Quick Notes

Electrifying personal mobility in India: Issues for consideration

Dominance of Two Wheelers

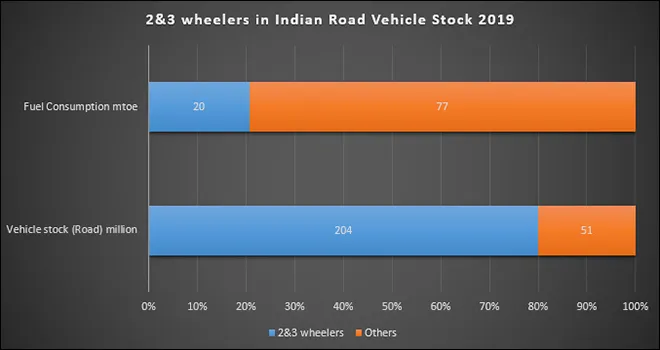

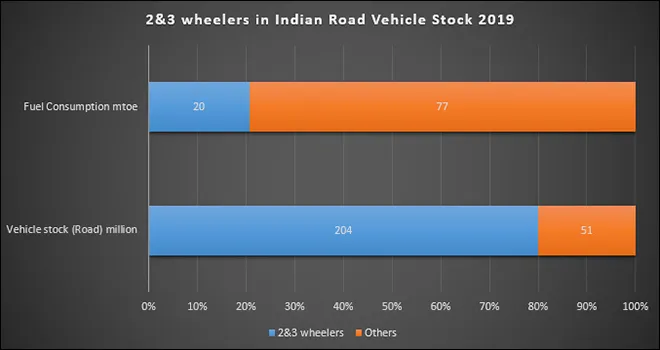

Indians travel nearly 5,000 kilometres (km) each year, a threefold increase since 2000. Vehicle ownership per person has grown five‐fold since 2000, with particularly significant growth in the fleet of two- and three‐wheelers. In the total vehicle stock of just over 200 million, the share of two- and three-wheelers is 80 percent (five times more than that of passenger cars) but their share of fuel consumption is only 20 percent. Three‐wheelers provide shared mobility and public transport, complementing a relatively low stock of 2 million buses that serve mass and public transport needs. Two- and three‐wheelers have grown faster than any other mode of personal transport in the last decade. The average daily distance travelled by two-wheelers in Indian cities is about 27−33 km with a maximum of 86 km and the average annual distance travelled is about 8,800 km with a maximum of 22,500 km.

The issue for consideration in the push for electrification is whether the focus on two-and three-wheelers for electrification will achieve the goal of decarbonising road transport. The high share of two- and three‐wheelers in India’s vehicle fleet is the reason why personal vehicles account for only 18 percent of its overall transport emissions and 36 percent even if two‐and three‐wheelers is added. This is much lower than many other countries; in the United States, for example, passenger cars account for 57 percent of total transport emissions.

According to the international energy agency (IEA), the transport sector is now the fastest‐growing energy end‐use sector in India. Energy use in India’s transport sector has increased fivefold over the past three decades, reaching more than 100 million tonnes of oil equivalent (Mtoe) in 2019. Transport is heavily reliant on oil, with 95 percent of demand met by petroleum products. Just under half of India’s oil demand is accounted for by transport. Oil demand has more than doubled since 2000 because of growing vehicle ownership and road transport use. The rapid growth of mobility was enabled by the expanding road network in India, which increased from 3.3 million km in 2000 to 5.9 million km in 2016. India’s total road network is now the second largest in the world, behind the United States (US).

According to the Ministry of Road Transport & Highways (MORTH), about 75,000 vehicles of all types are sold daily, and there are now at least 42 cities and towns in India that have over a million vehicles each. Indian cities with more than 1 million inhabitants already account for nearly 30 percent of total registered vehicles in India, and the level of vehicle ownership in urban households is higher than in rural households. In 2019, the motorcycle ownership rate was 1.4 times higher in urban areas than rural areas and the passenger car ownership rate was twice as high.

As in the case of most electric vehicles (EVs), electric two-wheelers face power and cost challenges. The rapidly falling price of batteries could reduce the total cost of the electric two-wheeler; however, to achieve cost parity with ICE two- wheelers (motor bikes), the ratio of the battery pack cost to total vehicle cost also needs to be higher, in addition to a low battery pack price. A higher battery-to-vehicle cost implies a reduction in the cost of the rest of the vehicle.

In this context, the policy on electrification of road transport should include cars that are predominantly owned by relatively affluent households. This will enable policy to use ‘sticks’ (disincentives) to move affluent urban families towards investing in ICE vehicles and limit the use of ‘carrots’ (incentives such as subsidies) that target low-income users of two-wheelers. This will shift the burden of decarbonisation, at least partly, on the affluent population in India. As vehicles excluding two- and three-wheelers are responsible for 80 percent of CO

2 emissions it will only be rational to make these the focus of India’s decarbonisation effort.

Subsidising Electrification

While India has a range of policies that support the increased adoption of a wide variety of EVs, electrification of road transport so far has largely come from two- and three‐wheelers. The number of electrified two- and three‐wheelers has grown by more than 60 percent each year on average since 2015. In 2019, India had a stock of 1.8 million electric two- and three‐wheelers on the road, and battery‐powered electric three‐wheelers (also called e‐rickshaws) were serving the demands of over 60 million people per day, mostly in urban areas. Sales are modest in terms of the size of the overall market, around 740,000 electric two- and three‐wheelers were sold in 2019, accounting for about 3 percent of total sales.

To increase the uptake of EVs, Faster Adoption and Manufacturing of Electric Vehicles (FAME), a subsidy programme was introduced in 2015. The second phase of the policy, FAME‐II, was approved in 2019 with a budget of US $1.4 billion for a three‐year period. This includes policy incentives for the purchase of electric and hybrid vehicles as well as for the deployment of charging stations. FAME‐II aims to increase the number of electric buses, two- and three‐wheelers and cars. Subsidies are offered only for vehicles with advanced battery chemistries, rather than lead‐acid variants that make up most electric two- and three‐wheelers sold today. In addition to these policies. State and city governments have also introduced policies to incentivise the uptake of EVs.

The recent increase in subsidies by 50 percent (US $200/kWh) and bulk tendering plans under Phase II of FAME is expected to reduce the cost of electric two-wheelers by 10 percent. But there are challenges. FAME II has been extended by another two years to March 31, 2024, from the earlier closure of March 31, 2022. The maximum cap is also increased to 40 percent of the e-two-wheeler cost compared to 20 percent earlier. 78,045 vehicles have benefited under the scheme as of 26 June 2021. The new revision of FAME and strong state support policies like the recently announced ones by the Gujarat government and Delhi government last year, may facilitate total cost of ownership (TCO parity with internal combustion engine ICE.

EV sales in India are expected to grow at 26 percent by the end of March 2023. High taxes on gasoline and diesel (about 60 percent of retail prices), lowering of goods and services tax (GST) from 12 percent to 5 percent on EVs along with tax and other incentives offered to EV purchasers are expected to drive growth of EVs.

The issue for consideration is the extent to which India can subsidise electrification of road transport and how this may affect other developmental and economic goals. It is not uncommon for policy makers to subsidise adoption of new technologies. These subsidies will evolve over time according to developments in technology. Policymakers have employed these subsidies to increase adoption of EVs, but these subsidies also interact with other goals such as limiting public spending and spending on other more immediate and vital necessities such as education and health care. The government values cumulative adoption of EVs and the international prestige of achieving targets for decarbonisation but the government should also be concerned overspending public funds on electrification. Potential adopters of electric two- and three-wheelers have heterogeneous, private values for EVs. Subsidies for EV adoption has a strong impact when there are a lot of inframarginal consumers who would adopt even at low subsidy levels, but it is weak when most consumers are on the margin like two-wheeler users in India. This means that without subsidies two-wheeler users are unlikely to opt for EVs. As noted above, policy should include not only incentives for adoption of EVs but also disincentives for investing in ICE vehicles by users who can do without subsidies.

Lifecycle Carbon Emissions of EVs

Cradle-to-grave assessments in the transportation sector model the environmental effects associated with the “complete” life cycle of a vehicle and its fuel. This consists of the vehicle’s raw material acquisition and processing, production, use, and end-of-life options, and the fuel’s acquisition, processing, transmission, and use. Life cycle assessments (LCA) of EVs, both in isolation and in comparison to ICE vehicle technology, is extensive and growing. However, as the literature grows, so does the range of results. The divergence is due to the differing system parameters of each study, including the selected goals, scopes, models, scales, time horizons, and datasets.

One recent research concluded that EVs must be driven 200,000 km before its “whole of life” carbon emissions equal that of an ICE. The large quantity of energy—and by extension carbon dioxide (CO

2) emissions—needed to manufacture a lithium-ion battery and the typical weight of an EV which is on average 50 percent higher than a similar ICE that requires more steel and aluminium in the frame are amongst the reasons. The “embedded carbon” in an EV before sale is, therefore, 20 to 50 percent more than an ICE. A modern lithium-ion battery has approximately 135,000 miles of range before it degrades to the point of becoming unusable. According to the study, an EV will reach CO

2 emission parity with an ICE just as its battery requires replacement. If this is correct, it raises concerns over CO

2 reduction potential of EVs. Other studies on the time it takes for how long EVs need to be driven to reach CO

2 parity with ICE varies. It varies on factors such as the size of the EV's battery, the fuel economy of an ICE car and how the type of power used to charge an EV is generated.

The issue for consideration is whether policy should pick technologies (such as EVs) or be technology agnostic and focus on outcomes such as level of CO

2 reduction. In this light, it is important to note that efficiency and emission parameters of ICE vehicles have substantially increased in the last decade and are likely to continue improving in the future. For example, Euro 6 diesels have emission levels comparable to EVs. In addition, lower acceleration and lighter weight of ICE vehicles create less road dust and tyre and road degradation which is an important source of urban pollution. Globally, an increase of EVs from the current level of about 5 million vehicles out of a billion to over 300 million out of 2 billion vehicles in 2040 is estimated to reduce oil demand only by less than 1 or 2 million barrels annually. However, improvement of efficiency of ICE vehicles is expected to reduce oil demand by over 20 million barrels per day which could substantially reduce pollution and CO

2 emission levels.

Policies for de-carbonisation of road transport through electrification without decarbonisation of power generation will merely shift pollution from tail pipes of vehicles to smokestacks of thermal power generators. Huge prior investment must be made in developing charging infrastructure. Though power generation capacity is not likely to be a deterrent to EV adoption in India in the next five years, advances in anticipation of electricity demand pattern for EVs and grid management will remain challenges. Most importantly ways and means to recoup taxes on petroleum derivatives that make a significant contribution to public finances must be found.

Source: India Energy Outlook 2021, IEA

Source: India Energy Outlook 2021, IEA

Monthly News Commentary: Natural Gas

LNG imports show signs of revival

India

LNG

India started buying prompt shipments of LNG from the spot market after a two-month absence, indicating a rebound in demand as the nation exits a deadly phase of the COVID-19 pandemic. Petronet LNG Ltd and Indian Oil Corp awarded tenders for delivery over the next few months, the first spot purchases since March. Both cargoes cost more than US $11/mmBtu, an unusually high level for Indian buyers able to turn to alternatives such as fuel oil and liquefied petroleum gas. Global energy use is quickly recovering from the devastation wrought by the pandemic, and the positive signal from India will help to push natural gas prices higher, though the nation’s demand recovery is still uneven and not all buyers there are eager to boost purchases. India is emerging from the COVID-19 wave that overwhelmed healthcare infrastructure and triggered localised lockdowns, causing a slump in natural gas consumption in the transport, commercial, and industrial sectors. India’s return to the spot market is in stark contrast to just last month, when companies were seeking to cancel and divert shipments due to a glut at import facilities.

India's top gas importer Petronet LNG will invest US $2.6 billion over five years to expand local infrastructure as investing in overseas projects is 'not lucrative' in the current LNG surplus market. The company was earlier planning to invest in projects in Sri Lanka, Bangladesh, Qatar, and Tellurian's Driftwood LNG project. India wants to raise the share of gas in its energy mix to 15 percent by 2030 from 6.2 percent and is raising its local output. Higher domestic supplies could hit costly spot LNG imports in the short term, but would not impact imports in the long term as India's gas consumption is expected to jump. Petronet plans to invest INR 66.9 billion to expand its 17.5 mtpa Dahej terminal in the west coast to 22.5 mtpa, build a new terminal in the east coast and building new jetty and LNG tanks at Dahej and Kochi. In the first phase, the Dahej terminal will be expanded to 20 mtpa by mid-2023, while a new 5 mtpa Gopalpur terminal in the east coast is expected to be ready by 2025. Petronet, which was previously planning to sell gas to fuel station owners, will invest INR 80 billion to set up its own 1,000 LNG fuel stations. It will invest INR 40 billion to set up 100 compressed bio gas generation plants over three years. Earlier in the day, the company was talking to various sellers, including Qatar, to buy gas at reasonable rates for the price-sensitive Indian market.

Achieving a major milestone for supply of re-gasified LNG (R-LNG) from India to Bangladesh, H-Energy signed a Memorandum of Understanding (MoU) with Petrobangla on 16 June 2021. The companies will soon finalise a long-term supply agreement to commence the supply of R-LNG to Bangladesh through a cross-border natural gas pipeline. A portion of the piped gas may also be utilised in West Bengal. H-Energy was authorised by the PNGRB, the regulatory body in India, to build, own, and operate Kanai Chhata-Shrirampur natural gas pipeline connecting H-Energy’s LNG terminal in West Bengal passing through various regions of the state and further connecting to the Bangladesh border. H-Energy is the only company to have received the authorisation from PNGRB to lay a pipeline till the border for the supply of R-LNG into Bangladesh.

Policy and Governance

A proposal to bifurcate state-owned gas utility GAIL (India) Ltd has been scrapped for now, and instead the company will monetise some of its pipelines by selling a minority stake through InvIT. GAIL has sent a plan for monetising two of its pipelines to the Ministry of Petroleum and Natural Gas and an Infrastructure Investment Trust (InvIT) is possible within the current fiscal if approvals come soon. GAIL is India’s biggest natural gas marketing and trading firm and owns nearly three-fourths of the country's 17,126-km gas pipeline network, giving it a stranglehold on the market. GAIL will monetise some of its pipelines by selling a minority stake through InvIT. The idea is to transfer pipelines with a steady revenue stream into a trust whose units can be sold to investors and the same can be traded on the stock exchange. This way, GAIL will upfront get money from such a sale that can be used for capital expenditure. To start with, GAIL plans to monetise the Dahej-Uran-Panvel-Dabhol pipeline and the Dabhol-Bengaluru pipeline. GAIL will retain a majority stake in the pipelines that run from Dahej in Gujarat to Dabhol in Maharashtra and from there to Bengaluru in Karnataka. Creating pipeline infrastructure, which will take the environment-friendly fuel to unconnected places in the country, is key to the government's objective of making India a gas-based economy. The government is targeting raising the share of natural gas in its energy basket to 15 percent by 2030 from the current 6.2 percent.

Rest of the World

Europe

Germany said Ukraine should remain a transit country for Russian gas, after President Vladimir Putin said it would depend on the former Soviet republic showing "goodwill" towards Moscow. Putin said that Ukraine's role as a transit country was not assured once the Nord Stream 2 pipeline linking Russia and Germany was complete. Germany expected Russia to adhere to an existing inter-governmental agreement committing it to sending gas via Ukraine. The gas transit treaty expires in 2024, but can be extended.

EU Energy Ministers meet in Luxembourg to debate prolonging EU support for some cross-border natural gas projects, despite the European Commission saying such funding should end to meet climate change goals. A proposal for the member states' position, drafted by Portugal, would prolong funding for some gas projects. Portugal’s proposal said that until 2030 investments to retrofit gas pipelines to carry hydrogen should be allowed to carry natural gas blended with hydrogen. It said projects in the island countries of Malta and Cyprus with PCI status should retain it until those countries are fully connected to the European gas network. That could help ensure the completion of Greece, Cyprus, and Israel’s EastMed pipeline to supply Europe with gas from the eastern Mediterranean.

Russia and the Far East

Turkey is expected to announce a new gas discovery in the Black Sea. In one of the world’s biggest finds last year, Turkey said it discovered 405 bcm of natural gas in the Black Sea’s Sakarya field, about 100 nautical miles north of the Turkish coast. Turkey, currently, has two drill ships working at several boreholes in the Sakarya gas field. If the gas can be commercially extracted, the discovery could transform Turkey’s dependence on Russia, Iran, and Azerbaijan for energy imports. Turkey expects the first gas flow from the Sakarya field in 2023. An annual gas flow of 15 bcm was envisaged from 2025.

Russian energy giant Gazprom expects domestic gas consumption to rise by 7.5 percent within the next five years as it embarks on a US $7 billion programme to supply gas to more households. President Vladimir Putin has tasked Gazprom to provide more natural gas to domestic consumers, who do not receive supplies of the fuel although Russia has the world's biggest reserves. Russia’s proved gas reserves stood at 38 trillion cubic meters in 2019, almost a fifth of global total, BP data shows.

Africa

BP and Eni are in talks over the future of their oil and gas assets in Algeria as the two groups increase efforts to refocus their businesses to tackle falling margins, rising debt, and climate pressures. Europe’s top energy companies are cutting back their oil and gas portfolios to keep only the assets most likely to be profitable and redeploy capital for a transition to clean energy as uncertainty mounts over future demand for fossil fuel. BP and Eni are in early-stage talks for the Italian group to take over BP's assets in Algeria. The sides are exploring an outright sale as well as an option for BP to receive stakes in Eni assets around the world, possibly in its flagship LNG development in Mozambique. The deal would help BP to dispose of its Algerian assets after its failure since 2019 to sell its 45.89 percent stake in the In Amenas natural gas plant. BP also holds a 33 percent stake in the In Salah gas plant. In Algeria, as in Angola, international groups that operate or own stakes in oil and gas fields earn fixed royalties based on the output from fields, in what are known as production sharing agreements (PSAs). As part of the strategy, the companies aim to focus operations on the most profitable fields, such as the Gulf of Mexico in the case of BP, and Egypt’s giant offshore Zohr gas field for Eni. Eni has signed a series of deals with BP in Africa, including stake sales in the Nour and Shorouk fields in Egypt and a big commercial contract for LNG from Eni's Coral South project in Mozambique.

Middle East

Six top Western energy firms are vying to partner in the vast expansion of Qatar’s LNG output., helping the Gulf state cement its position as the leading LNG producer while several large projects around the world recently stalled. Exxon Mobil, Royal Dutch Shell, TotalEnergies, and ConocoPhillips, which are part of Qatar’s existing LNG production were joined by new entrants Chevron and Italy's Eni in submitting bids for the expansion project. The bids show energy giants continue to have appetite for investing in competitive oil and gas projects despite growing government, investor, and activist pressure on the sector to tackle greenhouse gas emissions. Unlike Qatar’s early LNG projects in the 1990s and 2000s when the country relied heavily on international oil companies' technical expertise and deep pockets, the country's national oil company Qatar Petroleum (QP) has gone ahead alone with the development of the nearly US $30 billion North Field expansion project. It is, however, seeking to partner with the oil majors in order to share the financial risk of the development and help sell the additional volumes of LNG it will produce. Qatar plans to grow its LNG output by 40 percent to 110 mtpa by 2026, strengthening its position as the world leading exporter of the super-chilled fuel. Global LNG demand has increased every year since 2012 and hit record highs every year since 2015 mostly due to fast-rising demand in Asia. Analysts have said they expect global LNG demand will grow about 3-5 percent each year between 2021 and 2025. QP offered international bidders returns of around 8 percent to 10 percent on their investment, down from around 15 percent to 20 percent returns Exxon, Total, Shell, and Conoco have seen from the early LNG facilities.

China

China’s rising imports of LNG position it to surpass Japan this year as the world's largest buyer of the super-chilled fuel, pricing data, and cargo tracking firm ICIS Edge said. Japan has been world's biggest LNG importer for decades and the change would signal a major shift in one of the fastest growing energy markets. Purchases from Tokyo, which burns gas from LNG to produce electricity, have been in long-term decline. In the 12 months from June 2020 to May, China imported 76.27 mt of LNG, only slightly behind Japan’s 76.32 mt, ICIS LNG Edge said. It estimated China’s 2021 total LNG demand at 81.2 mt, above 75.2 mt for Japan. Independent and second-tier Chinese LNG buyers keen to lock in contractual supply with global sellers should keep China’s demand high. China’s efforts to cut emissions have boosted demand for LNG, which produces about half of the emissions of coal. The share of gas in China’s energy mix is around 10 percent, in third place behind coal and oil. Japan aims to cut its carbon emissions almost by half by 2030 and the resumption of nuclear power generation in recent years has reduced its LNG imports.

LNG prices are poised for more gains as gas-hungry China guzzles cargoes to feed a rebound in economic growth while the easing of coronavirus-induced restrictions restores industrial demand in India. Higher oil and coal prices have also helped lift global gas prices with spot Asian LNG prices doubling in just three months. China imported more than 7 mt of LNG in May, a record for that month, and looks set to import more over the next two months driven by strong industrial activity. South Korea’s newest and biggest nuclear reactor, Shin Kori-4, shut after a fire, which is expected to boost LNG demand. Overall, Asia LNG prices are expected to average about US $7.30 per mmBtu in 2021 and US $7.50 per mmBtu in 2022, up from US $4.20 per mmBtu last year.

Gas pipeline infrastructure facilities operator China Gas Holdings Ltd was investigating the cause of a gas pipeline explosion in central China over the weekend, and results were so far uncertain. Shiyan Dongfeng Zhongran City Gas Development Co Ltd, a non-wholly-owned unit of China Gas, is one of the gas suppliers for the area. China Gas said it had established an emergency response group to work with government departments on emergency measures and to investigate the cause of the incident. China Gas said that the operation right for piped gas in that area was originally owned by a gas company under Dongfeng Motor Corp, which in 2015 contributed the gas pipeline network while a China Gas unit contributed cash to jointly establish Shiyan Dongfeng, the unit in question.

Rest of Asia

Asian spot prices for LNG rose for a second consecutive week and touched their highest since January, buoyed by higher oil prices and firm demand from China and Europe. The average LNG price for July delivery into Northeast Asia was estimated at about US $10.95 per mmBtu, up 65 cents from the previous week. Demand from China remains robust, with the country importing more than 7 mt of LNG in May, a record for the month, as industrial activity picked up pace amid strong domestic demand. China’s robust imports are expected to continue in June and July, continuing to boost prices. China National Offshore Oil Corp (CNOOC) sought 10 LNG cargoes for delivery over July to March in a tender that closes on 4 June. A buy tender by Pakistan LNG received offers in the range of US $10.2937 to US $11.7747 per mmBtu for cargoes to be delivered in July, and US $10.51 to US $10.8312 for cargoes to be delivered in August. ADNOC LNG sold a cargo for 7-16 July loading at US $10.30 per mmBtu on a delivered basis, likely to India, while Oman LNG was offering a cargo for delivery over 7-9 August. Brazil’s Petrobras is seeking four cargoes for delivery over July to August as dry season and low reservoirs at hydro plants is spurring buyers to seek LNG cargoes to complement power generation with thermal plants.

Six oil and gas (O&G) blocks worth more than 900 million barrels of oil in Indonesia are up for grabs. The blocks on offer are South CPP, Subagsel and Merangin in Sumatra and Rangkas, Liman and North Kangean in Java. The blocks are estimated to have recovered 917.93 million barrels of oil and 598.09 billion of standard cubic feet gas in total. The South CPP, Rangkas, and Liman blocks will be offered with a cost recovery scheme, where exploration and production costs are reimbursed by the government. The other blocks will be given the flexibility to choose between cost recovery or a "gross split", which would allow contractors to shoulder the cost of exploration and production in exchange for retaining a bigger portion of the oil and gas they recover. Regular bids will be available for Merangin III and North Kangean, while direct offers from the government will be made for South CPP, Sumbagsel, Rangkas, and Liman. Indonesia’s state owned oil company Pertamina was put on a watchlist for removal from JPMorgan’s ESG EMBI index after its scores fell below a required threshold for inclusion.

News Highlights: 23 – 29 June 2021

National: Oil

Middle East’s share of India’s oil imports hits 25-month low

24 June: The share of Middle Eastern crude in India’s oil imports fell to a 25-month low in May, tanker data provided by trade sources showed, as refiners tapped alternatives in response to the government’s call to diversify supplies. India, the world's third biggest oil importer, in March directed refiners to diversify crude sources after the Organisation of the Petroleum Exporting Countries (OPEC) and its allies, led by top exporter Saudi Arabia, ignored New Delhi's call to ease supply curbs. The Middle East’s share dropped to 52.7 percent, the lowest since April 2019 and down from 67.9 percent in April, the data showed. Imports from Saudi Arabia, India’s second-largest supplier after Iraq, slipped by about a quarter from a year earlier, while supplies from the United Arab Emirates, which dropped to No. 7 position from No. 3 in April, fell by 39 percent, the data showed. Indian refiners bought higher volumes of gasoline-rich US oil in March, expecting a recovery in local gasoline demand to continue in the months ahead, Ehsan Ul-Haq, lead analyst for Oil Research and Forecasts at Refinitiv, said. Strong demand for light crude saw Nigeria improving its ranking by two notches to become the No. 3 supplier to India in May. Private Indian refiners Reliance Industries and Nayara Energy, however, boosted purchases of Canadian heavy oil to a record 244,000 barrels per day (bpd), equivalent to about 6 percent of India’s overall imports.

Source: The Economic Times

Assam CM requests PM Modi to transfer all assets of ONGC in the Northeast to Oil India

24 June: Assam Chief Minister (CM) Himanta Biswa Sarma has written to Prime Minister (PM) Narendra Modi requesting him to consider transferring all the assets of Oil and Natural Gas Corp (ONGC) in the Northeastern Region to Oil India Ltd (OIL). The move comes amid petroleum ministry’s directives to the former to sell stake in producing oil fields and hive off drilling and other services into a separate firm to raise production. Assam and Assam Arakan Basin can be considered to be a super basin of India with an estimated hydrocarbon resources of 7634 million metric ton of oil equivalent (mmtoe) and holds 5588 mmtoe of Yet To Find (YTF) resource potential, which is next only to KG Basin. Sarma in his letter to PM Modi, stated that almost the entire production of OIL comes from the Northeastern region and, therefore, the focus of OIL on exploration and production in this region is undivided. With more than 90 percent of employees from the region, the company would be able to focus with undivided attention on the operations and at the same time be sensitive to the aspirations of local people, he said. Sarma mentioned that with taking over of Numaligarh Refinery Ltd (NRL), OIL’s net-worth has improved substantially and it has led to vertical integration and with further expanding the operational areas and production, OIL can aspire to be the "only Maharatna Company of our region and would truly reflect the Act East Policy." He wrote that if OIL is given the ONGC assets, it can also endeavour to create hydrocarbon sector manufacturing and services hub in Assam which can in the long run aspire to provide services to the far eastern countries.

Source: The Economic Times

National: Coal

Odisha coal block to provide fuel security, strengthen aluminium operations: Vedanta

23 June: Vedanta Ltd said the coal block in Odisha allotted to it, once operational, will provide fuel security, improve power availability and further strengthen the company’s aluminium operations. The statement came soon after Vedanta emerged as the successful bidder for the Kuraloi (A) North coal block located in Jharsuguda district, Odisha which was put up for re-bidding in the second auction of blocks for commercial mining. The coal block is an optimal fit for the company’s Jharsuguda smelter given its logistical location and annual capacity. The mine has geological reserves of 1,680 million tonnes and an estimated per annum capacity of 8 million tonnes.

Source: The Economic Times

National: Power

Squirrels running on power cables led to outages: Tamil Nadu Electricity Minister

23 June: Tamil Nadu Electricity Minister V Senthil Balaji was trolled for his remark that frequent power outages in the state were caused by squirrels running on power lines. Squirrels which managed to climb the power cables and run on them result in frequent power outages, he claimed. The Minister had accused the previous AIADMK government of not initiating maintenance work and said this had led to frequent power cuts.

Source: The Economic Times

Electricity derivatives are set to transform India’s power sector

23 June: India consumes about 1,300 billion units on an annual basis. The captive power consumption is of course not included herein, and this only represents the formal grid connected capacity. The short-term power market is about 11–12 percent of India’s power sector accounting to 140 billion units of the total. The Exchanges-led electricity markets which commenced in the year 2008, has now been playing a central role in the power procurement strategy of 60+ distribution utilities and about 5000+ 1MW and above industrial and commercial consumers, referred to as the open access consumers. India’s Exchange market has been pretty simplistic delivery-based electricity market comprising of round the clock real time market, the day-ahead market and various other term-ahead products for trade on the same day up to 11 days forward. The government clearly intends to deepen and evolve India’s power market. A case in point is a recent agreement between the power ministry and the finance ministry, which paves way for introduction of longer duration forward delivery-based contracts up to 365 days on the power exchanges as well as the financially settled derivatives on the commodity exchanges.

Source: The Economic Times

National: Non-Fossil Fuels/ Climate Change Trends

Statutory approval process initiated for solar projects at four sites: Hindalco

24 June: Hindalco Industries Ltd said the process for statutory approval has been initiated for its solar power projects at four locations. The total capacity of the projects is 42 MW, Hindalco Industries said. The company further said a 20 MW renewable hybrid with storage project with potential of supplying round-the-clock power is under active consideration for its Dahej, Gujarat unit. In September last year, an additional 2.3 MW solar facility was commissioned in Alupuram, Kerala, taking the total renewable capacity of Hindalco to 49 MW, in line with company's target of 100 MW by FY22, it said. The company had earlier said solar projects at five sites which were under different phases of implementation were expected to be commissioned in the third quarter of ongoing fiscal. Hindalco had also said feasibility study for additional 60 MW solar projects, including floating and with storage option, has been initiated.

Source: The Economic Times

ACME, Brookfield Renewable to jointly develop 450 MWp solar project in Rajasthan

23 June: Solar power producer ACME said the company along with Brookfield Renewable will jointly build a 450 MWp (megawatt peak) solar project in Rajasthan. According to the company this solar project includes a 25-year power purchase agreement with Maharashtra State Electricity Distribution Company Ltd (MSEDCL), a wholly-owned subsidiary of the Maharashtra State Electricity Board, the largest electricity distribution utility in India and the second largest in the world. The project will provide clean and green electricity to over a million households.

Source: The Economic Times

50 percent of NPCIL’s generation in South shut down for maintenance

23 June: A total of 1,660 MW of atomic power capacity belonging to Nuclear Power Corporation of India Ltd (NPCIL) has been shut down largely for refuelling and maintenance in Southern India. India’s atomic power company NPCIL has a total of 3,320 MW capacity in Tamil Nadu (2,440 MW) and Karnataka (880 MW). The units that are under shutdown are—Kudankulam Unit 1-1,000 MW; two Units of Madras Atomic Power Station (MAPS)- 440 MW; Kaiga Atomic Power Station Unit 4-220 MW. The NPCIL is building four more 1,000 MW nuclear power plants in Kudankulam - Units 3-6. The construction of Units 3 and 4 is under progress while the construction work for Units 5 and 6 is expected to start soon. Construction work for 3 and 4 units was affected due to COVID-19 pandemic and the work is now in progress.

Source: The Economic Times

International: Oil

OPEC+ discussing gradual oil output rise from August

23 June: OPEC+ is discussing a further gradual increase in oil output from August as oil prices rise on demand recovery, but no decision had been taken on the exact volume yet. The OPEC and allies, known as OPEC+, is returning 2.1 million barrels per day (bpd) to the market from May through July as part of a plan to gradually unwind last year's record oil output curbs. OPEC+ meets next on 1 July. The talks mean that OPEC and Russia are likely to find common ground again on oil production policy. Moscow has been insisting on raising output further to avoid prices spiking, while key OPEC producers, such as Saudi Arabia, have given no signals on the next step until now. Crude oil prices rose, with Brent hitting US $75 per barrel for the first time since April 2019, as investors remained bullish about recovery in oil demand and concerns eased over a quick return of Iranian crude to the market.

Source: The Economic Times

International: Gas

China’s first solo-operated deepwater gas field starts production

25 June: China’s first solo-operated deepwater gas field started production, the country’s national offshore producer CNOOC Ltd said. Shenhai-1, meaning deepsea, is expected to produce up to 3.39 billion cubic meters (bcm) of gas every year, or roughly 2 percent of China’s total gas output, the energy major said. The deepsea gas project, built in the Lingshui 17-2 gas field in the South China Seas, will bring CNOOC's total gas production capacity in the sea area to more than 13 bcm annually, according to the company. Shenhai-1 is part of CNOOC’s plan to significantly increase its gas output to cut carbon emissions and help Beijing's climate goals.

Source: The Economic Times

Gas infrastructure across Europe leaking planet-warming methane

25 June: The potent greenhouse gas methane is spewing out of natural gas infrastructure across the EU because of leaks and venting. In the energy sector, methane is emitted intentionally through venting and by accident from sites such as gas storage tanks, liquefied natural gas (LNG) terminals, pipeline compressor stations and oil and gas processing sites. At one gas plant owned by Italy’s Eni near the town of Pineto on the country’s Adriatic coast, methane appears to be leaking from a rusty hole in the side of a tank. Eni said the leak at Pineto was from a water tank which would have had negligible amounts of gas and that it had been detected and fixed during regular maintenance. Experts said the new rules will shake things up for every oil and gas firm in Europe, not least because the EU is considering forcing companies to find and fix even the smallest leaks.

Source: The Economic Times

International: Coal

Glencore snaps up BHP, Anglo stakes in Colombian coal mine

28 June: Diversified miner Glencore will become the sole owner of the Cerrejon thermal coal mine in Colombia by buying out partners BHP and Anglo American, boosting its coal assets at a time when others are looking to exit the sector. Glencore said it expects to pay US $230 million for the combined 66 percent stake owned by BHP Group and Anglo when the deal completes in the first half of 2022. It sees production volumes at the mine declining materially by 2030. Mining companies have been reviewing their ownership of thermal coal assets as they transition out of polluting fossil fuels to meet emissions targets and shift towards sustainable investments. But global demand for coal is expected to jump 4.5 percent in 2021, after a record pandemic-led drop last year. An increase in coal-fired power generation in Asia, where many countries including China are still building new capacity, accounts for three-quarters of the rebound, the International Energy Agency (IEA) said recently. Glencore said owning 100 percent of Cerrejon would not compromise its climate commitments. It plans to become a net-zero emission company by 2050 and has set a goal of managing the depletion of its coal mines by the mid-2040s, rather than selling them.

Source: The Economic Times

China ferrous futures rise, coking coal and coke set for weekly gains

25 June: Chinese steelmaking ingredients and other ferrous futures rose, with coking coal and coke both on course for a more than 5 percent weekly gain against the backdrop of strong demand at mills and supply tightness. The most-traded coking coal futures on the Dalian Commodity Exchange, for September delivery, inched up 0.3 percent to 2,056 yuan (US $318.04) a tonne. Coking coal inventories held by 100 coking plants and 110 steel mills, surveyed by consultancy Mysteel, fell 3.2 percent to 15.7 million tonnes (mt), from a week earlier due to a supply crunch amid environmental and safety production inspections.

Source: The Economic Times

International: Power

Bangladesh scraps plans to build 10 coal-fired power plants

28 June: Bangladesh has cancelled plans to build 10 coal-fired power plants, amid rising costs for the fuel and increasing calls from activists to base more of the nation’s power on renewable energy. About 8 percent of the country’s current electrical power comes from coal, but until last year the nation had plans to significantly increase that percentage by building at least 18 coal-fired plants. Currently, more than half of Bangladesh’s electricity comes from natural gas, though some power plants also run on heavy fuel oil and diesel. About 3.5 percent of the country’s power comes from renewable energy, a percentage the nation plans to boost to 40 percent by 2041.

Source: Reuters

International: Non-Fossil Fuels/ Climate Change Trends

Togo launches West Africa’s largest solar plant

24 June: Togo has inaugurated the largest solar plant in West Africa, in a push to increase access to electricity and develop renewables in the small coastal country. The 50 MW facility, located in central Togo, will provide power to more than 158,000 households and save more than one million tonnes of CO

2 emissions, Togo’s President Faure Gnassingbe said. The plant was built in Blitta, 267 km (165 miles) north of the capital Lome, by AMEA Togo Solar, a subsidiary of Dubai-based AMEA Power. It hosts 127,344 solar panels expected to produce 90.255 megawatt hours (MWh) of power per year. Capacity for an additional 20 MW is scheduled to be built on the same site by the end of the year. AMEA Togo Solar will be able to exploit the plant for 25 years. Togo, which imports more than half of its energy from Nigeria and Ghana, is banking on solar power to develop access to electricity for its 8 million residents.

Source: The Economic Times

China vows to retaliate if US bans import of solar panel material from Xinjiang

23 June: China vowed to retaliate if the United States bans the import of a critical solar panel material from Xinjiang. According to a report in Politico, the Biden administration is mulling to ban the import of solar panel material——polysilicon—from the region, where the Chinese government has been accused of committing genocide against the Uyghurs minority. Chinese foreign ministry said that the US must respect the facts, immediately stop deliberately disseminating false information and, based on this false information, exert undue pressure on Chinese companies, Sputnik reported. Xinjiang produces about 45 percent of the world’s supply of the key component, polysilicon, the research said.

Source: The Economic Times

Portugal’s EDP eyes sale of up to three renewable asset portfolios

23 June: EDP-Energias de Portugal is preparing to sell up to three portfolios of renewable energy assets in Europe this year, potentially worth a combined €1.5 billion (US $1.79 billion), to help fund its clean energy ambitions. In line with a global effort to cut planet-warming carbon emissions, Portugal’s largest utility said earlier this year it wanted to abandon coal-fired power generation by 2025 and produce energy only from renewable sources by the end of the decade. Renewable and low-carbon energy businesses are attracting high valuations on public and private markets from cash-rich investors who expect steady growth in the market as policymakers seek alternatives to fossil fuels. As part of a plan to sell around one-third of the new wind farms and solar parks it builds, EDP will announce two portfolio sales in Europe in the short term, EDP’s Chief Executive Miguel Stilwell de Andrade said. EDP would aim to close the deals before the end of the year and invest capital back into the business towards its aim of adding 50 GW of clean energy capacity by 2030.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV