, where coal accounts for about a half of power generation according to the World Bank. The estimated economic cost linked to mortality from exposure to air pollution there was in the range of $500–900 mn annually, equivalent to 5.2–8.5 percent of national output in 2016.

Germany’s exit from hard-coal-fired power generation has prompted Swedish utility Vattenfall to speed up thinking about options for its modern coal plant at Hamburg Moorburg to minimise losses. Vattenfall has never been happy with the 1.6 GW plant that was conceived in 2007, opened in 2015, cost €2.8 bn ($3.05 bn) and supplies two-thirds of the port town’s electricity needs.

USA

According to the US, Canada and Mexico could help export US coal to Asia to get around the blocking of shipments by West Coast states concerned about the impact of the fuel on climate change. The two US neighbours will offer opportunities to export coal in talks that could be facilitated by the new North American trade agreement, the USMCA. Wyoming is a top US coal producing state, but its exports have been hampered. The states of California, Washington and Oregon have blocked permits for coal ports on concerns about coal’s impact on climate change. Some US lawmakers have complained about a lack of environmental standards in the USMCA. The West Coast Canadian province of British Columbia already exports some US coal. The Energy Department will direct up to $64 mn in funding for research and development into more efficient coal plants. Some types of coal could be processed to remove minerals for electric batteries that are in demand for electric vehicles and storing renewable power.

| CIL: Coal India Ltd, mt: million tonnes, , bt: billion tonnes, mn: million, bn: billion, tn: trillion, GW: gigawatt, SCCL: Singareni Collieries Company Ltd, FY: Financial Year, kWh: kilowatt hour, CEA: Central Electricity Authority, PPAs: power purchase agreements, LCB: Local Crime Branch, MSMC: Maharashtra State Mining Corp, USMCA: United States-Mexico-Canada Agreement |

NATIONAL: OIL

LPG penetration is 100 percent in Karnataka: IOC

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">LPG penetration rates cannot be established without household level surveys!

< style="color: #ffffff">Ugly! |

28 February. The LPG (liquefied petroleum gas) penetration in Karnataka is 'absolutely 100 percent' due to the Prime Minister Ujjwala Yojana, Indian Oil Corp (IOC) Karnataka executive director D L Pramodh said. In 2014, LPG penetration in the State was only 68 percent, but after the PMUY (Pradhan Mantri Ujjwala Yojana), massive number of gas connections were given in the last five years, he said. The 100 percent LPG penetration in the state will help women in rural areas to make their kitchens smokeless. Against the national average of 2.88 cylinders per family per PMUY annually, the figure is Karnataka 3.4 cylinders in Karnataka, he said. By 31 March, the IOC would commission the ₹100 mn Vapour Recovery System at the Devanagonthi terminal on the city outskirts which would ensure that vapour does not go out in the air when tankers are being filled with fuel. He said the IOC has started mobile fuel dispensers, delivering fuels at the doorsteps.

Source: The Economic Times

India’s import of US oil jumps 10-fold to 250k bpd: US Energy Secretary

26 February. US (United States) oil supplies to India have jumped ten-fold to 2,50,000 barrels per day (bpd) in the last few years, visiting US Energy Secretary Dan Brouillette said. He said Indian imports of US oil were 25,000 bpd a couple of year ago, and have now risen to 2,50,000 bpd. US is India’s sixth largest oil supplier. India began importing crude oil from the US in 2017 as it looked to diversify its import basket beyond the OPEC (Organization of the Petroleum Exporting Countries) nations. It bought 1.9 mt (38,000 bpd) of crude oil from the US in 2017-18 and another 6.2 mt (1,24,000 bpd) in 2018-19. In the first six months of current fiscal (2019-20), US supplied 5.4 mt of crude oil to India. Iraq is India’s top crude oil supplier, meeting close to one-fourth of the country’s oil needs. It sold 26 mt of crude oil to India during April to September. India, which is 83 percent dependent on imports to meet its oil needs, bought 111.4 mt of crude oil from overseas during April-September. Saudi Arabia has traditionally been India’s top oil source, but has been relegated to the second spot, exporting 20.7 mt of crude oil in the first six months.

Source: Business Standard

NATIONAL: GAS

IGL will make gas meters, lines up ₹11 bn war chest

3 March. Indraprastha Gas Ltd (IGL), the country’s largest CNG (compressed natural gas) and PNG (piped natural gas) service provider by sales and number of vehicles serviced, will soon start manufacturing household gas meters to reduce dependence on imports from China and secure a piece of the ₹43.9 bn market for such ancillaries expected to open up as the government expands city gas service to 407 districts. IGL managing director E S Ranganathan said the company was ready with a ₹11 bn investment plan for expanding CNG stations and pipeline network to meet an expected double-digit growth in city gas demand in 2020-21. IGL took piped gas to 2.8-3 lakh homes in the current fiscal and will maintain the same pace in 2020-21. Ranganathan said the gas meter manufacturing foray was prompted by the fact that supplies will be vulnerable as majority of these are imported — mostly from China — as demand rises on the back of expanding city gas networks. IGL will invest ₹1 bn to set up the factory to manufacture 10 lakh mechanical and smart meters a year and partnership talks are at an advanced stage, he said. Analysts saw the manufacturing foray as part of IGL’s preparation for life after it loses the monopoly over Delhi, the country’s largest CNG and PNG market, as per the regulatory norms.

Source: The Economic Times

PNGRB plans to allow lenders to replace defaulting city gas companies

28 February. Lenders will have a right to replace a defaulting city gas licensee with a new entity in consultation with the downstream regulator, as per a draft proposal by the Petroleum and Natural Gas Regulatory Board (PNGRB). The proposed amendment is aimed at addressing a key regulatory concern of lenders that was holding back financial closure for many city gas licence areas. The regulator, which has distributed 136 licences in the past two years and aims to award licences for another 50 districts this year, expects the proposed changes to help expedite financial closure for current and future licensees and speed up work programme. Lenders can then select a substitute within 90 days. The regulator would then transfer the city gas licence to the new entity if it meets all license conditions, as per the draft. The new entity will have to assume all the liabilities and responsibilities of the original licensee. In the draft proposal, PNGRB has also described in greater detail on when the financial closure will deem to have been achieved by the licensees.

Source: The Economic Times

NATIONAL: COAL

Efforts are being made to diversify the coking coal import sources: Pradhan

3 March. The government has taken several steps to secure coking coal supplies for the domestic steel industry and is making efforts to diversify the raw material’s import sources. While output of iron ore, another key raw material for the steel industry, in the country is sufficient to meet the current demand, the entire demand of coking coal is not met from domestic production as the availability of high-quality coking coal (low-ash coal) in the country is limited and, thus, no option is left but to resort to import of coking coal, Oil Minister Dharmendra Pradhan said. He said the government has taken several steps in order to secure coking coal supplies for the Indian steel industry. Efforts are being made to import coking coal from the US (United States), Russia and Mongolia to diversify the coking coal import sources, he said. Two coking coal mines Rohne and Rabodih were allocated to steel central public sector enterprises NMDC and RINL. He said that long-term linkage of raw coking coal was granted to Steel Authority of India Ltd from BCCL and lease of Tasra coking coal block was extended in favour of SAIL.

Source: The Economic Times

SCCL seeks MoEF nod to mine coal within 10 km of Shivaram sanctuary

2 March. The Singareni Collieries Company Ltd (SCCL) has sought approval from the Ministry of Environment and Forests (MoEF) for mining within a 10 kilometre (km) radius of Shivaram Wildlife Sanctuary in Peddapalli district. Though the mine is almost 7 km away from the sanctuary, it falls under the proposed eco-sensitive zone. However, the environment ministry is yet to notify the zone. If the project is approved, the new coal mine will occupy 195 hectares of the eco-sensitive zone and 173 hectares of space outside the zone. SCCL, the only coal producing company in south India jointly owned by the state and central governments, has been carrying out mining for more than 130 years. It currently operates 29 underground and 19 opencast mines in six districts — Kumaram Bheem, Mancherial, Peddapalli, Jayashankar Bhupalapalli, Bhadradri Kothagudem and Khammam.

Source: The Economic Times

Coal India’s February production likely to be 66 mt

1 March. Coal India Ltd is likely to register a 13 percent on-year rise in production in February to 66 million tonnes (mt). The world’s largest miner had produced 58.05 mt in the corresponding month a year ago. Cumulative production for the April-February period is expected to be 517.5 mt. Offtake, however, continues to be muted. It is likely to be 54.5 mt in February, a growth of nearly 6 percent on a year-on-year basis.

Source: The Economic Times

NATIONAL: POWER

Committee formed to study free electricity proposal: Maharashtra Power Minister

3 March. Maharashtra Power Minister Nitin Raut said a committee has been formed to study the proposal of providing free electricity to the public upto a limit. The Minister had said that the state government is considering a proposal to provide electricity for free to the people whose monthly electricity consumption is under 100 units. The Minister said that the state government is also considering making electricity cheaper for industrial use.

Source: Business Standard

India’s electricity supply rises 7.1 percent in February on strong demand

3 March. India’s electricity supply rose 7.1 percent during February, provisional government data showed, marking the second straight month of growth after five straight months of decline. Power supply rose to an average of 3.62 bn units per day in February, up from 3.38 bn units last year, an analysis of daily load despatch data from Power System Operation Corp Ltd (POSOCO) showed. POSOCO releases provisional load despatch data every day. Higher electricity supply could mean a rise in power demand, as electricity deficit in India is marginal. Electricity demand is seen by economists as an important indicator of industrial output. India’s annual electricity demand in 2019 grew at its slowest pace in six years, according to the CEA (Central Electricity Authority), amid a broader economic slowdown that resulted in a fall in sales of everything from cars to cookies, prompting some large-scale industries such as the automobile sector to slash jobs.

Source: Business Standard

Madhya Pradesh to pay ₹5.8 bn to private players without buying a single unit of power in 2021

2 March. The Madhya Pradesh government is likley to pay ₹5.8 bn to private power companies in 2020-21 without buying a single unit of power. At least that’s what the annual revenue requirement (ARR) submitted before Madhya Pradesh Electricity Regulatory Commission (MPERC) indicates. As per the ARR submitted by discoms (distribution companies) before MPERC for 2021, they have said that due to surplus power and after meeting the requirements of the state, they will “back down” power of producers. ‘Backing down’ means not buying the power that the state is entitled to under power purchase agreement (PPA). Discoms will ‘back down’ on four of the nine private power producers with which MP has signed PPAs — Torrent Power, BLA Power, Jaypee Bina Power and Essar Power STPS. This means, as per estimates for 2021, discoms will not purchase a single unit of power from these producers. Power producers are paid in two ways — fixed charge and variable charge. If the charges are fixed, they will have to be paid even if the procurer doesn’t take any power.

Source: The Economic Times

Uttar Pradesh government gives more time to defaulting power consumers for paying dues

2 March. Uttar Pradesh (UP) government has extended the deadline for two schemes till 31 March, under which defaulting power consumers, including farmers, have more time to clear their dues. The schemes are Asan Kist Yojana, which was introduced for defaulters for up to 4 kilowatt (kW) load, and Kisan Asan Kist Yojana, which is meant to give relief to private tubewell consumers. UP Power Minister Srikant Sharma in his letter to all pradhans (village heads) said that since harvesting season of the rabi crop is approaching, the deadline extension would be helpful for farmers. Sharma said the power department has collected a large amount through Asan Kist Yojana, which started on 11 November 2019, however, a large number of consumers are still left and, for them, extension of the scheme’s deadline from 29 February to 31 March may turn out to be a boon. Through the letter, Sharma said that despite heavy power generation cost (₹7.35 per unit), the department is supplying cheaper power to private tubewell consumers, farmers, and below-poverty line consumers, among others, as the deficit is covered by the grant received from the government. While the current rate for private tubewell consumers on an average is ₹1.21 a unit; for BPL consumers (for first 100 units), ₹3 a unit; and for domestic rural metered consumers (for first 100 units), ₹3.35 a unit, Sharma said. The defaulters, availing the facility, will have to pay 5 percent of the arrears due till 31 October 2019, or ₹1,500 along with their up-to-date power bills beginning from November 2019, Sharma said. Sharma said that the defaulters may pay their arrear in one go or in 24 or 12 instalments (24 instalments for defaulters of rural area and 12 instalments for urban area). Sharma said penalty for arrears up to 31 October 2019, would be waved off if the arrears and future bills are paid in time.

Source: The Economic Times

Rural power supply up 52 percent in 3 years: UP Power Minister

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Increase in rural power supply is positive!

< style="color: #ffffff">Good! |

29 February. By increasing an effective power supply from just 200 mn units to 305 mn units in the rural areas every year, the state government has not only boosted prosperity, but also succeeded in checking migration from the villages to the cities, claimed Uttar Pradesh (UP) Energy Minister Shrikant Sharma. The Minister said that his claims for rural prosperity were not only limited to increasing power supply in the villages, farmers have benefitted a lot as in the previous governments ,the average connections for tube wells were around 18,000 a year which had now risen to 45,000 a year and this has assisted farmers in increasing their farm production. He also submitted a 16-point schemes aimed to recover the losses. It included setting up of 59 police stations in different district to register crimes related to power theft. He said that the energy department had also put in place 55 enforcement squad to check incidents of power theft. Sharma said the department had come up with an encouragement scheme for the raid squad and associated team. He also mentioned execution of 'Mukhbir Yojana' (whistle blower scheme) under which people could inform the government about the incident of power theft without revealing their names.

Source: The Economic Times

Tatas may snap Mundra power supply to 5 states on tariff fuel

28 February. Tata Power, which runs one of the country's largest power plants at Mundra in Gujarat, has threatened to stop supply from the plant to five states beginning March if they don’t agree to tariff increases. Tata Power has made it clear that it will not be able to run the power plant unless the pass-through of additional fuel cost to consumers is allowed.

Source: The Economic Times

At 13 GW, power demand in Telangana soars to new record in 5 years

27 February. Telangana set a new record in the last five years in power consumption with the demand soaring to 13,040 MW. TSTransco said thanks to the free 24x7 power supply to the agriculture sector, which began two years ago, the demand had been seeing an upward trend. In Greater Hyderabad, the demand soared to 2,537 MW, which was 200 MW more than the power consumed on the same day last year. Power demand in February is around 9,500 MW. It increases slowly in March with temperatures rising and touches peak demand in mid-summer with usage of air-conditioners going up. Thanks to mercury touching 34-37 degree Celsius in the third week of February this year, the power demand touched the highest 12,780 MW recently. While power consumption in 2017 summer was between 6,700 MW and 7,000 MW, it hit a high of 8,500 MW in March during peak agriculture season. The demand touched 10,284 MW in March 2018 with the government providing free power to farmers. In August 2019, the power demand soared to 11,703 MW. Six months later, in January 2020, it touched 11,359 MW. Meanwhile, the government has asked all the discoms to ensure uninterrupted supply both for domestic and agriculture purposes.

Source: The Economic Times

Government aiming for round-the-clock power supply in Jammu and Kashmir in 2 yrs: Singh

27 February. The Central government is aiming to provide round the clock electricity supply to the Union territory of Jammu and Kashmir (J&K), Power and Renewable Energy Minister R K Singh said. He said that sufficient power is available in the country but J&K needs to address the issue by putting in place an adequate transmission and distribution system. He directed the concerned officers to prepare a project for capacity addition which could ensure round the clock power supply in the state and submit it to the Centre. The J&K government was advised to request for further release of eligible funds under various schemes like Saubhagya, DDUGJY, IPDS, PMDP etc. He also assured extending the project completion time of Saubhagya till June for completion of the pending work.

Source: The Economic Times

India sees privatization as answer to flailing state power firms

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Privatization of SEBs may improve efficiency but at the cost of equity!

< style="color: #ffffff">Bad! |

26 February. India’s federal government will encourage inefficient state power utilities to seek privatization and other institutional reforms to turn around money-losing operations and ensure reliable supplies to consumers, according to the top bureaucrat in the federal power ministry. States with electricity utilities that lose more than 15 percent of revenue due to archaic networks, power theft and sloppy billing and collections would be pushed to seek private participation in their distribution network as part of the country’s planned second wave of power reforms, Power Secretary Sanjiv Nandan Sahai said. India has been increasingly advocating privatization of ailing distribution companies (discoms) as government efforts since 2015 to revive the utilities failed to turn around the firms, known as discoms. These utilities lose money by selling power below costs, often delaying payments to generators and depriving customers of reliable and affordable electricity. The state governments will also need to do their part to ensure the companies can succeed, according to Sahai. He said states can draw upon examples of cities of Mumbai, New Delhi and Kolkata, as well as some smaller towns, where private participation has led to reduction in revenue losses and more viable operations. In one of the most recent such moves, Tata Power Co. last year acquired one of the distribution utilities in the state of Odisha.

Source: Bloomberg

Andhra Pradesh government releases ₹29.8 bn to clear power dues

26 February. The Andhra Pradesh (AP) government released a sum of ₹29.84 bn to clear long- pending dues to solar and wind power generators, central generating stations and state generating stations. Of the total, ₹21.99 bn will go to CGS and SGS while solar and wind power generators will get the balance. With this, pending payments to renewable energy generators have been cleared up to December 2019, according to an order issued by Energy Secretary N Srikant. The amount has been released towards payment of 25 percent losses of discoms (distribution companies) taken over for the years 2017-18 and 2018-19 under Ujwal Discom Assurance Yojana (UDAY) of the Government of India, the order said. The AP High Court recently ordered that all pending payments to renewable energy companies be cleared even as the matter related to re-negotiation of power purchase agreements has been referred to the AP Electricity Regulatory Commission.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

India’s solar industry under no compulsion to import modules from China: Singh

3 March. India’s solar power industry is under no compulsion to import solar cells or modules from China following the coronavirus outbreak, Power and Renewable Energy Minister R K Singh has said. India’s solar sector is a highly import-dependent industry. Solar modules account for about 60 percent of a solar project’s cost and Chinese firms supply 80 percent of cells and modules used. He said the government was actively promoting domestic manufacturing of solar equipment in India through several schemes such as M-SIPS, PM-KUSUM, CPSU Scheme, grid-connected rooftop solar programme, and also tenders for setting up solar photovoltaic manufacturing facilities. The ministry had recently decided to give extra time for the commissioning of power projects that face delays due to the virus outbreak in China. The government has set a target of installing 175 GW of renewable energy capacity by 2022. As on 31 January 2020, total renewable energy capacity of 86.32 GW has been installed in the country. Additionally, 35.09 GW capacity is under various stages of implementation and 34.47 GW under various stages of bidding.

Source: The Economic Times

Gujarat gets highest fund allocation for renewable energy generation

3 March. Gujarat has received the highest amount of Central Financial Assistance (CFA) to the tune of ₹1.18 bn among all states and union territories for new and renewable energy generation till 10 February of the current financial year 2019-20. The top five states after Gujarat included Maharashtra, Uttar Pradesh, Himachal Pradesh and Andhra Pradesh, which got an assistance of ₹528.8 mn, ₹517.1 mn, ₹304.8 mn, and ₹290.2 mn, respectively, Power and Renewable Energy Minister R K Singh informed. A cumulative solar power capacity of 26.97 GW has been installed in India during the past three years from 2016-17 to 2018-19 and current year till 31 December 2019. At present, most of the utility scale grid-connected solar and wind energy projects in the country are implemented by the private sector developers, which are selected through a competitive bidding process. The government has set a target of installing 175 GW of renewable energy capacity by 2022. As on 1 January 2020, the country had installed 85.90 GW of renewable energy capacity.

Source: The Economic Times

Savitribai Phule Pune University to launch solar panel walled building

2 March. The Savitribai Phule Pune University (SPPU) is set to inaugurate what it claims to be the first solar panel walled building in the country, with its glass facade mounted with panels made of cadmium telluride photovoltaic cells instead of the silicon-based cells. Unlike the silicon solar panels, the Cadmium Telluride (CdTe) photovoltaic cells are transparent and bring in natural light. Because the walls are made of glass, the building would also give the people inside the structure a feeling of being in an open space, director of School of Energy Studies at SPPU Sandesh Jadkar said. He said the walls would generate 19 units of electricity per day.

Source: The Economic Times

Research on to produce biomass LPG in 2-3 years: IOC

28 February. Indian Oil Corp (IOC) is in the process of developing LPG (liquefied petroleum gas) from bio mass and would succeed in another two to three years, the R&D wing of IOC said. This is being done in tune with the decision of World LPG Association to have at least 50 percent of LPG from biomass, including vegetable waste, by 2040. Accordingly, the country has taken a lead and in the process of developing the LPG from bio mass, which would bear fruit in another two to three years. IOC wanted at least 10 percent of LPG to be produced from bio mass and put in use, as this would be cost-effective.

Source: The Economic Times

Rajasthan plans to set up 30 GW solar capacity in 5 years

26 February. Rajasthan plans to set up 30,000 MW of solar power plants in next five years and is in talks with leading private and state-run companies to develop energy parks, the state’s Energy Minister B D Kalla said. This will add to an already installed capacity of around 50,000 MW in the state, he said. Recently, the Centre allocated Rajasthan a 25,000 MW ultra mega renewable energy park. The state government has identified land bank of 125,000 hectares in three districts — Bikaner, Jaisalmer and Jodhpur—for this park. He said of the 30,000 MW—the target Rajasthan has set for next five years—the state is looking to install solar plants of 10,000 MW in next three years in the first phase.

Source: The Economic Times

India’s cultivable land has the highest potential for wind energy generation: NIWE

26 February. India’s cultivable land areas have the highest potential - compared to wasteland and forest land - for installing wind energy projects at an estimated 347 GW at 120 metre above ground level, according to a report by the National Institute of Wind Energy (NIWE). The report said that out of India’s total estimated wind potential of 695 GW, 340 GW is possible in wasteland, 347 GW in cultivable land and 8 GW in forest land. According to the report, wind potential of 132 GW is possible in high potential areas with capacity utilisation fact (CUF) greater than 32 percent and wind potential of about 57 GW is possible in areas with CUF greater than 35 percent. India’s installed wind capacity has grown on an average of 20 percent since last 20 years. The Ministry of New and Renewable Energy (MNRE) had recently said that India has an estimated offshore wind energy potential to generate about 70,000 MW power and is planning to develop the first offshore wind energy project of 1 GW capacity off the coast of Gujarat. The NIWE had recently floated an expression of interest for this first offshore wind energy project of India. The government has set an ambitious target of installing 100 GW of solar and 60 GW of wind power by 2022.

Source: The Economic Times

INTERNATIONAL: OIL

OPEC, Russia moving closer to big oil cut as coronavirus hits demand

3 March. A panel of OPEC (Organisation of the Petroleum Exporting Countries) and its allies recommended cutting oil output by an extra 1 mn barrels per day (bpd) signaling that Russia and Saudi Arabia were moving closer to a deal to prop up prices which have been hit by the coronavirus outbreak. Saudi Arabia and some other OPEC members have been pushing for deeper cuts as crude prices have plunged 20 percent since the start of the year but had struggled to persuade Russia to support the additional reduction. The OPEC, Russia and other producers already have a deal in place to cut output from 1 January by 2.1 mn bpd, a figure that includes additional voluntary cuts by Saudi Arabia. But that has not been enough to counter the impact of the virus on China, the world’s biggest oil importer, and on the global economy, as factories are disrupted, fewer people travel and other business slows, curbing oil demand.

Source: Reuters

Venezuela’s oil exports rose 9 percent ahead of wind-down expiration date

3 March. Venezuela’s oil exports rose 9 percent in February from the previous month, as some buyers rushed to take cargoes ahead of the expiration of a wind-down period as part of new US (United States) sanctions on PDVSA and its trade partners, data from the state-run firm and Refinitiv Eikon showed. Washington imposed tough sanctions on PDVSA in 2019 and launched a strategy of “maximum pressure” this year to oust Venezuela’s President, Nicolas Maduro, extending sanctions to PDVSA’s main trade partner, Rosneft Trading, while making threats on other customers. Prior to sanctions, the US was the biggest buyer of Venezuela’s oil. Exports increased to 1.046 mn barrels per day (bpd) from 960,000 bpd in January, according to the data. The US Treasury gave buyers of Venezuelan oil until the end of May to wind down purchases. PDVSA and its joint ventures exported 31 cargoes of crude and fuel last month. The country’s fuel imports decreased almost 8 percent in the same period to 163,000 bpd. India was the largest direct destination for Venezuelan oil in February with some 234,000 bpd shipped to refineries there, followed by Cuba with about 100,000 bpd. US Special Representative for Venezuela Elliott Abrams said that Washington would go after customers of Venezuelan oil, including in Asia, as well as intermediaries helping Caracas hide the origin of its oil.

Source: Reuters

Somalia agrees offshore oil exploration roadmap with Shell/Exxon

2 March. Somalia has agreed an initial roadmap with a Shell/Exxon joint venture (JV) to explore and develop potential offshore oil and gas reserves, the Ministry of Petroleum and Mineral Resources said. Somali President Mohamed Abdullahi Farmajo signed petroleum legislation into law to help open up a new frontier market in Africa as the strife-torn country hopes new petroleum finds will help transform its economy. In October Shell and Mobil, which had a JV on five offshore blocks in Somalia prior to the toppling of dictator Mohamed Siad Barre in the early 1990s, agreed to pay the government $1.7 mn for historic leasing of the blocks.

Source: Reuters

Saudi Arabia may slash April oil prices to Asia by most since 2012

28 February. Top oil exporter Saudi Arabia is expected to make the deepest cuts to its monthly official selling prices (OSP) to Asia since 2012, tracking declines in Middle East benchmarks and weak refining margins as the coronavirus outbreak has cut demand. Large Saudi crude price cuts for a second straight month indicate that Asia, the world’s fastest growing demand centre for oil, is swamped with supplies after the spreading virus led to run cuts at Chinese refineries. Asian refiners will also begin shutdowns in April for spring maintenance further dampening crude demand. The April OSP for Arab Extra Light crude was expected to fall by $1.90 to $3 a barrel, the survey showed. Saudi crude OSPs are usually released around the fifth of each month, and set the trend for Iranian, Kuwaiti and Iraqi prices, affecting more than 12 mn barrels per day (bpd) of crude bound for Asia. State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices.

Source: Reuters

INTERNATIONAL: GAS

Bulgaria agrees 40 percent price cut of Russian gas imports

3 March. Bulgaria has agreed 40 percent cut in the price of natural gas it imports under its long-term import contract with Russia, its dominant gas supplier, Prime Minister Boyko Borissov said. The new price will be valid as of August and was achieved after Russia’s gas giant Gazprom agreed to link the price to benchmarks such as Western European gas market hubs. Bulgaria imports 2.9 billion cubic meters per year from Russia under a long term contract valid through 2022.

Source: Reuters

CNPC’s daily natural gas sales rebound to 500 mln cubic metres

3 March. China National Petroleum Corp (CNPC) said that daily natural gas sales has rebounded to 500 million cubic meters (mcm) from 460 mcm on 14 February as demand improves. The oil giant said it has also cut oil throughput by 20 percent in February amid the virus outbreak in order to reduce increasing inventory pressure, the company said.

Source: Reuters

US natural gas glut swells, prices turn negative at Texas Waha hub

3 March. Natural gas prices at the Waha hub in the Permian basin in West Texas fell into negative territory, forcing some producers to pay other parties to take their gas. The first swing to negative spot prices in almost seven months occurred due to pipeline constraints and as mild weather cut heating demand. Prices in the forward market have been trading below zero for weeks on expectations there will not be enough pipelines to transport record amounts of gas from the region’s shale oil fields. That gas that comes from oil wells, called associated gas in the industry, helped propel US gas output to record highs, driving prices to their lowest in years as production outpaces demand for the fuel. Analysts expect gas prices in 2020 to fall to their lowest since 1999.

Source: Reuters

Egypt increases usage fee for national gas grid by 29 percent

28 February. Egypt has increased the usage fees for its national gas grid by 29 percent to $0.375 per million metric British thermal units (mmBtu), the national gas regulator said. The price increase came as part of a "gradual liberalisation of the market", it said. Egypt had first set the usage fees at $0.38 per mmBtu in August 2018 for a year. In December 2019, Egypt had lowered the usage fees by 24 percent to $0.29 per mmBtu.

Source: The Economic Times

Indonesia’s PLN signs initial 20-year deal to buy gas from Pertamina

27 February. Indonesia’s state electricity company PT Perusahaan Listrik Negara (PLN) signed an initial deal to buy 167 bn British thermal unit of gas per day from PT Pertamina for 20 years, as it slashes the use of diesel fuel. The state energy company Pertamina will supply liquefied natural gas (LNG) to PLN’s power plants in 52 locations within two years with combined capacity of 1,870 MW, Pertamina CEO (Chief Executive Officer) Nicke Widyawati said. Pertamina will start delivering gas this year to five power plants with 430 MW combined capacity, Widyawati said.

Source: Reuters

INTERNATIONAL: COAL

US FTC blocks coal mining JV of Peabody Energy and Arch Coal

2 March. The US (United States) Federal Trade Commission (FTC) has rejected a proposed joint-venture (JV) between Peabody Energy and Arch Coal, the two largest coal-mining companies in the US, considering that such a JV would eliminate competition. In June 2019, Peabody Energy and Arch Coal announced plans to set up a joint venture (with respective stakes of 66.5 percent and 33.5 percent) to combine their assets in the Southern Powder River Basin and Colorado. This includes Peabody’s North Antelope Rochelle Mine and Arch’s Black Thunder Mine, the Caballo, Rawhide and Coal Creek mines in Wyoming and the West Elk and Twentymile mines in Colorado.

Source: Enerdata

British hedge fund billionaire Hohn launches campaign to starve coal plants of finance

2 March. British hedge fund billionaire Chris Hohn has launched a campaign to persuade central banks to starve hundreds of planned coal-fired power plants around the world of finance, aiming to block the projects before they can pose a threat to the climate. Investors are also concerned about possible risks to valuations of coal, oil and gas companies if governments decide to start rapidly cutting carbon emissions in line with the 2015 Paris Agreement to combat climate change. Hohn also urged regulators to force banks to publicly disclose their exposure to coal.

Source: Reuters

Coal’s share of China energy mix falls to 57.7 percent in 2019

28 February. Coal accounted for 57.7 percent of China’s primary energy consumption in 2019, the National Bureau of Statistics said, down 1.5 percentage points from the previous year as Beijing achieved its goal of reducing coal’s share to below 58 percent a year early. China’s coal use was still up 1 percent year-on-year in absolute terms as the country’s total energy consumption rose by 3.3 percent to 4.86 billion tonnes of standard coal equivalent.

Source: Reuters

INTERNATIONAL:POWER

Zimbabwe state power company to increase electricity tariff by 19.02 percent

27 February. Zimbabwe’s state power transmission company said it would increase its electricity tariff by 19.02 percent, effective 1 March. The southern African nation, which is enduring daily power cuts lasting up to 18 hours, last increased the tariff by 320 percent in October, saying this would help increase supplies.

Source: Reuters

Russia eyes bigger share in Mena power market

27 February. Russia is eyeing an increased share of Mena multi-billion-dollar power sector with the showcasing of its cable, generator and transmission providers at a dedicated national pavilion at the upcoming Middle East Energy in Dubai, UAE (United Arab Emirates). Furthermore, the pavilion will host the global launch of several Russian industry breakthroughs including the world’s first diagnostic connection for power transmission line repair. One of the Russian pavilion stars is FutureLab, a Ural Federal University start-up, that will use the show to unveil to the region CableWalker – the world’s first wire ‘drone’ diagnostics connection for power transmission line repair which is claimed to significantly help reduce health risks. Future Lab already has an agreement with Dubai Water & Electricity Authority for a pilot project for comprehensive data monitoring and analysis of its power lines, the creation of a Dubai digital power system and the opening of a local service company.

Source: Trade Arabia

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

UK plans to include onshore wind, solar in next round of support auctions

3 March. The British government announced plans to include onshore wind and solar power in its next round of auctions to help fund renewable energy projects, in a sign it is stepping up efforts to meet its climate targets. Under the so-called contract for difference (CfD) scheme, qualifying projects are guaranteed a minimum price at which they can sell electricity, and renewable power generators bid for CfD contracts in a round of auctions. The next round will start in 2021. The consultation period for its auction plans closes on 22 May. Britain was the first G7 nation to adopt a legally-binding target to cut CO2 (carbon dioxide) emissions to net zero by 2050, but the country is not yet even on track to meet a lower target of cutting its emissions by 80 percent by 2050. Last year, renewables, including bioenergy, wind, solar and hydropower, accounted for a record high of 31.8 percent of electricity supply in Britain, according to provisional government data. Costs for renewable energy technologies, including wind and solar power, have fallen sharply worldwide over the past decade and several European countries have reduced or stopped government support. Earlier, campaigners urged UK (United Kingdom)’s Prime Minister Boris Johnson to ramp up policies to curb emissions so the country so can lead by example when it hosts a major UN (United Nations) climate summit in Glasgow in November.

Source: Reuters

Russia’s floating nuclear power plant supplies 21 mn kWh of power

3 March. The only floating nuclear power plant (FNPP) in the world, Akademik Lomonosov, built by the Russian state atomic energy corporation Rosatom has supplied more than 21 mn kilowatt hour (kWh) of electricity, Rosatom has announced. The FNPP, built to withstand tsunamis and crashes with icebergs, and which is currently in trial operation in the town of Pevek in Russia’s Chukotka Region, has supplied more than 21 mn kWh of electricity to the isolated network of the Chaun-Bilibino energy system as on 26 February, according to Rosatom

Source: The Economic Times

Italian energy company Eni targets oil output peak in clean energy drive

28 February. Italian energy company Eni pledged to reduce its oil production from 2025 and slash its greenhouse gas emissions by 80 percent and in one of the most ambitious clean-up drives in an industry under pressure from investors to go green. Eni plans to boost its oil and gas production 3.5 percent a year until 2025 but then progressively cut back, mainly on crude, to ensure natural gas, which emits less carbon when burnt than oil, made up 85 percent of its overall output by 2050. While rivals such as Britain’s BP and Spain’s Repsol have also included emissions from the use of their products in carbon targets, Eni went one step further. Others, such as Total and Royal Dutch Shell, have focused on cutting the amount of carbon emitted by each unit of energy they produce. Technically, that means their headline target measures could fall even though their absolute emissions rise with increased production.

Source: Reuters

Rising sea levels put Myanmar’s villages on frontline of climate change

27 February. Three years ago, the villagers watched as the Sittaung River on Myanmar’s southeast coast crept closer to them, swollen by powerful tidal surges from the Gulf of Mottama that eroded its banks. Dismantling their wooden homes, they relocated several kilometres inland, away from the fertile fields they had cultivated for decades. Ta Dar U is among hundreds of villages at the frontline of Myanmar’s climate crisis, where extreme weather patterns and rising sea levels have amplified and accelerated natural erosion. Environmentalists consider Myanmar to be particularly vulnerable.

Source: Reuters

DATA INSIGHT

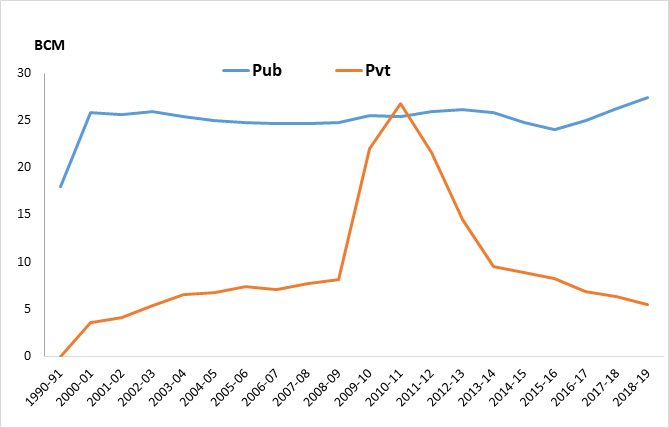

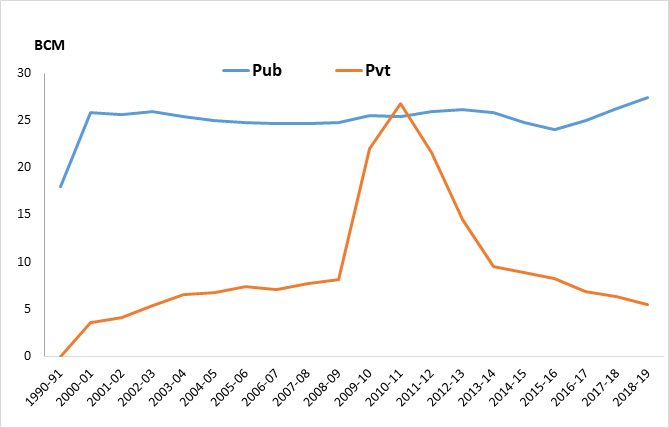

Natural Gas Production Scenario in India

| Year |

Share (%) in Natural Gas Production

by Sector |

| Public |

Private/Joint Ventures |

| 1990-91 |

100% |

0% |

| 2000-01 |

87.8% |

12.2% |

| 2010-11 |

48.7% |

51.3% |

| 2018-19 |

83.3% |

16.7% |

Trends in Natural Gas Production by Sector

Above figures are based on gross production figures of natural gas.

Source: Petroleum Planning & Analysis Cell, MoPNG

|

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV