VIRUS DISRUPTS SOLAR PANEL IMPORTS

Monthly Non-Fossil Fuels News Commentary: February - March 2020

India

Virus Impact

The Coronavirus outbreak in China continues to disrupt India’s renewable energy sector with about 3 GW of solar projects worth ₹160 bn at risk of penalties for missing their commissioning deadlines, according to CRISIL Ratings. It said that the developers might choose to implement projects with more expensive modules sourced from locations other than China in a bid to meet the commissioning timelines. But, this could erode returns as the modules may be 15 percent to 20 percent costlier, shaving as much as 3 percentage points off their returns. About 90 percent of solar modules and panels used in Indian solar projects are imported from China and Malaysia.

According to the government India’s solar power industry is under no compulsion to import solar cells or modules from China following the coronavirus. India’s solar sector is a highly import-dependent industry. Solar modules account for about 60 percent of a solar project’s cost and Chinese firms supply 80 percent of cells and modules used. The government is actively promoting domestic manufacturing of solar equipment in India through several schemes such as M-SIPS, PM-KUSUM, CPSU Scheme, grid-connected rooftop solar programme, and also tenders for setting up solar photovoltaic manufacturing facilities. The ministry of new and renewable energy had recently decided to give extra time for the commissioning of power projects that face delays due to the virus outbreak in China. The government has set a target of installing 175 GW of renewable energy capacity by 2022. As on 31 January 2020, total renewable energy capacity of 86.32 GW has been installed in the country. Additionally, 35.09 GW capacity is under various stages of implementation and 34.47 GW under various stages of bidding.

To boost domestic solar equipment manufacturing, the MNRE is planning to also include components under exemption from BCD. This comes after the ministry clarified that BCD over imported solar cells, modules, and panels will remain zero. The move is in line with the Centre’s efforts to promote domestic solar manufacturing which faces stiff competition from imports, especially from China. Indian solar equipment manufacturers had in the past requested the Centre to clamp down imports and suggested the government to impose duties on the same. There is an existing 15 percent safeguard duty on Chinese solar panels.

RE Policy and Market Trends

India’s RE sector seems to have lost its mojo, even as the total capacity has reached almost 86 GW by December 2019, the latest State of India’s Environment Annual report said. India has set itself a target of 175 GW RE capacity by 2022 -- mainly in the form of 100 GW solar (60 GW utility-scale and 40 GW rooftop) and 60 GW wind. Between 2014 and 2018, the RE sector grew from 2.6 GW to 28 GW, an aggregated growth rate of around 18 percent. Annual additions to solar capacity have dipped drastically to 6.5 GW in 2018-19, from 9.4 GW in 2017-18. In wind energy, against a sizeable 5.4 GW added in 2016-17, less than 2 GW was added annually in the following two years. The capacity auctioned to developers has remained almost constant at 2-3 GW. The share of RE in India’s power generation in 2018–19 was 10 percent, a far cry from the national goal of 40 percent share by 2030. The slowdown, naturally, raises doubts about India’s capability to meet the 175 GW target. To catch up, the country is now required to install 37.8 GW of solar rooftop, 32.1 GW of solar utility and 23.3 GW of wind power capacity in a short of just two and half years.

The government will set up ultramega renewable energy parks of a total of 50 GW in Gujarat and Rajasthan in what could be the world’s largest renewable energy investment programme. Industry majors such as Tata Power called it a quantum leap for green energy while experts also said the initiative poses a formidable threat to thermal power plants. In a letter to all solar and wind developers, the MNRE said land would be made available for setting up solar, wind and wind hybrid plants and that the proposed parks have necessary clearances from state governments and the defence ministry. The ministry has identified Khavada in Gujarat and Jaisalmer in Rajasthan for renewable energy parks of 25,000 MW each. The Power ministry will be requested to strengthen transmission to these locations within 24 months for evacuation of power from these parks. The government is already working on a 50 GW battery storage manufacturing plan. Renewable energy firms have hailed the move and said setting up of such large capacity in phases is possible.

Gujarat has received the highest amount of CFA to the tune of ₹1.18 bn among all states and union territories for new and renewable energy generation till 10 February of the current financial year 2019-20. The top five states after Gujarat included Maharashtra, Uttar Pradesh, Himachal Pradesh and Andhra Pradesh, which got an assistance of ₹528.8 mn, ₹517.1 mn, ₹304.8 mn, and ₹290.2 mn, respectively. A cumulative solar power capacity of 26.97 GW has been installed in India during the past three years from 2016-17 to 2018-19 and current year till 31 December 2019. At present, most of the utility scale grid-connected solar and wind energy projects in the country are implemented by the private sector developers, which are selected through a competitive bidding process. The government has set a target of installing 175 GW of renewable energy capacity by 2022. As on 1 January 2020, the country had installed 85.90 GW of renewable energy capacity.

Tidal Energy

Ocean-based tidal projects of Gujarat and in the Gangetic delta of Sundarbans in West Bengal have been cancelled by the respective state governments due to high capital costs. India has a long coastline of 7,500 km with immense potential for ocean energy. According to a study by IIT Chennai and CRISIL in December 2014, the tidal power potential of the country is estimated at about 12,455 MW. According to the study, the Gulf of Kambhat and Gulf of Kutch near Gujarat have an estimated potential of 7,000 MW and 1,200 MW, respectively, with Sundarbans having a potential of 100 MW. Tidal energy is a form of hydropower energy that exercises energy of the oceanic tides to generate electricity. India had shown its inclination towards tidal energy in 2011 when the 50 MW tidal energy plant was conceptualised in Gujarat. Globally, tidal energy plants are limited with only 500 MW capacity in operation with South Korea leading the actual and planned investments.

Utility Scale Solar Projects

SCCL is planning to install solar power plants of 300 MW capacity over 2-3 years to reduce its carbon footprints. CIL which alone accounts for 80 percent of the country’s domestic coal output, is also focusing on reduction of carbon footprint by technology upgradation in mining, exploring alternative source of energy and installation of LEDs and solar lights. The company has implemented roof top solar of 2.74 MW in Eastern Coalfields Ltd, Western Coalfields Ltd, Central Coalfields Ltd, Central Mine Planning and Design Institute, CIL (Headquarters) and a ground mounted solar of 2 MW in Mahanadi Coalfields Ltd. SCCL produced 64.40 mt of coal last financial year and its net revenue stood at ₹206.93 bn. The miner operates a 1,200 MW thermal power plant and has chalked out a plan for adding solar capacity. It announced the synchronisation of a 5 MW solar power plant in January, located in Telangana. The solar plants, when operationalised, would make SCCL the first government-owned coal company generating solar power for captive use. The company is currently operating 48 mines. Of these, 19 opencast and 29 underground mines are located in 6 districts of Telangana. The firm contributes 9.4 percent of India’s total domestic coal production.

Assam government administered the agreement signing for two solar power projects of 70 MW each at Dima Hasao district and at Amguri in Sivasagar district. Three agreements were signed – power sale agreement between APDCL and NC Hills Autonomous Council for 70 MW Solar Power Project to be installed at Dima Hasao, power purchase agreement between APDCL and Jackson Power Private Ltd and land lease and implementation support agreement between APDCL and Jackson Power Private Limited for the 70 MW Solar Power Project at Amguri Solar Park in Sivasagar.

Rajasthan plans to set up 30,000 MW of solar power plants in next five years and is in talks with leading private and state-run companies to develop energy parks. This will add to an already installed capacity of around 50,000 MW in the state. Recently, the Centre allocated Rajasthan a 25,000 MW ultra-mega renewable energy park. The state government has identified land bank of 125,000 hectares in three districts — Bikaner, Jaisalmer and Jodhpur—for this park. The 30,000 MW—the target Rajasthan has set for next five years—the state is looking to install solar plants of 10,000 MW in next three years in the first phase.

French electric utility firm ENGIE has fully commissioned its 250 MW solar project in Andhra Pradesh. The 200 MW phase was commissioned ahead of schedule in May 2019 and this milestone supports ENGIE’s ambition to be a major renewables development partner as India becomes one of the fastest growing countries in global energy transition. The remaining 50 MW was recently commissioned in order to provide power to about 400,000 people. The signing of the 25-year power purchase agreement with state-run power giant NTPC Ltd was announced at the inauguration of the Mirzapur solar power plant in March 2018. ENGIE has been present and active in India for over 40 years and has a total installed capacity of more than 1.5 GW in renewables, and employs around 1,000 people in power generation, engineering and energy services.

The Savitribai Phule Pune University is set to inaugurate what it claims to be the first solar panel walled building in the country, with its glass facade mounted with panels made of cadmium telluride photovoltaic cells instead of the silicon-based cells. Unlike the silicon solar panels, the Cadmium Telluride photovoltaic cells are transparent and bring in natural light. Because the walls are made of glass, the building would also give the people inside the structure a feeling of being in an open space. The walls would generate 19 kWh of electricity per day.

Wind Projects

India’s cultivable land areas have the highest potential - compared to wasteland and forest land - for installing wind energy projects at an estimated 347 GW at 120 metre above ground level, according to a report by the NIWE. The report said that out of India’s total estimated wind potential of 695 GW, 340 GW is possible in wasteland, 347 GW in cultivable land and 8 GW in forest land. According to the report, wind potential of 132 GW is possible in high potential areas with CUF greater than 32 percent and wind potential of about 57 GW is possible in areas with CUF greater than 35 percent. India’s installed wind capacity has grown on an average of 20 percent since last 20 years. MNRE had recently said that India has an estimated offshore wind energy potential to generate about 70,000 MW power and is planning to develop the first offshore wind energy project of 1 GW capacity off the coast of Gujarat. The NIWE had recently floated an expression of interest for this first offshore wind energy project of India. The government has set an ambitious target of installing 100 GW of solar and 60 GW of wind power by 2022.

Biofuels

IOC is in the process of developing LPG from bio mass and would succeed in another two to three years. This is being done in tune with the decision of World LPG Association to have at least 50 percent of LPG from bio mass, including vegetable waste, by 2040. Accordingly, the country has taken a lead and in the process of developing the LPG from bio mass, which would bear fruit in another two to three years. IOC wanted at least 10 percent of LPG to be produced from bio mass and put in use, as this would be cost-effective.

Petrol dealers in the state, including those in the city, would soon start selling CBG to boost its usage, OMCs stated. CBG, produced naturally through anaerobic decomposition from waste or biomass sources, is an environment-friendly alternative to CNG used in vehicles. OMCs stated that they were inviting applications from entrepreneurs to set up CBG plants. CBG would be sold to customers for ₹55.25 per kg, close to the CNG price of ₹55.5 per kg in the city. All India Petrol Dealers Association has so far received nearly 79 applications for setting up of CBG plants in Maharashtra. Since Maharashtra had many sugar factories, press mud from the factories could be used for manufacturing CBG.

An IAF AN-32 aircraft took off from Leh's Kushok Bakula Rimpoche airport using a mixture of 10 percent Indian bio-jet fuel. According to the government the use of a mixture of 10 percent indigenously produced bio-jet fuel to fly an IAF transport aircraft will not only help bring down carbon emissions, but also reduce the country's dependence on imported crude oil. Bio-jet fuel is prepared from "non-edible tree borne oil" and is procured from various tribal areas of India.

Rest of the World

Asia

A majority of households surveyed in South Asian countries, including India, said SHS have helped in improving their quality of life, according to a report by industry body GOGLA. SHS is a stand-alone photovoltaic system, which offers a cost-effective mode of supply of power for lighting and appliances to remote off-grid households. Established in 2012, GOGLA is a global association for the off-grid solar energy industry. The report surveyed 949 households in South Asia, mostly in rural India, on SHS. About 61 percent of those surveyed reported the grid as their main source of light and 62 percent said that SHS is their secondary source of power. Not just for off-grid customers, the solar home systems bring improvements in quality of life for on-grid customers as well. For enterprise, reliable solar light and power is leading to greater income and increased productivity.

Middle East and Africa

The UAE has issued an operating license for the Arab world’s first nuclear power plant, the nuclear regulator said, paving the way for it to start production later this year. The multi-billion-dollar Barakah nuclear power plant in Abu Dhabi, which is being built by Korea Electric Power Corp, was originally due to open in 2017, but the start-up of its first reactor has been delayed several times. The UAE, a key OPEC oil producer, wants to diversify its energy mix, adding nuclear power to meet rising demand for electricity and to help free up more crude for export. The country wants nuclear energy to provide 6 percent of its total energy needs by 2050. The license granted to the plant’s operator Nawah Energy Company will be for 60 years. When completed Barakah will have four reactors with a total capacity of 5,600 MW, and all with the same capacity. The UAE has not disclosed the total final investment in the project.

Senegal inaugurated the first large-scale wind farm in West Africa, a facility that will supply nearly a sixth of the country’s power when it reaches full capacity later this year. With the wind farm, Senegal will get 30 percent of its energy from renewable sources. The 158 MW wind farm was built by British renewable power company Lekela, which also has wind farms in South Africa and Egypt and an upcoming one in Ghana. Senegal’s first solar plant came online three years ago, and the country has since built several more. Other countries in the region are following suit with solar but are much further behind in terms of wind. The wind farm will provide enough electricity for 2 mn people and prevent the emission of 300,000 tonnes of carbon dioxide annually.

USA

The US Agriculture Department announced a goal for biofuels to make up 30 percent of U.S. transportation fuels by 2050, a move that could bolster an industry that has been otherwise battered by the Trump administration. Refineries are currently required to blend 20.09 bn gallons of biofuel in 2020, about 10 percent of projected crude oil production. President Donald Trump has been criticized by the corn-based ethanol industry after his EPA granted exemptions to the blend requirement for dozens of oil companies over the last two years. The biofuel goal, which also included getting the blend rate to 15 percent in 10 years, is part of a new department-wide sustainability initiative aiming to boost farm production by 40 percent and cut the farm sector’s environmental impact by 50 percent during the same period. The environmental goal also could deflect criticism from farmers and ethanol producers in an election year.

Europe and UK

The British government announced plans to include onshore wind and solar power in its next round of auctions to help fund renewable energy projects, in a sign it is stepping up efforts to meet its climate targets. Under the so-called CfD scheme, qualifying projects are guaranteed a minimum price at which they can sell electricity, and renewable power generators bid for CfD contracts in a round of auctions. The next round will start in 2021. The consultation period for its auction plans closes on 22 May. Britain was the first G7 nation to adopt a legally-binding target to cut CO2 emissions to net zero by 2050, but the country is not yet even on track to meet a lower target of cutting its emissions by 80 percent by 2050. Last year, renewables, including bioenergy, wind, solar and hydropower, accounted for a record high of 31.8 percent of electricity supply in Britain, according to provisional government data. Costs for renewable energy technologies, including wind and solar power, have fallen sharply worldwide over the past decade and several European countries have reduced or stopped government support. Earlier, campaigners urged UK to ramp up policies to curb emissions so the country so can lead by example when it hosts a major UN climate summit in Glasgow in November.

Poland will have to spend 60 bn zlotys ($15.56 bn) on its planned nuclear power plants over the next 20 years. Poland generates most of its electricity from carbon-intensive coal and is the only EU state that has not pledged to achieve climate neutrality in 2050. But facing pressure from the EU to reduce emissions, it has planned to build 6-9 GW of nuclear generation by 2040. Poland hopes to cooperate with the US on its nuclear energy project. France supports Poland’s transition away from coal by using nuclear technology to produce electricity.

Bosnia’s autonomous Serb Republic aims to add 1,000 MW of renewable energy sources by 2029 at a cost of 11.5 bn Bosnian marka ($6.7 bn) to smooth its transition from coal. The largest portion of projects, targeting solar, wind and hydro sources, will be carried out by the majority state-run power utility ERS. ERS operates two coal-fired power plants with a combined capacity of 600 MW and three big and several small hydropower plants with a total capacity of 617 MW.

Spanish forestry and energy group Greenalia SA has opened the Curtis-Teixeiro biomass-fired power plant with 50 MW of capacity and started selling the electricity on 1 March. Located in Spain’s northern region of Galicia, the Curtis-Teixeiro project involved an investment of €135 mn ($153.3 mn) and 19 months of construction, which was completed ahead of schedule. The Spanish ministry for the ecological transition has recently updated the remuneration parameters for certain renewable power generation facilities, allowing for payments for operations to increase to 7,500 from 6,500 hours annually. Noy Infrastructure & Energy Investment Fund has acquired a majority stake in a portfolio of two solar photovoltaic plants, in the Israel-based fund’s first investment in Spain. The two plants have a total installed capacity of 421 MW and are located in the Spanish province of Cuenca. The plants are under development and expected to become operational by 2021.

South America

Anglo American has signed a 15-year contract in Brazil to buy 70 MW of solar power from Atlas Renewable Energy as of 2022 for its operation in Minas Gerais. Atlas will invest 881 mn reais ($190 mn) in a solar farm in Minas Gerais state to cover the Anglo American contract. Anglo aims to be using 100 percent renewable energy by 2022.

Beside the green pastures and sugarcane plantations surrounding the farming town of Porto Feliz is the strange sight of hundreds of blue, silicon panes turned towards the sun. This solar farm, about 150 km from Sao Paulo, produces electricity for around 40 homes and small businesses like restaurants and gyms. Such DG operations are quickly multiplying in Brazil as investors bank on the long hours of strong sunlight across the continent-sized country, a late adopter of solar technology, and enjoy subsidies that have been pared back in countries like the US. Corporate and private investors are boosting solar panel production in one of Brazil’s few domestic manufacturing industries, as well as driving imports from China. Brazil’s solar power industry group Absolar sees DG investments ripling to 16 bn reais ($3.64 bn) in 2020 from last year. Those installations should add 3.4 GW of power generation capacity in Brazil this year. Canadian Solar has a plant in Brazil to assemble the modules with imported parts. Many Chinese companies, such as Risen, Trina, Jinko and Yingli, are also supplying the market.

Russia

The only FNPP in the world, Akademik Lomonosov, built by the Russian state atomic energy corporation Rosatom has supplied more than 21 mn kWh of electricity. The FNPP, built to withstand tsunamis and crashes with icebergs, and which is currently in trial operation in the town of Pevek in Russia's Chukotka Region, has supplied more than 21 mn kWh of electricity to the isolated network of the Chaun-Bilibino energy system as on 26 February.

| MNRE: Ministry of New and Renewable Energy, MW: megawatt, GW: gigawatt, mn: million, bn: billion, BCD: basic Customs duty, RE: Renewable Energy, CFA: Central Financial Assistance, km: kilometre, SCCL: Singareni Collieries Company Ltd, CIL: Coal India Ltd, LED: light emitting diode, mt: million tonnes, APDCL: Assam Power Distribution Company Ltd, kWh: kilowatt hour, NIWE: National Institute of Wind Energy, CUF: capacity utilisation fact, IOC: Indian Oil Corp, LPG: liquefied petroleum gas, CBG: compressed biogas, OMCs: Oil Marketing Companies, , CNG: compressed natural gas, IAF: Indian Air Force, SHS: solar home systems, UAE: United Arab Emirates, OPEC: Organization of the Petroleum Exporting Countries, US: United States, EPA: Environmental Protection Agency, UK: United Kingdom, CfD: Contract for Difference, CO2: carbon dioxide, UN: United Nations, EU: European Union, DG: distributed generation, FNPP: floating nuclear power plant |

NATIONAL: OIL

IOC plans to open LPG bottling plant in Mizoram, upgrade 100 outlets in NE

17 March. Indian Oil Corp (IOC) is looking to set up an LPG (liquefied petroleum gas) bottling plant in Mizoram, besides upgrading 100 retail outlets across the Northeast in the next financial year. The company is currently in talks with the Mizoram government for setting up the bottling plant in the state, IOC chief general manager G Ramesh said. The company would upgrade 100 retail outlets across the Northeast at an estimated cost of about ₹500 mn in the next financial year, he said. IOC is also looking to commission at least nine retail outlets in Mizoram in the forthcoming fiscal, he said.

Source: Business Standard

Bihar: Substantial fall in petrol, diesel sales

17 March. Petrol pump owners are a worried lot as sales of petrol and diesel have come down by 20-40 percent in the past fortnight amid fears of Covid-19 outbreak in the city. Petrol and diesel prices have been cut by ₹1.34 and by ₹1.28 respectively in the past one week due to fall in crude prices in the international market. The sale of diesel in Bihar plunged from 43,191 kilolitre (kl) in the first week of March (1 to 7) to 34,314 kl in the second week. Analysing the reason behind the fall in oil consumption and rate reduction, economist DM Diwakar said that the world market price of crude oil has declined to $37 per barrel from $51 per barrel.

Source: The Economic Times

India plans to top up strategic tanks with cheap Saudi, UAE oil

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Filling strategic oil reserves with low priced crude will optimise energy security!

< style="color: #ffffff">Good! |

16 March. India plans to take advantage of low prices for oil from Saudi Arabia and the United Arab Emirates (UAE) to top up its strategic petroleum reserves (SPR). Global oil prices have fallen around 40 percent in March as the impact of the coronavirus pandemic has destroyed demand, while supplies are growing following Moscow’s refusal to back deeper output cuts at a meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its OPEC+ allies. The oil ministry has written to the finance ministry to release about ₹48 to 50 bn ($673.7 mn) to buy oil in 8-9 very large crude carriers for filling the storage. Indian Strategic Petroleum Reserves Ltd (ISPRL) and India’s oil and finance ministry had no immediate comment, while ADNOC (Abu Dhabi National Oil Company) and Saudi Aramco declined to comment. India, the world’s third biggest oil importer and consumer, imports about 80 percent of its oil needs and has built strategic storage at three locations in southern India to store up to 36.87 mn barrels of oil or about 5 million tonnes (mt) to protect against supply disruption. ISPRL, a company charged with building of strategic storage, has signed a Memorandum of Understanding (MoU) with the UAE’s national oil company ADNOC for the lease of half of its 2.5 mt Padur facility. The leases allow the national oil companies to store their oil, some of which will cater for India’s strategic needs, while they can sell the rest to Indian refiners. Padur has four compartments that hold about 4.6 mn barrels each. The ISPRL has already leased half of the 1.5 mt capacity in Mangalore storage to ADNOC, which has stored about 5.5 mn barrels of Das oil in the cavern, while ISPRL has retained the remainder. India has also filled its 1.03 mt Vizag facility with Basra oil from another OPEC producer Iraq. While India is primarily taking advantage of low prices as a consumer nation, US (United States) President Donald Trump aimed to help US energy producers struggling to cope with the price fall by announcing he would take advantage of low prices to fill up the nation’s emergency reserve.

Source: Reuters

Oil India signs crude sales agreement with Numaligarh Refinery

15 March. Oil India Ltd (OIL), the country’s second-largest national oil explorer, announced it has signed an agreement with Numaligarh Refinery for sale and purchase of crude oil. The Crude Oil Sales Agreement (COSA) will come in effect from 1 April, 2020 to 31 March 2025, that is, for a term of five years, OIL said. The agreement is expected to streamline sale and purchase transactions of crude oil produced from fields in the North East India.

Source: The Economic Times

Excise duty on petrol, diesel up by ₹3 per litre as oil prices decline

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Increase in Excise will reduce low oil price benefit to consumer!

< style="color: #ffffff">Bad! |

14 March. The government hiked excise duty on petrol and diesel by a steep ₹3 per litre each to garner about ₹390 bn additional revenue as it repeated its 2014-15 act of not passing on gains arising from slump in international oil prices. Retail prices of petrol and diesel will not be impacted by the tax changes as state-owned oil firms adjusted them against the recent fall in oil prices and the likely trend in the near future. According to a notification issued by the Central Board of Indirect Taxes and Customs, special excise duty on petrol was hiked by ₹2 to ₹8 per litre in case of petrol and to ₹4 a litre from ₹2 in case of diesel. Additionally, road cess was raised by ₹1 per litre each on petrol and diesel to ₹10. With this, the total incidence of excise duty on petrol has risen to ₹22.98 per litre and that on diesel to ₹18.83. The tax on petrol was ₹9.48 per litre when the Modi government took office in 2014 and that on diesel was ₹3.56 a litre. Petrol and diesel prices, which are changed on a daily basis, were cut by 13 paise and 16 paise respectively as oil companies adjusted the excise duty hike against the drop in prices that warrants from international rates slumping the most since the Gulf war. Petrol now cost ₹69.87 a litre in Delhi and a litre of diesel comes for ₹62.58. The government had between November 2014 and January 2016 raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices.

Source: Business Standard

Kerosene subsidy removed via small price hikes over 4 years

13 March. India has eliminated subsidy on kerosene through small fortnightly price increases for nearly four years amid low oil prices, enabling savings for the government at a time when it is facing a revenue shortfall, thus raising expectations of a quick end to cooking gas subsidy that’s also being cut gradually. The government instructed state-run oil companies to price kerosene at market rates after regular price revisions obviated the need of subsidy for kerosene sold through public distribution system. Kerosene prices fell by 23 paise a litre this month, the first fall since July 2016 when oil companies started raising prices by 25 paise a fortnight following a directive from the government. Kerosene prices more than doubled to ₹36.38 a litre last month in Mumbai from ₹15.02 in July 2016. Price fell to ₹36.15 per litre in March. The subsidy on kerosene in the current financial year would be about ₹19.50 bn, according to the government’s estimates. In just three years, consumption of kerosene has halved. It fell to 4,152 thousand kilolitre (kl) in 2018-19 from 8,537 thousand kl in 2015-16. Consumption during April-January 2020 declined 29 percent from that a year ago. State-run oil companies have also been raising cooking gas prices by ₹4 per 14 kg (kilogram) cylinder every month, lowering subsidy bill for the government. Subsidised cooking gas prices have risen by about ₹70 per cylinder in eight months. The recent oil price collapse is expected to sharply cut cooking gas subsidy. If prices stay at current levels and companies continue to raise prices, cooking gas subsidy can quickly vanish. The cooking gas subsidy for the current fiscal is expected to be ₹230 bn, as per the government’s estimates.

Source: The Economic Times

India’s RIL buys 2 mn barrels extra Saudi oil for April loading

12 March. India’s Reliance Industries Ltd (RIL), operator of the world’s biggest refining complex, has bought 2 mn barrels of additional Saudi oil in a very large crude carrier for loading in April, traders said. Saudi Aramco, the world’s top oil exporter, has slashed its selling price for April and announced plans to raise output to a record 12.3 mn barrels per day (bpd). It was not immediately clear which crude RIL will replace with the additional Saudi barrels. The refiner, one of the biggest buyers of Venezuelan oil, is preparing to wind down purchases from the Latin American nation from April under pressure from US (United States) sanctions.

Source: Reuters

PHD Chamber seeks 25 percent cut in excise duty, VAT on petroleum products

11 March. PHD Chamber of Commerce and Industry has urged the government to reduce excise duty and VAT (Value Added Tax) on petrol and diesel by 25 percent to bring down the prices by ₹9 to 10 per litre. PHD Chamber of Commerce and Industry President D K Aggarwal said this can be a boon for the Indian economy as inflationary conditions will be benign and price cost margin of the businesses will improve. International crude oil prices have declined significantly from $63.27 per barrel as on 6 January 2020 to $31.13 as on 9 March 2020, while petrol prices in India (Delhi) decreased from ₹75.69 to ₹70.59 during the same period. He said the significant 50 percent fall in international crude oil prices has only resulted in 7 percent decline in the domestic petrol prices. The build-up of petroleum product prices because of various taxes, duties and commissions (fixed excise duties at ₹19.98/litre and VAT at ₹15.25/litre in Delhi) is so high that any significant crude oil price decline is also not reflected in the prices of petroleum products in India, he said. At this juncture, we suggest to reduce excise duties and VAT on petroleum, diesel and allied products by at least 25 percent to bring down the prices of petroleum products, which will be a big relief to the industry, boost and kick start economic growth while reviving the spirit in the economy, he said.

Source: Business Standard

NATIONAL: GAS

ONGC starts pumping gas from KG block

17 March. Oil and Natural Gas Corp (ONGC) has begun gas production from its most promising block in the Krishna-Godavari (KG) basin in the Bay of Bengal and is planning a ramp up production in coming weeks. ONGC’s KG-DWN-98/2 or KG-D5 block, which sits next to Reliance Industries' flagging KG-D6 area, holds key to the company’s output profile that is constrained by aging fields. The company began production from the first well on the KG-D5 block and is currently producing around 0.25 million metric standard cubic meter per day (mmscmd). It is doing a build-up mapping and the production is likely to rise to 0.75 mmscmd within next few weeks. ONGC is investing $5.07 bn in developing the oil and gas discoveries in the block. The project will cumulatively produce around 25 million tonnes (mt) of oil and 45 billion cubic meters of gas with peak production of 78,000 barrels per day (bpd) of oil and 15 mn standard cubic meters per day. Thirty-four wells are to be drilled under this project. Of these 34 wells, 15 are oil-producing, 8 are gas producing and 11 are water injecting wells. The discoveries in the block are divided into three clusters- Cluster-1, 2 and 3. Cluster 2 is being put to production first. The Cluster 2 field is divided into two blocks namely 2A and 2B, which are expected to produce 23.52 million metric tonnes of oil and 50.70 billion cubic meters (bcm) of gas. An Offshore Process Platform for processing and evacuating 6.5 mmscmd of gas has been built. Balance 5.75 mmscmd gas will be transported through ONGC’s existing sub-sea infrastructure and facilities, created at onshore terminal of Odalarevu at the Andhra coast. The Cluster-2B is expected to produce free gas of 12.75 mmscmd from eight wells and has a 16-year life.

Source: The Economic Times

Lower spot LNG prices may boost margins of CGD companies

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Mounting receivables will compromise CIL operational efficiency!

< style="color: #ffffff">Ugly! |

17 March. Low spot Liquefied Natural Gas (LNG) prices may boost margins of Indian city gas distribution (CGD) companies like Gujarat Gas, Indraprastha Gas Ltd (IGL) and Mahanagar Gas (MGL). Spot LNG prices have turned soft over the last year, falling to $4.7 per million metric british thermal units (mmBtu) in January 2020 from $8.4 per mmBtu in Jan 2019. Also, the coronavirus outbreak and its subsequent impact on LNG demand has led to spot LNG prices further dropping to $ 3.1 per mmBtu in March. The low prices would result in lower gas costs for CGD companies but the impacts would vary depending on the percentage of volumes coming from industrial segment, which uses LNG (liquefied natural gas) as feedstock instead of domestic gas, and proportion of LNG requirement met through spot, brokerage Jefferies said in a report. CGD companies supply domestically-produced gas to residential customers while imported LNG is supplied to industrial sector. Gujarat Gas now meets 55-60 percent of its LNG requirement through spot purchases, from 25 percent a year ago. MGL is another beneficiary of lower spot LNG prices with the industrial segment constituting over 15 percent of its total volumes. Moreover, LNG requirement is fully met through spot which has been a tailwind for margins. The impact on IGL is expected to be lower as 20 percent of the company’s LNG requirement is met through spot and the industrial segment constitutes less than 15 percent of IGL’s total volumes. CGD companies are also expected to benefit from a downward revision in the price of domestically produced natural gas, which is expected to be revised lower to $2 per mmBtu from April 2020.

Source: The Economic Times

NATIONAL: COAL

CIL’s receivables from power firms touch ₹138 bn in February

17 March. Coal India Ltd (CIL)’s receivables from power companies crossed ₹138 bn in February, increasing almost 71 percent since April 2019. CIL executives are alleging that power producers are disputing and refusing to pay incentives accrued for supplying coal beyond annual quota and revised logistics rates since 2017. A set of state-government owned power plants from Uttar Pradesh, West Bengal, Andhra Pradesh, Tamil Nadu and Rajasthan are not paying dues regularly on time which has inflated the overall receivables. All this has bloated the total receivables by ₹57 bn this year. CIL executives are in talks with its customers for bringing down the sum. Fuel supply agreements signed with power companies by CIL include a clause that requires generators to pay an incentive in the form of a premium over notified price, predetermined in the agreement if the dry fuel producer supplies more than 90 percent of the annual contracted quantity for some plants and 75-80 percent for a different set of plants.

Source: The Economic Times

Coal import declines 14 percent to 17 mt in February in wake of coronavirus outbreak

15 March. India's coal imports registered a decline of 14.1 percent to 17.01 million tonnes (mt) in February in the wake of the coronavirus outbreak, as per industry data. The country’s coal imports in February last year stood at 19.82 mt, according to a provisional compilation by mjunction services, based on monitoring of vessels' positions and data received from shipping companies. Of the total imports in February 2020, non-coking coal was at 12.25 mt, against 12.38 mt imported in January 2020. Coking coal imports were at 3.15 mt in February 2020, down from 3.95 mt imported a month ago. However, the country's coal imports registered an increase of 3.7 percent to 221.56 million tonnes (mt) in April-February period of the ongoing fiscal. India had imported 213.63 mt of coal in the year-ago period, according to the report by mjunction services. During April-February 2019-20, non-coking coal imports stood at 152.9 mt, slightly higher than 150.11 mt imported during the same period last year. Coking coal imports were at 44.3 mt during April-February 2019-20, as against 44.19 mt imported during the same period a year ago.

Source: Business Standard

Parliament passes law to open coal sector for commercial

12 March. Parliament passed a bill that will remove end-use restrictions for participating in coal mine auctions and open up the coal sector fully for commercial mining for all domestic and global companies. The Mineral laws (Amendment) Bill was passed in Rajya Sabha with 83 MPs voting in its favour and 12 against. The Lok Sabha has passed the bill. Coal Minister Pralhad Joshi said the legislation will help in bring more FDI (foreign direct investment) in the coal and mining sector, and boost economy. The Minister assured the MPs that the government will strengthen the Coal India Ltd (CIL). The Minister said India has one of the largest reserves of coal in the world and if it is not mined it would turn into "mud".

Source: Business Standard

NGT committee approves transportation of 2 lakh mt of coal: Meghalaya CM

12 March. Meghalaya Chief Minister (CM) Conrad Sangma said a committee of the National Green Tribunal (NGT) has approved transportation of two lakh metric tonne of coal in the state on condition that safety and environment norms will be followed. According to the CM, the state is likely to benefit by least ₹200 mn as revenue from the process. Of the total auction, 10 percent of the bid value will be deducted by Coal India Ltd (CIL) at source while the rest will be transferred to the state government after which royalties will be deducted, he said. The remaining money will be transferred to the respective coal stock owner. The CM warned that illegal extraction or transportation of coal, if found, will attract legal actions under section 21 of the MMDR Act 1957 (that include a penalty of at least 5 years imprisonment). The CM said different temporary depots will be set up across the state to ensure that strict environmental norms will be followed during the auctions and during transportation of coal.

Source: Business Standard

NATIONAL: POWER

Punjab widens DBTE scheme for power connections

17 March. Enhancing the ambit of the direct benefit transfer for electricity (DBTE) scheme under ‘Paani Bachao Paise Kamao’, the Punjab government has decided to bring farm contractors who cultivate the land on lease under it by changing the eligibility criteria. According to government calculations, each farmer trying to reap the benefit of the scheme is paid a sum ₹48,000 annually against the power used at their tubewells. Farmers are issued bills and in case one uses less power, one gets to keep the remaining amount of subsidy paid in cash by the government. The government had launched the DBTE in July 2018 as a pilot project at six feeders in four districts of the state. Presently, more than 250 feeders have been brought under the scheme, with around ₹16 lakh paid to farmers on power saved by them. Till now, only the actual landowners were eligible for this scheme, but with the latest circular issued by the Punjab State Power Corp Ltd (PSPCL), farm contractors who cultivate land have also been made eligible to get the benefits of this scheme. Besides, the government has also decided that any farmer who owns more than one power connection and decides to opt for the scheme will have to opt for this scheme for all connections running on his name. According to the power corp, a large chunk of cultivable land in Punjab is being tended by farm contractors and therefore the state government decided to make them eligible for this scheme.

Source: The Economic Times

AIPEF demands cancellation of PPA with Adani in Madhya Pradesh

16 March. All India Power Engineers Federation (AIPEF) demanded that the power purchase agreement (PPA) signed with Adani Power by Madhya Pradesh government should be cancelled as the power is already surplus in the state and power utilities are already paying thousands of crore as fixed charges without getting any power from private power generators. The proposal for construction of 1320 MW thermal plant by Adani was submitted in February and within one and half month not only the proposal has been accepted but PPA has also been signed. AIPEF said that in Madhya Pradesh average power demand in the state is 9000 MW and maximum demand is 14500 MW whereas the state has already signed power purchase agreements worth 21000 MW. AIPEF said that the Madhya Pradesh government has violated the Tariff Policy of India by awarding the project and signing PPA without competitive Bidding. As per policy all future requirement of power should continue to be procured competitively by distribution licensees except in cases of expansion of existing projects. Madhya Pradesh government should also clarify whether the approval of state power Regulator was taken before signing PPA.

Source: The Economic Times

Ind-Ra downgrades power sector ratings to negative

12 March. India Ratings and Research (Ind-Ra) has revised its outlook for the power sector outlook to negative for FY21 from stable-to-negative. It has been triggered by muted growth in electricity demand and rising discom (distribution company) dues due to limited improvement in financial profile of discoms since the launch UDAY (Ujwal Discom Assurance Yojana). Ind-Ra believes the discom resolution plans have provided lower-than-anticipated benefits, and hence the focus could shift to the privatisation of discoms, either through the franchisee model or the licensee model. Ind-Ra expects the renewable capacity addition to remain slow in FY21, on account of lower equity internal rate of returns generated by operational plants, limited domestic long-term funding availability post non-banking financial company crisis, continued poor health of discoms, and continuing infrastructure challenges on land acquisition and evacuation infrastructure. Around 16 GW of under-construction capacity has not seen any resolution till date and is likely to remain a challenge, due to the issues related to the settlement of past capex dues.

Source: The Economic Times

Power demand grows 2.1 percent in April-February this fiscal: Government

12 March. Power demand in the country grew 2.1 percent in April-February this fiscal to 1190.74 billion units (bu) from 1166.08 bu in the same period a year ago, Parliament was informed. During 2018-19, the power demand grew 5 percent to 1274.59 bu from 1213.32 bu in the previous fiscal, Power and Renewable Energy Minister R K Singh said. The power demand grew 6.2 percent in 2017-18. The electricity supply grew 2.2 percent to 1184.67 bu in April- February this fiscal from 1159.17 bu in the same period of 2018-19. Similarly, power supply grew 5.2 percent at 1267.52 bu in 2018-19 from 1204.69 bu in 2017-18. The power supply grew 6.1 percent in 2017-18 year-on-year.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

SECI to set up 50 MW solar project in Leh: Singh

17 March. Solar Energy Corp of India (SECI) will set up a 50 MW solar project in Leh, Power and Renewable Energy Minister R K Singh said. The government has planned for two solar plants each of 7 MW capacity with 21 MWh (megawatt hour) battery energy storage system at Leh and Kargil, he said. He said the total peak power demand of the union territory of Ladakh is 50 MW. SECI had issued a tender for 14 MW of solar with 42 MWh battery storage in Leh and Kargil under Prime Minister Development Package, 2015 for Jammu and Kashmir.

Source: The Economic Times

Andhra Pradesh discoms clear dues to renewable energy developers

16 March. Power distribution companies (discoms) in Andhra Pradesh have cleared all dues of renewable energy developers in accordance with a court directive, and scaled down the practice of reducing purchase of green power, bringing relief to the sector that has been under immense pressure in the state. About ₹6 bn has been paid to wind and solar developers. Curtailment of wind and solar power has also reduced. Renewable energy developers said that they have lost revenue of ₹14 bn due to curtailment of renewable power by discoms in the state since August.

Source: The Economic Times

Facility to turn plastic into fuel in the offing in Haridwar

13 March. The Haridwar Municipal Corp (HMC) officials said they are inviting bids to build a plant where plastic waste would be processed into fuel, on the lines of the one that is functional in Dehradun. They said the facility would be established before the Kumbh Mela 2021 begins. They said that the facility would be built through the private-public partnership (PPP) model. The Haridwar municipal corp will not be investing any money in the project, but will provide land to set up the plant with the capacity to process 10 tonnes of plastic waste.

Source: The Economic Times

India to add 25.7 GW of solar power capacity under PM-KUSUM scheme by 2022

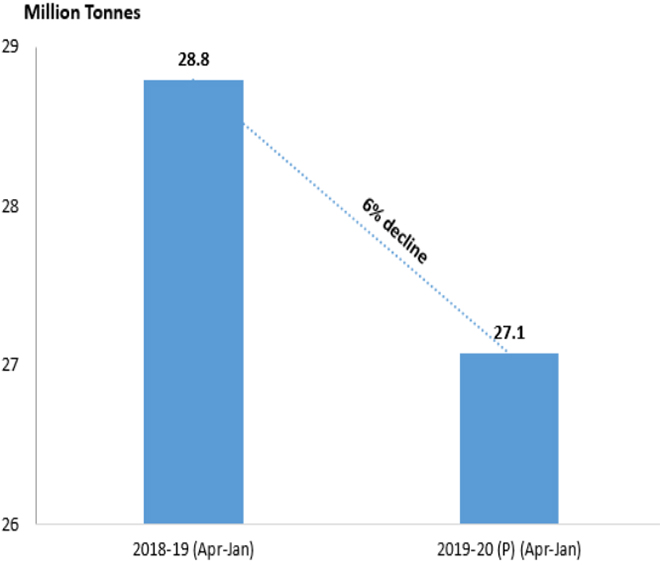

12 March. The government is aiming at 25,750 MW of new power generation capacity from solar plants under the ambitious Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme by 2022. Power and Renewable Energy Minister R K Singh said the installation of this solar capacity and savings in diesel consumption due to installation of 17.5 lakh standalone solar pumps under the PM-KUSUM scheme are likely to save emission of 27 million tonnes (mt) of carbon dioxide (CO2). The Ministry of New and Renewable Energy (MNRE) had launched the scheme last year with three components -- installation of 10,000 MW capacity through small renewable energy-based power plants of capacity up to 2 MW each on barren or fallow land of farmers; installation of 17.5 lakh standalone off-grid solar water pumps; and solarisation of 10 lakh existing grid-connected agriculture pumps. A total of 8,004.64 MW of renewable energy capacity has been installed during the April-January period of 2019-20 as compared to 5,978.47 MW installed during the same period of the previous year.

Source: The Economic Times

38 percent jump in India’s wind power capacity in the current financial year so far

12 March. India added 2,043 MW wind power capacity in the first 11 months of the current financial year (2019-20) as against 1,480 MW added last financial year, Power and Renewable Energy Minister R K Singh said. Wind power capacity installed in 2017-18 stood at 1,865 MW. Overall, the government has set a target of achieving 60,000 MW of installed wind power capacity by December 2022.

Source: The Economic Times

INTERNATIONAL: OIL

China cuts retail gasoline and diesel prices by most since 2013

17 March. China said it will cut the retail ceiling prices for gasoline by 1,015 yuan ($144.79) per tonne and diesel by 975 yuan, the biggest reduction since Beijing launched the pricing mechanism in 2013. The cuts, which track plunging global oil prices amid the coronavirus outbreak, the National Development and Reform Commission (NDRC) said. China has set a floor for retail prices at $40 per barrel. The cuts represent a 13.9 percent reduction in gasoline prices and a 15.5 percent drop in diesel prices. The NDRC said that the pricing mechanism for refined oil products will not be changed at the moment but would be opened to the market in the future, depending on the progress of Chinese market reforms.

Source: Reuters

Poland’s PKN lowers petrol prices amid virus fight

16 March. Poland’s biggest refiner, the PKN Orlen said it would reduce fuel prices at its petrol stations due to lower oil prices and to help fight coronavirus spread. This is the effect of not only cheaper crude oil. Lower fuel prices would be beneficiary for people who have to use cars, including the military, police, firemen and doctors who are directly involved in fighting the epidemic, PKN Orlen Chief Executive Officer Daniel Obajtek said.

Source: Reuters

Russia faces 2020 budget deficit of 0.9 percent of GDP at current oil prices

14 March. Russia’s budget deficit could reach 0.9 percent of gross domestic product (GDP) in 2020 at current oil prices, Finance Minister, Anton Siluanov said. The country’s economy has been hit by a slump in global oil prices and the spread of the coronavirus, with the minister saying the latter was having the bigger effect as it complicated transportation, tourism and trade. Russia has a rainy-day National Wealth Fund (NWF) made up of oil revenues accumulated in previous years. Siluanov said that the finance ministry expects oil companies to add 500 bn roubles to the fund this year.

Source: Reuters

New platform increases Iran’s oil production by 6k bpd

14 March. Iran’s oil production capacity increased by 6,000 barrels per day (bpd) after a platform was installed at the offshore Salman field in the Gulf, the Iranian Offshore Oil Company said. With the installation of the S1 platform at Salman oilfield, Iran’s oil output has increased by 6,000 bpd, the company said, estimating the value of the additional output at $240,000 a day.

Source: Reuters

US energy historian sees no easy way out of oil price collapse

13 March. US (United States) energy historian Daniel Yergin said it could be a long time before pressure is eased on sinking oil markets as the coronavirus causes public events and schools to close while global oil producers flood markets with crude. With global oil demand already sinking due to the spread of coronavirus, Saudi Arabia and Russia launched a war for market share, flooding global markets with crude. Oil traded in New York was trading at $30.76 a barrel, down more than 2 percent. Trump administration officials have been mulling several ways to support energy producers including buying oil at current low prices to stash in the Strategic Petroleum Reserve, which is held in caverns along the Texas and Louisiana coasts. Yergin discounted efforts to lay out a case that Saudi Arabia and Russia were dumping oil on global markets. Yergin said it would be hard to prove that anyone was putting out oil below market value, and in any case it would not be an overnight fix. He expected energy company consolidation to accelerate.

Source: Reuters

Oil market set for record surplus amid virus-led demand slump: Goldman Sachs

13 March. Goldman Sachs said the oil market could see a record surplus of about 6 mn barrels per day (bpd) by April, considering a bigger- than-expected surge in low-cost output, while a slump in demand was “increasingly broad” triggered by the coronavirus outbreak. Brent was set for its biggest weekly loss since 2008 as oil prices plummeted this week after top producer Saudi Arabia slashed its selling prices amid a price war with Russia and pledged to unleash more supply onto a market already reeling from falling demand due to the virus. The jump in inventories could also force some inland high-cost producers to shut production, since storage logistics may be stretched, the Wall Street bank’s analysts said. The bank pegged the demand loss due to the fast-spreading coronavirus outbreak at about 4.5 mn bpd, though it also pointed to some signs of improving Chinese oil demand. The accumulation of oil inventories over the next six months could be similar to a build up over 18 months in 2014-16, it said. Global demand growth, on the other hand, would see a reduction of about 310,000 bpd in 2021 and comfortably offset any fast supply response from high cost producers, especially with the shale output now forecast to drop by 900,000 bpd in the first quarter of 2021, the bank said.

Source: Reuters

Asian refiners may curb jet fuel output as coronavirus dents airline demand

13 March. Asian refiners may curtail jet fuel output by partially reducing processing as the fuel’s value versus diesel plunged after the United States (US) said it would ban European travellers to prevent the spread of the coronavirus. The regrade, which is the price difference between jet fuel and diesel with a sulphur content of 10 parts per million (ppm), fell to a discount of $3.86 a barrel, the lowest since 13 August 2015, according to data from S&P Global Platts. As a result of the US ban, jet fuel demand may drop by between 200,000-250,000 barrels per day, split between the US and European markets over the 30-day ban, Wood Mackenzie’s analyst said. Refiners may deal with the lower jet fuel value by cutting their processing runs to make less of the fuel, which is typically produced during the initial distillation of crude into products. Companies have already been cutting rates to deal with surplus aviation fuel because airline travel has declined as countries ban travel to halt the coronavirus spread. Jet fuel in Singapore was at $40.97 a barrel, down 49 percent this year, while 10ppm diesel was at $44.82, down 45 percent, according to Refinitiv data.

Source: Reuters

Saudi Arabia confirms extra April oil supplies to customers in Europe

13 March. Saudi Arabia will supply additional oil volumes next month to all customers in Europe who asked for an increase following a deep cut to Saudi official selling prices. European oil refiners including Total, BP, Shell, Eni, and SOCAR have all had allocations for additional Saudi crude oil supplies in April confirmed. Oil prices have weakened more widely, with Brent crude on track for its worst week since the 2008 financial crisis as investors fretted over the impact of the coronavirus on demand and plans by producers to boost output.

Source: Reuters

UAE joins Saudi in opening oil taps as row with Russia slams crude prices

12 March. The United Arab Emirates (UAE) followed Saudi Arabia in promising to raise oil output to a record high in April, as the two OPEC (Organisation of the Petroleum Exporting Countries) producers raised the stakes in a standoff with Russia that has hammered global crude prices. The extra oil the two Gulf allies plan to add is equivalent to 3.6 percent of global supplies and will pour into a market at a time when global fuel demand in 2020 is forecast to contract for the first time in almost a decade due to the coronavirus outbreak. Oil prices have almost halved since the start of the year on fears OPEC states would flood the market in its battle with Russia after Moscow rejected OPEC’s call for deep output cuts and a pact on cutting output that has propped up prices since 2016 collapsed. But Russia said it would not reverse its decision as it still believed cutting output would make no sense if the virus hit demand deeper than expected. Saudi Arabia, which has already announced it would hike supplies to a record 12.3 mn barrels per day (bpd) in April, said it would boost production capacity for the first time in more than a decade. Russian Energy Minister Alexander Novak said Saudi plans to raise output was “not the best option” and said Moscow was still open to dialogue with OPEC.

Source: Reuters

Petrobras cuts fuel prices in Brazil for first time since oil price collapse

12 March. Brazil’s oil company Petrobras cut fuel prices at refineries in the country for the first time oil price collapse, broker INTL FCStone and an association of fuel importers said. The oil company, which has a near refining monopoly in Brazil, reduced gasoline prices by 0.16 real per liter and cut diesel prices by 0.125 real per liter.

Source: Reuters

Mexico open to cutting oil output to support prices, but production already waning

11 March. Mexican Energy Minister Rocio Nahle hinted at the country’s “willingness” to cut crude oil output in a bid to support prices, but it was unclear whether any new voluntary curbs might go beyond already falling production. Saudi Arabia failed to secure Moscow’s support for deeper production cuts at a meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+. Saudi Arabia then slashed prices for its exports, threatening to flood the market with oil and drive prices even lower. Nahle signaled an openness to voluntary production cuts, but without going into any detail.

Source: Reuters

INTERNATIONAL: GAS

France’s Total makes gas discovery in the North Sea

17 March. France’s Total said it had made a new gas and condensates discovery located in the central North Sea offshore the United Kingdom, around 170 kilometre (km) east of Aberdeen. Total, which holds a 30 percent working interest and is operator of the field, said the well was drilled in water about 80 metres deep. It said analysis of the data and results are ongoing to assess to whether the find is commercially viable.

Source: Reuters

Steps to protect against coronavirus will not impact LNG production: US LNG company Cheniere

17 March. US (United States) liquefied natural gas (LNG) company Cheniere Energy Inc said it does not expect the steps it has taken to protect employees against the coronavirus to impact production at its facilities. Cheniere is the biggest buyer of natural gas and biggest exporter of LNG in the US and operates LNG export plants at Sabine Pass in Louisiana and Corpus Christi in Texas.

Source: Reuters

China sets pilot transmission fee for Siberian gas pipeline

13 March. China set the pilot transmission fee for the northern part of the “Power of Siberia” natural gas pipeline at 0.1825 yuan ($0.0261) per 1,000 cubic metres, the National Development and Reform Commission (NDRC) said. The 632 kilometre (km) pipeline section, opened in December last year, starts from the border in the northeastern province of Heilongjiang and ends in Changling in Jilin province. The (NDRC said the pilot transmission fee for the Heihe-Changling section will hold until the entire pipeline project is fully launched. The Power of Siberia pipeline is scheduled to be completed in 2023, allowing for natural gas from Siberia in Russia to be pumped all the way to Shanghai.

Source: Reuters

Gas exporter Turkmenistan tightens forex controls

13 March. Turkmenistan has tightened foreign exchange controls, a central bank document showed, after China, the main buyer of its natural gas, slashed imports and global energy prices collapsed. Gas exports to China are Turkmenistan’s main source of hard currency. PetroChina, the main buyer, has suspended some purchases as a seasonal plunge in demand added to the impact on consumption from the coronavirus outbreak.

Source: Reuters

Polish gas firm PGNiG sees tough 2020 as virus disrupts prices

12 March. Poland’s state-run gas company PGNiG expects 2020 to be very difficult because of the coronavirus-driven fall in oil and gas prices and long-term supply deals agreed when markets were stronger, its Chief Executive Officer Jerzy Kwiecinski said. Poland imports most of the gas it uses from Russia’s Gazprom under a long-term deal that expires in 2022. PGNiG has taken steps to reduce that reliance and agreed on supplies from the United States and Qatar.

Source: Reuters

Kazakhstan cuts gas supplies to China by 20-25 percent

11 March. Kazakhstan has reduced natural gas supplies to China by 20-25 percent, Energy Minister Nurlan Nogayev said, after importer PetroChina issued a force majeure notice to suppliers. PetroChina has suspended some natural gas imports, including on liquefied natural gas shipments and on gas imported via pipelines, as a seasonal plunge in demand adds to the impact on consumption from the coronavirus outbreak. Kazakhstan shipped 7.5 billion cubic metres (bcm) of gas to China last year and planned to gradually increase shipments to 10 bcm a year. Kazakh oil exports to China, suspended in mid-January, have not yet resumed, Nogayev said, because organic chloride continues to be detected in crude produced by CNPC Aktobemunaigas, a local unit of the Chinese energy firm.

Source: Reuters

INTERNATIONAL: COAL

ContourGlobal turns away from coal, axing plans to build Kosovo plant

17 March. London-listed power generator ContourGlobal has scrapped plans to build a coal-fired power plant in Kosovo, a decision welcomed by environmental groups, and said it would make no further coal plant investments globally. ContourGlobal also ruled out any further coal investments.

Source: Reuters

China’s January-February coal output drops 6.3 percent as coronavirus disrupts

16 March. China’s coal output in the first two months of 2020 fell 6.3 percent from the same period a year earlier as the coronavirus outbreak stopped miners from getting back to work after the Lunar New Year holiday was extended in a bid to contain the epidemic. China churned out 489.03 million tonnes (mt) of coal over January and February, down from 513.67 million tonnes in the same period last year, data from the National Bureau of Statistics (NBS) showed. To ensure sufficient coal supplies for power utilities, the central government had urged miners to resume production and rail companies to ensure enough capacity for shipping coal. The National Energy Administration said that production had reached 83.4 percent of total coal mining capacity as of 3 March. Port prices for Chinese thermal coal with energy content of 5,500 kilocalories per kg fell to 560 yuan ($80.03) a tonne from 576 yuan in mid-February when miners started to return for work. China imported 68.06 mt of coal in January and February combined, up 33.1 percent from a year ago, as some coal shipments that were unable to be cleared by Chinese customs in December arrived in early January.

Source: Reuters

Union members at Colombia’s Cerrejon coal mine vote to strike

16 March. The majority of members at two unions of Colombian coal miner Cerrejon voted in favor of a strike relating to a dispute over pay and benefits in the contract. A strike at Cerrejon, which is owned equally by BHP Group, Anglo American and Glencore, could cut the company’s coal production and sales outside of Colombia, the fifth biggest coal exporter in the world. Coal is the second largest generator of foreign currency for the Andean country after oil. Cerrejon is trying to reduce, freeze and eliminate benefits for employees using the fall in coal prices as an excuse while ignoring the depreciation of the Colombian peso against the dollar. The company exported 26.3 million tonnes (mt) of coal in 2019 and has 5,896 workers, of which 4,600 are union members. The last strike at Cerrejon was in February 2013 and lasted 32 days. Last year, coal prices fell to an average of $51.40 per tonne, down from $82.50 per tonne in the previous year, according to the Ministry of Mining and Energy.

Source: Reuters

Canada’s Brookfield halts sale of Australian coal port due to coronavirus

11 March. Canada’s Brookfield Asset Management has put the $2 bn sale or potential listing of its coal export terminal in Australia on hold due to travel restrictions amid the spread of coronavirus. The decision makes the Dalrymple Bay Coal Terminal (DBCT) the largest and most high profile corporate transaction in Australia to fall victim to the volatile financial market conditions sparked by the epidemic.

Source: Reuters

INTERNATIONAL: POWER

French power grid implements continuity plan for crisis

15 March. French power grid operator RTE said it would implement a continuity plan to allow its network to continue running while the government steps up measures to curb a coronavirus outbreak. RTE is to adopt working from home for many of its personnel, with staff only to work on site for vital functions, it said. The plan would be adapted depending on developments in the outbreak and grid safety maintained. A general shift to working from home and an easing in industrial production had reduced power demand, RTE said.

Source: Reuters

Power cuts to last indefinitely: South Africa’s ailing Eskom

12 March. Nationwide power cuts across South Africa of up to 4,000 MW will last indefinitely, state power firm Eskom said, as repairs take longer than anticipated. The latest blackouts, referred to locally as load shedding, were triggered by breakdowns at a score of generating units, including at Koeberg nuclear plant in Cape Town. Eskom has been battling repeated problems with its coal-fired power stations, prompting power cuts and dragging the economy into its second recession in as many years. Mining and manufacturing data due later are expected to reflect the impact of unreliable power supply.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

EU should scrap emissions trading scheme

17 March. The European Union (EU) should scrap its Emissions Trading System (ETS) or exempt Poland from the scheme, which helps combat global warming, to free up funds for Warsaw to fight the effects of the coronavirus. Under the ETS, the EU charges for the right to emit carbon dioxide. European power generators, industrial emitters and airlines running flights within the EU must buy permits to cover their emissions. Poland is the only EU state that refused at a December summit to commit to climate neutrality by 2050.

Source: Reuters

Coronavirus creating solar industry 'crisis': US trade group

17 March. The spreading coronavirus is threatening project schedules in the booming US (United States) solar industry following a year in which the sector topped natural gas as the nation’s top new power source. Fallout from the pandemic has impacted both supply chains and demand in the fast-growing industry, and the president of the top US solar trade group said its annual market report’s projection of 47 percent growth in 2020 will be ratcheted down in the coming weeks and months. It was still too soon to incorporate the pandemic’s impact into the sector’s outlook with certainty, the Solar Energy Industries Association said. Last year, the US solar industry installed 13.3 GW of capacity, a 23 percent increase from the prior year. Utility-scale projects accounted for nearly two-thirds of the market. The residential solar market had its biggest year every for installations at 2.8 GW.

Source: Reuters

UN aviation agency agrees to restrict carbon credits denounced by climate activists

13 March. The UN (United Nations)’s aviation agency approved restrictions for a global program designed to help airlines offset their carbon emissions, a move that curbs industry funding for older projects whose environmental benefits have been challenged by climate activists. The International Civil Aviation Organization (ICAO) council approved recommendations to exclude offset projects begun before 2016 while delivering emission reductions through end-2020, ICAO said. Developing countries had hoped a global push by airlines to offset emissions would mop up a glut of carbon credits awarded under earlier climate initiatives. One of the six programs is the United Nations’ Clean Development Mechanism (CDM), the world’s largest offset scheme set up under the 1997 Kyoto Protocol to help fund emissions reductions in developing countries. Aviation accounts for just over 2 percent of global greenhouse gas emissions, but with air traffic forecast to grow in coming decades, that percentage would rise if left unchecked.

Source: Reuters

China Energy Engineering to build waste power plant in Ukraine

11 March. China Energy Engineering Corp Ltd announced it will build the Karsa waste-to-energy plant in Kyiv, Ukraine. The Chinese state-owned energy group said its two subsidiaries had signed an engineering, procurement and construction (EPC) contract worth around $238 mn (€210.2 mn) and with a term of 36 months. Information on the customer has not been provided. The power plant will incinerate waste and be capable of processing 1,500 tonnes of garbage per day, China Energy Engineering said.

Source: Renewables Now

DATA INSIGHT

Crude Oil Production Scenario in India

| Year |

Production

(Million Tonnes) |

| 2001-02 |

32.03 |

| 2005-06 |

32.20 |

| 2010-11 |

37.69 |

| 2015-16 |

36.94 |

| 2016-17 |

36.01 |

| 2017-18 |

35.68 |

| 2018-19 |

34.20 |

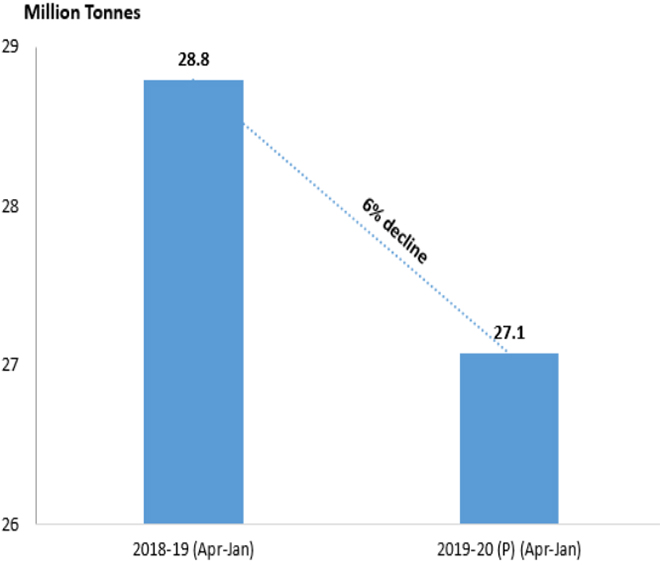

| 2019-20 (P) (Apr-Jan) |

27.07 |

Percentage Change in Current Year w.r.to Previous Year

P: Provisional

P: Provisional

Source: Rajya Sabha Questions & Ministry of Petroleum & Natural Gas

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

P: Provisional

P: Provisional PREV

PREV