IMPORT SUBSTITUTION TO BOOST DOMESTIC COAL CONSUMPTION

Monthly Coal News Commentary: May - June 2020

India

Domestic Production & Demand

CIL which accounts for over 80 percent of the domestic fuel output, has been mandated by the government to replace at least 100 mt of imports with domestically-produced coal in the ongoing fiscal. The Centre had earlier asked power generating companies, including NTPC Ltd, Tata Power and Reliance Power, to reduce import of the dry fuel for blending purposes and replace it with domestic coal. The government has also given directions to target thermal coal import substitution, particularly when huge coal stock inventory is available in the country this year. State governments have been asked not to import coal and take domestic supply from CIL, which has the fuel in abundance. The country’s coal imports increased marginally by 3.2 percent to 242.97 mt in 2019-20.

CIL’s sales fell 23.3 percent in May as utilities refrained from purchases amid record stockpiles and tepid demand because of a nationwide lockdown to curb the spread of the coronavirus. Offtake by customers, such as power generators, fell to 39.95 mt in May, down 23.3 percent year on year, though that represented a slight improvement from the 25.5 percent fall in April. May production fell 11.3 percent to 41.43 mt, compared with a 10.9 percent fall the previous month. More than three quarters of the electricity generated in India is derived from coal, with CIL - the world’s largest coal miner - accounting for more than four fifths of India’s domestic production.

CIL’s Odisha-based subsidiary MCL reported a 42.6 percent growth in top soil removal from coal seams during the current fiscal up to 25 May 2020 against the corresponding period last year. Highest among all coal producing companies, the subsidiary cleared 27.51 mcm of top soil and extraneous matter till 25 May, compared to 19.29 mcm during the previous corresponding period — a volume increase of 8.22 mcm. Despite lukewarm demand for the dry fuel from the consuming sectors, amid Covid-19 slowdown, MCL managed to produce 20.54 mt of coal up to 25 May this year, the highest among all coal companies of CIL.

The Western Coalfields' Adasa coal mine near Nagpurvia inaugurated recently is set up with investment of ₹3.34 bn. It will produce 1.5 mtpa. 14 coal mines with the investment of ₹115 bn will start operations in Maharashtra in the next four years, and 13,000 people will get employment.

Production of NCL rose by 2.5 percent to 4.32 mt the first fortnight of May up to 15 May and the company is on course to meet annual production target for 2020-21. Last month NCL produced 8.73 mt of coal, achieving 96 percent of the month’s targeted production. Importantly, there was no decline in growth compared to the same month last year. NCL is targeting a production of 113.25 mt during the current fiscal, entailing a growth rate of 4.8 percent. NCL is the third-largest subsidiary of CIL which contributed to 18 percent of CIL’s overall coal output of 602.13 mt during 2019-20. For two successive financial years, NCL has achieved its production target four days ahead of the closure of the fiscal. In FY2020, NCL produced 108.05 mt of coal.

CIL has decided to outsource underground mine development and operations. The CIL subsidiary, Central Mine Planning & Design Institute, will soon invite tenders for appointing such operators for two new underground mines that aim to produce at least 5 mtpa. CIL’s existing underground mines employ 44 percent of its workforce but account for only 5 percent of the output. It has 166 such mines out of a total of 360. CIL has firmed up plans to offer underground coal blocks to global MDOs to extract coal efficiently and profitably. Supervision and statutory manpower, however, would be provided by CIL. CIL uses MDOs for open cast but underground mines are run by its own workforce. At a later stage, MDOs are likely to be appointed for existing underground mines. At present, bulk of CIL’s open cast production is undertaken by MDOs, which produce coal more efficiently.

The power sector, a key coal consumer, is grappling with weak demand due to the lockdown and plants are operating at lower capacity, bringing down the demand for coal. To boost coal demand, the government has announced a slew of measures like increased supply for linkage consumers. It has also announced several relief measures for CIL consumers, including the power sector. CIL closed the financial year 2019-20 with coal production of 602.14 mt, against the target of 660 mt. It is targeting 710 mt of coal output in the ongoing financial year.

The state government has extended the Orissa Essential Services (Maintenance) Act, 1988 or ESMA in the MCL areas in Talcher by another six months, prohibiting strikes to ensure uninterrupted coal supply to power plants, according to a notification. The ESMA was clamped in MCLs Talcher coalfield areas on 15 May 2019 to prevent frequent strikes which were causing difficulties in power generation. The MCL area, which is prone to agitations, is being kept secured for coal production, dispatch and transportation for the public interest. Since it is apprehended that the situation may turn volatile this year as well, the government decided to further extend the ESMA by six months with effect from 16 May.

Environmental Burdens

The NEC, a unit of CIL in Assam, has temporarily halted its operations following protests over its impact on a subtropical rainforest nearby. An office order signed by NEC’s general manager based in eastern Assam’s Margherita said all mining operations have been suspended with effect from 3 June. The order stated that the “liquidation of present coal-stock will continue till existing coal stock is exhausted” and all necessary statutory formalities would be taken up with the statutory bodies concerned. The NBWL’s Standing Committee had discussed a proposal for the use of 98.59 hectares of land from the Saleki Proposed Reserve Forest land for a coal mining project by NEC. The NBWL had approved the diversion of this forest land, 41.39 hectares of which it said was unbroken, for NEC’s Tikok open-cast coal mining project. NEC had suspended the Tikok project in October 2019 but was producing coal in its Tirap open-cast project nearby. Tirap produced about 4 mt of coal. Tikok’s yield was higher. The NEC has about 1,100 employees and prolonged suspension of coal mining operations in Assam could lead to their relocation to other projects of CIL.

Coal miners and traders in Meghalaya have threatened mass defiance of the Covid-19 lockdown over what is being seen as the State government’s move to “carry coal to Newcastle.” The Meghalaya government had on 6 May issued an order allowing transportation of coal from Assam and other States for cement plants in the State, some of them in EJH district. The ‘irony’ of the order was not lost on many in the coal-rich EJH district whose economy began suffering after the NGT banned the hazardous rat-hole coal mining in April 2014. The Supreme Court later restricted the transportation of coal before the ban came into effect. According to Meghalaya’s coal mine owners and managers, the order to bring in coal to a State where thousands of coal mines were lying idle — EJH alone has about 60,000 pits — was a mockery of the economic crisis they have been facing since the NGT ban. Prior to the ban, EJH used to help generate the bulk of ₹6 bn the Meghalaya government used to get from coal trade.

A day after the Gauhati High Court admitted a public interest litigation petition challenging the National Board of Wildlife’s approval for coal mining in an elephant reserve in eastern Assam, the State government asserted that it has not approved mining in the area. The sanctuary, often referred to as ‘Amazon of Assam’ because of its sub-tropical rainforest, and the Saleki Proposed Reserve Forest where mining has been approved, is a part of the Dehing Patkai Elephant Reserve straddling Tinsukia, Dibrugarh and Sivasagar districts.

Coal Washing

Experts have described the decision by the Centre to do away with mandatory coal washing as a "retrograde" step. The inability of CIL to implement its promise of supplying washed coal has led to the erosion of around ₹1250 bn in market valuation in 10 years to 2019-20. The Centre is planning to do away with the mandatory requirement of washing of coal before it is transported to thermal power stations. In 2014, as part of its climate change commitments, the government had made coal washing mandatory for supply to all thermal units beyond 500 km from the coal mine. Washing coal increases the efficiency and quality of the dry fuel, therefore increasing its price. The criteria could be fulfilled either by blending with low ash imported coal or by washing domestic coal. On accounts of delays in setting up of washeries by CIL, blending with imported coal became the sought after option resulting in the rise of import of thermal coal The government is likely to offer major rebates on revenue share to winners of commercial coal block auctions in order to attract investments from local and global miners. This follows the announcement on liberalising commercial coal mining as part of the ₹20k bn Atmanirbhar Bharat stimulus. Companies that start early production from the blocks will be offered 50 percent rebate on revenue share payable to the government. Given the easy entry and exit norms, the government expects participation from Indian companies such as Hindalco, Jindal Steel & Power, JSW Energy, Adani Group and Vedanta, and global miners like Peabody, BHP Billiton and Rio Tinto. The government also proposes to increase the tenure of CIL contracts for raw coking coal to up to 30 years as an import substitution measure.

PSPCL has got a major relief as the Union government has done away with ‘washed coal’ condition for power plants. With this, the PSPCL will save at least ₹4 bn per annum, besides it gets a breather in a contempt petition filed by private thermal plants, seeking ₹28 bn coal washing charges from the corporation. It will bring down the power-generation cost in Punjab. Private power plants and PSPCL were caught in a legal battle over coal washing charges.

Commercial Mining

According to rating agency Crisil, the government’s move to open up commercial coal mining can halve the annual expenditure incurred on importing non-coking coal to as much as ₹450 bn because of substitution through domestic production. In fiscal 2020, India imported an estimated 180-190 mt of non-coking coal costing over ₹900 bn. On 20 May, the Cabinet approved liberalisation of coal mining by eliminating eligibility conditions for private sector participation. India has one of the largest coal reserves in the world at 300 bt, yet it imports a fifth of its annual requirement. At present, two government-owned miners, CIL and SCCL, produce over 90 percent of the coal. Last fiscal, the government had allowed 100 percent foreign direct investment in coal mining, enabling global miners to join the fray. According to Crisil, sectors such as power, cement and steel will gain the most as they are the largest consumers of non-coking coal.

The Cabinet recently approved the new bidding methodology for commercial coal blocks according to which the floor price bench-marked for auctions would be 4 percent of the revenue share, incrementing in multiples of 0.5 percent. If bidders raise the government’s revenue share to more than 10 percent in auctions, bids would be accepted in multiples of 0.25 percent of the revenue share thereafter. According to the Atmanirbhar Bharat package, not only fully explored coal blocks, but also partially explored ones will now be auctioned for commercial mining, and 50 assets will go under the hammer soon. ‘Representative prices’ will be used to compute the government’s revenue share from auctioned mines. The rates have been derived from a weighted combination of monthly prices of coal in various channels of transaction, including imports, for the month of March. The representative prices of non-coking coal between the G7 and G14 grades are in the range of ₹1,098/tonne to ₹2,619/tonne. Though the prices are higher than the notified price of the fuel sold by CIL industry sources said the rates look balanced. The coal ministry has also rolled out the ‘national coal index’, which is the weighted average of the change in coal rates based on FY18 price levels. Nearly 50 blocks will be offered for bidding. This is being done to reduce import of substitutable coal and increase self-reliance in coal production. Also, the government will invest ₹500 bn for building evacuation infrastructure. Coal gasification and liquefication will be incentivised through rebate in revenue sharing. CBM production would also be encouraged.

Five employees unions demanded that the Central government immediately withdraw the proposed commercial coal mining by private players, as it is detrimental to the interests of coal employees. The SCMLU-INTUC, SCWU-AITUC, SCE&W-HMS, SCEU-CITU and GLBKS-IFTU submitted a memorandum to the Director (PA&W) of SCCL in Kothagudem to this effect. SCMLU-INTUC activists staged a one-day dharna in Kothagudem against the privatisation of CIL and SCCL. Coal produced by private players to whom the new coal blocks would be allocated through auction would engage contact labour for coal exploration and the price of coal per tonne would be cheaper than CIL and SCCL.

Coal Trading Platform

India has decided to set up a coal trading platform, taking a giant leap towards completely throwing open the sector to market forces as the country gears up for commercial coal mining auctions, which will increase the number of sellers of coal. As per the proposal, entire coal produced in the country will be traded on a ‘Coal Exchange,’ an online platform where pricing is determined transparently through demand and supply. The exchange is being thought out on the lines of commodity exchanges, power bourses or the proposed gas exchange. This could mean the end of new FSA regime of CIL where the state-run miner signs contracts for coal supply with consumers. Coal consumers and traders welcomed the move but said the exchange should be started only when there are multiple buyers and sellers. The coal ministry is likely to begin auctions of about 50 coal blocks for commercial coal mining. The government said that discussions have begun in the ministry and a coal exchange is certain to be set up after the government addresses all related concerns. The proposed coal exchange may be the only trading platform for organised sale of coal.

Imports

CIL has been mandated by the government to replace at least 100 mt of imports with domestically-produced coal in the ongoing fiscal. The development comes at a time when the country on the one hand has abundance of domestic coal, while on the other hand there is a slump in demand of the dry fuel. In its bid to substitute imports with domestic coal, CIL is connecting with non-regulated sectors like sponge iron, cement, aluminium for domestic coal. The country imported 247.1 mt of coal in 2019-20, about five percent higher than 235.35 mt imported during 2018-19.

The country’s coal import dropped by 20 percent to 18.93 mt. The government is planning to bring the country’s 'avoidable coal imports' to zero by 2023-24. According to mjunction demand for coal import is expected to remain subdued in the short-term given the high coal stock levels in pithead and power plants. The coal import in May last year stood at 23.57 mt. However, coal import through the major and non-major ports is estimated to have increased by 10.76 percent over April 2020, based on monitoring of vessels' positions and data received from shipping companies. Import of coal in May stood at 18.93 mt (provisional) as compared to 17.09 mt (revised) in April 2020. Of the total imports last month, the import of non-coking coal was at 13.22 mt, against 12.28 mt in April. Coking coal imports were at 3.81 mt in May, up from 3.23 mt imported a month ago. During April-May, total coal import was at 36.02 mt, registering decline of 27.83 percent from 49.90 mt imported during the same period of the previous year. During April-May, non-coking coal imports stood at 25.50 mt, from 35.35 mt imported during April-May 2019. Coking coal imports were at 7.04 mt during April-May, down from 8.77 mt earlier.

Responding to the Centre’s new scheme to reduce import of coal, 17 independent power producers have applied to forgo their imported coal quantity, replacing it with supply from CIL. Adani Power, GMR Energy, Avantha Power, Lalitpur Power, and Vedanta are some of the private companies that have applied for the ‘import substitution’ scheme of the Centre. These units totalling 22,450 MW have cumulatively requested for 17.9 Mt of coal from CIL to substitute their imported capacity. This quantity is over and above the amount of coal these units already get from CIL under the FSA.

Coking Coal

The government has increased the tenure of coking coal supply to up to 30 years under the coal linkage granted in auction for non-regulated sector like steel. The development comes at a time when CIL which accounts for over 80 percent of the domestic fuel output, is connecting with non-regulated sector for domestic coal which is available in abundance in the country. The country on the one hand has abundance of domestic coal, while on the other hand there is a slump in demand of the dry fuel. To boost coal demand, the government has announced a slew of measures like increased supply for linkage consumers. It has also announced several relief measures for CIL consumers, including the power sector.

The centre has approved revised tenure for coking coal linkage for the non-regulated sector auction, the coal ministry has said in a letter to CIL and SCCL. For the auction of coal linkages in the non-regulated sector, the proportion of coal allocation between power and non-power sectors is decided to be continued at the same level as the average proportion of the last five years, which is 75 percent power and 25 percent non-power. For the auction of linkages, separate quantities will be earmarked for sub- sectors of the non-regulated sector and auctions will be conducted by CIL and SCCL through competitive bidding by earmarking a mine within a subsidiary as deemed fit.

Rest of the World

China

According to China National Coal Association, China’s coal consumption is expected to decline in the second quarter from a year earlier, but will see an improvement in the second half of 2020 as Beijing’s stimulus efforts boost demand. Industrial and economic activities were unlikely to fully restart in the current quarter due to coronavirus control measures, which would weigh on demand for coal. The world’s largest coal consumer used around 870 mt of the fuel in the first quarter, down 6.8 percent from the same period last year. The power sector’s coal consumption fell 6.8 percent to 507 mt, while that of the construction sector plunged 24.7 percent to 65 mt. The association warned of replacement of coal-fired power with non-fossil fuel sources in the second quarter, as increasing rainfall in southern China will boost hydropower generation.

China is expected to tighten coal import rules in the second half of 2020 to shore up its struggling domestic industry, after record arrivals in the first four months, just as demand tanked because of the coronavirus outbreak. Imports could drop as much as a quarter in the second half from the corresponding 2019 period which is likely to boost pressure on major coal exporters, such as Australia, Indonesia and Russia, which are already battling weak demand because of the virus. According to Wood Mackenzie China’s total thermal coal consumption may reach 1.9 bt from July through December. IHS Markit estimates China’s full-year coal imports could fall to 275 mt with thermal coal plunging about 20 percent on the year, but seaborne metallurgical coal arrivals seeing a slight pick-up. China National Coal Association expects demand to decline in the second quarter on the year, after a fall of 6.8 percent in the first quarter as the virus shut industrial plants. Chinese coal miners have cranked out record output in 2020 in response to Beijing’s call to ensure energy supplies, but the flood of imports, coupled with lower consumption, slashed profit margins by 30 percent in the first quarter.

China has excluded “clean coal” from a list of projects eligible for green bonds, according to long-awaited new draft guidelines published by the central bank. The new catalogue of eligible projects replaces the previous one published in 2015, and will be open to public consultation until 12 June, the People’s Bank of China said in a notice. China has sought to use green financing to pay for its transition to cleaner modes of growth, but the previous catalogue allowed it to be raised for the “clean use of coal”, including coal washing plants that remove impurities, and technologies that cut pollution during combustion. The inclusion of “clean coal” in the 2015 list had put China at odds with global standards, a point of contention for some international investors and many environmental groups. Chinese financial institutions provided billions of yuan in green financing to coal related projects last year, and have also supported other fossil fuel projects, including the expansion of an oil refiner. The new guidelines include projects that help replace coal with cleaner forms of energy for winter heating.

Britain

Britain will reach two months in a row without using electricity from coal fired power stations for the first time since its 19th century industrial revolution, according to the country’s National Grid. Britain was home to the world’s first coal-fuelled power plant in the 1880s, and coal was its dominant electric source and a major economic driver for the next century. Britain plans to close coal plants by 2024 as part of efforts to reach its net zero emissions goal by 2050.

Poland

Poland, the EU’s biggest hard coal producer, is considering closing at least three mines in coming months as the coronavirus pandemic forces it to accelerate its exit from the sector. Poland, the only EU member to refuse to pledge to become climate neutral by 2050, has long had a close relationship with coal, which has historically been a pillar of its economy. However the sector has often been loss-making in recent years, even as the state has sought to financially prop it up. The closures being looked at by the government include the Wujek mine. Wujek was the site of one of the bloodiest protests during communist rule and is a symbol of the nation’s ties to coal. The closures being considered would affect at least two mines owned by PGG, Poland’s biggest coal group, including Wujek. They would also affect one or more mines owned by state-run utility Tauron. The PGG mines would likely be taken over in the third quarter by state company SRK, which would gradually wind them down if the plan goes ahead. PGG has eight mines in total at present, and Tauron has three, while other companies own a handful.

Europe

German power utility Uniper’s new Datteln 4 coal-fired power station will begin operating on 30 May, it said. The 1,050 MW plant that has cost Uniper €1.5 bn ($1.65 bn) was granted an exemption from Germany’s plan to exit coal power by 2038 after the company argued that it made more sense to shut old capacity with high CO2 emissions to clear the way for state-of-the-art Datteln to operate into the 2030s. Environmentalists have criticised the compromise, saying the government lacked ambition and allowed coal operators to get off lightly.

Italy’s Intesa Sanpaolo said it had introduced guidelines curbing lending to the coal sector, joining the ranks of other banks looking to improve their green credentials. It said that under the new guidelines it would not grant new loans for investments in coal-mining projects or the construction of coal-fired plants. It said the aim was to support customers phasing out the use of coal in energy production and help the transition to low carbon alternatives. Italy’s ruling coalition has called for the phasing out of coal-fired plants by 2025.

| CIL: Coal India Ltd, mt: million tonnes, MCL: Mahanadi Coalfields Ltd, mn: million, bn: billion, mcm: million cubic meters, mtpa: million tonnes per annum, NCL: Northern Coalfields Ltd, FY: Financial Year, MDO: mine developer and operator, NEC: North Eastern Coalfields, EJH: East Jaintia Hills, NGT: National Green Tribunal, PSPCL: Punjab State Power Corp Ltd, CBM: coal-bed methane, SCCL: Singareni Collieries Company Ltd, FSA: Fuel Supply Agreement, MW: megawatt, EU: European Union, CO2: carbon dioxide |

NATIONAL: OIL

Prices of petrol and diesel should be brought under GST: Congress

15 June. Congress demanded that petrol and diesel should be brought under the Goods and Services Tax (GST) while attacking the government over increase in fuel prices. The party demanded that the 12 hikes in excise duty by Modi government since May 2014 on petroleum products should be withdrawn immediately until it is brought under the GST regime. The excise duty on petrol and diesel has been increased on petrol by an additional ₹23.78 per litre and on diesel by an additional ₹28.37 in last six years. The Congress leader stated that the Modi government has hiked taxes on petrol and diesel 12 times and has collected a whopping ₹17,800.56 bn in just the last 6 years between the financial year 2014-15 to the fiscal year 2019-20.

Source: Hindustan Times

Diesel prices rise to 19-month high

13 June. Diesel prices rose to their highest in 19 months and petrol to the highest since January, after oil companies raised fuel prices for the sixth time in as many days. In Delhi, the retail selling price of diesel was ₹72.81 per litre, highest since 8 November 2018. Petrol was retailed for ₹74.57 per litre, highest since 23 January this year. In Mumbai, petrol and diesel were retailed for ₹81.53 and ₹71.48 per litre, respectively. Oil companies raised petrol and diesel prices by 57 paise and 59 paise a litre, respectively. Petrol and diesel prices have gone up by a cumulative ₹3.31 and ₹3.42 per litre, respectively, when oil companies started raising prices after keeping them unchanged for weeks. Crude oil prices have doubled to about $39 a barrel since late April, pushing up rates for petrol and diesel in the international market with which local prices are expected to be aligned. Local fuel rates are playing a catch-up with the international price trends. For oil companies, price hikes have helped their net marketing margin turn positive.

Source: The Economic Times

ONGC likely to cut capex by 15 percent as pandemic delays projects

12 June. Disruption of global supply chains by the pandemic is delaying projects of Oil and Natural Gas Corp (ONGC), which may have to cut capital spending by about ₹40 bn to ₹50 bn, or about 15 percent of this fiscal year’s target. ONGC also faces another big challenge. Lower oil prices reduces cash flow and upsets the economics of some projects. Oil prices fell below $20 late April but have recovered to $40, giving ONGC a breather but they are still below its breakeven level. However, oil prices have not impacted its capex. Capex reduction would translate into lower fund requirements at ONGC this year but would also mean some projects would start production later than expected.

Source: The Economic Times

ONGC sells August-loading Russian Sokol crude at higher premium

10 June. ONGC (Oil and Natural Gas Corp) has sold one Russian Sokol crude cargo, loading August 2-8, at a spot premium of around $3.60 a barrel to Dubai quotes to China oil through a tender, traders said. ONGC sold one Russian Sokol crude cargo, loading 18-24 July, at a small spot premium of less than 20 cents a barrel to Dubai quotes to a Korean buyer.

Source: The Economic Times

IOC raises refinery output to over 80 percent as fuel demand rises

10 June. Indian Oil Corp (IOC) said it has boosted refinery run rates to nearly 83 percent of the capacity after the demand for fuel almost doubled with the easing of the coronavirus-led lockdown. The state-run refinery had cut its overall run rate by 25-30 percent in March to adjust operations due to slump in demand. It began raising throughput in May after some lockdown restrictions were eased. The company’s nine refineries saw throughput gradually being raised from about 55 percent of rated capacity at the beginning of May to about 78 percent by the month-end, and 83 percent as on date. In the case of LPG (liquefied petroleum gas), with IOC rolling out about 25 lakh cylinder refills a day, the average backlog is less than a day.

Source: The Economic Times

HPCL delays $3 bn Vizag refinery expansion

10 June. Hindustan Petroleum Corp Ltd (HPCL) has pushed back the completion of a billion-dollar expansion at its southeastern Vizag refinery to at least October-November due to a labour shortage and the onset of monsoon. The refiner had initially planned to complete the ₹209.28 bn ($2.77 bn) expansion, which will nearly double the capacity of its coastal plant to 300,000 barrels per day (bpd), in July. India has significantly eased the lockdown but a return to pre-Covid activity will take some time as inter-state transportation remain restricted and the virus cases are still rising. The expansion includes the replacement of a smaller crude distillation unit with a new 180,000 bpd at the refinery in Andhra Pradesh.

Source: Reuters

NATIONAL: GAS

India steps up bet on gas with first gas trading exchange

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">India steps on the gas with the first gas trading exchange!

< style="color: #ffffff">Good! |

15 June. India launched its first gas trading exchange, enabling local and foreign players such as Shell, Vitol and Trafigura to sell directly to domestic customers. India, a large emitter of greenhouse gases, is expanding its gas infrastructure, including connecting households with expanding gas pipe network, as it aims to raise the share of gas in its energy mix to 15 percent by 2030 from the current 6.2 percent. The nation’s current daily consumption of gas - which is less polluting than other fossil fuels such as coal and oil - is about 165 million cubic meters (mcm), of which 47 percent is met through imported liquefied natural gas (LNG). The India Gas Exchange director Rajesh Mediratta said the platform initially expected to facilitate trading in LNG, mainly cheaper spot volumes, as locally produced gas is sold at state-fixed prices to designated customers. He said the bulk of growth in India’s gas consumption would be met through imports. The India Gas Exchange offers spot and forward contracts at Dahej and Hazira in Western Gujarat state and Kakinada in southern Andhra Pradesh. Currently, global traders sell LNG to Indian clients through companies like Peronet LNG, IOC, GAIL (India) Ltd, BPCL GSPC. Shell is the only foreign company that sells directly to customers through its LNG terminal at Hazira. Oil Minister Dharmendra Pradhan said India would soon have a new gas tariff policy.

Source: Livemint

Plan to control Assam gas well fire submitted to Centre

13 June. Experts including those from Singapore have submitted a detailed draft plan to control the fire in a gas well in Assam’s Tinsukia district to the oil ministry, Oil India Ltd (OIL) said. The plan submitted to the ministry was drawn up to cap the well by a team of experts from M/s Alert, Singapore, along with those of ONGC (Oil and Natural Gas Corp) and OIL, while the first load of equipment mobilized from ONGC-Sibsagar has reached Duliajan and will be sent to the site after inspection by the experts. The blaze at OIL’s Baghjan gas well, which began on 9 June following a major blowout on 27 May, was still raging but the extent of it has been contained to the well with fire tenders kept ready at the site to arrest any incidents of flash fire. Production and operations in gas wells and oil wells of OIL were affected by blockades put up people at several areas of the district.

Source: Livemint

India to drive global gas demand post-slowdown, output to rise too: IEA

11 June. After a temporary slowdown in 2020, India is set to emerge as one of the primary drivers of growth in gas demand in Asia, the International Energy Agency (IEA) report said. Based on the IEA forecast, India is set to see an estimated 28 billion cubic meters (bcm) per year increase in total consumption during 2019-25, owing to a combination of supportive government policies and improved liquefied natural gas (LNG) and pipeline infrastructure. The report indicates that India’s natural gas production is also expected to increase 12 bcm a year in 2019-25, with most of the net increase coming from a handful of ongoing deepwater development projects. The report highlighted that the Asia Pacific region may increase its share of total LNG imports, from 69 percent in 2019 to 77 percent by 2025. Out of this, India will lead to LNG growth accounting for about 20 percent of incremental trade, and its imports too may increase by 50 percent between 2019 and 2025 to support strong growth in demand. Natural gas consumption in India rose by an estimated 10 percent year-on-year during the first quarter of 2020. On LNG front, India’s imports may increase by 16 bcm annually and reach 48 bcm by the end of the forecast period. With the recent addition of the Ennore and Mundra terminals and the expansion of the Dahej facility, effective regasification capacity stands at 53 bcm, the report said. India has come out with a roadmap to increase the share of natural gas in its energy basket from 6 percent to 15 percent.

Source: Business Standard

NATIONAL: COAL

CIL unions plan 3-day strike next month against commercial mining

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Opposition to commercial coal mining will only accelerate demise of coal!

< style="color: #ffffff">Bad! |

15 June. Coal India Ltd (CIL) trade unions are planning to go on a three-day strike from 2 July against the government’s move to open the coal sector to private players. The development comes at a time when the government plans to launch the process of commercial coal mining. Major demands of the unions are to stop the auction of coal blocks for commercial mining, stop separation of consultancy firm CMPDIL from CIL, ensure payment of high-power committee wages to contractor workers, increase ceiling of gratuity from ₹10 lakh to ₹20 lakh to all workers retired between 1 January 2017, to 28 March 2018.

Source: The Hindu Business L ine

CIL’s notified prices for coking coal to guide market: Analysts

11 June. Coal India Ltd (CIL)’s notified prices for coking coal will remain the major factor in the market as the representative prices based on the Centre’s national coal index are much higher. The coal ministry rolled-out a national coal index based on weighted average prices of CIL’s notified, e-auction and import prices for all sectors. Based on the index, it computed representative prices of each grade of coal. National coal index-based representative price of G17, a grade with one of the lowest energy content among CIL’s non-coking coal product basket, is slightly lower than CIL’s notified price for the non-power sector by 0.19 percent but this category was barely 0.2 percent of CIL’s sales in 2018-19. Former CIL chairman Partha Bhattacharyya said higher index-based prices showed that CIL is consumer friendly and competitive.

Source: The Economic Times

NATIONAL: POWER

PIL in Kerala HC questions exorbitant bills issued by KSEB to domestic consumers during lockdown

16 June. A Public Interest Litigation (PIL) has been filed before the Kerala High Court questioning the exorbitant bills issued by Kerala State Electricity Board (KSEB) to its domestic consumers for the coronavirus lockdown period. The PIL seeks a court directive to KSEB to introduce a monthly billing system as well as to take average consumption as consumption during the months of March, April, and May and spread the rest over the following months. Further, the petitioner has alleged that the bi-monthly billing system and the formula adopted by KSEB is not either approved or recognized by Kerala State Electricity Regulatory Commission, which is necessary under Kerala Electricity Supply Code, 2014. During the current month, bills are being issued by KSEB after a period of 76 days after adopting the bi-monthly billing system and formula, forcing large number of consumers to pay higher bills, the PIL stated while seeking the court's intervention.

Source: The Economic Times

Power discoms record rise of up to 90 percent in digital payments of electricity bills during lockdown

15 June. The power discoms (distribution companies) have registered a significant rise of up to 90 percent in digital payments of electricity bills in Delhi during the coronavirus-induced lockdown. The Tata Power Delhi Distribution Ltd (TPDDL), serving around 70 lakh consumers in north and northwest Delhi, received over 90 percent of its bill payments through digital modes during the lockdown. Earlier, only 65 percent of its consumers used digital modes of payment, the company said. The BSES discoms -- BRPL and BYPL -- are also receiving 90 percent of payments of electricity bills through digital modes and only about 10 percent through cheques and demand drafts, said a spokesperson of the company.

Source: The Economic Times

Delhi clocks peak power demand of 5.5 GW

13 June. Delhi’s peak power demand rose to 5,534 MW amid a sweltering summer, the highest so far in the season. The season’s previous high was 5,464 MW recorded on May 26, BSES said. Delhi’s peak power demand had been a bit muted for the last few days due to weather conditions including rain, but it is picking up now with rising temperature. BRPL and BYPL -- discoms of BSES -- successfully met the peak power demand of 2,495 MW and 1,282 MW respectively with an overall peak being 5,534 MW. Delhi’s peak power demand has started increasing and it may surpass last year’s peak power demand of 7,409 MW in July.

Source: NDTV

Central government caps tariff at public charging stations for electric vehicles

13 June. The Union ministry of power has reverted to its earlier rules, set in 2018, on public charging stations for electric vehicles (EVs). The latest revision has capped the ‘per unit cost’ of electricity to be used for charging an EV at a public station — for domestic charging, the existing rate of that particular state would be applicable. The power ministry in its new amendment has specified that the tariff for public charging station should not be more than 15 percent of the state’s average cost of supply (ACS). ACS is the average of the rates at which a state supplies electricity to all sets of consumers — domestic, commercial, industrial, and agriculture. All India ACS stands at ₹5.48 per unit (as last recorded in 2017-18). Power tariff for consumers in a state is decided by its State Electricity Regulatory Commission (SERC). However, the guiding principles are set by the Union ministry of power under the National Tariff Policy (NTP), issued periodically. The NTP was last issued in 2018. For 2019-20, the Delhi Electricity Regulatory Commission (DERC) had fixed the unit and tariff for EVs at ₹4.5/kWh (kilowatt hour) and ₹4, respectively.

Source: Business Standard

Power demand slump narrows to 10.5 percent second week of June

13 June. Soaring mercury levels during the second week of June in many parts of the country has resulted in narrowing of power demand slump to 10.5 percent, compared with a fall of 19.7 percent during the previous week. However, the slump in power demand in June so far has been slightly higher than 8.8 percent recorded in the previous month. In the second week of June, the power demand has improved due to intensifying heat wave from 8 June when peak power demand touched 153.13 GW and further shot up to 163.30 GW, as per data from the power ministry. The peak power demand of 163.30 GW is 10.5 percent less than 182.45 recorded in June last year.

Source: The Economic Times

Demand for power spikes in Punjab

12 June. With the start of paddy transplantation, demand for power rose by over 1,200 MW from the previous day to 9,296 MW. Power supply in the state was 2,072 lakh units. Punjab State Power Corp Ltd (PSPCL) is all set to maintain 8-hour power supply for tubewells. On the first day of paddy transplantation last year, power demand rose by more than 1,900 MW to touch 11,141 MW. Last year, PSPCL successfully catered to a record maximum demand of 13,606 MW and supplied the highest ever 2, 999 lakh units of electricity in a single day on 3 July last year. Due to the Covid-19 pandemic, power demand is likely to remain subdued this year.

Source: The Economic Times

Andhra Pradesh opposes amendments to Electricity Act

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Amendments to Electricity Act undermines constitutional powers of states!

< style="color: #ffffff">Ugly! |

12 June. The Andhra Pradesh (AP) government has opposed the proposed amendments to the Electricity Act, 2003, saying they were not only "against the spirit of the Constitution of India" but also were likely to undermine consumer interest and affect industrial growth. The proposed Electricity Amendment Act was apparently aimed at usurping the powers of the states, the state government felt. AP Transmission Corp Chairman and Managing Director (CMD) Nagulapalli Srikant presented the state governments views on the proposed amendments, as sought by the Centre, to the power ministry through a letter. It appears to offer more protection to generators than required, and is likely to increase power purchase costs which constitute 75 percent of power sector cost and thereby cost of service.

Source: The Economic Times

TANGEDCO to pay ₹1.6 bn as late pay surcharge

10 June. The Appellate Tribunal for Electricity (APTEL), New Delhi, has directed the Tamil Nadu Generation and Distribution Corp (TANGEDCO) to pay 50 percent of the late payment surcharge of ₹1.68 bn as on 20 May to DB Power Ltd in two equal parts -- first part to be paid (order passed on 8 June) and the second part to be paid within the week following that. APTEL also pulled up TANGEDCO for dragging the issue without appearing before it for the trial and insisted the TANGEDCO’s financial controller V Kasi to submit a report outlining the reasons for not appearing to fix accountability on the additional burden on Tangedco due to the delay.

Source: The Economic Times

UPPCL unlikely to raise power tariff this year

10 June. In what may bring relief to over 30 mn electricity consumers in the state, UP (Uttar Pradesh) energy department is mulling not to increase power tariff this year in view of economic slowdown triggered by coronavirus-induced lockdown. The UP Power Corp Ltd (UPPCL) said the utility has decided to keep tariff unchanged while filing the annual revenue requirement (ARR) with the UP Electricity Regulatory Commission (UPERC), which would eventually take a final call. Tariff hike of around 12 percent was effected in September last year. State Energy Minister Srikant Sharma said the focus was on rural areas where line losses had to be brought down to less than 15 percent to ensure round-the-clock power supply. Significantly, average line losses have been between 25 percent and 30 percent in most of the districts. Only Noida accounts for less than 15 percent line losses and is qualified to get uninterrupted power supply. According to UPPCL, the utility is reeling under financial arrears of more than ₹800 bn which needs to be recovered by controlling line losses and bringing in transparency in power distribution system. The development comes days after Chief Minister Yogi Adityanath said the state government would not impose any fresh tax on consumers. The UPPCL has submitted a fresh business plan to UPERC for the next five years.

Source: The Economic Times

Waive off power bills for poor: Congress

10 June. The Congress demanded that the state government stop extortion of money in the name of non-telescopic tariff plans and immediately withdraw this method of billing, which has become a burden for the consumers. The party also called for waiver of electricity bills for the lockdown period for the poor. All India Congress Committee secretary and ex-MLA Ch Vamshi Chand Reddy said the TRS government should waive off electricity bill payments of March, April and May to those consuming less than 200 units per month.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Tata Power to develop 120 MW solar project in Gujarat

15 June. Tata Power said its subsidiary Tata Power Renewable Energy Ltd (TPREL) will develop a 120 MW solar project for Gujarat Urja Vikas Nigam. The energy will be supplied to GUVNL under a power purchase agreement (PPA), valid for a period of 25 years from scheduled commercial operation date. The company has won this capacity in a bid announced by the GUVNL under Phase VIII in February. The project is required to be commissioned within 18 months from the date of execution of the PPA. Tata Power’s renewable capacity will increase to 3,457 MW, out of which 2,637 MW is operational and 820 MW is under implementation, including 120 MW won under this letter of intent.

Source: The Hindu Business L ine

SECI extends deadlines once again for 81 MW SCCL solar power projects in Telangana

15 June. The Solar Energy Corp of India (SECI) has for the second time extended the deadlines for submission of bids for three separate tenders with a total project capacity of 81 MW to be set-up at different locations of the Singareni Collieries Company Ltd (SCCL) in Telangana. SECI has extended the bid submission deadline for setting up of 34 MW ground-based solar photovoltaic power plants till 26 June. The earlier submission deadlines were 12 June and 13 May. The project will be situated at Chennur and Kothagudam. The deadline for the 32 MW grid-interactive solar plant has been extended till 29 June. The previous deadlines for it were 15 June and 15 May. The project will be located at SCCL’s overburden dump at Ramagundam and Dorli sites in Telangana. For the 15 MW floating solar project to be located at its thermal power plant storage reservoir and Dorli open-cast project, the fresh deadline for submission of bids has been extended till 1 July. Earlier, the deadlines were 17 June and 18 May.

Source: The Economic Times

Delhi University to set up School of Climate Change and Sustainability

14 June. The University of Delhi is establishing a School of Climate Change and Sustainability with an aim to train human resources capable of addressing and managing the emerging challenges facing the nation and the world. The Ministry of Human Resource Development provided supporting grants to the varsity under its Institution of Eminence Scheme for undertaking research in cutting edge areas with a focus on the national development as well as to make the varsity a world-class university. The school will take up research in priority areas of environmental changes and challenges. The school will also generate much-needed manpower in areas that manage sustainable developmental technologies in areas of energy, resource recycling, which include wastewater management and solid waste management and resource enhancement so that the development is sustainable.

Source: The Indian Express

Kerala to gauge wave power generation potential off Vizhinjam coast

14 June. State government, with the support of Union Ministry of New and Renewable Energy (MNRE), will explore the possibility of setting up a wave energy generation unit off Vizhinjam coast. An US (United States)-based company (Oscilla Power) which claims to have developed a unique technology for harnessing energy by attenuating the waves using a floating devise. The Union power department had in early 1990s experimented the wave energy potential of sea off Vizhinjam cost. In the pilot project, a 150 kW floating plant would be set up near the proposed international container terminal station. If the technology proves to be a success in all important aspects, the state government, though ANERT, would set up a 1 MW wave energy plant off Vizhinjam.

Source: The Economic Times

EDF wants India to play important role in its strategy of becoming carbon neutral by 2050

12 June. French electric utility company Électricité de France (EDF) expects India to play an important role in its global strategy of becoming carbon neutral by 2050. It is in the process of scaling up solar and wind power generation capacity in India to 2 GW by 2022 and is scouting for acquisition opportunities in hydro power, EDF India director Harmanjit Nagi said. EDF has an ambitious target of doubling renewable installed capacity worldwide by 2030 to 50 GW and has identified renewable energy, smart metering, smart cities, transmission and distribution, and nuclear power as key growth areas in India. EDF which took over the contract to build India’s largest nuclear power project comprising six atomic power reactors totalling around 10 GW after the original contractor Areva went bankrupt, is in discussions with the Nuclear Power Corp of India (NPCIL) over the techno-commercial offer that was submitted in December 2018.

Source: The Economic Times

Andhra Pradesh government nod for 10 GW mega solar power project

12 June. The Andhra Pradesh cabinet approved a proposal to set up a 10,000 MW mega solar power project to ensure uninterrupted 9-hour power supply to farmers during daytime, besides establishing an Integrated Renewable Energy Project (IREP). Information and Public Relations Minister Perni Venkataramaiah said as part of the IREP, 550 MW of wind power, 1200 MW of hydropower and 1000MW of solar power would be generated.

Source: The Economic Times

Solar power panels came crashing down after high-velocity winds hits Delhi-NCR

11 June. Solar power panels on Nizamuddin Bridge severely damaged due to rain and strong winds that hit parts of the national capital and adjoining NCR. The India Meteorological Department has predicted generally cloudy sky with light rain for next three days while partly cloudy sky with possibility of rain or thunderstorm on 15 and 16 June. The Maximum and Minimum temperature will hover between 41°C and 26°C respectively.

Source: The Economic Times

INTERNATIONAL: OIL

Defying Trump, Iran aims to keep offloading gasoline glut to Venezuela

15 June. Iran could send two to three cargoes a month in regular gasoline sales to ally Venezuela, helping offload domestic oversupply but risking retaliation from US (United States) President Donald Trump who has sanctions on both nations. Iran has since April sent five tankers totalling about 1.5 mn barrels to the leftist government of fuel-starved Venezuela, though the shipments have done little to alleviate hours-long lines at gas stations. A net gasoline importer for decades, Iran announced self-sufficiency last year with the third phase of its newly-constructed 350,000 barrels per day (bpd) Persian Gulf Star refinery in the port of Bandar Abbas. But the coronavirus pandemic cut demand to almost 450,000 bpd in the first quarter of 2020 from about 650,000 last of gasoline in the last quarter of 2019, but it soared to 172,000 in the first three year, according to energy consultancy FGE. Even before the virus, oversupply had reached 84,000 bpd months of this year, according to FGE.

Source: Reuters

Iraq agrees with oil companies on deeper output cuts in June

14 June. Iraq has agreed with major oil companies operating its giant southern oilfields to cut crude production further in June. Baghdad aims to improve its compliance with its output cut targets under a global deal with OPEC (Organization of the Petroleum Exporting Countries) and its allies to reduce oil supply. Iraq has agreed with Russia’s Lukoil to start an additional cut of 50,000 barrels per day (bpd) as of 13 June to lower production from the West Qurna 2 field to around 275,000 bpd. Lukoil cut output by 70,000 bpd in May in response to a request by Iraq’s oil ministry.

Source: Reuters

INTERNATIONAL: GAS

Exxon cuts Guyana crude output to avoid gas flaring

15 June. Exxon Mobil Corp has reduced crude output at its nascent project off Guyana’s coast due to problems with gas reinjection equipment, a move meant to avoid excessive gas flaring, Guyana’s Environmental Protection Agency head Vincent Adams said. Output at the Liza field, which Exxon operates in a consortium with Hess Corp and CNOOC Ltd, has fallen to between 25,000-30,000 barrels per day (bpd) after an issue with gas reinjection equipment, Adams said. Without the compressor fully functioning in order to reinject gas produced alongside the crude into the reservoir, Exxon had to reduce crude output to avoid exceeding a 15 million cubic feet per day limit agreed to with authorities for gas flaring, Adams said. Oil companies worldwide are seeking to reduce gas flaring from their operations in order to reduce greenhouse gas emissions. But that is complicated in places like Guyana, which lack gas pipeline infrastructure. Plans to build a gas pipeline from Guyana’s offshore Stabroek block to the coast have not yet gotten off the ground.

Source: Reuters

Australian state recommends approving controversial $2.5 bn Santos gas project

12 June. The Australian state of New South Wales said a controversial coal seam gas project planned by Santos Ltd should be approved as it would be crucial to plugging an expected shortfall in supply from 2024. The project could meet up to half of the state’s gas needs, helping to replace the rapidly depleting Bass Strait gas source that has supplied Australia’s southeastern states for 50 years. The state’s review found that in addition to providing essential gas supplies, the project would keep a lid on gas prices, support the development of gas-fired power stations to back up wind and solar power and create jobs. The state recommended imposing strict conditions to ensure the project does not deplete or contaminate water supplies and protects the Pilliga State Forest and the health and safety of the local community. Santos said it accepted the conditions and was in a position to ramp up appraisal well drilling as soon as the commission makes a decision.

Source: Reuters

Global gas demand on course for biggest annual fall on record: IEA

10 June. The coronavirus crisis and a very mild winter in the northern hemisphere have put global natural gas demand on course for the biggest annual fall on record, the International Energy Agency (IEA) said. Global gas demand is expected to fall by 4 percent, or 150 billion cubic meters (bcm), to 3,850 bcm this year – twice the size of the drop following the 2008 global financial crisis. Major global gas markets have experienced price falls to record lows as lockdowns and reduced industrial output due to the Covid-19 pandemic have stunted demand.

Source: Reuters

INTERNATIONAL: COAL

US coking coal risks possible overcapacity

12 June. No shipments of US (United States) coking coal from the US to China were recorded in April, and several US mining firms and traders have said they have not been able to transact with Chinese buyers recently amid the tightening of Chinese import restrictions. Some suppliers believe that it will take months for China to once more be a viable market for US coking coal, citing the level of difficulty they have encountered with Chinese buyers in April and May. Australian suppliers have had less difficulty, even though the restrictions were initially thought to apply specifically to Australian coal. Total US coking coal exports fell by 27 percent on the year to 3.13 million tonnes (mt) in April, while Australian exports saw an annual contraction of only 1.44 percent in the same month, at 13.4 mt. A survey of US coking coal mines indicated that production fell by just over 10pc in the first quarter, Mines Safety and Health Administration data show, and several mines that closed in March in response to the Covid-19 outbreak have since reopened.

Source: Argus media

China curbs coal imports after 5 months of record inflows

11 June. China has stepped up customs checks for coal imports, leading to lengthy processing delays at ports, as the country seeks to bolster the domestic coal industry. China is curbing coal arrivals through import quotas and quality restrictions on downstream users, such as utilities, following record imports for the first five months of the year. Coal traders said the backlog meant fewer import tenders from clients - mostly utilities in eastern and southern China. Authorities are seeking to support struggling domestic coal miners, and analysts expect imports to fall by as much as a quarter in the second half from the corresponding 2019 period. Fuzhou port would not allow mooring of a cargo chartered by a power utility that had exceeded its import quota of 1.2 million tonnes (mt) in 2020, the Fuzhou port said. The company previously imported more than 2 mt of coal annually. China’s coal imports totalled 148.71 mt in the January-May period, up 16.8 percent on year.

Source: Reuters

Indonesia’s 2020 coal exports seen at 435 mt: Energy ministry

10 June. Indonesia, a major global thermal coal producer, exported 175.15 million tonnes (mt) of coal in January to May and exports for the full year are expected to be 435 mt, the energy and mineral resources ministry said. The country exported 458.8 mt of coal in 2019, data from Indonesia Coal Miners Association (APBI) showed. The coronavirus crisis “significantly impacted” global coal markets, including Indonesia, APBI chairman Pandu Sjahrir said. He said 2020 global seaborne demand, which was estimated at 980 mt before the crisis, had now been revised down to 895 mt. Indonesia produced 228 mt of coal up to May, or about 42 percent of its full-year output target of 550 mt.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

EU set to slightly surpass 2030 renewable energy goal, but funding boost needed

15 June. The European Union (EU) looks set to slightly beat its goal to get a third of its energy from renewable sources by 2030, but public support will be needed to offset a drop in clean power investment due to Covid-19. EU countries’ latest energy policy plans would see the bloc reach a 33 percent share of renewable energy by 2030, surpassing its target by one percentage point, EU energy chief Kadri Simson said. Renewable sources including wind, solar, hydropower and bioenergy made up just under 19 percent of final EU energy consumption in 2018. The International Energy Agency (IEA) expects global growth in new renewable energy capacity to slow for the first time in two decades this year, as the pandemic causes financing challenges and delays construction of projects. Countries may have to revise their policy plans further as the Commission is considering setting tougher renewable energy targets next year, as it strives to reduce net EU greenhouse gas emissions to zero by 2050.

Source: Reuters

Repsol to invest $90 mn in two low-emissions projects in Spain

15 June. Oil and gas company Repsol plans to invest €80 mn ($90 mn) to build two new plants in Spain as part of efforts reduce its carbon emissions. Repsol will build what it said would be one of the world’s biggest net-zero emissions fuel facilities, based on green hydrogen generated with renewable energy and carbon dioxide produced by the Petronor refinery in northern Spain, in which Repsol owns a majority stake. The second plant will generate gas from urban waste, replacing some of the traditional fuels used by the Petronor refinery.

Source: Reuters

South Africa consults with industry on nuclear power plans

14 June. South Africa’s energy ministry began consultations with industry on preparations for a proposed 2,500 MW nuclear power plant building programme, which has faced opposition from environmental campaigners. South Africa wants to supplement its power capacity because of problems at state utility Eskom’s fleet of coal-fired power plants, some of which will be decommissioned over the next two decades. South Africa, which operates the continent’s only nuclear power plant near Cape Town, said that it planned to procure 2,500 MW of new nuclear capacity by 2024. South Africa’s long-term energy plan, released in October, listed nuclear power as an option in the longer term or in case a long-delayed hydropower project in the Democratic Republic of Congo does not materialise.

Source: Reuters

Canada’s oil patch cuts back climate efforts under pandemic

14 June. Canadian oil sands companies have shelved nearly C$2 bn in green initiatives in a cost-cutting drive to weather the coronavirus pandemic, a reversal in some of their commitments to reduce emissions and clean up their dirty-oil image. International oil firms left Canada in droves in recent years due to the high costs to turn a profit in the sector. Some investors and banks, meanwhile, halted financing in part to pressure the world’s fourth-largest crude producer to reduce the environmental impact of oil-sands production. This year, top producers Suncor Energy, Canadian Natural Resources and Cenovus Energy have cut a combined C$1.8 bn ($1.32 bn) in planned spending on green initiatives as losses mount due to economic lockdowns that have hammered oil demand. Suncor, which made most of the cuts, shelved a C$300 mn wind power project and a C$1.4 bn cogeneration plan, which would replace coke-fired boilers with natural gas units at its base operations, reducing carbon emissions and other pollutants.

Source: Reuters

Norway opens two areas for offshore wind in the North Sea

13 June. Norway has opened two areas for offshore wind power developments in the North Sea, including one along its maritime border with Denmark, the energy ministry said. Western Europe’s largest oil and gas producer generates most of its electricity from hydropower and normally has a surplus, but wants to develop offshore wind to make room for more industry as well as exports. The decision to open new areas means that developers could apply for project licenses, with the two areas offering a possibility to develop up to 4,500 MW of capacity, the ministry said. The 88 MW project could help to reduce CO2 (carbon dioxide) emission by up to 200,000 tonnes per year by replacing electricity generated by gas power turbines, Equinor has said.

Source: Reuters

Germany set to remove green power hurdles at next cabinet meeting

12 June. Germany is set to seal deals to remove two stumbling blocks to Berlin hitting its target for green energy to reach 65 percent of production by 2030. Chancellor Angela Merkel’s government has made renewable energy a pillar of Germany’s post-coronavirus economic recovery plans and Berlin is stepping up the pace ahead of the country’s parliamentary summer break and its European Union (EU) presidency. A draft of an addendum to a law on energy in buildings shows the removal of a solar capacity cap of 52 GW and a general rule to build wind turbines 1,000 metres away from homes are set to be passed at a 18 June cabinet meeting. The factors had contributed to concerns among investors in solar energy as the cap was fast being approached, as well as a sharp fall in the building of onshore wind power. Germany submitted a 10-year energy and climate plan to the EU, as well as approving a hydrogen strategy and cutting consumer bills in support of renewable subsidies.

Source: Reuters

US development agency proposes financing of nuclear power exports

11 June. A US (United States) development agency proposed lifting restrictions that bar the financing of advanced nuclear energy projects abroad, a move the Trump administration hopes will help the industry compete with state-owned companies in China and Russia. The US International Development Finance Corporation, or DFC, late opened a 30-day comment period on the proposal. The idea was included in the Trump administration’s Nuclear Fuel Working Group report released in April, on ways to modernize nuclear energy policy. Russia’s state-owned nuclear energy company Rosatom is also looking to sell nuclear technology.

Source: Reuters

France sees no winter power blackouts despite nuclear outages

11 June. France is unlikely to experience electricity blackouts this winter despite an expected tight supply situation with several of its nuclear reactors expected to be offline, French energy minister and the head of the power grid said. French winter electricity consumption is expected to be at around the same level as the previous year, Francois Brottes, head of electricity grid operator RTE, said. He said that France may have to import power during the winter to guarantee supplies, while electricity supply for the summer was secured. At the height of the pandemic, there was a 15 GW supply deficit, which should drop to around 6 GW in November and December 2020, Brottes said. The new coronavirus outbreak has disrupted utility EDF’s nuclear reactor maintenance plans, delaying the start of several reactors. French state-controlled utility EDF warned in mid-April it expected a sharp drop in its domestic nuclear power output to a record low in 2020 as a result of the fall in business activity caused by the coronavirus crisis.

Source: Reuters

Despite pandemic, new US solar capacity will grow 33 percent in 2020

11 June. New US (United States) solar installations will increase by a third this year, according to the report by the US Solar Industries Association and energy research firm Wood Mackenzie, as soaring demand by utilities for carbon-free power more than outweighs a dramatic decline in rooftop system orders for homes and businesses due to the coronavirus pandemic. The solar industry will install 18 GW this year, enough to power more than 3 mn homes, according to the report by the US Solar Industries Association and energy research firm Wood Mackenzie.

Source: Reuters

Global new clean energy investment totaled $282 bn last year

10 June. Global investment in new clean energy capacity rose 1 percent last year to $282.2 bn, research by UNEP, Bloomberg New Energy Finance and the Frankfurt School-UNEP Collaborating Centre showed. The United States (US) invested $55.5 bn in 2019, up 28 percent from the year before as onshore wind developers rushed to take advantage of tax credits before their expected expiry, the report said. Europe financed $54.6 bn, down 7 percent from 2018. China’s investment fell to its lowest level since 2013 at $83.4 bn due to continued government cutbacks on support for solar power. Globally, new coal-fired generation is estimated to have had $37 bn of investment last year; new gas-fired generation had $47 bn and $15 bn was invested in new nuclear generation. In terms of capacity, 184 GW of new clean energy was added last year, up 12 percent from 2018. Governments and companies around the world have committed to adding some 826 GW of new non-hydro renewable power capacity to 2030 at a likely cost of around $1 tn. The Covid-19 crisis has slowed down deal-making in renewables in recent months and this will affect investment levels in 2020.

Source: Reuters

Shell looks to Brazil solar power sales from farms that are due online in 2023

10 June. Royal Dutch Shell Plc is ready to start negotiating with potential clients the sale of future solar power on Brazil’s free energy market from its first farms due to start operating in 2023, Shell’s solar business development manager, Latin America Maria Gabriela da Rocha said. Rocha said the startup date would depend on the negotiations and was part of Shell’s strategy to move into renewable energy, betting on industries’ increasingly wanting to sign long-term clean energy contracts. Rocha said the majority of companies seeking clean energy contracts were multinational corporations with which Shell could negotiate internationally, while it also has a local sales unit negotiating in the local market in Brazil.

Source: Reuters

DATA INSIGHT

All India Electricity Generation by Type

| Year(s) |

Electricity Generation (Billion Units) |

| Conventional Generation* |

Renewable Generation |

| 2014-15 |

1048.67 |

61.72 |

| 2015-16 |

1107.82 |

65.78 |

| 2016-17 |

1160.14 |

81.55 |

| 2017-18 |

1206.31 |

101.84 |

| 2018-19 |

1249.34 |

126.76 |

| 2019-20 (April- February) |

1154.79 |

115.77 |

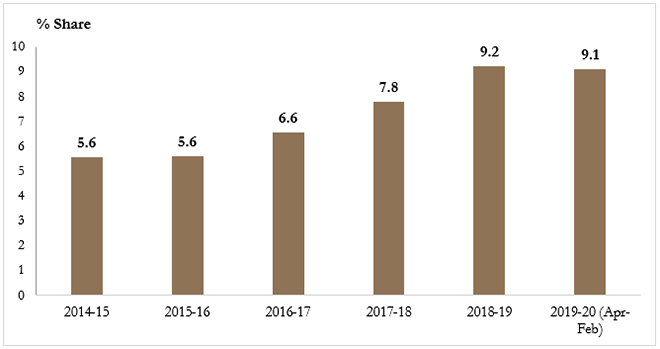

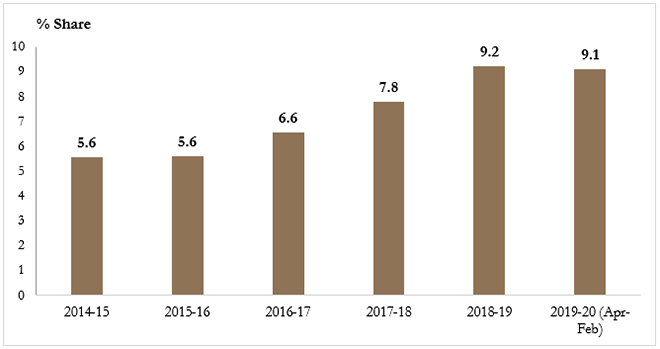

Trends in Share of Renewables Generation in Total Electricity Generation

*Generation from Thermal, Hydro and Nuclear stations of 25 MW and above only.

*Generation from Thermal, Hydro and Nuclear stations of 25 MW and above only.

Source: Rajya Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

*Generation from Thermal, Hydro and Nuclear stations of 25 MW and above only.

*Generation from Thermal, Hydro and Nuclear stations of 25 MW and above only. PREV

PREV