VIRUS SLOWS DOWN RENEWABLE ENERGY PROJECTS

Monthly Non-Fossil Fuels News Commentary: March - April 2020

India

Virus Impact

Following the lockdown and fall in electricity demand, several states are now curtailing renewable power purchases and have also issued notices on non-payment to generators. These states have invoked Force Majeure clause in their PPA with renewable projects to nix power supply and payment. While Punjab has told renewable power producers to run their units at their own cost and risk, UP, Andhra Pradesh and Madhya Pradesh have refused payment and have stated that they are curtailing renewable power. Renewable power including solar, wind, small hydro and biomass comes under ‘must-run status’, that is, it cannot be stalled or shut under any circumstances. The MNRE in a notice asked the states to comply with the must-run status of renewable energy. It also asked them to ensure timely payment to generating companies even during the lockdown period. Punjab had issued a notice to several renewable power producers that supply to the state, it will curtail electricity power purchase and generation. The demand for power went down by 31 percent, while there was a 68 percent increase in capacity which has been backed down. UP was the first state to refuse payment to solar power projects citing Force Majeure and inability to pay in wake of reduced revenue. The plea was declined by the SECI. According to SECI which comes under the MNRE and supplies renewable power to UP the inability of paying bills due to “insufficiency of finances or funds” cannot be claimed as force majeure Leading renewable energy players such as Azure Power, ReNew Power, SoftBank Energy and Hero Future Energies supply power to UP. Several group of renewable power producers had requested the Centre to clarify to the states on scheduling of renewable power and payment for the same.

India’s top 10 worst-hit states in terms of confirmed coronavirus cases also happen to be those which registered maximum addition of solar and wind energy generation capacity in 2019. There is no causal link between the geographical spread of coronavirus infections and renewable energy capacity addition. An analysis shows how the growth of the renewable energy capacity is at risk owing to the lockdown imposed across states. The analysis that superimposed the two data sets, obtained from government records, shows states such as Tamil Nadu, Karnataka, Rajasthan, Andhra Pradesh and Madhya Pradesh -- with some of the highest coronavirus infections -- added a total of 4,880 MW of solar and 24,949 MW of wind capacity last year. Tamil Nadu, which added 1,213 MW of solar and 9,286 MW of wind capacity during 2019-20 up to December is also the state with the second-highest number of confirmed cases as on 7 April, 2020. Rajasthan, which is also among the top coronavirus infected states, had added 1,617 MW solar capacity and 4,299 MW wind capacity during 2019-20. In case the worst hit states impose longer lockdown periods it can result in an extended hit to the growth of the solar and wind energy capacity. In terms of solar PV installations, too, the states with the highest capacity additions in 2019 were those with the highest number of infections, according to research and consultancy firm Wood Mackenzie. According to the consultancy that India could face over 21.6 percent or 3 GW of solar PV and wind installations being delayed as a result of the lockdown.

In a bid to minimise the impact of COVID-19 pandemic on the heavily import-dependent domestic solar industry, the MNRE has asked state and port authorities to identify land sites suitable for renewable energy manufacturing and export services hubs. The ministry is expected to provide full support to companies planning to expand or set-up bases in India for manufacturing and export of services in the renewable energy sector. The pandemic and its resultant lockdown has impacted operations of the solar industry. Hence, this step comes as a relief as far as local manufacturing of renewables is concerned. The ministry has also extended the deadline for the approved list of models and manufacturers by six months to provide some relief to renewable energy firms that are under stress due to the COVID-19 crisis. The earlier deadline was 31 March. According to the MNRE RE projects under implementation will be given extension of time considering period of lockdown and time required for re-mobilisation of work force. The spread of coronavirus has not only disrupted the supply chain of components used in RE projects but also has impacted the availability of workforce. The announcement of the extension of time will provide relief to all the stakeholders in Renewable Energy sector.

RE Policy and Market Trends

The government is planning to issue solar tenders of 20 GW capacity till June 2021 in order to achieve the National Solar Mission’s target of installing 100 GW grid-connected solar power capacity by 2022. The government has formulated and is implementing various schemes for promotion, development and deployment of solar power in the country to meet the targets. Under the National Solar Mission, the solar park scheme for setting up solar parks and ultra mega solar power projects targeting over 40,000 MW projects is underway. Apart from this, other schemes such as for setting up of grid-connected solar PV power projects with viability gap funding, and the government’s flagship PM-KUSUM are being implemented, among others. According to data reported on SPIN portal of the MNRE till 13 March 2020, rooftop solar power plants of an aggregate capacity of 1,922 MW have been installed in the country of which 346 MW have been installed in the residential sector.

The MNRE is confident the target of achieving 100 GW of solar power generation capacity by 2022 will be met and concerted efforts are being made to sort out issues, it has told a Parliamentary panel. The Parliamentary Standing Committee on Energy in its latest report had expressed dissatisfaction with the performance of the ministry for continuously missing on its yearly solar energy capacity addition targets. The MNRE was confident of achieving the target by 2022 and has worked out the detailed plan. The ministry, however, added that developers were facing constraints related to land acquisition, evacuation infrastructure, non-conducive state policy for development of solar and business environments. MNRE also informed that 9,000 MW of solar capacity is likely to be commissioned in 2020-21. According to the MNRE the budgetary allocation to meet the 2020-21 solar targets is sufficient and that it is confident of achieving the 100 GW target.

Transmission

The Board of state-owned shadow banking firm REC has approved a proposal to incorporate seven power transmission projects which would facilitate evacuation of renewable energy. These projects will evacuate clean energy from Maharashtra, Madya Pradesh, Karnataka and Rajasthan. RECTPCL (REC Transmission Projects Company Ltd) auctions these transmission projects and hands over the incorporated entities to successful bidders for development and operation. The seven transmission projects are allocated by the power ministry. These seven SPVs include a transmission system for evacuation of power from RE projects in Osmanabad area (1 GW) in Maharashtra. Besides, the board has also approved three transmission systems for evacuation of power from RE projects in Rajgarh (2,500 MW) SEZ in Madhya Pradesh; in Gadag (2,500 MW), Karnataka -- Part A and in Bidar (2,500 MW), Karnataka. These projects also include three transmission system-strengthening schemes for evacuation of power of 8.1 GW each from solar energy zones in Rajasthan.

About 1,000 MW of solar projects in Haryana are unable to transmit electricity because distribution firms are not giving them the required connectivity. According to the Distributed Solar Power Association, a body of solar rooftop developers a petition before the Haryana Electricity Regulatory Commission protesting the power discoms’ reluctance will be filed. All these are ‘open access’ projects, where developers supply power directly to their customers without routing it via a discom. But they need the consent of the area’s discom to do so.

Roof Top /Distributed Solar Projects

Tata Power has expanded its rooftop solar service to 90 cities across the country. Tata Power launched customisable rooftop solar solutions on a pan-India basis in September 2018.

The MNRE has recently decided to permit installation of innovative standalone solar pumps in test mode for which it has issued draft guidelines. New technologies for which patent or IP-related filings have been done would also be eligible to participate in the EoI. The applications would be evaluated by an Evaluation Committee constituted by ministry. The Committee might recommend testing of performance of the pump at National Institute of Solar Energy or any other NABL-accredited laboratory before allowing installation of such pumps in the field. After the recommendations of the Committee, the technology will be allowed for demonstration in the field after getting consent from the respective state implementing agency and the beneficiary farmers by the innovator. The guidelines highlighted that the innovator would be allowed to install up to 50 solar pumps in different parts of the state or country for demonstration purposes. Every month, the innovator will have to submit a detailed performance report of the pump including a comparative analysis with similar capacity MNRE specified pump along with feedback to the Evaluation Committee. At present, under the ministry’s PM-KUSUM scheme, only those standalone solar pumps which fulfil the ministry specifications are eligible to be installed.

Maharashtra Solar Sangathan, an umbrella association of over 1,000 solar system manufacturers in the state, has welcomed the latest tariff order issued by Maharashtra Electricity Regulatory Commission for rooftop solar power units. While the power regulator has exempted the rooftop units from Grid Support Charges till the cumulative installation of 2000 MW, the decision will give a breather to the rooftop solar industry, which was said to be in uncertainty for the past six months due to alleged policy paralysis. The association, however, has raised an objection to the capping of 2,000 MW.

Utility Scale Solar Projects

GUVNL, the holding company of all the power utilities in the states, has floated a tender for 700 MW capacity solar power projects to be set up in Dholera solar park. The selected companies will set up solar power projects in Dholera park on Build-Own-and-Operate basis in line with the provisions of the tender conditions and the standard PPA. GUVNL is re-tendering the 700 MW capacity which remained unallocated in solar tenders invited in January last year. A pre-bid meeting was also held at that time. The company has also given an option to bidders to raise queries before 3 April 2020. The deadline for submission of interest is 18 April. The opening of the financial bid and reverse e-auction will start on 27 April.

Despite its preoccupations with coronavirus vigil, Kerala has maintained its focus on the 1,000 MW Soura solar project. The KSEB has floated bids for setting up 150 MW of grid-tied residential rooftop solar project. Bids were floated to empanel contractors for design, supply, installation, testing and commissioning and 25-year maintenance. Earlier, the KSEB had awarded 46.5 MW of rooftop solar capacity in a recently-conducted auction to Tata Power, Waaree Group and Inkel. The 1,000 MW Soura solar power project includes 500 MW of rooftop solar power plants in houses, schools, hospitals and commercial establishments. Highways will also have solar panels. In irrigation canals and dam reservoirs, more floating solar power plants will be installed. The idea is dovetail together 500 MW rooftop solar, 200 MW ground-mounted solar, 100 MW floating solar, 150 MW solar park and 50 MW of canal-top solar.

Tata Power Solar Systems has got a letter of award to build a 300 MW plant for state-owned utility major NTPC Ltd at an all-inclusive price of ₹17.3 bn. This follows a post-reverse auction held on 21 February. The commercial operation date for the grid-connected solar PV project is set for September 2021. With this project, the order book of Tata Power Solar stands at ₹85.41 bn, including external and internal orders. Tata Power. Tata Power is India’s largest integrated power company and has an installed capacity of 10,763 MW together with its subsidiaries and jointly controlled entities. It has a presence across the entire power value chain -- generation of renewable as well as conventional power including hydro and thermal energy, transmission and distribution, trading and coal and freight logistics.

RECs

Sales of RECs rose over 64 percent to 2.142 mn units in February compared to 1.302 mn in the same month a year ago owing to high demand. RECs are a type of market-based instrument. 1 REC is created when 1 MWh of electricity is generated from an eligible renewable energy resource. A total of 1.491 mn RECs were traded on IEX in February compared to 1.059 mn in the same month last year. Power Exchange of India recorded sale of 651,000 RECs in the month under review against 243,000 in February 2019. The IEX data showed that both non-solar and solar RECs witnessed good demand, with buy bids exceeding sell bids. There were buy bids for over 1.7 mn RECs in the month against sell bids for over 1.2 mn RECs for the month of February 2019. Overall demand for RECs was high as the total sell bids at both power exchanges was over 2.5 mn units against sell bids of over 2.3 mn units. Under the renewable purchase obligation, bulk purchasers like discoms, open access consumers and capacitive users are required to buy certain proportion of RECs.

Hydro Power

The Centre will soon make it mandatory for states to meet part of their electricity requirement from hydro power plants, a reward to these projects that saved the country’s grid collapse during the nine-minute lights switch off. The power ministry is soon likely to notify guidelines giving states hydro power procurement targets on the lines of renewable energy purchase obligations. The move comes soon after nine-minute lights-off feat when the grid survived 32 GW demand drop for a few minutes backed by flexible generation from hydropower resources. The notification is pending since March last year when the Union cabinet approved measures to promote hydropower, which included declaring all such plants as renewable generation, tariff rationalisation measures and budgetary support for flood moderation and enabling infrastructure. The trajectory for hydro power obligation will be notified for discoms up to 2030, against 2-3 years in case of renewable energy projects.

Private utility Tata Power has commenced commercial operations of 178 MW Shuakhevi hydro power project in Georgia. Adjaristsqali Georgia – a joint venture between Tata Power, Norway’s Clean Energy Invest and International Financial Corp- is setting up a 187 MW of hydro project at a cost of around $500 mn. It has commissioned 178 MW of the total capacity. AGL will soon commission the remaining 9 MW Skhalta hydro power project, which is also a component of the overall Shuakhevi project scheme. Shuakhevi project is the only project in Georgia’s energy sector which has been funded by three of the largest financial institutes such as EBRD, Asian Development Bank and IFC, a member of the World Bank Group. The project will generate around 450 GW of clean energy to reduce the emission of greenhouse gases by more than 200,000 tonne a year. Tata Power has an installed hydro power capacity of around 500 MW with three plants in Maharashtra, which generates power for the domestic market.

Nuclear Energy

Nuclear power plants of 7,000 MW capacity are currently under various phases of construction in the country. The plants under construction include Unit 3, 4 and 5 of Kudankulam Nuclear Power Project of 3,000 MW capacity and a 500 MW capacity Prototype Fast Breeder Reactor in Tamil Nadu. Apart from this, there are two upcoming 1,400 MW capacity nuclear power plants including Kakrapar Atomic Power Plant in Gujarat and the Rajasthan Atomic Power Station. A 700 MW project, Gorakhpur Nuclear Power Plant, has also been planned on a 560 hectare area situated west of Gorakhpur village in Fatehabad district of Haryana. India is planning to add around 20,000 MW nuclear power generation capacity over the next decade.

Rest of the World

Global

As the world economy faces severe economic disruption due to the Coronavirus pandemic, global solar PV installations are expected to drop 18 percent from 129.5 GW to 106.4 GW in 2020, according to consultancy firm Wood Mackenzie. According to the cinsultancy the pandemic will have a significant impact on the global solar PV market and the construction and development is slowing as countries around the world enforce unprecedented lockdowns. According to Wood Mackenzie, wafer, cell and module production is ramping back up towards full capacity and construction at many project sites has resumed. The firm does not expect the impact on the Chinese PV market, either upstream or downstream, will continue beyond the end of the second quarter this year.

The share of VRE technologies – mainly solar PV and wind power -- in power generation can increase from 4.5 percent in 2015 to around 60 percent by 2050, according to a report by IRENA. According to IRENA electricity storage could play a key role in facilitating the next stage of energy transition by enabling higher share of VRE in power systems, accelerating off-grid electrification and indirectly decarbonising the transport sector. However, the system value of storage is often poorly accounted for in electricity markets, resulting in sub-optimal deployment of electricity storage. Based on recent analysis by IRENA, the share of renewables in global power generation is expected to grow from 25 percent to 86 percent in 2050.

More than 60 GW of wind energy capacity was installed around the world last year, driven by market-based mechanisms such as capacity auctions, a market outlook by the GWEC showed. New installations totalled 60.4 GW, up 19 percent from a year earlier and the second biggest annual addition on record. Overall, total wind energy capacity last year was more than 651 GW, up 17 percent from 2018. In 2019, China and the US remained the world’s largest onshore wind markets, together accounting for more than 60 percent of new capacity. GWEC forecasts that more than 355 GW of wind energy capacity added over the next five years, equivalent to 71 GW of wind energy added each year to the end of 2024.

Asia

Vietnamese private firm Trung Nam Group will at the end of this month start building a 450 MW solar farm in central Vietnam that will be the largest of its kind in southeast Asia. The $593.22 mn facility in Ninh Thuan province is scheduled to start power generation in the fourth quarter this year. Vietnam, which is working to limit its use of fossil fuel, would more than double its power generation capacity over the next decade to 125-130 GW to support economic growth. Trung Nam has received an approval from the province to build the wind farm, which will be connected to the national power grid. Ninh Thuan province is aiming to have 8,000 MW of renewable capacity by 2030.

Middle East and Africa

Ethiopia has signed a power purchase agreement worth $800 mn with the developers of a 150 MW geothermal plant. The Horn-of-Africa nation, which is the second most populous on the continent, has the second biggest electricity deficit in Africa according to the World Bank, with about two thirds of the population lacking a connection to the grid. Geothermal power refers to the use of underground hot steam to drive turbines which in turn generate electricity. It makes up a huge portion of the sources of electricity in neighbouring Kenya, which has abundant geothermal resources on the floor of the Rift Valley. Ethiopia’s Tulu Moye Geothermal plant, which signed the deal with the government, expects to start generating 50 MW of power when the first phase is completed in February 2023, rising to 150 MW at full completion in 2025.

Abu Dhabi’s department of energy has postponed the announcement of the winning bids for developing a 1.5 GW solar power plant in the Al Dhafra region. The department of energy will continue to ensure continued supply of safe, reliable water, wastewater and electricity services.

Europe and UK

The EBRD will provide a €40 mn ($44 mn) loan to Estonia’s Enefit Green to help the company develop solar energy in coal-reliant Poland. Poland generates almost 80 percent of its energy from coal, but under European Union pressure to reduce carbon emissions the government has encouraged investment in solar panels. Poland has increased its installed capacity to produce solar power by 175 percent in the past year to almost 1.3 GW, as the government launched a number of incentives for individuals and smaller companies to invest in solar energy.

France has cleared nearly 300 wind and solar power projects with total installed capacity of about 1.7 GW, and also approved several project deadline extensions because of the coronavirus outbreak. Progress on several renewables projects and the calendar for France’s renewables tenders have been disrupted by the outbreak. Measures have been taken to continue to support the sector, including the freezing of power prices for small rooftop solar projects, which were expected to decrease on 1 April. Among the 300 projects that were approved, 35 are onshore wind projects with a total capacity of 750 MW, while the rest are solar.

Portugal has postponed its second solar energy licensing auction due to the impact of the coronavirus pandemic, but still hopes to launch it by June if the spread of the outbreak starts to slow. Initially scheduled to kick off in April, the licensing auction for 700 MW of new solar energy capacity would help Portugal - one of Europe’s countries with most hours of sunshine per day - reach its ambition of having 7,000 MW of renewable energy by 2030. Portugal’s first mega auction of 1,150 MW of solar energy capacity last June attracted mainly international players, such as Spanish Iberdrola, French Akuo Energy, British Aura Power and German Enerpac Projects. It set a record minimum price per MWh of €14.6, while the average auction price was €20 MWh, less than half the base price.

Slovenia’s only nuclear power plant, Krsko, has not been affected by a large earthquake which hit neighbouring Croatia early but the government had started inspecting systems and equipment as a normal preventive action. The nuclear power plant continues to operate at full power.

Bulgaria will give more time for shortlisted investors to file binding bids for its Belene nuclear power project after measures over the coronavirus outbreak have limited access to the project’s data room. Russia’s Rosatom, China’s CNNC and Korea Hydro & Nuclear Power Co had to file their offers to invest in the estimated €10 bn ($10.7 bn) project by the end of April. French energy company EDF’s Framatome and US group General Electric, which had both offered to provide equipment for the 2,000 MW project and arrange financing, will also be part of the process. Italy’s Saipem has reached an agreement with Norway’s Equinor to develop technology to build floating solar power farms close to the coast. The agreement is between Saipem’s high-value services unit Moss Maritime and the Norwegian energy firm. Saipem, a market leader in subsea construction for the oil and gas industry, is looking to develop new lines of business to boost order books, including floating renewable energy farms.

USA

A US government agency has delayed issuing a permit for the Gemini solar power project in Nevada, one of the country’s largest proposed solar farms, over concerns about its impact on a historic region traversed by settlers of the American West. The US Bureau of Land Management missed its target to decide on the so-called Section 106 permit governing the project’s historic impact by the end of March, after overshooting a previous deadline in December. Many infrastructure projects are facing construction and supply chain delays due to the coronavirus pandemic. About a third of the nation’s planned utility-scale solar capacity could be slowed by the crisis, according to energy research firm Wood Mackenzie report.

The US EPA unveiled measures to help oil refineries cope with fallout from the coronavirus outbreak, including waiving anti-smog requirements for gasoline and extending the deadline for small facilities to show compliance with the nation’s biofuels law. The EPA will also extend the deadline for small oil refineries to prove their compliance with the RFS, the law that requires refineries to blend billions of gallons of biofuels like ethanol into their fuel or buy credits from those that do. The decision was related to ongoing litigation over the agency’s Small Refinery Exemption Program, which can free some small plants from obligations under the RFS. A federal court ruled in January that the EPA had been too free with the waivers, and while the agency did not challenge the ruling, some refineries have.

About 5 GW of big US solar energy projects, enough to power nearly 1 mn homes, could suffer delays this year if construction is halted for months due to the coronavirus pandemic. The forecast, a worst-case scenario laid out in an analysis by energy research firm Wood Mackenzie, would amount to about a third of the utility-scale solar capacity expected to be installed in the US this year. Even the firm’s best-case scenario would result in substantial delays. With up to four weeks of disruption, the outbreak will push out 2 GW of projects, or enough to power about 380,000 homes. Before factoring in the impact of the coronavirus, Wood Mackenzie had forecast 14.7 GW of utility-scale solar projects would be installed this year. Risks to supplies of solar modules include potential manufacturing shutdowns in key producing nations in Southeast Asia such as Malaysia, Vietnam and Thailand. Thus far, solar module production has been identified as an essential business and has been allowed to continue.

South America

Brazil’s largest fixed-line carrier Oi SA has kicked off a renewable energy project that will cut its operating costs by $77.09 mn per year. The renewable project, which involves 25 solar, biomass and hydroelectric mills totalling 123 MW in capacity, follows the so-called “distributed generation” model, in which Oi buys clean energy at lower prices. The first plant, a solar one based in the southeastern state of Minas Gerais, was inaugurated and the others are likely to start operations by year-end. The carrier expects to have 60 percent of its energy consumption coming from renewable sources by the end of 2020 compared with 15.8 percent since 2018.

| SECI: Solar Energy Corp of India, MNRE: Ministry of New and Renewable Energy, PPA: power purchase agreement, UP: Uttar Pradesh, PV: photovoltaic, MW: megawatt GW: gigawatt, mn: million, bn: billion, RE: renewable Energy, PM: Prime Minister, discoms: distribution companies, EoI: Expression of Interest, GUVNL: Gujarat Urja Vikas Nigam Ltd, KSEB: Kerala State Electricity Board, SPV: solar photovoltaic, RECs: Renewable Energy Certificates, IEX: Indian Energy Exchange, MWh: megawatt hour, VRE: variable renewable energy, IRENA: International Renewable Energy Agency, GWEC: Global Wind Energy Council, EBRD: European Bank for Reconstruction and Development, US: United States, EPA: Environmental Protection Agency, UK: United Kingdom, RFS: Renewable Fuel Standard |

NATIONAL: OIL

BPCL Kochi Refinery takes steps to maintain petroleum products supply

19 April. Though the outbreak of COVID 19 has hit the demand for petrol, diesel, fuel oil, bitumen, aviation turbine fuel (ATF) and other petroleum products, the requirement for cooking gas and liquefied petroleum gas (LPG), has gone up, according to BPCL (Bharat Petroleum Corp Ltd), Kochi Refinery. The crude oil processing has been reduced now to around 60 percent in view of the lower product demand. To meet the rising demand for LPG, BPCL had taken steps to improve LPG production in its refineries by appropriately modifying operations.

Source: The Economic Times

India records lowest crude oil production in at least 18 years

18 April. Despite efforts by the government to increase crude oil production and reduce the country’s oil import bill, India’s domestic crude oil output fell to 32,173 thousand metric tonne (tmt) in 2019-2020, the lowest level of production in at least 18 years for which data is publicly available. The last fiscal year’s production was down 6 percent as compared to 34,203 tmt of oil produced in 2018-19. In March, domestic oil production declined 5.36 percent to 2,701 tmt. The declining trend in production had pushed the country’s crude oil import dependence to an all time high of 86.7 percent in the April-February period of 2019-2020. The oil ministry is yet to publish data on crude oil import dependence for the full financial year 2019-2020 and March 2020. Prime Minister Narendra Modi had in March 2015 set a target for the government to decrease oil import dependence by 10 percent by 2022. India’s oil import dependence stood at 78.6 percent in 2014-2015. Oil Minister Dharmendra Pradhan had recently indicated there may be a need to revisit the existing strategy if the goal to cut oil imports had to be met.

Source: The Economic Times

UP distillers ask OMCs to look for newer depots for offloading

18 April. Sugar mills in UP (Uttar Pradesh) are still crushing sugarcane, producing molasses and increasing ethanol production continuously, and will continue to do so for the next month or more. With ethanol storage capacities brimming and liquidity nearing zero, sugar mills in Uttar Pradesh, especially those with distilleries, have been forced to look for new ways to tackle the situation following the lockdown imposed due to COVID-19 outbreak. The OMCs (Oil Marketing Companies) agreed to check the process of permissions in states like Assam and Odisha, which make zero ethanol blending as of now, and confirm how much ethanol they can take in those depots. Sugar mills in UP are still crushing sugarcane, producing molasses and increasing ethanol production continuously, and will continue to do so for the next month or more.

Source: The Financial Express

Over 15 mn free LPG cylinders given to poor: Oil Minister

17 April. Over 15 mn free cooking gas (LPG) cylinders have been distributed in the last two weeks as part of the government’s stimulus aimed at helping poor tide over hardships of lockdown, Oil Minister Dharmendra Pradhan said. Under the Pradhan Mantri Garib Kalyan Yojana (PMGKY), several relief measures have been announced by the central government for the welfare of poor, one of them being providing three LPG cylinders (14.2 kg) free to over 80 mn beneficiaries of Pradhan Mantri Ujjawala Yojana (PMUY) between April and June. For the seamless implementation of the scheme, the Oil Marketing Companies (OMCs) have been transferring an advance equal to the retail selling price of cylinder to the accounts of beneficaries. The beneficaries use this money to buy LPG refill. The OMCs are distributing 50 to 60 lakh cylinders per day, which includes about 18 lakh free cylinders to PMUY (Pradhan Mantri Ujjwala Yojana) beneficiaries. Pradhan took part in a webinar with over 800 LPG cylinder delivery boys.

Source: The Economic Times

'No mask, no oil' at petrol pumps across West Bengal

17 April. Petrol pumps across West Bengalhave decided not to sell fuel to those visiting without a mask, an official of the dealers' association said. To create awareness about the measures to contain the spread of coronavirus, it has been decided not to sell petrol or diesel to those drivers and bike owners who are not wearing masks, West Bengal Petroleum Dealers Association general secretary S Koley said. The pumps are putting up placards saying "no mask, no oil". He said that the response so far has been satisfactory and those not having masks are being turned away. The association, which has oil marketing companies Indian Oil Corp, Hindustan Petroleum Corp and Bharat Petroleum Corp as its members, has nearly 2,000 retail outlets under its fold across the state.

Source: The Economic Times

India dips in to weakened crude market to fill up its strategic oil reserves

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Filling up strategic oil reserves leveraging low oil prices will increase energy security!

< style="color: #ffffff">Good! |

17 April. India in a concerted effort to step up its energy security and taking advantage of prevailing very low crude oil prices in the international market is playing an active role through coastal Karnataka based Mangalore Refinery and Petrochemicals Ltd (MRPL) in filling Indian Strategic Petroleum Reserve Ltd (ISPRL) underground crude oil caverns in Mangaluru and Padur. The other strategic reserve of ISPRL is located at Vishakapatnam. The oil ministry has mandated ISPRL to work closely with public sector oil companies including MRPL to achieve the target of filling up Mangaluru and Padur caverns. India has built 5.33 million tonnes (mt) of emergency storage that is enough to meet its oil needs for 9.5 days it these three strategic reserves and also has allowed foreign oil companies to store oil there on condition that it can use this stockpile in case of an emergency. Series of crude oil cargos of varying volumes from 1 to 2 mn barrels that MRPL, IOCL and BPCL have sourced, will be unloaded in the single point mooring (SPM) of MRPL under jurisdiction of New Mangalore Port Trust during April and May before onset of monsoon in the region. MRPL confirmed that the first consignment of 2 mn barrels by MRPL and second consignment of 1 mn barrel by IOC (Indian Oil Corp) has already been successfully unloaded into the caverns.

Source: The Times of India

BPCL supplying petroleum products to Army amid all odds during lockdown

16 April. Bharat Petroleum Corp Ltd (BPCL) is serving the Army and paramilitary forces in remote Arunachal Pradesh districts despite all odds during the ongoing nationwide lockdown to contain COVID-19 pandemic. Petroleum products from Numaligarh in Assams Golaghat district are taken to Tawang and West Kameng districts in Arunachal Pradesh, BPCL said. In March, BPCL supplied 694 kilolitre (kl) of petroleum products to the armed and paramilitary forces apart from the BRO.

Source: The Economic Times

Petrol, diesel demand to pick up as government relaxes lockdown norms

15 April. Petrol and diesel consumption, which saw its biggest ever decline in the aftermath of a nationwide lockdown, is likely to pick up in the second half of the month as the government has allowed trucks to ply as well as farmers and industries in rural areas to resume operations after 20 April. Petrol and diesel sales had fallen by over 66 percent and aviation turbine fuel (ATF) consumption collapsed by 90 percent as the unprecedented nationwide lockdown shut factories, stopped road and rail transportation and suspended flights. The country’s petroleum product consumption fell 17.79 percent to 16.08 million tonnes (mt) in March. Diesel, the most consumed fuel in the country, saw demand contract by 24.23 percent to 5.65 mt. Petrol sales dropped 16.37 percent to 2.15 mt in March as the 21-day nationwide lockdown enforced to prevent the spread of COVID-19 took most cars and two-wheelers off the road.

Source: Livemint

NATIONAL: GAS

PNGRB likely to extend deadline by at least 3 months for city gas players

18 April. In a move that may help at least 41 companies, which were part of the ninth and tenth rounds of city gas distribution (CGD) bids, the Petroleum and Natural Gas Regulatory Board (PNGRB) is likely to extend the deadline for completing the committed works by at least three months. This comes after several companies had approached the downstream regulator to invoke the force majeure clause. A total of 136 geographical areas (GAs) were on offer in the ninth and tenth rounds of CGD bids. Companies had committed around 42.3 mn piped natural gas connections, 8,181 compressed natural gas stations and 174,000 kilometre (km) of steel pipeline network by 2029 under the two rounds. The deadlines are likely to be extended for those companies, which were part of the seventh and the eighth rounds. Other reliefs for the industry will be based on policy initiatives taken by the government. With the completion of the tenth round, the CGD network will be available in 228 GAs, comprising 402 districts spread over 27 states and Union Territories covering approximately 70 percent of India’s population and 53 percent of its geographical area. The regulator was also in the process of coming up with bids for the eleventh round, covering 44 GAs with the majority coming under Tamil Nadu (eight), Maharashtra (seven), and Madhya Pradesh (six). With the extension of the lockdown, the eleventh round of CGD bidding is expected to get delayed. Companies, which fail to meet the deadline, are supposed to pay a penalty. At present, India has 5.63 mn domestic, commercial and industrial PNG connections, 1,758 CNG stations and 50,216 km of steel pipeline infrastructure. Of the total consumption of natural gas in India, around 30 percent is consumed by the fertiliser sector; 19 percent comes under the CGD.

Source: Business Standard

GAIL expects gas demand to pick up soon

15 April. GAIL (India) Ltd, whose natural gas sales have dropped 30 percent since the lockdown began, expects demand for the fuel to pick up soon as fertiliser plants increase production ahead of the sowing season and electricity generation expands to meet increasing air-conditioning needs with rising temperature. GAIL and its customers are also seeking to cautiously manage their cash flows to avoid any future financial turbulence due to economic uncertainties induced by the lockdown. For GAIL, the biggest demand hit came from city gas companies that mainly supply to small industries and compressed natural gas (CNG) vehicles. CNG vehicles receive cheap domestic gas supply and as they went off the roads during lockdown, domestic production of gas too had to be reduced. Domestic and imported natural gas are currently available at record-low rates, an inducement for gas-based power plants to increase utilisation.

Source: The Economic Times

Government extends for third time bids to explore 11 O&G blocks

15 April. The government has extended the last date to bid for 11 oil and gas blocks to 10 June as it extended till 3 May a lockdown of the country to contain the coronavirus. The fifth bid round under Open Acreage Licensing Policy (OALP) opened in January and it was to first close on 18 March. However, the bid date was first extended to 16 April and then late last month, it was extended again but no closing deadline was given. DGH (Directorate General of Hydrocarbons) said that in view of the nationwide lockdown, the OALP bid Round-V last date for bid submission will be extended. The revised date was to be notified later. Under OALP, companies are allowed to carve out areas they want to explore oil and gas in. Companies can put in an expression of interest for any area throughout the year but such interests are accumulated thrice in a year. The last bid round, OALP-IV, saw just eight bids coming in for seven blocks on offer. Oil and Natural Gas Corp (ONGC) walked away with all the seven oil and gas blocks on offer. Of the 94 blocks awarded in the first four rounds of OALP, Vedanta has won the maximum at 51. Oil India Ltd has got 21 blocks and ONGC another 17.

Source: Business Standard

NATIONAL: COAL

India’s avoidable coal imports to be brought down to zero

21 April. India is planning to bring 'avoidable coal imports' to zero by 2023-24 amid abundance of fuel stock due to subdued demand by the power sector in the wake of the coronavirus-driven lockdown. This comes at a time when the country's coal imports increased marginally by 3.2 percent to 242.97 million tonnes (mt) in the just-concluded financial year 2019-20. Of the total, 110 mt of fuel was unavoidable import, while the remaining nearly 130 mt is avoidable import. This unavoidable coal import consisted of coking coal and coal with low-ash content. According to industry experts, India does not have much coking coal, which steel plants use to mix into iron to produce steel, and so has to import. Coal Minister Pralhad Joshi recently wrote to chief ministers of all states asking them to not import dry fuel and take domestic supply of fuel from CIL (Coal India Ltd), which has the fossil fuel in abundance. To give a boost to coal demand hit by the ongoing lockdown, the government has also announced a slew of measures like increased dry fuel supply for linkage consumers. It announced that no performance incentive shall be levied on power consumers if CIL supplies more than the upper limit of fuel supply agreement (FSA). About 80 percent of India's domestic coal production comes from CIL. CIL recorded an all-time high coal output of 84.36 mt during March 2020, registering 6.5 percent growth compared to 79.19 mt it produced in March 2019.

Source: Business Standard

CIL arm kick-starts roadmap to achieve 75 mt output by FY23

21 April. Western Coalfields Ltd (WCL) has launched a roadmap to achieve beyond 75 million tonnes (mt) of output by FY its contribution towards the ambitious 1 billion tonnes target of parent firm Coal India ltd (CIL). WCL achieved an output of 57.64 mt in FY2019-20, surpassing the target of 56 mt. The company registered highest ever single day production of 5.02 lakh tonne on 31 March 2020. WCL registered a growth of 8.4 percent, which is highest among all subsidiaries of CIL. The company has a target of 62 mt for the year 2020-21.

Source: Business Standard

No plans to scale down CIL’s FY21 production target amid subdued demand

19 April. The government has no plans to scale down Coal India Ltd (CIL)’s output target of 710 million tonnes (mt) for the ongoing fiscal even though the country has more than enough stock of the dry fuel amid subdued power demand due to the coronavirus lockdown. CIL’s pithead stock was at 74 mt as on 31 March, the highest ever. In spite of abundance of fuel stock and subdued demand by the power sector, the company will keep producing coal as the government feels the electricity demand will pick up in the days ahead with the onset of summer. Moreover, during monsoons there is less production of coal, so this is the time when the maximum production can happen, the official explained. Coal Minister Pralhad Joshi had recently asked states not to import coal and instead take supply from CIL, which has the fossil fuel in abundance. In a bid to spur coal demand hit by the ongoing lockdown, the government had recently announced a slew of measures like increased dry fuel supply for linkage consumers. Joshi had also announced several relief measures for CIL consumers, including the power sector, in the wake of the situation arising from the pandemic. The coal ministry announced that no performance incentive shall be levied on power consumers if CIL supplies more than the upper limit of Fuel Supply Agreement (FSA). About 80 percent of India’s domestic coal production comes from CIL. The company closed fiscal 2019-20 with coal production of 602.14 mt, against the target of 660 mt.

Source: Hindustan Times

NALCO considers operationalising Utkal-D coal block in Odisha during current fiscal

18 April. NALCO (National Aluminium Company Ltd) said it is considering operationalising Utkal-D coal block in Odisha in the current financial year. The company said it is in the process of obtaining mining lease of Utkal-E coal block, which was allocated to the government-owned firm along with Utkal-D coal block in May 2016. The lease for Utkal-D has been granted for a period of 30 years. The initial capacity of Utkal-D coal block is 2 million tonnes (mt) a year with a total mineable reserve of 101.68 mt. Utkal-D coal block was allocated to Nalco in May 2016.

Source: Business Standard

CIL to auction 60 percent stock by May

17 April. Coal India Ltd (CIL) plans to auction 60 percent of its inventory by May to liquidate stocks that touched a record 75 million tonnes (mt) in March. The company has decided to reduce floor price for bidding, from 20 percent-30 percent above notified price, to the notified prices and bulk of the offer would be for auctions allowing consumers to lift booked quantities over several months. The lockdown has hit coal demand as manufacturing and power generation have slowed down. CIL said demand outlook is not promising for at least the first half of this fiscal. CIL is expecting increased competition from imports as global coal prices have started to soften. Coal auctions are expected to help prevent the market from being swayed away towards import segment due to a possible drop in global prices.

Source: The Economic Times

NATIONAL: POWER

Delhi government extends power subsidy scheme

21 April. The state government approved the extension of existing subsidy on electricity bills for consumers. The government extended the 100 percent subsidy to the victims of 1984 riots for power consumption up to 400 units. This special electricity subsidy scheme has also been extended to the lawyers’ chambers within the court premises. Similarly, all the agricultural consumers will continue to enjoy subsidy in the fixed charges for agricultural connection at the rate of ₹105 per kWh (kilowatt hour). In its first budget after being re-elected to power in February, the AAP (Aam Aadmi Party) government had earmarked ₹28.2 bn as electricity subsidy for fiscal 2020-21.

Source: The Times of India

CII hails Telangana’s move to defer fixed electricity charges

20 April. The Confederation of Indian Industry (CII)’s Telangana chapter welcomed the decision of the state government to defer fixed electricity charges for the industry till the end of May. Chief Minister K Chandrashekhar Rao had announced that the state cabinet decided to defer fixed electricity charges for industry in view of the crisis due to coronavirus induced lockdown. He said the industrial units would have to pay only for the electricity they consume.

Source: The Economic Times

L&T Construction to modernise power distribution network in Bengaluru metro zone

20 April. Infrastructure major Larsen & Toubro (L&T) said that it has bagged an order to modernise the power distribution network in a subdivision of Bengaluru metropolitan area zone. With the scope involving conversion of high voltage overhead lines into underground cables and the creation of additional feeders for load bifurcation, the project will enhance the reliability of the power system. Similar distribution network strengthening orders have been received in the northern and western parts of the subcontinent as well. L&T said its power transmission and distribution business has also bagged orders to establish 220 kilovolt (kV) and 132 kV substations besides 132 kV cable networks in India, the Middle East and Africa.

Source: The Economic Times

India must use power exchanges to manage demand variation: IEX

20 April. It is important for India to leverage the flexibility offered by energy exchanges to ensure adequacy of power to meet fluctuating domestic demand in current times of Covid-19, according to Indian Energy Exchange (IEX). The CoVID-19 crisis has seen a 25 percent dip in national peak power demand from 165 GW in pre-lockdown period to 125 GW during lockdown. IEX said that the flexibility of trading in blocks of 15-minutes helps the ecosystem stabilise demand-supply schedule using IEX’s forecasting techniques on a real-time basis. IEX’s 15-minute trading blocks allow distribution utilities to procure power as per the changing demand during 96 different time blocks in a single day. For instance, on 14 April a southern distribution utility procured 345 MW during a time block and ramped up to 1,800 MW during another time block.

Source: The Economic Times

Cabinet likely to okay package for power discoms reeling under revenue loss in lockdown

20 April. The Union Cabinet is likely to approve next week a package for discoms (distribution companies) reeling under revenue loss due to lower power demand amid the coronavirus lockdown, including setting up of an alternative investment fund to pay off their dues towards electricity generation companies. The package may include steps like directions to the state and central power regulators to reduce electricity tariff. The payment of dues would help discoms to increase their electricity load (supplies) and ensure 24x7 uninterrupted power supply. According to government data, discoms owe ₹926.02 bn to power generation companies (gencos) as of February this year. A report by industry body CII had said discoms are likely to suffer a net revenue loss of around ₹300 bn and liquidity crunch of about ₹500 bn due to the coronavirus-induced nationwide lockdown. It said the power sector, one of the essential services under the lockdown till 3 May, is battling the twin issues of demand and liquidity compression.

Source: The Economic Times

Centre’s nod to draft amendment Bill, mulls DBT in power sector

19 April. In order to effect major reforms in the power sector, the Centre has approved draft of Electricity (Amendment) Bill, 2020 and plans to extend DBT (Direct Benefit Transfer) to the power sector so as to make subsidy benefits more targeted towards the poorer sections of society. The power ministry proposes introduction of DBT in the sector, wherein the electricity tariffs will be determined by commissions without taking subsidy into account, which will be directly given by the government to the intended consumers. The draft Bill intended to replace the Electricity Act, 2003, has been put into public domain for comments from various stakeholders within 21 days. The DBT system in the power sector, once implemented, would not only reduce the power subsidy burden of the state governments but also help in making electricity tariffs more economical through sharp reductions in cross-subsidy surcharges. At present, the state governments subsidise electricity tariffs of all households by keeping tariffs for commercial and industrial consumers higher. This has meant that commercial tariffs remain almost twice the level fixed for households (between ₹6-8 per unit), thereby affecting business activities and economic growth. The new Bill aims to end industrial and commercial consumers subsidising electricity charges for domestic consumers and farmers. For the needy, electricity charges would be lowered by transferring subsidy directly into the accounts of beneficiary consumers through the DBT platform. The scheme could reduce the cost of electricity for businesses by up to 25-40 percent to around ₹6 per unit, helping them increase their earnings at a time when Covid-19 has completely disrupted operations. However, the proposed changes could severely dent receipts of cash-strapped electricity distribution companies which, helped by the revival scheme UDAY (Ujwal Discom Assurance Yojana), are still struggling to cut losses.

Source: The Economic Times

MSEDCL introduces missed call, SMS service for power failure complaints

18 April. State Energy Minister Nitin Raut directed the state power utility firm, MSEDCL (Maharashtra State Electricity Distribution Company Ltd) to make it convenient for over 15 mn residential consumers across state to register complaints regarding power failure from home. Accordingly, the MSEDCL has come up with its quick, missed call and SMS service for its consumers to register complaints regarding the power failure through their mobile phone. The consumers who have not yet registered their mobile number can send SMS through the number which they want to register by typing MREG and send this SMS to 9930399303. The consumer’s mobile number will be registered within 24 hours of receiving this message. The MSEDCL has a SMS complaint service. It is not mandatory to register the mobile number for registering a complaint through SMS. The complaint can be registered from any mobile number. However, the correct 12 digit Consumer number is mandatory, MSEDCL said. Consumers can also register complaints on website and toll-free numbers 1800102343, 18002333435 or 1912.

Source: The Economic Times

Covid takes a toll on Saubhagya scheme in Uttar Pradesh

18 April. The pandemic triggered lockdown has gridlocked the Centre’s flagship Saubhagya scheme, which powered BJP (Bharatiya Janata Party)’s poll juggernaut in 2017 assembly elections in UP (Uttar Pradesh) with its last-mile electricity connectivity to households. UP Power Corp Ltd (UPPCL) said, Saubhagya’s second phase aims at electrification of 12 lakh more rural households this summer. While the state energy department managed to provide power to 5.5 lakh households, there’s uncertainty over its outreach to 6.5 lakh houses.

Source: The Economic Times

Power ministry asks state authorities to ensure smooth movement of raw materials for power supply

17 April. The power ministry has asked state level authorities to ensure no restrictions are imposed on production and movement of critical materials including coal, chemicals and gases required for power generation. The ministry wrote a letter to all state power officials, police, district magistrates and urban local bodies. It comes in the wake of the extension of nationwide lockdown till 3 May due to the coronavirus outbreak. As electricity is an essential service, the ministry has said smooth supply of the raw materials required for the functioning of power plants must be ensured. The ministry has requested no restrictions be imposed on production and movement of critical materials and intermediate or finished products to or from power plants. The ministry has asked state governments to issue similar permissions in respect of state generating stations and independent power producers which supply power within respective states.

Source: The Economic Times

Electricity demand growth just 1.3 percent in FY20, a 6-year low

16 April. Power consumed by highly industrialised states like Gujarat, Maharashtra and Tamil Nadu in FY20 was lower than their respective volumes in FY19. The three states are among the top five electricity users (other two being Uttar Pradesh and Rajasthan) and fall in power consumption in these places dragged down the country’s annual demand growth to a six-year low of 1.3 percent. Since most of the revenue of the power distribution companies (discoms) come from industrial and commercial customers, lower usage by these categories mean additional pressure on these already distressed entities. While Maharashtra’s power usage dropped 1.9 percent year-on-year to 155.2 bn units of electricity in FY20, the same in Gujarat fell 2.2 percent to 113.9 bn units and in Tamil Nadu slipped 0.7 percent to 108.7 bn units. According to information available in the latest tariff orders of these states, industrial and commercial consumers contribute about 55 percent of the discoms’ revenue in Gujarat, 73 percent in Tamil Nadu and 54 percent in Maharashtra. Lower FY20 income clashes with discoms facing revenue shortage with rising difficulties in meter reading exercises and payment collection amid the country-wide lockdown to contain the outbreak of the coronavirus.

Source: The Financial Express

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Andhra Pradesh plans new export policy for renewable energy projects

21 April. The state government is planning to launch an export policy aimed at large-scale promotion of renewable energy projects. The policy will enable the state to export power without obligation to discoms (distribution companies), stated a statement by the energy department. The projects will be designed for a combination of pumped hydro storage, solar and wind energy. The government has proposed to construct 29 pumped hydro storage projects with a capacity of 33,240 MW both on-river and off-river sites to convert renewable energy sources into round-the-clock power and attract investments. New and Renewable Energy Development Corp has already identified 29 locations in various districts for the projects. A draft policy document has been prepared in which it was proposed that some of the projects be taken up by the government and others by private developers. Andhra Pradesh is the first state to announce an export policy to meet the country’s renewable energy target.

Source: The Times of India

India’s virus lockdown gives world’s most polluted capital clear skies, clean air

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Economic lock down cannot be a permanent solution to clear pollution!

< style="color: #ffffff">Bad! |

21 April. Residents of New Delhi are experiencing the longest spell of clean air on record, according to government data, as a stringent lockdown to prevent the spread of novel coronavirus drastically cuts pollution in the world’s most polluted capital. With all transport and construction suspended, good air has emerged as one of the few positive byproducts of the lockdown to stem the virus, that has infected more than 17,000 people and claimed over 500 lives in India. A combination of industrial, agricultural and vehicle pollution blankets New Delhi and dozens of other Indian cities with a thick grey smog for several months of the year. Delhi was the world’s most polluted capital for the second year running in 2019, according to IQ AirVisual, a Swiss group that gathers air quality data globally. But during the first 25 days of the lockdown that began on 22 March, the concentration of poisonous PM2.5 particles in a cubic metre of air averaged at 44.18, according to a analysis of government data, indicating a rare “good” rating, the safest level on the scale. That is sharply down from an average concentration of 81.88, recorded between 22 March and 15 April of 2019, according to the analysis of data gathered by the Central Pollution Control Board. IQ AirVisual said New Delhi’s average annual concentration of PM2.5 in a cubic metre of air was 98.6 in 2019. Vehicular exhaust and dust from construction work significantly contributes to air pollution in New Delhi. India’s sprawling capital city has nearly 10 mn vehicles, more than the other three major cities - Mumbai, Chennai and Kolkata - put together. Shutting down India’s $2.9 tn economy has also significantly cut India’s fuel and power demand, helping pollution levels plummet. Experts warn that air quality will drop sharply once the government lifts the lockdown, that is scheduled to run until at least 3 May.

Source: Reuters

MNRE grants 30-day extension for renewable energy projects beyond lockdown

21 April. The Ministry of New and Renewable Energy (MNRE) said it has granted a 30-day extension beyond the lockdown period for renewable energy (RE) projects. It said that this would be a blanket extension -- there will be no requirement of case-to-case examination -- and there will not be any need for evidence to grant such extension. The MNRE said that all its RE implementing agencies will treat lockdown due to COVID-19, as Force Majeure. It said that the decision was taken after RE developers represented to the ministry that they should be granted a general time extension and additional time for normalisation after such lockdown.

Source: The Economic Times

BCD on solar modules being planned: MNRE secretary

20 April. To incentivise domestic manufacturing of solar modules and cells, the government is planning to introduce a basic customs duty (BCD) on import of equipment for the sector. The idea is to start with a small duty and gradually raise it to 20 percent, so that local solar power developers, who rely a lot on imports from China, don’t take a big hit in the short term. The BCD introduction will be concurrent with the removal of the current safeguard duties on import of solar equipment from China and Malaysia in July this year., MNRE (Ministry of New and Renewable Energy) secretary Anand Kumar said. In 2018, the government imposed safeguards duties on import of solar cells and modules from China and Malaysia for two years to arrest a sudden surge in imports from these countries. The duty was a near-prohibitive 25 percent in the first year, but came down to 20 percent for the next six months and then to 15 percent. The safeguard duties will go in July this year. India currently has solar modules manufacturing capacity of 7-8 GW. This includes the units of players like Adani Solar, Tata Solar, Waaree Energies and Vikram Solar. As per the ministry of commerce data, in the last one-and-a-half years, since the safeguard duty was imposed, imports of solar cells and modules have fallen drastically. Imports of cells, which stood at $2.15 bon in 2018-19, have reduced to $1.4 bn in FY20, up to November. Cell imports had peaked at $3.83 bn in 2017-18. According to MNRE, India has a total 87.2 GW renewable energy capacity, while 55 GW is in the pipeline and another 33 GW is under bidding stage. Another 15 GW will be bid out before 2020.

Source: The Financial Express

Avaada Energy bags 2 GW solar power project by NHPC

20 April. In an indication India remains a market of choice for renewable energy investors amid the global covid-19 led slowdown, Avaada Energy has bagged a 2,000 MW solar power project auctioned by hydro power major NHPC Ltd. Other winners in the auction conducted through e-reverse bidding included SoftBank, Axis Energy Ventures (Brookfield promoted), O2 Power (Temasek promoted) and EDEN Renewables.

Source: The Economic Times

NHPC conducts e-reverse auction for 2 GW grid connected solar project

17 April. NHPC Ltd said it conducted an e-reverse auction for a 2,000 MW grid connected solar project. NHPC conducted the e-reverse auction on 16 April 2020 for the 2,000 MW grid connected solar PV (photovoltaic) project to be set up anywhere in India in presence of NHPC CMD (Chairman and Managing Director) A K Singh and NHPC Director (Technical) Y K Chaubey, the company said. The e-reverse auction (e-RA), NHPC said, was conducted amongst seven bidders with aggregate capacity of 3,140 MW.

Source: Business Standard

Subsidies for fossil fuel increases while for renewables it falls

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Increase in subsidies for fossil fuels will increase consumption and pollution!

< style="color: #ffffff">Ugly! |

17 April. While the subsidies for oil and gas increased by 65 percent in the country between 2017 and 2019, the renewable energy subsidies fell by 35 percent. Last year, the fossil fuel subsidies in the country were seven times bigger than those for clean energy. This was revealed in the latest scientific study ‘Mapping India’s Energy Subsidies 2020’, jointly released by the International Institute for Sustainable Development and the Council on Energy, Environment and Water. The report highlights how the government’s support for fossil fuels has increased and declined for renewables in the last two years. However, since 2014, the general trend is still an overall shift from fossil fuels and towards clean energy, the report adds. The report states that this was largely due to the affect of increased competitiveness of grid-scale solar and wind on subsidy policies. The study emphasizes that the health and economic crisis caused by Covid-19 will influence subsidy expenditure. The study also observes that non-compliance with environmental norms has been a major area of concern for coal subsidies in recent years. According to the report, in the last six years, India has shifted significant public resources toward clean energy. Since 2014, fossil fuel subsidies have fallen by more than half, while subsidies for renewable energy and electric vehicles have increased more than three and a half times.

Source: The Times of India

Vikram Solar bags 300 MW solar project in Rajasthan from NTPC

15 April. Green energy provider, Vikram Solar, said it has bagged a 300 MW solar plant project for ₹17.50 bn from NTPC Ltd under the CPSU-II scheme. The solar plant would be spread across 1,500 acres in Rajasthan and is slated to be completed in 18 months, the firm said. Venkat Muvvala, head of EPC and O&M, Vikram Solar, said that previously, the firm has executed 50 MW solar plant project in Mandsaur, Madhya Pradesh and 130 MW solar project in Bhadla, Rajasthan for NTPC.

Source: The Economic Times

Government allows construction of renewable energy projects in revised guidelines

15 April. The home affairs ministry has allowed the construction of renewable energy projects in its revised guidelines regarding lockdown measures to be taken by ministries and departments in a bid to contain the COVID-19 epidemic in the country. The guidelines were revised following the government’s decision to extend the lockdown period till 3 May 2020. Sanjeev Aggarwal, founder and chief executive officer, Amplus, said that the government’s step to allow resuming the construction of renewable energy projects is a welcome move in favour of the renewable industry. MNRE (Ministry of New and Renewable Energy) secretary Anand Kumar, in two separate twitter posts recently had requested all state and port authorities to identify land for setting up renewable energy manufacturing and export services hub for which the ministry would provide full support to companies.

Source: The Economic Times

INTERNATIONAL: OIL

Abu Dhabi borrows $7 bn as low oil price bite

20 April. The emirate of Abu Dhabi said it had sold $7 bn of bonds in the third major sale this month by Gulf sovereigns seeking to counter slumping oil prices. The richest of seven sheikhdoms that make up the United Arab Emirates, Abu Dhabi sits on the bulk of the federation’s oil wealth. The six GCC member states, which also include Bahrain and Oman, depend heavily on oil income for between 65 percent and 90 percent of public revenues. Global oil prices have slumped this year due to population lockdowns to forestall the spread of coronavirus and a price war between Saudi Arabia and Russia.

Source: The Economic Times

Saudi Arabia gets physical with Russia in underground oil bout

20 April. Behind a Saudi-Russian truce to stabilise oil markets with a record output cut, market players are seeing the two production heavyweights still trading blows in the physical market. Russia has relied on Asian markets as a destination for its oil output since launching the 1.6 mn barrels per day (bpd) ESPO pipeline. This connects Russian fields to Asian markets through the port of Kozmino, the country’s main eastern export outlet, and also via a pipeline spur with China, the biggest Asian consumer. Saudi sales to Europe are poised to surpass 29 mn barrels in April, slightly less than the record of August 2016, shipping data showed. Supplies of Aramco’s Arab crude oil including Arab Light, the closest grade to Russian flagship in terms of quality, will rise to Italy, Turkey, Greece, France and Poland in April. All of these countries are regular buyers of Russian oil. Polish refineries will import a record 560,000 tonnes of Arab Light crude via Gdansk in April, the data shows. Poland will not import any sea-borne Russia’s Urals crude, for the first time in a long period, while Arab Light oil supplies to Poland will be steady in May, traders said.

Source: Reuters

US oil falls more than 10 percent to lows not seen since 1999

20 April. Crude oil futures fell, with US (United States) futures touching levels not seen since 1999, extending weakness on the back of sliding demand and concerns that US storage facilities will soon fill to the brim amid the coronavirus pandemic. The oil market has been under pressure due to a spate of reports on weak fuel consumption and grim forecasts from the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency. The volume of oil held in US storage, especially at Cushing, Oklahoma, the delivery point for the US West Texas Intermediate contract, is rising as refiners throttle back activity due to slumping demand. Production cuts from OPEC and its allies such as Russia will also kick from May. The group has agreed to reduce output by 9.7 mn barrels per day (bpd) to stem a growing supply glut after stay-at-home orders and business furloughs to curb the COVID-19 pandemic that has killed more than 164,000 people worldwide sap fuel demand.

Source: Reuters

Norway’s Supreme Court to hear case against Arctic oil exploration

20 April. Norway’s Supreme Court will hear a lawsuit opposing the country’s Arctic oil exploration brought by Greenpeace and other environmental groups, it said, in a landmark case for Western Europe’s largest oil and gas producer. The environmental groups argue that the Norwegian government’s decision to grant oil exploration licences in 2016 in the Arctic Barents Sea to oil firms, including Equinor, was illegal. Oil companies have already drilled exploration wells in some licences awarded in 2016, but have not made any significant discoveries.

Source: Reuters

Saudi Aramco’s oil allocations to Asia down by about 2 mn bpd in May

17 April. Saudi Aramco has allocated around 4 mn barrels per day (bpd) of crude oil to its Asian customers, which is lower than its full contractual volumes to Asia by about 2 mn bpd. Aramco said that it would supply its customers inside the kingdom and abroad with around 8.5 mn bpd of crude, in line with a supply cut pact agreed by Organization of the Petroleum Exporting Countries (OPEC) and other leading oil producers.

Source: Reuters

US court rules against permit in new setback for Keystone XL oil pipeline

16 April. A US (United States) court ruled against the US Army Corps of Engineers’ use of a permit that allows new energy pipelines to cross water bodies, in the latest setback to TC Energy Corp’s plans to build the Keystone XL oil pipeline. Keystone XL, which would carry 830,000 barrels per day (bpd) of crude from Alberta to the US Midwest, has been delayed for more than a decade by opposition from landowners, environmental groups and tribes, but construction was finally supposed to start this spring. Alberta in March said it would invest $1.1 bn in Keystone XL and back TC Energy’s $4.2 bn credit facility to get the project built.

Source: Reuters

INTERNATIONAL: COAL

South Africa’s Eskom notifies coal suppliers of potential force majeure on contracts

20 April. South Africa’s struggling utility Eskom said it had sent letters to its coal suppliers warning that it could declare force majeure if demand continued to drop during the nationwide lockdown. The government has imposed a nationwide lockdown, which started on March 27 and has been extended until the end of April, as it battles to curb the spread of the virus in Africa’s most industrialised economy. Exxaro Resources said its subsidiary Exxaro Coal, had received letters calling force majeure on the coal supply agreements for the supply of coal to Eskom’s Medupi and Matimba power stations for the period starting on 16 April until one month after national lockdown has been completely lifted. However Exxaro, which is one of Eskom’s main coal suppliers, said it was of the view that this did not constitute force majeure as stipulated in the coal supply agreements, as the power stations were still capable of supplying power and it planned to “vigorously defend” its position in the matter.

Source: Reuters

Japan’s SMFG to end lending for new coal-fired power plants

16 April. Japan’s Sumitomo Mitsui Financial Group Inc said it would no longer lend to new coal-fired power plants from 1 May, a day after peer Mizuho Financial Group Inc said it would stop financing new coal power projects. Japanese banks are among the few major lenders who have stuck to backing coal projects even as other banks worldwide have cut their exposure to coal.

Source: Reuters

INTERNATIONAL: POWER

US power demand falls to near 17-year low as coronavirus cuts use by companies

15 April. US (United States) electricity demand plunged to a near 17-year low as government travel and work restrictions to slow the coronavirus spread caused businesses to shut, according to analysts and the Edison Electric Institute (EEI) trade group. EEI said power output fell to 64,177 gigawatt hour (GWh) EEI. That was down 6.1 percent from the same week in 2019 and was the lowest in a week since May 2003. The US Energy Information Administration (EIA) projected economic slowdown and stay-at-home orders would reduce electricity and natural gas consumption in coming months. EIA said it expected power sales to the commercial sector to drop by 4.7 percent in 2020 as many businesses close, while industrial demand will fall by 4.2 percent as factories shut or reduce output. Electricity sales to the residential sector, meanwhile, will only decline about 0.8 percent in 2020, EIA projected, as reduced heating and air conditioning use due to milder winter and summer weather is offset by increased household consumption as many folks stay home. Overall, EIA said it expects total US power consumption to decline by 3 percent in 2020 before rising almost 1 percent in 2021.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Share of renewable energy up rapidly amid COVID-19: Finnish’s Wartsila

21 April. Finnish ship technology and power-plant maker Wartsila said the coronavirus outbreak has caused the share of renewable energy in Europe’s power production to increase rapidly. The pandemic has caused demand for electricity to fall across Europe, Wartsila said. Countries such as Germany, Spain and Britain have had to temporarily shut down coal-fired power generation, causing the share of renewable energy to increase rapidly in the power mix. Wartsila’s data analysis showed coal-based power generation fell by 25.5 percent across the European Union and the United Kingdom in the first three months of 2020 year-on-year, as a result of the response to COVID-19, with renewable energy reaching a 43 percent share. The drop in demand has sent electricity prices down, and the low electricity prices, combined with renewables-friendly policy measures, have begun squeezing out fossil fuel power generation, the company said. Germany has seen the share of renewables reach 60 percent, up 12 percent from a year ago period between March 10 and April 10, and coal generation fell 44 percent, Wartsila said.

Source: Reuters

Polish priest puts up giant solar cross in climate fight

20 April. By night, the 40-foot-tall cross on the Catholic church in central Poland offers a neon light show of blue, red or purple. By day, the cross produces the electricity to power the church’s lighting, heating and air conditioning. The cross, made of 18 solar PV panels, is the brainchild of Krzysztof Guzialek, the ecologically minded priest at Our Lady of Czestochowa church. He said he arrived at the parish in the summer of 2018 and wondered how he was going to cope with such huge electricity bills. The issue of climate change has put coal-reliant and staunchly Catholic Poland at odds with the European Union and the Vatican.

Source: Reuters

French utility EDF expects slump in domestic nuclear output to record low in 2020

16 April. French utility EDF said it expected a sharp drop in its domestic nuclear power output to a record low 300 terawatt hour (TWh) in 2020 as a result of the fall in business activity caused by the coronavirus crisis. It said nuclear electricity generation will range from 330 TWh to 360 TWh each year in 2021 and 2022. The utility had initially expected its 2020 nuclear power generation in France to be 375 to 390 TWh before the outbreak. EDF operates France’s 58 nuclear reactors that account for around 75 percent of the country’s electricity needs. EDF said a number of nuclear reactors may have to be taken off line this summer and autumn in order to save fuel at those power plants.

Source: Reuters

Uzbekistan invites bids for 100 MW wind farm project

15 April. Uzbekistan’s energy ministry issued a request for proposals on a 100 MW wind farm project that it said would be the first in the Central Asian nation. The Uzbek ministry said it planned to build wind farms with a total capacity of up to 3 GW over the next 10 years as part of its campaign to diversify energy sources. Uzbekistan has already struck deals on solar plant construction with several companies such as United Arab Emirates’ Masdar and Saudi Arabia’s ACWA Power, and is in talks with Russia’s Rosatom on finalising a nuclear power plant project.

Source: Reuters

DATA INSIGHT

State-wise Scenario of Coal Production & Reserves

| State |

Coal Production (Million Tonnes) |

| 2018-19 |

2019-20 (till January) |

| Assam |

0.78 |

0.29 |

| Chhattisgarh |

161.89 |

116.06 |

| J&K |

0.01 |

0.01 |

| Jharkhand |

134.67 |

98.49 |

| Madhya Pradesh |

118.66 |

103.40 |

| Maharashtra |

49.82 |

37.51 |

| Meghalaya |

0.00 |

0.13 |

| Odisha |

144.31 |

105.22 |

| Telangana |

65.16 |

53.78 |

| Uttar Pradesh |

20.28 |

14.80 |

| West Bengal |

33.14 |

25.55 |

| Total |

728.72 |

555.23 |

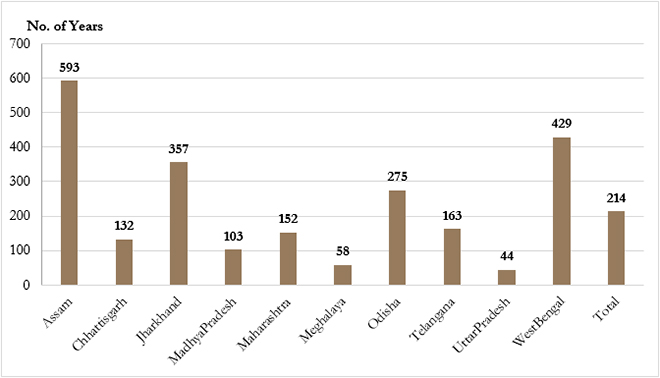

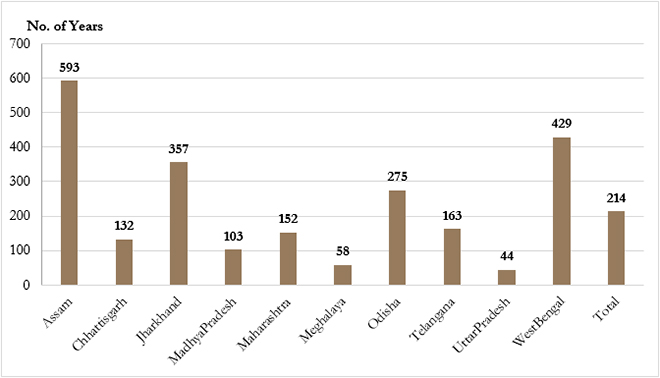

Reserve by Production Ratio* (No. of Years by which Coal Reserves will Last)

*Proved Reserves are taken (as on 1 April 2019) and Production Figures are taken for 2018-19.

Source: Lok Sabha Questions

Source: Lok Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.